Buying real estate is a very responsible matter. But despite this, deception when buying an apartment is a very common occurrence. In order to avoid being deceived when buying an apartment by the seller, study more carefully the living space being sold and the title documents for it.

Risks when buying an apartment

Many have seen advertisements in print media about the purchase/sale of an apartment without intermediaries. On the one hand, this approach significantly saves money on both sides. But, on the other hand, it significantly increases the possibility of adverse consequences.

Statistics maintained by real estate agencies and law enforcement agencies show a fairly high level of fraudulent activities during purchase and sale transactions.

Such actions are primarily associated with the provision of fake documents. Of course, we will not be able to verify the authenticity of all documents, since not all databases have open access; but, for example, it is quite possible to find out about the presence of “extra” people in an apartment from an extract from the house register.

The next risk is associated with settlements under a purchase and sale agreement. In most cases, monetary transactions between the seller and the buyer are carried out in cash. On the one hand, this saves time, on the other hand, there is the possibility of losing all your money.

Pay attention to those cases when the seller insists on a very urgent sale of the apartment and is even ready to make a “good discount”. As a rule, this may be due to the fact that the owner of the apartment is not a bona fide purchaser.

How to buy an apartment without risk?

So, let's take a closer look at the aspects that you should pay attention to when buying a home.

Preparation of documents. Of course, you need to trust the seller. But don't forget to check his words. You and I understand that transactions for the purchase and sale of an apartment are not the cheapest, and therefore we must treat them with the utmost caution.

We need to check the following documents:

- We look at the extract from the Unified State Register for all transactions related to the disposal of the apartment. It also reflects all the encumbrances that have been placed on the apartment, including arrests. Please note whether there are any legal disputes that are pending. And for greater reassurance, let us remember the provisions of the Civil Code, which establish the rule on the limitation period of 3 years. An extract from the Unified State Register is paid and, as a rule, is issued to the owners, members of their family or other interested parties. The simplest option is to order an extract on the Rosreestr website and receive it by email. It can also be obtained by submitting a written application in person to Rosreestr, through the MFC or by mail.

- Next, we pay close attention to the certificate of registered persons. Quite often there are situations when the seller “forgets” about family members and third parties who, although registered, do not live in this apartment. You buy an apartment, and after some time it turns out that the seller’s brother has been released from prison and, since he once refused to participate in privatization in favor of the seller, has the right to live in this apartment. He files a lawsuit, the court makes a decision that you should return the apartment back. But you weren't upset, were you? You file a claim for a refund from the seller... Well, it’s in vain that you weren’t upset... The seller, naturally, no longer has the money. Property too. Only a small salary, which he regularly receives every month. So the bailiffs assign him a “recovery” from his regular income. Have you already calculated how long it will take for your apartment to be refunded?

- We definitely check the seller’s documents. We look at his passport and check the information from it at the passport office. There are often situations where the seller may be an incapacitated person. The apartment is for sale. You buy it, fill out all the necessary documents, register and bring your things there. Everything is fine until the moment when you receive a summons from the court asking you to appear in court. You wonder: what’s the matter, I’m a conscientious purchaser! Yes you do! There are no complaints against you. But the seller... in general, he turns out to be incompetent; and at the time of the transaction he was not aware of the consequences of his actions. It turns out that the purchase and sale agreement is declared invalid, and you are left alone with a court decision and the impossibility of returning the money.

- If the agreement is signed not by the owner, but by a representative under a power of attorney, carefully read the power of attorney. The fact is that some owners limit the rights of their representatives: for example, he can negotiate and sign an agreement, but monetary transactions are not within his competence. To avoid unforeseen situations that could have negative consequences, do not be lazy and read the power of attorney carefully.

- Certificate from BTI. Some owners, after remodeling an apartment, “forget” to register it with the BTI. This may result in a fine. But to avoid this trouble, ask the owner to order an extract from the register from the BTI and study all the information about the apartment. This is also necessary so that you do not have problems in the future when selling this apartment.

We examine the appearance of the apartment. We will immediately clarify all the points that may concern you. For example, a poorly closing door, leaks on the ceiling, etc. After the fight, it will be too late to wave your fists.

Please pay attention to the price . In general, you should have a general idea of the value of real estate in your area. Such information can be obtained by monitoring the real estate market.

Don't know your rights?

Subscribe to the People's Adviser newsletter. Free, minute to read, once a week.

And, accordingly, if the apartment is not bad, but the price has been reduced, then there is something wrong here. Of course, a “good” option is also possible, when the owner simply does not know the prices and put the apartment up for sale without thinking, or he urgently needs money.

But there are times when fraudulent schemes come into play. For example, registration of a purchase and sale transaction using forged documents. Check everything thoroughly.

“Special” options for selling an apartment

Here we will briefly consider 3 situations: the sale of an apartment by assignment of rights, the sale of an apartment received as an inheritance, and the sale of an apartment in shared ownership.

- Sale of an apartment by assignment of rights (For more details, see How is the purchase of an apartment processed by assignment of rights?). This option is possible under two agreements: an agreement of shared participation in construction and a preliminary purchase and sale agreement.

According to experts, the “safest” agreement is a share participation agreement in construction. This is due to the fact that in addition to the provisions of the civil code, the buyer has additional “protection” under 214-FZ. But such an agreement involves the assignment of rights only by agreement with the developer. Moreover, if the apartment was purchased with a mortgage, then permission from the bank will also be required.

