It can be difficult to collect child support from the father of a child. It is even more difficult to achieve payments in a decent amount. Often, the parent pays simply ridiculous amounts. Although, the child receiving this money is not laughing. What to do if alimony is below the subsistence level? This will be discussed in this article.

Is the amount of alimony related to the “minimum wage” for living?

If the ex-husband pays small alimony, then this is, in principle, not a crime, provided that he does not hide his income.

The fact is that family law, unfortunately, does not in any way connect the amount of funds for child support and the cost of living. Maybe this is not entirely correct.

After all, alimony is the means by which the needs of a minor must be met. But here you need to think about the payer of the money. So that his rights are not violated either.

So, the child’s mother can always apply for child support if this has not already been done.

But given the father’s small official salary, their amount not only may be below the subsistence level, but most likely will be so.

Let's say a parent receives 12,000 rubles, he has 1 child, and has a writ of execution. What will be the payment amount? Only 3000 rubles. The cost of living, meanwhile, fluctuates around 10,000 rubles.

Is it possible to require the father to pay a larger amount of child support? No. This is prohibited by law for the following reasons:

- the amount of deductions from wages cannot exceed 50 (70 in exceptional cases)%;

- For 1 minor, only ¼ of the income can be withheld.

There is an opinion that with a small salary it is better to demand alimony in the amount of the subsistence minimum, at least in a fixed amount. Yes, this is really a good option for collecting money for a small salary. But the court may also make a decision unsatisfactory for the recipient of the funds.

When determining the fixed amount of money to be paid monthly, the financial situation of the payer is taken into account. He must also have means to live.

Consequently, if the father’s salary is too low, then the court decision may indicate an order to recover an amount equal to, for example, ½ share of the minimum living wage.

Thus, answering the question whether alimony can be below the subsistence level, it should be noted: yes, they can.

However, the concept of “minimum amount of parental benefits” is found in legal practice. When determining it, they are guided by the following:

- the minimum amount for life;

- the provision that the responsibility to support a parent falls on both the mother and the father.

The court must always find some kind of compromise and make a fair decision.

If a man transfers a small amount of money to his wife, then the first thing to determine is whether he is hiding his income?

If the real income corresponds to the official salary, but the husband pays little, then the court must establish the financial situation of each of the parties:

- basic income level;

- availability of additional income;

- possession of certain expensive property: real estate, car, etc.

In extreme cases, if the alimony is very small, you can try to appeal to the judicial authority again, with a request to review the procedure for fulfilling the obligation. But this is very difficult to do. It is better to consult a lawyer on this issue.

Procedure for increasing alimony

Where do you need to go so that the amount of payments is not less than the subsistence minimum, but at least equal to it? Firstly, you can come to a notary and draw up an alimony agreement, or make additions to it.

This can be done if the payer of the funds agrees to give more. If not, you will have to go to court for an appropriate decision.

It is worth emphasizing that in an agreement on the payment of funds for a child, it is unacceptable to underestimate the level of payments. For example: the father receives an income of 80 thousand rubles. The cost of living is 8-9 thousand. The parties agreed that the minor would receive 10 thousand rubles.

Is it possible to specify such an amount in the agreement? Probably, in practice, the notary will not have any questions.

But such an agreement could well be challenged, because if there had been an appeal to the court for the accrual of money, the child could have received not 10, but 20 thousand rubles.

If alimony is less than the subsistence level, and it is not possible to voluntarily agree on the amount of alimony, then you need to go to court.

If the husband pays alimony in shares, then you can make a request to change the procedure for fulfilling the obligation, that is, demand payments in a fixed amount of money.

If there is no question of how to pay - the money is not paid as a share of income, then you can ask for an increase in the amount of funds collected. It’s likely that you won’t be able to collect a lot, but you can achieve the “minimum wage.”

The most important thing in this matter is to substantiate your position in detail, to prove that the funds received cannot be below the minimum amount established by the state.

Reasons for increasing payments

If alimony is below the subsistence level, and there is a desire to increase it, you need to focus on the following grounds:

- deterioration in the financial situation of the recipient: loss of job, reduction in salary, deterioration in health, appearance of dependents;

- improvement of the payer’s financial situation: increase in income, termination of obligations in relation to other dependents, etc.

That is, for example, if a child from another marriage lived with the father and became an adult, then it is obvious that the financial burden on the parent has become less.

