Each parent wants to provide his or her own child with the necessary, improved living conditions for the child.

In recent years, there have been more procedures aimed at transferring their property to their children, and a contract for the giving of a child to a minor is a prerequisite.

As a result of the document, the process is officially completed and the child becomes the owner of parental property free of charge.

Legal regulation

According to the legislation of the Russian Federation, every citizen of the State has legal capacity from the moment of birth, which means that every resident of the country is able to have personal property.

The rule is applicable in the procedure of giving: a minor may own real estate, but cannot dispose of it until he has reached the age of 18.

The acceptance of property is legal and the basis for the transaction is a birth certificate or a minor ' s passport.

The principal document confirming the right of a minor resident of a State to own is the gift contract.

A citizen of a State who has not attained the age of 18 will not be legally able to be fully functional and his legal representatives will be fully involved in the transaction.

Such a function may be performed by:

- Guardians;

- Both parents;

- Adoptions.

According to article 185 of the Civil Code, a minor may obtain a power of attorney by virtue of which the future owner may designate any trusted person other than his or her parents or guardians.

Who can be gifted?

Any Russian citizen holding a State passport or a birth certificate is entitled to carry the function of a gifted person, and the opportunities of a minor are limited by age.

The main characteristics, depending on the age category, can be seen in the following classification:

- Until the 14-year period, a minor may sign legal representatives without the participation or presence of the future owner.

- From the age of 14 to the age of 18, the child is required to be present at the transaction by signing the contract in person, and the representatives of the gifted person are signed at the same time, expressing consent to the procedure.

From the age of 16, a citizen may participate independently in such transactions by confirming his or her own financial and property security, a procedure known as the emancipation of a minor; independent status may be obtained through the registration of a marriage and the exercise of entrepreneurship; the legal capacity of a child may be recognized by the court or guardianship authorities.

Conditions for the conclusion of a transaction

The process of giving a child is similar to that of adults: the basis is a gift contract; the child must carry an identity document; the present persons are the giver, the legal representatives of the minor and the immediate future owner (after 14 years of age mandatory); the accompanying persons sign for the gifted paper or consent to the transaction.

Read also the Treaty of Inquiry

Features and nuances

The proponent of the procedure is usually a close relative of the gifted person; the gift is made directly with the child ' s representatives; the agreement will not be valid without their consent; the giver has the right to present conditions for the future owner; the circumstances are reflected in the contract document; the basic principles are: education, marriage.

It is not unusual for a person to give a gift to a person who does not have a family relationship with a child; this means paying taxes as opposed to a transaction with a bond of blood; the child may receive a gift on his or her own from the age of six if he or she does not need State registration or notary certification.

Up to 14 years of age

At this age, the rights of a gifted person are clearly represented by parents, guardians or trusted persons; the presence of a minor is not even necessary; until the age of 14, a citizen cannot fully dispose of the acquired property.

A gifter may personally enter into a domestic transaction with a disabled person; from 6 to 14 years of age, a minor may accept a gift free of charge if he or she does not require registration.

Since the 14th birthday.

Children from the age of 14 are entitled to participate in legal transactions, the only condition being the written consent of representatives, and children may dispose of the funds allocated by their representatives.

When a child reaches the age of 16, he or she may be officially employed by means of his or her emancipation and self-management of his or her own property; in the remaining cases of recompensation with acquired real estate under a gift contract, only with the approval of the guardianship authorities, and it is prohibited to provide the property of a minor citizen.

A gift from the car.

A gift contract for a vehicle implies the same rules for minor citizens, who, by becoming the owner of movable property, will only use it when they reach the age of majority.

Representatives of a child are entitled to drive a car and the costs and taxes on the car are also borne by parents or guardians, and the law makes it possible to transfer a share of the transport if it is in similar ownership.

The share of the apartment

An agreement on the transfer of a property without money shall have legal effect if part of the property enters into force; the main feature of the right of the owner of a part of the dwelling is the failure to notify the remaining owners of the dwelling.

Please also read the grounds for the cancellation of the housing agreement.

The giver is officially able to transfer the share or part of it. The order of the transaction is in accordance with the right order. It is stated in the gift that the characteristics of the object are the share of the dwelling. The size of the property is specified.

How can a land or a house be donated?

The terms of the agreement are similar to those of a free-of-charge dwelling, and the procedure for giving is the same for all real estate.

