Calculating alimony penalties is an important step in collecting late fees. Incorrect determination of the amount can significantly slow down the process.

The recipient of the funds must determine the amount of the penalty ; the following will help to correctly determine the penalty for late payment:

We also tell you how to collect a penalty.

Who calculates alimony penalties?

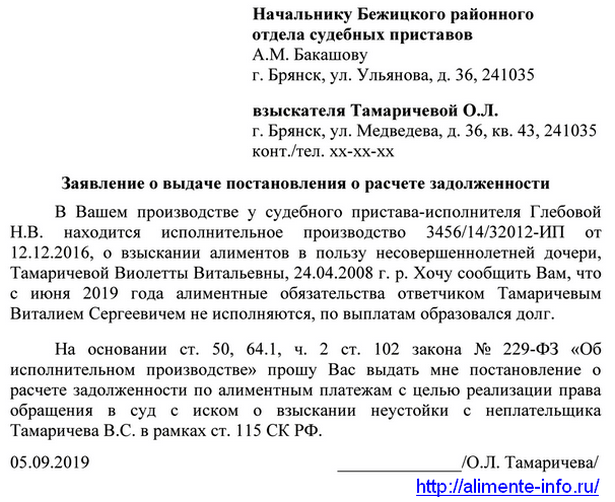

The claimant must calculate the penalty independently . However, in order to make the calculations correctly, the recipient of alimony should contact the bailiff and write an application for issuing a resolution to calculate the debt.

A penalty can only be collected if enforcement proceedings to collect alimony based on a court decision (order) or agreement. More detailed information can be found in the article “Penalty for non-payment of alimony”.

A penalty can only be collected if enforcement proceedings to collect alimony based on a court decision (order) or agreement. More detailed information can be found in the article “Penalty for non-payment of alimony”.

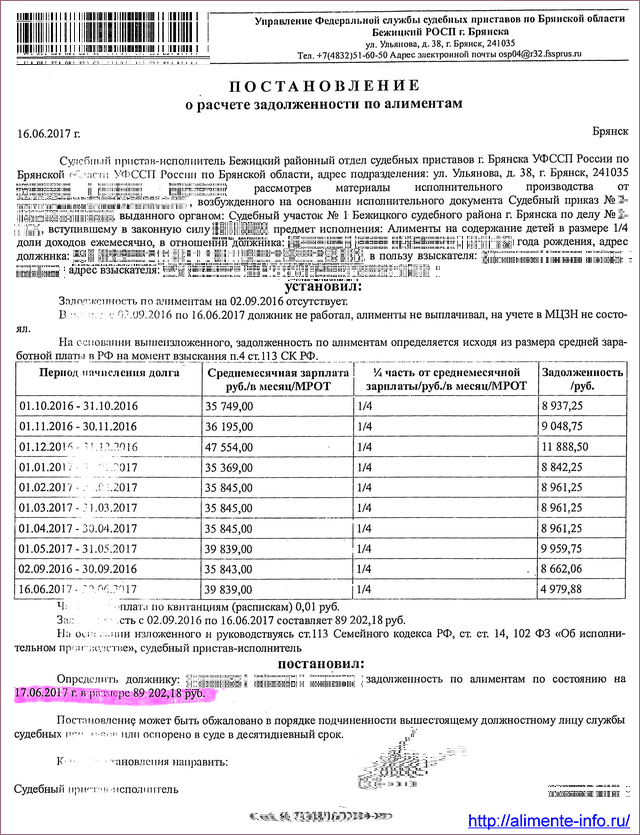

In the resolution, the bailiff indicates the monthly debt, and at the end calculates the total amount of debt for the entire period of non-payment:

As a rule, a debt settlement is issued directly on the day of contacting the bailiff service (Bailiff Service). It makes sense to contact the bailiff when the debt has accumulated for more than 2 months, since it is not advisable to collect the penalty earlier: its amount will be very small.

How to calculate a penalty correctly

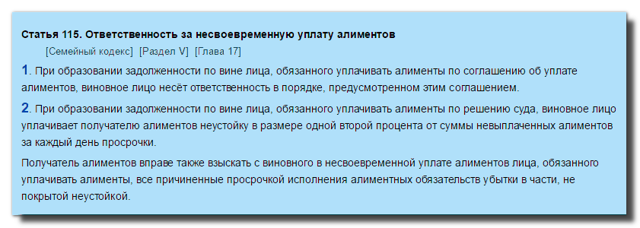

If alimony was collected legally, that is, through the court, then the amount of the penalty is 0.1% of the total amount of debt for each day of delay - Part 2 of Art. 115 of the Family Code (SC) of the Russian Federation.

Until August 9, 2018, the penalty was charged at the rate of 0.5% for each overdue day, but the amounts often turned out to be unaffordable to pay, so the percentage was reduced. At the same time, you need to pay a penalty for debts that were incurred before 08/09/18 in the amount of 0.5%, since in this case the law does not have retroactive effect .

If the debt arose later, the penalty will be 0.1%.

Regardless of whether alimony is collected in shares, a fixed amount or a mixed method, the calculation of the penalty will be made on the basis of the bailiff’s decision using the same formula.

