- As a result of privatization carried out in the country in the twentieth century, millions of people received ownership of their homes.

- Taking into account the housing crisis that has been raging in our country for a long time, most of the owners were forced to register their housing as shared and joint ownership .

- To do this, you need to draw up an agreement on determining shares in the apartment , a sample of which you will find in this article.

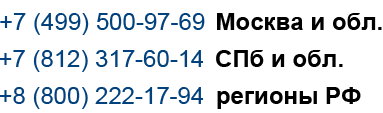

Dear readers! Our articles talk about typical ways to resolve legal issues. If you want to find out how to solve your particular problem, call the free consultation numbers:

Differences between joint and shared ownership

Joint ownership is the joint ownership of common property by citizens.

They own it on equal terms , having absolutely the same privileges and obligations. Maintenance costs, utilities and taxes are jointly paid.

- A good example would be an apartment owned by both spouses .

- If it was acquired after marriage , then ownership will not belong 50 to 50, as many owners are accustomed to believe, but 100% to both the first and second owners, that is, each will own the apartment completely .

- All property acquired after marriage becomes joint property by default.

- Unless other conditions are stipulated by an official marriage contract or a shared ownership agreement .

- Shared ownership is individual ownership of part of the common property.

In this case , there can be many co-owners and they do not have to be relatives. The size of the shares can also be different for everyone.

The most common option is an ordinary family living in an apartment and dividing ownership between all its members - parents and children.

In such a situation, utility payments come entirely to the entire residential premises , but everyone will pay taxes for themselves .

The share in most such cases is not determined by a specific premises and cannot be sold to strangers . It can be bought by relatives living in the same apartment.

You can also receive a cash reward , equivalent to the cost of the share upon sale. If desired, this option can be converted into the second – allocated share.

An example of an allocated share with specific meters and binding to a specific room would be a multi-room apartment (communal apartments are still a very common phenomenon in Russia), in which each room has its own owner .

The size of the rooms is different, and, accordingly, the size of the share . Utilities and taxes, with this type of property, everyone pays for themselves and only for their own meters.

The allocated share can be given as a gift or sold without the consent of all other owners . However, when selling, other “owners” will have the privilege of having the right to buy out their shares as a matter of priority .

After refuse to purchase, you can offer the deal to third parties .

What is the concept of a share in an apartment, read in our article.

Division and allocation of shares

In what cases is this required?

Situations that require division are sometimes the most banal:

- The presence of bad habits in one of the owners that interfere with the normal life of the other owners;

- The owners are strangers and/or do not get along well in the common area;

- The desire to have separate housing and manage it independently;

- Receiving material benefits - selling, or receiving monetary compensation for your share;

- Marriage contract – in the event that the spouses initially wish to have separate property.

Any owner who owns part of the real estate common property has the full right to allocate his share .

How is the calculation done?

The size of shares between owners is calculated as follows:

- In case of privatization , inheritance , purchase , divorce , in the absence of any additional factors (will, documented expenses for the purchase of most of the real estate), the real estate is divided into all owners in equal shares ;

- When entering into an inheritance and there is a will , the size of the shares will be determined by the will;

- Deed of gift . The size of the shares is determined by the document;

- The owner voluntarily allocates shares in his apartment . In this case, the size of the share will also depend on the owner himself.

In all these cases, there are no legally defined standards, so the minimum standards of square meters for 1 person , established by the laws of the Russian Federation, are taken into account.

Selection order

It will be possible to divide an apartment into shares for any form of ownership . Joint ownership allows for a portion of the living space to be allocated to each of the co-owners .

Also, the presence of such shared ownership allows the redistribution of existing shares and/or the allocation of new ones .

There are two options for solving property division:

- The share is allocated by mutual agreement of all owners. For this purpose, a special agreement is drawn up;

- If agreement cannot be achieved, the division is carried out forcibly , through an appeal to the courts.

Actually

- As a result of allocating a share in kind, the object is divided into separate, completely independent units .

- As a result, the owner receives isolated from all other owners , with a separate entrance, bathroom, toilet and kitchen.

- In other words, you get a full-fledged independent apartment, owned by only one owner .

The owner can obtain the right to dispose of his area at any time . In this case, the time that has passed since the day he took ownership does not play any role.

When allocating a share, it is advisable to seriously consider the possibility of dividing property in this way.

