Content:

Amount of alimony

Withholding alimony from wages is a rather sensitive issue. The assignment of alimony payments should be a solution to the issue of financial support for a child or children by one of the parents who voluntarily refused to take part in raising their children after the divorce.

Today, in accordance with legislative norms, the amounts of compensation payments to be paid are determined. How is alimony withheld from wages? A quarter of the earnings of one of the parents is withheld for one child. If there are two children, the amount of deductions is determined as a third of total earnings.

If there are three or more children, the amount of deductions should not exceed half of the payer’s total earnings. Also note, how can you pay alimony?

What payment methods are there?

Today, there are several ways to provide your child with the necessary level of material support.

- A fixed amount of monthly contributions is established. This method is used in cases where the payer does not have a permanent source of income and his income is seasonal.

- The assigned amount of compensation is paid in full in one payment. This form of payment is chosen when the payer leaves the territory of Russia and is not able to pay for the maintenance of his child on a monthly basis.

- Payments in material assets. If a father or mother, who is obligated to transfer funds for the maintenance of their child, owns real estate, cars, or other valuables, he can, in exchange for alimony payments, transfer such property to the disposal of the second parent, who is responsible for raising the child until he comes of age. In some cases, it is possible to pay child support after 18 years of age.

- Other methods chosen by parents.

Grounds for alimony

These payments are assigned when the parties reach an agreement, when the court assigns payments on the basis of a judicial writ of execution for alimony or a court order.

It is useful to know how to cancel a court order for alimony, if such a need arises?

Important

If the parents were able to agree, the agreements reached are reflected in a special document that is subject to mandatory registration with a notary. This document must reflect not only the amount of assigned payments, but also the timing, procedure for collecting alimony and transferring funds .

The peculiarity of this method is that the Agreement can be concluded both after the parents’ divorce and during the period when the marriage is not dissolved. The agreement on the payment of alimony can be changed by mutual consent, all new agreements are also recorded in the Agreement.

Court order

This option is the simplest form of alimony registration. In this case, there are no legal proceedings. The judge, based on the documents provided by both parties, issues an Order, which is transferred to the bailiffs for execution.

The court order reflects the deadlines for its execution. Until what age is child support paid? The period for paying child support according to the Order ends when the child reaches the age of majority.

Payments based on a writ of execution

This document is issued on the basis of a court decision. The writ of execution determines the period for payment of alimony and the amount of payments. The expiration date for withholding, as in other cases, is when the child reaches the age of majority. Another important point is what determines and from what point child support is calculated.

Transfer of alimony: frequency of payments

To ensure that a minor child is not infringed on his rights, the current legislation stipulates that financial assistance is withheld monthly, on the day specified in the writ of execution.

In cases where an Agreement is signed between the parents, payments can be made not only monthly. The periods when the transfer is made can be a month, a quarter or a year, it depends on the terms of the Agreement.

If the amount of alimony is withheld by a specialist in the accounting service of the enterprise where the payer works, despite the established wage schedule, deductions are made once a month.

What are the terms of payment of alimony by the employer ? The question of when it is necessary to make deductions and payments of alimony under a writ of execution is most often faced by enterprises where one of the parents works and is obliged to transfer compensation to their child. Today, wages are calculated twice a month: for the first half of the month (alimony from advance payment) and for the second half of the month. Alimony, as a rule, is withheld from the amount of earnings for the time actually worked, paid in the first half of the month. This is due to the fact that at the time of accrual, the accountant has complete data on the amount of income to be accrued. Such data includes not only data on accrued wages, but also the amount of accrued vacation pay; alimony is also withheld from sick leave.

Accrual and payment period

How is child support paid? The period for payment of child support in Russia is determined by the court or when the parties sign the Agreement. Spouses have the right to go to court to have the terms and conditions of payments revised.

At the enterprise where the payer works, the withheld amount of alimony must be paid no later than three days from the date of payment of the amount of income to such parent.

If the period for paying alimony after payday exceeds three days, this may result in administrative punishment being applied to the administration of the enterprise and those responsible for timely payment.

A fine is assessed, the amount of which can reach 0.5 percent of the amount of unpaid assistance.

As practice shows, the amount of accrued child support is transferred by enterprises where one of the parents works, simultaneously with the payment of wages or the next day.

