Divorce of spouses is an opportunity to remove obligations in relation to each other, but not in relation to common children. Paying child support is a parental responsibility under the law. It’s good when parents can agree on the terms of payments and calculate them without errors on their own. Otherwise, the legislation provides for forced settlement and the necessary amounts are withheld from the payer’s monthly income.

How to correctly calculate child support in 2018

How to calculate child support is prescribed in the Family Code. This is Article 113, which deals with calculation methods:

- based on the father's earnings;

- taking into account the minimum wage indicators for the region of residence;

- upon agreement on a voluntary basis;

- with the help of the court.

Knowledge of the calculation methodology helps to avoid absurd situations, so let’s consider the issue in more detail.

Salary method

When calculated from the employee's salary, alimony is paid monthly for children:

- up to 18;

- without parental care;

- disabled adults.

How is child support calculated from wages? The gist is this:

- 1 son (daughter) – 25% of earnings;

- two – 33% of earnings;

- 3 or more – 50% of the source of income.

How to calculate alimony for two children if a citizen, after divorcing his wife, with whom he had a common son (daughter), entered into another marriage, where he had another baby? In this case, both spouses receive 16.5% of his income.

50% is the maximum with this calculation method. The percentage can be higher (up to 70%) only if the payer is sentenced to correctional labor or the amount includes funds due for causing damage to the health of a son (daughter), as well as in the case of their paid education.

Method by voluntary agreement

Spouses have the right to calculate the amount of alimony themselves. When entering into an agreement on a voluntary basis, there is no minimum or maximum amount of payments. But, according to Article 81, the amounts cannot be less than those that are possible for appointment by the judicial authority. How to calculate child support for one or more children using this method?

The order is:

- 1 son (daughter) – from ¼ earnings;

- on the 2nd – from 1/3 of earnings;

- payments from 3 children - at least half of earnings.

According to the law (Article 117), a fixed amount is possible. But the contract must contain a clause providing for indexation of the amount depending on the cost of living.

Method according to the court

Where spouses cannot reach agreement, the court comes to the rescue.

With an official source of income, one son (daughter) accounts for a quarter of the father’s earnings, if there are two children - 33%, if three or more - half of the total monthly income.

If the payer does not have official work, the court has the right to assign amounts based on the average earnings in the country, that is, interest from 24 thousand rubles (6,000 rubles per child).

The amount of payments can be changed if the parent submits a request for this to the judicial authority. If there are reasons, the amount can be reduced or increased.

Change of size by court

The following may put forward an initiative to change the amount in a judicial body:

- recipient when expenses for children increase;

- the payer in a difficult financial situation: if it is necessary to support other dependents, his disability (group 1 or 2), and also if the payer’s children have property that provides funds or they are in a boarding school.

Arguments for reducing the amount of alimony cannot be:

- maternal wealth;

- property of children, if it does not generate income;

- children's pension provision.

The claim to the World Court must be accompanied by: the document in accordance with which the payments were made (agreement, judge's decision), evidence of the need to change the amount of funds paid, a receipt confirming the paid state duty.

As a result of consideration of the application, it is possible: a reduction in the amount, exemption from payment, replacement of fixed payments with equity payments and the opposite situation. The court has the right to release from the obligation to pay the amounts required by law if:

- children are 18;

- the minors were adopted by the mother's new husband;

- the son or daughter has committed criminal acts against the father who provides for them.

How to calculate the payout amount

Many people wonder how to correctly calculate alimony. This can be done using an online calculator. The rules that exist for calculating child support for one or more children are as follows.

- Enter how many children you and your 2nd spouse have in common for proportional calculation.

- Enter the payer’s salary level and the amount of additional sources of income.

- Select whether you want to deduct personal income tax (13%) from the official source of income.

- Click the “calculate” button, after which you will receive the required amount of monthly alimony.

About withholding funds

After determining the amount of amounts that, according to a court decision, the parent is obliged to pay, it will be necessary to transfer a writ of execution as a basis for withholding the amounts at the father’s place of work. The management of the accounting department is responsible for calculating and withholding alimony payments.

Indexing

The payment amount is subject to indexation. There are rules for this:

- the fixed amount is subject to indexation by a percentage increase in the cost of living for working people, people of retirement age and children. The choice of the size of the subsistence minimum is carried out depending on the region of residence of the children (Article 117);

- the court determines a fixed amount of payments. Its size is equal to the subsistence level.

Income tax

Alimony is withheld only after deducting 13% from the monthly source of income. It happens that these percentages are not withheld by the employer from the salary. Then the calculation of the required alimony is based on the entire amount.

Percentage of withholding from income

The percentage of payments withheld from the source of earnings should not exceed 70. This is the protection of the payer’s rights provided for by law, because he is obliged to provide not only for children, but also for himself. But sometimes the amount is so large that this percentage is not enough to pay. Debt arises.