You need to understand that, for example, dividing a one-room Khrushchev apartment into 2 - 3 shares will be very problematic . Adding an additional bathroom with a kitchen is completely out of the question.

Through the court

- In some cases, the transfer of property from joint to shared is possible only through compulsory judicial procedure .

- One of these situations is the impossibility of peacefully determining the size of their shares between the owners.

- To resolve this issue, the court calculates the amount of personal investments spent on the purchase and maintenance of real estate by each of the owners.

- Only those expenses that can be documented are taken into account.

- In some cases, when division of housing is impossible due to its design features, the court orders payment of monetary compensation in the amount of the value of the plaintiff’s share .

The second owner, upon full repayment of obligations and payment of the entire amount of compensation, becomes the full owner of the entire property . In such a situation, the owner’s consent to such a division of property is not required.

We recommend watching a video about how you can legally deprive an owner of a share in an apartment:

Agreement on the allocation of shares in an apartment

The essence and meaning of the document

An agreement is a document that transfers joint or personal property into shared ownership.

- The agreement is filled out in a simple form, signed by all existing owners and certified by a notary.

- The completed agreement is submitted for registration to Rosreestr , since the size and number of shares in the personal property of each owner change.

- The essence of this agreement is to equally grant rights to common housing to all family members, including children, if any, indicating the share belonging to each.

DOWNLOAD SAMPLE

You can download a sample agreement on determining shares in an apartment here.

How is it processed?

The requirements for this agreement have a number of conditions, if not met, the document will be considered invalid:

- Details, passport details and other information about the participants in the transaction must be as detailed as possible ;

- Precisely defined subject of the agreement : exact address, technical data (total area, living area, etc.);

- Clearly defined shares for each owner : to whom and how much;

- Detailed information about title documents that can confirm ownership: contracts for the purchase of housing, or a certificate of inheritance of a house/apartment;

- Privatization certificate of ownership.

Among other things, the agreement specifies additional conditions:

- procedure for operating property registered as shared ownership;

- unilateral ban on refusal to fulfill all obligations;

- absence of any encumbrances on real estate ;

- absence of any material claims against other owners;

- the procedure for making emerging additions and changes to the agreement;

- temporary deadlines for registration of additions and changes.

Read also about how to exchange a non-privatized apartment here.

What if it’s based on maternity capital?

The responsibility of parents is to allocate to all their children a certain share in residential premises acquired with the help or funds of maternity capital.

This is stated in paragraph No. 4, Article 10 of Law No. 256-FZ “On state support for families raising minor children.”

The size of the share for each of the owners will be determined by a voluntary agreement in writing . Property should be allocated not only to children , but also to the second spouse who has not yet become the owner.

If the property is joint (not shared) and was acquired with maternity capital funds, the agreement on the redistribution of shares and their sizes will be preceded by a preliminary division of joint property between the spouses .

In other words, the apartment will first be divided between husband and wife . And only after such a division, parents will be able to transfer part of their rights to real estate to their children .

In a situation where there is only one owner of the property and it is one of the spouses, the agreement, in addition to the children’s shares, may include the share of the second spouse (if not drawn up earlier).

Sample agreement on determining shares in an apartment based on maternity capital: download the form.

Possible difficulties

In reality, when separating, the following problems often arise:

- the apartment is still encumbered ( mortgage loan);

- lack of ownership of housing (the apartment is not privatized, there are no documents confirming ownership);

- the apartment is officially recognized as non-residential , not put into operation (construction, major repairs), recognized as dilapidated housing.

Find out how to choose a comfortable apartment to buy and what you should pay attention to in our article.

Didn't find the answer to your question? Find out how to solve exactly your problem - call right now:

It's fast and free!

How to draw up a contract for the sale and purchase of a share in an apartment: sample 2023

› Housing issue › Buying an apartment › How to correctly draw up a contract for the sale and purchase of a share in an apartment in 2023

11/19/2018 554 views

Since legislation is constantly changing, the contract for the sale and purchase of a share in an apartment is subject to changes. Selling not only the entire property, but also any part of it, is a very serious step.

As a rule, shared ownership in an apartment is formed after the privatization of the apartment for all family members living in it. After some time, the children grow up and move out of their parents’ apartment, but the share remains.

