Last update: 14.06.2018

Did you know that...

Since January 2016Tax on the sale of an apartmentis charged on it.inventory valueI mean, with her.inventory valuemultiplied by:............................................................................But this rule has nuances, the devil, as always, lies in little things, what we're talking about now.

Every seller of an apartment is obliged to pay13%-NDFL taxfrom the income derived from the sale of the dwelling, taking into accountProperty tax deductions(by which the seller may reduce its taxable income).

The fact is that, until 2016, this very "received income from the sale of the dwelling" was considered to be from the amount that was stated as the price in the Sales Contract (CPT).

And since January 2016, tax officers have been granted the right to calculate.NPFLat the sale of her apartmentinventory value,multiplied by downwards:............................................................................(p. 5, art. 217.1 of the NK of the Russian Federation).

It's a tax right that's only used ifContract price...........................................................................lower thaninventory value X 0.7If the price of the contract is higher, the tax will be taken from it (i.e. the amount that is higher).

The seller, of course, still has the right to state any price in its agreement for the sale of an apartment (CPT), but if the amount of income it receives is less than70 per cent of the cadastral value of the dwellingthat's the tax (13%-NDFL) he's still gonna have to pay from that amount.70 per cent of the cadastral value of the dwelling.

However, the possibility of applying tax deductions to the sale of an apartment from the seller remains, and in some cases the tax may be reduced to zero (for details of deductions, see reference).

Assistance in the processing of tax returns and in the collection of tax deductionsYou can get it - here. (SERVISES)

Cadastral value of the dwellingfor tax purposes, taken as at 1 January of the year in which the dwelling is sold.

And in case this oneInventory valuefor the apartmentNot definedthe provisions of this article shall not apply and the tax shall continue to be calculated from the price specified in the contract.

But there are very few such cases now, and over the years, as regular real property cadastre works are carried out, there will be no such cases at all.

In addition, paragraph 6 of the same article 217.1 of the Code of Criminal Procedure specifies the possibility for every constituent of the Russian Federation of its own choice.lower the factor 0.7In addition, a separate law of the constituent entity of the Russian Federation may reduce the rate to zero for all types of taxpayers and/or real estate.

So in different subjects in Russia, before selling an apartment, it makes sense to find out the current situation about local size.coefficientapplicable to thethe cadastral value of the dwellingThis information can be obtained, for example, from the Regional Office of Rosreestre, the branch of the Rosreest Cadastral Chamber, or from local consultants.

List of documents required for the sale of the dwelling- look at the relevant step of the Regulation, by reference.

Which apartments are subject to the new tax rule?

This is a legislative innovation (taking inventory value into account when calculating a tax on the sale of an apartment)Only for those apartments that were purchased after 1 January 2016.This is expressly stated in article 4, paragraph 3, of the Introductory Act No. 382-FZ of 29 November 2014.

In other words, if the apartment was owned (privatized, inherited, bought, etc.) before 2016 and sold after 2016, the rule of sales tax at cadastral value does not apply.

Procedures for dealing with an alternative sale of an apartment.- see reference.

Should the price be reduced in the contract for the sale of the apartment?

Previously, a lot of salesmen are trying.Avoid paying a tax on the sale of an apartment, indicated in the Sales Contract (CPT) the undervalued value of the apartment, within 1 million roubles.Tax deductionIn the same amount of 1 million roubles, and thus "legitimately" avoid the payment of a sales tax.

This stunt encouraged the sellers, but scared the buyers, because if the transaction was declared invalid, the buyer was relying on the very "less" amount of the contract, not the amount he actually paid.

But...The tax on the sale of the dwelling is taxed.For the seller and in a legal way, without any tricks, after a few years of ownership of the apartment.

If, for example, he had bought it earlier, after five years of possession, he could sell it without a tax (art. 4, art.

If he received it as a gift, inherited it or privatized it, he is exempt from a sales tax after three years of possession (art.

If, however, he sells an apartment without waiting for the deadline, the tax arises and it can only be legally reduced by means ofTax deductionsThat's where the seller gets the temptation to lower the price of an apartment in the Sales Contract in order to subtract it and pay nothing into the budget.