Calculate debt

Alimony debt appears due to evasion of payments, an error in calculation, etc. Debts can be calculated in two ways. The first method is possible if, even if there was an official source of income, the payer did not pay the required amounts.

The calculation formula is as follows: the number of months during which money was not paid is multiplied by the payer’s net income. The second method is used for individual entrepreneurs and informally working people. It is based on average monthly earnings.

The third method is based on regional indicators of the cost of living.

Debt has no statute of limitations.

Thus, the basics of the mechanism for assigning payments are as follows:

- joint provision of children, regardless of the relationship and place of residence of the father;

- the legislation does not condemn the payer to poverty: the amount of payments is established while preserving the rights of the father;

- the parent cannot ignore his responsibilities, otherwise the issue will be resolved through the court.

How child support is calculated, calculation of alimony from wages: example of calculation and procedure

If divorce allows a husband and wife to relieve themselves of their obligations towards each other, it does not allow this to be done in relation to a child. Paying child support is fulfilling your parental obligations. Ideally, the child’s parents themselves can calculate and determine the terms of payment of alimony. Otherwise, the procedure for forced calculation and deduction of alimony from wages provided for by law will be used.

Calculation of child support by voluntary agreement between parents

There will be no need to go to court to calculate child support if the parents reach agreement on the amount, order and frequency of money transfers.

All these conditions must be drawn up in the form of a special written document - an alimony agreement, which, moreover, must be notarized.

This document has the same legal force as a court decision to collect alimony.

So, in a child support agreement, parents can calculate child support themselves. The only condition is that the amount of alimony payment should not be lower than that which the court would assign in the given circumstances. How to determine this size? As a general rule, a parent must pay at least 25% of his earnings for one child, 33% of earnings for two children and 50%; for three, four or more children.

The amount of child support may be based on the parent's earnings or be a fixed amount.

By the way, you can pay a fixed amount of alimony not only monthly, but also in a lump sum - until the child reaches adulthood.

Instead of alimony, valuable property, such as an apartment or car, can be transferred. Of course, all this is possible if the parents have reached such a mutual agreement.

Thus, the calculation of alimony by agreement between the parents can be made:

- In the form of shares of the parent’s earnings (not less than those established by law);

- In the form of a fixed amount of money paid regularly (monthly, quarterly, annually);

- In the form of a fixed sum of money, paid once;

- In the form of property;

- In another way that the parents have agreed upon.

If the parents cannot reach an agreement on the calculation of child support, the court can do this.

Child support is calculated depending on the number of children, financial capabilities, and marital status of both parents. Together with the statement of claim for the collection of alimony, a calculation of the amount necessary to support the children and a documentary justification for the expenses must be submitted.

As a rule, the court determines the amount of payment as a share of the payer’s earnings. The calculation is simple: if there is one child, he is entitled to a quarter of the parent’s income, if there are two children, a third, and if there are three or more children, half of the income.

This option is possible if the parent has a permanent income from an official source. If a parent works unofficially, does not have a regular income and hides the amount of real earnings, the court calculates alimony as a fixed amount.

To calculate alimony, the minimum wage is used (in 2018 the minimum wage is 5,965 rubles) or the subsistence minimum.

The law provides for the possibility of changing the amount of alimony. One of the parents has the right to apply to the court with a request to increase or decrease the amount of alimony. If there are grounds for this (changes in financial capabilities, marital status), the court may increase or decrease the amount of alimony payments.

After the court determines the amount of alimony, the court order or writ of execution is sent to the parent’s place of work. These executive documents are the basis for withholding funds from the salary of the alimony payer.

Responsibility for fulfilling the requirements of the writ of execution lies with the management and accounting department of the enterprise or institution where the alimony payer works. The accounting department directly handles the calculation and retention of funds.

You can read more about this in the article How alimony is withheld from wages.

If the executive document contains a provision on indexing the amount of alimony (as a rule, when collecting alimony in a fixed amount), the accounting department recalculates alimony in connection with changes in the cost of living (by region of residence or by country) - quarterly. If, for example, the agreement on payment of alimony does not contain a provision on indexation of alimony or does not contain the procedure for its implementation, indexation is carried out according to the general rules provided for in Article 117 of the RF IC.

How is alimony calculated taking into account personal income tax? Withholding of alimony is carried out only after deducting income tax in the amount of 13% from wages. If the employer does not withhold income taxes from wages, alimony payments are calculated based on the entire amount.

Labor and family legislation establishes a limit on the withholding of payments exceeding 70% of wages. This is how the law protects the rights of the alimony payer, who is not only obliged to support his children (wife, parents), but also himself.

If the amount of alimony is so large that 70% of the salary is not enough to pay, arrears arise.

