The sale of a share in a privatized apartment is carried out according to the general rule of termination of joint ownership of property.

If all apartment owners reach a consensus, there will be no problems, and the single premises can be sold. But what if the cohabitants do not intend to move out of the apartment and are opposed to the sale of part of the property? How to avoid possible problems when alienating your share?

Sale of a privatized apartment

One of the advantages of privatizing real estate is obtaining the right to dispose of it. This power allows you to decide the legal fate of the premises, alienate it, transferring ownership to other persons, or otherwise dispose of the apartment.

Is it possible to sell a share in a non-privatized apartment? The legislation gives an unequivocal and decisive answer to this question: it is impossible. Before selling property, it is necessary to obtain the right to dispose of it, having decided on the shares. When the property is privatized, you can alienate the apartment or part of it without violating the rights of the cohabitants.

The transfer of ownership of housing from the state to private individuals who lived in the apartment and participated in privatization involves classifying such real estate as common property. The supporting document is the certificate of registration of property in Rosreestr.

The owners can divide the premises by agreement: in equal shares, without defining the parts, or in any other proportions.

Residents can dispose of their shares at their own discretion, but, unlike the sole ownership regime, there are the following restrictions:

- transactions, the subject of which is an apartment, can be carried out by the owners only after making a general decision (this applies to major repairs, sale, and exchange);

- the refusal of one of the owners automatically prohibits the others from entering into an agreement to change the legal or actual fate of the property;

- in case of alienation of their part, the first applicants for its purchase should be the participants in shared ownership.

If all owners want to sell an apartment, it’s easy to do it together.

The action plan is as follows:

- obtaining notarized permission from other owners to carry out the transaction;

- searching for a buyer and drawing up a contract in the prescribed manner;

- entry of a new owner into the Real Estate Register;

- division of money depending on equity participation.

This is the simplest option. But what to do when one of the owners does not want to own the apartment anymore, and the others do not agree to sell it? This situation is somewhat more complicated, but there are still mechanisms when one of the participants can sell his share.

The sale of real estate is allowed only if it is possible to dispose of it. To do this, the apartment must be privatized, then legal transactions can be carried out.

Selling a share in an apartment

Each co-owner has the right to terminate joint ownership and demand his share from other owners. Thus, the regime of common ownership for others does not end.

Owners of jointly owned property must first decide on the shares that are due to each of them. The division is carried out on the basis of an agreement, as well as in court. A co-owner loses rights to real estate when his share becomes the property of another entity.

The legislation provides for the right of co-owners to have a preemptive redemption of the share of another participant who decides to sell it.

How to sell a share in a privatized apartment?

- A person wishing to sell his part of the property must notify the remaining owners in writing. The price and other important terms should be the same as for other buyers.

- Within a month, the notified co-owners must decide on the possibility of purchasing part of the property.

- If there are no people willing to purchase it, then the seller can begin searching for a buyer for his part of the apartment. There is no need to wait a month if you have received written refusals to purchase part of the apartment from all owners.

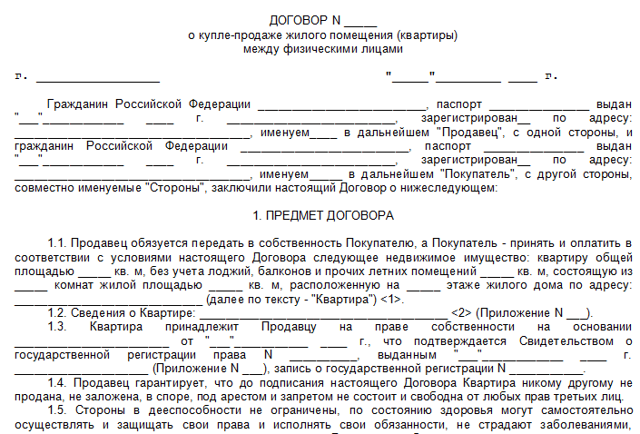

- An agreement is concluded to sell a share of the apartment.

The notification condition is also relevant for concluding transactions for the exchange of property.

If the seller has violated the requirement to notify co-owners, a statement of claim may be filed against him within three months, complaining that the rights of other owners have been violated. In this case, the plaintiff acquires a preemptive right to conclude a purchase and sale transaction with him. It is prohibited to give someone else the right of first refusal to purchase.

To sell part of the apartment you will need the following package of documentation:

- title documents;

- technical information;

- purchase and sale agreement;

- data from the house register;

- agreements on the definition of parts;

- a document confirming the absence of debts for the provided utilities;

- notification letters from shareholders and their responses.