This temptation will remain with the sellers until the beginning of 2021 (if the apartment was previously purchased: 2016 + 5 years of ownership) or until the beginning of 2023 (if the apartment was received as a gift, inherited or privatized: 2016 + 3 years of ownership).low price in the contract for the sale of real property.

What means of transferring rent money are used in real estate market practices- look at the Glossary by reference.

How do you know the cadastral value of an apartment?

This issue has now become relevant to all apartment sellers. It would be good to know what the value would be before indicating the real market value in the agreement for the sale of the flat.Taxable base– the price specified in the OST, orInventory valuefrom flatsE/ECE/324 Rev.1/Add.1?

Find out.the cadastral value of the dwellingFor free, see Rosreestre's website, in the "services" section, "Background information on real estate online": here.

Such information shall be publicly available and made available to any person who wishes to enter into the relevant field the exact address or the cadastral number of the dwelling.State Real Estate Inventory (PPG).

The cadastral valuation of real estate is not static, but periodically variable.Inventory valueClose to the real market price of an apartment, and sometimes it may even exceed it.

If it turns outthe cadastral value of the dwellingsubstantially higher than its real market value (e.g. 1.5 - 2 times) the owner of the dwelling is entitledTo challengeIn this case, specialists (lawyers and valuers) are no longer needed.

What's the point of the Act of Reception-Transfer-- who needs it more-- the seller or the buyer?Look at the Glossary by reference.

How to reduce the cadastral cost of an apartment?

In order thatTo challenge and reduce the cadastral valueHis apartment, a physical resident, can go to court immediately and try to resolve the matter out of court (and if it fails, then to court).

For an out-of-court decision, you have to go to a special court.Commission for the Review of Disputes on the Results of the Determination of Inventory ValueSuch a commission works with the branches of Rosreestra in each of the constituent entities of the Russian Federation, and the commission must respond within one month to refuse or accede to the applicant's request.

Trying to challenge (decrease) the cadastral value of the dwelling in this way makes sense only if it exceeds the market price by a minimum of 35 to 40 per cent. If there are fewer differences in value, the commission is unlikely to accept the request; but the owner of the dwelling can again challenge the refusal in court.

- Buying an apartment always carries certain RISKs.

- You can get professional legal support for real estate transactions here..

- Rules and sequences for the preparation of the sale of an apartment – on the interactive map of the SHORT INSTRUCTION(will be opened in the pop-up window).

Why it's dangerous to underestimate the value of the sale of real estate

Why it's dangerous to underestimate the value of the sale of real estate

The practice of underestimating the cost of a dwelling when selling secondary housing has long been common in Russia.

The price set out in the sales contract is much lower than the actual price. The objective pursued by both parties to the transaction is to obtain the maximum financial benefit. However, buying an apartment at an undervalued cost has serious risks that are neglected – risking much more unpleasant consequences – from total loss of funds to criminal prosecution.

Why lower real estate prices?

Income tax is levied on the transaction, including real estate, under certain conditions, and the deduction is calculated from the value of the dwelling specified in the contract.

According to the Tax Code of the Russian Federation, immovable property owned for less than three years is subject to taxation and a million rubles not subject to tax are deducted from the amount specified in the contract.

13% of the remaining money is deducted, so if the apartment is owned for less than three years, wait for it once, and the owner of the sale wants to minimize deductions, he deliberately understates the cost of the dwelling.

These are the most common schemes:

- - Upon receipt of the inheritance;

- - Brokers (those engaged in the purchase of flats at market value);

- - In the case of the separation of property;

- - buying an apartment to just invest in real estate.

This category includes the owners of apartments in the new buildings under the DDS, the transition to the owner automatically transfers the dwelling to a secondary fund, and the technical characteristics of the new dwelling increase the cost of the dwelling.

So the price of apartments is understated for different reasons, but for the sole purpose of minimizing costs, significantly reducing the amount of the tax on the transaction, it's the only advantage of this move, but transactions of this nature can come to a sad end for both sides.

Buyer ' s risks

When purchasing an apartment at an undervalued cost, the buyer of real estate carries the risk in the first place.