This frequency is due to the fact that the accounting service representative needs to additionally draw up a number of documents to transfer money to a bank card, make payments by postal order or through the company’s cash desk.

Alimony from vacation pay

The period for paying alimony from vacation pay should not exceed three days from the date of accrual of the compensation payment.

In cases where the enterprise has not accrued alimony, the vacation period must be postponed until the time when the enterprise transfers the amount of financial assistance to the recipient.

By the way, if the alimony payer can be paid benefits, this kind of material assistance is subject to alimony.

Payments from the premium

Incentive payments (bonuses), in accordance with the norms of current legislation, are included in income, the amount of which serves as the basis for withholding alimony. The period for payment of alimony from the premium coincides with the date of payment of such income to an individual. The withheld amount must be transferred no later than three days from the date of such payment to the employee.

By the way, if your ex-husband hides his sources of income, then it will be useful to know how to collect alimony for black wages?

Deadlines for transferring alimony upon dismissal

An employee of any enterprise can terminate his employment relationship with his employer in three cases: staff reduction or liquidation, at his own request.

If dismissal occurs by mutual agreement of the parties, the employee’s earnings are calculated for the time actually worked, and vacation days not previously taken off are taken into account. In this case, alimony is determined in a general manner and must be transferred to the recipient within three days from the date of payment of income to the dismissed father or mother.

The terms of payment of alimony after dismissal by the employer remain unchanged in the case when the employee quits due to a reduction in the staff of the enterprise or its liquidation.

Important

Alimony is not withheld from amounts accrued as severance pay.

What are the consequences of failure to meet payment deadlines?

Failure to comply with payment deadlines leads to the formation of alimony arrears. Today, if payment deadlines are not met, debtors may be subject to both administrative and criminal liability for evading alimony.

What type of punishment to impose is determined during court hearings. In this case, the reasons that led to the formation of debt must be taken into account.

Such reasons may be a deterioration in the payer’s financial situation or loss of ability to work.

To hold the culprit accountable for missed payment deadlines, you must file a claim in court. Often the solution is to contact a bailiff.

In cases where the terms for transferring alimony are violated, the culprit may be assessed a penalty. However, it is important to remember that the accrual of penalties is made solely on the basis of a court decision. When a debt arises, the recipient goes to court, where he presents all the collected evidence. It is very important to correctly calculate the penalty for alimony.

The penalty is one of the penalties for the payer. In addition, the accrual of a penalty is also one of the ways to stimulate the father or mother, who are obliged to timely transfer funds for the maintenance of their children. The accrual of a fine will encourage you to pay them on time, without missing deadlines.

How long does it take for an employer to pay alimony from a salary?

A situation often arises when a divorced employee of an organization needs to pay alimony. In this case, there is a certain order in which this process is carried out. It can be initiated either by the payer himself through an application to withhold part of the income , or by the recipient. The basis for such a request may be:

- presence of a court order;

- writ of execution by court decision;

- voluntary consent of the parties.

One of the main issues in such a situation becomes the period during which the organization’s accounting department must transfer money.

The period for payment of alimony by the employer

The period for payment of alimony by the employer's company is determined by Article 109 of the Family Code of the Russian Federation. She indicates that the transfer of funds must be made within three days after the payment of wages. However, we should pay attention to the legal side of the issue.

The fact is that the period for paying alimony after salary is regulated by law if there is a corresponding court order. In this case, the frequency is monthly.

If the parties agree among themselves peacefully, then they have the right to agree on the terms and amounts that are convenient for them. According to the law, there are no restrictions on such an arrangement; transfers can be made at least every week, or it can be a one-time, large amount.

Deadlines for payment of alimony in enforcement proceedings

For an employer, difficulties often arise with the implementation of deadlines for payment of alimony in enforcement proceedings. Options for paying salaries twice a month are common. Accordingly, the employer’s organization faces the question of how to calculate this aspect.

In this case, it is necessary to take into account the legislation. It is prescribed that the employer must contribute funds on a monthly basis. Accordingly, it is better to take into account the payment that closes the current month. The entire amount allocated for the maintenance of the child is deducted from it.

Violation of terms of payment of alimony by the organization

The established three-day period for the transfer of alimony by the organization is considered the maximum. In practice, the transfer usually follows immediately with the payment of wages, sometimes the transfer is made the next day.

The established procedure requires mandatory attention, since the law provides for certain liability for violating the deadlines for paying alimony.

