The article contains important nuances on how to properly construct a contract for the sale of an apartment using maternal capital (MC), in which cases it is not possible to use the MC as a way of avoiding the refusal of the Pension Fund and Rostreestra to conduct the transaction.

Contents:

In which cases it is not possible to buy with maternal capital

It is not known how long this government programme to support the country ' s fertility will last, so it is not necessary to delay the acquisition of real estate and the use of the certificate in a long box, especially since most of the transactions in the real estate market are now taking place either with mortgages or with maternal capital.

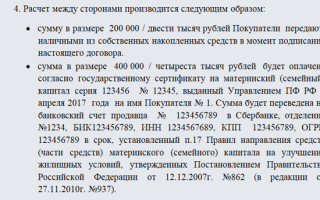

You can save yourself a lot of time if you know which property you can't buy on your mother's capital:

- Land plots

- Housing outside built-up areas

- Apartment or home not in conformity with residential and sanitary standards (San Pin)

- Non-residential premises, including a dormitory that does not have residential status, a non-residential basement or basement

- Living object over three floors

- Secondary housing, which is more than 50 per cent worn out;

- Real property for which the seller cannot prove ownership by a discharge from the Single State Real Estate Register (EGN)

In addition, it is not possible to buy a share of an apartment or a room in a communal apartment if it is not a separate property, a room in a commune should have its own ownership (in the old real estate registration format) and be a separate property subject.

Sales contract using maternal capital – a sample

In this case, the purchase is significantly different from the usual contract for the sale of real property, the existence of a special payment procedure and the distribution of shares among the members of the buyer ' s family.

According to the conditions for the presentation of the mother ' s capital, the owner is obliged to provide a share of the new home to all members of his family, but you can do so immediately at the purchase stage or after six months, and it makes sense to do so for two reasons:

- The allocation of shares after purchase will require a follow-up to Rosreest, the drafting and submission of the contract for the transfer of shares and, accordingly, the repayment of the State Ministry (2,000 roubles); you will save time and money if you do so at once by including the necessary terms in the contract of sale (the model of the contract below);

- It is easy to forget the need to allocate shares for children and husband within six months; the offence has not yet been specifically defined, but there have already been cases of procuratorial review of delays, and orders have been issued to eliminate them; this is difficult to call a penalty, but it is not very pleasant.

Sales contract form using mother ' s capital

download a model contract using maternal capital

The law clearly does not require the size of the shares allocated, but there is some practice which is based, among other things, on the provisions of the Family Code; for example, the proportion of real estate that has been paid for by the mother ' s capital must be equally distributed among family members.

Example:

An apartment worth 900,000 roubles is purchased for a family of four.

50 per cent of its value is paid by the maternal capital (MC).

50 per cent is paid from its own funds.

Consequently, half of the flat paid for by MK - Rs. 450,000 is to be distributed, i.e. 1/2 apartments.

With 1.2 apartments divided into four family members, we will receive the share to be allocated to each family member in the amount of 1/8:

1/8 = 1.2 : 4 persons

Pension Fund authorization

Without the Pension Fund ' s (FF) approval for the purchase transaction, it is not possible, and therefore, first of all, you need to comply with all the FP requirements for the housing to be purchased and the necessary documents to be made available.

List of required documents

- Of course, the mother's capital certificate itself, the original must be in your hands.

- The purchase requires the purchase of the property whose owner agrees to the sale scheme using maternal capital.

The downside for the seller is the fact that MC's credit is on average about two months old, but the real estate market has been quiet for a long time, and this is not the worst prospect for many.

- The selected housing should meet the requirements described in the second section and the requirements of the Pension Fund to negotiate the transaction.

- To submit to the FP a statement of the prescribed form for the use of MC housing funds, attaching the following documents:

- Copies of spouse ' s passports

- Copies of birth certificates for all children

- Original MC certificate

- A copy of the pension insurance certificate

- A copy of the contract for the purchase of housing with the site plan and copies

- If the dwelling is purchased on behalf of the mother, a notarized commitment is required to provide a share of the dwelling to all family members within the next six months. (If the situation allows shares to be allocated immediately upon purchase, you will save several thousand rubles and a few days of your time)

- Bank details of the seller for payment of MC funds to the seller for payment of real estate

If the facility is purchased as a mortgage, there will be an additional claim for the amount of the bank ' s debt. Bank mortgage will require a life insurance policy for the borrower. How to reduce the cost of the insurance or eliminate insurance at all is described here.