If alimony for a minor is below the subsistence level, then, as noted, you can ask the court to bring their level to the “minimum wage”. How to pay is often the choice of the recipient of the funds.

The position is argued based on the following circumstances:

- the payer’s income “jumps”;

- he receives income in kind;

- He has no income, at least official income;

- recovery of funds in shares is contrary to the interests of the son or daughter.

By the way, an unemployed person may accumulate debt based on the average salary level in the country. If it accumulates too much, then a criminal case may be initiated. Therefore, it is better for the payer himself, who receives unofficial income, to transfer some amount of money every month than to accumulate debts.

Collection and indexation of payments

What to do if the father pays small child support? This has already been discussed. Now you need to understand how to do this.

If you want to recover a monthly amount equal to the “minimum wage”, then you need to file a claim in which you need to ask for payments in an amount proportional to the cost of living. In addition, the following must be stated and justified:

- what amount of money does the minor need monthly to meet his needs, what standard of living is he accustomed to;

- what income does the recipient of the funds have;

- what is the recipient's family background;

- how much money the payer of the funds earns per month, what property he owns, whether he is a debtor for any obligations, for which ones;

- what is the payer’s marital status and health status.

The court studies this information in detail and puts it in the “scales”. Based on this analysis, the required and possible amount of payments is determined.

It should be noted that if money is paid in a fixed amount, then it is indexed, depending on whether the minimum required for existence has risen or fallen. This indexing is carried out automatically; there is no need to obtain a separate court decision.

Thus, you should not sit idle while receiving small alimony payments. There is always an opportunity to increase the amount of money received.

Can alimony be below the cost of living in 2018?

The question of how alimony should be paid is currently of interest to many: both recipients and payers. At the moment, the cost of living does not affect alimony in any way. They should be paid in proportion depending on the number of children, but for the calculation the salary is taken, regardless of its size.

How does alimony depend on the cost of living?

At the moment, Russian legislation provides for the amount of alimony, depending on the amount of payments taken for the calculation. Alimony payments must be levied on any type of income:

- pension;

- salary;

- unemployment benefit;

- scholarship.

In this case, the minimum required income affects primarily the fact that these amounts are adjusted on the basis of it - the salary cannot be lower than this indicator.

Maintenance payments must be paid accordingly:

- 25% for 1 child;

- 33% for 2 children;

- 50% for 3 children.

Even if the amount of payments due is less than the required funds, only the amount established by law will be charged. In this case, the required amount will also increase proportionally as the payer’s salary increases.

If the payer does not have any income, then the plaintiff is paid alimony payments from the federal budget. They can no longer be less than the minimum required amount for child support.

By the way, it differs depending on the age of the child.

If the plaintiff has two children, then the amount of the required payments is established by the court individually for each case, but certainly not less than the minimum limit.

If alimony is below the subsistence level, what to do?

The only way out, if the amount of accrued payments is below the minimum permissible income per person, is to contact a magistrate. It is this authority that can set the amount of payments in a fixed amount.

To do this, documents are presented in the same way as when applying to the court of first instance.

If the amount of alimony payments is set at a fixed amount, then it cannot be less than the minimum amount required for the child.

But often the judge in such a situation still awards half of the amount established by the state. This is due to the fact that, according to the Family Code, both parents are responsible for the child and both must also support him.

Therefore, half of all responsibilities, including financial ones, rest with the mother. In some cases, you can try to resolve the dispute through ordinary court. In some cases, it is possible to increase the percentage of deductions per child.

Where to go if alimony is below the subsistence level

For all issues regarding alimony payments, you should only go to court. The amount cannot be charged less or more than that established by the court. Moreover, if the dispute has already been considered previously, but then the plaintiff wants to consider the issue again, then in any case the case should be reviewed completely. Payment cannot be less than what should have previously been charged.

But at the same time, an automatic increase is not possible depending on the cost of living. After receiving a court decision, you need to contact the payer or bailiffs so that the amount that will now have to be charged is adjusted. You have one year to submit a court decision. After this, the case will need to be reviewed again.

Living wage and child support

Alas, if the ex-husband pays alimony less than the subsistence level, then sometimes nothing can be done. This indicator does not in any way affect the amount that must be paid. A larger amount will be charged only if the amount is determined individually by the court.

When it is possible to prove that alimony payments are significantly lower than the amount that is required, then sometimes it is not the salary that is taken for the calculation (if then the amount is significantly less than necessary), but a certain amount of payments, below which it will not be collected.

