Registration of ownership of an apartment by inheritance is necessary to formally secure ownership of residential premises. This article will tell you how such registration occurs.

Registration of rights to an inherited apartment and share in the apartment

Do I need to pay tax when receiving an inheritance under a will in 2015-2016?

Registration of rights to an inherited apartment and share in the apartment

If the successor inherited an apartment or a share in the right to it, then the matter is not limited to obtaining a notarial certificate. In this case, it is mandatory to register the right to an apartment (or share) in a special state register.

To do this, after receiving the notarial certificate, you should contact the Rosreestr service department. In addition to the certificate of inheritance itself, you will need the following documents:

Don't know your rights?

Subscribe to the People's Adviser newsletter. Free, minute to read, once a week.

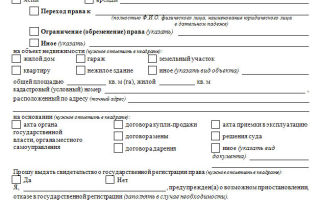

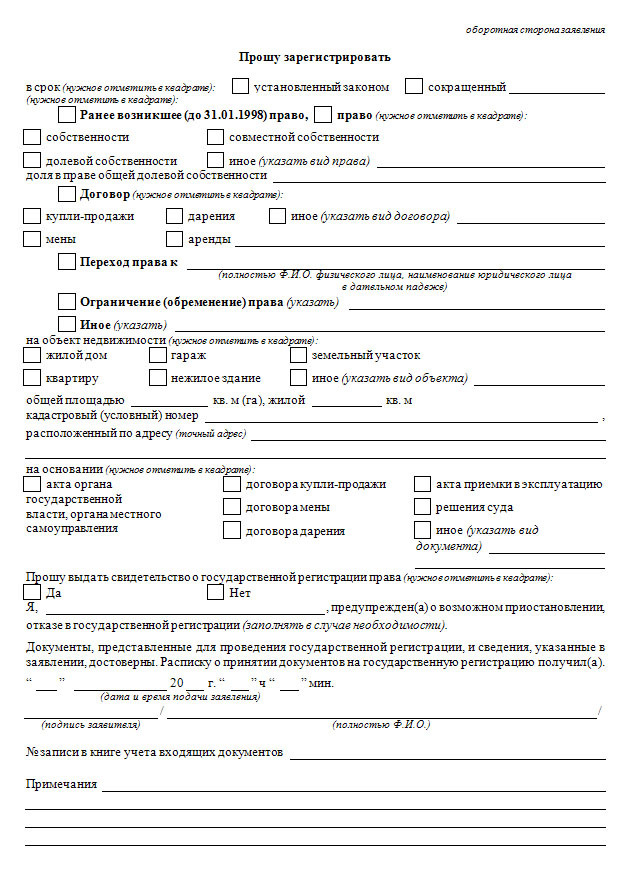

- application for registration (filled out directly when submitting documents);

- heir's passport;

- cadastral passport of the apartment;

- document confirming payment of the registration fee.

Within 10 working days, the person’s right to the inherited apartment will be registered. After this, he is issued a certificate of registration of rights. If one apartment goes to several heirs at once, then each of them receives a separate certificate of ownership share.

Do I need to pay tax when receiving an inheritance under a will in 2015–2016?

Today, when receiving an inheritance either by law or by will, you do not have to pay any tax. This applies to both inheritance of movable property and inheritance of an apartment or other real estate.

At the same time, registration of inheritance rights inevitably entails certain costs. Thus, for the issuance of a certificate at the notary chamber, the heir will have to pay a fee in the amount of 0.6% of the value of the received part of the inheritance. It should be noted that the amount of this contribution is halved for heirs of the first stage, as well as for full sisters and brothers of the testator.

In addition, when registering rights to inherited real estate with Rosreestr, the heir will have to pay a fee in the amount of 2,000 rubles.

Register ownership of inheritance

If the contract is in a simple form and the seller cannot come with me and give it to me for registration, can I take a general power of attorney from the seller and hand it over? DCT is not ready Yuri: What details do you need to pay for the registration fee for legal property rights? They gave me a password at the MFC, but I can’t log into the state department, where can I insert this password?