If the plaintiff overestimates or incorrectly calculates the amount of the penalty, the judge will recheck the calculations and, if necessary, recalculate the fine.

Formula for calculating alimony penalties

The alimony claimant must provide the court with a table showing the monthly calculation of the penalty for each day of late payments. The alimony debt itself is determined by the bailiff ; the recipient of the funds does not need to calculate it independently.

- Based on the bailiff’s decision, the plaintiff himself calculates only the monthly accumulation of the penalty using the following formula:

- N = SD × KDM × 0.1%,

- Where:

- N – penalty for 1 month;

- SD – amount of alimony debt;

- KDM – number of days in a month;

- 0.1% – penalty percentage: if the calculator does not allow you to multiply directly by percentages, then you can multiply the numbers by 0.001. One thousandth of the number is 0.1%.

However, the penalty most often needs to be calculated over a fairly long period. And here there is a nuance: when determining the amount of the penalty, in this case the amount of debt for the current month is summed up with the debt for the previous ones. For example, the formula for calculating penalties for 3 months will look like this:

H1 = DM1 × DM × 0.1% H2 = (DM1 + DM2) × DM × 0.1% H3 = (DM1 + DM2 + DM3) × DM × 0.1%

Total amount of penalty = N1 + N2 + N3,

Where:

- N1, N2, N3 – penalties for 1, 2 and 3 months, respectively;

- SD1, SD2, SD3 – the amount of debt for the first, second and third months of non-payment.

This happens due to the fact that with each unpaid payment the debt grows, and the penalty is charged for the entire amount of the debt , so the penalty will become larger and larger.

Table for calculating penalties

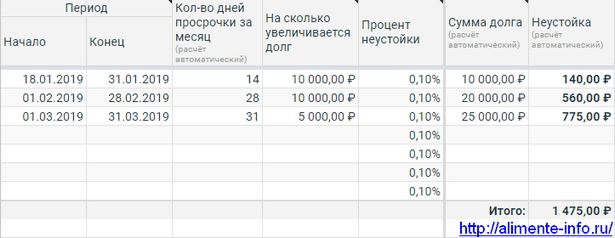

To correctly calculate the overdue amount, you must not only apply the formula correctly, but also not make mistakes when entering values on the calculator. To reduce the likelihood of error, you can use the table:

It will be enough just to indicate the periods of delay: they coincide with calendar months, but can be shorter if, for example, the debt arose in the middle or end of the month. The number of days for the period is calculated automatically after filling out the “Start” and “End” columns.

In the column “How much does the debt increase”, enter the debt for the corresponding period, specified in the bailiff’s resolution. In the “Amount of debt” column, the debt for the current period is automatically summed up with the previous ones, and a penalty is charged .

The table contains only data from the resolution on debt calculation issued by the bailiff conducting the proceedings.

There is no need to independently calculate the number of days or the amount of debt for several days - these calculations occur automatically.

By default, the table shows a penalty of 0.1%, but if necessary, this value can be changed to your own. The program will automatically calculate the penalty, and the final amount to be collected will appear in the “Total” field.

An example of calculating alimony penalties as a share of income

When alimony is collected as a percentage of salary, the payer's employer is most often responsible for calculating it. However, there are often cases when alimony workers quit their official place of work and do not register for unemployment. In this case, the bailiff will calculate the debt in shares of the average wage (AW) in Russia (Part 4 of Article 113 of the RF IC).

Example. Alexey P. must pay alimony in the amount of 1/3 of the income for the maintenance of two children. The man quit his job, but did not find a new job, did not register with the Employment Center, and did not declare his new sources of income. The debt accumulated for 3 months. In the resolution on debt calculation, the debt is calculated depending on the PPA as follows:

- May 2023: 47926 (SWP for May) / 3 = 15975.3 rubles.

- June 2023: 49348 (MSP in June) / 3 = 16449.3 rubles.

- July 2023: 46509 (FPA for July) / 3 = 15503 rub.

The calculation of the penalty for the court can be presented in the form of a table:

| 1 | May | 31 | 15975,3 | 0,1% | 495,23 |

| 2 | June | 30 | 15975,3 + 16449,3 = 32424,6 | 0,1% | 972,74 |

| 3 | July | 31 | 32424,6 + 15503 = 47927,6 | 0,1% | 1485,76 |

| Total: | 2953,73 |

If the court satisfies the claims, then the man will need to pay not only the alimony debt, but also interest for the delay.

As already mentioned, the collector does not need to calculate the monthly amount of the debt - this information is indicated by the bailiff. The recipient of alimony only needs to correctly calculate the amount of the penalty.

How to calculate penalties in a fixed monetary amount

The simplicity of calculating the penalty when collecting alimony in TDS lies in the fact that every month the debt increases by the same amount.

Suppose the father must pay 7,000 rubles per month for the child and has not transferred funds for 5 months. You can calculate the penalty as follows:

| 1 | March | 31 | 7000 | 0,1% | 217 |

| 2 | April | 30 | 14000 | 0,1% | 420 |

| 3 | May | 31 | 21000 | 0,1% | 651 |

| 4 | June | 30 | 28000 | 0,1% | 840 |

| 5 | July | 31 | 35000 | 0,1% | 1085 |

| Total: | 3213 |

For example, in this case, to find out the amount of debt in April, you need to multiply 7,000 by 2, since April is the second month of debt, and in May, you need to multiply 7,000 by 3, and so on.

