The pain of being a loved one is eventually replaced by other troubles, usually leaving some property that is later passed on to his relatives or other persons, and the legal nuances involved in these matters are many.

For example, the question often arose as to whether grandkids could claim the inheritance of their grandmothers by living parents; a number of legal nuances needed to be taken into account in answering that question.

You may also encounter the concept of the discovery of the inheritance (the object of the inheritance), which is considered to be open from the moment the death of the heir has been reported, since then children and other applicants may declare their intention to be the owner of the object of the inheritance.

Accordingly, the heir refers to the deceased from whom the inheritance is left.

The last heir (or heir) may be adopted by persons to whom the law permits, such as children, spouses, parents and other relatives.

Succession is a process of transfer, and on the part of the heir, of receiving inheritance property, as well as the rights and responsibilities that are related to it.

There are two ways that grandkids can inherit Grandma's property:

- It is a document in accordance with the form laid down by the law; the will of the person concerning the fate of the deceased ' s property after the latter ' s death is indicated in the will; children, grandchildren or any other person may be shown in the document;

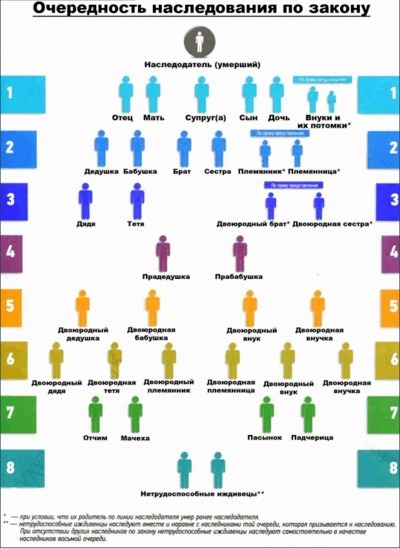

- According to the law, this case is complicated enough to encounter a mass of underwater stones. According to the Civil Code, first of all, the heirs of the first line of rights, to which the deceased ' s spouse belongs, her parents, if they are alive, and her children, may claim the right to inherit if one of the eligible heirs is no longer alive. If one of the deceased ' s children is not alive, their children may claim the same share as the law provides for the succession of the first line heirs.

So it turns out that the only way for grandchildren to get a right to inherit from their grandmother at the time of living parents is the will she left at the time of her life, which is the parent who is the son or daughter of the heir.

In general, the will is a credible guarantee that grandkids will receive the inheritance left by their grandmother, and this is the preferred option; however, the will may be challenged, but it requires strong reasons, and the decision to cancel is only taken by the court.

As for the priority of inheritance, the grandchildren are only in the fifth line, but if their parents, the son or daughter of the deceased grandmother, are also out of their lives, even if the deceased spouse is a dead grandson, they are entitled to claim the portion of the inheritance that was due to their parent.

For example, if the inheritance is left by the father ' s mother, the father ' s son or daughter cannot claim it.

There are situations in which there are several grandchildren, their parents, the children of the inheritor, are not alive and there is no will, and the inheritance must be shared equally between the grandchildren.

It is not only them who are entitled to claim inheritance, but also other relatives.

If the inheritance rights of these relatives are exercised, they shall receive their share of the property and the grandchildren shall share, in equal parts, the object of the inheritance in the proportion to which they are entitled under the law.

A separate category of heirs is those who were dependent on the deceased heir during the latter ' s life, and have a compulsory share in the inheritance.

They are entitled to it regardless of whether the other heirs, including children, agree with it and whether the person in question falls within the category of the inheritors of Release 1.

Moreover, such a person would receive his or her compulsory share of the amount provided for by law, even if the he or she had bequeathed everything to another person.

Dependency means that the person received material assistance from his grandmother, which was the only income for his grandson.

The law provides for inheritance options depending on the age of the disabled grandson who accepts the inheritance from his grandmother:

- If the heir is under 14 years of age, the inheritance right shall be exercised by his parents, guardians or adoptive parents, but on behalf of that person;

- If the person is 14-18 years of age, the consent of the parents, guardians or adoptive parents is required;Adults with limited legal capacity exercise their inheritance rights with the consent of the trustees.

