- Category: Real estate

- The instructions are written for those who are giving or are just about to give their apartment or room to another person.

- Donation between close relatives.

- Close relatives include:

- — Parents;

- — Children, including adopted children;

- - Grandparents, namely the parents of your father and mother;

- — Brothers and sisters (by mother and father or only one parent)

- Donation: tax 2018

In 2018, transactions between close relatives are still not subject to any taxes.

In accordance with clause 18.1 of Art. 217 of the Tax Code of the Russian Federation as amended. from 07/03/2016:

That is, the taxpayer is exempt from paying personal income tax in the amount of 13%. There is also no need to submit a tax return (clause 2, clause 1 and clause 3, article 228, clause 1, art.

229 of the Tax Code of the Russian Federation, the obligation to submit a tax return is assigned to individuals who received income from the sale of property owned by these persons and property rights, except for the cases provided for in paragraph 17.

1 tbsp. 217 of the Tax Code of the Russian Federation, when such income is not subject to taxation).

The donation agreement does not require mandatory notarization if the apartment is donated as a whole. But if you plan to donate a share in an apartment, then from 2017 mandatory notarization is required. Even if all shareholders make donations at the same time, the transaction is subject to notarization - Art. 42 of the Law on Real Estate Registration.

Transactions involving the donation of real estate are subject to mandatory notarization if the property belongs to a minor or a citizen recognized as having limited legal capacity .

If your transaction does not require mandatory notarization, then there is no point in paying additionally for such services. Usually, a transaction is carried out through a notary if there is a high probability of challenging the gift agreement in the future. But by and large, the fact that the transaction was carried out by a notary does not greatly affect the outcome of the trial.

If the donor was sane and there were no threats from the recipient, then it is very difficult to invalidate the transaction. If the contract is drawn up correctly, then the likelihood that the transaction can be challenged tends to zero. If you want to insure the deal, then take a certificate from the IPA and ND for the donor.

At the moment, real estate market participants practically do not conduct transactions through a notary.

If a notarial transaction had a significant advantage over a simple written transaction, then banks, when issuing a loan, would simply oblige the parties to conduct the transaction with the participation of a notary.

As a result, neither the purchase or sale of an apartment nor the donation is carried out through a notary; everyone prefers to save money.

- If you conclude a deal through a notary, such a service will cost:

- for a transaction amount up to 10,000,000 rubles inclusive - 3,000 rubles + 0.2 percent of the valuation of real estate (contract price);

- for an amount over 10,000,000 rubles - 23,000 rubles + 0.1 percent of the transaction amount exceeding 10,000,000 rubles, but not more than 50,000 rubles.

- Additionally, the notary may charge a fee for technical work (set by the notary himself), as well as for drawing up the agreement.

- If the transaction occurs between close relatives, the notary may charge you the following amounts for his services:

- — For drawing up the contract;

- - 0.3% of the cost of the apartment specified in the contract, but not less than 300 rubles.

- — For technical work, everyone has different tariffs.

- If you decide not to resort to expensive notary services, then you can register the gift agreement with Rosreestr in simple written form.

- For this:

- Download the donation agreement form

- We fill in everything that concerns you and your apartment.

- We print out the agreement in three copies: one for the registration service, and one for each party. The agreement must be printed on one sheet, or it must be stitched, numbered and the stitching certified by the signature of the parties. The signature on the stitch must extend beyond the bounds of the stitch.

The donor has the right to refuse to perform an agreement containing a promise to transfer a thing or right to the donee in the future, or to release the donee from a property obligation, if after the conclusion of the agreement the property or marital status or health status of the donor has changed so much that the execution of the agreement in the new conditions will lead to a significant decrease in the level of its life.

Self-registration of a gift agreement, sale and purchase, exchange, etc. through MFC.

Next we go to Rosreestr (the address for Moscow can be found on the official website of Rosreestr). In Moscow, if the parties to a gift agreement are individuals, the registration of such agreements is carried out by the Multifunctional Center (MFC). Video Video

The most unpleasant moment of the whole procedure is the queues. In order not to waste a day submitting and receiving documents, many services offer the opportunity to sign up for a specific time. In many MFCs, electronic registration for a certain day has become mandatory. This is very convenient, since sometimes you can stand in line for more than one day.

In many MFCs, electronic registration for a certain day has become mandatory. But this is not convenient if you need to submit documents urgently; there may not be an appointment time for the next few days.

To make an appointment, you must register on the state portal. services. If the object of the contract is residential premises, then the territorial unit to which you plan to apply should deal specifically with residential premises. This information can be clarified on the website or by additionally calling the specified department.

That is, if the apartment is located in the Northern Administrative District, and it is more convenient for you to submit documents to the Eastern Administrative District, then you can submit through the Eastern Administrative District, the main thing is that this territorial division deals with the housing stock.

Both the donor and the recipient need to come to the registration service or (MFC). Take with you your passport, three copies of the gift agreement and money to pay the state fee. There is an electronic queue at the MFC in Moscow.

An MFC employee will help you get the right coupon to see the specialist you need.

While you are waiting your turn, you can pay the state fee. If not, then take the details from the MFC and pay through Sberbank.

Donation: state duty 2018

The state fee for registering a gift agreement in 2018 is 2,000 rubles.

