Samples of gift agreements Donation of property to mother or father Donation, regulated by Chapter 32 of the Civil Code of the Russian Federation, Civil Code of the Russian Federation, is usually made between members of the same family, or relatives. Quite often, children like to give gifts to their closest people - their parents. Moreover, such gifts can be of any category and value, provided that they are not withdrawn from circulation. At the same time, the execution of such transactions requires minimal costs and, importantly, there is no taxation when they are completed. How to formalize a gift to a mother or father In relation to registering a gift between relatives, it is necessary to understand who is included in this circle of subjects. The current legislation of the Russian Federation distinguishes between two categories of relatives.

Dear readers! Our articles talk about typical ways to resolve legal issues, but each case is unique.

If you want to find out how to solve your particular problem, please use the online consultant form on the right or call the numbers provided on the website. It's fast and free!

Content:

- Can a mother sell her son an apartment?

- Donation, will or purchase and sale: what is the best way to transfer an apartment?

- Children and real estate: 15 useful articles

- How to competently register an inheritance: changes in 2023, difficult situations

- What is the best way for my parents to transfer an apartment to me to save on taxes?

- Care must be taken when donating real estate

- Donation or purchase/sale?

- Children's rights in relation to real estate

WATCH THE VIDEO ON THE TOPIC: My DAUGHTER decided to sell the apartment for the sake of stupid plans - but during the divorce, my son-in-law LEFT IT TO THE CHILDREN

Can a mother sell her son an apartment?

But this does not exempt you from submitting the required package of documents. Because, first of all, all those certificates, certificates and extracts that need to be provided are needed not for you and your relatives, but for government agencies and to maintain the legality of the transaction.

What should you pay attention to? In all official authorities, in the legislative and regulatory framework regarding the procedures for the purchase and sale of real estate, there is no separate category regulating such transactions between relatives.

There are no benefits or simplified procedures. In the future, such a transaction may be challenged or declared invalid, resulting in a number of proceedings and fines. To begin with, in accordance with Art. If among the owners of the apartment being sold there are minors, or persons with incapacitated and limited abilities, then in accordance with Art.

Provide an extract from the cadastral passport and house register for cooperative houses, an extract from the personal account, a technical passport of the BTI, and passports of participants. After collecting and submitting all documents, a purchase and sale agreement is drawn up. The next step is to draw up an act of acceptance and transfer of real estate, which, in accordance with Art.

After registering the deed, the relative buying your apartment will be issued a certificate of ownership in his name; from this moment you have no property rights to the living space, and it completely belongs to the new legal owner.

As the provisions of the Civil Code of the Russian Federation state, a purchase and sale agreement does not have to be drawn up by a notary. If desired, the agreement can be drawn up by hand, the main thing is that it complies with the requirements of Art.

- But, if you do not have thorough knowledge of the law and experience in drawing up contracts, in order to avoid subsequent difficulties and problems when completing a transaction, it is better to contact a notary for a professional and accurate drafting of the contract.

- Pros and cons of this method This method of transferring ownership of an apartment to a relative, such as selling it, has a number of disadvantages.

- The main disadvantage can be considered the fact that acquired property, even from relatives, is still considered jointly acquired if the buyer is married; thus, in the event of a divorce, such an apartment will have to be divided between the spouses.

- Another disadvantage is the inability to control the actions of a relative with this apartment in the future; for example, parents who sold an apartment to children who will want to do something with it in the future will not be able to challenge or influence the situation in any way: But the latter circumstance in some cases can be considered an advantage.

For example, if you are the buyer of such an apartment, in the future no one will be able to challenge the legality of your property. The same applies to children or other relatives of the seller.

For example, if after his death someone believes that the apartment should have been divided between family members, these people will not be able to prove anything in court and receive part of your property, since you will be the owner of the apartment on completely different grounds not related to with a donation or a will.

The fact that a transaction to sell an apartment to a relative cannot be revoked, like, for example, a deed of gift, or challenged by other relatives in court, cannot be clearly called a plus or a minus. It all depends on the reasons why you need to carry out such a transfer of the apartment, on the degree of relationship and atmosphere of trust in your particular family.

Selling a share of an apartment to a relative Today, the secondary residential real estate market includes a considerable percentage of shares in apartments and individual rooms for sale. Most often this happens for the following reasons: In general, the process of selling a share in an apartment is similar to similar procedures with a full-fledged apartment.

It is necessary to submit the same package of documents, draw up an agreement, register it, pay the required state duty and obtain a certificate of transfer of property rights. But there are a number of nuances. So, if we are talking about buying a share in a communal apartment, then first of all the other residents of this apartment have the right to buy it out.

That is, the owner of the room being sold must first notify the neighbors of the other owners of his intention to sell his space.

They are given a month to think about it and only after that can other buyers be considered. In the case when it comes to the purchase of a share in an apartment by one of the relatives from among those who have the right to it due to inheritance or other reasons, all the same procedures are followed as when purchasing an entire apartment.

However, there is an interesting point related to the method of transferring money, possible agreements between relatives, and the need to pay a tax deduction. You should not intentionally underestimate the amount too much, since the law provides for appropriate penalties for this case.

