In situations where it is not possible to register housing for all family members in accordance with the law on maternity capital immediately before the transfer of state support funds from the Pension Fund (PFR) budget, a guarantee of the allocation of property shares to children (wife or husband) is a written obligation taken on yourself as the buyer (parent - title owner) of the residential premises.

The obligation to allocate shares is a document certified by a notary or another person with a similar right, on the registration of property rights of family members of the certificate holder (including minor children) to residential premises acquired using maternity capital funds.

The obligation is provided to the Pension Fund of Russia when submitting an application for the disposal of MK funds to improve housing conditions. It contains information that the owner of the property (the certificate holder and/or her spouse) undertakes the obligation in the future to register the residential premises as the common shared property of the entire family.

When is it necessary to draw up a written commitment for maternal capital?

According to the “Rules for the use of maternity capital to improve housing conditions”, approved by Government Decree No. 862 of December 12, 2007, a written commitment is required in cases where:

- at the time of applying to the Pension Fund for disposal, the residential premises are not registered as the common property of the certificate owner and his family members (spouse, children);

- ownership of residential premises has not been registered in accordance with the procedure established by law.

That is, drawing up an obligation is necessary when

- Housing is not registered as common property the certificate holder, his spouse and/or children, namely:

- according to the contract, the acquirer (owner) is one or both parents (children are not included in the contract);

- the housing belongs to the owner of the certificate (spouse), but is pledged (mortgage) and shares can be allocated only after the encumbrance is removed.

- Registration of ownership of residential premises not carried out at the time of transaction:

- an agreement with installment payment has been concluded with the condition that the right to be registered after payment of the last installment;

- participation in shared-equity housing construction - ownership is registered after the multi-apartment residential building is put into operation;

- participation in a housing, housing-construction or savings cooperative (ZhK, ZhSK, ZhNK) - state registration takes place after all contributions have been made;

- construction of a private house (individual housing construction project) or its reconstruction - ownership is registered after the house is put into operation (receipt of a cadastral passport for individual homeownership).

Notarial obligation to allocate shares in maternity capital

Within the framework of the Rules approved by the Government, the obligation to allocate shares to the spouse and children in residential premises acquired using maternal capital funds can only be formalized by a notary or a person authorized by law to do so. The original of the obligation remains with the Pension Fund of Russia, and a copy is transferred to the holder of the certificate (the person who gave the obligation).

A simple written form of obligation drawn up without the participation of a notary has no legal force and is not accepted .

The obligation is given by the person who has the right of ownership of the residential premises. It could be:

- certificate owner;

- spouse;

- both spouses, if the two of them are buyers (purchasers) of housing or co-borrowers on a mortgage.

including adults , should be allocated shares under the obligation .

Parents must sign the pledge together in cases where they are:

- co-borrowers on a mortgage loan;

- parties to the agreement (buyers, participants under the contract, etc.).

What documents are needed to register an obligation with a notary?

To draw up a document containing a person’s obligation to allocate shares in a residential property purchased using maternal capital funds, the following documents (copies are possible, with the exception of a passport):

- Passport of the certificate holder and/or her husband.

- Birth certificates for all children.

- Documents on the adoption of a child (children).

- Marriage registration certificate.

- Maternity capital certificate.

- Title documents for residential premises (purchase and sale agreement, residential building agreement, land agreement for the construction of individual housing construction, extract from the register for cooperative members, etc.).

- Certificate of state registration of ownership of residential premises and/or land (from January 1, 2017 - extract from the Unified State Register of Real Estate EGRN).

- Loan agreement and mortgage agreement (if any).

