On the management of the mammary: art. 7,256-FZ, para. 3

You don't want to spend all the capital at once, you can use part of it, and then you can use the rest later.

Improvement of housing conditions.You can buy an apartment, build a house, or participate in a share building; another option is to use the certificate as an initial mortgage contribution, partial or full mortgage repayment.

For the education of the child: Decision of the Government of the Russian Federation of 24 December 2007 No. 926

Children ' s education.The State allows for the payment of uterus to a kindergarten, school, lycée, technical, institute and hostel provided by an educational institution, but the conditions must be met: the institution is licensed, educational programmes are accredited, and the child is under 25 years of age.

Capital for savings pension: art. 12,256-FZ

Accumulation of pension.The mother ' s pension can be allocated to the capital portion of the mother ' s pension, which will provide additional money in addition to the old-age pension.

Goods and services for children with disabilities.Certain items, such as headphones, computers, telephones, bed, equipment to train the motor apparatus, can be purchased for the social adaptation of a disabled child.

Monthly payments.At the birth of a second child, the uterus is allowed as a monthly payment until the child reaches the age of 1.5, but the rule does not apply to everyone.

In order to receive money every month, the conditions must be met:

The State permits the use of the mammary to improve living conditions at any time from the day of the child ' s birth, and the person who has received the certificate writes an application for the management of the baby ' s capital, which is usually the mother ' s.

Fathers have the right to administer the uterus if the child's mother dies, is deprived of her parental rights, or she has committed a crime against the child. The stepfather will not be able to use the certificate, except if he has adopted the children.

In 2014, we issued a mortgage of 2.2 million roubles for 17 years, and the loan was broken down according to the payment schedule so that by the end of the term the largest monthly payment was made. In comparison, the first year we paid 18,000 roubles per month and in 2023, we decided to use the mother's capital to reduce the loan.

Here's a list of the documents that were needed to pay off the mortgage with the mammary.

A certificate for maternal capital.The documents should be delivered to the RPF, which received the certificate.

If you've moved and bought an apartment in another city, you'll have to transfer your mother's capital to the RPF at your new place of residence, and I've got a certificate in the Nizhegorod region, and I've implemented it in Tatarstan (Kazani).

To that end, I wrote a letter to the Kazakh FIU about the transfer of the uterus from one region to another, which took 10 days.

Copies of parents ' passports, marriage certificates, SNILS.The registration of marriage, passport and SNIL of both parents is required if they are married.

If the marriage is not legal or if the parents are divorced, only the mother will be able to use the uterus, in which case her papers will be required.

A copy of the loan agreement.The Pension Fund is required to consult a document confirming the mortgage debt; the contract must confirm that the mortgage is an apartment; the mother ' s capital cannot be spent on apartments; a copy of the contract can be requested from the bank.

A copy of the sales contract or the equity contract (LDA).If you have bought an apartment in a building house, prepare a DUD registered in Rosreister, and a sales contract will be required for secondary housing.

Bank certificate on the debt balance.The certificate must state that it is issued for the Pension Fund. The period of validity is one month. If you do not have time to file with the RPF, you will have to ask for the certificate again.

A copy of the certificate of ownership or an extract from the EGRN.In our case, it was a certificate of ownership of an apartment because we bought an apartment as early as 2014, and today the certificate is no longer issued, and now the right to an apartment is confirmed by a discharge from the EGRN.

Obligation to allocate a share.According to the law, if one of the spouses uses maternal capital to improve living conditions, he must allocate a share of the housing to each member of the family. If the shares were not distributed immediately, then the loanor is obliged to do so in the future.

The owner of our mortgage apartment is the husband, so he's the one who made a commitment to give me and the kids shares in the apartment after we close the mortgage.

He's still in the RPF.

The husband's share is due within six months of repayment of the loan; the amount of the share is not specified by law.

But if you're gonna sell an apartment and buy another one, you're gonna have to get the custody agencies to agree on the sale, and they're gonna approve the deal if the baby's share in the new apartment is equal to the previous one.

If the purchased apartment was immediately divided between the parents and the children, the obligation does not need to be established.

https://www.youtube.com/watch?v=Nl9UDFPMsvc

Documents in the Pension Fund are reviewed on average one month; if the RPF approves the application, the money will be paid within 10 working days.

In our case, under the terms of the contract, the bank automatically sent the money to pay the principal debt with a reduction in the mortgage period and prepared a new payment schedule.

If the uterus is enough to pay the mortgage in full, don't forget to take a full credit check after sending the money to the bank.

Refusal may be granted for the following reasons:

1.Documents were not properly documented;

2.The application indicates the incorrect purpose of the management of the uterus;

3.The mother ' s condition was partially used and the application stated the amount without accounting for the money spent;

4.The parent was restricted or disenfranchised with respect to the child for whom he was certified.

In order to find out the reason for the refusal, send a complaint to the leader of the RPF, which usually comes within two weeks.

How do we allocate the share of children in an apartment after the mortgage is paid out with maternal capital?

One of the conditions for the use of maternal capital to improve living conditions is the allocation of a share to each member of the family, which is mandatory regardless of whether an apartment has been bought in cash or mortgageed.

