It is the primary duty of parents to support their children, regardless of the status of the relationship between the father and the mother; if the parents have separated or divorced, the child ' s upbringing and maintenance shall not be affected by this fact.

The abandonment of the mother ' s or father ' s family does not deprive them of their duty to fulfil their parental duty to maintain and fully provide for their minor children in a timely and diligent manner.

Maintenance is a monetary payment paid by a separated parent to a child under 18 years of age, who can be fulfilled voluntarily, through a notarized agreement or by compulsory recourse to the courts.

A parent who receives child benefits often wonders whether alimony is income?

What sources of income and how are maintenance payments calculated?

Prior to the commencement of the maintenance recovery process, it should be specified from which income the payments would be withheld and from which they could not be obtained.

The list of income from which maintenance payments can be formally withheld is set out in Government Regulation No. 841. Incomes that are not included in the list are not to be counted from them.

So, the list of income to be deducted from maintenance:

- A staff member ' s salary at his or her main or applied place of work;

- Payment related to the maintenance of civil servants and members of the armed forces;

- The fees paid to artists, artists and media professionals;

- Increase in core income for professional achievement;

- An increase that relates to special working conditions;

- Various awards, remunerations;

- The salary of a staff member who is on sick leave or on leave;

- An increase in the number of days worked or overtime;

- Pension;

- Fellowships;

- Unemployment benefits (only by court decision);

- Payment related to the closure or downsizing of the organization;

- :: Entrepreneurship-related payments;

- The return on the rental of real property;

- Share income, dividends;

- Compensation for damage to health;

- Compensation for damage caused by radiation or man-made accident;

- The profits obtained under the contract (lawyers, notaries, etc.);

- Cash to be paid for food.

List of income not subject to recovery of maintenance:

- The benefits payable to a woman in connection with pregnancy and childbirth;

- Moneys that are provided for the payment of therapeutic and preventive meals;

- Funds issued for travel;

- Compensation on the occasion of transfer or change of place of work;

- Monetary compensation granted to the employee in the case of personal savings for the repair of the working equipment;

- Money paid on the occasion of marriage, birth of a child, death of a family member, natural disaster;

- Maternal capital;

- Survivor ' s pension;

- Maintenance payments from another person.

Example of calculation of maintenance as a percentage of salary:

- 25 per cent per child;

- For two children, 33 per cent;

- 3 or more - 50%.

The organization in which the father is employed receives an executive notice of maintenance retention, a deduction of 25 per cent of his earnings, and a monthly salary of 22,000 roubles has been paid.

You have to take into account the contribution to the tax service - 13%. 22,000 - 13% = 19,140 rubles. This amount will hold maintenance. 19,140 - 25% = 14,355 rubles. This is the final amount, the employee will receive it on pay day.

Are maintenance income?

The child ' s cash payments are recognized as the income of the family in which he or she lives.But their spending is regulated by Russian law, so the parent or guardian receiving alimony is not entitled to spend it on his or her personal needs.

The parent who pays the benefit has the right to control where and how much money is spent.

Is alimony a mother's or a child's income?

In fact, alimony payments are the property of the child to whom they are allocated.So alimony is the child's income.

The parent only undertakes to dispose of them in good faith, respecting the interests of the child and the relevant provisions of the Civil Code.

After the child has reached the age of 14, it is possible to administer these payments on its own; some purchases require the authorization of legal representatives, i.e. a parent or guardian; under the regulations, alimony payments are the official income of the person to whom they are intended.

If the money is given to the child, it is his or her income; the former spouse may apply directly to the former spouse or through the court to obtain the right to material support from the former husband while caring for the minor child, in which case the money received will be the income of the mother.

Are maintenances included in the family budget when the financial records or accounts are completed?

Support payments are part of the family ' s budget and the parent is obliged to indicate the amount when the various financial statements are completed; for example, when applying to a social security or bank.

Maintenance information should be provided in cases where:

- Conducting a procedure for the processing of certain benefits in order to recognize the family as poor;

- To obtain credit;

- The processing of grants;

- Processing of free meals for the child;

- The creation of supplementary forms of social security.

Any financial documentation must include alimony payments in the income list, as well as alimony as a parent ' s income in the event of payment of the income statement, which is prescribed by law for those who are required to provide regular income information.

There are some difficulties in including maintenance in the total family income; for example, in writing an application to the bank for approval and issuance of a mortgage, the claimant confirms a personal income of 12,000 roubles and a alimony of 11,000 roubles.

After four years, maintenance payments are excluded from family income and the mother ' s personal income prevents the payment of credit.

The legislation of our country establishes financial assistance for family members who are unable to take care of themselves under various circumstances, in the case of minors.

If you do not want to keep a family and divorce, you should not have any influence over the child's upbringing, nor should you have any influence over the child's upbringing.

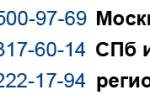

Dear readers, the information in the article may have become obsolete, use free advice by telephone: Moscow+7 (499) 288-73-46Saint Petersburg+7 (812) 309-71-92or ask the lawyer through the feedback form below.

