Buying an apartment is always a complex transaction that requires a lot of attention and knowledge, and various types of insurance for such transactions are now very common.

Real estate transaction- always high costs, which are a significant part of the family budget, and sometimes they also involve borrowing, so real estate insurance is now a very convenient and often necessary measure to protect its property interests.

Types of real estate insurance

In real estate transactions, the most common isFour types of insurance:

- Title (lets the apartment be insured against loss of ownership by the owner - title to the dwelling);

- Mortgage (implemented by banks to protect their financial interests in the transaction);

- Insurance of the developer ' s liability (applied in the conclusion of a contract of equity participation in construction to protect the interests of the developer when he invests in the property under construction);

- Insurance of real property itself (from various options for damage and destruction of all or part of property).

Each of the listed species has its own characteristics, both in content and in the implementation procedure.

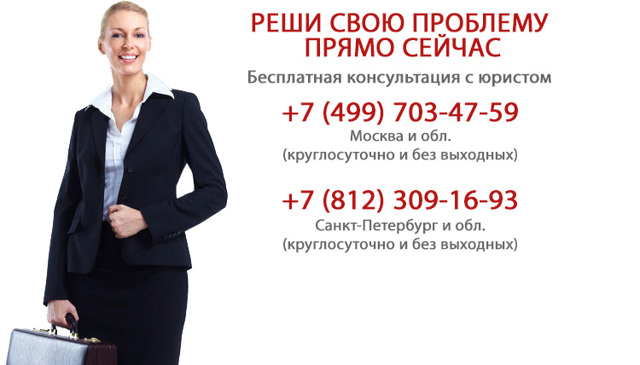

If you want to know how to solve your problem in 2023,use the online consultant's form or call on the phone.:

- Moscow: +7 (499) 110-86-72.

- St. Petersburg: +7 (812) 245-61-57.

How does insurance work?

The procedure for insurance of real estate in a sales transaction provides for the possibility of concluding a contract both before and after the formalization of the right of ownership (or before the signing of the contract of sale).

The procedure for insurance of real estate in a sales transaction provides for the possibility of concluding a contract both before and after the formalization of the right of ownership (or before the signing of the contract of sale).- However, the commencement of the insurance policy occurs at the time the ownership right arises (from the date indicated in an extract from the Single State Real Estate Register as the date the ownership right of the new owner arises).

- In order to ensure that the acquired property is fully insured, a new or potential ownerMakes a statement to the insurance company,which indicates its desire to provide insurance for a programme or for one of the selected (or specially formed) types of insurance.

- After a thorough review of the real estate contract, the insurers prepare a reply as to whether such insurance may or may not be available (generally, the insurance company is willing to do so only in respect of flats with a small risk of damage, which will subsequently have to be reimbursed).

- Depending on the manner in which real estate is insured,The amount of the final insurance payment will be determined(from the percentage to the market or technical value of the dwelling to the full reimbursement of the market price at which the dwelling was purchased).

- If you want to know how to solve your problem,use the online consultant's form or call on the phone.:

- Moscow: +7 (499) 110-86-72.

- St. Petersburg: +7 (812) 245-61-57.

Titular insurance

- This type of insurance is most often used where there is a risk of loss of ownership of the acquired immovable property (e.g. if the apartment has been transferred several times from one owner to another by various transactions, and any of them may be challenged, thereby invalidating all subsequent transactions).

- This type of insurance in relation to long-term apartments is considered undesirable for insurance companies, as the risk that an insurance recovery may be required will be very high, resulting in substantial losses to the insurers.

- In order to ensure that this type of insurance is fully implemented, the insurance company will carefully checkall possible risksIn such an apartment, and in the event that the dwelling fails to comply with the law, it may be lawful and reasonable to refuse to enter into an insurance transaction.

- This refusal would alert the insured person that the risk of the apartment being taken away by declaring it null and void is high.

Mortgage insurance

Mortgage insurance

- This type of insurance is one of the most common, as the vast majority of apartments are purchased using mortgage loans.

- Mortgage insurance is complex because the bank wants to protect itself from the loss of its financial resources.

- For this reason, in the course of a mortgage, insuranceis subject to the real estate property itself.(It is either the name insurance, the real estate liability insurance, or the real estate insurance), life, health, employment of the borrower, as well as, at the wish of the parties to the transaction, and of the borrowers (if any).

