Table of contents:

- What is the essence of the bill on shared sale of an apartment or private house?

- What functions does a notary perform?

- Pros and cons of the Federal Law on Shared Sale of an Apartment or Private House

- approximate cost

- Difficulties in connection with the innovation regarding the sale of a share of an apartment or house

- Consequences of the law

- Property of minors

- Conclusion

What is the essence of the bill on shared sale of an apartment or private house?

With the advent of the Federal Innovation, the right to alienate shared property began to have its own specific procedure. Previously, if you decided to sell an apartment or house, a regular mail notification was sufficient.

And now you need an agreement certified by a notary, even if in one transaction you want to make a complete alienation of absolutely all shares of real estate that you have.

The only exception to such a transaction may be certain investment funds.

According to the law, it is necessary that the owner notify in writing all persons involved in the transaction that he is going to sell his property.

The written document must contain all the necessary information regarding the terms of the sale, as well as an explanation of the reasons why the owner wants to complete this transaction.

At the same time, the document must also indicate the amount that he expects after the conclusion of the contract.

In fact, the sale of a share of a house or apartment can only occur a month after the relevant application appears. In addition, this operation can come into force if none of the parties involved in the shared real estate has any claims regarding the sale or objections in general. There is also an option that can help reduce the time required to conclude a contract. It lies in the lack of desire to acquire the same shared property by other owners. But in this case, the refusal must be in writing. Only under such conditions can a notary reduce the previously agreed period for execution of a transaction.

In fact, the sale of a share of a house or apartment can only occur a month after the relevant application appears. In addition, this operation can come into force if none of the parties involved in the shared real estate has any claims regarding the sale or objections in general. There is also an option that can help reduce the time required to conclude a contract. It lies in the lack of desire to acquire the same shared property by other owners. But in this case, the refusal must be in writing. Only under such conditions can a notary reduce the previously agreed period for execution of a transaction.

What functions does a notary perform?

The main task of a notary is to provide all the necessary conditions for compliance with all the rules of the contract by all parties to the transaction.

With the advent of innovations in the Federal Law, transactions for the purchase and sale of a share of real estate no longer took place without notifications, which were often associated with falsification of the signatures of the owners themselves.

Also, the notary must make sure that the persons participating in the transaction have reached mutual agreement regarding the transaction itself. To make sure of this, the notary must collect all the signatures, which will indicate that all parties involved in the agreement agree with everything and are ready to conclude a deal.

A very important element in the work of a notary is checking the authenticity of the transaction. If any suspicious or incomprehensible signs of the transaction agreement are identified, the notary must cease any actions related to the approval of such an agreement.

Pros and cons of the Federal Law on Shared Sale of an Apartment or Private House

The positive aspects of the innovations regarding the sale of real estate shares are:

A full check by the notary office of the rules of compliance with the purchase and sale transaction of a share of property by persons who have not reached the age of majority. This also applies to citizens who are incapacitated. In turn, this means that they are all responsible for ensuring that such agreements occur in accordance with the law.

A full check by the notary office of the rules of compliance with the purchase and sale transaction of a share of property by persons who have not reached the age of majority. This also applies to citizens who are incapacitated. In turn, this means that they are all responsible for ensuring that such agreements occur in accordance with the law. - From now on, notifications will be carried out in the following ways: either the seller will receive a refusal to purchase from the owner in writing, or the notary himself will send notifications about the upcoming sale to the owners by mail.

- The contract for the sale of shared property will be carried out only by the notary who will be located directly in your district.

- The deal will be concluded only between those citizens who are directly related to it. This means that third parties cannot participate in the transaction. That is, family members of both parties to the contract will not be able to have anything to do with the case, which thereby protects buyers from legal problems. This may be due to failure to respect the rights of people who are not related to this transaction.

Negative points can be considered:

- There are a relatively small number of notary offices in Russia, and this, in turn, can cause difficulties in conducting transactions.

- Payment for notary services when concluding an agreement. As a rule, such services are specified in the contract as “technical work”.

- An irreversible increase in the number of fictitious contracts for the sale of living space in order to avoid the possibility of obtaining permission for the transaction from a notary for other owners of the same apartment.

approximate cost

All tariffs are controlled by Article 333.24 of the Tax Code of the Russian Federation. This also applies to state duties. This law states that the total amount of duties on the total cost of the specified contract should be no more than half a percent. In this case, the amount should not exceed the limit of 20,000 rubles. The seller himself has the right to choose a more convenient method for accounting for value, the value of which will be presented in several options - cadastral or at market price. If there are both options for the cost of real estate, the specialist must choose the lowest price to take into account the different tariffs for the services offered.

All tariffs are controlled by Article 333.24 of the Tax Code of the Russian Federation. This also applies to state duties. This law states that the total amount of duties on the total cost of the specified contract should be no more than half a percent. In this case, the amount should not exceed the limit of 20,000 rubles. The seller himself has the right to choose a more convenient method for accounting for value, the value of which will be presented in several options - cadastral or at market price. If there are both options for the cost of real estate, the specialist must choose the lowest price to take into account the different tariffs for the services offered.

Difficulties in connection with the innovation regarding the sale of a share of an apartment or house

After a thorough analysis of all the features associated with the amendments to the bill, we can say that real estate owners may encounter various difficulties that cannot be excluded during the process of selling property, as well as when preparing legal documentation for the transfer of housing. Here is a list of problems that parties to the agreement may encounter:

- The main problem is the increasing cost of services. Previously, before the adoption of the law, to conclude a transaction it was enough to draw up a purchase and sale agreement for an apartment or house. But with the advent of amendments to the bill, persons participating in the transaction must now pay a fee for notary services. The amount of payments is half a percent of the total cost of the living space being sold, but with the condition that the minimum amount will be charged in an amount of no less than 300 rubles. There is also a limit, which is 20,000 rubles. In addition to the services provided by the notary, there may also be additional payments.

