In large transactions, it is usually desirable to obtain guarantees from both the seller and the buyer. A certain amount is required as additional security. Both advance and deposit are a form of advance payment. What is the difference between them and what is better for the seller and what is better for the buyer?

What an advance is

An advance is a form of payment that is made before the receipt of the goods or the fulfilment of certain terms of the contract; it is not considered a guarantee of obligations; usually, a small amount of the contract price is paid in advance when major transactions are concluded.

It is desirable that the amount of the advance should not exceed 10 per cent of the total value of the goods or services

The advance is in any case returned to its payer on refusal to perform the transaction, no matter who initiated the breach of the contractual relationship, the advance payment is not a compensation for the failed transaction.

Advance advance payment is used in situations where the parties have reached an agreement, but the basic contract needs to be deferred for some time.

This may be due to the unpreparedness of all documents, lack of all the necessary amount. To ensure that the parties to the transaction are not nervous, an advance is paid. The seller ceases to offer, for example, an apartment to others who wish to.

The buyer collects the documents and the missing amount for the purchase.

What's a deposit?

The deposit is a monetary sum which one of the parties to the agreement provides to the other as a guarantee for the fulfilment of the obligations undertaken (article 380 of the Criminal Code of the Russian Federation).

- If the party that made the advance payment failed to meet its obligations, the money will not be returned to it.

- Provided that the party to the contract who received the money and did not perform the required service was found guilty, the deposit is returned to the buyer in double value (381 articles of the Russian Civil Code).

- The payer will be able to receive the full amount of money back if the agreement is not implemented for objective reasons beyond the control of any of the parties to the transaction.

There are three main functions of the deposit:

- In the execution of the contract, the cash contribution will be treated as an advance payment;

- The parties shall place obligations on each other to transfer money; if one of the parties to the agreement does not comply with the terms of the agreement, the other party shall be compensated for the operation that has not taken place;

- The money paid is proof that both sides of the deal are willing to participate.

The deposit - the guarantee of compliance with the terms of the contract

The deposit - the guarantee of compliance with the terms of the contract

A deposit is usually made in a situation where the buyer is interested in acquiring a particular dwelling; the apartment is perfect for the buyer: close to his place of work, studies, relatives ' residence. It is not possible to find another option for the same money.

What's the difference between advance and deposit?

Both the advance and the deposit are a payment transaction, and the advance is not a guarantee of the actual performance of the contract; it only represents the portion of the amount transferred to the other party of the transaction before the terms of the agreement are fulfilled; this is its payment assignment.

The deposit is a more complex concept. In addition to being paid, it also carries a guarantee, certification of the parties ' consent to the transaction.

The differences between the terms "deposit" and "vans" should be considered in certain ways.

Table: differences between advance and deposit

| Comparison directions | Advance | Charges |

| Reference in legislation | None | Article 380 of the Russian Criminal Code |

| Refunds by seller | Yes (one time) | Yes (duplicate) |

| Buyer ' s Refund | Yes (one time) | At the seller ' s discretion (no obligation to return.) |

| Return to force majeure | Yes (one time) | Yes (one time) |

| Documentation | The drafting of a document is not required, usually referred to in the text of the main treaty. | A special deposit or receipt contract is being drawn up. |

| Functions to be performed | paid |

|

If a firm decision is made to purchase a particular apartment, the buyer is interested in providing the deposit; if the seller refuses to conclude the contract, the buyer will not remain in the bill but will receive double compensation.

If, however, the buyer decides to reserve the property but continues to seek a better dwelling, the advance money will be returned if the pre-agreement is abandoned.

Limitations on the application of deposit and advance

There are no restrictions on the use of the advance.

For the purpose of making a claim, the limitation is as follows: it relates to certain features of the disposition of real property; for example, a contract for the sale of immovable property is considered to have been concluded only after it has been registered by the State.

If a deposit condition is included, it will not be effective until the document is issued in Rosreister; the amount of advance payments received in such a situation will be considered as an advance; therefore, no return sanctions will be imposed.

The same applies to long-term leases.

It was important to avoid such situations by concluding a preliminary treaty, which did not need to be registered in Rosreister, which would enter into force at the time of its signature.

How to make a good document when buying real estate

When transferring money to the other party to the transaction, it is important that all the papers be processed correctly. Some rules should be taken into account:

- There is therefore no mandatory requirement for a separate advance document; therefore, if the parties have agreed on a deposit but have not produced any document, the monetary amount in question will be considered as an advance from a legal point of view;

- Another important point is the mandatory notarization of the deposit agreement;

- In determining the amount of the advance payment, the matter must be considered; on the one hand, the value to be applied must be tangible, on the other hand, limiting possible fraud; the standard is 5 to 10 per cent of the value of the transaction to be concluded.

Important: The law defines a limitation on the value of the deposit with the budget organization, in which case it may not exceed 20 per cent.

