Tax on the sale of a share in an apartment less than 3 years old: we apply a property deduction

By selling real estate, even if it is just part of the premises, a person receives income and therefore is required to pay a tax at a rate of 13% of the transaction value. However, you can apply for a tax deduction when selling a share of an apartment owned for less than 3 years, in order to avoid paying personal income tax or at least reduce its amount.

How to calculate the tax base when selling part of the property and take advantage of the benefit with maximum benefit?

In what situations is tax charged?

- you bought a home and have owned it for over 5 years - in this case, documents confirming the purchase price will not be needed and you will not even have to report the transaction to the Federal Tax Service;

- tax on the sale of a share of an apartment received by inheritance, privatized, acquired under a rental agreement is not paid if owned for more than 3 years.

The tenure period is standardly defined as the date indicated in the registration certificate, or the day when the package of documents was transferred to the authorized body for the registration procedure. Thus, it is mandatory to pay tax when selling a share in an apartment owned for less than 3 years.

What deduction can you get when selling part of the property?

If it is impossible to take advantage of the benefit and completely avoid taxation, you can at least get a tax deduction when selling an apartment in shared ownership. It comes in two types: based on purchase costs and fixed. Which one to choose depends on the situation.

Deduction in the amount of expenses incurred

You can take advantage of this benefit if the property was purchased under a contract and you have kept the documents confirming the purchase. Then you will only need to pay personal income tax on the difference in price. For example:

- you bought a home for RUB 4,000,000;

- a year later you sell it for 5,000,000 rubles;

- that means from 1,000,000 rubles. (this is profit), you need to pay 13%.

Is the sale of a share taxable if the purchase price was higher? No, in this situation no income was received, therefore there is no taxable base. But in this case, you will have to send a zero declaration to the tax office.

Standard deduction

If it is impossible to confirm the acquisition with documents, or the object was received as a gift or by inheritance, the owner can apply for a fixed benefit. In accordance with Art. 220 of the Tax Code of the Russian Federation, its amount is 1 million rubles. for each apartment.

However, when selling a share of real estate, taxation is not so clear. You can use compensation according to one of the following schemes:

- Pay tax on the sale of an apartment with shared participation from the whole object in proportion to the shares. For example, both spouses (Ivanov and Ivanova) own ½ of the home, sell it for 2 million, the deduction will be 1 million, so taxes are paid on the difference of 1 million. And this is 500 thousand for each, personal income tax 13% - 65 thousand;

Payment of tax on the sale of an apartment share

Real estate transactions, like any property transactions, are under the close attention of regulatory authorities and are subject to mandatory taxation. The sale of one or more shares in an apartment is quite common, but not always clear from the point of view of calculating fees to the budget. Certain benefits and deductions, as well as concessions for property owners, are legally approved. Today we will talk about how to pay tax on the sale of a share in an apartment in 2018.

Do I need to pay taxes?

Is the sale of a share of an apartment subject to tax? The answer to this question is ambiguous - it depends on the amount of the transaction, the procedure for registration, and the period of ownership of the property.

The main type of tax levied on the sale of real estate is personal income tax, abbreviated as personal income tax. The standard rate for this type of operation is 13%.

The amount is calculated regardless of whether the entire apartment is sold or only part of it (share).

For example, Petrova I.S. sold its share for 1.5 million rubles. In this case, the standard tax calculation will look like this:

1500000 * 13% = 195000 rubles

How to reduce tax?

The state provides Russian citizens with a number of concessions that will allow them to reduce the tax burden when selling property. Explanations are provided taking into account amendments to the Tax Code of the Russian Federation, which come into force on January 1, 2017.

Tenure period

The duration of ownership of the property has a significant impact on the calculation of the tax amount. In particular, the owner has the right not to pay any contributions to the budget from the purchase and sale agreement if he owns the property for a certain number of years.

According to the new requirements, the minimum period of ownership of a share of an apartment to use this benefit is 5 years.

It should be taken into account that this period refers specifically to the calendar period, i.e. 60 months from the date of acquisition of owner status.

Property owned for more than 3 years also falls under the benefit only in the following situations:

- received as a gift or inheritance from a relative;

- privatized;

- purchased under a dependent life annuity agreement.

If the property was owned for less than 3 years , then the seller can apply another type of benefits to reduce his tax burden.

A little about determining the tenure of property

The main document establishing the fact of ownership of a share of an apartment is a certificate of ownership, which is issued by regulatory authorities. For the convenience of calculating the minimum period, you should focus on the date specified in this form. In reality, the moment of commencement of ownership of property occurs on the day of registration of the package of documents.

A little more complicated order with shares. For example, Sidorov A.M. in 2011 he purchased an apartment in joint ownership with his parents, i.e. became the owner of 1/3 of the property. In 2014, his father died and bequeathed his share to him.

In 2017, Sidorov decides to sell his shares. In this situation, he has every right not to pay taxes on the transaction, since he first became the owner of part of the apartment in 2011.

The date of receipt of the first share is important, not each individual share!