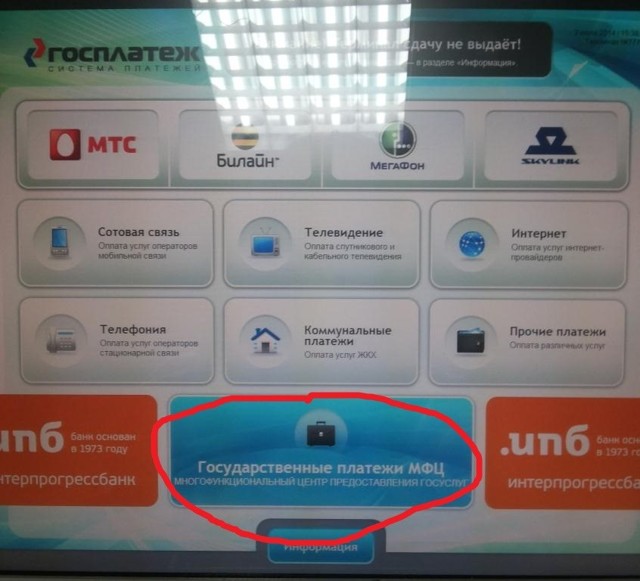

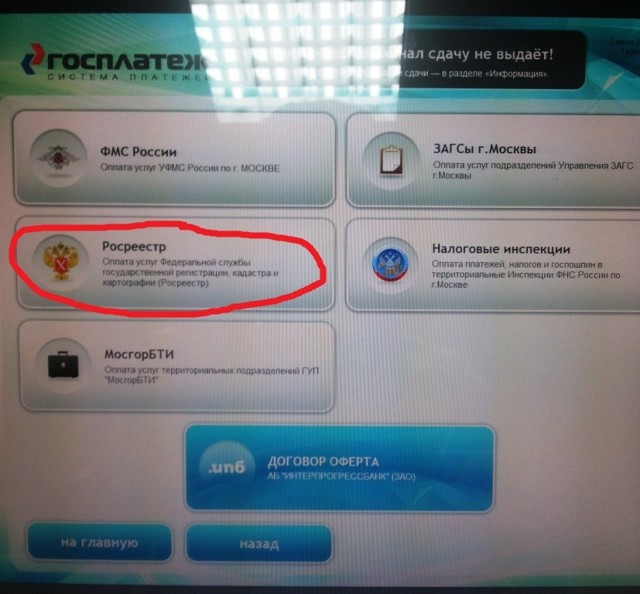

Details for paying the state fee can be found on the information board or asked from the employee who accepts documents for registration. You can pay the state fee through the payment terminal, which is located there. The commission for such an operation is charged at about 10%+-. Payment through the terminal looks like this:

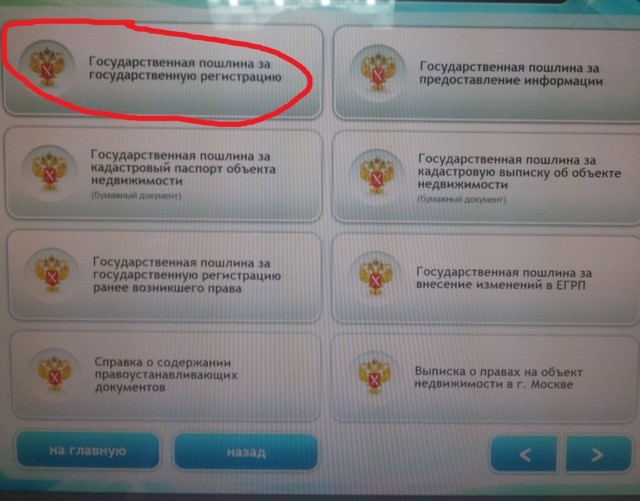

Select: “Government payments MFC”

Choose: “Rosreestr”

Select: “State fee for state registration.”

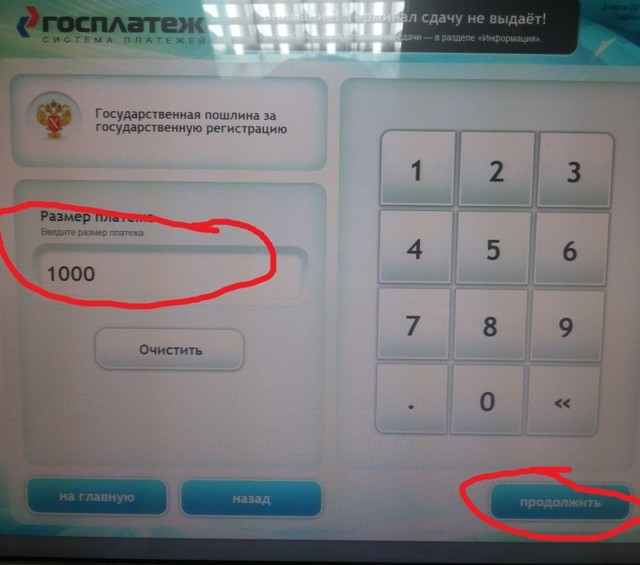

Enter an amount of 2000 rubles

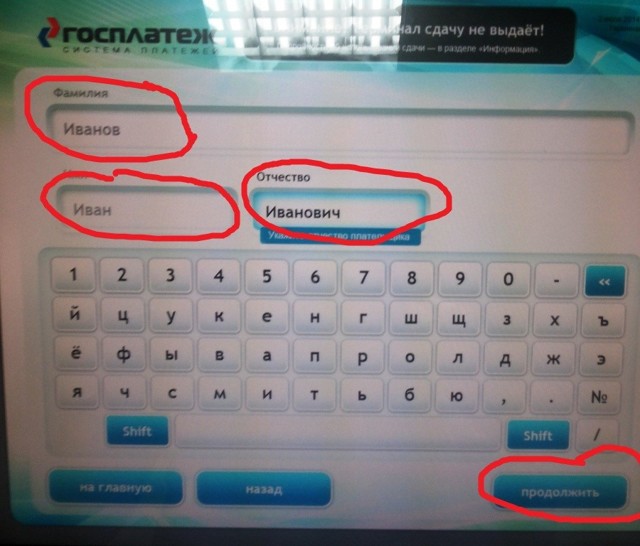

Enter the recipient's full name.

Enter the address of the recipient and press the “pay” button. The terminal will give you a receipt for payment. Attention: the terminal does not give change and does not accept change. Therefore, take with you the amount including the settlement fee. Change can be transferred to your mobile phone.

Submission of documents for state registration of transfer of ownership by way of gift between close relatives 2017

List of documents required to register a gift agreement between close relatives:

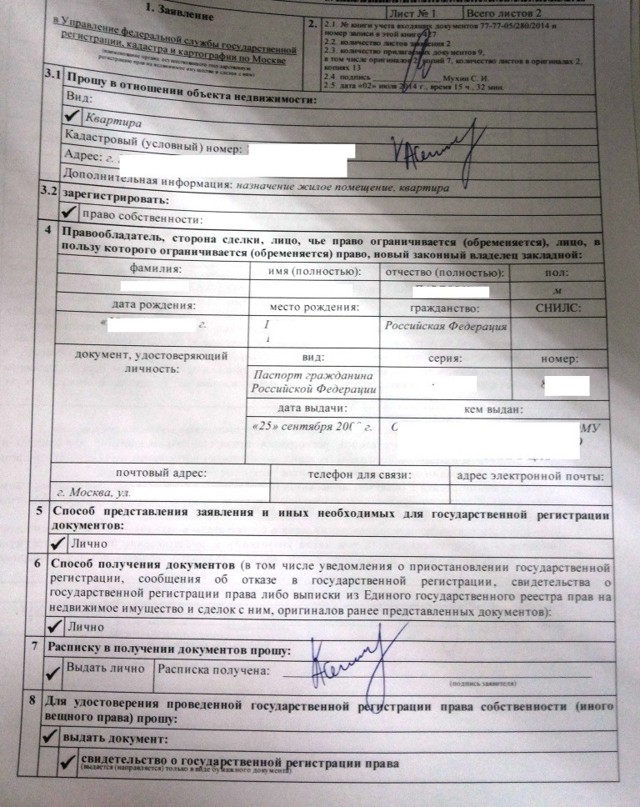

- Statement;