The completion of the land contract is only slightly different from the giving of the house; there is no item in the paper indicating the persons registered; the property and land taxes on the child ' s property pay the trustees; the registration of the gift agreement on real estate precludes the matching of values.

Legal representatives of the child

Parents, guardians and adoptive parents may represent the child ' s interests; all legal acts are carried out through them; the self-management of the property of a minor ' s guardians is limited; it is not possible to sell or change the gifted property.

The full rights to real estate pass over to a citizen who has reached the age of 18.

The representatives of a minor may dispose of the property if the actions do not involve damage to ownership; other types of transactions may be performed only with the consent of the guardianship authorities.

Treatment of a gifted minor

The procedure for the processing of gifts includes a number of requirements:

- Collection of necessary papers;

- Preparation of the textual content of the treaty;

- The payment of the civil servant ' s fee;

- Transfer of documentation to registration authorities;

- A registered right of ownership.

Self-determination of the gift contract

Participants in the grant process have the right to make their own contract and register real estate and property for the child, and must register according to their location in the relevant cadastre or Regpalat.

The contract is signed with the participation of both parties, and a package of papers is being collected, the list of which can be clarified through the consultation office at the place of the agreement.

After completing the necessary procedures, handing over the papers to the registrar, the parties to the transaction must wait ten working days; after a regulated period, the child receives a certificate of ownership.

In signing the contract, both parents of the child must be present during the proceedings; if one of them is absent, the child must be given notarized consent to the transaction.

Printing through a notary

An approach to a notary greatly facilitates the process of contract drafting and the transfer of property rights; a specialist ' s work will help to avoid misunderstandings and errors in the future; a service such as this will require more funding, but will include documentation of gifts and registration.

A property certificate, a gifted person, can be taken through Regpalata or a notary office.

List of documents

The documentary list includes the documents required for the preparation of the contract and the registration of the property.

- The identity of the giver and the minor;

- An extract from the home book;

- A cadastral passport indicating the value of the gift facility;

- An extract from the ECU, Rostreestra;

- The consent of the guardianship authorities;

- Transport;

- The consent of the co-owners of the property;

- Solidarity of legal representatives of a citizen who has not reached the age of majority.

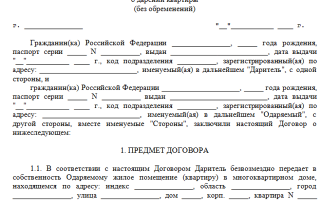

Formulation of the contract, content

The document of presentation shall only be in writing. The form of the paper shall contain the following different paragraphs.

- Time, place of agreement.

- Name of contract sheet.

- We need to specify the details of the giver, the host, the escorts.

- Information on transferable possession.

- Property rights.

- There is no burden on the living area.

- Value of the facility transferred.

- The size is indicated.

- The date of entry into force of the formal form is noted (if not the time of signature of the treaty).

- Number of copies.

- Individual signature of the form by all parties.

A filling-in sample may be downloaded from the relevant websites or requested by the public authorities; errors in filling should not be allowed.

Is notarization mandatory?

The particulars of a gift contract do not include a mandatory visit by a notary; a visit by a legal expert will simplify the procedure and avoid errors.

A visit by a notary's office will facilitate the smooth conclusion of an agreement; a legal service will help to avoid future inconsistencies and disagreements.

Registration

Papers required by Regpalata staff or multifunctional centre:

- Identification documents;

- Statements on behalf of both sides;

- Property rights documents;

- Three originals of gift;

- A receipt that confirms the payment of the majesty.

The registration of property rights lasts for 10 days, after which all the parties to the transaction, as well as the filing of the documents, come forward to obtain the certificate.

Taxation

No tax is imposed on a gifted minor in the only case where close relatives are the parties to the agreement: parents, grandmothers, grandparents, siblings.

If the participants do not draw up the list, the gift is subject to a standard tax of 13 per cent; the tax fee is paid by the parents of the disabled person.

Minutes of issuance of a gift contract for a minor

The benefits of giving property are greater than the negative, but the disadvantages are present, including the conditions that the giver has the right to prescribe in the agreement.

The possibility of full disposal of the gifted object may also be considered a problem, and the time of full possession should be expected only to the age of majority or to the age prescribed by the contract.

