The procedure for inheriting an apartment and other property after the death of the owner is determined, first of all, by whether the deceased managed to leave a will and whether there are reasons for recognizing this document as invalid. Otherwise, the distribution of property will be carried out in accordance with the current legal provisions.

Next, you are invited to familiarize yourself with all the significant nuances of the inheritance order and get a complete understanding of the procedure in question.

When and where to apply to inherit an inheritance?

Heirs by will and/or law are given a 6-month period to enter into an inheritance after the testator is officially recognized as deceased. First of all, you need to figure out where to go to take part in the distribution of inherited property.

Table. Where to go to inherit an inheritance

It is better to submit documents in person - this gives more guarantees that they will reach the recipient in a timely manner. If it is not possible to personally visit the court or notary office, documents can be submitted by mail.

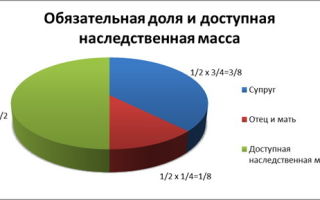

The procedure for distributing the inheritance is determined by the will, if its provisions do not violate the rights of citizens who have a mandatory share in the inheritance (information on mandatory shares is given in Article 1149 of the Civil Code) and other legislative norms. In the absence of a will or its recognition as invalid, the order of inheritance will be determined in accordance with the provisions of Art. 1142-1151 GK.

Step-by-step description of the inheritance process

To receive an inheritance, the interested party must go through several key steps. The standard sequence is as follows.

First stage. Certificate of death of the testator

In total, there are 2 grounds for opening an inheritance case, namely:

- death of a citizen, confirmed by an appropriate document (most often issued at the registry office);

- official judicial recognition of a citizen as dead.

Death certificate

To obtain a death certificate from the registry office, you need to present to the authorized employee one of the following documents/certificates:

- a court decision recognizing/declaring a person dead;

- a document confirming the death of a citizen. It can be obtained from a medical organization or other authorized body. The document is issued to family members or close relatives of the deceased. Also, such a certificate can be obtained by the legal representative of the testator;

- another document indicating the fact of death of a person who was subjected to unjustified political repression and subsequently rehabilitated in accordance with the provisions of the relevant law.

Federal Law of the Russian Federation of November 15, 1997 N 143-FZ “On acts of civil status”.

Second phase. Preparation of documents on opening of inheritance

The heir must obtain documents indicating the place of residence of the deceased at the time of his death. The following documents are considered as such:

- extract from the house register. Issued at the place of registration of the testator;

- a certificate indicating your last place of residence;

- unified (state) housing certificate;

- another certificate capable of confirming the citizen’s place of residence at the time of death.

The issuance of the documents listed above is within the authority of the passport office or multifunctional center. To obtain a certificate, the interested person must present a passport or other document that can confirm the existence of a relationship with the deceased. A certificate or other document confirming the death of a citizen is also submitted.

The body of the listed documents must contain information about the deregistration of the testator.

In some situations, in addition to the above items, a request from a notary is submitted. This point will be clarified on an individual basis.

Third stage. Confirmation of the grounds for participation in inheritance

The grounds for participation in the distribution of inheritance are determined by Article 1111. GK. The order of inheritance may be determined by the will left by the deceased citizen, or in accordance with current legislative provisions.

If inheritance occurs without a will, the heir must submit to the notary for consideration documents indicating the presence of a relationship with the testator or being dependent on the deceased.

The legal distribution of inherited property is carried out in order of kinship.

Heirs of the following lines are called upon to participate in the distribution of property only in the absence of heirs of previous lines.

To confirm the presence of family ties, marriage, birth, divorce and other suitable documents are considered. Also, the presence of family ties can be confirmed by an appropriate court decision.

If the deceased left a will, the heir must visit the notary who certified this document. If a notary has resigned, you must contact the official who has his archive. At the destination, the heir receives a note indicating that there have been no changes to the will or its cancellation by the testator.

In most cases, to participate in the distribution of inherited property under a will, it is enough for a participant in the case to present a passport and the above-mentioned mark. If the will indicates the fact of kinship, the heir will additionally have to confirm this point, similar to the situation with inheritance by law.