If the payer does not have any income, then the Law provides that alimony will be paid from state funds. In this case, they can no longer be below the subsistence level.

If the payer has a debt to pay, then you can immediately contact the bailiffs. They will begin to be paid after it is confirmed that there are no salaries, pensions and other income for calculation.

After this, the required deductions begin to be paid automatically.

Is it possible to apply for alimony at the cost of living?

In order for alimony to be paid no lower than the subsistence level, it is advisable to discuss these issues immediately, when their amount was initially established. In the future, in order to increase the amount of alimony that must be paid, you only need to go to court. There you need to give arguments - the payer’s shadow earnings, the need for large expenses for the child.

After this, a decision is made. Each such dispute is considered individually. It should be taken into account that if the payer does not work anywhere at all and has no income, then the required amount of money will be paid exactly not lower than the subsistence level. Such alimony will be paid from the state budget, its amount is fixed by the court.

How to increase alimony to a living wage

If alimony is paid below the subsistence level, you can try to increase the amount required. To do this, you need to go to court with all supporting documents.

For example, by attaching checks to pay for the child’s education or treatment.

You can also attract witnesses who can confirm that the payer has sufficient financial capacity to pay a larger amount.

A good lawyer will be able to find arguments and prove that the amount currently being charged may not be enough. Unless, of course, the parent himself receives a salary less than the subsistence minimum.

For example, if you work part-time, it is unlikely that you will be able to increase the amount of cash payments for your child at all.

But if opportunity allows, and at the same time, if the mother spends quite a lot on the child, if the subsistence minimum is half of the necessary expenses, then perhaps the court will set a larger amount that will need to be paid.

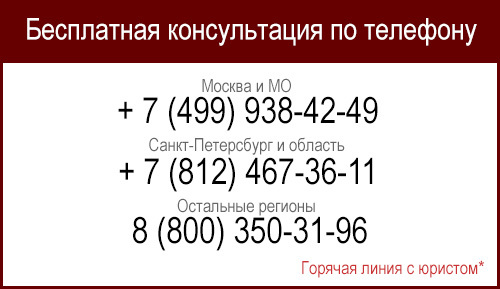

If you have questions, consult a lawyer. You can ask your question in the form below, in the online consultant window at the bottom right of the screen, or call the numbers (24 hours a day, 7 days a week):

How and how much child support should an unemployed father pay | Legal Advice

Last updated February 2023

After the end of the divorce process, the parent with whom the minor family member remains living has the right to receive alimony. However, what to do if the father, whose responsibility is to pay this monetary penalty, is unemployed?

Everyone knows that alimony is paid not only for the maintenance of minor children, but also for people who, due to their mental or physical disabilities, as well as age, cannot earn their own money on their own. The amount of this penalty is determined in court or by agreement of the parties. If they were unable to resolve this issue on their own, then the amount of alimony is deducted from the income of the party obligated to pay it.

If the parent paying child support was fired from his previous job and now has no income, then this does not relieve the obligation to pay child support.

Therefore, at the time of official absence from work, the percentage of mandatory monetary penalties is calculated based on the average salary, taking into account the number of dependents (children).

According to official data from the federal statistics body (Rosstat), the minimum All-Russian average monthly wage at the end of 2018 is 42,413 rubles. When calculating alimony, it is necessary to start from this figure.

- For the only child in the family, it will be 25% of the parent’s earnings (42,413 x 25% = 10,603 rubles);

- If two family members are dependent, then this deduction will be 30% of the salary (42,413 x 30% = 12,724 rubles);

- For three dependents, the parent is obliged to pay 50% of the money earned (42,413 x 50% = 21,207 rubles).

Let’s say a court ruling in the city of Taganrog obliges a parent to pay 14th of all income for his only child. However, it turns out that he does not have official employment.

As a result of this fact, the court will calculate the mandatory amount of contributions based on the average monthly salary in the Russian Federation for the month when the parent begins making payments.

If the alimony payer is registered with the employment center and receives official benefits, then alimony will be calculated based on this amount. The amount of benefits in 2023 is determined individually depending on life circumstances.

But in any case, the lower threshold of the benefit is 1,500 rubles. (plus regional coefficient), upper - 8,000 rubles. (plus RK), and if the alimony worker is of pre-retirement age, then the maximum amount is 11,280 rubles.

For example, an unemployed person receives an allowance of 10,200 rubles, respectively, alimony for one child will be equal to 2,2550 rubles. (10,200 x 25%).

