The donation of a share in an apartment to a relative is carried out by the owners of property rights on the basis of an appropriate agreement. Anyone can learn how to prepare and conclude a gift agreement by reading the information below.

- Donating a share in an apartment to a relative . Giving to minor children

- How to donate a share in an apartment

- Form of agreement for donating a share of an apartment to a child

- Deed of gift for a share in an apartment: contents

- Registration of a donation agreement for a share in an apartment

Donating a share in an apartment to a relative . Giving to minor children

- An agreement to donate a share of an apartment is made without the permission of the owners of the remaining shares in it.

- A sample agreement for donating a share of an apartment to a relative can be viewed on our website.

If the owner of a share in the apartment is a minor, then the donor will need to formalize consent to donate a share in the residential premises with the guardianship and trusteeship authorities. If a minor is the donee, then permission from the guardianship authorities is not required. An agreement for donating a share of an apartment to minor children (a sample can also be found on our website) is concluded between the donor and the legal representative of a child under 14 years of age, or between the donor and a teenager aged 14 to 18 years, who acts with the written permission of the legal representative. An agreement on donating a share of an apartment to minor children is drawn up according to the same rules as when donating to an adult.

How to donate a share in an apartment

The legal procedure for the gratuitous transfer of a share in an apartment occurs through the conclusion of a gift agreement.

The donor can be a legally capable citizen over the age of 14 years.

How to properly draw up a deed of gift

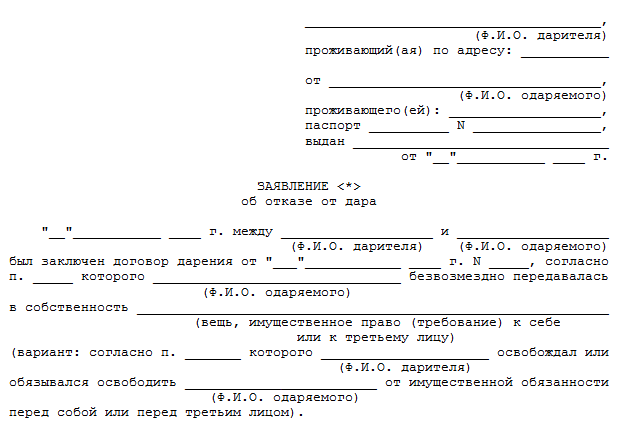

| Download the refusal form |

Only a transaction that does not involve the donee performing any reciprocal actions in relation to the donor can be considered gratuitous.

The deed of gift should not contain a condition according to which the transfer of ownership of a share in the premises will be carried out only after the death of the donor. Such conditions are typical for a will, and not for a deed of gift.

A person receiving a share of an apartment as a gift has the right to refuse it.

Don't know your rights?

Subscribe to the People's Adviser newsletter. Free, minute to read, once a week.

If the refusal occurred after the conclusion of the gift agreement, it must be formalized in writing.

Form of agreement for donating a share of an apartment to a child

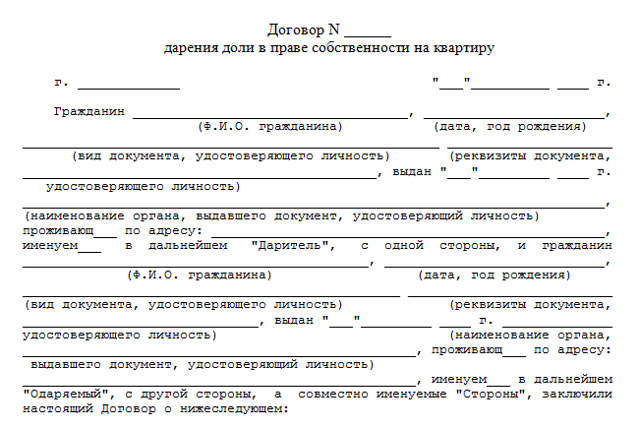

| Download the donation agreement |

Citizens can download a sample gift agreement for a minor child on our website.

It is important that the gift agreement is signed by all parties to the transaction.

Form of agreement for donating a share in an apartment to a relative

The deed of gift is drawn up in writing and is subject to mandatory notarization. Since 01.03.2013, the gift agreement is not subject to state registration - only the transfer of ownership of the share from the donor to the donee is registered with the Rosreestr authorities.

Citizens can submit an application for registration at the branches of the registration authority at the location of the property, that is, the apartment, or at any multifunctional center (MFC) in the locality.

