The statement of claim for the inclusion of property in the estate, a sample of which we will consider, is a standard application to the court. The paper is drawn up if certain property cannot be transferred to the heir due to the lack of a complete package of documents.

Deadlines and procedure for submitting an application

Inclusion in the estate and recognition of ownership may be necessary in case of mistakes made, lack of registration, or lost documents. The inclusion of property in the estate must be carried out in accordance with the procedure established by law.

Acceptance of inheritance and entry into ownership must be formalized in court. In the order of inheritance, a statement of claim is submitted to the court. There is no clearly defined period, but it is advisable to complete the action within six months.

There are a number of cases when activities are necessary:

- The deceased did not have time to legitimize the construction. Unauthorized buildings are not considered property;

- Housing is not privatized. Can be transferred to municipal records;

- Availability of funds in shares or securities;

- Paid, purchased real estate, without registration;

- Errors during registration made by the notary.

In practice, there are many cases that lead to the need to prove ownership as part of the inheritance estate. These cases are unique.

There can be many reasons for the issue:

- At the time of death, the deceased was divorced from his wife. There was no actual division of property. The notary refused to recognize the claimant's rights to the share. The property is jointly acquired, which has to be proven in court.

- The deceased was purchasing real estate in a house under construction. Documents for housing and registration will be issued after the delivery of the property. It is necessary to prove the fact of payment and the existence of rights to the property.

- A vehicle has been purchased. Payment has been made, registration with the traffic police has not been carried out. We prove the fact of purchase and sale.

- Home construction. They did not have time to legalize the building.

- Buying land. Transferring it from one status at the stage of commission.

- Transfer of real estate from residential status.

- The notary made a mistake; he incorrectly indicated the address of the object, the details of the heirs, and the model of the vehicle.

Required documents

The documents needed to prepare a claim, proof of ownership, are varied. The person filing the claim must be an heir by law and have papers confirming the relationship.

The main difficulty is collecting papers. The list of documents may include:

- Certificates of ownership;

- Property papers;

- Sales and purchase agreements;

- Papers confirming ownership.

Standard preparation implies the presence of documents: passport, copies for all participants in the process, death certificate, confirmation of inheritance rights, property valuation report, paid state duty.

Documents on the division of jointly acquired property of the spouses, documents on recognition of the building as premises and deregistration may be attached.

Situations are possible in which the deceased did not have time to register the object and transferred from one category to another.

Sample application

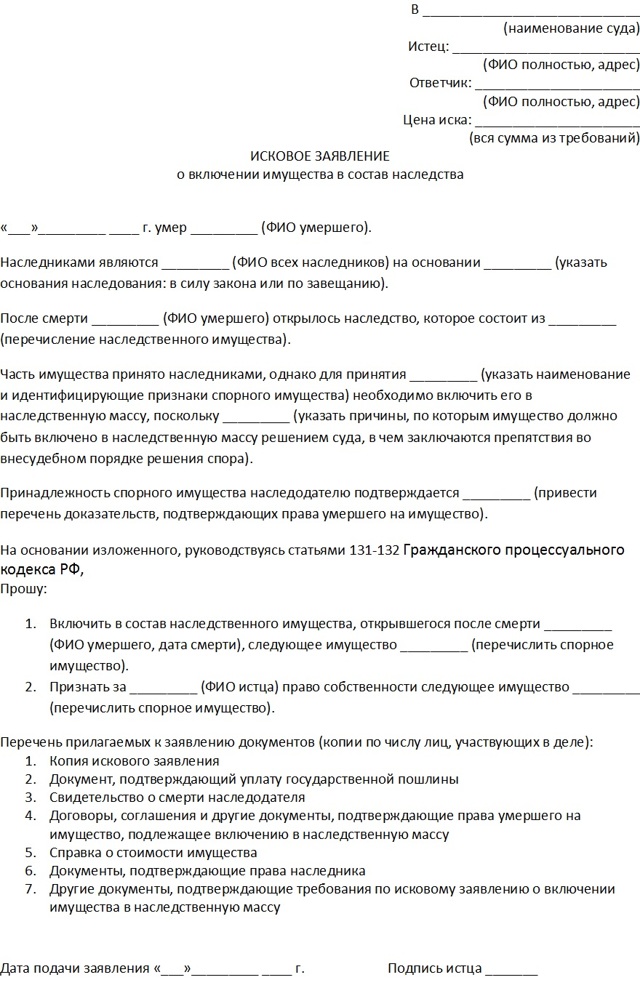

An application for inclusion in the estate, a sample of which we are considering, is filled out in the prescribed form. The claim for inclusion of property in the estate must contain the following columns:

- “Cap” with the name and address of the judicial authority where the case is being considered;

- Full name of the heir who filed the claim;

- Full name, address of the defendant;

- Full name of the notary organization, address;

- In the middle, enter the title of the document:

- The main part contains information about the deceased, residence, date of death, applicants for inheritance;

- A complete list of property, description, valuation, along with the subject of the claim;

- Reasons for refusal to recognize the estate;

- Arguments, documentary evidence of facts allowing the inclusion of a land plot, real estate, and other property in the inheritance mass;

- Forgiveness for the inclusion of property as part of the estate;

- Describe the documents provided;

- Confirm the document with a signature;

- Set the date.

The process will include several important steps.

- Identify property not included in the estate.

- Carry out the process of preparing documents.

- Competently draw up a statement of claim.

- Pay the state fee.

- Applications can be submitted in person or sent by registered mail with confirmation of delivery.

- Take part in a court hearing.

- After making a decision, if the result is positive, contact a notary.

- Re-registration should be carried out promptly.