Obligation to allocate shares in the use of mortgages

The shares are processed simply enough in a situation where, after accounting for maternal capital, the missing amount for the purchase of housing is paid.from personal fundsThe contract of sale is drawn up for all members of the family (the father may refuse) in the shares which the spouses themselves choose; the amount of the child ' s share is not regulated by law.

If any part of the money is taken by the family on creditThe problem is, you can't get real estate for a minor right away because the bank can't get it mortgaged.

Therefore, the person to whom the real estate is issued (this may be both spouses if one is a borrower and the other is with the borrower) makes a written commitment, which must be independent of whether the capital has been used for the initial contribution or the mortgage has been repaid previously.

This document is included in the mandatory list of documents to be submitted to the Pension Fund for payment.

The obligation is to sign the family member who will own the real estate under the contract, except that the certificate is not issued to the wife, and if the loan and the apartment are issued to the husband, he shall write the obligation.

This is for all members of the family who are not yet owners of real estate; for example, if the sale has been granted to both spouses, the obligation shall be for all children; and if the sale is signed by one of the parents, it shall be written to the other.

An obligation must be assured from a notaryIf this is not done, the document will have no legal effect and, as a result, the Pension Fund will reject the application for payment of maternal capital.

Two parents must be present when it is drafted.

The text states that parents undertake to convert the apartment or house into their children ' s property and property after the removal of the bank ' s encumbrance within the time limits established by law (six months).

It should be noted that the proportion will have to be allocated to all children who are raised in the family at the time of repayment of the loan and removal of the burden.

For example, a family with two children issued a mortgage using maternal capital in 2015, with a third child born in 2016 and a full credit cut in 2017.

A third child, among others, will need to be allocated a share.

Procedure for allocation of share

There are two ways to distinguish shares.One involves the signing of an agreement on the allocation of shares in housing, the other involves the establishment of a gift contract.

Both methods are not contrary to Russian law.

It is essential that all nuances be taken into account in the preparation and, accordingly, that the document be properly drafted and certified if necessary (the preparation of the document will be facilitated promptly by our lawyers).

- If the apartment is already in the joint property (husband and wife), any of the contracts shall be notarized.

- And when you have a joint property, then give a share of it to the spouses, and make sure of it not, for it is a means of sharing the property acquired during the marriage, and then a notary contract is made for the children.

A gift contract for children can also be drafted in simple writing, which is possible when the property is jointly owned as property acquired during marriage.

A spouse or spouse who has not signed a purchase or sale directly authorizes a gift, but a portion of the property remains jointly owned and, in fact, the rights of both spouses are respected.

On the other hand, such a scheme is partly contrary to the law, as it explicitly states that shares should be allocated to all family members.

Allocation of share with share of construction

A mortgage using mother ' s capital may be issued not only for the purchase of a completed dwelling but also for participation in the construction of a share; if the loan is paid prior to the transfer of the dwelling, the share shall be allocated by way of a contract of assignment of the duties of the debtor; such a contract, such as any transfer of ownership rights, shall be registered in Rosreestre.

Responsibility for non-performance

To date, no legislation has established which authority is required to monitor the implementation of the share obligation.

Nor is it clear where the responsibility of the signatory for its non-compliance is laid down, but there is no need to take this document lightly.

To date, there are a number of precedents in which perpetrators have been brought to justice, including criminal prosecution.

The scenarios may be as follows:

- Refusal of the subsequent transaction. For example, once the loan has been closed, the children ' s shares have not been allocated and the apartment has been sold. In court, the transaction is cancelled, the money is returned to the seller. The plaintiff may be any interested person, not only the PF. For example, a child who has not received his or her share can sue after reaching the age of majority.

- The proponent of the legal obligation is forced to allocate a share; the plaintiff may be both the PF and the Public Prosecutor ' s Office.

In recent times, several regions have been subject to inspections by public authorities (PF, guardianship authorities, the Public Prosecutor ' s Office) and those who have failed to comply with this obligation are held accountable; therefore, it is not worth taking any risks: an attempt to save on the allocation of shares may entail greater costs.

On all matters relating to children's share of the mortgage, contact our lawyers online or on a free phone.

Allocation of a share in real estate to children after the mortgage is paid out by the mother ' s capital

The use of maternal capital to pay mortgage is quite common, and there is one nuance that needs to be taken into account when choosing this method of repayment, and it is a matter of mandatory guarantees that children will become owners of the property once the dwelling is taken over.

The standard situation is that the family takes a mortgage to purchase real estate. The loan can be granted to one or both of the spouses, in this case it doesn't matter. Once the mortgage is repaid, the main lender (or lenders) becomes the full owner of the apartment.

Underage children can't legally be mortgage lenders, so once the loan is repaid, one or both parents become owners of real estate shares and the children don't.

In order to prevent such a situation from arising, in the event of a mortgage being paid off by family capital, the law provides for a certain procedure to guarantee children ' s rights and provide them with a living space.

The substance of this procedure is as follows: Family capital is transferred to the bank on the basis of a declaration by one of the parents indicating the purpose of its use and is transferred from the Pension Fund.