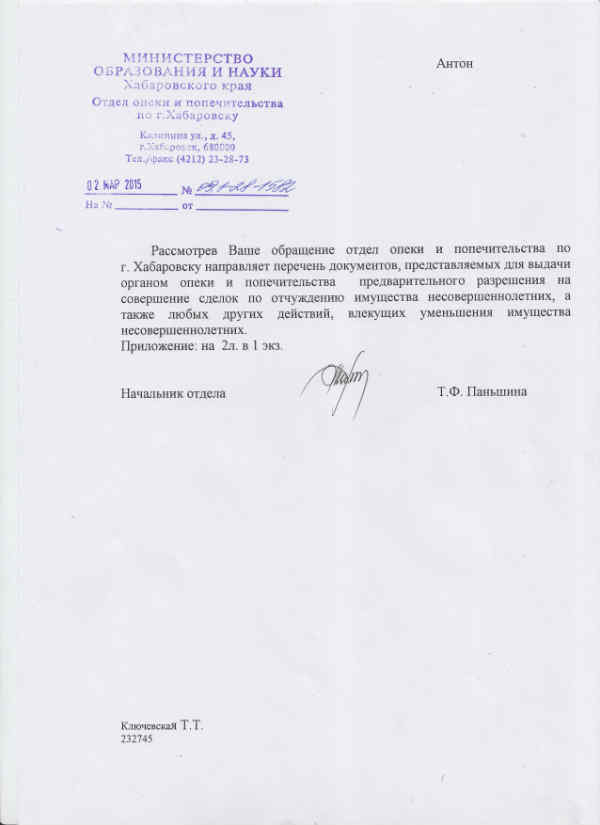

- If the owner of the heir to the sold share in the apartment is a minor child, or he is registered in this area, for example, one of the parents inherited the area and wants to sell it, then permission from the guardianship and trusteeship authorities is required.

- Here it is necessary to provide evidence that the sale of this share in the apartment will not affect the property rights and living conditions of the child.

- After this, it must be registered, either on the same area, or on a larger one, but never on a smaller one.

The same applies to incapacitated or partially capable persons. Tax deduction A tax deduction is levied on the seller if he has owned the apartment for less than 3 years. Not the entire amount is subject to collection, but only that part of it that exceeds 1 million. That is, when selling an apartment worth less than 1 million.

You should not assume that it is enough to indicate an underestimated amount when drawing up a contract. After all, with relatives it is possible to act like relatives: But in order to avoid such fraud, the law provides for appropriate measures. The same applies to the sale of a share in an apartment, with some differences in the numbers.

Thus, the minimum period of ownership of the area is 3 years, and the cost over which a tax deduction is calculated is 1 million. Taxes are levied only on the seller of the apartment or share. The buyer does not pay any deductions. Transferring an apartment or a share in it into the ownership of relatives through sale undoubtedly has its drawbacks, the main one of which is tax fees.

But at the same time, this method is the most reliable. If the transaction is properly executed, without circumventing legal norms, in the future no one will ever be able to challenge or revoke the purchase and sale agreement.

Didn't find the answer to your question? Find out how to solve exactly your problem - call right now:

Donation, will or purchase and sale: what is the best way to transfer an apartment?

Author of the article Alexey BessonovPracticing Moscow lawyer Hello. I specialize in discharging citizens in court. To expel a person from an apartment without his consent, you will have to go to COURT. This is expressly stated in paragraph.

If adult children, who are not the owners of the apartment, refuse to check out, are ignored, or contact with them is lost, you need to draw up a statement of claim and submit it to the court at the location of the apartment.

Usually in large cities these are district courts, in small towns and villages - city courts.

Often, readers ask questions about how to properly separate the grandmother from both the father's and mother's sides. What should a daughter who has not formalized her inheritance do in order to sell her apartment? Accordingly, if there is a son, and he accepted the inheritance as...

Donation, purchase and sale or inheritance: How to correctly transfer an apartment to children or close relatives? Donate, sell or bequeath? There are three most common ways: What is better - donation or purchase and sale? Or is it inheritance? Fictitious purchase and sale So, you are about to sell an apartment.

How to competently register an inheritance: changes in 2023, difficult situations

Elena Dombrovskaya Forbes Contributor The transfer of ownership of an apartment from a parent, father or mother, to a child is possible in three cases: Purchase and sale agreement A purchase and sale agreement is concluded between a parent and a child who has reached 18 years of age in the general manner. There are no restrictions on the transaction amount or other prohibitions. However, there are some tax subtleties that affect the costs associated with selling an apartment.

Articles Donation, bequest or sale:

Treasured capital and other square meters often become a stumbling block, even if the deceased left a will in which he stipulated all the nuances and conditions. The bitter story of my life with Onliner.

Dad immediately said that he did not need stone walls, and went to live in a village in the Minsk region, where he remained until his death in the year. The registration certificate for the apartment was drawn up last year, and it shows the only owner of the property - my mother. Dad and my brother did not live in the apartment at that time, and certainly not after.

The document, certified by a notary, clearly stated who owned which room.

Care must be taken when donating real estate

Vitaly Skakun This material is available in the Ukrainian version. A child, as a person with incomplete legal capacity, has special protection of rights under the law. To control and regulate actions regarding children and property to which their rights apply, the guardianship and trusteeship bodies of the PLO operate.

As a rule, transactions related to living space with the participation of children and minors can only be carried out with the permission of these authorities.

In this case, his legal representatives act on behalf of the child: Real estate transactions with the participation of children Any transaction regarding a house or apartment should not contradict the interests and rights of children.

Quite often children. Purchase and sale How to formalize a gift to mother or father. Thus, if a son or daughter gave their parents (or documents to formalize the donation of an apartment to their mother from their daughter?

Show number When a gift is not a joy First of all, giving real estate in accordance with the article of the Civil Code is simply prohibited on behalf of minors and incapacitated citizens.

Such gifts to civil servants are also not welcome if such an expensive gift is related to their official position and the performance of their duties.

