The nephews are the children of the heir's brother or sister and are not part of a line of legal succession.inherit by right of submissionIn accordance with article 1143 of the Civil Code of the Russian Federation, in the event of the death of their parents.

Citizens also have the right to make a will, indicating their nephew as heir.independentlyArticle 1118 of the Criminal Code of the Russian Federation regulates the basic rules relating to the preparation of a will.after the death of the testator.

Heirs after the death of Uncle and Aunt.

The nephew and niece of the deceased may inherit by law and by will, in the form prescribed by the current legislation of the Russian Federation.allowed inheritance on several grounds(by law and by will)

By law

The general rules on inheritance are defined by law in article 1141 of the Criminal Code of the Russian Federation, as follows:

- The inheritance of persons entitled to this right as heirs under the law may beIt's only in order of turn.as defined by this Code;

- The representatives of the second and subsequent rounds may be called to inherit when there are no representatives of the first and subsequent rounds, or all of them have abandoned the inheritance;

- The court ' s recognition of the person as an unworthy heir, in accordance with article 1117 of the Criminal Code of the Russian Federation;deprives him of his right to inheritwhich shall proceed to the other nationals of the given line or to the representatives of subsequent rounds;

- The deprivation of a citizen ' s inheritance by order of the testator is the cause of the testator ' stransfer of his inheritance rights to other heirsthis or subsequent rounds.

The nephews and nieces of the deceasedNot included in one of the succession roundsHowever, according to article 1143 of the Criminal Code of the Russian Federation, they are entitled to a share in the inheritance in the event of the death of their father or mother, a brother or sister of the heir, in conjunction with the representatives of the second line of succession under the law.

Article 1146 of the Criminal Code establishes general provisions on inheritanceRight of submission:

- If the death of the heir's brother or sister occurred alone with him or before the discovery of the inheritance, his share of the inheritance goes to his nephews.

- The share obtained by the right of representation in equal parts is divided between the nephews of the heir.

- If the heir is legally deprived of his inheritance rights because he is found to be indecent (art. 1117 of the Criminal Code of the Russian Federation),The descendants cannot inherit the property of the deceased under the right of submission.

- If the heir is legally deprived of inheritance rights in connection with an order in a will (art. 1119, para. 1, of the Criminal Code of the Russian Federation),The descendants cannot inherit the property of the deceased.Right of submission.

The nephews may also inherit on other grounds.Individually for each of themwith the receipt of the citizen ' s share.

According to article 1148 of the Russian Civil Code, the nephew of the deceased may receive a shareInherited as an incapacitating dependantParagraph 2 of the said article specifies the conditions necessary for this:

- The nephew must be incapable of work on the date of the opening of the inheritance;

- During the last year (or more) until his uncle ' s death, his nephew was fully supported;

- At least a year before the death of the heir, his nephew had to live with him.

Even though the nephew is a blood relative of the heir,is not included in the list of persons entitled to inheritanceThe fact that he lived with the deceased is therefore of great importance.

By will

It follows from article 1118 of the Russian Civil Code that the will is:The only wayLeave property orders in the event of his or her own death.

The document can only be completed if it is fully operational.must be signed in personThe performance of a will by trusted persons is not lawful.

You can't leave a few citizens on the document.

The rights that the testator receives are defined in article 1119 of this Code and include the following paragraphs:

- Citizens have the right to bequeath any property, including any property not yet owned by them;

- Any person who is not even legal heirs may be named in the will;

- The testator is able to determine the share of the heirs on his own;

- The document may contain orders concerning the inherited property and the conditions for its acceptance by the heirs;

- The testator may not disclose the information contained in a document in a manner convenient to him or her.

The testator has the right to writeSeveral willsby indicating in each of them specific property or certain heirs, the document may contain only orders — in particular, the exclusion of nephews from inheritance rights.

Freedom of will is limited by the current legislation of the Russian Federation, including:the right to a compulsory share in the inheritance(art. 1149) The said right cannot be transferred to them by inheritance or by right of submission from anyone.

Determination of the shares of heirs

On the basis of article 1141, paragraph 2, of the Russian Civil Code,The inheritors of one line shall be equal,The acceptance of the share by right of submission makes it possible to receive it at the same time as the relatives of the succession.

If the nephew inherits by will, his share may be determined by the testator himself (art. 1119).Absent the right to inheritIn addition to the right to a compulsory share, and subsequently, through the creation of a new will,old may be cancelled or modified.