In addition, the law provides that grandchildren shall have priority over certain types of grandma ' s property if:

- They shared an indivisible property;

- The grandson used an indivisible thing all the time until the day the inheritance was discovered;

- He and his grandmother lived on the same premises, in which case the grandchildren have the right to receive welfare and interior items, and if the grandson does not have his own housing, he may claim part of his grandmother ' s living quarters.

And if you make a bequest or a bequest or a bequest or a bequest or a bequest or a bequest or a bequest or a bequest or a bequest or a bequest or a bequest or a bequest or a bequest or a bequest or a bequest or a bequest or a bequest or a bequest or a bequest or a bequest or a bequest or a bequest or a bequest or a bequest or a bequest or a bequest or a bequest or a bequest or a bequest or a bequest or a bequest or a bequest or a bequest or a bequest or a bequest or a bequest.

A document may in some cases be challenged in court; this may be the case, for example, if it is proved that the person who inherited the bequest committed unlawful acts relating to pressure on the will of his grandmother.

It should also be borne in mind that the will may include not only the receipt of property but also:

- For example, the grandmother left the apartment to her grandson (or several) on will, but stated that the heir should provide the dwelling freely and for life to her neighbour;

- The testator's will is similar to the testator's will, but the testator's objectives are generally useful.

In exercising his inheritance right under the will, the heir undertakes to perform the testator ' s bequest or refusal if it is provided for by a document.

Their inheritance rights and the will of the deceased testator may be waived.

Regardless of whether the son, daughter, spouse, grandchildren or other persons do so, there are two ways to accept the object of the inheritance:

- Formal: This means carrying out the necessary legal manipulations that can be performed by contacting a notary.

- In fact, it requires the heir to perform certain acts that confirm that the heir is exercising his inheritance right.

Actions that confirm that the grandchildren have chosen to inherit include:

- Management of property received from the heir;

- Maintenance of the assets received, in particular the costs that it entails;

- Taking measures to protect it;

- Payment of debts left by the testator from its own funds.

It is important to bear in mind that inheritance law is actually exercised only until such time as other persons claiming to be the subject of inheritance are challenged; such disputes are settled only in court.

- If the grandmother does not indicate in what proportion it should be distributed among the heirs, it becomes their common property.

- It can be divided by an agreement between all the heirs.

- It is necessary to do so within three years, counting from the moment the inheritance is discovered.

In legal practice, there are often cases in which people wish to give up inherited property in order for their children to receive it, and there are many nuances on this issue as well.

Parents often choose ways to make their grandchildren inheritors rather than them:

- Refusal to exercise inheritance rights in favour of children;

- Intentional neglect by the deceased person's son or daughter to apply for property within the statutory time limit of 6 months from the time the object of the inheritance was discovered.

Both options are not the only right solution, especially if there are other first-line heirs; in both cases, the parents ' share may fall to them and the children of the person who relinquished their inheritance rights will not receive it.

In this case, notaries recommend that they inherit by law, after which they may be given leave, for example, to make a will, to give to their children.

In any event, you need a notary to take part in such matters. Given the number of nuances he proposes, you should consult a specialist and consult him; only he will be able to make the right recommendations by studying each particular situation.

Can grandchildren claim the inheritance of grandmothers: Do grandchildren and granddaughters have the right to claim a share of the inheritance?

Grandkids can inherit their grandparents in both situations, by will and by law. The first option always has priority. The second is more problematic, but it opens up the possibility of a mandatory share – under certain circumstances.

There are also situations where they don't get anything at all. Each option needs to be studied in detail in order to understand the subtleities of the inheritance by these relatives in different ways.

Do they have the right?

By will

The existence of a will written into a grandson or granddaughter greatly facilitates the transition process- in this case, it is sufficient for the notary to provide the will itself and the heir's identity card.

It's usually enough to get the property. There's no need to prove affinity in this case, so many nuances find a solution on their own.

A will may be sought from a notary in the deceased ' s place of residence, if any; a modern storage system allows a document to be found in any case where it is available.

Yes, the wills are challenged in court if there is a strong argument for the testator's incapacity.

By law

If a will cannot be found, the inheritance of the property is required by law, i.e. according to the order and distribution of the property within the nearest line, and the circumstances may not be in the best interests of the grandchildren, because other relatives will be the first ones in the line, if they are:

- The husband, the wife of the deceased;

- Children;

- My parents.

It matters!The grandchildren are assigned to the first line of blood, but there is a unique paradox.

Is a refusal in favour of grandchildren possible?