Registration of the new owner's property rights occurs on the basis of:

- certificates and extracts about residents who remain owners of the apartment;

- cadastral value of living space;

- applications from the new owner to register it;

- a receipt confirming payment of the state fee.

How to sell your share to prevent possible claims? Everything needs to be carefully documented. Save notifications of delivery of letters, as well as responses to them.

It is recommended that the refusals of other persons be certified by a notary.

Difficulties may arise if one of the co-owners is a minor. All transactions with an apartment in this situation must be coordinated with the trustee or guardianship authorities. Otherwise, there is a risk that the transaction will be declared illegal.

The rule of agreement with the authorities does not apply in the event of an increase in the share of a minor.

If you plan to sell an apartment where there are children or if you want to sell a child’s share, this can only be done with the consent of the board of trustees.

In this case, there should be the following guarantees:

- the child will have an equal or greater share of the real estate in the new home;

- or the minor will be allocated money for his share of the apartment and put on deposit until he reaches 18 years of age.

Selling part of the property in any case is a rather complicated process, since it requires not only agreement with the co-owners, but also in some situations, permission from the authorities is required to carry out the transaction.

Alienation of a share without the consent of the co-owners

What to do in a situation where you don’t want to lose a buyer, but you can’t comply with legal requirements?

- One option is a gift agreement, since this transaction is not subject to the condition of warning the remaining co-owners.

- Transfer of part of the apartment to pay off the debt.

- Forced allocation of shares.

All of the above methods are completely legal, but they must be carried out in strict compliance with the requirements for the transaction. Co-owners of an apartment can go to court to challenge its legitimacy.

Donation

A gift agreement is a transaction, the result of which is a gratuitous transfer of ownership from the donor to the donee. The subjects of such an agreement can be both individuals and legal entities.

The main key conditions for donating part of the real estate are:

- full legal capacity of the subjects (the donee may be a minor and partially or completely incapacitated, in which case the participation of a legal representative of such subject is necessary);

- written form;

- an indication in the agreement of all persons living in the apartment and those who can lay claim to it;

- the size of the area passing to the new owner;

- terms of transfer;

- If the donor is married, the notarized consent of the spouse is required.

When making a transaction, when not the entire apartment is donated, but only part of it, you need to contact a notary. He acts as a guarantor that the contract was concluded in the absence of coercion, voluntarily and on the terms of the gratuitous transfer of property.

The presence of a notary is also necessary if all shared owners of the property donate their part, as a result of which the beneficiary will receive the entire property.

Donation of real estate is subject to income tax at the generally accepted rate - 13% of the value of the property. The donor's immediate relatives to whom the property is transferred are exempt from paying tax. Such relatives are children, including adopted ones, the spouse of the donor and parents.

The contract often lowers the price of the apartment in order to reduce tax. This is not recommended, since in a controversial situation it will be very difficult to prove anything.

There is a slightly different option for transferring property. You can donate only part of your share. Next, the buyer becomes one of the co-owners and has the same pre-emptive right to purchase as other residents of the apartment. The rest of the share is sold according to the usual procedure.

A gift agreement is a legal instrument in case of reluctance to sell your part to co-owners. It is necessary to formalize it correctly and then there will be no claims against the donor.

Transfer of property to pay off debt

Ownership of a share ceases when one of the co-owners owes a debt to another person. The creditor has the right to demand termination of the debtor's rights to the property. In this case, the creditor becomes the owner of a share of the property.

In addition, if it is impossible to allocate part of the property or other co-owners refuse to provide it to the creditor, they have the right to redeem the debtor’s property to pay off the debt.

By decision of the judicial authority, a share of the property can be sold through a public auction.

How to properly design this diagram?

- The owner of the share borrows a certain amount from the person who agrees to buy the apartment. An agreement is drawn up indicating that the money was taken as collateral for the apartment.

- The debt is not returned on time.

- The lender demands his funds back and receives part of the apartment as repayment.

This is a legal way to transfer property to another person. Such an entity may also be a banking authority acting as a pledge holder. To do this, an agreement is concluded to transfer part of the apartment to a mortgage.

The bank demands money after the deadline for repayment of the debt.

The apartment is transferred to the mortgagee even if it is the person’s only place of residence, provided that the amount of debt is more than five percent of the value of the mortgaged housing and the period of delay exceeds three months.

The scheme of transferring property as collateral is quite common and profitable, although it does require some costs for obtaining a mortgage.

Forced allocation

Another legal option for alienating one’s share is the owner’s demand for the allocation of his part. This right is enshrined in the Civil Code. The owner of the share can exercise it by going to court.

Since an apartment is an indivisible property, the applicant is usually allocated a number of meters in proportion to its share in the common property. After determining the area owned by the plaintiff, he has the right to recover money from the co-owners for the redemption of his share.