If a contract for the assignment of rights was signed, and the developer did not fulfill his obligations, then there can be no claims against the original owner. The assignment of rights must be registered. An exception is a preliminary purchase and sale agreement.

- Buying an apartment received by inheritance (For more details, see What to look for when buying an apartment received by inheritance?). Inheritance in accordance with the law can be by law and by will. In both cases, it is possible to transfer the apartment to the heirs.

But the law “tacitly” establishes priority for the will. The main fraudulent scheme in this case is the forgery of a will.

According to the law, there are several lines of inheritance. The first includes close relatives of the deceased - children, spouses, parents. But there is another “unscheduled” queue - by right of representation. Such heirs have priority.

In addition, a so-called “testamentary refusal” is possible, when the deceased indicates in the will that, for example, his son must provide his mother with housing for the rest of her life.

Therefore, if the son suddenly decides to sell the apartment received by inheritance, the mother will exercise her right of residence by testamentary refusal.

The main problem when buying an apartment received by inheritance is the “sudden” announcement of heirs who were not included in the queue. This is due to the fact that the powers of notaries do not include checking all the relatives of the deceased; they only “record” all citizens who apply for an inheritance within the period established by law.

The second aspect that you should pay attention to is the situation when the seller is recognized as an “unworthy” heir, and the purchase and sale transaction has already been completed.

Example from practice: a brother and sister claimed to inherit an apartment. After the opening of the inheritance, the apartment was divided between the two of them. After some time, the sister “disappears,” although the brother claims that she got married and left. In fact, he kept her locked in the basement all this time.

The apartment, naturally, was “re-signed” to him, and he sold it. But my sister somehow managed to get out and run to the police. Well, then, as in the Brazilian TV series: the court declares the brother an “unworthy” heir and returns the apartment to the sister.

Everything would be fine, but what should a bona fide buyer do in this case? File a lawsuit against your brother to claim the money transferred for the apartment.

- Purchasing an apartment in common ownership (For more details, see What is special about buying an apartment from two owners?). According to current legislation, there is common shared and common joint property.

The main feature of transactions with such property is that the consent of all owners must be obtained for the disposal of joint property: it can be expressed in the form of a notarized consent; or the owners are included as parties to the purchase and sale agreement and each sign for themselves.

The most common situation is the sale of an apartment that is owned by two spouses. Or another option is possible: the apartment is owned by the husband, the wife is simply registered, but the property was purchased during marriage; Accordingly, the sale of living space requires the consent of the wife in any case.

Otherwise, the transaction may be declared invalid. Such citizens (whose consent was not “asked”) can go to court within 1 year from the moment they learned or should have learned about the transaction.

A separate issue is the situation when one of the owners of the apartment is a child.

In addition to the consent of the guardianship and trusteeship authority to complete the transaction, parents or legal representatives must provide the child with “new” living conditions no worse than they were before.

If they do not do this, then the minor retains the right to use the apartment, even if it is already owned by another person.

You can never predict all unforeseen situations. The main thing is not to get lost when difficult questions arise, but to solve them as they arise.

If you are confident in the “correctness” and reliability of all documents presented by the seller, then it will be much easier for you. And if you also turn to realtors, save yourself from wasted time and mental energy.

How to avoid being deceived when buying an apartment on the secondary market

Deception schemes when buying an apartment on the secondary market are only getting better every year. We will tell you in this material how to avoid fraudulent activities when purchasing real estate.

How to protect yourself when buying an apartment on the secondary market? There have always been many swindlers, swindlers, unscrupulous sellers in the real estate market, as well as buyers. The secondary market is indicative in this regard.

Fraud schemes can be very different, and even prudent and legally savvy people, when purchasing an apartment, cannot always quickly realize that they are faced with fraud, and when this becomes clear, it is almost impossible to change anything.

Cases of deception are associated not only with deliberate fraud, it happens that sellers simply do not agree on something, and then it turns out that the housing was not sold legally, and the unfortunate buyer ends up without an apartment and without money. Therefore, you should not neglect any precautionary rules, and in particular, do not agree to illegal methods of concluding a transaction.

What should raise suspicion

Professional scammers know how to handle things in such a way that their potential victims simply do not have any reason to be suspicious.

This must be remembered in order to be guided by the rules of precaution, no matter what.

However, here is a list of the most striking signs that the transaction may be fictitious, and that this is probably a fraudster or a person who is not telling something and is hiding something:

- offer apartments at very low prices;

- According to documents, the owners of the apartment have changed frequently over the past few years;

- the technical plan of the apartment and the actual layout are different;

- they require a large deposit from you;

- the seller delays for a long time in providing documents, or at least one of those you ask;

- the transaction is made by a person under the power of attorney of the owner of the apartment.

The presence of these signs does not always indicate some kind of deception. People very often sell apartments using powers of attorney if the real owners are ill or live abroad, and the lack of documents can be caused by objective reasons. And yet, any of these signs is a reason to think seriously.

Methods of deception

As mentioned above, not only sellers, but also buyers can enter into transactions fraudulently. But the former, perhaps, have more opportunities. And sometimes buyers unwittingly help them in this.

What types of deception schemes exist:

- the transaction is concluded with several buyers at once;

- the transaction is executed using false documents;

- the seller hesitates to check out of the apartment, and, according to a court decision, returns the money partially and for a long time;

- the seller asks in the contract to indicate an amount that will be less than the actual amount, and then, by a court decision, terminates the transaction and returns only the value specified in the contract;

- the buyer is not warned that there may be other applicants for the housing who in the future have the right to go to court.