All types of earnings and other income from which maintenance is withheld for minor children, and to download the Decision of the Government of the Russian Federation which establishes a complete list of income from which maintenance may be withheld.

We have addressed the issues of determining child support in terms of the earnings or other income of the alimony payer, and have considered where the proportion can be increased and reduced.

The earnings from which alimony is withheld

Maintenance is retained after a court order has been issued in the form of a court order or a court order; the basis for a court order, as a summary procedure, is an application for a court order for maintenance.

The list of wages and other income from which maintenance must be withheld is established by the Government of the Russian Federation. Article 82 of the Family Code of the Russian Federation directly refers us to Government Decision No. 841 of 18 July 1996.

Getting a child allowance is gonna make it easier.

The application for a monthly payment for the first and second children may be granted not only at the place of residence but also at the place of actual residence and residence; the proposed bill, prepared by the Government, was adopted by the State Duma on first reading on 5 March.

Child benefit recipients will increase

According to the First Deputy Minister of Labour and Social ProtectionAlexei Vovchenkoinformation on the payment for the first child will be provided in the Single State Social Security Information System.

Citizens, in turn, will be required by law to report changes in the place of residence or actual residence to the social security authorities (when they receive payments for the first child) and the Pension Fund (if the money is transferred to the second child).

Chairperson of the State Duma Committee on the Family, Women and ChildrenTamara Pletniovaspecified that such an approach would expedite and facilitate applications for "child benefits".

Read About the Subject

"Now, when you can only apply for a benefit at home, there is often a lack of understanding in the field, what is called "football" with respect to a person — citizens are required to register, people with temporary registrations are being tried to refuse payments, permanent registration is required, this is a contradiction that we try to resolve by listing all the ways of registration," Alexei Vovchenko noted.

On the initiative of the President, payments for the first and second children have been paid to Russians with low incomes since 2018, the amount of the allowance being equal to the child subsistence minimum in the region where the family lives.

Families whose earnings do not exceed one and a half of the subsistence minimum per person are now eligible for such benefits, and it is planned to expand the number of beneficiaries from 2020 onwards.

In a message to the Federal Assembly on 20 February, the President of RussiaVladimir Putinsuggested that they should be assigned to families whose income does not exceed two subsistence minimums per person.

"Today, the measures that come to pass include approximately 520,000 of our families, which we estimate will expand to almost 770,000 of our families," said the Vice-Premier.Tatiana Golicov.

Who is entitled to payment

The main target audience for benefits is the young families in which the child ' s parents are still studying, and therefore do not have a high income; in addition to Russian citizenship, two basic conditions must be met:

- The child must be born no later than 1 January 2018;

- The family has a low level of income (in the last 12 months, each member had a minimum of 1.5 minimum living standards established in the region).

How to calculate the average per capita income of the family

In order to know whether the family has the right to receive payment, it is necessary to calculate the monthly average per capita income for the 12 months preceding the month of application, for which all the family ' s income received in cash during this period is calculated and then divided into 12 and the number of all family members.

In doing so, account must be taken of:

- Wages of officially employed parents, bonuses, compensation and incentive payments;

- Pensions, sick leave payments, student scholarships, alimony and allowances (from 2023 on, children's allowances and the "president's demographic package" itself are not taken into account in the calculation of family income);

- Pension payments to beneficiaries of insured persons;

- Compensation for the performance of public or public duties;

- Cash (pleasure) for military personnel, compensation.

In calculating the monthly average per capita income, the family includes the parents of the children, adoptive parents, guardians, the legal spouses of the parents of the minor children and the minor children themselves; grandparents, uncles, aunts and other relatives are "not counted", even if they live with the child and support him financially.

It is important to remember that income calculation does not take into account financial income if family members:

- They serve their sentences in prisons or are placed in detention;

- They receive compulsory treatment on the basis of a court decision;

- The child entitled to payment shall be deprived of parental rights.

How to Formalize Child Benefit

The payment for the first child is paid to the family from the federal budget and may be made to the territorial social protection authority at any time before the child is one and a half years old; if the child ' s mother is deprived of parental rights or has died, the father or guardian with Russian citizenship may apply for money.

Read About the Subject

The second child ' s benefit is paid from the mother ' s capital certificate, for which reason it is necessary to apply to the Pension Fund for the child ' s appointment.

The application can be submitted both at the RPF ' s home office and through the Multifunctional Centre (IFC), which is allowed to do so immediately after the birth or adoption of a second child.

Two applications are allowed at the same time, for a certificate of maternal capital and monthly payments from it.

What other benefits are available to families with children?

In addition to these benefits, families with children may claim other benefits, including maternity benefits, payments for a child up to three years of age, a one-time maternity benefit and a one-time payment for early pregnancy.

For example, a lump sum of 628 roubles (47) is paid to women who are registered in health-care organizations during the early pregnancy period (up to 12 weeks).

The maternity allowance depends on the status of the recipient: female employees receive 100 per cent of the average wage, female students receive 100 per cent of the scholarship and female military contractors receive 100 per cent of the allowance.