And if the parents decide to divorce after this, then they have a mutual desire to divide these square meters.

Features of fractional sales

A knowledgeable realtor will tell you that selling a share is a long and not the most pleasant task, but it is not unrealistic; it is possible. If the property has previously been subject to privatization, then the boundaries of the shares of all its owners must be clearly defined in the document. The share is subject to sale both to any of the share owners and to a third (outside) party.

Before you start selling a share (not allocated), you must notify other property owners of your desire. Owners have the official right to buy out the share or abandon it. If the owners refuse, then the apartment is sold to third parties.

From the very beginning

The very first thing to do is to find out whether the share has been allocated in kind.

If the share is allocated in the form of a fractional number (2/10, 3/5, and so on), then the owner knows which part of the apartment belongs to him, this issue is resolved by agreement or in court.

Already allocated in kind, you can immediately start selling it, since it is considered a separate part, it will be possible to sell it faster.

Advocate

Before you start selling a share in an apartment in 2023, it would not be the worst decision to contact an experienced lawyer.

If a conflict arises between relatives during the sale, and one of the other owners does not allow the share to be sold, a lawyer is simply necessary. This will save time and nerves.

The specialist will also help draw up a purchase and sale agreement according to the new 2023 model, and will also help with other legal issues, for example, obtaining a notarization.

Purchase and sale

The sale of property divided into shares is regulated by a law that was adopted back in 2016. The law provides for the participation of a notary in a transaction in order to avoid illegal transactions. To sell a share in an apartment, you should follow certain instructions.

Firstly, other owners must send a notarized notice of sale.

In order to complete a transaction, you need to contact the MFC; the procedure takes place in several stages:

- Preparation of a package of documents;

- Payment of state duty;

- Signing an agreement at the MFC;

- On a certain day, the transfer of ownership will take place from one person to another.

In order for a sale of shared ownership to take place, notarization of documents will be required.

Contents of the agreement

The documents must provide reliable and complete information about all parties to the transaction; this includes not only the 2023 sample, but also samples from other years. This is required for a uniform interpretation of the subject of the transaction. The first paragraph of the contract defines the parties to this transaction, both the seller and the buyer.

The text of a sample agreement can be easily found on the Internet, but it must be drawn up in writing by both parties, in addition, the agreement must contain the signatures of the parties to the transaction.

After the immediate conclusion of the transaction, you will need to contact the state registry authorities to register the fact of transfer of rights from one person to another to the purchased real estate.

The contract must include all of the following points:

- Date and place where the contract was drawn up;

- Buyer and Seller Information:

— Full name; — Date and place of their birth; — Citizenship; - Floor; — Series and number of the identity document; — Who issued the identity card and when; — Address of residence, if not, then primary residence;

- Bank details;

- Description of the subject of the contract (real estate), which will necessarily contain:

— Area of the share being sold/acquired; — Signs of the apartment; — Address, exact location of the apartment;

- And also her number.

- Share price;

- Payment (procedure, as well as deadline);

- Details of papers that establish the existence of rights to the property being sold;

- Papers that reveal defects not only in the purchased share, but also in the entire apartment;

- Information about other owners;

- Responsibilities, as well as rights of the seller and buyer;

- Responsibility of the transaction;

- The procedure by which disputes will be resolved;

- If any financial costs arise during the conclusion, then it is necessary to specify the methods of payment;

- Number of copies of the agreement.

In addition, the parties will have to draw up a deed of transfer, which will subsequently be attached to the main purchase and sale agreement.

Download a sample contract for the sale and purchase of a share in an apartment in 2023

Download the act of acceptance and transfer of the share of the apartment under the purchase and sale agreement, sample 2023

Registration

Ownership rights to the acquired share in the apartment are exercised not in the seconds when the contract is signed, but at the moment these rights are registered. Documents are submitted to the State Register department for the territorial location of the property, where state registration of rights will take place.

In order for registration to take place, you will have to collect a package of documents

- Application for registration;

- A statement that the rights of the new owner have been registered;

- Direct agreement between the parties;

- Reception Acre;

- Identity cards of the seller and buyer;

- Permission (when selling the share of a person under 18 years of age);

- Documents permitting the sale of real estate;

- Papers that confirm the fact of notification of other owners of real estate about the sale of a share in it;

- Refusal of other owners to acquire the share being sold as a priority. You do not need to bring a receipt indicating that the duty has been paid.

