Last update: 24.03.2018

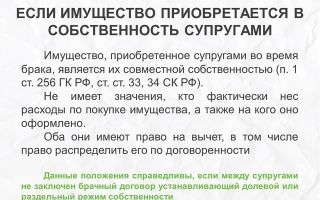

In the absence ofMarriage contractBetween the spouses, all the property they acquired during the marriage (including the apartment) is theirs.joint property(article 34 of the Russian Federation and article 256 of the Russian Civil Code).

The term "proceeds" is understood to be bought, earned, acquired fromJoint fundsI mean, if the apartment was bought in marriage, it's in the house.common property of spousesirrespective of who is registered with the property or who has been issued with the Property Certificate (Titule).

And the donated property received by one of the spouses (gift, inheritance, privatization) is not considered to be "received" and therefore does not apply tocommon property of spousesTrue, there is one nuance about privatization – see below:

Clarification on privatization in the relations of spouses

Bjoint property of spousesEvery one of them hasequal rightsfor the dwelling, unless otherwise specifiedMarriage contractWhen selling such an apartment, both spouses must jointly decide on the transaction (detailed below).

Where there is a marriage contract, all the rights of the spouses in respect of their common property are determined by their terms.

Kjoint property of spousesCommon joint property rules apply. When you give shares in common property, they have common equity property (for details on types of property, see the Glossary on the basis of these references).

The distribution of tax deductions between spouses when buying an apartment – how does this happen?

Personal property of the spouse on the apartment

In addition to the common joint (jointly acquired) property, each spouse has the right to:personal property(article 36 of the Russian Federation).

- As far as the apartment is concerned, it's gonna beone spouse ' s personal propertyif it is received personally by him♪ A gift ♪, Abstentionsas well as if she was:: Reprioritized................................................................................................................In a situation where the other spouse was not entitled to the privatization of the apartment (not prescribed at the time of the privatization) – privatization is, in fact, also a gift (from the State).

- If the apartment belonged to either of the spouses before the marriage, it is also, accordingly,personal property...........................................................................That's the wife.

- Also if the apartment was bought during the marriage, but with the proceeds of the salepersonal property of one of the spouses(e.g. handouts or cars), this apartment is not counted either.joint propertyand acknowledgedpersonal property...........................................................................That's the wife.

The exception is whenpersonal propertyOne of the spouses ' apartments was significantly transformed during the marriage (high maintenance, e.g.) at the expense of both spouses (art. 37). If the cost of the apartment has increased significantly as a result of such repairs, the apartment may be recognized by the court.joint property of both spouses.

There may also be a flat.personal property of one of the spousesin accordance with the conditionsMarriage contract.

Marriage contract/contractIt defines the rights and obligations of the spouses during the marriage and in the event of divorce, in particular the rights of the spouses to property acquired by them during the marriage; such a contract takes precedence over the ordinary (under article 34 of the Code of Criminal Procedure) allocation of the spouses ' rights to joint property.

Marriage agreementmust be certified notarized.

Actuation modeMarriage contractUnder article 40 - 44, chapter 8 of the Russian Federation.

If he bought a DUD apartment before the marriage and the property was already in marriage, would the apartment be the common property of the spouses?

Sale of an apartment shared by the spouses

Sale of an apartment in thejoint property of the spousesIn such a case, the contract for the sale of the dwelling is signed by the spouse in whom the right of ownership is registered, and a set of documents for the registration of the transaction is attached.writtenThe other spouse's notarized consent to the deal, and the same applies to the giving of the apartment.

Such writingThe husband's consent to the sale of the apartmentalso in the case of spousesDivorcedbut their common property (the apartment) was acquired during their marriage.

Divorce does not deprive spouses of ownership of common property, so the buyer of an apartment must always be aware of the rightsof both spouses.

If there is no written consent to the sale of the apartment from the second spouse or it is not certified by the notary, the transaction may be declared null and void by the court on that spouse ' s claim (which consent was not obtained).

If ownership of the dwellingregistered with both spousesthat separate consent to the sale is no longer necessary, rightjoint propertyIt's obvious here that both spouses simply sign next to the sales contract.

What may be the basis for invalidating the sale of an apartment?

Division of the apartment in the common property of the spouses

Sharing of common property between spouses(including apartments) may be as agreed by the parties, by signingProperty-sharing agreementas well as by a court decision,Court decision on the division of propertyAny of these documents may be the basis for the registration of each spouse ' s property right to an appropriate share of the dwelling, or to the entire apartment.

