The free transfer of real estate is a pleasant, but often also a very unexpected, gift.

Quite often, some time after the gift is processed, the gifted person decides to sell the apartment. This raises many questions: can the gifted property be sold to the party? When and how?

Dear readers, our articles talk about model ways of dealing with legal issues, but each case is unique.

If you want to know,How do you solve your problem -- use the form of an online consultant on the right or call on the phone at +7 (499) 577-04-19. It's quick and free!

Hide Content

Legal framework

The main legal and regulatory act regulating the transfer of real property free of charge (as a gift) is the Civil Code of the Russian Federation, in particular chapter 32, which reflects the main features of the presentation of the gift, the existing restrictions, the rights and obligations of the giver and the gifted, etc.

In addition, the sale of a gifted dwelling is also subject to chapter 30, section 7, of the Civil Code of the Russian Federation, which sets out the basic requirements to be met by the contract for the sale of real property, the procedure for registration in Rosreestrester for the transfer of ownership and other important points.

You may be interested in the following articles::

Consider whether a sale of a gifted dwelling, including a live gift, can be made, and the legislation in force does not contain any restrictions on the continued disposal of the gifted dwelling.

Thus, when the property is handed over free of charge, its new owner becomes gifted, and article 30, paragraph 1, of the Code states that the owner of the dwelling has the right to own, use and dispose of it at his discretion.It's possible to sell a gifted apartment.

In addition, the law answers the question whether a dwelling can be sold if the giver is alive, but there is one important point: it is mainly related to the right of the person who donated the dwelling to revoke the decision at any time; this can be done in the following cases:

- If the gifted person attempted the life of the giver (his relatives) or intentionally caused harm to health.

- If it was prescribed in the gift document that, in the event of the death of the gifted asset, the gift should be returned to the giver.

- In the event of a change in the property, marital status and state of health of the giver, provided that the performance of the gift contract would significantly reduce the standard of living of the giver.

Attention!The cancellation of gifts entails the return of property, which has been donated (art. 578 (5) of the Criminal Code of the Russian Federation).

When can we make a deal, how long after the gift?

Many citizens mistakenly believe that the sale of a gifted dwelling can only take place after a certain period of time (3 years, 5 years, etc.). In fact, this is not the case. Real estate obtained from a gift can be sold at any time after registration of the transfer of ownership in Rosreestre, but there is one important aspect of taxation.

As is well known, every citizen is obliged to pay a tax on the income of natural persons when selling real property (NDFL), and the law establishes a minimum period of time after which the income derived from the disposal of a dwelling is exempt from taxation (art. 217.1, para.

Article 217.1, paragraph 1, of the Code of Criminal Procedure states:For facilities received by a natural person from close relatives on the basis of a gift, the minimum duration of possession is 3 years.It follows that a citizen who owns a gifted dwelling (subject to specified conditions) is better placed to sell such property three years after its receipt.

If the property was donated by third parties (with whom there is no related relationship), then the sale should be concluded after the expiry of five years (art. 217.1, para. 4, of the NCK).

In this case, the new owner will be able to avoid payment of NPFL.

In the case of the immediate sale of the gifted dwelling (once the gift is issued), the seller will be required to pay a tax of 13 per cent of the cost of the dwelling.

How is the transaction and the conclusion of the contract?

In general, the disposal of a dwelling obtained on the basis of a gift is no different from the generally established sales procedure.The whole process consists of several steps:

- Determination of the value of real estate for sale: This can be done on its own by pre-analyzing market prices for similar housing, or by involving a specialized agency.

- Once the substantive terms of the future transaction have been determined, it is possible to start looking for a potential buyer while preparing the necessary papers.

The standard list includes documents such as:

- Identification;

- An extract from the EGRN;

- Technical passport of the apartment, etc.

A distinctive feature of the disposal of a gifted dwelling is that a gift contract will be a legal document for the abandoned dwelling.

Moreover, if the seller had a wife (husband), he would not need the wife ' s written consent to enter into such a transaction because the property in question did not amount to joint property.

- Negotiating with the buyer, agreeing on the basic terms of the future transaction, concluding a preliminary contract.

- Determination of the procedure for mutual settlement between the parties to the transaction – in most cases, a bank cell is rented to which the full cost of the dwelling is deposited, and the terms of its opening are set out in the supplementary agreement.

- Preparation and signature of the contract of sale and certification of the document by the notary (if necessary or at the wish of the parties).