- Another equally important problem is that this procedure requires a lot of time. For example, if previously, before the adoption of the law, the entire procedure could take several days, now the period for completing such a procedure has become much longer. Currently, the waiting time can be up to one month. This period can be reduced provided that the remaining owners write a refusal to receive the proposed shared real estate. But this happens extremely rarely.

There is also a risk that the deal could fall through. This is possible provided that the parties involved in the transaction do not give their consent. Another reason may be related to the long wait for the implementation of the current contract.

There is also a risk that the deal could fall through. This is possible provided that the parties involved in the transaction do not give their consent. Another reason may be related to the long wait for the implementation of the current contract. - The workload of notary offices or their absence. People living in sparsely populated areas may most often encounter a problem of this nature.

When selling a share of an apartment, do not forget about fraud. Remember that before concluding any transaction, for example, you decide to buy or sell real estate, it is recommended to consult with a lawyer.

Consequences of the law

New amendments to the law have been adopted in order to reduce the risks associated with fraud. But this also entailed negative aspects. One of these moments resulted in an increase in the amount for the implementation of any transactions related to real estate.

In addition, with the increase in financial costs, the time required to alienate the living space has also increased. For example, this procedure might have required only one day, but now it takes at least a month. Plus, no one will give you a guarantee that the deal will definitely take place.

So, how to sell an apartment in shared ownership?

One very important point is that if you are the only copyright holder of the apartment, then you can conclude a purchase and sale transaction without first seeking help from specialists. But for this you must have a document confirming the conclusion of the purchase and sale agreement.

Property of minors

If the purchase and sale transaction of shared real estate is carried out by persons who have not reached the age of majority, then the presence of a purchase and sale agreement certified by a notary is a prerequisite.

Conclusion

From all of the above, we can conclude that the newly introduced Federal Law has introduced some order in concluding transactions for the purchase and sale of shared ownership.

The law can greatly help stop the illegal plans of scammers, thereby protecting ordinary citizens from scammers.

There were often cases when the new owner of a living space soon learned that his property could not rightfully belong to him.

This is due to the fact that the scammers were able to carry out a transaction under a false agreement to purchase a share of an apartment or house.

The chance of finding the perpetrators after such fraud is very low.

Today, specialists from the notary’s office are responsible for the legality and compliance of the transaction, who fully ensure control over the fulfillment of all the listed conditions by all participants in the process.

Selling an apartment in shared ownership, legal advice

When selling an apartment that is in shared ownership, each party to the transaction faces certain risks and difficulties:

- it is difficult for the seller to find a buyer and sell the share at a realistic price;

- co-owners are preventing the sale;

- other rights holders challenge the deal and demand the court to annul it;

- the buyer, after concluding the contract and paying, cannot register the acquired property.

You can solve the above problems yourself if you know the features of shared ownership and the legal regulations for its sale.

Features of the procedure

Property that has several rights holders is called common property. Art. 244 of the Civil Code defines it as shared if it is divided into shares between all owners.

It should be taken into account that an ordinary apartment, which is in shared ownership, is not divided in any way in reality. A share is just a number on paper, which only indicates the owner’s right to part of the property.

The exception is “apartments on the ground”, where each co-owner has a separate entrance, and the room is documented for him.

An example of such real estate are apartments in houses of a housing-rental cooperative partnership (ZhAKT), built back in the 20s of the last century.

All co-owners equally own and use the housing. For example, if a two-room apartment is shared by four owners, everyone can be in any of the rooms.

To avoid conflicts and disputes, the co-owners establish the procedure for using the housing: they determine to whom, which room is assigned, in what order the kitchen and bathroom should be used, and discuss other household issues. If you cannot reach an agreement on your own, the procedure for use will have to be established in court.

Each owner can donate, bequeath or pledge a share without regard to the opinions of other copyright holders.

Sale is possible only subject to the right of first refusal. Exception: sale of a share at public auction when the property of the debtor owner is foreclosed on.

Right of first refusal

The right of first refusal means that before selling a share to a third-party buyer, the seller must offer it to other apartment owners.

Art. 250 of the Civil Code obliges the seller to send a written notice to the property participants indicating the price and terms of the transaction. If no one and the co-owners buy out the share within a month, the seller has the right to enter into a purchase and sale agreement (SPA) with any other person.

If there are several willing co-owners, the owner of the share chooses the buyer himself.

If all co-owners have written a refusal and notarized it, the seller has the right to sell the share without waiting for the end of the month.

The law prohibits sales below the value stated in the notice. Otherwise, the transaction can be challenged.

Lawyers advise you to carefully consider the drafting of the document and the method of sending. In practice, there have been cases when a co-owner stated that he was not informed of the proposed sale and demanded that the rights and obligations of the buyer be transferred to himself. According to Art. 250 clause 3 of the Civil Code, he has the right to file a lawsuit on this issue within 3 months.

A sample notification can be found on the Internet, downloaded here, or written yourself, following the following filling procedure:

- In the top center indicate the name of the document: “Notice of sale of apartment”

- Below:

- Full name of the owner of the potential buyer, registration address;

- Seller's full name, address, phone number.

- Start with the phrase: “I am the owner.” Next, indicate the size of the share in the apartment, location address, price

- Offer to buy out the share.

- List the terms of the transaction.

- Ask to write and send consent or refusal to the specified address.

- Date, full name, seller's signature.

The methodological recommendations for notaries contained in Letter N 1033/03-16-3 dated March 26, 2016, allow only two methods of transmitting notices:

- By mail with notification. A receipt of dispatch, a document of receipt, a list of investments is proof of compliance with the right of first refusal.

- Through a notary. Expensive, but the most reliable option. The notary himself, according to all the rules, sends out the notice, after which he issues a certificate of transmission of the notice.

Documents confirming the notification of all rights holders must subsequently be attached to the application for registration of the rights of the new owner.

Options for selling a shared apartment

Real estate experts believe that it is extremely difficult to sell a separate share in an apartment and this can only be done when:

- one of the co-owners wants to become the sole owner;

- the share is tiny, sold at a low price and purchased for registration.