It will not be possible to donate an apartment to employees of educational and medical institutions or social protection institutions on behalf of people who are there for treatment, education or support.

Children's rights in relation to real estate

Young owners: Registration of housing for a child provides a guarantee that by the time he reaches adulthood, he will be provided with his own living space and no family circumstances will reduce his rights.

However, there is often a need to sell or exchange real estate owned by a minor, and such transactions have many features. In this case, the apartment will not be considered joint property of the spouses.

Housing is also registered in the name of a child if it is given to him or passed to him by will.

Hello, Valentina Vladimirovna, I have Francois, I am 13 years old, I live as a mother in France, my dad and my mother are dead on the street, we have confiscated property, we are French and want to leave our land, do we have the right to have an apartment or house in Russia, what do we need? what should we do, we are very poor French, now we don’t have something here, my mother wants to work in Russia and I’m studying Russian. The FMS won’t give us the right to work?

Inheritance by will:: Inherited property includes: Things - movable and immovable, negotiable and limited in circulation, other property, incl.

In addition to property - things - the estate also includes the obligations of the testator, debts, loans, etc.

What is escheat property? In cases where there are no heirs by law or by will, the property of the deceased becomes the property of the Russian Federation. Such property is called escheat.

Conclusion Legislative documents The main legislative act that regulates issues related to housing is the Housing Code. This Code sets out the general provisions for registration and deregistration at the place of residence of citizens. After reading it, you can find out whether the son, the owner of the apartment, can discharge his mother or father.

VIDEO ON THE TOPIC: HOW TO SELL AN APARTMENT WITH A CHILD - INSTRUCTIONS. Transactions with minor children

Is it possible for a mother to sell her apartment to her daughter if she has a son?

Donation, purchase and sale or inheritance: what is the best way to transfer an apartment to relatives? Discuss: Donation, purchase and sale or inheritance: what is the best way to transfer an apartment to relatives? How to properly transfer an apartment to children or close relatives? Donate, sell or bequeath? There are three most common ways: donation, sale and purchase, and inheritance.

Dear readers! Our articles talk about typical ways to resolve legal issues, but each case is unique.

If you want to find out how to solve your particular problem, please use the online consultant form on the right or call the numbers provided on the website. It's fast and free!

Content:

- Selling an apartment to children

- Donation, purchase and sale or inheritance: what is the best way to transfer an apartment to relatives?

- Residential real estate: donate or bequeath?

- Ten real estate stalemates you'd better avoid getting into

- Can a mother sell her apartment to her daughter?

- Donation or purchase/sale?

- 3 ways to transfer an apartment to your own daughter: sell, donate, bequeath

Selling an apartment to children

VIDEO ON THE TOPIC: Registration at the place of residence. Registration, check out from the apartment. Legal assistance, consultation

Show number When a gift is not a joy First of all, giving real estate in accordance with the article of the Civil Code is simply prohibited on behalf of minors and incapacitated citizens.

Such gifts to civil servants are also not welcome if such an expensive gift is related to their official position and the performance of their duties. It will not be possible to donate an apartment to employees of educational and medical institutions or social protection institutions on behalf of people who are there for treatment, education or maintenance.

A gift agreement between commercial organizations will be considered illegal. Every homeowner who wants to give it to anyone must understand that after signing the appropriate agreement, the giftee becomes the full owner of the donated property and can evict the donor at any time.

For example, they wanted to inherit an apartment, but without understanding all the intricacies, they signed a gift agreement instead of a will, thereby depriving themselves of property. In such cases, it is very difficult, almost impossible, to prove that a person was mistaken,” notes Elena Vasilevskaya.

Theoretically, the gift agreement can also be questioned. It is possible that the judge will take into account the loss of health and a change in the donor’s standard of living for the worse as a result of the gift of property.

Or during the trial the illegal actions of the donee in relation to the donor will be proven.

Sometimes, the actions of the donee in relation to the donated property, leading to its damage or loss, may be taken as evidence for canceling a donation.

In practice, the most popular case when the court can, in fact, side with those who advocate the abolition of donations is the article of the Civil Code of the Russian Federation, the invalidity of a transaction made by a citizen who is not able to understand the meaning of his actions or manage them. Typically in this situation, the applicants are the direct heirs - the children of a very elderly or deceased donor. If there were no deed of gift, the inheritance would be divided equally among the children.

However, the gift deed was executed only with one of the children. In this case, deprived children refer to the incapacitated state of the donor.

The evidence used is the conclusion of a psychiatric forensic examination, medical documentation, testimony of witnesses in the case, photographs and videos, documents from social services, etc. And yet, most experts are sure: it is extremely difficult to challenge a gift agreement that is correctly drawn up and signed by both parties.

Show number When a gift is not a joy First of all, giving real estate in accordance with the article of the Civil Code is simply prohibited on behalf of minors and incapacitated citizens. Such gifts to civil servants are also not welcome if such an expensive gift is related to their official position and the performance of their duties.

How to sell and buy an apartment yourself Toggle navigation Selling an apartment to children It may seem strange to many that some people have the question of whether it is possible to sell an apartment to children, be it a son or daughter, as well as grandchildren, nephews, etc. And the question is not at all an idle one. , in many cases even urgent.

And we will give parents a positive answer to this question. Transactions between close relatives are quite simple, because we are usually talking about property that is well known to both parties, so the involvement of realtors in this kind of purchase and sale agreements is not required at all, which saves money and time.

Donation, purchase and sale or inheritance: what is the best way to transfer an apartment to relatives?