It is not possible to deny grandchildren if they are alive and able to own their parents, since all people are in the same line of succession.

It is possible, however, to inherit by right of representation if the parents of those claiming inheritance are already dead.

Inheritive transmission

If the parents of the grandchildren — the heirs died later than the heir but did not inherit — it is possible to use the heir's transmission.

Can living parents qualify?

It's only possible by a will written in the original grandkids.In other situations, they do not receive such a right, except in the case of transmission or inheritance.

What share do you get?

When they change values by will, they get exactly the share that the testator specifies – in the absence of a number of factors that may reduce their share or deprive them of the right to receive at all.

The inheritance under the law, subject to the factors that ensure the inheritance of the grandchildren, may be obtained in whole or in part, provided that there are other applicants with whom they must receive equal shares.

- In addition, grandchildren may expect a mandatory share in a number of cases.

- If they were dependent on their grandparents for a year or more before their death, lived with them on the same premises, received security, they were required to receive a compulsory share in any event.

- Mandatory shares are assumed even if there is a will that does not include grandchildren – this share is allocated by reducing the share of other heirs.

- Succession under the law also requires that this need be taken into account.

In which cases are they excluded?

In some cases, grandchildren are excluded from inheritance even if there are factors that enable them to accept property.

If this is the will of the heir, and it is written in a will, the grandchildren will not be able to obtain any property.

In the case of inheritance by the right of submission of a grandchild, this right is denied if the parents are excluded from the inheritance by the court.

Conclusion

Thus, although their grandchildren are primarily default, they have no priority and are direct heirs.

The process of inheritance often bypasses them, but there are a number of nuances in which they can claim to inherit, usually by the right of submission.

But it is also possible in other ways – for example, in a transmission that doesn't happen often, but it does happen.

Wherever it is more difficult to prove the right of a grandchild to a compulsory share of the inheritance, but such cases also occur, they are also dealt with quite frequently in judicial practice, and one conclusion can be drawn from this: grandchildren may have the right to inherit, but this right does not always arise, and only in the circumstances listed.

Only this state of affairs can relatives obtain property – in addition to will situations, where they can be listed as heirs by direct text, according to the will of the testator, which greatly simplifys the situation as a whole and for all parties involved, and eliminates disputes, disagreements.

Can grandchildren claim the inheritance of their grandparents with living parents

The procedure for the acceptance and presentation of an inheritance must always be clearly structured and consistent; therefore, when a controversial situation arises, it is always required to be resolved within the framework of existing legislation, especially when it comes to changing the order of succession.

Remember that grandchildren are not the heirs of the first line!

Who is the direct heir to the death of grandparents

Turning directly to the subject of the conversation, it is important to note that the provisions of current Russian legislation are stated.

If the heirs are, frankly speaking, the grandmother of the inheritance applicants in question, it is important to understand that her direct heirs will be the following:

- The spouse (grandfather);

- Children;

- Parents (but with old age in mind, this option is almost immediately out of the question).

All other inheritance options (including granddaughters, grandchildren — their sex is not important) become possible only if there is a pre-defined will — a testimonial act.

Can grandchildren claim inheritance with living parents

In accordance with the provisions of the Civil Code of the Russian Federation, such acts are carried out on the basis of the right of submission; in simple terms, this is a process in which, in lieu of direct heirs, the property is transferred to the next generation; however, such a link is established only when the direct heir dies before the death of the heir himself and fails to become a legal successor.

Otherwise, there would be a different regime for the transfer of property rights and would no longer be able to inherit such persons.

By law, if there is no will

With regard to the legal sequence of inheritance, grandchildren applying for the property of a deceased grandfather or grandmother in lieu of their father or mother (if, for example, one of them died before the death of their parents) are full participants in the inheritance case.

And their share is equal to that of the deceased parent; so if the grandparents have more than one son or daughter, and there is no spouse, the common property shall be shared equally among all the heirs.

If the spouse of the deceased survived, the separation also takes place in equal parts.But let us not forget that only the share of the heir is to be separated, with the preliminary exception of the marital portion.

By will

If there is a testator's will, the share of the property received will be specified directly by the testator, whether it is the grandparent or the grandparent, and the testator has full right not to mention all the heirs, but only those who the deceased considers to be worthy of his inheritance.