This is not a complete list of the methods that unscrupulous homeowners can use to make a transaction with maximum benefit.

One apartment – several buyers

One of the most criminal ways to profit from buyers is to sell an apartment to several buyers at once. And this is possible. For example, a person lives abroad or is planning to move.

He finds several buyers, concludes a purchase and sale agreement with each of them using duplicate documents for the apartment, most likely from different notaries, receives money from each buyer and leaves.

In this case, the owner of the home will be the one who manages to register his rights to a new apartment first, but for the rest the forecasts are disappointing, because it will be almost impossible to get your money back if it is impossible to find and bring to court a seller living abroad.

If none of the buyers passes state registration, the one who first concluded the deal will have an advantage in court.

How to avoid

First of all, remember that it is premature to transfer money to the seller before registering ownership rights. Give him the main amount after the authorities approve your right to the premises. Another important piece of advice - if you become aware of a double sale of an apartment, immediately go to court, perhaps you will be the first to prove your right to the purchased housing.

False documents

Using false documents, they can sell, for example, someone else's rented apartment. An unsuspecting person enters into a purchase and sale agreement, perhaps with a fake notary, transfers money ahead of time to the supposed owner of the property, and then finds out that the apartment has a completely different owner, and that he has entered into an agreement with a stranger. The price of such paper is zero.

How to avoid

To avoid getting into such a situation, be sure to check the legal ownership of the apartment. It is confirmed by the following documents:

- a certificate of state registration of the object in the name of the seller with whom you are dealing;

- an agreement of gift, inheritance or sale confirming the acquisition of ownership rights.

The seller does not specifically write out

The situation may be this: after the transaction has been concluded, and perhaps long before that, the seller decides not to check out of the apartment, explaining that he simply has nowhere to move.

The new owner, naturally, will try to get the former owner of the apartment out as quickly as possible, but he goes to court and asks for permission to stay and to cancel the contract.

And the court may allow him to do this if it considers the arguments for terminating the contract to be justified, ordering the return of the money received during the sale.

The problem is that the plaintiff can claim that the money was stolen or was spent, for example, to pay off some debt; he will not refuse the return, but will ask the court for a deferment or agree to a phased return of the money, as they say, from payday . Now you can imagine how long the repayment of this debt may take. For years.

What to do

In principle, there is nothing terrible in the story of a long discharge. This may be a vital necessity for the former owner of the property. According to the Housing Code, a citizen is obliged to vacate the premises in the event of termination of the right to use.

That is, the Law protects buyers in this case. Difficulties may arise if the seller is able to somehow cancel the transaction through the court.

To avoid such a situation, include in the contract a condition on the timing of the seller’s discharge, as well as a clause on penalties if the citizen does not check out, for example, before a certain date.

Reduced price in the contract

The owner of the apartment, concluding a deal with the buyer, may ask the latter to indicate a reduced amount in the purchase and sale agreement in order to pay less taxes or not pay them at all. In this case, the sale will take place partially by oral agreement; money in excess of the specified amount is transferred to the seller, at best, against a receipt, and sometimes without any written confirmation at all.

Perhaps after this the buyer will have the housing at his disposal and will not encounter any problems, although he must understand that he has become an accomplice to a tax violation, which is no longer good.

It could be worse if the seller suddenly decides to go to court and invalidate the transaction.

If the court sides with him, he will be obliged to return the money specified in the contract, everything that was paid to him in excess of the contract amount; if the buyer manages to return it, it will be with great difficulty.

How to avoid

Do not agree to the homeowner’s requests to indicate a reduced price in the contract. He will have to pay taxes on the transaction, not you, and you, if you agree to his terms, are greatly risking a certain amount of money. Demand that the contract indicate the full cost of the home being purchased.

Unexpected contenders

Another situation that home buyers often encounter is the unexpected appearance of the seller’s relatives who claim their rights to the purchased apartment.

This is not always associated with fraud; most likely, the former owner simply did not want to warn about possible difficulties, out of cowardice or greed.

In this case, this relative will have a chance to win the case in court if he really has the right to the apartment, and the buyer risks both housing and money.

How to avoid

Before the transaction, be sure to find out how the seller acquired the apartment.

If by inheritance, the sale will require the signatures of all heirs, if under a gift agreement, keep in mind that in some cases the property may be alienated by the donor, but if under a sales agreement, find out whether the housing was purchased during marriage, because in In this case, you will need the written consent of your spouse to enter into a transaction. It is also very important to find out whether the children of the owners can apply for the apartment; sometimes for a transaction you need to obtain permission from the guardianship authorities.

Other troubles and how to avoid them

In fact, when buying an apartment on the secondary market, you may encounter other serious problems that arise from the fact that the seller hid something or did not tell you.

For example, if redevelopment was done in an apartment without permission, the buyer may be denied registration, and sometimes this can result in serious fines, which the new owner will have to pay.

Therefore, always check the layout of the premises and the approved technical plan of the apartment.

You may also get an apartment with utility debts; to prevent this from happening, ask for a certificate from the utility services before signing the contract.

The situation can be much worse if the apartment is pledged or guaranteed, or is the subject of a dispute in court with third parties. In this case, she may be alienated.

It is sometimes simply unrealistic to find out some details about such proceedings; you can only protect yourself by adding a list of certain risks to the text of the purchase and sale agreement.

Fraudsters when buying an apartment in 2023 - schemes to avoid getting caught, on the secondary market, mortgages

- In a crisis market, the percentage of criminal transactions is always higher than in a calm economic situation.

- One of the main reasons is that many people who want to buy a home save on their own safety.