It is simpler and easier to find people willing to buy an entire apartment when all the co-owners have decided to sell their shares.

In this case, owners have two options:

- Sell your home together. The co-owners agree that one of them will complete the transaction. The proceeds from the sale are distributed according to the size of the shares. Consent must be notarized. All share owners must be present at the notary's office when concluding the DCT.

- Sold separately. Each owner is looking for buyers and selling the share independently.

The first option has more advantages than the second. More specifically, in the table below.

CriteriaTogetherSeparately| Compliance with the right of first refusal. | No need. | Necessarily. |

| Search for buyers. | Easily. | Difficult. |

| Possibility to buy with a mortgage. | Eat. | Unlikely. |

| State duty. | One for all co-owners, divided equally or according to shares. | Everyone pays for themselves. |

| Price. | Complies with the market. | According to experts, the price of a separate share is 30% lower than if it were first sold as part of a whole apartment and then divided. For example, if a share in a whole apartment costs 2 million rubles, then for a share sold separately, the seller will be able to ask for no more than 1.5 million rubles. |

| Determining the price. | It is not always possible to reach unanimous agreement. To avoid this, you should contact an independent appraiser. | Depends on the desire of the seller and market demand. |

Algorithm for selling an apartment

Regardless of the chosen method, the seller of a shared apartment takes the following steps.

Step 1. Decides how the apartment will be sold: jointly or separately.

Step 2. Determines the market value yourself, or by contacting an independent appraiser.

To set the right price, you need to study and compare many factors: year of construction, availability of amenities, proximity to infrastructure, class of apartment, etc. It is very difficult to take into account and conduct a competent analysis of all the components alone, without understanding the nuances of the real estate market. It is better to contact a specialist.

Expert opinion

- will eliminate unnecessary disputes between co-owners if they have made a unanimous decision to sell the apartment;

- may be necessary for buyers wishing to purchase real estate with a mortgage;

- will save time spent monitoring prices of similar housing.

Step 3. Sends a notice to co-owners if the apartment is sold in separate parts.

In the case of a joint sale, an agreement is entered into that one of the co-owners will represent the interests of the others. The agreement is certified by a notary.

Step 4. Prepares documents.

Some official paperwork may take a couple of months to complete, which means there is a risk of losing a potential buyer.

It is better to collect documents in advance:

- Proof of the seller’s identity is a passport if the owner is an adult. If the owner is under 14 years old - a birth certificate, from 14 to 18 years old both documents will be needed.

- Establishing rights (deed of gift, monetary contract, exchange or privatization).

- Proof of title: an extract from the Unified State Register of Real Estate, which allows the buyer to verify the purity of the proposed transaction, to ensure that there is no arrest, encumbrance, or a ban on sale. Data is generated at the time of request. The paper document is received at the MFC within three days. In electronic format - on the official website of Rosreestr within one day.

- Cadastral passport.

- Technical plan.

Issued within 2 weeks. It should be taken into account that the document officially does not have an expiration date, but the BTI requires it to be changed every five years. If more time has passed since the last production, you will have to make a new one. By law, a technical plan is not needed when completing a transaction. An exception is purchasing an apartment with a mortgage.

But MFC specialists sometimes require a document. Ordinary buyers also ask for it in order to check the data indicated on the paper with the real technical characteristics of the apartment and avoid possible discrepancies, for which they will later have to pay.

- Certificates from tax and utility services confirming the absence of debt.

- Extract from home book. You can get it from the EIRC free of charge on the day of application. It is taken no earlier than a month before the conclusion of the transaction.

- If the owner is a minor, permission from the guardianship and trusteeship authorities.

- If the apartment is sold in separate shares - confirmation of compliance with the right of first refusal (receipts for sending a notice, a certificate of transmission of a notice from a notary, refusal or consent of co-owners).

Step 5. Looks for a buyer.

To search, the seller needs:

- post an ad on the Internet on specialized websites (Avito, Domofon.ru), etc., in special social groups;

- give information to local media (newspaper, television);

- post offers for sale on bulletin boards;

- inform friends, colleagues;

- contact a real estate agency.

The more notification channels are involved, the higher the chance of selling the apartment quickly.

Step 6. Concludes a contract and has it notarized.

All transactions with shared real estate must be certified by a notary.

According to the law, the seller and buyer can independently draw up a written agreement. But in practice, most notaries do not accept “homemade” contracts, citing possible errors and lack of time to check. Typically, the DCT is prepared by the notary’s assistants, using pre-prepared templates.

Notarization will cost the seller 0.5 percent of the contract amount, but not more than 20 thousand rubles. (Article 333.24, paragraph 5 of the Tax Code).

The tariff is charged once. If the apartment is sold by shareholders jointly, the state duty is divided between them in equal shares (FNP Letter dated June 22, 2016 N 2173/03-16-3).

Step 7. Receives a deposit.

In almost all real estate transactions, the buyer makes a deposit - an agreed amount that guarantees the conclusion of the transaction. In case of refusal to sell, the owner will have to return the advance payment in double amount. If the buyer refuses, the money will remain with the seller (Article 381 of the Civil Code).

The deposit is taken into account in the cost of the apartment upon final completion of the transaction. In the case of a mortgage, the bank will deduct this amount from the down payment.

For the deposit to have full legal force, it is necessary:

- Sign the deposit agreement, which must be executed exclusively in writing (Article 380, paragraph 2 of the Civil Code).

- Draw up and certify with signatures a preliminary DCT, indicating in it the amount, conditions for receiving the deposit, the date of conclusion of the main agreement and the consequences of refusal by one of the parties.

- The seller writes a receipt for receipt of money, which remains with the buyer until the final completion of the transaction.

Step 8. Submits documents for registration to Rosreestr.

After signing the DCT, the bill of sale and a package of documents are transferred independently or through a notary to Rosreestr to formalize the transfer of ownership to the new owner. After checking the legality of the transaction, the buyer receives an extract from the Unified State Register of Real Estate, confirming that he is now the owner of the apartment.

