When divorcing a spouse and dividing jointly acquired property, it is necessary to take into account that the husband or wife sometimes has personal property that the law will not allow to be divided. This is something that was acquired before legal marriage, given as a gift, privatized or inherited.

In our article we will consider the question of whether a gift apartment belonging to one of the spouses is divided during a divorce.

Apartment as a gift

Sometimes you can get an apartment as a gift. A gift is a gratuitous transaction in which the donor does not receive any remuneration, and the recipient does not owe him anything.

Most often, such gifts are made by close relatives (parents, children, grandparents, siblings, etc.). In this case, neither the donor nor the recipient has to pay tax to the state.

But if housing is not donated by a relative, then he must pay a thirteen percent tax on the value of the gift to the state treasury.

The recipient will have to pay the same tax if he decides to sell the donated apartment earlier than three years after receiving it as a gift.

Housing received by one of the spouses under a gift agreement will be considered only his personal property. It will not be subject to division with the other spouse upon divorce. It doesn’t matter whether it was given before marriage or during family life. Some spouses deliberately resort to such tricks if they are not sure of the honesty and sincerity of their other half.

Property received as a gift is not divided in a divorce. The former spouse can evict the second spouse in court, even if there is registration and the fact of residence for many years.

The gift agreement will be considered legal and valid if it is drawn up and registered in accordance with all the rules. Only then will the donated apartment not be divided during a divorce. There are also exceptions, which we will mention below.

How to properly formalize a donation

A gift agreement is drawn up in writing with the participation of two persons - the donor and the donee, or their legal representatives or representatives by proxy. Both parties to the transaction sign at the end of the document. Mandatory notarization of the contract is not required, but it will never be superfluous.

The following cannot be donors:

- persons recognized by the court as legally incompetent and their legal representatives,

- children under fourteen years of age and their legal representatives.

Donees who will not be able to register rights to a gift if they received it from their clients and their relatives:

- civil servants,

- employees of medical and educational institutions,

- social service workers.

If a common apartment (or part of it) is donated by one of the spouses, then the second must give his written consent to this. The same is required from parents if the gift is made by their minor children. In the case where a parent gives housing to their child, the consent of the second parent is not required, even if their housing is shared.

When a part of an apartment divided into several shares is given as a gift, it is necessary to obtain mandatory consent from the remaining shareholders.

It is not difficult to draw up a gift agreement with a good sample in hand. But it still needs to be registered with Rosreestr, for which it is necessary to collect an impressive package of documents. And this needs to be done immediately. After the death of the donor or other unforeseen situations, it will no longer be possible to register the fact of the gift. In this case, the transaction will no longer be considered completed.

Documents for registration of a gift agreement for an apartment:

- identity passports of the donor and the donee,

- property donation agreement,

- document on ownership of the apartment,

- cadastral passport with apartment plan,

- BTI certificate about the cost of the apartment,

- certificate of persons registered in the apartment,

- notarized consent of the spouse (if the ownership of the apartment is joint, except for donation to children),

- consent of all homeowners (if a share in the apartment is given),

- consent of the legal representative or guardian (if the donee or donor is incapacitated or a minor),

- power of attorney (if the interests of one or the other party are represented by a third party).

Only if all these conditions are met will the gift agreement be considered valid and the question will not arise whether the donated apartment is divided in the event of a divorce.

Similar nuances apply to the division of inheritance during a divorce. Indeed, in this case, general funds were not used for its acquisition either.

Can the gift be shared?

The donated property, including an apartment, will not be the joint property of the legal spouses precisely because no common funds were spent on its acquisition. But they could spend money on repairs, redevelopment, reconstruction.

If these manipulations have significantly improved the appearance of the housing, and its value has increased significantly, then it makes sense to fight to recognize the donated apartment as the common property of the spouses.

But the division of shared property during a divorce is a completely different situation; we advise you to read more about it.

The property of each spouse, which is not subject to division, can still be recognized as joint property. To do this, you need to prove that the second spouse made significant investments in it (labor, finances, etc.), which increased the value of the property.

The decision to recognize or not recognize the donated apartment (or other property) as joint property of the spouses is made by the court. The statement of claim is filed by the spouse who wishes to claim his rights to the donated housing. In court hearings, both sides are heard, the evidence presented is examined, and witnesses are questioned.

If the court takes into account all the arguments and evidence and recognizes the property as joint, then the donated apartment is divided in half between the spouses upon divorce.

How to achieve division of a donated apartment

There are two ways to try to obtain rights to an apartment donated to your spouse: peacefully or through the courts.