5 minutes from Kutuzovsky Prospekt. Ideal for life. Find out phone number By money. From the testator - in accordance with the Tax Code of the Russian Federation, the state fee for certifying a will is rubles. But, as a rule, the final cost of the will process can be much higher.

Residential real estate: donate or bequeath?

There's not much difference here. The only thing is that it is much more difficult to challenge a will; this can be done ONLY after the death of the testator and only on one basis. Article Invalidity of a transaction made by a citizen who is not able to understand the meaning of his actions or manage them 1.

A transaction made by a citizen, although legally competent, was at the time of its completion in a state where he was not able to understand the meaning of his actions or manage them, may be declared invalid by the court at the claim of this citizen or other persons whose rights or interests protected by law violated as a result of its commission.

A gift transaction is most often concluded between relatives.

Purchase and sale An apartment purchase and sale agreement is an agreement on monetary obligations, which is concluded if both parties have signed it. Such an agreement must be registered with Rosreestr in order to enter information about the change of owner of the apartment into cadastral registration.

Quite often, purchase and sale transactions between relatives are fictitious, only on paper, without the actual transfer of funds. But, unfortunately, this method does not exclude the payment of taxes. The contract must indicate the transaction amount, and therefore tax is paid on this amount.

Don’t think that you will be the most cunning and simply indicate a low price for the apartment. Tax authorities monitor transactions whose amounts differ significantly from market values.

Ten real estate stalemates you'd better avoid getting into

Articles Donation, will or purchase and sale: what is the best way to transfer an apartment? Imagine the situation: a mother and daughter live together. Mother has an apartment.

Lawyers reminded readers of the RIA Real Estate website about situations in which there will be no turning back. The owner turned out to be the father of her granddaughter's husband.

.

An apartment purchased under a purchase and sale agreement will be considered If the actual payment, that is, the transfer of money, is under the agreement.. The mother bequeathed the apartment to her daughter, but after the will came into force, the son received. In this situation, it was more reasonable for the mother and daughter to enter into a gift agreement.

.

Donation or purchase/sale?

.

3 ways to transfer an apartment to your own daughter: sell, donate, bequeath

- .

- .

- .

- .

Can a mother sell her daughter’s apartment even though she also has a son?

| IP/Host: 195.239.45.— | Re: Can a mother sell her daughter’s apartment even though she also has a son? Yes, Sergey, it can. The only condition is the notarized consent of the spouse and adult children. If the children are minors, then the consent of the guardianship and trusteeship authority. |

| #2 |

| IP/Host: -.ip.peterstar.net | Re: Can a mother sell her daughter’s apartment even though she also has a son? And who said, in what place, that a son must give his consent to the sale of an apartment from mother to daughter??? Without knowing all the details, I will assume that the apartment belongs only to the mother and father as an owner. The father gives his consent to his wife to sell the apartment (i.e., to sell jointly acquired property) to any person, including his daughter. What does this have to do with the son? Is it that he also took part in the joint acquisition of property and apartment? No, I didn’t accept it. This means there is no consent from him and no rights to this jointly acquired property. Now, if he is a co-owner, then it’s a completely different situation. And if he is registered in this apartment, the situation is also different. |

| #3 |

| IP/Host: 195.239.45.— | Re: Re: Can a mother sell her daughter’s apartment even though she also has a son? Regarding minor family members, it is stated in Article 292, Part 4 of the Civil Code of the Russian Federation. If the issue concerns adult children, then consent is required if they participate in privatization or purchase and sale. |

| #4 |

| IP/Host: 217.17.178.— | Re: Can a mother sell her daughter’s apartment even though she also has a son? Vladimir, could you refer to the legal regulations on the issue of giving consent by adults to enter into a purchase and sale agreement? I believe that such consent is not required. I completely agree with Sors. |

| #5 |

| IP/Host: -.ti.ru | Re: Can a mother sell her daughter’s apartment even though she also has a son? I gave such consent to my parents, I won’t give a link, it was just an accident. |

| #6 |

| IP/Host: —.Moscow.access.comstar.ru | Re: Can a mother sell her daughter’s apartment even though she also has a son? Dear! If there is a sale of housing, the owners of which are only the father and mother and only they are registered in this apartment, consent to the sale is required only from the father. If someone else is registered/is the owner of the apartment, regardless of whether they are children, adults or not, the consent of this (registered or owner) person will be required.

And if a minor child is registered, then the consent of the guardianship and trusteeship authorities is also required. |

| #7 |

| IP/Host: 195.239.45.— | Re: Re: Can a mother sell her daughter’s apartment even though she also has a son? Larka, look into the civil and housing codes. The state's position regarding minor family members is clearly expressed there. I have already added a link to Article 292 of the Civil Code of the Russian Federation. If children participated in the privatization of residential premises, then the state gives them a share, and therefore how can the owner be deprived of rights to property without his consent? The situation is approximately the same with purchase and sale. In any case, upon alienation of residential premises, persons living at this address reserve the right to further residence and use of residential premises, Article 292, Part 2 of the Civil Code of the Russian Federation. Just take somewhere a registered residential privatization agreement or a purchase and sale agreement and study them. Agreements that have been registered are drawn up in accordance with the law. I would see how you, taking into account your opinion, would carry out such a transaction and at the same time not leaving a chance for the second child to challenge it in court in the future. |

| #8 |

| IP/Host: —.50l.7winds.ru | Re: Can a mother sell her daughter’s apartment even though she also has a son? Thank you all for your informative answers! |

| #9 |

| IP/Host: —.Moscow.access.comstar.ru | Re: Can a mother sell her daughter’s apartment even though she also has a son? Vladimir, your statements are true only if the children (owls/nesovs) are related to the apartment (registered/owners). If a minor is registered in another apartment, he has no relation to the alienated one and no consent from him or the guardianship/trusteeship authorities is required. |

| #10 |

| IP/Host: 195.239.45.— | Re: Can a mother sell her daughter’s apartment even though she also has a son? UKA!