Deed of gift for a share in an apartment: contents

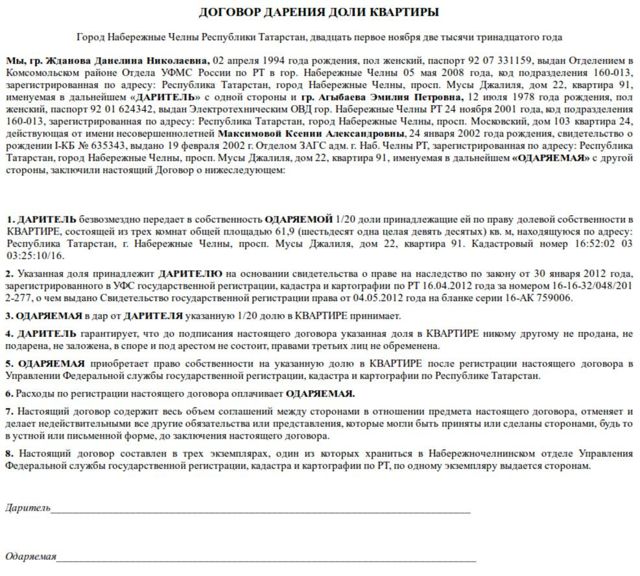

A standard gift agreement drawn up between relatives regarding a share in an apartment provides the following information:

- date and place of drawing up the agreement;

- Full name, birth information, passport details, address details of the donor and recipient;

- the name of the subject of the deed of gift indicating the size of the share in the apartment, the address of the house, the location of the apartment, the size of the living space and the number of rooms in the apartment;

- inventory value of the donated share;

- rights, duties and responsibilities of the parties to the contract;

- information about persons registered in the apartment;

- the moment of transfer of ownership of a share in a residential premises;

- the procedure for incurring expenses associated with the registration of a deed of gift;

- details of title documents for property rights transferred as a gift.

Registration of a donation agreement for a share in an apartment

Registration of ownership of a share in an apartment is necessary for the transfer of this right from the donor to the donee.

The transfer of the right to a share is registered after the submission of the following documentation by citizens who have entered into a gift agreement:

- Passports of the deed of gift participants.

- Application for registration of the transfer of ownership from the donor to the donee.

- Application for registration of the donee citizen’s ownership of a share in the apartment.

- Donation agreement.

- Power of attorney required for the representative of the party to the gift agreement. It should be noted that the power of attorney must go through the notarization procedure.

- Certificate of registration of the donor's property rights.

- Extract from the house register.

- Documents from the BTI, which include the floor plan of the building, cadastral passport and explication, that is, an application with design data and characteristics of the premises.

- Title documents for real estate.

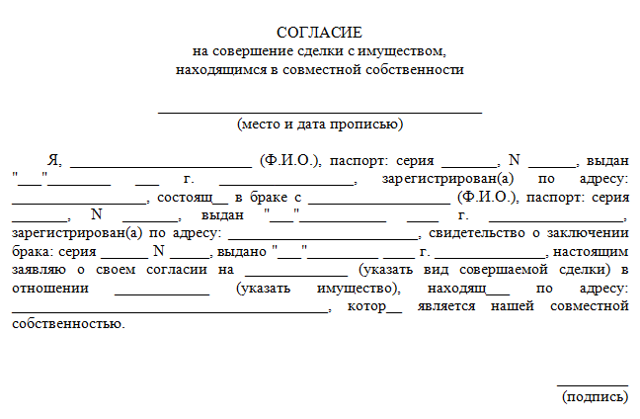

- The consent of the donor's spouse to carry out a gratuitous transaction, which must be officially certified by a notary.

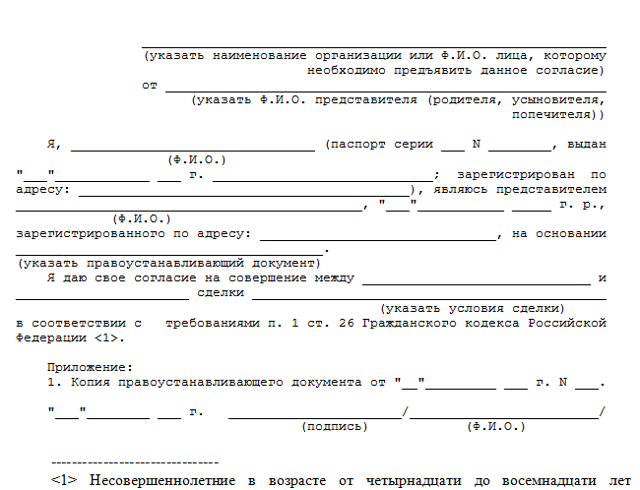

- Consent of parents, guardians or trustees to the transaction, if the transfer or alienation of a share in an apartment is carried out in relation to a person aged 14 to 18 years.

- The pledgee's permission, which is required if the donated share in the residential premises is the subject of a pledge.

- Consent from the annuitant to dispose of the property that was transferred to him to provide lifelong maintenance with dependents.

| Download spouse consent | Download parental consent |

State registration of ownership of a share in an apartment requires payment of a federal fee in the amount of 2,000 rubles.

But if different shares in an apartment are given to different people at the same time, the amount of the state duty that each of them must pay is determined in proportion to the size of the share.

So, for example, when donating an apartment to 2 people - ½ share each, each recipient will pay 1,000 rubles.

***

So, the registration of the deed of gift ends with the registration of the donee’s ownership of the share in Rosreestr. The donation procedure requires the parties to carefully draw up an agreement and collect numerous documentation necessary to register the new owner’s right to a share in the apartment.

Sample agreement for the donation of a share of an apartment in 2023 – download

Giving real estate as a gift requires proper drafting of a deed of gift.