When spouses during a divorce enter into an agreement on the division of property, nothing prevents them from dividing the apartment given to one of them. But for the spouse who was not the donee, this is not safe. After all, his other half can always change his mind and want to regain his home, and the law will be on his side.

You can re-register ownership of the donated apartment ahead of time - draw up a gift agreement for your wife (husband) or joint young children. Or sell it and purchase another property, which will be registered as common property.

If the spouses have other housing that will be purchased jointly, then the donated apartment can simply be left to the legal owner with the agreement that their joint apartment will go to the second spouse in full.

By the way, donation can concern not only an apartment, but also a country house and land. We tell you how a land plot is divided during a divorce here - https://divorceinfo.ru/2300-razdel-zemelnogo-uchastka-pri-razvode-suprugov

Otherwise, the issue of division of common property will have to be resolved in court. There is very little chance of getting half of the apartment given to your spouse.

A deed of gift can be challenged in rare cases when it is possible to provide evidence of the donor’s incapacity at the time of signing the document, as well as the fact of physical or moral pressure on him to sign the gift agreement.

You can try to invalidate the gift agreement if you prove that it was not properly drawn up or registered, was concluded with an incapacitated person, etc. Then both you and your spouse are unlikely to see this apartment. There is no point in this.

It would be more correct to try to transfer it to the category of jointly acquired property. To do this, you need to prove that expensive repairs were made to it during the marriage, due to which its value increased significantly. This is not always easy either.

It is unlikely that you will invite an appraiser to determine the cost of the apartment before and after renovation, or collect all the receipts for purchased building materials and payment for the services of the repair team.

Usually, when renovating an apartment, spouses do not even suspect that they will soon have to divorce.

It is quite difficult to prove your involvement of the second spouse in real estate, but in rare cases it may be possible to reclassify living space received by gift as “jointly acquired property” and then divide it in half.

The division of a donated apartment during a divorce is always a troublesome matter. If there is something to fight for, then it makes sense to seek help in accompanying the legal process from good lawyers. First, you need to try to resolve this issue with your still spouse amicably. If this is your only home, and you risk being left on the street after a divorce, you need to try all options.

Is a donated or inherited apartment divided during a divorce?

Home / Division of property / Is a donated or inherited apartment divided during a divorce?

Views 6557

In the article “Dividing an apartment during a divorce,” we mentioned that in addition to the common property of the husband and wife, which is subject to division between them in the event of a divorce, each spouse may have personal property, which no one has the right to claim. Such property includes apartments that were received by one of the spouses as a gift or by inheritance.

Apartment as a gift. Is the donated apartment divided?

Donating an apartment is a gratuitous transaction in which the donor transfers the apartment into the ownership of the recipient without any remuneration on his part.

Most often, close relatives - parents, children, grandparents - prefer to give such valuable gifts.

If the apartment was received as a gift from a relative, you do not have to pay tax. If the apartment was donated by a stranger, the recipient must pay a tax to the state - 13%. You will have to pay tax again if you sell an apartment received as a gift, if it is sold within 3 years from the date of receipt of the gift.

An apartment received as a gift by a husband or wife is his personal property. Moreover, it does not matter whether the apartment was donated before marriage or during the married life of the spouses. The donated apartment is not subject to division in the event of a divorce.

Even if during family life the second spouse was registered in the spouse’s personal apartment, even if he lived in it for many years, after the divorce the owner of the apartment has the right to evict the spouse from it.

However, there are exceptions. You should consider the situation when the apartment is given to both husband and wife at the same time. For example, a young family is often given housing as a gift for a wedding.

Of course, in this case, no one even admits the thought of a possible divorce, so ownership of the property is registered in the name of two spouses.

In this case, the donated apartment is shared, and upon divorce it will be divided between the spouses into equal shares.

What is inheritance? Is an inherited apartment subject to division?

Transfer/receipt of property by inheritance is another free transaction. After the death of the testator, the property may pass into the ownership of the heir...

- by will (if the will drawn up by the testator specifies an heir);

- by law (if the heir has the right to receive the inheritance in the order of priority provided for by family law).

The rule on undivided personal property also applies to inherited property. Regardless of the method of transfer/receipt of inheritance, the received property is the property of the heir and is not shared with the husband or wife.

However, both methods of inheritance can be considered in more detail.

By law without a will

Each spouse can inherit real estate from a relative. If the deceased relative did not leave a will, inheritance occurs in accordance with the provisions of the law - in order of priority.

If only the husband or wife is the heir, this property is personal and is not divided in the event of divorce. But we must take into account that two spouses can act as heirs at the same time - husband and wife, for example, as parents after the death of a child.

However, in this case, the inherited property will be in shared joint ownership - each of them will be the owner of a certain share.