Unemployment payments are made for a short period from 3 months to 1 year, depending on the circumstances. Therefore, if an unemployed person is registered, but payments have stopped, then the calculation will not be based on benefits, but on the average salary in the Russian Federation (as described above).

Important ! If a parent does not pay child support during official employment and continues to do so after dismissal, then recalculation of the debt will be calculated initially according to the official salary, and then according to the average salary.

The above related to the issue when there is a court decision (order) regarding alimony.

Whenever you have to go to court to collect, practice shows that it is better to collect in a fixed amount. This amount is determined based on the child’s needs and is tied to the minimum subsistence level in the region.

For example, a mother and child live in the Vologda region and she can be charged 1 or 1.5 or 2 subsistence minimums in the Vologda region.

Is it possible to reduce the amount of alimony?

Due to the fact that the percentage of deductions, which is based on the average salary in Russia, can be quite huge and many residents of small towns do not have the opportunity to pay this amount, the best option for both parties would be to resolve disputed relations without the participation of the court. In this case, it is necessary to fix a percentage or a fixed amount of funds that will be subject to deduction that suits everyone.

If the case does go to court, then when making a decision, this authority will take into account many facts that directly affect the amount of these payments.

Minimum alimony from an unemployed person

Important ! The minimum amount of alimony that a person without a job is required to pay can only be determined by a court. It is calculated taking into account the level of wages (if any), place of residence, the presence of children in the new family of the party who pays alimony, the time of dismissal of this subject from work and many other circumstances.

Methods for collecting alimony from a non-working person

There are three ways to collect child support from a non-working father:

- In a fixed amount. In order to use this form of collection, the party with whom the child lives must file a claim in court for the collection of alimony. After review, the judge will decide to impose a certain amount of monthly payment.

Important ! After the alimony payer officially starts working again, it is necessary to submit a new application to the court, asking for an increase in the amount of recovery from him, in connection with the resumption of stable earnings.

- Using an alimony agreement. The parties themselves agree on the amount of deductions, fix it in the agreement (contract), write down all the necessary conditions, confirm their agreement with signatures and notarize this document.

Important ! Without notarization, this agreement is considered void and the fact of its conclusion, if necessary, is almost impossible to prove in court.

- In proportion to the payer's earnings. If the parties have not chosen any of the above options and the payer is officially unemployed, then alimony is collected by allocating a percentage of the average salary in the region (country).

Important ! If payment does not occur, then the bailiff service will begin to collect the debt by seizing property belonging to the debtor and its further sale.

Finally, it should be noted that the legislation of the Russian Federation is constantly undergoing changes and therefore innovations should be studied in advance before filing a claim for the recovery of alimony from a non-working person.

Ordinartsev Roman Valerievich

What to do if your ex-husband pays little alimony?

Unfortunately, not all parents fulfill their responsibilities for raising and maintaining their children, despite the fact that they are clearly stated in family law. The obligation to pay child support remains with the parents until the children reach adulthood. It does not matter whether the parents and the child live in the same family or whether the marriage between the spouses has long since broken down and was officially dissolved.

If it is not possible to resolve all issues related to financial support for children and disputes arise regarding their provision, then child support obligations should be determined.

How much alimony should ex-husband pay?

The Family Code of the Russian Federation determines the amount of alimony due for child support. It depends on a number of circumstances.

If the alimony payer has a permanent job and a constant income, then the amount of alimony is set as a share of his salary or income.

So, for one child, one fourth of the father’s salary will be withheld, for two children - a third, for three or more - half of the entire salary and other income.

In some cases, alimony is assigned in a fixed fixed amount, which will depend on the value of the regional minimum subsistence level.

Despite the fact that these payments are called alimony in a fixed amount, their size will constantly change upward as the cost of living increases.

This is how alimony is calculated if the child’s father does not work, receives income in foreign currency, has a constantly changing salary, or receives it without official employment.

When determining the amount of alimony in an amount that is a multiple of the minimum subsistence level, the court takes into account the composition of the debtor’s family, whether he has other children in his second marriage, his state of health, and his average income.

The law gives spouses the opportunity to determine the amount of child support themselves, without resorting to the help of the court. In addition, the spouses can peacefully agree on the timing of payments and their order (cash or non-cash).

The main thing is that the amount of alimony that suits both parties does not violate the interests of the child himself. It should not be less than the amounts established by law and which would be awarded by the court. The agreement reached between the child’s parents is enshrined in a notarized alimony agreement.