The document readiness period is determined by Art. 16 Federal Law 218 and depends on the organization through which the right is registered:

- 3 working days if the documents are submitted directly to the state registration authority or the registration is carried out by a notary conducting the transaction;

- 5 working days when contacting the MFC.

Step 9. Receives the rest of the money.

As a rule, the parties make full payments only after confirmation of the transfer of ownership.

For the financial security of each party, there are three options for transferring money:

- Through a safe deposit box. Usually the buyer rents it at his own expense by presenting a contract, but the opposite is also possible. The lease agreement specifies the terms and conditions of access to the cell. The money is placed in a safe in the presence of participants in the procedure and is locked with two locks. The key to one is given to the seller, the other remains with the bank employee. The former owner of the apartment will be able to withdraw the money only by presenting an extract from the Unified State Register or another document specified in the contract.

- Through a letter of credit. The buyer opens a special account in which the required amount is reserved. As soon as confirmation of the transfer of ownership is received, the bank will transfer the money to the seller.

- Through a notary's deposit account. Similar to the second option. Only the buyer does not need to open a new account; the money is deposited with the notary. After receiving an extract from the Unified State Register of Real Estate, the notary transfers them to the former owner.

Step 10. Pays tax.

Having sold a shared apartment, each owner must pay sales tax - 13% of the share size.

The law defines situations in which the seller is completely exempt from paying tax:

- if he bought, acquired a share before January 1, 2016, received it as a result of a gift, will, privatization and owned the property for more than three years from the date of registration of the right;

- the share was acquired later than January 1, 2016 and was owned for at least five years

- the cost of the share is equal to or less than 1 million rubles, regardless of the period of ownership.

It is necessary to take into account that it makes no sense to greatly underestimate the price in the DCT, hoping to save on tax. According to the latest changes in the law, the tax office will still take no less than 70% of the cadastral value of the share, which was established in the year of the transaction.

The tax can be reduced through a tax deduction, which amounts to 1 million rubles.

Conclusion

At first glance, selling a shared apartment seems like a complicated matter. In practice, it turns out that everything is not so difficult. The need for a notary's participation eliminates all possible risks and legal consequences of the transaction. Compliance with the right of first refusal allows you to take into account the interests of all interested parties and prevent conflicts and disagreements between co-owners.

Dear readers!

Important! Problems related to housing fall into the category of complex cases. Consult for free with the specialists of our “Legal Center”

Moscow: +7 (499) 704-7078

Purchase of an apartment in shared ownership by spouses in 2023

to ask a lawyer . It's free!

Buying an apartment in shared ownership by spouses has its own characteristics.

According to the law, the “default” regime is the acquisition of real estate into common ownership, and then the spouses can divide it into shares.

But there are options to immediately distribute shares of ownership when necessary, for example, to obtain a tax deduction for one of the spouses.

Features of types of property

Shared ownership is a mode of ownership of an object in which each co-owner is allocated a separate part of the property.

Proportional shares can be allocated, for example, each owner owns 1/2 or 1/4, or uneven shares: for example, the husband can own 2/3, and the wife – 1/3.

This uneven distribution is usually used to obtain a property deduction.

In any case, property purchased during marriage is considered jointly acquired and will be divided in half upon divorce. The shares will be considered divided proportionally.

Unlike joint property, when a spouse cannot sell property without the permission of the other co-owners, the owner of a share can sell, donate, or bequeath it, essentially turning the property into a communal apartment . But, of course, the second party will have the priority right of redemption, so it will be necessary to obtain a refusal from the remaining co-owners of the property to purchase the share.

Purchase terms

The Civil Code of the Russian Federation states that by default, when spouses purchase housing, the regime of joint ownership applies. This rule continues in 2023. Most often, real estate is registered in the name of one of the spouses - it’s easier with documents.

But it is possible to acquire shared ownership, i.e. register for each spouse his part of the apartment, for example, in the following cases:

- when signing an agreement on the division of property after registration of joint ownership (the so-called allocation of shares, is carried out with the participation of a notary);

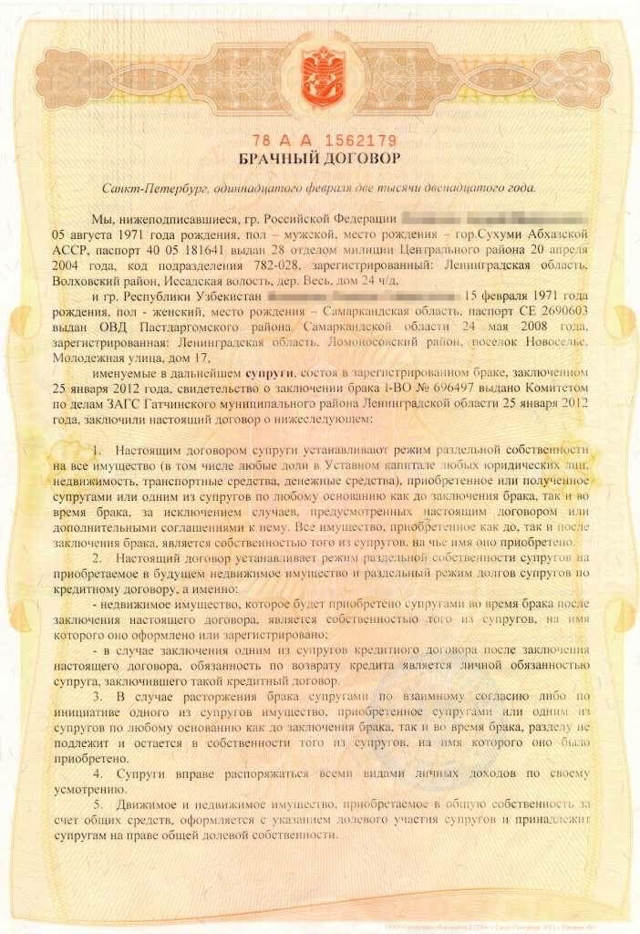

- when signing a marriage contract, and it can be drawn up both before and after the transaction;

- the acquisition by each spouse of a share in the apartment separately using their own funds not acquired during the marriage, for example, with donated money or proceeds from the sale of personal property.