- State registration of the transaction is done in Rostreister on the basis of a general declaration by both parties to the sales contract.

- The seller and the buyer then sign the transfer document, after which the apartment becomes fully owned by the new owner, and the seller can go to the bank and collect its money from the cell.

What are the nuances with regard to the percentage of housing received?

You can just as much sell a gift as an entire apartment.In this case, however, it will be necessary to comply with the requirement concerning the priority right of purchase enjoyed by the other co-owners of the dwelling, which is set out in article 250 of the Russian Civil Code. Thus, once the exact value of the transaction has been determined, the seller must notify each participant in the equity ownership in writing of its intention.

Co-owners may, in turn, do one of the following:

- To purchase the share for sale;

- write a written waiver of the right of priority purchase which they have.

According to the law, all these actions are subject to one month ' s duration, after which time the seller is entitled to sell the donated share to the outside buyer.

Help.There is no need to respect the right of priority purchase when the property in the equity property that is most donated to the site is registered.

There are sometimes situations in which the giver wishes to limit the right of the new owner to dispose of a gifted dwelling for one reason or another, such as the prohibition of the subsequent sale of a dwelling, exchange, lease, etc.

It's worth noting at the outset thatIn accordance with the legislation in force, it is not possible to issue a gift with a counter-condition.(such as a ban on the sale of donated housing).

This limitation follows from article 572, paragraph 2, paragraph 1, of the Criminal Code of the Russian Federation, which states that the contract from which the obligation of the person receiving the gift derives is not a gift; such a gift may be declared null and void by the court (art.

170 GKK of the Russian Federation).

Article 170 of the Code of Criminal Procedure: Inviolability of false and fake transactions

- By thinking of a transaction, that is, a transaction made only for the species, without the intention of creating legal effects corresponding to it, is negligible.

- A pretense transaction, i.e. a transaction that is made to cover another transaction, including a transaction under other conditions, is null and void; a transaction that the parties actually meant, taking into account the substance and content of the transaction, is subject to the rules applicable to it.

Thus, the grantor is not entitled to transfer the property with a prohibition on its further sale.

- Maintaining the right to live in an apartment or providing a similar dwelling in the event of the sale of a gift;

- specify that, in the event of the death of the gifted property, it will be necessary to return to the giver.

In conclusion, it is worth noting that, in general, the disposal of a gifted apartment does not contain fundamental differences from the ordinary sale of real property, the only major feature being taxation, as well as the lack of consent to the sale from the second spouse.

You didn't find the answer to your question?How to solve your problem, call me right now:

+7 (499) 577-04-19 (Moscow)

It's quick and free!

When you can sell an apartment after giving

As a gift to real estate, the lucky ones often wonder if they can sell a gifted apartment.

Contents of the page

The agreement for the giving of an apartment has its characteristics:

- Donation;

- The mutual consent of the parties, i.e. the giver wishes to present the apartment and the giftee is willing to accept it;

- The property of the giver is reduced, and the gifted one is increased.

The owner, whose right is registered under the law, may take property belonging to him or her at his or her discretion: to sell, gift, lease him or her.

The desire of the new owner to sell a gifted apartment, in most of the cases presented in practice, is easy to implement in the absence of old tenants.

The new owner may face a number of problems in trying to sell a gift dwelling:

- The giver, who is the sole owner of the dwelling, may enter into a gift contract without the will of the citizens residing in it.

- A gift agreement can be made not only for the entire dwelling but also for its share.

- In practice, older persons often act as a giver, with little knowledge of the law, who do not fully understand the consequences of their actions, and are confident that they will be able to live in it for the rest of their lives.

- The guardianship and guardianship authorities must agree to the sale of the apartment if the children are registered in it, but only if their parents are deprived of parental rights and are under guardianship.

- It's hard to find someone who wants to buy an apartment with foreign nationals in it.

A gift contract may specify the right of residence of the person who gave the dwelling in it, which, in the view of many lawyers, deprives him of the main ground of freeness. In the implementation of the gift contract, the legal aspects are particularly intertwined with moral aspects.

Is it possible to sell an apartment obtained from a gifted dwelling if a close person lives in it? From a legal point of view, the law suggests that an adult capable person must consider the consequences before committing such serious acts.

The contract of gift may be terminated at the initiative of the giver when he realizes that he will have no place to live after the sale of the dwelling which he has given to his beloved relative.

After a while, you can sell the apartment after the gift.