A sample application to the court for inclusion in the estate is the most important document that allows you to correctly describe the problem. The actual use of the apartment must be officially registered by filing a claim in court.

Judicial practice suggests many different options when citizens can file a claim and draw up statements. After the divorce, a statement of claim for the recovery of alimony, a share of jointly acquired property.

In the event of an accident, the statement of claim may contain demands to compensate the victim for damages.

Incorrectly specified apartment data when drawing up a will may cause it to be declared invalid and lead to the need to file a statement of claim demanding that the property be recognized as part of the estate.

You need to contact the judicial authority located at the place where the property is registered. You can deal with the issue personally or through a representative by issuing a power of attorney for him.

Wrong choice of organ can cause failure. Paying attention to the correct choice of organ is extremely important. If in doubt, it is advisable to contact a specialist. A mistake can be fatal.

Repeated applications will not be accepted.

Grounds for refusal to accept an application

In addition to the interests of the testator whose property rights are infringed, one can consider the reimbursement of funds under the loan agreement to the deceased, determining the share of payment by all heirs.

The claim is not always granted. There are a number of errors that can cause a failure:

- Wrong choice of judicial body;

- Making a decision earlier;

- The plaintiff withdrew the application;

- Failure to pay state duty.

Refusal is notified within five days. A repeated application will not be accepted for consideration. The judicial authority has the right to stop the consideration of the case if the package of documents is incomplete or there are errors in filing the claim. After correcting all the shortcomings, the process is resumed. The wrong choice of a judicial authority will cause failure and the impossibility of drawing up a repeated appeal.

State fee for filing a claim

To consider any property issue, it becomes necessary to pay a state contribution or duty. The amount of the contribution directly depends on the estimated value of the property. The size can vary from two hundred rubles to twenty thousand.

It is possible to document the cost with cadastral documents, an examination report, inventory paper, and bank statements. The size must be determined accurately. There is no need to distort data.

If a violation is detected, it is possible for the court to refuse to recognize the right of ownership. Failure to pay the fee will cause recognition of rights. It is very important to prepare all the necessary papers.

This is a prerequisite for obtaining a positive decision.

Sample statement of claim for inclusion of property in the inheritance (in the estate)

On this page you can download a template for a statement of claim for the inclusion of property in the inheritance (in the estate) prepared by our lawyers, taking into account the requirements of the current procedural legislation and the accumulated experience of its practical application.

The inclusion of property in the estate is necessary in order to assign property rights to this property to the heirs or heir.

Such situations arise when, during inheritance, for one reason or another, certain property or its share (apartment, land, vehicle, etc.) was not included by a notary (or court) in the inheritance and, accordingly, was not assigned to one from the heirs.

This statement of claim is subject to consideration in the district court. Do not forget that you need to pay the state fee and calculate the amount of the claim (see here.)

- In ________________________ (name of court and address) Plaintiff: ________________________

- (full name and address)

- (full name and address)

- (full name and address)

- State duty: ______ rubles.

- STATEMENT OF CLAIM for the inclusion of property in the inheritance (in the estate)

Defendant: _________________________________ Third party: ________________________ Price of the claim: ______ rubles; I, _____________ (indicate full name), am _______ (indicate degree of relationship) in relation to the testator ___________ (indicate full name), who died ___________ (indicate date). I am an heir by law / or by will (specify as appropriate) after the death of the testator. During his lifetime, ______________ (indicate the testator’s full name) he owned the following property by right of ownership:

Apartment located at: ___________________________; Land plot: area _______ sq. m., located at the address: ______________, with cadastral number: _____________; Residential building, residential purpose, total area ______ sq. m., located at the address: ________________; Cash in a bank account in ________ (account No. ________________, deposit ____________ (if any) in the amount of _________ as of __________________.

Car brand ____________, VIN number: _____________, _____ year of manufacture, color _________.

After the death of the testator, I turned to the notary with an application to accept the inheritance, but I could not find / restore documents confirming the right of ownership of the disputed property, and therefore, I was not issued a certificate of inheritance in relation to this property. Until now, the ownership of the above property is registered in the name of the deceased, i.e. to _________________ (indicate full name). According to an extract from the house register, the testator was registered at the address: ______________ (indicate full name).

After the death of the testator, I continued to use the above property. Due to the fact that I accepted the inheritance, I currently intend to formalize my rights to the remaining part of the inheritance property legally. The testator has other first-degree heirs (indicate if you are entering into an inheritance by law and the testator has living parents, children or a spouse.

In the header of the claim, indicate them as third parties). In accordance with Art. 1152 of the Civil Code of the Russian Federation, in order to acquire an inheritance, the heir must accept it. Acceptance by an heir of a part of the inheritance means acceptance of the entire inheritance due to him, no matter what it is and no matter where it is located. According to Art. 1142 of the Civil Code of the Russian Federation, the heirs of the first priority according to the law are the children, spouse and parents of the testator.

In accordance with Art. 1112 of the Civil Code of the Russian Federation - the inheritance includes things and other property that belonged to the testator on the day the inheritance was opened, including property rights and obligations. According to Art. 1114 of the Civil Code of the Russian Federation, the composition of the inheritance is determined on the day the inheritance is opened. According to Art. 218 of the Civil Code of the Russian Federation, in the event of the death of a citizen, the right of ownership of property belonging to him is inherited by other persons in accordance with a will or law.