Acquisition costs

One of the ways to significantly reduce the amount of tax on the sale of a share in an apartment is to provide documentary evidence of the costs of its acquisition. If the owner cannot prove in any way the losses incurred on the purchase of real estate, then he can take advantage of the following type of benefit - a fixed property deduction .

Lodygin R.D. acquired a share in the apartment in 2016 for 2.5 million rubles. In 2017, he will sell his part of the property at a price of 3.6 million rubles. In such a situation, the tax calculation will be as follows:

(3600000 – 2500000) * 13% = 1100000 * 13% = 143000 rubles.

It would seem that what is stopping you from indicating a smaller amount in the purchase and sale agreement and not paying any taxes. However, the procedure for determining the minimum value of the property being sold is established by law. In Art. 217.

1 of the Tax Code of the Russian Federation clearly states that the amount of income received from the sale of real estate should not be less than the established cadastral value of the property as of January 1 of the year of the transaction, reduced by a factor of 0.7. However, the required data about the object is not always available.

In such a situation, the owner is not limited by the requirements of this paragraph (clause 5 of Article 217.1 of the Tax Code of the Russian Federation).

Dobrova A.Zh. sold her share - ½ of the apartment for 4.5 million rubles. The cadastral value of the entire property is 15 million rubles. An example of calculating taxable income from a transaction:

15000000/2 * 0.7 = 5250000 rubles.

Since the sale price is significantly lower than the cadastral value, the amount of 5.25 million rubles is used when calculating personal income tax.

Property deductions in a fixed amount

Article 220 of the Tax Code of the Russian Federation contains detailed information about this method of reducing tax as a property deduction. The fixed amount of the benefit is set at 1 million rubles. It is important to understand how to use it:

- for one property;

- in different tax periods.

The situation is a little more interesting when applying a deduction for transactions with the sale of shares of apartments. Property owners can choose three scenarios for receiving benefits depending on their specific situation.

Consider calculation examples based on the following data:

Lopatin A.D. and V.D. decided to sell the apartment they inherited for 3.5 million rubles. Both work, so they have the right to apply deductions. Everyone owns ½ of the property.

Using a deduction for an entire property . In such a situation, an apartment purchase and sale agreement is drawn up, and the co-owners can apply a benefit in the amount of 1 million rubles in proportion to their shares.

1000000/2 = 500000 rubles

(3500000/2 – 500000) * 13% = 162500 rubles. This is exactly the amount of tax that each apartment owner will pay to the budget.

Using the deduction for apartment shares . Co-owners sell their share separately under different sales and purchase agreements. This is possible if there is evidence of ownership of each share. Then the calculation will look like this:

(3500000/2 – 1000000) * 13% = 97500 rubles.

Another interesting solution to the issue is possible if one of the co-owners is the owner for more than the established minimum period. In such a situation, when selling property, an additional agreement is concluded, which indicates the distribution of income from the transaction:

Lopatin A.D – 3 million rubles (owner for more than 3 years)

Lopatin V.D. – 500 thousand rubles (uses a property deduction for his share in the amount of 500,000 rubles). Thus, real estate sellers are completely exempt from paying personal income tax.

As can be seen from the example, a different approach to the legal registration of shares of property can significantly reduce the amount of tax on the sale of part of the apartment. It is important to correctly and accurately accompany the transaction, since the presence of errors or inaccuracies makes it possible for the Federal Tax Service to invalidate it and change the procedure for applying deductions in the direction of increasing the tax burden.

How to notify regulatory authorities about income?

Payment of tax on the sale of a share of an apartment is no different from the established procedure for transactions with other real estate.

The owner of part of the property is obliged to provide information about transactions last year by April 30, submitting reports to the Federal Tax Service in Form 3-NDFL.

There is no need to submit tax reports to regulatory authorities when selling property that has been owned for more than a specified period. In other cases, it is important to show that the owner took advantage of the deduction or reduced the tax on expenses for the purchase of real estate.

The deadline for transferring tax amounts in 2017 is June 15. Payment of the fee is possible only after confirmation of the correctness of the declaration and receipt of details from the controlling organization.

Citizens do not have the right to make payments to the budget in cash, so they will need to contact a bank or use Internet resources.

Penalties are provided for failure to comply with deadlines for paying taxes and filing returns.

If you have any questions or need help filling out your tax returns, our on-call lawyer online is ready to advise you promptly.

Tax on the sale of an inherited apartment, how to calculate if shares in real estate are sold | Legal Advice

Last updated March 2023

The inheritance received is not only a property benefit, but also the obligations of the heir for maintenance, payment of taxes, etc. Real estate taxation issues are of particular concern. The heir may decide to keep the inherited property or sell it.

- When the inheritance remains with the heir , then his concern is paying property tax. There are no particular difficulties: the inspection itself determines the amount, sends a notification and a receipt.

- Property For Sale . When, for example, there are several heirs to an apartment, after its sale, a division of the inheritance is possible. And then a lot of questions arise regarding tax (personal income tax) when selling an inherited apartment.

