There are only two ways to receive the property of a deceased citizen:

- by will. During his lifetime, a person took care of how his property would pass to his heirs;

- in law. The man did not declare his will during his lifetime.

A car, as an item of property of a deceased citizen, can be inherited in one of the following ways. At the same time, you need to remember that inheriting a car after the death of the owner follows a strict procedure and you need to meet certain deadlines.

Heirs of the first stage

If after the death of a person there is no will left written by him, relatives are called upon to inherit in order of priority and relationship. First-priority heirs have a priority right to receive all property, including a vehicle owned by a deceased close relative. Since they are his spouse, children or parents.

Heirs of the second and subsequent stages

- Those relatives who belong to the second and subsequent orders of inheritance can receive an inheritance only if there are no persons belonging to previous orders by degree of relationship, or if these persons cannot claim the inheritance (removed) or refused to enter into the inheritance voluntarily .

- The 2nd line of heirs are full and half brothers and sisters, grandparents of both parents and nephews of the person who died.

- 3rd line - aunts, uncles, cousins (cousins).

- 4th line – great-grandparents.

- 5th line - cousins (children of nephews), great-aunts and grandfathers (siblings of grandparents).

- 6th line - great-great-grandchildren (children of cousins), cousins (children of cousins), great-aunts and uncles (children of great-uncles and grandmothers).

- 7th line – stepsons, stepdaughters, stepfather, stepmother.

Deadline for entering into inheritance

According to the current laws of the Russian Federation, heirs must accept the inheritance no later than 6 months from the date of death of the testator. There are cases when the date of death of a person is unknown, and then you can receive an inheritance within six months from the day the court decision to recognize the citizen as deceased enters into legal force.

If the heirs refused to enter into ownership rights or were removed as unworthy, then the heirs of the next priority may accept the inheritance within six months from the date the rights of the heirs of the previous order arose. That is, a year may pass from the date of death of the testator.

Procedure for inheriting a car

In order to register inheritance rights for vehicles, you need to open an inheritance case with a notary. At the moment, you can contact any notary, without reference to the place of residence of the applicant or deceased person. This can be done by appointment or on a first-come, first-served basis. You must have a certain package of documents with you, namely:

- personal passport of the applicant-heir;

- death certificate of the testator;

- the will or data on the location of its copy;

- if there is no will, then you need to submit documents confirming your relationship with the deceased;

- documents for the car - STS, PTS. If the deceased owned several vehicles, then documents must be provided for each vehicle, including trailers.

The following practice usually works: the notary's secretary accepts the documents from the heir; indicates the missing ones that must be conveyed without fail; appoints a day of application to obtain a certificate of inheritance. Then the heirs simply wait for the appointed day to arrive.

Car assessment

To determine the market value of movable property as an object of inheritance, the notary will need a report from an independent expert on its value. The car is appraised on the date of death of the car owner. A person applying to inherit a car must independently and at his own expense contact licensed appraisers and order a report. He will be required to provide documents confirming his identity, a technical passport and a vehicle registration certificate, and, of course, a document confirming the death of the owner.

As a rule, the report will be ready within 2 - 5 days from the moment the car is inspected and photographed by a specialist.

The amount of state duty for performing notarial acts

Prices for work performed by notaries are regulated by the Tax Code, Part 2, Art. 333.24. Paragraph 22 states that heirs of the 1st degree of kinship of the testator pay 0.3% of the value of the deceased person’s property, but not more than one hundred thousand rubles. The remaining relatives will have to pay 0.6%, but not more than one million rubles. This is a state duty. However, along with the state fee, notaries charge money for the provision of legal and technical services.

Registration of inherited car

How to register a car as an inheritance in the traffic police? Is there any difference to the registration process as a result of a purchase? The process of registering a vehicle always occurs according to one “scenario” established by law, regardless of how the car owner acquired ownership rights: after purchase and signing a sales contract, as a result of a gift or inheritance.

The procedure for registering a car with the traffic police

The new car owner-heir in 2023 has 10 days from the date of receipt of title documents from the notary in order to register the vehicle. Also during this period, you need to have time to undergo a technical inspection of the car, obtain a diagnostic card and insure yourself under the MTPL system.