After the divorce of his parents, his mother has to protect the interests of a minor child, because in most cases the children remain with her.

If the ex-husband is in no hurry to help support the child, then she should not immediately file an application with the court. It is better to try to solve this problem through peaceful negotiations. Perhaps the child’s parents will be able to find a mutually beneficial solution and agree on when, in what amount and in what way the child will receive help from the father.

It is allowed for the debtor to pay for the child to attend kindergarten, private schools, treatment, and buy him clothes to pay child support.

All these points should be recorded in a settlement agreement, which is signed personally by both parents, and their signatures on it are certified by a notary.

The notary is also responsible for checking whether the agreement does not violate the interests of the children or any of them.

The advantage of amicably settling alimony claims against each other is that the agreement has the force of a writ of execution. If in the future the child’s father stops fulfilling it, then it will be possible to transfer the agreement to bailiffs, who will ensure its enforcement.

If the child’s parents were unable to agree among themselves, the issue of alimony will be considered by the court. The mother of the child can go to court either at the place of residence of the former spouse or at her place of residence.

You can write an application for a court order or a statement of claim for the collection of alimony yourself. Its samples are available for inspection and are posted in almost all courts.

You can also download the application on our website here.

The application is submitted to the court in two copies, one of which is intended for the child’s father.

Attached to the application are copies of passports, copies of children’s birth certificates, marriage certificates, or paternity certificates, a copy of the court decision recognizing the defendant as the child’s father, certificates of residence and income of the defendant. At the court hearing, it will be necessary to show the originals of those documents, copies of which are attached to the application.

The application is submitted to the court or can be sent by mail. After which the court informs the parties about the date of the trial or sends a court order to the parties. The received court documents, together with writs of execution, must be handed over to bailiffs, whose responsibilities include taking measures to collect alimony.

Often, the amount of child support received for a child is so small that it does not cover even a small part of the expenses that the child needs.

This happens for various reasons. It is possible that the child’s father regularly pays the required amounts, but then it becomes difficult for him. A new family appears, other children are born in it, who also need paternal support. The alimony payer either hides part of the income, or stops paying alimony altogether, or hides from the bailiffs.

To clarify the situation, the alimony seeker should, without wasting time, contact the bailiff.

His powers include checking the debtor’s income through the tax authorities, and he can also find out his salary from the accounting department at the debtor’s place of work. Based on these data, the bailiff will determine the reason for reducing the amount of alimony.

If he discovers violations in the actions of the company’s accounting department, he may raise the question of bringing those responsible to justice.

If alimony was collected in a fixed amount, it is worth making sure that the indexation required by law was carried out on it.

In addition, the bailiff has many other ways of influencing a negligent father. If he does not pay alimony for a long time and he has incurred a debt, then the bailiff has the right to describe the debtor’s property and sell it at auction. Make settlements with the child’s mother from the proceeds.

The debtor must understand the consequences of his failure to comply with a court decision or alimony agreement entered into by spouses on a voluntary basis.

Firstly, a penalty of half a percent will be charged on the amount of his debt for each day of delay. Of course, this will lead to an even greater increase in the amount of debt.

Secondly, when selling his personal property, in addition to this amount of debt, he will have to additionally reimburse the costs of the auction.

Thirdly, in such circumstances, not half, but 70 percent will be withheld from his salary until he fully repays the entire amount of the debt.

If the child support received by the mother is not enough for other reasons, for example, the child is sick and needs complex and expensive treatment, then she can file a claim in court.

It must justify the reason why the plaintiff is requesting additional amounts, attach all medical reports, certificates about the cost of treatment or medications.

After all, parents also have the responsibility to bear such expenses for the treatment or rehabilitation of a sick child.

If all the measures taken by the bailiff are unsuccessful, then the persistent alimony defaulter will be brought to administrative or criminal liability.

I want alimony from the real income of my ex-spouse, but he doesn’t show it anywhere

Hello! My ex-husband is engaged in trading and earns good money, but this is all unofficial. He must pay alimony, but his official income is zero.

When I applied for alimony, he was officially working, but that was almost a year ago. The court told him to pay 25% of his income. Since then, he has been working unofficially for six months. Tell me how to receive the legal 25% of his income, and not the minimum wage of 2 kopecks?

Maria

Then you will most likely have to contact the bailiffs or go to court.