In a situation where part of the property is insignificant and the owner has no interest in it, the court, by its act, can, without the consent of the owner, force him to give the property to the cohabitants. Then he also claims monetary compensation.

Thus, forced allocation can be carried out either with or without the consent of the owner.

The procedure is complicated by the following factors:

- it is necessary to determine the cadastral value of housing;

- the procedure for compensation and the timing of its payment depend only on the good faith of the co-owners.

Forced allocation is the right of the owner of part of the apartment. To do this, he must go to court and demand monetary compensation for his share.

How to sell a share in a privatized apartment?

The question of how to sell a share in a privatized apartment is relevant for any citizen who participated in privatization together with family members. How to sell a share in a privatized apartment without infringing on the interests of the co-owners?

Sale of shares in a privatized apartment according to the law

By law, each of the co-owners has the right to dispose of their share as they wish. However there are some restrictions:

- anything can be done with the apartment (sell, donate, exchange, undergo major repairs) only by all the owners by a common decision: if one does not agree, neither the transaction nor any other order is possible;

- When selling one of the shares, the co-owners must be first on the list of candidates for purchase.

Thus, if one of the owners is thinking about how to sell a share in a privatized apartment , he must first notify the other co-owners of his desire and inform them at what price he is selling. Only after this, if they are not going to buy, does he have the right to enter into an agreement with outsiders.

Thus, the sale of a share should look like this:

- The owner-seller determines for himself at what price he is going to part with his property, and finds a buyer who agrees to this price.

- Before concluding an agreement with the buyer, he notifies the other co-owners of the apartment about the planned sale. The notification must only be in writing - even if everyone lives in the same apartment and sees each other in person every day.

- The owners decide whether they want to buy out the share themselves. The law sets a strict deadline for their reflection - no more than a month.

- If the co-owners do not want the share to go to a stranger, they are obliged to buy it back at the price and on the terms on which the seller was going to enter into an agreement with a buyer who is not one of the co-owners.

- If a refusal is received or none of the co-owners decide to buy out the share within a month, the seller has the right to enter into an agreement with an outsider.

How to sell a share in a privatized apartment and not make a mistake?

The sale of a share itself is concluded according to the same rules as any other real estate transaction: in writing through Rosreestr with payment of state duty, etc. However, there are some nuances that can significantly ruin the life of the seller. Let's figure out how to avoid them.

The first of the pitfalls may be the case when the seller has already concluded an agreement, but one of the co-owners stated that he was not notified that the transaction was planned and, accordingly, did not give his consent. Within 3 months, he can file a lawsuit and demand that the court rule on the invalidity of the contract.

There is only one way to counteract this - to carefully document everything that is done. Notification of the planned sale is only by registered mail with a list of the attachments.

If the notification is made in person, prepare a document with the terms of sale in 2 copies and require the co-owner to leave a signature on one. The waiver of the right to purchase is best certified by a notary.

With this option, no future claims will help the litigant.

The rule of warning and advantage does not apply only to gifts. However, it should be taken into account that an attempt to use a gift to disguise a sale (the owner of a share gives it to a stranger, and he, in turn, then gives him money, since this is not prohibited) may not end exactly as the parties expect.

One of the co-owners of the apartment may try through the court to recognize such a deal as sham - and he will have every chance of winning the case. According to the law, the rules for a sham transaction are those established for the one that the parties tried to hide.

In this case, it will be a purchase and sale - without the consent of the co-owners or their refusal to buy it, it will be invalid.

The second option is more likely to refer to the tricks of the seller. Some, in order to avoid hassle with a warning, draw up an exchange instead of a sales contract.

It is categorically not recommended to do this: the rules regarding advantages will apply to me.

This is due to the fact that the legislator proceeded from the desire to either preserve the circle of co-owners, or to help ensure that their circle gradually narrows. Therefore, even in the case of exchange, the stranger must first obtain the consent of the existing owners.

The third “cunning” scheme looks almost legal:

- The owner of the share borrows money, indicating his share as collateral.

- He does not return the money on time.

- The lender demands the transfer of the pledged share into his ownership - according to the law, his demand is satisfied.

The chances of co-owners challenging such an agreement are somewhat less than, for example, in the case of barter: the law does not prohibit borrowing money, and a share in an apartment can be indicated as collateral without the consent of the other owners. However, the rules regarding a sham transaction can also be applied here, with the same consequences as mentioned above.

Sale through forced allocation of shares

In the event that there are disputes around the apartment and no one wants to give up, which is why there is practically no chance of selling the share through the right of first refusal, the owner, who wants to receive money in exchange for the share, has the right to demand its allocation. The law stipulates that the allocation is made in kind - that is, the allocated person must receive clearly defined square meters in the apartment.