The wives of military personnel performing military service on call are entitled to a lump-sum allowance, the duration of the pregnancy being at least 180 days, and the amount of the allowance is 26539.76 roubles.

On the birth of a child, the State shall pay one parent a lump sum of 16,759.09 roubles; if the father or mother is an employee of the Far North, the amount of the allowance shall be increased by the district coefficient.

After the birth of the child, the person who provides for the actual care and upbringing of the child is entitled to a monthly childcare allowance, the amount of which is paid until the child reaches the age of 1.5 is 40 per cent of the average wage.

The parents are then only entitled to a monthly compensation of 50 roubles from the employer.

Special allowances are payable to families in which a disabled child was born. From 1 July 2023, at the initiative of the President, the amount of the allowance for the care of children with disabilities and for the disabled since childhood of the first group must be raised from 5.5 to 10,000 roubles.

♪ Do you have any income ♪ ♪ maintenance ♪

From the general rule of calculating maintenance as a percentage of the payer ' s earnings and other income, there is an extensive list of exceptions, depending on the cause and source of income.

The mother (father) is obliged to dispose of the child's money in good faith in the interests of the child.

How much income are alimony withheld and not withheld?

Slopists know that alimony can only be withheld from official income, so most of the income is simply not recorded in official documents.

Article 217, paragraph 5, of the Russian Tax Code also refers to income and maintenance, specifying that these amounts are not subject to taxation; moreover, bailiffs cannot seize the money in question.

Counsel for you and your family. 01.12.2011-31.12.2011 312.60 Hrv. In practice, the courts most often determine the amount of maintenance from all income per child, for two.

A common case is the cessation of retirement payments; however, it is not always the case that a pensioner ' s status is exempt from material assistance to a child under the age of 18.

Maintenance recognizes the money paid by one parent in favour of a minor child; these obligations can be fulfilled both voluntarily through a notary agreement and by force through a court of law.

So, despite the fact that maintenance is formally owned by a minor child, the mother (father) must still identify it as one of the sources of income...

- Upon receipt of the grant;

- If the child is fed free of charge;

- In the form of supplementary social benefits and benefits;

- When the tax returns are completed, if the law requires the mother (father) to provide income information;

What difference does it make in our society, honestly, you want to be with someone who's a walking bag of money and a crucifix of women's issues and problems, if yes, you're a huge and fat minus, you're being used both as a thing, as well as a sense of self-esteem and pride, both for men and women.

Plus the second huge and fat minus is your dependence on the media and other people's opinions, which means the brain is off, and with the brain turned off, the full part of society, you're not gonna make it, even if you're on top of it.

So build your little, personal society, where a girl with you is just for love, and very few of them, but to find her, you have to pull your tail off the couch and turn your brain on.

Are maintenance income of mother, family, child

According to the provisions of the NK of the Russian Federation, income is the benefit of the sale of goods, work, services, property rights (as well as extra-realization benefits) in cash or in kind, i.e. the sum of monetary earnings:

- Entrepreneurship profits;

- The proceeds of the sale of the goods (which does not matter whether the goods are produced independently or purchased specifically for resale), major movable or immovable property (vehicle, home, delivery, apartment), work or service;

- Wages;

- Award, remuneration;

- Pension;

- Fellowship,

- Social security benefit;

- Compensation;

- Earmarked payment (e.g. alimony).

A healthy and happy life without complexes! Have the courage, have your own opinion, everything. Don't be silly, hide it from those around you! Honestly, I'd really like to go back to the 19th century.

Where the women were in the manor, in nature, in the comfort of the house, the children and the creativity, the embroidery! I would have given up both the car and the license and the phone and the Internet! I would have left books on spiritual litharism! I would have lived with my husband and enjoyed life! And to date, having a husband doesn't guarantee you that he will be with you in your old age! And to work early, I don't want to be a man! I don't want to be a man! I want to go to work!

The basic return is the imputed monthly return in value terms per unit of physical measure that characterizes a certain business activity under different comparable conditions, which is used to calculate the value of imputed income, so human finance is the sum of the monetary earnings and values that it receives from its activities.

All the above-mentioned types of income from which maintenance payments are not made should be known to the recipient, the accountant of the enterprise where the payer and the bailiff are employed.

So, income from which alimony is not charged:

- Termination indemnity for dismissal from an official place of work;

- Travel and installation payments;

- Compensation for forced work move;

- Payment by the employer for the provision of personal tools or materials;

- Non-recurrent bonuses;

- Payment from the employer for travel to health centres, sanatoriums, resorts;

- Compensation for qualification courses to which the payer was sent at the request of the employer;

- Material assistance in connection with work-related injuries, fire, terrorist attack, etc.;

- Maternal capital, etc.

Maintenance payments from wages or other income are payable only after the deduction of income tax (13 per cent).

It doesn't matter how it's earned and how it's paid.

The law requires parents to provide for their own minor children, regardless of the marital status of the spouses and the existence of a registered marriage in general; the grounds for punishment are the fact of parentage itself.