Afterthe division of the common property of the spouseseach spouse receives his or her share of the property (e.g. an apartment or a share thereof) inpersonal propertyand may dispose of it at his discretion without the other spouse ' s participation (without consent).

Division of common property of spousesIn both cases, the division of property ceases to be subject to the regime.joint property of spouses.Agreement on the division of common property between spousesSince 2016, it is mandatory to be certified from notaryus.

ModelAgreements on the sharing of common property between spousesYou can download it here.

Limitation period for a claim forthe sharing of the property of the spousesAfter divorce, three years.

The seller ' s wife ' s ownership of the apartment should not be confused with the spouse ' s right to use the same apartment.the right to usemay be an unpleasant surprise for the Buyer (see the Glossary for more details on these references).

Exploiting a transaction by an experienced lawyer reduces the risks of EVERYBODY (especially for an apartment buyer).The services of specialized real estate lawyers can be found here.

- "REELTOR SECRETS":

- A detailed action algorithm for the purchase and sale of an apartment is presented in the interactive map of the RUSSIAN INSTRUCTION(will be opened in the pop-up window).

Buying a joint property, how and for what?

When the decision to buy an apartment is ripe, the question arises as to how to do so correctly.

Common joint property as a concept

The concept of common joint property is provided by the Civil Code of the Russian Federation.

This is the type of common ownership of an apartment in which it may be owned by several persons when the share of each of them in ownership is neither mathematically nor physically determined.

According to the legislation in force, the right to joint ownership of an apartment is reserved only for spouses who purchase a property during the marriage.

Buying an apartment in common joint property

The purchase of housing in common joint property takes place in general order.

The procedure consists of the following steps:

- Checking the legal "purity" of the apartment;

- The conclusion of a sales contract with the signature of a transfer document;

- Payments to the seller (to be continued after State registration);

- State registration of joint property rights.

Consider each step.

Checking the legal "purity" of the apartment

When an apartment is selected and the terms of purchase agreed upon by the parties, the legal "purity" must be checked before the transaction is performed.

The verification shall include:

- Checking the seller ' s right-setting documents for the apartment.

- If there are more than one owner, all owners must be sellers.

- If the apartment was purchased in the name of one spouse during the marriage, the second spouse ' s consent to the transaction must be notarized.

- If minors or disabled citizens are registered or own an apartment, the consent of the guardianship and guardianship authorities is required.

Prior to the transaction, order a "sweet" extract from the EGRN confirming that the seller's ownership is not subject to the rights of others and the apartment is not under arrest.

Conclusion of a sales contract

The manner in which a sales contract is concluded depends on several factors:

- The owner of the apartment is one or a joint property of the spouses - the contract of sale is drawn up in simple writing.

- A common equity dwelling is a mandatory notarization of a transaction.

- The dwelling is purchased with the participation of borrowing funds, before the procedure for the conclusion of the contract of sale, the bank approves the loan and the contract of sale is prepared in accordance with the requirements of the bank.

- The dwelling is purchased with the funds of the mother's (family) capital – the approval of the transaction is required by the guardianship authorities; if it is also a mortgage, the guardianship authorities are given a notary obligation to allocate a percentage of the children after the mortgage has been paid.

Regardless of the form of the treaty, it should contain the following particulars:

- Details of the parties to the contract;

- Information on the object of the immovable property;

- the right-setting documents of the seller for the dwelling;

- The price of the contract and the manner of payment to the seller;

- Liability of the parties for non-performance;

- Information on persons who retain the right to use the dwelling after the change of owner (if any).

Method of settlement with the vendor

The payment procedure with the seller is not regulated by law and is subject to the agreement of the parties, except for the purchase of an apartment through credit.

In practice, payments to the seller shall be made in the following order:

- The first stage of the settlement is the transfer of the advance or deposit in the purchase dwelling to the seller ' s receipt.

- The second (principal) stage of the settlement is carried out when the contract of sale is signed.

Possible payment options with the vendor:

- With a signed sales contract, the parties visit the bank they choose to settle and transfer the money to the seller ' s account, which immediately makes a receipt of the money.

- A bank cell is rented by the parties and the seller receives the money only after an extract from the EGRN on the registration of the transfer of the right has been issued.

- A deposit account is opened in the bank to which the buyer contributes to the seller ' s account, which receives the money after the EGRN has issued an order for registration of the transfer of the right.