Many citizens do not want to spend extra time traveling to the traffic police without an appointment, so they use the electronic services of the state portal “Gosulugi” or MFC (multifunctional public service center).

The algorithm of action is similar: preparing documents, filling out applications, paying state fees and making an appointment at any time convenient for the heir to the traffic police takes place in advance, and at the appointed time he arrives by car to the State Traffic Inspectorate, presents the car for inspection and receives a new STS and license plates (according to desired).

Currently, it is possible to register a vehicle in one visit to the traffic police, without an appointment, simply on a first-come, first-served basis. However, this will take much longer.

Required documents

The package of documentation that must be submitted along with the car when re-registering does not depend on the method of contacting the State Traffic Inspectorate.

To register a vehicle, you must have original documents with you:

- personal passport of the heir;

- PTS, STS;

- title certificates from a notary;

- OSAGO policy;

- check for payment of state duty.

Car registration cost

The cost of the state service for re-registration of a car will depend on whether the old state registration remains on the body. numbers or the heir will prefer to get new ones. The price of the issue will vary by 2000 rubles. That's exactly how much it costs to get new state licenses. signs.

When registering, it will be mandatory to receive a new STS card (500 rubles) and make changes (data about the heir) to the car’s title (350 rubles). If suddenly there are no free lines in the technical passport, then you will have to buy a new form for 800 rubles.

Users of the State Services Internet resource can receive a discount of a third of the price. Payment must be made by bank transfer and through the portal.

Features of registration if there are several heirs

It often happens that an inheritance is divided into parts, and the heirs receive ownership rights in shares.

Regarding vehicles, this means that when registering, the car will be registered in the name of one of the heirs (at their discretion), and the rest will be indicated in the title and in the traffic police database. Each of them is required to sign statements in their own hand (or by an authorized representative).

Selling an inherited car

How to sell a car after inheriting? - ask those heirs who would like to sell it and get cash.

If the decision to sell is made immediately after entering into inheritance rights, and there is a buyer, then you can skip the procedure for registering the vehicle in your name.

The heir - the car owner can sign a purchase and sale agreement with the buyer and transfer to him the property, the registration of which will be his responsibility in the future. The seller will only need to present the title document according to which he received the car from the traffic police.

Tax on the sale of a car received by inheritance

Before the expiration of the vehicle ownership period of three calendar years, the sale of inherited property is subject to a 13% tax. In this case, you can take advantage of a tax deduction of 250,000 rubles. That is, reduce income by this amount and pay reduced income tax.

When more than three years have passed since the date of inheritance, the sale of the car will not be subject to taxes.

Do the testator's debts need to be paid?

If you inherited a car with unpaid fines and transport tax, do not rush to pay them. Pay attention to the dates and terms of the debt; perhaps some of them may already be written off due to the statute of limitations. Moreover, you should not pay for your own “automatic sins” if we are talking about large sums. Only if you are recognized as a debtor through the court will you have to make payments. It often happens that the debts of the deceased are written off due to statute of limitations.

Conclusion

How to register a car as an inheritance in the traffic police? What difficulties await the heirs? Such questions arise in people because not everyone encounters such events in their life, or at most only 1-2 times in their life.

In fact, the process of inheritance from a notary and the procedure for re-registering a car with the State Traffic Inspectorate are extremely simple and are within the law.

To do this, it is enough to contact any notary within six months from the date of death of the testator, enter into inheritance rights and register the car with the traffic police in the general manner. The use of modern technologies greatly simplifies operations and saves money.

The procedure for re-registration of a car by inheritance

The inheritance of vehicles raises the most questions, so today we will talk about how to register a car as an inheritance in the traffic police.

Owning does not mean controlling

Open inheritances are made directly on the day of death of the testator. As soon as this happens, all powers of attorney issued for the car lose their force. By confirming his consent to receive a car, in other words, by entering into an inheritance (regardless, by law or by will), a person acquires only the right of ownership to it.

And he acquires the right of disposal only after issuing a certificate confirming the right to inheritance.

According to the law, this procedure (registration) lasts 6 months so that the notary can find persons who have the right to the “obligatory share” (or verify their absence).

These could be minor children, a disabled spouse of the deceased, dependent people, etc. A complete list of persons can be found in the Civil Code of the Russian Federation.