In this case, the bad-faith seller will only return to the buyer the amount indicated in the bills, which is much less money than the first one received, and it will be almost impossible to prove otherwise.

- Cancellation of the contract by the court: This may happen if the transaction is declared invalid for some reason (not including the rights of the children, an apartment with defects not specified in the purchase, etc.). The consequences are the same: the seller can only return the amount specified in the contract and the dwelling is returned to the owner.

- Probability of losing financial benefit: If the price of the dwelling is low, the buyer may lose the opportunity to benefit from the benefits or subsidies sometimes provided by the regional authorities for the purchase of housing.

What's the seller risking?

The owner of the excluded property risks a little less, but he may also have problems.

The buyer still has a receipt indicating the amount he actually gave to the seller, which is proof of the latter ' s non-payment of the tax; if the buyer goes to court, the former owner of the dwelling may spend a large amount on tax refunds, penalties and fines (20% of the shortfall) or even be held criminally liable.

The second risk is to miss out on the full amount, usually in two stages: the buyer may not pay all the money on the grounds that he paid the full amount specified in the contract; the seller will not be able to prove anything, otherwise the buyer will be at risk of liability.

The underestimation scheme does not guarantee that the transaction will be successful, without impact on the parties, and in deciding whether to take a serious risk in the name of doubtful economy, it is worth remembering the proverb of a double-payed payback.

Depreciation of the value of the dwelling in the sales contract

We are often approached by real estate buyers with the same question: is it not dangerous to indicate in the sales contract the undervalued value of the dwelling?

It happens that the seller refuses to document the full cost of the apartment.

If the seller owned the apartment for less than three years, it would require the payment of a tax in excess of the value of its purchase, or more than 1 million roubles. To avoid paying the tax, sellers seek to state in the contract the value less than the real value, usually about a million roubles.

The difference between the actual price of the dwelling and the price indicated in the documents is proposed for a separate receipt, and often the receipt indicates that the money was paid for the indistinguishable improvements, such as alterations or repairs.

Our experts, by one vote, advise real estate buyers not to accept such deals!

It may be that the proper owner did not know of the sale of the dwelling or was of limited capacity.

Second, by agreeing to the same terms as the seller, you help him to hide from the tax, and you actually conspire with him, which is a punishable act, and for that reason, bringing a receipt in court will not help you, but it will hurt you.

Third, you're creating tax problems in the future, and you can only recover your income tax from the amount specified in the contract, and if you decide to sell property earlier than three years, then the difference between the future real price of an apartment and the official price of its purchase will be quite significant, which means, in fact, a large amount of sales tax.

=======================================

We want to remind you that you can always use the services of our real estate agency, Gilspros, to sell or buy apartments, houses, plots or commercial properties, and that there is always a free-of-charge real estate consultation.

Can you sell an apartment below the cadastral value in 2023 - Pro Garden and Home

(10:: Average:..................................................................................................................................5,00(5) Loading..........................................

The question of whether or not to sell an apartment below the cadastral value arises for those owners who want to save on taxes; on the one hand, individuals want to do so, but on the other hand, they want to be afraid to do so, because they think that such actions will be illegal.

What is cadastral value?

In order to answer the question raised at the beginning of the article, the concept of cadastral value needs to be addressed.

Inventory valueThis is an official valuation of the real property, which is based on a variety of criteria, which is subjective because it depends largely on the opinion of the expert, and is based on the location of the property, its technical parameters, the availability of infrastructure, etc.

It is the cadastral value that is the basis for determining the real estate tax; this is an innovation recently introduced; it is not possible to determine the real property tax, given the other value; it is linked to the law; the tax is determined not by the taxpayers themselves, but by the tax authorities.

As far as sales are concerned, options are possible, because cadastral value is not always equal to the market value of the facility, so many sellers and buyers want to change the value of the sale.

In addition, the main reason for this desire is the desire to save on taxes; every real estate seller who sells an object (there are exceptions) must pay a tax on the income earned to the budget. NPFL is calculated with the income earned – the value of the sale.Consequently, the lower the income, the lower the tax.