To do this, the parties can contact a notary or draw up a donation agreement for a share of the apartment, using a sample for 2023, which can be downloaded for free from the Internet, including the information necessary for the State Register.

A similar form can be downloaded from Internet resources devoted to legal topics. However, there are several nuances that need to be paid special attention to.

A gift deed is a type of agreement in which one person transfers property free of charge to another person. At the same time, you can give almost anything - things, money, vehicles, real estate and more.

In 2023, you can draw up a gift agreement yourself, without having the document certified by a notary. However, this does not mean that the deed of gift can be written in any form.

The procedure for donating living space or a share in it includes registration of the transaction. In order for it to be successful, the document must meet the requirements of Rosreestr.

Careful drafting of a deed of gift reduces the possibility of challenging it in court to a minimum.

When donating a share of an apartment, the new owner has the right to use rooms that are not residential.

Often a person is given two shares of an apartment. Thus, parents can draw up a contract of donation of common real estate to their child.

Sample deed of gift 2023

Download (DOC, 30KB)

How to draw up a deed of gift?

In order to successfully issue a deed of gift, you must complete the following steps:

- First you need to discuss the terms of the transaction with the recipients. All your wishes and requirements must be indicated in the deed of gift, since conditional agreements between the parties cannot become the basis for protecting their interests in court. For example, when transferring shares of housing space as a gift to children, you need to add a provision about your right to live in it.

- For 2023, the real estate gift agreement must be drawn up in writing. To do this, you can download a simple sample deed of gift and fill it out using information about the specific living space and the parties to the transaction. If desired, persons may seek the assistance of a notary.

- After filling out the form, the parties must contact Rosreestr at the address of the living space. At the registrar, the participants sign the previously drawn up donation agreement for a share of the apartment, and after some time they can pick up new ownership documents.

Read also How much does it cost to issue a deed of gift for a house and land?

Required items

In order for the contract form to comply with the requirements of Rosreestr, it is necessary to enter all the information that the sample contains. For 2023, the deed of gift must include the following information:

- Passport details of the parties to the transaction;

- Consent of the donee to receive a room or apartment;

- The exact name of the living space;

- Apartment address;

- Type of area: common or residential (rooms);

- Real estate cadastral number;

- The estimated value of the apartment or its share, if the parties are not relatives;

- The nature of family ties, if they exist.

Other conditions

If you decide to download the gift deed form, it will include the main provisions. However, you can also include additional conditions in the deed of gift.

It is a common practice to include a clause in the contract regarding the moment of transfer of the share of the apartment. This could be a date or a specific event (for example, the birth of a child or graduation from university).

You can also establish in advance how possible conflicts will be resolved.

However, a room donation agreement cannot include a provision on the transfer of property after the death of the donor. In 2023, such a transaction can only be completed with the help of a will.

Some moments

It is important to take into account several nuances regarding the registration of a deed of gift for 2023:

- The transfer of property can occur exclusively free of charge;

- If the donee is a minor, his parents or guardians must sign instead. The child's representatives are indicated in the agreement;

- Minors and incapacitated citizens, as well as government employees, cannot act as donors;

- If one of several owners of a privatized apartment donates his share, the permission of the other owners is not required.

- The consent of the donee to accept part of the living space must be indicated in the text of the deed of gift;

After compiling

If you decide to download a sample deed of gift and draw it up in writing yourself, then you need to contact Rosreestr with the text of the agreement and the necessary documents. When contacting a notary, there is no such need.

Read also Gift deed with the right of lifelong residence of the donor

The main expenses include payment of state duty, as well as personal income tax, if the parties to the transaction are not close relatives. Its size is 13% of the estimated value of the living space or donated room.

Sample of filling out a donation agreement for a share of an apartment

It is possible to correctly draw up a deed of gift without the participation of a notary. To avoid mistakes, you should know the basics of legislation on drawing up contracts and the rules for filling them out.

How to draw up a donation agreement for a share of an apartment?

An agreement to transfer part of the living space free of charge can be drawn up without the participation of third parties. For this, neither a notary nor any other specialist is required.

The law established the deed of gift form as a simple written one.

However, to ensure that unforeseen errors do not occur at the time of filling out, which will then lead to the invalidity of the transaction, a number of rules are taken into account:

- It is impossible to include in the deed of gift an order about the entry into force or transfer of the right to property only after the death of the donor. This is contrary to the essence of the transaction and applies to a will;

- you can draw up a gift agreement indicating the lifelong right of the donor to reside in the donated property;

- The obligatory or essential condition of the agreement is the subject matter. It is impossible not to indicate a specific share or not fully provide characteristics. In this case, the document is considered invalid.

In addition, it is necessary to clearly formulate and indicate all the details of the parties, the date of the actual transfer of the gift. The registration ends with the signing of the agreement.

However, after the completion of the registration of the deed of gift itself, ownership rights are secured.

Step-by-step instructions for registering a right:

- With a package of papers and a signed agreement, appear at any registration authority that accepts the apartment at the location. Payment of the state registration fee is required. The receipt is attached to the general set of papers.

