Home Alimony Size

Payment of alimony must be made regularly and without fail. This is the responsibility of the parent to whom they are assigned. By evading them, as well as for their delay, you can receive a penalty for alimony.

What is a penalty for alimony?

The penalty for late payment of child support is expressed as penalties, and is charged to the parent for failure to fulfill the obligation to provide for the child. In a way, this is also a certain motivator for compliance with the executive decision, since the fine in this case is not small, but grows in proportion to time.

Collection can be of two types:

Negotiable, when concluding an agreement between parents on the payment of money to the child, its amount, and penalties for alimony. The sizes are not limited here; parents install them themselves.

Negotiable, when concluding an agreement between parents on the payment of money to the child, its amount, and penalties for alimony. The sizes are not limited here; parents install them themselves. - Legal when a court decision is made. It is regulated by law, namely the Family Code of the Russian Federation (Article 115). It describes the fines imposed for late payment and the amount of the penalty, which is equal to 0.5% per day.

In any of these two types of fines, the debt will be counted every day, and its accrual will stop only when it is fully repaid. For alimony penalties, judicial practice does not cause much joy among payers, so they try to strictly comply with the instructions of the bailiffs.

Formula for calculation

If there is a need to file a claim to impose a fine, then you need to know how to calculate the penalty for alimony. Who calculates it? You can calculate it yourself, then the bailiff service will accurately calculate the amount. The calculation of the penalty for alimony is carried out according to a certain formula. This takes into account the assigned amount of alimony, the time of delay, and the percentage of penalties established by law.

If there is a need to file a claim to impose a fine, then you need to know how to calculate the penalty for alimony. Who calculates it? You can calculate it yourself, then the bailiff service will accurately calculate the amount. The calculation of the penalty for alimony is carried out according to a certain formula. This takes into account the assigned amount of alimony, the time of delay, and the percentage of penalties established by law.

How to correctly calculate the amount of debt, take a ready-made calculator for calculating alimony penalties, and by substituting the values you can calculate it.

Amount of debt = Child support payment * days of delay * 0.5%.

If you look at this in numbers, so that you can clearly see what a large fine can be for an unpaid period, you will get the following.

For example, the amount for alimony is 8,000 rubles. The parent did not pay for 2 months.

The total amount of debt will be 16,000 rubles.

Let's move on to the calculation.

Debt amount = 16,000 * 61 days * 0.5 = 4,880 rubles.

The total debt will be calculated from the accumulated amount and interest for the unpaid period, and it will be 16000 + 4880 = 20880 rubles.

Therefore, we can say, using a calculator for alimony, it is clear that it is very unprofitable to bring the matter to such a situation without paying the debt; the fine for late payment will only increase.

How to collect

The basis for collecting a penalty for non-payment of alimony is the actual non-receipt of funds for the child. How to collect a penalty for alimony, you must file a claim. A claim for the recovery of alimony penalties is filed with the court at your place of residence. It is necessary to correctly fill out the statement of claim for the recovery of alimony penalties. To do this, use the online sample on our website. A calculation of the penalty must be attached to the claim. To do this, you need to contact the bailiffs conducting the enforcement case, he will confirm the fact of delay and calculate the penalty.

The basis for collecting a penalty for non-payment of alimony is the actual non-receipt of funds for the child. How to collect a penalty for alimony, you must file a claim. A claim for the recovery of alimony penalties is filed with the court at your place of residence. It is necessary to correctly fill out the statement of claim for the recovery of alimony penalties. To do this, use the online sample on our website. A calculation of the penalty must be attached to the claim. To do this, you need to contact the bailiffs conducting the enforcement case, he will confirm the fact of delay and calculate the penalty.

Copies must be attached to the statement of claim:

- court decision to order alimony payments;

- writ of execution;

- birth certificates of the child(ren);

- bailiff's decisions on debt, debt calculation;

- receipt of payment of state duty. The amount of the state duty depends on the amount of the claim.

