Family Law > Child Support > How Much Child Support Should an Unemployed Father Pay?

For a working father, payments are deducted from his salary . But what if it doesn't work?

Some men hide their income from their ex-wives so as not to participate in child support. So how can you demand child support from a non-working father in 2023?

Is a non-working father required to pay child support?

- The question of how to collect alimony from the officially unemployed father of a child has recently become increasingly relevant.

- The answer to these questions is contained in Article 80 of the Family Code of the Russian Federation, according to which the obligation to support children until they reach adulthood rests with parents, regardless of their labor status.

- The procedure and amount of these payments can be negotiated between the mother and father of the child.

From this we can conclude that the obligation to support children is not affected by the absence of official work.

Sometimes a husband, divorcing his wife, may get an unofficial job in order to hide the amount of his earnings. Some of them even register with the Employment Service in order to obtain unemployed status.

But even if the amount of payments for child support is 50% of the amount of this benefit, it is still a very small amount.

In this case, Article 83 of the RF IC states that the mother can file a lawsuit to recalculate child support if the father does not officially work and his income does not allow him to provide normal living conditions for the children. In this case, the recalculation is made in hard cash equivalent.

For example, if a man receives a monthly unemployment benefit in the amount of 850 rubles, alimony will be only a little more than 200 rubles. (25% of the benefit). Of course, you can’t support a child with that kind of money.

To calculate what amount in hard monetary terms should be accrued to the child, the court may use the minimum subsistence level.

This value is individual for each region, but on average it is 8-10 thousand rubles. The court must take into account the possibility of maximizing the preservation of the normal standard of living of children.

Situations in which alimony is charged

What to do if your ex-husband doesn’t work and doesn’t pay child support? Such situations happen more and more often in the modern world.

Even if the father receives the maximum possible unemployment benefit (4.9 thousand rubles), then 25% of this amount (the amount of child support) is still not enough to adequately support a minor child.

However, it should be borne in mind that most unemployed people do not receive this amount, but only 850 rubles.

In this case, lawyers advise mothers to file a claim in court to transfer payments into a fixed amount of money. There will also be pressure on the man to more actively search for work.

The same application should be submitted if the father is not registered with the Employment Service.

You can find out how alimony is calculated if a person does not officially work from the bailiffs.

For this purpose, the average monthly salary in the Russian Federation is taken into account. This value can be found out at the time of calculating alimony in Rosstat.

Until what age is child support paid?

According to paragraph 2 of Article 120 of the RF IC, payment of alimony stops when the child reaches the age of majority (18 years).

This paragraph also clarifies that the termination of maintenance payments may be terminated earlier.

This is possible when the child receives full legal capacity, i.e. in the following cases:

- marriage or marriage;

- apparatus employed.

But at the same time, alimony can also be recovered from an adult child if he is disabled, i.e. disabled person.

Amount of payments from a non-working father

- The minimum amount of alimony if the father does not work is not established by law.

- That is why lawyers recommend that this issue be resolved peacefully through an agreement concluded between the two parties.

- In it, parents can independently indicate the minimum amount of payments that will suit everyone.

- But if it is not possible to conclude such a peace agreement, then the minimum amount of alimony is established by the court.

- The following life indicators of parents and children are taken into account:

- level of earnings;

- Family status;

- region of residence;

- reasons for the father's lack of work;

- the period during which the man is unemployed, etc.

- If the father voluntarily agrees to support the child, then the court sets the minimum amount of payments that the man can pay.

- If the payer evades alimony, its amount is calculated according to all the rules, taking into account the average salary in the Russian Federation.

- Sometimes the court can establish alimony in a fixed amount, the amount of which depends on the previous level of support for the child, as well as the family and financial situation of both parents.

The amount of alimony if the father’s official status is unemployed

Child support is calculated from this benefit . Their amount is established on the basis of a court decision or a voluntary alimony agreement.

But since in most cases the amount of unemployment benefits is very small, the alimony calculated from them will not be enough to ensure the normal existence of the child.

Amount of payments from unemployed parents without unemployed status

Since such a parent does not have official earnings, payments for the child are calculated taking into account the salary at the last job or the average wage in the payer’s region of residence.

If the parent is retired or disabled

If this value is below the subsistence level, then the state assumes obligations for alimony.