Before getting involved in a lawsuit for an increase in alimony, get evidence that your ex-husband is really hiding income.

The list of income from which you do not need to pay child support is much more modest.

In particular, it specifies payments for compensation for harm to health, financial assistance from the employer in connection with the birth of a child, a wedding or death of loved ones, and compensation for travel expenses.

In addition, alimony is not collected from income from one-time transactions for the sale of real estate: an apartment, a plot of land, a garden house.

So you write that your ex-husband is engaged in trading. If by this you mean forex and you know which forex broker the ex-spouse trades through, inform the bailiffs about this.

If trading for you means buying and selling shares on the stock exchange through a broker, who, again, is known to you, tell us about that too.

According to the law, within 10 days, the bailiffs will consider your application and make a decision: either satisfy your demands or refuse them. A copy of the decision should be sent to you the next day after it is issued.

Method 2. File a claim with the magistrate at your place of residence to change the amount of alimony - not as a percentage of earnings, but as a fixed amount. Or both at the same time. This is permissible if the alimony holder has an irregular or fluctuating income, or if there is no income at all.

- In an amicable way, the judge must evaluate whether the alimony paid is sufficient to fully support the children compared to what it was before the divorce.

- But if you are still awarded alimony in a fixed amount, then know that it must be indexed quarterly, that is, it must grow along with the “children’s” subsistence level in the region.

- Well, about how to write a claim in court, where and how to file it, read in the selection T—J.

If you have a question about investing, personal finance or family budgeting, please write to us. We will answer the most interesting questions in the magazine.

If your ex-husband or child’s father pays too little alimony: what to do?

After a divorce, many fathers try to avoid child support obligations or minimize the amount of payments for their children. Due to the dishonesty of fathers, mothers do not have enough money to provide a decent standard of living for their children. Are there legal ways to influence the father of a child who pays too low alimony?

Legal reduction of alimony

The alimony payer may file a claim in court to reduce the amount of alimony payments upon the occurrence of certain circumstances of a financial or family nature.

Most often, debtors go to court when the following life situations arise:

- The emergence of new dependents on the alimony payer. For example, a child was born into a new family. You can also apply for a reduction in alimony if a pregnant spouse or elderly disabled parents are supported by the alimony payer.

- If the debtor has been diagnosed with an illness or injury that has caused disability. In this case, the alimony payer becomes incapacitated and will not be able to provide for the needs of minors at the same level.

- If the offspring began to earn money on his own (started working as an entrepreneur, receives income from renting out real estate, found a permanent job, etc.). If earnings become constant and the amount is sufficient to meet the child’s essential needs, then the father can reduce child support payments.

- Father's big salary. If the alimony payer proves in court that the amount of alimony being collected is too high, and less money is enough to meet the child’s needs, then the court may satisfy the claim for a reduction in alimony.

- Low income for alimony payer. In this case, it will be possible to reduce the amount of alimony payments if it is proven during court proceedings that the low level of income is not a consequence of the debtor’s rash actions. He will have to convince the court that he cannot take any action to increase his income. But lack of work or refusal to register with the Central Employment Service is not grounds for reducing alimony payments.

The payer can reduce the amount of alimony only in court if, in order to assign it, the recipient had to file a claim in court. It is illegal to reduce payments on your own. In accordance with the law, a penalty of 0.1% will be charged on the amount not received every day.

If child support for minors is determined by the terms of a written agreement between the parents, then to make adjustments it is enough to put them in writing and have them certified by a notary. In this case, the parties to the agreement must reach an agreement to reduce the amount of alimony payments. If an agreement cannot be reached, the payer can file a claim in court.

Circumstances leading to a reduction in alimony

In order to understand what to do if child support is reduced, you should understand the reasons for transferring the reduced amount.

Lack of work

After losing a job, the alimony payer can contact the Central Employment Service for registration. He will be given unemployment benefits. Alimony payments will be transferred from this benefit. In this case, the amount of financial support for children will be significantly reduced, since the unemployed are paid a small allowance.

It will not be possible to increase child support payments if the father does not have an additional source of income. Moreover, the claimant will need to prove the existence of earnings in court. If the alimony payer is unofficially employed, then proving his employment will be problematic.

Women are forced to wait until the father finds a job with an official salary.

If, after losing a job, the alimony payer does not apply to the Central Employment Service, then he will not be paid benefits for the unemployed. Because of this, child support payments may stop. In this situation, termination of alimony support is illegal.