- Donation agreement (according to the number of parties to the transaction plus one copy for the registration service);

- Original passport of the donor and recipient (+ copy of the first page and the registration page);

- State duty;

- Original certificate of registration of ownership of the apartment from the donor (+ copy);

- Original written notarial consent of the donor's spouse, if the donated apartment is jointly acquired property (+ copy);

- If trustees act for one or both participants in the transaction - a notarized power of attorney (original and copy);

- Permission from guardianship and trusteeship authorities. This permission is necessary if the donee is a minor or incapacitated (+ copy).

- An extract from the house register, a copy of the financial personal account, or instead of these two documents you can take the Unified Housing Document.

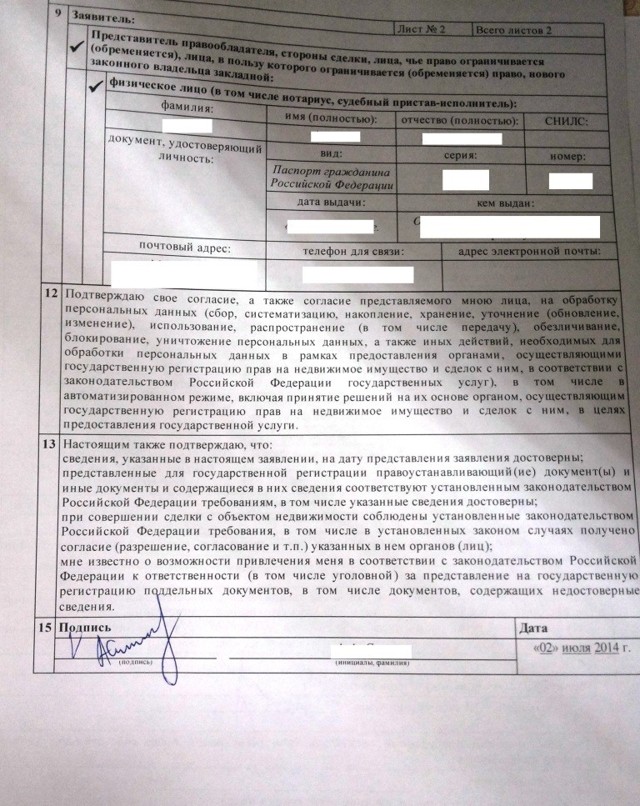

A sample application for registration of a gift agreement is here:

For Moscow, the above application is prepared by an employee of the MFC or Rosreestr. You will only need to double-check the entered data and sign.

Sample gift agreement from 2017 HERE.

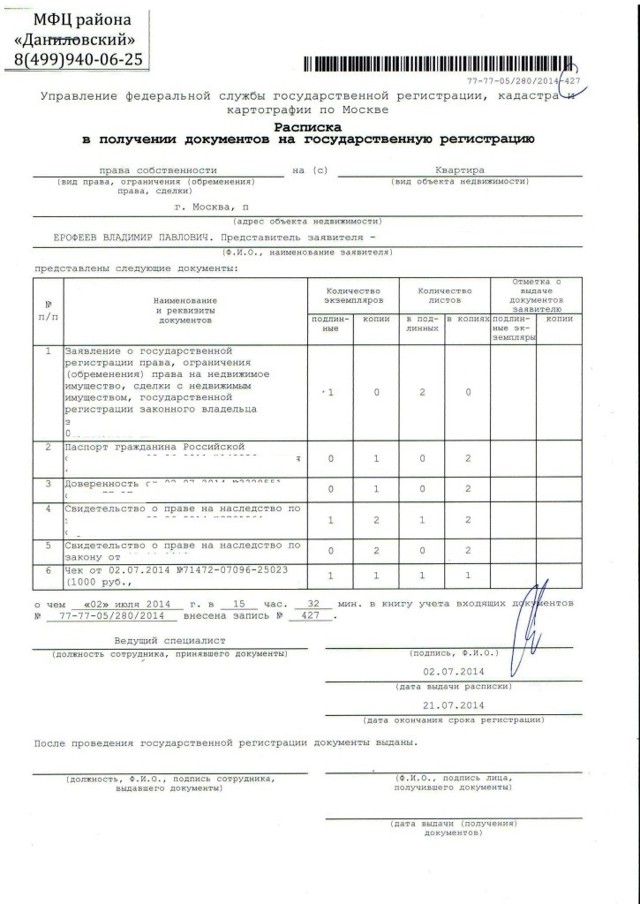

After providing a complete set of documents, you will be given a receipt for documents acceptance.

The above receipt does not quite fit our situation; it is given as a sample.

The receipt will indicate the date after which the documents will need to be received. According to the Law, Rosreestr has 7 days to register the transfer of ownership.

Deadlines for registering rights to real estate in 2018

The receipt will indicate the date the documents were received. In order not to waste time, we recommend checking on the Rosreestr website whether registration has taken place and the documents are ready. If the entry “Accepted decision to carry out state registration” appears on the website, then you can receive a registered gift agreement and an extract from the Unified State Register.

A certificate of ownership has not been issued since 2016. At the same time, both the donor and the recipient must come to Rosreestr, now not necessarily at the same time. If documents for registration are submitted through the MFC, then do not forget to find out the phone number where you can find out whether the transfer of ownership has been registered or not.

If the contract is drawn up incorrectly, even due to a typo or mistake in one word, it may not be registered. Therefore, approach the drafting of the contract with special care.

Receiving a gift agreement.

You must have a passport and a receipt for accepting documents with you. You already need to get in line to receive documents. You provide the Rosreestr (or MFC) employee with a receipt, a passport, and receive a registered gift agreement. That's all, congratulations on your successful self-registration of a gift agreement between close relatives.

For several years, our company has been successfully helping its clients register an agreement, eliminating the need to stand in tiresome queues and saving your time for more important issues. We take into account the legal features of each transaction; our contracts have passed the most thorough checks.

- We will be happy to provide you with services for drawing up and registering agreements in Rosester.

- Drawing up a gift agreement - 5,000 rubles.