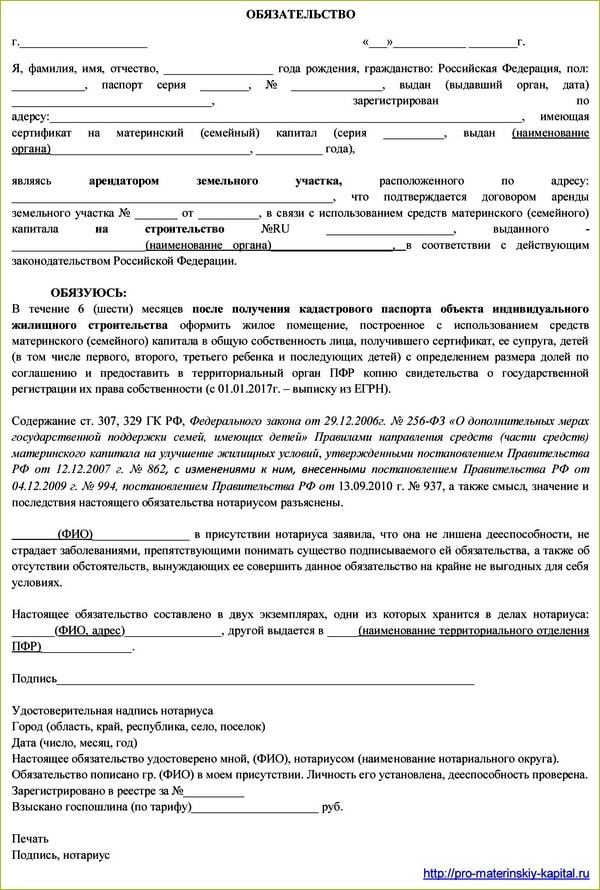

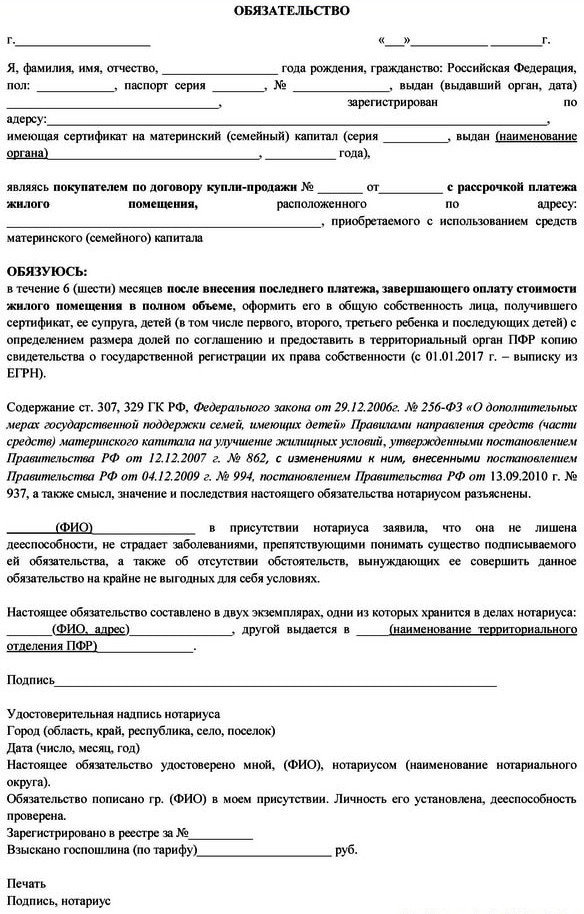

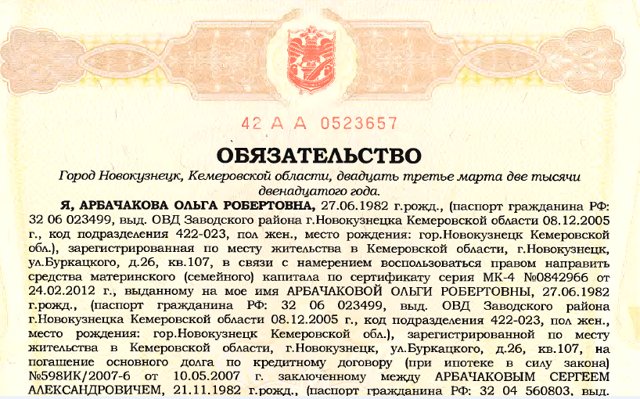

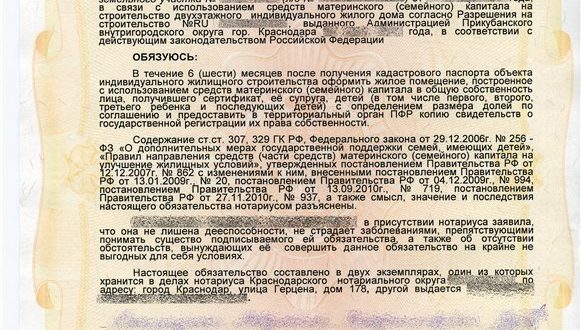

Sample obligation to allocate a share of maternity capital

The text (content) of the maternity capital obligation depends on the method of purchasing housing:

- ownership of the residential premises is registered in the name of the husband and/or wife;

- repayment of a loan or loan (with or without mortgage encumbrance);

- acquisition of ready-made housing, shared construction of an apartment building or construction (reconstruction) of a private residential building (individual housing construction project).

do not contain requirements for formalizing the obligation . In different regions, Pension Fund authorities may have their own requirements for the content of the obligation, so it makes sense to first clarify its form with the Pension Fund.