How is child support calculated and withheld from wages?

As an illustrative example, we can consider the calculation of child support from the salary of citizen Fedor Arkadyevich Ivanov. The salary is 35,000 rubles, the amount of alimony is 25% of the salary.

- Salary accrued to Ivanov F.A. – 35,000 rubles

- Personal income tax withholding: 35,000 * 13% = 4,550 rubles

- Withholding of alimony: (35,000; 4,550) * 25% = 7,612.50 rubles

- Transfer of alimony amount to the recipient's bank account: 7,612.50 rubles

- Bank commission for transfer of funds withheld: 76.13 rubles

- Transfer of bank commission for funds transfer: 76.13 rubles

- Transfer of wages to Pupkin F.A.: (35,000 – 4,550 – 7,612.50 – 76.13) = 22,761.37 rubles

If the payer evades payment or makes incomplete payment of alimony, a debt arises.

There are several methods for calculating alimony debt:

- Based on the amount of earnings (if the payer’s place of work and salary are known);

- Based on the average salary for the region of residence or country (if there is no data on the place of work and the amount of earnings of the payer during the period of debt formation);

- Based on the subsistence level (if alimony was paid in a fixed amount of money, a multiple of the subsistence level).

- Due to frequent changes in legislation, information sometimes becomes outdated faster than we can update it on the website.

- All cases are very individual and depend on many factors. Basic information does not guarantee a solution to your specific problems.

Calculation of child support from parents' wages. Calculation example

After a divorce, former spouses relieve themselves of mutual obligations. However, the law does not allow this to be done in relation to a minor child.

Supporting your own children is a parental responsibility. According to the law, alimony payments are withheld for the maintenance of:

- minor children;

- minor children who were left without parental care;

- adult disabled children.

Child support is withheld from the following income:

- from wages, regardless of the form of ownership of the business entity where the parent works;

- from income from the activities of an individual entrepreneur, including income from concluded contracts;

- from pensions, payments for temporary disability;

- from dividends from shares and securities;

- from scholarships;

- from fees.

From what other incomes alimony is withheld, we described here.

It’s good if parents sit down at the negotiating table, independently calculate and determine the terms of child support payments. Otherwise, the compulsory procedure provided for by law, calculation and deduction of funds from wages, is applied.

Payment of alimony according to agreement

If the former spouses reach an agreement and determine the amount, procedure and frequency of monetary contributions, there will be no need to go to court.

The established agreement is formalized in the form of a written alimony agreement. The document must be certified by a notary.

If the payer fails to comply with the conditions, the agreement has the force of an executive document, similar to a court decision on the collection of alimony.

By concluding an agreement, the child’s parents independently calculate the amount of child support. The maximum monthly payment amount is unlimited.

There is a minimum restriction - the amount of payments established by contract cannot be lower than the amount of alimony ordered by the court under similar circumstances.

What is the minimum amount of alimony allowed? According to the law, the alimony payer is obliged to transfer at least 25% of total earnings for the maintenance of one child, 33% for two children, 50% for three or more children.

Alimony is established in the form of:

- percentage of the parent's total income;

- fixed amount.

By the way, a fixed amount of alimony can be paid either until the child reaches adulthood or in a lump sum. Instead of cash, the payer has the right to transfer valuable property, for example, an apartment or a car. Of course, this must have the consent of the other parent.

Thus, in the child support agreement, parents have the right to establish the following payment procedure:

- as a share of the payer’s total income (the amount cannot be less than that established by law);

- in the form of a fixed amount transferred regularly (once a month, quarterly or annually);

- in the form of a fixed amount paid once;

- in property form;

- in any other way satisfactory to both parties.

You will learn how to collect alimony in a fixed amount by reading our article.

Payment of alimony in court

If the parents were unable to reach a compromise on child support payments, the court will do it for them.

When collecting alimony in court, the following factors are taken into account:

- number of minor children;

- financial capabilities of the payer;

- marital status of father and mother;

- needs of a minor child.

With a child support claim, the applicant is required to submit a calculation that includes the costs of maintaining the child. The amount of alimony payments must be documented.

As a rule, the procedure for payment in court is determined as a percentage of the total income of the payer. So, if there is one child in a family, he is entitled to ¼ of the parent’s earnings. If you have two children - 1/3, for three or more children - ½ of the income.

This payment procedure is optimal if the alimony payer is employed, his earnings are permanent and official. If the parent does not have a job, receives unofficial income, or hides the real amount of earnings, alimony is calculated as a fixed amount. When calculating the monthly payment, the minimum wage (minimum wage) or the subsistence level is taken as a basis.

The law allows you to change the amount of alimony payments. The recipient or payer has the right to file a claim in court to increase or decrease the amount of payments. The court will satisfy the plaintiff's demands if there are compelling reasons for this (change in financial capabilities, marital status).