The agreement for the giving of an apartment is subject to compulsory registration in Rosreestre, after which the new owner will be required to issue property rights in accordance with the procedure established by law:

- Collect the necessary documents;

- To contact the Rostreestra office at the location of the house;

- To obtain a certificate of ownership.

The law provides that public authorities have no more than three months to issue property rights.

State registration certificates are no longer issued, the new owner will receive an extract from the Single State Real Estate Register, which is sufficient. The gifted person will benefit without any expense, so he must pay a tax on the gifted apartment. If the apartment is given to a close relative, the tax will not have to be paid.

The new owner sometimes wonders when an apartment can be sold after a gift? Under the law, it can be sold as soon as an extract from the Single House is received, but it is only necessary to do so when there is an urgent need, because the tax will have to be paid.

Documents for the sale of an apartment received under a gift contract

When selling a gifted dwelling, a standard package of documents should be assembled for this type of transaction:

- Passports or other identity documents;

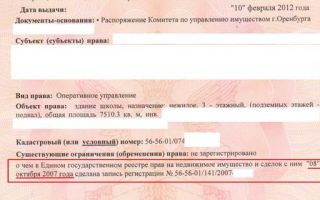

- An extract from the Single State House of Real Property Rights;

- Technical and cadastral passports;

- A certificate from the passport table stating that other persons are registered or living in the apartment;

- The consent of the guardianship authorities for sale if there are children among the prescribed persons;

- Sales contract;

- A receipt for the payment of the mistress.

The sale of a gifted dwelling does not require the consent of the husband or wife because it is not included in the common property of the spouses.

Taxes on the sale of an apartment

The sale of any real property is subject to income tax (NDFL), which is 13 per cent with residents of the Russian Federation, i.e. persons who have lived in the country for at least 183 days for 12 consecutive months and 30 per cent with non-residents.

Future promise treaty

What kind of tax will be paid to the new owner of the apartment if he plans to sell it depends on how many years he's owned it.To calculate the tax to be paid, the following nuances must be taken into account:

- When the apartment was given, the date of January 1, 2016 should be used as a reference;

- When the new owner registered his ownership of the gift before or after 1 January 2016;

- is a close relative or a stranger;

- during which period the new owner owns the apartment.

The EGRP records the arrival of a new owner at the property, starting from the date indicated in the statement, the period of ownership is counted. As from 1 January 2016, no sale tax may be paid if the property is no longer three years old but five years old.

The previous three-year period had been maintained for citizens who sold housing donated by a close relative, such as a grandmother and a grandchild. The regulations refer to the parents, husband, wife, children, brothers and sisters and are listed in the Family Code of the Russian Federation.

The daughter-in-law or brother-in-law is not a close relative and will be subject to a term of five years.

Sales up to 3 years after giving

If a gifted dwelling is to be sold by its new owner earlier than three years after registration in Rosreestre, he will have to pay a tax, regardless of the circumstances of the gift procedure.

A three-year period of tenure is mandatory until new legal acts are adopted; citizens who have other tax benefits, such as pensioners and persons with disabilities, are obliged to pay a tax when concluding a contract for the sale of real property.

If the giver is an outsider and the gifted person sells the apartment before the due date of five years, he will have to pay a double tax on giving and selling.

Local self-government bodies may adopt appropriate regulations on the reduction of tenure, i.e. in each region a period different from that of the Russian Federation may be established, which cannot be exceeded.

Since 2016, significant changes have been made in the rules for calculating the real estate tax, no matter how it was obtained, because of the widespread deliberate underestimation of the real value of the dwelling in the sales contract in order to reduce the amount of the tax.

This article describes the model ways of dealing with legal issues, but each case is individual. If you want to know how to solve your problem, please contact our consultant completely.

There are currently two types of value on the real estate market:

The price of the dwelling shall be determined by the seller in accordance with all the factors affecting the price of the dwelling:

- The foreign exchange market;

- Seasonality;

- The prestige of the area;

- The floor and a lot of other things.

The market value is unstable, subject to frequent changes and is determined approximately, depending on the current price of such housing, since no one will buy property with a clearly high value.

The inventory value is not influenced by external factors; it is defined as the cost of work and materials spent in construction, minus the wear and tear of the premises.

When the new owner, i.e. the gifted owner, applies for registration of ownership rights, the experts determine the cadastral value of real property; in most cases it is lower than the market value.

How to make a gift to the house properly

Under the new rules introduced since 2016, the calculation of the tax is based on the inventory value if the contract value is clearly understated.