Conclusion

The process of giving property to a child is not very different from the transfer of property to an adult. The principle of agreement is a non-reimbursable basis. The procedure uses certain resources, requires the collection of a package of papers. The process has much more to do with the benefits. By going through all stages of the transaction, the child is assured of a decent future.

Nuances of the contract for the giving of an apartment or its share to a minor child and its sample for 2023

To give a kid a piece of the apartment or all of it to him, a lot of people want to, but not everyone knows how to do it.

Specific features of real estate transactions involving children

Other transactions, which are not prohibited by Russian law, are also permitted.

Tendering involvesDonation to real estate propertyOr part of it is considered a normal commercial transaction, but if a child is a gifted child, there are a number of differences from a similar transaction between adults.

The very process of such action is governed by a gift treaty.

You can download the 2023 model of the housing contract for a minor child here.

Act as a party to the operationThe child can't do it on his own.so everything must be done in the presence of the person under whose care he is currently, most often the parents.

If a guardian is a person who has no family relationship with a child, such a contract will be taxed, and must be paid by the guardian.

In the contract, instead of the baby,The signature shall be issued by its representative, guardian or trustee..

However, this signature does not allow a child to dispose of a gifted dwelling, even though the minor will be the sole legal owner.

Until the age of 14, he is not entitled to dispose of the gifted property of his own free will, and upon reaching that age up to the age of majority, such acts may only be carried out under the supervision of the guardianship authorities.

If the child is represented by social workers or correctional or educational personnel, thenThe gift deal is perfect. It can't be done..

Mandatory terms of the transaction

- If a person wishing to enter into a contract for the giving of an apartment or its share,Marriedand the gifted real estate acquired in that marriage would require the notarized consent of the second spouse to carry out the transaction.

- Without this document, there will be no deal.

- In the event that the donor has other minor children, the existence of a document from the guardianship authorities to the effect that the transaction does not affect the interests of these children will be a prerequisite.

- If the guardianship authorities hold a negative opinion on the gift contract, the giver has the right to appeal to the courts in accordance with the established procedure.

- When it is intended to give a minor part of the available accommodation, it will have to be done.Several conditions:

- Timely payment for public utilities: Until the gifted person reaches the age of majority, this mission may be entrusted to a guardian or trustee.

- The prohibition of commercial transactions with gifted real estate, including its rental, may be mandatory.

Failure to comply with any of them can lead totermination of the contractA gift.

It is not enough to conclude and sign a gift contract for it to enter into force; once signed, it must be registered with the Registration Chamber, where the certificate of ownership of the gifted dwelling area will be issued.

It is possible, but it will not be easy, to break the treaty of giving which has entered into force. Only the giver, the public authorities, or the gifted may do so, and only in certain cases where there are good reasons for doing so.

The operation of such a treaty may be terminatedOnly by decision of the courtwhich will be provided with evidence of one or more of the following reasons:

- Deliberate infliction, as well as the threat of harm to a giver ' s health by being gifted, or an attempt on the health or life of both the giver and any member of his family.

- Significant deterioration of the donor ' s material and property condition.

- The careless attitude of the gifted to the new property.

- The death of a gift in the life of a giver, when this item is included in the gift contract.

- A serious deterioration of the donor's health.

- The agreement to give an apartment to a minor child was made through the deception of the giver if he was blackmailed.

- When the gift deal was concluded, the giver did not report his actions.

- The gifted one forced the giver to make a deal under threat of physical assault.

The court shall rule on the basis of the documents, facts and evidence provided for the examination.

The basic document for the conclusion of the gift transaction is the contract, and a model model of the contract for the giving of an apartment or its share to a minor child is used.

There's always a chance of missing some important detail in writing, so the best thing to do is to keep the deal clean.Take advantage of the services of an experienced lawyer or notarySo it is more likely that the treaty will be legally correct.

The treaty must be signed by both parties, since a minor child is not entitled to sign such a document,For him, that's what his legal representative does..

Each member of the transaction is given a separate copy of the signed document. It is not necessary to verify it from the notary, but it is possible to do so if the parties so wish. In such a case, one copy of the contract is prepared for the notary and remains with him.

If, for some reason, the giver cannot personally sign the document, he may do so on behalf of a person who has notarized power of attorney to produce the act in question.

The final contract for the giving of an apartment or its share to a minor child must contain:

- Detailed passport data on each party to the gift transaction;

- A description of the donated object, indicating its exact address, the floor on which the dwelling is located, and its actual state at the time of the donation.