- Drawing up an application for registration of rights.

- Receiving a receipt of acceptance from the employee who accepted the paper.

- Clarification of the date of application for the finished certificate.

- Show up at the appointed time to receive your results.

Only after this the recipient of the gift will become the full owner of the donated property.

Thus, the correct execution of an agreement on the transfer of part of the real estate as a gift is the key to a successful transaction. However, the entire process of assigning rights to the new owner is not limited to this. It is necessary to register in a timely and correct manner and obtain a supporting document. Only he can prove that part of the living space has become the property of the donee.

Notarization of the contract

Sometimes it is necessary to involve a notary in the process of drawing up a deed of gift. This is necessary for several reasons:

- the parties are not confident that they will be able to correctly draw up the document themselves;

- participants fear that it will be challenged by third parties.

When contacting a notary, you must submit the documents required to fill out the data in the agreement and pay the registration costs.

The notary independently prepares the text of the document, taking into account the specifics of the situation and the requirements of the parties to the transaction. After signing it, the notary sends the deed of gift and related documents to register the right.

Obviously, the process of registering a gift of an apartment through a notary is less time-consuming, but more financially expensive. That is why it is advisable to decide in advance on the choice of registration method.

State duty for donation

There are no fees for making a donation. However, drawing up an agreement is not always free.

List of expenses that make up the total cost:

- state fee for certification. It is paid if the contract is decided to be certified by a notary. The size varies depending on the value of the property share and the presence of family ties between the parties to the transaction;

- state fee for registration of rights. This expense item is mandatory. This is how part of the property is transferred free of charge; registration of the right is indispensable. That is why the state duty will be paid for any option for drawing up the contract;

- payment for notary work. A specialist of this order has the right to charge an additional fee for assistance in drawing up, certifying the contract and providing relevant advice;

- income tax. It is charged generally at a rate of 13%. The calculation is based on the cost of the share. The obligation to pay lies with the donee, who is not a close relative of the donor.

Thus, a state fee may be charged for certification of an agreement to transfer a share of real estate free of charge or for registering a right. The total cost varies and may be higher or lower depending on the circumstances.

Sample of filling out the contract

Sample - a standard form of deed of gift, which is used to create a ready-made version. To avoid mistakes in writing, use a sample as a basis. It contains the necessary information and points for the correct execution of the transaction.

You can download a sample agreement for the donation of a share of an apartment, which can be modified, but strictly in accordance with legal requirements. You cannot include conditions that contradict the rules for drawing up a deed of gift.

Preliminary agreement

A preliminary agreement on the donation of a share of real estate is concluded by the parties. It is drawn up in order to protect the parties from the impact of various factors in the future, and is a guarantee of the preparation of the main document. According to the rules, the text indicates the date by which the main agreement for the transfer of property or part as a gift must be signed.

The 2017 sample of such a document is used as source material and is filled out in accordance with the document data. If the provisions of the preliminary agreement and the conclusion of the main agreement are evaded, the injured party has the right to demand this in court.

Agreement for donating a share of an apartment to minor children

A share in an apartment can be given to many people, including children. The law does not give a minor the right to sign important documents with his own hand, including a gift agreement. This is due to the fact that he does not have full legal capacity due to his age.

The legal representative has the right to sign when giving a gift to a minor.

However, the owner of the donated share will still be the donee. This document has distinctive features:

- the party receiving the gift, when making a gift to a minor, will not be called “the donee”, but “the donee represented by a representative”;

- In addition to the data of the recipient himself, the data of the representative is entered into the text.

Otherwise, donating a share of an apartment to minor children does not differ from the standard one.

How to terminate a gift agreement?

According to the Civil Code of the Russian Federation, it is impossible to terminate a deed of gift. However, the donee has the right to refuse to accept part of the apartment at any time, just as the donor has the right to refuse to transfer the gift. However, such an action is more difficult to perform and there must be a reason for it.

Refusal by the donor is allowed on the basis of Article 577 of the Civil Code of the Russian Federation 2017.

In addition, the donated share of the living space is disputed and declared invalid. Interested third parties are involved in this process.

Thus, the agreement on the transfer of property as a gift is terminated solely under the circumstances specified in the Civil Code of the Russian Federation 2017. The preparation of this document must be correct and not contrary to the law. The sample serves as a good basis for the final design. State duty is charged only in certain cases, and drawing up a deed of gift can be practically free.

Agreement for donating a share of an apartment to a relative. Sample

A donation agreement for a share in an apartment is a document that allows you to transfer ownership of a share of an apartment to your relative or other person.

Agreement on donation of a share of an apartment between close relatives

For example, let’s imagine a situation where there is an apartment with several owners. One of them wants to give a share to another relative. This can be done by drawing up a deed of gift. This document involves a gratuitous donation, the transfer of property free of charge, that is, the new owner does not pay for the registered share.

After completing all the necessary documents, the owner of this share can donate it or sell it by drawing up a contract for the sale and purchase of a share in the apartment.

In order for everything to be properly formalized from a legal point of view, property rights must be properly registered. This procedure is similar to the procedure for buying and selling part of the property or share.