- Registration of a gift agreement in Moscow (except for New Moscow) – 10,000 rubles.

- Registration of a gift agreement in the nearest Moscow region and New Moscow – 17,000 rubles.

- To order a donation agreement and registration, please call.

- If you have any questions, I recommend calling the free Rosreestr helpline before submitting documents: 8 (800) 100-34-34

Agreement for the exchange of residential premises

One form of transfer of property from one person to another is an agreement for the exchange of residential premises , which is understood as an agreement to transfer one property in exchange for another.

The provisions regarding me are established in Sec. 31 of the Civil Code of the Russian Federation (Civil Code of the Russian Federation), but it is also subject to provisions on purchase and sale that do not contradict the essence of the exchange transaction.

The legislation establishes the essential terms of the barter agreement, the inclusion of which in the text of the document is mandatory.

The form of the exchange agreement is simple written, but notarization of the transaction is also provided.

There are situations in which a preliminary exchange , which is associated with the presence of an encumbrance on the property planned for transfer.

In addition, it is possible to transfer not only the entire apartment, but also a share in it.

After the conclusion of the agreement, the actual transfer of property occurs, during which a transfer and acceptance certificate as confirmation of the completed actions of the parties to the transaction and in order to prevent the emergence of controversial situations.

After all the above procedures are completed, the transfer of ownership is registered in Rosreestr, to which an application with documents is submitted. After the issuance of an extract on the transfer of rights, the apartment is considered to have passed into the ownership of the new owner.

Essential terms of the apartment exchange agreement

Like any other agreement, an agreement for the exchange of residential premises has essential conditions, the inclusion of which in the text of the document is mandatory.

The exchange agreement must necessarily contain a provision on the subject of the transaction , that is, the property being exchanged must be precisely defined and spelled out. To do this, you need to indicate its identifying characteristics :

- name (for example, apartment or room),

- number of rooms,

- apartment address,

- total and living areas and other information.

In addition, you must indicate:

- Data about the parties to the exchange - full name, passport details of the persons (owners of the transferred property) between whom the exchange is taking place.

- Mutual responsibilities of the parties .

- Data of title documents for the exchanged real estate objects.

- Persons who retain the right to use the transferred housing.

- The date of the exchange.

- Signatures of the parties to the transaction.

- Additionally, you can specify the period for transfer of property. Sometimes property is not transferred simultaneously, but at different times due to various circumstances.

Rights and obligations of the parties

- The main obligation for the parties to the transaction in question is the obligation to transfer the property specified in the text of the exchange agreement.

- If the transaction does not specify the conditions for additional payment, then the property is recognized as equivalent .

- If a certain amount is established as an additional payment, then the party to the contract has an additional obligation to transfer it.

If the terms of transfer of the apartment do not coincide, then the provisions of the Civil Code of the Russian Federation on counter-fulfillment of obligations (Article 328 of the Civil Code of the Russian Federation).

Exchange agreement form

The exchange agreement is drawn up in writing , and it does not require notarization.

However, in accordance with Art. 163 of the Civil Code of the Russian Federation, such a certificate is required if it is directly indicated in the law or in the agreement. Therefore, if you do not specify such a condition in the text of the document, then you don’t have to contact a notary.

two exceptions to the general rule that there is no need for notarization of a transaction :

- if the transaction is related to the alienation of property of a minor citizen or a person with limited legal capacity;

- if the transaction is related to the alienation of property that is in shared ownership .

If the contract is drawn up independently without the help of a notary, then when developing it you need to carefully and responsibly indicate the mandatory information in the contract.

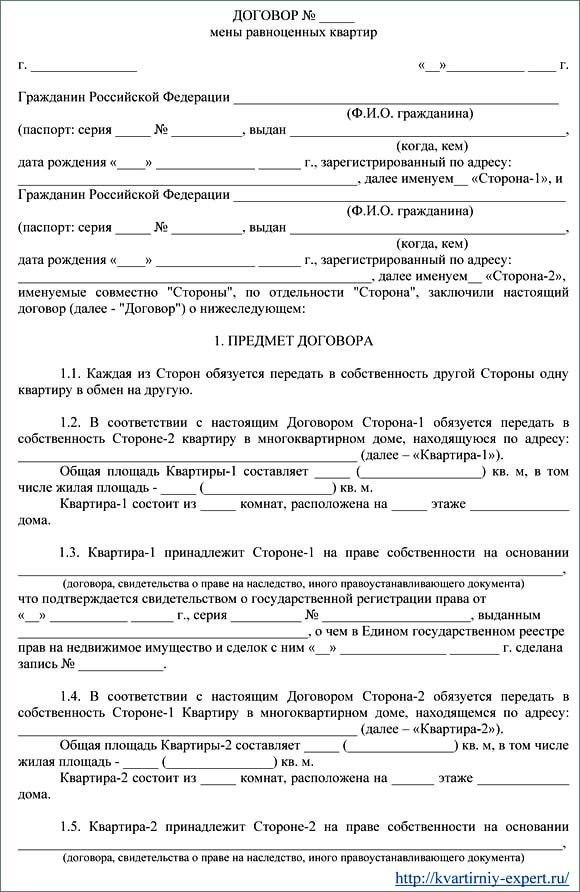

There are a large number of samples (standard forms) of exchange agreements for various real estate objects on the Internet. The most common and concluded when making a transaction is an agreement for the exchange of equivalent apartments, an example of which is given below.

Preliminary agreement for the exchange of an apartment

Parties wishing to exchange apartments may enter into a preliminary exchange agreement .

In practice, this situation arises if the property is under an encumbrance (pledge, mortgage) or if the parties agreed to transfer the real estate in a certain technical condition, having previously carried out repairs.

Also, a preliminary exchange agreement can also be concluded if the parties need to collect additional documents, for example, an extract from an apartment card or house register about the persons registered in the apartment.

Example

Between Kirillov V.S. and Kudryashov A.V. a preliminary agreement for the exchange of an apartment was concluded, which established the intention of the parties to enter into an agreement to exchange their homes in six months. The specified period is determined by Kirillov’s payment of the mortgage on the apartment planned for transfer.

After six months had passed and Kirillov had paid the mortgage in full, the parties entered into the main agreement and made an exchange.

When drawing up a preliminary exchange agreement, its parties must be indicated, the date and signatures must be indicated.

The subject of exchange and other conditions that indicate the need to draw up a full-fledged exchange agreement in the future (possibly indicating the expected date) must be indicated.