Mandatory includes a certification pointLegal capacity of representatives of both sidesIt also indicates the voluntary nature of their actions, the absence of coercion and threats.

A treaty signed by all parties and even certified by a notary is not the final stage of the gift process; registration is still pending with the Federal Registration Office at the location of the gift site.

- Despite the perceived complexity and need for more than one treaty, the whole process, as a rule,extended for not more than one month.

- The method of transferring the dwelling to the child ' s property is considered to be inexpensive and, unlike the will, has a number of advantages why it is so popular.

- The video shows how real estate transactions between relatives are taxed.

- A complete list of persons who are recognized by law as close relatives of the owner and who will not have to pay a tax when giving an apartment is provided.

You might also be interested:

Share in a minor's apartment — rules of contract

The share of a minor's apartment is not only a grand gesture, but also a certain contribution to his future; the ownership of a part of the estate guarantees that he will always have a roof over his head and some capital.

This is usually in conjunction with some significant date or event. The procedure for giving an apartment is that the owner gives part of it free of charge to the child ' s property, usually between relatives.

It is not uncommon for a secured person to give his or her property as a gift to a child without a parent and his or her home; many wealthy people may be frightened by the perceived complexity of the process; in fact, it is quite simple; the process of giving is widespread in the Russian Federation and is enshrined in law.

Rules of discharge

The Civil Code of the Russian Federation enshrines the concept of a gift treaty. Chapter 32 provides a specific explanation of this concept. This chapter describes the rules on how to write a gifted dwelling for a child.

In order to carry out this exercise quickly and correctly, and in order to avoid future problems, it is necessary to draw up an intelligent legal instrument for the transfer of property.

A model of a contract for the giving of a share to a minor can be found in various legal forums, or below by reference.

download sample

Note:First of all, the documents relating to the regulation of the gift process should be carefully studied.

The best way to obtain accurate and correct information is to consult a notary, and he can subsequently obtain and register an agreement to give a minor child a share of the estate.

When a decision is made to hand over a portion of the dwelling to one or more children free of charge, it is necessary to discuss the matter with their relatives and to prepare a package of documents.

This package includes:

- Identification documents for all parties to the transaction: The term "contractors" refers to all the owners of the dwelling, the persons in it, the persons in it, the persons in it, the persons in it, and the persons who are gifted.

- Technical passport.

- A document certifying ownership of real property, with shares if there are more than one owner.

- The written consent of all the owners of the dwelling to give a part of it is required to be officially certified by a notary office.

- A certificate from the technical inventory office showing the cost of the dwelling.

- A certificate indicating all tenants prescribed in the dwelling is issued by the responsible authorities of the place of residence.

- Written consent, minors ' representatives to accept the gift: representatives may be parents, guardians or guardians of children.

Once the documents have been collected, a notary can be visited.

Conditions for the preparation of the document

Even though you can make a contract on your own, it's better for a notary, and there's a reason for that.

These reasons are as follows:

- No matter how well a giver learns laws and regulations, there's always an opportunity to miss something important, a notary, thanks to better theoretical training and a great deal of experience, a mistake like that won't happen.

- If a copy of a gift contract is lost or destroyed, it can be recovered quickly, thanks to a copy and an electronic version held by a notary.

- The text of the document is written on the standard form of the prescribed form, which is of great importance in court proceedings.

- The notary ' s signature and stamp indicate that all the parties to the transaction were present at the time of signing the document, were in good mind and acted voluntarily without coercion.

The gift contract is drawn up for each person involved in the transaction. A copy of the notary retains it. The signatures are entered into in each document to be printed.

It should be noted that minors, before reaching the age of 14, do not have the right to sign, and that authorized persons or parents do so. Children may sign documents between 14 and 18 years with the written and certified consent of their parents or guardians.

This document may have different dates for the entry of gifted persons into ownership.

The period of time may be such as:

- The time of registration of the document;

- Attainment of majority;

- a fixed calendar date;

- Completion of secondary or higher education;

- Marriage registration.

Regardless of the time limit, the treaty is not retroactive and may be terminated by agreement of the parties or through judicial proceedings.

Is it possible and possible to give a minor a share of the dwelling?

Such conditions may be:

- Prohibition of the sale of an apartment within a certain period;

- The possibility of living on a gifted dwelling, but the inability to rent it to natural or legal persons;

- The obligation to pay for public utilities in a timely manner.

