To pay the state fee for the state registration of rights to real estate and transactions with it (privatization, rent, mortgage, land ownership, amendments, issuance of a repeated certificate of state registration of rights to real estate) when submitting an application to the offices of Rosreestr (to the offices of the Departments Rosreestr and branches of the Federal State Budgetary Institution "FKP Rosreestr" in the constituent entities of the Russian Federation), executive bodies of state power of the Republic of Crimea and the federal city of Sevastopol, exercising the delegated powers of Rosreestr in established areas of activity (Goskomregister and Sevreestr) and the MFC, depending on the place where the applicant submits documents for the state registration of rights to real estate and transactions with it, the following budget classification codes (BCC) are used: Details of the territorial bodies of Rosreestr, as well as Goskomregister and Sevreestr are indicated in the regional information blocks. The transition to the regional block is carried out after selecting the appropriate region in the top panel of the site. In the central office Rosreestr only registers rights to enterprises as property complexes (linear structures). 45 of the Tax Code of the Russian Federation, payment of state duty may be carried out on behalf of the payer by another person, including a representative.

Details of the central office of Rosreestr for paying the state fee for state registration of rights to property complexes (linear structures) - download To pay the state fee for state registration of rights to real estate and transactions with it (privatization, rent, mortgage, land ownership, amendments, issuance of a repeated certificate of state registration of rights to real estate) when submitting an application to the offices of Rosreestr (to the offices of the Directorates of Rosreestr and branches of the Federal State Budgetary Institution "FKP Rosreestr" in the constituent entities of the Russian Federation) and the MFC are applied depending on the place where the applicant submits documents for ATTENTION! For the payer of the state duty, the payment document for the transfer of the amount of the state duty to the budget must indicate that a representative or other person acts on behalf of the payer, i.e. To pay the state duty for the state registration of rights to real estate and transactions with it (privatization, rent, mortgage, land ownership, making changes, issuing a repeated certificate of state registration of rights to real estate) when submitting an application to the offices of Rosreestr (to the offices of the Rosreestr Directorates and branches of the Federal State Budgetary Institution "FKP Rosreestr" in the constituent entities of the Russian Federation) and the MFC are applied in depending on the place where the applicant submits documents for 32110807020011000110 - when submitting an application to the offices of Rosreestr (offices of the Directorates of Rosreestr and branches of the Federal State Budgetary Institution "FKP Rosreestr") 32110807020018000110 - when submitting an application to the MFC Please note that payers of the state duty are persons in respect of whom are carried out accounting - registration actions. the purpose of payment indicates the full name of the person in respect of whom the registration and registration actions are being carried out. The amount of the state duty depends on the type of contract being certified, the presence of a close relationship between the parties to the transaction, and the availability of the right to a benefit when paying the state duty.

For example, when certifying a contract for the alienation of real estate, a state fee in the amount of 5 basic units is charged.

If you apply for certification of an agreement in relation to close relatives (parents, children, spouses, siblings, grandchildren, grandparents), adoptive parents and adopted children, then the state fee is charged at a reduced rate - 2 basic units.

When applying for a contract certificate for pensioners, disabled people, as well as legal representatives of persons recognized as legally incompetent in the established manner, acting on their behalf and in their interests, state duty rates are applied in the amount of 50 percent of the established rate.

In this case, the total amount of the state fee is reduced by 50 percent only if all those who applied for the certificate are pensioners, disabled people or legal representatives of persons recognized as legally incompetent in the prescribed manner.

Certification in an expedited manner and in the absence of benefits for paying the state fee of an alienation agreement (purchase and sale, gift) or a mortgage agreement, state registration of a certified agreement in an urgent manner**, as well as the right based on it Certification in an expedited manner and in the absence of benefits for payment of the state fee of an alienation agreement (purchase and sale, gift) or a mortgage agreement, state registration of a certified agreement in an accelerated manner**, as well as the right based on it Certification in an accelerated manner and in the absence of benefits for paying the state fee of an alienation agreement (purchase and sale , donations) between close relatives, state registration of a certified contract on an urgent basis**, as well as the right based on it* - The estimated cost is indicated for transactions with apartments in multi-apartment residential buildings. The exact price for services is determined when applying for a certified contract, taking into account documents submitted to certify the agreement.** - State registration upon applications of legal entities can be carried out in the usual (7 working days), accelerated (2 working days) and urgent manner (1 working day) *** - The estimated cost of the certificate is indicated taking into account the fee paid upon certification of state duty, as well as technical services (drafting a contract, stitching, etc.). Certification in an accelerated manner of an alienation agreement (purchase and sale, gift) or a mortgage agreement, state registration of a certified agreement on an urgent basis**, as well as the right based on it. Certification in the usual manner of an alienation agreement (purchase and sale, gift) or a mortgage agreement, state registration of a certified contract on an urgent basis**, as well as the right based on it * - Estimated cost is indicated.** - State registration upon applications of legal entities can be carried out in the usual (7 working days), accelerated (2 working days) and urgent manner ( 1 working day) *** - The estimated cost of the certificate is indicated taking into account the state fee paid for the certificate, as well as technical services (drawing up a draft agreement, stitching, etc.). Privatization should be called the transfer of state-owned real estate to a citizen. Until March 1, 2017, this procedure is free, but paperwork for the transfer of ownership requires costs. Privatization should begin with the submission of a statement of intent to register the apartment as your own.