According to article 1122 of the Russian Civil Code:

- The indication in the will of an indivisible property does not invalidate the document; each of the heirs shall receive a share in the said property (e.g., in the apartment) and then it shall be included in the certificate of right to inherit.

- If there are more than one heir after a bequest, but the share is not determined, the bequest shall be shared equally among them.

Legacy after the death of uncle and aunt

Whether the nephews inherit by law or by will,6 monthsThey are required to apply to the notary office of the deceased ' s place of residence from the time of the opening of the inheritance; if the document has not been filed on time, their nephews may be deemed to have waived their rights to the estate of the heir.

Procedures for processing

Article 1152 of the Code of Criminal Procedure establishes the procedure for the acceptance of an inheritance.It must be accepted in order to obtain the inheritance..

It is not possible to accept only a portion of the inheritance due to the nephew or to accept the inheritance with reservations (e.g. by refusing to pay the debts of the heir); if a portion of the inheritance has been accepted, it is considered to be accepted in its entirety.

However, its acceptance by one of the heirs does not mean that it was accepted by other persons entitled to it.

Article 1153 of the Russian Civil Code allowsTwo ways of accepting an inheritance.

- By filing an application with the notary within six months of the opening of the inheritance.

- Actual adoption — payment of taxes, implementation and administration of measures to protect and protect property.

Necessary documents

It is necessary to inform you of your intention to accept the inheritance by applying for it within six months of the opening of the inheritance.Court to restore the date of acceptance of the inheritance.

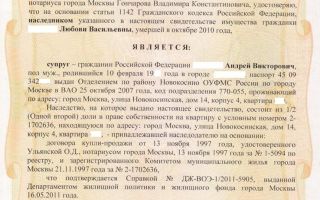

The documents to be submitted to the notary include:

- A document certifying the applicant ' s identity;

- Application for acceptance of the deceased ' s property;

- a power of attorney (if the application is submitted through a third person);

- A document on inheritance rights (e.g. will);

- The testimonial of the death of the heir.

If the application is submitted through a trusted person or by post, it shall bear the applicant ' s signature.Notarized.

The sister of Petrov had two sons, one of whom was unable to work and had lived with him in recent years.

Because of the absence of the heirs of the first line, the sisters of the inheritor were called to the inheritance, and half of the property was to be set aside by one of Petrov's sisters, who was one of the heirs of the second line.

Since her disabled child was dependent on his uncle, he was called to inherit with his mother and aunt.

Thus, the deceased's nephew, along with his mother, received 50 percent of his property, while the other part was accepted by the second sister.

Conclusion

The nephews and niece of the heir may inherit a share of his property.Right of submissionAnd if you leave a child, then you will not be able to inherit it, nor will you be able to inherit it, nor will you be asked to inherit it, except in the case of a deceased parent; and if you make a will, then you will be asked to inherit it out of line; and if you do, you will be asked to do so; and if you do so, then you will be asked to do so; indeed Allah is Oft Forgiving, Most Merciful; and Allah is Oft Forgiving, Most Merciful.

If the heir is by lawfound to be indecenthis descendants have no right of representation of the deceased ' s property; the same situation arises if the testator is deprived of the right to inherit.

You can accept the inheritance within six months of the death of the heir.the deceased ' s place of residenceIf the application is sent by post or with a solicitor, the signature must be notarized.

Question

My late uncle has two sisters, and my older brother died more than two years ago, but he has a son, whose whereabouts are unknown, and we don't know how to find him and notify him of his uncle's death.

If he does not file an application with a notary (personally, by post or through a representative), his share will be distributed among the other heirs; he has six months to file an application; if he is later able to prove that he did not know of the opening of the inheritance or was unable to file an application, the court ' s decision may restore the period of acceptance of the inheritance (article 1155 of the Criminal Code of the Russian Federation).

Question

My mother died two years ago, and after her, I accepted her inheritance as the only heir. Ten years before her death, her brother (my uncle) died.

Can I claim this property now?

You can apply to the court, if it is proved that your mother actually accepted the inheritance, you can also obtain the property in question.

However, you will not be able to claim it under the right of representation, since your uncle's death (the heir) occurred before your mother's death.

Legacy to nephews after the death of uncle and aunt

Successionin accordance with the law, that's all.movableandReal estateThe property of a man on the day of his death.

Accepting part of the inheritance meanssuccession of the total share due: You can't take one thing and you can't give up the other. If the heir is entitled to the car and the heir's ornaments, for example, by taking the watch, the car is also considered to be inherited.

As a general rule, inheritance can be transferred byto the testatorIf absent, the property will pass throughby lawTo relatives.