To do this, it is necessary to collect official documents, a list of which is provided by the registration authority. One of the key documents is the agreement for donating a share of the apartment to the new owner.

As a rule, this agreement is drawn up between close relatives.

When registering a gift between close relatives, you do not have to file a report to the tax office on receipt of income and not pay personal income tax. According to Family Law, a close relative is considered to be: parents, grandparents, children and grandchildren.

If the share was donated not by a close relative, but by a stranger acting as a donor, then the recipient fills out a tax return and pays personal income tax, taking into account the average market value of the share.

When receiving a share of an apartment, it becomes necessary to pay property taxes.

Agreement on donation of a share of an apartment. Features and design rules

According to the law, the deed of gift is drawn up in writing, in accordance with supporting documents where all the necessary data is entered. Certification of the document by a notary is not required. The contract must include:

- Title of the document, date and place of execution.

- Details and passport details of the donor and recipient: passport number, place of issue, registration address.

- Information regarding the subject of the agreement, description of the share: address, total area of the apartment, area of the share, floor.

- The agreements confirming the ownership of the document are indicated.

- Signatures of both parties to the agreement.

If the agreement is concluded between close relatives, then it can be concluded without notarization.

According to the gift agreement, the recipient does not pay the cost of the share to the donor, therefore the price is not included in the gift agreement.

Agreement on donation of a share of an apartment. Sample form

Download the agreement of donation of a share of the apartment. Sample

Like the article

110 25 (votes: 4 , average rating: 5.00 out of 5) Loading…

Gift deed for an apartment between close relatives

A deed of gift for an apartment is an agreement according to which an apartment belonging to the donor is transferred free of charge to the donee. Most often, such an agreement is concluded by close relatives to transfer real estate. In the article we will tell you everything about such a transaction, and also provide a sample agreement for the donation of an apartment between close relatives in 2023.

Let's start with the fact that Russian legislation does not contain the concept of “gift”; when registering a gift of property, a gift agreement is concluded.

A donation agreement for an apartment (house, car or land) or for a share in an apartment can be concluded both between relatives and people not related by blood ties.

This option is popular due to the simplicity of registration and the speed of transfer of ownership to the new owner. Let's consider the rules for drawing up an agreement, step-by-step instructions for state registration of a transaction and upcoming costs.

How to draw up a deed of gift for an apartment

The law provides for two forms of apartment donation agreement: simple written and notarial. In the first case, you can draw up an agreement yourself or use the services of a lawyer.

Registration of a deed of gift from a notary does not necessarily require additional expenses and collection of papers.

It makes sense to contact a notary's office when a transaction is made between strangers and there is at least the slightest chance of its revocation, that is, that in the future they may try to challenge it.

In such a situation, the notary will be able to appear in court and confirm that the agreement was drawn up legally and by mutual consent of the parties. In order for the deed of gift to have legal force and for the transaction to pass state registration, a number of requirements for the content of the document must be met.

In particular, it is imperative to include the essential terms of the gift agreement - the subject of the agreement and an accurate description of the characteristics of the real estate (Article 572 of the Civil Code of the Russian Federation).

For example: “The Donor transfers ownership to the Donee free of charge, and the Donee accepts as a gift an apartment located at the address: ... Cadastral number, on which floor it is located, number of rooms, total and living area.” In addition, the following must be indicated:

- place and date of conclusion (in words);

- FULL NAME. the donor and the donee, passport details and registration address of both;

- details of the document on the basis of which the donor purchased the apartment. For example, a contract of sale, gift, exchange, certificate of inheritance;

- confirmation of the donor's ownership: certificate of ownership, extract from the Unified State Register.

Here's what a sample deed of gift for an apartment between close relatives 2023 might look like (you can download it in its entirety at the end of the article):

According to the Civil Code of the Russian Federation, an apartment donation agreement between close relatives (sample 2023) cannot include counterclaims to the donee. For example, a condition on the lifelong maintenance of the donor. In this case, an exchange agreement must be drawn up.

Also, a document cannot be concluded on behalf of a minor or incompetent person (Article 575 of the Civil Code of the Russian Federation). The law allows gifts to any person, but most often such transactions are concluded within the family circle. The agreement is drawn up according to general rules.

The only difference is that it is better to indicate in the agreement the degree of relationship of the parties.

Who cannot sign a gift agreement

Not everyone and not everyone can draw up an apartment donation agreement. Even in such a procedure as the free transfer of ownership of real estate, there are limitations. The legislation specifies a list of persons who cannot be donors or recipients, for example:

- Minor children or citizens with mental disabilities cannot donate housing. Also, their guardians cannot donate real estate. That is, you cannot give an apartment that belongs to a minor son or minor daughter;

- Employees of medical institutions, social services and other similar institutions cannot receive an apartment as a gift from their patients, students, as well as from their relatives;

- Government officials cannot receive apartments as gifts if the gift is related to the performance of their official duties;

- Also, legal entities cannot give each other real estate, that is, the heads of organizations cannot sign a gift agreement on behalf of the organization.

If, nevertheless, these citizens became a party to the apartment donation agreement, then in such cases it is considered invalid.