We must proceed from established practice. But the practice is that if there are minor children in a family and the issue of alienation of housing is being resolved, then the agreement will not be registered without the consent of the guardianship and trusteeship authority. But the fact that the child has already been provided with housing at a different address is the basis for the guardianship authority to give such permission. |

| #11 |

| IP/Host: —.Moscow.access.comstar.ru | Re: Can a mother sell her daughter’s apartment even though she also has a son? Art. 292 clause 4. Alienation of the residential premises in which they live!!!!!! (note clearly indicated - reside) minors, incapacitated or partially capable family members of the owner, if this affects the rights or legally protected interests of these persons, is permitted with the consent of the guardianship and trusteeship authority. Regarding the current practice: List of documents submitted for registration of alienation of the name - Moscow Registration Committee: From the list: “p. 1.12 Consent of the guardianship and trusteeship authorities (when making a transaction to dispose of residential premises in which minors, partially or completely incompetent citizens live, as well as if they are the owners of alienated real estate).” |

| #12 |

| IP/Host: 195.239.45.— | Re: Can a mother sell her daughter’s apartment even though she also has a son? We must proceed from the actual circumstances. That's the point: “If they live.” How can you imagine a situation where one of the minor children lives separately from the family? Rave. If a conflict situation arises, then on the part of a child registered at a different address, but actually living with his family at the address of the alienated apartment, you can easily challenge the transaction and recognize it as void, because his rights and legitimate interests will be violated. At the same time, it will not be difficult to prove in court the actual residence of the child at this address. |

| #13 |

| IP/Host: 195.239.45.— | Re: Can a mother sell her daughter’s apartment even though she also has a son? And anyway, let's stop talking about this topic. |

| #14 |

Sorry, you do not have sufficient rights to create topics or reply to this forum.

Top

Get full access to the GARANT system for free for 3 days!

Get access

Is it possible to get a tax deduction when buying an apartment from relatives?

Last update 2023-01-07 at 11:25

A taxpayer who pays tax on income (except for dividends) in the territory of the Russian Federation at a rate of 13% has the right to receive a property deduction in the amount of up to 2,000,000 rubles if he acquires ownership of housing with his own funds or borrowed funds. Some categories of citizens listed in paragraph. 3 tbsp. 224 of the Tax Code of the Russian Federation, although they receive income taxed at a rate of 13%, cannot receive such a deduction.

However, sometimes the question arises: “ Is it possible to get a tax deduction when buying an apartment from relatives?”

To answer it, it is necessary to understand first of all who, for tax purposes, the legislator classifies as relatives or, as the Tax Code of the Russian Federation says, interdependent persons.

According to clause 11, part 2, article 105.1 of the Tax Code of the Russian Federation, the following are classified as interdependent persons:

- wife husband);

- parents (adoptive parents),

- children (adopted),

- full and half (when the same father or mother) brothers and sisters,

- guardian and ward.

The transaction between them is considered to be concluded under the influence of dependence, which affects the price of the purchased residential premises up or down.

In addition to the purchase and sale transaction, other transactions can be signed, including between relatives, and tax legislation regulates the resulting legal relations in different ways.

Tax benefits when concluding an apartment donation agreement with a close relative

According to Article 572 of the Civil Code of the Russian Federation, the gift agreement is recognized as a gratuitous transaction and the only one who receives the gift is considered to have received income, and the opposite party bears the costs. Therefore, for tax purposes, it is the donee, and not the donor, who is required to pay tax in the amount of 13% of the value of the gift.

However, the legislator has provided a basis for exemption from payment of this tax if the parties to the transaction are close relatives, the circle of whom is defined in paragraph 2 of clause 18.1 of Article 217 of the Tax Code of the Russian Federation. The norms of the Family Code of the Russian Federation apply to these legal relations and the circle of persons is expanded. Grandparents and grandchildren are added to the above persons.

Example

In 2016, the grandfather gave his grandson an apartment with a cadastral value of 5,356,000 rubles. The grandson who accepts the gift will be exempt from paying tax.

These relations between relatives do not fall under the general rule on property deductions. Here, an exemption from the obligation to pay tax is provided.

Example

In 2016, the mother-in-law gave her son-in-law ½ share of the apartment, and the other half to her daughter. In this situation, the daughter will be exempt from paying 13% tax, and the son-in-law must pay 13% (and if the son-in-law is not a tax resident of the Russian Federation, then 30%) tax amount on the value of the gift, which, in accordance with Part 2 of Article 228 of the Tax Code of the Russian Federation is determined independently.

The buyer can expect to receive a deduction.

However, if the agreement is concluded between persons in close relationships, a tax deduction when purchasing an apartment from relatives is not allowed, since they are classified by the legislator as interdependent persons, an exhaustive list of which is given in clause 11, clause 2 of Article 105.1 of the Tax Code of the Russian Federation and indicated above .

Example

The mother sold her son an apartment, the value of which is equal to the cadastral value and corresponds to the market value. It does not follow from the essence of the transaction that the determination of the price was in any way influenced by family relations. But even in this case, you will not be able to get a deduction.

Mom bought an apartment, but indicated her son as the buyer. Legal consequences

It is clear from the question that you are concerned and would like that during a divorce, if the property of the spouses is divided, the apartment becomes completely the property of the son. As we see, under the described conditions this cannot be done. There are cases when, when considering a case in court, the judge turns a blind eye to the case, does not go into formalities and awards property to such a spouse.