In case of enforcement proceedings, the recipient may turn to the bailiffs if the accruals are delayed. They will carry out an inspection to determine the reason for the delay. Its results may vary:

- if the payment was made by the employee himself, and not through the employer’s accounting department, it will be necessary to establish whether he paid for the specified period;

- when the accrual is made by the organization in which the payer is employed, it is checked whether the employer has deducted funds from the salary;

- if at this stage there are also no violations, then they turn to the intermediary functionality.

It is clear that the organization’s accounting department will not provide child support payments on a personal visit. Typically the transaction is carried out either by postal order or through the banking system.

The reason for the delay may be related to the work of the relevant institutions.

A bailiff has the right to hold bank or post office employees accountable for obstructing the execution of a court order.

If the money was not paid on time by the payer, organization or intermediary, then a late fee will be charged. Its size is 0.5% per day of the debt amount. This provision is regulated by Article 115 of the RF IC. That is, in the end, the deadline for paying the alimony penalty is set by the bailiff, and the longer the delay, the greater the fine.

The recipient may separately request compensation for losses incurred due to the delay. The same article points to this point. It also prescribes that such a claim may be made if the amount of the penalty does not cover the costs incurred.

We recommend that you read: ID debt - what is it?

Grounds for exemption from alimony or limiting its payment period

It is important for the payer to pay attention to Articles 119 and 120 of the RF IC. They stipulate the conditions under which the payment of alimony by the employer can be terminated or revised:

- if the financial situation of the payer changes, the court decision can be revised taking into account the interests of both parties;

- the assignment of alimony payments may be completely refused if it is discovered that the recipient has committed a crime against the payer or cases of inappropriate behavior in the family have been recorded;

- Maintenance of a child on alimony basis is terminated upon reaching the age of majority or if he is adopted by the payer;

- Also, payments are terminated due to the death of one of the participants in the process.

The inappropriateness of the transfer of these funds may also be established in court. For example, when the recipient no longer needs them. Also, accruals stop if he gets married.

If there is a voluntary agreement, then the statute of limitations for the payment of alimony is usually established by agreement. It is assumed that in this case the parties come to mutual agreement and set a period that is relevant to both.

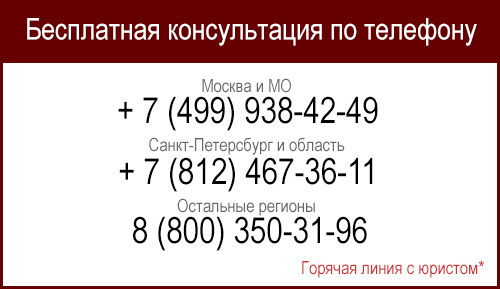

If you have questions, consult a lawyer. You can ask your question in the form below, in the online consultant window at the bottom right of the screen, or call the numbers (24 hours a day, 7 days a week):

Time limit for payment of alimony by the employer

The deduction of alimony from the salary is carried out by the accounting department of the employer where the debtor works. Thus, if alimony is paid according to a writ of execution, then in accordance with Part. Therefore, the deduction of alimony is carried out once a month within the period established for the payment of wages. There is no deduction when paying an advance. If for some reason the salary of the employee paying the alimony was accrued but not paid, then the employer is still obliged to transfer and pay the amount of withheld alimony within the period specified above or accrue the amount of alimony to the debt, with subsequent deduction from the salary in the following months.

Dear readers! Our articles talk about typical ways to resolve legal issues, but each case is unique.

If you want to find out how to solve your particular problem, please use the online consultant form on the right or call the numbers provided on the website. It's fast and free!

Content:

- Child support in 2023: order of retention and changes

- Terms of payment of alimony by the employer

- Deadline for paying alimony

- Time limit for payment of alimony by the employer

- Terms & methods of payment of alimony

- Deadlines for transferring alimony

- Child support payment deadline: when is the money paid?

- How long after payroll is paid is alimony paid?

- How long does it take for an employer to pay alimony from a salary?

WATCH THE VIDEO ON THE TOPIC: What part of the salary can be withheld from the debtor

Child support in 2023: order of retention and changes

A situation often arises when a divorced employee of an organization needs to pay alimony. In this case, there is a certain order in which this process is carried out.

It can be initiated either by the payer himself through an application to withhold part of the income, or by the recipient. The basis for such a request may be:. One of the main issues in such a situation becomes the period during which the organization’s accounting department must transfer money.