Withholding of alimony from wages

Collection of alimony from the earnings of an employed payer occurs as follows:

- The court determines the amount of the monthly payment, makes a decision and, on its basis, issues a writ of execution. This executive document is the basis for withholding alimony from the parent’s salary.

- The court order is handed over to the plaintiff or sent by mail to the bailiff service. The plaintiff or bailiff sends the document to the place of work of the alimony payer.

Requests for withholding alimony are mandatory. Responsibility for the timely and complete payment of child support lies with the administration and accounting department of the enterprise where the parent is employed. The accounting department calculates and maintains alimony.

Indexing

The writ of execution must contain the conditions for indexing alimony. If funds for child support are collected in a fixed amount of money, recalculation is simply necessary.

The accountant carries out quarterly indexation of alimony as the level of the subsistence level changes.

If the agreement on the payment of alimony does not contain the conditions and procedure for indexation, recalculation is carried out in accordance with the general rules provided for in Art. 117 RF IC.

Income tax when calculating alimony

How is alimony withheld, taking into account personal income tax? Alimony calculation is made from the “net” amount of wages, after subtracting personal income tax, the amount of which is 13%. If wages are not subject to income tax, alimony is calculated on the entire amount of earnings.

Maximum amount of alimony deduction from wages

As noted earlier, the total amount of child support for three or more children is collected in the amount of 50% of wages.

However, there is a nuance: labor and family legislation establishes a maximum limit on the amount of deduction - no more than 70% of earnings. In this way, the property rights of the alimony payer are protected, who must also support himself, his parents, his wife and children in the new marriage.

The amount of alimony may exceed 50% of the payer’s earnings in the following cases:

- the alimony payer is serving a sentence in the form of correctional labor;

- the recipient of alimony is a minor child undergoing paid education;

- Alimony contains compensation for damage (in case of harm to the health of a minor).

If the amount of monthly child support payments is so large that it covers 70% of the parent's earnings, a debt is created. You cannot reduce payments on your own. The amount of alimony established by the court can only be reduced by the court. If alimony is established by agreement, changes should be made to the document (with the consent of the alimony recipient).

An example of calculating child support from wages

Let's give a clear example: the payer is obliged to transfer alimony for one child. The salary is 35,000 rubles. Accordingly, alimony is 25% of the salary.

- Accrued wages – 35,000 rubles;

- personal income tax withholding – 35,000x13% = 4,550 rubles;

- withholding of alimony: (35,000 – 4,550) x 25% = 7,612.50 rubles;

- transfer of alimony to the bank account of the alimony recipient - 7,612.50 rubles

- deduction of bank commission for transfer – 76.13 rubles;

- actual receipt of wages by the payer - (35,000 - 4,550 - 7,612.50 - 76.13) = 22,761.37 rubles.

Calculation of alimony debt

If the payer evades payment of alimony, or incomplete payment is made, a debt arises.

Alimony debt is calculated in one of the following ways:

- the size of the salary is taken as a basis (if the payer is employed and the size of his salary is known);

- based on average wages in the region of residence or across the country (if there is no data on the place of work and the actual amount of income of the payer);

- based on the subsistence level (if alimony is set at a fixed amount).

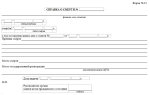

Calculation of alimony. We give examples with wiring

The most common type of alimony is retention in favor of minor children from one of the parents after divorce (Article 24 of the RF IC) or during marriage (Art. 80 of the RF IC).

When withholding alimony, you must comply with certain standards that are established in Article 109 of the RF IC.

Let us remind you that alimony:

- are withheld from the employee’s wages and (or) other income;

- are accrued monthly;

- are paid or transferred to the recipient no later than three days from the date of payment of wages and (or) other income of the payer from which they were withheld.

And if alimony is transferred by postal order, postal services are paid for at the expense of the alimony payer.

How to determine the amount of alimony

Family law provides for two options for calculating the amount of alimony, which, as a rule, is fixed in a writ of execution.

Option 1. In the amount of a certain share of earnings and (or) other income of the alimony payer.

Option 2. In a fixed amount.

The first option is used only when collecting them from parents for minor children in court. But the court determines the amount of alimony from a parent for the maintenance of minor children in a fixed sum of money if the parent’s income is irregular (Article 83 of the RF IC). Article 81 of the Family Code establishes that the court shall collect on a monthly basis:

- for one child - 1/4 of the parent’s earnings and (or) other income;

- two children - 1/3;

- three or more children - 1/2.

However, the size of these shares can be changed by court decision.

In addition, the law provides for indexation of alimony in proportion to the increase in the minimum wage (Articles 105 and 117 of the RF IC).