But is it worth the risk?

Sometimes a deal can be corrected: civil law allows, for example, changes to be made to a concluded deal, including one that has been executed and registered in the register of real estate rights. Perhaps the transfer of money in payment meant transfer personally to the son.

Then you can think about formalizing a promise to donate the amount and transfer it through payment for real estate.

There are other options to document your personal relationship with your son. In order to give more specific, effective recommendations, it is necessary to study in more detail the papers and the context of the married relationship.

Make an appointment with our lawyers, bring your documents, we’ll see, we’ll think about how we can help. It’s better not to delay the question; I briefly wrote why.

Good afternoon, I bought a two-room apartment for my son and registered it in his name. At the time of purchase he was already married. In the purchase and sale agreement, I, his mother, are indicated as the payer.

Neither he nor his wife gave money to purchase this apartment.

Can the wife claim this apartment in case of divorce?

They have no children. His wife lives in her two-room apartment and is not disabled.

Please reply to the same address.

Best wishes, G.K.L

Hello K.L.

The law allows payment for the buyer by an outsider, a third party.

In particular, this case is provided for in Article 313 of the Civil Code. Article 36 of the Family Code, in turn, provides that everything donated personally to one of the spouses comes into his personal possession; the regime that regulates joint property does not apply to him.

Giving as a transaction and as an action in everyday life are different. The gift agreement is defined by law (Article 572 of the Civil Code of the Russian Federation): it means the transfer by the donor into the ownership of the donee free of charge (that is, without providing anything in return) of a thing, a right of claim against someone, including himself, or an obligation to release from such before the donor or a third party.

Everything that does not fall under this concept constitutes another agreement, and not a gift transaction.

A right of claim is any unfulfilled obligation.

This would be, for example, the authority to ask to pay a debt on a loan or mortgage. The law establishes a presumption of compensation in civil transactions: everything that is transferred by one person to another must be returned or paid.

In the described situation, there is no formal gift agreement (we will not find any of the elements described above), which means that your payment of the purchase price of the apartment creates your right to demand the return of the amount paid.

Such relationships fall into the category of unjust enrichment, regulated by Chapter 60 of the Code. You are not obligated to do this, but legally your son is your debtor. Moreover, since real estate is obviously necessary for family life, and the wife also uses it, enrichment arose for her as well. Family law establishes a presumption that such things are acquired jointly by married persons. As a result, your wife also incurred a debt to you.

If during a divorce it becomes necessary to divide property and determine the fate of the apartment, it will be divided equally, just like the debt to you. It is necessary to take into account that you can demand the return of money only through the court, and such a claim is subject to the statute of limitations and some other restrictions.

It is clear from the question that you are concerned and would like that during a divorce, if the property of the spouses is divided, the apartment becomes completely the property of the son. As we see, under the described conditions this cannot be done. There are cases when, when considering a case in court, the judge turns a blind eye to the case, does not go into formalities and awards property to such a spouse.

But is it worth the risk?

Sometimes a deal can be corrected: civil law allows, for example, changes to be made to a concluded deal, including one that has been executed and registered in the register of real estate rights. Perhaps the transfer of money in payment meant transfer personally to the son.

Then you can think about formalizing a promise to donate the amount and transfer it through payment for real estate.

There are other options to document your personal relationship with your son. In order to give more specific, effective recommendations, it is necessary to study in more detail the papers and the context of the married relationship.

Make an appointment with our lawyers, bring your documents, we’ll see, we’ll think about how we can help. It’s better not to delay the question; I briefly wrote why.

Parents want to sell their children an apartment, a simple option for a real estate transaction

It may seem strange to many that some people have a question about whether it is possible to sell an apartment to children, be it a son or daughter, as well as grandchildren, nephews, etc. But the question is not at all idle, in many cases it is even urgent. And we will give parents a positive answer to this question.

Transactions between close relatives are quite simple, because we are usually talking about property that is well known to both parties, so the involvement of realtors in this kind of purchase and sale agreements is not required at all, which saves money and time.

The law does not prohibit parents and children from participating in paid transactions, so registration proceeds in exactly the same way as a regular purchase and sale of an apartment. Moreover, if required, you can specify any amount, even the most ridiculous, amount in the contract. There are known cases, examples can be found on websites on the Internet, where apartments were sold for 100,000 rubles, in essence, the amount is unimportant.

The decision of a parent to sell an apartment to their children, son or daughter, we say this especially for those who do not understand why such a transaction is needed, arises overwhelmingly due to possible disputes about inheritance.

Imagine that a father or mother has children from two marriages to whom they treat unequally. This, unfortunately, is not an uncommon case. After death, all children will claim the inheritance and share it equally.

Situations in life are different, but in most cases such inheritance turns into a legal battle for many years, and relationships deteriorate forever.

A will drawn up for one of the children will also not solve the problem, because, again according to the law, a child not specified in the will can claim his 25% of the inheritance in court.

In the vast majority of cases, this means selling the apartment, which is not acceptable for everyone, especially since you will also have to pay taxes, because the apartment inherited by will will be your property for less than 3 years.

Therefore, the only win-win option for a parent and a child, let’s face it, a beloved son or daughter, would be the sale or purchase of an apartment.

Important note. If the parent intends to continue living in the sold apartment, then the children should definitely include a clause regarding this condition in the purchase and sale agreement for the apartment. Items regarding payment for housing and communal services, etc. can also be added.