In addition, you need to have a certificate of the MC account balance not exceeding one month, which must be obtained in advance from the Pension Fund. At different times, the legislator has given mothers the right to use part of the different amounts within the certificate funds, which you may have forgotten, so the actual balance of the account may differ from the original amount.

How to avoid refusing to register a sale in Rosreister

In some cases, there is a problem with the acceptance of documents in the Rosreister himself. As a rule, if there is an error in the contract or there is an irregularity in the documents submitted, the Rosreestra staff member must inform you immediately, in the field, but the level of competence of these specialists has recently seriously deteriorated and the problem with the documents can be noticed much later. The most frequent reasons for refusals usually relate to formalities in which inattentional errors occur:

- Numbering of items in the treaty violated

- No passport issuing unit code specified

- The writing of the place of birth is different from the one on the passport, although the meaning is retained, e.g., the city of Kovrov and the mountains of the Korovs. Such discrepancies may be noticed and do not allow the document to go to work.

- It is not recommended to indicate the date of the treaty immediately, since in some cases Inspector Rosreestra must do so.

- Failure of the seller ' s spouse to consent to the sale

- The wrong name of the payer, his registration address, or other errors in the government fee receipt for the conversion of real estate. This can easily happen when you pay the public service at an unusual payment terminal.

But even where all of the above formalities have been met, PF officers may refuse to negotiate and approve the transaction on their own grounds.

In order to avoid this, I recommend that the draft contract be addressed in advance to the fund ' s responsible employee and that its content be clarified to ensure that all the legislative and local requirements that are relevant to your region or city are met.

Despite the long description of the stages of purchase using MC funds and the numerous requirements of the law, you can not only make a contract for the sale of an apartment on your own, using maternal capital, but also complete the entire transaction.

First, this procedure is not as complicated as it seems, and secondly, in part, it protects you from errors and unclean salesmen who perform their work by carefully checking documents for a sales transaction.

Although at times their demands seem excessive, in reality this greatly reduces the risks of buying and fears you from the danger of losing the already rare help of the state.

I wish you a speedy improvement in the housing situation!

A contract for the sale of a share of the dwelling using maternal capital (model)

67 views

Since 2007, there has been a programme in the territory of the Russian Federation to support families with the arrival of a second child, and the law provides for the allocation of a fixed sum to a special account at the time of the birth of a second child; however, the recipient cannot spend it for any purpose.

One option for the order is to buy a dwelling; until 2015, the Pension Fund refused to buy a share of the apartment from a uterus; the Supreme Court has made adjustments, so such transactions are allowed in 2023.

Consider how a contract for the sale of a share of the dwelling can be processed using maternal capital.

How to make a proper contract for the sale of a share using the funds of the uterus

In 2023, it was difficult to find a owner who agreed to sell a share of the dwelling into a mother ' s capital, the main reason being the long (up to 3 months) period of waiting for money from the Russian Pension Fund.

It is therefore advisable to find another option, e.g. a mortgage, which can then be repaid by means of public aid.

In addition, when buying a share of the State support, it is necessary that at least three years pass from the birth of the child, and the mortgage can be paid from the first days of the baby's life.

Some citizens, however, refuse the obviously convenient mortgage option for a number of reasons, including the refusal of credit institutions to issue loans or the failure to pay interest overpayment.

Regardless of the situation, Act No. 256 of 2006 allows the holder of the certificate to dispose of the funds of his or her choice within the framework of the law; therefore, often citizens who own the mammary make transactions for the purchase of shares in the dwelling.

The form of the contract for the sale of the share of the dwelling from the funds of the mother capital is not prescribed by law; therefore, it is possible to use the normal form of the contract for sale.

However, the document should contain a number of features:

- Data on the payment of a portion of the funds from maternal capital;

- The seller ' s agreement to wait for payment, as the funds will be transferred in two to three months ' time.