Maternal capital

With maternity capital, not everything is so simple. There are certain requirements for housing that was purchased with these funds.

For example, it will be possible to complete a transaction if an isolated living space is purchased - a separate room.

It will not be possible to purchase, for example, 2/3 of a one-room apartment, since there is no isolated room there, but you can purchase one room in a two-room apartment.

When drawing up a purchase and sale agreement based on the 2023 model, it is also necessary to comply with all the conditions of the civil legislation of the Russian Federation. The last stage in the sale of a share of real estate will be the state registration of property rights of the new shared owner of the apartment. It is possible to sell part of an apartment, but you will have to spend much more time on it than on selling a whole apartment. How to correctly draw up a contract for the sale and purchase of a share in an apartment in 2023 Link to the main publication

Purchase and sale of a share in an apartment in 2023

In the modern world, selling a share in residential real estate is often accompanied by difficulties. As practice shows, other owners do their best to obstruct the transaction, trying to convince the seller to act exclusively in their interests. When close people become parties to the conflict, buying and selling a share in an apartment in 2023 turns into real hell. Fortunately, there are certain legislative aspects that allow you to quickly deal with the problem and avoid declaring the transaction illegal.

Purchase and sale of a share in an apartment according to the law in 2023

Russian legislation imposes a number of requirements for operations whose object is shared housing.

This eliminates the possibility of fraud and protects transaction participants from illegal actions of attackers. One of the key requirements is to register the agreement with a notary office.

The specialist will check all the documents, make sure there are no violations, and only after that will put his stamp and signature.

As for the parameters of the apartment being sold, owned by several owners, there are no special restrictions. In other words, you can sell a share even in a small one-room apartment, but such options rarely find their buyers. If the apartment has at least two rooms, then it is much easier to find a buyer.

You should also take into account the fact that after the completion of the transaction, the new owner will be able not only to dispose of the purchased room, but also to use the remaining premises (except residential), having legal grounds for doing so. As for the reasons why a share in an apartment is purchased and sold in 2023, the most common are:

Of course, in real life, the list of circumstances that can lead to such a transaction is much wider. However, regardless of the reasons for the sale, compliance with legal requirements is mandatory for all participants.

How to sell a share in an apartment: step-by-step instructions

In order to completely eliminate the risk of a transaction being considered illegal, the seller must follow a certain algorithm of actions prior to signing the contract. The first step should be to send a notice registered by a notary to the remaining homeowners. This requirement is due to the fact that the co-owners have a priority right to buy out the share, but at a total cost.

Sample notice of sale of a share in an apartment in 2023

Next, the seller will have to wait 30 days, allotted to other owners to consider the decision. If the prospect of “expanding” their possessions does not interest them, then the decision should be expressed in the form of an official refusal.

Of course, there are situations when the relationship between co-owners is far from perfect, and the notice is simply ignored.

In this case, the end of the 30-day period qualifies as an automatic refusal to purchase and sell a share in the apartment in 2023.

If none of the co-owners has expressed a desire to become a buyer, the seller has the right to sell the share to any interested party, following the generally accepted algorithm of actions. To reduce time costs and avoid unnecessary queues, it is best to apply for the appropriate service at one of the “My Documents” branches. In this case, the step-by-step instructions consist of only 5 steps:

- Preparation of documentation;

- Payment of the state fee and attachment of a confirmation check to the package of documents;

- A visit to the MFC of both parties to the transaction and the conclusion of an agreement on the transfer of property rights;

- Submitting documentation to a center specialist and receiving a receipt with the request number and the planned date of service readiness;

- A second visit to the MFC after the date specified in the receipt and receipt of completed documents (one copy for each party, obtained individually).

Using the unique number indicated in the receipt, any of the transaction participants can independently check the status of the application. To do this, you must provide the specified number to the hotline operator or enter it in a special field on the organization’s official website.

The procedure for allocating a share before the sale

As mentioned earlier, if the notice of the decision to sell their part of the housing is ignored by other co-owners, or they are simply not interested in such a prospect, which will be confirmed by an official refusal, anyone can act as a buyer. However, in such a situation, the purchase and sale of a share in an apartment in 2023 implies the mandatory allocation of a specific part of the real estate owned by the seller.