In accordance with the law, in the absence of official earnings from which alimony can be deducted, bailiffs are obliged to recalculate alimony payments based on the average earnings in the subject of residence.

Further, this amount must be collected from the debtor even if he is not employed.

Insufficient level of earnings

If the payer’s earnings are low, then the amount of alimony payments collected as a share of the salary will also be small. In accordance with the law, the minimum wage must correspond to the subsistence level.

But some employers resort to tricks to reduce the amount of taxation. For example, an employee is hired on a part-time basis (0.3 rate, 0.5 rate, etc.). In this case, the alimony payer will receive an amount less than the subsistence minimum.

Accordingly, alimony payments will be collected from official earnings.

From the rest of the earnings paid “in an envelope”, money for child support will not be withheld. In this case, alimony collectors are advised to collect evidence that the father receives part of the salary unofficially.

Next, you need to go to court with a claim for an increase in alimony maintenance.

If during court proceedings the presence of an unofficial source of income is proven, the alimony payer will be held administratively liable.

The claim for an increase in alimony payments is satisfied, and money for minors is recovered:

- from official and unofficial earnings in shares, if the “gray” salary is paid constantly;

- if the payer’s earnings are temporary, then alimony payments are assigned in a fixed amount.

If the alimony payer’s earnings do not reach the subsistence level, the recipient of the payments can contact the bailiff to conduct an inspection of the organization where the payer is employed. The bailiff will check compliance with labor and tax laws.

If violations are discovered, management will be held administratively liable. Documentation drawn up as a result of the inspection can be used in legal proceedings.

It will help confirm that the father is deliberately avoiding fulfilling his alimony obligations in full.

Writing a statement to bailiffs

You should seek help from bailiffs if you have the appropriate documentation:

- writ of execution received by court decision;

- court order;

- alimony agreement certified by a notary.

In order for the bailiff to begin an investigation against the alimony payer, the recipient of the payments needs to draw up an application. Its form is not regulated by law.

If, after accepting the application, the bailiff does not take any action, then the alimony recipient has the right to file a complaint with the senior bailiff. If there is no further action, you should go to court.

Increasing child support through the court

Only the court can increase the amount of alimony previously prescribed by the court. The claim must be filed in the same court where the original claim or application for the issuance of a court order was considered.

If there is an alimony agreement, the clauses of which are not fulfilled by the alimony payer, the claim is filed with the court at the place of residence of the defendant. If the alimony recipient lives with young children, then the claim may be sent to the magistrate’s court at the plaintiff’s place of residence.

In accordance with the requirements of Art. 131-132 of the Code of Civil Procedure of the Russian Federation, the claim must contain the following information:

- name of the court;

- Full name and address details of the parties;

- title: “Statement of claim to increase alimony”;

- Next, the essence of the application is stated: the date of assignment of alimony support, its amount, the date of commencement of enforcement proceedings, the fact of fulfillment (non-fulfillment) of alimony obligations;

- Below are the circumstances that became the basis for increasing alimony payments with reference to supporting documentation;

- references to legislative acts confirming the plaintiff’s right to demand alimony;

- requirement to increase child support;

- a list of documentation supporting the claim;

- The document ends with the date of preparation and the signature of the applicant.

Download a sample statement of claim to increase the amount of alimony

Let's sum it up

Before filing a claim for an increase in alimony in court, it is worth understanding the reasons for the situation that has arisen. The debtor may have good reasons for such actions. In this case, the alimony recipient is wasting time and money.

If you want to find out how to solve your particular problem, please use the online consultant form below or call :

What to do if your ex-husband intentionally pays small alimony

If your ex-husband has a decent income but intentionally pays little child support, you can force him to pay more. There are many legal levers available to these fathers, which we will discuss in detail below.

https://www.youtube.com/watch?v=xK3POoT45ZE

Unfortunately, you cannot do without pitfalls. Thus, the ex-spouse may hide his income, show it incompletely, or come up with various reasons for reducing alimony. Therefore, if your case is not typical, or you do not want to waste your nerves and time, we advise you to contact a family law lawyer.

Get an initial consultation from several companies for free : fill out an application and the system will select suitable companies!

59 companies are connected to this service

Start selection in a few clicks >

Amount of alimony as a percentage

First, let's look at how much money the ex-husband is required to transfer to support his children. Child support can be established through the court:

- In a fixed amount of money.

- As a percentage of income: 25% for one child, 33% for two children, 50% for three or more.