Fourth stage. Acceptance of inheritance share

Within 6 months from the recognition of the testator as deceased, the heir applies to the notary in the district of residence of the deceased. An application is submitted to the notary for consideration, confirming the heir’s desire to accept the property due to him. Both personal submission of the application and its sending by the postal service are allowed.

The legislation also notes another option for accepting an inheritance, which involves the heir performing implicit actions confirming the fact of accepting the inheritance. These actions include the following:

- management of the testator's property;

- actions aimed at preserving inherited property;

- acceptance of expenses in relation to the maintenance of the inheritance, etc.

In such circumstances, the interested citizen is allowed to contact the notary even after the established 6-month period, but in this case he will have to provide documents and other evidence indicating the completion of the above actions (payment documents, witness statements, etc.).

Having received the application and all accompanying documents from the heir, the notary initiates the opening of the inheritance.

Fifth stage. Obtaining documents on the rights of the testator

To receive an inheritance, you need to confirm that the testator had rights to the inherited property using the appropriate documents. In addition, documents are submitted indicating the address of the property, its composition, as well as the estimated value.

The list of documents should be clarified on an individual basis, because it can change. The documents are submitted directly in the form of originals according to the number of heirs and copies. Copies remain part of the inheritance.

Sixth stage. Obtaining a certification certificate

At least six months after the death of the citizen, his heirs, who have collected and submitted all the necessary documents for consideration by the notary, must return to the specialist in order to obtain certificates confirming their rights to inherit property.

To obtain a certificate, the heir must prepare a passport and original documents confirming the existence of the necessary rights (the list is specified in a separate order). On each of the legal and title documents, the specialist puts notes on the issuance of a certificate to the citizen.

Based on such a certificate, the apartment can be registered to the new owner/owners.

Expenses upon entering into inheritance

The process under consideration is inextricably linked with the costs of paying various government duties and other contributions.

Table

| Obtaining a certificate of the right to participate in inheritance | 0.3% of the value of the inherited property, but not more than 100 thousand rubles |

| State duty for a spouse inheriting property acquired during marriage | 200 rubles |

| Inheritance of property located in the territory of another state | 1 minimum wage |

| Certification of a will and an application for the issuance of a supporting document | 100 rubles each |

| Certification of the revocation of the testator's will | 500 rubles |

| Obtaining a duplicate of any mentioned document | 100 rubles |

| Legal support (if necessary) | On average 500-4500 rubles and above |

The amount of expenses may change depending on amendments made to the current legislation and other circumstances, so these points need to be clarified on an individual basis.

The procedure for accepting and registering an inheritance for an apartment

Accepting an inheritance is an important procedure that requires the heirs to perform specific actions. The law establishes a certain inheritance procedure. How is registration and inheritance of an apartment carried out after death in 2023?

On what grounds does inheritance occur?

Civil law establishes only two grounds for the emergence of inheritance rights to the property of the deceased. These include inheritance by law and by will. They have their own characteristics of registration and distribution of property.

In law

If the apartment was not transferred by the testator to specific persons in a will, then it will be distributed among the successors by law. In this case, the principle of priority applies. The legislation divides all relatives into several stages depending on the degree of relationship with the deceased.

After the death of a citizen, persons from only one line are called upon to inherit. The call is made starting from the first line. If there are no heirs in it, they move on to the second and so on until the end, until they stop at the line where there are people who want to accept the inheritance.

The transition from one line to another is carried out not only if there are no heirs at all, but also if there are heirs, but they renounced their inheritance rights or were deprived of them in court.

The division of the property of the deceased in case of inheritance without a will is carried out in equal shares between the persons in the queue called to register the inheritance.

By will

Inheritance by will differs from legal inheritance in that the testator independently distributes his property. It establishes who exactly will inherit and what share each heir will receive. The provisions of the law on priority do not apply in such a situation.

The testator has the right to indicate in the testamentary document any people as successors. Family ties don't matter here.

But in no case should a citizen forget about compulsory heirs , if any. These include persons who are entitled to a share in the inheritance regardless of what the testator indicated in his will. These are children who are not yet 18 years old, mother, father, spouses who have lost their ability to work, as well as other dependents of the testator.

