List of persons retaining the right to use residential premises. Features of the sale of a share of real estate. The procedure for notifying other participants in common shared ownership of the sale of a share. Sample Application for waiver of the pre-emptive right to purchase a share of an apartment. Basic provisions for concluding a contract for the purchase and sale of real estate. A contract for the sale and purchase of real estate is a multilateral transaction, the parties to which can be individuals, citizens and legal entities of organizations of various organizational and legal forms. Under a real estate purchase and sale agreement, the seller undertakes to transfer ownership of a land plot, building, structure, apartment or other real estate to the buyer, and the buyer undertakes to accept the real estate and pay a certain amount of money for it.

The real estate purchase and sale agreement comes into force and becomes binding on the parties from the moment of its conclusion. This moment is the signing of an agreement by the parties, which reflects all the essential terms of the transaction.

For real estate purchase and sale agreements, the essential conditions are the subject of the agreement: the alienated real estate object, its composition and condition, quality, its location, the procedure and period for its transfer to the buyer, the price, procedure and terms of payment, the rights of third parties to the subject of the agreement, incl.

Dear readers! Our articles talk about typical ways to resolve legal issues, but each case is unique.

If you want to find out how to solve your particular problem, please use the online consultant form on the right or call the numbers provided on the website. It's fast and free!

Content:

- Sample notice of the pre-emptive right to purchase a share of an apartment

- Sample refusal to purchase a share in an apartment

- How to purchase a share in an apartment from relatives in 2018?

- Sample refusal to buy out a share of an apartment

- Preemptive right to purchase a share in an apartment

- Registration of purchase of a share in an apartment

- Purchase and sale of a share in an apartment in 2023

WATCH THE VIDEO ON THE TOPIC: Redemption of a small share of real estate

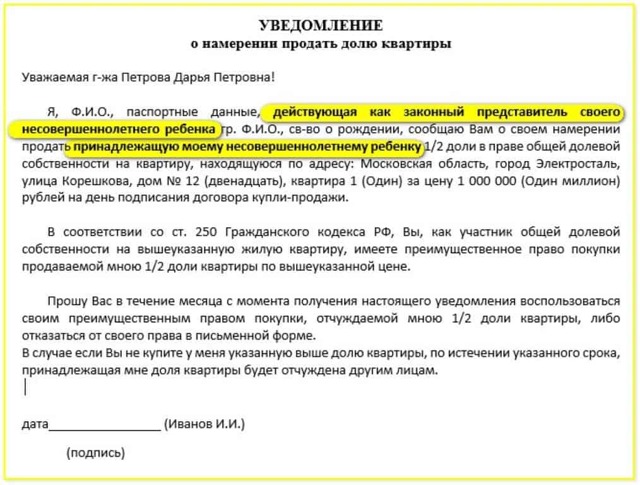

Sample notice of the pre-emptive right to purchase a share of an apartment

Response to a notice of sale of a share in an apartment. On a buyout offer. The purchase of a share of an apartment from relatives is carried out in several stages. In this article, you will become familiar with the specifics of purchasing shares in residential premises from family members.

Sale of a share in an apartment to a relative The sale of a share in an apartment to a relative involves the use of rules on the pre-emptive right to purchase such shares. When concluding a purchase and sale agreement or an exchange agreement in relation to a share in an apartment, its owner must remember his obligation to write in writing to all participants in shared ownership of the housing.

The sale of a share must be sent to the owners of the remaining shares in writing. The document must reflect information such as the price and terms of sale of property rights to a share in the apartment. Within 1 month from the date of receipt of the notice, the owners of shares vested with the pre-emptive right to purchase have the right to notify the seller of their desire to purchase his share.

Refusal to acquire shared ownership filed by a citizen with the right of first refusal, or refusal to acquire a share within 30 days, means that the seller has every reason to sell property rights to unauthorized persons not entitled to the right of first refusal to acquire a share in the apartment.

Redemption of apartment shares: stages Any method of disposing of common property, for example an apartment, occurs on the basis of an agreement of the owners. Next, we will consider the main stages of buying out a share of real estate from a relative.

Buying out a share of apartments from a family member The acquisition of a share in the form of a purchase occurs on the basis of a traditional purchase and sale agreement. Stages of purchasing a share of living space from a family member The sale of property rights to a relative occurs in several stages.

According to the provisions of the law No. Federal Law, registration of rights to a share in property with the state is carried out within 18 days. The registration period begins to count from the moment the application and additional documentation are submitted. Registration with the Moscow registration authorities is carried out within 12 days if rights to residential properties are registered.

The moment of transfer of rights to a share in a residential premises is considered the moment of state registration of this right. Documents confirming registration are an extract from the Unified State Register and a copy of the buyer’s certificate of ownership.