Together with the application for a government mortgage grant, RPF specialists will require the issuance of another document – a commitment to allocate a percentage of children after the real estate is made (detailed here).

Note that a mortgage may be issued alone on either of the spouses, but no mortgage may be issued on the other relatives, otherwise it will not be possible to dispose of the mother ' s capital.

The obligation is notarized and guarantees that children ' s rights to housing will not be infringed; without such a guarantee, family capital cannot be used to pay mortgages.

The following are important aspects of the obligation to determine the proportion of children:

- - The obligation is only processed if the full mortgage or a certain portion of the mortgage is paid;

- - The obligation is incurred by the family member who, upon repayment of the mortgage, becomes the owner of the real estate;

- - If the mortgage is issued on both spouses, the obligation shall be established on both sides;

- - to give full legal effect to the obligation is subject to notarization.

For example, if the mortgage is on the husband and the wife has a child from a previous marriage and the child is not adopted by the current husband, there is no obligation on him to make sure that he has a share in the dwelling.

Another important point is that all minor children who are in possession at the time of the issuance of the right of ownership are required to make a contribution, i.e. if the benefit received for the second child was used for partial mortgage payments and the full repayment of the loan occurred when the family had three children, then all three children are required to make a contribution.

In the text of the obligation, the mortgage lender guarantees that once the loan is fully repaid and all bank charges on real estate are withdrawn, he will take possession of the facility himself and make a share of it available to all minor children.

If the mortgage is issued on both spouses, both are entitled to the same guarantee; the law provides for a maximum period of six months for the entry into ownership and fulfilment of the terms of the previous obligation.

The proportion allocated to each child is not defined by law, and parents are entitled to act as they please, and the only thing to pay attention to is the minimum size of the living space per person in a given region.

There are two main ways in which children ' s share of real estate can be identified:

- an agreement on the allocation of shares;

- giving out shares.

The choice of the method is given entirely to the person who is in charge of allocating the share of real estate and transferring rights to the children, and is more common and, in addition, registration officials are more willing to accept documents that are issued in this way.

The following situations may arise in the allocation of shares in real estate: Under the terms of the mortgage, both spouses are lenders, and therefore both become owners of the flat with its share. In this case, it is easier to determine the shares of the children – each parent determines part of the property and makes it available to his or her children.

The second possible situation is similar to the first but has a significant difference: parents become owners of real estate, but their shares are not defined; such a case is not explicitly regulated by law, so it is possible that registration officials will require first the determination of the share of the parents in the apartment and only after the determination of the proportion of children.

The third situation is that the owner of the property becomes one of the spouses; in this case, it is up to him to decide which shares of the children are to be made; and the allocation of the share of the second spouse is not compulsory.

Notarization of a commitment to allocate a share in real estate to children

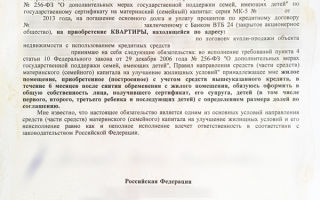

The obligation to allocate housing shares to their children is established and certified by the notary in accordance with Federal Act No. 256 of 29 December 2006, entitled "On additional measures of State support for families with children".

The cost of processing such a document is between 1,100 and 1,500 rubles; the obligation not certified by the notary is null and void and is not accepted by the pension fund; the original obligation is transferred to the PF.

Both parents who are borrowers and will become full-fledged owners of mortgage housing upon removal of the encumbrance must be present at the writing of the obligation; and if the borrower and the owner of the dwelling is one of the parents, only such a parent must be present in person.

The text of the document states that parents are obliged to arrange for their own dwelling (other dwelling) acquired with the use of maternal capital to be their own property, as well as the property of all their children who are in their possession on the date of fulfilment of this obligation, within the time limits specified by law.

The document contains the signature of the parents and the deciphering of the family name, family name and patronymic.

It will be recalled that Federal Act No. 256 of 29 December 2006 provides for a six-month period for the fulfilment of this obligation (i.e. the allocation of housing shares to children) from the time the mortgage is repaid, the mortgage will be returned to the borrower and the cancellation of the mortgage will be recorded in Rosreister.

Also, note the fact that the share of the dwelling will need to be allocated to all the children, the number of them in the family at the time the obligation is fulfilled, that is, the repayment of the mortgage loan.

For example, in 2013, you had a second child, you used your mother ' s capital to pay part of the mortgage, you paid it in full only in 2015, and by that time a third child was born in the family, so all three children will have to share.

- Since the establishment of a commitment to allocate a share in real estate to children implies a notarization of it, the violation of its terms (or the allocation of a percentage of children after the mortgage is paid out by the mother) is punishable by law.

- Possible forms of punishment include:

- - Commencement of criminal proceedings under the heading of fraud;

- - Cancellation of any real estate transaction;

- - the revocation of parental ownership of the property in question.

The whole procedure for allocating a percentage of children after the mortgage has been paid with the help of family capital is quite simple, and there may be difficulties in self-writing, but between the issuance of a document and the implementation of its obligations, few have been able to repay a mortgage in a couple or three years.