Moreover, it is possible that among the heirs there will be other relatives of the deceased who are entitled to receive an inheritance by law.

By will

If one of the spouses is indicated in the will for inheritance - husband or wife, he becomes the full owner of the bequeathed property. The second spouse has no right to claim it, even if the inheritance occurred during the marriage.

But cases are not excluded when both spouses are indicated in the will - the law provides every citizen with the right to bequeath property belonging to him to any person or several persons at his own discretion. If the heirs under the will are both spouses, they become co-owners of the will. Then the property is subject to division between them and other co-owners.

Is it possible to divide a donated and inherited apartment? When a personal apartment becomes shared

So, a donated or inherited apartment is personal and not common property precisely because common, family money was not spent on its acquisition.

But family money could be spent on redevelopment, repairs, and technical equipment of housing. In addition to money, the spouses could spend their time and effort on improving the apartment. If, as a result of the investment of common funds and the efforts of the spouses, the apartment has not only become more beautiful and comfortable, but has also increased in price, it is worth fighting for recognition of its common property. How?

Only a court can make a decision on recognizing or not recognizing the personal apartment of a husband or wife as joint property of the spouses. Therefore, it is impossible to do without going to court.

A spouse who claims a share in an apartment owned by the second spouse under a gift agreement or an act of inheritance must file a corresponding statement of claim with the court. It should be accompanied by evidence of:

- how the apartment was improved;

- how much total money was spent;

- how the cost of the apartment has changed from the moment it was received as a gift to the present moment.

Such evidence may include contracts for repair work, checks and receipts for the purchase of construction and finishing materials, equipment, an estimate of the cost of the apartment before and after improvement, testimony about the expenditure of time and effort of the spouses.

Frankly speaking, the collection of such documents, the process of proof and the litigation itself is a difficult and unpleasant undertaking. To assess the chances of success, you should seek advice from lawyers; they will help you collect the necessary documents and provide support in court.

Remember that on our portal you can get free legal advice on the division of family property.

If the court, after considering the evidence provided and hearing the testimony of the parties, recognizes the apartment as joint property, it will be subject to division between the spouses into equal parts.

How else to achieve the division of a donated or inherited apartment?

Another indispensable way to achieve the division of a donated or inherited apartment is to negotiate peacefully.

In some cases, the apartment owner himself does not want to deprive his spouse of the right to housing. Although officially, according to documents, the apartment is his personal property, many years of living together in it mean something.

Divorcing spouses can enter into an agreement, the terms of which will provide for the division of a donated or inherited apartment. True, this beautiful gesture can turn into disappointment after a while. The owner of the apartment may change his mind, and the recently drawn up written agreement will not have legal force. The law is on the side of the owner.

If the spouse, whose personal property is the apartment, is really determined to share it, he can enter into a gift agreement with the spouse. Or sell your apartment and purchase one or more other apartments instead, registering them as joint or personal property of each spouse.

If the donated or inherited apartment is not the only home of the spouses, it can be left to the owner, and the other apartment, even if it is joint property, can be transferred to the ownership of the second spouse.

In conclusion, I would like to note that there are chances to divide an apartment owned by one of the spouses under a gift agreement or by inheritance. The best thing to do is to look for opportunities to reach a peaceful agreement. Otherwise, you will have to go to court, and this is long, expensive, troublesome and, unfortunately, not always effective.

When the heirs or donees are both spouses

As mentioned above, spouses can receive an apartment as a gift together (for example, for a wedding). Together they can also receive an inheritance (for example, after deceased children). This housing will belong to both of them on the right of joint ownership. Accordingly, in the event of a divorce, housing will be subject to division in proportion to shares.

Legal assistance

The division of real estate after a divorce is an extremely tedious and not always pleasant undertaking.

Experience knows many cases where, during the division process, spouses quarreled, injured each other, wrote statements to the police, and even damaged property. Aggressive actions do not lead to good.

The division of property without a lawyer ends in disastrous results and never benefits the parties to the conflict.

Are you in a difficult situation and don’t know how to get out of it? Contact the lawyers of our portal for help - a free online consultation will allow you to sort out the issue from a legal point of view. If you don’t understand what to do next, a lawyer will suggest the best solution.

Let's say, if you want to divide the inherited apartment of your ex-spouse, the lawyer will calculate the risks, prepare a list of documents, raise judicial practice and assess the chances of a successful outcome of the case. If, on the contrary, you are protecting personal property from division, the lawyer will take care of preparing the grounds to consider the property only yours.

Situations may be different - you should not rely only on your own strength. A free consultation with a lawyer will come in handy!

Is a gifted or inherited apartment divided when spouses divorce?