- From this article you will learn what schemes scammers use to leave ignorant buyers without money and without an apartment.

What to pay attention to to avoid falling for dangerous fraud schemes

There are many types of fraudulent schemes, which are not so easy to identify even for experienced legal professionals.

It is important to remember that scammers always rely on transactions with non-professionals. Therefore, the first “bells” can be noticed even in the initial stages.

First of all, it is worth remembering that scammers usually lure gullible buyers with an unusually low price.

The second important factor is relationships with agencies. It is known that scammers are afraid of professional real estate agencies who can expose them even at the first meeting.

Therefore, criminal apartments are never sold under exclusive contracts with serious agencies. We offer a number of recommendations to help secure the transaction.

On the secondary market

Most fraudulent schemes are related to the sale of “secondary housing”, since it is much easier to implement them by colluding with the owner or intimidating him.

When buying an apartment, scammers use schemes that have been worked out over the years. Therefore, buyers have the opportunity to protect themselves if they do not neglect “safety precautions.”

For a mortgage

Many buyers think that housing purchased with a mortgage is checked by the bank, and by the time of the transaction its legal purity is “proven by default.” This is absolutely not true.

The bank verifies the authenticity of documents and the information contained in them, but that’s all. By the time the loan is issued and the transaction is registered, the borrower’s risks are no longer the bank’s problems - his risks are covered by the insurance company.

And the borrower will have to repay the loan no matter how successful the purchase turned out to be. Therefore, reliable protection against the risks of fraud is possible only on the part of the buyer, on his own.

In a new building from the developer

In recent years, the risks when purchasing a primary home have decreased, but have not disappeared.

Therefore, when selecting a new building through serious real estate agencies, the same check is carried out as on the secondary market. But the objects of inspection are the developers themselves.

If you are purchasing a home on your own, you should ask the following questions:

- How long has this developer been in business? What do they write in reviews about the purchased property?

- Does the permitting documentation meet the requirements required by the investor?

- On the basis of what laws is the transaction with this developer carried out?

- How are calculations made? Will the investor be able to subsequently prove that the purchase was paid for properly?

By assignment

In this case, the buyer does not acquire the right of ownership, but the right of claim - since the housing has not yet been built.

Such transactions are considered high-risk because they carry:

- risk of double selling;

- the risk of receiving a “long-term construction” or an unfinished project from a developer on the verge of bankruptcy.

In both cases, the likelihood of giving money to scammers is quite high, and without competent legal support it is unsafe to enter into such transactions.

Safety rules when buying a home

The risk of encountering fraud in real estate transactions is always highest in large cities.

Participants who do not use professional legal support for transactions are most susceptible to it. However, you can minimize the risks by adhering to the following rules.

Do not conduct transactions with a power of attorney from the seller

Conclude an agreement only with the seller himself or his legal representative (if the seller’s legal capacity is limited or absent). Any sales by proxy always involve high risks.

- It is by power of attorney that criminal apartments are most often purchased from owners who have never executed such powers of attorney.

- In addition, the owner can revoke the power of attorney during the transaction or even issue it to a notary who has been deprived of his license.

- There are many trustworthy but ignorant participants in the market who do not understand the buyer’s risks.

- It is worth trying to convince the trustee of the need for the principal to be present when signing the purchase and sale agreement.

Receive confirmation of acceptance of money

- According to the custom of business in our country, a receipt serves as a guarantee of receiving money for a sold home.

- But it can only be considered a reliable guarantee if it is written by hand by the seller, without corrections and in the presence of a representative of the other party.

- Either party has the right to stop registration after signing the agreement.

- Therefore, to guarantee the security of settlements, each party must fulfill its obligations under the transaction simultaneously with the other party.

- It is for this purpose that payments are usually made through a safe deposit box or letter of credit, in which funds are blocked until the transfer of ownership is registered.

- Any transfers of funds prior to registration or in the name of third parties involve the risk of the buyer losing all transferred funds.

- In this case, the transaction may be terminated without any chance of compensation for the buyer's losses.

Do not agree to an incomplete price in the monetary policy, even if the bank agrees to it

- Knowing about the practice of tax evasion by sellers, banks sometimes agree to conduct transactions with an incomplete amount indicated.

- But in this case, the bank does not risk anything, but the borrower may pay dearly for his gullibility.

- There are cases when sellers indicated incomplete prices not at all for the sake of reducing the tax burden.

- Under the guise of tax evasion, the goal may be to subsequently terminate the transaction in court with the return to the buyer of the amount specified in the contract.

Several years ago, a criminal group was detained, which included a former employee of a well-known agency and two elderly owners of a Moscow apartment.

These persons sold and reclaimed this apartment 8 times over 3 years.

The cost of the apartment was estimated at 9 million rubles; the contract indicated an amount of 1 million, which, by court decision, was returned to the victims. The scammers kept the rest of the funds for themselves.

Video: how to avoid being scammed

It is obligatory to carry out a full check of the legal purity of the apartment

In the example from the previous paragraph, we see that buyers of a “bad apartment” would not have suffered if they had studied the history of transfers of ownership of this object. Obtaining this data is not at all difficult.

To do this, you need to order an extended extract from the Unified State Register of Real Estate, in which you can see the history of transfers of rights and the grounds for changing owners. Too frequent changes of apartment owners will alert even the most gullible market participant.

You should be wary if you see in history the same surnames of owners who took ownership not by gift or inheritance, but by purchase and sale agreement.

Transfers of rights between family members can be classified as void or feigned and terminated without the participation of the court.