And the original of the commitment to allocate shares to children is given to the Pension Fund when it makes a statement on the targeted use of the womb, and, as they say, from the outside, out of the heart, yet it is not necessary to take this obligation lightly and forget it.

To date, the legislature has not clearly established who controls the performance of the obligation and the measure of liability for the offender, but it cannot be said that the breach of the obligation is completely unpunished.

There are many examples of people being held criminally responsible for fraud, but it is mainly related to the cashing of a certificate of maternal capital, and in the case of a simple failure to fulfil the obligation to allocate shares in an apartment to children, there are options for liability such as: recognition of an invalid sale of an apartment.

For example, the parents paid a portion of the dwelling with maternal capital, but failed to fulfil the obligation to allocate a share of the children; the apartment was sold, and the sale could then be contested by declaring it illegal, i.e. to return everything to its place (the buyer takes the apartment and the parents return the money to the buyer).

Any interested person, including a pension fund or a child who has reached the age of majority and has not been given the right to a share, may be the plaintiff.

The Public Prosecutor ' s Office and the pension fund may also raise this issue.

In a number of regions of the Russian Federation, State bodies (the Public Prosecutor ' s Office and the pension fund together by the guardianship and guardianship authorities) carry out checks to ensure compliance with the obligation.

Based on recent trends, the problem was intended to be resolved at the legislative level, and the consequences of inadequate performance of an obligation, such as a breach of time, often arose.

In general, if the obligation is overdue, no one will prevent it from being discharged on the grounds that the time allotted has expired.

Accordingly, there is no liability for the performance of a late obligation.

Failure to comply with the conditions set out in that document would expose the perpetrator to administrative liability, as well as to the payment of the previously received maternal capital to the full extent of the State ' s treasury.

Documents for children ' s share

- When you have determined which way of giving children shares in the apartment is most appropriate for you, the following documents should be prepared:

- - Applications for registration of ownership of a share in an apartment on behalf of each participant in the transaction (to be completed by the registrar),

- - an agreement on the allocation of shares in the apartment or a contract for the provision of the required number of copies (signed by the parties in the presence of the registrar),

- — Parental passports (originas and copies of all pages marked),

- - A marriage document (original and photocopy),

- — birth certificates for all children (originas and their photocopies),

- - A document showing the State registration of housing ownership (the original and its photocopy),

- A contract for the sale of an apartment (construction contract, etc.),

- receipts confirming the payment of public duties in the total amount of 2,000 roubles (this amount is shared equally among all parties to the transaction).

Documents can be submitted directly to the Registry Chamber or through the Multifunctional Centre, which takes about 10 working days.

If applied to the IFC, the time limit could be extended to 12 days, and at the end of the above period, the applicants would be issued State registration certificates with a specific percentage.

Marat Silin

Financial Lawyer Information Agency

Children ' s share in another apartment

Olga Kovalev Question for Tatiana Andrianova Hi, please tell us about our articles about model ways of dealing with legal issues, but each case is unique.

We want to buy a residential home with a land section not in the city, but in the medical advice area. If you want to know how to solve your problem, use the form of an online consultant on the right or call the phones on the website. If you send a message anonymously, you will lose the ability to edit and delete this message after sending it.

We're thinking of being a mother's capital, because we don't have all our money to buy, of course, we're still gonna pay the extra money, so there's a "first sweetie" on the ICN anyway, in my practice.

Today, with the buyer Math of the Jakapov apartment, they went to the Office of the Prosecutor of the City of Luberetz and wrote an explanation about a year ago, our client bought from the mortgage an apartment that had previously been purchased by a family with two children and the use of the ICN.

The deal was run by a local private realtor who, according to a conversation with him, didn't read the FZ at all and sincerely wanted to believe that he didn't understand what it was like to give children shares and how it worked, although the mortgage apartment was already "wrecked" by our client, the buyer, which was a very tempting price.

The parents made a notarized commitment to the children six months after the mortgage was closed, and the apartment was sold. You can single out the children in another apartment as much as you want, but that doesn't remove your original obligation.

As you can see, not only the buyer's problem, but also the seller's problem with the DA's is bad.

Yes, once the shares are allocated, you will receive all the benefits of selling an apartment with your own children, including custody, a reduction in the market price, and a mandatory notary at the time of sale.

That's why it doesn't always make sense to use MC to pay the mortgage.

I've encountered realtors who don't know what to do, and I'm ready to allocate shares, no question, but maybe it's gonna make it harder to sell, so I'm asking for advice here, and I'm not asking for an evaluation of my thoughts, except when the apartment is bought immediately, including for children.

One of the realtors advised, for example, to go to Trusteeship and write a new commitment to give a share in the new apartment in lieu of the first commitment. A typical case is an alternative transaction with children in ownership. The demand for custody is simple: no infringement of children's rights.

I wrote here in the hope that suddenly someone was doing it and knows what to do.

Obligation to provide for children ' s share of the dwelling when using

Children ' s shares have been allocated, registered in Rosreister, a large apartment has been found for purchase, and an advance has been accepted for your apartment.