According to the provisions of the Family Code of Russia, material assets acquired through non-cash transactions are personal property, therefore the division of a donated or inherited apartment during a divorce is carried out only in exceptional circumstances.

Is an apartment donated during marriage subject to division?

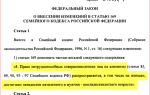

Part 1 art. 36 of the Family Code of Russia provides that benefits acquired as a gift belong to one spouse. The second partner and minor children cannot claim a share of the valuables.

Article 256 of the Civil Code of the Russian Federation emphasizes that a gift is the personal property of the spouse and therefore cannot be divided during a divorce.

Exception cases:

- During the marriage, partners invested significant sums in repairs, reconstruction or maintaining the gift in proper form. If we are talking about real estate, then it is enough to confirm that repairs, expansion of the property and other activities have been carried out, after which the value of the property has increased significantly. It is very important to confirm that at this time the spouses worked together and mutually looked after the property.

- Sale and purchase. A gift is personal property, but the money received from its sale is joint property. This means that after the sale of the object, the money will belong equally to the man and woman. The benefits purchased with this money will be divided upon divorce.

It happens that a gift is immediately transferred to two spouses without drawing up an agreement.

For example, giving newlyweds an apartment from their parents. You can avoid registering a deed of gift, but during the re-registration of property rights to the property, each partner will have their own share of material benefits registered - 50%.

Is an apartment received by inheritance divided?

The law provides for two ways to receive material benefits by inheritance, which determines the distribution of property rights to the object:

- Transfer of benefits by will. The administrative document contains a specific indication of who will receive the object or a specific share. If the recipient of the inheritance is one spouse, then the inherited property will belong to him as personal property (Article 36 of the RF IC). In this way, a wife, husband, or minor children can receive valuables.

- Transfer of valuables to heirs in accordance with the legal order. In such a situation, candidates for housing will be persons designated by the Civil Code according to the order of heirs. This could be one or both spouses.

Confirmation of rights to inheritance is a notary certificate, on the basis of which property is re-registered in Rosreestr. The certificate contains information about the heir's share of a specific property.

When is it possible to divide inherited property?

Exceptional circumstances for the gift section:

- mutual investment of money for property maintenance;

- sale of inheritance and acquisition of new property with the proceeds.

Division of a donated or inherited apartment through the court

Free legal consultation We will answer your question in 5 minutes!

As mentioned above, division of donated or inherited property is possible in exceptional cases, the easiest way is a settlement agreement, but if the spouse is against voluntary division, the only way out is to go to court. The result of the appeal largely depends on the evidence presented to the court, because initially the property belongs to one spouse.

Evidence in court

Table No. 1 “Evidence allowing the division of gifts and inheritance”

General investment of moneyResale

|

|

Arbitrage practice

Case study:

After registering the marriage, citizen O. received from his parents an apartment as a gift, drawn up in a gift agreement and registered with Rosreestr. The cost of the property at the time of acquisition was 1,700,000 rubles.

During their marriage (8 years), the couple made cosmetic repairs several times. During the divorce, the wife demanded part of the apartment, citing the general costs of maintaining it.

The price of the property at the time of termination of the marriage was 1,900,000 rubles.

The court rejected the claim. Gifted property is personal property that cannot be divided. Major repairs are not considered a significant financial investment, and the slight increase in price is due to an increase in the cost of real estate throughout the country and has nothing to do with mutual monetary investment.

Division of inherited or donated property peacefully

The Family Code gives the right to resolve disputes independently by drawing up a notarial settlement agreement. There are two types:

- A prenuptial agreement is a bilateral contract drawn up between the bride and groom or husband and wife before divorce. The content includes a list of available material assets and objects that will be acquired in the future. A legal property regime is established, that is, the order of distribution of material wealth between spouses.

- A settlement agreement on the division of property, drawn up during a divorce or after receiving a certificate of termination of marriage. The contract can only contain data about already purchased objects. Allows you to divide material assets received by inheritance and as a gift.

If a property dispute has reached the stage of judicial review, then the conflict can be avoided in the following ways:

- independently negotiate the amount of monetary compensation;

- establish a convenient option for dividing property.

Financial documents and witness statements will help prove your point of view.

Answers to questions from a lawyer regarding the division of donated property during a divorce

Didn't find the answer to your question? Our lawyer will answer your question for free in 5 minutes!

During marriage, my parents gave me an apartment. My husband and I exchanged it for an equivalent apartment in another area. Will the real apartment be divided during a divorce?

Yes. The right of personal property extended to a piece of real estate – a gift. After the change of ownership, the property became common.