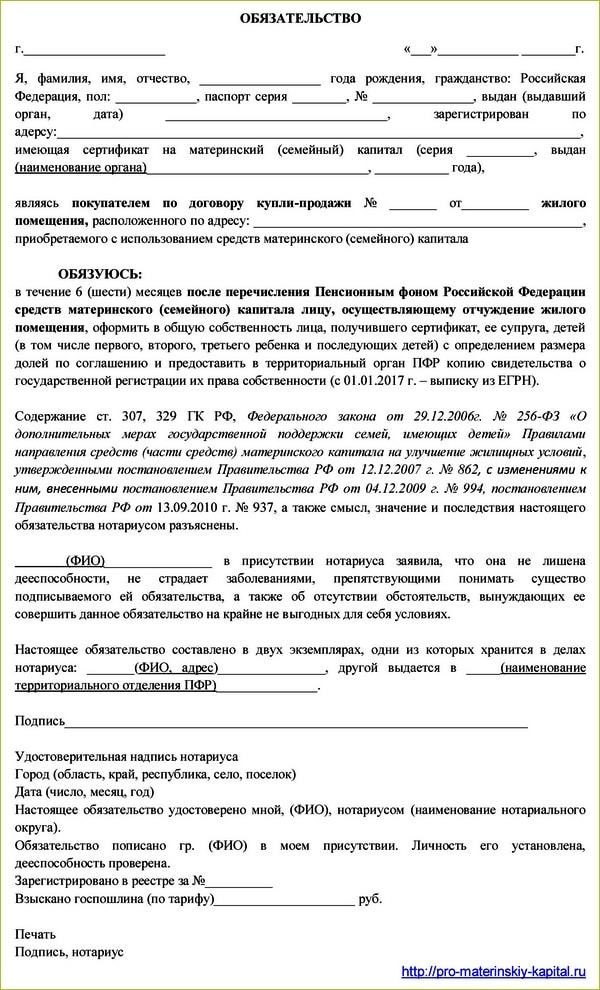

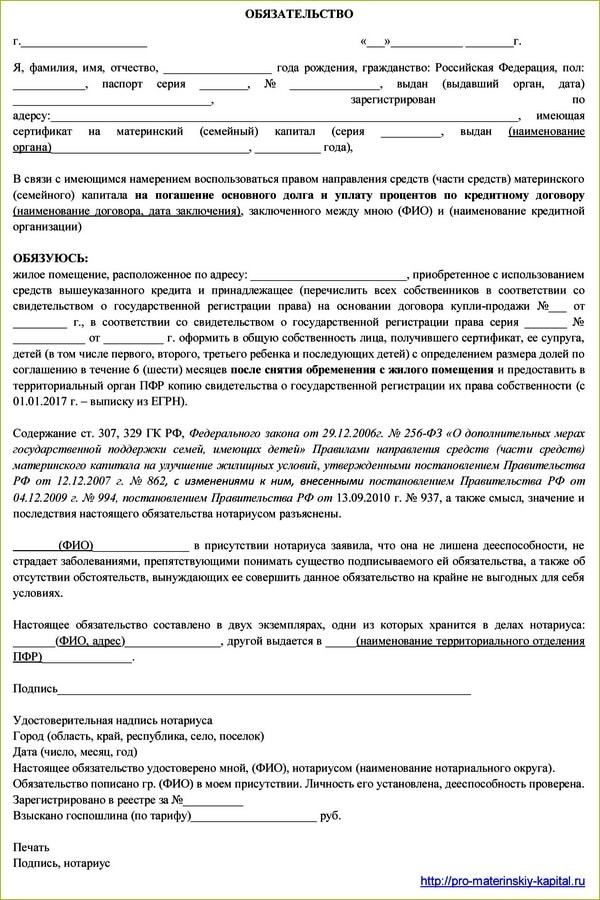

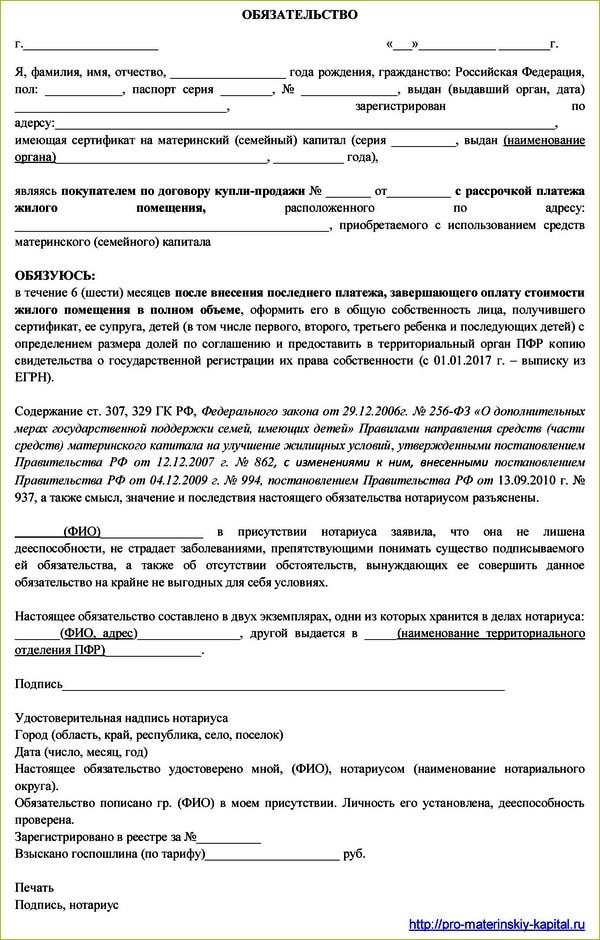

Below are sample examples of obligations to allocate a share of maternity capital:

- When purchasing a home by the owner of the certificate under a sales contract :

- When repaying principal and interest on a mortgage (home loan or loan):

- When purchasing housing in installments provided by an individual or legal entity:

- When receiving maternity capital for the construction of a residential building (or its reconstruction):

Of course, spouses can draw up an obligation form themselves and then go to a notary with it. But this is hardly advisable, since the notary may simply refuse to certify such a document. And even if he does agree to the registration, he will still have to pay the notary fee ( 500 rubles according to Article 333.24 of the Tax Code of the Russian Federation).

Be that as it may, the following information is indicated in all types of obligations :

- Full name of the person (persons) taking on the obligation, indicating passport details;

- Maternity capital certificate data (series, number, date of issue);

- Name of the Pension Fund of Russia body that issued the certificate;

- Purposes of using maternal capital funds (payment of the cost under the contract, loan repayment, construction of individual housing construction, preschool building, contribution to the cooperative);

- Details of the agreement (credit, mortgage, purchase and sale, equity participation, etc.);

- Description of the residential premises indicating the address of its location;

- The obligation to register the residential premises as the common property of all family members by agreement, determining the size of each person’s shares, indicating the transfer period and conditions (removal of encumbrance, putting into operation, obtaining a cadastral passport for a residential building, etc.);

- An obligation to subsequently transfer copies of state registration certificates of common property rights (from 2017 - extracts from the Unified State Register of Real Estate) to the Pension Fund of Russia;

- Notary's note confirming the identity and legal capacity of the person(s) giving the obligation;

- An indication of the number of copies of the document and the location of their storage (transfer);

- Signature indicating full name;

- Information about certification of a document by a notary;

- Date, notary stamp, amount of payment according to the tariff.

Fulfilling the obligation for maternity capital

The Rules state that the person who signed the obligation must register the residential premises as the common property of all family members within 6 months after the Pension Fund transfers MSC funds to the seller of the housing, and in the case of purchase with installment payment - within 6 months after making the last payment under the contract.

But, between the date of drawing up the obligation for maternity capital and its fulfillment, quite a long time may pass - perhaps many years (loan repayment, construction of a house, apartment, etc.), despite the fact that it indicates a six-month period.

Therefore, the obligation usually contains a condition upon the occurrence of which this period begins to be calculated. The following main conditions can be distinguished :

- removal of encumbrance (mortgage, pledge);

- making a share contribution to the housing cooperative in full;

- putting the house into operation after construction (reconstruction) and/or obtaining a cadastral passport.

Liability for failure to execute a notarized document

Despite the fact that the obligation is a necessary document for receiving state subsidies and is certified by a notary, that is, the document is “weighty” and indisputable, but so far there are no rules providing for liability (criminal, administrative, civil) for failure to fulfill its conditions, on does not exist in law today .

In addition, there is not a single legislative act establishing a body that should control this process. As is known, there is no connection between the Pension Fund of the Russian Federation, where obligations are stored, the guardianship and trusteeship authorities and Rosreestr for tracking transactions with such real estate.

However, by not allocating shares to children and/or spouse, the person obligated to do so violates the provisions of Law No. 256-FZ.

And in cases where facts of non-fulfillment of obligations to allocate shares are revealed, the information can be transferred to law enforcement agencies.

The prosecutor's office, as the body supervising the implementation of laws, has the right to file a claim with the court, which will oblige the fulfillment of the obligation or independently allocate shares to all family members, including minor children.

If residential premises acquired using the MK were sold without allocating shares in it, then this transaction may be declared invalid . Any interested person has the right to file a claim with such demands - the Pension Fund of the Russian Federation, the guardianship and trusteeship authority, children who have reached the age of majority, the prosecutor.