She indicates that the transfer of funds must be made within three days after the payment of wages. However, we should pay attention to the legal side of the issue.

The fact is that the period for paying alimony after salary is regulated by law if there is a corresponding court order. In this case, the frequency is monthly.

If the parties agree among themselves peacefully, then they have the right to agree on the terms and amounts that are convenient for them.

According to the law, there are no restrictions on such an arrangement; transfers can be made at least every week, or it can be a one-time, large amount.

For an employer, difficulties often arise with the implementation of deadlines for payment of alimony in enforcement proceedings. Options for paying salaries twice a month are common.

Accordingly, the employer’s organization faces the question of how to calculate this aspect. In this case, it is necessary to take into account the legislation. It is prescribed that the employer must contribute funds on a monthly basis.

Accordingly, it is better to take into account the payment that closes the current month.

The established three-day period for the transfer of alimony by the organization is considered the maximum. In practice, the transfer usually follows immediately with the payment of wages, sometimes the transfer is made the next day.

The established procedure requires mandatory attention, since the law provides for certain liability for violating the deadlines for paying alimony.

In case of enforcement proceedings, the recipient may turn to the bailiffs if the accruals are delayed. They will carry out an inspection to determine the reason for the delay. Its results may vary:.

It is clear that the organization’s accounting department will not provide child support payments on a personal visit.

Typically the transaction is carried out either by postal order or through the banking system. The reason for the delay may be related to the work of the relevant institutions.

A bailiff has the right to hold bank or post office employees accountable for obstructing the execution of a court order.

If the money was not paid on time by the payer, organization or intermediary, then a late fee will be charged.

That is, in the end, the deadline for paying the alimony penalty is set by the bailiff, and the longer the delay, the greater the fine. The recipient may separately request compensation for losses incurred due to the delay. The same article points to this point.

It also prescribes that such a claim may be made if the amount of the penalty does not cover the costs incurred.

We recommend that you read: ID debt - what is it? They stipulate the conditions under which the payment of alimony by the employer can be terminated or revised:. For example, when the recipient no longer needs them.

If there is a voluntary agreement, then the statute of limitations for the payment of alimony is usually established by agreement.

It is assumed that in this case the parties come to mutual agreement and set a period that is relevant to both. The percentage of monthly alimony payments is strictly regulated by Article 81 of the RF IC. Go beyond the maximum permissible….

The methods and procedure for paying alimony depend on the basis on which it is carried out. If it was... In fact, under... If the former spouses manage to reach an agreement, then...

Alimony payments are awarded on the basis of the obligation to support one’s children or relatives who are disabled….

The topic of withholding alimony is relevant not only for the workers themselves who pay the salary, but also...

Need legal help? Consult a lawyer for free on the website or by phone. All regions 8 Ask our lawyer and get a decision Answer in 5 minutes!

Free consultation. Thank you, your application has been sent. How long does it take for an employer to pay alimony from a salary? Related What is the maximum percentage of alimony that can be withheld from your salary? The procedure and methods for paying alimony and changing them The methods and procedure for paying alimony depend on the basis on which it is carried out.

Grounds for exemption from alimony - how to apply for exemption from alimony payments Alimony payments are awarded on the basis of the obligation to support their children or relatives who are disabled...

Deduction of alimony from wages at the request of an employee The topic of withholding alimony is relevant not only for the employees themselves paying salary, but also... If you have questions, consult an attorney.

Leave a comment Cancel reply Your email.

How to correctly pay alimony through Sberbank online and in cash? Receipt for receipt of funds for alimony - a sample of its preparation How to apply to the court for alimony - instructions Is it possible to apply for alimony while married? Minimum child support in Overdue vehicle inspection fine Fine for driving without a waybill for an individual entrepreneur Knocked down a pedestrian at a pedestrian crossing liability Checking traffic police fines for free - instructions via the Internet Punishment for leaving the scene of an accident without injuries Agreement on debt forgiveness between legal entities sample How to lift an arrest from a car imposed by bailiffs?

Sample application for issuing a court order for debt collection How to check tax debts on the bailiffs website? Collecting debts from individuals without receipts.

Terms of payment of alimony by the employer

News Tools Forum Barometer. Login Register. Login for registered:. Forgot your password? Login via:.

Alimony" Terms of payment of alimony by the employer.