In accordance with clauses 1, 2 of Art. 1152 of the Civil Code of the Russian Federation, in order to acquire an inheritance, the heir must accept it; acceptance of the inheritance under conditions or with reservations is not allowed. According to paragraphs 2, 4, Article 1152, Article 1153 of the Civil Code of the Russian Federation, the acceptance by the heir of a part of the inheritance means the acceptance of the entire inheritance due to him, no matter what it consists of and wherever it is located. Acceptance of an inheritance is carried out by submitting, at the place of opening of the inheritance, to a notary or an official authorized in accordance with the law to issue certificates of the right to inheritance, an application from the heir for acceptance of the inheritance or an application from the heir for the issuance of a certificate of the right to inheritance.

An accepted inheritance is recognized as belonging to the heir from the date of opening of the inheritance, regardless of the time of its actual acceptance, as well as regardless of the moment of state registration of the heir's right to the inherited property, when such a right is subject to state registration.

Calculation of claims and the amount of state duty: (LEAVE WHAT IS REQUIRED)

— According to the technical passport for the apartment, its inventory value (or indicate its market or cadastral value) is ______ rubles. — The cost of a land plot with a total area: ________ sq. m., according to the cadastral extract of the land plot is ________ rubles; — The cost of a house with a total area of ____ sq. m., at the address: ________, according to the independent assessment report (or cadastral extract) is _______ rubles; — The amount of funds in the bank account ________ (account No. _______, deposit “_____”) is ________ rubles; — A car of brand ______, VIN number: ________, _____ year of manufacture was purchased under a sales contract for ________ rubles; In total, the amount of claims is _________ rubles (specify calculation). The plaintiff also filed a demand to establish a fact of legal significance. Thus, the amount of state duty payable is ________ rubles (i.e. 000000 + 00000) rubles. I believe that my demands set out in the statement of claim are based on the law. Based on the above, guided by Art. Art. 12 Civil Code of the Russian Federation, art. art. 22, 131-132 Code of Civil Procedure of the Russian Federation,

I ASK THE COURT:

- Include in the inheritance remaining after the death of ________ (indicate the full name of the testator), the property: ____________ (indicate the property, for example, a residential building located at the address: ...).

- Recognize for the plaintiff _________ (indicate your full name), _______ year of birth, by inheritance, the right of ownership to: ____________ (indicate property).

Application:

1. A copy of the statement of claim for the parties to the case, the court and third parties; 2. Receipt of payment of state duty; 3. A copy of the death certificate of the testator; 4. A copy of the marriage certificate; 5. A copy of the will (if there is one); 6. Copy of birth certificate; 7. A copy of a previously issued certificate of inheritance;

8. A copy of the land ownership certificate; 9. A copy of the certificate of ownership of the apartment; 10. A copy of the certificate of ownership of the house; 11. A copy of the extract from the Unified State Register for the disputed property; 12. A copy of the bank deposit agreement; 13. A copy of the registration certificate for the car or PTS; 14. A copy of the technical passport for the apartment;

15. Copy of an extract from the house register; 16. A copy of the receipt for payment of utilities and maintenance of the apartment; 17. Copies of other documents confirming the circumstances stated in the claim; Date of application “____”____________ 20____

Plaintiff's signature ____________

Statement of claim for inclusion in the estate. Sample filling and form 2023

A statement of claim for inclusion in the estate will need to be drawn up in the event of a notary’s refusal to take into account a particular material object, right or sum of money as part of the inherited property.

As a rule, non-inclusion of property in the estate occurs due to the lack of necessary documentary evidence that this property belongs to the testator.

Hereditary mass

The inheritance mass is understood as the totality of property, money and special rights that belong to the testator during his lifetime as personal property. When opening an inheritance case, the notary establishes the estate to be inherited by will or by law.

Ideally, the estate includes all property, including the personal belongings of the deceased; however, household items and household items are included in the estate extremely rarely and only if there is a dispute between the heirs regarding these items.

It is mandatory to include in the estate the property the ownership of which is subject to state registration or the receipt of which is possible only with a certificate of receipt of the inheritance. Such property includes:

- real estate objects or ownership of a share in them;

- land;

- vehicles;

- bank deposits, shares, bonds, shares in authorized capital;

- funded part of pension;

- firearms;

- antiques and works of art;

- copyright;

- share savings, etc.

If ownership cannot be documented or the available documents are incomplete and contain inaccuracies, then the notary will certainly refuse to include them in the estate.

Only a court decision can oblige a notary to include property in the register of inheritance.

Inheritance and ownership

If there are no documents for the property at all, then no one will be able to include it in the inheritance mass - neither a judge nor a notary. In this case, additional steps will be required to recognize the ownership of the property by the deceased.

Since legal incapacity comes with death, the heir will have to recognize the right of ownership.

This is a complex legal action, since recognition of property rights of a deceased person is legal nonsense. The fact is that the deceased himself cannot go to court, and in order for the heir to go to court or other authorities, he must have the authority to do so. He does not have the rights, since he has not entered into the inheritance and cannot enter due to lack of documents.

It turns out to be a vicious circle, from which, nevertheless, you can get out. For this purpose, there is such a notarial trick as a certificate of inclusion of a citizen in the circle of heirs.

On the basis of this certificate, you can go to court not only with a claim for inclusion of property in the inheritance base, but also with a claim for recognition of ownership by inheritance or recognition of ownership of the deceased.

If the deceased at one time bought, received as a gift, exchanged or inherited property, but did not legally register it, the appropriate evidence of the acquisition should be provided to the court.

For example, if the deceased remained to live in the house of his parents, but did not take ownership of it after their death, documents will be required about the property of his parents, that the deceased lived in the house, paid for utilities, etc.

Transmission

A fairly common reason for the lack of title documents for property is missing the deadline for registration. For example, the testator purchased an apartment shortly before his death, but died before he had time to register the purchase and sale agreement.

