In the purchase of secondary dwellings, repairs or furniture, their value is often included in the price of the sales contract.

This entails additional costs for payment of taxes by the seller.

In order to minimize the cost, the parties to the transaction have to lower the real price of the dwelling.

To this end, they often enter into a contract for inseparable improvements in the sale of an apartment.

Dear readers, our articles talk about model ways of dealing with legal issues, but each case is unique.

If you want to know,How do you solve your problem -- use the form of an online consultant on the right or call on the phone at +7 (499) 577-04-19. It's quick and free!

Hide Content

What is this?

Consider what is meant by the concept of indissoluble improvements in the contract for the sale of an apartment: the indistinguishable improvements are the improved living conditions created by the previous owner:

- The availability of built-in household appliances at the time of sale;

- Replacement of old furniture, heating system, building materials;

- as well as the remodeling and renovation of the rooms.

They are inseparable because the former owner cannot separate them from the real estate.

It is worth noting that in the Civil Code there is no concept of "indistinguishable improvements", which was invented by sellers in order to reduce the amount of real estate sales tax, the value of which has been increased by the repairs carried out.

However, the contract is legal; in the event of a remodelling of the dwelling, this must be indicated in the technical documentation, otherwise it will be considered illegal.

You may be interested in the following articles:

- The employees of Rosreestra transmit the data on real estate transactions to the Tax Inspectorate, which requires the seller to pay the tax on profit on the basis of this information.

- In order to reduce the tax or avoid paying it altogether, the owner of the dwelling often invites the buyer to lower the valid price in the contract.

- The difference between the actual price and the price stated in the contract is the additional payment for the indissoluble improvements that the seller receives after the transaction has been concluded.

- Adds of the deal:

- The seller can reduce its tax costs.

Minutes of transaction:

- If the real value of the property purchased is underestimated, the buyer risks losing part of the money if his rights are to be defended in court.

- The seller, in turn, runs an additional risk that fiscal authorities may be interested in the legitimacy of the unbroken improvement transaction and bring the seller to justice, and may be forced not only to pay the tax but also to impose penalties.

How do you write a receipt right?

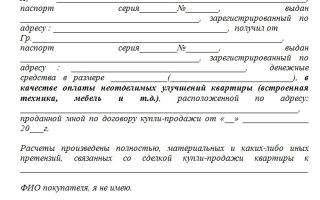

In order to document the payment of an additional sum for the indispensable improvements, the parties shall, upon mutual agreement, draw up a receipt.

The document provides a guarantee to the seller that he will receive an additional payment equal to the amount he invested in the renovation of the apartment without paying the tax.

Once a receipt is made, the buyer will be confident that the money paid for the dwelling will be returned to him if, for some reason, the seller cancels the transaction, not only for the principal but also for the additional amount.

This document, like others, requires the correct form. Written by the seller himself, written by hand, in free form.

In doing so, it should have a clear and clear formulation of all the circumstances and nuances of the transaction, the preservation of business style and all business rules.Only blue ink is used to write a receipt.

The exact passport data of both sides must be recorded:

- Name, surname, patronymic;

- A series and passport number;

- Which authority is issued and when;

- Place of registration.

The receipt also specifies, in addition to the fact that the money was received, the list of improvements for which the buyer pays the money; the amount is recorded in both figures and in writing, and the currency must be stated.

At the end of the receipt there is a date and a signature, which is signed in full, and a statement is made that the parties do not have substantive claims against each other and the calculation for the payment of inseparable improvements has been made in full.The receipt is not attached to the sales contract and is prepared before the seller pays the transaction tax.

The number of copies is equal to the number of entities involved in the transaction and does not require a mandatory notarization, but rather that it be written without errors.

Witness testimony always has a weight in court, so it is recommended that a receipt be prepared in the presence of witnesses so that, in the event of disagreement or rejection of a transaction by one of the parties, additional moral and material loss is avoided.

The ideal version of the document would be to clearly indicate when and how much money was received for the cost of housing and to indicate separately the amount for the indissoluble improvements, with mandatory transfers.

AlsoThe conditions under which the seller returns the money to the buyer must be specified on the receipt.This may be the seller ' s liquidation of the contract or its non-compliance with one of the points of agreement, in which case the seller is obliged to return the money to the buyer for both housing and improvement.

Making a sales transaction is a very serious moment. It's important for both sides to make a deal without unexpected consequences. The right way to make it is to guarantee their own security.