In such situations, the court applies the consequences of the invalidity of the transaction, and as a general rule, the court:

- obliges the parties to return everything received under the transaction (to the buyer - money, and to the seller - real estate);

- will impose an obligation on the seller to allocate shares in the residential premises returned to him to all members of his family.

The only possible chance to avoid the negative consequences of failure to fulfill an obligation when selling housing purchased for MSK is to purchase another residential premises with an area equal to or larger than the previous one and distribute shares in it to all family members.

Obligation to allocate a share of maternity capital: samples, terms, documents

Last modified: August 2023

Maternity capital has helped many families with two or more children resolve their housing issue. The procedure for selling funds under a family certificate is strictly regulated, and control is exercised by the State Pension Fund.

According to current legislation, the allocation of budget funds for the purchase of an apartment or house requires the mandatory allocation of shares to each family member.

If this procedure cannot be completed due to certain legal difficulties, an obligation to allocate a share of maternity capital is drawn up.

The document guarantees that the improvement of living conditions will affect everyone in the family, including minor children of certificate holders.

When is a commitment required?

You can learn more about the procedure for using money for maternity capital from Government Resolution No. 862, which gives the right to take into account the amount established by the state when purchasing or constructing a house, apartment, their reconstruction, as well as repaying part of the mortgage debt.

You can learn more about the procedure for using money for maternity capital from Government Resolution No. 862, which gives the right to take into account the amount established by the state when purchasing or constructing a house, apartment, their reconstruction, as well as repaying part of the mortgage debt.- To use funds from the budget, one of the parents needs to obtain a certificate and then write an application requesting the allocation of capital for a specific purpose related to improving living conditions.

- The obligation to allocate shares is a document obligatory for holders of a family certificate, submitted under the following circumstances:

When considering citizens' appeals, fund employees must request a certain package of documentation establishing the right to sell capital (loan agreements, deeds of sale, certificates of the balance of the mortgage debt, real estate documents, etc.).

- a mortgage has been issued on the property and there is an outstanding bank debt;

- It is planned to purchase credit housing, with the payment of capital as a down payment.

Since one of the main conditions for using funds to purchase a home is to vest the entire family with property, if the mortgage is outstanding, this requirement can only be met after the encumbrance on the mortgage is removed.

Is it possible to do without obligation?

To understand in what cases an obligation is drawn up, it is necessary to find out what it is and why it is necessary.

A document called an obligation to allocate shares is a legally binding document drawn up and certified by a notary.

The document establishes responsibility for the allocation of shares to each family member (spouses and their children) in an apartment obtained with funds from maternity capital.

The document is needed when submitting an application for the disposal of maternal capital, when compliance with the requirements of the law is currently impossible due to the presence of encumbrances. After the restrictions are lifted, the parents undertake to resolve the issue of dividing the living space into shares for each family member.

The conclusion that follows from the above is that it is necessary to specially draw up a paper only in cases where it is not possible to immediately allocate shares.

When the purchased housing has already been formalized immediately in the DCP (purchase and sale agreement) for all family members, the requirement for the document becomes irrelevant, and for the Pension Fund of Russia, the list of documents provided includes certificates confirming the rights to shares in the purchased real estate (deed of sale, property certificates).

How to create a commitment?

Notarization is one of the requirements for the document being drawn up (Federal Law No. 256 of December 29, 2006). Before going to the Pension Fund, if it is impossible to allocate shares, parents immediately contact a notary office to draw up and certify the paper.

Notarization is one of the requirements for the document being drawn up (Federal Law No. 256 of December 29, 2006). Before going to the Pension Fund, if it is impossible to allocate shares, parents immediately contact a notary office to draw up and certify the paper.

No other options for formalizing the obligation are accepted, and the original is submitted to the Pension Fund for verification and storage.

Drawing up the document requires the presence in the office of both spouses who have taken out a housing loan. Sometimes, for various reasons, only one of the parents is considered the owner and borrower. In this case, the presence of the second spouse is not necessary.

The text of the obligation must include a phrase that the parent promises to allocate a certain portion to each family member during the period of time established by law. Since during the period of collateral encumbrance no manipulations with the allocation of shares are possible, this procedure is carried out within a certain period after the end of the encumbrance.

The document is drawn up through a notary, and then checked and signed by the parents or one of them. Next to the signature, a full decoding of the full name is made, certifying that the document was signed personally by the parents.

A signed agreement, which establishes the shares that will be allocated to each member of the family, will help speed up the process of approving maternal capital.

The size of the share and the procedure for determining the optimal size of the allocated property is a topic that requires additional elaboration in legislation.

In the absence of other clarifications, parents are guided by common sense, as well as a number of provisions from housing legislation.

The problem of enforcement

When drawing up a document, the notary is obliged to ensure the legality of the transaction, i.e. compliance with all requirements and standards. Since the mechanism for monitoring the fulfillment of the obligation for maternity capital has not yet been adjusted, difficulties may arise in finding a notary willing to draw up the paper.

Currently, the levers of control over the implementation of the law on family capital are with the Pension Fund, which has every right at any time to check whether parents are complying with their obligations. Unpleasant consequences when revealing the fact of non-fulfillment of promises include administrative and criminal liability. Official representatives of the government, faced with the refusal of parents to allocate shares, have the right to insist on the cancellation of the transaction, or the forced division of property into parts between all family members.

If you plan to sell an apartment or house purchased with the help of budget funds, you must take into account that the absence of allocated shares in the living space put up for sale is a direct violation of the previously signed obligation. Before completing the purchase and sale, parents must agree on the transaction with the guardianship authorities, ensuring the protection of the property interests of minor citizens.

It is possible to sell housing legally only if the children are endowed with equivalent or better property, which is confirmed by documents considered by the guardianship authorities when making a decision to authorize the alienation transaction.

The law does not provide a separate algorithm for the distribution of shares in the purchased property depending on the type or size of living space. If only a share in the property is purchased at the expense of maternal capital, the right to receive part of the property is retained.

Options for drafting an obligation

For family certificate holders who intend to buy housing using funds from the budget, there are two options for allocating property to family members:

- through an agreement on the allocation of shares;

- by signing a deed of gift for each family member.