Only one is not allowed in the document: the obligation of the giftees to pay any compensation or to perform any service in favour of the recipient; in such a case, the gift is not given as such; the purpose of the presenter is to register the contract and pay taxes and fees.

Registration of a treaty

Even a contract signed and certified by a notary is not the end of the gift process; only after registration with the Federal Republic of Yugoslavia is the right of ownership transferred to a minor.

A gifter and a presenter are required to come to the territorial authority of the FRFA, with such documents in hand:

- Identification documents for both parties.

- It's a gift agreement.

- Certificate of State registration of ownership of real property.

- A cashier's check.

- Notarized declarations by both parties to the transaction on the transfer of ownership.

The State registration authorities will record the relevant records, under which a special stamp will be stamped on the gift document.

A certificate of State registration is issued to a gifted person, which indicates that the right of ownership has come into effect.

Necessary costs

Any transaction carried out in the manner prescribed by the State shall involve the payment of certain taxes and fees.

These costs are as follows:

- Income tax: 13% of the property value of the dwelling, or more specifically the portion that is transferred to the property, is not paid when close relatives (grandparents, grandparents, dads, mothers, children, brothers and sisters) are involved in the transaction.

- The State duty, which amounts to 1,000 roubles, is paid at the place of registration of the contract by the Rosreest authorities, including the cost of the State registration form and the services of the employees.

- The amount of this contribution is directly related to the value of the property that is transferred to the property of the gifted person.

Since the recipient is a minor and does not have a source of income, all payments are made by his or her parents or legal guardians; payment may be made on his or her own free will; this is not in violation of the law.

Special features of the transfer of real property to minors

Although the process of transferring part of the dwelling to children ' s property is clearly laid down in the Civil Code of the Russian Federation, there are certain nuances.

Attention should be drawn to the following:

- Children may dispose of their part of the apartment after reaching the age of 14 under the supervision of the State guardianship authorities;

- The official guardian is obliged to pay for the minor ' s utilities and property repairs, but does not have the right to rent, deposit or sell the property;

- In the event that the gifted minor has created conditions for the destruction, destruction of the received property or wrongful acts against the giver, the contract shall be cancelled and the property shall be returned to the original owner.

As a rule, the entire process does not take more than one month and is not accompanied by serious difficulties.

The share of the flat purchased for maternal capital.

Video on the theme

Conclusion of a contract for the giving of shares in an apartment

In civil law, the concepts of joint and joint property are distinguished; in the case of an apartment, the dwelling may be in equity; since it is not prohibited by law for other persons to give their share, one of the owners of the dwelling may give to another citizen (a relative, a friend, a work colleague) their share of the dwelling on the basis of an agreement to give a share of the dwelling.

However, the procedure for giving a share in an apartment is somewhat different from the conclusion of a contract for the whole apartment.

In this article, we will describe the characteristics of sharing property and the nuances of making a contract for giving a share in an apartment.

What's equity property?

The allocation of the share in the dwelling may be as follows:

- On the basis of the Law.For example, shares are formed when you inherit an apartment together with several heirs;

- On the basis of a will/consent to give shares in the dwellingin which the heir himself sets the shares.

The owner's share is his legal property, he can sell, give, or bequeath his share.

At the same time, there are some limitations to the management of their shares.

The owner of a share is free to dispose of his or her share of the dwelling, but if the share is sold rather than donated, the other owners must be notified of the sale in writing, and only if they refuse to buy, will they be allowed to sell their share.

Donation procedure

A gift contract is a transaction that leads to the transfer of ownership from one person (seller) to another (soldier).Donation is a mandatory condition of the contract for a share of the dwelling.

In other words, the giver may not, by giving a share of the dwelling and by entering into a contract, demand any payment from the giftee for the transaction or other terms; if so, the contract shall be voided.

Unlike a will by which the heir is entitled to property only after the death of the heir,A gifted person obtains ownership of the abandoned property as soon as the transaction is concluded(Registration of a share in an apartment).

If the owner wishes to give his or her relative or a person with whom he or she is not related his or her share of the dwelling after his or her death, a notary must be contacted and a will must be made.

Attention!

It is not only the owner of a certain share of the apartment who is entitled to the gift.

For example, if a person has full ownership of the dwelling, he may give, for example, to his son, not the whole apartment, but 1.2 shares in the apartment.