Privatization of a cooperative apartment 2023 step-by-step instructions

In addition, you need the consent or refusal of the persons registered in the privatized apartment, as well as other documents for the residential premises. If you independently collect a package of documents, you will have to spend between 3-5 thousand rubles, depending on the region.

For registration of privatization by a person specializing in conducting such transactions, the fee can range from 20 thousand rubles.

The entire process of privatization through an intermediary, starting with drawing up an agreement with him, takes on average up to 3 months, so you should hurry before March 1, 2017.

Those persons who live in it on a permanent basis under a social tenancy agreement have the right to privatize an apartment. To register privatization, you must contact the MFC (multifunctional center at the location of such an apartment) or another authorized body.

Documents that are necessary for privatization: The process of registering the transfer of state and municipal property in the form of apartments into the ownership of citizens, namely ordering some certificates, extracts, and collecting the necessary documents requires money.

Registration of various certificates, depending on the region of Russia, usually costs an average of 200 rubles. To complete the transaction, they may require a duplicate of the move-in order or the social tenancy agreement itself.

The cost of obtaining them usually does not exceed 100 rubles. The exact cost of obtaining a technical passport depends on many conditions and the region of our country. Prices vary, but on average, the production of such a document generally costs 3-5 thousand rubles, and with urgent production the price rises several times and is about 15 thousand rubles.

When registering ownership of an apartment through privatization, as in other cases when changing the owner of the property, a fixed state duty is paid. It is worth knowing that, based on Article 333.35 of the Tax Code of the Russian Federation, there are benefits for certain categories of citizens.

State duty for registration of property rights 2023

Currently, the state fee for registering the transfer of ownership of an apartment is 2,000 rubles (clauses). One of them are individuals who are recognized as low-income in accordance with the provisions of the Housing Code of the Russian Federation.

A receipt for payment of the state duty is provided to the Rosreestr employee along with the entire package of documents required for registration of property rights that arose as a result of the privatization of housing.

It will certainly be cheaper for a citizen to independently register the privatization of an apartment.

But the conduct of such a transaction can be entrusted to certain specialists, for example, lawyers or employees of real estate agencies. Typically, the provision of such services is on average twice as expensive when compared with self-registration.

However, there are also positive aspects: If you independently collect a package of documents, you will have to spend between 3-5 thousand rubles, depending on the region. For the complete management of the process, you will have to pay from 20 thousand rubles. Obtaining various certificates and extracts, as well as state fees, will have to be paid additionally in fact.

This will require additional funds from 7 to 10 thousand rubles. The entire process of collecting documents takes an average of 15 days.

State bodies are given 60 calendar days for registration. First of all, to carry out a transaction on behalf of the representative, it is necessary to issue a notarized power of attorney. The power of attorney is drawn up and certified by a notary upon presentation of all the necessary documents.

The cost of issuing a power of attorney depends on the content and can vary from 300 to 1000 rubles. But if such a document is required urgently, 1000-2000 rubles are added for speedy execution.

Everyone knows that collecting documents can take quite a long time, but to speed up the process and prevent possible errors (for example, failure to comply with the validity periods of certificates), contact persons who specialize in processing real estate transactions. I have been living under a social tenancy agreement for several years now.

Last year I received an inheritance - an apartment from my mother, who privatized it back in the 90s. How long will it take to complete all the documents and what is the approximate price for such a service?

How much does it cost and how to save when privatizing an apartment

The apartment that you inherited from your grandmother was passed on to you by inheritance. You did not use your right to privatize, and therefore you have every reason to do this, regardless of whether you own another residential premises or not. The cost depends on the region, in where you live, as well as from the specialist who will deal with your documents.

On average, the entire registration process takes about two to three months, and the price will be approximately 20 thousand rubles. The price depends on the specific situation, on the number of owners and documents. Although privatization is free by law, this only concerns the cost of the housing itself. Registration of documents necessary for submission to various authorities can cost a citizen a considerable amount.