How to collect a penalty

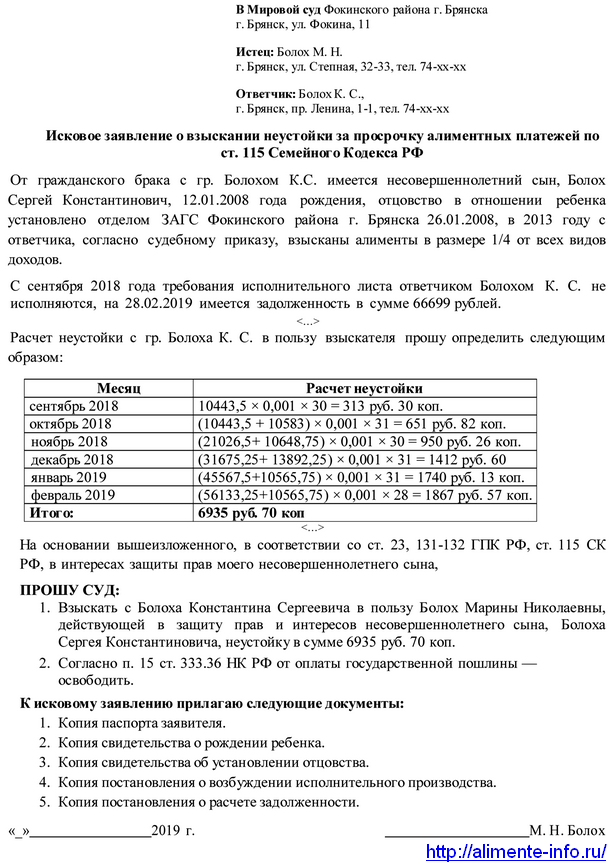

After the amount payable has been calculated, you need to apply to the magistrates court with a claim to collect the penalty. The plaintiff is exempt from paying state fees and has the right to file an application with the court both at the defendant’s place of residence and at his place of residence or location.

A table with the calculation of interest can be placed directly in the statement of claim : this will be convenient both for the plaintiff (since there will be fewer documents) and for the court, because the requirements and calculation of the amount will be in one place.

Calculation of penalties for alimony online calculator, how to correctly calculate the penalty, penalties for alimony, formula and sample calculation

A penalty for alimony is a penalty that can accumulate on existing debt. The law states that in the event of debt formation, the penalty is 0.2% of the amount of overdue debt for each day of delay.

The accrual of a penalty is a measure of civil liability, and it can be established by a court decision. It is not in the interests of the debtor to avoid paying penalties, since employees of the federal bailiff service have a whole arsenal of ways to achieve debt collection.

How does it arise

Dear readers! Our articles talk about typical ways to solve legal issues, but each case is unique. If you want to find out how to solve your particular problem, please contact the online consultant form on the right or call 8 (499) 288-21-40. It's fast and free!

The most effective method of dealing with evaders and non-payers of funds for the maintenance of their minor children is to calculate the penalty for alimony and then collect it in court.

From January 1, 2023, the amount of the penalty for alimony has decreased by 5 times! Previously it was 0.5% for each day, now it is 0.1% of the debt amount. Keep this in mind when you calculate your total debt for this year.

A penalty arises when a person obligated to pay alimony does not do so either on time or in full. Thus, there is a direct connection with penalties, because the calculation is made for each day of delay, while a fine simply means the payment of a fixed amount of money for a particular violation.

In this material we will reveal the main points of accrual, and also consider specific examples of such calculations, based on judicial practice. A penalty for alimony is one of the types of penalties provided for untimely fulfillment of alimony obligations.

Such responsibility allows for financial incentives for the defaulter for the sake of careful compliance with the conditions for providing for a minor child. There are certain rules that must be followed in 2018.

Which payments are charged?

The applicant’s lack of evidence of the defendant’s guilt for failure to fulfill certain obligations is already grounds for excluding them from the taxable base.

Even more powerful arguments for such a decision are evidence that he is not guilty of the defendant’s failure to fulfill his obligations, that the plaintiff is guilty of this. The penalty is reduced in accordance with Art. 404 Civil Code.

Such evidence may be:

- personal letters;

- audio-video recordings;

- joint photos;

- printouts of communications on social networks, websites, and email;

- accounting data of the defendant’s employer, etc.

For failure to pay the penalty within the period provided for by the Code of Administrative Offences, the defendant is liable under Part 1 of Art. 20.25 Code of Administrative Offences.

In Art. 115 of the Family Code of the Russian Federation (FC RF) indicates the responsibility of the parent for the untimely fulfillment of his obligations to pay child support. The parent will have to pay a penalty in the amount of 0.5% of the debt amount. The fine is calculated daily.

- Main difference

- penalties

- from the accumulated amount of debt is that it can only be collected if the alimony payer is at fault.