Model contract for the sale of a share of the dwelling using uterus

The contract must contain the following particulars:

- Name of documentA contract for the sale of shares in an apartment) is not required by law to include information on the use of maternal capital in the document ' s cap.

- Place of detention.Go to the village where he's being processed.

- DateNumber, month, year of signature.

- Information on the share seller (in thousands of United States dollars)F.I.O., date of birth, passport data and address of the propiska).

- Information on the presence of a trusted person.If the interests of an adult capable citizen are represented by a trusted person, the details of a notary power of attorney must be indicated.

If the share belongs to a minor owner, additional information must be provided on the legal representative (mother or father); when selling a part of the dwelling to a minor (between 14 and 18 years of age) by the owner, the legal representative only agrees to the transaction; and the owner acts as an independent seller.

- Similar details of the buyer.

- Data on the existence of a trustee on the part of the buyer.

- Information about the apartmentThe postal address, the total area, the deck of the house, the floor on which the apartment is located should be indicated.

- Size of shareThe value is given in fractional terms, e.g. 1/3.

- Rights and obligations of buyer and seller.

- Value of shareThe amount is written in numbers and in writing.

- Calculation procedureSince the ransom is made with the use of the uterus, it is necessary to specify the time within which the buyer will apply to the Pension Fund, the approximate period for the disbursement of the money, and the procedure for the transfer of the rest of the sum, and it is mandatory to specify whether there is an advance or deposit.

- Information on the transfer of the facilityIn the absence of a document, the seller remains the legal owner.

- F.I.O. and signatures of the parties.

- Model contract for the sale of a percentage of the dwelling using maternal capital

Pick up a contract for the purchase of an interest in an apartment for the mother ' s capital

How to sell a share of an apartment for a uterus.

The owner of a share of the dwelling may sell it to co-owners or third parties; however, only co-owners can buy it with the funds of their mother ' s capital.

The law imposes the following restrictions on transactions involving public funds when buying shares in an apartment:

- The object of the purchase is an isolated room.(room in a communal apartment, separate non-affiliated room).

- As a result of the purchase, family members become sole owners of the apartment(if the transaction is made in respect of a one-room flat).

- The living quarters are in joint property.(the transaction with respect to the facility in general joint possession is prohibited).

- The apartment meets sanitary standards(not considered dilapidated or accidental).

- The percentage relates to housing.In accordance with the law, accommodation means a place intended for the residence of citizens; the funds of the uterus will not be allocated for the purchase of a share of the non-residential space.

A transaction cannot be made to buy a share of a husband's or wife's apartment, but it is possible to pay for a portion of the apartment from a former spouse at the expense of the uterus.

An example.In 2015, the Supreme Court considered the claim of the citizen A. to the Pension Fund to challenge the refusal to purchase a share of the apartment on the basis of a uterus. In the proceedings before the court of first instance, the Court granted the applicant ' s claims.

However, the RPF filed an appeal and, in the course of its examination, the decision of the court of first instance was reversed; the court of cassation referred the case to the Supreme Court; the Supreme Court of the Russian Federation reversed the appeal decision and confirmed the decision of the court of first instance.

The funds of the uterus were transferred to the plaintiff ' s mother in order to pay for the share in the apartment.

Procedure for processing the transaction

Action algorithm:

- Document collection.

- Buyers ' discharge of the obligation.

- It's a contract.

- Notary I.D.

- Documents sent to RPF.

- Registration of ownership.

- Retrieving money.

Collection of documents

The seller must prepare documents in advance for the sale of the share

| 1 | Civilian passport |

| 2 | Notary power of attorney (if the transaction involves a representative) |

| 3 | Technical passport |

| 4 | Exit from EGRN |

| 5 | Legal instruments |

| 6 | An extract from the home book |

| 7 | Evaluation report |

In the case of buyers who are not accomplices, it is further necessary to submit a waiver of the ransom from the co-owners of the dwelling, and their priority right must be respected (article 250 of the Civil Code of the Russian Federation).

Statement of commitment

The seller needs to clarify with the buyer the existence/no obligation to allocate a percentage of children, which is necessary for the smooth passage of the registration of ownership rights in Rosreestre.

