- When dividing a mortgage loan or housing taken on a mortgage through a court, a citizen will have to file a statement of claim.

- Let's look at how the main and counterclaims are filed in court for the division of the principal debt on a mortgage, residual debt or property, and we will also give examples of filed claims.

Contents of the statement of claim for division of a mortgage loan

The statement of claim must include the following information:

- Name of the judicial authority to which the claim is filed

- Details of the plaintiff and defendant. Usually these are initials, place of residence, contact and passport information.

- Information about the lender - the name of the banking or credit institution where the mortgage loan was issued.

- The cost of the claim (the amount of loan obligations that must be divided between the spouses).

- The title of the document is “Statement of Claim.”

- Legal relations between plaintiff and defendant. If a marriage was concluded or dissolved, then indicate when, with whom, and exact data.

- The circumstances under which the loan was taken. As a rule, it is necessary to indicate the date and place of the loan, the purpose and purpose of the loan, the total amount of the loan, the amount paid, the amount of the down payment and the remaining balance on the loan. Information must be written down with links to supporting documents (certificates, loan agreement, receipts, checks, bank statements, bank statements).

- References to the norms of family and civil legislation are also provided.

- At the end of the document, claims are stated. Write how the housing mortgage and mortgage loan should be divided.

- In conclusion, a list of documents is required.

- Date of.

- Plaintiff's signature.

- Division of a mortgage loan in a divorce - who pays the mortgage debt and who lives in the apartment after the divorce?

- If you want to indicate other information regarding the issue of dividing the mortgage, describe it in the claim.

- But remember that the document must be drawn up in a strictly official style and comply with the requirements provided for in Article 131 of the Code of Civil Procedure of the Russian Federation.

Rules for filing a claim in court for division of a mortgage

When drawing up and writing a claim, you should adhere to the following rules:

- Draw up a statement of claim in at least 4 copies: for the court, the defendant, the creditor, and also for yourself to confirm the court’s acceptance of the claim.

- You can prepare a claim either in handwritten or printed form. No difference.

- You can only use black or blue ink when writing if you are preparing a handwritten document.

- Print the application on A4 sheet format. By the way, the handwritten version should also be drawn up on the same sheet of paper.

- Place the “header” on the right side of the sheet.

- In the “header” indicate the details of the court, plaintiff, defendant, credit institution.

- Write the title of the document in the middle of the line. You can simply write: “Statement of Claim.”

- Do not use periods or quotation marks after the document title. These are mistakes.

- The main part of the statement of claim should be divided into paragraphs.

- Requirements and list of documents should be presented in digital lists.

- Don't forget to put the date on the day you file your application with the court.

- Avoid offensive language towards the defendant or third parties involved in the case.

- Stick to a formal business style.

Mortgage in case of divorce with children - 6 nuances of dividing the mortgage in case of divorce if there are children in the marriage

If you do not want to write a lawsuit yourself, you can entrust this to a lawyer. Our highly qualified lawyers will help you with this.

Sample and example of a statement of claim to the court for the division of a mortgage loan

You can use the following sample applications for a mortgage loan section.

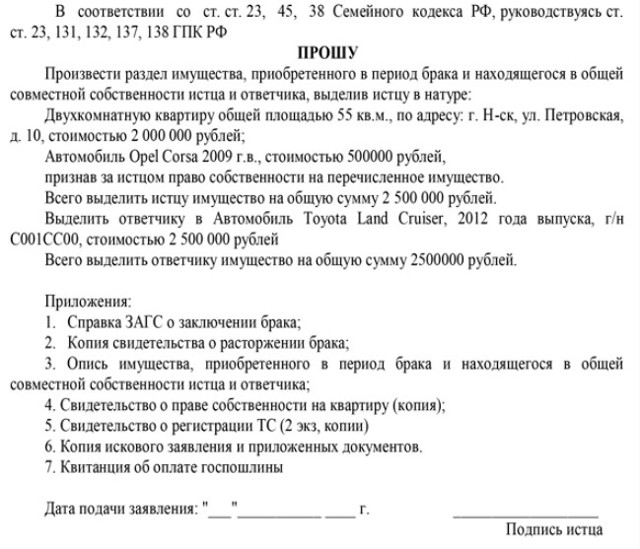

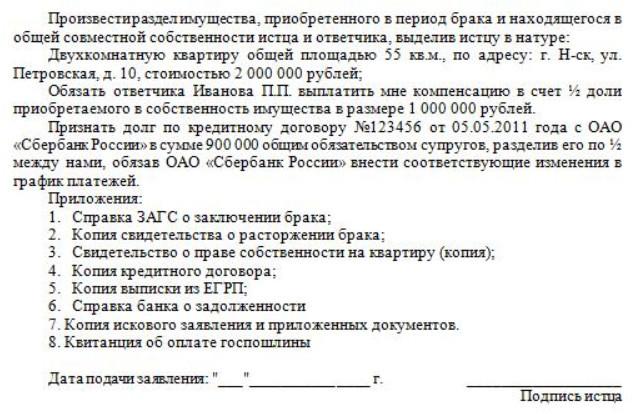

Example 1:

Example 2:

When dividing mortgaged housing, it is worth using a different example when you have to divide jointly acquired property:

There is a combined version of the statement.