Only persons entitled to a compulsory share, i.e.:

- Dependents who are not relatives;

- Persons with disabilities;

- Children who were in the care of the deceased.

Therefore, care should be taken in advance for the actual transfer of rights to a particular person whom the deceased wishes to be a successor.

Right of submission

The right of representation is not rare, but rather the pattern of the civil process; the very notion is most often used in the ordinary method of inheritance, i.e. by law.

If the first parent has written a will on a particular parent who subsequently died, the grandmother or grandfather has the right to rewrite the replacement in the text of the new heir.

Under the law of the inheritance transmission

There is another kind of inheritance, which is called an inheritance transfer, which is the transfer of the legal right to the next generation and gives them the opportunity to inherit.

A significant factor is the death of one of the parents following the discovery of the inheritance from the forefather, and the heir must therefore be one of the "principals" or the child of a person named in the will.

There are three periods that are necessary for the application of the legal relationship of the inheritance transmission:

- At the time of the death of one of the children ' s heirs, the right to inherit from their parents (i.e. from their grandparents) must already arise.

- There's no delay in accepting the inheritance.

- The heir's death must occur after the original heir is dead (even seconds are counted).

An additional factor is the obligation that the deceased heir should not accept the inheritance from his parent, only then will he be able to pass over to his children (i.e. grandchildren, if we are talking about the original heir – that is, grandparents).

Can you give up your inheritance in favor of your grandchildren?

In some cases, parents do not accept the property of the heirs — their fathers and mothers — in order to pass on to their children, i.e. the grandchildren of the deceased.

Or live family members with grandchildren want to give up inherited values in favour of their grandchildren.

This is a normal situation!

In order to achieve this, subjects of inheritance may do so in two different ways that differ in time, money and other reasons:

- It is not always possible for the heir to write a testator's will, but if there are other members of the first line, the property will pass to them.

- The heirs, the children of the deceased, accept all property, but later re-register it in the name of their children, i.e. grandchildren (in relation to the deceased).

Both options are correct and the choice depends solely on the will of the subjects of the legal relationship and the existence of specific circumstances.

On the basis of the above, it is necessary to understand that inheritance law, as part of civil law, requires detailed details on a case-by-case basis.

If there is at least one circumstance, the whole situation can be changed.

And that will depend directly on the subject of the legal relationship – that is, the individual and the purpose of his or her activities.

Can grandchildren claim the inheritance of their grandparents?

After the death of the grandparents, there may be many applicants for property, such as a surviving spouse, a son or daughter, the children of the inheritor...

Can grandkids get the rest of their grandma's house or apartment?

For example, about five months ago, Grandpa died, and he did not leave a will; he had children, a son and a daughter, who were the first heirs; the son committed a crime, escaped from the investigative authorities, and was wanted; and no one was found missing or dead.

He has a daughter, the granddaughter of the heir.

Question: Can the deceased's granddaughter receive the inheritance of her grandfather if her father is absent and appears not to be claiming inheritance? Is she entitled to half of her inheritance by right of submission if her father has not been declared dead or missing by the court?

That's what we're gonna talk about today.

A grandson and a granddaughter are heirs to a will

If there is a will, the property will be inherited by the persons mentioned therein. If the grandfather left a will in his lifetime and handed over all his property to his grandchildren, there will be no problem. The latter will accept the property as required by the will of the heir. By the way, the will may be declared null and void. As we have explained in this article.

But if there is no will, the inheritance procedure will be carried out in accordance with the law, according to the order.

You'll read more about the legal succession here.

Grandkids are legal heirs.

In the absence of the owner ' s will, the inheritance of his property takes place in accordance with the procedure laid down in articles 1141 to 1145 of the Criminal Code of the Russian Federation.

And suddenly it turns out that grandchildren don't belong to any line of legal successors, which is rather strange, because there are distant relatives, such as cousins or nieces, among those claiming property, and there are no loved ones...

Right of submission

But if they are in good health, then they are the ones who are the applicants for their grandfather's inheritance, and their children are gone.

Let us give an example: five years ago, the husband and wife of Ivanov died in the fire. They had an adult son. After a while, the father of the victim died in the fire of Ivanova. The deceased's brother claimed his right to property.

The successor in this case is the grandson of the late grandfather, who inherits the second and is not a candidate for inheritance, because the grandson will accept the property according to the right of submission – as the direct heir of the heir's daughter.