If you have information that there are no such people, and you can confirm this with evidence, then according to clause 2 of Art. 1163 of the Civil Code of the Russian Federation, the period for issuing a certificate of the right to inheritance can be significantly reduced.

But let's return to our situation. You came to the notary, presented him with all the documents confirming your right to inheritance, and wrote an application.

After all this, you will need to evaluate the car to enter into an inheritance, or rather, to calculate the notary fee, which will calculate the amount that the heirs will have to pay for issuing a certificate of title to the inherited property.

- For heirs of the first and second stages, it is 0.3% of the market value of the vehicle (but not more than 100 thousand rubles);

- For others - 0.6% (but not more than 1 million rubles).

Please note that the valuation of a car for inheritance (assessment of its market value) must be made on the date of death of the testator. The cost of the assessment will depend on the prices of the structure where you want to contact to carry it out.

Now all that remains is to wait the required period and finally receive the desired certificate. And then you will have to re-register the car by inheritance with the traffic police.

Re-registration of a car by inheritance

And the first question is, is there a time limit for this procedure? Of course. From the moment you purchase a certificate confirming your right to inheritance, you have only 10 calendar days to change the registration details of the car .

To do this, you will need a valid MTPL policy, which can only be obtained if you have a diagnostic card. So, having received a certificate of inheritance, we immediately perform the following procedures:

We undergo a full technical inspection and receive a diagnostic card from the operator. Next, we receive compulsory motor liability insurance in our name.

Now you can go directly to the traffic police and deal with the re-registration procedure. To do this, you will need to have with you a package consisting of the following documents (and preferably their photocopies):

- MTPL insurance policy;

- Passports of a citizen of the Russian Federation;

- Certificates confirming the right to inheritance and registration of the vehicle;

- Applications for re-registration;

- Vehicle passports;

- Receipts for payment of state duty.

We would like to add that from January 1, 2015 the amount of the state duty is:

- 500 rub. — issuance of a registration certificate;

- 2 thousand rubles - issuing numbers.

In addition to the documents, you will also need to provide the car itself to the traffic police.

Nuances of re-registration

In this case, you draw up a purchase/sale/donation agreement with another person, and after you receive a certificate of ownership, it is he who deals with all the procedures described above. You will only be required to provide the certificate itself and the contract.

If one car is inherited by several people at once, then it is registered in the name of only one of them (whom is decided by the heirs themselves). The presence of the rest will be noted both in the PTS and in the traffic police documents. The heirs will also be required to submit statements confirming that they agree to register the vehicle in the name of the specified heir.

If you do not want to wait 6 months to inherit a car, you can discuss this issue with the future testator and invite him to draw up a gift agreement instead of a will.

Fines from the previous owner

On the one hand, the fine, like any other debt, passes to the heir after he enters into inheritance . This means that if the testator liked to drive on the roads, his heirs will have to pay for it.

However, it is worth paying attention to when the fine was issued. If more than 2 years have passed since that time (or by the time of inheritance it will be 2 years), then according to Art. 39 of the Code of Administrative Offenses of the Russian Federation, the fine will lose its force and may not be paid.

Therefore, if you inherited a car burdened with fines, do not rush to pay them.

If something happens, you will simply be recognized as a debtor through the court, and there is a very real chance of not having to pay for mistakes that you did not make.

As you can see, the procedure for re-registering a car by inheritance with the traffic police is quite simple. In the absence of queues, it rarely takes more than one day. For those who have already waited their legal 6 months, this period will seem insignificant.

How to correctly register a vehicle received by inheritance with the traffic police

Quite often, the estate includes different cars. The heirs must enter into the inheritance and register this property in their name with the State Traffic Safety Inspectorate. Only in this case do they become full owners of the car, so they can use it for its intended purpose, sell or exchange it.

Only if there is correct registration, no penalties will be applied to the citizen.

How to register a car by inheritance

The process is carried out in the same way as for other property. To do this, you need to enter into an inheritance, have the car assessed, pay a fee and obtain an inheritance certificate.

What to do if there is one heir

If the recipient of the inheritance is one person, then this situation is considered the simplest.