The amount of child support is calculated based on all the needs of the child.

To do this, the mother must provide documents confirming the necessary expenses (food, clothing, paid classes, etc.).

If the father has unofficial income

Some payers are not officially employed, but at the same time they have some kind of unstable income.

Since it is difficult to officially confirm the income of such a father, there are two ways out of this situation:

- Track the receipt of money and its expenses . After the court makes a decision to collect alimony from him, the woman can submit an application to the bailiffs to track all the cash receipts and expenses of the officially unemployed father. Thanks to this, it is possible to determine the amount of the father’s income and collect alimony from him.

- Obtain evidence of the payer's receipt of income . Only witnesses who are not interested in the outcome of the court case can give evidence.

How is the amount of alimony calculated for an unemployed person?

How much child support should an unemployed father pay for one child?

To calculate this amount, the average salary in Russia or the region of residence is often taken into account. From this, ¼ of earnings per child is calculated.

The average salary for January 2023 is 30.1 thousand rubles.

This value may vary depending on the region of residence.

To collect alimony from a non-working father, the following part is calculated from this amount:

- ¼ (25%) per child, i.e. out of 30.1 thousand rubles. alimony will amount to just over 7.5 thousand rubles;

- 1/3 (30%) for two children, i.e. 9 thousand rubles. from average salary;

- ½ (50%) for three children, i.e. about 15 thousand rubles.

If the father has official unemployed status, then the minimum wage unemployment benefit is taken to calculate child support.

Its value in 2023 is 5965 rubles. 1,491 rubles will be collected from it as alimony. for one child, 1789 rubles. for two children and 2982 rubles. for three persons.

Filing for alimony during divorce and marriage

Filing for alimony is possible not only when spouses divorce, but also in an official marriage.

In this case, the court considers two situations in which it is possible to recover payments for child support:

- Separation of spouses.

- Parents live together, but one of them does not take any part in the financial support of the child.

You can find out how alimony is calculated in a marriage, during a divorce, and in the event that one of the parents is unemployed in the magistrate’s court.

When collecting payments from a spouse with whom an official divorce has not been filed, the court district should be chosen at the place of residence of the husband.

Moreover, if the spouses are still married, then it is not a lawsuit that is filed in court, but a simple application, since both parents are obliged to support minor children, regardless of their work status. There is no state fee charged when submitting this application.

How to apply for alimony

- If one of the parents evades paying child support, it is necessary to provide evidence to the court confirming that the father does not participate in the maintenance of the child.

- Experienced lawyers will help you find out how such payments are calculated and what is needed for this.

- In most cases, the following documents are required:

- checks and receipts confirming expenses for child support;

- receipts for clothing purchases;

- receipts for the purchase of school supplies;

- contracts confirming the child’s attendance at paid clubs, sections and classes;

- receipts for food purchases.

The court order is issued within a few days . Moreover, this does not require the presence of the plaintiff and defendant, since the court independently considers the application and evidence of the father’s non-participation in the maintenance of the child.

After this, a court order is issued, which indicates the amount of payments, terms and procedure for collecting alimony.

Child support from a parent who does not officially work can be collected in the form of a portion of his income or a fixed sum of money. Since the unemployed payer has no income, alimony is calculated based on the average salary.

The advantage of this method is that the alimony debt will accumulate . If the father finds work, this debt will be written off from his earnings. And if the payer never finds a job, then the debt is collected from the property owned by him.

But at the same time, a man can register as unemployed at the Employment Center and receive a minimum benefit, from which alimony will be deducted, so its amount will be very small.

If you collect alimony from a parent in a fixed amount, then payments will be transferred monthly, regardless of whether he has a job or earnings.

The disadvantage of this method is the fact that if the father gets a well-paid job, the amount of alimony will not change.

In addition, the court may assign a small fixed amount of alimony, since its minimum amount is not established by law.

Conclusion

Collecting alimony from a non-working father is a pressing problem today, since a certain category of men does not want to fulfill their obligations to support children.

There are two types of calculation of such payments, each of which has its own advantages and disadvantages. An application for alimony is submitted to the magistrate's court.