Dear readers! Our articles talk about typical ways to resolve legal issues, but each case is unique.

If you want to find out how to solve your particular problem, please use the online consultant form on the right or call the numbers provided on the website. It's fast and free!

Content:

- Registration of ownership of an apartment by inheritance

- Inheriting an apartment

- Arranging an inheritance is not at all easy

- Notaries will register housing documents in Rosreestr for free

- Registration and registration of inheritance rights in the MFC

- The testator did not register ownership of the house. Do heirs lay claim to it?

- Registration of ownership of inheritance

- Registration and registration of property rights in the MFC

You can send documentation by personally contacting the territorial offices of the MFC or Rosreestr, using electronic resources, postal services, or using the services of a courier.

Registration of ownership of an apartment by inheritance

Resolving the issue in court According to Art. The key to this rule is the fact that the testator owns the property included in the inheritance mass. In this article we will look at the nuances associated with real estate.

Possession and use during life of an apartment, house, land, etc. At the same time, by virtue of Art.

Thus, the lack of information in the Unified State Register of Real Estate about the ownership of real estate by the testator may call into question its inclusion in the inheritance mass.

The most well-known in this area are situations related to the transfer of rights to an apartment that belonged to the testator under the terms of social rent, or to an unregistered land plot.

But within the framework of this article I would like to talk about another case. In practice, the question often arises about the fate of real estate received by an heir, who himself subsequently died without having time to register the rights to it. Lack of registration of ownership of property received by inheritance Let us simulate an example for clarity.

Family of four: They live in an apartment owned by their father. He is dying. There is no will. The wife and children write applications to the notary to accept the inheritance. Three months later the mother dies. Yes, definitely. The fact is that, according to Part.

Unfortunately, some notaries refuse to include such property in the estate, citing the lack of state registration.

This approach is wrong. In accordance with clause of the FNP Board Options for action Accordingly, if you are faced with such a refusal by a notary, show him a link to this paragraph of the Methodological Recommendations.

If the notary continues to insist on his position, you have three options. File a complaint with the notary chamber of the entity in whose territory the notary operates. Appeal the notary's refusal in court. Include property in the estate and recognize ownership of it through the court.

The first option is simpler and more profitable in terms of timing. The second one is inferior to the first one in terms of timing, and the third one in terms of results, so I don’t recommend using it. The third may turn out to be more attractive than the first in terms of financial costs. There can be a lot of layouts here; you need to calculate it separately for each case.

Below I will try to formulate a few main points. Registration costs For the issuance of a certificate of inheritance rights, a state fee and a fee for the provision of legal and technical services to a notary are paid. The first size is set to pp. Fees for the provision of legal and technical services may vary depending on the entity.

And in practice, sometimes depending on the particular notary. In Moscow, this amount is 5. Now let's count. Suppose we are talking about inheriting an apartment worth Therefore, for the heirs of the first stage of the state.

Thus, in this case, it is more profitable for the heirs of the first priority to act through a notary, and for the rest - through the court. If there are several real estate objects that need to be included in the estate, then the likelihood that it is more profitable to go to court increases with each such object.

For example, if there are three real estate objects with a total value. If there are 4 or more objects, then, again, it is more profitable to go to court. A similar conclusion occurs when shares in multiple objects are inherited. When calculating, do not forget to pay attention to paragraph.

It must be remembered that this rule does not apply to fees for the provision of legal and technical services. Appealing a refusal through a notary chamber First of all, the refusal must be received in writing.

An unfounded statement that the notary refused will not be enough. This rule applies to all options. Based on the refusal received, it is necessary to prepare a complaint to the notary chamber to which the notary with whom the dispute arose is attached, outlining the factual circumstances of the case and justifying one’s position.

The complaint is reviewed within 30 days. And in this case, all disagreements must be eliminated - the notary will stop ignoring the provisions of the Methodological Recommendations.

And after the expiration of the period established by law, you will be able to receive a certificate of inheritance. Resolving the issue in court According to paragraph. In other words, if you go to court before the expiration of 6 months from the date of opening of the inheritance, then only the requirement to include the property in the inheritance can be satisfied.

I do not recommend going down this path, just as I do not recommend challenging the notary’s refusal in court. The fact is that time and money will be spent on the trial, but everything will return to the stage of interaction with the notary.