These rules apply to property that was transferred to the seller ' s property since 1 January 2016.

The value of the dwelling under the sales contract, which is determined by the experts of the cadastre chamber, is compared, then chosen the most, and used in the calculation of the tax.

The inventory value of the donated premises is used as a basis for the calculation of the tax where the seller wishes to conceal the actual income and indicates the undervalued value in the contract.

The level of cadastral value may be challenged by interested persons whose property rights or duties are directly dependent on the value.

If the owner disagrees with the cadastral value, he may attempt to reduce it by resorting to a special commission or court.

- The dwelling seller pays a tax equal to 13% of the cadastral value of the dwelling multiplied by 0.7 (the so-called "ponging factor").

- The new owner, who received a gift not from the entire apartment but from a certain percentage, is obliged to pay the tax according to the general rules.

- A tax deduction of 1 million roubles is available for tax payments.

- Examples:

The apartment is a gifted apartment: can it be sold, and how long?

When you get a flat through a gift to the recipient, there's a lot of questions about,How to use the metres receivedAnd if you can sell a gifted dwelling.

The answers to your questions can be found in this article, which reveals the fineness of the order of the gifted dwelling.

Dear readers, our articles talk about model ways of dealing with legal issues, but each case is unique.

If you want to know,How do you solve your problem -- go online in the right or call at +7 (499) 938-44-61. It's quick and free!

Show Content

The benefits and disadvantages of giving a place of residence, and what is best, whether a gift or a will, can be learned from our articles. Read also how the gifted dwelling is shared after a divorce.

Opportunity

- In accordance with article 572 of the Criminal Code of the Russian Federation, the term " gift " refers to the transfer of any property to another person.free of charge.

- Once a person agrees to accept a gifted dwelling, the contract will be negotiated and signed, everything is imposed on the recipient.rights and obligationsOn the order of the apartment.

- A certificate of ownership of the apartment and a sale of the metres obtained can be obtained only after the documents have been submitted to the judicial institution.

- As soon asThe witness will be in your hands.you can apply to the real estate agency or sell part or all of the housing yourself.

- Make the deal go away without a problem.the following conditions should be met:

- To the BTI to issue an application for cadastral statements;

- In the case of an application to the HEC to request an extract from the residence of the persons registered therein;

- Once the sale has been concluded, an act of reception and transfer of the dwelling must also be issued;

- The next owner then applies to the Fed, where he registers his rights to the metres obtained.

You can only get accommodation as a gift from people who are not your pupils, students, patients.UnlegitimateThese are transactions in which property rights are transferred from minors and disabled citizens.

Some people ask, "Can I sell the apartment I've given you right away or not? If not, how long can it be?"

Read about the procedure for giving housing and the procedure for State registration of the gift contract on our website.

In what time?

Once the gift is given, it is not possible to sell the dwelling becauseOther formalities still pendingIt's a deal that's been made.

The recipient needs to process the new property, pay a tax of 13 per cent, and then start looking for the buyer.

The tax does not have to be paid to the close relatives of the giver.

Treaty of giving alsohas no legal effectIf it is not supported by a certificate of ownership, it is not possible to sell a dwelling obtained under a contract of gift with only a contract in hand.

- This is due to the fact that the supervisory authorities require new accommodation metres to be reportedto avoid evictionfrom the living quarters of people in the category of vulnerable persons.

- Receive a certificate of ownership by providingMandatory package of documentsIn the Fed.

- The list of documents is as follows:

- Once these documents have been collected, payment will also be required.State dutiesand provide a receipt for the operation.

- Additional collection will be required in situations where minors and disabled citizens are registered on the premises.

- Once all the mandatory legal issues have been resolved, it is possible to start making arrangements for the sale of a gifted apartment.

You can also read about fraud and other private cases in the provision of housing, such as mortgages or the right to live for life on our website.

If the Giver Is Living

Is it possible to sell a gifted dwelling if the giver is alive?There's no limit whatsoever.

- It is possible to sell, to be made available on a fee- or non-reimbursable basis, and to inherit the dwelling that has been received after the issuance of the gift contract and the subsequent receipt of the certificate of ownership.

- The former owner may not prevent or prohibit the disposal of the already owned metres.

- It is to be understood that after signing the gift certificate and delivering the property certificate to another person,the old tenant may be evictedFrom a previous home owned by him.

- It's virtually impossible to argue the gift.