Similar articles:

- In contact with

- Classmates

- Google+

Alimony from the unemployed in 2023 in Russia: calculation, collection, sample application

Some parents mistakenly think that, citing lack of work, they can avoid responsibility for paying child support. Officially unemployed citizens, as well as those registered as unemployed, are required to make child support payments on the same basis as employed persons. How to pay alimony to an unemployed person in Russia? More details about this in our material.

Grounds according to law

Will child support be collected from an unemployed parent in 2023? Definitely, they are being exacted. The provisions of the following legal acts regulating this issue are still in effect:

It makes absolutely no difference whether the father works somewhere or not. Despite his lack of official income, he is obliged to financially help his child.

The amount of assistance provided to an unemployed parent as a child support payment is often greater than could be established as a share of the official salary.

In this regard, parents who are still avoiding child support obligations due to unemployment have an excellent incentive to finally think about and find a stable, and most importantly, official job.

Let’s immediately decide who is considered unemployed and who is simply not working. From the name of the concepts it is clear that neither one nor the other is officially employed.

An unemployed person is an officially unemployed citizen who joined the labor exchange on time and receives benefits.

A non-working person is also an officially unemployed citizen, but has not been registered with the labor exchange and, accordingly, does not receive any benefits. In this material we will use both meanings, so we immediately decided to clarify.

Whether a parent is registered with the Employment Center or not determines how child support collected from an unemployed person is calculated. We will analyze all the situations on how to pay alimony to an unemployed citizen in Russia.

Amount of alimony from an unemployed person

Let's discuss how to calculate the child support required from an unemployed father.

Article 83 of the Family Code provides an unambiguous provision that child support for a child under 18 years of age is collected from an unemployed parent exclusively either in the form of a flat sum of money or a flat sum plus a percentage of earnings.

Which is quite clear, since collecting alimony only in the form of a share of earnings from an unemployed person is, to put it mildly, difficult, since he does not receive a salary. Next, we will look at the amount of alimony for the unemployed in 2023.

Payment of alimony in a fixed amount is always assigned not only to unemployed alimony workers, but also when:

- the parent has irregular earnings;

- receives a salary in kind, some kind of barter, for example;

- has income in foreign currency.

In general, all situations where it is difficult to determine the amount of alimony payments as a percentage of the earnings of the respondent parent.

Before calculating the amount of child support due from an unemployed person, you need to check with him whether he is considered officially unemployed or not.

In other words, you need to check with the respondent parent whether he is registered with the Employment Center. If he is a member, then it is advisable to ask him to obtain a certificate from the authority about the amount of the benefit issued to him.

This certificate must subsequently be attached to the package of documents sent with the claim to the court.

Alimony from an unemployed citizen in 2023, as in previous years, is collected in a fixed amount of money.

But, if the parent is registered with the labor exchange, then the court in most situations assigns a share of the benefit plus a certain monthly amount of money.

The reasons for this are understandable - ¼ of the unemployment benefit is naturally not enough to meet the needs of the child. The citizen receiving benefits himself most likely also lacks it. Let's summarize everything said in the table:

| Father stands at the labor exchange | The court orders payments to children in the form of a share of unemployment benefits plus a fixed amount of money. |

| Father is not on the labor exchange | The court assigns only a fixed amount of money, since the father has no other income. |

Minimum amount

What kind of alimony can you expect from an unemployed person? We have already determined that they will be, rather, in the form of a specific amount of money. As such, the concept of “minimum alimony collected from an unemployed person” does not exist in the legislation. But, the insurance policy contains a provision that in any case, the amount of payments assigned must satisfy the child’s usual needs.

In judicial practice, most often when determining the amount of alimony from an unemployed person, the child's subsistence level is used. Each region has its own indicator.

In Moscow, let’s say, it is currently equal to 14,252 rubles, in St. Petersburg – almost 10,368 rubles, and in Murmansk – all 15,048 rubles.

Before you sit down to calculate the monthly expenses for the needs of the child, you need to clarify what the minimum cost of living for children is established in a particular region for a given quarter.

At the employment center

How much child support should a person pay if he is officially declared unemployed? The maximum amount of benefits paid to unemployed persons in 2023 is 4,900 rubles. The state cannot provide assistance above this amount. ¼ of 4,900 is 1,225 rubles.