- Regardless of whether housing is purchased in a new building or in a secondary market, mortgage insurance is a prerequisite for the bank ' s credit.

Developer ' s liability insurance

This type is used in the case of a built house which has not yet been put into service.

Insurance of the developer ' s responsibilityOne of several options:

- The sponsor bank ' s sponsorship, which, in the event of default by the developer, will be responsible for returning the funds to the donors;

- Applying an insurance company with sufficient resources to cover the debts of the developer vis-à-vis the shareholders;

- Use of the services of mutual insurance organizations, which also operate on the basis of a licence allowing the conduct of insurance activities.

Real property insurance for damage

This type of insurance is the only one that can be implemented at any time, starting with the creation of a right of ownership.

It involves payments from the insurance company if the apartment or house has been lost in whole or in part.

This is possible because of various natural, man-made emergencies or the misuse of property by neighbours.

Purchase insurance is a measure that, in the event of certain circumstances, may help to preserve the money invested, but in order to ensure that reimbursement is not denied, the rules set out in the insurance contract must be fully complied with.

- Moscow: +7 (499) 110-86-72.

- St. Petersburg: +7 (812) 245-61-57.

Or ask a lawyer on the website, it's quick and free!

Insurance of the transaction and contract for the sale of an apartment

Titular insurance makes it possible to recover possible damages in a situation where the property is transferred from one owner to another, for example, if the transaction itself proves to be invalid because of the court ' s decision.

This type of insurance becomes compulsory when mortgage loans are issued in banks.

What is the nature of insurance?

The risks are accompanied by any transaction for the acquisition of real estate, especially if the buyers decide all matters on their own, without any help from the experts.Any citizen has the right to enter into a title insurance contract.with any specialized company.

Purpose of such programmes -Remediation in a situation where rights to an object are lost.

The first title is a document establishing exclusive and legal title to real estate.

The right to property of a good-faith buyer over any type of real estate isprincipal subject matter of any insurance contractIt is this fact that is becoming central to the conclusion of the transaction itself.

Insurance protects any property related to immovable property, and this applies to any land.

Titular insurance has become quite common because, in practice, insurance cases are quite common.

Titular insurance protects not from future events, but from the consequences of what has already happened.

When a transaction is declared invalid

- When the law currently in force is violated, for example, the property is taken away and taken away by the rent payer; the owner does not consent and the premises are rented;

- The contract shall be signed with a citizen who has lost the ability to adequately evaluate his or her actions. For example, if he or she is mentally ill;

- If the sale takes place under threat or deception, with conditions of disadvantage imposed;

- A contract is concluded with one spouse, although the other has not given his or her consent;

- The transaction is performed by a person deemed incapable.

What kind of damages are reimbursed?

With regard to compensation for the cost of the dwelling,All amount paid, but...........................................Not the big one that went to the original purchase.Insurance can be very beneficial, especially when it comes to flats under construction.

Compensation is also awarded for costs associated with judicial proceedings, and the costs of judicial proceedings are described separately in the insurance policy.

The funds shall be reimbursed at the same time that the judgement enters into force.

Compensations are usually equal to the market value of the facility; the insurance contract specifies the maximum amount that a particular client may receive.Payments are made only on the basis of a court decision.

How much is insurance?

The amount of insurance is multiplied by a special rate, which is how each company calculates its remuneration, and all firms have different tariffs, and its base rate is not more than 0.3%.

The degree of risk is only one of the circumstances that may affect the final cost, and each insurers conducts a thorough analysis of the situation before entering into a contract.

A one-time payment for the entire period of insurance will help to reduce the rates of the insurance firm, and the policies themselves can be made for any period, within one year to ten years.

On the rules of procedure

In order to comply with all the formalities relating to title insurance, the representatives of the insurance company must first apply, which is the subject of a contract which must comply with all the requirements of the Civil Code.

The application and copies of each page of the passport are mandatory requirements for those who plan to sign such a contract.

The following basic documents are also provided for the apartment and house:

- Certificates that will confirm that there are no debts on utility payments;

- Act of transfer of the facility;

- A separate statement is made by a bank valuer, who writes about the real value of the apartment, the current state of it;

- A copy of the FLS is produced in the home office;

- The same authority shall provide information on the registration procedures;

- All transactions relating to the property in question need to be documented in copies;

- Exit from EGRP;

- A discharge from BTI.