It is more rational to wait for the expiration of the 6-month period and make two demands at once: Then, in the end, you will receive a court decision, with which you can go directly to Rosreestr to register the right.

More precisely, a claim with similar demands can be filed earlier, but then the court will simply suspend the proceedings, and consideration will take place only after the deadline for accepting the inheritance has expired.

The decision made by the court comes into force one month from the date of its adoption in final form. When receiving a copy of the judicial act, make sure that it bears the official seal of the court.

There is no need to return to the notary with this decision. You can immediately apply for registration of property rights to Rosreestr. In Moscow this is done through the MFC. The state registration fee will be rubles for each property. In conclusion, I want to say that it is better to never put off resolving issues of legal registration of your rights until later.

In particular, so that our heirs do not then spend a lot of time and effort proving their rights. The article was prepared taking into account the edition of regulatory legal acts in force on As an example, below is a court decision in a case in which it was required to include many objects, including real estate, in the inheritance estate and recognize the ownership of them.

The problem was precisely that the husband did not have time to register ownership of the share inherited after the death of his wife, and soon died himself. The notary refused to issue certificates of inheritance rights to children. The dispute had to be resolved in court. Extracts are attached, all identifying information is hidden.

The cost of services to support cases on the inclusion of property in the inheritance estate at the Maya Sablina Law Laboratory:

Inheriting an apartment

Certificate of the right to inheritance as a basis for state registration of rights Certificate of right to inheritance as a basis for state registration of rights These legal relations constitute the subject of inheritance law as a sub-branch of civil law.

According to the article of the Civil Code of the Russian Federation, an inheritance is things and other property that belonged to the testator on the day the inheritance was opened, including property rights and obligations.

The parties to the inheritance are the testator - the person who transfers the property, the heir or heirs - those to whom this property is transferred free of charge. A certificate of inheritance is an official document confirming a person’s inheritance rights to the property of a deceased citizen.

Relations related to the issuance and receipt of a certificate of the right to inheritance are regulated not only by the norms of the Civil Code of the Russian Federation, but also by the Fundamentals of Legislation on Notaries.

Receiving a certificate of the right to inheritance is a confirmation of the right that the heir already has, which belongs to him from the date of opening of the inheritance, regardless of the time of its actual acceptance, as well as regardless of the moment of state registration of the heir’s right to inherited property, when such a right is subject to state registration.

Arranging an inheritance is not at all easy

In the course of their resolution, the Supreme Court of the Russian Federation paid attention to the provisions relating to the fulfillment of obligations in full in favor of the heirs of the deceased creditor, the allocation of a marital share when a marriage is declared invalid and the registration of ownership of real estate in the absence of title documents.

Next, we will dwell in more detail on each determination of the Judicial Collegium of the RF Armed Forces in these civil cases.

Obligations under the loan agreement are fulfilled in favor of the heirs of the creditor. The Supreme Court of the Russian Federation agreed with the position of the court of first instance and overturned the ruling of the appellate court, indicating that if the debtor organization fails to fulfill its obligations to pay funds in the event of the death of the creditor, it is obliged to pay the debt to his heirs Art.

How to enter into an inheritance if the testator's property rights are not registered March 16 Sooner or later, the vast majority of citizens face the issue of registering an inheritance. Despite the fact that the main issues of inheritance are regulated in sufficient detail, various complex situations still arise from time to time.

One such example is the case when the testator did not formalize or register during his lifetime his ownership of real estate in the register of property rights.

Previously, under such circumstances, notaries refused to issue a certificate of inheritance and the heirs had to recognize their rights in court.

Do heirs lay claim to it?

So, you can use your resources as efficiently as possible: Leave a request on the website right now, and we will promptly call you back within just 15 minutes!

Notaries will register housing documents in Rosreestr for free

After her death, the person registers the share due to her in the apartment as an inheritance.

The State Registration Service refuses to register the mother's share, citing a lack of information in the Register of Property Rights to Real Estate. The notary speaks about the need to go to court.

Is it possible to register the right to a share in an apartment without court? If a trial cannot be avoided, then how to formulate the claims and who should be named as the defendant?