The right of inheritance transmission

In addition, grandchildren are the beneficiaries of the right of inheritance if their father/mother(s) dies after the death of their grandmother/grandfather and they have not been able to inherit, in which case the grandchildren will be the successors of the parents, not the dead grandmother/grandfather.

Mandatory share

The law provided for situations in which individual citizens claimed property, even if they were not legal heirs and were not mentioned by the testator.

Grandkids are required to inherit their share of the Grandparents ' inheritance if they held them.. The consent of the other successors to the inclusion of grandchildren in the succession is not required.

In order to obtain inheritance property, two conditions are required:

- The grandchildren must have lived and been provided for by the grandfather/grandmother for at least one year;

- The content obtained from the testator must be the only or main source of income.

For example, Sidorov, a citizen with group I disability, has been provided by his grandfather for the past seven years, and Sidorova's father and mother died 10 years ago.

During his life, his grandfather made a will, according to which his property was handed over to his wife; the value of his inheritance was estimated at 500,000 roubles; Sidorova is the first heir to be represented.

This means that even if there is a will, a portion of the property worth 250,000 rubles will pass over to her.

In the article, Mandatory share of the estate in the will, we explained who else could claim the owner's property.

Is it possible to give up inheritance in favour of grandchildren?

If the father and mother are alive, do they have the right to give up their inheritance in favour of their own children, the grandchildren of the testator?

No, you can't sign a waiver, you can't refuse because their children aren't legal successors.

On the basis of paragraph 1 of article 1158 of the Criminal Code of the Russian Federation, the refusal of inheritance may be in favour of:

- Legal successor;

- The person who inherits the will;

- A relative who inherits the rights of representation or transmission.

And grandchildren shall inherit only if their parents (son or daughter) have died; in all other cases, they shall not be entitled to inherit, therefore they shall not be allowed to give up their property in their favour.

What can you advise grandchildren who wish to acquire inheritance with healthy parents? The only option is to take the inheritance rights of the father or mother (grandparents) and then hand over the property (e.g. gift) to their own children.

Whether a grandchild can claim her grandmother ' s inheritance, inheritance by right of submission 2023

Succession by right of submission Who inherits by right of submission The inheritance by right of submission Whether grandkids can claim the inheritance of a grandmother by living parents Who cannot inherit by right of submission

Succession by right of submission

In this article, we will describe how the inheritance of the estate of the heir is carried out when the heir is legally deceased before the heir or dies on the same day as the heir, whether the grandchildren can claim the inheritance, and how they will inherit it.

In such cases, the law provides for special rules of succession under which descendants of deceased heirs are called upon to inherit.Succession by right of submission.

The right of submission is that.type of inheritance by law(art. 1146), when the legal share of the heir,to the death of the heir or at the same time as the heiris inherited by his children.

In other words, the children of the deceased heir take his place and inherit not according to his right, but according to the right of his parent, whose place he takes, and only within the extent of the portion of the inheritance which would have been due to him under the law, had he been alive.

Who inherits by right of submission

Succession by right of submission is possible only in the first threeIt's a matter of legal succession.

The law definesexhaustive list of personswhich may be the heirs of the right of submission, and this is:

- Heirs to the first line of the right of submission--Inheritor ' s natural grandchildren as well as their descendants(art. 1142, para. 2, of the Russian Civil Code).

- Heirs to Release 2 on the right of submission--nieces and nieces of the heiri.e. children of both full-born and half-brothers and sisters of the heir (art. 1143, para. 2, of the Code of Criminal Procedure).

- Heirs to Release 3 by right of submission--cousins of the heiri.e. children of both full and half-brothers and sisters of the heirs ' parents (art. 1144, para. 2, of the Code of Criminal Procedure).

The heirs of the right of submission thus occupy, among the other heirs, the place that the deceased parent could occupy if he were alive on the day of the discovery of the inheritance.

Helping experienced legacy lawyers. Tel. +7 (812) 989-47-47Telephone counselling

Succession by right of submission

Thus, succession by right of submission is possible only in cases:

- When the heir is by lawdied before the death of the heir.

- When the heir is by lawdied at the same time as the heir.(one day)

For example, if a father died before his grandfather, or both died on the same day, the grandson would inherit his grandfather's estate by right of submission, and only the portion of his father's inheritance would have been inherited if he had not died.