An example of a statement of claim to the court for the division of mortgage housing and the loan itself:

Filing a counterclaim for the division of mortgage debt and debt obligations

During a divorce, the defendant can file a counterclaim and put forward demands for the division of debt obligations on a loan, or for the division of a mortgage, or for the division of a mortgaged home.

In any case, you will have to file a counterclaim.

Let us note what data must be included in the counterclaim under the mortgage section:

- Name of the judicial authority, its address, precinct number.

- Information about the plaintiff.

- Defendant's details.

- Document title: “Counterclaim”.

- Information about the date of filing the main claim and the case number.

- Information about the subject of the dispute.

- Arguments about the need to file a counterclaim, about the relationship between the main (initial) and counterclaims. Point out that joint consideration of claims will contribute to a speedy resolution of the dispute between the parties.

- Evidence that confirms all the circumstances listed in the claim.

- Links to legislation.

- The plaintiff's claims on the counterclaim.

- List of attachments to the claim.

- Date of filing the claim, signature of the plaintiff.

Any important information, without which the court considers the demands against the defendant to be unfounded, must be stated in the counterclaim .

This is the same equivalent claim as the main one, but it is only filed from the defendant to the plaintiff.

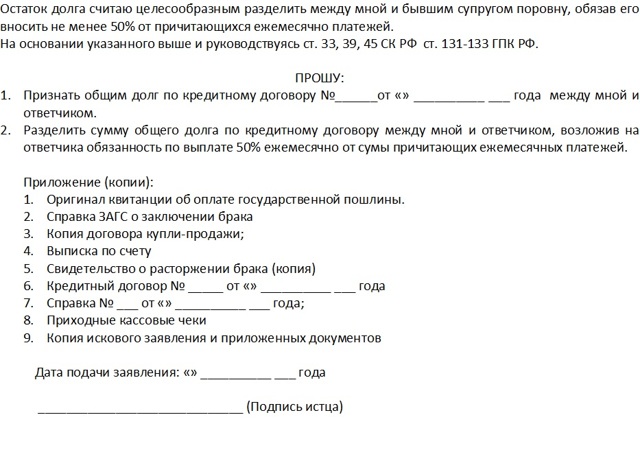

Sample and example of a counterclaim for the division of mortgage debt

A sample counterclaim to court for the division of a mortgage looks like this:

Example of a completed application filed by a counterclaim:

- When filing a counterclaim, follow the same rules as when writing a regular claim.

- But just don’t forget to write down that the claim is a counterclaim.

Still have questions? Just call us:

How is a mortgage taken out during marriage divided when spouses divorce: what to do with the loan, how to divide it, is it possible to refuse? Sample statement of claim

- During a divorce, few spouses manage to avoid division of property, most often scandalous.

- No lesser battles are raging around mortgages - how to pay a mortgage during a divorce, who should do it now that there is no more family?

- An unpleasant surprise for most is the fact that mortgages are not going away.

- In this article we will talk about the question: divorce and mortgage, how is the mortgage divided when spouses divorce?

Dear readers! Our articles talk about typical ways to resolve legal issues, but each case is unique.

If you want to find out how to solve your particular problem, please contact the online consultant form on the right or call +7 (499) 938-51-36. It's fast and free!

Hide content

What happens to the mortgage during a divorce?

How is a mortgage taken out during marriage divided during a divorce? Let's try to figure it out.

According to the law, it does not matter who took the loan, and it does not matter whether the other half acted as a guarantor (Article 39 of the Criminal Code).

It’s best, of course, if the “ex” don’t start anything, but before the breakup they sign a marriage contract and continue to pay the loan as before, and then figure out what to do with the home.

Article 39. Determination of shares when dividing the common property of spouses

- When dividing the common property of the spouses and determining the shares in this property, the shares of the spouses are recognized as equal, unless otherwise provided by the agreement between the spouses.

- The court has the right to deviate from the beginning of equality of shares of spouses in their common property based on the interests of minor children and (or) based on the noteworthy interests of one of the spouses, in particular, in cases where the other spouse did not receive income for unjustified reasons or spent the common property of the spouses to the detriment of the interests of the family.

- When dividing the common property of the spouses, the common debts of the spouses are distributed between the spouses in proportion to the shares awarded to them.

However, the reality is that there are not so many couples who would manage to maintain at least a neutral, let alone good, relationship. The former “doves” categorically do not want to have anything more in common with each other.

In this case, the following scenarios are likely::

- selling the apartment at auction and covering the debt (the remaining amount is divided in half by the ex-husband and wife);

- division in proportion to shares;

- dividing the loan into two equal parts;

- re-registration for one holder, and the second is simultaneously deprived of any rights to living space.

It is clear that this can only be done through the courts. Financial institutions are generally reluctant to make such changes. Thus, dividing a mortgage in a divorce is not an easy matter. And what to do with a mortgage when spouses divorce is of concern to a huge number of people.

A trial is, of course, unpleasant, but even that is not the worst thing. The former “half” may deliberately ignore payments and eventually achieve forced repossession of the home and sale at auction.

There is one more difficulty - the bank can go to court itself, as soon as the spouses “delight” the creditor with the news of the divorce and the application for division of the loan. This is a risky step and is not part of the bank’s plans.

Moreover, even if the payment history is far from perfect (and this is observed among more than half of all mortgage holders in Russia). That is why, before declaring anything, former loved ones need to first agree with each other, and then with an experienced lawyer about further actions.