The procedure for concluding an exchange agreement

Having selected suitable options for the exchange, the parties can begin to determine and agree on the essential terms of the transaction. After which an exchange agreement is drawn up indicating the agreed conditions. The contract is considered concluded after reaching an agreement and signing it.

- When drawing up the transfer and acceptance certificate, the condition of the exchanged residential premises, existing defects and a list of property acquired as a result of the exchange of the apartment (furniture, plumbing, interior items) are described.

- Next, the parties prepare a number of documents required when registering the transfer of ownership, and submit them to the registration authority (directly to Rosreestr or through the MFC).

- After submitting documents to the territorial body of Rosreestr, the said body checks the documents and, in case of a positive decision, issues an extract that certifies the fact of transfer of ownership of the apartment.

- Special cases of exchange of residential premises include the following situations:

- one of the exchanged apartments belongs to a minor;

- apartments are of unequal value, exchanged with an additional payment;

- the apartment being exchanged has several owners (common property).

If the apartment belongs to a minor citizen, then a transaction in relation to it can be carried out only with its notarization (Clause 2 of Article 54 of the Federal Law of July 13.

2015 No. 218-FZ “On state registration of real estate”).

If apartments of unequal value are exchanged, then the exchange agreement must specify the value of the transferred objects , as well as the procedure for paying additional payment by the party whose apartment costs less.

If the apartment is in common ownership , then for any transactions on the alienation of property, including under an exchange agreement, a notarized consent of the owners of shares in the apartment is required (Clause 1, Article 42 of Federal Law No. 218-FZ).

Apartment share exchange agreement

Often, an apartment belongs to several owners at once, who are entitled only to a share in the common property, which is also a property right, which means that this share can be disposed of , for example, by making an exchange. However, this raises some nuances that should be taken into account.

When exchanging a share in an apartment, it is necessary to obtain permission from other owners , since the law provides a pre-emptive right of purchase (exchange) in the event of the sale of a share by one of the owners. Otherwise, the procedure for exchanging a share of an apartment does not differ from the procedure for exchanging a home as a whole.

The act of acceptance and transfer of an apartment under an exchange agreement

After signing the exchange agreement, the actual transfer of property follows. In order to record this fact and avoid any future disputes on this issue, it is necessary to draw up an act of acceptance and transfer of the apartment.

The transfer deed contains the following information:

- sides;

- basis (barter agreement);

- date of;

- property and equipment that is transferred along with the apartment;

- You can also provide a provision on the condition (existing repairs) of the apartment.

The document is signed by both parties.

The transfer and acceptance certificate in the case of the exchange of apartments is drawn up twice: first, the fact of transfer of one apartment is recorded, then another.

As with any other transaction involving the transfer of real estate from one person to another, the exchange agreement should be submitted to the territorial body of Rosreestr to register the transfer of ownership of the apartment. In this case, the basis for such registration is the agreement itself.

In order to register the transfer of rights, it is necessary to collect the following package of documents :

- application for registration of transfer of ownership of new and old real estate;

- certificate of ownership of the apartment (extract from the Unified State Register of Real Estate);

- barter agreement;

- receipt of payment of state duty in the amount of 2,000 rubles.

In particular cases of exchange of residential premises, this list may be supplemented with other documents related to the peculiarities of certain legal relations (consent of other owners, information about notarization of the transaction, etc.).

The territorial body of Rosreestr reviews the package of documents within the period established by law, carries out an inspection and makes an appropriate decision.

If such a decision is positive, then the applicant is provided with an extract , which indicates the transfer of ownership of the apartment from the previous owner to the new one.

After receiving an extract from the Unified State Register of Real Estate, the apartment is considered to have become the property of the new owner.

Judicial practice on barter agreement

Basically, judicial practice on barter agreements is associated with two types of violations when concluding the specified transaction:

- The court cancels transactions if its essence is not precisely the exchange of an apartment, that is, if another transaction is implied (for example, a purchase and sale). In this case, it is necessary to carefully draw up the contract and not make a similar factual mistake.

- Contracts that do not contain all essential terms . It is also prohibited to violate the obligation to notarize the agreement if the owner is a minor or if the apartment is in shared ownership.

Conclusion

An apartment exchange agreement is one of the ways to purchase an apartment and improve living conditions. The exchange of an apartment may be of equal value and require additional payment, since the cost of the exchanged objects may be different. The provision for additional payment must be reflected in the text of the exchange agreement.

To avoid possible controversial situations (including legal proceedings), it is necessary to draw up the contract as competently as possible, including all essential and other conditions relevant to the transaction. After concluding an agreement, when transferring property, it is necessary to draw up an act of acceptance and transfer of the apartment and register the transfer of ownership of both real estate objects.

Exchange agreement with additional payment

I plan to exchange my apartment for another, but the cost of my apartment is slightly less than the exchanged one. Is it possible to establish a condition in the exchange agreement regarding additional payment on my part?

Answer

Such a condition can be established in the exchange agreement, but with clarification of the procedure for transferring funds and its duration. It is advisable to record the transfer of funds with a receipt in order to avoid various controversial situations.

Related exchange of privatized apartments: required documents

The exchange of an apartment is one of the most complex real estate transactions, since it includes elements of the labor-intensive procedure for buying and selling housing.

Today, the issue of exchanging privatized housing is very relevant, this is due to the presence of a number of advantages of this segment in the real estate market.

Is it possible to exchange?

The problem of exchanging a privatized apartment is faced by many owners who are interested in purchasing another real estate option in exchange for the existing one.

Modern legislation provides several options for resolving this issue:

- sell the apartment and buy new housing with the proceeds;

- exchange a privatized apartment for a privatized one (to do this, the owners simply need to formalize the transaction at the registration chamber).

If such an exchange is made, burdensome expenses and additional costs can be eliminated.

Obtaining municipal housing in order to leave a privatized apartment is not provided for by law. Such a transaction will be considered illegal.

Homeowner's rights

The owner of privatized housing has the right to put the property (apartment) up for sale. When a buyer is found, you can begin searching for the right housing option.

The owner has the right to exchange his apartment for a property with similar characteristics.

The basis for these options is the completion of a transaction, the result of which is considered to be the existence of the right to transfer ownership of the property. Legally, the registration of these transactions is almost similar.

Controversy

When the issue of exchange is the subject of numerous disputes, the conflict can be resolved in the following ways:

- resort to the sale of the share of a specific family member through the acquisition of the share of relatives;

- acquisition of a share by an outsider.

How to exchange a privatized apartment for a privatized one?

Today there are several ways of this type of exchange.