This amount is not even enough to pay for the services of a child’s municipal kindergarten. That is why it is advisable to request payments in a fixed amount. But the downside of a fixed amount is that if the child support father subsequently gets a well-paid job, the assigned child support will remain the same.

They can only be changed through the court, by filing a new claim.

How much child support an unemployed person is owed depends on how long ago they lost their job. If more than a year has passed since this moment, then the amount of alimony from the unemployed will be determined based on the minimum wage established in a particular region.

The minimum income of a working citizen living in the capital in 2023 was 17,560 rubles.

Accordingly, for one child, based on this principle for determining the amount of payments, the following will be assigned: 17,560 × 25% = 4,390 rubles.

For two people, alimony from an unemployed person who quit more than a year ago will be equal to: 17,560 × 33% = 5,794.80 rubles. Finally, for three children: 17,560 × 50% = 8,780 rubles.

If the parent lost his job not so long ago, less than one year ago, then when determining the amount of alimony from the unemployed, his last earnings are taken into account. In this case, certificates of income from the last place of work are requested.

If disabled

As surprising as it may sound to some, payments to children from disability benefits are also made. This is directly indicated by subparagraph a) of paragraph 2 of List 841 of the Resolution.

How is child support collected from an unemployed disabled parent? It all depends on the parent’s disability group.

If the father has a disability of group II or III, under which he can work in light types of work, then the court, in addition to the share of the benefit he receives due to the child, may assign some additional amount of money.

If the parent is a disabled person of group I, then you should not count on alimony amounts exceeding the share of the benefit. In any case, when determining the amount of alimony collected from an unemployed disabled person, the court will take into account information from medical certificates indicating his state of health.

If you are a pensioner

All pensioners who are obligated to pay child support pay it. The only exceptions are citizens receiving pensions due to the loss of a breadwinner.

Before collecting payments from a pensioner, you need to clarify whether he works somewhere officially or not. Most pensioners in Russia are employed and receive both a pension and a salary.

In this case, alimony is calculated from all types of income.

Not on the labor exchange

In such a situation, alimony from the unemployed must be collected exclusively in the form of a specific amount of money. How to determine it? To do this, you need to calculate the monthly costs for the child:

- for accommodation, payment of utilities;

- for food;

- for clothes and shoes;

- to pay for nanny or day care services;

- for children's entertainment, a trip to the circus, for example;

- for toys - what baby doesn’t need them;

- on medicines - no one is immune from illness.

For all these costs, you need to make a detailed summary list, indicating down to the penny. This list should be attached to the package of documents prepared for the visit to court.

The resulting amount in the list must be divided by two, since both parents are required to bear the costs of maintaining a common child. The required figure will become the amount of the required payments.

Alimony collected from an unemployed person for the maintenance of two children is calculated in a similar way.

Procedure

So, where to start the procedure for collecting alimony from an unemployed person?

- Step one. We are trying to negotiate with an unemployed father on drawing up a voluntary agreement on child support. The unemployed parent may have other sources of income, such as dividends from bank deposits or income from renting out a house.

- Step two. If a parent refuses to voluntarily provide help, we will find out whether he is registered as unemployed. If so, we ask him to request a certificate from the Employment Center about the amount of benefits received. We attach it to the package of papers for the court. We also clarify when exactly he lost his job, and whether a year has passed since that moment. This information is relevant for determining the amount of alimony.

- Step three. We are collecting a package of documents for the court. Their detailed list is presented below.

- Step four. We estimate the monthly costs for the child and draw up a detailed calculation.

- Step five. Let's go to court.

The main goal is to prove in court that the requested amount of alimony is completely justified. To achieve this, it is important to correctly calculate the costs for the baby and not miss a single detail.

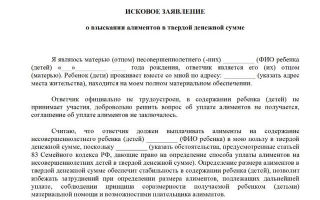

Statement of claim

In 2023, there are no new requirements for writing a claim for alimony from an unemployed person. You can use standard alimony forms posted in the public domain on the official websites of court districts. The court application states that the defendant is not working and justifies the requested amount of alimony. A sample application can be downloaded here.