The same rule applies to nephews and cousins of the heir, i.e. the death of their parents before or at the same time as the heir will be a condition for their right of submission.

In that case,if the heirs of the right of submission are multiple, they'reAnd share equally in the inheritance.which would have been legally due to their deceased parent, which is one of the basic rules of succession under the right of submission.

Let us give an example:

And if he has three children, one of whom has passed away before him, then the children of the deceased will be called to inherit by the right of submission, but not by the other two of the heirs of the first line, but they will share a portion of the inheritance between them, if he is alive, and the inheritance will be divided into three equal parts, one of which will pass by the right of submission to the heirs, and the other two will inherit by the common law the two children of the inheritor.

It should also be borne in mind that heirs to the right of submission are liable in the estate only for the obligations(s) of the heir, but not for the obligations of their parent, to whom they represent.

Can grandchildren claim a grandmother's inheritance with living parents?

The law stipulates that:Heir ' s grandchildrenas his nephews and cousins,They are not the direct heirs.This means that a grandchild cannot claim his grandmother's inheritance on an equal basis with his mother.

Although grandchildren are primarily inheritors, the law allows them to inheritRight of submission onlythe principal condition of which:The death of a direct heir by law, i.e. their parent,before or at the same time as the heir.

Only then can the descendants of this heir claim to inherit by right of submission.

What is remarkable in the law is that grandchildren, as well as nephews and cousins and cousins of the heir,Can't inherit.after the deceased heir,Even if their parents didn't accept the inheritanceThe fact is that their right to inherit is derived from their parents ' right to inherit, i.e. if the heirs ' children, while alive on the day of the opening of the inheritance, have not accepted the inheritance, the grandchildren are not entitled to the property.

In this case, the inheritance will be transferred to the other heirs under the general rules of succession under the law.

Take an example:

After the death of the heir, there were three of his heirs, two daughters and one son; the daughters of the heir claimed their inheritance by contacting the notary in a timely manner, and the son did not apply to the notary in order to regularize his inheritance rights within the six-month period prescribed by the law, nor did he take any action that would indicate the actual acceptance of the inheritance, i.e. the father ' s inheritance is not claimed.

And if he had not had daughters, he would surely have been of the inheritors of the second, but if he had not had daughters, he would surely have been of the inheritors of the second, and if he had not been of the heirs, he would surely have been of the inheritors of the second, and if he had not been of the heirs, he would surely have been of the inheritors of the second, and if he had not been of the heirs, he would surely have been of the losers.

More than that, the heir's son.Can't even say no. And from the inheritance of his children,Since his children are not independent inheritors of the first line, but can inherit only by the right of representation of his parent, which is conditional on his death, and the deceased heir cannot give up his inheritance.

However, article 1158 of the Criminal Code allows other heirs under the law to abandon their inheritance in favour of the heirs of the right of submission, i.e. in the event of the death of one of the heirs under the law, the remaining heirs have the right to renounce their share of the inheritance in favour of the children of the deceased heir, who will inherit by right of representation of their parent, in which case the children of the deceased heir will inherit his share of the inheritance in accordance with the right of submission, and the share of the heir who has abandoned the inheritance in their favour.

Thus, a grandchild may inherit the property of his grandparents in a living parent.Only if there is a will in his favour..

Grandkids claim to inherit their grandmothers by living parents:

When a person dies, there is a great deal of trouble, but the main problem is when relatives start thinking about the division of property.

If there is a desire to examine in more detail the question of the rotation of relatives who are entitled to inherit the property after the death of a relative, you can ask for information about article 1261 of the Criminal Code of the Russian Federation. Legal direct inheritance of grandchildren can only be obtained in two cases:

- Before she died, the old lady wrote a will, indicating a man who would receive her property, such as grandchildren, a son, a daughter, or a husband.

- The first chain of granddaughters is restricted to the right to provide.

The question of whether a grandchild can claim the inheritance of a living father may entail different conditions under which such transfer of possession is permitted.

It matters!Children are always the first applicants for research capital or wealth, and if they wish, they can give everything to their grandchildren by giving up their wealth.

If the children of the inheritor are dead, their child may legally possess the property that Grandma left behind by virtue of the right to provide, but the main condition is that the parent of the child must die before the death of the first parent, otherwise the distribution will be completely different.

Heirs to the first line after grandma's death, grandpa.

