- Today, due to the unstable economic situation in the country, parents are trying with all their might to ensure a future for their child.

- It would seem, how can you now help a person who has not yet reached the age of majority?

- After all, only then does a person acquire all the rights and obligations provided by law.

Is it possible to give an apartment or a share in an apartment to a minor child? It turns out that even at this age, children can become full owners of one or another movable and immovable property.

Dear readers! Our articles talk about typical ways to resolve legal issues, but each case is unique.

If you want to find out how to solve your particular problem, please contact the online consultant form on the right or call +7 (499) 938-51-36. It's fast and free!

Hide content

Many people advise investing in real estate . This way, your savings will be stable and unlikely to depreciate much. This is what most of our citizens do, buying apartments and houses.

And so, when a new little resident appears in the family, he also wants to give him a place where he will feel safe.

But how can you register real estate for a person who is not only under the age of majority, but maybe even a minor? After all, even due to his age, a child will not be able to simply carry out a purchase and sale agreement on behalf of his parents.

But there is always a way out, and it is called a gift agreement. Today in this article we will look at how to donate a share in an apartment to a minor child, and also study all the nuances and features of this procedure.

Features and difficulties

- For example, regarding the subject of this transaction.

- On the one hand, it is the donor, that is, a person who is related to the recipient, perhaps a relative, but perhaps not.

- It is also necessary to understand that the second party in this situation is a minor who cannot yet, in the full sense of the word, be responsible for his actions, and therefore, in fact, cannot independently accept the gift.

- This should be done for him by his legal representatives - guardians and trustees .

- Another feature of the gift is that it does not require formal registration of the contract by a notary.

- Notarization in this case is only your whim.

- Form of agreement for donating a share of an apartment to a minor child (sample).

All you have to do is download the contract form from the Internet and fill it out. You can also draw up a preliminary agreement yourself and then consult with a lawyer.

In what case is it possible?

Donating a share of an apartment to a child is possible subject to certain important conditions specified in the Civil Code.

So, the first and most important of them is the fact that the minor has a legal representative . Otherwise, he cannot accept the gift on his own.

Also, if the gift of a share in an apartment to children occurs in a family, then both spouses must agree to this transaction. For example, a father bought an apartment and decided to give its share to his son from his first marriage. But his current wife is against such an action and does not give her consent.

Due to the fact that all property acquired during marriage is jointly acquired, the transaction will not take place due to the lack of consent of one party.

How to give?

In order to give real estate as a gift, it must first be in your direct ownership .

Also, do not forget that you can formalize a donation in two ways - by contacting a notary, and by contacting the body that registers real estate transactions, in other words - Rosreestr .

You must collect a package of necessary documents in proper form. In addition, you should contact a representative of the minor who could help him accept the gift.

- Remember that it is strictly forbidden to simultaneously act as a donor and a representative of the recipient.

- There they check all the documents and information you provide, study them carefully and only then register both the transaction and the documents, and after that your child becomes the full owner.

After the documents are collected, you either visit a notary, who properly draws up a power of attorney, or go to Rosreestr with the representative’s signature on the papers.

Of course, in order to apply for registration of a gift, it is necessary to correctly collect the documents. The very fact of whether your documents will be accepted or not depends on this.

- Therefore, you need to pay great attention to drawing up the necessary package of documents - this is what we will do.

- The first thing that should be in your folder is an application for state registration of rights to real estate and transactions with it.

- You must also have a document that would indicate that you, as expected, paid the state fee , which means you can apply for a government service.

Since one of the parties to the donation is a minor, there must be a document proving the rights of his representative. In our case, this is a power of attorney.

Since three people are involved in the transaction - the parties and the representative, everyone must be identified. Therefore, it is necessary to present passports and original birth certificates of minors if they have not reached the age of fourteen.

To do this, you need to present documents that would indicate for you that you are the owner, for example, a certificate of ownership .

Don’t forget about such an important and at the same time necessary document as a gift agreement. We talk about the basic requirements for drawing up a donation agreement for a share of an apartment in the next article.

Consent is required even regardless of the fact that the spouse acts as the child's representative.

If you are divorced and want to donate property that was also acquired during marriage, you have the right to do this without the consent of your spouse only after three years have passed from the date of divorce.