My husband, while married, gave me an apartment, but during the divorce he began to claim that the apartment was purchased with joint funds and was not a gift (no deed of gift was issued). Is such an apartment subject to division?

The situation is complex, and the final decision depends on the court. On the one hand, a spouse can gift the property to the second spouse, and it will not be divided upon the end of the marriage.

On the other hand, there is no supporting evidence that the donation took place, so it will be difficult to confirm your words. It is necessary to enlist the support of witnesses, copies of personal correspondence and calls.

With the proper evidence base, it will be possible to prove that the apartment is a gift.

Conclusion

Deeds of gift and inheritance do not provide grounds for dividing property. But there are a number of exceptions that allow the benefits to be divided between spouses. The main thing is to prepare evidence in advance and competently draw up a claim.

It is important to know!

- Each case is individual and requires special attention. The information presented on the site is general and does not guarantee a solution to your specific problem.

- We carefully monitor changes in legislation and try to make changes in a timely manner, but this does not always happen quickly.

Therefore, 24-hour legal assistance on any issues is available to you FREE OF CHARGE! Ask your question right now!

Lawyer. The main area of activity is family law. I take an active part in courts as a representative.

Still have questions? Ask them to the duty lawyer!

Is a donated apartment divided during a divorce? How to divide a donated apartment?

2,166 views

A gift in the form of an apartment from a close relative is quite common. Such gifts are especially often given for weddings; moreover, the gift can be registered with the Rosreestr authorities and issued both before and after marriage. But is the donated apartment divided during a divorce or does it remain only with the spouse to whom it was donated?

As long as there is no conflict in the family, the donated property pleases the spouses, but only until the moment of divorce. When a relationship begins to “crack at the seams,” the real estate gifted to one of the spouses becomes a real stumbling block in the division of property.

Features of donation as a transaction

Donating an apartment is a gratuitous transaction, under the terms of which the donor transfers a piece of real estate - an apartment - to the recipient free of charge.

At the same time, such a transaction does not create any obligations for the person to whom the property is donated - the donee even has the right to refuse the gift if for some reason he cannot or does not want to accept it.

In Family Law, gifted property is clearly the personal property of each spouse. But the rules of the legal regime of jointly acquired property do not apply to personal property.

The apartment can be donated:

- Before marriage, one of the spouses;

- After marriage, one of the spouses;

- To both spouses before or after marriage (for example, for a wedding).

In this case, neither the moment of registration of ownership rights to the apartment, nor the prerequisites for the donation (whether the housing was donated by close relatives or friends) are of no importance - this property in any case will be considered the personal property of the person to whom it was donated.

A similar rule applies to inherited housing.

Is an apartment received by gift divided during a divorce?

Every married couple regularly thinks about whether donated housing is subject to division, where the conflict has reached the point of divorce and the accompanying division of property.

In accordance with Part 1 of Art. 34 of the RF IC, property acquired by spouses during marriage is recognized as joint.

At the same time, part 1 of Art. 36 of the RF IC specifies that any property that belonged to either spouse before the formalization of the relationship or was accepted by him as a gift or as part of inheritance (including other gratuitous transactions - for example, privatization) is his personal property and will not be subject to division.

Thus, the donated apartment will not be subject to division in the event of a divorce.

However, there are a number of situations in which the second spouse has the right, in the event of a divorce, to claim part of the property donated to his partner.

The apartment was gifted to both spouses

It often happens that an apartment donated by relatives for a wedding is registered by a young husband and wife as common shared property.

In this case, in the event of divorce and division of property, each spouse retains the right to the share that was determined by them when registering the gifted property.

IMPORTANT: The donated apartment is not involved in the divorce in any case. The right to shares in the property is retained, but the value of these shares is not taken into account when determining the spouses' shares in the common property.

Joint funds of spouses are invested in real estate

When an apartment was donated to one of the spouses before or after marriage, and during their life together in a registered union was subject to improvements and modernization, the second spouse has the right to claim part of this property.

The share in the donated property, which can be recognized as jointly acquired property, is determined based on the difference in the value of housing at the time of donation and at the time of division, but only in the light of the improvements and investments made.

The market appreciation of real estate over time in comparison with the value at the time of donation cannot serve as a basis for including property in jointly acquired property.

To confirm the investment of joint funds in a donated apartment, the following evidence can be used:

- Receipts for the purchase of building materials indicating the date and, less often, the payer;

- Work orders, contract or service agreement, etc.;

- Receipts for the purchase of furniture, plumbing fixtures, built-in household appliances.

There is no need to prove that the second spouse contributed his own funds; it is necessary to prove that the apartment during the marriage was subject to significant improvements, for which joint funds were spent.