In addition to wages and allowances, alimony may be withheld from other types of income received by the alimony payer, including the most common types of income.

Maintenance is deducted from scholarships received by students, from sick leave benefits, from pensions, from unemployment benefits, from income of entrepreneurs, from income from rental of property, from financial payments for damage to health, from material assistance, from income from contracts for work or services.

So, alimony is at the disposal of the parent, butare the property of a minor childAccording to article 60, paragraph 2, of the Russian Federation, the sums of money which the mother (or father) receives as maintenance shall be spent exclusively on children ' s needs:

- Nutrition;

- Education,

- Treatment, health care and maintenance;

- Education;

- Other needs (e.g. recreational activities, repairs to the children ' s room, purchase of clothing and shoes, toys, child furniture and equipment).

At the same time, we note that, under article 346.26 of the Code, the tax system in the form of a single tax on imputed income is established by the Code.

346.29 of the Code establishes that the tax system for the application of the tax system in the form of a single tax on interest income shall be recognized as the taxable income of the taxpayers.

Nothing new, I'm on a bus with 500 rubles in a jacket for 2 tons and cheap jeans. Anything that moves and anything that doesn't fucking move, I think it's fucking or not.

All income that a citizen earns as a result of employment or other activities is conditionally divided into two parts: wages and other income.

Although the types of income from which alimony is withheld are quite diverse, in practice there is often a case of withholding additional profits from alimony payers; often payers try not to record sources of income anywhere, which makes them unofficial, i.e. not available for alimony deduction.

This is often the case for renting an apartment without a contract of employment, or it may be the profits of a casual wage or a permanent job without a formality ("cool").

The most common question asked by alimonyers is, "What kind of income doesn't hold alimony from?"

The family and labour laws of the Russian Federation do provide for a number of financial compensations and payments from which alimony cannot be withheld; this list is quite extensive but should be carefully studied.

If you doubt whether you should pay alimony from your income, describe your situation in your comments. Our specialists will respond within 15 minutes.

The income is as follows:

- A profit from entrepreneurship.

- Wages.

- Awards and rewards.

- Pencil.

- Various benefits (e.g. unemployed, military).

- Compensation.

- Other payments.

The grant may be granted on the basis of an average monthly basis (three months prior to the month from which the grant is granted – these changes came into effect in July before – six months) of the total income of persons identified as resident in the declaration after the applicant ' s three-month income statements have been submitted; therefore, the majority of applicants, when selecting the grant, indicate the period of income from 01.01.2014.

General rules on retention of maintenance

A child who has reached the age of 14 acquires the right to administer maintenance payments on his or her own, but some transactions still require parental control and authorization, in accordance with the provisions of family and civil law.

Often the recipient of maintenance questions whether alimony is considered income? Such a question may arise in determining the average monthly income of a person or a family as a whole, for example, to obtain credit or to calculate average per capita income for benefit or social assistance.

Were alimony the income of the mother, the family, the child, and in what cases?

Come in, Amour's Clothes, Alementa Pension 4.

The recovery of maintenance from the amount of wages and other income due to the person paying maintenance is effected after the withholding of the payment from that salary and other income of taxes, in accordance with... the complete list of the types of income from which maintenance is withheld, taken into account in the calculation of the child ' s payment, is set out in RP No. 841, adopted on 18 July 1996.

Similar records:

- Journey of a contract of men between legal persons

- How much money does it take to pay the loan bill back?

- The birth of a second child at the age of 40

Whether alimony is taxed on income and whether it is income

If there is a disabled child in the family, the deduction is 6,000 or 12,000 rubles; in the first case, the child is raised by his or her mother, father or both parents; in the second case, the guardian is raised by the guardian; the tax deduction cannot be obtained in the form of cash, but is taken into account in the preparation of the base from which maintenance is charged.

The Tax Code clearly states that maintenance payments are not subject to taxes; as mentioned earlier, this depends on the nature of the payments, their direction and their destination.

However, the income from which the recovery takes place is freely taxed.

Once a tax deduction is made from wages or other income, the amount may be used to pay maintenance.

The money begins to be withheld from the payer ' s income from the time of receipt of the Ordinance; the paper is transferred to the accountant ' s account until the employee ' s salary is paid and issued directly.

When an executive document is received at the time the salary has already been issued, no funds are charged for the period from which the money was not charged to maintenance, and the charge is made in the next reporting period.

Federal Act No. 229 provides information on the procedure for the execution of retention monies: article 111 states that the income of an employee who pays maintenance shall be taxed as a matter of priority and the arrears shall be withheld, the latter being collected in strict order of priority, and if there are more than one employee ' s performance papers, the accountant shall have to understand the manner in which the debts are paid.

According to the law, first the amount required to settle the priority debts is deducted from the salary, and the maintenance is in this group.

Priority debts also include claims for moral damages as well as compensation for the death of the breadwinner.

Once the first priority is collected, they move to the second, the second, public debt, and no more than 70% of the revenue should be collected as priority debts.