It is also necessary to obtain a certificate from the BTI authorities that would confirm the direct registration address of each of the participants in the donation.

Now let’s figure out how exactly a contract for donating a share of an apartment to a minor child should be drawn up.

How to draw up a contract?

A deed of gift for children for a share in an apartment is a document that contains an agreement to act when one party gives something as a gift to the other.

The contract for the child must also be drawn up in accordance with the rules .

The content of this document is always the same, so you can easily find a sample agreement for donating a share in an apartment to a minor child on the Internet. But it’s also worth remembering that you must edit the contract to suit yourself, some things you need to include and some you don’t.

The rights and obligations of the parties must be specified in the gift agreement . That is, the donor must donate the property, and the recipient must accept it or fulfill some condition in order to accept it. In our case, for example, finish school, enter a university, and so on.

- The contract also clearly states the circumstances for which the parties are necessarily responsible.

- So, for example, if the donor knows that there are shortcomings in his gift that can cause various types of damage to the recipient, for example, material or, even worse, physical damage, then the donor will definitely have to compensate for it.

- The conditions as a result of which this agreement is terminated must also be specified.

- For example, if the donee did not fulfill the conditions that were specified in the contract, then it must certainly be terminated.

There are also other circumstances that affect the termination of the contract.

By maternity capital

Property acquired under the “maternity capital” program can be gifted, but only to your child . This is evidenced by Federal Law No. 256-FZ of December 29, 2006, which regulates this program.

Download a sample agreement for donating a share in an apartment to children based on maternity capital.

Tax payment

The donee must pay the tax , but since in fact he is a minor citizen, this is done by his legal representative. But most often, the donors themselves pay for the tax, thereby not creating problems in formalizing the agreement.

Can a minor child donate his share in the apartment? By law, he cannot independently manage his property without the help of a guardian. Therefore, in most cases it is impossible to donate or sell your property.

But if it is proven that such an action is committed, for example, with the aim of benefiting a minor, then such an action is permitted.

For example, a minor needs money for an operation, and he and his guardian decided to sell a one-room apartment owned by the minor.

- For example, a minor must be registered with a parent who also has some property.

- If another child is registered in the apartment, it will first be necessary to provide him with an alternative housing option.

- Drawing up a gift agreement is a very simple process if you know its sequence and main nuances.

- That is why it is worth approaching the study of the issue of donation first theoretically and only then practically, because it will depend on you how you carry out the donation procedure and how much of your free time you will spend on it.

Didn't find the answer to your question? Find out how to solve exactly your problem - call right now:

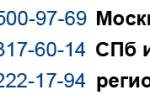

+7 (499) 938-51-36 (Moscow)

It's fast and free!

Is it possible to issue a deed of gift for a minor child?

In the life of every parent who cares about the well-being of their children, the question arises: is it possible to issue a deed of gift for a minor child. General conditions and forms of donation to a minor, features of the process of donating various types of real estate, independent execution of a donation agreement, documents for its registration and other nuances will be discussed below.

Gift agreement for a minor: form

A deed of gift for a child can be issued in two forms: oral and written (simple or notarial).

To make an oral gift, the donor only needs to transfer a certain item to the gifted child. However, the possibility of concluding such an agreement orally is limited by the legislator. In particular, the oral form of deed of gift is prohibited:

- If the contract contains a promise to make a gift of movable property in the future.

- If legal a person gives any movable property whose value is more than 3 thousand rubles.

- If real estate is donated, since such an agreement requires mandatory state. registration.

If the conditions of written form are not observed in these cases, such transactions will be void.

A special feature of concluding an oral gift agreement is the direct transfer of the gift from the donor to the recipient. This action can be accompanied by both a material transfer of an item (giving a gift from hand to hand) or be of a symbolic nature (handing over car keys, handing over a gift certificate).

In most cases, the deed of gift has a simple written form.

There is a common misconception that a deed of gift for a child, especially an apartment, land, non-residential premises or house, is subject to mandatory notarization. The law does not contain such a requirement, therefore visiting a notary to draw up a gift agreement is a citizen’s right, not an obligation.

Remember that for performing these notarial actions the parties will have to incur additional costs in accordance with the established tariffs.

