When a couple divorces, the issue of financial support for a child is as acute and radical as possible.

How much will a father (most often a minor child stays with the mother) pay for his child's maintenance? Do you have "clean" or "filter" payments? How long will payments take place?

Similarly, there are many nuances: What if the father works informally, or if he has other children, from previous marriages? In this article, we will try to find answers to all these questions.

Method of entry

Before we look at it, there are alimonys with "clean" or "filter" wages, let us find out what the father has to do to help his children, all of which are set out in article 104 of the Family Code of the Russian Federation.

First of all, it is a share charge, in accordance with which a certain percentage of the father ' s official salary is calculated in the form of cash to cover the child ' s needs; this is the type of maintenance that is most common.

The second option is a specific fixed amount that the father is obliged to hand over to the mother of his child, either once or monthly, which may be fixed by the court or set out in a contract signed between the former spouses and certified notarized.

But there is another possibility of paying child support, a mixed assessment whereby financial assistance to a child is provided in other ways not always expressed in monetary equivalents, most often when the father is unemployed on a permanent basis or his salary is insufficient to cover the child ' s basic expenses.

Payment period

Most often, the father begins to pay alimony immediately after the divorce; in some cases, the first day of such payments is the date on which a woman takes legal action to settle disputes over alimony.

When a father can stop paying a certain amount for his child's maintenance, as mentioned above, alimony is a payment that provides material support for a minor child.

That is, once his son or daughter turns eighteen, he has the legitimate right to stop providing financial assistance to his own child.

It is noteworthy that if a minor child continues to study (at an institute, school or college), he or she still loses the right to formal support from his or her father.

And when you have reached the age of majority, then when you have reached the age of majority, you will not be able to help your children, nor will you be able to help them, nor will you be able to help them, nor will you be able to help them, nor will you be able to help them, nor will you be able to help them.

However, there are nuances here, for example, if the child or daughter of a maintenance worker is disabled from childhood (no matter what illness), the father is obliged to assist him in the continuation of the period regulated by Russian law.

Types of wages

Now, let's move directly to the question of how are alimonys written: "clean" or "filter" wages? Before we get to the point, let's find out what these terms mean.

First of all, it should be known that these terms are not official terms, but popular ones. "Dirty" wages are the amount that a person earns per month without tax calculations. While "clean" wages are the money that an employee receives in hand. It is clear that "Dirty" wages are more "clean." So what is the amount of alimony calculated?

According to the legislation of our home country, there are a number of detailed instructions as to how alimony is paid: for example, article 99, paragraph 1, of the FZ "On execution", dated October 2, 2007, states that alimony is calculated from the amount left behind by tax retention, in other words, "clean" wages.

How to determine how much to pay

According to article 81 of the Family Code of our home country, a fixed percentage has been established to regulate the amount of payments.

But what percentage of the maintenance salary per two children is the amount required is one third of the salary or 33 per cent.

- If the children are three or more, the father is obliged to pay at least half of his salary, but not more than seventy percent.

- A model for the calculation of maintenance will be given below.

- So if the father received 80,000 rubles per hand in a month, the amount calculated from this salary for one child would be no more than 20,000 rubles for two children, just over 26.5 thousand rubles for three or more, not less than 40,000 rubles.

- If the maintenance worker has minor children from different marriages, the amounts in question shall be distributed equally among them according to a court decision.

It is worth mentioning that the above-mentioned amounts cannot be final, as a woman in court may increase her child ' s share, and in some cases a man may apply to the court for a reduction of maintenance, which will be approved during the hearing.

Now let's find out what else can be part of the benefits that ensure the full maintenance of a minor child?

What revenue is accounted for

First of all, it is clear that salary is taken into account (if the maintenance worker works in an official enterprise), and this includes the various bonuses and incentives granted at work and shown in the accounting statements (overtime, salary supplements, incentives and leave).

Where else can alimony be calculated? Scholarships, pensions, unemployment or disability benefits are all the income of a person that must be recovered, including royalties, income from the sale of real estate, etc.

However, there are others from whom alimony cannot be charged.

Which income is not taken into account

These include:

- Survivor ' s pension benefits.

- Compensation for injury or injury resulting from the performance of official duties.

- Other compensations (due to man-made disasters, care for a disabled family member, etc.).