The buyer simply gives cash to the seller from hand to hand as a receipt.

Submission of documents and procedure for State registration of the transfer of ownership of an apartment

- Documents for State registration of the transfer of the right may be filed with any Multifunctional Centre in the territory of the Russian Federation.

- The application for registration shall be submitted by both parties to the treaty or by their representatives on a notary power of attorney.

- The required documentation package includes:

- Documents certifying the identity of sellers and buyers;

- A contract of sale with a transfer document;

- Credit contract (in the case of mortgage use);

- A receipt for the payment of the government service (in 2017 it was 2,000 roubles).

After State registration, an extract from the EGRP is issued confirming the establishment of a joint property right over the dwelling.

Tax on property of individuals

The tax on the property of individuals on the dwelling is calculated on the basis of its cadastral value, which is shown on the website of the FNS or Rostreestra.

The housing tax rate is 0.1 per cent of the cadastral value. It should be noted that the Tax Code provides benefits for certain categories of citizens. Please note that you may refer to the beneficiaries.

Co-owner shares are recognized as equals for the calculation of the joint property tax.

Tax deduction on income tax on physical patients

Since 2014, each partner may receive a deduction of 13 per cent from the NPFL from the sum of 2,000 rubles for an apartment purchased jointly owned.

When a real property is purchased with a mortgage, the owners are also entitled to refund the income tax on interest paid for the use of the loan; the interest paid is limited to deducting the sum of 300,000 roubles.

A tax deduction may be made on the purchase of several accommodations, provided that the total cost does not exceed 2,000 roubles.

Common property of spouses — model contract 2018

The law provides for a common regime of ownership of the property when it is part of the common property of the spouses.

In practice, this means that the land, a separate dwelling and all types of property belong to the parties on an equal footing; the features set out in the Act will be explained in detail below; in parallel, the procedure for dealing with such property will be described, as well as options for dealing with such property.

What do you mean, shared property?

Any other means of acquisition, including wills, other forms of inheritance, a model gift, and all other free legal relations in this case will be exceptions.

Items transferred under non-reimbursable agreements cannot and should not be part of the common estate; therefore, the concept of the joint property of the spouses is to acquire any property during a legal marriage, regardless of who acquires it; rights will be completely equal.

How does the recognition of the joint property of the spouses take place?

To this end, there is no established procedure, compulsory registration or other action necessary for such recognition.

The main sign here is the purchase of any property during the current marriage, which may include any type of property:

- Driving and real estate;

- Monetary assets;

- Bank and deposit deposits;

- Everything else that is material.

The model of a contract of sale to the joint property of the spouses, as a document, is not legally valid; the object automatically falls into the total mass, so it should not be mentioned again in the civil contract.

Model contract of sale in joint ownership

Legal regime for joint property

First, what regime is meant by finding an object on an equal footing without excluding ownership rights.

Secondly, the legal regime relates to the disposition of the common mass: if there is no marriage contract or any other agreement, all possible transactions will be permitted only with the mutual consent of both parties, and the mortgage dwelling.

The consent indicated here must be notarized.

Family Code of the Russian Federation — joint property of spouses

It is not lawful for a party to change the general order except by mutual agreement or by a court decision.

To download the Family Code of the Russian Federation in its final version

Marital property — article 34 of the Russian Federation

This article expands the concept of total mass to include not only physical objects but also any kind of money.

These include pensions, any benefits, established wages, copyright fees, the transaction of the banking segment, and everything else that is among the property benefits.

Article 34 of the Family Code

Tax deduction for joint property — changes 2018

The current tax legislation in this part has not changed in the current year.

Accordingly, the tax deduction is a separate preference for which each entity must apply separately, and the same rule applies to the sale of real property; the deduction remains the same and the general procedure for applying for it will be explained further.

How can you obtain a tax deduction for the joint property of a couple?

A deduction is made only in respect of one entity, if a conditional dwelling is acquired during marriage and only one person is included in the certificate, taking into account wages and a fixed tax base for only one entity.

In order to do so, a formal declaration must be submitted to the territorial tax authority, indicating the intention to receive a tax deduction, within one fiscal year, and the deadline is 30 April.

Common joint property of the spouses on an apartment upon divorce

By default, real estate will be divided into equal parts. This is done both in kind and in cash equivalent.