In this case, the heir's right of ownership will be recognized by the court through the procedure of transmission.

Statement of claim

Drawing up a statement of claim on your own is an impossible task for a non-specialist, even if standard templates are used. There is also a standard template on our website, but it is recommended to use it for informational purposes only.

There are no typical situations in inheritance cases, since the quality and type of property, the number of heirs, the timing and grounds for which property cannot be included in the inheritance mass are deeply individual events.

Moreover, not every certified lawyer is able to draw up a competent statement of claim in inheritance cases. Therefore, it is advisable to contact not just a lawyer, but a lawyer specializing in this area of law. Only he will be able to take into account all the nuances of the case, assess the rights of the heirs and the prospects of the case.

Legal regulation

Issues regarding the inclusion of real estate in the estate of inheritance are regulated by Resolution of the Plenum of the Supreme Court of the Russian Federation 10/22 of April 29, 2010.

Thus, in accordance with the content of the Resolution, the right of heirs to inherit real estate that belonged to the testator de facto is determined, even if the property was not registered with him. The condition for obtaining the right to inheritance in this case will be proof of the deceased’s ownership rights.

Parties to the claim

Only an heir can act as a plaintiff in inheritance cases. The authority of the plaintiff is confirmed by the notarial certificate mentioned above.

It is necessary to distinguish a claim for inclusion in the estate from a complaint against the actions of an official, in our case a notary. Although the controversial relationships are superficially similar, there are significant differences between them. A complaint against the actions of a notary with demands to oblige him to perform this or that action is filed with the court if the notary’s refusal is illegal.

If the notary’s actions are lawful, then there is no point in complaining about him, since this will not solve anything. That is, one should not complain, but solve the problem on its merits, for example, recognizing the deceased’s right of ownership and asking for the inclusion of the object in the estate.

There is no defendant for the type of claim under consideration, and the notary is invited to the court hearing as an interested party.

Scheme of the claim

All statements of claim are drawn up according to a single scheme, and differ only in the content of the claims. Thus, an application for inclusion in the estate has the following structural components:

- “cap”, in which the court to which the claim is sent, the plaintiff’s full name and his address, the notary’s full name as an interested party and his address are named in order;

- preamble, which sets out the events preceding the application to the notary. For example, “On December 22, 2022, my father died without leaving a will. I am his only heir. When the hereditary mass was opened, it turned out that…”, etc.;

- a narrative that describes events from the plaintiff's point of view. For example, “On March 12, 2010, my grandmother died. The father remained to live in her house and lived in it until his death, paid taxes, made repairs, and added a veranda. However, he did not contact a notary and did not officially take possession of the inherited property”;

- the motivational part, which consistently sets out the evidence supporting the claims;

- the operative part, which sets out the requirements in a concise form. For example, “I ask you to recognize the deceased’s ownership of the house”;

- list of attachments to the claim;

- signature and date of filing the claim.

If proof of the validity of the claims is expected to involve witnesses, then the claim will need to list them.

Once again, we would like to draw your attention to the fact that inheritance cases are a complex category of claims, and the courts place high demands on their preparation and motivation. Therefore, these claims must be drafted by qualified lawyers.

State duty

The amount of state duty on claims for inclusion in the estate is calculated based on the value of the property included in the estate, which is regulated by Art. 333.19 Tax Code of the Russian Federation.

The value of the property can be determined by:

- cadastral valuation;

- at the average cost of property on the market for similar goods;

- appraiser's conclusion.

Jurisdiction and jurisdiction

Cases related to inheritance law fall under the jurisdiction of district (city) courts.

Jurisdiction of claims for inclusion in the estate is established based on the location or location of the inherited property.

Statement of claim for inclusion of property in the inheritance estate

During the process of entering into an inheritance, a notary may refuse to issue a certificate in respect of some objects and recommend filing a claim with the court to include the property in the inheritance mass. This need arises when the testator’s ownership of the thing cannot be confirmed with documents. That is, when such documents are missing, compiled incorrectly, or contain errors. For example, a non-privatized apartment, a summer cottage or a plot of land, the ownership of which is not registered in the state register of rights.

When entering into an inheritance, documents regarding the property are provided both by the heirs and requested by the notary who conducts the inheritance case.

The court's decision on the claim for inclusion of property in the inheritance mass will become the basis for taking the object into account as part of the inheritance and dividing it between the heirs or recognizing the right of ownership in the order of inheritance.

For your convenience, we have posted an example of such a claim. If you have any difficulties, you can use the help of the site’s on-duty lawyer.

On March 11, 2018, Tsvetkova Valentina Sergeevna, my mother, died. This fact is confirmed by death certificate series EM No. 1862142 dated March 11, 2018. On the date of opening of the inheritance, I was her only heir according to the law of the first stage. Valentina Sergeevna Tsvetkova’s will was not drawn up.

After the death of Valentina Sergeevna Tsvetkova, an inheritance was opened, which included funds placed in banking organizations, an apartment in an apartment building in the village. Bolshoye Selo, as well as a land plot with a total area of 2987 sq. m. m. at the address: Yaroslavl region, s. Bolshoye Selo, st. Radishcheva, 48, cadastral number: 68/598-4684/21.

As the only heir, I accepted the inheritance and turned to the notary Polishchuk Andrey Markovich with an application to obtain a certificate of right to inheritance. The notary refused to issue a certificate in respect of the land plot due to the lack of information about the registration of ownership rights to it in the Unified State Register of Rights to Real Estate.

At the same time, in accordance with Art. 1112 of the Civil Code of the Russian Federation, the inheritance includes things and other property that belonged to the testator on the day the inheritance was opened, including property rights and obligations.

