You can conclude a transaction for the purchase and sale of an apartment not only with an individual, but also with the state. Most often, such transactions are concluded in cases where it is very difficult to find real buyers for living space.

The process of selling real estate to an individual and the state is practically no different, but has certain features.

Dear readers! Our articles talk about typical ways to resolve legal issues, but each case is unique.

If you want to find out how to solve your particular problem, please use the online consultant form on the right or call +7 (499) 577-04-19. It's fast and free!

Hide content

Is it possible to formalize a real estate purchase and sale transaction with government authorities, including the city administration?

The legislation does not limit the circle of persons who could enter into a real estate purchase and sale transaction with an individual. Therefore, the state, including the city administration, has the right to buy real estate from a citizen.

The legislation does not limit the circle of persons who could enter into a real estate purchase and sale transaction with an individual. Therefore, the state, including the city administration, has the right to buy real estate from a citizen.

The transaction is concluded on the basis of a written agreement, which specifies the cost of the apartment, which the buyer undertakes to pay to the seller. In general, the procedure is no different from a regular purchase and sale between individuals, only a government agency acts as the buyer.

Transfer of ownership of an apartment can occur in two ways:

- free of charge by registering deprivatization (the procedure is established by local authorities);

- by signing a contract between the parties and paying the buyer the amount agreed upon therein.

Municipal authorities purchase apartments from the population to implement social programs operating in the region, for example, to provide housing for orphans. They can make purchases from both developers and citizens if their proposals meet the program requirements.

The entire process of purchasing real estate from individuals is prescribed at the legislative level in the Law of 04/05/2013 No. 44-FZ.

You may be interested in the following articles:

The possibility of selling living space to government agencies will depend on whether there is a need to purchase real estate in the region.

Information about current social programs is published on the official website of the municipality , as well as on a specialized electronic trading platform.

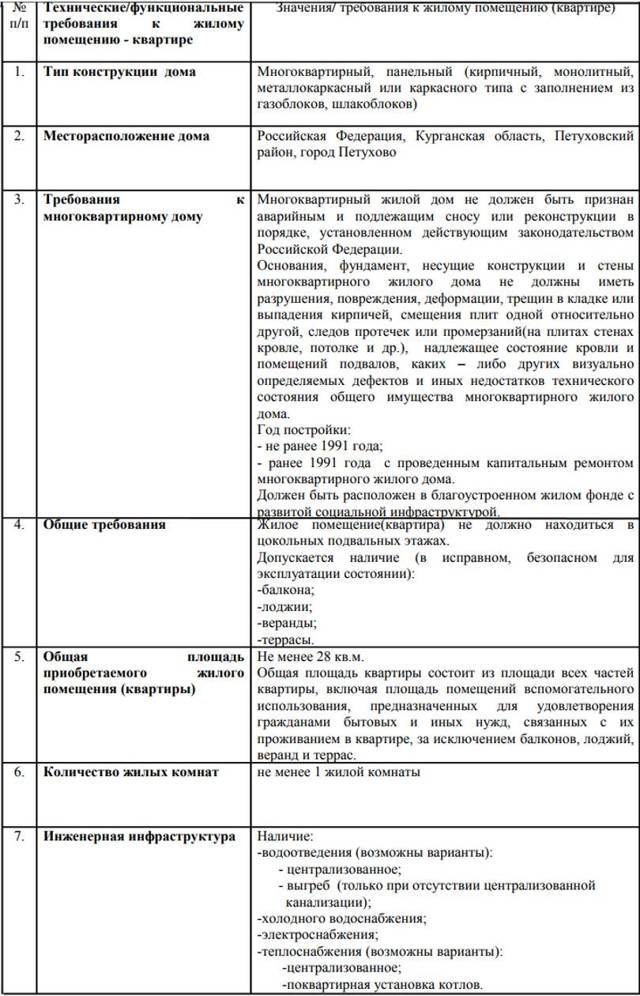

In addition, municipal authorities will buy an apartment only if its characteristics meet the requirements.

Where to begin?

The consideration of such an application is carried out by the authorized body in the field of housing construction. The period for consideration of the application does not exceed 30 days. During this period, the applicant is sent a response from the government agency.

The state enters into real estate purchase and sale transactions with individuals based on the results of auctions.

In a written response, the apartment seller receives information about the planned auction and the conditions for signing the contract. The response received is not a guarantee that the transaction will take place. The city administration may not choose a specific apartment for purchase for various reasons.