You go to foster care with a full package of docks for a sold apartment and a bought apartment.

Write a form application for permission to sell an existing apartment and buy a found one.

You wait 15 days in fact faster, you get permission for custody to sell, such an apartment purchased only from the funds of maternal capital is not subject to the section because the funds of maternal capital are legally designated.

At the same time, you sell and buy apartments, a notary deal, pre-negotiate with all the parties involved in the transaction and the notary.

For example, Sber would make such a deal by holding a bank mortgage, and what if the children have a share? If the purchase was paid out of the funds of the mother's capital, the situation was different from the Supreme Court's 4-KG ruling on other difficult issues. The allocation of children's share, the mother's capital for the purchase of a dwelling. Not always when buying a dwelling, children's shares can be immediately allocated.

If you use mortgage funds, many banks don't allow a share to be allocated to children.

In this topic, more messages are given, so the form of the forum is automatically changed to tree-like.

You can see the branches containing new messages, the other branches are folded. Can you not give the husband a share of the apartment purchased for the uterus? Under the rules of the law, a dwelling purchased with the funds of maternal capital must be registered as the common property of parents and children.

Thus, the Constitutional Court of the Russian Federation does not provide for the possibility of excluding the beneficiary ' s spouse from the ownership of the purchased apartment; if no agreement has been reached between the parents or one of them does not sign the contract, the shares will be awarded through the court.

In the event of the purchase of an apartment with maternal capital, the family has an obligation to the Russian Pension Fund to provide children and parents with shares in the acquired dwelling; together with an application for an order to the Pension Fund, an obligation to allocate shares is required.

The use of maternal capital implies the allocation of the share of the whole family: Mother ' s capital in which proportion of the mother ' s capital is equal to the share of the mother ' s capital in the flat. Mother ' s capital has not allocated a share of the share of the mother ' s capital. I ask you again, I need to allocate shares in the house purchased with the mother ' s capital and the husband is in detention. If you send a message anonymously, you will lose the opportunity to edit and delete this message after sending it.

- So, there's a "first sweetie" on the ICN, anyway, in my practice.

- Today, with the buyer Math of the Jakapov apartment, they went to the Office of the Prosecutor of the City of Luberetz and wrote an explanation. In accordance with the rules for the provision of maternal capital, when the dwelling is to be completed, the parents also undertake to allocate a share of the dwelling to each and every child.

- The above-mentioned federal law provides for a six-month period for the fulfilment of this obligation, i.e. the allocation of housing shares to children from the time the mortgage is repaid, the mortgage will be returned to the borrower and the removal of the encumbrance will be recorded in Rosreister.

- The share in the dwelling will have to be given to all the children, as long as they are in the family at the time the obligation is fulfilled, i.e. the mortgage loan will be repaid in your case, for three children.

- The legislation does not specify the proportion of the child to be reflected in the obligation and subsequently identified.

- But the Russian Housing Code states that the standard living area per person is 12 square metres.

- The main use of maternal capital improves housing conditions and allocates the proportion of children to the Agreement on the Distribution of the Agreement on the Determination of the Share of Maternal Capital in accordance with para.

- The property is not only for children, but also for the spouse, who is not yet the owner of the dwelling.

Is it possible to give children shares in another apartment if there's a mortgage?

In the event of the purchase of an apartment with maternal capital, the family has an obligation to the Russian Pension Fund to provide children and parents with shares in the acquired dwelling; together with an application for an order to the Pension Fund, an obligation to allocate shares is required.

The use of maternal capital implies the allocation of the share of the whole family: Mother ' s capital in which proportion of the mother ' s capital is equal to the share of the mother ' s capital in the flat. Mother ' s capital has not allocated a share of the share of the mother ' s capital. I ask you again, I need to allocate shares in the house purchased with the mother ' s capital and the husband is in detention. If you send a message anonymously, you will lose the opportunity to edit and delete this message after sending it.

- So, there's a "first sweetie" on the ICN, anyway, in my practice.

- Today, with the buyer Math of the Jakapov apartment, they went to the Office of the Prosecutor of the City of Luberetz and wrote an explanation. In accordance with the rules for the provision of maternal capital, when the dwelling is to be completed, the parents also undertake to allocate a share of the dwelling to each and every child.

- The above-mentioned federal law provides for a six-month period for the fulfilment of this obligation, i.e. the allocation of housing shares to children from the time the mortgage is repaid, the mortgage will be returned to the borrower and the removal of the encumbrance will be recorded in Rosreister.

- The share in the dwelling will have to be given to all the children, as long as they are in the family at the time the obligation is fulfilled, i.e. the mortgage loan will be repaid in your case, for three children.

- The legislation does not specify the proportion of the child to be reflected in the obligation and subsequently identified.

- But the Russian Housing Code states that the standard living area per person is 12 square metres.

- The main use of maternal capital improves housing conditions and allocates the proportion of children to the Agreement on the Distribution of the Agreement on the Determination of the Share of Maternal Capital in accordance with para.

- The property is not only for children, but also for the spouse, who is not yet the owner of the dwelling.