The first line of heirs after the death of the first parent is determined by the following related composition:

- spouse (daughter);

- The mother or father of the deceased;

- Kids.

How to inherit from grandkids after Grandma's death

Child custody with living parents

In order to take possession of property legally or by will, it is important first to ascertain whether a grandchild is entitled to inherit and only then to accept by filing the necessary documents and a declaration with the notary.

It is important to study the will carefully, since its content may include, in addition to the inheritance and certain obligations, the possibility of adding mandatory paragraphs to the testator ' s performance is in accordance with article 1137 of the Russian Civil Code, which is referred to as the testator ' s testator ' s testator ' s testator ' s testator ' s testator ' s will.

The obligations stated in the paper shall take effect upon confirmation of ownership.

The last will of the first parent

Who is entitled to a mandatory share after grandma's death

An unlimited portion of the property must be acquired by the persons indicated by the grandmother in the will; children, the mother, the father, the spouse and dependants have the formal prerogative, regardless of the document produced.

In which cases the grandchildren will not inherit the property

Loss of inheritance by grandchildren is possible in such cases:

- A dead person has been deprived of his or her legal parental rights during his or her life;

- The deceased did not wish to write a relative's will because he felt that he was not worthy of any kind of inheritance (home, car, money) or committed unlawful acts against the testator.

The transfer of property may only take place after the conviction that the grandson has the right to inherit after the death of his grandmother.

The Act establishes a list of the important conditions under which the transfer of possession to the hands of a descendant is possible.

In any event, if there is doubt and uncertainty as to the validity of the acts committed, it is better to consult with a specialist in the field of jurisprudence.

Does the granddaughter have the right to inherit a grandmother if there is no will? How to share the inheritance of the Consultation Resource

From a procedural point of view, the existence of a will greatly facilitates inheritance. If grandkids are specified in the will of their grandparents, they will be guaranteed the portion due to them, regardless of the existence of other applicants, in addition, they will not have to prove a related relationship – only a will and an identity card.

However, if the grandkids or granddaughters are not listed in the will, they will receive nothing even if they could inherit under the law (by the right of submission), with the exception of the compulsory portion, as discussed below.

Disputing the will in court proceedings is a complex procedure that can only be initiated with the help of a professional lawyer and reliable evidence of the testator's incapacity and invalidity of the document. Read more in the article "A challenge to the will to inherit after death".

In cases where a will has not been made or has been challenged and declared null and void by the court, inheritance shall take place according to the law, in accordance with the rules laid down in civil law.

According to the SC of the Russian Federation, the first line of heirs includes the husband or wife, the father and mother, as well as the children; the grandchildren also belong to the first line, but are not direct successors.

They can only obtain inheritance from the right of submission – instead of their own parents, the children of the heir if they have already died (before the heir or with him).

In other words, if the children of grandparents are still alive, they will inherit if they are already dead — instead of children, the possibility of inheritance goes to grandchildren and granddaughters.

To better understand the succession of grandchildren after the death of grandparents, consider examples.

Is it possible for a grandchild to claim the inheritance of his grandmother in a living father if a will is made? This is only possible if the person is in possession; in such a situation, the property will be allocated exclusively to the points of the will.

If the order has been quashed by a court order, the property will be legally distributed, so the grandchildren will not receive it.

If the heir of the will learns that the successors are trying to cancel the document, he may also defend his interests by taking part in the proceedings.

Who is the direct heir? Can a grandson or a granddaughter claim inheritance?

The transfer of inheritance rights is possible in two ways: by law and by will. How can you inherit after your grandmother's death without will? You need to contact a notary and confirm your relationship with the deceased.

The direct heirs of her grandmother's death are her spouse, her children, and her parents. These persons are first-time applicants.

- None,

- And they were found to be indecent,

- They wrote a waiver of property.

Are the grandchildren heirs after the death of their grandmother? They will not be direct successors, but the grandchildren of the dead children are entitled to inheritance. It is based on the right of submission. Consider this procedure in more detail.

The right of submission is a special transfer of power over property that arises in the event of the death of parents who are the main beneficiaries, such as the death of a grandmother, whose successors are trying to determine whether the grandson has the right to inherit?

The only parent of a child died at the same time as his or her grandmother, in which case the grandson or granddaughter has the right to inherit from his or her grandmother if there is no will; he or she has the right of representation, i.e. from his or her parents.