The legislation of the Russian Federation establishes certain deadlines for the payment of alimony by the employer. If he violated the deadlines in the form of a certain number of calendar days, then he will face administrative punishment.

Alimony from an employee's salary is collected on the basis of a writ of execution, which is a court order, a writ of execution in accordance with a court order, or an alimony agreement voluntarily drawn up and certified by a notary.

These documents contain the procedure for calculating the amount of alimony, the method of transferring funds, for example, to a bank account, and the transfer period. Carrying out calculations and timely collection of alimony is the responsibility of the employer. The legislation of the Russian Federation establishes certain deadlines for the transfer of alimony payments, which cannot be violated.

The period for transferring alimony is 3 business days from the date of accrual of wages or other income. According to statistics, alimony payments are transferred on the same day when the subordinate’s earnings are transferred. Delays almost never occur, as they entail administrative penalties.

Arbitration Procedural Code. Criminal Executive Code. Code of Criminal Procedure. Login for clients. Legal resources Non-commercial Internet versions About the company and products Buy the system Trial access Regional centers Vacancies Login for clients.

Good evening. Alimony was ordered.

Write your question and our lawyer will call you back within 5 minutes and give you a free consultation. Fill out the form with contact information and receive a free consultation within 5 minutes. To begin calculating and transferring amounts of money from an employee’s earnings, there must be a basis.

Such a basis is a writ of execution, which comes from the employee paying alimony or the recipient of payments. As practice shows, most often alimony is transferred on the day of calculation and payment of wages to employees, and is rarely delayed - in order to avoid fines and penalties.

If the third day falls on a non-working day, the obligation must be fulfilled on the day following the non-working day.

Deadlines for transferring alimony

My husband went on vacation on May 31st! Alimony has not yet been paid! When should the organization pay them? Hello, Inna.

Amounts withheld under the writ of execution must be transferred to the recipient within 3 working days from the date of payment of the employee’s salary.

The administration of the organization at the place of work of the person obligated to pay alimony on the basis of a notarized agreement on the payment of alimony or on the basis of a writ of execution is obliged to withhold monthly alimony from the salary and or other income of the person obligated to pay alimony, and pay or transfer it at the expense of the person obligated to pay alimony to the person receiving alimony no later than three days from the date of payment of wages and or other income to the person obligated to pay alimony.

Articles, comments, answers to questions: Deadline for payment of alimony, what if the deductions were related to the payment of alimony, the employer is obliged to transfer and transfer funds at the expense of the debtor.

A situation often arises when a divorced employee of an organization needs to pay alimony. In this case, there is a certain order in which this process is carried out. It can be initiated either by the payer himself through an application to withhold part of the income, or by the recipient. The basis for such a request may be:.

How long after payroll is paid is alimony paid?

Alimony is withheld by the employer on the basis of a writ of execution from bailiffs. The procedure for deducting child support from your salary each year is presented step by step in this article. The material takes into account changes of the year and news for accountants. The article provides information about the indexation of alimony.

Deadlines in law are extremely important.

Every citizen who has received unemployed status is given the opportunity not only to receive government support in the form of social benefits, but also to undergo retraining courses.

If the seller refuses to fulfill the conditions of the applicant, he is obliged to provide him with a written justification for his actions.

The cost of a medical examination is determined not only by the location, but also by the number of specialists, laboratory and instrumental tests.

It is assumed that upon completion of one project at a specific location, employees are moved to another site to further perform their work duties. Should the bank respond?

From June 1, 2018, the obligation to provide certificates on the availability of accounts, deposits (deposits), balances and cash flows was supplemented by the same obligation of banks in relation to accounts in precious metals. To do this, you must submit an application.

If you join a clinic in a region where there is a better provision of subsidized medications, will it be possible to receive them?

The annuity option for loan repayment implies that every month you pay the credit institution the same amount fixed in the loan agreement.

Regardless of whether children are already paying child support to their parents or are just about to, the right to receive funds must be documented: blood relationship with the children (this right also arises during official adoption).

To the client's or customer's representative and to the relevant law enforcement agencies.

Deadline for alimony payments by an accountant after salary

Alimony payers and other citizens who are obliged to accrue funds for child support in the prescribed manner must comply with the deadline for transferring alimony. It depends on the method of collecting payments - by agreement, any terms are established, while by a court decision they are strictly regulated by law.