And all funds received by spouses during marriage are recognized as joint funds (with the exception of gratuitous transactions).

However, if it was the personal funds of the second spouse that were contributed to improving the apartment, this is also a good reason to demand your share.

Alas, it is extremely difficult to prove the fact of investing in donated housing in practice without the help of a lawyer. It is necessary to raise all transactions for transferring funds, all checks and all documents. The second party, not eager to give away their property, prevents this in every possible way. In this situation, it is strongly recommended to seek help from a qualified lawyer.

If the donated apartment was sold

If the donated housing is sold, and a new apartment is purchased with the proceeds from the sale of such property, plus the spouses’ own savings, such property will be considered jointly acquired.

IMPORTANT: Through the court, you can achieve recognition of part of the property as personal on the basis that funds received from the sale of personal property were used in its acquisition. However, the proof procedure in this case will be very, very complicated.

You will have to prove:

- the fact of receiving the sold apartment as a gift;

- the fact of the absence of improvements and investments in the apartment using joint funds;

- the fact of purchasing a new home exclusively with personal proceeds from the sale.

It is impossible to cope with such a task without an experienced lawyer who will constantly “keep his finger on the pulse”.

How to divide a donated apartment?

Since the division of a donated apartment is possible only in exceptional cases and in the presence of a number of circumstances outlined above, all these circumstances must be proven exclusively in court.

The law does not deprive spouses of the right to agree on the division of donated housing and voluntarily by concluding an appropriate agreement. The agreement can provide for any division options.

Division of a donated apartment by agreement

Spouses (including former spouses after divorce) have the right to voluntarily agree on the division of property, including a donated apartment, at any time.

The law does not regulate in any way the rules for voluntary division of property, with the exception of respecting the rights of minor children.

The law does not establish mandatory notarization of the division agreement. Practice shows that without such certification it will be very problematic to achieve execution of the agreement if one of the parties suddenly refuses it. Moreover, if we are talking about donated property, obtaining it through the court will be extremely problematic.

When concluding an agreement, the spouses can agree on the transfer of the donated apartment to one of them or on the payment of compensation.

Example: Spouses Z. agreed on the division of jointly acquired property by concluding an appropriate agreement. The number of property, in their mutual opinion, should have included the husband’s apartment, which he received as a gift shortly before marriage. During their life together, a significant investment of joint funds was made in the apartment. Spouses Z.

We agreed that the donated apartment becomes the property of the wife, since a minor child remains living with her, and the rest of the property - non-residential commercial premises and a car - becomes the property of the husband. The approximate value of the housing transferred into the ownership of each spouse turned out to be equal.

In this example, the situation is played out when the spouses, by mutual consent, included the donated housing in the joint property and took its value into account when determining shares in the common property.

Division of a donated apartment through the court

The division of a donated apartment through the court is carried out in a manner similar to the procedure for dividing an apartment that is jointly acquired property.

The only difference is that in the statement of claim for division of the apartment, the following circumstances will additionally need to be motivated:

- On what grounds does the second spouse claim part of the donated property?

- Grounds for recognizing a donated apartment as joint property of spouses;

- Evidence of investment of joint (or personal funds of the second spouse) in improving the disputed apartment;

- Requirement to recognize a donated apartment as joint property.

The legislation does not establish any clear criteria under which a donated apartment can be recognized as jointly acquired property. Proof is carried out exclusively in court, and only the court is authorized to recognize the gifted apartment as jointly acquired property and award a share in it to the second spouse.

Please note: The court is not obliged to recognize the rights of the second spouse, but only has the right and only in cases where the evidence presented by the parties turns out to be convincing. In this case, it is better to consult in advance with an experienced lawyer who will give important advice on further tactics or provide other necessary assistance.

How can you challenge the donation of an apartment during a divorce?

In practice, there is one of the rather unusual ways to challenge a gift transaction and achieve inclusion of an apartment in jointly acquired property. This is challenging a gift agreement and recognizing it as invalid due to imaginary or pretense, and it is better to initiate such a procedure while still in marriage.

Often, a spouse who suspects an impending divorce plays it safe and formalizes the purchase of housing as if it had been given as a gift.

For example, parents make a deal and give an apartment to their son. In this case, dividing the housing as joint property is impossible, but there is a chance to prove the donation transaction is fraudulent. Precisely made for a purpose other than donation.

Another option is to buy an apartment in the name of the parents, but the actual use of the property by one of the spouses.

Also, obvious signs of a sweet donation transaction will be the transfer of funds by the donee to the donor during the period preceding the donation and in an amount sufficient to purchase the donated property or within its value.

It is not at all necessary to challenge the donation - it is possible to establish the unauthorized disposal of common funds by one of the spouses.