By purchasing such an apartment, you risk that it is not even your transaction that will be terminated, but the previous one in the chain in history. And this can deprive you of all chances for a successful resolution of the situation.

As a bona fide purchaser, your only hope is that the seller will one day pay the full amount owed by the court.

Make sure there are no reasons for subsequent termination

Of course, it is impossible to foresee all the reasons - there are too many of them. But it is possible to avoid the most common risks if you use the following recommendations:

| Pay an advance with precautions | After choosing an apartment, it is customary to pay an advance for it. There is a fraudulent scheme built precisely on the “collection” of advances and their subsequent non-repayment. The advance is accepted by a private realtor (not the owner or agency) and, contrary to business custom, continues showings and accepts advances from other persons. Having collected the required amount, the scammer disappears. Another option is that after accepting the advance, a break in the purchase agreement is provoked. As a result, the advance remains with the seller according to the agreement |

| Make sure the seller is competent | If the seller is a patient of a drug treatment or psychoneurological dispensary, he has the right to terminate the transaction at any time. The legal basis is the statement that at the time of signing the contract the seller allegedly did not realize the essence of his actions. Quite often, such sellers act at the instigation of scammers. You can make sure that the seller is not limited in legal capacity due to health reasons by requesting certificates from the relevant dispensaries. It is important that the certificates include the wording that the person is not registered. If the certificate states that the seller “has not asked for help since the specified period,” this means the presence of medical assistance. cards at this institution. In this case, the security of the transaction requires an examination of the seller by a psychiatrist-narcologist on the day of the transaction to guarantee its validity. |

| Make sure the seller is not bankrupt | This risk is associated with the recently entered into force law on bankruptcy of individuals. persons Its essence is that a person who has been declared or has declared himself bankrupt has the right to terminate all real estate transactions within 3 years before and after the declaration of bankruptcy. As a rule, this applies to insolvent clients of credit institutions. Entry into force of the law on bankruptcy of individuals. individuals has opened up new opportunities for fraudsters. One way to determine whether a seller is “at risk” is through information obtained from a credit bureau. |

Obviously, the listed schemes are not the entire arsenal of scammers. Therefore, when conducting legal due diligence, it is wise to use the services of those who know how to conduct it and successfully prevent the risks of dangerous transactions.

Attention!

- Due to frequent changes in legislation, information sometimes becomes outdated faster than we can update it on the website.

- All cases are very individual and depend on many factors. Basic information does not guarantee a solution to your specific problems.

That's why FREE expert consultants work for you around the clock!

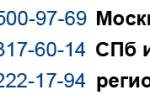

APPLICATIONS AND CALLS ARE ACCEPTED 24/7 and 7 days a week.

How apartment sellers are deceived: realtors can deceive when selling an apartment

It seems that the seller of the apartment is in almost no danger: as a rule, real estate buyers are deceived. Unfortunately, this is not the case - the seller may lose both the apartment and the money. Today we tell you how to fool a naive owner.

Fined for breaking a deal

Transactions are not concluded immediately: often the purchase and sale agreement is signed several months after the first meeting between the seller and the buyer.

Extended deadlines are a risk: if at the last moment one of the participants decides to refuse the deal, the other party will suffer losses.

To protect themselves from loss of money and time, the seller and buyer enter into a preliminary purchase and sale agreement or a deposit agreement. With its help, you can “stake out” the property you like or buyers who are ready for a deal.

Under the terms of the contract, the buyer transfers money to the seller. This is a deposit. If the buyer refuses the deal, it will not be returned: it will remain with the owner as compensation for damage. If the deal falls through due to the fault of the seller, the buyer may demand a double amount back.

The deposit agreement is designed to protect the parties, but sometimes it is used by scammers. The scheme looks like this: an unscrupulous buyer draws up an agreement and includes some difficult condition in it - for example, to discharge the entire family, including minor children, in one day.

If the seller cannot resolve this issue, the buyer has the right to claim that essential terms of the contract have not been met. The deal falls through, due to the fault of the apartment seller. This means that he must return the deposit received in double amount. The amount can be quite significant - the size of the deposit is not limited by law.

The buyer can transfer either 10% or 50% of the value of the property.

Sell for more than agreed

Sellers are increasingly turning to real estate agencies.

This is convenient: you don’t need to monitor the market, place advertisements, conduct viewings, deal with documents and check every line in the contract.

If the seller is busy and cannot find time, he can issue a power of attorney to one of the agency employees. However, in this case, you need to approach the choice of a realtor with extreme caution.

An unscrupulous agent can deceive: complain about supposedly low demand and ask to reduce the price, even if a buyer has already been found. The realtor will make a deal, sell the apartment at a higher price and keep the difference between the real cost and the price that you discussed the day before. The seller will pay a double commission.

Slip counterfeit money

Payment in cash is very rare: people mainly use safe deposit boxes and letter of credit accounts. However, this method still exists.

Be careful if you receive money from hand to hand. Firstly, there is a risk of getting a “doll” - this is when the buyer first shows and lets you count real money, and then quietly slips in a stack of cut paper, covered with a couple of bills for authenticity. Secondly, there is a risk of not receiving the entire amount: only part of the bills may be original. The rest will be fake.

Better not take risks. If you dare to pay in cash, count the money on a special machine in any Russian bank.

Wait until the cell rental period expires

A safe deposit box is the most convenient and common method of payment. This is relatively safe: the seller and buyer come to the bank, count the money under the supervision of employees, seal it in a bag and place it in a pre-rented safe deposit box. You can open the box only after registering the purchase and sale agreement.