The obligation to pay interest for non-payment arises for any of the above-mentioned methods of assignment, both contractual and legal. In any of these cases, a statement of claim is written to recover alimony penalties.

Responsibility for non-payment

Also, when imposing a penalty payment, you can recover compensation for losses incurred during the lack of cash receipts. When filing a claim for alimony penalties and indicating such a requirement, the plaintiff will have to arm himself with irrefutable evidence of this fact.

Also, when imposing a penalty payment, you can recover compensation for losses incurred during the lack of cash receipts. When filing a claim for alimony penalties and indicating such a requirement, the plaintiff will have to arm himself with irrefutable evidence of this fact.

The first will need to prove that he paid certain payments that were previously made from funds received for the maintenance of the child by the other parent, and therefore, during the absence of these payments, he had to pay them himself. At the same time, the second participant can prove his innocence in the untimely transfer of funds for the child, if there was a good reason for this.

There are cases when the payer is not at fault:

- severe financial condition, confirmed by documents;

- administrative leave initiated by the employer due to lack of work;

- severe and prolonged illness that does not allow you to work or earn an income.

But if the defaulter’s jurisdiction is proven, and he still continues to evade payment and imposed fines, then he may be brought to criminal liability, which will entail arrest for up to 3 months.

Financial support is the responsibility of a parent who does not want to properly support his child. Therefore, you should not ignore this issue; you must strictly monitor the transfer of funds. And in case of their absence, take all steps to correct the situation. The law is always on the side of the child and will exert its influence on the defaulter.

Attention! Due to recent changes in legislation, the information in this article may be out of date. However, each situation is individual.

To resolve your issue, fill out the following form or call the numbers listed on the website, and our lawyers will advise you for free!

Penalty for alimony: how to collect, how to calculate, which court to file

Collection of alimony penalties is the mother’s right (in most cases) to receive compensation and at the same time to punish the child’s father for being late in paying alimony. Or he didn’t pay them at all for some period of time.

The alimony penalty is provided for in Article 115 of the Family Code. Previously, it was 0.1% per day, but on July 3, 2008, the law was changed, the legislator increased its size to 0.5% per day, and the interest of mothers in this issue took on completely different contours.

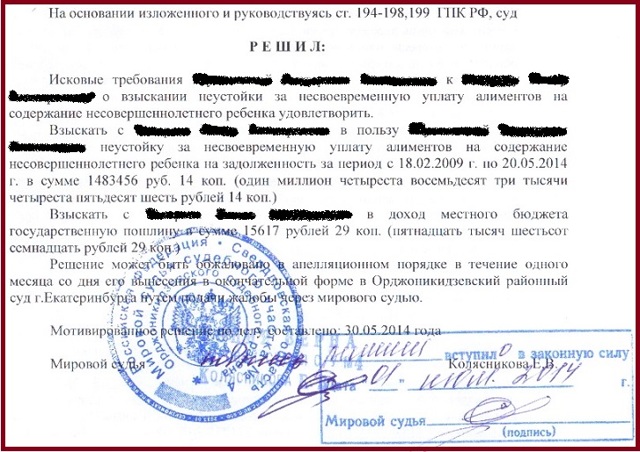

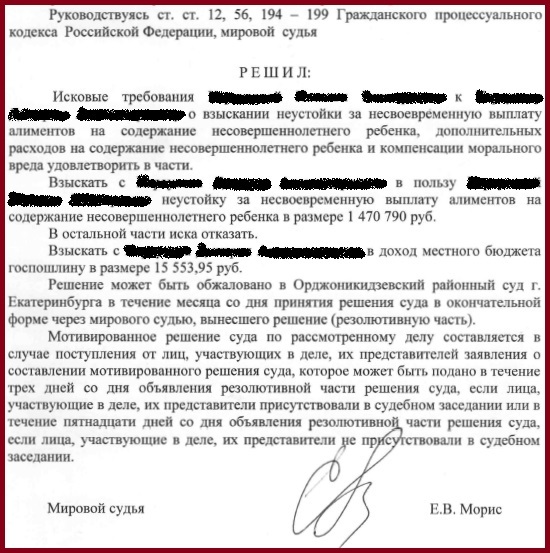

But the most interesting thing came in December 2012, when the Supreme Court put an end to many years of disputes and contradictions in judicial practice and found that it was impossible to reduce the alimony penalty. After this, she became a formidable weapon in the hands of mothers.