Is it possible to allocate a share of the child ' s mortgage

In the case where the parent ' s share of the ownership of the dwelling acquired from the funds of the uterus has not yet been determined, i.e. joint property without the distribution of the share or the property is owned by one of the spouses, an agreement to determine the amount of the share may include conditions for the division of the joint property of the spouse, the subject of which is the jointly owned acquired or built housing.

The share of housing purchased using ICN means is not part of the joint property acquired during the marriage, but is divided between parents and children in accordance with the law on maternal capital.

The rules for determining the proportion of accommodation to be allocated to children are not established by law, but should take into account the minimum housing standards established by the legislation of the constituent entities of the Russian Federation; such an apartment purchased only from the funds of the mother ' s capital may not be divided as the funds of the mother ' s capital are legally intended.

- Other relatives of grandparents, brothers, sisters, stepchildren, stepdaughters, etc.

- The share of children who have paid the mortgage with maternal funds can be used to repay the principal debt and interest on the mortgage.

- It does not matter when the loan is received, before or after the birth of the second child, nor who is the loan borrower.

- Oh, girls, I've got blood in my head, thoughts, one scarier than the other.

- I remember signing the notary's commitment that I'm supposed to divide the house into all the kids within six months.

- Young family, mortgage, birth of a second (or subsequent) child, mother's capital...

- From time to time, another notion has been firmly placed in this row — the obligation of parents to allocate a share of the children in the living quarters.

- It is drawn up if the family uses the funds of maternal capital to repay the mortgage debt.

- Mortgage loans are most often made by couples, where both spouses are with borrowers and at the same time owners of mortgaged dwellings.

- That is why we will consider this option in our article.

- Once you have received a certificate of maternal or family capital, you must return to the relevant address of your residence in the Russian Federation ' s Pension Fund ' s territorial office.

- There must be a statement that you wish to channel his funds (or part of the funds) to cover the housing loan.

- The PF specialist will necessarily require you to do so in a number of other documents in the following circumstances: Without prior commitment, the Pension Fund will not allow you to use your maternal capital to pay off the mortgage.

- The obligation must be drawn up by the owner of the dwelling for which the loan and mortgage are issued.

- It is this person who guarantees the share of the children, the spouse.

- So both spouses are co-owners of the apartment.

- But there may be cases where an apartment is purchased with credit funds in a mortgage prior to marriage.

Let's give the kids a fair share. - Yeah, yeah, yeah, yeah, yeah, yeah, yeah, yeah, yeah, yeah, yeah, yeah, yeah, yeah, yeah, yeah, yeah, yeah, yeah, yeah, yeah, yeah, yeah, yeah, yeah, yeah, yeah, yeah, yeah, yeah, yeah, yeah, yeah, yeah, yeah, yeah, yeah, yeah, yeah, yeah, yeah, yeah, yeah, yeah, yeah, yeah, yeah, yeah, yeah, yeah, yeah, yeah, yeah, yeah, yeah, yeah, yeah.

The owner will be one of the spouses (the purchase of the dwelling).

That is when he issues the obligation on his own behalf.

As a general rule, the obligation is given in respect of: for example, a woman married a man who has a son from the first marriage and had two children together during the marriage.

In respect of the child of the husband of the first marriage, the wife did not establish a related relationship; when applying for the management of the mother ' s capital, the woman submitted an obligation to allocate a share to two children only.

- In the event that the purchased mortgage is originally issued to spouses and children, certified copies of the documents confirming the ownership of the dwelling (purchase contract, sale certificate, ownership certificate) from the children and spouses shall be submitted to the pension fund, together with the statement of disposition of the mother ' s capital.

- The obligation to allocate housing shares to their children is established and certified by a notary in accordance with Federal Act No. 256 of the year entitled "On additional measures of State support for families with children".

- The cost of such a document is in the order of 1,100 to 1,500 roubles.

An obligation not certified by a notary is null and void and is not accepted by the pension fund; both parents who are borrowers and will become full owners of the mortgage housing upon removal of the encumbrance must be present in the preparation of the obligation.

- If the borrower and owner of the dwelling is one of the parents, the personal presence of the parent is mandatory.

- The text of the document states that parents are obliged to arrange for their own dwelling (other dwelling) acquired with the use of maternal capital to be their own property, as well as the property of all their children who are in their possession on the date of fulfilment of this obligation, within the time limits specified by law.

- The owner will be one of the spouses (the purchase of the dwelling).

- That is when he issues the obligation on his own behalf.

As a general rule, the obligation is given in respect of: for example, a woman married a man who has a son from the first marriage and had two children together during the marriage.

In respect of the child of the husband of the first marriage, the wife did not establish a related relationship; when applying for the management of the mother ' s capital, the woman submitted an obligation to allocate a share to two children only.

- In the event that the purchased mortgage is originally issued to spouses and children, certified copies of the documents confirming the ownership of the dwelling (purchase contract, sale certificate, ownership certificate) from the children and spouses shall be submitted to the pension fund, together with the statement of disposition of the mother ' s capital.

- The obligation to allocate housing shares to their children is established and certified by a notary in accordance with Federal Act No. 256 of the year entitled "On additional measures of State support for families with children".