Buying out a share in an apartment with a mortgage If there is a lack of funds to buy out property rights, citizens often turn to banking organizations that provide mortgages. Problems in obtaining a mortgage The procedure for obtaining a mortgage loan for the purpose of purchasing a share in a residential property from a relative may be associated with a number of difficulties.

The fact is that credit institutions are reluctant to issue borrowed funds for the acquisition of shares in the right to an apartment. Only those citizens who need to buy the last share of a residential property have a good chance of becoming a borrower.

This approach ensures that the entire apartment becomes collateral for the mortgage loan and reduces the risks of the banking organization issuing the loan. Banks often doubt the purpose of a loan issued to a person to purchase a share in housing from a relative.

This is due to the fact that unscrupulous borrowers can spend loan funds for their personal needs. They enter into a fictitious deal with a family member to sell a share, acquiring property rights to a residential property for free, and use the borrowed funds for other purposes not related to the acquisition of real estate.

Due to these factors, banks have a low level of confidence in borrowers who want to buy out a share from a relative, and set fairly high interest rates on such mortgage loans.

Consequences of the illegal sale of a share in an apartment If the seller sells the share before the expiration of a month after notifying relatives with a pre-emptive right to purchase, then any of the participants in shared ownership has the right to file a lawsuit. Relatives of the seller who have the right of first refusal have the right to transfer the rights and obligations of the buyer of a share in real estate in court.

Such a transfer of rights and obligations is carried out by the court on the basis of a statement of claim for violation of the interests of persons with the preemptive right to purchase a share.

Sample refusal to purchase a share in an apartment

Notarized notification of the sale of a share Having a part in common shared ownership, you should not hope that you will be able to sell it quickly. In this case, the order involves notifying other shareholders about the upcoming sale.

It is clear that the owner has the right to dispose of his part at his own discretion, sell it or donate it, but on condition that the pre-emptive right to purchase a share from other owners is not violated. This rule does not apply only to public auctions.

Features of the implementation of the pre-emptive right of acquisition The Civil Code obliges the owner to draw up a notice of sale of a share of a house or apartment and send it to other owners of real estate if alienation to a third party is expected.

In the case when all shareholders express their reluctance to purchase a part of the common property, it can be sold to a third party.

How to correctly draw up a notice of sale of a share in an apartment, what information needs to be included in it, the timing and procedure for delivery.

Basic provisions for concluding a contract for the purchase and sale of real estate A contract for the purchase and sale of real estate is a multilateral transaction, the parties to which can be both individuals, citizens and legal entities of organizations of various organizational and legal forms.

Under a real estate purchase and sale agreement, the seller undertakes to transfer ownership of a land plot, building, structure, apartment or other real estate to the buyer, and the buyer undertakes to accept the real estate and pay a certain amount of money for it.

The real estate purchase and sale agreement comes into force and becomes binding on the parties from the moment of its conclusion. This moment is the signing of an agreement by the parties, which reflects all the essential terms of the transaction.

For real estate purchase and sale agreements, the essential conditions are the subject of the agreement: the alienated real estate object, its composition and condition, quality, its location, the procedure and period for its transfer to the buyer, the price, procedure and terms of payment, the rights of third parties to the subject of the agreement, incl.

In addition, any of the parties to the contract can indicate the conditions that are essential for it and in respect of which an agreement must be reached. Note: If, before concluding the main purchase and sale agreement for a real estate property, a Preliminary purchase and sale agreement for this property was concluded between the parties, then the main purchase and sale agreement must be concluded on the terms and conditions.

Sample refusal to buy out a share of an apartment

To exercise their right to sell a share in an apartment, the owner must follow the following algorithm: STAGE 1. We notify you about the sale of your share in the apartment. The seller must inform the other owners in writing of his desire to sell the share, since they have a pre-emptive right. The notice indicates at what price and under what conditions the sale will take place.

Preemptive rights in the purchase and sale and waiver of them When we undertake any action or transaction with our property or real estate, we do not always know all the nuances of this process, which means the result may not be what we expected.

Basic provisions for concluding a contract for the purchase and sale of real estate A contract for the purchase and sale of real estate is a multilateral transaction, the parties to which can be both individuals, citizens and legal entities of organizations of various organizational and legal forms.

Under a real estate purchase and sale agreement, the seller undertakes to transfer ownership of a land plot, building, structure, apartment or other real estate to the buyer, and the buyer undertakes to accept the real estate and pay a certain amount of money for it.

The real estate purchase and sale agreement comes into force and becomes binding on the parties from the moment of its conclusion. This moment is the signing of an agreement by the parties, which reflects all the essential terms of the transaction.

For real estate purchase and sale agreements, the essential conditions are the subject of the agreement: the alienated real estate object, its composition and condition, quality, its location, the procedure and period for its transfer to the buyer, the price, procedure and terms of payment, the rights of third parties to the subject of the agreement, incl.