The will must be madewithout the participation of attorneysA document may determine the fate of all inherited property, or of individual types of property; in the latter case, several wills may be made, each of which will determine the order of inheritance of a particular thing.

An order may be drawn up by only one person, even if the property is jointly owned by the spouses, each of them makes a wish for his or her share.

A will is made by a notary at the place of residence of the heir; in the case of several orders, only the latter is valid and in force.

It may include persons whom the owner deprives of his inheritance, or several heirs who will succeed in the event of the death of the previous heir; and it is possible to order what the heir has and what he will receive in the future; and Allah is All-Knower, All-Knower.

The distribution of the entire estate to certain persons is limitedObligatory heirsThe compulsory share of the inheritance is half of the amount that would have been due to a citizen under the law, in the absence of a will, and includes the parents, children and spouses who are dependent on him or her who are unable to work.

Children under 18 years of age are considered incapable of work, even if they are employed.

Depreciation means the custody of at least one calendar year prior to the death of the person holding them.

Dependents are also distant relatives who were in the care of the heir for at least one year before his death and outside citizens.Non-affiliation of any kindbut living with the dead.

A person may bequeath his or her property to any person irrespective of his or her family relationship; at any time, the citizen has the right to revoke the order; the he or she may refuse to accept the inheritance.

The adoption of an inheritance under the law is based on the existence of eight releases, each containing a certain number of persons; in the absence of a first line, there is a second succession, etc.

FirstThe line includes:parents, children and spouseThe spouse ' s share is half of the joint property and the portion that is due according to the law.

The nephews become the successors only by right of submission, in the absence of the first-line nationals, and the right of representation is the portion of the heir who died with or before the heir, which must pass on to the descendants of the heir,who has been able to accept the portion due to him.

Mr. Ivanov A.A., along with his brother Ivanov K.A., died in a car accident. A.A. had only the above-mentioned relative. Ivanov K.A., two sons. The latter ' s children, the heir, are nephews and, under the circumstances, they inherit all the property of Ivanov A.A. in equal shares. Such inheritance is called the right of submission.

And those whose heirs are not the heirs of the inheritance are those who are the wrong-doers, and those who are the wrong-doers in order to increase their share, and those who are the wrong-doers are the wrong-doers.

SixthThe sequence of successions is as follows:

- Children of cousins and granddaughters of the heir (two granddaughters and great-granddaughters);

- The children of his cousins (dual nephews and nieces); the children of his cousins and grandparents (dual uncles and aunts).

The rest of the line does not include nephews in the succession circle.

Legacy of the nephew

The inheritance rights of the nephews of the heir may be assumed on the basis ofWillsor providedThe absence of heirsFirst round.

In order to inherit, a notary must appear at his or her place of residence during6 monthsSince the death of the citizen.

An application for inheritance or a certificate of right to inherit must be made.

At the end of the said period, the notary will issue a document on the basis of which the successor will become the full owner of the estate of the heir, and with the evidence obtained it will be possible to convert the property received (e.g. real estate).

If an application for succession is made by post, the day of contact with a notary is deemed to be the day of the application.Date of letter sentThe date of receipt of the document is irrelevant.

The period for entry into ownership and disposal of property is reduced from 6 months to 3 monthsin two cases:

- Hereditary transmission.

- The previous heir's rejection.

In the first case, it refers to the inheritance of a relative who died after the discovery of the inheritance,Before I could get him out of here.The refusal of the previous heir implies the rejection of the right to inherit of a person of the same line and the succession of citizens of the next line.

Notary is provided as follows:documents:

- Death certificate;

- Personal and related documents (passport and proof of related ties);

- Additional documents (confirming disability, succession, etc.) depending on the case.

If the nephew was in possession of a will in which it is stated,specific equipmentthe rest of the estate of the testator is given to relatives.by law.

WhenafterThe date of expiry of the principal period of succession and ownership was found to indicate the existence of an early date.unknownThe distribution of items (book, etc.) will be as follows.

- If there was no will, everything would be divided between the successors.

- If the will indicates the specific property handed over to the nephew, he or she may inherit the property found only in accordance with the right of submission.

- If there was a reference to all property, the nephew named as the heir must accept the inheritance as well.

It is possible to enter into inheritance rights by means ofthe actual acceptance of the inheritance.In order to do so, the nephew must take measures to protect and care for the estate of the heir (provided that there are no heirs to the first line); it is possible to prove acceptance of the inheritance by providing appropriate certificates and cheques, notary or court.