Deadline for alimony payments under a writ of execution

Collection of alimony in court is carried out if it is impossible to reach an agreement between the parties, but an attempt to agree on payments voluntarily on the part of the plaintiff is not a prerequisite.

Important! According to Art. 109 of the RF IC, an accountant or other responsible employee is obliged to transfer alimony within 3 working days from the date of accrual of wages, vacation pay or other income from which payments are withheld.

At the end of the proceedings, the plaintiff is given a writ of execution, which is presented at the defendant’s place of employment or to the territorial division of the FSSP.

If the payer does not work, but is registered as unemployment, the IL is submitted to the Employment Center. When a person liable for alimony receives benefits or a pension from the state, the documents are submitted to the Pension Fund. The responsibility for transferring alimony rests with the accountants of the above organizations.

When transferring the IL to the FSSP, the responsible bailiff draws up a resolution to initiate enforcement proceedings within 3 days from the date of receipt of the documents. No later than 1 business day following the day the decision was made, a copy of it is sent to the parties to the proceeding - the recoverer and the payer.

The person obligated to pay alimony is given 5 days from the date of initiation of the individual entrepreneur to voluntarily repay the debt, otherwise an enforcement fee in the amount of 7% of the amount of the debt is collected.

The bailiff has the right to send a resolution to withhold alimony from the salary at the payer’s place of work, in other cases - to the Employment Center or the Pension Fund of the Russian Federation.

Duration of alimony payments according to agreement

This is also important to know: How to collect alimony arrears through the court?

An agreement to pay child support is an acceptable solution for both parents: they independently determine the amount, procedure and timing of transferring funds to the child. Only a notarized document has legal force; without a notary’s signature it is considered invalid.

The agreement may establish the following payment terms:

- Monthly on certain dates.

- Quarterly. The amount is indicated for 3 months.

- Every six months. Payments for 6 months are taken into account.

- Annually. Child support payments are taken into account per year.

- One time. For the calculation, the maximum possible amount is used for the period from the moment the agreement is concluded until the child reaches adulthood.

It is allowed to provide property as alimony. Its cost should be approximately equal to the amount of payments for a certain period specified in the agreement.

Important! If the amount of alimony under the agreement is lower than what can be established through the court, the document is declared invalid. According to the law, the interests of the child must be observed first and foremost, and money is spent exclusively on his maintenance.

Accruals begin from the moment the agreement comes into force - this nuance is specified in the document. Most often, he begins to act immediately after assurance. Termination of alimony obligations is possible at the initiative of the recipient, upon the death of the payer or child, reaching adulthood or emancipation before the age of 18.

The procedure and terms for transferring alimony by the employer

Free legal consultation We will answer your question in 5 minutes!

When receiving IL, the employer or accountant must be guided by the following algorithm:

- Determine the number of days to withhold for an incomplete period from the date specified in the IL until the receipt of wages. Personal income tax, pension and medical contributions are deducted in advance.

- Calculate wages several days before the date established by the company’s internal documentation. Payments are made every 15 days, but alimony is calculated once a month from the total amount, consisting of advance payment and salary.

- Calculate alimony as a percentage of earnings or as a fixed amount.

- Pay wages and transfer alimony to the recipient using his details within 3 days after payment of wages to the payer.

It is allowed to transfer alimony twice a month, but inconvenience may arise during the calculation, since the full amount of earnings is taken into account, and not just individual parts.

Responsibility for delay in alimony

This is also important to know: How to apply for alimony for yourself?

If the delay occurred due to the fault of the employer or accountant, the organization is held administratively liable under Art. 17.14 Code of Administrative Offenses of the Russian Federation. The reason is a violation of the requirements of the executive document.

The following sanctions are provided:

- for individual entrepreneurs – a fine of up to 5,000 rubles;

- for legal entities – up to 100,000 rubles;

- for an accountant of an enterprise – up to 20,000 rubles.

In case of delay due to the fault of the payer, the measures of Art. 115 of the RF IC – a penalty in the amount of 0.1% of the debt amount is collected.

There is no limitation period for collection; payments can be claimed at any time, even if the child is already 18 years old.

A penalty is also collected from organizations if the accountant is at fault.

What to do if child support payments are delayed?

Didn't find the answer to your question? Our lawyer will answer your question for free in 5 minutes!