What documents are needed? The package of documents consists of:

- plaintiff's passport;

- a document indicating the relationship of the baby with the defendant - a birth or adoption certificate or a court decision;

- marriage or divorce certificates of the plaintiff and the defendant;

- certificates of residence of the plaintiff with the baby;

- certificates about the amount of unemployment benefits received by the defendant (if he is recognized as unemployed);

- certificates about the amount of the defendant’s pension (if he receives a pension for any reason);

- calculating costs for a child;

- papers confirming expenses: checks, receipts, etc.

- Copies are sent to the court along with the originals.

Let's summarize. Alimony from unemployed citizens in Russia is collected according to the general principle. They are awarded either in a fixed amount of money plus a percentage of the defendant’s other income, or exclusively in a fixed amount. Alimony is also withheld from unemployment benefits, pensions, including disability benefits. The only exception is survivor benefits.

The minimum alimony payment for the unemployed is not established by law. But, as practice shows, it is related to the subsistence minimum per child established in a certain region. In any case, the court assigns an amount commensurate with meeting the child’s usual needs.

Still have questions on the topic Ask a lawyer

How to collect child support from the officially unemployed father of a child?

Many payers and recipients of alimony mistakenly believe that their failure to pay due to the fact that the father does not work (due to lack of work as such or dismissal from a previous place of employment) is valid or that the alimony obligee is completely exempted in this case from the need to pay funds for child support . However, this is not at all true, and often alimony from a non-working father can be collected in a much larger amount than from a payer with a fixed salary (and therefore, in many cases, this is not beneficial, first of all, to the payer himself)!

The Family Code (FC) of the Russian Federation is completely built on the observance and protection of the rights of minor children, including defending their right to receive maintenance from both parents, regardless of their social status, and the Federal Law “On Enforcement Proceedings” talks about specific legal instruments to combat "draft dodgers".

If, when assigning alimony, the parent did not attempt to get a job or did not register with the employment center (PEC) as officially unemployed, then arrears will accumulate , in accordance with the amount of which it will be possible to hold the debtor to various types of liability :

- civil-administrative;

- criminal

In addition, the claimant and the payer should be aware that if alimony was collected from a working citizen , who subsequently intentionally or inadvertently lost his job and is unable to pay the due funds, the accumulation of arrears of unpaid funds is provided for, which also results in bringing the person to justice .

How is child support calculated if the father does not work?

In a situation where one of the parents does not have a job, the second parent, who is actually raising the child, has the full right to file a claim for alimony, guided by Art. 80 and 83 of the RF IC, which establishes:

- the obligation of both parents to provide financial support for their minor children;

- the possibility of collecting alimony in a fixed amount from a non-working parent.

The award of alimony in a “fixed amount” allows you not to be tied to the amount of earnings of the child’s father or other income, but to establish the amount of payments in accordance with Art.

117 of the Family Code of the Russian Federation, in proportion to the size of the subsistence minimum established in a specific region of the Russian Federation (the national average subsistence level for children at the beginning of 2018, established by Government Decree No. 352 of March 30, 2017, is 9,434 rubles ).

If alimony has already been assigned for payment, then the “punishment” for the absence of a job of the person in respect of whom it was established and from whom it was collected before losing his job will be:

- Education and rising debt:

- Collection of a penalty (fine) for late payments - if the plaintiff files a corresponding statement of claim with the magistrate (the amount of the penalty is 0.5% of the amount of debt for each day of delay).

- Application of liability measures to the debtor:

- Civil-administrative (deprivation of a driver’s license, travel ban, blocking of certain government services, foreclosure of property to pay a debt, etc.);

- Criminal (involvement in accordance with Article 157 of the Criminal Code of the Russian Federation).

How is minimum child support determined in 2018 for a non-working person?

Art. 80 of the Family Code establishes the obligation of both parents to support their children. In this regard, they must equally bear the costs of their upbringing. This principle is the basis for the calculation of alimony from a non-working person in a fixed monetary amount, which includes:

- establishing a living wage per child in the region of residence;

- approximate cost calculation for your child per month (taking into account additional expenses - for treatment, for visiting paid sections, etc.);

- correlation of these amounts and recovery of half of the total amount from the defendant - since parents are equally obliged to support their common child.