When drawing up an agreement, a notary is involved, who independently prepares and certifies the document. It will be required in the future, when registering family property, taking into account the established share ratio. Registration actions are carried out by the territorial branch of Rosreestr after restrictions on the right of disposal are lifted.

When registering through the transfer of a gift, shares are distributed and transferred to each of the family members with further registration of changes in Rosreestr according to a similar scheme.

If in the first case you will need to pay for notary services, then when making a gift you only need to pay the standard fee for registration services.

Setting shares

To avoid possible accusations of violating the rights of a child, it is recommended to proceed from the standards adopted in housing legislation - 12 square meters per person. In each region, the minimum permissible footage differs, based on the specifics of regional legislation, which requires clarification of the minimum housing standards.

When the mortgaged property is distributed between the co-borrowing parents, the allocation of shares is made for each of the owners, and in the case of joint ownership, the distribution is agreed upon between the spouses.

When assigning property to children, it is necessary to take into account that parents will be responsible for actions in relation to property belonging to children.

If the property belonged to only one of the spouses, the second also has the right to allocate a part. If desired, the spouse has the right to refuse to distribute shares in favor of his children or spouse.

Responsibility for neglecting the provisions of the obligation

The law requires the procedure for the distribution of property shares to be carried out within a strictly established period. A 6-month period is allotted for implementation. The starting point for the time allotted for registration is the moment when the property is released from the encumbrance and can be re-registered legally:

- after commissioning during construction of the facility;

- after the mortgage has been repaid and the lien has been removed.

The responsibility for monitoring compliance with the terms and requirements of the law lies with the main body regulating payments of family capital - the Pension Fund of Russia.

Despite the absence of strict regulations for checking compliance, evasion of legal requirements can lead to serious troubles, including criminal liability.

Pension Fund employees have the authority to initiate criminal prosecution under the article “Fraud,” or to force the allocation of a share by force through the court (the allocation is made on the basis of a court order).

These measures are extreme; in practice, there are more often cases when representatives of supervisory authorities give an order to re-register shares taking into account all family members.

Is it possible to allocate shares in another property?

Due to insufficient regulation, parents can take advantage of the negligence of government officials when selling housing without distributing shares.

If such a violation is detected, punishment threatens not only the parents, but also the employees who allowed such a transaction. In some cases, the purchase and sale transaction of an apartment (house) is executed subject to the allocation of other property to the children.

Only strict adherence to the procedure will allow you to avoid legal problems and attention from supervisory authorities:

- Introduction to ownership of the purchased apartment for all family members.

- Coordination of a new transaction for the sale of real estate with the guardianship authorities, subject to the provision of other equivalent property.

- Registration of alienation of real estate in accordance with received permits.

This process is quite complicated, as it requires close cooperation with the guardianship authorities and thorough preparation. However, this option is the only correct one, excluding any claims from third parties or supervisory authorities.

If there is a second apartment or house that is equivalent to the acquired property, it will not be difficult to agree on the allocation of a share to the child in another property. If the second piece of property is just planned for acquisition, it will be possible to obtain permission from the guardianship to sell the home only after a preliminary transaction for the purchase of a new home in which minors will be registered as the owners.

Deed of gift or allocation of shares

Registration of real estate under a deed of gift takes place as part of the standard procedure for making changes to the database of owners, without causing any special difficulties with registration.

Sometimes disputes may arise regarding the distribution of shares. Depending on whether the apartment is in common ownership or registered in shares for spouses, the distribution of shares is carried out either for the entire property or for each of the shares of the spouses.

Otherwise, the decision on the method of allocating shares is made taking into account the legal features of the documents - agreement or deed of gift.

Involving lawyers specializing in real estate matters or paying for the services of a notary will help eliminate problems with registration.

Since the obligation through an agreement requires mandatory certification, this method of registration provides a high degree of security, eliminating the risk of making any claims to the legality of the procedure.

Similar articles:

Share:

No comments yet

Obligation to allocate a share of maternity capital to children in 2023

Maternity capital is a state subsidy that can be used if appropriate conditions are met. This benefit cannot be used without distributing shares of the acquired real estate to children, a spouse.

The obligation to allocate shares of maternity capital is fulfilled by various methods that are suitable for each specific situation.

When is it necessary to draw up

According to Government Decree No. 862 of December 12, 2007 on the rules for using maternity capital to improve housing conditions, drawing up a written commitment is necessary in the following cases :

- If the property at the time of submitting the application to the Pension Fund of the Russian Federation is not registered as the joint property of the certificate holder, his children, spouse;

- The right to own residential premises has not been formalized in accordance with the procedure established by law.

Consequently, this obligation is drawn up when the real estate is not registered in the common ownership of the owner of the maternal certificate, spouse or spouse, as well as their children:

- In accordance with the agreement, real estate can be owned by one or both parents, without the participation of children;

- It is in the use of the owner of maternity capital, but was purchased with a mortgage, and the allocation of shares is possible when the encumbrance is lifted.

Registration of rights to real estate property is not carried out when making a transaction :

- The owner has entered into an agreement with payment in installments if the registration of ownership rights is carried out upon payment of the last installment;

- The owner has become a participant in shared housing construction - registration of rights to real estate is carried out when an apartment building is put into operation;

- A participant in a housing, housing-construction or savings cooperative registers ownership of the property if he makes all the necessary contributions;

- When constructing or reconstructing a private house, registration of ownership is carried out when the house is put into operation. The owner receives a cadastral passport indicating his rights to the house.

The procedure for distribution of shares in accordance with the law

The recipient of the certificate has the opportunity to choose how to distribute and allocate shares of living space to children, using maternity capital.

To do this you should:

- contact a notary to draw up an obligation to allocate shares of housing to each child, determining the size of this property;

- choose how to allocate shares from the legal side - under a gift agreement, that is, a deed of gift, or a corresponding agreement;

- register a formal obligation under which the property owner can transfer ownership rights to co-owners.

Only one parent holding a maternity capital certificate can allocate shares of living space to each child, spouse. No one else is allowed to carry out this registration. To do this, the owner must submit an application to the Pension Fund of the Russian Federation along with an agreement or gift deed, as well as other documents.