Registration of purchase of a share in an apartment

Notification of the sale of a share of a land plot sample The notary takes over all the functions of drawing up the notice, sending and confirming it.

If the notified person does not appear before the notary within the prescribed period, but receives notification that the letter has been delivered, the latter issues a certificate stating that the co-owners have been notified in the manner prescribed by law.

In situations where there is no confirmation of delivery of the notice, the notary issues a certificate stating that all possible measures have been taken to properly notify the co-owners of the upcoming sale.

But the receipt of such a certificate should be agreed upon in advance, since such a document is not provided for by any regulatory act. Attention Naturally, this service is paid, but it is the most reliable of all those described above.

Text of the notice A sample notice of the sale of a share in an apartment should not be sent to all neighbors at once. Notice of sale of a share of a land plot sample Sale of shares of a land plot Sample notice of the pre-emptive right to purchase a share How to correctly draw up an offer to purchase a share in an apartment? Sample notice of the pre-emptive right to purchase a share Sample notice of the sale of a share in an apartment How to sell a share in an apartment Notice of sale of a share of a land plot sample m.

Legal features of issuing a notice of sale of a share in an apartment, example and form, as well as free advice from lawyers.

But it reached particular tension in large cities.

Citizens literally buy one or two meters in an apartment and, at best, receive the coveted registration; at worst, those with a larger share move in and survive.

Hundreds of very specific real estate agencies now specialize in the sale of shares in apartments, the number of which is growing like mushrooms after rain. Until recently, no one knew what to do about this situation.

For more information about these types of apartment ownership, see the separate Glossary article at the link. Here we will consider only the case of common shared ownership, since it is this that allows you to sell a share in an apartment, and it is here that the right of first refusal to purchase this share or room applies.

Extract from the House Register - Who? Form, type and composition of this document. But first, he must offer to buy out his share to other participants in shared ownership, that is, other apartment owners, neighbors.

And only if the neighbors refuse to buy out the share, the Seller of this share has the right to sell it on the open market to a third-party buyer.

Both for owners and buyers. Most often, problems arise for those who decide to sell property with several owners.

Refusal of the pre-emptive right to purchase a share in an apartment: sample document, how long it is valid Refusal to purchase a share in an apartment. In many ways, the difficulty lies in the fact that Art. Only the official refusal of the co-owners provides grounds for putting the share up for sale on the real estate market.

On the one hand, the law does not require that the refusal of the remaining co-owners to renounce their pre-emptive rights to repurchase be formalized with a notary, but practice shows that observing such an order is in the general interest, in order to avoid possible disagreements in the future.

Today we will talk about how to refuse to buy a share in an apartment. What does the law say?

The project provides for the execution of transactions with the involvement of a notary. Without his services, it is impossible to sell a share of real estate. This was done in order to avoid illegal sales schemes.

Waiver of pre-emptive right to purchase sample form

Free from mobile and landline Free multi-channel phone 8 If you find it difficult to formulate a question, call the free multi-channel phone 8, a lawyer will help you 1. You can’t just print it out. The notary must certify. One of the co-owners gave a notarized waiver of the pre-emptive right to purchase a share in a communal apartment. After some time he died.

Dear readers! Our articles talk about typical ways to resolve legal issues, but each case is unique.

If you want to find out how to solve your particular problem, please use the online consultant form on the right or call the numbers provided on the website. It's fast and free!

Content:

- Statement on refusal to use the pre-emptive right to purchase shares

- How to sell a room in a communal apartment in 2018

- Room purchase and sale agreement sample form

- Waiver of preemptive right to purchase

- Sample refusal to purchase a share in an LLC

- Sample refusal to purchase a share in an apartment

- Waiver of the right of first refusal (2018)

Statement on refusal to use the pre-emptive right to purchase shares

VIDEO ON THE TOPIC: Waiver of the pre-emptive right to purchase

When selling a share in the right of common ownership to an outsider, the remaining participants in shared ownership have the pre-emptive right to purchase the share being sold at the price for which it is sold, and on other equal conditions, except in the case of a sale at public auction, as well as cases of sale of a share in the right of common ownership of land plot by the owner of a part of a building or structure located on such a land plot or by the owner of premises in the specified building or structure.

Public auctions for the sale of a share in the right of common ownership in the absence of consent of all participants in shared ownership may be held in cases provided for in part two of Article of the Civil Code, and in other cases provided for by law.

The seller of a share is obliged to notify in writing the other participants in shared ownership of his intention to sell his share to an outsider, indicating the price and other conditions under which he sells it.

If the remaining participants in shared ownership refuse to purchase or do not acquire the sold share in the right of ownership of real estate within a month, and in the right of ownership of movable property within ten days from the date of notification, the seller has the right to sell his share to any person.