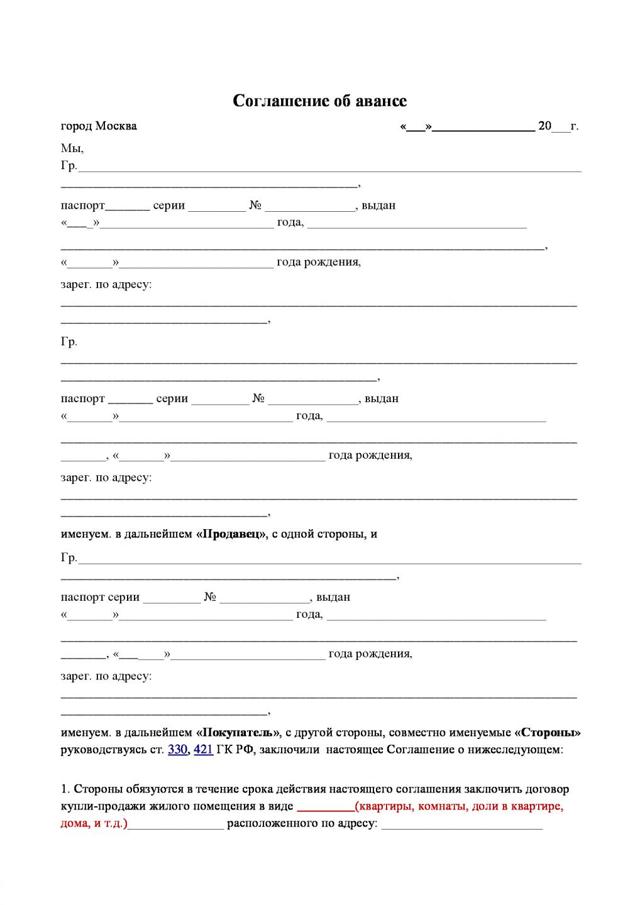

Advance agreement

In practice, a separate advance agreement is rarely concluded, usually included in the main or preliminary agreement, which indicates the amount of the money and the time frame for making it.

The following items are required for the issuance of a separate advance document:

- The agreement shall include data on the parties to the main contract.

- Information on the subject matter of the transaction shall be provided and a detailed description shall be provided. Details of the full value of the transaction shall be provided.

- The amount of the advance paid is fixed. It is usually calculated as a percentage of the total transaction price. The remaining amount and the time of payment is specified.

- The due date for the advance must be recorded.

- The way in which the money is transferred is determined. There may be several options. If a decision is made to use a cash-free form of payment, it is necessary to submit the details of the bank through which it will be made. If a cash advance is received, a receipt must be made in the transfer of the money. This should be done in the presence of witnesses. The books must be re-calculated. The option of opening a bank cell is possible.

- The intended consequences of the failure of the transaction are specified and the penalties are specified for each party in case of breach of the terms of the contract.

Usually, there's a lot of money as an advance.

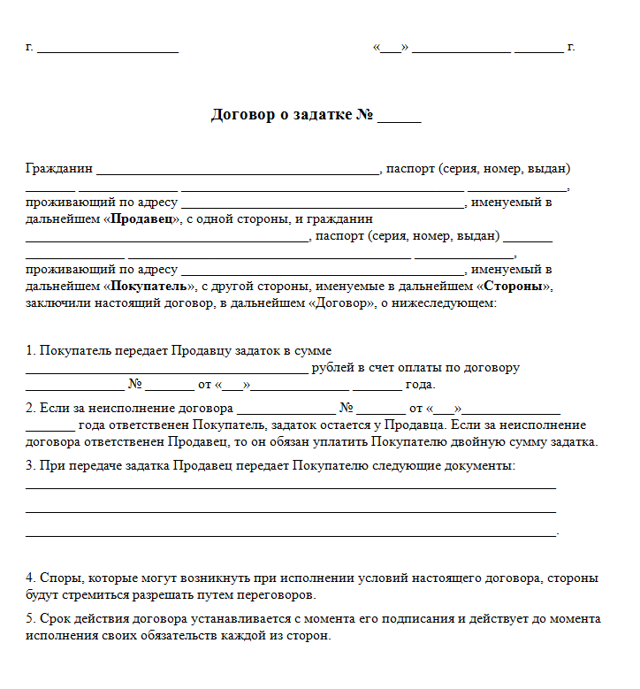

Deposit Treaty

The deposit document is not of a strictly fixed form; according to the SC of the Russian Federation, the main requirement is to be written; this document is considered provisional and must contain certain sections:

- The title of the document must be recorded and the word "requisites" must be included. It may be "the deposit treaty" or "the deposit agreement".

- The document contains basic information on the buyer and seller: the IFI, the passport, the date of birth and the place of registration for the natural person should be entered into; if the party to the transaction is a legal entity, the name, INN, legal address and the person authorized to conclude the agreement shall be entered into the contract of the organization.

- All information on the subject matter of the transaction shall be specified. If it is an apartment purchased, the full description shall be given: address, location in the house and on the floor, area full and living, number of rooms, and room metres.

- The amount to be paid is fixed. It must be indicated in writing.

- The timing of the performance of the obligations by both parties to the transaction is specified, and it would be better if the same document dealt with all possible consequences when the terms of the main contract were breached, thus avoiding serious conflicts.

- There should be a place for drafting and the date of issuance of the document.

- The document is certified by the parties to the transaction.

If witnesses are present at the writing of the contract and the transfer of the money, it will increase the weight of the document.

How to Avoid Fraud in Buying an apartment

The issue of pre-payment usually arises in transactions where the price is high enough; the transfer of money as an advance or deposit carries certain risks that are linked to the possibility of deception in the provision of goods or services.

One of the fraudsters ' schemes is the receipt of a deposit and the disruption of a transaction, and the contract sets out a time frame for the return of funds in case of breach of obligations.

The seller then defers to the point where the buyer misses the period when the deposit is likely to be returned, after which the seller refuses to enter into the underlying contract.

As a result, the buyer loses its money.

In order to reduce the risk of being deceived, the advance or deposit should be documented

When selling an apartment, the seller can obtain a deposit from a number of persons, one of whom is in fact a contract and the real estate passes to the buyer, then the fraudster disappears and the fraudulent buyers continue the legal proceedings with the new owner of the dwelling, and this risk can be significantly reduced when the document is issued.

But it is not always possible to save a contract from fraudsters. When prepaid and issued, the buyer discovers that the transaction is unclean. In such a situation, the buyer initiates its breakup, and therefore does not receive the sum it has paid back.

The long-term advance granted, although subsequently recovered, is the provision of interest-free credit to fraudsters.