- The obligation to pay tax arises if the period of ownership of the inherited property does not exceed 3 years (36 months from the date of receipt of ownership). But not 5 years, as when selling non-hereditary real estate acquired after January 1, 2016.

- The amount of taxable income can be reduced by a property deduction in the amount of 1 million. The costs of purchasing this apartment by the previous owner cannot be taken into account, and no expenses for repairs or utility bills can be taken into account.

- You cannot underestimate the cost of an inherited apartment being sold. From 01.01.2016, the value of the property specified in the purchase and sale agreement is verified with its cadastral value , which is very close to the market value. If the contract indicates less than 70% of the cadastral value, the tax will be assessed additionally by the tax office.

- In the case of the sale of an apartment by several owners under 1 contract , a deduction of 1 million is provided for the entire object, and not for each owner. Those. Everyone receives a deduction, but only according to their share (example: 1/2 share means a deduction of 500 thousand rubles, 1/3 share means a deduction of 333.3 thousand rubles).

- If each owner sold his share under a separate purchase and sale agreement, then each has the right to receive a property tax deduction in the amount of 1 million rubles.

- There are no benefits for different categories of citizens (pensioners, disabled people, minors, etc.). After selling an inherited home, no one is exempt from paying tax. Well, maybe only those who have owned it for more than 3 years.

To determine whether an inherited apartment is subject to tax upon sale or not, you only need to consider the period of ownership of the apartment. It is useless to look for advantages in taxpayer status. It is possible to avoid the tax burden by waiting for a three-year period of ownership of the apartment, or by reducing the proceeds from the sale to zero by deductions or expenses (if the size allows).

How is the tenure period calculated?

- If the heir did not have a share in this housing earlier, before the death of the testator, then the period of 36 months is calculated from the moment of the death of the testator.

- When a person inherited a share in housing in which he already had his own shared ownership. For all interests, the starting date of ownership is the earliest date on which the interest in the property was acquired.

Example : the heir had a ¾ share in the apartment since 2007. In 2018, he inherited a ¼ share in the same property. In 2023 I sold everything.

The period of ownership of the entire object at the time of sale is considered equal to 12 years (from 2007 to 2023). Therefore, there is no need to submit a declaration.

- If the heir is not a tax resident, then the three-year rule is not applicable. Non-residents must pay tax in any case at a rate of 30%.

- Which month is counted and which is not:

- If the date is before the 15th, then the month is not counted,

- If after the 15th day, then the month is counted.

What is considered a tax, what is a state duty

Some people confuse tax and duty. These are completely different concepts.

- State duty - paid to the notary for issuing a certificate of inheritance, that is, in order to enter into and formalize the inheritance.

- Tax - payment to the state budget of the amount received from the difference between income from the sale and deductions/expenses under a transaction from the sale of housing that has been owned for less than 3 years (5 years).

How to calculate tax

The tax is determined using a standard formula, the same as for taxation of sales of other residential real estate (not inherited).

|

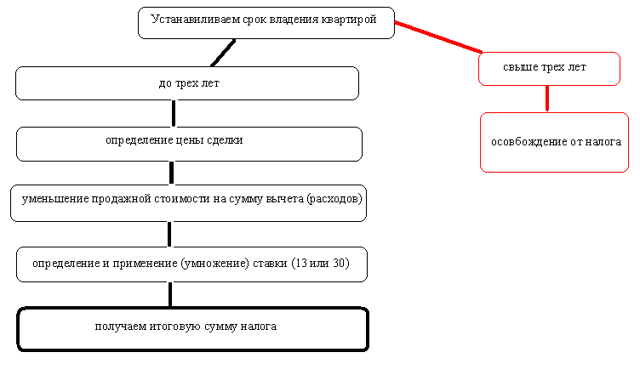

Schematically, the procedure for determining the amount of personal income tax is as follows:

It is sometimes mistakenly believed that the property deduction is subtracted from the final tax amount. But no, the 1 million deduction is deducted from the amount of the purchase and sale agreement, and not from the tax amount.

An example of an incorrect calculation : the property was sold for 11 million rubles. The taxpayer first mistakenly multiplied the sales price by the rate (11,000,000 X 13% = 1,430,000), and then took away the deduction (1,430,000 – 1,000,000 = 430,000). The result was 430,000 rubles, although it should be equal to 1.3 million (11,000,000 – 1,000,000 = 10,000,000; 10 million X 13%).

Everything here is extremely simple - this is the amount that is indicated in the text of the purchase and sale agreement. There are several points that may confuse a taxpayer:

- Discrepancy between the actual money transferred and the official figure in the documents. The taxpayer attaches receipts to the declaration and refers to witnesses who will allegedly confirm the real, and not the “paper” order of the calculation figures. But all this is not important, the tax office will only accept the text of the sale and purchase.

- Payment in installments . Some deals provide for staged payments. Despite this, the price is determined not as a separate payment (first or last), but as the total amount of payments.