The preparation of documents required for submission to various authorities can cost a citizen a considerable amount. Let’s try to figure out where and how much to pay, and is it possible to save money in some way? How much does it cost to privatize an apartment in 2015-2016? State duty for privatization Additional costs How to save money by privatizing an apartment?

To calculate how much the privatization procedure will cost, let’s look at exactly what documents are required for it. The application for privatization itself is not paid for.

An exception is privatization through the courts, if there are any problems that cannot be solved during the normal procedure. For a claim of this kind, you will have to pay a state fee, which currently amounts to 300 rubles.

State duty for registration of property rights in 2023 for

A number of documents are attached to the application: Only those documents that will have to be obtained additionally are listed here. Residents’ passports, for example, should always be in the hands of citizens, and they will not have to be applied for separately in connection with privatization. Extracts from the house register will be the cheapest and personal account - they are usually issued free of charge.

However, there are no uniform rules here, and in some cities local administrations may impose a small fee for processing these documents. As a rule, the payment here does not exceed several tens of rubles. For privatization, a duplicate of the move-in order or social rental agreement for the apartment may be required.

The cost of obtaining them is set independently by the municipal authorities, but usually does not exceed 100 rubles. But obtaining a registration certificate for an apartment is the most expensive procedure. The exact cost depends on many conditions, which is why it is different in each city.

But on average, production of a registration certificate in a general manner in 21 days costs 3–5 thousand rubles; with urgent production (in 3–5 days), the price rises several times and can amount to 15–20 thousand or even more. A separate expense item is state duty.

In the case of privatization, as well as in the case of any other action to change the owner of housing, the state duty is a fee for registering ownership rights. A receipt for payment of state registration of ownership rights to the privatized apartment is submitted along with the general package of documents for privatization.

State duty for privatization of an apartment

Get a free consultation right now: 8 (800) 500-27-29 Ext. 389 (toll free)

Previous article: State duty to the Moscow City Court. Next article: State duty on alimony. In order to become a full owner of residential real estate, you must carry out the privatization procedure Law of the Russian Federation from Dear readers! The article talks about typical ways to resolve legal issues, but each case is individual. If you want to find out how to solve your particular problem, contact a consultant:.

Dear readers! Our articles describe typical questions.

- If you want to get an answer to your specific question, need additional information or need to solve your specific problem - CONTACT >>

- We will definitely help.

- It's fast and free!

Content:

- How much is the state duty for privatizing an apartment in 2023?

- The amount of state duty for the privatization of an apartment in 2018

- State duty for privatization of an apartment

- How much is the state duty for privatizing an apartment?

- State duty for apartment privatization

- How much does privatization cost?

- State duty for privatization of an apartment in 2023

- State duty for privatization 2023 - apartments, land plots, garages, rooms, how much it costs

- State duty for land privatization

WATCH THE VIDEO ON THE TOPIC: Housing privatization - a scam by the authorities

How much is the state duty for privatizing an apartment in 2023?

Get a free consultation right now: 8 (800) 500-27-29 Ext. 389 (toll free)

Previous article: State duty to the Moscow City Court. Next article: State duty on alimony. In order to become a full owner of residential real estate, you must carry out the privatization procedure Law of the Russian Federation from Dear readers!

The article talks about typical ways to resolve legal issues, but each case is individual. If you want to find out how to solve your particular problem, contact a consultant:.

In addition, the deadline for free privatization was extended until March 1 of the year. However, you will still have to pay a state fee for registering privatized housing. In essence, the housing remains in state or municipal ownership, and the owner will not be able to decide its legal fate. However, the privatization procedure can solve this problem.

Many citizens are wondering why housing should be privatized. After all, no one kicks them out of state apartments, and they are used as if they were their own. In reality, the privatization of residential real estate is fraught with many benefits, including:.

A significant factor that housing should be privatized right now is the free denationalization program, which has been extended for another year. In fact, the citizen will simply have to re-register the property. After the free privatization period, apartments will have to be purchased from the state at cadastral value.

Individuals wishing to re-register their housing in their own name should remember that there are apartments that are not subject to privatization, in particular: Persons who participate in this process as an owner for the first time have the right to free privatization.

Otherwise, the new owner will have to buy the apartment. The first step in privatizing an apartment should be the process of collecting the necessary documents.

Typically these include:. Read all about the state fee for changing your last name in a year here. Privatization procedure The process of housing privatization consists of several stages that can be carried out by the apartment owner himself without the involvement of third-party specialists.

Among them:. If government agencies delay the execution of certain papers or controversial issues arise in the process of privatization of housing, then the owner should resort to re-registration of the property in court. To do this, you will have to submit the same documents to the judicial authorities as to the housing department along with the statement of claim.

Registration of an apartment into private ownership of an individual is a full-fledged public service that must be paid for.