The latter’s help will definitely be needed if the proceedings with the credit institution nevertheless go beyond the bank office and continue in court; he will help determine how to divide the mortgage in a divorce.

Can the bank require early repayment?

And this will be an absolutely legal step (Federal Law No. 102-FZ, as amended in 2016).

The bank will do the same if there was a large debt at the time of the divorce..

So it turns out that the spouses find themselves in a trap. On the one hand, the issue of payments cannot be resolved through the head of the credit committee.

On the other hand, a requirement for early repayment may follow. It is necessary to decide what to do with the mortgage during a divorce, and for this you need to clearly understand how the mortgage is divided during a divorce.

How to divide a mortgage during a divorce?

To divide a mortgage after a divorce you must:

- the borrower submits an application to the bank, attaching documents (divorce certificate, children’s identity cards);

- the application is reviewed by the credit committee;

- the decision is communicated to the creditor.

How will mortgage terms change after a divorce? As a result, payments are distributed according to one of the following options :

- equally (Article 38 SK);

- according to shares;

- the loan is reissued to one borrower.

- Even if the credit institution refuses for any reason, the court may grant such a request - of course, if both spouses prove their worth as payers.

- And this is the level of income, and work experience, and, among other things, credit history - yes, yes, and they can remember it, because it is assumed that instead of one payer on the loan there will now be two!

- There is a high probability of refusal if the wife did not work for a long time and looked after the children.

It will be much more difficult with distribution into unequal shares. It is impossible to say anything definitely in advance, since each case will be considered individually.

It’s one thing when there is a marriage contract - then there will be fewer questions. Also, the court may (although not a fact) allocate most of the apartment to the person with whom the children will remain.

There may be such an option - the debt will not be divided into two, since in fact there is nothing to take from the person. He either does not work and has never worked, or his income is such that it is clearly not enough to repay the mortgage.

In this case, the apartment, along with the mortgage debt, is completely transferred to the main lender, and the “released” former member of the union is paid compensation (if he claims it)

The bank's decision on the distribution of payments may be positive, but it may also be negative (most often). And then the issue will have to be examined in court. It is better not to try to do this without an experienced lawyer - as practice shows, judges are more inclined to side with banks in controversial issues!

For re-issuance of a loan, the bank has the right to charge an additional commission - from 0.5 to 1%.

Then additional annexes are drawn up to the main loan agreement, which outlines the repayment procedure for each member of the couple.

But you shouldn’t especially hope that everything will work out right away.

Banks really don’t like to grant requests for even simple restructuring and are looking for any clue to refuse. And more often than not, they find it. This is especially true for re-issuing a loan to one holder. A potential candidate will be checked very meticulously for his solvency.

Collection of documents

The following documents will be required for the trial::

- general civil identity cards of husband and wife;

- marriage contract;

- documents for the apartment;

- collateral agreement;

- certificate of termination of marriage;

- birth certificates for children;

- the actual claim;

- state duty receipt.

Going to court

It definitely contains:

- data of the main borrower;

- date of taking out the mortgage, details of the creditor organization;

- characteristics of the apartment;

- data on the second borrower;

- information about the bank’s refusal to make payments;

- requirement to recognize the possibility of allocating shares, respectively, the loan subject to division;

- date of;

- list of attached papers;

- signatures.

Waiver of obligations by one of the parties

Another frequently asked question is how to get rid of a mortgage during a divorce? And is it even possible to do this?

There are options, there are two of them:

- one of the holders pays everything himself, and then, by way of recourse, demands compensation (Article 325 of the Civil Code);

- a claim is filed for redistribution of shares and, accordingly, payments.

Article 325. Fulfillment of a joint and several obligation by one of the debtors

- Fulfillment of a joint and several obligation in full by one of the debtors releases the remaining debtors from fulfillment to the creditor.

- Unless otherwise follows from the relations between joint and several debtors:

- the debtor who has fulfilled a joint and several obligation has the right of recourse against the remaining debtors in equal shares minus the share falling on himself;

- what is not paid by one of the joint debtors to the debtor who has fulfilled the joint obligation falls in equal shares on this debtor and on the other debtors.

- The rules of this article apply accordingly when a joint and several obligation is terminated by offsetting the counterclaim of one of the debtors.

Statement of claim for division of mortgage after divorce, sample

It’s better to come to an agreement peacefully. And in general, do not share anything regarding the loan, but continue to pay as you paid in the general manner. Then you won't have to go to court.

- We hope you now have an idea of how a mortgage taken out before marriage is divided during a divorce and how a mortgage is divided after a divorce.

- Watch the video: mortgage in marriage, how is it divided in case of divorce?

Didn't find the answer to your question? Find out how to solve exactly your problem - call right now:

+7 (499) 938-51-36 (Moscow)

+7 (812) 467-38-73 (St. Petersburg)

It's fast and free!

Statement of claim for division of mortgage after divorce: sample, features

According to statistics, a significant portion of marriages in Russian families break up. For former spouses, the difficulty of such a situation lies not only in moral terms, but also in material terms.

In most cases, divorce is associated with the need to divide acquired property, but mortgage obligations are also subject to division.

This procedure involves many nuances that are worth learning about before initiating divorce proceedings.