There are certain rules to be followed in order not to get caught by fraudsters:

- Always document the transfer of funds.

- A small deposit or advance should be made. If the seller agrees to a larger payment, the transaction should be abandoned.

- It is necessary to know the conditions under which the payment will be lost, and it is better to consult a lawyer on this point.

You can't get a single answer to the question of whether an advance is better or a deposit. The deposit is the possibility of obtaining a guarantee in the course of a transaction.

Advance - advance payment made in advance for a service or goods to be received or executed at a later date; in each situation, the pros and cons should be weighed.

If it is not possible to make a decision on its own, legal advice should be sought.

You didn't find what you were looking for? Go back to finding the flats according to the parameters of the model project. Support the project, tell me about the tipdoma.com on social media:

Prepaid on the purchase of an apartment

Last update: 27.03.2022

Prepaid for the sale of an apartment- is a small fraction of its value, which the buyer gives to the seller, thus confirming its intention to buy this apartment from him.

Prepaid for the sale of an apartment- is a small fraction of its value, which the buyer gives to the seller, thus confirming its intention to buy this apartment from him.

In the secondary market, between physical persons, the money is usually transferred in cash, from hand to hand, and when purchased from Devolper, the money is deposited in the organization ' s cash register, or transferred anonymously to its account, as the first (security) payment.

In the primary marketSo what we're going to look at is the case where the buyer itself influences the advance payment process and negotiates the terms of the prepayment itself – that is, the case of the buyer.for the secondary market.

Prepaid rentIn sales transactions, the contract (agreement) is entered into for a specified period of time and is counted in the amount of future payment of the transaction.Prepaidthe owner of the dwelling (the seller) and his or her trusted person, i.e. the real estate agency that sells his or her apartment.

PrepaidWhen buying an apartment, it may be presented in the form ofdepositorAdvancesWhat is the difference between these two options?Policy differences between deposit and advanceWhat is more commonly used in real estate market practices and why?

Charges on the purchase of an apartment

Charges- it's a uniform.Prepaid rentswhere, in the event that the transaction was not caused by the buyer, the value of the deposit shall be retained by the seller.

Charges- it's a uniform.Prepaid rentswhere, in the event that the transaction was not caused by the buyer, the value of the deposit shall be retained by the seller.

In the event that the transaction did not take place within the specified period at the seller ' s fault, the seller is obliged to return the amount.depositBuyerDuplicate.

So,deposithas a function in it.effective enforcement of obligationsThe party responsible for the failure of the transaction is financially liable.

It seemed logical, but it was because of financial responsibility,deposit agreementWhen buying an apartment, it is rarely used.

In particular, real estate agencies,PrepaidFor a sold apartment, they almost never take it in uniform.depositand, accordingly, are not financially liable if the transaction was disrupted by their client, the seller of the apartment.

In fact,depositThis concept is regulated by law and is described in the Civil Code (arts. 380, 381 of the Criminal Code of the Russian Federation).

Unlikedeposita clear definition of the concept"Vans"Not in the HC, but still.advanceIt is considered that if, in the case of the introduction of the vehicle, the use of the vehicle shall be carried out in accordance with the provisions of this Regulation, it shall be deemed to have been carried out in accordance with the rules of procedure of the Working Party on the Transport of Dangerous Goods and the Working Party on the Transport of Dangerous Goods and the Working Party on the Transport of Dangerous Goods and the Working Party on the Transport of Dangerous Goods and on the Transport of Dangerous Goods and on the Transport of Dangerous Goods and on the Transport of Dangerous Goods, as amended by the Working Party on the Transport of Dangerous Goods on the Transport of Dangerous Goods and on the Transport of Dangerous Goods and on the Transport of Dangerous Goods and on the Transport of Dangerous Goods and on the Transport of Dangerous Goods, as amended by the Working Party on the Transport of Dangerous Goods on the Transport of Dangerous Goods and on the Transport of Dangerous Goods and on the Transport of Dangerous Goods.Prepaid paymentsthe parties did not expressly state in the contract/agreement that it wasdepositthe law treats this amount asadvance(P.3, art. 380, SC of the Russian Federation).

Model Treaty of DepositWhen buying and selling a second-hand apartment, you can download it here.

Advance in the purchase of an apartment

AdvanceAmount recognizedPrepaid paymentstransferred by the buyer to the seller for future payment of the transaction, butwithout a security functionI mean, if the deal didn't happen for any reason--advanceIt's just that he's coming back to the buyer, and no one's really responsible.

AdvanceAmount recognizedPrepaid paymentstransferred by the buyer to the seller for future payment of the transaction, butwithout a security functionI mean, if the deal didn't happen for any reason--advanceIt's just that he's coming back to the buyer, and no one's really responsible.

As a matter of fact,advance- It's what it is.depositIt doesn't matter as a matter of fact, because it's not a guarantee of the buyer's obligation to buy a given apartment.

In practice, sellers tend to avoid accepting advance payments on terms and conditions.deposit, but prefer to accept.........................................advancebut not "pure", but with additional conditions.

In the Advance Treaty, provision is made forPenaltiesFrom the buyer's side.

if the buyer unjustifiably refuses to buy an apartment,advanceHe's not coming back (detained as a fine), but if the seller has changed his mind to sell the apartment, he's just returning the amount.AdvancesBuyer without any fines.

These are not equal conditions, but this is the practice of the market, and the possibility of such prepayment (with additional conditions of advance) is enshrined in article 381.1 of the Russian Civil Code.

AcceptanceAdvances(notdeposit), in particular, facilitate the construction of "alternate transactions" and "chains", as a result of the fact that there is a lack of transparency in the design of alternative transactions.

Here, one seller is dependent on the other seller in the chain and takes financial responsibility for the disruption of the transaction, in the case ofdeposit- would be unreasonable.