You didn't find the answer to your question?How to solve your problem, call me right now:

+7 (499) 577-04-19 (Moscow)

It's quick and free!

Sales contract for inseparable improvements of the dwelling (model)

Main/Sales of the apartment / Sales contract for the sale of the indissoluble improvement of the dwelling

Previews 175

The contract under which the purchase and sale of the indissoluble improvements of the dwelling is effected is negotiated by the parties – the preparation of the document is not a mandatory requirement and is not directly regulated by law; the issue of separate payment for "undistinguishable terms" is discussed at the stage of the drafting of the preliminary agreement.

The notion of inseparable improvements (conditions)

Indistinguishable conditions are all the changes that the owner of the dwelling and his relatives have made in order to improve the living space, such as alteration, renovation of the apartment, installation of its built-in household appliances and expensive plumbers.

The cost of housing shall be calculated on the basis of:

- The year of construction of the house, its characteristics, the price of the land on which it is situated;

- The location of the object (infrastructure is important, the region ' s prestige is important);

- the area/plane of the dwelling.

Renovation of the apartment typically requires substantial investment – after repairs and equipment are done with household appliances, it increases at a price; technically, this makes it possible to charge the buyer a separate fee.

Civil Code

The issue of charging an additional sum for the indissoluble improvement of housing in the form of a sales transaction is not regulated by the legislation in force. The only mention of the improvements introduced can be found in article 623 of the Russian Civil Code on rental housing, which means that the parties can resolve the matter on their own — directly by the law — that will not violate the law.

Why make a contract?

In practice, the sole purpose of the contract of sale is to reduce the taxable base, and by agreement of the parties, the buyer pays the price separately:

- Housing itself;

- (the price is fixed by the seller and discussed with the buyer).

The total is equal to the real cost of the object.tax (13%)The second part of the payment will be paid by the buyer as compensation for the costs previously incurred (the document is not attached to the sales contract, therefore no tax is levied).

The seller pays only for the sale of an apartment that has been owned for less than five years (in the cases specified by law - less than three years); this rule is set out in article 217.1 of the Russian Federation; if the apartment in question has been purchased more than five years ago or sold less than previously (i.e. no actual profit has been earned), there is no point in separate processing of housing contracts and no improvement.

How can the contract of sale of unbroken improvements be properly processed?

If the parties agree, a preliminary contract for the sale of an apartment is drawn up, which sets out all the improvements made and their value.

The main contract is in the majority of cases entrusted to the notary, since any inaccuracy in the preparation of the document leads to very serious problems (loss of or money for housing).

The specialist is provided with a certificate of real property value drawn up by an independent valuation company, which is stated in the document.

The contract for the sale of inseparable improvements to the party ' s apartment is set out separately. The number and cost are indicated in the document. It also contains all the details of the parties to the transaction, the object of the sale, the manner in which the money is transferred (cash, non-cash, through the bank account).

In drawing up the tax declaration, the seller submits copies to the tax inspection:

- of the treatySales apartments(a second agreement, negotiated by the parties, is not granted because the amount formally paid to the seller compensates for previous investments);

- Money-recovering documentsHousing(not for improvement).

He also applies for a tax deduction (the State provides an opportunity to reduce the tax base).

A tax declaration is drawn up even if the seller does not actually receive the proceeds of the transaction; this may happen if the amount of sale after the deduction of 1 million roubles. (This is precisely the amount of tax deduction granted by the State) is less than or equal to "0" (namely for this purpose and a "improvement" scheme has been developed).

One copy of the sales contract for improvements remains with the seller and the buyer.

The receipt of money is confirmed by a handwritten receipt by a blue pen (in case of disagreement, the handwriting examination will confirm the seller's writing of the receipt – only signature is not sufficient to identify the identity) The document is not certified by the notary, but it will be recognized by the court if the buyer has to defend his rights in challenging the transaction.

Risks to buyer/seller

Formally paying for improvements made by the seller (his relatives) does not lead to enrichment, which offers a legitimate opportunity to reduce the tax base; in practice, this is a very controversial issue.

In most cases, the seller simply indicates the amount – no one seeks to document the entire cost of the apartment; this leads the tax authorities to impose penalties on the seller.

The only way to cancel them is through a court of law, and provided that all documents have been correctly drafted – it is worth having a lawyer consult at the drafting stage.

Buyers are also not insured against risks.