Who collects the penalty - the court or the bailiff?

Since the mother received a writ of execution (sometimes a court order) on the issue of alimony and handed it to the bailiff, she believes that the bailiff should collect the penalty. “I collected alimony through the court .”

In fact, this is not entirely true.

The writ of execution was issued by the magistrate for the collection of alimony (that’s right), and not for the collection of alimony penalties. These are still different things, they have different legal natures. Alimony is the main obligation, forfeit is a punishment, a fine, a measure of responsibility. Various articles of the law, respectively.

Correct answer: although alimony was previously collected through the court, in order to collect the penalty, the mother must still file a lawsuit in court. It is a claim, a statement of claim (and not an application for the issuance of an order).

In this case, it must be submitted to a magistrate (and not to a district or city court). Many (including lawyers) are confused on this issue.

The confusion is caused by the fact that according to the law (Article 23 of the Code of Civil Procedure of the Russian Federation), magistrates consider civil cases only up to 50,000 rubles, the price of the claim should not exceed this limit.

And the alimony penalty is almost always more than 50 thousand rubles, often it even exceeds a million.

But the alimony penalty, as the courts agree, has an accessory (interdependent and mutually consequential) nature from the fate of the main obligation (alimony), and therefore should be considered in the same place where alimony was collected, that is, in the magistrate’s court.

Territoriality and state duty.

Let's assume that the child's mother and his father live in different cities. This situation occurs often, in every second case. Several years ago they divorced and moved away.

And a logical question arises: to which particular magistrate should I file for collection of the penalty - at my place of residence, or at my father’s place of residence?

In this issue, too, confusion and chaos reigned for a long time; some judges considered in favor of the father, guided by the general rules of jurisdiction (Article 28 of the Code of Civil Procedure of the Russian Federation). Accordingly, claims from mothers were not accepted, they were sent to file far away, the claims were returned, etc.

Other judges, believing that alimony and penalties are interrelated, accepted and considered cases at the place of the mother, guided by the jurisdiction chosen by the plaintiff (Part 3 of Article 29 of the Code of Civil Procedure of the Russian Federation).

Recently, this issue has been more or less settled; for the most part, the courts have sided with mothers and began to accept claims at their place of residence. The second point of view now prevails.

The answer to the question about the state duty follows from this. Claims for the recovery of basic alimony payments are not paid by state duty. As a result, the penalty began to be collected without state duty.

Who calculates the amount of the penalty?

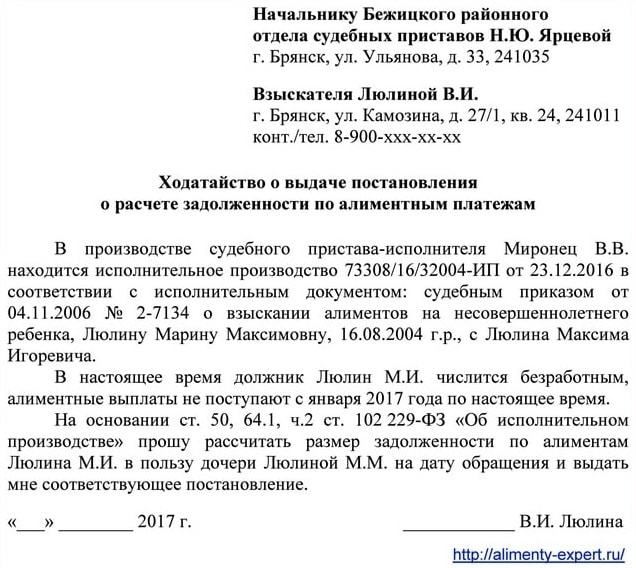

There is a common point of view that the calculation of the alimony penalty should be done by the bailiff. After all, he is in charge of enforcement proceedings. This point of view is strengthened by the fact that the bailiff makes the calculation of the principal debt for unpaid alimony - he issues a resolution on the calculation of the debt.