Therefore, when designing chains, they always applyadvance.

How to organize monetary calculations in an alternative dwelling transaction- see reference.

Advance agreement for the purchase of an apartment

Secondary marketAdvance agreement (or agreement)is prepared in arbitrary writing between physical persons, the direct participants in the transaction, the buyer and the seller (the same applies to anddeposit).

Options are allowed whenadvancemay make or accept a trustee on behalf of the Buyer or the Vendor, respectively, or a real estate agency.

Advance agreement for the apartmentThe notary, among other things, is the official witness to the actual transfer of money, which makes it more difficult for the seller to avoid liability in the event of a breakdown of the transaction.

What if the seller is not discharged from the sold apartment- look in that note.

Substantive conditionsAdvance agreementsare:Amountandperiodadvance paid,address...........................................................................andvalueapartments,FIO and passport dataBuyer and seller.

Substantive conditionsAdvance agreementsare:Amountandperiodadvance paid,address...........................................................................andvalueapartments,FIO and passport dataBuyer and seller.

It would also be desirable to indicateTreatykeythe terms and conditions of the transactionsuch as the conditions and the place where the mutual calculations are to be carried out (al, insane, etc.).

), the terms of the contract of sale (notarized or in simple writing), the allocation of transaction costs between the parties, and the amountAdvancesis included in the cost of the apartment being purchased.

BAdvance agreementshould be provided forterms of return and non-return of advanceand (if the parties deem it necessary) liability and penalties or damages in the event of refusal by one of the parties to conclude a transaction for the sale of the apartment under the terms of the agreed terms.

It is possible, for example, to draw up all the terms of the advance contract, taking into account the terms of the particular transaction, with the assistance of specialized lawyers (including remotely).

Model Advance TreatyWhen buying and selling a second-hand apartment, you can download it here.

Treaty of depositThe treaty would then be subject to the provisions of articles 380 and 381 of the Code of Criminal Procedure (receivability).

Can an advance or a deposit be refunded if you change your mind about buying an apartment?- see this note.

RoleAdvance agreementsmay carry out andPreliminary contract for the sale of an apartment (PAC)between the "secondary" physicals (not to be confused with the CCP between the developer and the developer).

In fact, it's the same thing asAdvance agreementbut emphasis is placed here on listing the terms of a future transaction to which a pre-payment is entered into (advance) Several real estate agencies use such RAPs.

In the primary market, instead ofAdvance agreementsThe developer can useAgreement on reservation/prefabrication of flatsthat the essence of such an agreement does not change either.

The difference here is that when you buy a new building, it's the same thing that's going to be paid for.Prepayment(i.e. apartments) does not yet exist.

Therefore, the identification of the apartment here takes place, as in the main contract with Devolper, according to the design document, rather than the real postal address.

Otherwise, all significant conditionsAdvance agreementsIt should also be respected here.

Exploiting a transaction by an experienced lawyer reduces the risks of EVERYBODY (especially for an apartment buyer).The services of specialized real estate lawyers can be found here.

- "REELTOR SECRETS":

Rules and sequences for the preparation of the dwelling transaction - look at the interactive map of the BACKGROUND INSTRUCTION(to be opened in the pop-up window) In particular, the relevant steps describe how the buyer of the dwelling should act when making an advance or deposit and how to act on the seller ' s receipt.

Advance, deposit, deposit - flight review

To solve your problem, you'll get it now.

Free consultation:

Show Content

The deposit, the advance, and the deposit - we learn to distinguish

There are three concepts of first deposit -- bail, deposit, and advance -- which are legally completely different, which are also different.

- Charges- security of the buyer ' s obligations to the seller (i.e., confirmation of its serious intention to buy an apartment), as well as part of the value of the real estate, prepayment. Under the terms of the deposit, if one of the parties fails to fulfil its obligations within a clearly defined time frame, it pays the aggrieved party a default. If the obligation is breached by the buyer, the seller is entitled to keep the deposit. If the seller has not fulfilled the terms, the penalty is doubled to the buyer. In any case, the deposit is not refundable. Unless the transaction has taken place and the seller or buyer is guilty.

- AdvanceWhen buying an apartment, a more mobile way of prepayment. In the case of a failed sale, the seller simply returns the advance at full cost to the buyer.

Both the advance and the deposit are recorded as part of the total cost of the dwelling.

- BailThe buyer makes a deposit in lieu of money, followed by an unconditional obligation to repay the debt.

The advance does not require a clearly defined amount; this is part of the value of the dwelling, which will be significant enough for both parties to the transaction, and will be commensurate with the cotton of the seller or vendors in the ongoing relocation, the search for a new dwelling and others.

I mean,the amount of the advance - the concept of strictly individualBetween the parties to the transaction, although it is customary to adjust the amount between 5 and 10 per cent of the value of the dwelling, it is important that the arguments be relevant and supported by the actual situation.

Moreover, in any event, the injured party would be able to return the advance in full.

Another question about deposit: The amount is irrecoverable under any circumstances, the only question is whether it goes to the purchase account or to the default account, so it is much more difficult and more responsible to decide on the amount.

The interest is also determined by the parties on the basis of mutual agreement. The more the value and the desire to have this particular dwelling, the more the amount is offered, so it is difficult, as a percentage, to identify statistical averages of the deposit.

Bail and deposit

The deposit agreement containsSuch positionsas:

- The price of real estate;

- Its characteristics are the area, the number of rooms, the characteristics;

- Address of the dwelling sold;

- Amount of deposit;

- Information on the parties to the transaction – F. I. O., passport data;

- The time frame for the fulfilment of the obligations of the parties.

A written advance agreement also specifies the duration of the sale transaction, the terms of return, and fines in case of refusal of the transaction.