Forced exchange

In the case of an exchange of a privatized apartment of a small area, when its owners are several people, the only optimal solution would be to sell it with the subsequent division of the proceeds (depending on the share of the owners).

Civil housing legislation does not provide for forced exchange.

An apartment that has been forcibly privatized cannot be exchanged. This transaction can only be carried out with municipal housing.

A successful exchange of a privatized apartment depends only on the ability to negotiate with relatives.

Related Exchange

Modern legislation does not provide for the term “related exchange” of privatized apartments. Therefore, an exchange agreement concluded between relatives is drawn up taking into account all the rights and obligations provided for in a standard agreement.

According to legal standards, such an exchange is equal to a purchase and sale agreement and the same documents are needed:

- Proving ownership (deed of gift, privatization certificate, purchase and sale agreement, exchange, etc.).

- Certificate of registration of ownership.

- Cadastral number.

- Certificate of appraised value.

- A copy of the personal account.

- Extract from the house register.

- Passports of the parties to the transaction.

- Certificate of registration.

- Certificate of marriage or divorce.

Before exchanging a privatized apartment for a privatized one, it is necessary to obtain the consent of the second spouse. It is issued in the form of a written application.

In the case of an exchange of an apartment privatized by one of the spouses, gifted/inherited, if the marriage contract provides for sole ownership, permission will not be required.

If minors participate in the privatization, their birth certificates and permission from the guardianship authority will be required to conclude the transaction.

Do you need a sample agreement on the privatization of non-residential premises? See here.

To a non-privatized

In this case we are talking about a mixed type agreement. It combines elements of barter and exchange, which are prescribed in the relevant sections of the document.

This exchange option is considered the most difficult, since the participants in the transaction are real estate objects of different legal statuses:

- one belongs to a state or departmental foundation;

- the other is the property of an individual/legal entity.

In addition to the difficulties in formalizing this type of exchange, its disadvantage is the condition under which a new tenant of non-privatized housing will not be able to privatize it if he has already exercised the right of free privatization.

But if other family members living in the apartment have not yet exercised this right, then the possibility of privatization remains.

Give it to the state in exchange for smaller living space

- According to the provisions of the privatization law, citizens can transfer privatized apartments into the ownership of a state/municipal fund in exchange for smaller living space.

- In this case, government agencies enter into a social rental agreement with such owners.

- The need to return privatized apartments to the state in exchange for a smaller area has become urgent for many residents who are unable to financially maintain this property, especially in the context of rising property taxes.

- Participants in projects to improve living conditions also give privatized apartments to the state (this applies to owners of apartments in dilapidated and old buildings, Khrushchev-era buildings).

To privatized land

You can also exchange a privatized apartment for privatized land; the transaction is formalized in the form of a purchase and sale agreement. To avoid obtaining permission from the guardianship authorities, it is better to temporarily discharge minors to another place.

Collection of taxes is possible in this situation (if as a result of the transaction one of the parties makes a profit due to unequal exchange) on this profit.

Before concluding such a transaction, you should carefully check all real estate documents and their legality; for this, both parties can:

- contact Rosreestr at the location of the property;

- resort to the services of a lawyer or realtor.

Apartment prices

In the case of an exchange of apartments, their owners already recognize that they can be considered of equal value. But often exchanged apartments have different market prices.

To determine this value, a professional appraiser is invited. This will allow you to find out the difference in housing costs and determine the possible additional payment.

In most cases, apartment owners participating in the exchange prefer to independently negotiate an additional payment “by agreement of the parties.”

Interests of minors

When minor children are registered in the apartment planned for exchange, it is important to ensure that their rights are respected.

This transaction must be monitored by the guardianship authorities. They check:

- whether the child’s share is preserved;

- if necessary, agree on its increase.

In case of such an exchange, the guardianship authorities must submit the following documents:

- Documents confirming ownership, indicating all copyright holders.

- Documents certifying the degree of relationship of residents.

- Copies of bills for the apartment.

- Excerpt from the house book.

- Technical passport.

- Cadastral number.

- Certificate about the cost of the apartment.

Procedure

The procedure for exchanging a privatized apartment for a privatized one implies the implementation of mirror actions of both parties.

The presence of some nuances and details is allowed, but the actions do not change.

Step-by-step instruction

The modern procedure for exchanging real estate today comes down to selling an apartment with the simultaneous acquisition of an alternative option. Citizens have the opportunity to choose an apartment within the budget (the cost of their housing and cash savings).

The sequence of actions to carry out the exchange is as simple as possible and consists of the following stages:

- assessing the value of your apartment;

- estimating the cost of an alternative option;

- searching for a buyer;

- signing an exchange/purchase agreement;

- implementation of the transaction.

Required documents

The following documents must be submitted to the registration authority at your place of residence:

- Owner's statement.

- Documents (title) for the apartment.

- Excerpt from the house book.

- A certificate from the tax office confirming the absence of debt.

- Certificate of regular rent.

- Technical passport.

- Floor plan and explication.

Before submitting documents, you must pay a transaction registration fee. The original payment receipt is attached to the package of documents.

On its basis, an exchange agreement is registered, signed by the parties and certified by a notary.

Barter agreement

To transfer one privatized apartment in exchange for another, the exchange parties sign an exchange agreement. One of the parties to this transaction becomes the buyer (takes ownership of the property), the other becomes the seller (transfers ownership of this apartment).

The exchange agreement is considered a document of civil law type and is a compensated agreement (distinguished by the presence of consideration).

According to the document, the apartment that is transferred under this agreement is provided only as an exchange for another. At the same time, it is envisaged that a complete list of citizens acquiring the right to use this apartment will be preserved.

An agreement to exchange a privatized apartment for a privatized one must be registered.

According to current legislation, state registration:

- carried out in several stages;

- must be completed within 30 days from the date of submission of the application and package of documents.6

Where to start privatizing a cooperative apartment in 2018? Read here.

How much does a power of attorney cost to privatize an apartment? Detailed answer in this article.

Exchange tax

Transactions related to the exchange of housing that has been owned for more than 3 years (regardless of how it was acquired) are not subject to tax, according to the Tax Code of the Russian Federation. Otherwise, the tax on income from barter will be 13% of the cost of the apartment.

Alternative deal

In the exchange agreement, the value of the property is stated as the same (for convenience and tax exemption for the party receiving the additional payment).

Additional payment can be made after the conclusion of the transaction (in the presence of a lawyer). This operation is called an alternative transaction or hidden exchange.