And the mother, by analogy, believes that the bailiff should calculate everything, even the amount of the penalty.

Moreover, I once heard such a point of view even from a magistrate, however, in some incomprehensibly gambling context, when the plaintiff presented one calculation, the defendant another, and the judge said: “ Let’s also instruct the bailiff to calculate... ”. And she instructed.

But the correct answer is that the plaintiff must calculate the penalty.

The bailiff is not obliged to calculate the penalty and will not (even on the instructions of the judge in the described case they refused to pay). The bailiff works only within the framework of the writ of execution, and in this document there is not a word yet about collecting a penalty.

Calculating the amount can be quite complex arithmetically. The number of days is large, it is not clear what to do with the amounts actually paid by the father - should they be deducted or not, especially since they are chaotic in nature, whether they should be counted towards the repayment of the principal debt or not, and if they are counted, then for what specific month, the amounts are different , the penalty rate changed, etc.

It's really difficult. Even a lawyer, not to mention a woman who works, for example, as a seamstress in the village.

But we have to, there’s no escape from it. This is a direct requirement of the law (Article 132 of the Code of Civil Procedure of the Russian Federation), which requires that the calculation must be attached to the claim and signed by the plaintiff. If there is no settlement, the judge has the right to leave the claim without progress, and then return it altogether.

If you can’t make the calculation yourself, ask a lawyer to do the calculation on your behalf. Fortunately, the court recovers the lawyer’s costs from the defendant.

How to calculate the amount of the penalty?

The amount of the alimony penalty must be calculated on an accrual basis.

In this regard, there are further disagreements. Paragraph 4 of Article 113 of the RF IC states that the calculation of alimony debt is made at the time of collection. And by analogy, many mothers try to apply this here, when claiming a penalty. Like, there is a period - 5 years, that is, 1826 days, the bailiff calculated the amount of debt - 300,000 rubles, let's multiply all this by 0.5%, and that's it.

But this approach is wrong.

The first month of delay in paying alimony, the debtor receives one amount of debt, the second month - already more, the third - even more, and so on.

It should be taken into account that alimony is collected monthly, and the penalty is collected for each day. The alimony arrears for a specific month begin to flow from the first day of the next month - from this day it must be counted. Sometimes the calculation of the penalty is done in Excel by specifying a calculation formula; it happens that this is actually simpler.

Difficulties are also caused by rare but actually made alimony payments by the father. For example, if he paid 200 - 300 rubles a couple of times during the year, what should he do with these amounts when calculating the penalty? Which month should they be attributed to and where should they be addressed - to reduce the principal debt or to reduce the penalty?

These amounts must be included in the reduction of the principal debt. 200 rubles of alimony were paid by the father this month, we adjust the amount of the principal debt by this amount, and from next month we continue to charge a penalty taking into account these 200 rubles.

Can the court reduce the amount of the penalty due to disproportionality?

This has previously been applied by the courts. The fact is that Article 333 of the Civil Code allows this - in civil legal relations.

And the courts applied this article in alimony - they say, you, as a plaintiff, have received a penalty of one and a half million, but this is too much, I think, here’s 150,000 rubles for you.

The amount of the penalty was determined absolutely arbitrarily, as if the judge had turned his hand in his hat and pulled out a random forfeit with the required number.

But the Supreme Court in 2012, in its review of civil cases (issue 3), cut short all these troubles and ruled that it is no longer possible to mix civil and family law. It is civil legislation that allows for a reduction in penalties under civil contracts, but family legislation does not provide for the possibility of such a reduction, and if so, then it is impossible.

The confusion in this matter was stopped, and the justices of the peace began to collect penalties for late alimony in full. As much as is in the calculation, so much will be in the decision. And in the writ of execution.