Even if their names are not included in the will document, they will be allocated their due portion of the property. This must be taken into account, otherwise other successors will receive less than what was originally specified in the will.

A testamentary document is drawn up in the presence of a notary. The person completing it must be fully capable and clearly aware of his actions.

How to apply?

The procedure for registering an inheritance for an apartment after death in 2023 is carried out in stages.

Preparation of a documentation package

To accept an inheritance, you need to collect some papers. Their list may differ depending on what property is transferred to the successor and on what basis the inheritance occurs. In this case, the apartment is inherited, which means you will need the following documents:

- Heir's passport.

- A certificate indicating the death of the owner of the property.

- A document confirming that the testator and successor are relatives. This could be a birth certificate or a marriage certificate. Such a document is required if inheritance is carried out by law.

- Will. It is provided if the inheritance is transferred by will.

- Cadastral passport and other technical documentation.

- A certificate certifying the absence or presence of encumbrances.

- Extract from the house register.

If necessary, the notary will require additional documents.

When collecting papers, it is important to ensure that everything is formatted correctly and there are no typos or inaccuracies. It is also necessary that the documents are genuine and valid. If these requirements are not met, the notary will return the papers.

Compiling and submitting an application

To obtain the right to inheritance, successors must submit an application indicating their desire to accept the inherited property. The document is drawn up in written form. It contains the following information:

- Personal data of the heir and testator.

- Date and place of death of the citizen.

- Confirmation of the existence of a family relationship with the deceased.

- Description of the deceased's property.

- Information about the remaining heirs.

- Desire to inherit.

- Date of document preparation and signature.

There are several ways to submit an application to a notary. You can come to the office in person and hand over documents. But heirs do not always have the opportunity to do the registration themselves. In this case, they can use the services of a trusted person by drawing up a power of attorney for him.

If the successor is in another city and cannot come to the place where the inheritance was opened, he has the right to send an application through the post office. But first you need to have the document notarized. Sending must be carried out by registered mail with notification and an inventory of the contents.

It is important to comply with the deadlines for accepting the inheritance. The application must be submitted within six months from the date of death of the testator .

Conducting an assessment

When registering an inheritance with a notary after the death of the testator, the successors need to find out how much the apartment costs. This is important for further payment of duties. To do this, the heir needs to evaluate the property.

The assessment is carried out by private companies and the state body BTI. Which one to contact is up to the successor to decide. To carry out the assessment, you will need to prepare the following documents:

- Passport.

- Documents on the basis of which the property was owned by the testator. For example, an agreement to purchase or donate an apartment.

- Certificate of encumbrances.

- Cadastral passport.

As a result of the inspection, the specialist draws up an evaluation report, which must be submitted to the notary.

The heir will need to pay a certain amount for the assessment. Each company sets its own prices. The cost of the service is also affected by the region where it is performed. On average, you will have to pay 3-7 thousand rubles for the procedure.

Payment of duty and tax

For successors, tax and state duty upon entering into an inheritance are always a pressing issue. As for taxation, it does not apply to inheritance. The state duty cannot be avoided.

The heir must pay the notary fee. Its size is determined for each citizen separately depending on the value of his share and the degree of his relationship with the deceased. The law establishes the following rates:

- 0.3% of the price of the inherited part, but not more than one hundred thousand rubles. This percentage only applies to relatives who are closely related to the deceased.

- 0.6%, but not more than one million rubles. All other successors will have to pay twice as much.

There are categories of persons who are allowed by law not to pay the state fee. These include:

- People who took part in the Second World War.

- Citizens who became disabled as a result of the Second World War.

- Heroes of the USSR and the Russian Federation.

- Knights of the Order of Glory.

- Successors who received a bank deposit, pension savings by inheritance.

- Minor heirs.

The law also provides benefits for some citizens. A 50% discount is provided to people with the first or second disability group.

You can pay the state fee at a bank, through an ATM or using the State Services portal. The receipt must be presented to the notary.

Obtaining a certificate

After six months from the date of death of the testator, the heirs can visit the notary's office to pick up the certificate. This document will confirm that the successor has the right to inheritance. After receiving it, the citizen can safely re-register the apartment in his own name.