However, since it is almost always impossible to allocate part of a city privatized apartment into a separate isolated room, the allocated one has the right to demand that the co-owners take his share and pay him compensation. The amount of compensation will be determined by the court. This method is convenient in that it does not require the consent of all co-owners, but it has 2 unavoidable difficulties:

- An independent assessment of the apartment by an expert will be required.

- Receiving money will take a long time, because collecting a debt from a person who does not want to pay is a very difficult procedure.

Sale of a share in an apartment if the co-owner is a minor

Difficulties may also arise if among the co-owners there is a child under 18 years of age. In this case, any transactions affecting the interests of a minor require additional approval from the local guardianship authority. Without this, the sale of a share can easily be considered illegal.

This rule does not apply only to those cases where, as a result of the planned transaction, the share attributable to the child increases. However, if the parents or persons replacing them plan to sell the child’s share in the apartment, the consent of the authorized body is required. It can only be obtained if there are guarantees that:

- the child will acquire a greater or equal share in the new apartment;

- or the funds due to the child for the share will be placed on a deposit, which only he himself can dispose of after reaching the age of majority.

Selling an apartment with shares

A pressing question for many owners is how to sell real estate divided into shares? The most common problem is the lack of certain shares in kind in privatized housing, which leads to disputes between owners and difficulties in formalizing real estate transactions.

You can get an answer from our lawyers during a free consultation on the website or by phone. General points regarding the procedure for preparing title documents and selling shares in an apartment are disclosed in the article.

Differences between common shared and joint ownership

The concept of shared ownership implies ownership of an apartment/house in equal or unequal shares, where each party has the right to dispose of its part - donate, sell and inherit.

Joint ownership does not establish clear shares for each owner, which implies the use of property on an equal basis. In this case, the premises can be disposed of only with the permission of the remaining shareholders with the allocation of their share.

In 2018, the law underwent a number of changes, which are primarily aimed at mandatory notarization of a transaction with shared sale of real estate.

Allocation of shares for sale

The legal sale of an apartment with shared participation requires the mandatory allocation of a share with its subsequent assessment. The procedure for allocating a share in kind occurs in 2 ways:

- by agreement of the parties - each owner has a specific room/rooms;

- in court - a separate room or part of the property - ½, ⅓, etc.

With the percentage of parts of the premises in shares, the sale of the apartment occurs in the same order, but not by indicating a specific premises, but by area. For example, a 1-room apartment of 40 sq.m. divided between 2 shareholders in equal shares - 20 sq.m. for everyone.

For further assignment of the right to real estate, any of the owners has the opportunity to allocate their share for subsequent disposal.

The co-owners retain the right of first refusal (PP) at the same rate that will be offered to other buyers.

If the shareholders refuse the offer, the owner can put the property (share) on the market, and if there are several buyers, the right to choose a bidder remains with the seller.

If the PP is violated (price change, lack of awareness), then the owner has the right to file a lawsuit within 3 months to invalidate the purchase/sale.

Note!

This right applies only to compensated transactions with property in favor of third parties. When a share is sold to one of the co-owners, the standard loses its force, and the buyer is determined by the seller.

Procedure for selling a share in an apartment

Registration of the sale of shares in an apartment, as well as the transaction of purchase/sale of real estate with shared participation, requires compliance with the law. According to the current standards of the Federal Law of the Russian Federation, the owner must follow the following scheme:

- notification of all shareholders about the sale of their part of the property - a letter with notification and indicating the amount or an announcement on the Rosreestr website;

- 30 days from the date of sending the written notice are allotted for the opponent’s response;

- if the offer is accepted by the co-owners of the living space, the purchase and sale transaction is executed on the primary terms (the amount in the letter/advertisement cannot be changed);

- It is possible to conclude a purchase and sale agreement for a part of an apartment with third parties only if the shareholders refuse.

The transfer of a share to one of the owners is identical to the general scheme with registration of property in Rosreestr, payment of tax, state duty (in 2018 - 2 thousand rubles).

How to draw up a contract?

In order not to break the law and quickly complete a transaction, a number of points should be observed:

- agreement for the purchase and sale of an apartment by shares, which includes information about each party, a description of the living space, cost, rights of third parties (co-owners);

- the document is certified by a notary;

- transfer deed – a document confirming the transfer of ownership to a new owner;

- registration of the right to a share of real estate in Rosreestr or MFC with payment of taxes and duties.