To do this, he performs the following actions:

- Initially, you need to find a notary involved in a specific matter;

- an application and other documents are prepared confirming the relationship with the testator, and documentation for the car is also needed;

- the car is assessed, allowing it to be determined what state duty must be paid to enter into an inheritance;

- a fee is paid;

- after 6 months after the death of a person, an inheritance certificate is issued to the heir;

- You must come with it to the traffic police within 10 days to register.

What to do if there are several of them

Often, a deceased citizen has several close relatives who lay claim to the car. In this case, all heirs perform the same actions as if there was one recipient of the property, but at the same time they are allocated only a certain part of the car.

After registration, several co-owners appear. They independently decide how they will manage this property.

How can I restore my rights myself? You can find out here.

Usually, when a compromise is found, they sell the car, after which the proceeds from this process are distributed among all former co-owners. If they cannot come to one decision, then they have to go to court.

How to register

First, you need to obtain a certificate of inheritance, for which the heir collects the necessary documents and submits them to the notary. The car is assessed, after which the duty is paid. All these actions must be completed within six months after the death of the testator.

If you do not meet the deadline, the use of the car will be illegal, therefore, if such a violation is detected, the driver will be held administratively liable.

What documents are needed for the traffic police?

When registering a car that was inherited by a person, it is necessary to prepare certain documentation.

It includes:

- application for vehicle registration;

- applicant's passport;

- certificate of inheritance, confirming the citizen’s right to this property;

- a compulsory motor liability insurance policy, which must be issued for each car, and you can obtain it from any insurance organization after providing an inheritance certificate and other documents for the car;

- diagnostic card for the car, issued after passing the technical inspection;

- registration documents left by the deceased owner;

- technical papers for the car, which include the title and other documentation;

- receipt for payment of state duty.

How to register ownership of a car?

- When registering a car with the traffic police, the heir independently decides whether the previous license plates will be retained or new plates will be obtained.

- To pay the fee, you can take a receipt directly from the traffic police officers, so you can pay it immediately, and then return to the registration window for subsequent processing.

- You can make an appointment in advance with the traffic police on the State Services website, which will save the citizen from having to stand in line for a long time.

Procedure for registration of a vehicle

The process of registering an inheritance is considered standard.

It is divided into stages:

- initially the notary opens the case;

- he identifies all the heirs to whom a notification is sent so that they can declare their rights to the inheritance of the deceased person if there is no will in which the deceased himself distributes his property among other people;

- a person who can lay claim to a car submits an application to a notary, and it must be accompanied by papers confirming the relationship with the testator;

- Next, you need to evaluate the car, pay the fee, and only then, after 6 months after the death of the car owner, receive an inheritance certificate;

- registration of an insurance policy for a car;

- together with it and other documents, you must contact the traffic police within 10 days to register the car.

Deadlines

The period during which it is required to register a car with the traffic police depends entirely on when exactly the inheritance certificate is issued. Therefore, you first need to find out when the notary will present this document to the heir.

Based on Art. 1163 of the Civil Code, a certificate of inheritance is issued only six months after the death of the testator.

Article 1163, Civil Code.

Deadlines for issuing a certificate of the right to inheritance 1. A certificate of the right to inheritance is issued to heirs at any time after six months from the date of opening of the inheritance, except for the cases provided for by this Code.

2. When inheriting both by law and by will, a certificate of the right to inheritance may be issued before the expiration of six months from the date of opening of the inheritance, if there is reliable data that, in addition to the persons who applied for the issuance of the certificate, other heirs who have the right for the inheritance or its corresponding part, is not available.

3. The issuance of a certificate of the right to inheritance is suspended by a court decision, as well as in the presence of a conceived but not yet born heir.

It is this period of time that is given to all heirs so that they can lay claim to different property.

What is the environmental class of a vehicle and how to find it out? The answers are here.

There is a possibility that the certificate will be issued earlier, but for this the heir must have strong and official evidence that there are no other claimants to the inheritance.

It is possible to completely suspend this period, which requires a court decision. After receiving the certificate of inheritance, you must contact the traffic police to register within 10 days. If this deadline is missed, you will have to pay a fine.

The registration process with the traffic police is considered simple, and it does not require the preparation of numerous documentation. Often the procedure does not take more than an hour, but if the necessary papers are not prepared in advance, registration can take up to two days. You will have to take out a compulsory motor liability insurance policy in advance.