Required documents

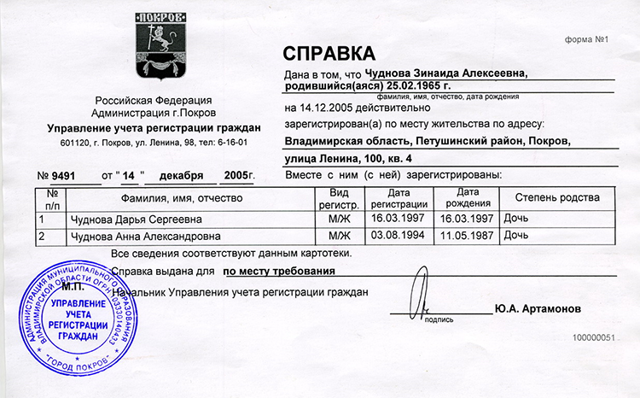

To sell an apartment by an individual, the municipality requires the same list of documents as in the case of a transaction between two individuals. So, the list of documents includes:

- ID card of the owner of the living space (seller);

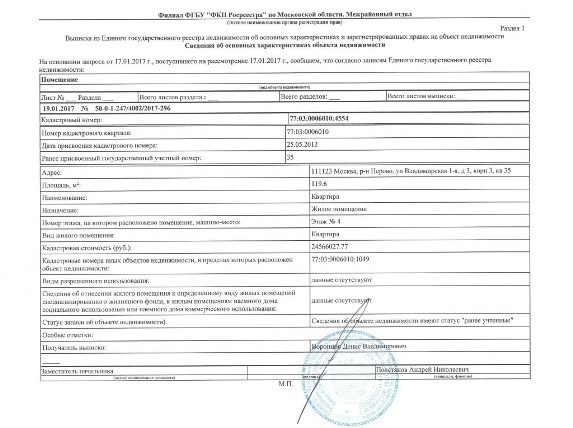

- documents confirming ownership of real estate;

- technical and cadastral passport of the apartment;

- certificates from the tax service and other government bodies (housing and communal services, Rosreestr), confirming the absence of utility debts for the apartment and legal encumbrances for concluding a transaction;

- appraiser's conclusion on the real market value of the property (if necessary);

- notarized permission to sell from the second spouse, if the apartment was purchased during legal marriage;

- permission to sell the guardianship and trusteeship authority if a minor child is registered in the apartment.

The collection of documents for sale is the responsibility of the apartment owner, and the contract for concluding the transaction is prepared by the administration.

The entire process of selling real estate to the state consists of the following stages:

- The seller clarifies the requirements for real estate that the administration plans to purchase in accordance with social programs.

- In accordance with the requirements, the owner of the property, if necessary, carries out preparatory repair work, since it will not be possible to sell the property in poor condition; the premises must be residential.

- The seller determines the market value of the living space; if necessary, he can contact independent appraisers.

- If the administration has submitted a suitable application for the purchase of real estate, the owner collects the documents necessary to conclude the transaction and submits his proposal to participate in the auction.

- If the auction was successful and the administration chose the seller’s offer, the parties enter into a purchase and sale agreement.

- The property is transferred to an authorized employee of municipal authorities by signing the appropriate act.

- Contact Rosreestr to complete the transfer of ownership rights.

- After the transaction is concluded, the seller receives the proceeds from the sale of the apartment into a bank account.

Nuances and features

The main difference between the sale of residential space to the state administration and a transaction between two individuals is participation in the auction.

This is due to the fact that there may be many offers to sell an apartment, and government agencies are obliged to choose the most profitable option. Selection can occur in several stages:

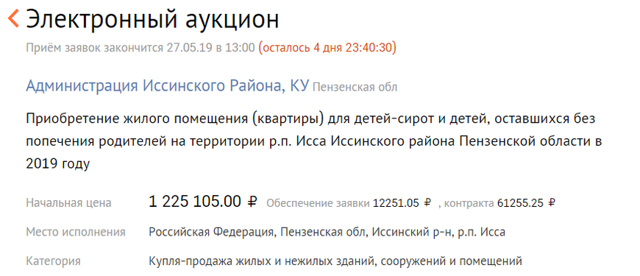

- Electronic auction. The administration places an application on federal Internet platforms indicating the purpose of acquiring real estate and its cost.

-

If no proposals have been received from sellers for the initial application, then the administration holds a repeat auction at the federal level.

If applications are still not received, the next step is to contact the Federal Antimonopoly Service of the Russian Federation to obtain permission to organize a request for proposals.

- The request for proposals is carried out in the form of submission of paper bids by bidders. It takes much longer than an electronic auction.

To become a participant in the auction, the seller must have an enhanced qualified electronic signature.

The procedure for selling real estate by an individual at auction includes the following processes:

- Submission of documents. The apartment must fully comply with the requirements specified in the application, and there should be no problems with documentation. The auction participant must contribute a certain amount to secure the transaction (5-10% of the set price).

- Participation in auctions. From the moment the seller submits an application until the start of the auction, about a week passes. At the end of the auction, the winner is given a corresponding protocol.

- Inspection of the apartment by a commission. It is organized by the municipality and includes authorized employees who, during the inspection, establish compliance of the actual conditions in the apartment with state requirements. After it is completed, a contract is issued, to ensure compliance with the terms of which you need to pay a certain amount (about 5% of the value of the property).

- If the parties agree to the terms of the contract, the document is signed using an electronic digital signature.

- State registration of the rights of the new owner of real estate.

- Transfer of funds to the seller’s account (transfer is carried out 1-2 weeks after state registration).

Funds are credited to the seller’s account guaranteed, since the transaction is concluded using funds from the budget, and all expenses from the budget are clearly planned. The money will be received in accordance with the terms specified in the contract.