When selling a share in violation of the pre-emptive right, any other participant in shared ownership has the right, within three months, to demand in court the transfer of the rights and obligations of the buyer to him. Assignment of the pre-emptive right to purchase a share is not permitted.

Participants in shared ownership of real estate who have been notified by the Seller are not required to express their refusal to purchase a share in writing, however, in order to avoid wasting time when registering a transaction and unnecessary questions from the registering authority, it is advisable to formalize the refusal of the pre-emptive right to purchase in writing if there is such a possibility.

If the alienation of a share is carried out on the basis of a notarized agreement, then certified statements of co-owners refusing to purchase the share must be sent to a notary to confirm the authenticity of Art.

If the alienation of a share is carried out on the basis of an agreement signed in simple written form, then the application for state registration must be accompanied by written consent from the other co-owners, which must be drawn up by each co-owner in the body carrying out state registration of rights, or be notarized Art.

See other legal documents... Application for waiver of the right of first refusal Application for waiver of the right of first refusal and consent to the buyer’s use of certain premises in a residential building.

To the relevant organizations From gr. Moscow Moscow, st. C, total area 9 sq. From the right of first refusal according to Art. Moscow, Moscow region, Russian Federation, January nineteenth two thousand and five. Moscow, Moscow region, Russian Federation. The consent was signed by Victoria Viktorovna Golovkova in my presence.

The identity of the person who signed the document has been established. Capacity has been verified.

When selling a share in the right of common ownership to an outsider, the remaining participants in shared ownership have the pre-emptive right to purchase the share being sold at the price for which it is sold, and on other equal conditions, except in the case of a sale at public auction, as well as cases of sale of a share in the right of common ownership of land plot by the owner of a part of a building or structure located on such a land plot or by the owner of premises in the specified building or structure. Public auctions for the sale of a share in the right of common ownership in the absence of consent of all participants in shared ownership may be held in cases provided for in part two of Article of the Civil Code, and in other cases provided for by law. The seller of a share is obliged to notify in writing the other participants in shared ownership of his intention to sell his share to an outsider, indicating the price and other conditions under which he sells it.

Preemptive right to purchase a share Attention: According to which, when alienating a share to an outsider who does not have a share in the right to this property, the transaction is subject to mandatory notarization.

This applies to shares of houses, apartments, rooms, non-residential premises, shares of land plots.

I quote the law: When selling a share in the right of common ownership to an outsider, the seller of the share is obliged to notify in writing the other participants in the shared ownership of his intention to sell his share, indicating its price and other conditions under which he is selling it.

How to sell a room in a communal apartment 2018

The conditions for using the pre-emptive right to purchase and the procedure for waiving the pre-emptive right to purchase are regulated by the Civil Code of the Russian Federation and other laws. When alienating his share for compensation, a participant in shared ownership must comply with the rules of the pre-emptive right of purchase of other participants, provided for by the Civil Code of the Russian Federation.

The seller receives the right to sell his share to a third party only if he receives a waiver of the pre-emptive right from other owners of shared ownership or after the expiration of the period for exercising the pre-emptive right provided by law. The seller is obliged to notify all owners of his intention to sell the share to an outside buyer.

The notice of sale of a share is drawn up in writing, indicating the price and other conditions of sale.

If other owners formalize a waiver of the first right of purchase, or do not purchase the offered share within ten days for movable property or within one month for immovable property from the date of notification, then the participant may sell his share in the ownership right to an outsider.

Room purchase and sale agreement sample form

Preemptive right is the right that the owners of other shares of this apartment have. Its essence is that if one of them sells a part that belongs to him, he must first offer to buy it back to other participants. Only if they refuse can he declare it to be sold on the open market.

In particular, the article of this normative legal act establishes primarily the law. It contains an important condition - offers to purchase an apartment must be made on the same basis for the owners of other shares and for other people.

Let's consider the situation using an example: Sales procedure In order to organize the sale of a share in an apartment, it is necessary to obtain a refusal to purchase it from other owners.

WATCH THE VIDEO ON THE TOPIC: The right to purchase a room or share. 07/17/2012

Waiver of the pre-emptive right to purchase a share of an apartment:

But in practice, this situation is extremely rare. If you contact a notary, the authorized person will tell you how to draw up a waiver of ransom. Often clients are asked to fill out ready-made forms. This greatly simplifies the process. Sample Below we can see a sample waiver of the right of first refusal.

As already mentioned, the document has no special features. His text often fits into sentences. Also, to refuse a share, you can, as we have already said, do nothing at all. If the owner, after receiving the notification, does not react to it in any way, this will be regarded as an unwillingness to enter into a transaction with the co-owner-seller.

Certificate of refusals But that's not all.