When going to court to collect alimony, you must ask for exactly half the amount required monthly for each child. This is due to the fact that both parents are required to participate in these expenses. In this case, it is necessary to prepare a calculation of alimony based on actual receipts from stores, as well as for a certain period of time in advance.

Thus, the attached calculation of alimony and the rationale for it are important for determining the amount of alimony. After all, it is one thing, for example, to support a healthy teenager, and quite another to support a disabled child. In this case, maintenance costs increase due to the need for special care, medications and medical procedures.

- All this information is important for the court, because in many cases the second parent works unofficially and lives in abundance, and in order to evade his parental responsibilities, he tries to obtain the minimum alimony collected from the non-working person, hiding his income and real marital status.

- In addition, even if the second parent is officially unemployed , it is necessary to point out to the court possible hidden sources of income. This could include informal rental of real estate, interest on bank deposits, etc. All this will allow you to achieve a fair amount of alimony in court.

At the same time, not only official certificates are taken into account, but also evidence provided by the parties regarding hidden income. The main thing is that these materials do not contain any assumptions, but clearly indicate the facts of the availability of income.

- Answer a few simple questions and get a selection of site materials for your case ↙

A non-working parent is obliged to support his child until adulthood - this provision of Art. Art. 80, 83 of the RF IC give the right to collect alimony payments from negligent parents. In this case, the person actually raising a common child independently decides how these funds are collected:

- voluntarily;

- forced through the court.

Through a notarial agreement with a non-working person

We are talking about the mutual drawing up of a notarized voluntary Agreement on child support, in which parents, in order to reach a compromise, can agree on the amount, frequency of payments or come to another convenient solution to this issue.

Example

Olga and Konstantin stopped living together, the child remained with his mother.

Thinking about assigning alimony, knowing that Konstantin did not have a job, Olga suggested that he re-register the car, once purchased with his funds, in the child’s name. Konstantin agreed.

The parents secured this circumstance with a notarial Agreement, replacing alimony payments with the transfer of movable property in the form of a car to the child.

Lawyer's comment. Olga and Konstantin made a wise decision for both parties. Olga received a car for use, while having collected alimony by court decision, she would have waited quite a long time for the debt to accumulate, then for a procedural decision to collect it.

Konstantin avoided forced collection measures, especially if the debt reached 10,000 rubles, the bailiff could “block” his driver’s license, and if the debt grew, the property in the form of the same car could be “sold” to pay off the debt .

By filing a claim in the magistrate's court

We are talking about applying to a magistrate's court at the location of the payer or the claimant - at the choice of the applicant (i.e., according to the principle of alternative jurisdiction ). Regarding unemployed citizens who have no income, the court collects alimony in a fixed monetary amount, based on the cost of living in the region of residence of the family.

Example

Natalya and Pavel divorced, for some time Pavel gave his ex-wife certain amounts for the child. Soon Pavel lost his job and stopped sending money for his son. Pavel refused to respond to Natalya’s verbal entreaties to help financially.

Soon, the ex-wife applied to the magistrate court at Pavel’s place of residence with a claim for the recovery of alimony in a fixed amount of 4,422 rubles. — which is 1/2 of the subsistence level per child in the Bryansk region (8,844 rubles.

) - in the region where the child lives.

The procedure for filing an application to court against a non-working father

The procedure for applying to court to hold a non-working father liable for child support is no different from a claim against a working person. The only distinctive feature is the method of collecting funds from the payer - according to Art.

83 of the RF IC, it must be determined in a fixed sum of money , and if the payer has other income (for example, from leasing property) - the funds can be recovered simultaneously in shares and a fixed sum of money .

The statement of claim is filed with the magistrate’s court at the place of residence of the plaintiff or defendant (at the plaintiff’s choice) and contains:

- Information about the plaintiff (full name, address, telephone number).

- Information about the defendant (full name, address, telephone number).

- Data on the child (children) - full name, age, employment, needs.

- Abstract statement of the problem:

- the reason for filing the claim;

- the second parent has no official income;

- failure to register the defendant as unemployed at the employment center;

- calculation and justification of expenses per child per month (with the attachment of real checks, receipts, etc.);

- an indication of the payer's known income.

- Requirements for the court - assignment of alimony in a fixed amount;

- Calculation of a fixed amount of money.