When selling an apartment to the state, the seller takes virtually no risk. The transaction is carried out in accordance with the law, which guarantees the receipt of funds.

When selling an apartment to the state, the seller takes virtually no risk. The transaction is carried out in accordance with the law, which guarantees the receipt of funds.

The risk of losing money can only arise when selling a home through an intermediary. Realtors give the seller a price that differs significantly from the one set by the administration. The difference can amount to more than one hundred thousand rubles.

Sellers who want to use the services of intermediaries need to clearly know the real market value of the apartment so as not to undercut the price.

Expenses

The seller's expenses when concluding a purchase and sale transaction include:

- State duty for obtaining an extract from the Unified State Register.

- State duty for making changes to the Unified State Register (USRN) (if necessary).

- Payment for certificates from the BTI.

- Repayment of utility bills (if any).

- Registration of a passport for an apartment in the BTI, floor plan (the cost of the service depends on the area of the apartment).

- Payment for confirmation from the Federal Tax Service that there is no debt to pay taxes on the apartment.

- Obtaining an extract from the house register (in some cases an archival extract may be required).

- Expenses for legalizing the redevelopment, if this has not been done previously.

- Payment for notary services when obtaining consent to sell the second spouse’s real estate.

- Payment for the services of an appraiser and realtor (if necessary).

- State registration of a residential purchase and sale agreement (both parties to the transaction pay equally).

Deprivatization of housing: features and procedure

Deprivatization of real estate is the voluntary transfer of a privatized apartment into the ownership of the state free of charge.

To deprivatize, the owner of the apartment must contact the city administration with a corresponding application. As a rule, the administration does not refuse to admit real estate to the balance sheet. The owner must provide the following documents along with the application:

- passport;

- ownership documents;

- privatization agreement;

- certificate of absence of encumbrances;

- extract from the house register;

- technical passport for the apartment.

- The received documents are checked within 30 days, after which an agreement on deprivatization of housing is concluded with the owner, which is subject to state registration.

- After deprivatization, a social rental agreement is concluded with the owner and members of his family, on the basis of which they can live in the premises, but they do not have the right to re-privatize the housing.

Didn't find the answer to your question? Find out how to solve exactly your problem - call right now:

+7 (499) 577-04-19 (Moscow)

It's fast and free!

Sell an apartment to the state step by step: market and cadastral price

Maintaining an apartment in some situations is accompanied by excessive costs. Selling to the state helps to get money at your disposal along with the elimination of unnecessary responsibilities. Below we talk about how to sell an apartment to the state without mistakes with maximum benefit for the property owner.

Is it even possible to sell an apartment to the state?

The Housing Code of the Russian Federation and other thematic legislative acts do not prohibit the acquisition by the state of real estate from private individuals. Such operations are carried out by municipalities to implement approved social programs. For acquisition, a standard procurement scheme is used using open electronic trading (auctions).

To sell an apartment to the state correctly, the seller needs to study:

- standard requirements for real estate;

- pricing mechanism;

- features of taxation;

- step-by-step algorithm of actions;

- accompanying documentation.

For your information ! Sometimes it is advisable to transfer property to the state free of charge (reprivatization).

Pros and cons of such a sale

If the housing is not privatized, upon demolition you can count on receiving similar real estate or compensation. If you sell the apartment to the state in time at a high market price and then sign a social tenancy agreement, conditions will appear for using the above-mentioned benefit.

However, a regular sale to the state also implies several significant advantages:

- reliability of the counterparty;

- transparent transaction processing scheme;

- prompt receipt of payment after conclusion of the contract;

- no additional costs for advertising, real estate agencies, lawyers.

After completing such a transaction, the following expenses are eliminated:

The costs of maintaining the apartment are excluded - it is enough to sell the housing to the state.

Is it possible to sell a share in an apartment?

Such operations are not prohibited by law. However, in practice certain difficulties may arise. It is necessary to make sure that the allocation of the share is formalized:

- there is a BTI plan with exact dimensions and configuration;

- The owner's rights are confirmed by an extract from the Unified State Register of Real Estate.

Other apartment residents have the right of first refusal. How to notify co-owners about the sale - read our previous article.

For your information ! You can sell the state at least an entire room with a separate entrance.

Which apartments are the authorities interested in?

The most in demand are one-room apartments that are ready for immediate move-in.

It is definitely not possible to sell the following housing to the state:

- with illegal redevelopment;

- pledged, encumbered or seized, with other restrictions for sale;

- in poor technical (aesthetic, sanitary) condition;

- with the lack of modern engineering networks.

And the example discussed above with dilapidated housing is an exception. A similar scheme can be applied if the property is not yet included in the list for planned demolition. Responsible municipality officials clarify the location of the building in zones with the right to resettlement.

Housing for orphans

You can sell your apartment to the state as part of a targeted program for orphans. The requirements for real estate in this case do not differ from the rules discussed above.

For all privileged categories of citizens, living space standards are established at the regional level. Standard – 18 sq. m. per person. It is adjusted by local legislative authorities. In the capital, for example, for a family of two people the standard is 44 square meters.