But this option also has its advantages: the notary’s office will definitely conduct a so-called “purity of the transaction” check, starting from identifying existing encumbrances (restrictions) on the subject of the gift, ending with the legal capacity and mental state of the parties making the transaction. Therefore, it is almost impossible to challenge a deed of gift drawn up and certified by a notary.

Note! If the donation was written, then the cancellation of such an agreement is made in a similar form.

General conditions for donating to a minor

There are several features of making a gift to a minor.

- A conditional gift is prohibited, so such an agreement will be void.

- In the case of gratuitous transfer of property with limited circulation to a minor, the period of the children’s legal capacity to own such things should be taken into account. For example, giving a child firearms or bladed weapons is prohibited, since their possession is permitted only to persons who have reached the age of 21 and have received the appropriate license.

- If one of the parents acts as the donor of property to a minor, then the other parent must act as the donee on behalf of the child. In the absence of a second parent (single mother, death of one of the parents, deprivation of a parent’s rights), his role in concluding a gift agreement is performed by the guardianship and trusteeship body.

A deed of gift for a child under 14 years of age can be issued without his presence. Before a citizen reaches the age of 14, a gift agreement is signed for him by his parents (adoptive parents or guardians).

From 14 to 18 years of age, a person can make transactions himself, subject to the written consent of his legal representatives. The only exception is the emancipation procedure, when a child from the age of 16 is recognized as fully capable.

Donation of real estate to a minor

The transfer of real estate as a gift to a minor occurs in the following stages:

- Written agreement.

- Submitting documents for registration to Rosreestr.

- Obtaining an extract from the Unified State Register of Real Estate on the transfer of the right to real estate to the child.

Any legal transaction has many nuances and pitfalls. Therefore, let us consider in more detail how the process of donating real estate to a minor occurs.

Is it possible to give an apartment to a minor child?

A deed of gift for an apartment to a person under 18 years of age is drawn up on the basis of an agreement, which is drawn up in three copies - one for each party and one for storage in the registration file. The law allows citizens to draw up such contracts on their own, without the help of a lawyer or notary, and then register them.

For government Registration documents will be required:

- donor's identity card;

- birth certificate or passport of the minor;

- an extract from the Unified State Register for the apartment or a certificate;

- consent of the co-owner of the donor's property, certified by a notary;

- consent of the child’s legal representatives to receive an apartment as a gift;

- receipt of payment of the fee for registration of the right;

- apartment donation agreement (3 originals).

The entire package of documents is submitted to Rosreestr. At the time of submitting documents, the following must be present:

- donor;

- n/l a child who receives an apartment as a gift and has reached the age of 14 years;

- his representative in law.

Ownership of the apartment is completely transferred to the minor after receiving an extract from the Unified State Register of Real Estate on a receipt issued by the specialist who accepted the documents for registration.

How to give a share in an apartment to a minor child

The owner can donate a share in an apartment at his own discretion, and the consent of the other share owners is not required. The agreement for donating a share of an apartment to minor children occurs in the presence of their legal representatives.

If the donor's property is joint, then a mandatory condition for donating a share to a minor is its preliminary allocation. You can donate either the entire share or part of it.

Re-registration of a share to a minor under a deed of gift is similar to the process of donating an apartment.

Independent registration of deed of gift

The law does not contain a requirement for mandatory notarization of an agreement on the transfer of a gift, including real estate. Therefore, if the parties to the agreement are limited in material resources, they are quite capable of independently completing the transaction in simple written form and registering it with Rosreestr, provided that real estate is being donated.

When drawing up an agreement yourself, it is necessary to describe its essential terms, without specifying which the latter will be considered unconcluded.

For an agreement to transfer a gift, the only essential condition is its subject matter. An object is something that the donor gives as a gift and the recipient accepts as a gift.

It is necessary to describe in detail the individual characteristics of the object of donation by which it can be identified, as well as the data of the donor and the recipient.

When preparing a deed of gift yourself, it is recommended to consult with a professional lawyer.

Gift to a minor: procedure for registering real estate

Documents for submission to Rosreestr:

- Donation agreement in three copies.

- Passports of the parents of the minor, documents on the establishment of guardianship/trusteeship/adoption (if available), birth certificate of the gifted child (up to 14 years old) or his passport (from 14 years old).