For example , a room is for sale. The parties determined that payment would be made within 1 year in monthly installments of 50,000 rubles. Moreover, the last payment is 75,000 rubles. The transaction price will be 625,000 rubles. (50 thousand X 11 + 75 thousand).

- Purchase and sale with related transactions . Often a transaction is accompanied by real estate services, the work of appraisers, insurers, etc. In parallel with the contract, so-called counterfeits (auxiliary transactions) are concluded so that the general transaction is successful. The amounts paid for these ancillary transactions do not in any way affect the price of the master contract.

For example , the parties agreed on a price of 1,000,000 rubles. To search for residential real estate, check its legal purity, and assist in paperwork, buyers entered into a service agreement with a real estate company. 100,000 rubles were paid for the work performed. The price of the purchase and sale transaction will be 1 million rubles, that is, without taking into account the cost of realtor services.

- Comparison with cadastral value . Today, market and cadastral values are approximately equal. The Tax Code stipulates that for donations (for tax purposes) the value of real estate is applied at least 70 percent of the cadastral value, regardless of the value that the parties indicate in the agreement. For the purchase and sale of such strict frameworks at the legislative level are not established. However, tax authorities apply this 70 percent principle in their control and audit activities. Therefore, if the transaction price is greatly reduced, Federal Tax Service inspectors may charge additional tax.

This is the amount by which the transaction price is reduced before taxation.

- 1 million rubles is a property deduction, a fixed amount.

- expenses are a variable indicator and depend on actual and documented costs. Expenses, as a rule, are not comparable to 1 million, so they are almost never used in practice, see below for more details why. In exceptional cases, expenses are used if several properties are sold in one year (and the 1 million deduction can be used only for 1 property).

Bid

- 13% is the amount used by Russian citizens.

- 30% are foreigners or non-residents.

As for the 30% rate, it applies to persons who are not tax residents of the Russian Federation.

That is, those permanently residing in Russia for less than 183 consecutive days in one calendar year. In addition to foreigners, a Russian may not be a tax resident. Let’s say he has housing abroad and primarily lives there.

By and large, it is not citizenship that matters, but the length of continuous residence in Russia.

Where to submit 3-NDFL

Tax reports should be submitted to the territorial inspectorate at the official address of registration of the citizen's place of residence . This usually coincides with the place of permanent residence of the taxpayer.

That is, the documents are not submitted:

- not at the location of the object of sale,

- not by temporary registration (place of stay),

- neither by actual residence (for example, renting housing without registration),

namely, according to the citizen’s registration.

Appendix to the declaration

List of documents submitted to the Federal Tax Service:

- Completed declaration;

- Documents for the apartment. If the declarant applies a fixed deduction, then a purchase and sale agreement and a financial document on the income received (receipt, bank account statement, etc.) are presented. However, the payment document is not always drawn up by the parties to the transaction, but is replaced by the seller’s inscription on receipt of money, made either according to the text of the agreement or in the act of acceptance and transfer of housing. In this case, it is enough to submit the contract and the acceptance certificate.

- If expenses are taken into account, then the application also includes documents on cash expenses for purchasing an apartment as the property of the seller.

- Declarant's passport;

- Register of documents.

There is no need to submit any applications or notifications (as, for example, when receiving a deduction for purchasing a home) to the Federal Tax Service. As well as documents confirming the status of the owner before the transaction. That is, whether the inheritance was by law or by will, this does not affect the sales tax.

Applications are provided in copies, which are certified by the declarant himself with his signature. The inspection employee may require the originals to confirm the accuracy of the copies.

When reporting is sent by mail, copies of contracts and payment documents are notarized.

Deadline for filing a declaration

- The completed package of documents must be submitted to the tax office by April 30 of the year following the year for which the declarant is reporting.

Example : money was received from the sale in 2018, which means the declaration with attachments must be submitted by 04/30/2022.

- If the last day of delivery falls on a weekend, then this day is automatically transferred to the first weekday.

Example

Personal income tax when selling a share in an apartment less than 3 years old

The sale of shared ownership in an apartment is recognized as a complex transaction with mandatory notarization. Income of an individual arising from the sale of property is subject to personal income tax.

To reduce the amount of tax, the seller has the right to apply a deduction - an amount that reduces the tax base.

Obligations to the budget to pay tax arise when an apartment is sold before the minimum tenure period expires.

Paying tax on the sale of shared ownership

Income received from the sale of shared ownership in an apartment is taxed at 13%. When fulfilling obligations to the budget:

- The full amount of the sale is taxed if the value specified in the sales contract exceeds the value established in the cadastre. If the sale price differs from the cadastre by more than 30%, the amount of tax will be additionally assessed by the tax authorities.

- The tax is paid at the end of the year in which the purchase and sale transaction took place.

- Information about the income received, the tax calculated, and the deduction applied must be submitted to the territorial body of the Federal Tax Service. The form for submitting information is declaration 3-NDFL.