How to determine the price

An apartment can only be sold to the state through an auction, so the bidding process is determined by a standard procedure. The cheapest offer that matches the characteristics of the published application wins.

According to cadastral value

This specific definition of evaluation is implemented to solve the following problems:

- calculating taxes on real estate and income received;

- registration of rights of inheritance, donation;

- performing exchange operations.

The calculations are made by specialized divisions of Rosreestr. In the standard methodology, in addition to general technical parameters and the year of construction, correction factors are used to take into account the economic characteristics of a particular region. The calculation is performed no more than once every 2-3 years.

If you sell an apartment to the state at the current cadastral value or higher, you will have to pay tax on the difference with the purchase price. The maximum discount from this level is allowed no more than 30%. As of March 2023, a deduction of 1 million rubles is valid. It is allowed to reduce the tax base by this amount.

For your information ! When selling below the cadastral value, certain rules for calculating personal income tax apply. Which ones - read this link.

By market value

In this option, the following parameters have a significant impact on the price:

- square;

- number of rooms;

- location taking into account the nearest infrastructure;

- year of construction;

- architectural features of the building (brick, monolith, etc.);

- actual state.

Taking into account the intended purpose of the apartment, it is enough to make “cosmetic” repairs or provide preparation for finishing.

The current market value of an apartment can be determined by the level of comparable offers. For prompt verification, they use information from agencies and consolidated specialized sites. An alternative is to have a professional appraiser prepare a report.

Sales procedure

To clarify current requests, you can contact your local administration with a written application. The relevant information is published on the official website of the municipality, as well as on a specialized electronic trading platform. Housing is purchased by:

- for orphans, veterans, low-income people, and other benefit categories;

- when moving from emergency housing;

- as part of reconstruction programs.

List of required documents

Preparation is no different from a standard sale. To sell the premises to the state, you will need:

- civil passport, other identification document;

- certificate of registered residents;

- certificate of absence of utility debts;

- extract from Rosreestr with no encumbrances.

If there is a minor child in the family, permission for guardianship and trusteeship will be required.

Step-by-step instruction

Standard algorithm of actions on how to sell an apartment to the state:

- They clarify the market value and determine an acceptable selling price.

- Perform preparatory repair work.

- Contact the local administration to clarify the procurement plan (monitor the current status of auctions).

- When a suitable proposal appears, the necessary documents are collected.

- Submit an application to participate in the auction.

- If the result of the auction is positive, a purchase and sale agreement is drawn up.

- Receive payment into a bank account.

- The property is transferred according to a deed to an authorized representative of the municipality.

- Visit the branch of the MFC (Rosreestr) to complete the transfer of ownership rights to the municipality.

Attention! The agreement and act are developed by the municipality independently. There is no need to fill out anything in advance. Download an example of a municipal contract from this link.

Auction

The current status of proposals is studied online on the government procurement website. Registration is not required at this stage. The built-in filtering system will help you find the necessary information based on specified criteria.

The detailed description of the application contains a technical specification. This document is available for download. It defines the characteristics by which the selection of apartments will be carried out. Similar data will be checked when signing the transfer acceptance certificate.

To participate in the auction you must be accredited. This procedure is offered in an expedited version for an additional fee. To avoid unnecessary expenses, it is recommended to do it in advance.

The collected documents are scanned and sent electronically to the appropriate auction site. They make a security transfer to the organizers’ account. The exact amount is indicated in the application. It is returned after the auction is completed. The listed actions are performed according to the accompanying instructions. If any difficulties arise, please contact the information support service.

Each application from the seller consists of two parts. The first contains general information. During the auction, it is necessary to confirm the price offer. If the result is positive, contact the administration again. The municipality will create a commission to accept the property and prepare a purchase and sale agreement for execution.

Transfer by deprivatization

Deprivatization is the free transfer of an apartment back to the state. It will not be possible to sell through deprivatization, since this is a free procedure. It is carried out only with the consent of all owners.

The application and accompanying documents for deprivatization are submitted to the municipality. After a positive response:

- sign the agreement and transfer acts;

- give consent to register a new entry in the Unified State Register of Real Estate;

- enter into a social rental agreement.

Important ! After the apartment is transferred under this scheme, the possibility of secondary privatization is excluded.

Is it possible to bequeath an apartment to the municipality?

A will in favor of the state is permitted by the legislation of the Russian Federation. This document can be changed at any time, so the current owner has the right to dispose of it at his own discretion. Additional notifications and approvals from municipal authorities are not required. A will can only be executed by a notary.

Transferring or selling an apartment to the state helps reduce financial obligations. You should study in advance the peculiarities of pricing of the real estate market and taxation. If independent participation in the auction causes difficulties, turn to specialists for help.

Answers to questions on the topic of the article can be obtained in the comments to the publication or from our duty lawyer. Repost and like, share your own experiences and comments.

Pay attention to additional information in the thematic sections of our website.