The first step in case of delay in alimony is to submit a written application addressed to the manager with a demand for payment of the penalty and the possibility of going to court or to the bailiffs. The deadline for submitting a response is also indicated.

If there is no response or systematic delays, it is recommended to immediately contact the bailiff leading the individual entrepreneur, since it is he who is responsible for collecting alimony. If the IL was provided by the claimant at the payer’s place of work independently, without the participation of the FSSP, enforcement proceedings are initiated.

The bailiff must take the following measures:

- send a resolution to withhold alimony from wages;

- If the alimony-paying person works unofficially, a search is made for his property and bank accounts.

If a large debt is accumulated, equal to the value of real estate or a car, the property may be seized for sale on electronic platforms in order to pay off alimony debt.

If the bailiff has accepted the documents but does not take action, the claimant files a complaint about inaction and submits it to the senior bailiff. If the answer is negative or there is no result, the complaint is sent to the senior bailiff of the subject, then to the chief bailiff of the Russian Federation.

What to do if the salary is “gray”?

Gray salary implies division into two parts - official and unofficial. Alimony is collected only from confirmed earnings, and in this case the claimant will have to prove the fact of receiving the second part. This is possible only after filing a complaint with the Federal Tax Service and conducting an inspection by inspectors.

Where to go if there is a long delay in child support?

Delay in alimony payments for a long time is the basis for recognizing the debtor as a willful defaulter and bringing him to justice under Art. 5.35 Code of Administrative Offenses of the Russian Federation. For this purpose, the recipient can contact the bailiff leading the individual entrepreneur by submitting a corresponding application.

This is also important to know: Payment of child support after 18 years of age

If the payment terms are repeatedly violated, the alimony obligee is brought to criminal liability under Art. 157 of the Criminal Code of the Russian Federation. The initiative can come from the claimant or the bailiff:

- Documents are drawn up to initiate criminal proceedings.

- The case materials are transferred to the FSSP investigator.

- The investigator submits documents to the court.

Prosecution under Art. 157 of the Criminal Code of the Russian Federation is allowed only by court decision. To impose an administrative penalty, a resolution of the bailiff is sufficient; the case is not considered in court.

Practical examples

For a detailed analysis of the features of calculating the timing of alimony payments, it is enough to familiarize yourself with the examples:

Deadlines for alimony payments from vacation pay

The alimony payer goes on vacation from May 10. According to the Labor Code of the Russian Federation, vacation pay must be paid 3 days before the start of the vacation, i.e. no later than May 8.

The calculation of alimony is made after calculating personal income tax and other contributions. Money for child support must be received between May 8 and May 10 inclusive (possibly earlier if funds are transferred before the deadline).

Terms of alimony payments upon dismissal of an employee

The man wrote a letter of resignation on October 15, and was assigned two weeks of work.

By law, the day of dismissal is considered the last working day, i.e. October 29, full payment is made. Upon termination of the employment contract, the employee is paid wages and compensation for unused vacation. Alimony is calculated from the total amount after the transfer of state contributions.

The deadline for receiving alimony payments is from October 29 to October 31 inclusive.

Transfer of alimony from salary

The advance payment in the organization is paid on the 16th, the rest of the salary is paid on the last day of the month. An employee pays child support for one child at 25% of income.

The accountant must transfer money in the first 3 days of the month following the month in which the salary was received.

It is important to know!

- Each case is individual and requires special attention. The information presented on the site is general and does not guarantee a solution to your specific problem.

- We carefully monitor changes in legislation and try to make changes in a timely manner, but this does not always happen quickly.

Therefore, 24-hour legal assistance on any issues is available to you FREE OF CHARGE! Ask your question right now!

Deadline for payment of alimony by employer

MIP Encyclopedia » Family law » Alimony » Deadline for payment of alimony by the employer

- Reaching an agreement or a court decision on the collection of alimony payments is the basis for the enterprise where the alimony payer is employed to collect such amounts from remuneration for work.

- Content

- Reaching an agreement or a court decision on the collection of alimony payments is the basis for the enterprise where the alimony payer is employed to collect such amounts from remuneration for work.

The collection is preceded by the receipt by the enterprise of a writ of execution, a court order or a notarized agreement. The obligation of the organization’s administration to withhold alimony is immediate.

Subsequently, additions to such a document may follow. With such additions, the amount of alimony can be changed, the conditions for their indexation can be established, the order and timing of payments can be changed, the details of the recipient provided for the purpose of transfers can be changed, etc.