An alimony payer who fails to fulfill his obligations is considered guilty of failure to pay if he:

- refused to transfer to the recipient funds assigned in court;

- hid his place of residence and work, and also gave false information about himself and his income;

- provided underestimated amounts of earnings for calculating alimony;

- during a certain period of time did not belong to the category of employed or unemployed citizens, and did not transfer payments to the recipient;

- was brought to administrative responsibility for failure to fulfill his obligations to pay alimony, after which he continued to evade payments;

- This is not the first time he has received a warning from a bailiff about criminal prosecution.

At a court hearing on the issue of collecting a penalty, the alimony payer has the right to prove his innocence if the lack of payments is due to a good reason.

Collection of a penalty from the payer is possible if the following grounds exist:

- availability of a writ of execution establishing alimony payments;

- the document on collection of funds is being executed by the bailiff service;

- the court granted the claim for a fine for non-payment of funds;

- alimony debt was formed due to the fault of the payer.

If the alimony payer is not at fault for the delay in payments, then it is impossible to collect a penalty.

You can find out more about why it is necessary to calculate alimony debt and how bailiffs calculate the amount of the penalty amount here.

According to Russian legislation, a penalty can be collected if two conditions are met:

- Availability of a document indicating the need to pay alimony (alimony agreement, court order, writ of execution).

- The fact of deliberate evasion of payment.

If at least one of the listed conditions is not met, no penalty will be collected.

Delay may not always be intentional, and therefore it is necessary to examine typical options when a penalty will not be applied to the debtor, including:

- delay of wages or non-payment (there must be a supporting document);

- the delay in payment was not due to the fault of the debtor (accounting or banking error, computer failure);

- serious illness of the payer, which affected his income;

- the occurrence of force majeure circumstances (catastrophes, military operations, natural disasters, etc.);

- the payer does not have a writ of execution (interest cannot be collected for the period when the writ of execution or order was not transferred to the alimony payer).

Late payment can only accrue if the payer has an outstanding debt. What’s interesting is that if the recipient did not have time to file a lawsuit to claim the penalty, and the alimony payer paid off the debt obligations, the court will most likely refuse to pay.

There are two options for paying alimony in percentage terms and in a fixed amount.

As for the first case, non-payment is not entirely accurate, especially when the payer’s salary changes from month to month. To calculate the penalty, you need to know the exact official income of the payer.

If we are talking about a fixed sum of money, it does not matter what income the alimony payer has, since the penalty will be calculated based on the amount assigned by the court, just as in the case of an alimony agreement that specifies the exact amount of payments.

Penalties are applied regardless of the form in which alimony must be paid - in a flat sum of money or as a percentage of the alimony payer's salary.

How to calculate correctly and who should do it?

The calculation of the penalty is made by bailiffs. They are entrusted with the obligation to conduct proceedings for the collection of alimony on the basis of a writ of execution. If the alimony payer has already accumulated a payment debt, then the recipient should contact the bailiff so that he can calculate the amount of the fine.

The bailiff has information about the payer’s income, from which the amount of the penalty will be calculated, and he also knows all the nuances of making such calculations. The applicant, of course, can independently calculate the fine, but there is a high probability that such calculations will not be taken into account at the court hearing.

Even if all payments are made by a bailiff, it would not be superfluous to familiarize yourself with the procedure for their implementation in order to have an idea of what amounts can be recovered from the payer for his untimely fulfillment of obligations.

The recipient of funds also has the right to recover other losses from the payer. These losses may arise due to untimely transfer of alimony, which is not covered by the penalty (Article 115 of the RF IC).

The settlement made by the bailiff is drawn up in the form of a separate document, which, together with the statement of claim, the recipient of the funds submits to the judicial authority for consideration.

The calculation of the penalty for alimony is based on two formulas. One of the options is used to calculate the fine per calendar month.

Penalty = D×N×P

- D - the amount of debt generated in a month; N - the number of days in a month;

- P is the percentage of penalties established by the executive document.

An example of calculating a penalty: the payer is entrusted with the obligation to pay alimony, which he has not fulfilled for three months. He incurred a debt in the following amounts:

- January (31 days) - 10,000 rubles.

- February (28 days) — 9,000 rub.

- March (31 days) - 11,000 rub.

The penalty is 0.5%, which means the amount of the fine will be as follows:

- As of 02/01/2018 - 10,000×31×0.5%=1550 rubles.

How to calculate the penalty for alimony? Calculation example

Every father must pay alimony to ensure a decent life for his children (we will assume that children are most often left with their mother). But not all people are in a hurry to fulfill their obligations. And most often, on the contrary, they try to avoid responsibility (even if initially they shower their ex with assurances and promises). Failure to pay child support results in debt. In turn, debt collection involves the imposition of penalties as punishment for the negligent “dad”.

In 2023 (however, as before), alimony penalties can be used as a type of liability only in court proceedings.

Who is eligible to receive these funds? How correctly and who should calculate the penalty for alimony? From what time does the right to calculate the penalty begin? What should be the size of the debt for alimony payments in order to accrue a percentage of the penalty on it and who calculates the amount of the penalty? Who should apply to calculate penalty payments for 2023? In what cases can the alimony provider avoid charging a fine?

If the mother more or less understands the process of calculating alimony payments and calculating the debt on them, then with a penalty everything is much more complicated.