Can a contract be refused?

Another possible reason is that there's too many transactions where there's an object that's trying to cover it.

Only the owner of property registered in Russia can conclude an insurance contract.

Effectiveness of title insurance

Recovering damages from the insurers is not the only benefit to the client who entered into the contract.

The insurance company itself conducts a full inspection of the real estate facility before signing any documents, which is clearly better than the procedures carried out by the clients themselves, because the capacity of legal professionals is much greater than that of ordinary citizens.

If professionals refuse insurance, it could becomeBig time to think about it..

The process of communication with the bank is facilitated by the issuance of mortgage title insurance, which reduces not only the risk to buyers but also the overall interest rate.

The value of such a contract may be affected not only by the outcome of the examination, but also by the period for which the conclusion is signed, as well as by the state, the total cost of the facility itself.

At the same time, the insured person is required to participate in court proceedings when the need arises.

It's like that.insurance will not protect against any situation, but only against cases where a real estate transaction is declared invalid.But sometimes it's enough to protect itself from questionable purchases.

Real estate insurance

For most Russians, real estate is the most expensive property available to them. Thousands of transactions are made every year with residential and non-residential properties. But one in every 20 subjects fears a deal with them. Why do most citizens still believe that the main risk they face is the possibility that their money will be taken away from them when they deal? They imagine it so that strong guys will approach them, threaten them, and take away a purse or a suitcase with a few million rubles?

However, most fraudsters use cash-for-money schemes in real estate transactions that do not require gross violence.

The buyer himself voluntarily gives up the money, and he doesn't even know that very soon he's gonna be without the home he bought, and without the money, because no one's gonna give it back to him. It's hard to consider all the fraudulent schemes, especially if there's no relevant experience.

Especially since these schemes, like the virus, are constantly improving, and real estate insurance is the best way to protect themselves from such a virus.

Some might rightly point out that real estate deals are often conducted with professional realtors, which is true, but the problem is not getting smaller.

This area is not sufficiently regulated by the legislator, and in the case of real estate errors it is not necessary to count on more than 5 per cent of the amount of the contract itself.

And it's not that easy to get that 5% because it's gonna have to prove in court that the damage was caused precisely by the realtor's miscalculation.

There's an option where realtors are self-insured, but it's true for big real estate agencies.

They use the services of insurance companies to distance themselves from the masses of competitors, making them more attractive to customers, and it is believed that the coverage provides protection against the likely risks posed by underperformance of agents.

Their failures may result in significant financial losses to clients, and insurance and licensing of real estate activities are not required under the law.

The formal insurance covers the costs incurred as a result of non-compliance with the terms of the agreement to dispose of the property under the auction.

They may be related to the fact that the transaction itself is not legally valid and omissions were made in collecting information on the subject matter of the transaction.

The problem for a client who has suffered financial losses is that it is very difficult to obtain substantial insurance compensation in such cases.

The problem is also exacerbated by the fact that there is no legislation that establishes a clear and universal list of the work carried out by the realtors.

It is therefore difficult to prove that a precedent relates to an insurance case.

It was necessary to establish a causal link between the damage suffered by the client and the realtor, and it was difficult to do so because of the lack of legislation.

Finally, there is no model contract for the provision of services by real estate agencies, each of which has its own models of agreements with its own characteristics.

Therefore, the evidence of a breach of the obligation to dispose of real estate by the real estate agent will be those actions that are contrary to the terms of the contract.

If it was not possible to do so, the contract of action would not specify obligations, which would be the reason for the refusal to pay the insurance.

It's important to know that a realtor's error or negligence often occurs after the agency's or realtor's liability policy has expired.

In this case, it will not be possible to obtain the insurance amount, and in order to avoid it, it is necessary to insist on the imposition of a certain condition in the agreement.

It is that, in an insurance case, compensation is payable regardless of when a claim has been brought under the contract.

Because real estate transactions are not reliable, the security of real estate transactions needs to be taken care of separately and independently by insurance against financial risk and loss of property rights, for which the legislator has provided two types of insurance: property and title.

Property insurance

It is simple with property insurance, which is that the insurers undertake to compensate the insured for financial losses if any of the envisaged cases occur.

Compensation shall be paid in the amount provided for by the insurance contract concluded.