According to the drawn up notarial obligation, the owner of the property is obliged to carry out the specified distribution within 6 months, otherwise troubles may arise.

How to determine the size of shares for children

Many parents have a question about determining the size of the established share. They often find it difficult to decide. After all, if you allocate one hundredth of the entire living space, it will seem very small.

But no one is immune from divorce, which will entail the division of property for each family member in proportional parts. For most families, this question causes a lot of difficulties.

Regulations do not regulate the smallest share, but each person is entitled to 12 square meters of living space . This size may vary in different regions of the Russian Federation. If it is impossible to allocate the specified number of meters in a property, then it remains to adhere to sanitary standards - 6 square meters for each person.

Notarial obligation

In accordance with the rules approved by the government, the obligation to provide a share of residential premises to a spouse, as well as a child, if the property was purchased with maternity capital funds, must be formalized with the involvement of a notary or a person authorized in this matter . The original of this document is stored in the branch of the Pension Fund of the Russian Federation, and its copy is issued to the owner of maternity capital who provided the obligation.

The obligation has the right to be formalized by a person who is:

- owner of the certificate;

- spouse.

It can also be submitted by spouses, provided that if both purchased residential premises or took out a mortgage on it.

The obligation allows you to provide shares of real estate to natural and adopted children who have reached or have not reached the age of majority. This document must be drawn up by both parents if they:

- mortgage loan co-borrowers;

- both parties to the contractual agreement, for example, as buyers, participants in the contractual agreement, and so on.

Compilation requirements

When drawing up a document distributing shares in real estate, the drafter must indicate:

- last name, first name and patronymic, passport details;

- series, number and date of issue of the maternity capital certificate;

- name of the pension fund body that provided the certificate;

- for what purposes will the maternity capital funds be used;

- details of the contractual agreement for a loan, mortgage, purchase and sale, equity participation;

- information about the living space, including the address of its location;

- the number of copies of the obligation where they will be stored or transferred.

This document must also contain:

- the obligation to register residential premises to all family members, by mutual agreement and allocation of the area of shares, which clearly states the timing of the distribution of shares, when the encumbrance will be lifted, put into operation, a cadastral passport and other conditions will be provided;

- an obligation under which a copy of the certificate of state registration of rights to the entire residential area will then be transferred to the Pension Fund of the Russian Federation;

- a notary's mark, which establishes the identity and legal capacity of one or two persons constituting the obligation;

- signature of the compiler with its transcript and initials;

- information certifying the document from a notary;

- date and cost of the service.

Responsibility measures

In accordance with current legal norms, parents who have not provided their children with the necessary shares of living space are charged with:

- Administrative liability in the form of a fine, which may differ in different regions. Violators receive orders to correct the situation. Repeat offenders can be jailed for up to five years. In addition, such persons face reimbursement of funds to the state for the purchase of real estate using maternity capital.

- Declaring the transaction for the acquisition of residential space invalid. The judiciary sometimes makes such a decision.

Documents for registration

The obligation to allocate shares of a property acquired through maternity capital requires the provision of:

- passports of the certificate holder or second spouse;

- birth or adoption certificates for each child;

- a document certifying marriage registration;

- maternity capital certificate;

- documents confirming the right to living space;

- extracts from the Unified State Register of Real Estate;

- loan and mortgage agreement.

Fulfillment of obligation

Standard conditions establish the deadline for fulfilling the obligation using maternity capital. It is no more than 6 months from the date of:

- commissioning of a residential complex;

- release from encumbrance;

- transfer of funds from a maternity capital certificate.

Cost of the procedure

In accordance with the Tax Code of the Russian Federation, certification of a transaction on an item that is not subject to assessment is equal to 500 rubles . But tariffs may differ in different regions and reach up to 1,500 rubles .

Thus, the obligation to allocate shares in the living space is a notarial document ; it confirms the acceptance of responsibility by the executor to distribute the shares, establish the terms and conditions of this operation. After signing, this paper becomes binding on the drafter, who is responsible for execution.

Legislative acts establish such a document in order to protect the interests of each minor child from various unfavorable situations in the family. Consequently, all children who have the right to own a share of the living space will in no case be left without a roof over their head.

When and how to allocate shares to children when using maternity capital funds? The answer to the question is in the video below.

You might also be interested in:

Allocation of shares in maternity capital without a notary

The law obliges the owner of housing purchased using maternity capital to allocate shares in the ownership of all family members: parents and children, including those born after the purchase of the property.

Since it is not always possible to allocate shares immediately when purchasing property, the law allows this to be done after the issuance of maternity capital funds.

As a guarantee, an obligation , which displays the conditions upon the occurrence of which the citizen will have to allocate the appropriate shares, for example, after repaying the mortgage.

A transaction for the allocation of shares is subject to notarization, but in some cases this procedure can be avoided. Practice shows that if property is acquired by one of the parents there is no need to notarize the transaction .

Is it possible to allocate shares to children without a notary?

all children and parents to be given shares in the property rights . However, there are situations when it is not possible to dispose of real estate immediately after purchase:

In these situations, it is possible to use maternal capital funds before full ownership rights arise. To do this, an obligation drawn up by a notary , under the terms of which the owner of the property will be obliged to allocate shares to all family members within 6 months after the occurrence of such an opportunity.

It is possible to register shares for children under an obligation without a notary if the property was originally acquired by one of the parents and is his sole property or is part of jointly acquired property.

If the property is in shared ownership of both parents, then registration of real estate in the name of the children is carried out by a notary. Or in court if one of the owners refuses to fulfill the obligation.

How to allocate shares to children based on maternity capital

to fulfill the legal requirement and allocate shares to children without having the agreement certified by a notary if the capital funds are used as the missing amount for the purchase of housing. The right to conclude such a transaction arises for parents when the child turns 3 years old (after whose birth the right to receive a maternal certificate arose).

there is no need to draw up an obligation and subsequently contact a notary to allocate shares , since it is possible to register ownership rights for all family members at once .

To do this, the parties draw up a purchase and sale agreement , under the terms of which parents and children will act as home buyers (the law does not prohibit minors from purchasing real estate).

In this agreement, it is necessary to indicate the size of the shares in the property of each family member, for example, each person has 1/4 of an apartment.