In the event of disagreement between the parties, the matter will be decided by judicial review; the shared property of the spouses in the joint purchase of the apartment implies that the property belongs to each party in certain shares.

In this case, each entity has the right to do almost whatever it wants with its share, and it is always worth remembering the rules of priority purchase over the second owner.

If you have any questions, consult a lawyer to ask your question in the form below, in the window of an online consultant on the right at the bottom of the screen, or call the numbers (round the clock and without the weekend):

A contract for the sale of the apartment to the joint property of the spouses

Common property of the spouses on the apartment

When you give shares in common property, they have common equity property (for details on types of property, see the Glossary on the basis of the references given).

In addition to the common joint (jointly acquired) property, each spouse has the right to personal property (art. 36). If the apartment belonged to either of the spouses before the marriage, it is therefore also the personal property of that spouse.

Also, if the apartment is purchased during the marriage, but with funds derived from the sale of the personal property of one of the spouses (e.g., a gift or a car), the apartment is also not considered as joint property but is recognized as the personal property of the spouse.

Nuances for the purchase of a flat by spouses

Although article 35 of the Family Code clearly stipulates the possibility of managing marital property without the consent of the other spouse, this rule is amended in the case of real estate, the share of the property of the spouses in the joint purchase of the apartment is clearly stipulated in the marriage contract.

It is recommended that each spouse ' s share of the property be described immediately in order to minimize disputes in the event of divorce and to prevent legal proceedings leading to the division of property.

In the event that you plan to purchase a joint property, you will in any case require the written consent of the second spouse.

A contract for the sale of joint property

1. — The seller undertakes to hand over to the buyer and the buyer undertakes to take over the joint property and pay.

When faults are identified in the Housing Home, buyers are required to report them in the transmission document.

The sales contract is intended to deal with the situation where the real estate (a flat) is owned by several persons, and other models are also found on website 74.

Joint property arises in the following situations: inheritance, marital status, formation of the peasant (farm) economy, privatization, joint purchase of belongings, joint construction of the property, association and mixing of things.

Property held in equity and joint ownership should be distinguished.

Features of a contract for the sale of an apartment for a seller with two buyers

It is possible to sell the apartment to two buyers through two separate contracts, each registered.

After the two buyers ' accommodation has been completed, they enter the equity property, which is the main characteristic of the sale and is necessarily reflected in the subject matter of the contract.

The following factors contribute to the drafting of one transfer document: The circumstances referred to are entered into the treaty and are essential, along with:

- The price of the dwelling;

- Conditions for payment and transfer of ownership;

- Rights and obligations of the parties;

- Liability of the parties;

- The conditions and reasons for the avoidance of the contract.

In general, the rules of the treaty are governed by articles 131, 454 of the Code of Criminal Procedure and article 3, paragraph 3, of the Code of Criminal Procedure.

TREATY FOR THE SALE OF EMERGENCY, HOUSE, Land, Buildings 2023

Failure to comply with the form of a contract for the sale of real property renders it null and void.

In the contract for the sale of real property on the sale of a dwelling, building, construction under the contract for the sale of a building, construction or other real property, the rights to the land occupied by such property and necessary for its use shall be transferred to the buyer at the same time as the title to such real property is transferred. in the contract for the sale of real property, a proportionate reduction in the purchase price of immovable property; in the case of the free removal of the defects of immovable property within a reasonable time; and in the case of the reimbursement of the expenses incurred to remedy the defects of immovable property.

On the basis of law or treaty 1.

Persons who use a dwelling on the basis of a life-long housing contract (life-long); the transfer of ownership of real property from the contract for the sale of real property to the buyer are subject to State registration. Project, model, form, form, template, example of a simple written transaction form (without notary) 1.

Sale of the apartment jointly owned

There are three forms of property ownership:

- The sole, i.e. the legal owner of the property is one person - physical or legal - the right of ownership is confirmed by the State registration and its entry in the EGRN - the Single State Real Estate Register.

Buying an apartment is a common joint property - Lawyer.RU

216 lawyers are on the website right now.

Hello, I'm planning to buy an apartment in the common property of the spouses, which was bought under the DUD, and the property was acquired.

What documents should be requested to ensure that the risk is zero?

What documents should they provide for sale?

How is the sales contract drawn up? Who is there? Does it matter if they have children if they are not written there?

Legal advice online Answer on site within 15 minutes Ask question

Legal responses (9)

- 9.8 Rating

- 7,216 feedbacks

- expert

Peter, good afternoon!