- Documents for real estate that is transferred under a gift agreement (if any) - these can be certificates of ownership, extracts from the Unified State Register.

- A receipt confirming payment of the state fee (the amount of the fee and details for its payment will be indicated by the document acceptance specialists).

- Notarial consent of the spouse for the gift, if the donor is the second spouse, and the property transferred as a gift is jointly acquired.

Methods of submitting documents for registration of rights to real estate when concluding a gift for a minor:

- By personally submitting documents to any branch of Rosreestr in the territory where the property is located or by post. You can pre-register through the Rosreestr portal by choosing a convenient time and date for visiting the office of the registration authority.

- By personally visiting an MFC branch at any address convenient for the parties in the region where the property is located. Pre-registration is carried out through the “My Documents” electronic service.

- Electronically through the Rosreestr portal.

- On-site service is usually chosen if the donor is limited in his ability to visit the Rosreestr or MFC office in person (serious illness, old age, etc.).

You can choose any convenient method. However, when submitting an application via the Internet, you will still have to come to Rosreestr at the appointed time to submit and pick up the documents.

Gift deed for a minor child: pros and cons

A deed of gift for a minor child, as well as any methods of transferring real estate or other object as a gift. has its advantages and disadvantages. Let's consider them from a practical point of view.

The disadvantages of this design are two points:

- All expenses for the maintenance of property donated to a minor are borne by his parents (guardians, trustees) until the child reaches the age of 18 or is emancipated.

- Registration of an agreement to gift real estate to a minor child limits the possibility of further actions with it. From this point on, it will be impossible to dispose of real estate (rent, exchange, sell, mortgage) without the prior consent of the guardianship authorities.

The advantages of registering a deed of gift for a minor are the following facts:

- As a long-term investment, a deed of gift is a more reliable way to secure a child's future than a traditional will or sale transaction involving relatives. The donated property cannot be divided as joint property after a divorce. It is impossible to revoke a gift to a minor, such as a will.

- A gift transaction between relatives is not taxed.

- It is more difficult (almost impossible) to foreclose on property owned by a minor, to encumber it with the rights of third parties or interested parties, it cannot be pledged under a loan agreement, or taken away for the debts of parents and other relatives.

If you have questions regarding the preparation of a deed of gift for a minor, please consult a lawyer.

Donating a share of an apartment to a minor child: sample agreement

Re-registration of real estate for children can serve different purposes. The desire to ensure their future, to protect interests in a situation of parental divorce, or something else - the methods and rules of registration remain the same. Below you can find out more about donating a share of an apartment to a minor child.

What features does the law contain?

Children are not formally prohibited from being the owner of real estate. This applies to both the whole property and a part, for example, a share in an apartment. All responsibilities regarding the apartment until adulthood are performed by parents or guardians:

- pay for the maintenance of housing, common areas in apartment buildings and utilities;

- provide contributions for capital repairs of apartment buildings;

- maintain the apartment in proper condition (repair);

- pay off tax debts.

Therefore, in accordance with the current civil legislation, donating a share in an apartment to a son, daughter, grandchildren or other children with whom the donor is not even related is permitted.

However, when registering, it is necessary to take into account a number of procedural features:

- On behalf of the owner, the contract is signed either by his parent (under 14 years old) or by the child himself (from 14 to 18 years old), but with the consent of the parent.

- The gift agreement must be certified by a notary.

- The transfer of rights must be registered in Rosreestr. Only after this the transaction can be considered completed.

IMPORTANT. In this case, the co-owners do not have a preemptive right. There is no need to collect written refusals from them or send notices.

It is not necessary to obtain the consent of the guardianship authority (guardianship authority) to donate a share in the apartment to a minor child.