- If there is any difficulty in conducting a sales transaction, a specialist may be consulted.

- The lawyer can not only guide you, but also write you up.Action planIn a specific situation.

If you have found a mistake, please select a piece of the text and click Ctrl+Enter.

You didn't find the answer to your question?How to solve your problem, call me right now:

+7 (499) 938-44-61 (Moscow)

+7 (812) 425-63-42 (St. Petersburg)

It's quick and free!

Tax on gifted apartment after gift and sale in 2023

Real estate transactions are generally taxed, not only on sales, but also on gifts.

It is a gift from the law that significant benefits have been granted to some NPFL citizens, as well as in the subsequent tax on the sale of property.

Today, we will examine in more detail the tax on the gifted dwelling, first immediately after the gift deal itself, and then when the gifted dwelling is sold.

Tax after giving

The transformation of the apartment involves the creation of income on the part of the gifted person; he does not spend his own money as a gift, he receives the expensive property – real estate – in the eyes of the law; he has a taxable income from which the gifted person must calculate and pay the tax on his own.

The income tax is calculated at 13% according to the rules that we will elaborate on below.

The tax on the gifted dwelling shall be exempt from the close relatives of the giver; if the transaction is concluded between natural persons who belong to the circle of close relatives, no contribution shall be paid for the gifted dwelling; nor shall the tax declaration be paid.

List of people who, by law, do not pay tax contributions when receiving an apartment as a gift:

- The spouses are among themselves;

- Parents and children (e.g. giving a son or daughter);

- Adoptions and adoptions;

- Grandparents and grandchildren;

- Sisters and brothers are to each other, both relatives and mothers are to be regarded as having the same father/mother.

The rest of the gifted have to pay taxes from the gifted dwelling.

The giver never pays the NPFL after the gift, no matter who he gave it to, the NPFL doesn't have to pay because he doesn't have any income.

How to Calculate and Reduce

In order to calculate the tax payment under the gift agreement, you have to take the tax base and multiply it by the tax rate; the amount received is the amount to be transferred to the budget; the automatic payment is not calculated; the gifted person has to do everything himself.

Data for calculation:

- The tax base takes the value specified in the agreement for the donation of the dwelling. If it is not available, the inventory value of the dwelling is taken into account. If the inventory value is not determined, the inventory value can be taken from the BTI certificate.

- The tax rate is 13%. You can't reduce the rate, it's the same for all citizens.

An example of calculation.Victor Vasiliev received an apartment under a gift agreement from his uncle. Victor is not a close relative under the law, so he needs to calculate and pay the budget of the NPFL. The contract states the cost of the apartment at 1,500,000 rubles. By 13%, Victor received: 1,500,000 * 0.13 = 195,000 rubles.

How to Reduce

It is not possible to reduce NPFL directly – tax deductions and benefits are not included – nor is it possible to reduce the tax base by 1 million, as the vendors at the OST do.

The following methods are almost legal: they are not prohibited, nor are they permitted:

- There is a risk that the NPFL will charge the NPFL on the basis of market prices, plus a fine.

- Transfer the apartment through a relative. There will be a chain of agreements for the giving of an apartment. Theoretically, such a chain can be cancelled through a court of law if the purpose of tax avoidance is identified.

- Instead of giving a OST for an amount not subject to income, the risk is exactly the same as in the previous paragraph.

ATTENTION: All fictional treaties run the risk of being quashed through court. Read a great deal of material on the subject of the challenge by reference to this reference and here by the statute of limitations.

Procedure and list of documents

In order to pay the tax, the following documents must be collected:

- A gift to the apartment;

- An extract from the EGRN on the registration of property rights;

- 3-NDFL declaration - upload a blank form and sample for 2018 reporting;

- Owner ' s passport (don ' t need the donor ' s passport).

The declaration is filled in in the same way as sales. Read our previous material more about it.

The next step is to report to the FINS at the place of the taxpayer ' s residence; during the reception, the inspector will check the completeness and help identify the gross errors.

The time limit in this case cannot be broken, otherwise fines can be obtained:

- Complete and file the declaration by 30 April;

- Payments received until 15 July.

The fastest way to file the paperwork is through the taxpayer's personal office online.

From her husband to her wife

The question of whether gifts are taxed between spouses is clearly not answered by the law; neither the wife nor the husband need in this case file a tax report and pay a contribution to the budget from a gifted apartment.