Refusal and deprivation of the right to inheritance

The legislation reserves the right of heirs to refuse to accept an inheritance. Successors use this right for various reasons. There is no requirement to report to the notary why it was decided to abandon the property.

There are two types of failure. The first type is unconditional, when a citizen simply renounces his share. In this case, his property is distributed among other successors in equal parts. The second type of refusal is in favor of other persons. With it, the heir indicates to whom his share should be transferred.

The waiver must meet the following requirements:

- Irreversibility, that is, the right to inheritance cannot be returned back.

- No conditions or reservations.

- Universality, that is, it is impossible to refuse part of the property, only complete refusal is possible.

- Legality so that other rights are not infringed.

In addition to refusal, successors can also be forcibly deprived of inheritance rights. This happens if they are found unworthy. This is possible in the following cases:

- The heir committed a deliberate crime against the life and health of the testator and his family members.

- The successor tried to increase his share in the inheritance through illegal actions.

- The heir did not fulfill his obligations to support the deceased.

Also, a parent who was deprived of the rights to raise him or her does not have the right to inherit the property of a deceased child.

Re-registration of ownership

After receiving a certificate of inheritance, the successor must undergo state registration of property rights. It represents making changes to the register about the owner of the property.

Why is registration necessary?

Re-registration of the right to residential premises received as an inheritance is required so that the heir becomes the full owner of the property and can dispose of it at his own discretion. This allows a citizen to make transactions with property and register other persons in the apartment. But this also imposes some responsibilities, for example, to pay for utilities.

Collecting papers and drawing up an application

To register the right to an apartment, it is necessary to prepare a number of documents. Their list includes:

- Passport.

- A certificate that confirms the existence of inheritance rights.

- Certificate certifying the death of the former owner.

- Papers on the basis of which the testator was the owner of the apartment, for example, a deed of gift.

- Cadastral passport.

- A certificate indicating the presence or absence of encumbrances.

- Power of attorney, if a proxy acts on behalf of the applicant.

After paying the state fee, you will need to attach a receipt to the specified package.

Payment of state duty

A fee is charged for issuing a state registration certificate. You can pay the fee in different ways:

- Through a bank branch.

- Using an ATM or terminal installed directly in the Multifunctional Center.

- Through the State Services portal.

The fee is 2 thousand rubles.

Submitting an application and receiving a certificate

After collecting documents and paying the state fee, the heir must submit an application to Rosreestr or the Multifunctional Center. This can be done in several ways:

- Personally.

- Through a proxy with preliminary execution of a power of attorney.

- Via the post office.

- Through the Internet.

When accepting papers, employees issue a receipt. It indicates the date when you can pick up the certificate. On the appointed day, you must appear at Rosreestr or the Multifunctional Center and receive the document. Typically, the period for issuing a certificate does not exceed 10 days.

Thus, the procedure for inheriting an apartment involves performing certain actions. To become a full-fledged owner of a home, it is important to undergo state registration after registering an inheritance.

How to register an apartment after the death of a relative?

Registration of an apartment after the death of the owner is a necessary procedure to ensure the transfer of rights to property. It requires the collection of an impressive package of documents and entry into inheritance by the owner’s relatives. How to properly register ownership of an apartment from a legal point of view?

Peculiarities

After the death of the owner, all of his movable and immovable property is included in the inheritance base. It is subject to transfer to heirs according to one of the following options:

- By will;

- By inheritance.

In the first case, there is a will in which the owner expresses his desire to transfer the apartment and other property to certain heirs. In the second case, the apartment is transferred to the heirs in order of priority.

To open an inheritance, you should contact the notary in charge of the case. It is important to prove your right to receive an inheritance. To do this, write an application and provide documents confirming the relationship. The decision about who will get the privatized apartment after the death of the owner is made by the notary individually on the basis of current legislation.

Circulation period

If one of them did not have time to do this and has a good reason, he has the opportunity to restore the deadline. But this is only possible by court decision. You will have to prove a valid reason through documentation. If after 6 months the heirs of the first stage have not declared their rights, the heirs of the next stage are involved. The application period for them is 3 months from the day following the expiration of the first 6 months.

If an unborn child is recognized as an heir, the period of entry into inheritance is extended until the moment of his birth. In this case, documents are submitted for him by legal representatives, who are parents or guardians.