Maximum amount of alimony. According to Article 138 of the Labor Code, the amount of deductions under one or more enforcement documents cannot exceed 50% of the wages due to the employee. This rule also applies when withholding alimony, but with two exceptions that allow you to withhold more than 50% from an employee:

- if deductions are made from the employee simultaneously under a notarized agreement on the payment of alimony and under other executive documents (Article 110 of the RF IC);

— in case of collection of alimony for minor children, the maximum amount of deductions from wages increases to 70%.

If an employee must pay under two or more writs of execution at the same time, one must be guided by subparagraph 1 of paragraph 1 of Article 111 of Law No. 229-FZ. Requests for alimony are granted first priority.

How to record alimony payments

Alimony is withheld after personal income tax is paid. This rule is established in paragraph 4 of the List.

Withholding of alimony under writs of execution is carried out by debiting the accounts on which the employee’s income is accrued, and by crediting account 76 “Settlements with various debtors and creditors”, to which the “Alimony” sub-account is opened.

After all, not all of the employee’s income from which alimony is collected is reflected in account 70 “Settlements with personnel for wages.”

To reflect income from leasing property, account 73 “Settlements with personnel for other operations” should be used in accordance with the Instructions for the use of the Chart of Accounts, approved by Order of the Ministry of Finance of Russia dated October 31, 2000 No. 94n.

How to calculate alimony: an example of calculation for a child, how it is calculated from a salary

Regardless of whether the child’s parents are married or it has been divorced, they are obliged to take care and financially support him until he reaches adulthood. Custody, according to the Family Code of Russia, should have been divided equally. In the event of a divorce, whichever parent is dependent on the child has the right to receive financial support from the other parent.

In recent years, it has been quite difficult to understand how alimony is calculated, what is the procedure for calculating it, because the legislative framework is constantly being amended. Alimony relationships are regulated by the Family Code of the Russian Federation, Federal Law of the Russian Federation No. 229 of November 2, 2007 and RF Proclamation No. 841 of 1996.

How much is child support calculated?

The amount at which alimony can or should be calculated is not legally defined. They are paid by the father or mother if the children are being raised by the father, regardless of whether they have a regular income or not. Child support is a mandatory payment guaranteed to children by law.

Alimony for children born in marriage is calculated taking into account the rights of the child and the payer

Therefore, it is imperative to understand how alimony is calculated:

- a non-working parent;

- father or mother who has an unstable income or part-time job;

- a parent who has a job with a stable salary (the amount of salary does not matter);

- individual entrepreneur, etc.

Important! Employment and lack of stable income are not taken into account. The income of a parent who is not involved in raising a child affects only the future amount of child support payments. It must be deposited every month into the account of the mother or father raising the common child.

How to calculate child support

Before you understand how mandatory child support is calculated, you need to understand the principle of calculation. The Family Code of the Russian Federation stipulates that a child, after leaving the family of one of the parents, should not find himself in worse living conditions than before the divorce. At the same time, the alimony recipient should also not find himself without a means of subsistence.

Alimony for 4 children - what percentage

Calculations are carried out based on:

- minimum subsistence level (funds necessary to support a healthy baby);

- the minimum wage (the current minimum wage as of 2018 is 9,489 rubles) in the region or region;

- the needs and requirements of the child (according to the law, more funds need to be allocated for a child who needs additional care, special maintenance or treatment);

- private features.

Important! In order to correctly calculate alimony payments (without infringing on the rights of the payer and his children), the court takes into account the employment of the alimony payer and his physical condition.

For example, an unemployed father will pay a fixed minimum.

The amount of earnings, the presence of other dependents of the payer, his state of health (disability, need for treatment, etc.) are also taken into account.

An important point in clarifying the question of how alimony is calculated from the payer’s income is the type of payments. They can be voluntary or compulsory.

In the latter case, the amount of maintenance will be calculated by the magistrate based on the documents provided, the minimum wage and the cost of living. When drawing up a voluntary agreement, the father and mother of the baby agree on the amount of the benefit independently.

The document must indicate the billing period, the amount of maintenance, and the method of payment.

When calculating, different indicators are taken into account

The procedure for calculating percentage content

If the payer is an officially registered employee and receives monthly earnings, then alimony is calculated as a percentage of income. The principle is defined by Article 81 of the RF IC. It states that the percentage of deductions is directly proportional to the number of children:

- ¼ salary or 25% - when raising one child;

- 1/3 of the salary or 33% - for the maintenance of two children;

- 1/2 salary or 50% - when raising three or more children.

When concluding a settlement alimony agreement, the percentage calculation procedure is often used to calculate child support. He is eligible if the payer works for a full-time salary and receives a full salary (including a sufficient minimum). Otherwise, the payment procedure in a fixed amount is applied.