- The seller of the share has the right to choose the type of tax benefit. It is allowed to apply a deduction in the amount of a fixed amount to income or expenses actually incurred when purchasing shared property (Article 220 of the Tax Code of the Russian Federation).

The procedure for paying tax on the sale of shared ownership coincides with the procedure for taxing income received from the sale of an entire object. The only difference is in the application of deductions and calculation of the minimum period of ownership of the property.

Minimum period of ownership of property

The obligation to pay tax does not arise when selling an apartment after the minimum period of ownership has expired. The period is calculated from 3 to 5 years, depending on the basis for taking ownership of the property.

The procedure applies to residential real estate or shares in it acquired after the beginning of 2016. A share in property acquired before 2016 is taxed upon sale if it has been owned for less than 3 years.

The conditions for release are detailed in Art. 217.1 Tax Code of the Russian Federation.

| Minimum tenure | Exemption from tax on the sale of a share in property acquired or received after 2016 |

| Up to 3 years | Absent, tax is paid in full (minus property deduction) |

| After 3 years | Owners of previously acquired shares in a privatized apartment who received property by inheritance, gift from a close relative, or life annuity agreement are exempt |

| After 5 years | All types of property owned |

The minimum ownership period is calculated from the date of registration of the property in the state register.

For shared ownership property received by inheritance, the period is calculated from the date of opening of the inheritance.

The exception is when the owner receives a share in the apartment if there is an existing part of the property. The period is calculated from the date of commencement of ownership of the first part of the shared property.

Application of a property deduction of 1 million rubles when selling shared ownership

For each sale of a property, the seller has the right to apply a deduction in the amount of 1 million rubles. The condition also applies to shared ownership of one property. The amount of deduction due to each owner depends on the procedure for executing the purchase and sale agreement.

According to the Federal Tax Service of the Russian Federation, when selling shares under one contract as a piece of real estate, the owners are provided with a deduction in proportion to the existing parts of the property. In case of sale of a share of property under separate agreements, each seller receives the right to a deduction in the amount of 1 million rubles.

D.V. Egorov in a letter dated July 25, 2013 No. ED-4-3/[email protected]

| Recognition of the object of sale and purchase | Deduction amount |

| Sale of a share by each owner simultaneously under one agreement executed for the object | Provided in proportion to the shares per each owner |

| Each owner's share is sold as a separate object. The sale of shares is carried out under separate agreements | Provided to each person in full - in the amount of 1 million rubles for a separately sold object |

Calculation of tax payable

Owners of shares must independently calculate the amount of tax paid to the budget.

Example No. 1 on the distribution of shares when selling an object on the basis of one agreement

An apartment worth 2.5 million rubles, which was in shared ownership, was sold as a single object before the expiration of 3 years of ownership. The owners owned shares of 30% and 70% of the total area. After the sale, individuals were provided with deductions of 300 and 700 thousand rubles, respectively. At the end of the tax period, persons paid tax:

- First owner: H1 = (750,000 – 300,000) x 13% = 58,500 rubles;

- Second owner: H2 = (1,750,000 – 700,000) x 13% = 136,500 rubles.

Both owners are required to submit declarations of income, calculated taxes, deductions and amounts due.

Example No. 2 on the distribution of deductions when selling a share in an object on the basis of a separate agreement

Let's use the conditions of example No. 1, changing the terms of sale. Each share was sold under a separate agreement. At the end of the year the tax was calculated:

- After applying the deduction, the first owner did not have an obligation to pay tax (750,000 – 1,000,000);

- The second owner has an obligation: H2 = (1,750,000 – 1,000,000) x 13% = 97,500 rubles.

Sample 3-NDFL when selling a share in an apartment

Distribution of the deduction amount when selling shares of spouses

Property acquired by spouses during marriage is jointly acquired. Persons have equal shares regardless of who is recorded as the main owner. Along with the standard grounds for owning property, there are cases of other distribution of shares in accordance with the terms of the marriage contract. Persons have the right to receive a deduction when selling residential property:

- In equal shares distributed between spouses.

- According to the expenses incurred when purchasing a share in the apartment.

Amounts spent on the purchase of property must be confirmed by payment documents attached to the declaration.

Declaration of income

After a year of receiving income from the sale of real estate, you must:

- Submit a declaration indicating the amount received from the sale of the apartment. The deadline for submitting the declaration is set until April 30 of the year following receipt of income (Article 229 of the Tax Code of the Russian Federation).

- Include a deduction in the declaration that reduces the taxable amount.

- Calculate the tax payable to the budget.

- Pay off the obligation before July 15 of the year of submission of the declaration (Article 228 of the Tax Code of the Russian Federation).

Missing the deadline for filing a declaration or paying off obligations entails the imposition of sanctions in the form of fines. Submission of the declaration is allowed in person, electronically or by mail.

Important! The declaration is submitted when selling a share in an apartment when the property has been owned for less than 3 years and in the case when, based on the results of tax calculations, no amount to be paid arises.