- Travel income or amortization.

- Humanitarian assistance.

Methods of transferring money to a child

In practice, such means of alimony are most common:

- From the workplace: This option is considered the most needed, so we will discuss it in more detail below.

- For this purpose, not only the name, name and patronymic of the recipient, but also of the payer, but also the date of payment, the amount and the exact period of time for which the payment is made, must be indicated in the postal translation; the address of the recipient should be retained; it is desirable to retain all the documents relating to the transfer up to the child ' s majority, so that the unfair recipient does not bring the maintenance worker before the court, who allegedly did not participate in the maintenance of his or her own child.

- From hand to hand: It is good for spouses to be able to communicate with each other in peace after divorce, discussing the upbringing and maintenance of the child together, but it is important to be very careful here. By giving alimony in person, it is important to take a receipt of the necessary amount as alimony payments. The document must include specific data (who, for what and how much they received) as well as the exact date of the transfer of the money.

From work

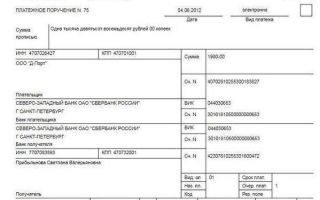

What is the procedure for the payment of maintenance by an enterprise in which a divorced parent can work? First of all, an official document must be placed in the financial department of the workplace, according to which a certain amount of money from his/her salary will be deposited into the bank or personal account of the spouse; such a document may be a court order, an executive note or a notary agreement of both spouses.

According to it, the company ' s general accountant calculates the amount (if not recorded) and transfers it to another cash account.

In the course of the transfer of maintenance through the company ' s books, a special maintenance order is being issued, which not only indicates the beneficiary ' s bank details but also indicates the amount of the payment over which period it is made (in the format: month and year), the personal data of the maintenance provider, and the number of the document according to which such manipulations are carried out.

However, this is not all the information necessary for the transfer of funds; it is necessary to specify the "filter's" salary, the number of days worked, the amount of the tax (which usually does not exceed 13 per cent), the tax number of the individual contributor and the amount of payment arrears, if any, that we have examined how to reflect the alimony in the accounting profession.

It is also worth pointing out here that child support payments must be paid within three days of the receipt of wages.

Otherwise, the recipient may claim damages, which would pose numerous problems not only for the alimonyer but also for his employer.

Therefore, it is very important to note, when bank transfers are processed, that payment is a priority; this will help the staff of the financial institution to transfer the amount as soon as possible.

It is also worth knowing that maintenance may be performed through an accountant ' s office without the staff member ' s knowledge if the proof of payment (payment order) has been delivered to the staff member ' s place of work.

In which cases the court decides the case

There are situations in which the spouses cannot agree on the amount of the money transferred, or where the alimonyer conceals his or her official salary, or works informally or irregularly, in which case the case is referred to the court.

The judge, in view of the financial situation of both spouses, may make such decisions in order to create favourable conditions for the maintenance of a minor child:

- If the payer is not employed, he or she must pay a fixed monthly amount for the maintenance of his or her child, calculated in accordance with the minimum subsistence level of the region.

- If the alimonyer has irregular income or it is not possible to determine his payment arrears, the amount of the payments may be equal to the average wage of the region where the person concerned lives.

- If the payer receives a salary in non-rubber currency and has additional sources of income, the judge shall fix a specific amount of maintenance paid monthly or, very rarely, once.

Required penalties

Sometimes, if maintenance payments are delayed, the recipient may request an assessment of the damages; the amount of maintenance needed to be multiplied by 0.5 and by the number of days of arrears.

The applicant will be required to pay the amount received together with the legal costs.

However, the court may lighten or quash the sentence in its entirety if it is proved that the delay occurred as a result of the serious illness of the payer, the difficult family circumstances or the bankruptcy of the enterprise in which the maintenance worker worked.

Other penalties for non-payers

If a maintenance worker avoids payment, he or she may face the following sanctions by a State:

- Ban on going abroad.

- Restrictions on the use of driving permits.

- Loss of parental rights (on the basis of a court hearing).

A few words in conclusion

As can be seen, the issue of alimony continues to be acute and painful to many divorced couples.

The fact that the spouses cannot agree and come to a common denominator should in no way affect the well-being of their children.