Unfortunately, scammers can even fool bank employees. In the locker rental agreement, they specify access periods: after this time, the seller will not be able to collect the money.

When submitting an agreement to Rosreestr, an unscrupulous buyer “accidentally” makes a mistake and delays the process of registering the agreement - this is how fraudsters wait until the period of access to money expires.

As a result, the buyer is left with an apartment and money, and the seller is left with nothing.

Caught in greed

If a property costs less than a million rubles, the profit from its sale is not subject to any tax.

To save money, savvy sellers specify in the contract a price that falls within the taxable minimum.

Often they become victims of their own greed: the buyer pays exactly what is written in the document and calmly registers the contract. It is almost impossible to punish a fraudster: formally, he does not break the law.

Ask to close the debt in advance

Some sellers accommodate buyers who do not have enough money and provide payment in installments. Unfortunately, not all borrowers are honest and conscientious people.

In order not to pay, scammers try by all means to persuade the seller to inform Rosreestr that the payment has been made in full. Even if in fact the debt has not decreased at all. The deceiver will always find something to justify his request: he wants to do a redevelopment, transfer the apartment to a non-residential property, or merge it with a neighboring apartment - anything that requires the removal of the encumbrance.

To prove the purity of intentions, a fraudster can issue a power of attorney to dispose of his property, enter into a loan agreement, or write a receipt.

Don't believe it. The power of attorney can be revoked on the same day. The collateral can be easily transferred to another person. As a result, it will be very difficult to collect the debt - so instead of meeting halfway, offer the buyer to take out a loan from the bank.

How to avoid falling for tricks

First of all, carefully read all documents, calculate the consequences and risks, clarify the terms of contracts that seem suspicious to you. If the buyer begins to fuss, refuses to change unfavorable conditions for you and is in a hurry to make a decision, refuse such a deal. Losing a customer is not as scary as losing several million rubles.

If you are not well versed in the laws, hire a lawyer who will help you draw up an agreement so that you are not deceived. Or contact a real estate agency.

This way you will get help from all the necessary specialists at once: lawyers, appraisers, mortgage brokers. The activities of real estate companies are not licensed, so choose a large agency with a strong legal department.

It is advisable that the company be more than five years old.

How to avoid becoming a victim of scammers when buying an apartment?

katrin_timoff/Fotolia

Alexey Zubik, commercial director of BSA, answers:

Firstly, you should pay attention to the people who are selling you an apartment.

If these are elderly people, people with mental disabilities or people leading an antisocial lifestyle, you should not enter into a transaction with them, since they may have relatives who have the right to the property and will not be happy with the sale of the property. In this case, they may claim that the seller was in an insane state when signing the contract, and demand its termination.

5 signs your real estate agent is a scammer

5 types of transactions that need to be notarized

It is also worth being more vigilant if the sale of an apartment is not carried out personally by its owner, but by a trusted person.

It may turn out that the power of attorney has long been invalid, and the transaction will not have legal force. You should definitely ask the trusted person about his relationship with the owner.

It would also be a good idea to consult with the notary who executed this power of attorney.

I would recommend studying the documents confirming the ownership of the property. It is necessary to find out whether the seller is the direct owner of the apartment, whether it suddenly belongs to the state or a private company, because without their consent the transaction cannot be considered completed.

If the property belongs to the owner not on the basis of a purchase and sale agreement, but on the basis of a court decision, then it is necessary to apply to the court with a request to view the original document.

Such documents are often forged, and if you sign an agreement with a fraudster, after transferring money, he has the right to demand his property back, since according to the law the transaction will be considered invalid.

It is very important to check who has the right to living space. Spouses, minors, relatives, persons considered missing or in prison - all of them, after some time, can apply to have the transaction declared illegal.

You should contact the passport office or order an extract from the Unified State Register to clearly determine who is registered in this apartment and has rights to it.

If someone other than the owner is listed there, you must either demand to write them out, or contact them and obtain written consent to sell the property.

- Situations are different, and it is hardly possible to protect yourself one hundred percent from scammers, but by following these simple rules, you will protect yourself from the most common types of fraud.

- 5 types of fraud when selling secondary apartments

- Checking the legal cleanliness of an apartment: 10 pain points

Maria Litinetskaya, managing partner of Metrium Group, member of the CBRE partner network, answers:

Today, when demand on the secondary housing market has noticeably decreased and relatively low prices are no longer so alarming to buyers, it is especially easy to run into scammers. Here are a few points that should alert you.

- Suspiciously low commission or its absence. Sometimes a realtor agrees to help you for a nominal fee. However, having found a suitable apartment, he convinces the owner to raise the price and receives part of this difference as a reward. Only after this the fraudster agrees to show the apartment to the client. In this case, when concluding a deal, you will pay the realtor much more than usual, without knowing it. In order to avoid this, it is better for the buyer and the owner of the apartment to meet in person at the negotiation stage and discuss all financial issues.

- The transaction is made by proxy from the owner of the apartment. One of the most widespread methods of deception is the sale of an apartment through dummies. Often the real owners are not even aware that their apartment is for sale. Fraudsters fraudulently obtain a passport, find a similar person, go with him to a notary and issue a general power of attorney for themselves with the right to sell the apartment. Therefore, transactions under powers of attorney should be treated with particular care and all documents should be carefully checked.