Errors in calculating personal income tax

Error No. 1. Submission of the 3-NDFL declaration is carried out not immediately after receiving income, but at the end of the calendar year. The tax period for a tax is defined as a calendar year, after which reporting is submitted on the data of all the person’s income, declared deductions, and calculated tax. All data is combined in one reporting form.

Error No. 2. When determining the minimum period of ownership of shares in property, it is not calendar years that are taken into account, but consecutive months. For example, to determine a three-year holding period, 36 months are taken into account.

Answers to frequently asked questions

Question No. 1. Is it possible to provide updated data if an error is identified in the calculation of personal income tax in the declaration?

If an error is discovered, a revised declaration must be submitted. Amounts paid to the budget are subject to adjustment.

Question No. 2. Is tax paid when selling a share in an apartment owned by a minor?

The fact that a taxpayer is a minor does not exempt a person from paying taxes when receiving income. The responsibility for repaying tax payments of a minor is borne by his parents or guardians.

Tax on the sale of a share in an apartment (#4898)

Tax on the sale of a share in an apartment: tax on the sale of an apartment as a whole (including shares in it) or by shares, ways to reduce the tax, registration of the transaction >>>

Often the seller is required to pay tax on the sale of a share in an apartment. Why “often” and not always? It all depends on three factors:

1. The period of ownership of the share (that is, the period during which the share in the apartment was owned by the seller). 2. The selling price of the share and the cadastral value of the apartment as a whole.

3. The procedure for registering the purchase and sale of a share.

Duration of ownership of a share in an apartment

Until 2016, the rule was in force: if the share was in your property for 3 years or more, then the income from its sale was not taxed. The amount of income does not matter. Such income is not subject to declaration.

On January 1, 2016, the rules changed. The necessary changes were made to the Tax Code by Federal Law No. 382-FZ dated November 29, 2014. I would especially like to emphasize that the new rules apply only to those shares that were registered in ownership from January 1, 2016 and later . This is clearly stated in paragraph 3 of Article 4 of this law.

It stipulates that the new tax calculation procedure “applies to real estate acquired after January 1, 2016.” If ownership was registered earlier (in 2015, 2014, 2013, etc.

year), then the old rules for calculating tax on these shares apply: income from the sale of shares that you have owned for 3 years or more is not taxed.

So, the rule about the 3-year period remains. But now it applies only to shares that were received:

- by inheritance;

- as a gift from a close relative. According to Article 14 of the Family Code, close relatives are considered to be parents, children, grandparents, grandchildren, full and half (having a common father or mother) brothers and sisters;

- on privatization;

- under an annuity agreement (lifetime maintenance with dependents)

If you sell such a share in an apartment and the share has been in your ownership for 3 years or more, then you do not need to pay sales tax. The selling price of the share does not matter.

For the remaining shares received in ownership after January 1, 2016, this period is not 3 (three) , but 5 (five) years. By the way, local authorities have the right to reduce it (down to zero) for all or certain categories of citizens (for example, for pensioners).

Example: You are selling a share in an apartment.

Situation 1 The share is received by inheritance. You will not pay tax if at the time of sale the share has been in your ownership for 3 years or more. Income received from the sale will not be taxed, regardless of its amount.

Situation 2 You bought a share after January 1, 2016. You will not pay tax if at the time of sale the share has been in your ownership for 5 years or more. Income received from the sale will not be taxed, regardless of its amount.

—————————-

Moreover, 3 years is not three calendar years. This is 36 consecutive months. Therefore, the three-year share holding period can begin at the beginning, middle or end of the year. Similar rules apply to 5 years. This is 60 months of continuous ownership of the share. For more information on how to determine the tenure period, see the link.

How to determine the beginning of the period during which the share was in your property? Usually simple. The date from which this period begins to count is indicated in the Certificate of Ownership of the share.

the registration record was made in the Unified State Register of Rights to Real Estate and Transactions with It REQUIRED DATE In addition, this period is indicated in the extract from the state register of rights to real estate by share.

The required date is in line 3 “Type, number and date of state registration of the right.”

There are three exceptions to this rule in which it does not matter when the Certificate is issued or what date is indicated in the extract. They apply to apartments received:

- by inheritance. The right of ownership arises on the day the inheritance is opened (see paragraph 4 of Article 1152 of the Civil Code). This is considered the day of death of the testator;

- in a cooperative. The right of ownership arises after payment of the share and execution of the act of acceptance and transfer of the apartment (see paragraph 4 of Article 218 of the Civil Code);

- until 1998. Before this date, state registration and registration of a Certificate of Ownership of the apartment were not required (see paragraph 1 of Article 6 of the Federal Law of July 21, 1997 N 122-FZ).

Attention!

If the share was acquired in parts (for example, you bought 1/4 of the share, and received another 1/4 by inheritance and, as a result, became the owner of 1/2 of the share), then ownership of the entire share is counted from the moment the share was first registered . The fact that the size of this share has increased (from 1/4 to 1/2) does not matter. For more information on calculating the tenure period when receiving shares at different times, see the link.