How much does renewal cost?

The registration of the car in the name of the heir is carried out at the State Traffic Safety Inspectorate, and a fee will have to be paid for this.

Since 2018, the main services include:

- issuance of a registration certificate – 500 rubles;

- replacement of numbers, if necessary for the new owner - 2 thousand rubles;

- if it is necessary to register, replace license plates and PTS, then 3.3 thousand rubles are paid;

- often the heir is a citizen of another country who wants to take the car abroad, and in this case registration is not carried out, but transit numbers are issued, for which you have to pay 1.6 thousand rubles;

- if you need to change the name in the PTS if there is free space, then 850 rubles are paid;

- if there is no space in the PTS for a new entry, but the owner needs to be changed, then 1.3 thousand rubles are paid if the signs are preserved.

Is registration available online

The State Services portal and other services on the Internet actually offer a lot of government services that allow you to pay various fees, pay fines or perform other actions. This even includes the opportunity to apply to register a car that has been inherited.

After filling out the application form, you will receive an electronic ticket by email containing the date when you need to come to the traffic police department with the necessary documents for registration. Additionally, on the State Services website you can pay the state fee with a significant discount and print a receipt.

Fines for violation

If the car is not registered for inheritance within 10 days after receiving the inheritance certificate, the new owner will have to pay a fine of 1.5 to 2 thousand rubles.

What liability occurs for failure to pay traffic fines? Read the link.

If serious errors are revealed in the registration documents, then a traffic police officer may be held accountable. In this case, the payment will be equal to 2 to 3.5 thousand rubles.

A separate punishment is intended for heirs who drive a car without registration after the death of the testator, and it is represented by a fine from 500 to 800 rubles.

Are fines of the previous owner inherited?

The legislation clearly states that when accepting an inheritance, not only valuables are transferred, but also the debts of the deceased person. Therefore, if the testator had various debts and unpaid fines, then they will have to be repaid to the new owners of the property.

Conclusion

Thus, if a car is inherited, it must be timely and correctly registered by the heir. If there are violations, they will be the basis for the imposition of significant fines. It is important to understand the correct sequential steps required for registration in order to avoid violations and errors.

Car by inheritance: registration in the traffic police, certificate from a notary, sale after inheritance

If the vehicle is inherited, it is important to know the intricacies of registering it in your name. Difficulties often arise in re-registration, deregistration or sale. We will touch on all possible nuances and illustrate with examples important points when a car was inherited.

Currently, powers of attorney to drive a vehicle are not issued. Whoever received the documents for the car and the car itself has the right to operate it. These actions replace a written power of attorney.

If the testator, during his lifetime, transferred documents and a car into someone else’s hands, from the day of his death the use of such a car becomes illegal. The car must be included in the estate.

And until the heirs and their rights to the inherited property are clear, unauthorized persons (not applicants for the inheritance) must transfer the car to the heirs or a notary.

As practice shows, the heirs continue to use the car. If there are no other claimants to the property, there are no problems. Moreover, before issuing a certificate of inheritance, a notary can issue a certificate of actual acceptance of the inheritance. That is, the car will be in the hands of the heir legally.

Even if the 6-month deadline for entering into inheritance is missed, the court may establish the right to own the car. This basis is called actual entry into inheritance. In this case, it will be taken into account that the actual owner spent his own money on maintaining the vehicle, maintained it and protected it from third parties.

If other claimants to the property appear who object to the ownership of the car by one of the heirs, the situation will be resolved in court (see also who has a mandatory share in the inheritance).

We formalize the entry into inheritance

The first step to turning the vehicle into your property is to register an inheritance:

- Entry into inheritance by law (without a will). This occurs according to the general rules provided for any other property. It is enough to be a relative of the testator. You can contact a notary at the place of residence of the deceased, expressing in writing your desire to accept everything that is due to you.

- Entry into inheritance under a will. In the case where a will has been drawn up for a car. But just a will is not enough; the heir is also required to obtain a certificate from a notary.