What does the law say about the division of property after divorce?

The main provisions regarding the division of property after divorce are determined by the Family Code of the Russian Federation. Spouses have the right to divide property both during marriage and after the termination of official relations. The legislation regulates the following issues of division of property :

- section forms;

- questions from copyright holders regarding the requirement for division;

- main stages of the process;

- types of property that can be divided;

- obligations and rights of the parties.

According to the current legislation, it does not matter which of the spouses the property acquired jointly during marriage was registered in the name of. After the dissolution of the union, both spouses have equal rights.

The exception is cases of concluding a marriage contract, which stipulates special clauses for the division of property in the event of divorce. In some cases, the court may take into account the presence of minor children and change the proportional distribution of acquired property.

If children reach adulthood, no changes in the equal distribution of shares should be expected.

Today there are two main forms of division of marital property:

- voluntary - in this case, the spouses reach mutual agreements and sign a settlement agreement on the division of the mortgaged apartment, other property and debt obligations, such a document is subject to mandatory registration with a notary;

- judicial - in this case, one of the spouses files a claim with a judicial authority to initiate the trial process.

With a voluntary form of division of property, the expiration date depends on how long it takes for the spouses to reach a compromise. For judicial proceedings, a two-month period for consideration of the case is legally established, but in practice, for various reasons, the process may be delayed over time.

During a divorce, not only jointly acquired property is subject to division, but also debt obligations. The court, based on the citizen’s statement of claim, determines the size of the share of debt obligations of each spouse. If they wish, they can independently agree on the distribution of the financial burden after the divorce.

What property is not subject to division?

According to current legislation, in the absence of a marriage contract, the property that was acquired in a joint marriage is subject to division between spouses. After the dissolution of the marriage, agreements must be reached within 3 years. In standard situations, all acquired property is divided equally.

Only jointly acquired property is subject to division, which means that such a procedure cannot be carried out in relation to items acquired by a person before marriage. The same rule applies to gratuitous transactions in the form of donation, privatization or inheritance; such property belongs only to the spouse to whom it belongs according to the document.

Copyright and intellectual rights cannot be separated, except in the situation of obtaining income as a result of their use. According to existing rules, the following are not subject to division:

- things received or purchased before marriage, with the exception of situations where, during marriage, the spouses spent a certain budget on improving the condition of such an item;

- present;

- inherited property;

- personal belongings of spouses, with the exception of accessories made of precious metals or stones, as well as luxury items;

- items of children's clothing and equipment for the child's needs, bank accounts or property registered in his name;

- previously divided items, the division of which occurred on the basis of mutual agreement.

Spouses have the right to put forward demands for division of property when filing an application for divorce in court. The rules for the official dissolution of a union do not apply when persons are in a civil marriage. With this form of residence of persons, each of them is the owner of things that were personally acquired by them or officially registered in their name.

In such a situation, experts advise registering jointly acquired property as shared ownership. In theory, in court, if you live together without a stamp, it is possible to recognize property as jointly acquired, but in practice such cases are classified as “complex” and require a large amount of evidence and competent legal assistance.

Questions regarding the division of special types of property

In practice, during divorce proceedings, questions most often arise when dividing an apartment, car and mortgage obligations. If there is a vehicle in the family, the parties have the right to independently agree on the principles of division of property or defend their rights in a judicial body. In the latter case, one of the following decisions will be made:

- compensation in cash in accordance with the market value of the car and the spouse’s share;

- compensation through the provision of other property in proportion to the value of the share.

If you have a plot of land or an apartment, the following scenarios are possible:

- equal distribution of shares between spouses;

- allocation of a share in kind;

- transfer into the property of one of the spouses and the other receiving monetary compensation.

It is worth considering that receiving an act of division of property is not a sufficient basis for acquiring ownership rights. In order to become a full-fledged owner, a spouse must go through the state registration procedure.

The section of mortgaged property has certain specifics. An agreement on the division of property between spouses and a mortgage may have several scenarios for the development of events. The property can be sold, and the funds received can be used to repay the loan.

Loan obligations can be divided between spouses in equal shares, and after the divorce, each of them will pay their own debt.

The mortgaged property may be transferred to one of the spouses, who will be obliged to repay the loan obligations in full.

Where to file a claim for division of marital property?

An application for division is submitted to a district or magistrate's court. The determining factor for the choice of institution is the territory of residence of the defendant and the total cost of the issue. The following rules regarding the value of the claim should be followed:

- magistrate court - up to 50,000 rubles;

- district - more than 50,000.

The list of documents may differ depending on the circumstances and is determined based on what property and liabilities are subject to division. What documents need to be collected for the division of marital property:

- identification;

- fee payment receipt;

- certificate of marriage or divorce;

- birth certificates for each of the minor children;

- documents regarding property and mortgage obligations in the form of certificates, contracts, checks and receipts, appraisal reports;

- statement of claim and copies according to the number of participants in the process.

The legislation defines strict requirements for filling out a claim, which do not depend on the subject of consideration.

To avoid errors and misunderstandings, experts advise using a standard application form and taking into account existing generally accepted recommendations for filling it out.

If possible, it is worth using the services of a lawyer or lawyer on marriage issues, which will significantly save time and effort and help maintain psychological health.

What should be included in a statement of claim for division of marital property?

The document form consists of several sections, in each of which you need to fill out a certain type of information.