In any case, the algorithm for purchasing an apartment by a husband and wife in shared ownership is practically no different from the usual procedure. Several nuances should be taken into account, for example, specifying the shares of each owner in the agreement, as well as paying the cost of the property separately for each share.

The role of the marriage contract

A marriage contract drawn up between spouses is the most significant document that regulates the distribution of shares. A husband and wife can agree on how their share of property will be distributed between them in the event of a divorce. It no longer matters how the apartment was purchased, to whom it was officially registered and other factors.

The amount of shares specified in the marriage contract remains with the former spouses in the event of divorce.

If you take out a mortgage

If the apartment was purchased with a mortgage, then it is registered as the joint property of the spouses. The mortgagee of the mortgaged apartment is the bank. The parties cannot allocate shares until they pay off the debt and remove the encumbrance.

After paying off the mortgage, the parties can arbitrarily distribute the shares depending on their needs - or leave the housing in joint ownership.

The situation is more complicated when the spouses divorced while the mortgage was being repaid. In this case, the issue of dividing shares and debt obligations is resolved jointly with the bank. Spouses can divide the home immediately and take out a separate loan for each share, or they can divide the property later, after paying off the entire mortgage.

In shared construction

Many families try to purchase housing during the construction stage, as it is much cheaper. At the same time, when purchasing, general money is invested in the “top-up”. At the same time, the contract itself can be drawn up for both spouses, or for one of them - but from the point of view of the law, there is no difference between the forms.

When spouses purchase housing under the DDU, the property is transferred to the category of common property, which is reflected when registering ownership rights after completion of construction. The apartment is registered in the name of the person indicated in the DDU, but when dividing property in the event of a divorce, it is divided equally between the spouses.

The parties can enter into a marriage contract in which they stipulate the size of their shares. It may be signed during the construction stage, but the provisions of the contract will come into force after construction is completed.

If the share is allocated to children

Children can become homeowners in the following cases:

- if housing was purchased with maternity capital funds;

- if the parents decided to voluntarily allocate shares to them (donate them);

- if an alternative transaction is made with the allocation of a similar share to a minor.

Buying a home with children among the owners is associated with a number of features: according to the law, parents cannot take shares belonging to their children, and vice versa . Therefore, shares in the apartment being purchased must be allocated immediately. Such property cannot be shared. In addition, such a transaction takes place under the control of the guardianship authorities.

In what cases is a notary needed?

Notarization of a transaction requires expenses, and significant ones at that. Therefore, you should immediately understand whether a notary is needed when conducting transactions.

In accordance with the latest amendments, certification of a transaction by a notary is required only when alienating property that is in common ownership, as well as when dividing shares. When purchasing a home, no mandatory certification is required.

Therefore, spouses buying an apartment in 2023 do not need to have the transaction certified by a notary if:

- they purchase an apartment from a sole seller;

- intend to own housing as common property.

But to allocate shares, you will have to visit the notary chamber. Or if children are involved in the transaction. Or if there are several sellers .

What should be in the contract

There is no standard template for drawing up a contract. But there are mandatory elements that must be present in the agreement. Thus, the contract states:

- time and place of the transaction;

- data of the seller and both spouses-buyers;

- detailed characteristics of the property being sold - an apartment, indicating its area, address, location in the house, etc.;

- cost of the apartment;

- method and procedure of payment;

- the duration of the transaction;

- rights and obligations of the seller and buyers;

- settlement of disputes;

- number of copies compiled.

The agreement can be drawn up in printed or handwritten form. At the end of the document, all participants in the transaction must put their signatures and transcript.

Procedure for completing a transaction

The rules for purchasing a home in shared ownership are slightly different from purchasing an apartment in shared ownership. The general procedure is as follows:

- find the seller, preferably the sole owner of the property (this simplifies the sales process);

- discuss with him the terms of sale of the apartment;

- enter into an agreement specifying the shares of each future owner of the property;

- pay their shares from funds that belong personally to the spouses and are not jointly acquired;

- submit documents for state registration.

When carrying out more complex actions, many nuances must be taken into account. And if you want to make a purchase in shared ownership, then it is better to involve a professional lawyer in the transaction, and not a simple realtor.

But it’s generally easier to first buy a home in common ownership, and then, with the help of a notary, divide the shares or enter into a marriage contract.

Receiving a tax deduction

The allocation of shares is important for obtaining a property tax deduction. If there is joint property, one of the spouses receives the deduction, the other writes a refusal.

With shared ownership, each spouse receives a tax deduction in accordance with their share separately from each other.

You can receive compensation even in different time periods - this is not limited by law.

Sometimes it makes sense for one of the spouses who earns more to allocate a larger share so that he can return the maximum amount of money.

The total amount of the deduction is 2 million rubles for one property, so it will still not be possible to return more than 13% of this amount . If a person has not fully used his right, he can transfer the balance to another property and receive his deduction in full.

Useful video from the site ipotek.ru about the features of buying an apartment in shared ownership:

DO YOU HAVE ANY QUESTIONS? ASK OUR LAWYERS:

What documents are needed to sell an apartment, shares, problems with documents | Legal Advice

Last updated April 2023

The main difficulties when buying and selling an apartment are collecting documents and the procedure for completing the transaction. The preparation of documents must begin before a potential buyer appears, since collecting documents will take time. An application for registration of a purchase and sale agreement is submitted to:

- Federal State Service registration, cadastre and cartography (hereinafter referred to as Rosreestr), recently most territorial departments of Rosreestr do not accept documents, dealing only with registration;

- Multifunctional center (hereinafter referred to as MFC).