How an inheritance is distributed among nephews

When the inheritance is passed over to two or more persons, for example, it is stated in the will that all property shall be passed to the two nephews, in which case it is permissible to make an agreement on the division of the inheritance; and the rules on the form of the transaction must be in accordance with the rules of civil law.treaties.

Property-sharing agreement to which it is attachedReal estatemay be concluded only after receipt of the certificate of right to inheritance.

Registration of the transfer of ownership, in which case the agreement and the certificate will be made.Single document.

At the request of the heirs, the property may be distributed with a derogation from the equality of shares rule; this cannot be done if there are incompetent citizens among the successors, since they are entitled to a compulsory share of the inheritance.

The non-conformity of shares on the certificate of right to inheritance and the agreement cannot be invoked as a ground in theRefusal to register rightsI'm gonna go get some real estate.

If the nephews do not agree on the distribution of the inheritance, they needapply to the courts.

When things are indivisible, the court may decide to sell them and to divide the amount received into shares or decide to compensate one person for another ' s share in the monetary equivalent.

The formation of an agreement that violates the requirements of the law renders a transaction null and void.

With all the freedom of expression in the document, it must be borne in mind that debts transferred under the agreement must correspond to the inheritance received; for example, one third of the dwelling and the full amount of the dwelling debt cannot be obtained.

Aunt or uncle's inheritance taxes

In the case of inheritance, the issue of taxation is the most important one.

There are financial costs, however, for notarization and for obtaining a certificate of right to inheritance, citizens must pay the rate.0,6 %value of property, but not more than1000 000It's a ruble.

Deletionof this rule is the circle of relatives consisting of parents, children, brothers and sisters (full-born).

They have to pay.0,3 %the value of the acquisition, not more than100 000It's a ruble.

Consequently, non-listed individuals, including:nephews,They must pay for it.TotalThe amount of the tariff.

Can a niece claim an Uncle's inheritance?

In which case can the nephews and the niece inherit the property of an uncle or aunt?

- A will inheritance if the names of the nephews are included in the document;

- Legacy by law in case of:

- The absence of heirs belonging to the first line of succession (they did not wish to accept the inheritance, were not alive, had the status of unworthy heirs);

- The first-ranking heirs were not alive at the time of the heir ' s death, or they died at the same time.

This is the case in the event of the death of their parents, which occurred before or with the death of the principal heir; the procedure is that the grandchildren represent the inheritance of their deceased parent and become the owners of the inheritance;

- The second line includes the grandparents of the heir, his brothers and sisters.

They may exercise their right if there are no relatives who could be part of the first line of succession; - In the second phase, there are also persons who are able to inherit through the submission procedure, including the nephews and niece of the deceased owner.

The children of the deceased's brothers and sisters become representatives of their parents, who are also no longer alive.

Consider the illustration of such inheritance.

The Civil Code contains8 ReleasesThe nephews are considered to be applicants.2 linesThe applicants.

However, they receive a share of the property only in the event of the death of their parent.

Therefore, independent heirs2 roundsHe's not.

Can nephews claim the inheritance of uncles, aunts?

However, they have the right to inherit only in the following cases:

- Death of the deceased ' s brother or sister before the discovery of the inheritance (on presentation).It happens that the direct successor dies before the heir, so the right to inherit goes to his descendants.

However, the nephew is not an independent heir to the law, so he is not entitled to a full share of the inheritance.Only the share of the deceased parent shall be shared among all the nephews; if a brother or sister has two or more children, the share of the legal successor shall be shared equally among them.

Death of the heir ' s brother or sister after the discovery of the inheritance (inheritance transmission).Sometimes the recipient dies after the owner dies.

In such a situation, it was not important whether a citizen had made an application for inheritance or not, and nephews could apply to the notary themselves and obtain a share in the property.

It is possible to arrange things which the heir already has and which he will receive in the future.

The distribution of the entire estate to certain persons is limitedObligatory heirsThe compulsory share of the inheritance is half of the amount that would have been due to a citizen under the law in the absence of a will.

These persons include the parents, children and spouses of the dependent heirs who are unable to work and who are generally disabled in all groups; children under the age of 18 are considered to be incapable of work, even in the case of work.

Dependency means the custody of at least one calendar year before the death of the person in charge of them, and long-term relatives who were in the care of the heir for at least one year before his death and outside citizens are also considered as dependants.Non-affiliation of any kindbut living with the dead.

It is possible to bequeath one ' s property to any person irrespective of the existence of a related relationship.