Such a document should serve as a complete source for the court, on the basis of which it can understand the reasons for the divorce and the plaintiff’s requirements.

A sample statement of claim for the division of a mortgage after a divorce has a standard form. The following sections of the document can be roughly distinguished:

- header - the court data is indicated in the form of the full name, information from the plaintiff, defendant and their residential addresses, contact phone numbers, cost of the claim, amount of state duty, type of claim document;

- main text - information about the place of marriage or its dissolution; if it is necessary to obtain consent from the spouse for divorce, complete information regarding minor children is indicated;

- basic information - the reason for going to court, a list of evidence that the plaintiff is right, a description of the property and obligations to be divided, special circumstances that an individual should ask to be taken into account;

- the final section is a list of documents for consideration, date of execution and personal signature.

Despite the fact that, according to current legislation, after a divorce, property and liabilities are divided equally, in practice the court may take into account special circumstances and make a different decision.

The verdict may be influenced by the presence of minor children who remain to live with one of the spouses after a divorce.

If a person claims real estate, he can make a request to leave all related items and household items.

The document must indicate that the case had not previously been considered in court, and the spouses could not reach a common agreement. You must also indicate:

- the fact that there are no marriage contracts or other agreements;

- a complete list of property indicating the value of their assessment in rubles, as well as existing liabilities;

- a list of property that the plaintiff believes should go to him after the divorce, as well as a list of grounds for making such a decision.

In accordance with the current rules, the document can be filed with the judicial authority by either spouse. When receiving property whose value exceeds the share of one of the spouses, the second has the right to receive compensation. This fact is also reflected in the document in the form of an indication of the amount of payment and the calculation technology by which it was made.

In addition to the claim of the spouses, an application may be submitted to the judicial authority by third parties. Such a claim is filed if they claim to receive part of the partners’ property due to the presence of debt obligations that can be covered by confiscated property

Cost issues

The divorce procedure for each spouse can be quite costly, as it will require payment of a number of items. Major expenses include:

- state duty;

- assistance and services of an appraiser;

- payment for legal services;

- notarization of required papers.

Payment of the state duty is made by each spouse independently in the amount that was determined by the court decision upon division. The state duty for dividing the property of spouses can range from hundreds of rubles to several thousand. If a settlement agreement has been reached between the spouses, then they are released from such obligations.

In difficult situations, specialists are advised to seek the services of lawyers. A division specialist can guide spouses in a difficult psychological situation in the right direction, give the necessary advice and help with paperwork. Cooperation in most cases involves the following forms of interaction:

- conducting one-time consultations;

- preparation of required documents;

- legal support of the process;

- representation of interests in judicial and government bodies.

If one of the spouses disagrees with the decision of the judicial authority, it is possible to file a complaint before the document enters into force. The review procedure is carried out in accordance with current legislation. An appeal to a higher authority is submitted in the prescribed form through an appeal to the judicial authority that made the decision in the case.

Conclusion

The process of divorce in the absence of a settlement agreement between spouses can be morally complex and time-consuming. According to current legislation, acquired property and obligations of partners after termination are divided equally. The law establishes a list of items that do not fall under this rule.

When dividing mortgage obligations, there are several ways out of this situation. To make the right decision, the judicial authority must competently draw up a statement of claim, which indicates information not only about the circumstances and reasons for the divorce, but also the plaintiff’s opinion regarding the divisible property and obligations.

Recommendations for dividing a mortgage in a divorce

Having an outstanding mortgage and dividing the property encumbered by the mortgage adds a lot of complications to a divorce.

In this situation, divorcing spouses immediately have many questions. How to divide an apartment that is pledged to a credit institution? Who and in what part should pay off the mortgage loan in the future? How to resolve the issue with co-borrowers?

Moreover, each situation has many specific nuances, so there is no unambiguous solution and algorithm for dividing responsibilities for a mortgage and collateral real estate. Moreover, law enforcement judicial practice has not yet developed precedents that would serve as guidelines when courts make decisions in similar situations.

It is not surprising that completely different court decisions are made in similar cases, even opposite ones.

The situation with a mortgage is complicated by the fact that in these legal relations the interests of three parties are affected at once (divorcing spouses and the bank), in contrast to the division of property not encumbered by a mortgage, where it is enough for only the former spouses to come to an agreement. Therefore, finding a solution that satisfies all stakeholders at once can be much more difficult.

In many cases, when dividing mortgage housing and loan repayment obligations, the interests of one of the parties are significantly impaired.

For example, there are precedents when a borrower, deprived of an apartment during a divorce, is forced to repay the loan for a long time.

Or a bank that wants to sell a mortgaged apartment for which the loan is not being repaid is faced with a situation where the mortgaged apartment, by court decision, is no longer considered the sole property of the borrower.

Legal regulation

- These difficulties in dividing mortgaged housing in the event of a divorce are associated, first of all, with insufficient legal regulation of this issue in Russian family and civil legislation.

- When considering divorce cases where the issue of mortgage is raised, the courts are guided by the Family Code, the Civil Code and the Federal Law “On Mortgage”, as well as the mortgage agreement drawn up between the bank and the borrower.