- The cost of such a document is in the order of 1,100 to 1,500 roubles.

An obligation not certified by a notary is null and void and is not accepted by the pension fund; both parents who are borrowers and will become full owners of the mortgage housing upon removal of the encumbrance must be present in the preparation of the obligation.

If the borrower and owner of the dwelling is one of the parents, the personal presence of the parent is mandatory.

The text of the document states that parents are obliged to arrange for their own dwelling (other dwelling) acquired with the use of maternal capital to be their own property, as well as the property of all their children who are in their possession on the date of fulfilment of this obligation, within the time limits specified by law.

Children ' s share in the use of maternal capital

Federal Act of 29 December 2006 on additional measures of State support for families with children.

No. 256-FZ provides for the right of citizens to receive a State grant, the maternal capital used primarily to improve the housing conditions of such families.

At the same time, they are legally obliged to make arrangements for housing purchased from ICN funds.in the common property of the holder of the certificate, his spouse and children.

Article 10 of Act No. 256-FZ does not have a single time limit for such processing, as:

- The transfer of housing to the family ' s share ownership may take place both immediately at the time of the transaction and many months and years after its conclusion;

- There are enough situations in life where, in principle, it is not possible to transfer property immediately at the time of the transaction to the common property of all family members (especially in the case of minor children).

Commitment to the Pension Fund on maternal capital

The obligation is provided for in the Regulations on the Allocation of Funds (Part of Funds) of Maternal Capital for the Improvement of Housing Conditions, approved by Government Decision No. 862 of 12 December 2007 (hereinafter referred to as the Regulations).

Obligation requiredRPF authorities in the following cases:

- Housing is not a common property of all family members;

- The ownership of the dwelling is not registered with the RPF at the time of the application for maternal capital.

In practice, such situations occur when:

- The owner of the dwelling is already the owner of the certificate and/or her spouse (without children);

- The dwelling is encumbered (mortgage) and the children (child) are not the owners of the dwelling;

- The house (a flat) has not yet been built or put into operation, so it is impossible to obtain ownership of the property;

- One parent (or both parents but without children) is a member of the JSC, a savings or other cooperative;

- To obtain compensation for a built house (or reconstructed house) put into operation after 01.01.2007, which does not have ownership of the certificate holder, his spouse and/or children (this is true almost always for children).

The owner (the holder of the certificate and/or the spouse) of the dwelling should draw up the obligationapply to a notary officewith a package of required documents.

The notary will issue the paper in the light of all the circumstances of the purchase of the dwelling and specify the condition upon which the statutory calculation will begin.6 monthsFor the transfer of the dwelling to the common property.

The cost of notarization varies from region to region and from notaries to region.How much is a liability for maternal capitalThe average notary rate is between 500 and 1,500 rubles.

Fulfil the obligationIt can be done in two ways:

- To conclude an agreement on the allocation of shares;

- To enter into a share-giving agreement.

There is no legal liability for non-compliance with the commitments made in respect of maternal capital, but in the event of the discovery of the case by any interested body (FRR, guardianship authorities, prosecution, etc.), it is not possible for a person to be held responsible for the failure to fulfil his or her obligations under the law.

) he or she may apply to a court which will decide whether to compel him or her to make arrangements for the allocation of shares or whether he or she will distribute them to the members of the family on his or her own.

There is also a risk of imposing a court duty on a family to return its maternal capital back to the Pension Fund (in fact, as in the case of diversion).

Was it necessary to allocate children ' s shares in the use of maternal capital?

Under article 10, paragraph 4, of Act No. 256-FZ, in the event of the acquisition of housing (construction, reconstruction) from the funds of the uterus, the right to own it shall be granted to the parents and children (including those born subsequently) in accordance with an agreement indicating the share of each.

Since the common property of the dwelling is subject to formalizationand for future childrenthe agreement should contain a provision on the possibility of reducing (redistribution) the share of participants in common property.

The minimum amount of the child ' s share is not defined by law; therefore, the proportion is determined by the owner(s) of his/her choice.

But it should be borne in mind that the legal acts of the constituent entities (the municipalities) of the Russian Federation set minimum standards for housing.9-12 square metres per person.

It is therefore appropriate to allocate a percentage that will not be below the established area.

The distribution of shares must take place according to the letter of the law,in............................................................................. 6 monthsWhen the RPF transfers funds to the real estate seller, the property is converted into general ownership through the conclusion of:

Shares are selected:

- The spouse (or spouse if the original property of the apartment or house is in the hands of the husband);

- Children (mother-in-law, adopted), including adults, and subsequently born.

Other relatives (grandparents, grandparents, brothers, sisters, stepchildren, stepdaughters, etc.), even in the case of living together in such an apartment (home),No share.

Children ' s share of post-mortgage mortgage with maternal capital

The funds of the uterus can be used to repay the principal debt and interest on the mortgage; however, when a loan is received, whether before or after the birth of the second child, or who is a loan borrower, it may be either one of the spouses or both; the main point is that it should be earmarked, i.e., for the purchase of a dwelling.