Advantages and disadvantages

In terms of registration and the future fate of real estate, we can highlight the following advantages and disadvantages of an agreement to donate a share of an apartment to children.

| pros | Minuses |

| There is no need to obtain the consent of co-owners and guardianship authorities, unlike DCT. | Mandatory certification from a notary is required. |

| If a deed of gift is issued between relatives, the new owner of the share is exempt from taxes. | Without state registration, the transaction cannot be considered completed. |

| Property is registered in the name of the child immediately after state registration, unlike a will. | If in the future it becomes necessary to sell, donate, or otherwise dispose of the share before adulthood, you will have to obtain consent from the guardianship authorities. |

| It is possible to register electronically through a notary - it is quick and convenient. | |

| It is very difficult to challenge a donation, provided that the transfer of rights is registered in Rosreestr, unlike a will. |

The donation also has other legal consequences. They can be viewed from different perspectives. In one case this will be an advantage, and in another - a disadvantage. The list of nuances that must be taken into account when re-registering shares is as follows:

- The share becomes the property of the child. This means that it is the child who is the owner of part of the property, and not his parents, although the latter temporarily act on his behalf. After reaching adulthood, the child will have the right to independently decide what to do with the housing - sell, donate, bequeath at his own discretion. In this case, the donor will not be able to impose his opinion.

- It will be problematic to transfer the share as collateral (for example, against a loan) until the child reaches adulthood.

- Donation does not replace the right to participate in the sale of maternity capital. In other words, if a child is given a share in an apartment, he will still participate in the distribution of living space purchased with maternity capital.

- The terms of the donation cannot be specified in the contract. For example, that property passes to the grandson only if the grandmother receives the right to permanent residence in the apartment.

- It is also prohibited to establish compensation for housing in any form - cash, goods or services. The contract will be cancelled.

IMPORTANT . A deed of gift is an unconditional contract. It should not contain any obligation to reimburse the cost of the share on the part of the donee. The recipient only agrees to accept the gift.

Do I need a notary?

This document must be certified by a notary. Donating a part (share) without a notary will result in refusal to register the transaction. Participants in an agreement to donate a share of an apartment to minor children must contact a notary office for certification. This cannot be avoided.

In the course of his work, the notary:

- independently draw up a legally competent text of the deed of gift (texts from participants are almost never accepted anywhere);

- will check whether the rights of third parties have been violated;

- will assess the legal purity of the share in terms of the presence of arrests and encumbrances;

- will check the sanity of the parties to the transaction;

- will formalize the consent of the donor’s spouse to alienate the share;

- will register the consent of the minor’s parents to receive a share.

Therefore, there is no requirement to sign any contract before visiting the notary. The draft agreement for donating a share of an apartment to a minor will be prepared by the office employee himself.

IMPORTANT. Certification of the contract by a notary does not replace the state registration of rights in Rosreestr. Both procedures are necessary.

What documents will you need?

Before donating a share in an apartment to a child, the parties to the transaction will need to collect the following package of documents:

Agreement for donating a share of an apartment to children

This document is drawn up by a notary on the basis of documents and information provided by the parties to the transaction.

As a rule, notaries do not accept texts compiled by the parties to the transaction independently for notarization.

However, the donor and parents of the donee need to familiarize themselves with the mandatory conditions that must be contained in the deed of gift in order to control the work of the notary.

Sample and blank form 2023

- You can download a sample agreement for donating a share in an apartment to a child here.

- You can download a blank form for an agreement to donate a share in an apartment to a child here.

- In some cases, it is necessary to agree on a gift for the future - a contract of promise of donation after some time. Download a sample preliminary agreement for donating a share of an apartment to a minor here.

At the same time, the fact of donation cannot be made dependent on the actions of the minor aimed at enriching the donor.

In addition, donation in the event of the death of the donor is prohibited - for this purpose the law provides for a will.

How to compose correctly

The finished text of the contract must contain:

- Full names of the parties and the parent of the minor.

- The legal essence of the agreement: “The donor gave a gift free of charge, and the donee accepted the following property.”

- Indication of the share size.

- Description of the apartment with address, area, cadastral number and other characteristics.

- Signatures of the parties.

Other conditions are included in the contract at the request of the parties. Most often, these are guarantees from the donor about the absence of persons registered in the apartment, the absence of debt on utility and tax payments.

Rules for signing the agreement:

- The adult donor signs independently.

- A child from 14 to 18 years old signs himself. The legal representative (parent) signs below his signature, confirming his consent to the transaction.

- For a minor under 14 years of age, his legal representative signs.

The text should not contain conditions regarding the child’s payment of any amounts, goods or services towards the real estate.