Inheritance of an apartment by will

Inheritance by will takes precedence over inheritance by law. If there is a will, the apartment and other property passes to the heir, regardless of the degree of relationship and priority.

But the legislation establishes restrictions in the form of a mandatory share. It is allocated even in the presence of a will in relation to another person to the following categories:

- minors or disabled children;

- disabled parents;

- disabled spouse.

At the same time, they inherit no less than half of the share due to them in the case of inheritance in the order of priority.

The will may contain a so-called testamentary refusal.

If we are talking about real estate, this is the will of the testator with a requirement for the heirs to grant a certain person the right to use the apartment indefinitely or for a certain period of time.

This right will be retained even if the heirs sell the apartment. It is fixed in the unified real estate registration database as an encumbrance.

Inheritance of an apartment by law

If there are no applicants belonging to the first line, heirs from subsequent lines are called in order. If someone from one queue refuses to take over, applicants from another queue cannot take his place. In this case, the inheritance is distributed among the members of his queue in equal shares.

There are heirs who become heirs by right of representation. They have the opportunity to claim property if an heir from the previous line died before the inheritance was formalized.

Moreover, they must be his closest relatives. They can claim property as a result of the death of an heir from the previous line before the inheritance is formalized.

His immediate relatives will inherit by right of representation.

The heirs are included in the following lines:

- Spouse, children and parents.

- Grandparents, brothers and sisters.

- Aunts and uncles.

- Great-grandparents

- Great-aunts, grandfathers, granddaughters and grandsons.

- Cousins, nieces, aunts, uncles.

- Stepfather, stepmother, stepsons or stepdaughters.

There is another queue, which includes dependents who do not have the ability to work. They can be called upon to inherit from any of the queues. Moreover, they must be officially recognized as such at least 1 year before the date of death of the testator.

Payment of state duty

Those who have entered into an inheritance are required to pay the fee established by law. The specific amount depends on the relationship with the previous owner.

In accordance with tax laws, direct relatives must pay 0.3% of the entire value of the property. In this case, the amount should not exceed 100,000 rubles.

This category includes parents, spouse, and natural and adopted children.

All others pay 0.6% of the value of the entire property. In this case, the amount cannot exceed 1 million rubles.

The following heirs are exempt from paying the fee:

- Heroes of the Soviet Union and the Russian Federation;

- Participants and disabled people of the Second World War;

- Full Knights of the Order of Glory.

To assess the value of the testator's property, the notary requests not only title documents, but also data on the value. If the heirs do not agree with the established amount, an independent examination can be ordered.

Apartment decoration

To do this, you need to contact the branch of the MFC or Rosreestr. The following documents must be provided:

- Certificate of acceptance of inheritance;

- Passport;

- Death certificate of the previous owner;

- Certificate of ownership or extract from the Unified State Register of Real Estate;

- Receipt for payment of state duty.

The responsible specialist will accept the documents and provide a receipt for their receipt. He will also set a date when you can come for ready-made documents and an extract from the Unified State Register of Real Estate. The latter will indicate a change in ownership. From this time on, the heir is the rightful owner of the apartment. If there are several heirs, the apartment is registered as shared ownership.

The apartment is not privatized

There are situations when the previous owner did not have time to privatize the apartment. As a result, the municipality or the state is officially considered its owner. Residents use the apartment on the basis of a social tenancy agreement and are tenants.

If the apartment is not privatized, the law allows for solving the problem in two ways:

If the tenant managed to submit an application and documents for privatization, and then died within 2 months, relatives can inherit the right to own the living space. We are talking about those relatives who lived with him and are registered in this apartment. Some of them are renewing their social tenancy agreement. Then the privatization can be completed.

It is important that the previous employer has time to submit an application and does not withdraw it from privatization.

If the deceased left a will, it may mention the apartment as the only transferred object or among other property. In this case, the right to privatize passes to his heir.

But the law prohibits infringing on the rights of other persons registered at the place of residence in this apartment.

Even if they are not directly indicated in the will, in the event of privatization they receive the required shares.