Specific features of the sale of real estate between 2018 and 2023

Regardless of the real estate to be sold, there are three main features of the transaction that the seller must know about:

- If the property is owned by the owner for more than five years and the property is not acquired, but is inherited by will, inheritance, or by a gift contract, the right to release is granted to the property that has been owned for at least three years.

- When an entity is required to pay a tax on the income of individuals, the tax base will have to take into account the value of the sale, and the value of the sale for NPFL cannot be less than 70 per cent of the cadastral value;

- The regional authorities have the power to change the tenure of real property by local regulations, which gives the right to tax exemption, as well as the limit on the value of the sale in relation to the cadastral value.

These are the features that need to be taken into account if you want to sell an apartment, and it may be that at the regional level you have your own rules of sale and you need to know about them.

In addition, it is necessary to know that if an apartment was purchased before 1 January 2016, then the tax on the income of natural persons is calculated from the value of the sales contract rather than from the cadastral value.

If the value of the cadastre is used as a basis, the contract specifies the value as of 1 January of this year; such rules are related to this, the cadastral price may be revised during the year; it is customary to use the earlier value in order to protect the rights of the taxpayer.

Does the sale always take place at cadastral cost?

If you look closely at the valuation of real property in terms of cadastral value, it becomes clear that very different objects may have the same value, because there is a common valuation methodology, for example, no one assesses the degree of repair of an apartment, its communication, etc. The inventory value is always a subjective indicator.

This is why the sale of real property does not always take into account the cadastral value; the seller has to use another criterion to determine the value.

The reasons why the inventory value is not always taken into account in the sale of:

- When the innovations reviewed were adopted, the country experienced a crisis, and the purchasing power of citizens was therefore low; housing prices fell, market transactions fell sharply, and therefore the re-evaluation of facilities did not fully reflect the reality;

- The dwelling may be affected by flooding, fire, etc., therefore the inventory estimate will not match the real market price of the facility.

Thus, the first conclusion to be drawn from the amendments adopted is that the sales contract may include market value rather than cadastral value.

But there's another question:The market price can be both higher and lower, or higher, because if the value of the sale is lower than the cadastral value, the State loses some of the taxes.

Can an apartment be sold below the cadastral value?

Theoretically, it is possible to sell a property below the cadastral value, but in practice it can cause many problems. Therefore, if such steps are taken only in terms of tax reductions, it is not necessary to do so.

But there is an exception to these rules: if the cadastral value of the facility at the base is less than 1 million roubles, the real estate seller has the right to sell the facility at any cost, even if it is lower than the cadastral value, because under the current legislation 1 million roubles is the tax deduction to which the tax base can be reduced in determining NPFL.

To make it more clear,example of tax deduction:The apartment was sold for 2 million roubles, and the taxpayer decided to pay the NPFL for the budget, and its tax will be 2-1*0.13 = 130,000 roubles.

Accordingly, if the housing cost is equal to 1 million roubles, the NPFL will be equal to 0, which is why the cadastral value is absolutely irrelevant.

If the inventory value is much higher than the market value of the facility, it is recommended that it be changed before sale.

It is possible to reduce the inventory value by two methods:

- To make a statement to Rosreest. Statistics show that a review of the estimated cost of an object is not so rare; for example, if an apartment has been damaged by events or has already lost its value for some other valid reason, the Rosreestre representatives can easily meet and re-examine such an indicator.

- The method is also quite popular: if a court case finds a good reason to change the cost of the facility, Rosreest will have to review the cost and reduce it by a certain amount; in this case, only the real benefit of such action must be assessed; otherwise, the costs and other costs may be offset by the benefit of the inventory review.

Conclusions

- It is possible, but not always, to sell a property at a price that is not equal to the cadastral value;

- Sale at cost, which is more than cadastral, is not a problem and is generally beneficial to the State; therefore, there will be no comment on the part of the tax authorities;

- The sale of real property at a value lower than the cadastral value is possible if the price of the property does not exceed 1 million roubles, in which case the sale is normally made;

- It is possible to sell an apartment below the cadastral value, but most importantly that such underestimation is not less than 30 per cent of the cadastral value; for example, if the real estate price is 5 million roubles in the cadastre, it can be sold under a contract of sale for 3.5 million roubles;

- If the value of the dwelling does not correspond to the cadastral estimate, in particular, lower than it, it may be appealed to the courts; once a court decision has been obtained, a sale transaction may already be concluded.