The main advantage of the gift contract is that it is possible to own a share or an entire apartment in the life of the giver, and it is almost impossible to challenge the transaction.

The Civil Code does not state that a gift must be given as a compulsory gift; the gifted person has the right to refuse the gift at any time before the gift is given directly to him.

There are also some restrictions on giving a share of the apartment.The conclusion of a gift contract is not possiblein such cases:

- An agreement to give a share of the dwelling will not be considered as valid if it is made by an incompetent person or a minor (under article 28 of the Criminal Code of the Russian Federation);

- It is not possible to conclude a gift contract between employees of medical or educational institutions, social welfare institutions and citizens who are in the care or living in such institutions;

- A gift may not be obtained by public servants on account of their official position;

- In other cases;

In order to properly draft the gift contract, you can download a sample of the share contract in the Internet apartment and after it has been filled in, or obtain a ready form for filling in when you apply to the notary counter.

A contract to give a share of the apartment a sample.

By making the gift itself, care must be taken to ensure thatIt contained the following data:

- The props of the giver and the gifted;

- The object of the gift;

- The time frame for the transfer of the right to property for donation;

In the case of a share in the dwelling, it is necessary to specify:Which part of the dwelling (room), number of square metres, etc.:

- The exact address of the flat in which the share is transferred (1/2, 1/3 etc.), its deck capacity, the total number of rooms in the dwelling;

- Information on citizens who are registered in an apartment and have the right to reside in it, etc.;

- Date and place of the transaction;

- The details of the right-of-occupancy housing documents;

- the documents proving that the real estate is not on bail or under arrest.

At the end of the contract, the signatures of the parties must be signed; with regard to the notary certification of the donation agreement, the notary is required only if one party insists on doing so.

List of documents

In order to enter into a contract for a share of the dwelling, the following must be collected:List of documents for the registration of documents:

- State registration fees: As of 2017, the value of the State duty is 1,000 roubles;

- A contract of three shares of the apartment, one of which will remain in the hands of the giver, the other will be given to the gifted person and the third will be handed over to the registration authority;

- Xerocopies of all pages of the passport of the gifted and gifted person;

- Documents confirming the ownership of a citizen who wants to give his or her share.

- Expensions from the home book and the EGRP, such data are necessary to identify all persons who live in the apartment, and thus it is also clear whether there are any charges on the apartment;

- Technical passport for the apartment;

- Cadastral passport for the apartment;

- Notarized consent from the spouse to enter into a deal to give a share in the apartment;

Registration granted

State registration of a gift contract (irrespective of the type of property that is donated) is a compulsory procedure.If it did not pass the registration procedure, it would be declared invalid.

Registration of the gift contract is required at the address of the apartment in which the share is donated; the procedure for State registration of the gift is carried out at the Federal Registration Service.

A representative may also file for registration, but for this purpose he must have a notary power of attorney, to the effect that the gift contract has been registered by the State, the authorized official shall place an inscription on the gift contract.

Tendering to a minor

- Minors are also allowed to have a share of the dwelling under the Act.

- The rules governing the granting of a gift, where a citizen under the age of 18 is giftable, are almost no different from the ordinary contract for the giving of a share of the dwelling.

- The treaty shall contain such information:

- The details of the giver and gifted person (name, name, patronymic, addresses of permanent registration/actual residence);

- The object of the gift: the address of the apartment, the total area, the number of rooms, the living area, the number, the proportion of the gift given to the minor;

Important nuance:At the time of signing the contract, the signature must be given by one of the parents in lieu of the minor child, since it is the parents who are the legal representatives of their children.

Although a parent's contract is concluded, the owner of the share will still be the child.

Warning

Although the child will then become its full owner of the share in the apartment which is donated to him, he or she will have the right to dispose of his or her share only when he or she reaches the age of eighteen.

If you wish to give your share, where the minor children are also registered, the agreement may be reached with the consent of the guardianship and guardianship authority.

Treaty form

Blank for giving a share of the dwelling to a child (.doc)

Additional costs

- Although the gift contract is a free transaction, the gifted person owes an income tax equal to 13 per cent of the value of the gift received (in this article, the share in the apartment).

- However, the income tax on the share of the dwelling is exempt from the close relatives of the giver (spouses, children, parents, siblings and siblings).

Pensioners are not exempt from the tax if they are not relatives of the giver; moreover, the 13% tax is payable not only if they have received an apartment or share in it, but also other types of property - land, home, cottage.