If the seller, or its heirs (as an option, the spouse), decides to return the sold apartment and the claims are satisfied, the court will require that only the sum prescribed in the main contract be returned; the issue of the additional payment will require further attention – any inaccuracy in the contract and the receipt will result in the loss of a substantial sum.

Another important nuance is the tax deduction.When you buy a dwelling, you can make up for some of your expenses.

This requires Russian citizenship, residence in the country for at least six months in the last 12 months, payer of NPFL (taxes are paid not only from wages but also from other income – for example, from renting housing).

The point is to reduce the tax base – the State returns to the taxpayer a portion of the amount paid to the State ' s NPFL. The maximum tax deduction for the purchase of housing is 2 million roubles. The tax base is reduced by 13 per cent of this amount (260,000 roubles).

For example, if the apartment is sold for 1 million rubles, only 130,000 rubles will be returned (in this case the real cost is taken into account). Generally, the so-called "improvement" costs are almost half the cost of the dwelling. This is one of the arguments against the creation of an additional contract.

If, for any reason, the buyer is interested in acquiring a particular dwelling, the loss of part of the tax deduction may be tolerated.

The remainder can be used to purchase other properties, tuition fees or treatment.

Since 1 January 2014, changes have entered into force whereby the balance of the deduction is not cancelled but transferred to other expenditures; it was not possible to use the balance until that time.

The next important point relates directly to the "indistinguishable improvements".

Before accepting the seller ' s terms and depriving itself of part of the tax deduction (if the sum stipulated in the main contract is less than 2 million roubles).

), it is worth making sure that "improvements" are of interest and will not then have to be spent on repairs, new appliances and plumbing, which will make the transaction even more unfavourable to the buyer.

When you buy a remodeled dwelling, you need to know if the changes have been legalized, and the owners often do the remodeling without any agreement.

If the changes are contrary to the rules (e.g. they have affected the carrying walls), the court will order the return of the flat to its original form.

It's a huge waste.

The sale of "improvements" separate from the apartment, although not directly contrary to the law, is a controversial issue. All "improvements" are an integral part of real estate and, according to articles 128 and 133 of the Russian Civil Code, cannot be considered a subject of civil rights. If the circumstances are unfavourable, the transaction may be recognized through a court of law that is inconsistent with the law, pretense, bonded (arts. 168, 170, 179 of the Russian Civil Code). Is it appropriate to conclude a contract for the sale and sale of inseparable improvements? How to draw up a document and delete all risks? The website's lawyers will provide answers to questions of interest.

Indistinguishable improvements in the apartment: what is this in the SC of the Russian Federation?

Today, the concept of "indistinguishable improvements in the apartment" can be found in two situations: when renting or hiring property, these improvements are often the subject of disputes between the owner of the dwelling and the tenant; and when selling, they are used to reduce the seller's tax; what is this, what is regulated, where is applied, and how to avoid potential conflicts – consider next.

The concept of inseparable improvements

The legislative understanding that such improvements are inseparable gives rise to article 623 of the Civil Code of the Russian Federation, according to which modifications to property that cannot be removed without causing damage to the apartment are considered inseparable.

- Remodeling of dwellings - demolition of partitions, installation of a shower cockpit instead of a bath, transfer of plumbing, ventilation;

- Installation of additional technical equipment and refurbishment - batteries, air conditioner, warm floor, replacement of wiring and water supply, gas pipeline;

- Major maintenance and renovation of the apartment;

- In some cases, it may also include sanitary treatment for mice, bedbugs, cockroaches.

The main criterion for the indissoluble improvement of an apartment under the Russian Civil Code is that it cannot be dismantled without substantially destroying or damaging the apartment.

For example, the following are not integral improvements:

- household appliances — washing machines, refrigerators, stoves, dishwashers, vacuum cleaners, microwave ovens, etc.;

- Furniture (selected and garrisons) – if they are not built into the structure of the apartment, such as some closets;

- A plumber, if it did not require the relocation of the water supply system (e.g. the installation of a shower cockpit requires the transfer of pipes and the replacement of the sink does not imply such action; the shower cockpit will be an inseparable improvement and the sink will be separated);

- Welfare items and household items — dishes, items of everyday use.

Attention! Anything you can take with you without compromising your real estate is a separable improvement. For example, if the heater is tied to the wall with screws, it can be removed without problem; it is considered to be a separable improvement.

The above understanding is used only for rented apartments; the unbundled improvements in sales are defined slightly differently – we will consider them in the relevant section of the article.