By virtue of article 35 of the Family Code

When one of the spouses makes a transaction on the disposition of the common property of the spouses, it is assumed that he acts with the consent of the other spouse.

A transaction made by one of the spouses on the disposition of the common property of the spouses may be declared null and void by the court on the grounds that the other spouse did not consent only upon request and only if it is proved that the other party to the transaction knew or ought to have known that the other spouse did not agree to the transaction.

For one of the spouses to enter into a transaction on the disposition of property,The right to which State registration is required, a transaction for which a legally binding notary form is established, or a transaction for which compulsory State registration is required, must obtain the notarized consent of the other spouse.

Accordingly, a notarized consent of the second spouse is required.

) to be 100% sure of its reliability, up-to-date form 9 (on persons registered in the apartment), preliminaryconsent to a transaction by the guardianship authoritiesIf there are minors whose shares are registered (even if they are not prescribed in the dwelling), and if there are other property owners (notarials), you will see all of them in the EGRP discharge.

For the sale of the certificate, the basis for the acquisition (the DUD contract registered and the certificate of acceptance from the developer), in general, to make the transaction faster and more reliable through a notary, but it will cost in the region of 17-19 thousand (values on the SPB) in Moscow, and it will make the contract subject to the terms stated by the parties to the contract.

What documents should be requested to ensure that the risk is zero?

- For the deal, you're gonna need:

- a passport (seller and buyer) or a power of attorney, if any, to represent the interests of the power of attorney

- Certificate of registration of ownership of the dwelling

- Landmark passport for an apartment (the cashier ' s passport may be requested by the bank if you buy the apartment on mortgage)

- Non-debt and electricity certificate

- Exit from the house book.................................................................................................................................

How is the sales contract drawn up? Who is there? Does it matter if they have children if they are not prescribed?

In an arbitrary form, the parties to the contract are the seller and buyer

If the children do not have a share and are not registered in the dwelling, their availability is irrelevant.

- Good afternoon!

- You can make a contract of sale yourself or ask a lawyer for help.

- If the sale is registered for one of the spouses, the other requires notarization for the sale of the apartment.

- If the children are neither prescribed nor owned, then the sale and purchase will not be affected.

Dear Peter, please ask the sellers to take an extract from the EGRIP, as well as a certificate from the passport table... if only one of the spouses is registered with the apartment, take the other's notarized consent to the sale (if the apartment is purchased during the marriage)... ask if there is no marriage contract... for the children, if there is one, it is better to remove the registration (there, to the grandmothers)...

- Hello.

- The second wife's consent was written, and I'm gonna do it for the kids.

- Under the current legislation of the Russian Federation, children are not entitled to parental property:

60. The property rights of the child.4 A child does not have the right to own the property of his or her parents, nor does his or her parents have the right to own the property of the child; children and parents living together may own and use each other ' s property by mutual consent.

Since children do not have a share in property rights, they do not have the right to a parent ' s home and may dispose of it without any restrictions; the consent of the guardianship authority is not required for the transaction.

However, I recommend that you clarify whether a mother ' s capital has been used for the purchase of this apartment, which is important because parents are obliged to allocate a percentage of the children first and then sell them with the purchase of a new dwelling, often the parents avoid the obligation, which carries the risk of challenging the transaction in the interests of minors.

- 8.8 Rating

- 6931 feedback

- expert

What kind of documents should be requested to seek zero risk? What documents should they be provided for sale? How is the sales contract drawn up? Who is there? Does it matter if they have children if they are not written there?

- Hello.

- - Sales contract.

- - Treaty of the DDU

- - Trust from the second spouse, if the paperwork is done by someone alone.

- You can ask for a certificate of payment for the rent, but if the apartment is owned, it is unlikely that the money has not been paid.

The risk here is for both spouses to be capable, you can ask for background checks on the PND to show, and check on Rosreestr's release to ensure that the apartment isn't secured or arrested.

Check the FSPS website to see if there are any debts on the vendors.

The husband's consent is not necessary, as the seller of 2, and they both sell, once jointly owned.

How is the sales contract drawn up? Who is there? Does it matter if they have children if they are not prescribed?

Any lawyer can write it up if you don't know how to do it, or take a template from the Internet.

The seller and buyer are shown.

Kids don't matter, they don't have a share of it, but to see if it's bought with maternal capital, if it's worth it, if it is, the baby's got a share.