This topic is less covered on the Internet, and therefore many additional questions arise about receiving a penalty for late payment of alimony. You can find the answers on our Court portal.

Guru (and not only in this article - scroll through the “Family Law” subsection - you won’t regret it at all).

In addition, a practicing lawyer is constantly on duty on the site.

He will help the site user with invaluable advice completely free of charge.

Basis for calculating alimony penalties

The rate of penalties is established by family law and enshrined in the Family Code, which is in force on the territory of our state. The penalty will be half (0.5) percent for each day of delay. This percentage is determined by article number 175 of the Family Code of the Russian Federation.

Penalties are assessed in the specified amount for the amount of the principal debt for each day (we repeat).

But in order to calculate them, two periods are taken as a basis: a period of time equal to the number of days in the month for which payment was not received and a period of time equal to the total number of days for which the debt arose.

To calculate penalties added to debt obligations for alimony, a special formula for calculating penalties is used (we will talk about it later in the text). Accordingly, the greater the debt accumulated by the alimony defaulter, the larger the amount of the penalty will be added to this debt.

Situations for satisfying a claim for a penalty

The calculation of the penalty for alimony and its addition to the amount of the principal debt can only be carried out by a court decision.

And in order for this decision to be made in favor of the plaintiff (and in our case, this is the mother), there must be direct intent and guilt in the actions of the father.

The person obligated to pay alimony in a timely manner will receive penalties on the amount of the debt as punishment if the following conditions are met:

- when applying to court, the recipient of alimony payments must have a concluded voluntary agreement regarding monthly alimony payments or a court decision to award monthly alimony payments;

- the form of the writ of execution received by the court decision on the assignment of payments in favor of the child must be handed over to the bailiff to the executor and enforcement proceedings must be initiated on its basis (if this document does not work out in the hands of the claimant, the claim will be denied);

- another document from the bailiff, who, according to the law, calculates the penalty - directly calculating the amount of debt and the amount of penalties, prepared on paper at the request of the claimant;

- the presence of malicious intent in the actions of the payer, expressed in the deliberate delay of payments or a complete refusal to transfer funds to meet the needs of his child (there were no delays in salary or receipt of unemployment benefits, he was not on sick leave, did not go on a business trip, etc. .).

Only if all of the above conditions are met at the same time will it be possible to achieve a positive decision on the claim for a fine for the unscrupulous parent.

Situations of refusal of a claim for a penalty

The alimony payer will be exempt from punishment in the form of penalties for the amount of arrears of monthly payments in favor of his child, subject to the following conditions:

- if during the period of non-payment the defendant did not receive the money earned;

- in this case, he himself is not the culprit of the delay (for example, if the salary was not received by collecting part of the earnings for a disciplinary offense, this will not be a valid reason), but the bank, accountant, manager, etc. are to blame;

- if during the period of non-payment the defendant could not earn money due to deteriorating health and was on sick leave for treatment all this time;

- if the defendant was unable to pay due to an emergency, natural disasters, declared martial law or another situation that he was unable to overcome on his own;

- if the claimant, having received the writ of execution in his hands, left it collecting dust on a shelf at home and did not hand it over either to the bailiff or to the defendant’s place of employment, and at the same time did not notify him of the existence of an obligation to pay monthly alimony by court decision.

In all of the above cases, the defendant will need to provide evidence of the absence of malicious intent in his actions. And although he is not obliged to do this, every document presented to the court will be a plus in his favor.

About the payment procedure

Before you figure out how to calculate the penalty for alimony, you need to understand that in order to correctly calculate the penalty, it is not necessary to take into account how the alimony was awarded: as a percentage or a fixed payment.

The main thing is to know how much the father had to pay his children monthly. The total number of days of delay will also play an important role here. When making calculations, a month will be taken for the reporting period. Most often, a table is used to reflect debts and penalties.

Determining the amount of the fine can be done in two ways, depending on your convenience. Both are correct and permitted by family law law. For greater convenience of recording all the initial data and calculating the results, a table is most often used.

For clarity, we will look at an example of calculating the penalty in both options.

Option 1

For each month, the amount of debt is taken, then multiplied by the number of days in the reporting month, then multiplied by the fine rate.

| June 1st month of debt | 12 000 | 30 | 0,5 | 12000*30*0,5%=1800 |

| July 2nd month of debt | 12000+120000 | 31 | 0,5 | 24000*31*0,5%=3720 |

| August 3rd month of debt | 12000+12000 +12000 |

31 | 0,5 | 36000*31*0,5%=5580 |

The result is: 12,000 + 12,000 + 12,000 + 1,800 + 3,720 + 5,580 = 47,100 rubles a father owes his children in just three months.

Option 2

For each month, not the total amount of debt is taken, but the amount of debt for each month, and is multiplied not by the number of days for the reporting month, but by the total number of days for which the delay was allowed, and then multiplied by the fine rate.

Month Debt Number of days Rate % Fine amount

| June 1st month of debt | 12 000 | 92 | 0,5 | 12000*92*0,5%=5520 |

| July 2nd month of debt | 12 000 | 62 | 0,5 | 12000*62*0,5%=3720 |

| August 3rd month of debt | 12 000 | 31 | 0,5 | 12000*31*0,5%=1860 |

The result is: 12,000 + 12,000 + 12,000 + 5,520 + 3,720 + 1,860 = 47,100 rubles a father owes his children in just three months.