Indistinguishable lease improvements

The tenant of a rented dwelling may repair it, purchase furniture and equipment; in some cases, the indissoluble improvement of the rental dwelling is required: major repairs, electrical changes or a gap between rooms.

The question of who pays for these manipulations and whether the owner of the dwelling reimburses the improvements made is entirely dependent on the contract.

General rules:

- Separated improvements are not compensated, the tenant takes them with him when he leaves. If the parties agree, the owner of the apartment may keep them on condition of compensation. For example, purchase the furniture in the living room from the employer at a cost based on wear and tear.

- Non-segregated improvements must be agreed with the owner of the dwelling. If not agreed, compensation will not be awarded, even if it is stipulated in the contract. The agreement must be made in advance before work begins. Subsequent agreement (in fact) is not and is considered as a breach of contract.

Options for the formulation of a contract

At the time of the conclusion of the lease of real property, the condition of inherent improvements should be included in the text – there is no need to conclude a separate agreement for this; it is also not necessary for the notary to approve it; there are several options for the formulation of the terms in the contract.

1. Parties agreed to make improvements with the agreement and at the expense of the owner of the dwelling

The essence of the terms.Non-segregated improvements need to be previously agreed with the owner of the dwelling who pays for the work or compensates for it when the tenants leave.

Example of wording. "The lessor shall have the right, with the written consent of the lessor, to make inseparable improvements to the leased property and the lessor shall be obliged to reimburse the lessor for the value of such improvements."

CouncilsWe recommend that a conciliation procedure be included in the text of the contract – for example, by simple notification or by the drafting of a special agreement – and that a period of compensation be set by which the owner of the dwelling should transfer compensation.

Example of the wording of this term in the lease agreement: "The parties shall agree on the integral improvements by entering into a supplementary agreement to this Treaty which shall specify the nature of the work, the duration of the work, the result and the manner in which the work is to be accepted, the cost of the renter, the time frame and the reimbursement of the value of the indivisible improvements by the lessor".

To download a lease with compensation for the indissoluble improvements.

Example 2: Parties agreed to make improvements with the agreement of the owner of the dwelling, but at the expense of the tenant

The essence of the terms.Unbundled improvements in rented property need to be agreed with the owner of the dwelling, but the full cost of the work falls on the tenants — the owner of the dwelling does not compensate them in any way.

Example of wording."The lessor shall be entitled, with the written consent of the lessor, to make inseparable improvements to the leased property and the value of such improvements shall not be compensated by the lessor."

CouncilsIf such a condition were to appear in the contract, the tenant would not be able to compensate for the improvements made, even if he had spent a substantial amount on them.

To download the lease without compensation for the inexorable improvements.

Example 3: Parties agreed to make any improvements without the consent of the owner of the dwelling

The terms of the contract, which allow the lessee to perform inseparable improvements without the knowledge and consent of the owner of the dwelling, are illegal; even if they are included in the text of the contract, they cannot be applied in practice, they are null and void in the sense of civil law.

If, for example, the tenant renovates the premises without the owner ' s consent, he will not be able to recover compensation from the tenant, even if the contract so requires; moreover, the owner will bind the tenant through the court to bring the dwelling into its original form.

Example 4: The issue of improvements is not resolved by the treaty

If the agreement does not contain any mention of the indissoluble improvements, the law shall apply.

- The lessee accepts the lessor ' s consent;

- The lessor subsequently compensates for the cost of the work.

Thus, it is only possible to exclude compensation if the owner consents to it by including a special condition in the contract; otherwise, the owner is obliged to reimburse the tenant.

Procedure for carrying out the work and for obtaining compensation

There is no mandatory procedure for manipulation of housing by the law, and our portal recommends that the tenant adhere to the following option:

- Determine the composition of the work, prepare preliminary estimates, estimates.

- It is written to agree with the owner of the apartment on the work to be done; this should be done not merely by formal notification, but by means of a full supplementary agreement specifying what work will be done, how much it will cost and how compensation will be paid.

- Carry out the work, take it by certificate from the contractor, collect all cheques and receipts and send copies to the lessor for reimbursement.

To download a supplementary agreement on inseparable improvements.

If the owner of the dwelling refuses to compensate for the indissoluble improvements, they can be prosecuted.

Tax question

There is no need to declare unrequited improvements under a contract between individuals, and legal entities – firms of any form of organization – must take these transactions into account in the calculation of taxes.

The nuances of accounting and taxation, however, will depend on the accounting policies of the company, the tax regime and even the timing of the improvements in the firm's operations.