All official income of the payer is taken into account

But before calculating maintenance, they conduct an audit of the alimony provider’s income. According to Russian legislation, earnings include those funds that a person receives legally (pays taxes on income). When figuring out how to correctly calculate alimony from a salary, and what the amount of support will be, you need to consider:

- official bonuses and vacation pay of the employee;

- additional payments and sick leave payments;

- benefits from managing your own business (IP, CJSC, LLC, etc.);

- other types of wages.

Important! The amount of maintenance is calculated only on the actual amount, that is, on the balance after taxes. According to the changes that came into force in 2013, the child support provider must pay accruals until the child’s 23rd birthday if he or she has entered a university.

Procedure for settlements in a fixed amount

In a fixed or fixed amount, alimony is calculated only if the payer is unemployed or has incomplete or inconsistent earnings. The same procedure should often be considered relevant when managing a person as an individual entrepreneur.

A fixed monetary amount is an alternative method for calculating the child’s financial contribution. It provides for determining the amount of benefits as a multiple of the subsistence minimum (see PM below).

The calculation procedure requires collecting from the payer an amount that is a multiple of the PM, but not the average or equal to it. Both 2 PM and 1/10 PM can be awarded.

Maintenance for a child may be collected in court

You can agree on the amount of payment either voluntarily by signing an agreement with a notary, or you can collect it through the court. To have an idea of how fixed or fixed alimony is calculated, you need to get a few facts:

- find out PM. It will be different in different regions. There are also differences between national and regional. At the time of 2018, the PM amounted to 9,489 rubles;

- determine the standard of living familiar to the child. After the payment of funds, his situation should not worsen;

- determine the financial security of the alimony recipient, his marital status and the presence of children from another marriage, if one was concluded;

- identify additional features.

Important! In order to correctly calculate the amount of the benefit, the PM in the region of residence of the child, but not the payer of the maintenance, is taken into account. If PM is not established in a certain region, then maintenance will be calculated and paid according to the data established for the country. The fixed amount is indexed in accordance with Federal Law of the Russian Federation No. 229 of 2007.

What can be the maximum amount for alimony?

In Russia there is no maximum indicator for cash accruals. But at the same time, deductions in a fixed amount of money are considered to be minimal, and calculations as a percentage of earnings are considered to be maximum, since the amount of funds is always larger. At the same time, the “maximum” indicator is more often referred to as percentage deductions.

An approximate calculation of alimony can be made using an online calculator

Article 99 of the Federal Law of the Russian Federation “On Enforcement Proceedings” determines how child support is calculated and the maximum barrier for deductions from wages. It should not be more than 70%. After paying alimony, the payer must have at least 30% of the total income left for food, otherwise he will not have enough means of subsistence.

Calculation of alimony from wages, example

Knowing the percentage deductions established by law and the RF IC, you can independently calculate the amount of alimony accrual for one child from wages using the example below.

Let's assume that the father receives a monthly salary of 36,000 rubles. After the divorce, he was left with one child.

According to established standards, he must transfer 25% of his salary to his mother every month.

Alimony from the child's mother

The amount will be calculated as follows: Al. = Salary x 25% / 100% = 36,000 x 25% / 100% = 9,000 rub.

Accordingly, if you have two children, instead of 25% you need to substitute 33% into the formula. Calculation of maintenance for three children is carried out with a substitution of 50%.

Online alimony calculation

To avoid miscalculation, you can use an online calculator. Similar services are available on many legal websites. If the user does not know how to calculate alimony in real time, then you need to carefully fill out all the required fields.

Click "Calculate". Online services calculate not only the monthly amount, but also indicate the number of total payments until the child reaches adulthood and the total amount of maintenance.

This information will be useful if the payer is a debtor, and the other parent decides to collect funds from him in court.

When calculating financial benefits, you need to remember that this is not an average or a general value, but the amount of funds necessary for the parent who is dependent on the child for his full upbringing. Therefore, if an amicable agreement on the amount of maintenance and its payment cannot be reached, it makes sense to enlist the support of a legally competent person.

Calculation of alimony - how is it calculated and withheld from wages?

Sometimes the help of relatives to each other is legally secured in the form of alimony. The Latin origin of the term explains its meaning, because the root of the word translates as “nutrition.” Payment of alimony is made by one family member to another; it can be done voluntarily or under duress.

Alimony and current legislation

The Family Code of the Russian Federation is the main document regulating the payment of alimony. Section IV of this legal act determines who, in what cases, to whom and to what extent should transfer alimony payments. The grounds contained in the RF IC give the right to go to court to obtain the funds required by law.

The next document regulating the procedure for appeals, the choice of court and the rules for considering cases is the Civil Procedure Code of the Russian Federation.