And remember that it is only in respect of personal property that a marriage may be given between the spouses; for example, if the dwelling is acquired in marriage and the share of the husband is not given in it, then give half of it in order that the wife may become a full-time owner; and if you have a marriage contract or a share agreement, then divorce is not necessary.

From my aunt to my nephew.

In order to know if you have to pay a tax after giving in a given case, you have to look into the next of kin, your aunts/husbands and nephews, your mother-in-law and daughter-in-law, your mother-in-law and your brother-in-law, and your cousins and cousins are not included in the list, which means that the tax for the gifted apartment is compulsory.

In order to avoid a tax, you can pass the house through a relative, for example, so that your nephew doesn't pay for the apartment that his aunt gave him, you have to conclude two gifts:

- Between an aunt and a sister/brother who belongs to a nephew.

- Between the mother/father and the son, the nephew will end up with an apartment that the NPFL does not have to pay for.

Not a relative.

Whether a tax should be paid when giving a non - relative is certainly true: outsiders are not a close relative and are not exempt from paying the NPFL from the gifted dwelling.

The tax can be reduced by reducing the price of an apartment specified in the gift, and before making such a decision it is necessary to weigh all the pros and cons.

The risk of subsequent tax collection is higher, the greater the difference between market (cadastral) and the declared price of the gifted property.

Tax on the sale of a gift dwelling

If the owner of the gifted dwelling decided to sell it in the future, the NPFL will also pay after such a transaction. In this case, the seller, the former owner of the dwelling, is the one to whom it was given.

Thus, a gifted apartment may be taxed twice:

- For the first time upon receipt of a gift, if the gifted person is not exempted from NPFL;

- For the second time in the sale of a dwelling, if the deduction cannot be applied or the limitation period for the ownership of the dwelling has not expired.

Taxes on the sale of gifted housing can be avoided if the real estate has been used for a long time or if the income is covered by a tax deduction.

Who Should Pay

The tax is calculated and paid by the housing seller, the former owner of the pre-gifted apartment; it is not automatically defined, so all calculations must be done on their own.

When selling a gifted apartment, it doesn't matter the degree of relationship of the parties to the transaction, as in giving, even if the dwelling is handed over to the child, the tax is still due.

Calculation procedure

The general formula for calculating NPFL when selling a gifted apartment is as follows:

(D - NV) * 13% = NPFL where

D is the sum of the income from the sale. It is stated in the contract itself as the price of the gifted real estate and is supported by payment documents – bank statements, receipts.

NV is a tax deduction. For the sale of a gifted dwelling, only one deduction can be made, fixed at 1 million roubles. The tax deduction is not applicable because the seller has not incurred any expenditure on the purchase of the dwelling at the time.

13% is the NPFL rate. To be easy to calculate, you can multiply by 0.13 is arithmetically correct.

NPFL is the total amount of income from the sale of gifted real estate to be paid to the budget.

How to Avoid or Reduce

It is possible to avoid the payment of the tax entirely if the property after the gift was owned for longer than a certain period, which was previously 3 years for all owners, but since 2016 there have been major changes in NCs.

In order to determine the duration of possession, an extract from the EGRN or a certificate of ownership will be required, and a date for registration of the right must be found on the document.

In the Release:

On the Witness:

From that date, the period of tenure to be released from NPFL is calculated as follows:

- If the date of registration is 3 years up to and including 31 December 2015, regardless of who was the giver;

- The date of registration was January 1, 2016 and later, and the donor was a close relative for three years.

- The date of registration was 1 January 2016 and later, and the donor was not a close relative for five years.

If more than three (5) years have passed between giving and selling, the tax does not have to be paid, nor does it require a declaration.

If the duration of the ownership does not completely avoid the tax, it can be reduced by a fixed deduction of 1,000,000 roubles; the amount of the deduction is deducted from the price of the dwelling and the difference is multiplied by 13%; the amount received is transferred to the budget.

In 2018, she decided to sell it for 1,500,000 rubles. It wasn't a tax exemption for two years. To reduce the tax burden, Ludmila decided to apply a fixed deduction. The tax calculation is as follows: (1,500,000 - 1,000,000) * 0.13 = 500,000 * 0.13 = 65,000 rubles.

Read more about the deduction on the sale of the dwelling in the following article.

A step-by-step payment instruction

In order to pay the tax, it is necessary to:

- Collect documents: OST, payment documents to the contract.