Attention! You can consult with the portal's on-call lawyer on how to account for improvements in the facility's balance sheet.

Indistinguishable improvements in the sale of an apartment

In sales transactions, one can also see the notion of "indistinguishable improvements in the apartment", but in a different context, which is used in the OST to understate the tax base and, as a result, to reduce the seller's tax on sales.

Non-segregated improvements are not necessarily considered as leases; these may be expensive furniture, household appliances and design repairs; the most important is to match the amount that needs to be reflected in the documents.

The scheme is as follows:

- The parties agree on the sale of an apartment, but the seller intends to reduce the price in the OST in order to reduce the future NPFL.

- The parties have two OSTs, one for an apartment, the other for an indissoluble improvement.

- In Rosreister, only the DCR of the dwelling is surrendered, and the right of the buyer is registered.

- The buyer is calculated according to two contracts and the seller receives the full cost of the dwelling.

- When the 3-NFFL declaration is completed, the seller only shows the value of the dwelling as specified in the LVC. The tax is reduced.

Although the NKK of the Russian Federation does not explicitly prohibit such acts, they are not entirely lawful.

Samples of documents

The following improvements will be required to process the sales transaction:

If you don't have enough money to buy an apartment, you can take a mortgage for this deal in Sberbank.

Risks of the parties

In the case of such a transaction, both the seller and the buyer bear the risks. If the value of the dwelling is substantially lower than the market, the tax authority may initiate a more thorough review of the transaction.

- Pays the NPFL according to hidden income;

- will be liable for tax liability and will impose a fine.

As a result, the seller, relying on tax savings, may suffer losses.

The buyer, on the other hand, risks the cancellation or avoidance of the transaction only obtaining the amount specified in the DCR of the dwelling and simply losing the rest.

In both cases, special attention should be paid to the drafting of agreements and the writing of agreements.

Dear readers, the article provides information relevant to the date of the release of the material. Legislation is constantly changing, so we recommend that we approach our on-call lawyer to resolve individual issues.

You were interested in the material?

Read further: A daily rental agreement.

Illiteracy for indissoluble improvements

People who make up a sales contract are interested in thinking about the need for the seller to make a receipt, especially if the property buys a couple of people together by adding their shares. A receipt for so-called indissoluble improvements in a few copies is being developed if an agreement to sell real estate is made by a specific number of entities.

A document shall be drawn up in accordance with a specific scheme to be followed by all parties to the sales relationship; it shall guarantee the seller the receipt of additional money without taxation if the seller has completed the repairs and the buyer has recovered the principal and additional amount in the event of termination of the contract.

The concept and features of inseparable improvements

This includes the moments of major repairs to the home, its remodelling, reconstruction or other reconstruction work, the purchase and installation of new generation of household appliances, and these supplements are called indistinguishable because they cannot be separated from real estate.

If the room was valued in one sum when people were about to purchase it, after such renovation of the dwelling in question, it would raise the price that buyers should know by agreeing to such a point.

For example, if a heating system has been converted in the rooms or the floors have been replaced by a former owner, the buyers must purchase the product in that form, realizing that this cannot be changed by paying extra money for the type of work that has been carried out in the building on sale and that the replacement or office is not subject to consideration by potential buyers.

How can the inseparable improvements be taken into account in sales transactions?

Buyers and sellers who are about to make a deal need to understand that the implementation of measures that fall into the category of inseparable improvements cannot be reversed.

The following criteria may be used to assess the seller ' s assets in the case of a transaction in this format:

- The actual condition of the premises;

- Whether there are jobs there that could increase the amount of the payment;

- For what period are the purchase payments calculated and whether anything can change significantly during that period.

When entering into the first or second part of the amount specified in the contract, it is necessary to discuss with the seller the points which may increase it and when drafting a specific agreement; to write a receipt confirming the position of both parties; and to make an indistinguishable improvement in the sale of the dwelling, so that implementation and implementation are necessary in advance.

Requirements and rules for the preparation of receipts

A model of a receipt for the indissoluble improvement of the dwelling will be useful to the individuals who make up the contract for sale. The new owner of the dwelling received under the contract, where something has improved, writes a handwritten receipt. This indicates his personal data, describes the passport of the citizen, specifies all the nuances of the transaction.

The figures and letters indicate the sum of money, which has been entered for improvements and signature.

The seller receives its allowance for the work performed and the buyer obtains a guarantee that no financial claim will be made against it; the document is not prepared by hand.