The bond is often made with the participation of a notary, and the bail agreement contains many positions that spell out the obligations of the parties – the pledgeor and the pledge holder – before the transaction.Core provisions of the treaty:

- The distribution of the roles of the parties - the pledgeor and the pledge holder;

- Information on the claims that secure the pledge, i.e. the main contract;

- Information on the property that is the subject of the pledge, a description of the exact characteristics;

- Whether the subject matter of the pledge can be replaced, with what conditions;

- Obligations, rights of the pledgeor and of the pledge holder in detail (rights of use of collateral by the pledge holder, terms of return, non-return of property, etc.);

- The ratio of the assets to which the claim is made;

- What are the risks and responsibilities of both sides;

- The period of validity, conditions of change, etc., the details of the parties to the transaction.

The collateral insurance will be an excellent additional step, and the transfer of the property itself takes place after the signing of the bond.

At the end of the bond contract, taking into account the obligations of both parties, the pre-existing property is transferred to the primary owner, the pledgeor.

You can return bail for other reasons.if the terms set out in the contract permit this, in most cases it depends on the subject matter of the pledge.

The security of various types of property, not only immovable property, is regulated by separate laws; the legal relationship of the parties may not even be considered as collateral at all.

Various expenses for the purchase of an apartment

In addition to the principal value, the buyer has to take into account additional costs in the search, transaction and registration of the property for the new owner.

- Consider the value of the sales contract, which would amount to a minimum of 3,000 roubles or more.

- The next expense is a government fee for the registration of housing, as well as the registration itself.

- If the buyer uses the services of the bank to settle with the seller, fees and other contributions are unavoidable, especially in the case of mortgage payments, etc., then the bank will also require insurance for the home and life of the owner.

- Married couples notarize a mutual agreement for the sale-purchase of an apartment. Without this paper, the deal is impossible.

- The power of attorney (if necessary) to sign the transaction would be less than 1,000 roubles instead of the buyer.

- The real estate tax is sometimes a big waste, especially if you buy or sell an apartment, which changed the owner less than three years ago because of the legacy, the sale, etc.

Realtoral commissions: How not to overpay

You may need real estate services or agency to search and process. You may have to choose whether you want time or money. Either you look for an apartment yourself or you pay the money and do it for you.3-6 per cent of the cost of housing purchasedIn addition to the cost of several parallel services, specialists, it's going to be more expensive than they promised at first, which includes:

You may need real estate services or agency to search and process. You may have to choose whether you want time or money. Either you look for an apartment yourself or you pay the money and do it for you.3-6 per cent of the cost of housing purchasedIn addition to the cost of several parallel services, specialists, it's going to be more expensive than they promised at first, which includes:

- Monitoring of the real estate market according to the purchaser ' s specified parameters;

- An inspection of the dwelling;

- Verification and preparation of documents of the parties to the transaction.

There are a lot of real estate frauds, which involve small-time agencies, freshmen, so it's better to go to time-tested companies, even though they have higher prices.

All services provided must be specified in a contract between the buyer and the agency.

So all kinds of duties, taxes, extra expenses are paid by the buyer on its own, and the realtor has nothing to do with it.

The services to be provided, as well as possible additional services, are discussed with the agent in advance and the cooperation paper is signed.

It happens.2 types of tarifficationMediation services:

- A flat rate for specific services with any type of real estate;

- As a percentage of the cost of housing, a particularly high fee is requested for out-of-town facilities.

If the agency works with interest, what is it going to do with the estimated amount on which the increase in the rate depends, because even 1% is a serious amount in such transactions.

Conclusion

As a result, the financial and legal issues involved in real estate transactions are very closely linked, so any financial transactions should be documented on a sheet of paper with mutual signatures, which would be a strong argument in the event of dissatisfaction by one of the parties or litigation.

We've already realized that you have a particular problem.

Call, we'll decide:

What's the difference between an advance and a deposit when you buy an apartment?

Charges

The deposit is the sum of money that the seller receives from the buyer as an advance payment for the dwelling, as well as for the purpose of guaranteeing the transaction. If the transaction is successful, the deposit is credited to payment. The concepts and functions of the deposit are set out in the Civil Code of the Russian Federation.

The characteristics of the deposit are as follows:

- The contract of deposit shall be concluded exclusively in writing and shall enter into force after the contract of sale of the dwelling has been registered.

- The contract should clearly state that the amount transferred is a deposit.

- All the parameters of the real estate, the full details of the parties, as well as the real amount of the transaction, must be specified.

The deposit is not just a guarantee for the seller; if the sales contract is not signed by the seller, it will have to return the double deposit to the buyer.

To download a sample of the deposit when buying an apartment.

If, after signing the deposit, the seller would be interested in buying the property at a higher price, it would be interested only if the difference in value was greater than the loss of the double deposit.

The buyer, if he finds a cheaper purchase option, will also compare the benefit to the loss of the deposit, so the greater the amount, the more likely it is that neither party will refuse the transaction.

The amount of the deposit is not regulated by law.

Before entering into a contract, the buyer should verify the following points:

- The seller has title documents and all the information in them is correct.

- All property owners are present at the conclusion of the transaction and agree to the sale of the dwelling.

- Only real estate owners can receive the deposit!

- The contract of deposit is usually certified by the notary, which incurs additional costs for notary services.

If the seller did not make the transaction and the buyer could not receive the payment due to it, he could apply to the court, and the decision was very likely to be in favour of the injured party.

Advance

The advance is part of the payment for real estate made by the buyer before the transaction takes place; the advance has a purely payment function and has no guarantee of sale; the procedure for making it is not clearly prescribed in the law.

If the transaction does not take place, the seller returns the advance to the buyer; therefore, there is no possibility of loss of money for the seller, but there is no guarantee that the transaction will take place. The buyer ' s wish to make the advance, not the deposit, usually discourages the seller.