- Fill in the 3-NPFL declaration. Reference to the filling-in procedure, the declaration form and the sample can be found above in the section on gifts.

- A package of documents will be delivered in person to the FINS on the place of residence or via online services: the personal office of the taxpayer or the State Service, which is required by 30 April of the year following the sale.

- After filing, until 15 July, the amount of the tax to the budget will be paid.

IMPORTANT! If the amount of the tax deduction in calculating the amount of the tax deduction exceeded the value of the sale under the LCD, it is still necessary to file a declaration. For example, if the dwelling is sold for 900,000 rubles, the amount of the tax will be less than zero – there is no need to pay the budget; but the tax should be notified by filling in 3 NPFLs.

What happens if you don't pay the tax?

Penalties are imposed for violation of the Tax Code, and the tax payer may be fined not only for non-payment of the tax but also for failure to file a declaration:

- If the application was not transferred to the tax office by 30.04 – a 5 per cent fine from the NPFL received for each month of delay, but not more than 30 per cent.

- If they didn't file, and the tax didn't pay – a fine of 20% of the amount plus the penalty.

- If the application has been filed, but the tax has not been paid – the tax penalties 1/300 of the Russian Central Bank's key rate for each day missed.

In each of the situations described, the solution is to remedy the violation as soon as possible (3 NPFL or tax) and to request the inspection to reduce the amount of the fine to a minimum; if the delay is small, the tax will be favourable.

The tax on the gifted dwelling is paid for both the gift dwelling and its subsequent sale.

In the first case, a close relationship with the giver will help to avoid the tax or significantly reduce it, and in the second case, the length of possession or the deduction of property.

We need to look at the tax issue before we can get the paperwork right in advance, and we should not forget the new form of the 3-NPFL, which we can download on our portal.

If you have any questions on the subject of the article, ask our lawyer on-line chat.

- The portal team's gonna be grateful for the buzz and the repost!

- Read further: A review of the current law on the giving of an apartment.

When you can sell an apartment after giving

You can become the owner of real estate in a number of ways: you can buy a dwelling, you can inherit it, you can buy it, you can buy it, you can buy it, you can buy it, you can buy it, you can buy it, you can buy it, you can buy it, you can buy it, you can buy it, you can buy it, you can buy it, you can buy a house, an apartment or a share is a fairly common type of transaction, and if you don't plan to use it, you can ask when you can sell it after giving it?

What does the concept of "real property creation" mean?

The Civil Code of the Russian Federation, in particular article 572, allows a person to hand over his or her own property, and it is a free-of-charge disposal of a property or other property to another person.

If you are under 18 years of age, you must have the consent of your parents and the guardianship and guardianship authorities.

The order of the transaction is as follows:

- Preparation of a package;

- Recourse to Rosreister with a gift;

- Retrieving from the register.

In addition to the gift contract, the following should be provided in Rosreister:

- Cadastral passport of real estate;

- Certificate of registration of property;

- A bank receipt for the payment of the mistress.

A person who gives property to a close relative does not pay a tax to the State.

In what cases is the gift contract null and void?

A gift transaction may be challenged in the event of:

- Confessions by the giver that he is incompetent;

- If the person who gave the apartment did not report on their actions at the time of signing the contract.

If the gift has been challenged in court, all transactions with the real estate object shall also be cancelled, and the number of such transactions shall not matter; once the judge has made a decision declaring the gift contract null and void, the gifted person shall be obliged to return the property to the previous owner.

If the apartment was sold to another person, the seller must compensate the buyer and pay the full amount of the money.

Conditions for the sale of the gifted dwelling

Russian legislation does not restrict a person ' s right to sell a gifted dwelling; immediately upon receipt of a certificate of ownership, he has the right to sell real property; Darenia means the full transfer of property rights from one person to another; therefore, the giver ' s permission to sell is not required.

There are cases in which a close relative is given a share in an apartment or house, and there is a right between the giver and the gifted person to share the property.

If a person wants to sell part of the property, he must respect the right to buy, which means that the citizen must first offer his share to the second owner.

After a written refusal to buy, the apartment can be sold to any person.

In the past decade, the tax law had changed several times, and there had been earlier regulations whereby the owner paid the State a tax of 13 per cent of the value of the gifted apartment, and the value of the real property was stated in the contract concluded between the buyer and the seller.