Waiver of preemptive right to purchase

The apartment is located at: A copy of the certificate of ownership, as well as an extract from the house register attached. The defendant, in violation of the order of Art.

This procedure is regulated by the norms of the Civil Code, namely the article If the sale is carried out in violation of the conditions, other owners have the right to challenge the transaction in court and regain the rights and opportunities of priority buyers.

But this is not so easy to do, since other owners have an advantage in purchasing it. And only after receiving a waiver of the priority right from them, you can freely dispose of your part of the real estate. Preemptive right to purchase a share in an apartment This is the right of each co-owner to purchase a share of the property being sold before the property is put up for sale.

But the proposed conditions should not differ - it is impossible to declare a price lower than the value that was offered to the owners in an open sale. In case of price changes, all owners must be warned, otherwise, when going to court, the transaction will easily be invalidated.

Legislative framework The legislation provides for the sale of one's share of the apartment to any buyer, but on the condition that the owners of the remaining part of the dwelling do not apply for its acquisition. In this case, the owners must waive their rights in writing. It is necessary to draw up a notarized refusal; such a document will eliminate various disputes and disagreements.

An article of the Civil Code of the Russian Federation regulates relations in this area. It happens that the owners are far away or their location is not known at all.

Using the online document processing service Documentoved, you can find and download a sample on our website in a matter of minutes.

By law, all shareholders must be notified of the planned sale of a share. If one of the shareholders dies, then his share is inherited.

Then six months must pass from the opening of the inheritance, and only when an heir has been identified, the seller has the right to contact him, like other shareholders, to notify him of the upcoming transaction. Typically, spouses have common property.

If one of them sells an apartment, then the other spouse should know about it. The same procedure applies after a divorce if the property is recognized as common.

Sample refusal to purchase a share in an apartment

If you wish, you can draw up the document in the same way as any other application - with a “header”. But in practice, this situation is extremely rare. If you contact a notary, the authorized person will tell you how to draw up a waiver of ransom.

Often clients are asked to fill out ready-made forms. This greatly simplifies the process. Sample Below we can see a sample waiver of the right of first refusal. As already mentioned, the document has no special features.

His text often fits into sentences.

Waiver of the right of first refusal (2018)

If the owner intends to sell his share of the apartment, he will need to correctly observe the pre-emptive right of purchase in relation to the remaining co-shareholders.

In turn, the co-owners are also assigned certain obligations - they will need to either agree or waive in writing the pre-emptive right to purchase the share.

How to do this correctly from a legal point of view? If you are in doubt which is better:

- .

- .

- .

How to buy or sell a share in an apartment?

In recent years, one of the most popular real estate transactions has been the purchase of a share in an apartment. It allows a person to become a home owner with minimal financial outlay. To conduct such a transaction, it is important to know what a share in an apartment is, how the purchase of such real estate is formalized, and what risks are associated with it in 2023.

Download sample documents

What is a share in an apartment?

Shared ownership arises when an apartment is divided between several owners, determining which of them owns which part of the property. Each part of such property that has its own owner is called a share .

In what situations does a person have the right to a share in an apartment? This happens in the following cases:

- When a spouse purchases real estate, his other half automatically receives rights to 1/2 of the property. Natural shares in an apartment can be allocated according to a marriage contract or a notarized agreement between spouses;

- if an apartment or house was purchased by several people on equal rights, and all of them are listed as the owners of the purchased housing. In this case, the property will be divided between them into shares;

- when inheriting part of real estate;

- when completing transactions with maternity capital.

Owners of different shares in the same apartment or private house have a pre-emptive right to purchase a share in the apartment. This means that the owner of a share who decides to sell his property must first offer to buy it out to other shareholders, and only if they refuse to offer the property to third parties.

An alternative to a transaction for the sale of a share in an apartment is the sale of a room in the apartment. What is the difference? When purchasing a room, a personal account for utilities is opened per person . His home becomes inviolable.

When purchasing a share, the new home owner does not have clearly allocated property that others cannot use . He pays the general utility bill and pays utilities in proportion to his share.

What risks are associated with purchasing a share in an apartment?

Transactions with real estate shares have their pitfalls and can be challenged in the following cases:

- if during the sale of housing the pre-emptive right to purchase of other shareholders was ignored;

- if the selected living space is registered in the name of a minor child;

- if, due to objective reasons, it is impossible to allocate the new owner’s share in the apartment.

In such situations, the purchase and sale transaction is recognized as invalid in judicial practice. The property is returned to the ownership of the former owner. To prevent this from happening, the buyer needs to carefully study all the documents for the share in the apartment and seek help in completing the transaction from a notary .

What documents are needed to purchase a share in an apartment?