Donation procedure: step-by-step instructions

To give your share in an apartment to your daughter, son, grandson or other child, you must do the following:

- Collect documents from the list. If necessary, order a fresh extract from the Register and check the absence of encumbrances.

- Pre-visit a notary for consultation and transfer of documents. The text of the deed of gift is prepared within one working week, depending on the workload of the office.

- Appear at the time appointed by the notary to sign the agreement. The following must be present in person: the donor, the recipient (if he is over 14 years old), the parent or guardian of the child.

- If the donor is married, a spouse must also be invited to the transaction. The notary will issue consent to the alienation of the share.

- During the reception, check the text of the contract for typos. Next, the parties sign the documents.

- The completed agreement and consent should be attached to the rest of the documents. Now it is necessary to carry out state registration of the transaction.

- Documents for state registration are accepted by the nearest MFC. It's better to make an appointment in advance.

- During the appointment, the specialist will fill out an application for registration, which must be signed. Together with the documents, the application is sent to Rosreestr. A receipt is issued regarding receipt of papers.

- After registration, the donee (his parent) receives an extract from the Unified State Register and a copy of the agreement with a note.

Registration takes from 5 to 14 business days.

IMPORTANT. Today, the option of electronic registration through the notary who certified the transaction is available. Such registration is faster and easier, because you don’t need to wait in line, and registration takes place in one visit to the notary’s office without the participation of the MFC. The service costs from 1,500 rubles.

Taxation

The following tax rules apply:

- The donor does not pay any taxes regardless of his relationship with the minor.

- The donee does not transfer personal income tax to the treasury if the donor is his close relative (parent, grandmother, grandfather, brother or sister). In other cases, it is necessary to transfer 13% of the share price to the budget.

- From the date of state registration, the child receives an annual obligation to make tax payments for housing.

All tax responsibilities until the child reaches adulthood are performed by adults for him.

Conclusion

To the question of whether it is possible to give a share in an apartment to a minor, the current legislation answers positively. A gift agreement is the most optimal way of re-registration, since it eliminates unnecessary payments to the budget. On the other hand, the donation of a share must be certified by a notary, which entails additional costs for the parties to the agreement.

You can learn more about whether a gift or a will is better in a special post.

If you need professional free legal advice, we are waiting for you. Sign up through an online consultant.

Please rate the post and like it.

We formalize the donation of real estate: can a minor child donate his share in the apartment?

- Real estate alienation operations are always associated with a number of difficulties.

- Especially if minors are involved.

- For example, the issue of donation - on the one hand, a minor child can receive an apartment or a share in it as a gift.

- But it will hardly be possible to give as a gift.

To solve your problem RIGHT NOW, get a free LEGAL consultation: +7 (499) 504-88-91 Moscow +7 (812) 385-57-31 St. Petersburg

Children and real estate - who is considered a minor?

It is a common belief that any minor, that is, a person under 18 years of age, is not considered competent enough to transact real estate. Theoretically, not everything is so simple here.

If we turn to civil legislation (Chapter 32 of the Civil Code), we can read that only minors (under 14 years old) have the opportunity to donate a share in a home (Article 575 of the Civil Code). But an older citizen - from 14 to 18 years old - can theoretically make this transaction, but only under the control of the board of trustees (Article 26; 28 of the Civil Code).

The supervisory authority must receive confirmation that in this transaction there will be no abuse of the rights of an individual who is not yet mature enough to fully understand all the nuances and consequences of the legal actions being taken.

Can a minor child donate his share in the apartment?

But in practice, guardianship never gives consent to such a transaction - for someone to give on behalf of another. The reason is a discrepancy with the necessary condition of any donation: a person alienates his home himself, of his own free will, of course, irrevocably and free of charge.

They are somewhat more willing to approve the sale of a share in housing owned by a child (although this is also extremely rare).

Is it necessary to involve guardianship authorities and in what cases?

The participation of the board of trustees is mandatory in any transaction where the property rights of a child are affected (Article 37; 292 of the Civil Code; Article 56; 60 of the Family Code).

In order for them to approve it, it is necessary to provide documented evidence that the rights of the little citizen will not be violated and his living conditions will not suffer from this alienation in any way (Article 21 of Federal Law No. 178-FZ of July 18, 2009).