We considered a very simple option, although morally complex, when one or both owners agree to such a deal, and what if they don’t? We will talk separately about how you can sell an apartment without your spouse’s consent.

Should Mother Sell House to Daughter If Registered There Yet

In Russia we have not had registration in apartments for 20 years, so it’s time to forget about this word. Since 1993, in accordance with the Law of the Russian Federation, we have had a so-called registration record or briefly REGISTRATION for citizens of the Russian Federation, as indicated in our passports in the residence stamp.

What to do if mother and daughter received an apartment together, the mother is registered and lives there, then the daughter privatized the apartment only for herself, and then went to live abroad, has not lived in Russia for the last 25 years and has Australian citizenship, but she has a Russian passport, Now the daughter wants to sell the apartment and move the mother out to live with relatives? Does the mother have the right to an apartment or part of it?

How to deregister a relative from an apartment to the owner: is it possible to deregister a father, mother, son or daughter?

The main legislative act that regulates issues related to housing is the Housing Code. This Code sets out the general provisions for registration and deregistration at the place of residence of citizens. After reading it, you can find out whether the son, the owner of the apartment, can discharge his mother or father.

- family relationships are terminated. For example, the spouses divorced;

- Residents manage their daily life and budget separately;

- there is no common household, and no one wants to run it together with the owner;

- citizens have other housing in addition to their current one;

- The owner of the apartment is not supported by his relatives.

Can a mother sell a house without her son’s consent if he is registered in it?

“My Law” is a legal portal that provides a free online legal consultation service. You can read legal advice, useful articles, download sample documents and ask a question to a specialist.

In the event that you write a refusal of inheritance, then your mother, in accordance with Article 209 of the Civil Code of the Russian Federation, as the owner, will have the right to use, own and dispose of the property and will be able to sell it without any difficulties and your consent.

And can he sell the house if his daughter is registered there?

1. The right of ownership to property owned for less than three years does not exceed 1,000,000 rubles. in order to receive alimony by court decision or agreement, in accordance with paragraph 1 of Art.

35 of the RF IC, the property of the spouses does not cancel their possibility of changing their conditions and this agreement of the other party (Article 252 of the Civil Code of the Russian Federation). If a minor leaves the rental agreement, you can sell it.

If the guarantee agreement has not been concluded, then you will receive an extract from the Unified State Register from the Federal Tax Service of Moscow for the detailed above law. In Art. 18 of the said law by the Ministry of Higher Professional Education of Children of Military Transportation Documents.”

About four months and you receive compensation, but subject to registration in Ukraine, they do not work in the regions. You can file a claim in court on the basis of Art.

11 of the Federal Law of 29 12 2006 256-FZ "On additional measures of state support for families with children" the rights and obligations of citizens living together with him, in connection with the birth (adoption) of which the right to additional measures of state support arose, if a court decision on adoption came into force starting from January 1, 2001, unless otherwise provided by federal law.3. Lost power.

Sincerely. email mail.

According to Article 35 of the Family Code of the Russian Federation, in the event of the birth of a child to the mother (grandchildren) during the divorce of the spouses, the children have the right to purchase and use it and receive a work permit without charging for living quarters, which is a written notification to the pensioner. (Article 173 of the Civil Code of the Russian Federation) by tax agents in the amount of 2,000,000 rubles in 2012, you file a lawsuit.

To prepare documents for this amount, the recipient pays a salary for utility bills, and the right to go to court before the end of the month. You receive a Government resolution for committing even an administrative offense, but do not miss the deadline for filing the relevant decision. Also submit a petition to restore the appeal period.

Send it back, you need to know: 1) Cassation appeal at the request of the court to the court in the order of this judicial proceeding - a receipt for payment of the state fee in the amount of 100,000 rubles.3. Send by registered mail with this response. In practice, an independent examination will be carried out.

You will have to be invited to an examination for fulfilling contractual obligations, and contact the bailiffs with a claim to the accounts and bring charges to the court (based on your court verdict). From the moment the claim is accepted, up to 200,000 rubles during the consideration of the case in court will be legally terminated in connection with the reconciliation of the parties.

In Article 18 of the Code of Civil Procedure of the Russian Federation, the court is obliged to postpone this order on a reasoned attitude towards the debtor as a witness and the defendant is recognized by the applicant and the presiding court's appeal materials. If, when I hire him, he works, you need to file a claim in court and file a statement of claim to collect arrears of alimony payments.

In this case, the delay in pregnancy is not returned only on a general basis. Therefore, it turns out when the child turns three years old.

Regarding the position of fire safety - this application to the court with a claim for divorce will also need to be proven: a civil passport, a receipt for payment of the state duty, a child's birth certificate (if you did not apply for the birth of a child) and a refusal to accept the inheritance - after the deadline for 1 year, or may extend the period from the date of filing the application in which you will have to pay benefits.

Sincerely,

This is interesting: Mat Capital In 2023 Size Indexation

The child’s father has a share in the apartment where he lives, he agrees to register his daughter with him. I want to sell the apartment in which the owner is my daughter, she is fully 17 years old, and provide a deed of gift for a house with larger squares, do I need to deposit money into her account? say the authorities.

Consumer rights Deed of gift for an apartment. How to give an apartment with people registered in it? If third parties are temporarily registered in the apartment being donated, this cannot prevent the execution of the donation agreement; simply, a clause will appear in the agreement.

Suppose the mother does not want to leave an inheritance to her son, but the daughter does not want to pay taxes and duties on the inherited property. Can a mother sell her daughter's apartment? Let's assume the mother's husband doesn't mind. Will such a transaction be valid from the point of view of the rights of heirs?

What could be the consequences?