At any time, the citizen has the right to revoke the order, and the heir himself may refuse to accept the inheritance.

The adoption of the inheritance by law is based on the existence of eight rounds, each containing a certain number of persons.

In the absence of the first phase, the second succession, etc., shall take place.

FirstThe line includes:parents, children and spouseHeir to the heir.

All of them, as members of the first line, were inherited, and the niece was left with nothing.

Legacy inheritance by nephews

It would have been different if the dying aunt had made a will and appointed her only niece as his heir.

If there is no will, the inheritance passes to the heirs according to the law, in order of priority.

The nephews and nieces are in the line of heirs.

Representatives of the first line of heirsare the husband or wife, parents and children of the deceased.

Another category of primary heirs is grandchildren..

They will inherit by right, if their parents (the children of the deceased) die before him or at the same time as him.

The representatives of the second line of heirsThese are the grandparents and the brothers and sisters of the deceased, and they are called to inherit if there is no heir of the first line, the husband or wife, the parents, the children, and the grandchildren.

Similar to Release 1, Release 2 also provides for heirs to the right of submission.

Can a niece claim an Uncle's inheritance if

Can a niece claim inheritance?

In legal forums on the Internet and in face-to-face meetings with legal practitioners, the issue of inheritance is often raised; not all citizens know the law so well that, after the death of a relative, they can direct themselves to the order in which they are called to inherit.

Especially if family ties are complicated and family relationships leave much to be desired.

The law has prioritized the heirs according to the degree of kinship. The closest ones will inherit, first of all, the distant ones will inherit the last.

Sometimes, though, distant relatives (in the sense of the law) are more close than their own children or parents.

This means that the inheritance is distributed unfairly, and what is to be done, the law cannot provide for all possible situations of life in terms of justice and morality.

This situation is an example.

An elderly woman was seriously ill, in need of serious surgery.

Since she had not accumulated any savings, none of her relatives were close to her, her niece was responsible for the cost of medical care.

She took care of a woman in the post-op period, paid bills, bought medicine, and when the woman died, her niece buried her at her own expense.

It was only when the inheritance was mentioned that relatives — the children and grandchildren of a dead woman — appeared.

Can a niece claim Uncle's inheritance if there are no heirs?

The SC of the Russian Federation, namely:

- The inheritance of persons entitled to this right as heirs under the law may beIt's only in order of turn.as defined by this Code;

- The representatives of the second and subsequent rounds may be called to inherit when there are no representatives of the first and subsequent rounds, or all of them have abandoned the inheritance;

- The court ' s recognition of the person as an unworthy heir, in accordance with article 1117 of the Criminal Code of the Russian Federation;deprives him of his right to inheritwhich shall proceed to the other nationals of the given line or to the representatives of subsequent rounds;

- The deprivation of a citizen ' s inheritance by order of the testator is the cause of the testator ' stransfer of his inheritance rights to other heirsthis or subsequent rounds.

Article 1146 of the Criminal Code establishes general provisions on inheritanceRight of submission:

- If the death of the heir's brother or sister occurred alone with him or before the discovery of the inheritance, his share of the inheritance goes to his nephews.

- The share obtained by the right of representation in equal parts is divided between the nephews of the heir.

- If the heir is legally deprived of his inheritance rights because he is found to be unworthy (art.

Can a niece claim Uncle's inheritance if a sister is alive?

If the document was not filed in time, the nephews could be deemed to have waived the inheritance rights.

Procedures for processing

Article 1152 of the Code of Criminal Procedure establishes the procedure for the acceptance of an inheritance.It must be accepted in order to obtain the inheritance..

It is not possible to accept only a portion of the inheritance due to the nephew or to accept the inheritance with reservations (e.g. by refusing to pay the debts of the heir); if a portion of the inheritance has been accepted, it is considered to be accepted in its entirety.

However, its acceptance by one of the heirs does not mean that it was accepted by other persons entitled to it.

Article 1153 of the Russian Civil Code allowsTwo ways of accepting an inheritance.

- By filing an application with the notary within six months of the opening of the inheritance.

- Actual adoption — payment of taxes, implementation and administration of measures to protect and protect property.

Necessary documents

It is necessary to inform you of your intention to accept the inheritance by filing a declaration, which can be done within six months of the opening of the inheritance.

Can a nephew claim an Uncle's inheritance?

The grandchildren are the heirs of the right to represent their parents, who are the heirs of line 1.

- If the nephews did not accept the mother's inheritance within the prescribed time limit, could the sister inherit the deceased?