This is a mandatory (minimum) list of documents that must be collected.

| 1 | Seller's and buyer's passport | If the owner of the home is a minor - birth certificate and passport of the parent/guardian. |

| 2 | Contract of sale | Prepared in 3 copies: 2 – for the parties to the transaction, 1 – remains in the registry. organ The agreement is made in simple written form, with the exception of a transaction on behalf of a minor, when selling a share (shares), then notarization of the agreement is required. 3 copies are attached to the agreement. the act of acceptance and transfer of the apartment or in the text of the agreement a separate clause is indicated, which indicates that the fact of signing the agreement is at the same time confirmation of the transfer of the apartment from the seller to the buyer. |

| 3 | Spousal consent | Most often, sellers are family people and the property is jointly owned (even if it is registered in the name of one of the spouses). The consent of the husband/wife must clearly identify the apartment and the right to sell. This document is executed by a notary. When a marriage contract is drawn up and contains issues related to real estate, a copy certified by a notary is provided. Consent is not required when receiving living space as an inheritance or as a gift. |

| 4 | Receipt of payment by the buyer to the state. duties | Original, copy. You can provide the document details (number, date of the check, bank that made the transfer). But to save time, avoid hitches, confusion, etc., it is better to present the document itself. The amount of state duty in the standard case is 2000 rubles. |

| 5 | Statement on state registration of transfer of ownership of an apartment | The document is written in the prescribed form (Appendix No. 1 to the orders of the Ministry of Economic Development No. 920 of December 8, 2015). The application is drawn up separately from the seller, separately from the buyer. MFC specialists help draw up an application; the parties to the transaction only sign the document. |

Additional documents may be required

Registration of a transaction by proxy

At the registration authority or MFC, when submitting documents to register the sale and purchase of an apartment, the presence of the parties is not required. Any person who has a notarized power of attorney issued by a party to the transaction has the right to conduct a transaction.

The power of attorney must clearly state the authority to submit documents for state registration. Moreover, one representative can submit documents from both parties to the transaction at once, there are no restrictions.

Sale of a share in common shared ownership

When selling a share in an apartment, an important document is the officially formalized refusal of other shareholders of the right of first-priority redemption. To do this, the owner of the share notifies the other co-owners in writing about its sale.

The notice must indicate the price, important terms of sale (deferred payment, abandonment of furniture, obligation to carry out pre-sale repairs, etc.).

You can sell a share to an outsider only if you have a written refusal to purchase it from all shareholders or if there is no response from them within a month.

Another important condition of the law when selling a share is that the agreement must be certified by a notary. A simple written form is not suitable; such a transaction will not be registered in Rosreestr. When selling a share in an apartment to a third party, you cannot change the price or other conditions specified in the notice sent to the co-owners of the premises.

Notarization is required for any variations with shares (one share is sold, several and all at once, that is, the entire apartment).

If shareholders sell an apartment to one person at the same time with the drawing up of one agreement, then notification of pre-emption is not required.

Sale of real estate when the owner is a minor or incapacitated

If the owner of a home or a share in a home is a minor/incapacitated person, you must obtain the written consent of the guardianship authority (see sale of an apartment with a child by the owner). To do this, provide the specified body with:

- notification of alienation of old and purchase of new housing;

- passports of parents/guardians;

- an extract from the passport office about registered persons (see extract from the house register);

- certificate of ownership (extract from the state register of real estate) for the residential space being purchased and sold;

- technical passports for both premises;

- child's birth certificate or passport (if age ≥14 years).

If the consequences of the sale of an apartment infringe on the legitimate interests and rights of an incompetent/minor, the guardianship authorities may prohibit its alienation.

Example : The Baryshsky District Court of the Ulyanovsk Region considered the complaint of G.A. Mikhailova. due to the prohibition of the authorized body on the sale of the apartment.

From the case materials it is clear that the applicant applied to the guardianship to obtain permits for the sale of an apartment belonging to her minor ward. The permit was refused due to a violation of the girl's interests.

The guardian challenged this decision through the court, justifying it by stating that the legal rights of the minor and her interests were not violated, since instead of a ¾ share in the apartment, the ward would receive a ½ share in another home. In addition, the premises are empty and there is nothing to pay for utilities.

The court rejected the claim, citing the fact that the grounds allowing the guardianship and trusteeship authorities to authorize the alienation of a share in the home do not include the lack of funds to maintain the property. The decision was appealed and left unchanged.

A real estate transaction involving a minor/incompetent person is also subject to notarization.

Preparatory stage for sale

Preparing for a transaction is a somewhat larger stage than collecting documents. You should make sure that the apartment is negotiable, that is, when concluding, executing and registering the contract, no insurmountable or difficult obstacles will arise. Therefore it is required:

- order a cadastral passport from Rosreestr (cadastral chamber) and see if everything corresponds to the title documents, real data (address, area, cadastral number, purpose, etc.) If the apartment is not registered in the cadastral register, either the status is previously registered, or errors are found in cadastre, then take appropriate measures (register/make changes);

- call a BTI specialist to inspect the apartment for exact compliance with the layout, installation of engineering equipment, etc. If deviations are detected, everything should be brought into documented compliance using construction methods or left as is and legalized by the local administration. This is an important issue, since such discrepancies may be grounds for subsequent termination of the contract by the buyer;

- request from the management company, HOA, ERIC, etc. reconcile calculations for utility bills, contributions for major repairs and, if there is a debt, pay off without fear of a legal claim from the buyer, who may be billed for payment of the debt, penalties, and legal expenses. In addition, if such a debt comes up when the buyer checks the apartment, it may cause distrust in you and become a reason for refusing the deal;

- familiarize yourself with the database of enforcement proceedings on the website of the bailiffs (fssprus.ru/iss/ip) or at an in-person appointment to ensure that there are no exacting measures against you and other participants in shared ownership (if the apartment is shared), since otherwise this may develop into a seizure of the apartment, which will make it impossible to sell it;

- obtain from the MFC a certificate of registered persons in the apartment (extract from the house register). It is possible that there is an error in the passport office (an unauthorized person was accidentally registered) or someone registered (restored registration) in the apartment according to a judicial act, which the owner did not know about for some reason. Such a problem cannot be solved overnight, and when concluding a contract it can result in a huge nuisance;

- request an extract from the state register of real estate for arrests, encumbrances, etc. If such facts are established, it is necessary to find out the initiator of such measures and resolve the problem in an accessible legal way.