Since this may indicate a lack of seriousness of intent.

An advance should also be made in writing, and the contract or receipt should contain real amounts, as well as full information on the parties ' real estate and claims.

To download a sample of the advance agreement when buying the apartment (blank).

Due to the poor settlement of the advance process in the purchase of housing, there is a high risk that fraudsters will be encountered by the buyer, and there are also cases where the advance is taken by an agency that may also commit fraudulent acts.

If the advance has not been recovered and the failed buyer has applied to the court, the decision may depend on many nuances.

What's better?

The reason why the transaction did not take place may be very diverse and not depend on the personal will of the buyer or seller, but the other party has the right to demand the performance of the contract of deposit, and it is unlikely that it will come to grips with the problems of the party that refused the transaction.

The deposit is more attractive to the buyer if he is very interested in buying a particular dwelling; for example, the house or apartment is ideal for personal requests, and it is very difficult to find another such option; the seller will also insist on the deposit if the price of the dwelling is high, and it is more likely that the buyer will find a more appropriate option.

Each option may be more appropriate in a given situation.

In any event, before entering into a contract of advance or deposit and transfer of money, it is necessary to ascertain whether all documents are available and whether the proposed sale is authorized.

If a person is unable to fully appreciate the proper drafting of a contract, legal counsel is required; a properly drafted contract will help to protect rights in the event of a dispute.

If you need help with the sale of an apartment, our on-call online lawyer is ready to respond promptly to all your questions, as well as to prepare all the necessary contracts and receipts for you.

Advance or deposit in the purchase of an apartment - What's the difference?

The Main "Bought-Sales of the Apartment "What's the difference between advance and deposit when buying an apartment?

555 views

When buying an apartment to "book" an attractive object, the buyer often makes an advance or deposit on the condition that the seller will not sell the property, otherwise it will be obliged to return the money. Consider how these types of payment are different and which option is best used.

Definitions

The advance is generally understood as part of the value of the dwelling paid to the seller in advance; technically, it does not impose any obligations and the owner is entitled at any time to sell the dwelling to another buyer, returning the advance to the person who paid it.

The deposit is a serious obligation, and if you pay it, the buyer can't give up the transaction without a good reason, otherwise you can say goodbye to the money, no one can pay it back, and there is often an extra fine.

Example: If a person paid a deposit of 100,000 rubles and then turned down the deal, he would have to pay another 100,000 rubles as compensation for the time spent.

But most of all, this payment creates a problem for the seller, severely limiting it to a manoeuvre between the buyers; in fact, if the owner refuses to sell the apartment to the paying buyer, it will not only have to return what he took, but also pay the same "upper".

What's the difference between an advance and a deposit when buying an apartment?

The advance does not involve obligations and is not much different from the deposit. This is the main point to be taken into account. A term such as "vans" is not known by the law, but "deposit" is known. At the same time, if the document does not specifically state that the money paid is a deposit, the amount is considered as an advance payment for the purchase of real estate.

Real estate agencies, real estate agents and sellers prefer not to make additional commitments and therefore actively refuse to make deposits, choosing to take only advances.

On the other hand, the advance contract usually contains many paragraphs suggesting the possibility of unilateral termination of the contract, non-return of the money received, and so on.

Thus, this payment, in the case of the purchase of housing, is most often smooth as a deposit, although it is not.

What's better than an advance or a deposit when you buy an apartment?

For a buyer who wishes to retain the right to buy a given dwelling, the deposit is the most interesting and advantageous option; it creates the obligations required by the buyer.

From the point of view of the seller/real estateer, it's the best advance, because it can be returned at any time without any obligations and extra fines/issues.

When buying real estate, there are many problems and nuances that deserve close attention, free advice from experienced professionals will point to the most common situations that are important for the successful completion of the transaction, and they can also accompany the entire sales process in order to reduce any potential risks to a minimum.

If you want to solve your problem, then...:

- Please describe your situation to the lawyer on the online chat room;

- Write the question in the form below;

- Call +7.499)369-98-20 - Moscow and Moscow Region

- Call +7.812)926-06-15 - St. Petersburg and Region

What's the difference between deposit and advance?

Today, many people make advance payments when making real estate deals, but what is the difference between these types of advance payments? How is it correct to make advance or advance payments? And do you need to write down a deposit or advance in 2023? Next you will know the answers to these questions.

download document samples

Prepaid, deposit, advance and deposit on purchase of a dwelling

Prepayment is a certain amount of money that the buyer transfers to the seller's account as a preliminary payment under the sales contractThe pre-payment indicates the seriousness of the seller ' s intentions and is also used as a pre-payment to pay part of the rent for the purchase, and the model of the sales contract is here.

Prepayment must be recorded in the main contract of sale, but in some cases a separate prepayment contract is also allowed, which will be used as an annex to the main agreement.

There are two types of advance payment – deposit and advanceThe bond contract is also similar in meaning, but it does not involve the transfer of money, but of property.

These prepayment methods are very close in meaning, but they cannot be confused because they have a number of legal differences, and it must also be remembered that the following paragraphs should be written in the contract regarding prepayment:

- Data on the parties to the transaction;

- The amount of the advance payment and the date of payment;

- Reference to the main contract for the sale of an apartment;

- The type of advance payment - advance, deposit or deposit (if this information is not specified but the money is transferred, the default is that the money is paid as advance);

- Additional obligations that arise between the seller and the buyer after advance payment and liability in the event of a breach of those obligations;

- The signatures of the parties.

What's a deposit?

The deposit is the sum of money that is transferred by the buyer to the seller as a guarantee of the performance of the terms of the sales contract.The deposit is considered to be a form of prepayment.

The deposit agreement must be written and the text of the agreement must explicitly state that the money is a deposit (if it is not considered as an advance) The model of the deposit agreement can be downloaded here.