In a number of cases, in addition to the indicated codes, to make a decision on the case, acts of the Plenum of the Supreme Court of the Russian Federation will be taken into account (for example, Resolution of the Plenum No. 9, adopted back in October 1996). It contains instructions and is actively used by judges in the following situations:

- the payer does not provide information about income;

- the payer knowingly provides false information about income;

- the payer’s earnings are less than the subsistence level in the region;

- the claimant demands payment for the child’s education at the university;

- the payer wants to reduce the amount of the penalty for unfulfilled obligations to pay alimony;

- In addition to collecting the amount of debt, the plaintiff wants to receive compensation for moral damage due to late payment.

On issues related to alimony, substantive law also regulates:

- Tax Code of the Russian Federation;

- Labor Code of the Russian Federation;

- Decree of the Government of the Russian Federation “On the list of types of wages and other income from which alimony for minor children is withheld.”

From what income is alimony withheld?

The income from which alimony can be deducted is clearly defined by current legislation. Most often, alimony is withheld according to the standard procedure, but in some cases there are exceptions.

Payments begin to be withheld from the defendant only after the necessary court decision appears. The defendant is obliged to pay alimony in the amounts and terms established by the court.

Important: alimony can be deducted not only from wages from the main place of work, but also from income from part-time employment.

Alimony payments are withheld from the following types of income:

- from the defendant's salary;

- from the salary of employees (both state and municipal);

- from additional payments, fees and allowances;

- from average earnings;

- with bonuses.

Important: the amount of alimony is determined by the court - it can be a fixed amount of money or a percentage of the defendant’s earnings.

Alimony may also be withheld from other sources of income of the defendant:

- from income from the rental of movable or immovable property;

- from income from business activities;

- from unemployment benefits;

- from pension payments;

- with financial assistance;

- from income received under contracts for the provision of services or performance of work;

- from student scholarships;

- from sick leave benefits.

Payments from which alimony is prohibited from being withheld

The list of payments from which alimony can be deducted is quite long. However, there are also such monetary receipts of the defendant from which it is prohibited to collect alimony. These include:

- payments in connection with pregnancy and childbirth;

- maternal capital;

- funds for the maintenance of a minor;

- survivor benefits;

- assistance at birth, burial, natural disaster, marriage;

- compensation for travel on a business trip;

- compensation for special meals in medical institutions;

- compensation when transferred to another place of work or to another region.

Grounds for paying alimony

For an obligation to pay alimony to arise, the following grounds must exist:

- kinship or family connection;

- conditions provided for by law or agreement of the parties, such as need, disability of the recipient;

- the payer has the funds necessary for payments;

- there is a court decision to collect alimony, an agreement between the parties or a court order to pay alimony.

How is child support paid?

In order for funds intended for alimony payments to be withheld from wages, it is necessary to have a document confirming the legality of such actions. It could be:

- An executive document issued on the basis of a court decision or order.

- A voluntary agreement on the payment of alimony, concluded between the payer and the recipient before a notary. Its legal force is equivalent to a writ of execution.

If one of these documents is missing, then the funds accrual procedure cannot be carried out. To do this, you must first enter into an agreement with the payer or file a lawsuit to collect alimony.

When the accounting department of the enterprise or organization where the alimony payer is employed has one of the specified documents, then there will be legal grounds for their calculation.

The following may transfer an alimony agreement to the payer’s place of work:

- bailiffs who initiated proceedings in the case;

- collector of funds;

- payer of funds.

Judicially

The possibility of collecting alimony by going to court is provided for by the legislation of the Russian Federation, even without first filing a claim for divorce.

Such situations may arise when one of the spouses refuses to support a child or does not fulfill its obligations to support a disabled family member.

It is necessary to go to court when the other party voluntarily refuses to enter into an agreement on alimony payments. In this case, if the necessary conditions are met, the collection of alimony will occur through compulsion.

In court, alimony is withheld:

- In the absence of official registration of marriage. A procedure for establishing paternity will be necessary, which is possible if there is information about the child’s father in the birth certificate, the reality of conducting a medical genetic examination, and the presence of other irrefutable evidence.

- According to a simplified procedure in the order of writ proceedings. To obtain a court order, you must provide documents confirming family composition, sources and level of income, place of residence, being in a registered marriage, as well as all dependent children. Having studied the materials in the case, taking into account the position of the parties and their financial status, the judge makes a decision on the collection and payment of alimony.

- By way of claim proceedings. It is considered the most universal way of assigning alimony payments. In this case, alimony can be assigned in a fixed amount or as a share of income. In claim proceedings, it is also possible to recover funds for the previous period that created the debt for payment. To file a claim, copies of the plaintiff’s passport, children’s birth certificates, registration or divorce certificates, original certificates of family composition at the place of residence of the plaintiff and defendant (if such information is available), as well as a calculation of the amount required for maintenance, with justification for expenses, are provided .