If there are no more registered people in the apartment, and a person with a different residential address is appointed as the heir, it is allowed to continue the privatization that has begun. But in practice, in most cases a court decision is required, since the municipality often opposes this.

Who does not have the right to receive an apartment?

Persons who do not live in the apartment and are not direct heirs cannot apply for it. In addition, in Art. 1117 of the Civil Code of the Russian Federation introduces the definition of unworthy heirs. These are the people who are denied the right to inherit, even if they are included in the will. The following persons are considered unworthy:

- Citizens who have committed an attempted or completed crime against the health and life of the testator, and equally members of his family;

- Parents previously deprived of parental rights;

- Persons who maliciously evaded the maintenance of the testator, if such an obligation was imposed by law.

As a result, after the death of the owner, the apartment passes into the inheritance base. It can be transferred by will or law to his heirs. To do this, you need to go through a certain procedure, after which you can take ownership of the apartment and other property.

Apartment as inheritance

Inheritance

Inherited property or inheritance is property with the right to manage it that passes to a successor upon the death of the owner. In law, there are two types of inheritance - by will and by law.

Registration of inherited property under a will presupposes that there is a special notarial act, previously drawn up by the testator, in which the recipient of the inherited estate is indicated.

When registering such an inheritance, the notary must be provided with this act.

It is important to understand that the article describes the most basic situations and does not take into account a number of technical issues. To solve your particular problem, get legal advice on housing issues by calling the hotlines:

Call and solve your questions right now - it's fast and free!

The procedure for obtaining inherited property by law is that heirs are called from the immediate family circle of the owner of this property. The inheritance is divided among the closest relatives in equal shares.

The legislation defines eight categories of citizens who can, in order of priority, claim inheritance. Of course, the successors of the main group are the children, spouses and parents of the deceased.

In subsequent stages, the level of family ties with the testator or officially formalized relations is determined. Last but not least are disabled dependents and, directly, the state.

Disabled dependents can claim inherited property provided that there are no successors of previous orders, and the dependent himself was supported by the testator at least a year before his death.

The procedure for inheriting an apartment

In order to become the owner of inherited property, the inheritor must perform a number of actions. First of all, contact a notary. The successor submits to the notary an application for acceptance of the inheritance according to the established form and a package of necessary documents.

This must be done six months from the date of opening of the property.

In order to receive a certificate of inheritance , the heir needs to collect the following package of papers:

- The act of death of the testator.

- Passport of the heir.

- Papers confirming family ties between the deceased and the successor.

- Certificate from the passport office about the last place of residence of the testator.

- Receipt for payment of state duty.

If the inheritance estate includes real estate, in particular an apartment, then documents confirming the deceased’s ownership of this property as an owner are added to the general list. Such documents include a certificate from the BTI, an extract from the Federal Tax Service.

The law allows partial acceptance of an inheritance if the shares of each heir are determined. If the inheritance mass is of a general nature, then accepting even an obligatory part of the inherited property indicates that the heir is not against accepting the entire amount of the inheritance.

Refusal of inherited property is possible. It is performed voluntarily and must be registered with a notary in writing.

Registration of an apartment by inheritance

If we are talking about inheriting real estate, then registering the right to own this property is not enough. It is also necessary to register the living space with the relevant organization.

Only after this will the successor have the right to dispose of the received property at his own discretion. To register property with the Federal Registration Service, you need to collect a package of documents.

However, all this can be formulated in the form of a certain list of actions.

To register real estate ownership, you must complete the following points:

- Obtain a certificate of inheritance from a notary.

- Collect additional documents: an extract from the Federal Tax Service stating that the property belonged to the deceased, a certificate from the BTI, an extract from the passport office about the number of people registered in the apartment, an extract from Rosreestr.

- Complete an assessment of the apartment and attach the report to the general package of documents.

- Contact the Federal Registration Service (FRS), where real estate ownership is registered within a month.

List of documents for registration

Registration of inherited property can take a long time.

The successor will need not only to obtain a certificate of inheritance, but also to familiarize himself with the list of additional documents necessary for further registration of real estate ownership.

In order to avoid any problems with the registration of inherited real estate, you need to collect a complete package of the following documents and contact the Federal Reserve System. This organization may require the following documents:

- Certificate of right to inheritance.