The deposit is not only a security but also a punitive function, since penalties are imposed in the event of the cancellation of the main contract of sale.If the transaction does take place, the deposit is recognized as part of the principal payment.

The amount of the deposit is not regulated by law, but when buying an apartment, the amount of the deposit is usually between 5 and 10 per cent of the value of the dwelling.

What's an advance?

Advance is also a monetary sum that the buyer transfers to the seller as advance payment.However, the advance is made only to confirm the seller ' s seriousness of intention, but not to enforce the agreement (then as a deposit and confirm the buyer ' s intention and is used as security).

If, for any reason, the main sales transaction did not take place, the seller was simply obliged to return the outstanding advance to the buyer, and there were no penalties for that cancellation.

Theoretically, an advance agreement for the purchase of an apartment may be made either orally or in writing, but in practice it is the written form that is used because it is more legally reliable; the model of an advance agreement is based on this reference.

The amount of the advance is also not regulated by law, and in practice the amount of the advance is between 5 and 10 per cent of the cost of the dwelling.

What's bail?

Bail is certain tangible objects that the buyer transfers to the seller's property as security for the transactionBail may be provided by any property (precious goods, household appliances, machinery) or by the dwelling itself (in which case the mortgage contract is referred to as a mortgage).

The bond agreement should include information on what to do with collateral in the event of the failure of the underlying transaction; for example, in the case of a mortgage contract, the mortgage would normally be tendered – after the sale, the money paid is returned to the buyer, and the rest will keep the bank. The model of the pledge contract can be downloaded from us.

The value of collateral is determined by consensus of the parties or by independent valuation of the market value of the facility.

What's the difference between advance, deposit and bail?

Now let's find out what makes the advance different from the deposit.The main difference between the two is that the deposit performs both a security and a punitive function, while the advance only performs a security function..

If, after the transfer of the money, the main sales contract was completed and the apartment moved to the new legal owner, the difference between the advance and the deposit could not be noticed.

If the sale of the dwelling fails, the difference between the pledge, the advance and the deposit will be immediately clear:

- If the advance payment was made in the form of an advance, in the case of cancellation of the underlying sale, the seller must return the advance to the buyer in full, without taking into account the guilt of each party;

- If the advance payment is made in the form of a deposit, then in the case of cancellation of the sale of the dwelling, a number of options are possible.

- If the advance payment is made in the form of a pledge, in the event of the failure of the underlying transaction the enforcement of the collateral is effected under the main contract.

What's better - deposit, advance, or bail?

Let's find out what's different about bail, deposit and advance when buying real estate:

- If the buyer is determined to buy an apartment and has no money problems, it is recommended that the contract of deposit be drawn up.

- If, in turn, the seller decides to sell the apartment and trusts its partner, it is recommended that the contract of deposit be drawn up.

- If a party is not sure of its own power or does not trust the partner, it is reasonable to limit itself to an advance agreement; such a contract can be terminated at any time and the cancellation will not result in a fine;

- A security agreement for the purchase of an apartment is rather rare, since the advance and deposit contracts are more convenient, the only exception to this rule is mortgage agreements.

Do you need a written form?

- All real estate transactions must be in writing, and the bond, advance or deposit on the purchase of an apartment is no exception to this rule.

- The contract of deposit or advance must be signed by all the parties to the transaction and include the following particulars: the parties to the contract (FIO, and the number and series of passports), the reference to the underlying sales contract, the amount of deposit or advance, the date of transfer of the money, and the rights and obligations that arise for each party after the conclusion of the contract.

- The written form allows for the legalization of the transfer of money and, at the time of registration of the contract of sale in Rosreister, a pre-payment contract must be provided together with other documents.

It should also be borne in mind that the transfer of money should be recorded not only through a pre-payment contract but also through the preparation of a receipt of receipt of money.The fact is, in practice, there are sometimes cases where, after the transfer of money, the seller begins to claim that it has not received the money from its partner – in which case the fraudulent buyer needs to go to court and prove the transfer of the money, and the receipt will act as such evidence; the model of the receipt is provided by reference.

What's not coming back, a deposit or an advance?

- If prepayment was made for the apartment, in the event of cancellation of the basic agreement, the money will not be returned to the buyer only in one case – if the contract of deposit has been entered into and if the buyer itself is responsible for the cancellation of the contract.

- If the seller is responsible for the cancellation of the agreement, the seller must return the money to the buyer in double amounts.

- If there is an advance contract, the money must be returned to the buyer in a standard amount, regardless of the fault of the party.

To watch a useful video

An advance apartment-- what does that mean?

During the choice of dwelling, the buyer may encounter the term "the apartment is in advance." What does that mean in 2023?This term means that someone has already made an advance or deposit on a given apartment.Does this mean that the buyer cannot make the seller a better offer?

If it is clearly stated in the agreement that the transfer of money imposes certain restrictions on the seller, in some cases the buyer is not in a position to make a proposal, and it will depend on what obligations are specified in the contract text.

- Let's say that the text of the contract states that once the money is transferred, the seller is not allowed to show and offer an apartment to any other person – in which case the other buyer is not really able to make its offer.

- Another situation: the text of the contract states that after the transfer of the money, the seller is obliged to remove the notice of sale of the apartment from the agency's website – in which case the possibility of making its offer remains.

- If the agreement does not prescribe restrictive measures, the buyer is fully entitled to make its offer.

It should be borne in mind that the existence or absence of restrictive measures in the contract does not affect the rules for the return of security; in other words, the seller may terminate the money transfer contract with the old buyer, but it must still return the advance payment to the standard (if there was an advance transaction) or double the value (if there was a deposit transaction).

Conclusion

Now you know what the difference is between an advance and a deposit and what a advance payment is.