How to sell an apartment to the state or city administration

Home / Buying and selling an apartment / Secondary and new housing / How to sell an apartment to the state or city administration

Views 183

The state is engaged in the acquisition of real estate within the framework of social programs to meet its own needs, so municipal authorities can be considered as a potential buyer of the apartment. The process of alienation of real estate in favor of the state is not much different from the sale to an individual, but there are some features in the sales algorithm that you should know about in advance.

Is it possible to sell an apartment to the state or city administration?

You can sell your apartment to the state. The process involves concluding an agreement and paying the price specified in it, that is, a full-fledged purchase and sale transaction takes place, only the seller is represented by a government agency. You can transfer your property to the state in one of the following ways:

- Free of charge, having gone through the process of deprivatization (reprivatization, deprivatization, as sometimes mentioned in the literature). The procedure for deprivatization is established by local authorities.

- Sell for a certain price by signing a contract.

Why local authorities buy housing is easier to understand with an example.

In Region N, a program has been introduced to provide housing for orphans. To ensure this, it is necessary to purchase apartments in the amount of 50 units. There are 2 options being considered - buying housing from developers or from private individuals. For example, 30 units. purchased from developers, and 20 from private individuals at auction.

The administration has some requirements for the property, for example, the price is not more than XXX rubles. per 1 m2, and the area is not less than U m2. Individuals or their representatives - realtors - take part in the auction, and if they win, a contract is drawn up for the transfer of real estate to the state fund for a set price.

Purchases are also carried out to support other programs, for example, the provision of apartments to young professionals working in villages; providing housing for displaced people.

Having found out how the sale process occurs, it is worth assessing the pros and cons of alienating property in favor of the state.

Advantages and disadvantages

The positive points include:

The disadvantages include high competition, which encourages you to change the price to a lower level.

If the final decision to sell is made, it is necessary to analyze whether the apartment will be liquid among the offered analogues.

Real estate requirements

The administration does not acquire all apartments; the following requirements are put forward for real estate:

- No encumbrances. There are several types of encumbrances. Arrest means that, by a court decision, the disposal of property is prohibited, or a bailiff acts, imposing an arrest until a certain judicial act is executed. A loan taken against real estate also indicates the presence of an encumbrance. If a lifelong annuity agreement with a dependent was concluded in relation to the apartment, the housing also cannot be sold. Restrictions on sales may be associated with the rental of premises and the prohibition of guardianship and trusteeship authorities on the alienation of property if a share in it belongs to a child under 18 years of age.

- Satisfactory condition. If the house is subject to demolition, the apartment is on the verge of destruction, it will not be possible to sell it to the state.

- Legalization of redevelopments. Any changes related to transformation—moving walls, gas equipment—must be approved by the BTI. Otherwise, the owner may be fined for making unapproved changes and required to return the apartment to its original condition.

Housing that is in shared ownership can also be sold. In this case, it is necessary to obtain the consent of the remaining owners for the sale. It will not be possible to force the state to buy out the share, but if a corresponding application is submitted by government agencies, it should react quickly and offer a share of the housing.

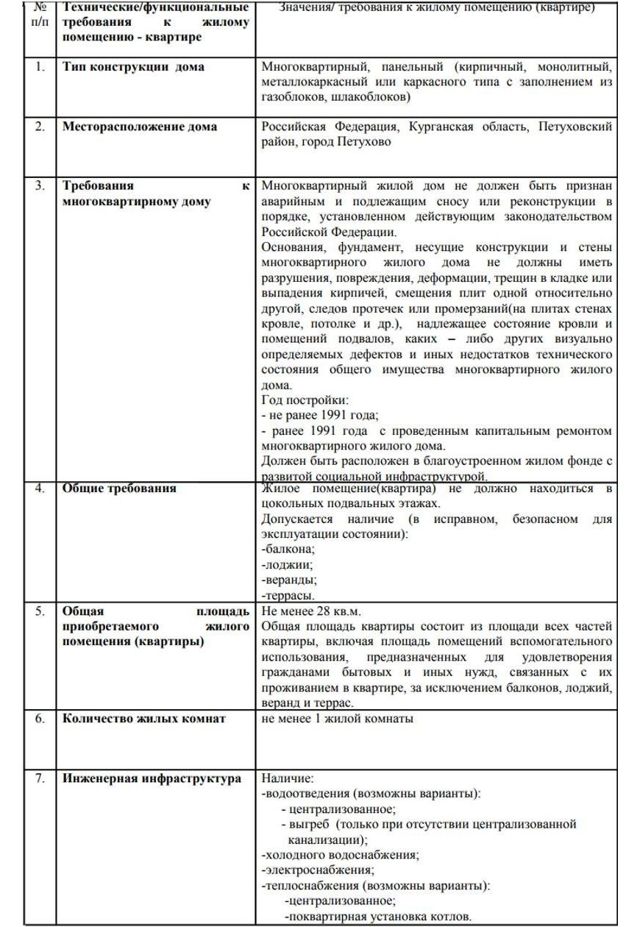

You can search for the necessary information on the government procurement website. Requirements are usually presented in the form of a summary table:

By studying the document on the website, you can determine whether the apartment meets the established criteria.