Is it the father's fault for the penalty?

Article 115 of the Criminal Code, which describes the penalty, states that collection is possible only if there is fault. In court, my father almost always says that it’s not my fault, that I couldn’t get a job, that my mother is disabled, I support her, and so on.

But civil legislation (for example, Article 401 of the Civil Code) is harsh in this matter. The debtor must take all measures to fulfill his obligation. Only real force majeure can forgive you.

But real force majeure is war, natural disasters, acts of a government agency. Did any of the above happen in your case? No. There is no document about this. But have you, as a debtor, taken all the measures? Could you get a job? They could.

Not settled? We didn't get settled. This means that not all measures were taken. This means that the court has established guilt.

Especially after the review of the Supreme Court in this matter, a firm bias was established in favor of the fact of proof of the father’s guilt in causing the penalty.

The collection of alimony penalties is also useful in terms of the subsequent deprivation of the father of his parental rights.

And here two arguments are applied at once: the above-mentioned proof of the father’s guilt (when depriving parental rights, one must also prove the fact of culpable failure to fulfill one’s parental responsibilities. And here, it turns out, the guilt has already been proven in another process, prejudice).

And the second point is the amount of the penalty, which is added to the amount of the main alimony debt and thus takes on a frightening outline. It’s one thing when the alimony debt = 300,000 rubles. This is bad, but the situation is common.

And when the alimony debt is 300,000 rubles plus a penalty of 1,500,000 rubles - it looks much more significant, right? And this is a serious lever for the mother to negotiate with the father about recognizing the claim (if you admit the claim for deprivation, I will forgive you the penalty), and for the court the claim for deprivation looks much more justified.

Actual collection of the awarded penalty.

A writ of execution is issued for the fine collected, and the mother presents it to the bailiff.

Next is the standard procedure for enforcement proceedings, which has been repeatedly described in other articles (see list of articles below). Collections, as a rule, are made, and if not immediately, then the debtor can be tormented and pressed for the rest of his life, then half of his pension can be snatched away, and then he can also receive money from his heirs.

Bruskov Pavel

See also:

State duty on penalty for alimony

According to the law, the court may waive the penalty or reduce its amount. To achieve this result, it is necessary to carefully prepare all documents indicating good reasons for non-payment of alimony and the absence of fault of the alimony payer. In addition, if the amount of the penalty is too high, then it can be argued that its size is disproportionate to the consequences of violations of non-payment of alimony. For example, if the amount of the penalty is several times higher than the amount of debt, then it is likely that the court will reduce the amount of the penalty at the request of the defendant. Evidence in favor of reducing the penalty can include medical certificates about the presence of severe forms of illness, documents on disability, certificates of registration as unemployed, certificates of wages, information about the presence of other dependent children of the debtor.

Dear readers! Our articles talk about typical ways to resolve legal issues, but each case is unique.

If you want to find out how to solve your particular problem, please use the online consultant form on the right or call the numbers provided on the website. It's fast and free!

Content:

- Penalty for alimony 2023

- State duty penalty for alimony

- State duty when filing an application for alimony

- Collection of penalties for alimony

- State duty to court for alimony

- The Constitutional Court allowed to reduce the penalty for alimony

- How to collect a penalty for late payment of alimony

- Limitation period for alimony

WATCH THE VIDEO ON THE TOPIC: How alimony should be calculated #family_law #alimony

Penalty for alimony 2023

Free from mobile and landline Free multi-channel telephone If you find it difficult to formulate a question, call the free multi-channel telephone 8, a lawyer will help you 1. You need to file a claim for a penalty for delay in child support payments.

I'm interested in the size of the state duty. Good afternoon. This is a claim to protect the interests of the child; no state fee is paid. Do I need to pay a state fee when filing a claim for alimony penalties? State duty to the court when collecting penalties for alimony The alimony payer allows a delay in the payment of alimony collected by court decision.

Should I pay a state fee when filing a claim in court to recover alimony penalties? In judicial practice, there are two positions on this issue.