- The basic principle of the division of mortgage property during a divorce, set out in the above-mentioned legal acts, is that:

- residential premises acquired by spouses during marriage using mortgage funds are jointly acquired property, which entails corresponding legal consequences;

- the joint property of the former spouses should be divided in half, unless a different order is specified in the marriage agreement;

- when dividing property acquired by spouses with borrowed funds, including a mortgaged apartment, it does not matter at all to whom the mortgage loan was issued.

Financial obligations to the bank are also assigned equally to divorced spouses, regardless of whether they were co-borrowers or the mortgage was issued to one of them.

Thus, based on the requirements of Russian family law, the “fifty-fifty” principle applies when dividing any joint property of spouses. However, in practice, dividing a mortgaged apartment in half is quite problematic, since the housing is pledged to a credit institution, and the owners cannot take any legal actions with it.

How to avoid problems during division

Most conflicts and controversial situations related to a mortgaged apartment can be avoided by first concluding a prenuptial agreement.

Russian legislation allows you to draw up a marriage agreement both before registering a family and during family life.

However, statistics show that, despite all the advantages of marriage contracts, no more than 5% of Russians draw up such contracts.

Another important legal safeguard that is used to protect the interests of all parties to a mortgage is the mortgage agreement.

Currently, credit institutions, which have repeatedly encountered problems with mortgage payments by former spouses, have acquired quite a solid experience in legal mortgage disputes.

As a result, mortgage agreements drawn up by banks minimize the lender’s risks in the event of a divorce between borrower spouses.

The vast majority of banks try to make both spouses co-borrowers on the loan, which, in principle, is beneficial for the married couple themselves, since they can combine income and receive a larger loan amount.

In addition, many banks began to include an important condition in their mortgage agreement: “If the family relationship between the co-borrowing spouses is dissolved, the terms of the mortgage agreement do not change.”

Such a clause in the contract is additional insurance for the bank.

If the spouses who agreed to this condition of the mortgage agreement divorce and one of them refuses to pay the mortgage, then financial responsibility for the payments will completely pass to the other.

Such a legal guarantee, unfortunately, protects exclusively the interests of the bank, and divorcing spouses will still have to defend and defend their interests.

Practical recommendations

In fact, divorcing spouses have only three options:

- continue to pay the loan;

- find the missing cash and pay off the mortgage early. After this, you can sell the apartment at a favorable price and divide the proceeds in half or by agreement of the parties;

- sell a mortgaged apartment with the consent of the bank.

To divide a mortgaged apartment, you can contact the credit institution that issued the mortgage directly with a request to approve the sale of a common matrimonial apartment.

It is difficult to predict the reaction of a particular bank to such a proposal. In this situation, a credit institution can:

- agree to the sale of a mortgaged apartment;

- demand early repayment of the mortgage by the spouses, justifying this by the fact that the upcoming (or already registered) divorce violates the agreed terms of the loan agreement;

- oblige the spouses to pay the mortgage without selling the apartment.

In many cases, the bank agrees to sell the mortgaged apartment, since this reduces the risk of non-payment of debt by divorced spouses. If the bank's consent is received, the spouses need to find a buyer for their mortgaged home who agrees to purchase an encumbered apartment.

In this situation, the buyer, in order to take ownership, must first compensate the bank for the amount of debt on the mortgage loan and wait until the entire process of removing the encumbrance from the purchased apartment is completed.

Of course, not all buyers will agree to such a difficult option, since the risks increase and the time drags on. Therefore, divorcing spouses who want to sell a mortgaged apartment often have to reduce the price of their home in order to interest a potential buyer.

Regardless of the development of the situation with the sale of the apartment, the divorcing spouse must continue to make payments on the mortgage loan. Otherwise, the situation can only get worse. A bank that does not receive loan payments has the right to sell the mortgaged apartment at auction, and the price of the sold housing, as a rule, is much lower than the market price.

From the proceeds from the sale, the credit institution will retain the principal debt, fines, penalties, unpaid interest and expenses for organizing auctions, and only the remaining amount will be divided between the former spouses. As a result, you can be left without housing and without financial compensation.

Another important rule when divorcing persons who borrow mortgage funds is that they must notify the credit institution of the divorce . Under the terms of any mortgage agreement, borrowers are required to immediately notify the bank of significant changes in their lives, including divorce.

If the parties to the mortgage agreement cannot reach an agreement, they must go to court. As already mentioned, there is no clear development of the situation during the trial.

The court may force the credit institution to carry out transactions with the mortgaged apartment, oblige the mortgage agreement to be reissued for one of the divorced spouses, and oblige the spouses to continue making payments until the loan is repaid. Other solutions are also possible.

If spouses decide to repay the loan in order to then sell the apartment, it is possible to divide the mortgaged property into shares during the divorce. To do this, they need to contact the creditor bank with an application.

However, problems and pitfalls are also possible here. For example, the bank will refuse this option.

He may not be satisfied with the income of one of the spouses, who, when registering shared ownership, must act as an independent borrower.

Or the mortgage collateral is a one-room apartment, the division of which into shares in kind is not possible. Such property, according to the Federal Law “On Mortgage,” should not act as an independent subject of mortgage.

The bank's refusal can also be appealed in court.

Another option for division during a divorce is that one of the divorcing spouses, free of charge or for monetary compensation, signs a waiver of his share in the common housing encumbered with a mortgage, and the other agrees to take on all payments on the mortgage loan.