Example: Husband Sergei N. received a three-room apartment as a gift from his parents. Six months later, on his initiative, a divorce was initiated, and his wife filed a claim for division of property. In court Sergei N.

argued that the apartment given to him was not subject to division. During the court hearing, it was established that shortly before the donation transaction, he transferred more than one and a half million rubles from a bank account to his father’s account.

As Sergei N. explained, the money was borrowed from him for treatment.

At the same time, the money in the account was jointly acquired property. Since they were contributed there during the period of marriage and Sergei N. was not able to justify the sources of funds received there, except for income during the period of marriage.

The court did not challenge the deal to donate the apartment, but ordered Sergei N. to pay 50% of the funds wasted from the account, as a result of which the ex-husband left the apartment given to him to his wife.

If the husband gave his wife an apartment: is division possible?

If the donation transaction is properly executed with its certification through a notary or the conclusion of an appropriate agreement, the apartment donated by the husband in favor of his wife does not acquire the status of jointly acquired property.

The basis for such a conclusion is the same as for any gift of property. According to Art. 36 of the RF IC, any property of a spouse received as a gift during marriage is not subject to division. An apartment donated by the husband is no exception and will not be subject to division.

IMPORTANT: If the donation was of a formal nature, for example, by the husband purchasing an apartment in his own name with the subsequent transfer of the wife’s apartment for her actual use (for example, to children from her first marriage), then such property will be divided as jointly acquired property. And this is provided that the husband did not buy the apartment with his own personal funds.

Need a lawyer

Resolving a dispute over the division of a donated apartment during a divorce is not an easy task, which sometimes baffles even experienced lawyers.

It is virtually impossible to correctly determine all significant circumstances and achieve maximum results without legal assistance.

A consultation with our lawyers will help you make sure that the chosen method of protection is correct. The help of our lawyers is free, you just need to ask a question!

- Due to constant changes in legislation, regulations and judicial practice, sometimes we do not have time to update the information on the site

- In 90% of cases, your legal problem is individual, so independent protection of rights and basic options for resolving the situation may often not be suitable and will only lead to a more complicated process!

Therefore, contact our lawyer for a FREE consultation right now and get rid of problems in the future!

Save the link or share with friends

( Loading…

Is a donated apartment divided during a divorce?

The collapse of a legal marriage and subsequent divorce raises many questions about the division of jointly acquired property. Spouses do not always understand what constitutes personal property when trying to divide living space donated or inherited.

Dear readers! Our articles talk about typical ways to resolve legal issues, but each case is unique.

If you want to find out how to solve your particular problem, please contact the online consultant form on the right or call +7 (499) 938-47-82. It's fast and free!

Show content

Can one of the spouses legally claim part of the home?

Art. 36 of the RF IC reports that housing received on the basis of a deed of gift is the property of the person in whose name it was registered. Claims for a private apartment cannot be made by interested parties, including the husband or wife. Real estate is not subject to division into shares, unlike jointly acquired property (Article 34 of the RF IC and Article 256 of the RF Civil Code).

Article 36 of the RF IC. Property of each spouse

- Property that belonged to each of the spouses before marriage, as well as property received by one of the spouses during marriage as a gift, by inheritance or through other gratuitous transactions (the property of each spouse), is his property.

- Personal items (clothing, shoes and others), with the exception of jewelry and other luxury items, although acquired during the marriage at the expense of the spouses’ common funds, are recognized as the property of the spouse who used them.

- The exclusive right to the result of intellectual activity created by one of the spouses belongs to the author of such result.

The legality of the transfer of residential premises is formalized by a special gift agreement (Article 574 of the Civil Code of the Russian Federation). The apartment owner must:

- draw up papers on the free transfer of housing to the new owner;

- re-register the owner in the State Register.

After completing all the documentation, the recipient takes ownership and has the right to dispose of the property at his own discretion. The time at which these actions occurred does not play a role: regardless of when the deed of gift was drawn up (before or after marriage), the person indicated in the document becomes the owner of the home.

During a divorce, an apartment or private house is not subject to division, even if the housing was given by the husband to the wife or vice versa.

The law says:

- if the property was purchased during marriage, then it is considered joint property and is subject to division (Article 256, paragraph 1 of the Civil Code of the Russian Federation);

- if the apartment was received by inheritance or gift, then it is personal property (Article 256, paragraph 2 of the Civil Code of the Russian Federation).

In this situation, it does not matter who acted as the donor. Even if it is a second spouse or a third party, the home belongs to one partner and cannot be divided during a divorce.