To complete a purchase and sale transaction for a share in an apartment, the following documents are required:

- passports of the buyer, seller and other shareholders managing the real estate;

- title documents for housing;

- extract from the Unified State Register;

- certificates from the BTI;

- those. plan and cadastral passport of the apartment;

- document on the allocation of shares in the apartment;

- certificate of privatization of real estate;

- written refusals of other shareholders to purchase housing;

- an advance agreement or a deposit agreement. Samples can be downloaded here and here;

If real estate is sold by a married person, he will also have to attach to the documents a marriage certificate and the wife’s written consent to the transaction, which can be downloaded here. If children live in the apartment, the seller will also have to provide their birth certificates with permission from the guardianship authorities to conduct the transaction .

The presented package of documents is used both when purchasing a share in real estate from a stranger, and in transactions with relatives. If an apartment is purchased with maternity capital, you will need a certificate for it and permission from the Pension Fund to conduct a transaction using maternity capital . Samples of all documents can be obtained from a notary.

How to buy a share in an apartment?

How to purchase a share in an apartment? This procedure is carried out as follows:

- First, the seller notifies other shareholders of his intention to sell the property. He must send them a written offer to buy a share in the apartment until they all give him a written refusal. A sample offer for the sale of real estate for persons with first right of purchase can be obtained from a notary or downloaded. Shareholders must make a decision to purchase or refuse it 30 days in advance. Only after such a refusal can one proceed to the next stage of the transaction;

- Then they collect documents for real estate;

- After this, a deposit agreement and a purchase and sale agreement for a share of the apartment are drawn up. A sample purchase and sale agreement can be found here. They are notarized;

- Based on the above documents, the buyer transfers money for the apartment. This can be done through a safe deposit box or by bank transfer;

- after this, the buyer and seller must contact Rosreestr with documents for housing and register the share in the apartment in the name of the new owner. A transaction fee is paid;

- Next, the buyer needs to wait for documents on ownership from Rosreestr. After receiving them, you will need to agree with other shareholders on the procedure for using the shared use of residential premises. Such an agreement must be notarized; you can download it here.

Next, the buyer and seller sign a property transfer deed, which can be downloaded. After this, the share in the apartment passes to the full disposal of the new owner.

Allocation of shares in transactions with maternity capital

Maternity capital can be used both to obtain a mortgage for the purchase of an entire home, and to purchase a dedicated share in an apartment. Such a transaction will be approved only if the share in the apartment being sold is separate from the rest of the premises .

For example, the Pension Fund will approve the purchase of a room in a two-room apartment, since such a room is an isolated room. But he will not be able to approve the purchase of part of a one-room apartment for maternity capital, since it is virtually impossible to allocate a natural share in it.

After purchasing a share in an apartment using maternity capital, the owners are required to transfer it from joint ownership to shared ownership. You can do this in the following ways:

- by drawing up an agreement on the size of shares between family members. You can download it here;

- having issued a deed of gift for a share in the apartment for the child. You can download it here;

- dividing the property purchased with maternity capital in court.

The priority option for allocating a share in an apartment purchased with maternity capital is an agreement between spouses. Such a document must be registered with a notary and submitted to Rosreestr with other documents for the apartment. The government agency will prepare new documents for the ownership of the apartment and transfer them to the home owners.

How are shares in an apartment purchased with maternity capital divided in 2023? In most cases, they are divided in proportion to the number of family members: one share for each parent and for each child .

What is the minimum amount of shares in an apartment purchased with maternity capital that should accrue to each child? The law does not establish minimum and maximum share sizes.

The distribution of shares in an apartment purchased with maternity capital is carried out at the discretion of the buyers themselves.

Depending on the number of family members, there may be 1/4, 1/5, 1/9 apartments per person.

Watch useful video

Buying real estate from relatives

Purchasing a share in an apartment from relatives can be arranged in several ways:

- under a gift agreement, a sample of which can be downloaded here. If such a transaction is concluded between close relatives, it can be completed without paying a fee;

- under a regular purchase and sale agreement. When registering it, the buyer pays a state duty of 1000 rubles for registering the property;

- under an inheritance agreement. You can download it here.

If the previous owner of a share in an apartment purchased it with a mortgage, the buyer can enter into an agreement with him on the assignment of rights of claim, transfer the loan to himself and receive the right to dispose of the property. A sample agreement for the assignment of rights of claim can be downloaded here.

Sale of a share of a minor owner

Selling a share in an apartment of a minor owner has its own characteristics. To formalize it, you need to contact the guardianship authorities and agree on a deal with them.

If they approve it, it will be necessary to allocate the child a similar size share in another residential premises . Then the guardianship will not object to such a deal.

In this case, it will be possible to transfer the property to the new owner not only under a purchase and sale agreement, but also under a gift agreement.

If the child does not actually live in the apartment, there is no need to allocate a special share to him. It is enough to open an account in his name at Sberbank and transfer the proceeds from the sale of the home to it. Guardianship will also not challenge such a deal.