According to the Resolution of the Plenum of the Armed Forces of the Russian Federation dated May 29. 2012 No. 9, in the absence of properly executed documents confirming the testator’s ownership of the property, the courts consider the demands of the heirs to include this property in the inheritance.

Land plot with a total area of 2,987 sq. m. m. at the address: Yaroslavl region, s. Bolshoye Selo, st. Radishcheva, 48, cadastral number: 68/598-4684/21 belonged to my mother, the testator, in accordance with the resolution of the Committee for Municipal Property Management of the Administration of the village.

Big village No. 18/58n dated March 19, 2006 on the transfer of ownership for running a personal subsidiary plot. Valentina Sergeevna Tsvetkova used the indicated plot for its intended purpose, bore the burden of its maintenance, and paid the tax. In violation of the requirements of Art. 131 of the Civil Code of the Russian Federation, ownership of the land plot was not registered in the prescribed manner.

Inheritance: what is included in the inheritance, a claim for the inclusion of property

The property that citizens receive after the death of the testator is called the inheritance estate. Its composition is determined on the basis of title documents. If the object is not properly registered or the documentation is lost, the heirs must prove their right to the object in court.

The concept of hereditary mass

The estate is understood as the totality of all the property of the deceased, his property rights, debts and other credit obligations. The inheritance mass is divided among the heirs of the owners in full.

The division of the inheritance occurs as follows:

- by will;

- according to family ties.

The testator independently distributes the inheritance mass among the selected persons in full or in a certain share. The heir can be a relative, an outsider or a legal entity.

To enter into an inheritance, the person specified in the will does not present to the notary a document on family ties. It is sufficient to have an identity document (for an individual) or a Unified State Register of Legal Entities (for a legal entity).

To enter into an inheritance on the basis of family ties with the deceased, it is necessary that the will:

- was not compiled;

- declared invalid;

- challenged in court;

- revoked by the testator;

- does not include the entire hereditary mass.

The law provides for the order of inheritance. In general, the civil code includes 7 stages. The first of these includes the mother, father, wife, husband and children of the deceased.

Important! To enter into an inheritance, a citizen must provide information about family ties.

Composition of the hereditary mass

The estate is the entire amount of property, property rights and debt obligations of a person formed at the time of his death. Property, the ownership of which has been transferred to another citizen, is not included in the inheritance.

The heir accepts his allotted share of the inheritance in full. You cannot accept one piece of property and refuse another. Acceptance of property and refusal of debt obligations is prohibited.

Entering into an inheritance does not imply reservations or conditions of the heir. A citizen does not have the right to independently determine the composition and volume of property received.

What is included in the inheritance:

- property rights;

- debentures;

- things;

- intellectual property.

Property rights

What is included in the hereditary mass? One of the components of the inheritance mass is property rights. They are understood as rights associated with material (property) claims arising in the process of distribution of property.

Property rights include:

- copyright;

- participation in shared construction;

- rights to compensation for harm;

- the right to receive wages or pensions unpaid to the deceased.

After entering into an inheritance, the person who received a share in the property rights of the deceased has the right to demand the fulfillment of obligations from individuals or legal entities. They must provide the heir with the property or funds that should have been given to the deceased.

Property responsibilities

The inheritance includes the debt obligations of the deceased. Features of inheritance of property responsibilities:

- the obligation is assigned to all persons who entered into an inheritance, regardless of age, volume of inherited property, presence/absence of a will;

- the period for claiming the debts of the deceased is 3 years from the date of formation of the debt;

- the volume of debt obligations accepted by the heirs cannot exceed the volume of property received;

- debts are shared jointly among all heirs, in accordance with the shares of property received.

Important! Inheritance does not include personal property obligations, such as alimony. In the event of the death of the recipient or payer, the obligation to pay support terminates.

Things

Material objects are creations of nature or man intended to satisfy human needs. They are divided as follows:

- generic and individual;

- consumed and unconsumed;

- natural and created;

- movable and immovable.

Individually defined things are items of movable or immovable property that are one of a kind. These include objects of art, an apartment, a house, a car.

Generic things include items that are determined by number or weight. The law does not establish a clear line between generic and individual things. For example, one car with personal license plates is an individual object. Several cars of a certain model will be generic objects.

Consumable things can be consumed, as a result of which they are used up. These include food, building materials, spare parts, and fertilizers.

Non-consumable items do not disappear after a single use. They are designed for long term use. These include real estate, cars, and household appliances.

Natural things are created without human intervention. They appear under the influence of natural actions. For example, pearls. Crafted objects are created through human action. These include everything that is made by man, a car, real estate, household appliances.

Movable objects are objects that can be moved. These are any objects, equipment, vehicles. Real property cannot be moved without loss or significant disturbance to the properties. This is a house, apartment, cottage, land plot.

Intellectual property

Intellectual property is property that is created through intellectual activity. Examples of such objects are:

- logos;

- trademarks;

- computer software;

- database;

- inventions;

- masterpieces of art and culture;

- industry samples.

The right to intellectual property is exclusive. The recipient has the opportunity to own and dispose of it at his own discretion.

What is not included in the estate

The law limits the possibility of including a number of rights, obligations and items in the inheritance property. Among them:

- personal rights and obligations of the deceased;

- items for which the testator did not have ownership rights;

- non-material rights of a citizen;

- the share in the joint property of a married couple belonging to the second spouse.

Personal rights and responsibilities are inextricably linked with the personality of the deceased. Among them:

- receipt and payment of alimony;

- payment of fines;

- receiving compensation payments;

- subsidies;

- free use agreement.