The easiest way to do this is to reach an agreement with the co-owners. So, when the object of the transaction is a 3-room apartment owned by three people, the share of each owner will be 23 square meters. In fact, this will be a room and some part of the common space.

When other owners refuse to make contact, the seller has no choice but to go to court. In this case, the allocation of the share is made using ordinary mathematics, provided that each of the co-owners is endowed with the same rights. It is important to understand that when filing an application with the court, it is recommended to seek legal advice.

Amount of tax on the sale of a share in an apartment

When the issue with the co-owners has been successfully completed, the buyer has been found, and the seller is considering how best to use the proceeds from the transaction, one important nuance must not be overlooked.

In particular, we are talking about obligations to the tax authorities.

In fact, the purchase and sale of a share in an apartment in 2023 is not much different from other real estate transactions, which means it involves paying a tax of 13% of the amount.

Of course, there are certain nuances that can arouse considerable interest among the payer and protect him from unnecessary costs.

Few people know, but tax will have to be paid only if the transaction value exceeds 1 million, and the property has been owned by the seller for less than 3 years.

It is noteworthy that even if the cost parameter is exceeded, only the resulting difference is subject to taxation.

How to reduce real estate sales tax in 2023

Can I sell half or part of my share?

In legal practice, there are many examples when the owner of a share in residential real estate wants to sell some part of his possessions. This question is especially relevant when it comes to a multi-room apartment with a large area, mainly owned by one person.

As for the legislative side of the issue, there are no prohibitions or obstacles; the main thing, as in other cases, is to notify the other co-owners in advance. Further purchase and sale of a share in the apartment in 2023 occurs according to one of 3 options:

- Finding a buyer and completing a transaction;

- Transfer of part of the housing under a gift agreement, but with the actual transfer of funds (no need to notify co-owners);

- Use part of the share as collateral when drawing up a loan agreement.

How to sell the share of a minor (child)

When the object of the transaction is a share belonging to a child, the algorithm of actions will be slightly different. First of all, parents or legal representatives planning to carry out the sale will need to obtain the approval of the guardianship authorities.

It is important to understand that the purchase and sale of a share in an apartment in 2023 will be possible only if the seller proves that the interests of a minor will not be infringed. In other words, as a result of manipulations with housing, the baby should not join the ranks of the homeless.

Authorized authorities will not allow the sale if:

- The apartment is the child’s only living space;

- The transaction will cause a deterioration in the living conditions of the minor.

If there are no such circumstances, then in order to obtain consent, the seller will have to provide the guardianship authorities with confirmation that the money from the transaction will be transferred to the child’s bank account, or the minor will be provided with part of equivalent housing.

What to do if one of the owners does not agree

Modern Russians who want to sell their share of living space often face serious opposition from co-owners. In other words, one or more owners express categorical disagreement with the transaction. The only way out in such a situation is strict compliance with legal requirements.

To ensure that the purchase and sale of a share in an apartment in 2023 is not protested in the future, first of all, send a written notice to all co-owners, informing them of your intention. If within 30 days none of the owners has expressed a desire to become a seller, you have the right to find a buyer yourself, having previously taken care of allocating a share in its natural form.

It is important to understand that in cases where co-owners refuse to consent to the transaction, most likely the seller will be forced to go to court. Of course, the co-owners will not be able to prevent the transaction, however, if the issue is resolved through the court, the availability of documents that can confirm the distribution of notifications will play an important role.

Can a husband sell his share of an apartment?

The apartment, which is the joint property of the spouses, is subject to division after divorce. In other words, each of the former spouses has the right to sell their share. In this situation, the priority right of redemption belongs to the second spouse, which means that he should be notified in writing about the decision made.

When the second spouse is not interested in purchasing or does not have sufficient monetary assets, the purchase and sale of a share in the apartment in 2023 occurs through the market. However, practice proves that such a development is unlikely, especially if there are minor children in the family. In most cases, housing goes to the spouse who is raising the children.

Is it possible to sell a share in an apartment purchased with a mortgage?

Modern practice has many examples when the object of the transaction is a share of mortgaged housing. It should be understood that such a procedure is not without some difficulties, since obligations to the bank have not been fulfilled. As for the right of first refusal, it, as before, remains with the co-owners.