Registration of refusal of a share in an apartment

A person has the right to refuse a share in an apartment after receiving notification of ownership of it. He can do this in the following ways:

- take a sample waiver of the pre-emptive right to purchase a share of an apartment, draw up a similar document with your data and have it notarized. The document must be made in two copies, one of which must be handed over to the seller personally or by recommended letter;

- donate property to a relative. In this case, you need to draw up a deed of gift for the property;

- sign a waiver of a share in real estate when a spouse purchases a home;

- if the property was inherited by a person, write a refusal of the inheritance. It can be downloaded here and must also be notarized.

Also, an individual has the right to formalize a refusal to receive a share of real estate during its privatization . You can download the sample here. In this case, he will not formally be the owner of the property, but will receive the right to use it for life.

Sample waiver of right of first refusal sample

Waiver of the preemptive right to purchase is one of the options available to property owners. Today we will tell you how to correctly refuse foreclosure, as well as sell your property without much difficulty. Who can…

Waiver of the preemptive right to purchase is one of the options available to property owners. Today we will tell you how to correctly refuse foreclosure, as well as sell your property without much difficulty. Who can issue a waiver of the pre-emptive right to purchase a share? The point is that all co-owners of property under the Civil Code of the Russian Federation have a pre-emptive right of redemption.

Sometimes co-owners do not want to buy shares, but they are not in a hurry with the mentioned process. This means that before putting the property up for sale, the owner is obliged to offer a deal to other owners.

If they formalize a waiver of the pre-emptive right to purchase, the operation may continue without their participation.

But here it is worth paying attention to several features.

- But here it is worth paying attention to several features.

- Transactions with shared ownership have some nuances, violation of which will lead to cancellation of the sale.

- When owners offer to buy out a share by preemptive right, they must take into account that the conditions must be the same as in the case of concluding an agreement with strangers.

- For example, if the co-owners were offered to buy a room for 400,000 rubles, but after refusal they put it up for 300,000, other owners will be able to challenge the deal.

- Bargaining is allowed, but other owners of the property do not have the right to demand a price reduction.

In fact, with proper preparation, the procedure will not cause any trouble.

Waiver of the pre-emptive right to purchase begins with notification of one of the owners about the sale of their property.

It’s better to do it this way: All this is extremely important when preparing the paper you are studying.

After all, some believe that if they “play silent”, the co-owner will not be able to sell his share. Waiver of the pre-emptive right to purchase can be formalized using different methods. Allowed: It is best to use the second scenario.

- It will help prove the fact that the person has not violated the current legislation.

- Especially if a citizen decides to buy out a share from a co-owner seller.

- As you might guess, the waiver of the right of first refusal (a sample paper will be presented later) has a specific form of presentation.

- We are talking about written consent or refusal of the proposed operation.

Ideally, the document is written by hand, but you can print it using a printer.

The main thing is to notify the owner-seller of your decision.

Waiver of preemptive right to purchase sample waiver

You can just wait a month and not deal with additional paperwork. An oral agreement has no legal force.

Although you can try to prove refusal or consent to buy out a share using video and audio means. It is important to correctly draft a statement of waiver of the pre-emptive right to purchase.

Application for waiver of the pre-emptive right to purchase a share

This document must contain specific information.

Namely: In addition, at the end of the paper they put the date of registration and the signature of the relinquished owner.

Waiver of the pre-emptive right to purchase – Notary

If a citizen decides to act through a notary, he will have to wait for certification of the waiver of the pre-emptive right to purchase.

Let's consider the procedure for contacting a notary office. The thing is that this operation requires little preparation.

A notarized waiver of the pre-emptive right to purchase requires the following papers: In addition, you will have to pay for notary services.

Refusal to purchase a share in an apartment sample - in 2018

Typically, the cost of registering foreclosures is about 1.5 thousand rubles.

- More accurate information must be clarified at a specific notary office.

- What does the correct example of waiver of the right of first refusal to purchase a share look like?

- It is slightly different from the generally accepted type of statements.

- The structure of the paper will be as follows: If you wish, you can format the document in the same way as any other application - with a “header”.

But in practice, this situation is extremely rare.

If you contact a notary, the authorized person will tell you how to draw up a waiver of ransom. Below we can see a sample waiver of the right of first refusal.

Often clients are asked to fill out ready-made forms. As already mentioned, the document has no special features. Also, to refuse a share, you can, as we have already said, do nothing at all.

If the owner, after receiving the notification, does not react to it in any way, this will be regarded as an unwillingness to enter into a transaction with the co-owner-seller. Typically, after the owners decline to buy out the share, the seller must do one more thing before putting the property on the market.

Namely, to issue a certificate of refusal from a notary.