Good afternoon, Matvey Sanych! Starting from September 27 of the year, the period for state registration of rights to housing facilities, garages, parking spaces, and the issuance of a repeat certificate should not exceed 12 calendar days from the date of submission of the application and the full package of documents required for state registration of rights and the issuance of a repeat certificate.

The issuance of information on registered rights to real estate objects in the housing stock, garages, parking spaces, land plots contained in the Unified State Register of Rights shall be carried out by territorial departments no later than the day of application; the issuance of information contained in the Unified State Register of Rights by the department for issuing information on registered rights shall be carried out in accordance with the provisions of Art.

According to paragraph. The heir who accepted the inheritance, regardless of the time and method of its acceptance, is considered the owner of the inherited property, the bearer of property rights and obligations from the date of opening of the inheritance, regardless of the fact of state registration of rights to the inherited property and its moment, if such registration is provided for by law.

In accordance with paragraph.

The above article precisely enshrines one of such exceptions to the general rule, when the right of ownership of property arises not at the time of state registration of this right, but at another moment - the moment of opening of the inheritance, and it is from the moment of opening of the inheritance that the heir who accepted the inherited property, becomes its owner.

The testator did not register ownership of the house. Do heirs lay claim to it?

They have the opportunity to reclaim such property from illegal possession.

Thus, the Supreme Court noted that the owner has the right to reclaim residential premises from someone else’s illegal possession, including from a bona fide purchaser, if two conditions are simultaneously met.

This is enshrined in the review of judicial practice approved by the Presidium of the Supreme Court. Let's consider how a municipality can protect escheated property.

Hello. If you have received an apartment as an inheritance, a certificate of right to register the transfer of rights to the apartment will be necessary. 5. 0 Registration of property rights is a right, not an obligation.

Vladislav Kulikov The State Duma adopted in the second main reading a bill clarifying the powers of notaries. One of the fundamental innovations: The service will be absolutely free for citizens.

According to Pavel Krasheninnikov, Chairman of the State Duma Committee on State Building and Legislation, the bill is designed to solve several socially significant problems at once, increase the stability of civil circulation, the level of security of citizens, and also provide them with additional comfort when performing notarial acts.

Registration and registration of property rights in the MFC

How to register a land plot as property by inheritance? Acceptance of a land plot as an inheritance A statement of claim for recognition of ownership of a land plot by inheritance is submitted to a notary's office. This application must be prepared in accordance with strict legal rules. If the application is drawn up incorrectly, the cadastral court may refuse to accept the claim.

Entering into inheritance for an apartment on March 21 When it comes to entering into an inheritance, people are confused. How to prepare documents? Where to contact?

Not everyone can afford to purchase real estate. But, on the other hand, inheriting a house can bring with it a lot of trouble.

The procedure for registering an inheritance is quite complicated and requires a lot of time and attention; for the sake of the desired property, the heirs are forced to resolve complex issues that the testator did not have time to resolve during his lifetime. We are talking about typical problems that heirs have to face when registering residential buildings as their property, and ways to solve them.

How to register an apartment by inheritance? – ZHS Magazine

If you inherited an apartment, this does not mean that it automatically became your property. For it to become yours, you must accept the inheritance and register ownership of it. At best, this will take six months, at worst, you will have to argue with other heirs in court.

How to register an apartment by inheritance?

Inheritance occurs by law and by will.

Inheritance by law occurs if the deceased did not leave a will. In this case, relatives inherit the apartment in order of priority:

- children, spouses and parents.

Grandchildren are also in first place, but are not direct heirs, but inherit by right of representation. This means that they only inherit the apartment if their parents die;

- full and half-siblings, grandparents;

- uncles and aunts;

- next come great-grandparents, children of nephews, cousins and their children;

- and only at the very end come the stepsons, stepdaughters, stepfather and stepmother.

Inheritance by law occurs automatically: the notary finds all known heirs in order. Each heir receives an equal share with the same rights.

According to the will, the apartment is inherited by those heirs and in those shares that the deceased indicated in advance in the will.

The testator can bequeath the apartment to anyone: any person, organization or state. He may exclude any relative from the inheritance. But if the testator has relatives who are entitled to an obligatory share, the law cannot deprive them of their property.