The buyer may request from the seller

The buyer also prepares for the transaction, so he can carefully check the legal “purity” of the apartment, including conducting inspections, requesting documents, information, etc. In order for the contract to be concluded, the buyer’s interest must be satisfied and such curiosity must not be hindered. Most often, the buyer requests the following documents from the seller:

- Certificate of absence of debt on payment for housing. Can be obtained from the organization servicing the house (HOA, management company, etc.).

- An extract from the Unified State Register is issued to the Federal Reserve System at the location of the apartment. It is a way to insure yourself by establishing that the seller is the actual owner of the premises. It also allows you to verify the legal “purity” of the apartment (that it is not mortgaged, not under arrest, and there is no legal proceedings against it). You don’t have to ask the seller for the extract, but get it yourself within a few minutes here.

Any interested person can obtain an extract by contacting the local Federal Reserve Authority or submitting an application through the Rosreestr website. An extract can be ordered for a specific type of real estate; you need to know the exact address.

- A certificate about the number of registered persons is issued at the passport office.

In order to avoid the discovery of “dead souls” after purchasing residential space, before going to the Federal Reserve Service, you should request from the seller a certificate about the composition of the persons registered in the premises.

There are times when they register a friend and forget about it.

If such a “friend” was not registered before registering the sale and purchase of an apartment, then the new owners will have to spend their own effort, time and money to remove him from the registry. accounting through the court.

- Certificate from narcotics/psychiatric dispensary. It will serve as a guarantee to the buyer against undesirable consequences that may arise after purchasing a living space. If the owner of the apartment is mentally unwell and is declared incompetent by the court, when concluding a transaction with him for the alienation of real estate, his guardian will easily recognize it as void through the court. If this happens, the buyer is obliged to return the payment received to the previous owner of the property, and the seller to the buyer, and it is good if this is done in full and on time.

- Marriage/divorce certificate. Thus, the buyer ascertains whether anyone else must give consent to the transaction.

- Technical certificate. It is not needed for the transaction, but from this document you can find out that no redevelopment was carried out in the apartment. If this passport is not available, then you can offer an extract from the cadastre with a graphic part as an alternative.

When preparing documents for a transaction, it may turn out that some of them are lost; this can lead to problems when registering the agreement. Thus, if the passport of one of the parties is lost/damaged, the registrar has the right not to accept the package of documents.

Where can I go to get my lost document restored?

| Lost document | The body that carries out the restoration of the document |

| Title document | Federal Reserve Service or MFC at the location of the housing |

| Passport | Federal Migration Service department at the person’s place of residence |

| Birth certificate, marriage/divorce certificate |

Civil registry office |

|

MFC, Rosreestr |

There are possible pitfalls when completing a transaction

Sale of an apartment that has been seized, pledged or is the subject of a legal dispute

To avoid such problems, you need to independently order or request from the seller an extract from the Unified State Register for the purchased housing. When the owner of the premises provides it, you need to look at the date of issue - the later the better.

The layout of the apartment does not match those. plan

Before going to the Federal Reserve System, you need to carefully study the living space you are purchasing. Interventions in the layout are often identified during an inspection.

If in any doubt, do not hesitate to ask the residents of neighboring apartments for permission to inspect their home, or ask the owner of the premises for technical assistance. plan or extract from the BTI.

When confirming that adjustments have been made to the initial housing plan, before carrying out the state. registration of the transaction, convince the owner of the apartment of the need to obtain a new technical. apartment plan.

Violation of the procedure for registration of real estate ownership

For example: the premises were purchased with maternity capital, but, in violation of the law, the living space was registered only in the name of the parents, without allocating a share to the children. Before buying an apartment, you need to carefully check the reasons and deadline for purchasing the apartment by the seller.

In order to minimize risks, you should not transfer the entire amount into your hands before registering the transaction!

Errors in documents

In custody:

When submitting documents to the reg. authority (MFC), in order to save time, it is possible to pre-register via the Internet - you don’t have to sit in line for a long time, just go to the registrar at the specified hour.

- An employee of the Federal Reserve Service/MFC is required to issue a receipt indicating the date and time of receipt of the documents, as well as when it is necessary to apply for a certificate of registration of real estate for the new owner.

- In this article, we looked at the main points that you need to pay attention to when selling an apartment, what documents are needed to submit an application for a transaction to the registration authority and possible problems associated with its registration.

- Ordinartsev Roman Valerievich

Buying an apartment in shared ownership in 2023

Types of ownership: shared and joint

In order not to confuse such concepts as “shared” and “joint” ownership, we propose to immediately define and differentiate them:

- Shared ownership - when citizens have the right to own and dispose of only a strictly allocated share within a single real estate object.

- Joint ownership is when citizens have equal rights to one object. Such property is allowed to be divided, but until the moment of division, each owner has the right to consent (or refuse) the transaction.

Important information! Shared ownership can arise not only due to the shared acquisition of an apartment, but also as a result of inheritance, or as a result of divorce.

Shared ownership: main nuances

Purchasing housing in shared ownership has a number of features. Of course, the owner has the right to independently dispose of personal property, but only when we are talking about part of the joint property: there are some restrictions on the possibility of this disposal.

When purchasing a share in an apartment, you need to know about many of the intricacies of the legal plan, since incorrect registration entails the danger of declaring the transaction illegal.

Reasons for the emergence of shared ownership of an apartment

According to the law, housing that belongs to more than two owners is common property, which, as we have already found out, can be shared or joint.

With shared ownership, the apartment is divided into shares, which may or may not be equal. The allocation of these shares is carried out based on the wishes of the owners, or according to a court verdict. Each owner receives title documents for his personal share within one apartment.