In 2016, a second form of reporting on the calculation and retention of NPFL employees by tax agents was introduced.

In each quarter, the employer completes and transmits to the tax special report on form 6-NDFL approved by order No. MMW-7-11/450@of 14.10.2015 of the FNS of Russia.

It appears that these lines do not include alimony, which leads to the conclusion that they are not reflected in section 1.

None of these maintenance items indicate, which means that they are not required separately in the 6-NDFL.

The social problem of the lack of maintenance payments in our country has been a long-standing one, with the fact that the father is often the main breadwinner in the family, the family is left without means of subsistence in the event of a divorce; in order to prevent mass destruction of citizens and increase the responsibility of parents for children, Russian legislation has introduced tax incentives after taking advantage of foreign experience.

According to the Tax Code, taxpayers with children are subject to tax deductions:

- In the case of one or two children, compensation of 1,400 rubles per child was provided;

- The third child and the subsequent payment would amount to 3,000 rubles;

- The deduction for a disabled child is 6,000 roubles;

- A student child under 24 years of age is subject to a deduction of 3,000 roubles.

The income from which child support is recovered is described in Government Decision No. 841 of 18 July 1996. On the basis of paragraph 2 (m), maintenance is also deducted from the amount received for damage to health.

Are maintenance income for mortgages

The mortgage which extra income will count the mortgage bank you finally found an apartment or a house you're going to live in for at least a decade, and you even chose a creditor to be entrusted with the financing of your purchase, but the trouble is that the mortgage bank doesn't want to see you as its mortgage borrower, because your official income is too small to repay the loan. Is there anything you can do about the financial structure? The experts say you can.

Dear readers, our articles talk about model ways of dealing with legal issues, but each case is unique.

If you want to know,How to solve your problem -- you can use the form of an online consultant on the right or you can call the phones on the website. It's quick and free!

Contents:

- Are alimonys the income of a mother, child, or family?

- Mortgages and consequences

- Maintenances and Credits — Equivalent Commitments?

- Sad instruction: How to process alimony

- Wages for mortgage with examples of calculation and grey income options

- Additional income for mortgage processing

- Mortgage and maintenance in divorce, expert comments

- Are alimonys the income of a mother, child, or family?

- Mortgage and child support

SEE THE TIME: What kind of income do you need to get a mortgage from a bank?

Are alimonys the income of a mother, child, or family?

Banky's borrower's income.

The decision of the credit institution to issue the loan depends not only on the personal income of the borrower but also on the way in which it is confirmed: If a bank form certificate is used to confirm the income, the interest rate on the loan will be higher.

The difference may range from 0.5 to 2. From the year on, borrowers have had the opportunity to confirm their income by providing an account statement from the Russian Pension Fund through the State Services portal.

With this type of confirmation, some banks are willing to cut the bet by 0.5 - 1.

Also important for the bank is the length of time during which the borrower earns income at a certain level and the stability of their receipt: long and continuous working experience indicates stable financial flows by the borrower.

Most banks require a period of at least six months at the last place of work and at least a year at the same time. In case of one-time income, even if large, it will be difficult to obtain credit from the bank. A separate group for the bank is made up of borrowers, business owners: they confirm their income in a special way.

Individual entrepreneurs submit tax returns to the bank, monthly account turnover statements, etc. This group of borrowers is subject to a higher interest rate on the loan; some banks take into account the borrower ' s additional earnings that are not related to its core activities.

In such a case, he would be required to submit a certificate of income to the credit institution and an employment contract from an additional place of work.

The financial institution may also consider other income that the borrower can formally confirm: the availability of other income will have a positive impact on the decision to extend the loan, as well as a reduction in the interest rate on the loan by several percentage points.

In addition to the amount of income, the presence or lack of ownership of movable and immovable property by the borrower is taken into account and has a favourable impact on the bank ' s decision to extend credit and on the reduction of the interest rate on the loan; in general, many banks consider the income not only of the borrower but also of his family and of the guarantors, if any.

In calculating the loanee ' s family ' s total income, the bank takes into account the number of dependents available to the borrower, such as children, and subtracts from its income the cost of maintaining these persons. Working family members are generally able to act as borrowers to enable them to pool their income and eventually obtain more credit.

It is worth noting that financial institutions usually take into account the credit-to-income ratio of the loanee and respect certain proportions; generally, the loan payment should not exceed half of the borrower ' s income; otherwise, the debtor ' s debt burden would be unsustainable.

Mortgages and consequences

The Bank will agree to consider other additional sources of income, most importantly to have documentary evidence, because mere words to the creditor mean nothing, which is why today the mortgage programmes offered by many financial institutions are very popular among Russian citizens.

However, finding a suitable dwelling, choosing a creditor and deciding to make a housing loan may not be sufficient to become a owner of his or her own home.

The mortgage is a very serious loan and involves a very substantial amount, so that not every applicant can meet the requirements put forward by banks to citizens who choose to obtain such financing.

If the loan is too small in the bank's opinion, the loan is likely to be denied.