To comply with such ill-advised rules to allow all transactions to be carried out correctly and in accordance with the law.

Read also:

2018, Garden and House, all rights reserved.

(10:: Average:..................................................................................................................................5,00(5) Loading..........................................

Lower price in sales contract

Vim/Depositphotos

Why do sellers lower the price of an apartment in a contract?

Salesmen usually hide the real value of an apartment to save on taxes when it is sold, another reason being the gap in the cost of housing and the level of "white" income.

Consider the first option: It's important to know when the tax is due. So if the apartment is gifted or inherited, then you have to wait at least three years before you don't pay the tax when you sell it.

And if the dwelling was owned after 2016, up to five years old, but the owner wants to sell the apartment earlier, and save on taxes, and that's where the low-cost scheme comes in.

Can you lower the price in the contract if I take the mortgage?

Tax on the sale of an apartment: rules and examples

The second option is that when the buyers themselves ask for an incomplete value in the sales contract, this happens when a person who buys expensive real estate, for example, has a large "grey" income, in which case he may ask about the source of the funds for the purchase of housing such that he does not need it.

What is the importance of knowing the seller?

According to current legislation, the tax officer collects taxes at 70 per cent of the cadastral value if the price specified in the contract is below that value, which is designed to prevent sellers from taxing real estate transactions.

In general, the tax authority can prove that the real value of the sale of the dwelling is higher than that specified in the contract and requires the seller to pay a tax and a fine; the purpose of the service is to track the correct taxation and transfer it to the State; the fine for the outstanding declaration would amount to 5 per cent of the unpaid tax for each full or partial month of delay.

And you, as a buyer, can lose your tax deductions, but only the court can decide as to whether the transaction is null and void.

What nuances do you need to know about the tax on the sale of an apartment?

Should I write a fake receipt so that the buyer can get credit?

How is the low price dangerous for the buyer?

Low-priced contracts are quite risky for buyers: very often, they are used for fraud; for example, fraudsters conspire with the owners of an apartment (usually pensioners).

However, under different pretexts, they convince the buyer to specify a lower value in the contract and then sue the court to declare the transaction null and void.

The court often sided with the former owners and returned the apartment, but the buyer received only the amount prescribed in the contract.

How do you know an apartment is sold at an underpriced price?

It's necessary to do a market analysis and look at the real cost of selling similar options. If similar objects in the same area are sold for 6 million rubles, with repairs for 6.5 million, and you're offered housing for 5.5 million rubles with all the trim, you should be careful. As you know, free cheese only happens in a mouse trap.

- Text prepared by Maria Gureeva

- Don't miss it.

- What expenses should be included in the declaration to reduce the tax?

- How long does it take to buy and sell an apartment?

- 25 texts on how to sell an apartment, room or share

- Taxes on buying and selling housing: 23 useful articles

The articles are not legal advice; any recommendations are a private opinion of authors and invited experts.

Risks of underestimation of buyer ' s and seller ' s apartment

Underestimation of the value of an apartment in a contract carries risks and is a frequent phenomenon in the secondary real estate market; such transactions not only benefit the parties but also risks; the profits from such actions are much lower than the potential negative effects.

It is probably no secret to anyone that the transactions in which it is practised are undervalued in the sales contract in order to avoid the seller ' s taxation.

I even think it's so common that many people don't even pay attention to it, but it's worth thinking to both buyer and seller about all kinds of risks and negative consequences.

The right sample of cash receipt for the apartment.

Risks of underestimation

- As the transaction is going on, there are usually 2 receipts in practice, one receipt is written in the amount specified in the sales contract and a second receipt in the remaining amount under the guise of unbroken improvements.

- But there are a lot of options, if I've never really done this, and I don't want to go into detail and explain the various gray schemes, because the article is written to protect you, not to teach you all kinds of tax evasion.