Reasons for the emergence of shared ownership:

- If privatization occurs for all persons who are interested in it, at the time of privatization.

- If the marriage is dissolved and the former spouses share an apartment that was previously in their common possession.

- If housing is inherited by several heirs at the same time.

Note! The share of housing that is sold must be allocated in kind, or as a ratio to the total area of housing.

The owner of the share must have a document in his hands where his share is indicated in fractional (or percentage) indication.

A share is a legal definition when owners can share housing, selling which is required to obtain consent from their co-owners for the new owner to move in.

Preemptive buyout

After purchasing an apartment as shared ownership, the law imposes certain restrictions on the possibility of selling your own share.

Article 246 of the Civil Code of the Russian Federation determines that all manipulations that affect the interests of shared owners can only be carried out in accordance with their mutual desire.

Article 250 of the Civil Code of the Russian Federation defines the procedure for the priority right of redemption: when a share in common housing is sold to a person interested in this purchase.

First of all, the owner must offer to buy out his share to other owners of this property (they can make a decision to purchase within 30 days).

Only after receiving a written refusal from them, the owner acquires the right to sell his share, but to third parties.

When making a transaction with third parties, it is prohibited to set a price lower than what was previously offered to the co-owners.

Keep in mind! Violation of property rights when selling a share of joint property allows co-owners to easily protest the illegal transaction within 90 days from the day it took place.

Spouses: buying a home in shared ownership

Since the purchase of housing by spouses implies that there will be joint ownership, and not shared ownership, the procedure for registering such a transaction has a number of its own nuances.

When selling housing purchased in joint ownership, you will need to obtain consent with notarization from your spouse.

On a note. Despite the fact that during a transaction of acquisition of joint ownership it is necessary to decide on the issue of for whom the documents will be drawn up, in reality this aspect does not play a significant role, since regardless of who the contract is concluded for, both spouses have equal rights in relation to housing.

Taking care of simplifying the situation in the event of a possible divorce, the husband and wife have the opportunity to use any of three methods:

- Re-register and re-enter a new agreement for two.

- Draw up an agreement between each other, where you note the size of each person’s share in the event of divorce.

- Initially, carry out a reasonable drafting of the marriage contract.

Spouses, if desired, can draw up documents not only for one, but also for two at once. In this case, if registration is made in the name of both spouses, you will need to allocate a share and be sure to indicate in the papers exactly which share belongs to which of the spouses.

One way to get rid of the danger of further disagreements is to conclude a marriage contract. It should indicate in detail what property the husband and wife had before their marriage.

From here it will be easy to find out what property was acquired during the marriage and, accordingly, should be divided during a divorce.

Among other things, the contract can specify the ratio of shares of each spouse in jointly acquired property upon its acquisition and upon divorce.

Keep in mind! Concluding an agreement is the most civilized and preferable option, due to the fact that it can indicate not only the amount of shares for each person in the purchased apartment, but also indicate the right of ownership of all other things and valuables.

Shared ownership with unmarried people

- When housing is purchased not by spouses, but by citizens, even if they are related, there can be no talk about registering joint ownership, but they can easily register shared ownership.

- In order for them to formalize shared ownership of housing, they should simply conclude a contract for the purchase and sale of an apartment and indicate in the contract information about the amount of money contributed by each, indicating which share belongs to which of them.

- As a result, after registration with Rosreestr, the extract will indicate that the apartment is jointly owned by several citizens and the size of each share will be indicated.

We remind you that even if you thoroughly study all the data that is in the public domain, this will not replace the experience of professional lawyers! To get a detailed free consultation and resolve your issue as reliably as possible, you can contact specialists through the online form .

Did you call a notary?

To the question: “Is a notary needed when purchasing housing in shared ownership?”, we answer in the affirmative.

When buying a home and registering it as shared ownership, you need to contact a notary to draw up an agreement and have it certified. Only a certified agreement is considered valid, and a transaction involving the purchase of a share can be registered by Rosreestr.

By contacting a notary's office, you can register one of three types of real estate ownership, namely:

- Sole right of ownership by one person (but, in the case of an official marriage, the apartment is recognized as joint property).

- Common joint ownership of both spouses.

- Shared ownership.

After the transaction has been certified by a notary, you will need to collect papers and contact Rosreestr to record the transfer of ownership of the property.

Shared ownership with children when buying a home

There are situations in which children can become owners of housing or its share:

- According to the terms of the contractual agreement : when the mother and father of the child wish this themselves. Then the parents buy an apartment simultaneously both on their own behalf and on behalf of the child, whose interests they represent.

- According to the letter of the law . For example, if a new apartment is purchased with money received from the preliminary sale of an apartment with children as co-owners. Then, according to the law, minors are required to have their own personal share in the new housing. And no less than what was in the sold apartment.

Note! When children are involved in a real estate transaction, then shared ownership always arises.

When is a “equity” mortgage?

A shared mortgage is issued only if certain conditions are met. Despite the fact that banking organizations are ready to offer their borrowers different mortgage “scenarios,” each case requires individual consideration.

We present three main reasons why citizens go to the bank to take out a mortgage on their home equity:

- For the reason, when the borrower already has a certain number of shares, and he wants to receive money in order to become a full owner of the property himself, buying out the remaining share.

- For the reason when the borrower owns only a single share, but wants to expand and buy at least one more share.

- For the reason when the borrower, not being the owner of any share, wants to buy a share in the apartment.

How to get a mortgage for a share in a home

- The borrower collects the documents required by the issuing bank for the mortgage.

- All existing co-owners issue a written waiver of the right to priority purchase of a share of housing.

- The bank requests information confirming that the co-owners are not relatives of the borrower.

- Then the seller provides the bank with: a certificate of ownership and an agreement to obtain information from the house register and the consent of the spouse (if any).

- Buck begins to consider the possibility of providing a mortgage for the purchase of a share of the home.