Therefore, the State has established the concept of alimony, which may be awarded at a court hearing, which may be increased or reduced for objective reasons considered during the proceedings.

The State has specified the percentage of maintenance and the official salary of the payer, which is regulated in order to ensure the safety of the minor child and to improve his maintenance.

Divorced spouses have the right, by mutual agreement, to change the amount of maintenance expected by entering into a contract and by notarizing it.

What kind of salary are alimonys, clean or dirty?

As much as the couple love each other, there's a crisis in their lives sooner or later, and they're having some problems in their relationships, which eventually leads to divorce, because not all couples are able to cope with the unpleasant moments.

When there are no children, divorce is less painful, but when there is a common child, there are many problems during the divorce: division of property, determination of custody of the child, assignment of maintenance, and many people ask, ‘Is maintenance paid to the child from the pure or the dirty?'

Concepts of "net" or "filter" wages

The recipient and payer need to know what kind of income the alimony is charged on, the situation in our country is difficult, and not every person with children can find a good job with a decent salary.

They don't pay taxes, they don't pay their income anywhere, but many women who bring up their children alone, it's important to know: maintenance is paid on what salary?

The answer to this question is also important to payers, and it is the manner in which the retention will ultimately determine the amount of the payments and the amount that will remain in the custody of the alimonyer, or, for example, in the bank account.

When a married couple divorces, the question of the child's continued financial support is as acute and radical as possible. Before determining whether maintenance payments are paid with "clean" or "filter" wages, it is necessary to know what the father has in place to provide financial assistance to his own children.

All provisions on alimony payments are listed in article 104 of the SC.

It is important to note that this is a share charge, which calculates a certain percentage of the father ' s official salary in the form of money for the child ' s maintenance and upbringing, as well as for all his needs; in most cases, this is the type of maintenance charge.

There is another way available: there is a fixed amount which the father of the child is obliged to hand over to the child ' s mother every thirty days in a timely manner; the amount of the payment is fixed by the court; sometimes the amount is prescribed in the contract concluded by the two spouses; it must be certified by a notary.

There is another possibility of financial assistance to a child, mixed, and according to her, the payment of money to a child is not always in the form of cash equivalents; this is possible when the father does not have a permanent job or his salary is insufficient to cover the child's basic expenses.

In most cases, the father begins to pay alimony immediately after all the documents for the dissolution of the marriage have been issued.

In some cases, the date on which a woman applies to court for a decision on maintenance disputes is considered to be the day on which such payments are made.

In general, men are the contributors of maintenance and women are responsible for the upbringing of common children, and do fathers wonder when they can stop the monthly payment for their children?

Maintenances are payments made every thirty daysIt is important to note that once the child ' s son or daughter is 18 years old, the father has every right to cease providing financial support to his child.

If a minor is enrolled in a higher education institution, he or she still loses the right to formal support from his or her father; this may also be a college or school, not necessarily an institute, university or academy.

This is because while a child is studying at a university, he or she still needs money to live, eat and buy stationery.

In some cases, fathers, realizing that they no longer have a legal obligation to the baby, stop providing stable material support to their child.

For example, if the daughter or son of a person who is obliged to pay alimony — a person with a disability from birth — does not really matter what kind of illness he has, the father must provide assistance to his Chad for the period established by Russian law.

Is the alimony paid on a net or a dirty salary?

"Dirty" wages are the amount a person receives once a month without different tax calculations.It's illegal.

When a person is found to be hiding his income, he may face a penalty, but the "net" wage is the official income that he receives in hand or in a bank account, and taxes are withheld from him.

According to the current legislation of our country, there are a number of detailed instructions as to how maintenance is administered, and the UK states that alimony is calculated only from the amount remaining after tax retention.

In other words, alimony is collected solely from net wages.

How do you calculate alimony from your salary?

One child usually has to pay no more than a quarter of the income, and that amount should be sufficient under the law. How do you calculate alimony if a man has two children?

One third of the wage, or 33 per cent, is considered to be the necessary amount for the maintenance of infants; if the former loved ones have three or more children, the father is obliged to pay at least one half of his salary for the Chad.It should be noted that the percentage of maintenance on official income cannot be more than 70 per cent.