It is possible to be insured against loss of property during fire, domestic gas explosion, car accident, flood, natural disasters, as well as unlawful acts of robbery, hooliganism or vandalism.

This type of insurance is more popular, it is required by creditors when a mortgage is issued. Title insurance is less popular, although the risk of losing ownership of a purchased apartment or house may be greater than its loss of fire or gas.

Titular insurance

Title insurance refers to risk insurance to lose ownership of acquired real property.

It is designed to protect this right from a third party ' s claims to this property, which arose before and was preserved after its purchase.

Although this type of protection for real estate transactions has recently emerged in our country, it is nevertheless very effective in protecting property rights.

The title insurance covers the title of the owner or creditor, other interested persons who are involved in the creation and transfer of property rights. Why is the risk of loss of ownership in some cases higher than the loss of property due to fire, flood, etc.?

It is very difficult to assess the transparency and legitimacy of all previous transactions with the property by buying a house or an apartment on the secondary market without special training and skills.

This leads to the risk that, in the future, one of the previous disposals of the apartment or house you bought will be declared null and void by the court.

The effect of this decision is that all subsequent transactions, including the contract of sale signed by you, will be declared null and void.

In such cases, an apartment, house, garage or piece of land will have to be returned, but it is not necessary that you receive the full amount paid for the property purchased, and you may also suffer other losses related to the repairs made, etc. All of this is compensated by the underwriter under the title insurance contract.

However, there are certain requirements for the agreement to be signed with the insurance company, and before signing it, experts from the insurance company are required to verify that the transactions with the insured property are clean.

Depending on what they find, what they doubt, the company will agree to enter into a contract or refuse if the risks are too high; in other cases, the doubt will influence the amount of the insurance policy payments.

The amount of the contract ranges from 0.3 per cent to 3 per cent of the value of the property, the minimum duration of the title contract being one year, the maximum being 10 years.

Real estate insurance: insurance companies

Title insurance is offered by many companies; however, public figures insist on the introduction of real estate insurance through a special fund that has yet to be established.

The need for such a fund is due to the fact that there has been an increase in the number of cases of purchase of real estate from bona fide buyers; the private reason for such withdrawal is illegal privatization.

No compensation shall be paid to the affected owners for the removal of the apartments.

The draft envisaged that the fund would not only deal with real estate insurance by providing financial guarantees to buyers, but would assist in the gradual and progressive improvement of existing legislation in the area of property transactions.

Cost of real estate insurance

The value of the insurance policy depends on factors such as:

- The period for which the insurance agreement is issued;

- The life of the insurance facility;

- The extent to which the real estate, where it is located, is worn out;

- The value of the insured dwelling;

- The probability of an insurance accident.

In general, it is necessary to set the minimum rate for the insurance policy at least 0.3% of the cost of housing; the maximum rate is 3%; for example, for housing insurance, the policy will cost 0.5%; for extra-urban real estate, it will vary from 0.3%, reaching a maximum value of 1.4 %; for residential and non-residential real estate, it will vary from 0.4% to 1.4 %.

The calculation of monthly payments is based on the market or estimate of the cost of the subject matter of the insurance; in the latter case, the expert who is authorized to do so concludes that all participants offer very similar tariffs and services in the market for the provision of insurance services.

Share:

No comment

How to Insurance the Purchase of Housing in a Building Home

Buying an apartment in an undeveloped building is a profitable investment, which saves the future owner's money and allows him to get a home under his own design and individual planning.

But in the Russian Federation there are fairly bad companies that only receive housing contributions, albeit not the full cost, and then freeze construction at the foundation stage, declaring their bankruptcy.

How can you protect yourself and your investments from fraudulent building organizations? How can you get an insurance policy for an apartment in a new building? What underwater stones can this type of policy have? We'll talk about this in our article.

Why insurance the apartment in the new building?

It is possible, and even necessary in some situations, to provide insurance for undeveloped housing, and every citizen has the right to decide whether he or she needs such a policy or whether he or she trusts the developer.

But if the future owner buys an apartment on loan, the bank's mortgage contract will make sure that insurance is made compulsory.

The bank will not want to lose its funds because of the bankruptcy of an unfair construction firm, which means that the chosen insurance company will have to cover the balance of the loan. The standard insurance policy includes the following risk situations:

- Delay in the construction and delivery of the facility;

- Delay in the settlement of the new building;

- Destruction of the home due to natural disasters, industrial accidents and terrorism;

- Bankruptcy of the construction organization responsible for the facility under construction;

- A double-sale scheme for an unconstructed apartment.