Only property that a citizen possessed by right of ownership is subject to inheritance.

The following are not subject to inclusion in the inheritance mass:

- leased property, objects used with the consent of the owner;

- certificate for maternal capital;

- unauthorized construction of real estate objects, the construction of which is not legalized in the manner prescribed by law.

Important! The certificate for maternal capital is not inherited. The document is reissued in the name of a spouse or child. Other heirs by will or by law do not have the right to claim public funds.

Objects of property that were actually the property of the deceased, but were not properly registered, are not included in the estate. To acquire rights to such property, heirs must file a claim for inclusion in the estate and recognition of ownership.

Statement of claim for inclusion in the estate (sample)

- To acquire ownership of the property of the deceased, which was not properly registered, we will consider a statement of claim for inclusion in the estate (sample).

Sample claim for inclusion of property in the estate:

- details of the judicial authority (name, address);

- information about the applicant;

- defendant's details;

- the notary who opened the inheritance case is indicated as a third party;

- cost of claim;

- Title of the document;

- information about the deceased (full name, date of birth and death, presence/absence of a will);

- information about the heirs (full name, family relationship with the deceased);

- a list of the testator's property that was included in the inheritance;

- a list of property that is not included in the list of inheritance;

- the reasons why the notary refused to include the property in the inheritance mass;

- arguments and evidence about the need for its inclusion;

- reference to law;

- claims for inclusion of an object in the estate;

- inventory of the attached evidence base;

- date of preparation and signature of the applicant.

A sample statement of claim for inclusion of property in the inheritance estate can be downloaded here

Important! The document is drawn up taking into account the norms of civil procedural legislation.

The document is submitted to the judicial authority (district or city court) at the location of the property or at the location of the notary’s office.

The defendant is the body that refuses to recognize the deceased’s ownership of the property. For example, a local government body does not want to recognize the rights of a deceased citizen to a land plot that was in use by right of gratuitous provision.

The price of the claim is calculated based on the full cost of the object in respect of which the meeting is being held.

Application

The applicant is required to prove that the property actually belonged to the testator. To do this, you must attach the following information:

- title documentation;

- information confirming the right of use (social tenancy agreement, move-in order);

- resolution on the transfer of property for free use;

- certificate of inheritance.

In addition to the information listed, the applicant must attach general information:

- personal document;

- information about the death of the testator;

- will (if any);

- documents on family ties;

- expert assessment of property not included in the inheritance;

- duty payment receipt.

Amount of state fee to court

Like any other property claim, an application for the inclusion of property in the inheritance is subject to payment. The minimum duty is 400 rubles, the maximum is 60,000 rubles. the calculation is made based on the value of the property.

If its price is less than 20,000 rubles, then you must pay 4% of the cost. If the price of the object is more than 1 million, the applicant will pay 13,200 rubles. and 0.5% of the value exceeding 1 million.

Court decision to include property in the estate

Having received a court decision, the applicant must provide it to the notary in charge of the inheritance case. After an object is included in the inheritance, it is subject to the rules of law on inheritance by law.

What is hereditary mass? This is a complete list of things, property rights, obligations and intellectual property of the deceased, which pass to the heirs after his death. If an object that was actually owned by the deceased is not included in the estate, the heirs have the right to file a claim to include the object in the inheritance.

To do this, the applicant must substantiate his claim with strong evidence, indicate information about whether the citizen is an heir in accordance with the will or the law.

Statement of claim regarding inheritance estate

A statement of claim for inclusion of property in the estate or a statement of claim for the estate is drawn up to confirm the fact that the deceased was the owner of the property claimed by the heirs, if the necessary documents are missing or drawn up incorrectly. The plaintiffs in this case will be the heirs interested in formalizing their rights to the property.

Inclusion of privatized housing in the estate

The most common case of filing a claim for the inclusion of property in the estate is the improper execution of a privatization agreement.

In such contracts, the address of the residential premises may be incompletely indicated, and errors may be made in writing the personal data of both the deceased and other parties to the contract. The contract may not be executed, and the signature of the deceased may be missing.

In an agreement concluded with several citizens, the shares of each of them may not be determined (in this case, an additional requirement is stated to determine the shares).

How to file a claim for an inheritance estate

A statement of claim for inclusion of property in the estate must be submitted within the 6-month period established for acceptance of the inheritance. If the plaintiff did not manage to meet this deadline, he has the right to make an additional demand for recognition of ownership of the inherited property. Details about inheritance: Inheritance legal relations.

The statement of claim is within the jurisdiction of the district court, regardless of the cost of the claim (Clause 5 of Part 1 of Article 23 of the Code of Civil Procedure of the Russian Federation).

Features of the statement of claim for inclusion of property in the inheritance mass

Requirements for inclusion in the estate are property, the state duty is determined as for property disputes, depending on the value of the claim. The cost of the claim is determined by the value of the property. For real estate, you must take a certificate of its inventory (cadastral) value; for movable property, you can attach a certificate from an appraiser.

The amount of the state duty on the day of filing the claim can be found here: state duty to court. It should be noted that in inheritance cases, a significant reduction in the amount of payment of the state duty is possible upon an application for a reduction in the amount of the state duty.

- The statement of claim must be accompanied by copies of it according to the number of defendants, a receipt of the state duty, a death certificate of the testator, documents confirming the rights of the heir (birth certificate, marriage certificate, will, etc.), a certificate of the value of the property, an agreement in which there were clerical errors , other documents confirming the rights of the deceased to property to be included in the inheritance mass.