Loading...

Model contract for the gift of a minor child — real estate, share of an apartment

The child ' s gift is popular because of the desire of the parents or close relatives to provide for the children ' s future; by agreement, the donor party shall hand over to the child property or property rights free of charge.

The terms of the agreement are generally in line with the standard of procedures for gifts contracts, and some of the differences are related to the status of one of the parties, namely, the minority of the party to the transaction (art. 572-582).

The contract must be drawn up in writing and must be certified by the signature of the giver and his legal representative.

The text of the agreement shall contain information detailing the parties to the agreement, including the passport and residence (propiska) data, and a full and detailed description of the subject matter of the agreement in strict conformity with the legal documents establishing it.

Features

- The gift procedure consists of the donation by one party of property or rights (claim) to another party free of charge.

- It follows from the grant that the giver does not have the right to bind the gift to the performance of the gifted person or his representatives, or to the occurrence of certain circumstances.

- An agreement must be concluded with one of the parents of the minor child (the option is accepted with both) or his or her guardian, but upon registration of the document the ownership of the transaction shall be transferred directly to the child.

Nuances of receiving a gift

Among the features of the agreement are several circumstances, one of which is that the child ' s representative (legal) and not the child ' s own representative, who consents in writing to the child ' s acceptance of a given gift.

Full ownership of the transferred property upon receipt of the State registration document may be deferred for a specified period of time or until a certain circumstance has occurred, and the certificate shall include an appropriate indication of the encumbrance.

The child is the owner, but will be able to dispose of it once the specified condition has been met.:

- Completion of studies;

- Attainment of a certain age;

- Marriage, etc.

A contract for the giving of a minor child may be concluded not only by the parents or close relatives but also by citizens who do not have a relationship with the gifted child.

Pending the conclusion of the agreement, it is desirable to consult a lawyer about the possibility of challenging the agreement by a third party so that the child does not have any problems with the gift in the future.

Minors between the ages of 6 and 18 years have the right to act as a gifted party independently if the latter implies free benefit and does not require assurances from a notary or official registration (arts. 26 and 28 of the Russian Civil Code).

Under 14 years of age

If the client is under 14 years of age, his or her representatives (guardians) are entitled to receive a gift on his or her behalf; if the donors are properly capable, the gifted persons aged 6 to 14 are entitled to enter into self-sustained agreements in the form of small-scale household transactions, agreements on the order of funds allocated by the guardians for certain purposes or for their own free disposal.

from 14 years of age

Children between the ages of 14 and 18 are free to make a gift deal independently (with the written consent of the guardian) and are given without the consent of their parents or guardians if they are a minor domestic transaction.

They have the right to freely dispose of their income and funds allocated by their parents (guardians) for specific purposes or free disposal.

Model contract for the donation of real estate to a minor

A minor ' s real estate certificate is appropriate in the following situations:

- The sale of an apartment in which the minor is a co-owner;

- divorce of the child ' s parents;

- in the form of a gift by grandparents, grandparents or other relatives of close relatives.

The relatives of the guardian/guardian may not make transactions with a minor under guardianship only if the agreements do not relate to the transfer of property to him or her in the form of a gift or free of charge (art. 37 of the Criminal Code of the Russian Federation).

To download the gifted minor's property form.

The car is a gift.

The gift of a car is similar to the transfer of real property; only the registration of the agreement is carried out not by the registration service but by the vehicle inspection, with the issuance of a vehicle certificate (TC) in the name of the new owner.

To download the form to the child of the vehicle.

Agreement to give a minor a share in the apartment

A child ' s share of the dwelling as a gift requires the same procedures as for the entire transfer of the facility (collection of documents, conclusion of an agreement, registration of the transaction with the public authorities).

The difference lies in the correct detailed description of the subject matter of the agreement — a specific share, not an entire subject.

To download the form to the underage child ' s share of the apartment.

Legal representatives of the child

The minor ' s legal representative (parent, guardian or guardian) is granted to the minor, except in the cases specified by law; the child will have the right of ownership of the object received from the time of registration of the contract.

When a child reaches the age of 14, he or she may dispose of the gift himself or herself, but under the supervision of the guardianship authorities.

Until that age, legal representatives are entitled to perform any procedure for the use of a gift that does not cause its destruction or damage, except in the case of change of ownership (purchase, sale, exchange).