When completing this transaction, the purchase and sale agreement specifies a condition according to which part of the amount will be paid to the seller from maternal capital funds . After signing the contract, the parties register ownership, but the property will be pledged to the seller until the contract is paid in full.

After registration of ownership rights, buyers must apply for the release of capital funds to the Pension Fund. If everything is properly completed, the Pension Fund transfers the funds to the seller’s account, after which the parties to the transaction must remove the encumbrance from the housing in Rosreestr.

Distribution of shares when using maternity capital

Clause 1 Art. 42 Federal Law No. 218 of July 13, 2015 “On State Registration of Real Estate” states that a transaction for the allocation of shares must be certified by a notary.

Regarding this rule of law, there is no explanation as to whether the transaction is subject to certification if the owner is a sole or the property is jointly owned by the parents.

Practice regarding this issue is ambiguous .

When alienating property under joint ownership, the law obliges such a transaction to be completed with the notarial consent of the spouse , but does not indicate whether the agreement itself is subject to certification .

In this case, the consent of the spouse is required only so that the second owner cannot subsequently challenge such an agreement. Based on this, we can conclude that there is no need to notarize the transaction of alienation of shares from the right of joint ownership.

The Rosreestr office for the Republic of Tatarstan also adheres to this rule. In its clarification dated August 12, 2016, the Department reports that the transaction for the allocation of shares, in accordance with Art. 7 Federal Law No. 172, is not subject to notarization if the property is alienated from individual or joint ownership.

Allocation of shares to children when using maternity capital in 2023

In this situation, the certificate will be provided with budget money only if there is a notarial obligation to redistribute property rights in favor of children. This is required to oblige recipients of government money to comply with legal requirements.

How to allocate shares to children when using maternity capital

If the home was purchased on credit, after making the last installment on the mortgage loan, you need to obtain a mortgage document from the bank. You need to contact the Rosreestr authority with this document to remove the encumbrance from residential real estate.

Upon consideration of the application, the owner will be issued a Certificate of Registration of Property Rights or an Extract from the Register of Property Rights - a document that confirms ownership of the residential premises.

From this moment, the owners have the right to dispose of the residential real estate they own, in particular, to distribute it into shares.

Agreement on the allocation of shares to children (sample)

An agreement is drawn up to allocate a share of the premises since maternity capital was used. It is certified by a notary office. But there is only a risk that such a document will be drawn up with errors.

And government agencies will not agree to accept it. An agreement is being prepared for the parents to donate parts of the premises to children who have not reached the age of majority.

Disputes may arise when they sort out the form of ownership - common property (then you will first need to establish the share of each spouse) or shared

Interesting: At what age do you have to drink strong alcoholic drinks?

Features of a share in an apartment under maternity capital in 2023

An apartment purchased with mortgage funds and serving as collateral belongs, as a rule, to the spouses or one of them. The allocation of shares in it is possible only after full repayment of the debt.

Having liquidated credit obligations to the bank, you need to obtain a mortgage on the residential premises from it and submit an application for removal of the encumbrance to Rosreestr, attaching the necessary documentation: an agreement on the acquisition of the property, an extract on the transfer of title, a mortgage.

How to allocate shares for maternity capital

- information about the participants in the transaction, characteristics of the housing, indicating the exact area must be indicated here;

- It is necessary to indicate information about what share will go to each child;

- shares must be allocated to each child born before the mortgage loan is repaid

Agreement on the allocation of shares in maternity capital, sample 2023-2019

It is worth noting that, as in many other cases, the spouse cannot count on carrying out this procedure without the assistance of a notary. The corresponding requirement is established in Article 42 of the same Code, which regulates the procedure for registering real estate objects.

The procedure for allocating shares in maternity capital

Real estate, the cost of which was paid only with MSK funds , becomes the common property of all family members in equal shares . Moreover, the agreement must contain a condition on possible further redistribution (reduction) of shares in connection with the birth of other children.

Agreement on determining shares in maternity capital

The letter of guarantee itself does not indicate a fixed size of the share of housing for the participants.

However, when directly registering shared ownership, it is necessary to rely on the accepted standards for the area in a house per 1 resident.

The Housing Code of the Russian Federation has set a figure of 12 m2 by 2023; in the regions, this figure may have its own meaning - you need to use it. In addition, there is an absolute sanitary minimum, below which the dimensions cannot be lowered - this is 6 m2.

Interesting: How to Cash Out Maternal Capital If Your Child is Already 3 Years Old

I have the right

Parents can choose any of the above methods , based on the gratuitous transfer of part of the property. Both of these methods are legal, but most often parents choose to donate property. If all the formalities of the procedure are followed correctly, no problems with registration should arise at the registration centers.

Obligation to provide a share of housing purchased with maternal capital funds

When dividing shares based on the fact of purchase and sale, at the time of its preparation, all future owners are indicated . The same registration procedure is applicable during the construction of a residential property at the expense of MK with the subsequent registration of a cadastral passport and a second document - on the right of ownership.

Allocation of shares to children when using maternity capital in 2023

- Full names of all parties to the agreement.

- Passport details. If children do not have a passport, then you need to indicate the series and number of the birth certificate.

- Place of registration of all members of the agreement.

- Dates of birth of children and parents.

- Full address of the property indicating the name of the country, subject and city.

- The total area of the property that appears in the agreement.

- The number of the entry in Rosreestr, based on which the property belongs to one of the spouses.

- Date and place of drawing up the agreement.

- The size of shares for each party to the agreement.

- Which parent is the children's representative?

- Other information that the parties wish to indicate in the agreement.

How to properly formalize the allocation of a share to children when using maternity capital? Sample of a share allocation agreement

If the allocation of a share is carried out by a minor, one of the parents, acting as a legal representative in this matter, has the right to sign instead. The child's representative is additionally indicated in the content of the contract or agreement.

Rules for allocating a share of real estate to children when purchasing it using Maternity Capital funds

- the property must be located within Russia;

- you need to formalize the purchase of a separate home, not a share;

- the transaction can be of any form, only taking into account the laws;

- When drawing up an application for the use of material capital, you must write the purpose and amount, and also attach all supporting documentation.