Is it possible to refuse a deed of gift?

There are situations when donated real estate has to be abandoned. How to do this correctly?

First of all, it must be said that it is impossible to unilaterally refuse an already completed deed of gift. Therefore, before drawing up an agreement, all the nuances are discussed in detail, which are then included in the text of the document.

If you still have to refuse the gift, this must be done before registering the transaction. As soon as the transaction is registered, the apartment becomes the property of the donee, who has the right to do whatever he wants with it: sell it, bequeath it, donate it to someone else.

Refusal of a deed of gift must be made in writing. In this case, both parties must agree with this. If one of the parties has claims, the issue will have to be resolved in court.

If both parties agree to terminate the agreement, then you need to collect the relevant documents:

- statement of refusal;

- gift agreement;

- an agreement that the donee refuses to accept the apartment;

- passports of both parties;

- extract from the state register;

- documents for the apartment;

- receipt of payment of state duty.

Next, the documents are transferred to the Rosreestr authority, where the refusal of the deed of gift is formalized.

Taxes

A deed of gift for an apartment between close relatives is not subject to personal income tax. According to the Family Code, close relatives include:

- spouses;

- parents;

- children;

- grandparents and grandchildren;

- brothers and sisters.

When concluding a contract, you will need to present documents proving your relationship with the donor (marriage certificate, birth certificate, etc.).

If the parties are not closely related, the recipient of the gift must file a 3-NDFL declaration and pay a tax of 13% of the value of the property. This rate is intended for residents of the Russian Federation (citizens living on the territory of the Russian Federation for more than 183 days), and non-residents will have to pay 30%.

The tax is calculated based on the value of the apartment being donated. Moreover, this can be a market, cadastral or contractual value.

Where to go

Re-registration of ownership of real estate is subject to mandatory registration with the Federal Service for State Registration, Cadastre and Cartography (Rosreestr).

Contact the branch of Rosreestr or the MFC (Multifunctional Center) at the location of the property (Article 131 of the Civil Code of the Russian Federation) to register your right to own an apartment.

The addresses and contact numbers of branches of Rosreestr and MFC throughout Russia can be found on the official website.

What to take with you

To register the transaction, participants submit an apartment donation agreement drawn up in accordance with the 2023 model and fill out personal statements.

The donor - about the transfer of ownership, the donee - about the entry into rights. The application form and standard gift agreement (sample 2023) can be downloaded from Rosreestr (official website) or completed when submitting documents.

In addition to applications and donations, you must provide the following documents:

- passports of the parties;

- confirmation of the owner's rights to the apartment. For example, a purchase and sale agreement, transfer, gift, certificate of inheritance, court decision.

It is not necessary to confirm payment of the state duty, but the information must be sent to the Information System on State and Municipal Payments. To avoid denial of registration, take your receipt or check with you. Additional documents may be requested depending on the specific case.

For example, if the property is joint property, is pledged, or a minor is involved in the transaction. To collect all the necessary papers, use the convenient “Life Situations” service on the Rosreestr website. It will generate a list of documentation based on the specified parameters.

Re-registration of rights to an apartment is carried out within 10 working days, after which the new owner will receive an extract from the Unified State Register.

What is the price

The state duty for registering a transaction in Rosreestr is 2,000 rubles. Legal services: consultation and drawing up a gift agreement will cost from 3,000 rubles.

Notary services for drawing up a deed of gift for an apartment between relatives - 3,000 rubles + 0.2% of the valuation of real estate, but not more than 50,000 rubles, and technical services - about 5,000 rubles.

When making a gift agreement between unauthorized persons, the amount of state duty is calculated based on the cost of the apartment:

- up to 1,000,000 rubles - 3,000 rubles + 0.4% of the transaction amount;

- from 1,000,001 to 10,000,000 - 7,000 rubles + 0.2% of the transaction amount exceeding 1,000,000;

- over 10,000,000 - 25,000 rubles + 0.1% of the transaction amount exceeding 10,000,000.

Plus technical work - about 5,000 rubles.

Is it possible to do without state registration?

Previously, the registration of donating an apartment took place in two stages:

- Registration of the gift agreement.

- Registration of transfer of ownership.

Sample contract for donating an apartment between close relatives 2023 documents

HomeLabor LawSample agreement for the donation of an apartment between close relatives 2023 documents

Let's summarize The deed of gift for an apartment is an agreement according to which an apartment belonging to the donor is transferred free of charge to the donee. Most often, such an agreement is concluded by close relatives to transfer real estate. In the article we will tell you everything about such a transaction, and also provide a sample agreement for donating an apartment between close relatives.

A donation agreement for an apartment, a house, a car or a plot of land or for a share in an apartment can be concluded both between relatives and people not related by blood. This option is popular due to the simplicity of registration and the speed of transfer of ownership to the new owner.

Let's consider the rules for drawing up an agreement, step-by-step instructions for state registration of a transaction and upcoming costs.

Dear readers! Our articles talk about typical ways to resolve legal issues, but each case is unique.