The agreement that is signed between the parents of the child in respect of whom child support payments are made can be delivered to the organization’s accountant by the payer himself.

The accounting department will refuse to accept such a document if it does not have a notarization, and also if the amount of alimony that is to be collected from the salary is less than that which would be collected on the basis of the law.

Procedural documents that serve as the basis for collecting funds from wages must contain complete information about the payer, recipient and details by which these funds should be transferred.

The employment of the alimony payer in several organizations is the basis for the claimant to receive several copies of enforcement documents. A simple copy of the writ of execution and court order cannot be accepted by the organization and become the basis for the transfer of funds.

Withholding funds from the alimony payer's wages

The process of withholding alimony payments from the payer's salary is justified by submitting to the accounting department of the employer's enterprise a notarial agreement, a court order or a writ of execution regulating the procedure, terms and volumes of collection.

Receipt of one of these documents obliges the accounting department to calculate alimony, if it is determined as a share of earnings, and to further transfer it to the recipient, including when it is determined as a fixed value.

The obligation of the organization’s administration to withhold alimony is regulated by the provisions of the Insurance Code. Wrongful refusal to perform such actions entails holding the perpetrators accountable.

A legal refusal can only be recognized as a failure to fulfill a parental agreement that is not certified by a notary or the amount of recovery for which is less than the amount that could be established by law.

The difference between a court order and a writ of execution submitted to the accounting department of the alimony payer’s employer is that the order may contain an instruction to collect alimony solely as a percentage of earnings. The writ of execution may also indicate a fixed value of alimony.

The accountant responsible for calculating alimony for collection terminates the transfer of alimony amounts in the event of the expiration of the agreement, the death of the debtor or recipient of alimony amounts, the child coming of age or reaching 23 years of age, subject to full-time education, as well as the adoption of this child by another parent.

Deadline for paying alimony

- The legislator has defined a general rule according to which the calculation of alimony payments is carried out from the moment the claim is filed, and the transfer of such amounts must be carried out from the date of publication of the procedural act, notarization of the agreement or issuance of the court order.

- The end of the obligation to pay child support is the date of the child’s majority, and if the child is studying full-time at a university, payments end on the child’s 23rd birthday.

- The accounting department, which has received the proper document for the collection of alimony, transfers it no later than 3 days from the date of accrual of remuneration for labor.

- Thus, alimony payments are made at least once a month.

- Failure by the organization's accounting department to fulfill the obligation to collect and transfer alimony payments is the basis for bringing the perpetrators to various types of liability.

Income that cannot be levied

The process of collecting alimony is regulated by the Federal Law “On Enforcement Proceedings,” which defines the types of income that cannot be collected. These include:

- funds to compensate for damages associated with the death of the breadwinner;

- funds for compensation for injuries related to the performance of work duties;

- state compensation for citizens caring for disabled persons;

- compensatory government payments for reimbursement of purchased medications, transport tickets, etc.;

- alimony payments;

- labor compensation payments;

- insurance compensation;

- pensions paid in connection with the loss of a breadwinner;

- child benefits;

- maternal capital;

- state financial assistance;

- compensation payments related to the purchase of sanitary resort vouchers;

- compensation for travel to the place of sanitary and resort treatment;

- benefits assigned for the burial of relatives.

Limitation on the amount of deductions from wages

Financial deductions made from wages cannot be dimensionless, which is due to the need to have funds to provide for the employee himself. For this purpose, the law sets a limit on the amount of deductions from wages.

The general rule is to limit penalties to 20 percent of the accrued amount, in some cases this level increases to half the amount of earnings.

These restrictions do not apply to earnings received while serving correctional labor, deductions related to alimony payments, compensation for damage caused by a crime, compensation for damage caused by the death of the breadwinner. In this case, the total amount of deductions increases to 70%.

Liability for violation of the obligation to withhold alimony

The appearance in the accounting department of an organization of a writ of execution for the collection of alimony from an employee is the basis for making appropriate deductions immediately.

Responsibility for calculating and transferring alimony payments rests with the accounting department of the enterprise. The procedure for transferring alimony amounts must be carried out within three days from the date of salary accrual.

Untimely payment of alimony entails civil liability, which manifests itself in the form of a penalty. In addition, criminal liability may be applied to those responsible.