In the absence of a document, Rostreest will return the contract without registration, and the seller is wasting his time.

The obligation is in writing notarized and parents guarantee the transfer of the property portion to the children within six months of receiving the right to share in the dwelling.

Notary certificate

The law provides for notarization of the contract if the object of the transaction is a share in the apartment; the parties may apply to the notary office to draw up the contract.

The notary will not only provide certification services, but will also issue a contract (for an additional fee).

The costs of a notary certificate may be:

- It's split in half between the sides.

- It's on the seller.

- It's on the buyer.

Since 2023, the notary has been responsible for providing documents to Rosreest, so the parties will not have to take action on their own to register the transaction.

In order to do so, the parties must pay the Minister of State for the registration of the law and sign the declaration at the notary office.

Documents sent to RPF

Remittances do not occur automatically; the holder of the certificate must apply to the authorized authority.

The application shall be accompanied by:

- The applicant ' s civil passport;

- An extract from the EGRN;

- Sales contract;

- a notary obligation;

- The details of the seller ' s bank account.

The application can be submitted directly to the RPF, through the IFC or the State Services, depending on the method chosen.

The decision to grant the applicant ' s claim is taken within 30 days, and the deadline for filing documents through the IFC is increased by 2-3 days.

Transfer of funds to the seller

The money is not transferred to the buyer; the law stipulates that payment must be made directly to the seller ' s account.

The decision to pay is made within 30 days, but the direct payment is made within 60 days.

The cash shall be sent to the account specified by the holder of the certificate in the application and the bank account's certificates shall be attached to the documents.

Judicial practice

Since 2007, there has been an impressive case law on the purchase of shares in an apartment by means of a uterus; if the Pension Fund refuses to transfer funds, the holder of the certificate may apply to the court, and the courts support the plaintiff even in the most unusual transactions.

ExampleInna applied to the Pension Fund to buy a share of an adult son ' s apartment, and the young man went to study in another city and needed money.

The woman decided to buy his share and arrange the apartment for herself and the minor children, and the Pension Fund refused to pay the money, and Inna applied to the court, and when the application was considered, it became clear that all the requirements for a deal with the uterus had been met.

The competent authority ' s refusal to investigate was unlawful and the court had granted the complainant ' s claims.

There are even more bizarre decisions in judicial practice, so in case of refusal, it is necessary to defend your interests in court; in 2023, there are enough positive examples.

ExampleCatherine applied to the Pension Fund to pay off a consumer loan, and the woman explained that the loan was made to her to buy a share of her former husband ' s apartment.

The competent authority refused to pay her, and the mother brought a claim against the Pension Fund before the court, and the court granted Catherine ' s claim.

The funds of the uterus were transferred to the repayment of the consumer credit.

In 2023, the holder of a certificate for the uterus may spend money on the purchase of a share of the apartment; in the event that the Pension Fund refuses to issue the funds of the sanctuary, the citizen may apply to the court.

Legal advice is needed before legal proceedings can be initiated, and our website specialists will help develop a strategy for the trial and provide other legal assistance.

In order to do so, it is necessary to describe the problem in the form of communication and to provide the on-call lawyer with a telephone contact number or an e-mail address.

- Due to the constant changes in legislation, regulations and judicial practice, we sometimes fail to update information on the website.

- Your legal problem is 90 per cent individual, so self-protection and basic solutions are often not appropriate and will only complicate the process!

So contact our lawyer for a free consultation right now and get rid of the problems in the future!

Save the link or share it with your friends.

Assess the article.

(1:: Average:..................................................................................................................................5,00(5) Loading..........................................

Preparation and writing of a contract for the sale of shares in an apartment with maternal capital: sample, use options

In 2007, he appeared in Russia.The law on maternal capital,Provision is made for the provision of financial assistance to mothers after the birth of a second child.

Most of the funds received from the State are from young parents who invest in the purchase of housing.

Most families now cannot afford to buy a good apartment because of the very high cost of real estate, even with financial assistance in the form of matériel.

But there is.alternative solution- Buying a share in the apartment (FZ No. 256). You can see below the model of the contract for the sale of the share of the dwelling on the mother's capital.