Documents for the sale of shares in 2018

The purchase of an apartment with shared participation in 2018 is formalized by Rosreestr. To register the right to part of the living space, the buyer must prepare a package of documents:

- an application in the form - from the owner, an application for changing ownership rights - from other co-owners, in the case of purchasing a share in equal proportions;

- an agreement on allotment in kind or a court decision;

- identification documents of each party to the transaction;

- title documents of the parties;

- if the co-owner is a child – consent of the guardianship authorities;

- power of attorney in the absence of one of the participants;

- passport for the apartment from the technical inventory bureau.

In each individual case, the list of documents may change. You can find out the full list and reduce temporary losses by seeking advice from competent lawyers.

A transaction with ownership shares has several options.

To co-owners

Sale to co-owners can be voluntary or forced. In the first case, the owner sets the price himself and offers part of the property to the co-owners.

The second option implies the following: if the owner’s share is considered significant (the largest relative to other owners), then the issue can be resolved in court, recognizing the residents’ shares as insignificant.

To make a redemption, all conditions must be met:

- the share is insignificant;

- real allocation is impossible;

- the owner is not interested in using the common property;

- the interests of a minor child are not affected.

To third parties

If the apartment has several owners, then one of them has the right to dispose of the property if the co-owners refuse the agreement.

Inflating prices intentionally and then lowering them when selling to another person is a variant of deception, which leads to termination of the contract in court.

The same applies to a gift agreement, which can be challenged in the case of a compensated transaction, knowing all the intricacies of the legislative framework of the Russian Federation in 2018.

To creditors

In the case of real estate pledge or by court decision (loan debt), real estate auctions are held without the consent of the shareholders and the owner himself.

Note!

If you were sold an apartment or part of it with two co-owners, one of whom was not present at the transaction and did not give consent, then the risk of deception and termination of the transaction is high. The interested party has the right to apply to the court within 3 months to demand that the sale be declared invalid.

How to sell the entire apartment in parts?

The situation of selling an apartment in shared ownership, when there is one buyer and several sellers, requires the right approach. There is no need to enter into a separate agreement with each owner, except for transactions at different times. You can sell an apartment with several owners subject to a number of formalities:

- if all owners agree with the transfer of rights to property (sale), then a single agreement is concluded, which specifies the procedure for settlement with each participant in the transaction;

- there is no requirement to notify shareholders about the transaction due to their unanimous consent;

- The contract is certified by a notary, which is one of the main conditions.

Any individual or legal entity can sell or buy an apartment in equal/unequal shares. The procedure for completing a transaction is described above, and controversial issues can be clarified by contacting the experienced lawyers of our company.

By law, an agreement can be written in free form, which also provides for several options for transferring money:

- transfer to each seller a portion of the money commensurate with the share sold;

- transfer of the entire amount to one of the shareholders with subsequent redistribution of finances between the former shareholders.

If there are 2 or more buyers, then the form of ownership can be joint or shared.

If you are interested in how to sell an apartment in parts to one owner, then in this matter you should start from all the above actions - allocating shares, preparing documents for each part of the property, selling the property.

Sale of a share of a minor child

Another pressing question for property owners is how to sell an apartment, the shares of which are registered in the name of children, and what the Russian law says on this issue.

According to the law, a minor does not have the right to dispose of real estate without the consent of the guardianship and guardianship. In this process, the interests of the child take first place.

In order for a transaction to receive approval from higher authorities, you must provide:

- a document confirming the opening of a bank account in the name of the child, to which the money will be transferred after the sale of the home;

- confirming facts about the new place of residence, the conditions in which should not be lower than in the housing being sold.

How to sell an apartment with donated shares in an apartment or room to a child is also established by Art. 60 RF IC, Art. 26, 28, 37 of the Civil Code of the Russian Federation, which talk about the property rights of the child, his legal capacity and the ability to dispose of his property.

If the second owner is against

If all owners sell shares, then there can be no questions. But what to do if one or more shareholders are against the deal? The purchase and sale of an apartment, the ownership of which is in shares, is possible without the consent of all owners. If any of the participants object, there are several options for solving the problem:

- an objection to the notification of a transaction with the share of one of the owners is recognized as a waiver of the pre-emptive right to purchase, and further actions continue in the general manner;

- in case of refusal to formalize a notarized refusal, the transfer of ownership can take place under a gratuitous donation agreement, which is permitted by law and does not entail litigation.

Bottom line

Every adult can dispose of shares in real estate. To sell or buy a share or the entire apartment in shared ownership, you should know a few things:

- transactions with children under the age of majority are carried out under the control of guardianship and trusteeship authorities;

- mortgaged housing can be transferred into ownership to another owner only with the consent of the bank;

- it is possible to sell a donated apartment, as well as an acquired or inherited one, in joint or shared ownership, having received the consent of opponents or by allocating the natural part of the housing;

- the shareholder’s disagreement with the transaction does not deprive the citizen of the right to transfer rights to living space

How to sell a privatized apartment with shares

The sale of privatized housing, which is in shared ownership of several people, is often done these days. This is a consequence of the mass privatization of apartments in the nineties of the 20th century. The subtleties of this process are of interest to many apartment owners, as well as their heirs and relatives.