It happens that the developers themselves offer the option of an insurance firm with which a customer-friendly contract can be concluded, which may be a fraud because the company is highly likely to collude with the insurers.

It is necessary to choose a firm that has proven itself in the Russian market, and it is worth noting that title (own title) is not required to be insured if the construction has not yet been completed and all the necessary documents have not been completed.

How do I get a policy?

The financial risk insurance contract is based on the full cost of the facility or on the equivalent of the amount of the loan issued. Before signing the contract, the insurance firm will carefully check the documents relating to the developer.

- Local authorities ' authorization to build a residential home;

- A land lease agreement for construction work;

- The investment contract, which was provisionally awarded by the local authorities and the developer;

- The contract between the construction organization and the shareholders;

- Other documentation demonstrating the legal relationship between the developer and the donor;

- Investment contribution certificates.

After reading the official documentation, the risk assessment is carried out by an insurance expert or a whole commission of 60 main points.

The commission ' s opinion is valid for not more than two months, for which the client is required to sign the insurance contract; if this does not occur, the conclusion becomes null and void and the procedure will have to be repeated if the insurers so agree.

The firm will then decide whether the developer is reliable and whether a policy can be established.

Cost of insurance

The cost of acquiring the insurance policy will depend on the conditions under which the construction is carried out and on the reputation of the construction company in the Russian market.

The cost of the policy is 0.75-2% of the cost of the flat, so if the apartment is worth 5 million rubles, the insurance will have to pay between 30 and 40,000 rubles.

The table below shows the main insurance companies that propose such a policy.

The calculation of the cost of the policy shown in the table was done for the flat in the building house.

Moscows with a value of 3,000,000 roubles were selected, and not only real property, but also disability and loss of ownership were selected.

It should be understood, however, that the price proposal is not definitive, as there may be additional allowances for the associated conditions, which may affect the likelihood of a risk situation.

Main disadvantages of housing insurance

The main drawback is the possibility of a fraud insurance company who conspires with an unfair developer, who can be protected by signing a contract with an established or proven firm, whose terms will not be so loyal to the client and will require more documentation, but the policy will be real and valid.

There is also a high probability that the insurance company will refuse to enter into a contract because the terms will be unfavourable or the reputation of the developer is questionable.

Since the amount of the risk is large enough, the percentage of the value of the dwelling in the form of an insurance premium will be maximum, and the value will also be affected by whether the dwelling is bought for its own money or on credit.

Mortgage will be higher than the cost of the policy.

What if the construction company went bankrupt?

If the construction company has officially declared its bankruptcy and the under-construction housing has been pre-insured, the formal landlord is entitled to the full amount of compensation that will cover the full cost of the dwelling.

Under the terms of the insurance contract, the period of time for which the victim is required to file an insurance claim must be clearly specified; if the documents are to be handed over later, the insurance organization has the right to refuse compensation.

The claimant is also required to attach documents to prove that the developer has failed to fulfil his obligations to return the funds invested, and a certificate of bankruptcy of the construction organization will be required.

Conclusion

The provision of housing insurance in an under construction building may be a mandatory condition of the creditor bank; in other situations, such insurance is voluntary.

In this case, it is necessary to use the services of the insurance company not only to be safe from financial losses, but also for the experts to assess the safety of the developer.

The cost of the insurance policy will be up to 2 per cent of the cost of the insurance facility itself.

Insurance for the purchase of an apartment — the sale transaction and the cost of the insurance

The acquisition of an apartment carries certain risks, both in new buildings and in the secondary market.

https://www.youtube.com/watch?v=8bzFe7L_hks

In view of the increasing number of real estate frauds, home purchase insurance is becoming increasingly important.

Dear readers, our articles talk about model ways of dealing with legal issues, but each case is unique.

If you want to know,How do you solve your problem -- go online in the right or call at +7 (499) 938-65-46. It's quick and free!

Hide Content

Insurance for the purchase of an apartment

- This type of insurance ensures that possible losses due to unforeseen circumstances can be recovered.

- It is compulsory for the purchase of housing by means of a mortgage.

- This condition requires banks to sign a loan contract.