Dear readers, our articles talk about model ways of dealing with legal issues, but each case is unique.

If you want to know,How do you solve your problem -- go online in the right or call at +7 (499) 938-51-36 -- it's quick and free!

Hide Content

Action algorithm

- Better in advance.To open your bank account.The most appropriate option would be a State-owned Sberbank, but any other banking institutions could be selected;

- Documents:Certificate, passports (spouses and spouses, if married), birth certificates for children, SNILS, INN of the mother, purchase papers for the dwelling must be provided to the Pension Fund (local administration);

- necessaryapply for the transfer of maternal capital to the seller ' s accountAll additional conditions must also be indicated in the text of the contract of sale;

- in the case of:When the child is under three years of age, he or she should first obtain a housing loan.Thereafter, it is necessary to write a letter to the Pension Fund Office and request that the funds from the mother ' s capital be transferred to cover the mortgage (art. 7 FL 256).

All other nuances should be clarified in the local executive committee.

Limitations

Main purpose of the Maternal Capital Act- To ensure a good future for children, and normal living conditions are an integral part of that provision.

The mother ' s capital may be used for the common good of the family, but it must take into account the needs of the child.

The sale of a share of the dwelling for the mother ' s capital includes:a number of restrictions,on the use of mat capital on the housing issue.

For example:

- The law applies only to real estate located in Russian territory;

- The acquisition of shares (angles) smaller than the size of the room is prohibited;

- The funds should not be used to repay the commissions or fines of creditors.

How do you buy an entire share of the apartment?

The purchase of a share in an apartment by means of a capital master is possible and permitted by law only if the share purchased is completely separate from the other parts, i.e. corresponds to one room.

Only then will all necessary conditions be created for the child ' s development.

There is a possibility of a buy-back, which gives you the prospect of buying an entire apartment. Usually, these deals are made with close relatives, such as grandparents. Although the pension fund is rather cautious about such transactions and may refuse to hand over the money, it is better to find third parties for the transaction.

There is.Several options for buying part of the housingfor funds issued as maternal capital:

- Purchase of a separate room in the apartment;

- Buying a share of housing;

- Share participation in the construction of the new house;

- Reconstruction of the existing old house with an increase in residential space.

The most advantageous and cost-effective is the purchase of a percentage of the dwelling, the characteristics of which are provided for in the legislation in force.

In order to obtain a share in the dwelling from the means of maternal capital,A number of documents are needed,which are required to be transferred to the Pension Fund.

He's-- he's-- he's-- he's-- he's-- he's-- he's-- he's-- he's-- he's-- he's-- he's-- he's-- he's-- he's-- he's-- he's-- he's-- he's-- he's--Includes:

- Passport (passport);

- Certificate;

- Statement of the purpose of the certificate and the amount required;

- A certificate that confirms ownership of the share of the dwelling;

- A copy of the contract for the sale of the share of the dwelling on the basis of the mother ' s capital;

- A document proving that the accommodation is free;

- A commitment document that guarantees that the share of the dwelling to be purchased will be the common property of all members of the family.

An important condition of the sales contract is to indicate the amount of the transaction involved, and the seller's and buyer's personal accounts must also be present, as well as all necessary bank details for the exchange.

In addition:

- The contract must specify all persons who claim to be entitled to a share;

- The number of sellers should be equal to the number of shares sold;

- A contract for the sale of a share of the dwelling using maternal capital should be made with the participation of an experienced lawyer in order to avoid inaccuracy;

- It should be borne in mind that the share purchased becomes the common property of each member of the family (art. 10 FL 256).

- When drafting a treaty, careful care must be taken to ensure that it does not contain various errors and inaccuracy.

- A model contract for the sale of a share in the dwelling for the mother ' s capital.

- Contract for the sale of shares in the dwelling with maternal capital: Model 2.

Conclusion

- Buying a share in an apartment with family capital can give people many opportunities for survival and development.

- Type of transactionAllows for quick and affordable housing.

- But it must be borne in mind that the property purchased will be shared, and all members of the family must be equal owners.