A compulsory share in the inheritance is the part of the inheritance that is necessarily received by minors or disabled children, disabled spouses, parents or dependents of the testator. These heirs receive their share regardless of the will. In this case, the share must be no less than what they would receive if inherited by law.

For example, a person bequeathed the entire apartment to his sister and left nothing to his minor children from his first marriage, with whom he does not get along. According to the law, this is not possible - children are entitled to a mandatory part of the inheritance. If the mother of the children wants to challenge the will, their shares in the apartment will be determined by the court.

In exceptional cases, the court may reduce the obligatory share or refuse it altogether: for example, if the heir under the will lived in the bequeathed apartment, but the heir to the obligatory share did not live in it.

Why is inheritance by will more reliable?

Because this is how the testator himself determines to whom he wants to leave the apartment. Without him, people whose existence he didn’t even know could get an apartment: for example, a great aunt.

Let's say a grandmother is close to her grandchildren and does not want the apartment to go to their alcoholic father. Or he wants to leave the apartment to his beloved stepdaughter, and not to his own sister. In all similar cases, the grandmother must make a will.

This is a delicate moment, but if one of your grandparents promised to leave you an apartment, her words alone are not enough. In order for her to be sure that her will will be carried out, she needs to draw up a will in which she clearly indicates the heir.

No matter how you inherit the apartment - through a relationship or by will - the inheritance must be properly formalized. The procedure is the same in both cases.

This means that the heir can live in the inherited apartment, but until the inheritance is formalized, he cannot sell or rent it out.

Prepare documents

Death certificate. It will be issued at the registry office.

Remove the deceased from registration at the place of residence . The simplest case is that the deceased lived in the apartment that he bequeathed. Then you need to provide the death certificate to the passport office or the Federal Migration Service at your place of residence and receive an extract from the deregistration. The document will be issued in 5 working days.

Utility accounts need to be reissued . To do this, contact the management company with your passport and death certificate.

After changing the payer's data, utility companies must recalculate from the date of death. If the deceased is not discharged, utility bills will continue to come to his name and will be charged for him too.

If the deceased had benefits, they immediately disappear - you cannot use them, you may be fined for this.

Certificate of the last place of residence of the deceased. It will be issued at the registry office, MFC or local administration. The certificate must indicate everyone who lived with him. Instead of a certificate, a similar extract from the house register may be suitable.

If there are no documents?

If you are missing some documents, there are no documents that prove your right to property, they are lost and cannot be restored, you will have to go to court. A notary will tell you how to resolve the case in court.

Accept inheritance

To become a rightful heir, the inheritance must be accepted. This is a legal procedure that confirms your rights to inheritance.

To accept an inheritance , go to a notary. He will open an inheritance (start the procedure for registering an inheritance) and open an inheritance case in which you are indicated as an heir.

Provide the notaries with the following documents:

- passport;

- death certificate of the testator;

- a certificate of the last place of residence of the testator and the composition of his family;

- a will or other document that confirms that you are an heir: for example, a birth or marriage certificate;

- a certificate of registration of ownership or other document that confirms the testator's right to property: for example, a purchase and sale agreement or a certificate of registration of ownership.

Sometimes the notary may need additional documents.

You need to fill out an application at the notary.

The document must include information about the notary, information about the deceased uncle (full name, date of death, last address), information about you (full name, address, connection with your uncle), and a description of the bequeathed apartment.

The notary will tell you what to write. At the end, write that you are asking for a certificate of inheritance and list all the attached documents that confirm what was written.

After this, the notary will open the inheritance case. He will check all the documents, make sure that you are legally capable and that your demands for the apartment are legal.

- As a result, you can receive one document if you intend to use the apartment together, or different ones if you want to claim individual shares.

- If there is an unborn child among the heirs , the shares can be divided only after his birth.

- If the heirs argue about shares in the inheritance , the notary suspends the case until the court decides

- After the court's verdict, you will not have a certificate of inheritance rights, but a court order.

To do this, you can live in an apartment or move into it, pay bills, repairs, take care of the safety of the apartment, pay all debts, etc. Such actions indicate that you do not refuse the inheritance and express your will to acquire it.