All its subtleties are written in detail, the notarization of paper is not mandatory, and it is essential to indicate everything without mistakes.

Model(s) of receipts for inseparable improvements

Important subtleties and drafting advice

It is worth saying that the concept referred to in the Civil Code is not used by the vendors who have made the repairs because they have to pay overtaxes; the receipt is designed to make the seller pay less tax than it should be, so that it should not be attached to the sales contract when going to the notary.

This option of compensation for improvements made should be negotiated in advance and in detail, since it is not included in the formal contract; if the document of sale is issued by the notary branch and certified, the receipt does not concern this point, it is the result of additional agreements between the parties to the transaction.

The receipt not only allows the seller to pay less taxes, but also allows the buyer, in cases of termination of the contract, to receive the full amount of the contract and the money paid for the improvements; if the apartment is purchased by a couple of people, a receipt of the sample must be prepared for each party to the agreement.

Video on the theme:

Amazing proposal: to prepare a contract for the sale of inseparable improvements in real property

Today, 12.09.2017, I have been asked to prepare a contract for the sale of inseparable improvements in real property.

There is an apartment (residential property) with two owners: one-third of the share in the right to joint equity, and one-third of the share, respectively.

The owner of the 1/3 share sells its share to the owner of the 2/3 share.

The seller wanted to save money on the tax, and naturally he didn't think of anything better than lowering the price of the contract.

The buyer seemed to have agreed, but claimed some "paper" for the difference between the actual price to be paid to the seller and the price specified in the contract.

The parties agreed that such a "paper" could be a "sale contract for unbroken improvements", and they asked me for assistance in preparing such a contract.

But I think I may have misunderstanded something, snooping around on the Internet, and nothing but that some tricksters are trying to reduce their tax burden in an incredibly incredibly incredible way, I didn't find it.

- Once I realized that I had been approached for some kind of magical action, which I was unable to perform because I did not have the appropriate expertise in metaphysical sciences, I refused to make such a contract.

- I bring to the public's attention the very fact that there is some practice of creating "sale contracts for the indissoluble improvement of real property".

- I personally have the following questions:

1. How can we sell improvements that are inseparable from the real estate object? So we sell the apartment separately, and the renovation of the apartment (the expensive cafeteria on the walls, expensive glass packs, sliced into the walls of copper pipes, copper wiring, etc.) is sold separately from the apartment itself?

2. As I understood it, "the contract for the sale of inseparable improvements in real property" is not presented in Rosreest, together with the contract for the sale of the real property itself to register the transfer of ownership; that is, in the Rosreestra registration case, there is no such "contract", but the money has been paid.

The real estate facility itself sold much cheaper than the buyer paid for it, because the buyer paid, say, 100 p. and another 100 p. for what (for some improvements) it was not clear whether the buyer who paid the seller 200 p. (100 p. for real estate and 100 p.) was entitled to pay the buyer for the sale.

- for "improvement", to require the application of the effects of the nullity of the transaction (the contract for the sale of unbroken improvements) and the return of 100 pp to the seller.

The relevant contract has been verified by experts from Rosreestre, and is available in the registration file.

How do you think, and most importantly, how could the idea of such a "contract" come about?

Unbundled improvements in the sale of an apartment – problem solved for 1,000 ~ - Lawyer.ru

604 lawyers are on the website.

Taxation of real estate transactions.

Good evening: An 8 million roubles.4 million mortgage apartment was purchased in the contract as value and 4 indissoluble improvements.

There was a need to sell before the end of the three-year period. For the tax inspection, 4 million or 8 million roubles would be relevant for the calculation of the sales tax.

Is it better to make a contract for the same 8 million with unbroken improvements, or just point out 4 million (buyer agrees)?

Thank you.

C. Clarifying client

If any revenue is taxed, but I have spent $8 million on the purchase, including indissoluble improvements (there are 3 receipts from the previous vendor worth 8 million) and as a result of the new deal, I have no income of the same amount of 8 million.

If in the new contract 10 million and no improvements are lost (selling with good maintenance and all furniture) then I pay 10-8*13 or 10-4*13

C. Clarifying client

I live in a small town and home is one of the best tax workers in principle know that the estimated value is much more than 4 million. how much more likely it is that questions will arise if only 4 million are indicated (and not better if in this case there is a rating for the indistinguishable improvements i.e. the total amount is much higher)

Thank you.

The client left a review of the service to show the Legal Counsel online Response to the website within 15 minutes to ask a question.