How to properly sell a privatized apartment with shares?

In order to describe the entire procedure for such a sale, it is necessary to understand how privatization differs from purchase and sale.

Privatization from a legal point of view is a gift from the state. In the process of donation, real estate is transferred from public ownership to private ownership. The state donates real estate to those who have submitted an application for privatization.

All minor residents of the apartment automatically acquire their share in the privatized property, since their interests are represented by the parents who wrote the application.

The purchase and sale agreement, in contrast to privatization, is carried out between two property owners on a reimbursable basis.

The fundamental difference between these two legal processes does not seem to be great. However, the overwhelming majority of privatized apartments are registered for several people, which creates a lot of legal problems.

Real estate that is in joint private ownership can be sold all at once with general consent or in parts, subject to certain procedures.

The procedure for selling an apartment does not depend on who took the initiative. The algorithm of actions in this case is as follows.

- If all the residents of the apartment unanimously decided to sell their living space, then in the purchase and sale agreement it is necessary to mention as sellers all the residents named in the privatization document.

- Homeowners under 18 years of age are represented by their parents or guardians.

- To sell living space in which minor citizens live, the consent of the guardianship authorities must be obtained.

- The contract for the sale and purchase of an apartment must stipulate the parts attributable to each seller.

In accordance with the law, each participant in the sale receives a proportional share of the money. In practice, the distribution of funds is carried out mainly by agreement.

Have a question or need legal help? Take advantage of a free consultation:

How can I sell my share?

It is possible to sell part of the apartment, but it will be difficult, because all owners of shares of the living space are equal in their rights. This means that the actions of one of the owners should not harm the other.

The sale of a share is carried out as follows.

- When deciding to sell his part of the apartment, the seller determines the price and finds a buyer.

- In this case, a purchase and sale agreement can be concluded only with the consent of all other owners of the residential premises. To do this, they must be notified in writing against signature one month before the transaction.

- Owners of shares in this residential premises have the right of priority. Regardless of the presence of a buyer, another owner who wants to buy the part being sold has the right to do so first.

- One of the co-owners or all owners of the privatized living space can buy the part being sold.

- Co-owners of the living space can purchase a share only at the price agreed upon by the seller and the buyer.

- If, after a month, all co-owners refuse the acquisition in writing or do not respond to the notice, the seller can carry out his transaction. However, he can only do this at a pre-agreed price. Otherwise, the transaction may be declared invalid.

Thus, the fundamental difference between the sale of a share and the sale of the entire apartment in common ownership is the mandatory notification procedure, the right of priority and the impossibility of reducing the price when concluding an agreement.

Share in a privatized apartment

When registering privatization, a simplified form was often used, including all family members who submitted an application in the list of owners. However, there comes a time when it is necessary to decide on the parts that fall on each owner.

This is done in accordance with the provisions of Chapter 16 of the Civil Code of the Russian Federation. This procedure depends on family relationships and the presence of minor children.

To designate shares, owners must submit applications to Rosreestr. This is done so that the division of the apartment into parts is formalized.

Along with the application, a notarized agreement on the issuance of a share of living space to each owner is submitted. If such an agreement cannot be concluded, the disputed issues are resolved in court.

In addition, the following are submitted to Rosreestr:

- copies of passports of all property owners;

- permission from the guardianship authority if there are minor children among the owners;

- technical passport for real estate;

- receipt for payment of state duty.

In accordance with the provisions of Art. 18 of the Housing Code of the Russian Federation, Rosreestr must make its decision within a month. If everything is in order with the documents, then each owner of the privatized living space receives a certificate of ownership of his share.

Selling an apartment with shares of minors?

- When selling residential premises in which the owner of a share is a minor, you must obtain permission from the guardianship authorities.

- The main task of this institution is to prevent adults from reducing the share that was originally allocated to the child.

- If, after the sale of the residential premises in whole or in parts, the child receives a portion that exceeds the initial one, then any notary will formalize the transaction without the permission of the guardianship and trusteeship institutions.

There is one more condition for the legality of the sale of privatized living space with parts from minors. It lies in the fact that the money received from the share owned by a minor will be placed in a deposit account in a bank until the owner of the share comes of age.

Is it possible to sell a child's share?

Such an opportunity exists, which allows parents to use the child’s share to improve the living conditions of the whole family.