All of the above actions, both in the first and second options, are carried out by the bailiff. However, all his calculations are not worth a penny without a court decision. The judge has the right:

- refuse the plaintiff;

- award the full amount of the penalty;

- apply penalties to the debtor partially.

Penalty for alimony: calculation, collection and responsibility

Grounds for demanding a penalty

Knowing what a penalty for alimony is, you can sue the debtor just a few months after the late payment and receive a fairly serious amount along with the accumulated debt. According to the Family Code of the Russian Federation (Art.

115), it is 0.5% for each overdue day. Although the calculation begins not from the first day of delay, but from the beginning of the month following the payment month.

The only exception can be a situation when an agreement has been drawn up between the parties with the amount of the penalty specified in it.

To apply a penalty for late alimony against a defendant, the following conditions must be met:

- a court decision (order or writ of execution) or a voluntary agreement on the payment of maintenance and penalties for alimony is already with the applicant;

- The writ of execution on maintenance payments has already been sent to the bailiff service. While it is only with the prospector, there are no grounds for demanding payments yet;

- the debtor missed the deadline through his own fault, knowing about the need for payments.

If the reason for the delay was the illness of the debtor, delays in wages or ignorance of the need to pay, a penalty for non-payment of alimony is not imposed. Although this does not exempt the debtor from paying the assigned maintenance.

It will not be possible to collect a penalty for late payments even in cases where the delay was caused by a natural disaster or catastrophe.

And also in cases where the writ of execution was not transferred to the defendant due to the fault of the prospector.

Calculation of debt amounts

To calculate the penalty, you need to know the defendant's monthly income and the number of days that have passed since the last payment. After determining the amount of the penalty, you need to go to court and demand payments in the amount of the calculated amount. However, if it is indicated incorrectly, the application will be returned. And, in order to correctly calculate the penalty, you should use a special calculation form.

Online calculator for calculating penalties

The principle of determining penalties is to multiply the number of days of delay by the interest rate. In this case, each month for which there is a debt is taken into account separately. The formula for calculating alimony penalties can be presented as follows:

Z * D * 0.5/100, where D is the number of days in the month being calculated;

Z – amount of overdue at the beginning of the month, rub.;

0.5 – half a percent per day.

Using the same formula, an online calculator is used to calculate the penalty for alimony, which is quite simple to use. In order to calculate the penalty for alimony, you should:

- enter the number of days in the month for which the amount of alimony penalties is calculated;

- specify the interest rate (default – 0.5%). As judicial practice regarding alimony penalties shows, by agreement, the amount of the penalty can be increased, creating an additional incentive not to delay payments;

- do the same for each of the months for which there is debt.

The alimony penalty calculator cannot automatically determine the entire amount over a long period. Moreover, if the monthly payment constantly changes, depending on the debtor’s income. Some of the work will have to be done manually, but the alimony penalty calculator allows you to simply set the starting date of the debt, rather than calculate the number of days.

In order to better understand, it is worth considering an example of calculating a penalty:

- in March, the debt on the part of the defendant amounted to 10 thousand rubles, in April – 11 thousand, in May – 9000;

- at the time of June 1, a month had already passed since the last debt, and 2 and 3 months, respectively, since other payments;

- for March the defendant owes 10,000 * 31 * 0.5/100 = 1,550 rubles, for April - (10,000 + 11,000) * 30 * 0.5/100 = 3,150 rubles, for May - (10,000 + 11,000 + 9,000) * 31 * 0.5/100 = 4650 rub.

The total amount of debt at the beginning of June is 9,350 rubles. In total, the debtor is required by law to pay 39,350 rubles - regardless of who calculates this amount and in what way, its amount should be the same. Of these, 30 thousand rubles represent alimony for the specified period.

Going to court

To go to court with a claim for alimony penalties, a statement of claim is drawn up; to fill it out correctly, you can use a sample claim drawn up taking into account all the current requirements of the legislation of the Russian Federation. A lawyer can help you determine how to calculate alimony penalties. A claim for the collection of alimony penalties is filed with the magistrate at the defendant’s place of residence.

Sample statement of claim for the recovery of alimony penalties.

If the child whose maintenance is paid by the defendant is already 14 years old, he has the right to independently file an application for a penalty for each day of delay. In this case, the statute of limitations is not taken into account - money can be recovered even after several years. Although for most other fines and penalties the statute of limitations is 1 year.

Liability on the part of the debtor

The applicant may demand from the defendant not only the recovery of alimony penalties, but also compensation for those losses that were incurred due to late payments. True, one statement is no longer enough for this.

And it is required to provide evidence of a cause-and-effect relationship between the debtor’s failure to fulfill obligations and the plaintiff’s financial losses.

An example of such an evidence base could be a loan agreement taken to purchase clothes or medicine for a child.

For refusal to execute a court decision to pay a penalty for alimony, there is jurisdiction that provides for the same punishment as for failure to pay the principal amount. Exceptions are cases where payments were late through no fault of the debtor.