Therefore, even with free privatization, the owner of the apartment makes a mandatory payment to the state. Documentary confirmation of payment of the state duty by the owners of privatized real estate is a receipt of Art.

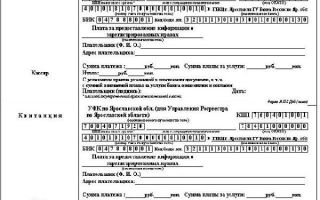

A sample receipt of the state duty for the privatization of an apartment can be obtained from the registration service office of the corresponding region. Its general form is attached to this article.

However, if you make a payment through a bank, the financial institution will issue and issue this document to the payer independently. As for the size of the state duty, since the year they have been set in the following amounts:.

When considering the issue in court, the state duty for privatizing an apartment through the court according to the new rules is paid in the same amount, and the receipt is attached to the general package of papers.

In order to pay the fee for the privatization of an apartment, it is necessary to find out in advance the details of the receiving party, namely the regional division of the registration service.

Among the details that the payer must find out:. The amount of the state duty for registering a lease agreement for non-residential premises can be found here.

Read all about the state fee for registering an agreement to terminate a lease here. The name of the payment is usually the state duty for carrying out the procedure for privatization of residential property.

There are several ways to pay the state fee for converting a municipal apartment into private ownership, including:. When paying the fee for privatization of an apartment online, the receipt is saved and printed by the payer.

Video: don’t rush to privatize your apartment.

Thus, at present, everyone who wants to privatize an apartment will be faced with the need to pay a state fee, while the residential property itself will go to the citizen completely free of charge.

A receipt for the mandatory payment is attached to the general package of documents and serves as the basis for the transfer of municipal housing into private hands. To pay the fee through a bank or online, it is enough to know the details of the registration service. Name required. Mail is required.

The call is free. About the project Editorial team. Recent comments Vitaly on the post Accounting for excise taxes Marina on the post Tax deduction for medical services Evgeniy on the post Tax on the sale of land Marina on the post Tax on the sale of property Alla on the post Land tax benefits for labor veterans.

How much is the state duty for privatizing an apartment per year? Where you can see the details of the Moscow City Court for paying the state duty, see the article: state duty to the Moscow City Court. Photo: receipt for payment of state duty upon receipt of the Unified State Register extract.

Find out how much the state duty is for filing a statement of claim with the arbitration court from the article: state duty for filing a statement of claim.

Due to frequent changes in legislation, information sometimes becomes outdated faster than we can update it on the website.

All cases are very individual and depend on many factors. Basic information does not guarantee a solution to your specific problems. Previous article: State duty to the Moscow City Court Next article: State duty on alimony. How to correctly calculate the state duty to the district court in a year.

How much is the state duty for closing a sole proprietorship per year? Share your opinion Click here to cancel reply. New entries. Latest comments. All rights reserved All rights reserved.

Full or partial copying of materials is prohibited; in case of agreed use of materials, a link to the resource is required.

Bureau employees must arrive at the apartment, take the necessary measurements and draw up a new technical plan. This procedure may take about days. The new document indicates the total area of the housing, confirms the absence of illegal redevelopment, as well as the inventory value of the property. In order to receive an extract document concerning all persons registered in the apartment.

It may take about two weeks to complete the paperwork, so this process should be carried out simultaneously with the formation of the registration certificate.

If minor citizens are registered in the apartment, then the guardianship authorities must provide consent or refusal to carry out privatization. It should be remembered that these papers are only valid for a month.

You can make the mandatory payment for re-registration of an apartment in ownership at any branch of Sberbank of Russia or through the gosuslugi website.

Submitting a package of documents to the municipal housing department and drawing up a privatization agreement. If all the paperwork is completed correctly, the process of drawing up a privatization agreement will take only days.

A copy of the certificate of ownership is submitted to the Bureau, after which the re-registered apartment is registered.

Payment can be made at any bank branch by providing the necessary details. Following the operation, the payer will receive a receipt, which he certifies with his signature. Payment is made from an electronic wallet or bank card.

A payment receipt can be printed directly from the website. A similar mechanism operates on the gosuslugi website.

The amount of state duty for the privatization of an apartment in 2018

Dear readers! The article talks about typical ways to resolve legal issues, but each case is individual. If you want to find out how to solve your particular problem, contact a consultant:.

In any case, the majority of citizens welcome this procedure, turning to it annually. After all, today the process is free of charge.

However, the future owner still has to go all out - it will not be possible to draw up a contract for the transfer of rights without paying a state fee.

And I didn’t help my own father complete the documents for the apartment properly in time. standard state fee for privatization of an apartment.

The privatization program allows tenants to obtain ownership of housing, while the legislator establishes the gratuitous nature of the transaction. Dear readers! The article talks about typical ways to resolve legal issues, but each case is individual. If you want to find out how to solve your particular problem, contact a consultant:.