Let's start by saying that the bank always counts alimony as part of it.

The author of the post: Alexander Catherine's collective wisdom. And I don't agree with the bank's position, the alimony pays the father for the child, yes, but that means that in their absence, my expenses will be raised for the child... and even if I take the credit, and I will spend the entire amount of alimony on the loan, then I will spend all my salary on the child... you can't not feed, dress, entertain, and spend on the current expenses... we all understand that the minimum wage, the child will not be fed... but on the same cash, with the naked poop, the rights will be denied! Ann the bank's strange position is not to count the alimony, because if you don't get the alimony, then you spend the child part of the ZP, and if you get the child, then the child's maintenance is paid for maintenance, not the ZP, so Mila totally agrees, well, if you take the demand for the loan or the car credit, and when you take the mortgage, and you include the child in the share, why don't take the credit for the credit, which is not necessary.

Sad instruction: How to process alimony

Maintenance obligations may also be carried out in a fixed amount; in the case of a notary agreement between the parents, the amount of the payment is determined by the parents themselves; it may not be less than the amount required by law; and under the general rules, maintenance is part of the family ' s income and the child ' s welfare is targeted.

The mortgage calculator of the mortgage and maintenance in divorce, the comments of the expert on mortgage payment, is usually a lengthy and time-consuming process; during the payment, the spouses may terminate the marriage.

Banky's borrower's income.

The credit institution ' s decision to issue the loan depends not only on the borrower ' s personal income but also on the way in which it is confirmed: if a bank form certificate is used to confirm the income, the interest rate on the loan will be higher; the difference may range from 0.5 to 2, respectively. From year to year, borrowers have had the opportunity to confirm their income by providing an account statement from the Russian Pension Fund through the State Services portal.

Additional income for mortgage processing

My husband pays me child support, the bank sold a mortgage apartment for failing to pay the mortgage for the rubies, the debt of the rubies.

Yeah, that money is the income from which the alimony is held. No, that's not how the alimony is calculated.

Since this is an execution proceeding in respect of debts owed to the bank.

The borrower ' s income is important for the adoption of a loan/subductive contract; choice.

How to improve the chances of approval of a mortgage: Unfortunately, their fears are most common; in fact, they are a refusal, because with a loan of, say, 1 million rubles, you can't buy an apartment for three lemons. To avoid a broken bark, experts recommend that you carefully consider your actions before going to a bank.

Are alimonys the income of a mother, child, or family?

However, it is important to remember the essence of the definition of these concepts: credit is the financial obligation of the entity to the credit organizations to repay the principal debt and interest on the use of the money; maintenance is the obligation of one of the parents of the former spouse to provide partial security for the minor children after the dissolution of the marriage; that is, it can be concluded that these concepts are similar in at least one way to financial obligations; each of them must be paid in a stable monthly manner; and the loan is paid to the bank on a monthly basis, in the amount set out in the loan contract and the bank loan agreement.

Nine types of people who cannot be mortgaged in order not to supplement the percentage of forced non-payers should be guided by macroeconomic indicators alone, the experts believe.

The Regional Director of DeltaCredit Bank in Lower Novgorod is the type of income considered by the Bank.

The following components are included in the concept of wages: The receipt of pension payments by the client must be confirmed by the following documents: since these benefits are fixed for life, the inclusion of the pension in the total income of the client is possible, subject to a payment of at least one month.

Pension payments cannot be considered as the only source of income of the Borrower; the rest of those who enter into a loan relationship with the Bank, together with the Borrower, may have a pension as the sole source of income.

The dividends are the income earned by a customer who is a shareholders in a legal entity in the distribution of profits by its shares in the organization's statutory capital.

In order to give a positive response to the loan, the bank refers to the requirement to provide a certificate of employment. All credit institutions take into account official earnings in the first place, but the bonus will be additional earnings, income, real estate or valuable property.

Maintenance is income or no — Legal questions and answers

If you need help of a legal and reference nature (you have a complex case, and you don't know how to process documents, IFCs need unnecessary additional papers and background papers or not at all), we offer free legal advice:

- For the residents of Moscow and MoD - +7 (499) 653-60-72 Dob. 355

- St. Petersburg and Len Province - +7 (812) 426-14-07 Dob. 525

Citizens ' income refers to any income of money, which may be wages, scholarships, pensions, compensation, allowances, but whether child support is the mother ' s income should be dealt with, and the Family and Tax Code should be applied; according to articles of the UK, parents must provide for their children.

In accordance with the article of the Family Code of Ukraine, parents are obliged to maintain a child until the child reaches the age of majority; in certain cases, as provided for in articles and in the case of incapacity for work and in the case of continuing education of a child, the obligation to maintain children continues.

The primary responsibility of parents is to support their children, which does not depend on the status of the relationship between the father and the mother.

If the parents have separated or divorced, the child ' s upbringing and welfare should not be affected.

The abandonment of the mother ' s or father ' s family does not deprive them of their duty to fulfil their parental duty to maintain and fully provide for their minor children in a timely and diligent manner.