- Attached documents:

- a copy of the plaintiff's passport;

- a copy of the child's birth certificate;

- a copy of the divorce certificate (if available);

- checks and receipts for child expenses;

- certificate of income of the plaintiff and other documents relevant to the case.

When filing a claim for alimony, the state fee is levied on the defendant, not the plaintiff.

A sample statement of claim for alimony from a non-working person can be found below.

You can download a sample statement of claim for alimony in a fixed amount from an unemployed person here.

Who else can count on receiving support from a non-working person?

The legislation of the Russian Federation provides that not only adult children, but also the following persons have the right to alimony, including from an unemployed citizen:

- adult disabled children in need of care;

- an official wife (including an ex-wife) who is pregnant with a common child or on maternity leave for a child up to 3 years of age;

- official spouse (former spouse) recognized as needing financial assistance.

When filing such claims:

- the applicant's arguments are carefully checked by the court for the presence of documentary evidence;

- the marital status of the applicant and the future payer is established (the presence of other dependents - parents, children);

- the reason for the social status of the parties is taken into account (for example, the presence/absence of disability of the child, the claimant or the payer, the pension age of the payer, etc.).

Alimony from an unemployed person - 2 simple ways to collect debt through court!

The obligation to pay alimony for the maintenance of minor children is established by Chapter 13 of the Family Code (FC) of the Russian Federation. When the alimony payer has an official job and “white” income, there are no problems with collecting it. Difficulties begin when the alimony payer is unemployed.

The content of the article:

○ Is an unemployed person obliged to pay alimony?

○ So how much?!

○ How to collect alimony from an unemployed person?

○ Calculation example.

○ Video (lawyer E. Terekhov).

○ Is an unemployed person obliged to pay alimony?

The very first question. In general, the answer is always YES , I must.

Let us explain why: after the divorce, fathers (and in rare cases when a child is left with the father, their mothers) refuse to pay child support for minor children, arguing that they are unemployed and, accordingly, they have no income.

But this circumstance is not a reason for refusing to pay child support. We discussed divorce issues in detail in this material .

Article 80 of the RF IC imposes on parents the obligation to support their minor children, regardless of whether they have income or not.

○ So how much?!

- When the first question is resolved, the second is usually asked: so how much alimony should an unemployed person pay?

- Let's consider several situations related to the collection of alimony from an unemployed person:

- 1) If a citizen is officially recognized as unemployed and receives unemployment benefits.

In this case, the citizen should receive benefits.

Its size is set based on the average salary from the last place of work, or on the average salary in the region. From these amounts alimony is collected in the appropriate amount.

Often, the amount of unemployment benefits paid is so small that it does not cover the entire alimony debt, but for the province, collecting the average wage in the region is sometimes beneficial.

Thus, from citizen N, living in the small town of Bobrov in the Voronezh region, in 2013 the court collected alimony in the amount of 1/4 of the average salary in the region , which at that time was about 27 thousand rubles in the Voronezh region. At the same time, in provincial Bobrov, with a population of just over 30 thousand people, the average salary barely exceeded 15 thousand rubles.

2) If a citizen is unemployed, but has a disability group or a pension.

When considering a child support case, the court will take into account all of the parent’s income. If this income is significantly lower than the subsistence level established in the region, then alimony is “paid” by the state. In this case, it is important for the plaintiff to collect as much evidence as possible of the child’s “need”, which will determine the amount of alimony collected.

3) If a citizen is not officially employed anywhere, but has an unstable income or periodic earnings.

If, during the divorce, the parents were unable to agree on a specific amount of alimony to be paid, and the court cannot collect it, since the parent is not officially employed, there are several options for getting out of this situation:

○ Tracking the debtor's cash receipts. After the court decision is made, you must contact the bailiff's office with an application to track the debtor's income/expenses. After the bailiff has verified all the debtor’s financial transactions, the court orders a new trial to establish the amount of alimony to be collected.

○ It is possible to find witnesses who will not be interested parties in the case under consideration and will be able to testify regarding the debtor’s income. The lawyer, in agreement with the client, must find (preferably before the trial) several witnesses and file a motion to interrogate them.

○ How to collect alimony from an unemployed person?

Alimony is collected from an unemployed person in two ways:

1) The general procedure is a share of the payer’s earnings.