Interesting: How long does it take for alcohol to be completely eliminated from the body?

- by including all family members as homebuyers and giving each of them an equal share in the common law;

- registration of housing in the ownership of one or both parents, with the simultaneous execution of an obligation for the subsequent distribution of shares - this obligation must be certified by a notary office, and the actual distribution of shares must take place no later than 6 months after registration of rights;

- through the court, at the request of the Pension Fund of Russia or the prosecutor's office - if the parents have not fulfilled their obligations within the period specified above.

Allocation of a share to children in maternity capital in 2023: registration of an obligation, instructions

Who is the apartment registered to? Joint property, for me and for my husband, do the same as in the post, agreement on the allocation of shares + donation, just the husband gives everything and is left without a share, in the event of a divorce, the issue will be resolved with his share. It’s strange that these are such problems. All this is described in the law.

Allocation of shares to children after repayment of the mortgage with maternal capital in another house

31 Aug 2018 glavurist 192

Maternity capital obligation: how to formalize, price at a notary, documents

The obligation for maternity capital arises in the case of using state support funds (MS) to improve living conditions. The document expresses the consent of the parents to allocate shares in the ownership of real estate for each of their pupils.

Where does the obligation come from?

- Legal relations with the use of maternity capital are structured in such a way that they must fully satisfy the interests of each of the family representatives, since the subsidy is in the nature of common property.

- Based on this principle, a special obligation arises at the legislative level, which must be fulfilled when using a certificate to improve the living conditions of parents and children.

- According to the provisions of a special regulatory act covering the rules for disposing of maternity capital, before registering a triad of rights to housing acquired through the said subsidy, authorized persons (parents) must draw up a document expressing the fact that the real estate becomes shared, and their co-owners of such allocated parts become pupils.

- The obligation to distribute (allocate) “children’s” shares is a document expressing the future status of residential real estate and determining the scope of rights of each family member to it in the event of attracting subsidies in the form of maternity capital.

- Peculiarities:

- The obligation is always drawn up by a notary (compliance with the notarial form is one of the main conditions);

- The absence of a document entails the Pension Fund’s refusal to dispose of state aid funds;

- The obligation must be formalized in person at a notary's office or with the involvement of third parties exercising powers under a power of attorney;

- Required only if living conditions are improved:

- Purchasing a finished residential property using your own savings and microfinance;

- Participation in the shared construction program;

- Registration of mortgage relations;

- Repayment of a targeted loan previously issued for the construction of your own home;

- Construction of a private residential building by the family’s own efforts or with the help of a contractor;

- Carrying out work on the reconstruction of existing real estate with the fulfillment of conditions for increasing technical characteristics and increasing the area of the facility.

In exceptional cases, it will not be necessary to draw up an agreement on the allocation of shares, in particular:

- The moment of transfer of the triad of rights to a newly acquired real estate coincides with the period of making a subsidy in favor of repaying part of its redemption value (if the housing is purchased with MK and one’s own savings);

- Under the purchase and sale agreement, all family members are on the buyer’s side and the property immediately becomes shared property.

Sample commitment

At the legislative level, there is no single template indicating the exact content of the agreement (obligation) on the distribution of shares when using maternity capital to improve current living conditions. It is for this reason that, depending on the region of residence, territorial branches of an extra-budgetary fund (PFR) may establish specific requirements for the textual form of the document.

As a general rule, a sample agreement has the following points:

- Title of the document;

- Date and place of compilation;

- Information about the buyer/holder of the certificate who has agreed to assume the stipulated obligations;

- Certificate number and issuing authority;

- Direction of funds implementation;

- Details of the document in connection with which the triad of rights to real estate arose (sale and purchase agreement, mortgage, shared construction, etc.);

- The text of the obligation to transfer real estate to the status of shared ownership, indicating the maximum period for fulfilling the requirement, identifying information about the real estate and listing the persons in whose favor the specified actions will be performed;

- The regulatory framework in accordance with which the document is drawn up (Articles 307, 329 of the Civil Code of the Russian Federation, Federal Law No. 256);

- Indication of the presence of full legal capacity and familiarization with the consequences of the legal relationship being formalized;

- Information about the number of copies of documents and the location of their storage;

- Signature of the parties.

Download a sample obligation to allocate a share on a mortgageDownload a sample obligation to allocate a share when purchasing a residential premisesDownload a sample obligation to allocate a share when building a houseDownload a sample obligation to allocate a share in installments

Documentation

The list of documents that should be provided when registering an obligation includes the following papers:

- Passport of the subsidy bearer (maternity capital);

- Certificate for MK;

- Spouse's passport;

- Birth certificate or passport of the child (everyone raised in the family);

- Adoption documents (if the student was previously adopted);

- Certificate confirming the marriage relationship;

- Documents indicating the existence of a triad of rights in relation to real estate:

- Foundation agreement;

- Registration certificate;

- Extract from the Unified State Register of Real Estate;

- Transfer and acceptance certificate;

- Technical plan or cadastral documents;

- Documents confirming the mortgage legal relationship (if the property was purchased with borrowed funds from the bank):

- Mortgage agreement;

- Surety agreement;

- Pledge agreement;

- Insurance policy for living space;

- Certificate of debt balance on the mortgage obligation;

- Written consent of the bank to contribute funds to MK to pay off the debt burden;

- Payment repayment schedule.

Service cost

Notary fees may vary slightly depending on the area of residence. When registering an obligation, authorized employees of notary offices include the following scope of services in the price:

- document preparation and other technical work;

- request for missing papers (if the applicant is unable to provide them independently);

- certification of the document.

On average, the price for these notarial procedures can be about 3.5-10 thousand rubles. In some cases, the applying parents may need to draw up a marriage contract, on the basis of which shares will subsequently be distributed.

The law does not prohibit the owner of the subsidy from independently drawing up a sample obligation and having it certified by a notary for 500 rubles, but the likelihood of being refused to perform these actions is very high.

Similar

Law enforcement practice and legislation of the Russian Federation changes quite quickly and the information in the articles may not have time to be updated. The latest and most relevant legal information, taking into account the individual nuances of your problem, can be obtained by calling toll-free 24/7 or by filling out the form below.