And in some cases, such as difficult family situation, dismissal from work or serious illness, the court can not only cancel the payment of penalties, but also reduce the amount of alimony.

Calculation of penalties for alimony online calculator, how to correctly calculate the penalty, penalties for alimony, formula and sample calculation

Not all fathers take responsibility for their responsibility to provide financially for their children. Some avoid paying monthly alimony for a long time and accumulate long-term debts. Are there effective ways to influence irresponsible fathers - persistent non-payers of child support?

Yes, the legislation provides for several types of liability for evading the provision of financial assistance to one’s own children - from financial liability to administrative and even criminal liability. You can read more about liability measures in the article “Malicious evasion of alimony payment.”

This article is devoted to financial liability for alimony debt - a penalty or penalty.

Penalty is a type of fine that is applied to the alimony payer in case of late alimony payment. The amount of the penalty depends on the amount of the debt and the length of the delay, thereby stimulating the father to timely and fully fulfill his financial obligations to the child.

Using an online calculator, you can correctly calculate penalties and alimony penalties

Just a few months of late alimony payments - and the amount of debt will grow not only on its own, but also due to an impressive fine.

The penalty is charged if the following grounds exist:

- A voluntary agreement has been concluded or a court decision has been made to pay alimony;

- The writ of execution has been submitted to the bailiff service;

- A debt on alimony payments has arisen due to the fault of the alimony payer;

- A court decision was made to charge a penalty on the amount of the debt.

Will not be charged in the following cases:

- The writ of execution has not yet been transferred to the bailiff service;

- Debt in alimony payments arose due to delay or non-payment of wages, illness of the alimony payer;

- The debt arose due to the fault of the employer’s accounting department or banking institution, which calculated and transferred alimony payments;

- Timely payment of alimony was impossible due to force majeure.

The amount of the penalty can be determined in two ways - contractual and legal.

- In the first case , parents should enter into a child support agreement, which will stipulate all the conditions for payment of sums of money: amount, term, method of payment, as well as responsibility for late or incomplete payment. The amount of penalties can be any if established by mutual consent of both parents.

- In the second case , in the absence of a voluntary agreement between the parents, the rules of the law that are binding on everyone apply. According to Part 2 of Article 115 of the Family Code of the Russian Federation, the penalty is 0.5% of the monthly alimony payment for each day of delay.

In both cases, the accrual of penalties begins on the first day of the next month after the month in which the alimony payment was overdue. Accrual occurs until the alimony debt is repaid.

Penalties are applied regardless of the form in which alimony must be paid - in a flat sum of money or as a percentage of the alimony payer's salary.

The assessment of a fine or penalty for alimony debt is the responsibility of bailiffs who are handling the case of collecting alimony in accordance with the writ of execution. The bailiff has information about the court decision or alimony agreement, the place of work and income of the alimony payer, and the amount of the debt.

The court will rely only on the calculation made by the bailiff. The court will not take into account the approximate calculations of the parents.

However, it will be absolutely useful for parents to know how to correctly calculate the penalty for alimony. Firstly, to understand the principle of calculating penalties, and secondly, to know what amount of money (alimony debt, fine, penalty) you can expect when going to court.

There are two main formulas that are used by bailiffs to calculate penalties for alimony debt.

Amount of debt for the billing month * number of days in the month * penalty percentage

The alimony payer evaded paying alimony for three months.

The amount of debt was:

- March – 20,000 rubles;

- April – 21,500 rubles;

- May – 23,000 rubles.

- March: 20,000 * 31 * 0.5% =3100

- March + April: (20,000 + 21,500) * 30 * 0.5% =6225

- March + April + May: (20,000 + 21,500 +23,000) * 31 * 0.5% =9997.5

The total amount of the penalty for three months of late alimony payments: 19,322.50

Amount of debt for the billing month * total number of days of delay * penalty percentage

The alimony arrears accrued over the course of three months:

- March – 20,000 rubles;

- April – 21,500 rubles;

- May – 23,000 rubles.

The total number of days of delay is 92.

- March: 20,000 * 92 * 0.5% = 9200

- for April: 21,500 * 61 * 0.5% = 6557.5

- for May: 23,000 * 31 * 0.5% = 3565

The total amount of the penalty for three months of late alimony payments: 19322.50

- Due to frequent changes in legislation, information sometimes becomes outdated faster than we can update it on the website.

- All cases are very individual and depend on many factors. Basic information does not guarantee a solution to your specific problems.

Calculator for calculating penalties for alimony + formula for penalties for non-payment of alimony

Child support arrears are a fairly common phenomenon today. Therefore, the legislation establishes additional liability measures for the payer of funds. These include the collection of penalties for alimony.

This is the subject of a separate lawsuit. But before submitting it, the total amount of penalties must be correctly determined.

And our calculator for calculating alimony penalties, which you can use completely free online, will provide significant assistance with this.

In addition, the results of the calculations can be easily printed and presented as one of the attachments to a future statement of claim.