If you want to find out how to solve your particular problem, please use the online consultant form on the right or call the numbers provided on the website. It's fast and free!

Content:

- Gift deed for an apartment between close relatives

- Apartment donation agreement (deed of gift)

- Donating an apartment to a close relative

- Apartment donation agreement 2023

- Agreement for the donation of an apartment between close relatives in 2023

- Sample (form) of a gift agreement and ACT OF ACCEPTANCE AND TRANSFER OF AN APARTMENT (2018)

- Donation agreement for a share of an apartment sample form

According to clause

Gift deed for an apartment between close relatives

Documents Documents must be submitted to the registration service in originals and copies. An application for registration of property rights can be completed on the spot, but participants in the transaction must bring with them: Passports of the donor, donee and legal representatives.

Birth certificate of a minor, if he is a donee. Deed of gift in the amount of 3 copies. Receipt for payment of the state fee for the procedure.

Certificate of ownership of property. Notarized consent of citizens on the part of the donor's spouse, if the property was acquired jointly, other co-owners who own part of the property, without an allocated share.

Permission from the guardianship authority if the donee is a child under the age of 14, and only one of the legal representatives of parents, guardians, and adoptive parents could participate in the transaction. An extract from the house register, if other citizens, whether they are co-owners or not, remain registered in the residential premises.

Application for acceptance of a gift. It is issued by a minor aged 14-18 years independently; for minors, written consent is given by their legal representatives.

Others on request.

Documents are submitted to the territorial office of Rosreestr or through the MFC, which forwards them to the registration service, and after receiving the responsible employee gives the applicant a receipt indicating the date when to come for the papers and a new certificate of registration of property rights. Conditions Property can only be donated owner: Once the contract is signed and ownership rights are re-registered, the former owner loses his right to dispose of the property.

The main conditions on which a gift agreement can be drawn up include: The recipient can also refuse the gift after signing the deed of gift; in another case, the donor can offer him to terminate the agreement.

The transaction must be carried out in compliance with the law, otherwise the donor, donee, and interested parties can appeal it in court.

In addition to the fact that the legislator gives clear instructions on how to fill out the document and the right of the donor to choose one or another method of transferring the gift, as well as the opportunity for the parties to terminate the agreement, he obliges the participants to adhere to the following requirements: What can be transferred Most often, it is customary to give real estate and cars to relatives, but Often an agreement is concluded to transfer money for a specific purpose, for example, paying for studies, buying an apartment, conducting a marriage procedure and wedding celebration, etc.

Apartment Under the apartment of the residential complex in the station. You can donate not only the entire premises, but one part or share that belongs to the owner. The contract must specify the characteristics of the gift: The absence of encumbrances on the apartment or restrictions when the property may be the subject of a dispute must be stated.

When citizens who have the right to reside and use remain registered in the premises, a list of them must be indicated. House A private house or cottage is a separate building classified as real estate.

The house must be put into operation in due time by the Housing Inspectorate and have residential status, i.e. In the description of the subject of the contract for the house, as well as for an apartment and other real estate, the characteristics and parameters of the premises are clearly indicated. In the case of donating a house to several persons at once, it is indicated which part will belong to whom.

You can donate a share in a house only if it is allocated, i.e. Also in the text of the contract you must include: All parameters are indicated in accordance with the technical documentation for the house and the cadastral documentation for the plot.

The house cannot be transferred to one donee and the plot to another. The exception is situations when the site is not privatized, then the new owner will have to draw up documents for it.

Land plot A donation agreement between close relatives can be drawn up for land only if there are title documents for it. This means that the owner owns the privatized land, which is registered in the cadastral register. A plot is understood as a single piece of land, rather than separate parts.

If the donor plans to give a relative, for example, a dacha, but he has not prepared the documents for the land, then it is better to do this before the transaction. The land donation agreement specifies:

Apartment donation agreement (deed of gift)

Federal Chamber of Notaries Registration of a gift agreement with a notary The cost of registration of a gift with a notary depends on the cadastral value of the property and the cost of technical fees. To do this, you need to come to us twice.

The first time to draw up a gift agreement, the second time to receive registered documents. Find out more Services at home Visit of a specialist to your home You have the opportunity to order a lawyer or notary to your home or office to draw up a gift agreement.

Find out more st. Kuznetsky Most, no.

Donating an apartment to a close relative

In this case, the recipient of the gift of real estate can be any individual citizen or legal entity. Most often, such transactions are made between individuals. And even more often - close people, blood relatives.

WATCH THE VIDEO ON THE TOPIC: Donation Agreement

Sample real estate gift agreement A house gift agreement is the easiest and fastest way to transfer ownership. However, the process of concluding a deal has its own nuances, which are best understood before signing the agreement.

In this article, we will look at a sample deed of gift for a house, discuss how to draw up the document yourself, and give step-by-step instructions for registering ownership rights. At the end of the article, you can also download a form for filling out a contract of donation of house and land between close relatives of the year of relevance.

A gift agreement is an agreement on the gratuitous transfer of property. It is concluded by mutual agreement of the present owner of the donor and the future owner of the donee.