If the bank is satisfied with the solvency of the second spouse, then the transfer of ownership of the mortgaged housing is registered with the territorial registration authority. As a rule, the bank charges a commission for re-issuing a loan agreement (0.5% - 1% of the remaining debt).

Statement of claim for division of a mortgaged apartment

Statement of claim for the division of a mortgaged apartmentAverage rating 5 from 1 users

The Family Code allows spouses to divide common property by drawing up an agreement or in court. The division of a mortgaged apartment through the court is carried out after filing a statement of claim. To compile it, you need to refer to the norms of the Code of Civil Procedure of the Russian Federation and the Tax Code of the Russian Federation.

Section methods

The RF IC (Article 34) establishes that all property acquired by spouses during the existence of family relationships belongs to the category of jointly acquired property . Provided that funds for the purchase were taken from the general family budget. This rule applies not only to property assets, but also to general debts.

For example, if spouses decide to divide an apartment purchased under a mortgage lending program, either party may insist on the need to divide the loan debt if it has not been fully repaid to the bank.

Spouses can divide the balance of debt obligations independently with the agreement of the bank. Until the mortgage debt is fully repaid, the spouses do not have the right to divide the apartment itself, because it is pledged to the bank. This means that it is prohibited to make legal transactions with it.

Methods for dividing a mortgage:

- The apartment is put up for public auction. The proceeds are used to repay the loan debt. The remaining funds are divided in half between the spouses.

- The loan account is divided in certain shares between the spouses, then each pays his part independently. Upon completion of payments, the apartment is divided between payers in accordance with the law.

- The mortgage debt is repaid by one of the spouses, the other then renounces the rights to the property. For renunciation of rights to the apartment, the party who becomes the sole owner pays compensation. Its size is equal to half the amount already paid on the loan.

- The former spouses then continue to jointly repay the debt. Upon completion of payments, the apartment is divided between them according to the law.

It should be taken into account that in some cases not all of the presented options are feasible. For example, if funds from maternity capital were used to repay part of the debt, the apartment cannot be put up for auction.

How to file a claim

If the spouses cannot agree on the division of the mortgaged apartment and debt, they have to go to court. All decisions regarding the division of bank loans are made by the judge only in agreement with bank representatives.

Drawing up and filing a statement of claim are carried out according to the general rules set out in the Code of Civil Procedure of the Russian Federation.

Information contained in the statement of claim:

- name and address of the judicial organization;

- document's name;

- information about the plaintiff (full name, passport details, date of birth, residential address);

- information about the defendant;

- social status of the plaintiff and defendant, i.e. whether they are married with reference to documents (marriage or divorce certificate);

- main part. This indicates what the plaintiff sees as an infringement of his property rights;

- a proposal for division with reference to regulations confirming the legality of the plaintiff’s claims;

- preliminary calculation of the cost of the claim;

- list of documents attached to the application. This paragraph must contain copies of general passports, an agreement with the bank, and financial statements on payments. You can attach any other documents if the plaintiff believes that they will help win the legal dispute;

- date of compilation and signature with transcript.

State duty

The submitted claim must be accompanied by a payment document confirming payment of the state fee. For property disputes, it does not have a fixed value. To calculate, you will need to resort to Art. 333. 19 Tax Code of the Russian Federation. The amount of the state duty will depend on the value of the property being divided.

Where to submit

The statement of claim should be sent to the district (city) court at the defendant’s place of residence. If for some reason this is not possible (for example, the defendant lives abroad), you should contact the authority at the location of the property.

A claim can be filed in two ways:

- During a personal visit, submit it to the court office.

- Send by registered mail.

The first option is preferable, because If there are any shortcomings in the claim, the plaintiff will be immediately informed about this. A judicial representative can also submit an application if he has a notarized power of attorney. In this case, information about it must be included in the statement of claim.

Division of mortgage property upon divorce

Most of the modern population, and especially young families, purchase housing with a mortgage, using borrowed funds.

A mortgage is a type of collateral in which real estate remains the property of the debtor, while the latter has the right to own and use such property, and the creditor, in the event of failure of the debtor to fulfill his obligations, has the right to obtain satisfaction of his claims through the sale of this property.

Within the framework of modern realities, this method of purchasing housing is becoming increasingly popular, since despite overpayments on interest, citizens can afford to acquire their own, albeit encumbered, housing in the shortest possible time, while paying the entire cost of the apartment seems possible only for units that Young families are rarely included.

However, the statistics are disappointing - most marriages are dissolved. And, accordingly, the question arises of how to divide property acquired during marriage.

By virtue of Article 256 of the Civil Code of the Russian Federation, property acquired by spouses during marriage is their joint property, unless the agreement establishes a different regime for this property.

Part 1 of Article 33 of the Family Code of the Russian Federation also contains a provision that the legal regime for the property of spouses is the regime for their joint ownership.

The legal regime applies unless otherwise provided by the marriage contract.

In accordance with paragraph 1 of Article 39 of the Family Code of the Russian Federation, when dividing the common property of spouses and determining shares in this property, the shares of the spouses are recognized as equal, unless otherwise provided by the agreement between the spouses. According to paragraph 2 of Article 38 of the Family Code of the Russian Federation, the common property of the spouses can be divided between the spouses by their agreement.