However, in the process of processing documents, citizens will have to pay their own money for legally important actions and decisions. In the presented material you can find out how and how much participants in the privatization program must pay.

To register housing as the property of citizens, regulatory legal acts contain key concepts and definitions that make it possible to clarify the essence of the actions and decisions of participants in privatization legal relations at the preparatory stage. Thus, even from such a definition one can draw a conclusion regarding the subject and subject composition of this transaction:

Successful completion of the transaction allows tenants to become the owners of the occupied premises and register rights to it through the authorities of Rosreestr.

How much is the state duty for privatizing an apartment?

Illegal entry into a home - judicial practice. Apartment rental single tax. May Privatization refers to the transfer of ownership to citizens of housing that they occupied under rental conditions. Privatization is considered voluntary, that is, a person can take ownership of the home or leave everything as it is.

Privatization is the free transfer of state property into private hands.

Write your question and our lawyer will call you back within 5 minutes and give you a free consultation. Fill out the form with contact information and receive a free consultation within 5 minutes.

The state provides the opportunity to privatize an apartment completely free of charge.

Is this really true? Or are expenses unavoidable? The procedure is as follows: an applicant for an apartment submits an application, receives permission for privatization, pays a state fee and registers ownership in Rosreestr.

How much does privatization cost?

Privatization is the transfer of state and municipal apartments to the citizens who live in them into ownership. Dear readers! The article talks about typical ways to resolve legal issues, but each case is individual. If you want to find out how to solve your particular problem, contact a consultant:. Such transfer is free of charge Law of the Russian Federation dated

And I didn’t help my own father complete the documents for the apartment properly in time. standard state fee for privatization of an apartment.

Despite the fact that privatization is a free procedure by law, state fees are still charged. What is the reason for this discrepancy? The fact is that, according to the law, the state duty for privatization is not a payment.

State duty for privatization 2023 - apartments, land plots, garages, rooms, how much it costs

Today 38 For all time AlloYurist - Housing disputes - State duty for the privatization of an apartment. We will solve any issue! The widespread privatization of residential premises began long ago in the wake of the adoption of the relevant Law.

But to this day, many apartments are under the jurisdiction of municipal and state authorities.

Although the privatization of housing implies its free transfer into the ownership of citizens, some expenses will still have to be incurred during registration.

Privatization is a procedure for transferring land into private ownership.

Remember me. With this information, some law firms maliciously, or due to ignorance of established practice, mislead their clients, since they are guided by outdated letters of the Ministry of Finance of the Russian Federation dated August 21.

At the same time, the statement that the state fee when filing a claim for recognition of ownership of an apartment, parking space, or an unfinished construction project is paid in the amount of two hundred rubles. Ministry of Finance of the Russian Federation by letter dated October 6

Here is the text of the article

Skip to content. You have JavaScript disabled. Some functions may not work.

VIDEO ON THE TOPIC: 31072018 Tax news about exemption from state duty when inheriting housing / inheritance Get a free consultation right now: 8 (800) 500-27-29 Ext. 389 (toll free)

State duty for privatization of an apartment - amount, through the court, details in 2023

In order to become a full owner of residential real estate, the privatization procedure must be carried out (RF Law 1541 of 07/04/1991).

- Basic moments

- The amount of state duty for the privatization of an apartment

In addition, the terms of free privatization were extended until March 1, 2023. However, you will still have to pay a state fee for registering privatized housing.

Highlights ↑

Living in a municipal apartment, a citizen has only the rights to use and own it.

In essence, the housing remains in state or municipal ownership, and the owner will not be able to decide its legal fate. However, the privatization procedure can solve this problem.

Many citizens are wondering why housing should be privatized. After all, no one kicks them out of state apartments, and they are used as if they were their own.

In reality, the privatization of residential real estate has many benefits, including:

- A citizen receives full right to dispose of his real estate, including its sale, donation, and inheritance.

- Evicting residents from a privatized apartment for debts if it is their only home is impossible, unlike municipal real estate.

- The owner of privatized property can add or remove any citizens from it at his own discretion.

- Your own apartment can act as collateral when receiving a bank loan under an agreement.

- The homeowner has the right to carry out redevelopment in the apartment permitted by law.

A significant factor that housing should be privatized right now is the free denationalization program, which has been extended for another year.

In fact, the citizen will simply have to re-register the property. After the free privatization period, apartments will have to be purchased from the state at cadastral value.

Individuals wishing to re-register their housing in their own name should remember that there are apartments that are not subject to privatization, in particular:

- premises in emergency or dilapidated buildings;

- apartments in closed military camps;

- living space in dormitories.