You didn't find the answer to your question?How to solve your problem, call me right now:

+7 (499) 938-51-36 (Moscow)

+7 (812) 467-38-73 (St. Petersburg)

It's quick and free!

A contract with maternal capital, a model and a download form for 2023

A contract with maternal capital is a common name for agreements that use maternal capital as a payment.

Files in.DOC:Letter of agreement with maternal capital

In fact, there are only two types of contracts to be concluded with the application of mammary, namely a contract for the sale and sale of housing (including mortgage contracts) and an optional contract with an educational institution, where tuition is possible at the expense of the mammary.

Scope of maternal capital

In addition to improving the family ' s living conditions and providing the child with education, maternal capital can also be used to:

- Creation of a savings portion of the mother ' s pension;

- Ensuring the conditions for social adaptation and treatment of a disabled child;

- to receive monthly allowances for the second and subsequent children.

The forms of use of maternal capital listed in the list are not contractual and are processed by a decision of the FRF of the Russian Federation on the mother ' s application.

In addition to an application to the FP, the use of a uterus for the purpose of educating a child or acquiring a dwelling will also require the conclusion of a contract with the housing seller or an educational institution.

Contracts for the acquisition of real estate

Recent legislative changes have reduced the number of prohibitions on the purchase of housing with maternal capital.

For example, the restriction on the acquisition of residential property beyond built-up areas, as well as dych, has been lifted; since 1.01.2022, capital housing structures in the garden dormitories have been equated with residential housing, provided they are registered in Rosreestre, so long as there is no practice of purchasing maternity funds, but it will be available soon.

A ban on the use of maternal capital for the acquisition of:

- Land for construction;

- Housing, but in accordance with sanitary and housing standards;

- houses with more than three floors;

- Non-residential premises;

- apartments in secondary housing stock, which is more than 50 per cent worn out;

- The ideal share is the digital designation of the share of the property, without it being allocated in kind, with the corresponding registration in Rosreister.

Features of a contract with a mother ' s capital

The use of maternal capital in the acquisition of housing differs significantly from the standard contract for the sale of real property.

- The entity and the related share distribution of the acquired housing;

- On a payment basis;

- the need to obtain permission from the PF for the use of the uterus.

All members of the parent ' s family are subject to the contract, and each member of the family is given a share in the dwelling when the contract is drawn up or within six months after the transaction is made.

It is desirable to make the allocation of shares at the same time as the conclusion of the contract, i.e. to include a relevant section in the treaty; this would facilitate the continuation of the procedure; if the contract originally provided for joint participation, the registration procedure in Rosreestre would be a one-time one.

If the share is allocated after the contract, it will have to be applied twice to Rosreister to register the sales contract and to record the change in the shares, which not only takes time, but also leads to additional monetary costs.

It is possible to try not to register a contract on the distribution of shares among family members by limiting itself to the registration of a sales contract in which the question of shares has been omitted, but it is only a matter of time before such failure to comply with the requirements of the law comes into play, but inspections by RPF and the Public Prosecutor ' s Office are already under way.

Harmonization with the Pension Fund

A permit from the Russian Pension Fund will be required for the purchase of housing for which it is planned to use the mother ' s capital, and an application must be made to the PF ' s Residential Unit to obtain the permit.

The application shall be accompanied by:

- A certificate of maternal capital;

- The seller ' s written consent to a uterus-based transaction is required because the transfer of funds from the PF to the seller ' s account may take a considerable amount of time;

- The address of the dwelling, the cadastral description of the dwelling, will enable the PF staff to determine whether the dwelling meets the requirements of its status and performance;

- Copies of the spouse ' s passports; if copies are not certified notarized, the originals will also have to be produced;

- SNILS;

- Draft sales contract;

- If the dwelling is purchased only by the wife, she will be required to pay her share of the dwelling to all members of the family within six months; the obligation must be certified by the notary; and if the contract of sale itself provides for the allocation of the share, then the obligation will not be required.

- The number of the seller ' s bank account to which the FP will have to transfer the money;

- If an apartment is purchased using a mortgage, an additional bank certificate will be required;

- RPF statement on the balance of the maternal capital account.