The state duty when filing a claim in court for the recovery of alimony penalties must be paid in accordance with paragraph. As stated in paragraphs. Thus, the Tax Code of the Russian Federation exempts from payment of state duty only when filing claims for the collection of alimony, and not other claims.

Obviously, the requirement to collect alimony is not identical to the requirement to collect a penalty for alimony, since the penalty is a form of civil liability of the alimony payer for untimely fulfillment of obligations to pay alimony.

In Article 12 of the Civil Code of the Russian Federation, the right to demand an award to perform an obligation in kind and the collection of a penalty are named as independent methods of protecting the right. Thus, for claims for the collection of a penalty for late payment of alimony, the Tax Code of the Russian Federation does not provide for an exemption from paying state duty to the court.

There is no need to pay a state fee when filing a claim in court to collect alimony penalties. Plaintiffs in cases of protection of the rights and legitimate interests of a child are exempt from paying state fees to the court.

Collection of a penalty for late payment of alimony can be safely attributed to the case of protecting the rights and legitimate interests of a child, since in accordance with Article 60 of the RF IC, a child has the right to receive maintenance from his parents and, accordingly, to receive alimony in a timely manner.

Please note that plaintiffs in disputes regarding the collection of alimony are exempt from paying state fees to the court.

However, we emphasize that when filing claims related to the interests of minor children, the state fee does not need to be paid if the plaintiff, in addition to alimony, asks: If the plaintiff asks to collect a penalty, for example, for late payment of alimony for an adult child, spouse, other relatives receiving maintenance based on a court decision, then you will have to pay a state fee to the court.

Does the exemption for payment of state duty provided for in paragraphs. In accordance with paragraphs. Thus, tax legislation exempts plaintiffs from paying state taxes only in disputes regarding the collection of alimony.

Persons filing claims in court in accordance with Art. The benefit established by paragraphs.

The exceptions are demands for an increase in alimony for minor children and for the collection of penalties in connection with late payment of alimony for minor children, upon presentation of which the plaintiffs, acting in the interests of the children, are exempted from paying state duty in accordance with paragraphs.

By the decision of the magistrate, N.’s demands were partially satisfied. By the ruling of the magistrate, N.’s appeal was made. By the appeal ruling of the city court, the ruling on leaving the appeal without movement and its return was left unchanged.

The courts proceeded from the fact that the requirement to pay a penalty for violating the deadline for paying alimony by virtue of clause. The courts did not take into account that for claims for the collection of a penalty for late payment of alimony, tax legislation does not provide for an exemption from paying state duties.

This provision of the law should apply to all cases of protection of the rights and legitimate interests of the child, including property ones. The state duty is not paid, refer to the fact that the requirement is derived from the requirement to collect alimony.

How is the state duty calculated for a claim for the collection of alimony penalties?

Calculated according to the article Is it necessary to pay a state fee when filing a claim in court with the Bailiffs Department for the recovery of damages caused by inaction and compensation for moral damage if consolidated enforcement proceedings were initiated on the basis of writs of execution for the collection of alimony for minor children, as well as the recovery of penalties in connection with with the resulting debt.

When filing claims for alimony and penalties, I did not pay the state fee in accordance with Art.

Therefore, as I think, if enforcement proceedings are initiated in the interests of minors and the bailiff commits illegal actions that lead to damage, then the claim for compensation for damage should also be defined as filed in the interests of minors and the payment of state fees should be exempted.

When filing the claim, I did not pay the state fee and did not indicate in the claim on what basis I am asking to be exempted from paying it. I received a ruling to dismiss the claim due to non-payment of state fees. Do I have to pay by law, and if not, what should I do now, what should I indicate in a private complaint?

Thank you in advance for your response. Yes, they must, they will return it if you win the case. Is the state duty paid on a cassation appeal based on the amount of the alimony penalty? Any appeal or cassation complaint is subject to payment of a state fee in the amount prescribed by the Tax Code of the Russian Federation.