Legal responses (6)

For the tax inspection, 4 million or 8 million roubles would be relevant in the calculation of the sales tax. Would it be better to draw up a contract for the same 8 million with unbroken improvements, or would it simply indicate 4 million (buyer agrees)?

It's 4 million that will be important for the tax because it's the official cost of the apartment.

- Dear Elijah, hello.

- The contract will then be valued at US$ 4 million.

- In fact, the legal risks here are minimal – you and the buyer are making a deal at the price you're pointing out, guided by the principle of freedom of contract of civil law.

- Hello!

- In your case, there should be no indication in the treaty of 8 million, including indissoluble improvements,

- Next.

- By virtue of article 209 of the Criminal Code, the income earned by the taxpayer is recognized as the object of taxation.

- On the basis of article 208 of the Russian Federation, for the purposes of chapter 23 of the Russian Federation, income from sources in the Russian Federation includes income from the sale of real property located in the Russian Federation, other property belonging to the Russian Federation.

- a physical person.

Article 210, paragraph 1, of the Russian Federation stipulates that in determining the tax base, account shall be taken of all the income-earner ' s income, whether in cash or in kind, or of the right to an order which he has obtained, as well as the income in terms of tangible benefits determined in accordance with article 212.

NK of the Russian Federation.

Article 17, paragraph 17.1

217. The NCK of the Russian Federation stipulates that the following types of income of natural persons are exempt from taxation: income earned by natural persons who are tax residents of the Russian Federation, the corresponding tax period for the sale of dwellings, apartments, rooms, including privatized dwellings, dach, garden houses or plots of land, and shares in the said property held by the landlord for three years or more, as well as for the sale of other property;

- owned by a taxpayer for three years or more.

- Instead of using the right to receive a property tax deduction

- Taxpayer ' s right to reduce his taxable income by the amount of his actual and documented expenses related to

- To obtain these revenues.

As money of 8 million roubles will actually be received in connection with the sale of the apartment, it is in accordance with article 208.

- 209 NKR will be subject to NPFL taxation.

- The conclusion of a sales contract with the indissoluble improvement of the dwelling in question does not change

- The legal nature of the money in question as part of the value of the dwelling.

- In such a case, you cannot reduce the taxable income to the sum of the actual expenses incurred for the maintenance and maintenance of the apartment, as these improvements have been made by your seller, so the revenue from whose sale is a target, the value of the work does not affect the determination of the taxable work.

- NPFL bases.

The claimant ' s argument that the inseparable improvements sold under a separate sales contract are movable property, which is not included in the value of the dwelling, but is a separate object of taxation, which is reasonably not recognized as non-law-based.

The institutions, concepts and terms of the Russian Federation ' s civil, family and other branches of legislation used in the Russian Federation ' s Tax Code apply in the sense in which they are used in these branches of legislation, unless otherwise provided in the Tax Code itself.

Russian Federation.

Since the Tax Code of the Federal Republic of Yugoslavia does not provide otherwise, article 15, paragraph 2, 1 and 3 of the Code of Criminal Procedure provides as follows:

16 The housing code of the Russian Federation, under the apartment, recognizes a structurally separate room in a multi-family house that provides for direct access to public premises in such a house and consists of one or more rooms, as well as an auxiliary room intended for the satisfaction of citizens of the domestic and other needs of their remaining accommodation in such a separate room, the apartment being a residential building and as such should be suitable for the permanent residence of citizens (to comply with the established sanitary and technical rules and standards, to ensure that the accommodation is accessible and accessible to citizens).

Other requirements of the law).

According to article 133GC, paragraph 1, of the Russian Federation, a thing which cannot be divided in kind without destruction, damage having made a difference in its purpose and which is in circulation as a single object right is an indivisible thing even if it has composite rights.

- Parts.

- Because the indistinguishable improvements of the immovable property are part of this facility, which cannot be separated without its destruction, have damaged the changes in its purpose, therefore they cannot be considered as a separate item, they are not

- they form new things — a separate object of movable property.

- Given that inherently separate improvements are not an independent subject of civil rights, they cannot therefore be considered as a criterion for the notion of property under the civil law of the Russian Federation.

- the sale of the dwelling as part of its value.

This position has been confirmed by case law - see the Appeal of the Tomsk Regional Court of 24 February 2015 in case N 33-562/2015

- 7.7 Rating

- 7761 feedback

- expert

Hello, Elijah!

The tax will be based on the amount of the transaction, i.e. $4 million.