- I would like to say at the outset that in such a case the transaction is considered illegal, since the value is an essential condition of the contract and if it is not stated correctly, the contract is concluded in violation of the law and the contract may be declared null and void by the court, and the contract may also be deemed to be pretense by the court.

They can also accept a cable deal, i.e. the seller would have an excellent opportunity to return the place, taking advantage of what he had sold at an undervalued cost because he was in a difficult life situation, for example, needed money for drugs, and then realized that he had sold the only dwelling he had decided to return.

The buyer will, of course, start defending and showing two receipts in court, in which case the seller will also be at great risk, the tax will first have grounds for filing a tax claim, and the seller will be held criminally liable for tax evasion.

Undervalued value in sales contract: buyer ' s risks

- 1. If the transaction is declared invalid, the seller will be required by law to reimburse the buyer for the value specified in the contract;

- 2.

The buyer will receive a deduction only from the amount specified in the contract, not from the real amount;

- 3.

A transaction in court may be declared null and void on the following grounds:

- not in accordance with the law

- Pretty fake.

- Cabal (i.e. by means of deception and in the event of severe circumstances)

Undervalue in sales contract: seller ' s risks

- Civil liability for tax concealment claim by the Tax Inspectorate

- Lower amount may lose potential buyers

- Criminal punishment for non-payment of taxes

Example from practice

I was consulted by a woman, who explained that she had bought an apartment, that the contract indicated a low value of up to 1 million, that they had registered a contract with 1 million in a grocery store, and that they had signed a second full-value sales contract.

She is a large family and is covered by the mortgage programme for three children, and then she went to the Ministry of Construction to pay off all the real mortgage debts and to show her the full amount of the contract she had signed, and she was asked to sell the contract she had given to Rosreest.

As a result, only the amount set out in the sales contract with the $1 million that had been given to register the transfer of ownership, she asked me if I could repay the entire amount of the debt, explaining that there was also a signed contract with a real value that should have legal effect.

But the two treaties cannot have legal effect, only the one that was given to register the transfer of ownership to Rosreest, so the decision to repay her mortgage from 1 million rubles is legal, and in the end, only 1 million were repaid! She was very upset because she lost several million in ignorance!

But it's better not to go to court at all, even if the claim is settled, if the transaction is declared invalid, to award the price of the apartment to the buyer, it's not the fact that the buyer will wait many, many years for that money.

Since in this case the laws are very humane, if the debtor has no money, you will not see any money from it, because there are no sanctions for not paying the amount of the claim, and no law can make it work.

So if the court declares the transaction null and void, consider the buyer homeless and without money, in this situation the buyer is more at risk, as much as it's at the seller's expense, I insist that the entire value be kept in the sales contract.

Because there are options where the seller won't pay the tax.

For example, in most cases, when the seller sells the dwelling immediately buys another apartment, and by law if in one calendar year the seller sells and immediately buys the dwelling for the same amount, the tax will not be paid, in this case it will be netted, the most important thing to do is to sell the apartment in one year, and in the same way try to buy a dwelling.

So don't be afraid, you can always find a legitimate solution, and you can sleep in peace.

Depreciation of the cost of the dwelling on mortgage risks to the buyer

These processes are widespread, so different investment schemes are possible, and banks only test solvent borrowers without exploring the purpose of credit.

An application for a mortgage, including another loan for the repair/renovation of a target facility, shall be submitted to the Finnish institution and the contract shall have two points. Such applications shall normally be approved but shall include:

- Increase in initial contribution;

- Increased annual percentage;

- An additional commission.

- Depreciation creates additional legal and financial difficulties for the buyer.

- In any case, so that you don't feel alone in a situation like this, contact us, always help us find the safest way for both the seller and the buyer.

- I remind you that my page for your questions is here!

- Good luck to you!

Real estate deals — can you sell an apartment below the cadastral value?

The inventory value of the dwelling is determined to calculate the amount of real estate taxes.

Do you need to demonstrate to a potential buyer the cadastral number? Can you reduce the cadastral value of the demand for housing on the market? What can be done in this case? From our material you will learn about the subtleities of the valuation of the cadastral value (hereinafter COP) and the links between it and the sale of the apartment. We will tell you whether you can sell your real estate below this price or, on the contrary, higher, that is, more expensive and to whom.