Example In March 2017, three people purchased an apartment. Father, his son and father's brother. 1/3 each. In September 2023, the father died. In this regard, his son received his father's share (1/3) as an inheritance. As of September 2023, the son's share was 2/3.

In this situation, the son is considered to own 2/3 of the share since March 2017.

Thus, tax on the sale of a share owned by the seller for 5 years or more (more than 5 years), and in some cases 3 years or more (more than 3 years), does not need to be paid in principle. There is no need to file a tax return (form 3-NDFL) for such a transaction. This income is not subject to declaration. Therefore, if this is your case, then you don’t have to read further.

Tax on the sale of a share that has been owned for less than 5 (five) or 3 (three) years may have to be paid. But there are two other factors at play here:

1. Sales price of the share and cadastral value of the apartment as a whole. 2. The procedure for drawing up a share purchase and sale agreement.

Let's talk about them in more detail.

Selling price of a share in the apartment and registration of the transaction

Your income is the selling price of the share under the purchase and sale agreement. There is an exception to this rule. It applies to shares acquired in property after January 1, 2016. For such shares, taxable income is equal to one, but maximum amount:

— or the sale price of the share under the agreement; - or the share price calculated from the cadastral value of the apartment, multiplied by 0.7.

Example : You are selling a 1/2 share in an apartment that you received ownership of in 2017. The cadastral value of the apartment is 4,200,000 rubles.

Situation 1 The selling price of the share under the agreement is RUB 1,800,000.

The price of the share, calculated from the cadastral value of the apartment (and the coefficient 0.7) is: 4,200,000 x 0.7 x 1/2 = 1,470,000 rubles.

The largest amount is considered your income. This is the sale price of the share under the contract - 1,800,000 rubles.

Situation 2 The selling price of the share under the agreement is RUB 1,200,000.

The price of the share, calculated from the cadastral value of the apartment (and the coefficient 0.7) is: 4,200,000 x 0.7 x 1/2 = 1,470,000 rubles.

The largest amount is considered your income. This is the cost of the share, calculated from the cadastral price of the apartment - 1,470,000 rubles.

The seller of a share in an apartment has two ways to reduce income when calculating the tax on the income received. He can choose any of them as he wishes.

Method one. Income minus expenses

By selling a share in an apartment that has been owned for less than three years, you have the right to reduce the income received by the amount of expenses associated with the acquisition of this share. Such expenses must be supported by documents. The tax office will check them!

Quote from Article 220 of the Tax Code (clause 2, paragraph 2):

“... a taxpayer has the right to reduce the amount of his taxable income by the amount of expenses actually incurred by him and documented in connection with the acquisition of this property.”

Accordingly, tax must be paid on the difference between income and paid expenses. If expenses are greater than income (for example, a share in an apartment was sold cheaper than purchased), there is no need to pay tax on the sale of the share.

Example Ivanov has owned a share in an apartment for less than three years. He decided to sell it.

Situation 1 Ivanov bought a share for 1,200,000 rubles. The selling price of the share and its taxable income is RUB 2,300,000. Tax is imposed on income in the amount of:

- 2,300,000 (sale value of a share in an apartment) - 1,200,000 (costs of purchasing a share) = 1,100,000 rubles.

- Tax amount: 1,100,000 x 13% = 143,000 rubles.

Situation 2 Ivanov bought a share for 1,250,000 rubles. The selling price of the share and its taxable income is RUB 1,120,000. Tax is imposed on income in the amount of:

- 1,120,000 (sale price of a share in an apartment) - 1,250,000 (costs of purchasing a share) = 0 rub.

- There is no need to pay tax.

In most cases, the share in the apartment is not purchased separately. Usually it comes into ownership along with the apartment itself, purchased by several shareholders (for example, a family). In this situation, the amount of expenses for the acquisition of a specific share is either indicated in the purchase and sale agreement of the apartment itself, or determined by the formula (if the cost of each share is not indicated in the agreement):

| Purchase price of the apartment as a whole | X | Share size | = | The amount of expenses for the acquisition of a share |

Example A family of 3 people purchased an apartment worth RUB 6,700,000. Each family member owns 1/3 of the share. The purchase and sale agreement for the apartment does not indicate the cost of each share. It only shows the total price of the apartment.

In such a situation, the purchase price of each share is: 6,700,000 (total cost of the apartment) x 1/3 = 2,233,333 rubles.

Method two. Property deduction

By selling a share in an apartment, you have the right to receive a property tax deduction.

A deduction is a certain amount established by law that reduces the income from the sale when calculating tax (read more about deductions at the link). For real estate, it is 1,000,000 rubles. in year.

This is stated in Article 220 of the Tax Code (paragraphs 1 and 2). If income exceeds the deduction, tax must be paid on the excess amount. If not, no tax is paid.

Attention!

When selling property that is in shared ownership, the total amount of the deduction is distributed among the co-owners IN PROPORTION to their shares. The fact is that this deduction is provided not in relation to each seller, but in relation to one object (for example, an apartment or house).