Prepayment may take the form of advance and deposit, the main difference being that, if the underlying contract is cancelled, the advance must be returned to the seller, but if the contract is concluded, the perpetrator of the cancellation will be fined..

If the buyer is confident of its decision and the seller trusts it, it is recommended that a deposit be entered into as it is more reliable.

Advance and deposit: What to choose in making a transaction

It is no longer enough for a contract to be concluded simply to hit hands; therefore, in the practice of various transactions, including real estate transactions, interest and advance are increasingly used. Advances and deposites are the most common means of prepayment of a transaction.

But often people don't see the difference between a deposit and an advance, and this in turn can have undesirable consequences for the parties to the transaction. What kind of contract should be concluded – an advance or a deposit? To understand, it is necessary to understand the very legal nature of the terms "costs" and "wans".

So, what's a deposit?

The deposit is the monetary amount paid by one party to the other to the future payment of the transaction to ensure its execution and to confirm the seriousness of the intent to conduct the transaction.

The deposit is a means of securing the performance of obligations, i.e. resorting to the deposit is worth ensuring the performance of the contract.

The concept of deposit is defined in article 380 of the Civil Code.

What's an advance?

The advance is the amount that is transferred before the transaction is made by one party to the other to the payment due under the transaction. The purpose of the advance is to confirm the reality of the intent to perform the transaction but not to enforce it. The Civil Code does not contain separate articles on the advance.

What's the difference?

The difference is the consequences of termination and default – the security function of the deposit; if the transaction is made, the difference between the advance and the deposit is not noticed; however, if the transaction does not occur in the case of an advance, it simply returns.

The party responsible for the failure of the transaction shall not be subject to any penalty under the advance contract unless the parties to the advance contract have imposed a fine; in the case where the transaction was not caused by the party making the deposit (buyer), the deposit is lost and the deposit remains with the recipient (seller).

If the transaction is not attributable to the recipient of the deposit, the amount of the deposit must be returned in double amount, i.e., if the deposit is 100 roubles, the depositee is obliged to return 200 roubles; this rule is contained in article 381 of the Russian Civil Code and determines the most significant differences between the advance and the deposit. The deposit allows the parties to control each other.

The recipient of the deposit controls the money and the payer controls the liability in the form of a penalty in the amount of the deposit, which is the security function of the deposit.

Do you make money without writing?

In the case of real estate transactions, the deposit is always higher than that amount, so the deposit agreement must always be in writing; this rule is set out in article 380 of the Criminal Code of the Russian Federation, which allows the parties to confirm that money has been paid.

The deposit agreement may be drafted in an arbitrary form in the form of an agreement on the form of an organization or real estate agency, etc. The most important thing is that it is correct and contains the amount of the deposit and the following details: F.I.O.

of the parties or the name of the organization, their place of residence or legal address, the organization ' s passport or details, the time frame for performance of the obligations, the subject matter of the agreement (real property) indicating the address and other characteristics that permit the precise identification of the object, the signatures of the parties.

The same rules apply to the advance agreement, although a one-way receipt from the recipient of the advance may be made in the case of an advance.

Doubts - deposit or advance?

An oral deposit agreement produces the consequences provided for in article 162 of the Criminal Code of the Russian Federation, i.e. the parties are deprived of the right to rely on evidence but may provide written evidence.

In the event of doubt as to the award of the sums paid under the contract, those amounts would not be considered as a deposit, but as an advance, which did not perform the security function but was part of the future payment.

Violation of the form of the deposit agreement, until proven otherwise, has the same effect.

In real estate practice, there is the notion of a deposit, but if money is deposited into a real estate agency, the term is more appropriate to an advance payment or a security contribution.

The only function of this amount is to confirm the seriousness of the intent to conduct the transaction, since the "swap" is usually returned in the event of a breakdown of the transaction by either party; therefore, there is a serious confusion in terms and in the professional real estate environment.

However, if, due to this confusion, a document is drawn up calling the amount a deposit and indicating that the money is being paid to the seller, it will trigger the application of the deposit rules with all the consequences.

Limitations on the application of the deposit

There are several groups of contracts that are considered to have been concluded since the time of State registration, including all transactions in real estate, and contracts with non-residential premises and land are deemed to have been concluded since their signing.

This creates a situation in which the inclusion of a deposit clause in a treaty that enters into force from the time of State registration and the payment of the deposit amount prior to the State registration of such a treaty would not give rise to the sanctions provided for in the deposit provisions.

This is due to the fact that such treaties are deemed to have been concluded from the moment of State registration by virtue of article 433 (3) of the Criminal Code of the Russian Federation.

Fortunately, in such situations, the courts tend to recognize the amount in advance and it does return to the owner, but double return in the situation will have to be forgotten.

The same rule applies to leases concluded for more than a year, since contracts concluded for less than one year are not subject to State registration; the general practice of realtors with such amounts is to draw up a separate deposit document.

In order to avoid such a situation, those relations were usually placed in a separate treaty, for example, a preliminary one, which was not subject to State registration and entered into force at the time of signature.

Obviously, the advance is not good for the buyer, because if the deal doesn't take place, the money just comes back.

The buyer lost time, did not purchase real estate and did not receive any interest in the seller ' s use of its money; some unfair sellers may specifically take advances.

The purpose of such an operation may be to make free use of foreign funds, for example, of several potential buyers.

The deposit agreement is the most reliable way to enforce the transaction; even if the transaction fails because of the fault of the other party, the bearer of the deposit will be able to compensate for its losses.

However, for the same reason, the recipients of the deposit do not want to assume responsibility.

This contradiction is resolved by using a simple advance, which does not carry a security function, that is of such benefit to the payer (buyer).

Anton Lebedev, AF Lawyer, Yurinform-CENTRE, SPBGKA