Such a transaction will become possible only if the credit institution that issued the mortgage gives its consent to it.

It is also important to take into account the fact that if one of the owners becomes the buyer, then the likelihood of receiving approval from the bank is quite high.

As for attracting a third-party buyer and redistributing financial obligations, banks rarely approve such a transaction for the sale and purchase of a share in an apartment in 2023.

The best option is to sign a preliminary agreement with the buyer, pay off the remaining debt early and get rid of the encumbrance. This development of events will allow you to avoid unnecessary paperwork and complete the transaction without any obstacles.

How to buy a share in an apartment: step-by-step instructions

If you pay attention to the specifics of the documentation accompanying the transaction, they actually repeat the process of conventional home acquisition. Even the contract concluded between the parties is standard. As for the stages of the procedure, they include:

- Preparation of documentation (including photocopies of documents certified by a notary, papers for an apartment, various certificates and extracts);

- Visit to a notary and conclusion of an agreement between the seller and the buyer;

- Visiting the “My Documents” office or an authorized authority to submit documentation, complete the transaction and transfer property rights.

The total duration of the procedure, starting with the submission of documentation and ending with the signature of all papers, takes approximately 14 days.

Is it possible to buy a share in an apartment using maternity capital?

Many Russians are interested in the issue of purchasing a share of residential real estate using maternity capital funds.

Of course, if certain conditions are met, the purchase and sale of a share in an apartment in 2018 can be made using money received from the state for the birth of a baby, but there are also quite strict restrictions.

In particular, the object of the transaction must be a separate living space, which is only possible in two situations:

- The share being purchased is a separate room;

- Part of the apartment is being purchased from the co-owner.

If you plan to spend maternity capital on purchasing part of a one-room apartment, then you should not count on approval of such a transaction. The only exception is the situation when, as a result of the transaction, the apartment completely becomes the property of the buyer.

Although difficulties often arise when conducting transactions with shared real estate, if you strictly follow the law and refuse attractive but fraudulent schemes, you can complete the entire procedure quite quickly.

Sale of a share in an apartment without the consent of other owners

Sale of a share in an apartment in 2023 - sample purchase and sale agreement and notification

- Banks Today Live

- Articles marked with this sign are always relevant . We are monitoring this

- And comments to this article are answered by a qualified lawyer , as well as the author of the article himself .

Having a share in an apartment gives its owner the right to dispose of it, including to sell it. Many people believe that in order to sell a share, it is necessary to obtain the consent of the remaining shareholders. But it is not so. Let's figure out how to properly sell a share in an apartment.

According to some data, from 50 to 80% of all housing in Russia is in shared ownership. This is not only “utilities”, but also housing in new buildings. The reasons that housing belongs to several owners may be different, but most often it is the consequences of a divorce.

transactions with shares to be the most “difficult” , as they are often associated with scandals between family members or neighbors. However, a share in an apartment is an expensive property that gives the owner the right of ownership, use and disposal. In other words, having a share in the apartment, he can live in it, or he can sell it.

The main feature of shared ownership in apartments is that the shares do not always have a “physical” embodiment, that is, allocated in kind. Quite often the owner tries to sell a share that is registered only on paper (that is, 1/2, 1/3, etc.).

You can sell both “ideal” shares (that is, allocated only on paper) and those allocated in kind. Realtors claim that the share allocated in kind can be sold for much more - this is almost a full-fledged home.

From the point of view of the law, the sale of a share in an apartment is almost no different from the sale of an apartment. "Almost" means that there are 2 differences:

- You can sell a share in an apartment only through registration with a notary;

- When selling a share, it is mandatory to offer to buy it back to the remaining owners. Contrary to popular belief, you do not need to obtain the consent of other owners to sell a share !

Other aspects are the procedure for registering property rights, taxation, etc. - the same as when selling an entire apartment.

One of the features of transactions with shares is that quite often the shares are not sold, but given away. The advantage here is that when donating a share, you do not need to offer to buy it to other owners, which saves time.

Therefore, we will consider executing a transaction with a share of an apartment using two options – sale and donation.

Selling a share in an apartment - step by step

To sell a share in an apartment, you first need to allocate it (if it has not already been allocated). This applies to cases where the apartment is jointly owned by spouses. It is necessary to draw up an agreement on the division of shares (if there are no disagreements), or the court will divide the apartment.