Online calculator for calculating penalties for alimony Art. 115 RF IC

The calculator for calculating penalties for alimony can be used regardless of what size of sanctions is taken as a basis. Let us remind you that when an agreement on alimony was signed, the amount of the penalty is established by it. Otherwise, a legal penalty for alimony applies (Article 115 of the RF IC). Its amount is half a percent of the debt amount for each day of delay.

Sanctions apply regardless of who is the recipient of alimony. After all, in addition to children, both the second spouse and elderly parents have the right to them.

Our alimony penalty calculator will allow you to calculate sanctions for each month of debt existence. After all, it may turn out that the amounts of monthly alimony may differ. For example, this happens if payments are tied to the debtor's income.

To use the calculator, you need to know the amount of debt for each month, the period of non-payment in days, as well as the rate for sanctions. Then all calculations will occur automatically.

Formula for calculating alimony penalties for non-payment

It's quite simple. If the monthly payment amount differs from each other, then data is taken for each month, and then the resulting final penalties are summed up.

In order not to be mistaken about how to correctly calculate the penalty for alimony, we will give one simple example.

Let’s say the amount of alimony debt for February was 2,000 rubles. The debt period is 15 days. Based on the penalty rate of 0.5%, we get the following.

2000 x 15 x 0.5% = 150 rubles

This is only a penalty for one month. The same sample for calculating alimony penalties can be applied to other periods of debt existence.

If the monthly debt is the same, then calculating the alimony penalty can be made simpler. It is enough to calculate the total duration of the delay and multiply the resulting figure by the amount of debt for the month. From this value you will then need to take half a percent.

Let’s assume that the alimony debt for December from January to February 2017 was 3,000 rubles. The delay for January was 30 days, for February 15, for a total of 45 days. Then the calculation will be like this:

3000 x 45 x 0.5% = 675 rubles (we mean the penalty for alimony for one period)

As you can see, there is nothing complicated. But using our calculator, you can spend just a few minutes on the entire calculation process.

Procedure for collecting penalties for alimony

To collect alimony you need to take several sequential actions.

Step 1. Determining the amount of debt

If the collection of alimony is carried out on the basis of a writ of execution or a court order, then you should contact the bailiffs to obtain a resolution on the amount of the debt by month.

When the alimony stipulated in the agreement is not paid, the bailiff’s help may not be needed at the first stage.

Step 2. Calculation of alimony penalties

When the amount of alimony debt and the period of arrears are known, then it’s time to use our calculator. After the calculation is completed, all results can be printed and used as an attachment to the claim.

Step 3. Preparing and filing a claim for the collection of alimony penalties

It is addressed to the magistrate at the debtor’s place of residence. As a rule, the case is considered within a month. When a claim in court for alimony penalties is won, you should obtain a writ of execution from the office after the decision enters into legal force.

Step 4. Contacting the bailiffs

To force the collection of alimony penalties, you should contact the bailiffs again with a writ of execution. It is possible that it will be combined with documents to collect an existing alimony debt.

With the help of lawyers in St. Petersburg, alimony penalties can be collected in the shortest possible time.

How to write a claim for alimony penalties

We have already noted that the collection of alimony penalties in court occurs by filing a lawsuit. The statement of claim itself for the recovery of alimony penalties has the following approximate structure.

At the very beginning, the name of the court is written, as well as information about the plaintiff and defendant (debtor). It is further indicated on the basis of which the debtor has an obligation to pay alimony. If payments are ordered by the court, then details of the relevant decision or court order are provided.

After this, emphasis should be placed on the fact that alimony obligations are not being fulfilled. In confirmation, you can refer to a certificate of debt from the bailiffs, which was received before going to court.

Then information about the accrued penalty is provided. You can refer to the fact that the calculation is attached to the statement of claim. After this, a reference is made to the norms of the insurance company, which allow you to apply for a penalty.

The final part of the claim is standard: the composition of the claims (point by point), list of attachments, date and personal signature of the plaintiff (his representative by proxy).

Copies of the original court decision and the writ of execution are attached to the claim. You will also need a certificate from the bailiff and calculation of the penalty.

Specific features of a claim for penalties

If there is arrears in payments for the child, then the state duty when collecting alimony penalties is not paid. This is due to the fact that paying a fine is an additional way to protect the interests of the child. And claims on this topic do not require legal expenses (so says the Tax Code of the Russian Federation).

When the recipients of alimony are other persons, then if a penalty for alimony is collected, the application to the court requires payment of a state fee. It is calculated on a general basis at a certain percentage of the amount of the claim.

Unlike other types of penalties, the court does not have the right to reduce the penalty for alimony. Therefore, if all the calculations were made correctly, the court will always satisfy the claim in full.

It should be remembered that claims for the award of a penalty for alimony for children are not subject to the statute of limitations until they reach adulthood. This means that a penalty can be accrued for the entire period of alimony debt, provided that the child goes to court within 3 years after the child reaches 18.

Finally, a court decision to award a penalty does not relieve the debtor from paying alimony. And if so, then their collection will continue.

Legal support in collecting alimony penalties

The calculator we offer significantly simplifies the process of determining the amount of sanctions. However, it is also important to properly prepare the claim materials and defend your position in court.

An experienced lawyer can help you collect penalties for alimony. He will undertake the obligation not only to write and file a claim, but also to represent your interests in court and before bailiffs.