Yes, it is paid if the defendant files it. Please tell me, when filing an application for collection of alimony penalties, do I need to pay a state fee and in what amount? Good time. There is no need to pay state duty, since plaintiffs in cases of protection of the rights and legitimate interests of a child are exempt from paying state duty to the court.

In accordance with Article 60 of the RF IC, a child has the right to receive maintenance from his parents and, accordingly, to receive alimony in a timely manner. You do not need to pay state duty. It will be recovered from the defendant taking into account the amount of the penalty awarded for payment.

Good afternoon Amount of state When filing a complaint by an individual, the amount of state duty is calculated according to the formula: If you have one of the preferential categories, then you are exempt from paying state duty. Good luck. The following are exempt from paying the state fee: Can I, together with the Claim for the collection of a penalty for arrears of alimony, file for a change in the amount of alimony, for a fixed amount?

Or file 2 claims. Is state duty paid on claims for changes in the amount and procedure for paying alimony? The main thing is to correctly draw up and substantiate the statement of claim, which will be difficult for you to do on your own, without the help of a lawyer.

Contact a lawyer on our website personally or write to him by email. I am going to file an application with the magistrate to collect a penalty for alimony. Am I required to pay a state fee and in what amount? The penalty amounts to

When filing a claim for the recovery of a penalty for late payment of alimony for minor children, the plaintiff is exempt from paying the state duty on the basis of subparagraph 15 of paragraph 1 of the article. The state duty to be recovered from the defendant if the said claim is satisfied is calculated in accordance with subparagraph 1 of paragraph 1 of the article Bo -Firstly, you need to apply to the district court with this amount of penalty.

Secondly, you need to pay state duty. Help me calculate the state fee for a claim for alimony penalties, a penalty in the amount of .91 rubles. In accordance with paragraph. By virtue of Art. Federal Law No. In your case, the state duty is not charged.

The ex-husband filed a claim for alimony penalties. I am filing an objection and a counterclaim to reduce the debt due to illness and difficult financial situation.

I also want to submit an application for deferment of the state duty, since I do not know the amount of the claim.

How to do it right? Hello, dear Svetlana Sergeevna! Firstly, according to the article of the Civil Procedure Code of the Russian Federation in short - the Code of Civil Procedure of the Russian Federation, the judge accepts a counterclaim if: When filing such a claim with the magistrate, you have the right, in response to your husband’s claim for the recovery of alimony penalties on the basis of an article of the RF IC, to submit a Petition to the judge to suspend consideration of his claim until a decision is made on your claim.

Thirdly, when considering the ex-spouse’s claim for the recovery of alimony penalties, be sure to use the provisions of the Resolution of the Constitutional Court of the Russian Federation of October 6 in the Objections to the claim.

Moreover, in accordance with subparagraph 2 of paragraph 1 of article According to paragraph 6, on claims for a decrease or increase in payments and distributions, based on the amount by which payments and distributions are reduced or increased, but not more than for a year.

Therefore, by how much you want to reduce the amount of alimony arrears monthly, multiply by 12 - this will be the cost of the claim. You can make it even simpler.

Pay any amount of state duty when filing such a claim with a magistrate, for example, RUB. The judge will then indicate in the Determination how much additional state duty you need to pay for such a claim. Good luck to you. The ex-wife filed a claim to collect a penalty for alimony debt, which amounts to rubles. The prosecutor's office calculated a penalty in the amount of rubles.

The amount of alimony debt included a three-month period of care for a pensioner who has reached the age of 80. The pensioner himself received compensation in the amount of rubles against signature, and then handed it over to me from hand to hand.

However, the bailiff calculated the debt for this period based on the average salary in the Russian Federation, and not on income in rubles. At the same time, they did not take into account the fact that I could not work while caring for a pensioner, I could not receive unemployment benefits either, and caring for a pensioner is counted towards non-insurance periods of service.

Can I file a counterclaim for recalculation of alimony arrears based on the above circumstance? Will there be any sense in this and will it be necessary to pay a state fee?