According to article 210 of the NKK of the Russian Federation 1.

In determining the tax base, account shall be taken of all the taxpayers ' income, whether in cash or in kind, or the right to which they are entitled, as well as the income in the form of a material benefit determined in accordance with article 212 of this Code.

It is desirable that the treaty should not indicate the indissoluble improvements, which are usually indicated in a separate form.

Good luck!

- Hello!

- In accordance with article 208 of the NK of the Russian Federation

- For the purposes of this chapter, income from sources in the Russian Federation includes:

- 5. Income from sales: real estate in the Russian Federation;

- According to article 130 of the Russian Civil Code

- Real property (real property, real estate) includes land, subsoil and all that is firmly connected to land, i.e., objects whose displacement is not possible without disproportionate damage to their purpose, including buildings, structures and construction in progress.

- Thus, if you own an apartment, this is a taxable income.

- In accordance with article 224 of the NK of the Russian Federation

- The tax rate shall be set at 13 per cent, unless otherwise provided in this article.

- According to article 210 of the NK of the Russian Federation

- For income subject to the tax rate established by article 224, paragraph 1, of this Code,The tax base is defined as the monetary value of such taxable income reduced by the tax deductions provided for in articles 218 to 221 of this Code.taking into account the characteristics set out in this chapter.

- In accordance with article 220 of the NK of the Russian Federation

- In determining the amount of the tax base in accordance with article 210, paragraph 3, of this Code, the taxpayer shall be entitled to the following property tax deductions, which shall be granted on the basis of the characteristics and in accordance with the procedure laid down in this article:1)Property tax deduction on sale of propertyas well as the share(s) in it, the share(s) of the organization ' s statutory capital, the assignment of rights to a claim under a contract of share-building (under a equity investment contract or under another equity-related contract);

- The property tax deduction provided for in paragraph 1, subparagraph 1, of this article shall be subject to the following characteristics:(1) Property tax deduction shall be in the amount of income:Tax period received by the taxpayer from the sale of dwellings, apartments, rooms, including privatized dwellings, dach, garden houses or land or share(s) of the said property owned by the taxpayer for less than three years, not exceeding a total of 1,000,000 roubles, as well as the amount of income earned during the tax period from the sale of other property (except securities) held by the taxpayer for less than three years, not exceeding a total of 250,000 roubles;Instead of obtaining a property tax deduction in accordance with subparagraph 1 of this paragraph, the taxpayer is entitled to reduce his taxable income by the amount of the actual expenditure he has made and documented for the acquisition of the property.

Since article 220, paragraph 1, paragraph 2, of the Constitution of the Russian Federation relates the actual costs incurred to the acquisition of property in accordance with article 130 of the Code of Criminal Procedure, there is no provision for a reduction in the cost of unbroken improvements.

On the basis of this, you are entitled to reduce your taxable income by 4,000,000 roubles, i.e. the cost of the dwelling under the contract.

4 million rents specified in the contract

I believe that the FNS will not accept the amount of unbroken improvements.

Hello, Elijah.

According to Article 220: Property tax deductions

1. In determining the amount of the tax base in accordance with article 210, paragraph 3, of this Code, the taxpayer shall be entitled to the following property tax deductions, which shall be provided in accordance with the characteristics and procedures laid down in this article: 3) property tax deductions,The amount actually incurred by the taxpayer for new construction or for the acquisition of housing units in the territory of the Russian Federation, apartments, rooms or share(s) thereof, acquisition of land or share(s) thereof provided for individual housing, and land or share(s) thereof on which the acquired dwelling(s) or share(s) thereof are located;

Actualthat is, all the costs, including the inexorable improvements, are subject to tax.8 million roubles.

In your case, the house was owned.less than 3 yearsand its valuemore than 1 million. is therefore subject to taxation.

In your case, you should use the tax deduction method.Income less expenditure.

Situation 1

You bought a house (with improvements) for 8 million rubles, you sell it for 8 million rubles.

8,000,000 - 8,000,000 = 0 (this amount is taxed, i.e. no tax)

Situation 2

You bought a house (with improvements) for 8 million rubles, you sell for 10 million rubles,

- 10,000,000 - 8,000,000 = 2,000,000 (this amount is subject to tax and the tax will be 260,000 roubles).

- If you specify in your contract for the sale of a house a total of 4,000,000 roubles, you will also not be taxed, as the amount after deduction will be negative.

- 4 000 - 8 000 000 = -4,000,000 rubles

- Good luck.