It is often the case that a man did not have one marriage but had two failed marriages from which he had two children, for example, in which case the amounts in question were equally distributed among all the children by court order.

It is worth noting that the above-mentioned amounts cannot be considered final; if necessary, a woman has the right to legally increase the share of the child ' s benefit.

In some cases, a man may also challenge the court ' s decision and file for a reduction in maintenance, which will be approved during the hearing.

Of course, if the amount of the payment is not commensurate with his salary, the salary must be taken into account when calculating the amount of the child ' s assistance from the father or mother.

This is relevant if the maintenance worker works in an official enterprise, and it is also important to include all the bonuses and incentives that have been given to the person at work, and it is important that all of them be disclosed in the accounting statements.

This may also include overtime, salary supplements, various incentives and leave payments, and may also take into account scholarships, pensions, unemployment and disability benefits, in other words, all the income of a person that is subject to compulsory recovery.

There is a list of income that will not be taken into account by the court in calculating maintenance:

It must be borne in mind that if a maintenance worker evades payment, he or she may face the following sanctions from the State:

And if you turn away, then surely Allah is Oft-Forgiving, Most Merciful.

In most cases, before and after divorce, the spouses enter into a common agreement in which the father of the child undertakes to provide financial assistance to his or her children.

This allows for a peaceful break-up, which will not affect the baby's psychological state, because if he sees his parents fighting, he's experiencing a certain amount of anxiety, which has a negative effect on his mood.

From what salary are alimonys paid: black or white, how do you get it from informal wages, and how do you calculate it - clean or dirty?

The question of the retention of child support for minor children is of concern to both parties, the payer and the recoverer.

Both may wonder from which part of the salary will be deducted.

Companies often pay, along with the official part, the so-called "black" payment.

Is it possible to recover amounts from her?

What is the calculation, clean or filthy?

"Dirty" wages are usually defined as the amount of the employee's accrued income prior to taxation, and by "net", respectively, the income from which NPFL has already been paid.

These terms are informal and apply only in a conversational environment.

Under the law, alimony must be withheld after the income tax of 13% has been deducted, which means the recovery is made on the employee ' s net salary.

Calculation of maintenance by example.

White or black?

It is also common to hear such concepts as "white" and "black" wages, as well as informal words that refer to the official and informal part of the salary.

- Organizations often pay employees' salaries in two instalments – a certain share is paid officially, the balance is given informally in an envelope.

- At the same time, all contributions are paid from white wages – NPFL, insurance premiums, and black taxes are not paid.

- Sometimes the official component of earnings is the minimum wage level established in a given region.

This is a violation of labour law and is punishable by fines, but employers continue to experiment actively in trying to minimize their tax costs on employees ' salaries.

- Maintenance under the law is withheld only from the official net earnings after 13 per cent of the income tax has been withheld.

- What, then, is to be done with alimony, how can it be deducted from payer's salary if most of it is informal and paid black?If the court determines that maintenance is retained in a firm amount of money, there is no problem with this issue.

- The employer will keep the same amount of money on a monthly basis, and it does not matter how wages are paid – officially or not.

- The same applies when the amount of maintenance is determined by the voluntary agreement of the spouses.

- If, on the other hand, the court has determined that alimony must be recovered as a percentage, the amount of retention may be significantly reduced because part of the salary is paid black.

With informal earnings, the maintenance rate will not be withheld.

What do you do in this case? Is there a legitimate way to get the percentage off the black salary?

How do you get a black wage?

As a general rule, if the spouses have not entered into a voluntary maintenance agreement, the retention is made as a percentage of net income after deduction of NPFL:

- 25 per cent for one minor;

- 33% on two;

- 50% on three.

More than 50 per cent may be withheld voluntarily only when the employee so requests in the application and in the event of payment arrears; in the latter case, the retention rate may be as high as 70 per cent.

- Interest is withheld from official white net earnings.

- With a "black" informal wage, there's no way to calculate interest.

- If it is known that the minor ' s parent pays a part of the salary informally, the applicant may apply to the court for a fixed sum of money for the children.

- In doing so, it is necessary to substantiate its request in the suit.

- Another way is to negotiate peacefully with the alimony payer and to determine a reasonable amount for both parties, which will be deducted from the payer's salary and other income on a monthly basis.