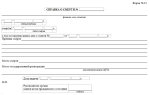

Documents for a notary

After providing all the documents, the notary, six months after the death of the testator-owner of the car, will issue you a certificate of title to the car left to you. But first, to enter into an inheritance, the notary will require the following documents:

- Death certificate of a person. The date of death indicated in this document is the date of opening of the inheritance (from this moment all powers of attorney, oral agreements, etc. of the deceased cease to be valid);

- Certificate of registration of the vehicle with the State Traffic Safety Inspectorate and PTS. These documents will confirm that the car being inherited belongs to the deceased;

- Confirmation of relationship (marriage) between the deceased and the applicant for the car. Most often this is a birth certificate, a record of children, a passport, an act establishing guardianship, etc. Other documents may also be needed. For example, a daughter-heiress changed her last name after marriage. When entering into an inheritance, according to the law, she must additionally submit a marriage certificate to the notary in order to subsequently receive the car of her deceased father;

- A certificate of the value of the car that will be inherited. To obtain such a certificate, you need to order a car valuation (for inheritance). The notary needs to know about the cost of the vehicle, since the state duty will be determined from this amount;

- Information about the place of residence of the deceased (to ensure compliance with the territorial principle);

- Receipt for payment of state duty.

How can a minor inherit an inheritance of a vehicle?

There are cases when the heir is a child. In this case, his parents (guardians, trustees) will formalize the right to the share due to the child.

How much should you pay and how to save

Before entering into an inheritance, you must pay the state fee for the notary. It is determined from the assessment of transport. The car is valued on the date of death of the testator.

If this is ignored, the notary will refuse to issue a certificate of title to the property left to you.

In order for your future car to be assessed according to all the rules, you should contact a professional appraiser who is a member of the SRO (association of appraisers).

Calculation of state duty

- if you are a first-degree heir (son, daughter, spouse, brother, sister), then pay the notary 0.3% of the value of the inheritance, but not more than 100,000 rubles.

- in other cases, the state duty for notary services is 0.6%, but not more than a million rubles.

Example: A son inherited a car after his father’s death (first line of inheritance). According to the appraiser's report, the value of the car on the day when the father died was 400,000 rubles. Consequently, the son must pay notary services in the amount of 1,200 rubles.

In some cases, provided for in Article 333.38 of the Tax Code of the Russian Federation, heirs may be exempt from paying the notary state fee. For example, minors.

In addition, the notary charges a fee for legal and technical services. For 1 car the tariff ranges from 2000 to 3000 rubles. depending on the region of the Russian Federation.

This tariff is legal. But the notary must justify the essence of the service.

Although the very fact of studying inheritance documents, drawing up and printing a certificate of inheritance, etc., is a service.

It turns out that the cost of registration with a notary will be: state tax plus the tariff for services.

How to save time and money - draw up a gift agreement in advance

You can effectively save time, money on state fees, assessments and significantly simplify the procedure for transferring the vehicle of a deceased relative into your ownership. You just need to prepare a gift agreement in advance (see deed of gift for a car).

If you know for sure that you are the direct heir of your father, grandfather, uncle or other relatives, then you can (of course, with the consent of these persons) in advance, during their lifetime, draw up an agreement to donate a car to you. In this case you:

- You won’t have to wonder how to inherit a car and collect numerous documents. It will be considered that, according to the gift agreement, it already belongs to you. You only need to re-register with the traffic police.

- in the event of the owner's death, it is possible to use the car immediately, without waiting for six months.

However, it is not profitable to draw up such a gift agreement between non-close relatives, since in this case the donee is obliged to pay 13% personal income tax for the next year after the date of the donation. And parents, children, brothers, sisters, husband, wife are exempt from such payment if they do not sell this car in the next 3 years.

Tax on the sale of a car if you owned it for less than 3 years

Do not forget about the tax when selling a car received as an inheritance. If immediately after issuing the certificate by a notary you decide to sell the vehicle (or owning the vehicle for less than three years), you will have to pay tax. The amount is calculated depending on the price of the property sold.

Any income of a citizen is subject to taxation (personal income tax), and when selling a car that has been owned for less than 3 years, the owner becomes obligated to pay tax. If you intend to sell an inherited car, you should know the following:

- the basis for calculating the 13% tax is the sales amount exceeding 250,000 rubles (since the new owner did not incur any acquisition costs);

- So, if, according to the purchase and sale agreement, the subject is a car worth 300,000 rubles, then the tax will have to be paid on 50,000 rubles (300,000 - 250,000): 50,000 X 13% = 6,500 rubles.