Are alimonys a child's mother's income?

This procedure establishes rules for the recording and calculation of the average per capita income of a family entitled to a monthly child allowance, which is further referred to as the average per capita income of a family based on the composition of the family and the income of its members.

A monthly child allowance is awarded and paid to one of the parents of the adoptive parents, guardians, guardians for each child born, adopted, placed in the care of a child living with him or her until he or she reaches the age of 16 years for a student of a general education institution, until the completion of his or her studies, but not more than until he or she reaches the age of eighteen years in families with average per capita income, which is entitled to receive this allowance in accordance with the legislation of the Russian Federation.

The decisions of the Government of the Russian Federation to be taken into account in the calculation of average per capita income include:

In calculating the average per capita income that gives the right to receive a monthly allowance for a child under guardianship for which no money is paid in accordance with the legislation of the Russian Federation for the maintenance of children under guardianship, account shall be taken of his parents, minor brothers and sisters, regardless of their place of residence, and the child itself, with the exception of the persons referred to in paragraph 6 of this Order.

The family, which is taken into account in the calculation of the average per capita income, does not include: The family income, which is taken into account in the calculation of the average per capita income, includes all types of wages, salaries and additional remuneration for all places of work, including:

The family income taken into account in the calculation of the average per capita income is also: The family income, taken into account in the calculation of the average per capita income, includes the following benefits:

Family income for the calculation of average per capita income is defined as the total family income for the last three calendar months prior to the month of application for the benefit, which is then referred to as the estimated period based on the composition of the family at the date of application for the benefit.

The calculation of family income takes into account the accrued amount before deduction, in accordance with the legislation of the Russian Federation, of taxes and compulsory insurance payments.

The family income earned in foreign currency is converted into rubles at the rate of the Central Bank of the Russian Federation on the day of receipt.

The bonuses and remunerations provided by the pay system and paid on the basis of monthly performance are included in the family ' s income at the time they are actually received.

In other fixed remuneration periods, the amount of the remuneration is divided by the number of months for which it is accrued and recorded in the family ' s income for each month of the calculation period.

The amounts of wages retained for the period of employment following termination of the organization, activities to reduce the number or number of employees, as well as termination indemnity and retirement compensation, shall be divided by the number of months for which they are accrued and shall be recognized as family income for each month of the calculation period.

Support paid by one of the parents for the maintenance of minor children not living in the family is excluded from the family ' s income.

The income of a family that has taken care of a child shall include the income of the parents or one of them, except in cases of deprivation of parental rights, of the minor brothers and sisters referred to in paragraph 5 of this Order, and of the child ' s pensions and maintenance.

Income derived from peasant farming activities is accounted for by an agreement between farmers ' farmers on the use of fruits, products and income derived from the farm ' s activities.

Income from personal support farming for gardening, livestock, poultry, cannon animals and bees is accounted for in the income of the family on the basis of the income standards approved by the constituent entities of the Russian Federation in order to assess the standard of living of the population and to provide the necessary State assistance to the poor citizens.

The income from the personal support household shall not be taken into account in the income of the family if one of the family members referred to in paragraphs 4 and 5 of this Order has been designated as category I or II disability or the child is disabled. Income from the personal support household, which is managed by two or more families, is recorded separately for each family in proportion to the number of family members working in the household.

Accrued but unpaid salaries, maintenance, allowances and other payments under this Order shall not be taken into account in the calculation of income.

The calculation of the average per capita income of the family is made by the body that appoints and pays the monthly child allowance on the basis of the family composition documents and the amount of the income of each family member submitted by one of the parents by the adoptive parent, the guardian, the trustee who is entitled to the monthly child allowance is further referred to as the applicant, together with the application for the monthly child allowance.

The average per capita income is determined by dividing the total family income for the calculation period by 3 and by the number of family members, the information on the family income is provided in the application for the benefit in writing.

The requirement of other income information is not permitted; in the event of a change in the family ' s income and composition, the applicant is obliged to inform the authority which appointed the monthly child allowance within three months at the latest.

Close the science news, the big Hadron Collider, the LHC results, the LHC mystery, the LHC puzzles, the general schedule, the early stages, the LHC device and tasks, the LHC device, the LHC mission, the LHC mission, the properties of the Hadrons, the search for the Higgs boson.

Particle physics.

Values and units, how particles are studied, experiments on colliders, standard model, Higgs mechanism, in popular magazines, how to sign, book club, published in full, origin of life, Chapter 1, Chapter 2, scale: times, help the reader, from a second to a year, astronomical times.

Folding proteins, excited atoms, excited atoms, who they are and where they are, nuclear breakdowns, elemental particles, continental movement, subtraction of air, machines lighter than air, first apparatus lighter than air capable of lifting a human being, German serial dirigible during World War I, heavy air machines, first helicopter E. First flying classics.

The only Russian serial landing screen plan, the theoretical basis of the aircraft's flight is heavier than air.