What documents should be requested to ensure that the risk is zero?

documents supporting ownership of the apartment and the absence of encumbrances

What kind of documents do they have to provide for sale?

If both owners are listed in the certificate of ownership, no additional documents are required if only one of the spouses is identified, the other person ' s notary consent to the sale is required.

How's the sales contract coming up? Who's there?

Seller and buyer

Does it matter if they have children if they are not prescribed?

How old are children and have maternal capital been used in the purchase of DUD?

- The seller must have:

- Certificates of ownership

- Contract on the basis of each owner; technical and cadastral passport.

- There should be no temporarily discharged persons in the apartment, since they may already be registered with the new owners.

- These include:

- - Prisoners serving sentences; - members of the Emergency Service; - children in educational institutions; - elderly persons placed in nursing homes;

- - Persons treated in a psychoneurological clinic.

- 3. The apartment is free of charge:

- Not leased

- Not on bail.

- Not under arrest

- Not in the rent.

- It is not the subject of a trial.

- 4 If remodeled, it must be legalized

- 5. Notarial consent of the spouse

- 6. If there is a child, permission from the guardianship authorities

Hello!

which is the joint property of the spouses.

- In this case, both spouses can be vendors, and this is the best option for you.

- For Rostreestra, you need:

- 1. Vendor and buyer ' s passports;

- 2. Sales contract;

- 3. The act of reception/transfer;

- 4. Certificate of persons registered in the dwelling in question (not registered);

- 5. EMG vendor certificate

6.

It's a receipt from the buyer.

- You may also request the following documents, but it is not necessary to submit them to the Rosreister:

- Cadastral passport,

- Certificate of non-payment for rent, electricity, gas.

Model contract for the sale of the apartment to the joint property of the spouses

Hello, in this article, we will try to answer the question, "Provision of a contract for the sale of the apartment into the joint property of the spouses." You can also consult lawyers online free of charge on the website.

In this way, buyers acquire 1/2 shares in the right of common share ownership in equal shares of 1/4 shares in each right.

One way to establish joint ownership of an apartment is through its privatization, which is carried out on the basis of the Russian Federation's Law on Privatization.

What sales contract is needed to sell the joint property of the spouses?

One spouse can sell property acquired during marriage only if the other does not object to the transaction.

But if the owner were to live in a common dwelling, it would be impossible to expect positive results from the court, as that would not be the case.

With regard to the part of collective property sold, please note that this can only be done by means of a contract; its form and structure will not normally differ from the general contract; the division of property between spouses by agreement is notarized and the ownership of the new shares is then registered with the EGRN.

Registration of an apartment acquired during marriage

The information about the apartment, the address, the square, the deck, the number of rooms, and so on, the more detailed the better.

The EGRN's statement lists all owners who own an apartment together, i.e. one real estate property corresponds to one registration in the public register, and the old certificates, where all owners are listed in the same document, also have legal effect.

In general, this can be done with any property: an apartment, a house, a non-residential property, a car, and so on.

If the husband pays the mortgage and he and his wife are divorced, or they're going to divorce, then that's the case, and it's generally settled through a court of law.

Sale of jointly acquired immovable property

If persons under the age of 18 are co-owners of an apartment in the right to share property, permission to sell the dwelling must be obtained from OIE.

In particular, under article 34 of the Russian Federation, property acquired by spouses during marriage is their joint property.

By virtue of the fact that participants in joint property constitute a family or a family but a labour community with a common purpose and interests, there are no agreements between them, but there may be agreements between them.

Each spouse has the same right (with the other spouse) to own, use and dispose of joint property as defined in article 35 of the Family Code.

Cyril, a dwelling purchased by married couples, becomes their joint property, whether it is acquired by both spouses or by one of them.

The currency in which it is to be paid should be indicated; if it is possible to pay in instalments, the frequency of payment with the amount should also be noted.

In such a case, all owners have completely equal rights to own, use and dispose of the dwelling (article 253 of the Russian Civil Code).

The currency in which it is to be paid should be indicated; if it is possible to pay in instalments, the frequency of payment with the amount should also be noted.

And then, when the property is divided, it will be counted, which means that in a court of law, the husband's private home, the common property of the spouses, will be recognized.

From 31.01.1998 until that date, EGRP, the Single State Register of Rights, had been in operation and had been maintained in the BTI.

Equitable ownership of real estate – the purchase of an apartment into common property without an indication of shares.