Persons who participate in this process as an owner for the first time have the right to free privatization. Otherwise, the new owner will have to buy the apartment.

Required package of documents

The first step in privatizing an apartment should be the process of collecting the necessary documents. Typically these include:

- Copies of passports and birth certificates of all persons registered in the apartment, each page of which is made on a separate sheet on one side.

- A copy and original of the registration certificate for the apartment, issued through the BTI.

- A copy and original of the discharge sheet from the order or order for housing.

- Copy and original of the social housing tenancy agreement.

- An extract sheet from the housing office's house register, which is valid only for one month.

- Personal account number and its details.

- Permits from the guardianship authorities, if minors are registered in the apartment.

- A document confirming payment of the state duty.

In some cases, additional documents may be required:

- copies of documents on timely payment of utilities;

- certificate that a citizen who arrived from another region did not participate in privatization there;

- written and certified by a notary office refusals of persons registered in the apartment to participate in privatization upon application.

Privatization procedure

The housing privatization process consists of several stages that can be carried out by the apartment owner himself without the involvement of third-party specialists. Among them:

| Stage | Description |

| Invitation of specialists from BTI | Bureau employees must arrive at the apartment, take the necessary measurements and draw up a new technical plan. This procedure may take about 14-30 days |

| Obtaining a registration certificate | The new document indicates the total area of housing, confirms the absence of illegal redevelopment, as well as the inventory value of the property |

| Contacting the Housing Office | In order to receive an extract document concerning all persons registered in the apartment. It may take about two weeks to complete the paperwork, so this process should be carried out simultaneously with the formation of the registration certificate |

| Visit to the guardianship authorities | If minor citizens are registered in the apartment, then the guardianship authorities must provide consent or refusal to carry out privatization. It should be remembered that these papers are only valid for a month |

| Payment of state duty | You can make the mandatory payment for re-registration of an apartment in ownership at any branch of Sberbank of Russia or through the website gosuslugi.ru |

| Submission of a package of documents to the municipal housing department and drawing up a privatization agreement | If all the paperwork is completed correctly, the process of drawing up a privatization agreement will take only 7-14 days |

| Receiving a certificate of ownership | This document is issued by the registration service and legitimizes the right to dispose of the apartment |

| Registration with the BTI | A copy of the certificate of ownership is submitted to the Bureau, after which the re-registered apartment is registered |

If government agencies delay the execution of certain papers or controversial issues arise in the process of privatization of housing, then the owner should resort to re-registration of the property in court.

To do this, you will have to submit the same documents to the judicial authorities as to the housing department along with the statement of claim.

Amount of state duty for privatization of an apartment ↑

Registration of an apartment into private ownership of an individual is a full-fledged public service that must be paid for.

Therefore, even with free privatization, the owner of the apartment makes a mandatory payment to the state.

What does a receipt look like (sample)

Documentary confirmation of payment of the state duty by the owners of privatized real estate is a receipt (Article 333.18 of the Tax Code of the Russian Federation).

It reflects such aspects as:

- Full name of the payer and his residential address.

- TIN and checkpoint of the registration service, within the framework of which the process of privatization of the apartment is carried out.

- Payment amount in numbers and words.

- Date of preparation of documents and signature of the payer.

A sample receipt of the state duty for the privatization of an apartment can be obtained from the registration service office of the corresponding region. Its general form is attached to this article.

However, if you make a payment through a bank, the financial institution will issue and issue this document to the payer independently.

As for the size of the state duty, from 2023 they were set in the following amounts:

| Sum | For whom |

| 1,000 rubles | For citizens |

| 15,000 rubles | For organizations |

When considering the issue in court, the state duty for privatizing an apartment through the court according to the new rules is paid in the same amount, and the receipt is attached to the general package of papers.

Photo: receipt for payment of state duty upon receipt of the Unified State Register extract

Where can I find out the details?

- In order to pay the fee for the privatization of an apartment, it is necessary to find out in advance the details of the receiving party, namely the regional division of the registration service.

- You can clarify the details:

- Among the details that the payer must find out:

- full name of the department;

- his tax identification number and checkpoint;

- personal account number to which the payment should be made;

- name of the servicing bank;

- BIK and OKTMO.

The name of the payment is usually the state duty for carrying out the procedure for privatization of residential property.

What is the best way to pay the state fee?

There are several ways to pay the state fee for converting a municipal apartment into private ownership, including:

| Payment method | Description |

| Through Sberbank of the Russian Federation | Payment can be made at any bank branch by providing the necessary details. Based on the results of the operation, the payer will receive a receipt, which he certifies with his signature |

| Via the Federal Tax Service website | On the website of the tax service in the “Electronic Services” section there is a convenient opportunity to pay the state duty using pre-identified details to the registration service. To do this, you will have to go to the “Payment of state duty” tab and fill out the fields of the electronic form. Payment is made from an electronic wallet or bank card. You can print a payment receipt directly from the website |

| Through State Services | A similar mechanism operates on the website gosuslugi.ru. However, in order to make a payment, the user will have to register, go to his personal account and fill out an electronic form in the “Taxes, fees, payments” section |

- When paying the fee for privatization of an apartment online, the receipt is saved and printed by the payer.