- When filing claims for inclusion in the estate of residential premises transferred under privatization agreements, you must additionally attach an application for privatization, a certificate of family composition at the time of privatization, a warrant or a social tenancy agreement.

- For complex issues when drawing up a statement of claim for inclusion of property in the estate, please consult a professional lawyer.

Sample statement of claim for inclusion of property in the inheritance estate

In _____________________________ (name of the court) Plaintiff: _________________________ (full name, address) Defendant: ______________________ (full name, address) Cost of the claim: ______________________ (full amount of the claims)

Statement of claim for inclusion of property in the inheritance

“___”_________ ____ died _________ (full name of the deceased).

- The heirs are _________ (full name of all heirs) on the basis of _________ (indicate the grounds for inheritance: by force of law or by will).

- After the death of _________ (full name of the deceased), an inheritance was opened, which consists of _________ (list the composition of the inherited property).

- Part of the property is accepted by the heirs, however, in order to accept _________ (indicate the name and identifying features of the disputed property), it is necessary to include it in the inheritance mass, since _________ (indicate the reasons why the property should be included in the inheritance mass by a court decision, what are the obstacles in out-of-court proceedings dispute resolution).

- The ownership of the disputed property by the testator is confirmed by _________ (give a list of evidence confirming the rights of the deceased to the property).

- Based on the above, guided by Articles 131-132 of the Civil Procedure Code of the Russian Federation,

- Ask:

- Include in the inheritance property opened after the death of _________ (full name of the deceased, date of death), the following property _________ (list the disputed property).

- Recognize the ownership of the following property as _________ (full name of the plaintiff) _________ (list the disputed property).

List of documents attached to the application (copies according to the number of persons participating in the case):

- Copy of the statement of claim

- Document confirming payment of state duty

- Death certificate of the testator

- Contracts, agreements and other documents confirming the rights of the deceased to property to be included in the inheritance mass

- Certificate of property value

- Documents confirming the rights of the heir

- Other documents confirming the requirements for the statement of claim for inclusion of property in the inheritance estate

- Date of application “___”_________ ____ Signature of the plaintiff _______

Statement of claim for inclusion of property in the inheritance

Sample statement of claim for inclusion of a privatized apartment in the inheritance estate

In __________________________ (name of the court) Plaintiff: ______________________ (full name, address) Defendant: ____________________ (full name, address) Defendant: ____________________ (name of the defendant, address) Cost of claim: ____________________

(full amount from claims)

STATEMENT OF CLAIM

on the determination of shares and inclusion of property in the inheritance mass

“___”_________ ____ between _________ (full name of citizens, participants in privatization) and _________ (name of the municipal body, party to the agreement) an agreement was concluded for the transfer of an apartment into the ownership of citizens, under the terms of which _________ (full name of citizens) transferred residential premises at the address: _________ (full address, including region, city, street, house, apartment).

When drawing up the agreement, the shares of all owners were not determined; the following errors were made _________ (list the errors in the agreement).

“___”_________ ____ one of the owners of the residential premises _________ (full name of the deceased) died. I am the heir of ___ (queue of succession) after the death of _________ (full name of the deceased) on the basis of _________ (indicate the grounds for inheritance, by law or will).

The absence of shares and other errors made during the execution of the contract prevent the registration of an inheritance after the deceased.

https://www.youtube.com/watch?v=_LMD9-poH9Y

In accordance with Resolution of the Plenum of the Supreme Court of the Russian Federation No. 8 of August 24, 1993 “On some issues of application by courts of the Law of the Russian Federation “On the privatization of housing stock in the Russian Federation”, improper execution of a privatization agreement cannot serve as a basis for refusing to satisfy the heir’s demands for inclusion of property in the inheritance the mass, if the testator expressed his will during his lifetime to privatize the occupied residential premises and did not withdraw his application, because for reasons beyond his control he was deprived of the opportunity to comply with all the rules for preparing documents for privatization, which he could not be denied.

In accordance with Article 3.1 of the Law of the Russian Federation dated July 4, 1991.

“On the privatization of housing stock in the Russian Federation”, in the event of the death of one of the participants in joint ownership of residential premises privatized before May 31, 2001, the shares of participants in common ownership of this residential premises are determined, including the share of the deceased. In this case, the specified shares in the right of common ownership of this residential premises are recognized as equal.

Based on the above, guided by Articles 131-132 of the Civil Procedure Code of the Russian Federation,

Ask:

- Determine the shares in the right of common shared ownership of residential premises at the address: _________ (full address of the apartment) belonging to _________ (full full names of all participants in the privatization agreement) equal, in the amount of ___ share for each.

- Include in the inheritance property opened after the death of _________ (full name of the deceased, date of death), ___ share in the right of common shared ownership of residential premises at the address: _________ (full address of the apartment).

- Recognize for _________ (full name of the plaintiff) the right of ownership of the residential premises (share in the ownership of the residential premises) at the address: _________ (full address of the apartment).

- Petition:

- Please request from _________ (name of the local administration) the documents that served as the basis for the privatization of the residential premises at the address: _________ (full address of the apartment), which will confirm that the testator expressed his will during his lifetime to privatize the occupied residential premises.

- List of documents attached to the application (copies according to the number of persons participating in the case):

- Copy of the statement of claim

- Document confirming payment of state duty

- Death certificate of the testator

- Privatization agreement

- Certificate of the cost of the apartment from the BTI

- Documents confirming the right of inheritance

- Other documents confirming the requirements for the statement of claim for inclusion of property in the inheritance estate

- Date of application “___”_________ ____ Signature of the plaintiff _______

Statement of claim for determination of shares and inclusion of property in the inheritance mass

Statement of claim for inclusion of property in the inheritance estate

The citizen owned a residential building. After his death, the specified residential building was hereditary property. According to the certificate of the right to inheritance under a will, certified by a state notary, after the death of a citizen, five people become heirs in equal shares.