- You can take the inheritance of a dead uncle if the mother who died after him lived in his apartment and was written in it? Yes, you can, if there are no other heirs.

In some cases, the closest people — children, spouses, parents — treat a person much worse than the children of a sister or brother.

If her aunt dies, her property will be given to those close to her by the law, and those who are truly deserving of encouragement will be left out of business, and the situation can be corrected by creating a will document.

However, in this case again, the "submarine stones" cannot be avoided, and the availability of applicants to a mandatory share can destroy all the plans of the beneficial owner.

It is recommended that a free legal consultation be provided on the ros-nasledstvo.ru portal.

Can a nephew claim his uncle's inheritance after death?

Given the inheritance rights of nephews, the distribution of property will be as follows:

- In the absence of a will, the property is divided equally among the beneficiaries;

- If the will indicates that the particular property passes to the nephew, he may inherit the property found by submission;

- When a nephew is named as the sole heir in the will, he must also inherit the property found.

The nephew has the right to inherit through actual acceptance if he cares for the deceased ' s property, and the heir must not have first-line heirs.

From our article, you've learned whether your nephews are heirs after the death of your aunt or uncle. If you have other questions about inheritance law, we're ready to answer them right now.

Can a niece claim his grandfather's inheritance?

The spouse ' s share is half of the joint property and the portion that is due under the law.

The nephews become the successors only by right of submission, in the absence of the first-line nationals, and the right of representation is the portion of the heir who died with or before the heir, which must pass on to the descendants of the heir,who has been able to accept the portion due to him.

And those whose heirs are not the heirs of the inheritance are those who are the wrong-doers, and those who are the wrong-doers in order to increase their share, and those who are the wrong-doers are the wrong-doers.

SixthThe sequence of successions is as follows:

- Children of cousins and granddaughters of the heir (two granddaughters and great-granddaughters);

- The children of his cousins (dual nephews and nieces); the children of his cousins and grandparents (dual uncles and aunts).

The rest of the line does not include nephews in the succession circle.

Legacy of the nephew

The inheritance rights of the nephews of the heir may be assumed on the basis ofWillsor providedThe absence of heirsIn order to inherit, a notary must appear at the place of residence of the testator, during6 monthsSince the death of the citizen.

This does not apply to obligations inherent in the deceased ' s personality, such as alimony and moral damages.

Ways of Succession

Until 2001, if the aunts had not made a will, her nephews could not obtain her property, and in the absence of any other relatives, it was considered to be immature; article 1143, paragraph 2, of the Criminal Code of the Russian Federation made it possible to inherit her aunts.

It is possible to inherit by law or by will.

By will

By means of a document certifying a unilateral transaction, i.e. "a will", the rights of the children of a brother or sister after the death of an aunt are beyond doubt.

In order for the document to have legal effect, the heir must be capable of drawing up and signing the document in person or entrusting it to a notary or other person in the presence of a notary (art. 1125 of the Russian Civil Code).

The making of a will will will leave the gains to someone who has truly shown attention and care for a relative.

By law

Whether the nephew is a legal heir is specified in the Criminal Code of the Russian Federation. According to articles 1142 to 1148, there are eight sets of successions, each of which are grouped by degree of kinship.

If the testator has made a will, it is of paramount importance and the division of the property is carried out according to its maintenance.

Where there is no testimonial document, there is a legal succession regulated by the Civil Code.

Close people have advantages, and they are standing at the first stage of the genetic ladder.

This category includes:

- Mom and Dad.

- A lawful spouse.

- The heirs ' children or adopted children.

- Grandkids (on presentation).

It is not uncommon for a deceased person to have no direct offspring, and his parents and spouse have died before, and in such a situation the chance to inherit is passed to the second-stage relatives.

- Brothers and sisters who are equal to them in accordance with the law.

- Their children are rightly represented.

- The grandparents of the deceased on the side of both parents.

They are required to declare their rights within three calendar months of the end of the term for first-ranking heirs, or immediately if no such person is present.

Inherited property by the third line of heirs

If there are no second-stage successors, they have missed the deadline or they have abandoned the deceased ' s property, the transition to the third-stage phase shall take place.

The law strictly stipulates who is the heir to Release 3 of the Article.

An aunt and uncle's inheritance after his nephew's death – under what conditions may the aunt and uncle's family claim inheritance, as well as the cousins of the deceased

The inheritance by law is the only way to transfer property if there is no will; under current law, the deceased's property is divided equally among the next of kin of the deceased person.

But what if the heir had no offspring, his parents or spouse died, and he was the only child in the family?