It turns out that if you sell your share separately, it is considered a separate object. Therefore, you receive a deduction in the full amount (RUB 1,000,000). And if you sell an apartment (including your share in it) together with other owners, then the apartment is considered such an object. Therefore, a deduction of 1,000,000 rubles.

will be distributed among all owner-sellers.

This is where the procedure for completing a purchase and sale transaction becomes of great importance.

Option one . The apartment is sold as a single object under one apartment purchase and sale agreement. Your share in it is also sold along with the apartment. In such a situation, a deduction of 1,000,000 rubles. distributed among all sellers in proportion to their shares.

Option two . The apartment is sold in shares. That is, each owner sells his share under a separate agreement. In such a situation, EVERY owner has the right to receive a deduction of 1,000,000 rubles. This is stated in one of the letters of the Federal Tax Service of Russia, which is mandatory for use by all tax inspectorates (see link).

Example A family of three sells an apartment for RUB 3,700,000. This price is more than the cadastral value of the apartment. Each of them owns 1/3 of the apartment. The apartment was inherited. Therefore, there are no costs to purchase it. Apartment sellers take advantage of the deduction.

- Situation 1 The apartment is sold as a single object under one apartment purchase and sale agreement.

- Each owner receives the right to a deduction in the amount of: 1,000,000 (total deduction amount) x 1/3 = 333,333 rubles.

- The taxable income of each owner will be: 3,700,000 x 1/3 (income) – 333,333 (deduction) = 900,000 rubles.

Each owner must pay a tax on it in the amount of: 900,000 rubles. x 13% = 117,000 rub.

Situation 2 The apartment is sold in shares. That is, under three share purchase and sale agreements concluded by each owner with the buyer. The cost of each share is RUB 1,233,333. (which gives a total of 3,700,000 rubles). In this situation, each owner receives the right to a deduction in the amount of 1,000,000 rubles.

The taxable income of each owner will be: 1,233,333 (income) – 1,000,000 (deduction) = 233,333 rubles.

Each owner must pay a tax on it in the amount of: 233,333 rubles. x 13% = 30,333 rub.

This is 86,667 rubles. less than with option 1.

How to reduce tax?

If you read the text above, then the answer is clear. It is necessary to correctly formalize the purchase and sale transaction. Sell the apartment in shares, not as a whole. That is, under several agreements for the purchase and sale of shares, and not under one agreement for the purchase and sale of an apartment.

But there is another important point. As you can see from the example above, when selling the entire apartment, the income was distributed among the apartment owners in proportion to their shares.

However, in the apartment purchase and sale agreement, the owners have the right to establish any other procedure for the distribution of income. Which is in no way tied to the size of their shares.

This is stated in one of the letters of the Federal Tax Service of Russia, which is mandatory for use by all tax inspectorates (see link).

If the contract does not define this procedure at all (that is, it only indicates the total cost of the apartment and does not reflect how income is distributed between the co-owners), then the sellers have the right to enter into an agreement on the distribution of income between them. For information on how to draw up an income distribution agreement, see the link.

What is the benefit? It will arise if at least one of the owners has owned their share for more than 3 or 5 years. In this case, the largest amount of income must be distributed to him. And the rest is between the other co-owners. Moreover, the share of income accruing to each of them must correspond to the amount of deduction due to them. In this situation, no one will have to pay tax.

Example A family of three (father, son and daughter) sells an apartment for RUB 3,700,000. This is more than the cadastral value of the apartment. Each of them owns 1/3 of the apartment. At the same time, the father has owned his share for more than 5 years, and the son and daughter have owned it for less. There are no costs for purchasing an apartment. Therefore, the sellers (son and daughter) take advantage of the deduction.

The apartment is sold as a single object under one apartment purchase and sale agreement. The agreement provides that the income from the sale of the apartment is distributed as follows: - son - 333,333 rubles; - daughter - 333,333 rubles;

- father - 3,033,334 rubles. (3,700,000 – 333,333 – 333,333).

In this situation, the father does not have to pay tax, regardless of the value of his share. He has owned his share in the apartment for more than 5 years. The son and daughter are entitled to a deduction in the amount of: 1,000,000 (total deduction amount) x 1/3 = 333,333 rubles.

The taxable income of each of them is equal to: 333,333 (income) – 333,333 (deduction) = 0 rub.

No one has to pay taxes on this deal. At the same time, the son and daughter are required to submit a tax return. The father is not required to submit a declaration.

- Portal “Your taxes” 2018

- ____________________________________________________________________________________________________________________

- ATTENTION!

DO NOT POST YOUR QUESTIONS IN THE COMMENT SECTION. IT IS INTENDED SOLELY FOR DISCUSSION OF THIS MATERIAL. FOR QUESTIONS THERE IS A BUTTON “ASK A QUESTION ON THE SITE”.

QUESTIONS ASKED HERE WILL BE RUTHLESSLY DELETED! HOPE FOR YOUR UNDERSTANDING