The allocated “ideal” share is sufficient for its sale, and it is not required to allocate it in kind. Although this is recommended by realtors, since the share allocated in kind is much more expensive. It is usually difficult to allocate a share in kind due to the fact that the layout of the apartment does not allow it to be divided without claims from other owners.

Concepts of Debit and Credit in practice

To sell an already allocated share, you need to follow a certain procedure.

Stage 1

Notification of owners of other shares.

A mandatory condition for the sale of a share is notification of the owners of the remaining shares in the apartment about the sale. They have a pre-emptive right to buy this share at the offered price. This norm is clearly established by legislation, namely Article 250 of the Civil Code of the Russian Federation.

Co-owners must be notified in writing, and the sale price and other terms of the transaction must be indicated.

Then there are 3 options:

- the remaining participants refuse in writing to buy the share - you can sell it to outsiders;

- if they did not refuse in writing, but also did not express a desire to buy a share in their property within a month, it can also be sold to outsiders;

- one of the co-owners agreed to buy the share at the proposed price - the deal is finalized.

It is very important to have documentary evidence that the notice was sent to other owners. A simple option is a registered letter with notification. More complex - if all the necessary operations are carried out by a notary.

If other owners have not been officially notified of the sale of the share, 3 months after the transaction one of them may sue and demand that the rights of the buyer be transferred to him.

Stage 2

- Drawing up a purchase and sale agreement and notarization of the transaction (you can download samples on this page - links below).

- As mentioned above, one of the features of transactions for the sale and purchase of shares in apartments is mandatory notarization transactions.

- If the owners of other apartments refused to purchase the share (or they remained silent for a month from the date of receipt of the notice), there are all the necessary documents, and most importantly, a buyer for the share has been found - a purchase and sale agreement can be drawn up.

The details of the contract are standard, as with the sale of the entire apartment (of course, it is indicated exactly what share is being sold). Also, the contract must reflect all the necessary details - the seller and the buyer, the address of the apartment, its area, the transaction price, and other data.

Since the agreement will still need to be certified by a notary, he can also be entrusted with drafting the document. More precisely, he is unlikely to accept a document drawn up by someone else.

Notary services are not free:

- The state duty is 0.5% of the contract price, minimum 300 rubles, maximum 20,000 rubles;

- legal and technical services (that is, drawing up a purchase and sale agreement): depending on the city, this ranges from 2,000 to 6,000 rubles;

- if you entrust him with notifying other owners about the sale, it will cost about another 1,500 rubles plus postage.

Who pays for the services must be agreed upon in advance. In the practice of realtors, there are cases when both parties divide the costs in half, or when all costs are paid by the buyer.

Before certifying a document, the notary will check the existence of ownership rights, as well as the presence of arrests or other restrictions on the property being sold.

Stage 3

Registration of transfer of ownership in Rosreestr.

The purchase and sale agreement of a share in an apartment in itself, even certified by a notary, does not mean that the buyer has ownership rights. The transaction must be registered with Rosreestr.

You can submit documents for registration in 3 ways:

- contact Rosreestr - in the branch, by registered mail or via the Internet;

- submit documents through the MFC;

- submit documents through a notary.

Filing documents is free in any case (even through a notary; from February 2023 they cannot require additional payment). You only need to pay a state fee of 2,000 rubles. If you submit documents electronically, the state duty is reduced by 30% to 1,400 rubles.

You need to submit the following package of documents:

- application in the prescribed form;

- a notarized purchase and sale agreement and an act of acceptance and transfer of property;

- documents confirming notification of other shareholders - notifications of their receipt of letters or written refusals;

- passports of both parties to the transaction;

- other documents upon request.

The transaction will be registered within 3 working days after submitting documents through the Rosreestr branch, or within 5 days if the documents were submitted through the MFC.

Let us note that since 2016, “stamp” certificates of registration of rights to real estate are no longer issued; they have been replaced by extracts from the Unified State Register of Real Estate on a regular A4 sheet.

Download a sample contract for the sale and purchase of a share in an apartment

| “ Sample agreement for the sale and purchase of a share in an apartment ” If the apartment is purchased by several buyers for common ownership |

|

| “ Sample contract for the sale and purchase of a share in an apartment ” If the apartment is not sold as a whole, but only part of it |

Download a sample notice of sale of a share in an apartment

| “ Notice about the sale of a share in an apartment ” It is sent to other owners |

What is the difference between donating a share and selling it?