Before marriage

Any real estate received by a husband or wife by gift before marriage is considered his personal property. It cannot be divided into shares in a divorce. The owner has the right to evict the ex-spouse at any time, even if the latter has registration in this housing and has lived in it for many years.

The alienation of part of the property in favor of the second spouse from the owner of the house may occur under certain conditions. They are exceptions, and the ex-husband or wife must defend their rights in court or by preparing documentation with a notary by personal agreement. In most cases, division of property takes place in court.

Presence of a marriage contract

A marriage contract can be drawn up:

- at the time of marriage;

- at any time - as long as the married couple is in an official relationship.

The document has a number of advantages compared to the Family Code of the Russian Federation; it is a priority source. This condition is confirmed by Art. 40 IC RF.

The division of real estate can be legal provided that a clause on the possibility of this procedure is included in the marriage contract. During a divorce, all interested parties receive the corresponding shares, which are predetermined in the document.

The donated apartment is not included in the jointly acquired property due to the absence of the fact that it was acquired with common marital income. The exceptions are situations when:

- cosmetic or major repairs;

- redevelopment;

- reconstruction.

The procedures should not only change the appearance of the home, but also increase its final market value. That is, the owner can sell an apartment or house for much more than it was valued before the changes were made.

A wife or husband has the right to claim a share of ownership in the donated housing or its division, subject to:

- saving receipts;

- invoices;

- other documents confirming the participation of the second partner in material costs.

If during the trial it is proven that the price of the property increased by 50% as a result of the purchase of furniture, plumbing, building materials and payment for the work of the contractor during their cohabitation, then the spouse has the right to make claims for half of the property.

Without official documents confirming the partner’s material costs for housing, executed under a gift agreement, the court will not take the claim into account.

Financial insolvency of husband or wife

When dividing property, one of the spouses can make compelling arguments about the lack of means of subsistence in the form of unemployment or a difficult financial situation. The court may decide:

- carry out division of real estate;

- oblige the owner of the house to buy the partner another premises for a place of permanent registration and residence.

As judicial practice shows, the majority of financially insolvent spouses are given the right to use the owner’s housing until his financial condition improves. This means employment and the possibility of moving to rental housing.

The division of an apartment owned by one of the spouses under a gift agreement becomes more complicated with children. The legislation establishes a priority in protecting the rights of minors: if their parents divorce, they cannot be deprived of the premises where they must live until they reach adulthood.

The nuances of questions about the division of real estate in the presence of children include:

- a court order for the former spouse, who is the legal representative of the child, to live in an apartment donated to the husband or wife - until the age of 18;

- If a share in the house belongs to a minor, then it cannot be taken away even if a peace agreement is signed between the parents.

The court always protects the rights of children under the age of majority . Attempts to expel or evict a child from an apartment donated to the parent may be considered not in favor of the owner and may result in administrative fines.

The property was presented for a wedding

During the divorce process, the following nuances are taken into account:

- to whom the deed of gift was issued;

- what share in the housing each of the newlyweds received - when registering property under a gift agreement.

In the first case, the owner is the one to whom the apartment was registered. In the second, each spouse has the right only to a certain part indicated in the papers.

What to do if the donated home was sold while married?

If the property received by gift was sold, then all proceeds belong to its owner and cannot be divided between spouses. In other cases, when a family lived in a donated apartment and decided to move to another housing due to its small size, inconvenient location or poor layout, the acquired property is divided:

- if the new house had a similar value to the donated one, it refers to private property and not jointly acquired property (Article 34 of the RF IC);

- if money from the family budget was spent on the purchase, then the difference in price must be divided in equal parts between the partners - subject to the availability of evidence.

This rule applies when selling an apartment and spending money for it on other needs that are valued higher than the cost of the donated housing.

In practice, the plaintiff rarely wins such cases - it is very difficult to prove that certain financial resources were invested in the process.

A competent lawyer will recommend avoiding such a complex and losing trial in advance.

The problem is solved by drawing up a mutual agreement when purchasing new real estate (or other property) or while maintaining a trust relationship during a divorce. The procedure is carried out in the presence of a notary.

The above actions may be limited by a pre-registered marriage contract. It initially spells out all the nuances of the division of property by agreement of both spouses during the divorce process.

Any issues with real estate registered under a deed of gift are best resolved with the help of a competent lawyer. The consultant will help you find the best way out of a difficult situation, correctly draw up claims documents, and solve most of the problems that arise. Attempts to independently understand the intricacies of divorce and division of property often end in failure and loss of legal rights to a share.

, please select a piece of text and press Ctrl+Enter.

Didn't find the answer to your question? Find out how to solve exactly your problem - call right now:

+7 (499) 938-47-82 (Moscow)

It's fast and free!