Formally, such a procedure is no different from a similar transaction for the sale of a share of any owner. However, parents will have to prove to representatives of the guardianship and trusteeship authorities that the child will only get better from such a sale.

To obtain permission to sell a share, parents must provide evidence that the child in the apartment purchased to replace the one sold will be in better conditions. In addition, he will have a large share in the common property there.

If the housing issue is not significant for the child, then proof of the parents’ good intentions can be a bank account opened in the name of the minor owner, where the money received from the sale of his share of the living space will be placed.

Selling without the consent of its co-owners?

It is almost impossible to do this legally. Even if such a transaction is formalized by a notary, it will not be accepted in the Roserester, since there will not be a complete set of documents, namely, the refusal of all owners of the living space to purchase this share.

However, there are other ways to transfer ownership of real estate. For example, a veiled sale could be a gift of one’s share.

In this case, the law does not require the mandatory consent of homeowners. After all, a person can donate his share not only to a third party, but also to a co-owner of the living space.

Another way to transfer a share to a third party is to alienate it as collateral.

The owner of the share can transfer it to the bank in exchange for issuing a large loan. If a person does not repay the loan on time, this part of the apartment goes to the bank, which is equivalent to selling it to a third party. The co-owners of the property are not able to resist such a process.

Thus, the sale of a privatized apartment owned by several people is difficult, subject to many procedures and nuances. Indeed, in this case, the law guards the legitimate interests of several people - co-owners, including small children.

Attention! Due to recent changes in legislation, the information in this article may be out of date. However, each situation is individual.

Sale of a share in a privatized apartment

From the article you will learn: how to sell a share in a privatized apartment through a purchase and sale agreement, through a donation and through a pledge, as well as how to recognize the sale of a share in an apartment as illegal.

The privatization process is a legal action provided for by the Law of the Russian Federation of July 4, 1991 No. 1541-1 “On the privatization of housing stock in the Russian Federation,” as a result of which real estate (land, apartment, house, room, etc.) becomes the property persons who have performed all the actions specified in the law.

An apartment can be privatized by one person or a group of people. The right to privatize living space is available to everyone who, at the time of submitting documents to the registration authority, is duly registered in it as a permanent resident legally. Thus, privatization is often registered in the name of all family members: spouses, children and other relatives.

Over time, the spouses may divorce, or children may inherit the shares of their parents, and then the owner of the share, who does not want to share this apartment with other co-owners, has the right to sell his property. Let's consider how to properly carry out the purchase and sale, respecting your interests and without violating the rights of the other co-owners.

Is it possible to sell a share in a privatized apartment?

It is important to immediately clarify such an important nuance as the difference between the legal terms “ joint ownership ” and “ shared ownership ”. You can sell a share, but the size of this share must be allocated and indicated in the title document.

If the apartment belongs to several persons on the basis of joint ownership, then the sale can be carried out only of the entire apartment, or a preliminary division of shares can be carried out, after which each of the co-owners will be able to dispose of their own share at their own discretion.

When all co-owners equally agree with the sale, then the situation is resolved very simply. It is enough to conclude an agreement between everyone on the sale amount and its division after receiving money from the buyer, after which you can begin to formalize the sale and purchase. It’s a different matter when someone wants to sell their share, and the rest are against it. Here a completely different algorithm of actions comes into force.

Today, there are mainly three schemes for selling a share in an apartment , which fully comply with legal norms and have been worked out in practice. If you are a co-owner of an apartment, you can adopt any scheme to turn your square meters into money.

Scheme No. 1. Sale through donation

The sale of a share in an apartment can be carried out with the consent of the remaining co-owners. Due to various circumstances, obtaining such consent may be impossible or very difficult. However, the law allows the donation of a share - for this the consent of the remaining co-owners is no longer required.

It is extremely important to draw up a deed of gift correctly . It is highly recommended to entrust this operation to an experienced lawyer. If any legal requirement is not met, the remaining co-owners will subsequently be able to protest the document in court and have the transaction declared invalid. And there are quite a lot of requirements:

- It is necessary to fully list all other co-owners, indicating the size of their shares.

- Indicate all persons who are not co-owners, but are registered in this living space on a permanent basis.

- How many square meters are transferred to the recipient?

- On what grounds did this share become the property of the donor?

- If the share belongs to a legally married person, you will need to attach a notarized consent of the spouse to the transaction to the deed of gift.

For those who decide to purchase a share in an apartment through a gift, it is important to remember that according to the law (Article 217 of the NKRF, clause 18.1), only close relatives of the seller are exempt from paying 13% tax on the value of the share.

If the share is purchased by the spouse, son or daughter, father or mother of the seller, then no tax is paid, all other buyers will be required to pay it.