This exchange option is considered optimal for everyone:

- time to select options is reduced;

- favorable conditions are created for multi-stage transactions before exchanging a privatized apartment for a privatized one.

After analyzing the documentation, the registration authority may see a significant difference in the market value of the exchanged apartments and, on this basis, invalidate the exchange agreement.

Video about exchanging an apartment

Related apartment exchange documents

Related exchange of privatized apartments

Intrafamily real estate exchange is one of the types of real estate transactions common during the Soviet period. Currently, the legislation does not provide for any advantages when carrying out a related exchange of apartments - the same requirements are imposed as for ordinary transactions.

each owner must have a full package of title documents (privatization agreements, certificates of donation, inheritance); availability of a technical passport for each property; personal accounts from the housing department about the movement of registration and discharge of residents; certificates from utility services about the absence of debt; notarization of the consent of the spouses to the exchange; an exchange agreement registered with the justice authorities.

How to properly collect documents for related exchange of apartments

There are many methods to make your own living conditions better. Related to apartments, the documents for which must be drawn up quite carefully, is the most common method, which is used by the maximum number of owners of one form or another of housing.

Today, when everything can be sold and bought, this type of exchange turns out to be a little forgotten, and not all relatives are in a hurry to take advantage of this method of increasing the living space of a house or apartment.

Related exchange of apartments - preparation of necessary documents

Moreover, the Plenum of the Supreme Court of the Russian Federation in its resolution dated 02.07.

2009 No. 14 directly stated that “relative exchange of apartments” is not provided for by the Housing Code of the Russian Federation in the sense that it is impossible, being a family member of a social housing tenant, to exchange your share in an apartment provided that a third person moves in as a family member.

Thus, a privatized apartment is the property of a person intending to make an exchange, and therefore the exchange of privatized apartments is, in fact, a purchase and sale transaction, the rules for which are specified in the Civil Code of the Russian Federation.

Does Russian legislation provide any benefits to relatives who want to change socially-tenanted living quarters? At the moment, related exchange of apartments requires the same documents to be collected as for a regular separate living space between strangers.

In the latest edition of the Housing Code of the Russian Federation, such a phrase as “kinship exchange” does not appear at all.

The question of whether there are any privileges for relatives who wish to exchange living space is popular. But currently, related housing requires the same documents and certificates as when exchanging between strangers.

- Lawyers state the fact that they are often approached with questions about apartments.

- In order to collect all the necessary documents for housing between relatives, you need to take into account a number of factors.

- Russian legislation does not define such a concept as “kinship exchange”.

PRO new building 7 (499) 703-51-68 (Moscow)

At its core, a related apartment exchange is a transaction for the sale or purchase of housing. First, one of the parties offers their apartment. After receiving the funds, she is looking for options to purchase for her own residence.

In this case, apartments are changed on the same basis as ordinary people - to improve living conditions. Or, if you wish, change your place of residence to another that more fully meets the requirements.

Exchange of apartments between relatives

There are many ways to improve your living conditions. The method that is most popular is the purchase and sale transaction. But we should not forget that not so long ago, before the mass privatization of real estate, almost the only way to get the desired living space was to exchange apartments.

Now, in a time when everything is bought and sold, this exchange option is no longer so popular, but still sometimes relatives who want to exchange their meters and formalize such an action still strive to resort to it.

Related exchange of apartments - documents

Article 72 of the Housing Code of the Russian Federation defines the right of an apartment tenant to... Based on Part 5 of Art. 72 of the Housing Code of the Russian Federation, participants in apartment exchange can exchange apartments between two or three more tenants who live in the same or in different cities and towns.

The apartment agreement consists of 3 copies (two for the exchanging parties and one for the owner of the housing, the municipality for its registration).

What documents are needed for related exchange of apartments?

Ask a question to a lawyer and get an answer in 1 minute!

An approximate list of title documents submitted for registration of transactions and (or) rights arising on their basis (purchase and sale, exchange, rent, donation, assignment of claims, termination, etc.)

Hello! An exchange agreement is a transaction, but free of charge. To conclude it, a package of documents is required as in a regular paid transaction: title documents, confirmation of state registration of ownership of property and technical passports and the exchange agreement itself, the only condition being that the value of the exchanged property be equal.

It does not matter whether the parties to the transaction are relatives. The agreement can be concluded either in simple written or notarial form. An exchange agreement, which, like other agreements for the transfer of ownership, is subject to mandatory state registration with the relevant body (registration chamber).

Here is a sample example: APARTMENT EXCHANGE AGREEMENT

Related exchange of apartment shares

Real estate transactions may concern not the entire property, but part of it. If a certificate of ownership has been issued for a share of the living space, then there is a legal opportunity to sell, bequeath, or donate the property.

Unlike the entire apartment, part of the area is decorated with some features. The exchange of shares of an apartment between relatives is carried out according to established regulations.

Knowing the existing rules will help you carry out the transaction without complications.

Basic Rules

Is it permissible to exchange the existing share of real estate? The law clearly allows this to be done in compliance with the established regulations. The size of shared ownership is not limited; any part can be sold at the request of the owner. There are differences between municipal and privatized transactions that should be taken into account. In general, the scheme is quite transparent and is used in practice, allowing the necessary legal operations to be carried out.

Legal support

There are legislative acts on which this action is based. The main law is Articles 567, 454 of the Civil Code of the Russian Federation in the current edition.

Real estate transactions are an important part of the life of civil society, so they are given a particularly careful description.

Each specific situation requires compliance with the rules, since deviations lead to legal disputes and conflicts between interested parties.

Alienation of shared ownership can be carried out through exchange and sale; each transaction has its own characteristics. According to Art. 567, barter is considered to be the actual act of exchanging goods that have different owners. The exchange procedure is similar to the sale and purchase, but the financial component as the main action is not present in the act.

The sale of a share is carried out according to the rules of Article 454, according to which the seller transfers the goods, and the buyer pays the amount established by the contract.

In addition to this article, additional legal provisions may be applied. For example, in complex cases when it comes to the sale of securities and the sale of special types of goods.

In the case of the purchase and sale of real estate, the rules apply to any share or the entire property.

The provisions have legal comments and explanations, and there is judicial practice on this issue. For example, any type of real estate, land for an apartment, house for a room, or other similar action can be exchanged.

Coordination with other owners

In practice, this is the most important issue of concern to the participants in the action. Is permission required from the owners of the remaining parts of the living space? The remaining owners have a pre-emptive right to purchase the share of the apartment being sold. The offer is made in writing, indicating the main provisions of the transaction, including the price. If citizens do not want to purchase property, they must refuse in writing. After which the object is put up for sale in the public domain.