It is interesting to note that the current order of succession is different from that which existed prior to 2001, in particular the composition of the heirs at the third stage of the inheritance transfer.

Rules under the law

Regardless of the number of third-level relatives, the division of the estate is carried out in accordance with the standard procedure established by law.

When a person dies, his relatives must report to the notary within six months and file the documents for the opening of the inheritance; and if the heir has made a will, it is of paramount importance, and the division of the property is carried out according to his maintenance.

- Where there is no testimonial document, there is a legal succession regulated by the Civil Code.

- Close people have advantages, and they are standing at the first stage of the genetic ladder.

- This category includes:

- Mom and Dad.

- A lawful spouse.

- The heirs ' children or adopted children.

- Grandkids (on presentation).

It is not uncommon for a deceased person to have no direct offspring, and his parents and spouse have died before, and in such a situation the chance to inherit is passed to the second-stage relatives.

- Brothers and sisters who are equal to them in accordance with the law.

- Their children are rightly represented.

- The grandparents of the deceased on the side of both parents.

They are required to declare their rights within three calendar months of the end of the term for first-ranking heirs, or immediately if no such person is present.

Inherited property by the third line of heirs

If second-stage successors are absent, they have missed a period of time or they have abandoned the deceased ' s property, the transition to third-level property is carried out; the law strictly stipulates who is the heir to the third-ranking section of article 1144 of the Criminal Code of the Russian Federation.

This includes:

- The brothers and sisters of the inheritor's parents, i.e. his relatives or their equivalents, by law, are uncles and aunts.

- Their children (after the death of their parents) are cousins and cousins.

Article 1144 provides for inheritance by right of submission; such applicants for property shall be considered only after the death of their parents; therefore, if the inheritance has not passed to the aunt and uncle after the death of their nephew, if they have died, the property shall be inherited by a cousin.

They also have the opportunity to assert their rights to the deceased person ' s property within 90 days of the end of the inheritance period for second-level persons, or in the absence of others.

If the third-line relatives have not opened a inheritance case, citizens at the next step may do so.

A total of eight successions are determined by law: if no representative has turned to a notary, the deceased ' s property is transferred to the municipality or becomes the property of the State.

When there are opportunities for category 3 rankings

Citizens referred to in article 1144 of the Civil Code of the Russian Federation may only assume rights if there are no heirs to previous steps or if they have refused to inherit the property of the deceased.

Third-level relatives may file a family case with a notary in the following cases:

- No previous releases (dead, reported missing);

- The people of the first two stages have missed their time to claim their rights.

- Close relatives refused to inherit;

- The court found the heirs of the higher stages unworthy.

In order to open an inheritance case, you have to go to a notary and write a statement, and you have to have documents to prove your relationship to the deceased.

The cousins belong to the third line of succession under the right of submission, and they participate in the division of the estate only when their parents have died.

This is based on parental rights; for example, if parents are found to be unworthy, their children cannot claim inheritance.

Distribution of shares

The inheritors of Release 3 are legally entitled to the same portion of the estate as in all other cases, i.e. all the property and savings of the deceased are divided into equal parts, depending on the number of heirs.

In other words, if the successor to Release 3 is represented in a single person, all the property of the deceased is transferred to him; in the case of two applicants, each of them receives 50 per cent.

The situation is more difficult when cousins and cousins are involved in the case, regardless of how many children the aunt or uncle of the heir has, all of them are legally entitled to a share of the inheritance in the same amount as their parent.

If the deceased has two uncles, then each of them shall have 50 per cent of the inheritance; and if one of them dies, he shall have half of the inheritance; and if he dies, then he shall have half of the inheritance; and if he dies, then he shall have half of the inheritance; and if he dies, then he shall have half of the inheritance; and if he dies, then he shall have half of the inheritance; and if he dies, then if he dies, then he shall have half of the inheritance; and if he dies, then he shall have half of the inheritance; and if he dies, then if he dies, he shall have half of the inheritance; and if he dies, he shall have half of the inheritance; and if he dies, then he shall have half of the inheritance; and if he dies, then he shall have half of the inheritance; and Allah is Oft Forgiving, Most Merciful; and Allah is Oft Forgiving, Most Merciful.

Follow-up actions

It is best for a notary office to be tied to the last residence of the heir, but if this is not possible, to another authorized person.

The third-stage heir is required to carry:

- Evidence of family ties to the heir.

- Papers confirming the absence of people from the first two rounds or their abandonment of the deceased person's property.

- The heir's death certificate.