A clear (+) advantage will be that, despite the lack of official employment, the alimony payer will still accumulate debt, since the amount of alimony will be calculated based on the average salary in the region. This will continue until the debtor gets a job. But if this does not happen, the debt will be collected at the expense of his property.

- (-) The disadvantage of this type of recovery is that if an unemployed person is registered with the employment center, the amount of alimony will be calculated based on the amount of unemployment benefits, which is barely enough to cover the debt.

- 2) Collection in a fixed amount of money (this type of collection was described in more detail by us in this article ).

- (+) The advantage of this method is that the court sets the amount of the monthly payment (for example, 4,000 rubles), which the alimony payer transfers to the account, regardless of the presence of official employment.

- (-) Minus - even if an unemployed person gets a permanent job and starts earning 40,000 rubles or more, the amount of alimony paid will still be 4,000 rubles.

If you have filed a claim for alimony (see.

: how to file and where to file such a claim ), and the debtor evades paying them, the lawyer can file a petition to bring the debtor to administrative punishment or criminal liability for malicious evasion of alimony payments (you can find out what the debtor faces for this by following the link ).

By a court verdict, the perpetrator may be subjected to community service/forced labor or even sentenced to imprisonment for a short term (Article 157 of the Criminal Code of the Russian Federation). In addition, the court, at the request of the plaintiff’s representative, may seize property (partial or full) for subsequent collection of alimony debt.

○ A simple example of calculating alimony:

The average monthly salary in the debtor's region is 25 thousand rubles . The court awarded alimony in the amount of 1/4 of the earnings. Based on the general rule for calculating the amount of alimony, 6,250 rubles and his real income will not have any significance.

- Materials on the topic with

- ○ VIDEO : lawyer Evgeny Terekhov tells how to collect alimony if the ex-husband receives “black” wages.

- If you have any questions or want to share your story of how you sought justice, write in the comments.

How much child support should an unemployed man pay?

The current family legislation determines the procedure, order and features of collecting alimony for minor children and the resulting arrears in alimony payments, including from non-working parents . Now the relevance of this issue in Russia is associated with high levels of unemployment and unofficial employment.

Let us recall that the main legal acts regulating alimony legal relations are the Family Code of the Russian Federation and the Federal Law (FL) “On Enforcement Proceedings”.

The state’s protection of the rights and interests of children, including their material support from parents, is the reason for enshrining in legislation a number of basic principles on which the entire child support system is based.

Amount of alimony

In accordance with Art.

83 of the Family Code of the Russian Federation, if the alimony payer does not work, has an unstable income, or his income cannot be determined (that is, he has earnings, but is not officially employed), then collecting alimony in shares will be difficult.

It is more expedient for the applicant to demand from the judicial authorities the establishment of alimony obligations in a fixed monetary amount. This will allow the claimant to receive a certain amount of funds regardless of the debtor’s employment .

How much should a non-working father or mother pay, who does not live with the child or does not participate in its financial support? The calculation base is based on the cost of living per child , established quarterly in each individual region of the country (Part 2 of Article 117 of the RF IC).

The disadvantage of this method may appear if the unemployed person is employed in a job with a high level of income.

Regardless of what the amount of his monthly earnings becomes, he, according to the court decision, will be obliged to pay only the amount specified in the writ of execution.

A way out of this situation may be to review the amount of alimony due to a change in the financial situation of the payer.

Example of calculating a monthly fixed payment

The obligation to provide an estimate of the amount of funds necessary for the monthly maintenance of the child lies with the plaintiff.

It is the claimant's side that must justify the demands placed on the defendant, based on the need to provide the child with the usual level of expenses.

The calculation must indicate and document the financial costs associated with the monthly maintenance of a common child.

When performing the calculation, it is necessary to clarify the level of subsistence level for children , which is established by decree of the regional government. Taking into account the obligation established by law to support the child equally by both parents, the claimant may demand that child support be established in the amount of half the subsistence level .

For example, in Moscow for the 3rd quarter of 2018, the cost of living per child was determined at 13,938 rubles (this amount is given in Moscow Government Decree No. 1465-PP dated December 4, 2018). For comparison, the average cost of living for children in Russia for the same period was 10,302 rubles