Insurance for the acquisition of real property in the secondary housing market is equally important, and property rights usually arise when a contract of sale is signed, but if there has been a large number of such transfers, there may be a situation of violation of the law: the restriction of the rights of third parties.

There will be no litigation; the owner of the property may be declared to be another owner; the purchase will be declared null and void; in such a situation, the insurance company must cover the entire loss.

BACKGROUND:Insurance for the sale of an apartment may be issued both before the contract of sale is signed and after the contract of sale is concluded, starting with the registration of the contract of sale of the dwelling.

The reasons for invalidating a transaction may be direct fraud or mere error.The contract for the purchase of real property will be null and void under the following circumstances under articles 168, 169, 170, 171, 172, 173, 174, 175, 176, 177, 178, 179 of the Russian Civil Code:

- The document was signed by an incompetent person with a mental disorder.

- Agreement with a minor: At the request of his parents or guardians, the transaction may be terminated by a court of law.

- The sale of an apartment under threat of life, as well as under fraudulent circumstances, is considered to be a lie to conceal the facts in which the contract would not have been concluded.

- The conclusion of a contract with only one of the owners of the dwelling, for example, where the spouses have equal shares of property and the signing of the contract took place with only one of them without notification to the other.

- Mistakes, list of sales documents.

- The sale of real property without the consent of the guardianship authorities, in the event that the child was registered in the apartment.

- Cable transaction, i.e. transaction concluded under highly unfavourable conditions for one party under external conditions.

- It's a fake or fake deal that was set up to cover another deal.

- Violation of the privatization of real estate.

- Restriction of the rights of heirs.

IMPORTANT:When signing a contract with an insurance company, it is necessary that all the circumstances under which the purchase of real property may be declared invalid be recorded in the contract; otherwise, the insured person may refuse to recover the insurance amount due to the absence of a basis for the insurance case in the text of the document.

Insurance companies promise to fully reimburse:

- The buyer ' s loss of the value of the dwelling;

- Additional costs to be incurred as legal costs.

The insurance contract must state that the insurers must reimburse the amount on the basis of the market value of the dwelling.In this case, the client will receive full compensation.

The following factors influence the cost of the policy:

- The cost of housing;

- The first year of insurance is based on the highest rates since the risk of a transaction becoming invalid is the highest.

- The life of the dwelling;

- The assessment shall be carried out with the assistance of a legal expert on the basis of the documentation provided for the apartment to be purchased, taking into account the number of changes in ownership of the dwelling from one person to another.

The value of the sale insurance depends entirely on the value of the dwelling.The value can be taken from the purchase contract for real property or from the estimated value of the BTI.

The insurers recommend a minimum of three years for real estate insurance when a sale is made, since under the Russian Civil Code, a challenge to a transaction can be made no later than three years, although in some situations the limitation period may be 10 years.

This is due to the fact that this period is determined not from the time the apartment was purchased, but from the time when the claimant became aware of the sale.

When insurance is issued, the insurance companies check the cleanness of the transaction; if they have doubts, the company will refuse to provide insurance because of the high risk of declaring the transaction invalid.When significant risks are identified, the company will increase the insurance rate.The maximum rate that insurers use is 3%.

IMPORTANT:When a mortgage is issued, the amount of the insurance will depend on the cost of the dwelling and not on the amount of the loan provided.

The basis for compensation is a court order declaring a transaction null and void.Payments shall be made within 10 days of the commencement of the declaration of invalidity of the transaction.

The insured person may refuse to pay the insurance amount in the event of non-compliance with certain requirements prescribed in the insurance contract if the procedure or time period for notifying the insured person of the existence of the insurance case has been violated.

Also, if the document listed certain lawyers with whom the insurance company cooperated and the client went to another law firm, it would be a reason to refuse to pay the insurance.

ATTENTION:When a transaction is made for the purchase of an apartment, it is not possible to be 100 per cent sure of the cleanness of the transaction; in order to avoid unforeseen situations, it is better to enter into an insurance agreement for the sale of the dwelling.

This is the only guarantee of financial protection, and when an insurance case is established, the buyer will be fully reimbursed.

You didn't find the answer to your question?How to solve your problem, call me right now:

+7 (499) 938-65-46 (Moscow)

It's quick and free!

Protection of real property in disposition: insurance for the sale of an apartment

To solve your problem, you'll get it now.

Free consultation:

Show Content

What's real estate insurance?