The plaintiff’s father did not register ownership of the share of the residential building in accordance with the procedure established by law, but entered into inheritance rights, lived in the disputed residential building, and bore the burden of maintaining the property belonging to him. The plaintiff's father passed away.

Within the six-month period established by law, the plaintiff turned to the notary with an application to accept the inheritance. However, the plaintiff was refused by the notary due to the fact that during his lifetime his father did not register ownership of the share of the disputed residential building. In this regard, the specified property is not included in the inheritance mass.

The plaintiff asks the court to include real estate in the estate that opened after the death of his father. recognize his ownership of a share of a residential building.

- In _____________ city court ___________ region_________________________________________

- Plaintiff: _________________________________________________________________

- Defendant: Administration of the rural settlement _______________ _____________ municipal district___________________________

- Third parties: Notary of ___________ ________________________________________________________________________________

- ______________________________________

- Department of the Federal Service for State Registration, Cadastre and Cartography for the __________ region___________________________

State duty: based on Part 1 of Art. 333.19 of the Tax Code of the Russian Federation is _______ rubles ___ kopecks

- STATEMENT OF CLAIM

- On the inclusion of property in the inheritance mass, recognition of the right of ownership of inherited property

___________________ - on the basis of a certificate from __________ s/s dated ________ for No. ___ belonged to a residential building, log, located in the village of _______________ district, _____________ s/s ___________ region. _____________________ died ____________. After his death, the specified residential building was hereditary property.

According to the certificate of the right to inheritance under a will, certified by a state notary _________ state notary office _________________, registered in the register under No. _________ heirs, after the death of _________ in equal shares are _____________, _______________, ________________, __________________, ____________________ My father is _____________________, in accordance with the procedure established by law, not registered ownership of ___ residential building located in the village of __________ __________ district, but entered into inheritance rights, lived in the disputed residential building, and bore the burden of maintaining the property belonging to him. Currently, by the Decree of the Head of the Administration of the rural settlement __________ _______________ Municipal district of the ___________ region from _________ city No. _______ the specified household was assigned a postal address: ______________________________________________________________ died ____________ in the village _________, __________ district, ___________ region. Death certificate ______ No. ________ dated _________. After the death of ___________, ___ residential building located in the village of ________ was hereditary property. According to the technical passport issued by the State Unitary Enterprise MO "________" as of __________, the disputed residential building consists of: a residential building ______, structures ___. The inventory number of the disputed residential building is __________. The well __ was built after the death of my father, but I took part in its construction by investing personal funds. The heirs of the first stage after the death of _________ are: me, - his daughter - ___________________ and his wife ____________________ .Within the six-month period established by the legislation of the Russian Federation, we turned to the notary with an application to accept the inheritance. However, the notary refused us, due to the fact that during his lifetime my father did not register ownership of the ___ disputed residential building. In connection with this, the specified property was not included in the inheritance estate. Currently, the costs of maintaining ___ the disputed residential building in the form of payment of necessary utility bills, tax deductions, etc. I bear - ___________________, who is the heir of the first priority after the death of his father. Based on clause 2, part 2, article 218 of the Civil Code of the Russian Federation, in the event of the death of a citizen, ownership of the property belonging to him is inherited by other persons in accordance with the will or law .According to Art. 1141 of the Civil Code of the Russian Federation, heirs by law are called upon to inherit in the order of priority provided for in Art. 1142-1145 and 1148 of the Civil Code of the Russian Federation. In accordance with Art. 1142 of the Civil Code of the Russian Federation, the heirs of the first priority according to the law are the children, spouse and parents of the testator. By virtue of Art. 1154 of the Civil Code of the Russian Federation, an inheritance can be accepted within six months from the date of opening of the inheritance. Based on Art. 1112 of the Civil Code of the Russian Federation, the inheritance includes things that belonged to the testator on the day the inheritance was opened, and other property, including property rights and obligations. The Constitution of the Russian Federation in Part 1 of Art. 45 enshrines state guarantees for the protection of rights and freedoms. By virtue of clause 1 of Art. 12 of the Civil Code of the Russian Federation, one of the ways to protect the right is the recognition of the right.

Thus, in accordance with the norms of the current legislation, there are all grounds for including property in the form of ___ residential building located at the address: _________________________________ into the inheritance mass after the death of ________________, who died on __________ in the year __________, ___________ district, _________ region, as well as recognition I have ______________________ ownership rights to the disputed residential building with buildings.

Based on the above and guided by Art. 218, 1112, 1141, 1154, 1156 Civil Code of the Russian Federation, –

I ASK THE COURT:

1. Include in the inheritance mass opened after the death of _________________, who died _____________ in the village of ____________, _____________ district, _________ region, real estate in the form of a ___ residential building Lit.

_____, buildings _______, located at: ___________________________________________________2.

Recognize for me —_________________—, ownership of ___ residential building Lit____, buildings ___ located at the address: ___________________________________ by inheritance.

Applications:1. Copies of the statement of claim;2. Receipt for payment of state duty;3. A copy of the certificate of the right to inheritance under a will;4. Copy of death certificate ______________5.

A copy of the extract from the household ledger dated _______ No. ________;6. Copy of birth certificate _____________;7. Copy of birth certificate ______________;8. A copy of the marriage certificate dated __________;9.

A copy of the technical passport dated ___________;

10. Copy of the Resolution of the Head of Administration dated __________, No. _______.

- ____________________

- " " _______________ G.