Grandkids are not considered direct heirs after grandma's death.

The following conditions must be met for the transfer of ownership under the right of submission:

- The parent of the grandson is in relation to the deceased child or adopted child;

- The heir has not been deprived of his parental rights or, if he has been, restored to them;

- The grandchild's parents died before or at the same time as her.

Another question that many users are interested in is whether grandkids can claim their grandmother's inheritance with living parents? No, it's illegal. In the HC, the inheritance to this category of persons can only pass on to the one described above, the way in which property is obtained.

Do you have the right to inherit a grandchild if the children are alive, but they have abandoned their property or have been declared unworthy? No, in that case the property will be distributed among the remaining members of the first line; and if they are not present, then the second line of rights will be granted.

7. The deceased's close relatives are divided according to the degree of kinship. For example, the great-grandparents of the heir belong to the fourth line.

Grandparents may receive their grandmother ' s property, but this requires a number of conditions, such as the death of their parents; if the parents die later, they will not be able to claim the inheritance on the basis of the SRs.

For further information on this subject, please refer under the heading "Ordinance of succession".

Inheritive transmission

Inheritive transmission is another statutory method of inheritance by grandchildren after the death of grandparents, if direct heirs – children – die not earlier but later by the heir, unlike the right of representation, which applies only in the case of legal succession, the transmission also extends to bequest orders.

The simplest way to explain the principle of the use of a genetic transmission is by example.

Example 4

At the time of his death, his only son was alive, but after a short time, he also died before he could inherit.

Since the death of the direct progeny did not occur earlier, but later on, the heir, the grandchildren could not inherit the right of submission, but they were subject to the provisions of the law on inheritance transmission.

Thus, the grandchildren of Timsluuk acquire a legal share in the inheritance.

Mandatory share of inheritance

The right of grandchildren to a compulsory share in inheritance is a middle ground between inheritance by law and will.

It arises from grandchildren who are not listed in the will (or are directly deprived of the will) but who, under the law, may claim a share of the inheritance on the grounds that they are minors who are incapable of work (group I or II disabled persons), incapable dependants of the deceased grandfather or granddaughter; it means receiving material support from the deceased, who was the main source of livelihood for the grandson or granddaughter.

The compulsory share will be half the share that a grandchild would receive in a common inheritance. To calculate the share, the total value of the inheritance must be determined and divided by the number of first-line heirs by law or by willing heirs. The amount received must be divided in half, and that will be the amount of the compulsory share.

We would like to refer to the Land and Housing Grant Agreement.

Can a great-grandmother or a great-grandfather inherit the property?

Alas, it is not possible to refuse grandchildren to inherit from the living children of Grandma even by transmission and right of submission; article 1158, paragraph 1, states that the refusal is only valid for the heirs (whether by law or will).

Once the successors have determined who the heir is, they must go to a notary office and be informed of all the potential heirs, because it is not the duty of the notary to look for the heir.

The documents to be submitted to the notary will vary slightly depending on the way the inheritance is obtained.

- The passport of the successor;

- Death certificate.

A legal transfer of rights would require confirmation of affinity; for example, a birth certificate could be used as a supporting document.

If the procedure is based on the right of submission, evidence must be provided:

- The relationship of the heir and the deceased parent;

- Affiliation with a deceased parent.

I mean, we need to get some paperwork that can be traced back to the relationship.

In the will

A copy of the order must be provided. You can find it by checking the register of wills, or in the deceased ' s personal belongings, at the notary office of the heir ' s place of residence. This document must be compiled in several copies, one of which remains in the office.

If no order is found, it is not possible to confirm its existence; ownership is distributed by law on the basis that there is no will.

Outcome

Grandkids or granddaughters, unless specified in the willing order, are not direct heirs to the first line of law, and therefore are granted inheritance rights only under certain conditions provided for by civil law.

The most common method of inheritance by grandchildren is the right of submission.

It was most difficult to obtain a compulsory share of the inheritance on the basis of dependency status, since it was extremely difficult to prove that a dependent person was a dependent.

Adults with limited legal capacity exercise their inheritance rights with the consent of the trustees.

Adults with limited legal capacity exercise their inheritance rights with the consent of the trustees.

Is a refusal in favour of grandchildren possible?

Is a refusal in favour of grandchildren possible?