If the defendant does not pay alimony and has a black salary, the claimant is entitled under article 112 of the UK to file an application for compulsory recovery of the debtor ' s property in respect of the debt.

Another way to recover alimony from informal earnings is to apply to the UBEP and the Public Prosecutor ' s Office to address the issue of malicious concealment of real wages.

What if the payer doesn't have an official job?

- If the minor ' s parent does not have an official job at all, he or she is unemployed.

- In such a case, the applicant must apply to the court for maintenance in a firm amount of money at a multiple subsistence level.

- It provides justification and evidence that the payer has no formal earnings.

- Once again, it is possible to agree peacefully on the amount of detention for joint children.

Conclusions

- Maintenances are always deducted from the portion of the salary left behind by the deduction of income tax (NDFL at 13 per cent).

- Retention is made only on the basis of the official earnings from which the employer makes contributions to the tax and funds.

- If the payer receives the money informally or does not earn any income, it is possible to apply to the court for a fixed amount of money instead of a percentage.

Is the alimony calculated on the basis of a net or dirty salary?

The fundamental question in the maintenance area is: maintenance is paid on a net or dirty salary? The answer to it is important to both the payer and the recipient, because the manner in which the retention payments are made will also depend on the amount of the payments and, accordingly, the amount that will be left to the alimonyer in his hands or in a bank account if the wages are put on a map, for example.

Consider the problem and try to give a big answer to the question.

Variance in calculation

To begin with, we learn how much difference exists between the different ways of calculating the amount of maintenance, for ease of calculation by the installer of 10,000 rubles for the maintenance of a minor.

Let's assume that a man has one child on which he pays 25 per cent of his salary, as required by the Family Code of the Russian Federation.

- 2,500 roubles will go in favour of the recipient of the money;

- 6,525 roubles will remain with the payer;

- 975 roubles will go to the State in the form of NPFL.

Option two: first, taxes are withheld. With the income that is the wage, the alimonyer has to pay only one tax, it has already been mentioned. This is NPFL, a payment that is based on the individual's income. Who will receive what amount of money if first, in the accounting of the company where the payer works, the tax will be counted first?

- 1,300 rubles will go to the coffers;

- 2,175 rubles will be alimony;

- 6525 rubles will live for the payer.

Thus, in any event, the alimonyer receives the same amount, the only difference being the amount that will be paid in favour of the minor and the amount that will be paid in favour of the State.

We see that in the second case, the State receives more; however, it is the second way of withholding funds that is legitimate.That is, the situation where alimony is paid with dirty wages is not in accordance with the provisions of the law.

It's time to invoke the law.

Legal framework

The Family Code of the Russian Federation does not provide an answer to the question asked.

- Parents are obliged to support their children.

- The shares are as follows: for one child, a quarter of the income, for two, a third, for three or more, and for half.

There is a need to refer to another important law governing relations, including in the area of maintenance, the Executive Proceedings Act.

In article 99, part 1, it is expressly stated that the retention of the debtor ' s income is calculated after the proceeds have been withheld from the taxes provided for by the law.

The accountant of the organization that received the executive list must first retain all taxes and then calculate the amount of maintenance.

This method of calculation is, in principle, fair; it is held from the amount actually due to the payer rather than from the amount of the payment called the dirty wage; the dirty income is not handed over to the payer.

On what salary are alimonys paid, dirty or clean?

The amount of monthly maintenance per child and the balance of the payer ' s money will depend on whether the alimony is paid on a net or dirty salary.

Net and dirty wages

In legal practice, it is customary to distinguish between two types of wage security for employed citizens:

- "Dirty" income;

- "net" payments.

This amount is recorded in the income statements, accounting records and staffing tables for a particular post; before reaching the employee, the payment is subject to the withholding of all government taxes and taxes, so that the actual earnings earned will be much lower.

Once income tax and pension contributions have been withheld from wages, there will be a "net" income, which is the amount of remuneration that will be paid to the employee's bank account.

Example:

The citizen of Protopopova, A. E., works as a teacher at the secondary school. According to the income certificate provided by the accountant, a woman earns a monthly income of 48,000 roubles.

After the transfer of the money to the organization's account, the income tax – 13% and the RPF – is recosted at 2%. After the profit is calculated at 15% (13% + 2%), the Protopopian A.E. bank account will receive a profit of 40,800 roubles.