The best evidence would be, for example, a contract for the sale and purchase of another home. Or, again, a donation - from which it will be clear that the child received ownership of, at a minimum, housing not in the worst conditions.

The words “living conditions do not deteriorate” usually mean:

- larger housing;

- the apartment is the same in terms of the number of square meters, but with a separate room for the child;

- purchasing an apartment in a more prestigious area, with more developed infrastructure, where, for example, a school is within walking distance.

However, each case is individual and will have a special approach. All these factors are good for selling a child’s share, but not for donating it.

Guardianship will not give consent to the donation, if only because, based on the law, donation is the gratuitous and voluntary alienation of a thing in favor of a third party, which can only be performed by a fully capable person. And the fact that the donor is not yet an adult is in itself a violation of this condition.

To obtain consent from the guardianship, in addition to the owner’s consent to alienation (notarized):

- civil passports of both parents and the owner of the share;

- title papers for the share;

- technical documentation for the alienated area and that given in exchange;

- application for approval of a gift on behalf of the child.

The request is considered within two weeks, after which the supervisory authority gives a written response.

In what cases is it impossible to make a donation?

In all, if the board of trustees does not approve it. As already mentioned, regulatory authorities are extremely reluctant to approve transactions involving the alienation of children’s property in general, and even more so donations.

Responsibility for alienation of property from minors

If a violation is detected on the part of the guardians, the transaction will be declared illegal and the property will be returned to the owner. Moreover, if guardians not only neglected routine rules, but also received benefits, then they may face criminal liability.

So, an attempt to donate a share in housing on behalf of a child is almost guaranteed to fail. Moreover, if we are talking about a minor – under fourteen years old – citizen.

If such an action is really necessary, it is better to wait until the person reaches the age of majority and his informed consent to donate part of his property rights.

This is guaranteed to save guardians from unnecessary questions from law enforcement officers.

If you find an error, please select a piece of text and press Ctrl+Enter.

To solve your problem RIGHT NOW, get a free LEGAL consultation: +7 (499) 504-88-91 Moscow +7 (812) 385-57-31 St. Petersburg

Gift of minors

Gift agreement for a minor child

Russian legislation considers all citizens to have legal capacity from the moment of birth, regardless of age. Therefore, minors may own any property.

It is important to understand that the article describes the most basic situations and does not take into account a number of technical issues. To solve your particular problem, get legal advice on housing issues by calling the hotlines:

Call and solve your questions right now - it's fast and free!

Registration of ownership of a citizen who is under 18 years of age is carried out if he has proof of identity (passport or birth certificate).

It should also be taken into account that the child cannot take part in such transactions independently . Its representatives are natural or adoptive parents and guardians. Therefore, the procedure must be carried out in their presence.

A gift agreement for a minor child is mandatory . The document contains the following information:

- Name;

- about each of the parties (full name, passport details, place of birth, registration and residence, telephone numbers);

- about real estate (location, area, number of rooms, floor, etc.);

- documents establishing the right to dispose of the apartment;

- absence of encumbrances;

- housing costs;

- the moment of entry into force of the agreement;

- signatures of interested parties.

You can draw up a document according to the sample by adjusting the necessary information and entering new data. You can view and download here: [donation agreement for a minor].

Donating an apartment to a minor child pros and cons :

- simple registration procedure;

- the right of ownership arises from the moment the minor takes possession of it;

- a negative point is the need to pay a tax of 13% if the transaction is concluded between people who are not related;

- in some cases the deed of gift may be cancelled;

- after the transfer of property, the donor loses all rights to it;

- termination of the contract is allowed at any stage of execution;

- if there are errors or inaccuracies, the responsible authority refuses to register the document;

- low state duty.

Procedure for donating to a minor

Donation of real estate to a minor child takes place in the following order:

- Preparation of documents according to the established list.

- Drawing up a preliminary agreement if it is not possible to make a donation at the moment.

- Signing of the final version of the contract.

- Sending the contract to a notary for certification.

- Payment of state duty.

- Transfer of tax.

- Submitting an application and documents to the territorial office of Rosreestr.

- Acceptance of the application by the responsible authority.

- Issuance of a certificate of ownership.