Selling price

If everything is in order with the condition of the apartment, its value should be determined. The state can purchase an apartment at the cadastral value, which is often underestimated, or at the market value.

The cadastral value is determined every 5 years . The amount matters when calculating sales taxes.

So, if the housing has been owned for less than 5 years (in the case of a gift, inheritance or receipt under a life annuity agreement - less than 3 years ), you need to pay a personal income tax on the sale in the amount of 13% (for residents).

The sales price is compared with the cadastral price, and if it is higher than the cadastral value, multiplied by a reduction factor of 0.7, then the calculation is made from the sale amount, and if the price is lower, then the tax is calculated from the cadastral value, multiplied by 0.7.

The market value reflects the specifics of the property and is determined taking into account the location of the apartment, infrastructure, layout and other factors affecting the comfort of living. The assessment is carried out by agencies that are licensed to do so.

The procedure for selling an apartment to the state

Unlike a standard sale, where Buyers come to the Seller in search of the desired option, sales to the state involve an application by the owner of the apartment with an offer to purchase his property.

Stages of purchasing an apartment by the state

There can be a lot of potential sellers, and in order to choose the best option, the state provides a procedure for evaluating proposals at the auction. There are several stages of selection:

- Conducting an electronic auction. Information is posted on federal Internet platforms. To find suitable conditions, you need to search for information about auctions on the Internet or contact the city administration directly. On the website, such offers are presented as follows:

- If there are no offers from Sellers for the application, the auction is held again, but only on the federal electronic platform. In the absence of applications, the Administration applies to the Federal Antimonopoly Service of the Russian Federation for permission to organize a request for proposals.

- Organizing a request for proposals involves submitting applications in paper form indicating the price of the property and its main characteristics. The procedure has a number of disadvantages compared to electronic filing. Disadvantages: time spent collecting documentation, lack of information about similar proposals from competitors, length of the process and lack of guarantee that the administration will make a positive decision.

To participate in electronic auctions, the participant must have an enhanced qualified electronic signature, as well as make a security payment in the amount of 5-10% of the cost of housing.

Seller's actions

Buying an apartment at an electronic auction organized at the federal level includes the following processes:

- Submission of documents. Before you start selling an apartment to the state, you need to make sure that the housing meets the stated requirements and that the documentation is in order. The application must be “secured” by depositing a specified amount.

- Participation in the auction. By this time, about a week has passed since the application. At the end of the auction, a “winner’s protocol” is issued.

- Next, you should expect an inspection of the apartment by a commission. Based on the results of the inspection, a contract is issued. As security for the fulfillment of the terms of the contract, an amount is deposited, the amount of which is about 5% of the value of the property.

- If everything is in order and the terms of the contract do not raise doubts or contradictions, you can sign the document using an electronic digital signature. On average, about 20 days pass from the moment the application is submitted until the contract is signed.

- State registration of transfer of ownership.

- Receipt of money in a bank account within 1-2 weeks after state registration.

Homeowners often ask: why do realtors convince people to take part in an auction? This means only one thing: the apartment meets the requirements, its price is below the market average, and the realtor hopes to win the auction and sell the housing to the state, setting a price slightly higher than the required one, and make a profit.

Agents can take on security payments themselves so as not to miss out on a profitable deal. As a rule, they have agreements with the government agency and have no doubt about the success of the matter. There are also “misses” when the home is not sold as planned, and the agency quickly looks for other options to cover unforeseen expenses.

Documents for selling an apartment to the state

When offering housing to the city administration, it is necessary to prepare the following documents:

- passport or other identification document of the seller;

- the basis document that served as the basis for acquiring ownership of the apartment;

- USRN extract;

- information about persons registered in housing;

- registration certificate for housing;

- a certificate received from the housing and communal services department confirming that there is no debt for utilities.

The collection of documents is the responsibility of the apartment owner.

Contract

The administration is developing the content of the contract for the purchase of real estate, which must be read and all points worked out.

Payment

The amount will be credited to the account only after registration of the contract. There is no need to be afraid of such an order. In the process, budget money is spent, which can only be used for its intended purpose. Expenses are planned, so the money will be credited to the account exactly within the period specified in the contract.

Transferring to a bank card is considered the most profitable. Since the transaction is paid through Sberbank of Russia, the transfer will be made free of charge. When paying via Savings Book, 1% of the transfer amount is charged, which is quite significant, given the considerable cost of real estate.

What to do with privatized housing that no one wants to buy?

Consideration of this issue is relevant, since we are talking about the transfer of property to the state free of charge. Reprivatization is beneficial in the following cases:

- the owner is unable to pay housing taxes;

- the apartment is unsuitable for habitation and is in disrepair;

- the housing is located in a place where no one wants to buy it;

- the apartment was transferred by will, but the heir does not want to accept the inheritance (for example, due to the large debts of the testator).

During reprivatization, costs associated with repairs of property, including those necessary in connection with a fire or flood, are borne by the state.