But you will still have to contact a notary for a certificate. This will make it easier in the future, for example, to register an apartment in your name. Without a notarial certificate, you will have to prove the fact of acceptance of the inheritance through the court. The process can take a long time and will cost much more than a notary's services. You can contact a notary for a certificate at any time - even after 10 years.

How to register an inheritance if the apartment is not privatized?

If the testator died before he had time to privatize a municipal or state apartment, his relatives can retain the right to use the apartment and register ownership of it.

If the heirs lived in the same apartment, they can renew the social tenancy agreement in their name and privatize it in the future. Heirs who did not live with the deceased cannot claim the apartment.

If the testator has started the privatization procedure , the heirs can inherit the apartment. This is a complex process - most likely, you will have to argue through court with the municipality or state.

The heirs can be both relatives and any people mentioned in the will.

Pay the fee

To enter into an inheritance, you must pay a special fee to the state. This is an analogue of the previously existing inheritance tax. The notary will calculate the exact amount of the fee - all you have to do is pay it. The fee must be paid before the notary begins work.

You can estimate the amount of the fee in advance yourself. The duty is calculated based on the cadastral, inventory or market value of the apartment.

The cadastral value of the apartment is indicated in the cadastral passport, the document on the inventory value is issued by the Bureau of Technical Inventory (BTI), the market value is assessed by professional appraisers with a license. You need to choose the lowest cost.

The apartment must be appraised on the date of death of the testator, and not at the time of submission of documents.

If the inherited apartment, according to one of the estimates, costs 6 million rubles, you, as an heir, will have to pay 0.3 or 0.6% of this amount: 18,000 or 36,000 rubles.

If you lived with the testator in a bequeathed apartment and continue to live there, you do not need to pay a fee

Some people (such as minors) may only pay half the fee or none at all. Read more about benefits when paying duties in Article 333.38 of the Tax Code.

Obtain a certificate of inheritance

Having received a certificate of inheritance, you become a full heir, but not yet the owner

If you can prove to a notary that the deceased has no other relatives or heirs, you can receive a certificate of right to inheritance within 6 months

Refuse inheritance

Until you have received a certificate of right to inheritance, you can refuse the inheritance in someone else's favor or just like that. You can only refuse in favor of a person who can become an heir by law: for example, in favor of a sister, parents, children. You cannot refuse in favor of your neighbor next door or your wife.

Receive an extract from the Unified State Register of Real Estate on the transfer of ownership

To become the owner of an apartment, take the certificate of inheritance to the MFC. There the document will be transferred to Rosreestr, and you will be given an Extract from the Unified State Register of Real Estate (USRN) about the transfer of ownership.

Take with you to the MFC:

- passport;

- certificate of inheritance and its copy;

- receipt of payment of state duty. For an ordinary apartment you will have to pay 2000 ₽. If you have a special case, check on the Rosreestr website or by calling the help desk at tel. 8 800 100 34 34.

You will become the full owner only after receiving an extract from the Unified State Register of Real Estate on the transfer of ownership. From now on you can dispose of the apartment as you wish.

Let someone else do the fuss

As you can see, becoming the owner of an inherited apartment is not so difficult. Your main task is to collect documents and wait.

But if you don’t have time to go to a notary and submit documents or you live in another city, you can draw up a power of attorney and another person can do the fuss for you.

A power of attorney can be written to any person and entrust him with the entire process: preparation of documents, communication with a notary and registration of property rights. The power of attorney must be notarized.

Remember

- Inheritance occurs by law and by will. If the deceased did not leave a will, the relatives inherit the apartment in order of priority. According to the will, the apartment is inherited by those named in it. In both cases the procedure is the same.

- The heir can move into the apartment and live in it immediately after the death of the testator. If he lives in it, pays the bills and maintains the apartment, he is considered to have accepted the inheritance.

But in order for the heir to become the owner and be able to dispose of the property, it is necessary to obtain a certificate of inheritance and state registration of ownership.

- To register an inheritance, you need to go to a notary, fill out an application, accept the inheritance and open an inheritance case.

- If within 6 months the heir does not apply for acceptance of the inheritance, the apartment will go to other heirs in order of priority

- If the heirs argue about shares in the inheritance, the notary will suspend the case until the court makes a decision.