What amount to calculate the state duty from:

State duty penalty for alimony

We will send the material to you by email: By clicking on the button, you consent to the processing of your personal data and sending letters. Read more Almost every legally significant action is subject to various types of state duties and taxes.

When applying to a court, payment of the state duty established by the Tax Code of the Russian Federation is mandatory. Its size is established depending on the type of appeal and citizens are required to pay the specified amount to the local budget before filing a claim.

If you believe the law, then alimony is no exception.

Contents of the article: 1. Decision on the penalty for alimony; 2. State duty and deadline for filing an application for a penalty; 3. Calculation of penalties for alimony.

The articles posted on our website are of an informational nature about resolving certain legal issues. However, each situation is individual. To solve a specific problem, you need to fill out a form on the website, or ask a question to the online consultant on the right.

Better yet, call us by phone! It's faster and free! Multi-channel toll-free number hotline 8 free call! In particular, you can calculate online how much state fees you need to pay for your claim. In a similar way, you can determine the amount of penalties for non-payment.

For this purpose, there is a special calculator for calculating alimony penalties in accordance with paragraph.

Collection of penalties for alimony

The following documents must be attached to the claim: Alimony agreement or court order, court decision, writ of execution for the collection of alimony; Calculation of the penalty made by the bailiff; Receipt for payment of state duty.

However, some lawyers believe that a claim for the collection of alimony penalties is a logical continuation of the case for the collection of alimony, therefore they recommend paying a state fee in the amount of rubles in accordance with subparagraph 14 of paragraph 1 of the article. If the court leaves the claim without progress due to incomplete payment of the state fee, it will be possible to make an additional payment .

How to collect a penalty for alimony in court?

State duty to the court when collecting a penalty for alimony State duty to the court when collecting a penalty for alimony The alimony payer allows a delay in the payment of alimony collected by court decision.

Should I pay a state fee when filing a claim in court to recover alimony penalties? In judicial practice, there are two positions on this issue. The state duty when filing a claim in court for the recovery of alimony penalties must be paid in accordance with paragraph. As stated in paragraphs.

Thus, the Tax Code of the Russian Federation exempts from payment of state duty only when filing claims for the collection of alimony, and not other claims.

The Constitutional Court allowed to reduce the penalty for alimony

You are here: Is there a statute of limitations for alimony? At the legislative level, such a time period is established in relation to alimony related to the award of mandatory cash payments.

By statute of limitations it is necessary to understand such time periods that are provided by law in order to protect the rights of a citizen, as specified in Art.

The expiration of these deadlines serves as the basis for termination of the possibility of defending the interests of a person using the judicial procedure for resolving the dispute.

Dear lawyers, what state fee must be paid when filing a claim to collect a penalty for non-payment of alimony. In a court.

More than RUR The applicant must determine the price of the claim independently before going to court. This value is equal to the amount by which the amount of payments per child will be reduced for the year - see.

Limitation period for alimony

Should I pay a state fee when filing a claim in court to recover alimony penalties? In judicial practice, there are two positions on this issue. The state duty when filing a claim in court for the recovery of alimony penalties must be paid in accordance with paragraph. As stated in paragraphs.

Penalty for non-payment of alimony The law provides for various penalties applicable to a persistent defaulter of alimony.

To determine the amount of debt for which a penalty will be charged, you should contact the bailiffs involved in the forced collection of previously awarded alimony. The amount of debt will be confirmed by a certificate in a certain form.

It is advisable to ask for a breakdown of the debt by month. Then it will be easier to calculate the penalty. After the amount of the penalty has been calculated, you can prepare a claim filed at the debtor’s place of residence.

In this case, regardless of the size of the penalty, the statement of claim must be addressed to the magistrate.

Free from mobile and landline Free multi-channel telephone If you find it difficult to formulate a question, call the free multi-channel telephone 8, a lawyer will help you 1. You need to file a claim for a penalty for delay in child support payments. I'm interested in the size of the state duty.