If there are also no people willing to make an exchange, then the offer is drawn up in a similar way and can be put up for exchange with outsiders. Having in hand the waiver from the remaining owners, the owner of part of the apartment can exchange it for another area in another apartment.

The rules for exchanging shares of an apartment between relatives do not differ from the general provisions. Regardless of existing family ties, the transaction must be properly registered.

Exchange methods

The law establishes two regulated methods for exchanging part of real estate. A simple exchange procedure involves drawing up an agreement with prescribed conditions. When paying extra for the difference in footage, the data must be included in the document. Then the contract is submitted for registration to Rosreestr and the meters change their owners simultaneously, through a one-time action.

Currently, a transaction in the status of barter is used quite rarely; citizens prefer to sell their property. Exchange remains relevant in municipal housing when there is no certificate of ownership. Permission from the legal owner will be required for any action with the apartment in which interested parties are registered.

The actual exchange can be carried out using a standard sale, which allows you to be more confident in the legal purity of the transaction and reduce possible risks.

You will need to conclude two purchase and sale agreements and submit registration papers at the same time. Special conditions may be prescribed, for example, only a single execution of two contracts.

The obvious disadvantage of this action is the double material costs of registration.

If there are complex relationships between the parties, then the function of a mediator will help eliminate the human factor. A realtor can buy a share in someone else’s name, sell the second one and re-issue the documents in the required direction. This complex option is quite often in demand if the relationship between share owners has reached a dead end, but the issue needs to be resolved.

Preparatory actions

Before registration begins, the owner will need to perform some manipulations. It is necessary to print out an official appeal to the remaining shareholders. The document must establish the price of the object and regulate the terms of the transaction. Those wishing to do so must officially confirm their consent or refusal; the application indicates the deadline for the response.

According to the rules, citizens are given a month to resolve their financial issues. Missing a deadline is a proven reason for attracting outsiders. Thus, other owners can delay the sale of the share only for one month. An official waiver will be required to be provided to the buyer to ensure the proper conclusion of the contract.

If this stage is excluded, the transaction may be declared invalid at the request of interested parties. It should be noted that the price for the share offered to residents must coincide with the selling price.

This is also a frequent reason for challenging a transaction in court, so it is not recommended to manipulate the value. In addition to the owners, it is a good idea to assure your intentions with registered citizens by informing about the upcoming transaction.

If there are people willing to purchase real estate, they have the primary right to purchase a share.

If it is impossible to agree on the issue with the other owners, then it is necessary to resolve the issue in court. For example, the place of residence of the owners is unknown, there is an unreasonable refusal to sign a notice and other provocative actions of citizens.

How to correctly draw up a contract?

The exchange or sale agreement can be signed between the parties independently or notarized. The latter option will allow a specialist to check the document, make recommendations and refuse certification if it contains dubious aspects.

The service is paid, but significantly reduces the risks of subsequent cancellation of the contract. It is recommended to contact a notary if the transaction has aspects different from the standard situation, for example, the participation of several real estate objects. The contract itself will need to be registered in the state register; only after changes have been made, the operation is considered completed.

Required documents

To exchange shares of an apartment between relatives, you will need the necessary package of documents. In each specific case, the package may have its own characteristics, but the basic kit consists of the following information:

- document on the right of ownership of the object;

- issuance of a technical passport of the BTI;

- notification of refusal to the remaining owners in the apartment;

- USRN extract confirming ownership;

- certificate of family composition;

- receipts for government fees.

It should be noted that when donating a share of property, it is not necessary to obtain permission from the remaining owners. A deed of gift is the most democratic way to transfer your share to a relative, and also does not require payment of tax.

When a notarized contract is drawn up, a specialist will check the required package of accompanying documents and give an opinion on the legality of the operation. After contacting Rosreestr, the documents and the contract are subject to verification; after a maximum of 14 days, participants can receive documents confirming the completion of the transaction.

Subsequently, you will have to pay an income tax of 13% for outsiders, 30% for non-residents. Related transactions of exchange and gift are not taxed; you will need to attach a certificate of close relationship from the registry office.

Refusal of registration

Employees of Rosreestr or MFC check the submitted documents and determine the eligibility of the owner. Emerging issues are resolved in a working manner: the participant is notified, and the package is returned for revision or it is required to supplement it with missing certificates. In a situation with shares, you will definitely need to provide a notice signed by your neighbors.

Participants' passports may be expired and will need to be renewed. The technical passport may not correspond to the data specified in the text of the contract. If, in the opinion of the applicant, the refusal of the government agency is unfounded, then it will be necessary to file a claim in court.

Features and nuances

When the question arises about exchanging parts in several apartments, you will have to coordinate the issue with all existing owners at two addresses.

The important aspect is that the shares must be proportionate offers. The condition is checked during the exchange transaction in order to avoid fraudulent schemes.

If such violations are discovered, the transaction is declared invalid and canceled in court.

Often there are transactions to exchange a share for a full-fledged apartment. It is necessary to include in the text of the contract a clause on additional payment for the difference in meters. Then the procedure will become legal and cannot be challenged. The owner of the apartment independently decides on the amount of the surcharge. What matters is the actual condition of the object, the size of the proposed share, and the location of both areas.

Transactions on real estate owned by minors and incompetent citizens can only be carried out with the permission of the guardianship and trusteeship authorities.

Exchanging shares of an apartment between such relatives is always difficult. It will be necessary to provide evidence that the deal will be beneficial and will not infringe on the rights of citizens.

Supervisory authorities always strictly check the upcoming operation, since they are responsible by law for competent support.

Share transactions are always more difficult to carry out than with a single owner. Sometimes it is necessary to preliminarily allocate a share if the documents are drawn up for joint ownership or the certificate of ownership is issued to one family member. This procedure takes time; in a conflict situation, it is impossible to do without a trial.

In the case of property acquired during marriage, a notarized permission of the second spouse is also required for real estate transactions. During a divorce, the question of dividing a share of real estate may arise; two new owners appear. The issue is resolved in court and the resolution on the conditions is the main document for Rosreestr.

In order not to worry about the competence of the actions performed, it is recommended to contact intermediaries who have practical experience in this area of the exchange and sale of shared property. This step will allow you to complete the transaction much faster and anticipate difficult moments. Realtor services are paid, but the efficiency is much higher.

Despite the related transaction, it is necessary to correctly draw up the contract and fulfill all procedural requirements. If legal issues arise, you should consult with an experienced lawyer before entering the legal field.