The percentage of children (spouses) paid out by the mortgage must occurwithin 6 months of removal of the encumbrance(s)from the living quarters.

The mortgage is withdrawn when the entire mortgage debt has been fully paid, and a certificate of non-payment of the loan is required and an application must be made to Rosreister (the owner of the home and/or bank).

Thereafter, after a certain period of time, the owner may obtain a certificate of State registration of the right to housing, without specifying the existence of a charge of "the mortgage by virtue of the law" (since 2016 only excerpts from the register of rights, EGRP, since 2017 EGRN).

- Once the pledge is withdrawn, the children must be given a share in accordance with the obligation.Share option:

- In order to ensure that the allocation of shares does not give rise to formality problems, it is desirable to consult first at the Rosreestra office.

- For all listed documents (distribution agreement, share agreement, share transfer agreement) as of 2016 mandatoryNotarized.

The exception is transactions with land shares and property forming a mutual investment fund, and therefore both instruments (agreement and gift contract) must be concluded through a notary.

The general procedure for the registration of dwellings into common property is as follows:

- WhenThe owner of the dwelling is one of the spouses.to him:

- First, a share of the second spouse would be required by agreement on the division of the joint property (if acquired during the marriage).

- After registration of shares, parents may conclude either a share of the child or a share of the child; in these documents, a second parent will apply for the minor child; and in the agreement the share may be determined in accordance with the interests of each of the parties to the common property, including minor children.

- In circumstances whereBoth spouses have the right to property, so you can:

- Precisely.joint propertyHousing — to enter into a gift contract or agreement with respect to children at the outset;

- When property is shared- It will have to be the same as the first: first, the joint property agreement, and then from each (one) parent ' s share, some of it is handed over to the children.

In the event that the owners of the property do not fulfil the obligation because they cannot agree on the amount of the shares allocated, or one of them avoids the transaction (conclusion of agreement, contract), the other parent is entitled to sue the court to compel his or her husband or wife to make a transaction or to request the distribution of the shares among all members of the family.

In the construction and reconstruction of a residential building with a certificate

With the use of maternal capital for the construction and reconstruction of housingalways mandatoryAn obligation to allocate shares is required.

This is due to the fact that ownership of the built (remodeled) housing at the time of the application for the MC ' s order cannot be registered in the common property of the family members.

This is due to the following reasons:

- Construction- The object is not built (not completed), i.e. it does not yet exist physically or legally as a living space;

- in reconstruction– The object of the ISS will in the future have different technical characteristics and the already modified facility will be registered with ownership and share in this right.

Obligation issued:

- The person who obtained the building permit - the holder of the certificate or the spouse;

- the owner of the dwelling to be renovated.

A newly built house, regardless of which of the spouses is registered as property, is jointly acquired property, so first it is necessary to:

The question often arises as to whether, in addition to allocating a share of the building,Allocate a percentage of land to childrenon which it is located.

Despite the fact that article 10 of Act 256-FZ requires that only housing units built with the MK funds must be allocated shares in the land, in accordance with article 35 of the Land Code of the Russian Federation, the removal of the building (construction) located on the land and owned by one person shall be carried out in conjunction with the land plot.

Therefore, the allocation (transfer) of the share of the house is a disposal transaction, and therefore the land is to be divided.

When buying a flat under a share-sharing agreement (CSS) or through housing cooperatives (CBOs)

Obligation to allocate a share of the child and spouse in the allocation of maternal capital for the specified purposes alsoMandatoryis prescribed by the Regulations and is required by the RPF authority when accepting an application for possession of the certificate.

This is due to the fact that the property rights of all family members cannot be registered at the time of the management of the mother ' s capital, at which point the dwelling is usually either under construction or put into service and the documents for it are issued much later.

In these cases, the funds of the uterus are directed.For the following payments:

- The price(s) of the dwelling under the equity agreement;

- An introductory and/or equity contribution to a housing cooperative.

As a rule, an equity contract is concluded with one of the spouses (often with the wife and the husband) as well as in a cooperative where the husband or wife is usually a member.

All documents after construction are issued to one of the spouses and the dwelling cannot be transferred directly to the family ' s share of the property; therefore, the obligation provides for the condition upon which the owner of the dwelling undertakes to transfer the shares to the children.

If the housing purchased or constructed is not in common ownership

These are cases where, without a commitment to share, the RPF simply does not approve a statement on the disposition of maternal capital, although there are no clear legal obstacles to the regularization of housing at the time of applying for payment to the RPF.

These include:

- All transactions for the purchase of a dwelling where the buyer indicates one or both spouses (without children);

- A contract for the sale and distribution of payment is concluded with parents (without children) subject to registration of the buyer ' s ownership right after payment of the last deposit (with or without mortgage);

- The acquisition of housing by means of a mortgage (or other housing) in which one or both of the spouses or both of the borrowers are the owners of the dwelling and the shares can be distributed after the mortgage has been removed;

- The construction of a residential home (both internally and by the contractor) where the ownership of the LIS is granted to a person who has been granted a building permit;

- The payment of the uterus is in the form of compensation for the building of a residential home after 2007, which was originally owned by one of the spouses.