It is important to know that ownership is the property where the share of each of the co-owners is clearly defined, but if there are no such restrictions, the property is joint.

At the same time, according to the documents, the owner must have only one: or the husband or wife; the second half automatically obtains the right to 50 per cent.

For example, if another property is purchased and the wife is named as its owner, she is a full-fledged and sole owner; it is logical that in the event of divorce, the husband will have the first apartment and the second wife.

We are undersigned:,,,,,,,,, : passport: series ___,...................................................................................................

,,,,,, : the passport series,.................................................................................................................

The division of property is possible both at the dissolution of the marriage and after the dissolution of the marriage at the request of either spouse. A three-year statute of limitations applies to the claims of the spouses for the division of the common property of the spouses whose marriage has been dissolved.

One of the spouses must obtain the notarized consent of the other spouse in order to perform a transaction on the order of real estate and a transaction requiring notary certification and (or) registration in accordance with the procedure established by law.

Common property of the spouses on the apartment

The purchaser shall be entitled to take possession of the acquired Quarter after it has actually been acquired.4.4 The consignee shall be entitled to:4.4.1.

The right of ownership of the dwelling shall be retained by the seller until the buyer has paid the contract price in full.

Joint ownership of the spouse ' s apartment may be recorded in the drawing up of a marriage contract in which shares are determined in proportion (art. 256 of the Civil Code of the Russian Federation).

The disposal (sale, gift, change) of property held in equity is now subject to compulsory notary certification.

Documentation of the sale transaction

The cash amount of rubles in respect of the payment of the amount acquired by KWARTIRU is paid out to KOVARTELEM as an off-the-shelf account, such as the amount of the mortgage loan provided under the loan contract: (Option 1) in cash by the transfer of the amount of the money from its ruble account N in the bank" to the ruble account of PRODAVEN N opened by the bank ".

There is an apartment privatized in 1997 for me and my husband and now an adult son, shared by the three of us, to sell this apartment, and there is a privatization certificate, a cadastral passport and a technical passport from the dwelling documents, since the son does not live in the city and he has a general power of attorney to sell the apartment.

If you acquire a new dwelling already in marriage, yes, it will be considered joint property! The determination of the share of the joint property of the spouses (sharing by shares) is recognized as a division of the joint property and is subject to compulsory certification by the notary.

This Treaty is drawn up in four copies, one of which is kept in the Office of the Federal State Registration, Inventory and Cartography Service for Moscow and is issued to each participant in the transaction.

This property is considered by law to be joint property, which both spouses have the right to dispose of.

If there is one, it could also be a problem, and an extract from a home book shows exactly who's in the apartment.

Common joint property on the apartment

In general, in today ' s world, there is an increasing tendency to buy or sell real estate; every person must know that such a procedure is responsible, serious, and requires important details.

Joint property may be registered in either single or joint share or common joint property.

I.O., the person authorized to sign, subsequently referred to as "PRODEVEC", on the second hand, concluded this Treaty, which reads as follows:

Similar records:

- Registration at a mobile bank

- Before the age of a student, they can get a subsidy to the apartment.

- Eye of the Roux Nurse ' s Standards

- Confiscation

- Legal articles

- Grants

- Fines

Common joint property of spouses Model sales contract

A contract for the sale of a common joint property dwelling: a model lounge for the sale of an apartment on its own

The right to common joint property is usually understood to mean the right of several persons to use and dispose of property which is theirs on a trust basis.

You are given the opportunity to draw up a contract for the sale of a joint property apartment on your own by means of a contract designer.

It is noted that the seller undertakes to transfer ownership to the buyer and the buyer undertakes to accept and pay for the apartment transferred within the relevant time and in the manner specified by the contract.

When the apartment is in common joint ownership, this means that there are no shares in it; therefore, the buyer needs to pay attention to this when reading the documents on the apartment.

As a seller, notify the buyer whether the sold apartment is under arrest, on bail, whether the rental is the subject of the lease.

If there are such charges, note this in the agreement and specify the number of copies in which the contract is drawn up.

You can move on to the following options for a sales contract - the filling samples are presented by the designer and have already been completed according to the type of contract chosen: All types of sales contracts that can be prepared by the designer, see Sales Contracts >>.

The fact that the second spouse made less contribution or was at home because of illness, childcare and other circumstances (they must be respectful); there should be no controversy.

And if you do not give, then you will not be able to give it to them.