The main difference between a contract for donating a share and selling it is that the donor will not need to offer to buy the share to the owners of other shares. Accordingly, you don’t have to wait for written refusals from them or waste a month of time waiting for an answer.

The remaining stages do not change significantly. Instead of a purchase and sale agreement, you need to draw up a gift agreement. Experts also advise contacting notaries for this, since the slightest mistake will make it possible to subsequently protest the fact of the donation.

As in the case of the sale of a share, notarization of the agreement is mandatory. The state duty is exactly the same - 0.5% of the transaction amount.

Another feature of donation is that quite often shares are given to minors (children, grandchildren). To draw up a gift deed for a minor, one of his parents must also participate in the transaction.

Registration of the transaction in Rosreestr proceeds in the same way as in the case of the sale of a share. Only the list of documents differs:

- application in the prescribed form;

- notarized donation agreement;

- passports of the one who gives and the one to whom the share is given;

- if one of the parties to the agreement is under 18 years old - consent of the guardianship and trusteeship authorities;

- if available, a document on family ties between the parties to the agreement;

- other documents upon request.

If the gift agreement is drawn up correctly, other interested parties will not be able to challenge it. cancel the fact of donation only in 3 cases:

- death of the donor due to the fault of the recipient;

- the donor was forcibly forced to sign a gift agreement;

- at the time of signing the agreement, the donor was incapacitated or was under the influence of narcotic or psychotropic substances.

After registering a gift agreement in Rosreestr, the recipient receives ownership of a share in the apartment and an extract from the Unified State Register of Real Estate.

Do I need to pay sales tax?

The sale of real estate in Russia is subject to personal income tax (with the exception of certain cases). As a general rule, you need to pay tax if the property has been owned by the seller for 5 years or less.

But there are several features here. You may not pay tax on the sale of the following shares:

Agreement on the allocation of shares in maternity capital

Maternity capital funds can be used to purchase housing only if the children and each parent are allocated shares in the property rights.

Since it is not always possible to immediately determine the size of shares for all family members when purchasing real estate, the Pension Fund (PFR) allocates maternity capital funds after the parents provide an obligation to allocate shares .

This document is a guarantee that the purchaser of the home undertakes within 6 months after registering the property rights in Rosreestr.

When the moment of fulfillment of the obligation arrives, parents must give their children shares in the apartment by submitting a corresponding agreement .

Such a document is drawn up by a notary, but in some cases it can be drawn up without his participation.

An alternative way to allocate shares to all family members when purchasing a home using capital funds is a gift agreement.

How to allocate shares when using maternity capital

Legislation allows you to use targeted maternity capital funds for the purchase of housing only under the condition that it will be registered as the property of all family members (including children born after the certificate is issued).

Housing can be recognized as common property only after the following circumstances occur:

- Registration of ownership - if real estate is acquired under an agreement of shared participation in construction, then ownership arises after the house is put into operation. When constructing a residential building - after registration of ownership of the finished building.

- Removal of collateral by the bank - if the apartment is purchased with a mortgage.

To issue funds for these needs, the Pension Fund requires parents to provide a notarial undertaking, under the terms of which the owner will have to allocate shares of the property within 6 months after the right to dispose of the property.

It is also possible to avoid the requirement to allocate shares on the basis of an obligation. This can be done in case of purchasing finished housing under a purchase and sale agreement . Upon concluding this transaction, the seller has the right to transfer the property immediately into common ownership, indicating in the agreement the shares of all members of the buyer’s family.

To complete such a transaction, a purchase and sale agreement is concluded with the seller, in which it is necessary to indicate that part of the funds will be transferred to his account from maternity capital.

After completing the transaction, the parents contact the Pension Fund and submit an application for an order - to transfer funds to the seller’s account.

Their application is considered for about a month, after which the funds are transferred to the seller within 10 working days

After full payment of the contract, the parties need to contact Rosreestr with an application to remove the encumbrance on the property (since until this moment the property is pledged to the seller).

The size of the shares for children when using mat. capital

The legislation does not indicate what the mandatory size of shares in maternity capital should be, so citizens often allocate the most minimal shares to children.