Consider the draft contract with a staff member of the Pension Fund, which will immediately point to deficiencies and advise on the best option, which will eliminate the possibility of refusing to register the contract in Rosreister or refusing to transfer maternal capital from the PF.

Size of shares

No regulation gives a clear indication of the size of the share of housing purchased from maternal capital; based on established practice, it can be said that the distribution of shares follows the following pattern.

Arifmetically, the share of acquired property corresponding to the amount of maternal capital is calculated.

Example:: At a housing price of 1,000,000 rubles, 250,000 rubles were paid out of the mother ' s capital, i.e. a quarter, thus 1/4 divided by the number of family members, provided that 4 persons in the family would each have 1/16 of 1/4.

Formation of the treaty

The drafting of a contract for the sale of housing using maternal capital is a little more difficult than the drafting of a similar contract, but without a masculinity, so it is better not to invent it, but rather to use the template available on the website; the shablon is a model and will only require individualization under specific circumstances.

The individualization of the treaty will require the insertion of the following data into the template:

- Information about the parties to the contract - the seller and the buyers - it should be remembered that the buyers will be (if the contract immediately provides for the division of shares) all members of the family;

- Information on the place to be purchased - area, number of rooms, address, floor, etc.;

- Information on the price of housing;

- Information on the method of payment, indicating which amount is paid from its own funds, which is the mother's capital, which is the mortgage loan;

- Information on what proportion of the total value is paid by the parent and, accordingly, what proportion is due to each family member.

Don't put a date on the contract, it'll be done by Rosreister's employee at the time of acceptance of the registration contract.

Registration of a treaty

Full ownership shall be transferred to the buyer only after final settlement with the seller.

As mentioned above, the transfer of money by the Pension Fund is a long-term process, so when a sales contract is registered, a Rosreestra employee issues a certificate to the seller stating that the housing sold to him is subject to an encumbrance until he receives money from the FP.

A contract for the sale of an apartment with a mother ' s capital (model)

The holder of a mother ' s certificate may spend it on improving housing conditions, including the purchase of housing.Total amount paid for the purchase of an apartmentor use the grant asInitial mortgage contribution.

The contract of sale must be drawn up inin writingThe text of the agreement states that the payment shall be made on the basis of the funds of the mother ' s capital.

If you're gonna use state support to buy an apartment, you're gonna have to turnStatementto the Pension Fund (SPF), together with a list of required documents.during the month.

If the RPF approves the transaction, the money will be transferred to the seller ' s account10 days.

Features of buying an apartment using mother ' s capital

The mother ' s capital is able to pay the full cost of the dwelling or part thereof, to buy an apartment in the primary or secondary real estate market.

Conditions for the use of the certificatefor the purchase of housing:

- The apartment should be located in Russian territory.

- You can't buy dwellings that are in an emergency or dilapidated state.

- Only the purchase of a separate dwelling, and not a share thereof, can be processed.

- The statement of disposal of the uterus must indicate the purpose for which the owner is requesting funds.

- It is not allowed to buy an apartment from first-degree relatives.

Features:: Sales and sales involving the use of the funds of the uterus:

- In an apartment to be purchased, an allocation must be made.shares of all family members.

- Cash transfers carried outafter the signing of the treatySale, registration of property in Rosreestre and approval of the RPF transaction.

- Cash is not given in hand —The fund is self-sustained.The necessary amount to the seller ' s account.

To use the means of government support, it's necessary.Stick to the next algorithm:

- To enter into a contract for the sale of an apartment.

- Register property in Rosreister.

- Prepare a statement on the disposition of maternal capital and complete the necessary list of documents.

- Go to RPF.

- Wait for the decision to be made and the money transferred to the seller ' s account.

- Remove the encumbrance from real estate.

How to draw up a contract for the sale of an apartment with a mother ' s capital

The form of the treaty must necessarily bein writing- Failure to comply with this requirement renders the transaction null and void.all parties to the treaty- Parents act on behalf of children under 14 years of age, an older child signs a contract on his or her own.

ReturnNotaryfor the assurance of a treaty to be required if:

- The purchase of housing is carried out from a person who has been declared incompetent or one of the owners is under 18 years of age;

- Sellers own real estate in shares.