The state duty is 2 thousand rubles. You can find out the details for transferring funds at the department where you plan to undergo the procedure, or on the department’s website. When paying, you must receive a receipt or check to confirm it. Additionally, you need to pay for notary services.

Permission from the guardianship authorities is not required if the child’s parents are present at the conclusion of the transaction. Otherwise, you need to obtain an additional document.

If the child is under 14 years of age, his representatives have the right to act on his behalf. The child may not be present during the signing of the contract and further operations.

After 14 years of age and until adulthood, a citizen has the right to enter into transactions if there is appropriate permission from his representatives. The document is signed by the recipient, as well as his parent or other responsible person.

The right to dispose of the received property arises for the child only upon reaching the age of 18 years.

Donation example

Semenova Anna Igorevna decided to give her grandson Semenov Vitaly Petrovich her apartment with an area of 45 sq.m. The specified housing is the property of Semenova A.I., since it was inherited.

Semenov Petr Ivanovich, acting on behalf of his son, accepts this apartment as a gift. The inventory assessment of the home is 1 million rubles.

Semenova A.I. guarantees that the property rights of other persons do not apply to this apartment.

As a result, an apartment donation agreement was drawn up, which reflected the specified information.

Semenov V.P. is the owner of the property after registration of ownership. His father assumes the responsibility to pay taxes, make repairs, maintain the apartment, and transfer contributions for major repairs.

Expenses regarding this agreement are borne by Semenova A.I. The authenticity of the document is confirmed by a notary.

Donation on behalf of a minor

The donation process can be completed on behalf of a minor citizen who is 14 years old or older. Until a child turns 16 years old, permission from the guardianship authorities is required.

(vehicles, etc.) can be registered on behalf of the child

The registration process in this case includes the following steps :

- Collection of necessary documents.

- Obtaining consent from guardianship authorities.

- Obtaining permission from parents or other representatives.

- Drawing up the text of the contract.

- Submitting documents and agreements to a notary office for certification.

List of documents

Donation of real estate to a minor is carried out in the presence of the following package of documents:

- agreement in three copies (for each of the parties and the registration service);

- extract from the Unified State Register of Real Estate;

- an extract from the house register indicating the citizens registered in the apartment at the time of signing the document;

- permission from the spouse to carry out the procedure;

- cadastral passport;

- certificate of inventory assessment;

- an application to Rosreestr from each party to register ownership rights;

- confirmation of tax payment;

- consent of the child’s representatives to complete the transaction;

- document confirming payment of state duty;

- power of attorney for a representative if third parties are involved in the procedure.

If the donation is made on behalf of a child , then you must first collect the following documents:

- written permission from each parent;

- permission from the guardianship authorities;

- agreement in two copies (an additional copy is made);

- confirmation of the identity of parents and child;

- document establishing ownership;

- receipt of transfer of state duty;

- statement on behalf of the donor.

Conclusion

- Donation is a procedure that allows you to transfer ownership of real estate to a citizen.

- Legislation allows the transfer of real estate to citizens under the age of majority.

- If the party to the transaction is a person under 18 years of age, then the procedure takes place in the presence of his representative.

- In the case of donating housing to strangers, tax is required.

- To complete the procedure, a minor or on his behalf must provide a certain package of documents.

- The donation process involves a certain procedure.

- The right to dispose of real estate appears only upon reaching 18 years of age.

- Minors can become donors with the consent of the guardianship authorities or representatives.

- A donor who has not reached the age of majority can only enter into a contract for movable property.

The most popular question and answer regarding making a gift for a minor

Question: How is a gift of a share of an apartment made to a minor?

Answer: The donor can transfer any share of the apartment to a citizen under 18 years of age. In this case, there is no need to notify other homeowners about these actions.

The procedure requires permission from the guardianship authorities or representatives of the child. A draft share donation agreement is drawn up in advance . The document records which part of the apartment is subject to donation, location and other characteristics. If the parties have no objections, then the final version of the document is drawn up.

The deed of gift is drawn up in writing and must be certified by a notary office.

The transfer of ownership is registered in Rosreestr. This process follows the same procedure as when donating an entire property.

Samples of applications and forms

You will need the following sample documents:

- deed of gift to a minor.

Still have questions or your problem is not resolved? Ask them to practicing lawyers right now!

Call and solve your problems right now - it's fast and free!