If your ex-spouse has a permanent official income and this amount suits you, it is better to use the first option. However, it must be remembered that the size of these shares can be reduced or increased by the court, taking into account the financial or marital status of the former spouses and other circumstances.

Reasons why an ex-husband can deliberately make the percentage of alimony less through the court:

- the birth of a child in the child's new family;

- the appearance of an elderly dependent (mother or father), or a pregnant wife;

- acquisition of disability;

- receiving a large salary (income) and, as a result, an excessively high amount of alimony, disproportionate to the needs of the child.

Dismissal from work, the ex-husband’s reluctance to find a job or register with the Employment Center (Employment Center) is not a reason for reducing the amount of alimony.

In turn, you have the right to increase the percentage of small alimony payments in the presence of a number of circumstances. Such reasons are not regulated by law, since they include a very large number of different conditions. Basically, they relate to your financial situation:

- loss of regular income due to dismissal or layoff from work;

- deterioration of the general financial situation due to the appearance of a new dependent. For example, the birth of another child without financial assistance from the father, or caring for a disabled relative;

- receiving disability;

- the child has a serious illness, which requires expensive medications.

When filing an application to increase the alimony percentage, you need to make sure that your ex-husband has no reason to lower it, otherwise time and money in the courts will be wasted.

Remember - alimony is calculated not only from the ex-spouse’s salary, but also from any other income. For example, from renting out an apartment, from selling a car, or from winning the lottery.

Amount of alimony in a fixed amount

If the ex-husband has an unstable income or no official job at all, then it is better to choose alimony in a fixed amount. It is established on the basis of the maximum possible preservation of the child’s previous standard of living, taking into account the financial and marital status of the former spouses.

When filing a claim in court to receive a fixed amount of alimony, you must provide evidence of its validity. If the court finds it too high, then the amount of alimony can be significantly reduced. Therefore, it is better to collect all documents, receipts, certificates confirming expenses for the child/children. For example, this could be payment for:

- nutrition;

- public utilities;

- clothes and shoes;

- kindergarten, school, clubs, sections, additional education;

- nanny, tutor;

- medicines, doctors, health camp;

- cultural leisure and other expenses.

Since the maintenance of children is the general responsibility of the parents, the resulting amount of expenses must be divided by two. This will be the amount of alimony in a fixed amount.

Voluntary alimony

If the spouses managed to agree among themselves, then the amount of alimony can be established without going to court.

It is better to formalize such an agreement not just in words, but through an agreement that is certified by a notary.

If in the future the ex-husband does not comply with the established conditions, you can always submit a notarial agreement to the bailiffs, since it is equivalent to a writ of execution.

The terms of the agreement must include the following:

- the amount of alimony (you can set it either as a fixed amount or as a percentage of income);

- payment procedure;

- indexation of alimony (this item is not mandatory, but if you have set a fixed amount of money, then indexation will help avoid inflation);

- the term of the agreement, as well as the procedure for its amendment and termination.

The agreement may also include other additional terms and conditions. For example, liability for violation of the agreement, fines, penalties.

Responsibility for non-payment of alimony

If the ex-husband evades alimony, does not pay in full or hides income, then it is necessary to bring a writ of execution (court order, notarial agreement) to the bailiffs. The document is submitted at the place of actual residence of the ex-husband. If you don’t know it, then submit it to your address.

In the application to initiate enforcement proceedings, be sure to indicate all the information you know about your ex-husband: address, telephone numbers, place of work, additional income (for example, renting out an apartment, commercial activity).

If information about the place of residence and work is unknown, indicate the addresses of parents, other relatives, and friends of the husband. Don't forget to include your bank details and contact information with your application.

After initiating enforcement proceedings, bailiffs can eagerly take on your husband and force him to pay alimony, as well as find income hidden from you. Within their competence:

- seize property and bank accounts;

- impose a ban on the sale, donation, exchange of real estate and vehicles by blocking opportunities for the state. registration;

- restrict a man’s travel abroad;

- fine for failure to comply with the bailiff's requirements;

- suspend your driver's license;

- initiate criminal prosecution.

- You also have the right to recover from your husband a penalty in the amount of 0.1% of the unpaid amount of alimony for each day of delay and losses that arose due to his failure to fulfill his obligations.

- Sources:

- The amount of alimony collected from minor children in court

- Collection of alimony for minor children in a fixed amount

- Initiation of enforcement proceedings

- Responsibility for late payment of alimony