- Incompetent sellers. Stories about buying real estate from alcoholics, drug addicts and mentally ill people for pennies have become the talk of the town. However, such transactions can be easily challenged in court. Such indiscretion can be costly for the buyer. Therefore, it is a good idea to ask the seller for a certificate from a psychoneurological dispensary. If he has nothing to hide, it is not difficult to get her.

- Realtor being too friendly. As a rule, realtors are excellent psychologists. They know very well how to win over a person and how to maintain a conversation. But if the realtor suddenly became your best friend and the conversations gradually turned to personal topics, then this is a reason to be wary. Perhaps you should establish some distance to maintain a sober mind.

- "Error" in the address. There are cases when realtors deliberately show the buyer not the apartment that is for sale, but exactly the same one in a neighboring house, but with good repairs. In residential areas, all houses are usually of the same type, so it is easy to confuse them. And this plays into the hands of scammers. When the buyer decides to make a deal, an agreement is concluded with him, where the real address of the apartment is written down. In such cases, the deception is revealed too late. Therefore, before going for an inspection, it makes sense to independently study the place where the house is located. Unscrupulous sellers show miracles of ingenuity and constantly come up with more and more new deception schemes. In such conditions, even a prudent and legally savvy person cannot always immediately understand that he is dealing with swindlers. Only one piece of advice can be given here: always remain vigilant, be attentive to everything, especially to the little things.

How to find out that an advertisement for the sale of an apartment is fake?

7 main mistakes when transferring money when buying an apartment

The managing partner of the law firm "ENSO", the president of the Institute for the Development and Adaptation of Legislation, the head of the committee for assessing the regulatory impact of the all-Russian public organization "Business Russia" Alexey Golovchenko answers:

It should be clarified that the developer or seller may be a fraudster. Developers are not scammers in the strictest sense, but for one reason or another they sometimes do not take into account the interests of their investors.

They build individual housing construction skyscrapers, sell them, and then demolish them. They collect money through housing construction cooperatives, but the projects ultimately remain unfinished.

Now the situation is improving a little, since a compensation fund is being created for such situations.

The second type of fraud is at the seller level. For example, you may stumble upon an apartment, which may later be taken away by third parties. It is necessary to check whether there are other interested parties (in addition to the seller) who may have claims to this property, and whether there is a violation of the rights of third parties.

We had a case with a purchased Moscow apartment, when the apartment was purchased from a person who bought it after illegal privatization by the previous owner. As a result, all transactions were declared invalid, and the apartment went to the state. This means that sometimes it is not enough to check only the seller, you need to look at the entire history of the property.

We are also familiar with situations where an apartment was sold during its short-term rental period by falsifying documents. I would also be wary of properties sold at a large discount. A common scheme lately: the seller, after selling an apartment, pretends to be insane and disputes the deal.

All dubious situations that raise suspicions of the seller’s dishonesty should be analyzed!

How can you protect yourself from such circumstances? There is no correct advice that will guarantee you against dealing with a scammer.

If you have any doubts, I would recommend contacting a qualified lawyer (along with working with a realtor) who understands these issues.

Because only a legally savvy specialist will be able to track the entire history of the property and the seller/developer, as well as identify possible risks.

5 main risks when buying an apartment on the secondary market

Because of the “black” realtors, we were left without housing and registration. What to do?

The head of the TSN Real Estate group of companies, president of the guild of realtors of the Pushkinsky district of the Moscow region, Tatyana Sedykh, answers:

Sophisticated methods of real estate fraud are multiplying and developing day by day. And most often in the direction of secondary housing.

One of the latest criminal schemes looks like this: the seller of an apartment receives money from the buyer for the property, and three or four months later he challenges the deal in court, citing mental illness, which was allegedly in the acute stage at the time of the transaction. And the apartment is returned to the seller, despite the fact that the new owner most likely has already managed to make repairs to it. Unfortunately, it is impossible to prove the fact of fraud and return the money spent. Moreover, such an outcome is truly “favorable”. After all, sometimes it happens that the seller has “already spent” the money or “didn’t receive it at all” - retrograde amnesia is also a well-reasoned loophole for scammers.

The second option: black realtors buy up shares in apartments and force neighbors to move out, creating unbearable living conditions.

There are a lot of options for fraudulent schemes! Therefore, in matters relating to the secondary real estate market, you should be vigilant and choose only trusted specialists to help. In the practice of realtors, there is an algorithm that is recommended to be followed when planning real estate transactions.

After you have finally decided on the property, the first thing you need to do is check the availability of title documents for the apartment and make sure that the civil passport of the seller of the property belongs to him and there is no doubt about its authenticity.

Then it is worth checking the actual and documented living space of the property and checking the legal cleanliness of the apartment. It is really difficult for an ordinary buyer to do this on their own without a legal education and access to various databases.

Therefore, when dealing with housing, it is better to contact a certified real estate agency that has not only permits for activities, but also a good reputation in the market. This is one of the main guarantors of the purity of the transaction.

Answered by lawyer, K. Yu. n. Yulia Verbitskaya:

The first and main condition. You will have to independently delve into the essence and check all the documents presented to you. If necessary, get one or more consultations from specialists (lawyers and realtors).

The simplest and most reliable scheme for purchasing housing is a purchase and sale agreement, according to which one party (the owner, the seller) sells, that is, transfers, in exchange for a sum of money specified in the agreement, the other party (the buyer) the ownership of the property (apartment).