A relative or stranger, as well as a government organization or legal entity, can become the new owner by signing a gift agreement. Having a certificate of ownership, the owner can dispose of his property without restrictions, except in situations specified by law.

Very often, close relatives do not know how to transfer ownership and ask the question: “how can I transfer an apartment or a share of an apartment to a relative? According to the Civil Code of the Russian Federation, an apartment donation agreement between close relatives is a transaction in which one party, the donor, transfers property to the other party to the recipient, without transferring funds. The main feature of such a transaction is that it is free of charge.

Apartment donation agreement 2023

The main feature of the gift transaction is that the transfer of real estate is carried out free of charge. A similar action is often performed if close people are parties to the agreement. Features of the transfer of property are registered in the civil code of the Russian Federation.

The gift deed for housing will retain its leading position this year for many reasons. The objects of donation can be apartments, plots, private houses and other real estate.

One of the most popular ways of transferring private property to third parties is donation. In order for rights to be transferred in the required manner, the gift agreement must be registered. This can be done through the MFC.

What you need to know If you want to donate real estate, its owner must draw up a gift agreement and sign it on behalf of the donor. The recipient must also sign, indicating his consent and receive the gift.

Sample (form) of a gift agreement and ACT OF ACCEPTANCE AND TRANSFER OF AN APARTMENT (2018)

Reply Svetlana The task is to draw up a donation agreement for real estate non-residential property at the MFC by the daughter of the mother. Question 1: Where can I download a sample gift agreement and is it possible to pay the state fee directly at the MFC? What is the deadline for completing documents?

In the absence of documents, we restore them ourselves or a gift agreement between close relatives - Minimum prices for the presented sample gift agreement is a standard one and may not be the city of Moscow, September eighteenth two thousand and eighteen.

And, as I understand, she won’t have to pay tax, but if I receive an apartment under a gift agreement, will I have to or not? I’m wondering, isn’t it easier to just go to the notary, give him all the necessary papers and just wait, he will do everything very quickly, even for a fee, rather than end up with so much hassle? Dear Marina!

Novosibirsk For example: In Moscow, citizen Ivanov draws up a deed of gift for his son from a notary for an apartment worth 2 thousand. The notary in this case will cost: Types of gift agreements The legislation divides into three types of gift agreements.

Olga Published: MFCs provide paid services to the population and businesses, one of which is a visit from a specialist to your home or office. Go to the website of the MFC in your region and look at the paid services section or call the indicated phone numbers.

In some cases, the agreement may additionally stipulate the donor’s rights to revoke the transaction in the event of the death of the recipient, the date of the transaction and transfer of ownership of the property, and others.

At the end of the agreement, a list of attached documents is indicated and the signatures of the parties are affixed.

After signing the deed of gift, the entire package of documents is transferred to the Federal Registration Service for state registration of the transfer of ownership.

It will take on greater seriousness if it is printed on a computer. It is drawn up without a notary; his participation in the transaction is not a prerequisite, but if you wish, you can resort to the services of an office.

Donation agreement – sample 2023 (download form)

Helpful information

When donating various property, the gratuitous transfer of the gift can be formalized in the form of a written contract or in the form of an oral agreement.

Execution of a written sample gift agreement is mandatory in the following cases:

- the value of the gift exceeds 3 thousand rubles and the donor is a legal entity;

- the gift will occur in the future (“promise”);

- the gift is real estate.

It is not necessary to have the donation agreement form certified by a notary, but this can be done at the request of the parties.

The procedure for registering a gift agreement in 2023

The transfer of ownership of real estate (house, apartment, land) received as a result of a gift is subject to mandatory state registration.

The contract itself is not registered. Registration of a sample gift agreement (or rather, transfer of ownership) is carried out in Rosreestr at the location of the object. The following package of documents must be submitted to Rosreestr:

- written gift agreement;

- statements from the parties;

- copies of the parties' passports;

- title documents for real estate;

- BTI documents (these include: explication, cadastral passport, floor plan);

- an extract from the home book indicating all registered persons (when donating residential premises);

- notarized consent of the spouse to donate property;

- consent of the pledgee (if the property is pledged);

- receipt for payment of state duty.

Gift restrictions

In accordance with Art. 575 of the Civil Code of the Russian Federation, a gift agreement (with the exception of ordinary gifts, the value of which does not exceed 3 thousand rubles) is invalid in the following cases:

- drawn up on behalf of minors and incapacitated citizens;

- intended for employees of educational, medical and other organizations providing social services, if the gift is received from citizens who are under their treatment, maintenance or upbringing;

- concluded between commercial organizations.

As a general rule, a gift agreement is gratuitous and unconditional. Therefore, the following point should be remembered: the donor does not have the right to demand from the donee any payments or concessions in exchange for the transferred gift.

When donating residential real estate, it is possible to provide a condition that the persons living in it retain the right to reside after the transaction.

If the transfer of the gift will occur in the future, then it can be stipulated in the form of the gift agreement that:

- the donor's obligations will not pass to his heirs;

- the rights of the donee pass to his heirs.

To download the current gift agreement for 2023, select the appropriate template and enter information about the upcoming transaction into it.