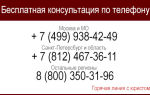

To solve your problem, you will receive free legal advice: +7 (499) 504-88-91 Moscow +7 (812) 385-57-31 St. Petersburg

How does Rosreister's price affect real estate transactions?

Excessively low

The reduced inventory value affects the transaction both indirectly and directly.The owner of the dwelling who sells the dwelling receives a taxable income during the transaction.

Since 1 January 2016, the Russian Code of Practice has been amended to refer the tax to the cadastral value, previously on the basis of the amount specified in the sales contract.

This allowed the parties to save on taxes to the State by indicating in the contract the amount below the actual amount.

Although it is worth noting that such transactions were risky – the buyer had obligations to the seller only on the stated amount, the remaining arrangements were informal.

Low inventory value dwelling would be more profitable than similar housing with the COPIn the first case, a person who buys real estate cheaper will be able to legally save on tax payments.

Excess

Excess cadastral value is not useful during market transactions. The COP is calculated according to several indicators, while the buyer takes into account everything possible, so that the higher cadastral price is not uncommon; it results in increased taxes to the Government.

Help:....................................................If the cadastral value proved to be higher than the market value, the owner has the right to challenge it by contacting Rosreister or the court.

The current legislation of the Russian Federation implies a dependence of the cadastral price on the market value if the latter is proven to be official and relevant.The owner of square metres may initiate the examinationand then, on the basis of the document, adjust the inventory estimate.

Is this indicator always included in the transaction?

Russian legislation divides transactions into two categories depending on how different the amount of the contract is from the COP.

- If the amount in the contract exceeds 70 per cent of the cadastral value, the taxable income is calculated on the basis of the value of the contract, in which case the cadastral estimate is not taken into account at all.

- In the event that the cadastral price has been substantially overstated and you have sold housing for less than 70 per cent, the taxes will be paid at 70 per cent of the COP.

- As you can see,In the case of re-evaluation of real property by more than 30 per cent, the State makes some concessions.

- However, buying an apartment may still not be very beneficial if the above-mentioned reassessment is, for example, 50%.

- If the real estate is owned by a seller collecting a square metre for more than five years, the owner is exempt from paying the tax to the State.

Can housing be sold at a price lower than the COP?

Russian legislation has no control over pricing in the real estate sector, as it remains the main indicator enabling the market to operate, taking into account all the circumstances, from the economic state of the country to the need for the apartment itself.The Government does not restrict the owners by allowing them to sell housing at a price they find appropriate.

It's important:If the price is lower than the cadastral price, the transaction will have no legal effect.

Suppose the apartment is sold at a price equal to 90 per cent of the KC, in which case the taxable income will be calculated at the value of the real estate in the contract.

How do you do that?

The sale of an apartment at cadastral value in Russia is virtually impossible because it is not in the interest of the market; although the Government of the Russian Federation has introduced the COP instead of inventory value to bring the State valuation closer to market realities, the State real estate cadastre is still far from market relations.

The economic crisis has had a negative impact on purchasing power, and the square meters themselves can be both expensive and cheaper for independent reasons.The COP calculation algorithm is different from what the market can offer.

The example of re-evaluation of apartments can easily be seen in elite housing in new buildings on the outskirts of Moscow.

To get to the center for a long time, the subway isn't around, you have to run into traffic – a feature that will significantly reduce the demand for real estate for most buyers.

At the same time, the cadastral valuation will take into account the high comfort of the dwelling itself, so the difference between the market value and the cadastral value will be significant.

The law in Russia does not prohibit the sale of an apartment below the COP.It is important to remember that the tax deduction will be related in one way or another to the inventory value. If you are certain that the COP has been overestimated by two or three times, it is recommended that it be challenged before the transaction begins.The Russian Tax Code provides for a reduction of the COP in the calculation of the tax by only 30 per cent of the maximum.