General real estate insurance is the protection of the owner of the premises against the possible risk of loss/loss not only of real estate rights, but also of the property itself.

Loss of ownership of real property may occur only by a court decisionif the court declares the transaction illegal and therefore invalid, this is an insurance case and the company(s) reimburses the owner(s) for the full market value of the dwelling.

Unfortunately, not all insurers offer a type of real estate insurance service, but a number of large insurers ' firms have such a product on their list of services.

UrgentIt is recommended to refer only to audited, long-established insurance firmsIt could be alpha insurance, Tinkoff insurance and so on.

What dangers can she avoid?

An insurance policy issued in the course of processing a sales contract is intended to shield the owner of immovable property from declaring the acquisition of real property null and void and, as a consequence, illegal; a force majeure may occur in the form of a claim from the former owner of the property that was lost to him in addition to his will.

Recognition of a transaction is possible due to various factors established by law, such as:

- It was done by citizens who were found to be incompetent.

- The act was signed only by one spouse without the consent of the other, although the question concerned the disposition of the common property.

- The presentation took place through deception, deception, intimidation or a combination of difficult circumstances.

- Formed an individual or a group of persons who are unable to understand the significance of the actions taken.

- A person has committed a substantial contradiction to the legislation in force, for example, the transfer of property by the payee without the consent of the direct recipient.

- The owner exceeded his contractual power.

Types of procedure with a brief description

There are clearly defined types of insurance for premisesLet's take a closer look.

- Titular - protects the owner from the possibility of losing possession.

- Mortgage is no longer protecting the owner, but the creditor as a financial and credit institution against damages.

- Liability insurance protects the investments that the developer has made.

- Real estate insurance against various external factors that destroy it.

There are other classifications, however, which can be found in the theory of insurance legal relations.

Attention!Some firms have chosen to divide insurance schemes, so there is no single and clear classification.

To dateInsurance companies take a case-by-case approach to each of their clientsThe determining factors will be the period of insurance, the value of real estate on the market and the degree of risk of loss or damage.

To sum up all the above-mentioned insurers, the estimated price range for title insurance for all real estate transactions in Moscow and St. Petersburg is between 0.2 per cent and 2.6 per cent per annum.

The interest on the transaction is calculated in a year from the market value of the dwelling, and it is the amount received that the real estate owner undertakes to pay in respect of the insurance company according to the schedule agreed upon in the contract.

Insurance companies carry out shares and sometimes the above interest rates may be slightly lower.

How will compensation be paid?

The payment of compensation for the insurance issued to you is set at the amount of the damage received.It is calculated on the basis of the value of the real property at the time of the judgement against you and its official entry into force.

The amount must not be higher than the amount of insurance established under the contract between the two parties; the basis for your receipt of payment is the enforceable judgement of the court or the approval of the insurance firm.

Standard list of actions:

- We need to report to the insurance company's office.

- Present the documents on the basis of which you claim payment.

- Make a statement.

- Wait for the results of the review.

- Get the money in the insurance fund or through the transfer.

It matters!If for any reason the insurance company refuses to pay, you can file a statement of claim.

If you have the necessary papers attached to it, you can appear before the court, and if the case is heard, you will take up the case and set the date for the hearing with the parties. All you have to do is prepare carefully for the event.

Real estate insurance is an excellent opportunity to protect yourself, your loved ones, and your own investments. At the moment, the insurance market is not ideal, there are also problems.

The main problem is that it is not always the case that companies identify with risk, or reduce the amount of payments; for this not to happen, the insurance contract must first be thoroughly examined.

An important fact is the choice of insurance company.Her ratings and reviews are the main factor.

We've already realized that you have a particular problem.

Call, we'll decide:

How do you insurance the deal when you buy an apartment?

460 lawyers are on the website right now.

Hello, question to the Moscow lawyers.

The situation is that I sell my apartment and buy two others (one mortgage and two money from the sale of my apartment).

I've made an advance for two of them, but I'm worried about her legal integrity, the owner has never seen him, he's only gonna be on a deal, and I'm just talking to the realtor, and she's doing everything she can, and this real estate lady doesn't even want to show her passport when she's putting out a confidant, and she's always giving me copies of the documents, and she's only doing the originals after a long deal.

They're not gonna provide any papers from the PND and the ND.