The transactions listed are permitted only with the participation of the guardianship authorities protecting the property rights of the child (art. 37 of the Criminal Code of the Russian Federation).

Processing procedure

The drafting of the agreement shall consist of the following steps:

- Preparation by the parties of documents (on the parties and the subject matter of the treaty);

- The drafting of a text of a gift, its negotiation by the parties and signature by authorized persons;

- Registration of the transaction through the transmission of documents to the public registry authority;

- To obtain a State certificate confirming ownership of the property of the gifted party.

List of documents

The following documents are required for the issuance of the gift:

- Documents certifying the identity of the giver, his spouse (if any), the gifted person and his representatives;

- The certificate of marriage and the notarized application of the donor ' s spouse for the disposal of the property or the declaration of the donor ' s absence of the marriage at the time of the acquisition of the property;

- Legally establishing documents for the transferred property;

- Confirmation by the Tax Service of the absence of tax debts (in property);

- Evaluation report;

- Authorization of guardianship and guardianship authorities (if the interests of minor children who are co-owners of the intended gift are affected).

Formulation and content of the contract

The document may be drafted in an arbitrary manner by the parties themselves or by a notary, and any version of the text should contain the following information:

- The place and date of the agreement;

- Full data on the passport of the giver;

- Full data on the birth certificate (from the age of 14 on the passport);

- Data of the legal representative on the passport;

- A reference to the adequacy of the donor party and the voluntary nature of its expression of will;

- Information on the object of the gift:

- Description.

- Law-making documents.

- Estimated or inventory value.

- Note that there is no burden on the gift in any form.

Once a contract has been concluded, a record of the State registry authorities is required to give it legal effect.

Do you have to assure a notary?

The gift is in writing and must be registered by the State in order to change ownership for the purpose of the transaction; notarization of the procedure is not required by law, but may take place if the parties so wish (art. 574 of the Criminal Code of the Russian Federation).

Registration

When the procedure is in place, a special registration mark shall be placed on the contract and the title of the gift holder shall also be registered with the issuance of the relevant document for the possession of the gift.

The following documents are required for the State registration of the gift:

- Statement by the parties to the agreement;

- A document on the payment of the State duty;

- Documents confirming the authority (trust for representation of interests; certificate of guardian/guardian);

- Confirmation of the identity of the parties to the transaction (certification, passports, minors will require a birth certificate);

- The right-setting documents of the giver for gift (acquisition agreement, TC registration certificate);

- A contract for the giving of property or property rights;

- Notarized declaration by the spouse of the giver of consent to the disposal of property or declaration by the giver that he did not have a formal marriage at the time of the acquisition of the gifted property;

- Confirmation of the address of the propiska (registration) for the parties to the contract.

The registration of a gift to a minor requires the presence of those who sign the document (the gifter and the giftee with his or her representative).

The documents submitted for registration of rights are subject to legal review within 10 days, as is the legality of the transaction as a whole.

When contradictions in documents or other reasons for refusal to register are identified, the documents are returned for correction; the registration of the transaction on movable property is carried out in the same way, except for the place of registration which is carried out at the vehicle inspection.

Taxation

Documentation of family or close relationships is required when a transaction is processed by a notary and tax authorities when checking taxes.

A close relationship must be in place at the date of the agreement, as well as at the time of the transfer of the gift to the property of the gifted person (the date of registration).

If minors are not close relatives of the giver, they are not exempt from the payment of the tax.

The duty to pay the tax on the value of the donated property rests not on the gifted person himself, but on his legal representatives.

The gift shall not be taxed if the parties to the contract are close relatives by direct means (art. 217).

A gift agreement involving a minor child is a legal procedure in which the transfer of ownership of non-material or property rights is carried out.

Therefore, in order for the transaction to be recognized as valid and legitimate, its implementation requires strict compliance with the norms and requirements of the current legislation of the Russian Federation.

Video: A contract for the giving of an apartment, a filling-in and a form, an apartment for minors, legal advice

Attention!

- Because of frequent changes in legislation, information sometimes becomes obsolete faster than we can keep it up to date on the website.

- All cases are very individual and depend on many factors, and basic information does not guarantee that your problems will be solved.

That's why you have 24/7 expert consultants working for you!

APPLICATIONS AND APPLICATIONS ROUNDLY AND WITHOUT DAYS OF EXPERIENCE.