In various regions there are programs for resettlement from housing subject to demolition. Living in an apartment under a social rental agreement, residents can receive an offer to move to an apartment with an area of at least 18 m2 per person (in Moscow). If a citizen is the owner of dilapidated housing, he will only get an apartment of equal value, but not a larger one.

After reprivatization, the former owners have the right to live in the apartment, but will not be able to dispose of it, for example, sell or exchange it, leave it as collateral, and reverse privatization will be impossible. Do not forget about the need to pay utility bills on time. According to the law, if the tenant evades payment for more than six months, the tenant will be evicted to a smaller premises through the court.

Even if you want to deprivatize an apartment, you may encounter a number of problems; the process will be impossible if:

- the owner has other housing;

- apartment in collateral;

- one of the owners is a minor (guardianship consent is required);

- there is rent arrears;

- other owners do not agree with deprivatization;

- part of the housing was inherited (heirs do not have the right to deprivatize housing).

Whatever the owner’s decision - to transfer the housing free of charge or for payment through an auction, the process is strictly controlled by the Prosecutor’s Office and fraud is excluded.

The process of selling property to a municipality or deprivatization has many nuances. Not every home can be transferred to social services, and in order not to waste time, ask a lawyer questions: Which apartment can be sold to the administration? How can deprivatization be beneficial? What price can be set for the sale of housing to the administration?

Sale of an apartment to the city administration: terms of sale, documents

![]()

Selling an apartment to the city administration is usually of interest to owners of sought-after homes. The municipality, along with citizens and organizations, can act as a purchaser in transactions for the purchase and sale of residential property. Housing is purchased from citizens for various reasons. These may be social programs or personal needs of the administration. However, like any residential real estate transaction, selling an apartment to the municipality has its pitfalls, pros and cons.

Features of selling housing to the municipality

Some owners believe that as soon as they set out to sell an apartment to the municipality, the administration immediately undertakes to buy it. However, such a belief is incorrect. City authorities are not obliged to purchase housing that does not meet the required parameters, or that is not required at all. The administration cannot be forced to purchase. The court will also not satisfy such demands.

If the apartment turns out to be unclaimed, the seller can sell it in one of the following ways:

- sell to the administration (if it agrees);

- transfer to the ownership of the municipality free of charge.

Deprivatization

Deprivatization means the voluntary and free transfer of housing to the administration. An owner may have various reasons for wanting to get rid of a home, even if they don't pay for it. Reasons for transfer may be:

- unwillingness to pay taxes or other housing payments;

- living in another city or region;

- refusal of housing received as an inheritance;

- unwillingness to bear expenses resulting from damage to the home due to fire, flood, etc.;

- the premises are not suitable for habitation due to dilapidation or disrepair.

In such cases, the city authorities, although they are not obligated to purchase unnecessary living space from the owner, can offer him to get rid of unnecessary costs by transferring the apartment to the balance of the municipality.

Having thus transferred his home, the former owner has the right to continue living in it if he wishes. However, his other rights are limited:

- you cannot give, sell, or bequeath living space;

- it is impossible to privatize the apartment a second time (the right is granted once);

- the procedure for renting out a home becomes more complicated;

- housing cannot be collateral for a mortgage or lending.

The transfer procedure involves the owner writing a statement of abandonment of the home. Having received such an application, the administration acquires the right to dispose of the apartment at its own discretion in the future.

How to sell a home to the administration

It is quite possible to sell housing to city authorities. To do this, the owner should visit the local self-government body with a corresponding application. The statement indicates that the owner intends to transfer the home to the state for compensation.

The application is submitted to the authorized body, which will send a response to the applicant within 30 days. If the administration's decision is positive, the response will indicate the date of the auction and the terms of sale.

There are two ways to sell residential real estate:

- Sale based on cadastral value.

- Sales at market price.

A specific feature of such transactions is the way the administration acquires real estate from the population. Residential premises are acquired only through auction. In this case, the purchase and sale agreement for the premises must contain a condition under which the seller undertakes to pay tax on income received from the sale of the apartment in accordance with Art. 226 Tax Code of the Russian Federation.

Pros and cons of the deal

Selling living space to the state has both advantages and disadvantages. The advantages of such agreements include:

- purity of the transaction - in this case, the acquirer is the state itself, which means that sales operations will take place in strict compliance with the law;

- no extra costs - there is no need to pay for the services of notaries and lawyers, civil servants will take care of the work;

- moral satisfaction - apartments are purchased by the municipality to provide housing for orphans, respectively, the sale of such property is help to the disadvantaged.

There are no specific disadvantages to such transactions, but the seller will have to face some inconveniences, including strict requirements for the apartment being sold.

In addition, the seller will have to wait several months before he can receive the proceeds from the sale. This is due to the fact that the money allocated for the purchase is targeted and each transaction must be carefully checked and agreed upon.

Requirements for sale

In order to sell residential premises to the state, the seller should first of all familiarize himself with information about the auctions through which such sales are carried out. Information about them is reflected on specialized resources.

To be sold through an auction, the home must meet the following mandatory parameters:

- have no encumbrances and are not pledged;

- does not apply to dilapidated or emergency;

- manipulations with the layout must be legalized;

- be suitable for habitation.