Moreover, if the buyer is not a citizen of the Russian Federation, then a tax rate of 30% is applied.

The value of the share must be indicated in the deed of gift, although the transaction is gratuitous. It is not recommended to underestimate its size, since if it is underestimated by more than 20% of the market value, consequences such as a fine may follow.

After the deed of gift is completed, the money is transferred to the seller by the buyer through a safe deposit box. The transfer agreement is concluded with the participation of the bank; the condition for issuing money is usually the presentation of a document confirming the transfer of ownership from the donor to the recipient.

There is another option : you can donate part of the share, and after registering the donation, legally sell the remaining part, since the new co-owner will have the right of priority purchase.

This scheme will be more expensive for the parties, but its reliability is also higher.

It is also used in cases where the buyer does not have the opportunity to pay off the entire cost of the share at once, and the parties agree to carry out the transaction in two stages.

Scheme No. 2. Sale through collateral

This method is used when the bank agrees to accept this share as collateral for issuing a loan. A transaction of this kind is called a mortgage. If you took money, but were unable to return this amount within the pre-agreed period with interest, the share will become the property of the pledge holder (the bank).

Lawyers are often asked : does this rule apply to housing that is the only one for the owner of the share and his family? Answer: yes – it applies, as expressly stated in: Art. 446 Code of Civil Procedure of the Russian Federation, Art. 337, 348 of the Civil Code of the Russian Federation. There is no need to fear that the bank will seize real estate for debts, only in the cases specified in Art. 54.1 of the Law “On Mortgage”:

- The amount of debt is less than 5% of the value of the collateral.

- The debt is overdue for less than 3 months.

Often, owners of shares in real estate do just that, deliberately borrowing money from the bank so as not to pay it back later. When there is no hope of selling a share profitably, such a scheme is profitable, even taking into account the costs of obtaining a mortgage.

Scheme No. 3. Simple sale

A fairly simple method, but in practice not so often used due to the fact that the seller has to comply with strict rules, such as proper notification of all co-owners of the intention to sell the share, as well as compliance with the deadlines for waiting for their decision. In general, the procedure looks like this:

- The owner of the share orders a real estate appraisal in order to further use the result in all operations. You will have to come to terms with the fact that it is impossible to get as much for your share by selling it separately as you could get by selling the entire apartment and then dividing the resulting amount.

- Each co-owner is sent a registered letter notifying them of their desire to sell and indicating the sale amount. You must wait 30 days for the decision of the co-owners from the moment they receive the notification. Only after this can the share be put up for public sale, since within a month all other co-owners have the right to buy the share for the specified amount in advance of other buyers. A good insurance would be a notarized refusal of the remaining co-owners to buy out the share, but it is not always possible to obtain them.

- A purchase and sale agreement for a share in an apartment is concluded between the seller and the buyer. Where are indicated: the size of the share, its value, description of the share and the procedure for mutual settlements.

- The transaction is registered in the Unified State Register, about which the buyer is given a corresponding extract.

How to recognize the sale of a share in an apartment as illegal?

Disputes surrounding the sale of shares in an apartment are not uncommon in modern judicial practice. Co-owners, buyers, as well as third parties whose rights have been violated can challenge transactions. A sale and purchase formalized by an agreement and registered in the Unified State Register can be challenged only in court.

Co-owners of the apartment can go to court within 3 months from the moment they became aware of the purchase and sale.

In this case, you cannot challenge the transaction itself, but only demand that the rights and obligations of the buyer under an already registered agreement be transferred to your name.

If the court's decision is positive, the plaintiff will pay the former owner of the share the amount specified in the agreement and will become the owner of this share.

It is important to note that this type of litigation takes a lot of time and costs, so it is better to first try to resolve the dispute peacefully. You can entrust negotiations on your behalf to a professional lawyer. This method will help resolve the dispute without involving the court through a settlement agreement.

Any transaction can easily be declared invalid in court if the plaintiff can prove that the law was violated during its conclusion. For example, the buyer transferred the entire amount to the seller before signing the purchase and sale agreement, or the seller is a person who does not have rights to this property and transactions with it.

The statute of limitations for cases of this kind is very important:

- Within a year, you can challenge the transaction if you can reliably establish the moment from which the plaintiff learned about the circumstances preventing its legal conclusion.

- Void transactions can be contested within 3 years. For example, if the plaintiff can prove that the seller did not receive money from the buyer.

- Third parties who are not participants in the purchase and sale have the right to file a claim in court if their rights are infringed within 10 years from the moment they should have received information about this infringement.

All these circumstances play a decisive role in determining the value of the share. A large number of different risks scares away buyers, so the proceeds from selling a share can obviously be less than what it is actually worth.