- To enter into an inheritance, you must pay a fee: 0.3% of the cost of the apartment for close relatives and 0.6% for other heirs.

- If you lived with the testator in a bequeathed apartment and continue to live there, you do not need to pay a fee

- The notary will issue a certificate 6 months after the opening of the inheritance. Having received the certificate, you will become a full heir, but not yet the owner.

- To become the owner of an apartment, obtain an extract from the Unified State Register of Real Estate on the transfer of ownership. From now on, you can manage the apartment as you wish.

You can read more about inheritance in the Civil Code of the Russian Federation.

Registration of ownership of an apartment by inheritance

Registration of ownership of residential property is the official recognition and confirmation on behalf of government bodies of the fact of the emergence of a person’s authority over the property. The institutions authorized to carry out the registration process include:

In order to certify the rights to an apartment or a share in common property, an heir must:

- collect certain documents ;

- fill out an application in the prescribed form;

- pay the duty ;

- provide data for official certification.

You can send documentation by personally contacting the territorial offices of the MFC or Rosreestr, using electronic resources , postal services , and also using the services of a courier .

Upon acceptance of the information, the citizen will be issued a receipt , and after the expiration of the period allotted for registration, an extract from the Unified State Register of Real Estate , indicating the legality of ownership of the inherited real estate.

How to register ownership of an apartment by inheritance

For a citizen who has received an inheritance in the form of an apartment, in order to have full ownership of the property, it is necessary to comply with the state registration procedure :

- The future owner must obtain a certificate of inheritance from an authorized notary representative. This document is the basis for certifying the rights of the owner.

- You will need to provide the following information: the applicant’s passport details, cadastral number of the apartment, a certificate of no debt for utility bills, etc.

- In the future, you should contact the registration authorities, which may be the MFC or Rosreestr.

- It is necessary to fill out an application in the prescribed form.

- Payment of state duty is required.

A notary has the opportunity to issue a certificate of the right to inheritance at any time after 6 months from the date of opening of inheritance proceedings (Article 1163 of the Civil Code of the Russian Federation).

Registration of inheritance at the MFC

To carry out mandatory registration of ownership of inherited real estate, the future owner has the opportunity to contact any territorial branch of the MFC, namely:

- At the location of the residential premises.

- At the registration address of the citizen who received the inheritance.

- At the place of permanent or temporary residence of the person.

Example

Citizen S., a resident of the city of Samara, inherited an apartment from his cousin, who lives in St. Petersburg. Citizen S. entered into inheritance rights, in confirmation of which a certificate was issued by a notary.

Having returned to his permanent place of residence, the future owner submitted documents to the MFC branch to register ownership of the property. Upon receipt of the application, a receipt was issued with a list of the information submitted and the date of official certification.

The fact that the inherited housing is located in another city district did not become an obstacle to certifying the rights of the owner.

The employee of the territorial office of the MFC, who received the information, redirects the collected data to Rosreestr, where a mark made about the certification and the documents are sent back.

The MFC is a body that acts as an intermediary in the process of mandatory state registration of property rights between the interested party and Rosreestr.

Registration of the right to inheritance in Rosreestr

From January 1, 2017, the state register of rights to real estate and transactions with it merged to the merger of the responsibilities of two different institutions, namely:

- Reception of documents for registration of powers and provision of cadastral data is carried out by one body.

- The issuance of the requested information and ready-made documentation is carried out from single windows of territorial branches of the real estate register and multifunctional centers.

- A person who wishes to certify ownership of an apartment received by inheritance has the opportunity to send documents to the local branch of Rosreestr in one of the following ways:

- Based on the results of the certification, the owner of the property is issued an extract from the Unified State Register of Real Estate , which is the main document confirming the powers of the new owner.

- Information registered by an authorized state body can be delivered to the interested person by courier service for an additional fee.

- You can receive a certain share in an apartment by inheritance on the following grounds:

- Based on the fact of drawing up a will, in which the personal order of the person establishes the circle of heirs and specific property (parts thereof) falling on each.

- Distribution of property according to law. Inheritance in this case is carried out in a certain order, for example, the priority recipients include: spouses, children and parents. Heirs of the same line claim equal shares of property (Article 1141 of the Civil Code of the Russian Federation).