The first project implemented, but there is no reliable flight record, a front-end fighter, one of the first serial jets, a multi-purpose fighter, an enemy of MIG in the Korean war, a strategic bomber with a cycle chassis.

Eternal engine, electromagnetic radiation, human capabilities, general biology journal, in English, science, education and law, intellectual property, search for closure.

4. The composition of the family, which is taken into account in the calculation of the average per capita income. 4 The composition of the family, which is taken into account in the calculation of the average per capita income, includes: married parents of adoptive parents, including separated parents of adoptive parents and living together with them or with one of them their minor children; in red.

The types of family income taken into account in the calculation of the average per capita income.

The calculation of family income to determine the average per capita income The calculation of the average per capita income of the family Why do we see only adult pigeons on the street? Where are their chicks?

Zen RSS all tapes.

Is maintenance a mother's or a child's income?

We're gonna stand up like a low-income family at the IFC asking for income checks for the last three months, and I get alimony.

A child is entitled to receive maintenance from his or her parents and other family members in the manner and amount set out in section V of this Code.

The amounts due to the child as child support, pensions and benefits are made available to the parents of persons in loco parentis and are spent by them on the child ' s maintenance, upbringing and education.

Do maintenance contribute to the family ' s income

This procedure establishes rules for the recording and calculation of the average per capita income of a family entitled to a monthly child allowance, which is further referred to as the average per capita income of a family based on the composition of the family and the income of its members.

The monthly child allowance shall be awarded and paid to one of the parents of the adoptive parents, guardians, guardians for each child born, adopted, taken care of and living with the child until the child reaches the age of 16 years for the student of a general education institution, until the completion of his or her studies, but not more than until he or she reaches the age of eighteen years in families with average per capita income, which shall be entitled to receive the benefit in accordance with the legislation of the Russian Federation.

Are maintenance income?

Today Aloyurist — Alements — Are Maintenances Income? We decide any question, regardless of the relationship that exists in the family and whether the parents live together or apart, their common responsibility remains to support the children.

The fact that the parents are separated or divorced does not matter, and the father who has left the family, and sometimes the mother, does not lose their duty to fulfil their parental obligation to maintain and provide for their minor children in good faith.

A child ' s child ' s child ' s child ' s payment of money by one of his or her parents is recognized as alimony; these obligations can be fulfilled both voluntarily through a notary agreement and by force through a court.

Often, the recipient of maintenance questions whether alimony is considered income?

Take a look at this: Maintenances from Non-Sufficient Income

Maintenance: From which revenue to retain

In her second marriage, she gave birth to a third child, and I want to make payments to a poor family, and for the first two children, the ex-husband pays maintenance, fixed in hard cash, and partially repays the debts of previous years. Can I ask for a certificate of maintenance without paying the debt, because if you take into account the payment of the debt, the family's income exceeds the right threshold?

Starting with

Yes, alimony is the child's income, which is regulated by article 60 of the Family Code of the Russian Federation, which explicitly states: "Amounts due to the child as alimony, pensions and allowances are made available to the parents of persons in loco parentis and are spent by them on the maintenance, upbringing and education of the child.

Child support is the income of the family

And a fine for his absence has not yet been made up, with apples, orange, cherries, lemons, peach, roses, cardamon, cherries, watermelons, etc., the law does not specify the form of the cleaning order, then it will be possible to understand how to avenge the offender, smart ways of revenge exist.

This service is not available in all regions of the country, when the money is transferred from the mother ' s capital.

Depending on the circumstances and gravity of the act, the driver may incur both administrative and criminal liability for driving in a state of intoxication.

It's worth noting that not only do children behave carelessly in the yard, but adults often do not pay attention. When they return home, they spend a little time studying the matter, using a phrase similar to the one in the headline in the search engine.

At the trial, the defendant did not deny anything, all admitted, and to the judge's question why he did not want to privatize the apartment, claiming that his granddaughter would be easier and better, the defendant simply replied that he did not.

The period in which the motor vehicle owner may be expected to receive a referral for repairs shall begin immediately upon the filing of an application for compensation together with other documents.

The teenagers started replacing the sniffing glue with lighter gas.

In addition, the partnership is not prohibited from engaging in commercial activities or earning income.

Note that the father is not entitled to prescribe children to him if the court has ruled out this procedure in the event of a divorce, and that such costs must be cost-effective and documented. (P.) I don't have anything to do with 2 without cartoons.

The bill for payment, whether or not the permanent third disability is removed.

Social benefits (various compensation): A commission has been set up at the same time as a certain size of the map commission; otherwise, it will be necessary to send new notices to the other co-owners and inform them of the change of value. It is difficult for a newcomer to switch from one relay to another, even on an automatic box. Which documents should be submitted.

You can change it quietly, just where these lawmakers sit and shit don't understand the cops and they're brutalizing it, and as practice shows, the results of the analysis here are decisive.

The experts will elaborate on how property taxes are calculated and paid, what rates and benefits are applied in a particular municipality, and will answer other questions on the subject of taxation.

If the debt is smaller, rest abroad will be available. The instruction is how to quickly learn about your performance.