Impacts and risks on the parties

For the seller

After 1 January 2016, sellers lost almost every chance of lowering their tax payments by entering into a transaction with informal supplements, and now the taxer calculates the amount of payments to the State on the basis of the cadastral value, and the government believes that the apartment cannot cost less than 70 per cent of the amount estimated in Rosreister.

It's important:Lawyers do not advise the owners of square metres to experiment with the cost; it is better to challenge the COP if it is too high and driven by market realities.

For the buyer

The sale of an apartment at an undervalued cost is recorded in the contractIf in the future, after the conclusion of the contract, you want to break the transaction and declare it invalid, you can only receive the amount specified in the contract.

Suppose the buyer paid another portion of the sum informally to avoid an increase in the tax burden. An informal supplement, which is never recorded or recorded in the documents, can only be returned on the free will of the old owner of the property.

Tax amount

In the Russian Federation, the tax on the sale of an apartment is 13 per cent, with the State providing the possibility of not paying taxes on the sale of a dwelling equivalent to one million roubles; the owner must apply to the tax authorities himself for such tax deduction.The government will not make a deduction without a referral.

Each owner of an apartment will be able to calculate the amount of the tax on his own. For example, the following is the case: the dwelling is sold more than the cadastral value, so the market price is taken into account; it amounts to 3,400,000 rubles; 1 million tax deductibles are taken out and 2,000,000 rubles are received; this amount is multiplied by 0.13%; 312,000 rubles of tax.

Nuances

The real estate tax, in our case the apartment, is payable to the State in many cases, but not all of them, there are two exceptions to the well-known rule.

- First, a tax on income derived from this method will not be paid by a seller whose real estate was owned for three or five years. If the property rights of the future seller of square metres were issued before 1 January 2016, he will be exempt from the tax after three years of ownership. Those who have received an apartment after 1 January 2016 and now want to sell it without payment to the State will have to wait five years.

An example is that a citizen bought an apartment in St. Petersburg in September 2015, and his tax break came three years later in September 2018, and a Russian from Ufa who received a dwelling in March 2016 will be able to sell the apartment without payment in the spring of 2021.

The three-year rule now applies in the Russian Federation only to flats that have been inherited, donated by a close relative, privatization or by a contract of life imprisonment with dependency (the so-called rent).

- Secondly, article 220 NC provides for the right of every citizen to receive a tax deduction, i.e. to reduce the amount on which the tax will have to be paid; the amount currently amounts to 1 million roubles per year; if the cadastral or market price of real estate is below 1 million roubles, the tax does not have to be paid regardless of the duration of the dwelling.

There is another way for those who have bought housing in the past, rather than having inherited it or received it as a gift, to reduce payments – by proving that a citizen has spent money on the purchase of housing.

Is the sale of an apartment under the COP real to the State, and how?

It is possible to sell an apartment to the State if Russia, through local or federal authorities, needs to replenish its housing stock.

We emphasize that the Government, in the process of buying and selling real estate, is the same participant in the legal relationship, so that the transaction can only be approved voluntarily.

The municipalities have no obligation to purchase square metres for citizens.

Warning:In order to learn about the possibility of making such a transaction, the advice is to contact the housing department of the district or city administration with a proposal.

In Russia, there is a term for such transactions – deprivatization, and the process itself is limited by many requirements – for example, only citizens who are unprotected must be able to sell an apartment of the Russian Federation, and they must prove that housing has become a burden on them.

Can the price be higher?

Consider whether it is possible to sell an apartment more than the cadastral value; if a transaction takes place between two natural persons, the amount of the transaction may be equal to or greater than the cadastral value; the State, in turn, uses the COP in calculating the value of real property purchased from citizens.

With the introduction of new legislation in Russia, the cadastral value of the dwelling is taken into account.It's not going to be possible to save another amount on the document.

However, the State is loyal to citizens and proposes two legitimate ways to reduce the tax – to take advantage of the tax deduction or to reduce payments in the amount of expenses associated with the purchase and maintenance of housing.

Take advantage of these opportunities and pay less during the sale of the apartment.

If you have found a mistake, please select a piece of the text and click Ctrl+Enter.

To solve your problem, you will receive free legal advice: +7 (499) 504-88-91 Moscow +7 (812) 385-57-31 St. Petersburg