- Extract from the BTI on the layout of the apartment.

- Extract from the Unified State Register - about the absence of encumbrances on the living space.

- Paper from the passport office indicating the number of residents registered in the apartment.

- Extract from Rosester.

- Valuation report to determine how much an apartment is worth.

To speed up the property registration process, it is worth collecting the entire package of documents before submitting them for registration. Before registration is completed, the sale or exchange of living space is not allowed.

Apartment tax

According to the law, apartments transferred as inherited property are not subject to taxation if they have been owned by the deceased for three years .

If the period of ownership of the apartment is less than three years, then the tax amount is determined based on the assessed value. In this case, it is necessary to pay income tax on the apartment valuation amount exceeding 1 million.

rubles

In all other cases, the successor of the inheritance only needs to pay a state fee . The amount of the state duty is determined based on the cost of the apartment. The cost of the apartment is stated in the appraisal report.

Apartment valuation

It is necessary to estimate the cost of an apartment for a number of reasons. First of all, based on the cost of the apartment, the amount of the state duty is determined, which must be paid to the notary.

Also, based on the assessed value, the amount of income tax is determined if the property belonged to the deceased for less than three years . If the owner has owned the apartment for more than three years, he does not pay income tax.

In addition, an appraisal report is needed to register the property as the property of the successor. The assessment is carried out either by BTI specialists or by representatives of a specialized company dealing with this issue. The assessment is formalized by contract. As a result of the work being completed, the customer is issued a corresponding certificate.

There are two valuation options: market and cadastral. Market valuation uses the value of a similar property on the real estate market, while cadastral valuation uses the cadastral value of the living space.

Notaries, as a rule, prefer to use the market value of the property, but the heir himself has the right to determine what value of the property should be chosen.

Division of an apartment transferred by inheritance

Based on the provisions of housing legislation ( Article 16 of the Housing Code of the Russian Federation ), residential premises can be of different types: apartments, rooms, residential buildings.

Such property is inherited in the general manner with the provision of the relevant documents, but sometimes there is such a living space that passes to the heirs by common ownership.

In this case, either general management of the property is determined, or each successor receives a certificate of inheritance for his part of the home.

It is possible to enter into common ownership of shared property only if the desire of all heirs is registered in writing.

Pitfalls arise when dividing privatized property. In this case, the part of the deceased owner is inherited in accordance with the general procedure. Participants in common property can allocate their share, both in kind and in value.

Example of inheriting an apartment

The couple bought an apartment. A year after the purchase, the husband died. The couple have two children.

The deceased's wife and children acted as heirs, but his mother began to lay claim to a quarter of the property, since she considered that all property was simply divided between four heirs: herself, the deceased's wife, and two children.

She submitted an application to the courts substantiating her claims, but the court rejected the citizen.

What is the reason for the refusal and why cannot the mother claim a quarter of the inherited property if she is the heir of the first priority, and the inheritance is carried out according to law? The reason for the refusal is that the wife of the deceased is the owner of 50% of the apartment due to the fact that the property is their jointly acquired property. The rest of the apartment is inherited on a general basis and is subject to division between four heirs. It turns out that the mother can only claim a quarter of half the apartment, and not the total inheritance.

Conclusion

In conclusion, we can formulate a number of rules and points that must be followed in order to avoid problems when registering inherited property and living space in particular:

- It must be remembered that inheritance of property is carried out in two ways: by will and by law.

- The order of inheritance is determined by the presence of blood ties and officially formalized family relationships.

- To receive inherited property, you must obtain a certificate of inheritance.

- Registration of inheritance for an apartment after the death of the testator requires contacting a notary.

- To register ownership of housing, documents are required to inherit the apartment.

- There is no inheritance tax on an apartment if the owner has owned the property for more than three years.

- The appraisal of an apartment for inheritance is carried out by the BTI or a specialized appraisal company.

- The division of the inherited estate, which includes real estate, is carried out by determining the shares of the heirs.

- The law allows for general shared management of the received property and for each heir to manage his or her share independently.

- Privatized property and property inherited by spouses have nuances in determining the shares of heirs.

Still have questions or your problem is not resolved? Ask them to practicing lawyers right now!

Call and solve your problems right now - it's fast and free!