- When selling a car for 250,000 rubles or less, no tax is paid. But the declaration must still be submitted to the Federal Tax Service.

And even in a situation with preliminary registration of a gift agreement, if the car has to be sold earlier than 36 months from the date of ownership, you will also have to file a 3-NDFL declaration and pay tax if the car is sold for more than 250 thousand rubles. (property deduction).

Naturally, if the heir owns the car for more than 3 years, then there is no need to pay tax. There is no need to submit a declaration. The three-year period is counted from the date of receipt of the certificate of inheritance for the car.

Refusal of the inherited machine

If none of the heirs entered into the inheritance, then all inherited property passes to the state. If you miss the six-month deadline for entering into an inheritance with good reason, you can try to restore it in court (see restoration of a missed deadline for entering into an inheritance).

When the debts of the deceased exceed the value of the inheritance, it is better to issue an official refusal to enter into rights to the property of the deceased. In practice, inheritance, including in the form of a vehicle, is refused when the deceased has many unfulfilled obligations. Moreover, one cannot refuse only one type of property, while another cannot be accepted. The refusal is categorical, that is, completely from one’s share.

And if you receive an inheritance, then the law obliges you to accept the due share in full along with existing debts. This is not always beneficial for relatives (see who pays the loan for the deceased). You can refuse an inheritance within six months after the death of the testator, even if you have already accepted the property. After an official refusal, it will be impossible to regain the right to accept the due share.

Re-registration of vehicles with the traffic police

Within 10 days from the moment you become the full owner of the car (from the date of receipt of the certificate of inheritance) received as an inheritance, you must provide documents to the traffic police for registration:

- a compulsory motor liability insurance policy issued to you;

- application for re-registration;

- Your general passport;

- certificate of right to inheritance issued by a notary;

- car registration certificate (in the name of the testator);

- vehicle passport with a transfer record (the record is made only by the heir and indicates the details of the inheritance certificate);

- receipt of payment of state duty;

- directly the car (for inspection).

Since the certificate is a document about the heir as the rightful owner of the car, the 10-day period begins from this day. This certificate confirms the change of ownership. And this is an absolute basis for re-registration of car rights. If this is not done within the specified period, a fine of 1,500 to 2,000 rubles may be imposed.

In 2023, the state fee for car registration is:

- 850 rub. (500 rubles for issuing a vehicle certificate + 350 rubles for making changes to the PTS) - if you keep your previous license plates.

- 2850 rub. (2000 rubles for issuing license plates + 500 rubles for certificate + 350 rubles for making changes to the PTS) - in case you want to change the plates.

If you use the State Duma portal, the cost of the fee will be 30 percent less, that is, 595 rubles. or 1995 rub. (depending on the composition of registration actions).

Deregistration of a car under the previous owner occurs simultaneously with registration indicating the new owner, the procedure is completed within one day.

If there are several heirs for 1 car (or a car for two)?

When entering into an inheritance without a will, the car may go to several heirs at once. In this case, the car can be registered in the name of only one new owner, for whom it is up to all purchasers to decide. In this case, the remaining heirs can be indicated in the registration data of the traffic police database, and in the PTS in the “other notes” column.

According to a will, no one assigns a car to several persons, but in the absence of a will, this may well happen. As a rule, the heirs either agree to sell it and divide the funds, or leave it alone and take compensation.

Selling a car without re-registration with the traffic police

According to the traffic police regulations, it is allowed not to register the vehicle to the new owner-heir if the latter wishes to sell it immediately.

- Example 1: a young woman who does not have a driver’s license inherits a car. Since her plans do not include obtaining a driver’s license, she wants to immediately sell the car without wasting time registering with the traffic police in her name. You can immediately register the vehicle with the inspection for the buyer, but providing a certificate of inheritance is mandatory in any case.

- Example 2: during the life of the owner, the car was not registered with the State Traffic Safety Inspectorate and there is no mark on the owner in the PTS. The question arises - how to sell such a car after inheriting? And in this case, you can bypass the stage of registering with the inspectorate in your name; the law allows the sale of such a car immediately after receiving a notarial certificate. In this case, you will additionally need to pay a state fee of 350 rubles for making changes to the PTS.