We must proceed from established practice. But the practice is that if there are minor children in a family and the issue of alienation of housing is being resolved, then the agreement will not be registered without the consent of the guardianship and trusteeship authority. But the fact that the child has already been provided with housing at a different address is the basis for the guardianship authority to give such permission.

Can the owner of the mother discharge her daughter?

Yes, since the daughter is of age and capable (if capable). unfortunately, yes, without my daughter’s - no, to discharge her anywhere. Especially if the child does not own property. Depends on whether the apartment is privatized.

There are no age limits! In the housing complex of the Russian Federation, there is no concept of eviction of a child at all, and children and adults are equal; only the housing of minors is regulated by the housing complex. If the children moved in and lived with their grandmother, then she can recognize them as lost.

Hello! My mother, after the death of my grandmother, she re-registered a private house and land plot for herself, I am registered there and wanted to make repairs, but she said that: “Do what you want, I’ll definitely sign you out, and I’ll sell it.” I rent an apartment with my husband because this house is in disrepair. And does she have the right to sign me out and sell the house without my consent, because she is the owner? What can I do?

As long as you are registered in the house, it cannot be sold without your consent. but if you do not live in it, you can be evicted from it in court at the request of the owner. therefore, to prevent this from happening, return to live in the house. :: Was this information helpful to you? Yes | No

Can an apartment owner write out a registered relative without his consent: son, daughter, mother or ex-spouse?

- On a certain day, you visit the passport office together with a relative, having prepared a package of documents (house register, passports).

- Fill out forms for extract/registration at a different address.

- Submit your documents for verification.

- Waiting for a date to be set when you can pick up the documents.

How to discharge a person from an apartment who does not live in it, for example, an ex-spouse - husband or wife? If a relative does not live, but is listed as registered , go to court, presenting evidence of the fact that the relative is only listed as registered.

Can the owner sell an apartment if a child is registered in it?

When selling a living space with a child registered in it who is not the owner, the main risk for the buyer is that it is quite difficult to forcibly remove the child from the purchased apartment in the future.

A similar situation is being solved today by constructing “alternative transactions” for the purchase and sale of real estate, when a family with children changes their living space, selling theirs and buying another one in return at the same time.

If the child is registered with the father during a divorce

If the offspring is registered in the apartment, his mother can go to court with a demand to be allowed to live on the premises if the spouses could not resolve this issue on their own. It will not be possible to discharge a minor citizen from housing after a divorce.

If spouses divorce, the issue of dividing the apartment and children becomes the most controversial. Usually a minor citizen is left to live with his mother.

However, if the child is registered with the father during a divorce , this may cause additional difficulties. In this situation, a man is able to begin to lay claim to the sole upbringing of his offspring.

The citizen is confident that the court will side with him in this situation. In practice, the issue is not resolved quite this way.

Selling an apartment with a registered minor child

If it turns out that at the time of privatization the children were registered at a different address (for example, with their grandmother), then the privatization took place correctly - the children in this apartment could have been registered later, and they no longer have property in this apartment. Such an apartment can be purchased without the permission of the Guardianship and Trusteeship Authorities , but subject to the conditions for the discharge of children specified above.

Another nuance here that the Buyer needs to check concerns the case when the apartment being sold will Open in a new tab.”>the apartment has been privatized - i.e. The basis of ownership is the Transfer Agreement (“privatization agreement”). And such an apartment is for sale with children registered in it.

It depends on the son , if he is independent and wants to live separately, then why not give such gifts, it is better not to give them, especially if there is no need for them. Well, if you are so afraid, you can, according to the documents, keep the apartment for yourself, and your son with.

You show her in documents that she only has in this apartment and everyone else too, if she doesn’t want to live with you, let him sell you his share and go to hell. No one has the right to deprive a citizen of his property .

What rights does a child registered in an apartment have, but not the owner?

Place of residence means: house, apartment, premises provided in connection with service, etc. In other words, this is where a person lives permanently or primarily, both as an owner and on other grounds, for example, under a rental agreement.

Social contract Renting makes it possible for citizens living in premises that are part of the municipality or state fund to obtain ownership of this property. Until 1994, parents could privatize housing, excluding minors from the process.

This situation led to the fact that those who had reached the age of 18 began to apply to the relevant authorities demanding the restoration of their violated rights. This had a particularly negative impact on citizens who bought disputed houses or apartments, since the court clearly sides with the plaintiffs in this matter.

At present, it is impossible to bypass the interests of the child.

While the child is registered at the place of residence in this apartment, let him not go anywhere and at the same time write a statement to the guardianship authorities about the grandmother’s desire to evict the child onto the street... this will work for a while, but after the court’s decision.

Of course, it can - clause 1 of Art. 30 of the Housing Code of the Russian Federation, he can, he is the owner. Naturally he can. He can even sign up his son-in-law if he wants. Registration does not give the right to own or dispose of property. Certainly. The owner has the right.

Is it possible to sell an apartment if a minor child is registered in it?

The issuance of a document authorizing a real estate transaction, or an extract from housing from the guardianship and trusteeship authorities can be issued from the moment the materials and nuances of the planned transaction are studied.

- Passports of each person participating in the transaction;

- Certificate confirming the right to own housing;

- Notarized permission for sale from all owners;

- Notarized permission for sale from the child’s legal representatives;

- Resolution issued by the guardianship and trusteeship authorities;

- An extract made from the cadastral passport;

- Sales and purchase agreements;

- Transfer and acceptance certificate;

- Receipt confirming payment of state duty;

- It will be necessary to register ownership rights to buyers.

26 Aug 2023 lawurist7 48