Thus, in the absence of encumbrances on the property and the existence of agreements between the spouses, the issue is resolved simply - those planning a divorce or divorced spouses sign an agreement on the division of property, with which (when dividing real estate) they apply to the body that registers rights to real estate to make changes to the information contained in the Unified State Register of Rights.

If there is a dispute between spouses, the issue is resolved in court and changes are made to the Unified State Register of Rights on the basis of a judicial act that has entered into force.

However, what if real estate encumbered with a mortgage is subject to division? Indeed, in this case, in accordance with paragraph 1 of Article 34 of the Family Code of the Russian Federation, not only joint property, but also the joint debts of the spouses are subject to division.

In accordance with paragraph 1 of Article 391 of the Civil Code of the Russian Federation, transfer of debt is allowed only with the consent of the creditor, in the case of a mortgage - a bank or other credit organization. But most borrowers, when submitting mutually agreed upon applications for division of property and transfer of debt, often receive a refusal from the lender on such an application for division of property and amendment of the loan agreement.

Attempts to divide property with the simultaneous division of debt in court in the absence of the consent of the creditor also do not lead to success.

Loans and mortgages section

Division of credit in case of divorce

The difficult financial state of a family very often becomes the rock on which it breaks. It is now difficult to find married couples in Russia who do not have any credit obligations. In the event of a divorce, many former spouses have questions and disputes about how to share the burden of repaying debt obligations to financial institutions.

It is necessary to understand that the article describes the most basic situations and does not take into account a number of technical issues. To solve your particular problem, get legal advice on housing issues by calling the hotlines:

Call right now and solve your questions - it's fast and free!

Loans issued by credit institutions are issued in the name of a specific person. This does not mean that only one of the spouses will have to return them during a divorce.

Debt obligations are distributed among former family members in proportion to the divided property acquired during the years of cohabitation.

The exception is those cases in which it is proven that the loan funds were spent only on the needs of one of the spouses. The property is divided in accordance with the RF IC.

Division of credit after divorce most often occurs in court. This issue can be resolved peacefully by concluding a bilateral agreement between the parties. This procedure is provided for in Article 38 of the UK .

The criteria that determine the community of debt between spouses include mutual consent of the husband and wife to receive a loan and spending the loan funds for common needs. The court does not take into account loans taken by spouses before entering into a marriage relationship with each other. The community of debt obligations of the spouses is determined by Article 45 of the Family Code .

At the same time, according to Article 35 of the same Code, the interests of children and the contribution to the family budget of each of the former spouses are taken into account when making a decision on the division of debt obligations.

Many debt issues can be resolved on the basis of prenuptial agreements . The division of family property and credit obligations during a divorce is considered in court on the basis of a statement of claim filed by one of the parties upon divorce.

The most common controversial cases of debt division in judicial practice are related to credit obligations for a mortgage and the purchase of a car. Debts to pay off the loan for the car fall on the shoulders of the person who will keep it.

If the market value of the car exceeds the debt obligations on the loan taken out to purchase it, the spouse to whom it is brought before the court will have to pay the difference to his former marriage partner.

Division of mortgage in divorce

Certain difficulties in dividing debt obligations during a divorce arise for mortgage-related debts . This is a sore spot in which it is very difficult to find a middle ground.

There are various ways to solve this problem. The first and simplest is the sale of the apartment, repayment of loan obligations from the amounts received and the division of their balance after covering the debt obligations between the spouses.

In practice, ex-spouses resort to such a solution extremely rarely.

The second method is to divide the apartment and pay loan obligations according to the occupied space. The third option is that one of the spouses remains the owner of the apartment, who compensates the other for his share of participation in the real estate, expressed in market money equivalent.

When considering the issue of dividing mortgage debts during a divorce, the court takes into account factors such as minor children and other dependents, the amount of financial participation in the purchase of an apartment or house by each spouse, as well as who is the official owner of the property .

Difficulties in dividing mortgage debts also arise in cases where housing was purchased by one of the spouses before marriage .

In most such cases, the court makes decisions on compensation payments in the amount of equity participation in its acquisition during the marriage relationship.

The division of debt obligations of persons in a civil marriage is not considered by the courts.

Most mortgage agreements treat spouses as co-borrowers. The division of debt obligations under such loans can be carried out in several ways:

- the previous agreement is divided, with the consent of the parties and the bank, into two new ones, in which each party assumes obligations to the financial institution in its part;

- one of the spouses pays off the mortgage loan and issues an amount to his ex-marital partner to reimburse his costs in the amount determined by the court.

When drawing up new contracts, you will need to pay a commission fee and reissue the insurance contract.

Conclusion

- According to the laws in force in the Russian Federation, after the divorce of spouses, after the division of jointly acquired property, debt obligations accumulated during the years of marriage can be divided.

- The loan for the division of property of spouses can be divided voluntarily or by court decision.

- The statement of claim to the court is drawn up on a standard form.

The most popular question and answer regarding loans and mortgages

Question: Will one of the spouses pay debts on loans after a divorce if he did not even know about their existence?

Answer: Current legislation exempts from paying loan obligations those spouses who can prove in court that the borrowed funds were not used for the needs of the family. This is extremely difficult to do. Accordingly, you will most likely have to pay.

List of laws

Still have questions or your problem is not resolved? Ask them to practicing lawyers right now!

Call and solve your problems right now - it's fast and free!