In 2016, the Tax Code was amended and now citizens who own property between 3 and 5 years of age do not pay the tax when selling it; for people who have received an apartment from close relatives, the previous time limit of 3 years from the date of receipt of the property title document has been maintained; in addition, the following categories of citizens do not pay:

- The heirs of the property of close relatives;

- People who have privatized municipal housing;

- Persons who have received real estate under a contract of rent (life support for pensioners or disabled persons).

In order not to pay the tax or wait until the end of the five-year period:

- Present documents confirming the relationship between the giver of the dwelling and the gifted person;

- Provide a gift, signed in early 2016 and later.

In all other cases, a citizen will have to pay 13 per cent of the tax on the income of natural persons from the value of the sale of the dwelling if he owns it for less than five years; if a person sells a share of the dwelling, he is obliged to pay the NPFL regardless of the time of ownership.

Many people try to deceive the tax authorities and deliberately understate the value of the dwelling in a sales contract, the FNS has the right to apply to the BTI for a certificate of the real price of the real property, and the tax on the income derived from the sale of the dwelling will be calculated on the basis of the value specified in the document.

The tax charge for the sale of a gifted dwelling may be reduced under the following conditions:

- The new owner of the dwelling, selling a gifted apartment, received a tax deduction; according to the legislation in force, every citizen of the Russian Federation is entitled to a tax deduction of up to 1 million roubles; compensation is only available once;

- A person who has been given an apartment after it has been sold shall acquire a new dwelling within one year; the price of the property purchased shall be less than the amount obtained from the sale of the old dwelling, in which case the tax shall be withheld from the difference.

If the new apartment is more expensive than the real estate sold, the citizen does not pay the NPFL.

The payment of a contribution for the income of individuals will require:

- Prepare documents and apply to the territorial tax authority;

- Fill out the form on form 3-NDFL and hand it over to the IFNA staff member.

The package of documents includes::

- A copy of the passport;

- A copy of the certificate of right to an apartment;

- Taxpayer's income certificate.

Every year on 30 April, citizens are required to account for the income received; prior to that date, they must present the documents to the FINS and pay the NPFL.

How's the gifted real estate deal going?

The sale of donated real property takes place in a certain order; each stage must be strictly observed, otherwise the transaction can be declared invalid; the duration of the ownership of the dwelling does not affect the sequence of actions.

To sell a gifted dwelling, the owner must:

- Prepare a package of documents necessary for the sale of the dwelling;

- To enter into a contract with the buyer for the sale and purchase of housing;

- Sign the document and make the calculation: the seller gives the buyer the real estate documents and the seller, in turn, transfers the money for the apartment to the account;

- Go to Rosreestra territorial office and officially confirm the deal.

After a few days of waiting, the buyer will receive an extract from the Register Office and a certificate of ownership of the dwelling.

- Contract between buyer and seller;

- Signed certificate of transfer and receipt of the dwelling;

- Document on State registration of the gift treaty.

The following documents will be required for the sale of the dwelling:

- Cadastral passport and technical documentation;

- An extract from the home book containing information on persons registered in the apartment;

- Certificate of non-debt for utilities;

- Conclusion of the independent expert on housing costs;

- Authorization of the spouse to sell real estate;

- The authorization of the guardianship authorities to carry out the transaction if minor children are registered in the apartment;

- A housing gift;

- The seller's civil passport.

The Registry Office is provided with the same documents as for the sale of real property, as follows:

- Sales contract;

- A document from the bank confirming the transfer of money;

- A bill of payment of State duty.

Sale of donated shares in the apartment

As mentioned earlier, when selling a share of an apartment, a person must offer it to other owners, and the tenants may consider buying a part of the property within one month.

- If the owner has made a positive decision, the sale of the share in the dwelling is a transaction;

- If the answer is no, the person has the right to sell part of the property to outsiders.

Sellers often violate the priority right to purchase real property, and if such a situation arises, other owners may challenge the transaction by applying to the court within three months.

A person has the right to make any transactions with the gifted property as soon as a certificate of ownership has been obtained; when a gifted real estate is sold, the owner is obliged to pay the State a tax on the income of the natural persons.

There is a time frame within which a contribution may not be paid:

- 3 years of ownership of property for close relatives who received it as a gift;

- Five years of ownership of an apartment for the rest of the population.

The seller may take advantage of the property deductions and reduce the tax burden. After the sale of the gifted goods, the person must apply to the Registry Office and obtain the documents necessary to pay the NPFL.

Recent developments

No significant legislative changes were envisaged in 2023.

Our experts are tracking all legislative changes to provide you with reliable information.