It is known from the history of the apartment that her grandmother lived in it her entire life and that she owned the apartment on the basis of privatization in 1993 and that she died on January 4, 2010 and left the apartment to someone else.

The documents contain:

- Certificate of Right to Succession, 31.08.2010;

- - A certificate of ownership dated 17 September 2010 on this new owner;

- - A copy of the owner's passport;

- Is there any reason to worry about unknown relatives who are potentially claiming an apartment or something?

- How can I be sure of the legal purity of this apartment?

With a second flat, it's the same question, but it's not a legacy, it's a sale, but it's owned for less than three years.

The client left a review of the service to show the Legal Counsel online Response to the website within 15 minutes to ask a question.

Legal responses (6)

Marina, if the first bequest has been taken over, there's no point in worrying about possible heirs, because they're nothing to do with it... the only problem can be if people are registered there, but it's settled...

For the second apartment, there are no questions at all, except that it may be the subject of a dispute (e.g. joint property of spouses who are no longer married and have not divided property)

Marina, hello!

I join my colleague -- if the apartment has passed through a notary and a registration authority, the likelihood of any deception is reduced many times -- and I would only advise you to ask for information about the will (either the owners or the notary).

Hello, Marina!

Only recently here on the website, a man had the same problem, he bought an apartment, and he was afraid there might be problems in the future, and I advised him to cover the deal against the adverse effects (real estate insurance), so he did.

This is the most reliable option, because if the transaction is declared invalid, you'll return your money, especially the security services will check the cleanness of the transaction and the sellers through their channels.

Good luck to you!

- Certificate of Right to Succession, 31.08.2010;

If a testimonial is a testimonial, then no other heir can challenge the deal even in theory; he will have to challenge it first, which is very problematic.

A certificate of ownership dated 17 September 2010 for this new owner;

It's 2014, and since then, the document has not been challenged by anyone, and the statute of limitations has already been missed, if anyone had intended to do so, so the absence of the deceased's relatives is likely to be quite certain.

Is there any reason to worry about unknown relatives who are potentially claiming an apartment or something?

There's no point in worrying about unknown relatives.

With a second flat, it's the same question, but it's not a legacy, it's a sale, but it's owned for less than three years now.

It's not your problem, it's your problem, it's the seller's problem.

Notarize the transaction and there will be no problem. No notary in his or her right mind or in his or her sober memory will make a deal with a "left" document or a clearly inadequate person. Nor is the existence or absence of a record in the PND any reason to refuse a transaction. This is not incapability when the unsub fails to account for his or her actions. Inability is determined only by the court.

Hello, if the apartment is not the object of a crime, or if it has been abandoned by the owner against his will to demand it from a good-faith buyer, it is not provided for by law.

The legal documents are the right to inherit, thus selling its heir, and hence, by its own free will, the dwelling is inherited.

When buying an apartment, ask the seller for an extract from the home book and the personal account.

You can order an extract from the EGRP in Rosreest, from which you will see information about all the owners of the apartment, all the law changes, this is public information for any person, 200 rubles of government.

In another apartment, check the same documents, the statements from the home book, the personal account, the legal documents, i.e. the contract of sale, the certificate of State registration of the law.

Order statements from the EGRP. 400 rubles isn't a big sum, but it's gonna be a lot more obvious.

That's the first time I've ever heard a panda and a pund to ask, maybe that's what you practice.

There is always a significant risk with inherited apartments; in this case, I would like to point out that no one knows if there are any other heirs or not; it is not possible to vouch for that.

The fact that an apartment was handed over to an alien was particularly disturbing, and in such cases the date of the commencement of the statute of limitations could not even be assumed, since it was not possible to determine whether the period of limitation had begun.

No one knows when the heir can learn about the discovery of the inheritance.

In practice, after many years, the court had restored the duration of the inheritance; given the age of the owner, there might also be heirs entitled to a compulsory share of the inheritance.

The second point of risk concerns the question of good faith acquisition; according to the law, good faith can only be referred to in the event of the acquisition of property through a refund transaction.

In this case, the owner received the apartment free of charge, on the basis of the inheritance, so the question of the purchaser's characterization as good faith does not arise, with all the consequences.

The third warning point is that you can't meet a salesman, find out what you're talking about, and you don't have to buy an apartment from strangers.

I believe that Edward Mirass is fully entitled to offer insurance for the deal, and no other way to guarantee full security.