Waiver of the right of first refusal sample

To do this, he will have to collect some documents.

More precisely, then: In exchange for this, the notary will issue a certificate in the established form.

- It will serve as proof that the co-owners have expressed their refusal of the pre-emptive right to purchase (a room or another share) in one form or another.

- Now you can safely search for buyers among third parties. We figured out how to negotiate a property sale with multiple owners.

- A sample waiver of the right of first refusal will no longer cause any trouble.

- In fact, it is easier to arrange it than it seems.

Each share owner can sell his property, but first he is obliged to offer a buyout to the co-owners.

Application for waiver of the right of first refusal

If this is not done, then other property owners will be able to quickly challenge the deal in court. If a citizen has sent a notice of sale and is also concerned about obtaining the relevant evidence, you can freely carry out purchase and sale transactions with third parties.

Waiver of the pre-emptive right to purchase a room sample

Waiver of the preemptive right to purchase is one of the options available to property owners. Today we will tell you how to correctly refuse foreclosure, as well as sell your property without much difficulty. Who can issue a waiver of the pre-emptive right to purchase a share? The point is that all co-owners of property under the Civil Code of the Russian Federation have a pre-emptive right of redemption.

Waiver of the pre-emptive right to purchase a share

After all, some believe that if they “play silent”, the co-owner will not be able to sell his share. Waiver of the pre-emptive right to purchase can be formalized using different methods. Allowed: It is best to use the second scenario.

Ideally, the document is written by hand, but it can be written using a printer.

Waiver of the pre-emptive right to purchase a share

- Let's look at an example.

- The main thing is to notify the owner-seller of your decision.

- If you wish, you can draw up the document in the same way as any other application - with a “header”.

- Namely, to issue a certificate of refusal from a notary.

- There are often situations related to the need to sell your share of an apartment and this is not prohibited by law.

- But this is not so easy to do, since other owners have an advantage in purchasing it.

- And only after receiving a waiver of the priority right from them, you can freely dispose of your part of the real estate.

This is the right of each co-owner to purchase a share of the property being sold before the property is put up for sale. Just call from any region of Russia: Or contact our online consultant!

How to apply?

But the proposed conditions should not differ - it is impossible to declare a price lower than the value that was offered to the owners in an open sale. The law provides for the sale of one's share of the apartment to any buyer, but on the condition that the owners of the remaining part of the home do not apply for its acquisition.

In case of price changes, all owners must be warned, otherwise, when going to court, the transaction will easily be invalidated. In this case, the owners must waive their rights in writing.

⇒ This right is also often called “primary”. It is necessary to draw up a notarized refusal (such a document will eliminate various disputes and disagreements).

Documentation

Article 250 of the Civil Code of the Russian Federation regulates relations in this area. obligated all transactions related to the sale of real estate shares to be notarized.

- It happens that the owners are far away or their location is not known at all.

- Therefore, on January 1, 2017, some changes were made to the legislation, which are also valid in 2018.

- It states that the owner, if he wishes to sell a share of the home, can publish this announcement electronically on the official website.

- This is a website of a government organization that registers rights to real estate.

Having decided to sell his share of the apartment, the owner is obliged to notify the other co-owners about this, indicating its value.

Waiver of the preemptive right to purchase is one of the options available to property owners. Today we will tell you how to correctly refuse foreclosure, as well as sell your property without much difficulty. Who can issue a waiver of the pre-emptive right to purchase a share? The point is that all co-owners of property under the Civil Code of the Russian Federation have a pre-emptive right of redemption.

Sample order

The notice must be in writing.

- It must be sent by registered mail with a list of attachments.

- Receipts and acknowledgment of delivery will serve as evidence that the consent or waiver of the right of first refusal was executed in accordance with the law.

- ⇒ A sample notification of the sale of a share can be viewed at this link.

- ⇐ It’s good when part of the real estate owned by the seller is clearly stated in the documents. If a sale suddenly takes place in a communal apartment, the seller of the share will need to send a request to Rosreestr to obtain information about the owners of other rooms.

This statement is paid, so the request is accepted with a receipt of payment.

Statute of limitations

- The co-owners, having received notification from the seller, must formalize their consent or refusal to purchase a share in the apartment.

- The refusal certified by a notary is sent to the owner of the share being sold by registered mail.

- Only after receiving refusals from all co-owners or not receiving them within the prescribed period, the owner of the property can put his share up for public sale.

In the video about Sample waiver of the right of first refusal, sample

Attention!

- Due to frequent changes in legislation, information sometimes becomes outdated faster than we can update it on the website.

- All cases are very individual and depend on many factors. Basic information does not guarantee a solution to your specific problems.

That's why FREE expert consultants work for you around the clock!

APPLICATIONS AND CALLS ARE ACCEPTED 24/7 and 7 days a week.