In this particular case, your task is to check the presence of the seller’s registered ownership of the apartment (public information contained in the electronic database of Rosreestr); check the absence of restrictions, encumbrances and court cases (pledges, arrests - information is also in the Rosreestr system); study as deeply as possible the legal “provenance” of the apartment (preferably from the moment of its first purchase and privatization). Next, check for the consent of the seller’s spouse to complete the transaction (if the seller is not married, there must be notarized confirmation of this fact). And lastly, indicate the actual property of the acquisition (it is desirable that this amount be close in order to the value of the object determined for tax purposes; this amount can also be found in the Rosreestr databases). If you independently or with the help of specialists check the initial data and legal status, you can be confident about the future of your transaction.

With regard to other forms of acquiring an apartment: donation, exchange, rent, share participation agreement, agreement on the creation of a housing cooperative and other forms - you should remember that these agreements are relatively complex.

Each of them carries additional risks that must be taken into account and worked through in order not to become a victim of financial scammers and not to join the ranks of defrauded shareholders - victims of fraudsters in the construction industry.

Elizaveta Nekrasova, general director of the luxury real estate bureau Must Have, answers:

Some are sure that scammers are only after one-room apartments in panel houses outside the Moscow Ring Road, and they are not interested in expensive apartments five minutes from the Kremlin. This is a very dangerous mistake.

Of course, there is an order of magnitude less fraud in the elite segment - the industry of professional brokers, lawyers and notaries leaves little chance for attackers.

However, all sellers and buyers should know the basic rules on how to protect themselves from scammers.

The first piece of advice to sellers and buyers is to never, under any circumstances, attempt to conduct a transaction on your own. This is about the same as sewing your own boots or removing appendicitis - you can try, but the result is unlikely to please you. And for a swindler, a client who is far from the intricacies of the real estate business, but eager to save on commission, is the most tasty morsel.

When choosing a realtor, contact only a well-known real estate agency that has been on the market for many years. His employees definitely don’t need a scandal and the loss of years of earned reputation for the sake of one dubious deal.

It is best to choose an employee on the recommendation of friends or acquaintances who went through all stages of the transaction with this person and were satisfied with the service. Ask the head of the department how many years this employee has been working, how many successful transactions he has under his belt.

In addition to security, a good realtor will significantly speed up the deal: thanks to many years of experience, he knows perfectly well how much apartments of the same type and size, on the same floor, in the same area, with the same views and the same neighbors cost.

Therefore, from the very first viewing, he can tell the owner the market value of his apartment, at what price it makes sense to display it in advertising blocks, and whether bargaining is appropriate.

Do not get involved with single brokers: no one will give you a guarantee that at one time they were not kicked out of the company for fraud or incompetence.

In addition, in the agency you have another protection from fraudsters - a lawyer who works not for a commission, but for a salary. Unlike a broker, he doesn’t care whether the deal is closed or not.

At the slightest suspicion of an attempted fraud, it is better for the lawyer not to allow him to enter into a deal, so that there are no unpleasant questions for him later.

Ask the lawyer to provide relevant extracts and certificates that none of the owners or people registered in the apartment are registered with a psychoneurological or drug addiction clinic. This is one of the well-known frauds: a healthy person buys a certificate for money that he is insane.

Then he sells the apartment, receives the money, and the next step is to file a claim in court to declare the transaction invalid and apply the consequences of the invalidity of the transaction. If the owner is insane, he cannot be aware or responsible for his actions.

Therefore, the apartment is returned to the owner, but the money may not be returned to the buyer: the insane seller lost it, drank it away, donated homeless kittens to a shelter - you can think of anything.

Be sure to get confirmation that there are no encumbrances on the apartment: it is not pledged to the bank and there are no rights to it from third parties, there are no legal disputes over it, and no seizure has been imposed.

Never keep your passport, SNILS, certificate of ownership and other documents in an accessible place.

It's sad, but sometimes the people you trust the most turn out to be scammers - these could be your friends and even relatives. If there is no safe in the apartment, at least lock the desk drawer with a key.

Certificates of ownership can be stored in a rented safe deposit box - it costs very little.

- Text prepared by Maria Gureeva

- Do not miss:

- All materials in the “Good Question” section

The apartment was sold without the owner's knowledge. Is it possible to return housing?

Which secondary apartments are not worth buying? Legal aspects

20 articles on how to buy a secondary apartment

The articles do not constitute legal advice. Any recommendations are the private opinion of the authors and invited experts.

Quite often there are situations when the seller “forgets” about family members and third parties who, although registered, do not live in this apartment. You buy an apartment, and after some time it turns out that the seller’s brother has been released from prison and, since he once refused to participate in privatization in favor of the seller, has the right to live in this apartment. He files a lawsuit, the court makes a decision that you should return the apartment back. But you weren't upset, were you? You file a claim for a refund from the seller... Well, it’s in vain that you weren’t upset... The seller, naturally, no longer has the money. Property too. Only a small salary, which he regularly receives every month. So the bailiffs assign him a “recovery” from his regular income. Have you already calculated how long it will take for your apartment to be refunded?

Quite often there are situations when the seller “forgets” about family members and third parties who, although registered, do not live in this apartment. You buy an apartment, and after some time it turns out that the seller’s brother has been released from prison and, since he once refused to participate in privatization in favor of the seller, has the right to live in this apartment. He files a lawsuit, the court makes a decision that you should return the apartment back. But you weren't upset, were you? You file a claim for a refund from the seller... Well, it’s in vain that you weren’t upset... The seller, naturally, no longer has the money. Property too. Only a small salary, which he regularly receives every month. So the bailiffs assign him a “recovery” from his regular income. Have you already calculated how long it will take for your apartment to be refunded?