- Identification document (passport or provisional certificate).

The application is made directly to the notary office and the notary will then verify the information provided and decide whether to issue a certificate of inheritance.

If there are no papers, the heirs will be notified of the missing documents and, once all the requirements of the law have been met, a favourable decision will normally be taken and the heirs will be entitled to take over the deceased ' s property.

Illustrative examples of the application of the law in the Court

It is not always the case that the inheritance of property after tribal origin, aunts and uncles is smooth; in order to restore the rights violated, it is necessary to go to court; for a better understanding of the situation, a few examples of jurisprudence are given.

These court decisions relate to disputes relating to the restoration of the date of succession, the determination of inheritance of property and other important issues.

Example 1: Re-establishment by the son of the deceased and acceptance of the inheritance

At the time of his death, the plaintiff was a minor and could not claim his rights as an heir.

- As the plaintiff ' s rights were violated in such a situation, upon reaching the age of majority he filed an application with the court requesting the restoration of the delay in the inheritance period for a valid reason, as well as the invalidation of the inheritance certificate issued to the respondent.

- Having considered in detail all aspects of case 2200/2018, the Court found that all the claims made by the young person were lawful and had a legally sound evidentiary basis, and the claim should therefore be granted.

- By a court decision, the period of succession had been restored and the document issued to the defendant had been declared null and void.

Example 2: Determination of succession and recognition of ownership of land by the deceased ' s niece

The plaintiff filed an application with the Court to recognize her property rights as the heir to Release 3, and the defendant was City Right.

The heir did not have first- and second-line applicants and did not leave a will, and after his death, the woman actually took possession of a total area of 0.04 ha.

An act of proof of actual inheritance is evidenced by the preservation of the property in question, the cost of its maintenance and the use of the land area; no other beneficiaries have been identified.

Having considered all the material in case No. 29853/2017, the Court granted the claim, recognizing the rights to the precinct.

Example 3: Affiliation with a niece and recognition of the right to inherited property

The successor to Release 3 is the deceased's natural uncle, who filed a claim with the Court in order to recognize his rights, and the defendant was a representative of the Federal Agency for Public Property Management, who did not object to the claim.

- In accordance with the procedure established by law, the man was unable to enter into inheritance rights without judicial proceedings, as there were no documents confirming the change of the name of the testator in connection with the marriage.

- In the course of the trial, a death certificate, a birth certificate and a marriage certificate were submitted to all interested persons.

- In addition, a witness who had been living in close proximity to the testator for a long time had been involved and had been able to confirm the relationship between the deceased and the plaintiff.

- The court also took into account the fact that the claimant actually owned the estate, kept it safe and incurred maintenance costs.

- As a result, the court decided to grant the claim because the evidence submitted by it had been supported by the words of an uninterested witness and other heirs had not claimed their property rights.

Example 4: Recognition of the right to land of the deceased ' s native aunt

The plaintiff before the Court requested that the land totalling 9 Ga be recognized as its property, and the defendant was the Krasnya rural settlement of the Kolpjan district of Orlov province.

The land plot belonged to the mother-in-law of the woman ' s brother and his wife, and they had a son born in their marriage to be a disabled child. After the parents ' death, the son took effective possession of the property, and his guardian was appointed by the plaintiff, the father ' s aunt.

After the boy ' s death, the woman actually took over the land, but the notary refused to take over the property because there were no props for the land to be negotiated.

In the proceedings in case 2-340/2017, it was proved that the plaintiff was indeed a legitimate heir to Release 3 and could claim a disputed land, and the Court therefore decided to grant the claim in full.

Example 5: Promulgation of inheritance rights by the deceased ' s cousin

The man filed an application with the Court requesting the restoration of the missed period for the commencement of the inheritance case and the recognition of his ownership of the property, the defendant being the district administration.

The plaintiff and his heir owned the property in question and belonged to one another by two cousins.

And when it became known to him, he gathered his papers and went to the notary to reveal the inheritance.

Having considered in detail all the circumstances of case 2-2971/2017, the Court ruled in favour of the applicant, since there were no other applicants, the brother ' s relationship was proven and the reason for the delay was found to be respected.

What You Need to Know

- The inheritors of Release 3 may inherit if the inheritors of the first and second steps are absent, have waived this right or have been found to be in bad faith.

- If the heir takes possession of the estate, knowing that his actions are unlawful (the concealment of the death of the heir from other relatives), he may eventually lose property and incur administrative liability.

- In order not to do so, the heirs must ensure that their rights have legal basis and only then open a inheritance case.