- Video: don’t rush to privatize your apartment

- Thus, at present, everyone who wants to privatize an apartment will be faced with the need to pay a state fee, while the residential property itself will go to the citizen completely free of charge.

- A receipt for the mandatory payment is attached to the general package of documents and serves as the basis for the transfer of municipal housing into private hands.

- To pay the fee through a bank or online, it is enough to know the details of the registration service.

Attention!

- Due to frequent changes in legislation, information sometimes becomes outdated faster than we can update it on the website.

- All cases are very individual and depend on many factors. Basic information does not guarantee a solution to your specific problems.

That's why FREE expert consultants work for you around the clock!

APPLICATIONS AND CALLS ARE ACCEPTED 24/7 and 7 days a week.

State duty for purchasing an apartment in 2023 - Advice from lawyers and advocates from Moscow

If you need assistance of a legal nature (you have a complex case and you don’t know how to fill out documents, the MFC unreasonably requires additional papers and certificates or refuses them altogether), then we offer free legal advice:

- For residents of Moscow and Moscow Region - +7 (499) 653-60-72 Ext. 448

- St. Petersburg and Len. region - +7 (812) 426-14-07 Ext. 773

Taxes when buying and selling real estate in Ukraine in the year Taxes when buying and selling real estate in Ukraine in the year Unfortunately, buyers sometimes forget, or do not fully realize that taxes and fees will also be added to the main payment. The same applies to real estate sellers.

They often do not take into account that the proceeds from the transaction will be reduced due to taxes. Let's take a closer look at what taxes Ukrainians must pay when buying and selling real estate.

What taxes and fees must be paid when purchasing real estate First of all, you must remember that concluding a real estate purchase and sale agreement in accordance with the legislation of Ukraine is subject to not only taxes, but also duties.

Buying and selling an apartment What documents are needed To purchase and sell an apartment in a year, the following requirements must be met:

Buying an apartment: Regardless of whether he is a buyer or a seller, when completing a transaction, obligations arise to the state to pay taxes, duties and other payments provided for by the legislation of Ukraine.

Therefore, when planning to buy real estate, it will be useful to know in advance what tax will be collected from you when purchasing an apartment.

Taxes and fees when purchasing an apartment on the secondary market When concluding a purchase and sale agreement, tax obligations are imposed on each of its parties.

Buying an apartment: taxes in Ukraine

When registering real estate transactions, the obligation to pay the state duty lies with the buyers, except for joint acquisition options.

In this situation, the amount of the fee is distributed equally between the counterparties, regardless of the size of the shares. State duty for state registration of rights - receipt To pay the state duty for registration of ownership of real estate, the interested party will need receipts and details.

The registration authority of the MFC or Rosreestr is responsible for issuing completed forms. After making the payment, the original payment document must be kept in order to be attached to the main package of registration documents.

You can also view bank details and receipt forms on the official website of Rosreestr. For citizens and legal entities in the city.

When submitting an application to the MFC - When submitting an application to Rosreestr - The procedure for paying the state fee for state registration of rights The state fee for registering ownership of real estate can be paid in several ways.

Choose the most convenient one, but do not forget to carefully check that the receipt is filled out correctly, because the speed of transaction registration depends on this.

Available options for transferring funds: Through a bank operator - the most popular method, involves the payer personally contacting a bank branch, for example, the territorial office of Sberbank. You will need a passport and a pre-filled receipt form. Be prepared to pay a small commission.

Through self-service terminals - payment can be made in cash or using a personal plastic card. Pre-registration of the user and receipt of a password is required. The result of the transfer of money will be the receipt of a check confirming the fact of settlements with the budget. The document must be retained for further presentation to the registration authority for its intended purpose.

Remember that you must pay the state fee for registering rights to a property before completing the transaction. Sample receipt for payment of the state fee for state registration of rights in Moscow for individuals.

State registration of rights and cadastral registration of real estate

When registering real estate transactions, the obligation to pay the state duty lies with the buyers, except for joint acquisition options. In this situation, the amount of the fee is distributed equally between the counterparties, regardless of the size of the shares.

State duty for state registration of rights - receipt To pay the state duty for registration of ownership of real estate, the interested party will need receipts and details.

The registration authority of the MFC or Rosreestr is responsible for issuing completed forms.