In all other cases, contact the notaryNot necessarily..

The full cost of the dwelling can only be paid after the child3 yearsI can make it up to you.ordinary sales contractorTick-off contract.

The buyer makes an initial contribution in the case of the distribution, and the balance is divided into equal instalments and paid to the seller in the same payment according to the specified schedule.

Document confirming the right to use maternal capital to purchase housing —specific certificateIts details should be included in the sales contract.

RPF requires to be specified in a contractcondition for the percentage of children in an apartment to be purchasedas well asMandatory writtenwhich must be certified by the notary.6 monthsAfter the funds were paid to the seller, or after the encumbrance was removed.

Formulation of a contract of sale with and without mortgage

Family capital can be spent before the child is born.3 years:

- If familyThere's a mortgage.taken for the purchase of a ready-made dwelling, it can be paid off by the means of the uterus.

- The holder of the certificate maySet up a mortgageand to send funds to the initial contribution.

In order to obtain a mortgage for maternal capital, the following documents must be submitted to the bank ' s branch:

- Passport;

- The income certificate of the natural person;

- A copy of the certificate of maternal capital;

- a copy of the workbook.

During10 daysOnce the bank has received approval of the transaction from the bank and a mortgage agreement, the seller ' s account receives the necessary amount for the dwelling. After the recipient of the certificate must apply to the RPF for the transfer of the State ' s support funds to the bank ' s account.

The bank contract must clearly specify:Purpose of credit processingIf the document indicates a different purpose or a consumer loan, the RPF will refuse to pay.

Model contract 2023

The form of the agreement is not different from the usual sales contract.

- Date and place of the transaction;

- The passport data of the seller and buyer;

- Detailed characteristics of the subject matter of the contract (specific address, deck, number of rooms, square area);

- The amount of the transaction and the manner of payment;

- Responsibilities of the parties;

- The signature of the parties to the agreement with the decryption.

In addition to the mandatory paragraphs,text of the treatySales with maternal capital are further specified as follows:

- Payment will be madewith the use of maternal capitalby transferring the money from the RPF account to the seller ' s account.

- Time frameduring which the holder of the certificate must apply to the fund for the management of the capital.

- What amount is paid by the buyerat his own expensein the event that the funds of the uterus are insufficient to pay in full.

Authorization from the Pension Fund

It is necessary to channel maternal capital into the purchase of an apartment.Receive permission from RPFThe certificate holder ' s place of residence requires an application to the fund ' s branch for the management of the funds.

The form is provided by the staff of the office and should indicate:

- What the owner wants to spend money on;

- the amount (full or only part of the capital).

Earmarked fundsmay not exceed the price of the contractor the remaining unpaid portion thereof (Regulation No. 862, para. 8.1).

If so, the fund transfers funds to the seller ' s accountfor a month and 10 working daysAs from the date of adoption of the declaration.will refuse to transfer the paymentthe balance of payment under the contract must be paid by the owner of his funds or terminated and returned to the original legal relationship.

In some cases, RPF staff may check the area purchased; if the apartment fails to meet the sanitary requirements, the fund staff may refuse to transfer the money on the certificate.

Documents for the sale of the flat from the capital

In accordance with paragraph 8 of Regulation No. 862 the following list of documents must be attached to the application for the management of the uterus:

- Certificate holder's passport.

- A copy of a sales contract marked Rosresstra.

- An extract from the EGRN indicating the owner of the applicant ' s apartment.

- A notarized commitment to allocate shares to all family members.

In addition, it may be necessary:

- if the application is submitted through a representative- Notarized power of attorney and his passport;

- if the spouse of the certificate holder is involved in the transaction- Passport and marriage certificate;

- if the purchase of the dwelling takes place on a part-time basis- a certificate from the seller concerning the amount of the outstanding amount.

All copies providedwith the original documentsafter verification, they will be returned to the applicant.

The application, together with the list of documents, may be submitted:

- Personally to the RPF ' s residence section of the holder ' s certificate;

- Through the Multifunctional Service Centre (IFC);

- By post;

- In the form of an electronic document via the Gosu Services Portal or the Personal Office of the insured person on the RPF website.