Typically one-room apartments from 18 to 32 m2 are required. Inspectors are sent to the home, whose task is to assess the condition of the home and communications. If there are deficiencies, the seller is required to eliminate them. The condition of the apartment should allow a new tenant to settle in immediately.

Required documents

The sale of residential property to a municipality does not require additional documentation from the seller. The list of papers required for drawing up and signing an agreement is standard:

- a document confirming the existence of proprietary rights to the living space being sold;

- if the apartment has several owners, each of them must agree to the transaction;

- certificate of the number of registered (registered) citizens;

- extract from Rosreestr;

- certificate from housing and communal services about the absence of debts;

- sample agreement for the purchase and sale of residential premises.

Additionally, you may need technical documents confirming the habitable condition of the apartment, as well as (if necessary) an expert opinion determining the market price of the home.

In fact, the sale of living space to the municipality is identical to the sale to a citizen. The main feature of such agreements is that the transaction is carried out through tenders. Conditions regarding the condition of the home are also not specific and meet the requirements of the average buyer.

If you have any questions, you can ask them free of charge to the company’s lawyers in the form provided below. An answer from a competent specialist will help you make the right decision.

![]()

Sale of an apartment to the city administration

People who are interested in how to sell an apartment to the city administration are mainly homeowners, for which there has been no demand for a long time among individuals and commercial organizations.

Such a transaction is quite possible, since the law does not in any way limit the list of entities entitled to buy or sell real estate, including housing. Therefore, the city administration may be among the buyers.

She has the same rights and responsibilities as any of them.

Selling Features

The sale of an apartment to the city administration does not require any additional documents, except for the documentation that is necessary to conclude a standard purchase and sale agreement provided for such transactions with real estate between subjects of civil law. Housing legislation in this case does not impose any additional conditions either for the seller of housing or for the buyer represented by the administration of the city or any other locality.

Many homeowners are confident that as soon as they want to sell their home to the city administration, it will simply be obliged to buy it. In fact, this is absolutely not true.

The administration, like any other buyer, has the right not to purchase any property that is not suitable or not required. No matter what benefits the seller has, they do not give him the right to forcefully sell housing to anyone.

In this case, it is useless to demand from the administration a guaranteed purchase of living space, and even more so to sue it.

Thus, housing appears in Russia that no one needs, including its owner. How can the latter get rid of excess living space, and therefore the need to make utility bills, pay taxes, insurance, etc.

? Although the administration has the right not to buy unnecessary housing from the owner, it can help him avoid unnecessary expenses. To do this, a statement of refusal to use your own housing is sufficient.

This gives the administration of the locality the right to independently dispose of this living space in the future.

Often the administration buys housing from individuals through an open competition.

In this case, the contract may include a clause stating that when concluding a contract with the city administration, an individual, having sold the living space, is obliged to pay taxes associated with the paid contract.

This in no way means that the seller must make any tax payments for the buyer, that is, in this case, for the city administration. We are talking only about paying tax on income received by an individual as a result of the sale of his property.

Can such a contract negotiate conditions related to the inclusion of utility bills in the price of housing that has become the subject of sale? Here, the options are significantly limited by the Housing Code of the Russian Federation, Article 153 of which states that only the owner is obliged to pay for utilities from the moment he acquires ownership rights.

Realtor help

In recent years, offers from realtors to individuals to sell housing to the city administration as part of one or another social program (providing housing for orphans, assistance to refugees, etc.) have become more frequent.

Can the administration purchase residential space using the services of realtors? The law does not prohibit her from resorting to the help of intermediaries, which means this is quite possible and is not necessarily fraud.

However, the possibility of a dishonest deal on the part of the intermediary cannot be ruled out.

The fact is that although the law does not prohibit the city administration from purchasing housing through realtors, internal orders of its leaders may prevent this in order to save budget funds.

Therefore, before concluding an agreement with a realtor to sell housing to the city administration, it is worth familiarizing yourself with the regulations that the latter follows when purchasing living space.

This will help avoid misunderstandings and avoid becoming victims of scammers.

Even if a transaction with a realtor is completely legal, this does not guarantee that the seller of the property will not be put at a disadvantage. To understand this, it is enough to familiarize yourself with the mechanism for selling housing to the city administration through intermediaries.

Having collected information about the living space intended for sale, the realtor offers the owner a guaranteed sale of his home within the framework of one or another regional initiative (for the accommodation of orphans, assistance to refugees, etc.). At the same time, the intermediary claims that only he has access to the administration necessary to organize the purchase.

As a result, the seller often overpays the intermediary, giving him an amount that is a significant part of the cost of the home.

How to avoid overpayment?

- First, the seller should always be aware of the real value of his home and set appropriate conditions when concluding a contract.

- Secondly, it is better to discuss the intermediary’s remuneration not in a specific amount, but as a percentage of the transaction value.

- Finally, the best option is to contact the city administration directly, which is actually rarely difficult. After all, if officials are interested in buying housing, the resources at their disposal give them the opportunity to independently find the owner and negotiate with him directly.