What kind of salary do you keep alimony from?

The principles of retention of funds are detailed in the articles of Federal Act No. 229 of 2 November 2007 "On execution proceedings", article 99 of the legal instrument defines the following principles for withholding money from official profits:

- Maintenance payments will be made from the payer's income only after all government taxes have been withheld, so the percentage of the retention will be based on net earnings.

- Monetary obligations may not exceed 70 per cent of a citizen ' s official profits; given that one person may have several obligations (appliances, loans, compensation for damage caused), the law sets out the order of retention of funds; maintenance refers to the payment of the first line.

Model calculation from the example of a citizen of Protopova (beginning above):

All mandatory budgetary contributions were withheld from women ' s income, after which the employee was required to teach a card of 40,800 roubles.

By order of a justice of the peace, a woman transferred the monthly allowance to her minor child, who was permanently separated from the mother with the father, and the court ordered the transfer to be 25 per cent of the official income.

The rules of the executive procedure stipulate that the accountant of the organization shall submit documents to the bank, specifying two accounts: the recipient of the grant and the contributor of maintenance, so the transfer shall be automatic, in which case the child ' s father may receive the following amount of payment:

40,800 * 25 per cent = 10,200 rubles, which amounts to less than 70 per cent of the official profits, so the money will be transferred to the minor child in full.

The "net" payer, after retention of maintenance, will remain as follows:

40 800 - 10200 = 30 600 rubles.

Procedure for calculating and retaining maintenance

A free legal consultation will answer your question in five minutes!

Article 81 of the Family Code of the Russian Federation provides that the court shall have the power to award maintenance as a proportion or percentage of the official income of an employed citizen, as follows:

- In the case of one payee, 25 per cent or 1/4 of the profits;

- For two children (biological or adopted), 1/3 or 33 per cent;

- If the retention takes place in favour of three and more children, half of all profits.

Another method of calculating the contributions, in a firm monetary amount, is set out in article 83 of the Family Code of the Russian Federation, which is relevant in the following cases:

- The profits are accrued in foreign currency;

- The income is not constant.

Recovery of maintenance with grey salary

Gray profit is a simple popular definition of income that is given by the employer "in envelope".

- The purpose of such payments is tax evasion (the employer pays less tax because only the amount that comes into the cards is declared);

- The employee is officially listed as receiving a SMIC salary (at the end of 2018 it was 7,800 roubles);

- The additional payments are paid to the employee informally and are not included in the accounting statements.

If it became known that a child-bearing parent received more than a declaration, measures should be taken to increase the contribution.

Step 1 confirms that the payer ' s salary is significantly higher than the official certificates; the Pension Fund will not help because it only accumulates official data; the citizen concerned may apply to the following authorities:

- The Municipal Statistics Division, which will prepare a certificate on the average income of an employee for a particular job;

- FNS – The IRS will respond to the appeal and inspect the company where the citizen works.

In practice, there are possible signs of "grey" income:

- Taking up a good position by the payer;

- The enterprise is actively developing and announcing new vacancies;

- Previously, the income of the firm in question had been significantly higher.

Step 2 - applying to court with the evidence gathered.

In addition, financial documents must be submitted that confirm the amount of the child ' s expenses; the legal representative of minors, according to articles of the UK, may request an increase in maintenance if he or she is unable to pay for the needs of joint children on his or her own.

It is also important to know: How to recover maintenance debts through court?

Judicial practice

Our lawyer will answer your question for free in five minutes!

An analysis of judicial practice shows that 35 per cent of applications for increased maintenance are successful.

This is the average for Russia, which depends on the fact that it is very rare for the plaintiff to prove the existence of a grey income.

Witness testimony — parents of the parties, neighbors, close friends, and acquaintances — can help in a positive outcome.

The law stipulates that the money for the maintenance of a minor child or a disabled relative will be withheld from the "white" income, in order to protect the property rights of the payer, who must have a means of subsistence after payment of all monetary obligations.

All provisions on alimony payments are listed in article 104 of the SC.

All provisions on alimony payments are listed in article 104 of the SC. If the court determines that maintenance is retained in a firm amount of money, there is no problem with this issue.

If the court determines that maintenance is retained in a firm amount of money, there is no problem with this issue.