By agreement

An agreement to pay alimony is a document concluded in writing and certified by a notary. According to Art. 100 of the Family Code of the Russian Federation, a notarized agreement on the payment of alimony has the same legal force as a writ of execution.

Important: a unilateral change in the terms of the agreement on the payment of alimony or a unilateral refusal to fulfill obligations is not allowed (according to Part 3 of Article 101 of the RF IC).

The interested party, in the event of a significant change in financial or marital status, if it is impossible to reach agreement on changing or terminating the agreement, has the right to file a claim with the court to terminate or change the terms of the alimony payment agreement. This opportunity is guaranteed by Part 4 of Art. 101 IC RF. The court takes into account any information that deserves attention in the case.

By agreement, alimony may be paid:

- in shares of the person’s earnings or other income;

- in a fixed amount payable periodically;

- in a fixed amount of money, paid in one lump sum.

Compensation for alimony is also provided for by the provision of property or other means on which there is an agreement. An alimony agreement may contain different ways of paying alimony, which is enshrined in Art. 104 RF IC.

Important: an agreement on the payment of alimony is drawn up by a notary individually in each case.

How is child support calculated?

Various ways of fulfilling alimony obligations are established by law. The standard way to determine the amount of alimony is to allocate a certain share of the payer’s total income.

There is also an alternative - alimony payments in a fixed amount of money. In the latter case, their size will depend on the cost of living established in the region of residence of the minor.

If such an indicator is not available, the cost of living in Russia is taken into account.

Important: the court takes into account the salary of the alimony payer. It must be no less than the minimum wage (minimum wage).

Revenue share

Article 81 of the RF IC determines the share of alimony payments depending on the number of children for whom they are collected from the defendant’s salary. The court sets the following monthly payments:

- one quarter of earnings or other income - for one child;

- one third of earnings or other income - for two children;

- half of earnings or other income - for three or more children.

The size of shares specified in the law may be reduced or increased by the court. The marital status of each party is taken into account, as well as other circumstances that deserve attention. These include:

- financial situation of the alimony payer;

- need of children;

- financial situation of the parent permanently living with the child;

- whether the alimony payer has other dependents.

When concluding a voluntary agreement on child support, parents can independently determine the amount needed for their child. It is important that the level of payments chosen by agreement is not lower than that assigned through the court in shares, so that the rights of a minor child are not infringed.

Fixed amount

The appointment of alimony payments in a fixed amount is provided for in Art. 83 of the Family Code of the Russian Federation and can only be when the following conditions exist:

- there is no voluntary agreement on the payment of child support between the parents;

- the alimony payer has irregular or changing earnings;

- in addition to the main type of income, the alimony payer has additional income;

- the parent obligated to pay child support receives income or earnings (in whole or in part) in the form of a natural product or in foreign currency;

- the alimony payer has no income;

- it is impossible or difficult to collect alimony on a shared basis;

- alimony payments in shared order violate the interests of the recipient or payer.

If none of the specified criteria is confirmed, alimony payments will be assigned in a proportion of the payer’s income.

Important: you can choose the method of paying alimony (in a fixed amount or in a share) without going to court. To do this, an agreement on the payment of alimony is concluded, certified by a notary.

It is equally important that the amount specified in the voluntary agreement is no less than what could be assigned by the court when considering a claim in the same situation.

How is child support deducted from wages?

Alimony payments are withheld and transferred to the recipient's account by the accounting department of the enterprise or organization where the payer is employed.

The basis for deduction of funds from wages is an executive document or a voluntary agreement legally equivalent to it.

In more detail, the calculation of alimony payments is as follows:

- to begin with, personal income tax is withheld from the payer’s salary;

- the amount of the accrued payment corresponds to the share of earnings or a fixed amount specified in the writ of execution or voluntary agreement;

- payments made under the writ of execution are made once a month, while by agreement they can be in accordance with the procedure specified in it (for example, once a quarter);

- the funds are transferred to the recipient’s specified account no later than 3 days from the date of payment of the salary of the alimony payer;

- the amount of funds withheld for a minor child cannot exceed 70% of the salary of the alimony payer;

- according to Art. 117 of the Family Code of the Russian Federation, it is mandatory to index payments in proportion to the increase in the cost of living for a specific socio-demographic group of the population in a constituent entity of the Russian Federation or throughout Russia.

In cases of errors, the responsibility established by law is borne by the accounting department and the head of the enterprise (organization) in which the alimony payer works.

Indexing

Periodic recalculation of alimony payments is their indexation. It is made to maintain the level of payments taking into account the impact of inflation. All payments that are assigned in a fixed form or indicated in a multiple/fractional ratio to the cost of living are subject to indexation.