In the event of termination of marriage, the rights to common property are not automatically terminated.

According to the law, the spouses have three years after the dissolution of the marriage in order to justify their rights to it through the court; if the illegal sale, gift or change occurs after the divorce, the period of three years shall apply if during the marriage, taking into account the one-year period.

Often people also go to court after the deadline for filing a complaint.

How to get the husband ' s purchase of the apartment into joint ownership: a sample of the sales contract

In this case, it will only be required to notify the second owner of its intention.

The real estate tax is paid by the owner according to a certain amount of his or her share; the tax deduction is also distributed proportionally to the amount of his or her share.

As you can see, a shared form of ownership gives each owner more rights and independence, while a jointly arranged dwelling can be operated by its owners only with a notarized permit for any transaction.

Agreement for the sale of real property of the apartment, housing, land, buildings, 2023

Failure to comply with the form of a contract for the sale of real property renders it null and void.

In a contract for the sale of real property — a proportionate reduction in the purchase price of real property; a free remedy for real property defects within a reasonable period of time; and reimbursement of its expenses for the elimination of real property deficiencies.

The transfer of ownership of real property under a contract for the sale of real property to the buyer is subject to State registration.

Housing Consultant

Such property may include the following: the agreement must be in writing.

With regard to maintenance, two types of ownership may be placed on the premises to be purchased:

- Total ownership of property;

- Total joint ownership of real estate.

The sales contract must state all the personal details of the spouses and, if necessary, the amount of each seller ' s share; a model contract for the sale of an apartment jointly owned must be registered in Rosreestre.

There is no tax on such a transaction, but the sellers of the dwelling can rely on a property deduction that will be distributed among the spouses according to the amount of their share, if any.

Model contract for the purchase of an apartment in common joint property

What do you mean, shared property?

The private form of ownership is when a person is the sole owner; he can do transactions and transactions without agreement with the tenants; the most advantageous option; the joint type is the type of property that has several owners.

But they have full control over them on an equal footing.

When a person is married, some of his rights and duties take a special form, and this is the case with the acquisition of real estate.

A contract for the sale of joint property

1.

3.2 Buyers are required to carry out a detailed inspection of the Housing House before signing the transfer certificate.

When faults are identified in the Housing Home, buyers are obliged to indicate this in the transfer document, and the sales contract is intended to deal with the situation where the real estate (a flat) is owned by more than one person.

There are other samples on website 74.

Joint property arises in the following situations: inheritance, marital status, formation of the peasant (farm) economy, privatization, joint purchase of belongings, joint construction of the property, connection and mixing of things.

Within the framework of joint (common) property, the share of each participant is not determined.

Model contract for the sale of spouses ' joint property

The following is registered at the address of the city of Moscow, referred to subsequently as the producer, on the one hand, and a citizen of the Russian Federation of the FIO.

Date of birth, place of birth of Moscow, gender of men, passport: series ___, issued by the Russian OFMS Mountain Office.

The Parties agreed that, in accordance with article 5, paragraph 5, of the Kyoto Protocol, in accordance with the provisions of article 3, paragraph 1, of the Kyoto Protocol, the Parties to the Kyoto Protocol shall:

488 The Civil Code of the Russian Federation does not create a right of bail for the said apartment by PRODAVOV, and the right of ownership of the dwelling is retained by the seller until the buyer pays the contract price in full.

8. At the time of signing this Treaty, the following persons are registered in the above-mentioned apartment:

13. Before signing the transfer certificate, the risk of accidental damage or loss of the dwelling is borne by the proxies.

The parties are aware of the use and disposition of the common property of the spouses.

Sale of the apartment jointly owned

There are three forms of property ownership:

- The sole, i.e. the legal owner of the property is one person - physical or legal - the right of ownership is confirmed by the State registration and its entry in the EGRN - the Single State Real Estate Register.

Sharing of common property between spouses(including apartments) may be as agreed by the parties, by signingProperty-sharing agreementas well as by a court decision,Court decision on the division of propertyAny of these documents may be the basis for the registration of each spouse ' s property right to an appropriate share of the dwelling, or to the entire apartment.

Sharing of common property between spouses(including apartments) may be as agreed by the parties, by signingProperty-sharing agreementas well as by a court decision,Court decision on the division of propertyAny of these documents may be the basis for the registration of each spouse ' s property right to an appropriate share of the dwelling, or to the entire apartment.