- Regardless of the decision of the testator, a mandatory share is provided for minors and disabled relatives of the deceased person (Article 1149 of the Civil Code of the Russian Federation).

To officially register the owner’s rights to a specific part of the property, future owners will need to perform a division or allotment of a share in the common property; such division can be accomplished by:

- Conclusion of a written agreement between the heirs.

- Appeals to court.

- After reaching an agreement or making a court decision on the basis of which the inheritance shares will be determined, the notary will issue a certificate of the right to inheritance .

- Further mandatory registration is carried out in the general manner : the applicant sends the collected package of documents to the territorial offices of the MFC or Rosreestr, receives a receipt for delivery and, within the specified period of time, applies for an extract from the Unified State Register of Real Estate.

- The main difference in the procedures for registering part of an apartment from the whole object is the need to provide, among other documents, a court order or an agreement on division, allotment of a share.

At the request of citizens, a notary can issue a certificate of the right to inheritance to all interested parties together or separately to each of them (Article 1162 of the Civil Code of the Russian Federation).

Deadline for registering property rights after inheritance

The current legislation of the Russian Federation does not establish a specific period during which the heir is obliged to register the received property as personal property. It is important that within six months from the date of death of the person, the interested citizen declares himself to the authorized notary body.

At the same time, according to Art. 16 Federal Law dated July 13, 2015 No. 218 Federal Law provides for a clear time frame for the official certification by registering institutions of the owner’s powers:

- 3 working days from the date of submission of the application and the information attached to it to Rosreestr. When sending documentation electronically – 1 business day.

- Within five days from the moment the documents are received by the employee of the multifunctional center.

The date of state registration of property rights is the day an entry on the completed certificate is made in the Unified Real Estate Register.

Documents for ownership of an apartment by inheritance

an apartment and wish to officially register ownership of the received property must collect the following package of documents:

- Applicant's passport details.

- A certificate of inheritance rights issued by a notary.

- Receipt for payment of state duty.

- An extract from the house register (apartment card), which contains information about the persons registered in the residential premises.

- Cadastral document.

- Certificate of absence of arrears in payment of utility services.

- Statement of the established form.

may be requested as additional information

- If the apartment has undergone redevelopment, a document confirming the legality of the changes made.

- When registering a share in common property, it is necessary to present an agreement on division, allotment of a part, or a decision of a judicial authority on the commission of such actions.

In the process of accepting documents, an employee of the authorized registration body checks the completeness and correctness of the information sent.

The amount of the state fee, which is payable for registration of rights of ownership of property transferred by inheritance in 2017, has not changed compared to the previous calendar year and is:

- 2 thousand rubles for citizens;

- 22,000 rubles for legal entities (clause 22 of article 333.33 of the Tax Code of the Russian Federation).

When registering shared ownership, the state fee is paid by each applicant in equal parts.

Example

Participants in the registration process are three adults, that is, each of them has a share of the right equal to 1/3. The amount of the contribution to be paid is calculated as follows:

2000 × 1/3 = 666.7 rub.

- Payment of the mandatory fee must be made before submitting documents for registration due to the fact that without presentation of a receipt confirming the corresponding transfer, information will not be accepted.

- The state duty can be paid both in cash and in non-cash forms.

- The current legislation of the Russian Federation defines specific requirements that must be observed by citizens who have inherited an apartment or part of a residential premises and wish to register ownership of a property.

- To register property rights, heirs must submit certain documents and pay a state fee when applying to the registration authority.

- After acceptance of the application and other information attached to it, the received data is checked, and if no reasons for refusal of registration are identified, information about ownership is entered into the Unified State Register of Real Estate.

Is it possible to refuse part of the inheritance and accept the other?

My grandfather left me as an inheritance a car and part of an apartment, or rather 1/4. I would not want to become the owner of a residential property. Tell me, do I have the opportunity to refuse to accept the property, but still receive a car? It is not possible to accept the inheritance only in a certain part, by personal choice. The current legislation of our country (clause 3 of Article 1158 of the Civil Code of the Russian Federation) defines an unconditional refusal or full accession to inheritance rights.