Purchase and sale of apartment 2023

One year of experience in real estate. You could reduce the amount on which the tax is calculated by either using a tax deduction by 1 ruble, or by the amount previously spent on the purchase of real estate for sale.

The amount of tax was not tied in any way to the cadastral value, so citizens underestimated the value of real estate in the purchase and sale agreement to the amount of a tax deduction of up to 1 ruble or to the amount previously spent on the purchase of real estate Sale of an apartment less than 5 years in ownership new law C This article will not be discussed about the apartment tax, namely the tax on the sale of residential real estate, the tax on the sale of property owned for less than 3 years, as well as the tax on the sale of property that has been owned by the seller for less than 5 years. In this article, in the most adaptive form, you can find out more about the tax on the sale of an apartment in a year. Let us immediately make a reservation that in this article we are talking only about those individuals - citizens of the Russian Federation who sell the following property, NOT used in business activities: Changing the minimum period of ownership of property for tax exemption C

State fee for registration of property rights

Share participation in construction. Participation agreement: N In electronic form p. For an enterprise as a property complex: And including a copy of the technical passport of the real estate object, prepared by the body of the organization for state technical accounting and or technical inventory, if such a passport is available in the registry file.

For each plan or permit: Territories of a cadastral quarter, territories within a cadastral quarter, a territorial zone, a zone with special conditions for the use of the territory, the territory of a cultural heritage site included in the unified state register of cultural heritage objects, historical and cultural monuments of the peoples of the Russian Federation, territories of advanced social economic development, territorial development zone in the Russian Federation, about a gambling zone, about forestry, a forest park, about a specially protected natural area, a special economic zone, hunting grounds, For each document: A copy of another document on the basis of which information about the property was entered into the Unified State Register of Real Estate For each document:

State duty for privatization of an apartment

The fourth and penultimate stages are subject to government fees. The purchase and sale agreement is considered concluded only from the moment of registration. Additional costs may also arise if there is a need to make changes to the cadastral passport. In other words, if the new owners decide to redevelop, they will have to pay a fee for this as well.

For example, if the parties to a lease agreement are two individuals and one legal entity, then the state fee for state registration of the agreement is paid by each individual in the amount of .6 rubles 2 rubles divided by 3, a legal entity - .3 rubles 22 rubles divided by 3.

Author of the article Svetlana MitrofanovaLawyer. Work experience - 14 years Hello. The cost of the purchase and sale agreement depends on whether the notary was required to be contacted or at one’s own request.

State duty for registration of rights to real estate - how much to pay?

The state provides the opportunity to privatize an apartment completely free of charge.

Is this really true? Or are expenses unavoidable? The procedure is as follows: an applicant for an apartment submits an application, receives permission for privatization, pays a state fee and registers ownership in Rosreestr. The size of the state fee for the privatization of an apartment deserves special consideration. How much will you have to pay in a year?

State duty charged for registering ownership of real estate in 2023

The receipt has a form established at the legislative level. It states: Together they are proof of payment, which are transferred to the registrars. If funds are deposited through the terminal, you need to carefully double-check the entered data: Sometimes a stamp is required on the check. A bank teller will help the citizen in this matter.

Expenses of the buyer when buying an apartment on the secondary market Expenses when buying real estate with a mortgage The main cost column falls on the seller, since he must, according to the unspoken rules of the real estate market, prepare the property for sale, at least according to documents. Let's look at what the seller bears when selling an apartment, the list of required papers depends on: What the buyer of the apartment pays for documents, services: The costs of ordering and payment fall on the seller.

If instead of the applicant, his representative applies to the registration chamber, a power of attorney certified by a notary will be required. A receipt for payment of the state fee for registering property rights when submitting an application and the documents attached to it is provided at the request of the applicant; he can present it later.

However, the registration process will only be started after payment has been confirmed. If the citizen does not confirm the fact of making the payment or the registrar does not find information about it in the information database, after 10 working days the documents will be returned to the applicant.

What documents prove the identity of a citizen of the Russian Federation? How can I find out the details?

The main document regulating the rules for calculating and paying taxes is the Tax Code of the Russian Federation. Changes are periodically made to it, which ordinary taxpayers are required to know and comply with.

Therefore, today we will figure out what changes this year affected the calculation of tax when selling an apartment. The basis for payment will be the provision of a declaration and the necessary documents confirming the ownership and sale of the apartment.

The Tax Code determines the deadline by which they are submitted to the tax authority for verification - April 30 of the following reporting year. This means that for the purchase and sale of an apartment that was completed in the year, you are required to report by April 30 of the year.

Providing a tax return is the responsibility of the taxpayer. In any case, the Federal Tax Service will be notified that the transaction has been completed and the transfer of ownership rights has been registered in Rosreestr.