The order of payment is the main detail of the payment order. The sequence in which the bank writes off money from the current account depends on it. Let's look at specific examples and samples of how to correctly indicate this detail in a payment order in 2023.

Reference books and sample documents will help you fill out payment orders correctly and timely transfer taxes and insurance premiums. Download for free:

The BukhSoft program automatically generates payment orders with current details. The program itself will supply the correct details of the counterparty or tax office, KBK, payment order and tax period code. Try it for free:

Download sample payment slip

Where do they put the order of payments in a payment order in 2023?

The order of payment in the payment order in 2023, as before, is indicated in field “21”. Numbers from 1 to 5 show the bank in what order it should write off funds from the account of a company or individual entrepreneur.

The significance of the codes is in descending order: “1” is the most significant payment, “5” is the least significant payment. It is important for an accountant to know this sequence. If you make a mistake, the bank may not accept the payment.

Please note: if a company or individual entrepreneur does not have sufficient funds in the account, they will be written off in the sequence established by Article 855 of the Civil Code of the Russian Federation.

Payment priority code in 2023

Here are the order of payments in the payment order in 2023:

- “1” – payment for compensation for damage to life and health; transfer of alimony withheld from wages;

- “2” - payments under writs of execution for income to authors for the results of intellectual activity and income to company employees (salary and severance pay);

- “3” - tax payments, payments to the Social Insurance Fund and the Pension Fund of the Russian Federation in accordance with the requirements and regulations (arrears); payment of wages and other income to employees;

- “4” - other payments in accordance with executive documents;

- “5” - other transfers in calendar order (the bank first executes the document that was received first).

Let's look at it in more detail in the table:

Please note: the bank where you have a current account follows the above sequence only if there are no funds in the account. As soon as the funds are received, the bank will debit in accordance with the significance of the payment.

If there is money in the account, the bank will write it off in calendar order.

Priority of payment: taxes and insurance premiums

When transferring taxes, insurance premiums, paying fines and penalties for them, the order of payment in the payment order may have the values “3” and “5”. The order of “3” and “5” in payment orders determines the order of debit when there is not enough money in the current account.

Table. Priority of payment: taxes

Payment order and order of payment

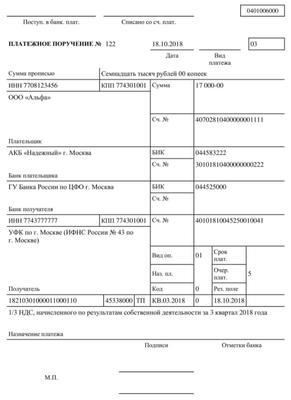

The legislation provides for a standard payment order form.

When paying taxes, contributions, customs and other payments to the budget, use the standard payment form and fill it out in accordance with the rules approved by Order of the Ministry of Finance No. 107n dated November 12, 2013.

Examples of indicating the order of payment in a payment order

Let's look at examples of how to correctly indicate the order of payment for personal income tax, transport tax, and when transferring VAT to the budget by a third party.

Example 1

The company transfers an advance payment for transport tax. Gamma LLC (Moscow, TIN 7725638945) owns the car. The vehicle is registered at the location of the branch in Ramenskoye, Moscow Region. The branch is registered with the Federal Tax Service of Russia in the city of Ramenskoye.

- Checkpoint of a separate unit - 506987563.

- The company transferred to the budget an advance payment for transport tax (KBK 18210604011021000110) for the second quarter in the amount of 964 rubles.

- In field 101 “Payer status” code 01 is indicated.

- In field 109 “Document date” – the value is “0” (payment for the current period; the Tax Code of the Russian Federation does not provide for the need to prepare a calculation for transport tax).

In field 107 “Tax period” KV.02.2022.

Example 2

The Gamma company has employees and is a tax agent for personal income tax (TIN 7708123456) registered with the Federal Tax Service Inspectorate No. 24 for St. Petersburg).

- Gamma current account number 40702810423659875365 at Stable Bank, account number 30101812369875326471, BIC 044259875.

- The company paid personal income tax to the budget (KBK 18210102010011000110) for May in the amount of 54,700 rubles.

- In field 101 “Payer status” code 02 is shown.

Example 3

The company “Sigma” (TIN 4656986259, KPP 465698756, registered with the Federal Tax Service No. 11 for the city of Kursk) partially paid VAT to the budget for the company “Gamma” (TIN 4626895647, KPP 469853687, registered with the Federal Tax Service No. 26 for the city). Kursk).

Payment amount – 25,400 rubles. KBK VAT – 18210301000011000110.

- The accountant indicated in the payment order:

- – “Payer’s INN” – “Gamma” number;

- – “Payer checkpoint” – “Gamma” code;

- – “Payer” – “Sigma”;

– “Recipient” – UFK for the city of Kursk (Inspectorate of the Federal Tax Service of Russia No. 426 for the city of Kursk);

- – “Purpose of payment” – “4656986259/465698756 // for the company “Gamma” // 1/3 VAT accrued based on the results of its own activities for the second quarter. 2023";

- – “Payer status” – code 01;

- – “Document date” – the date of signing the declaration for the second quarter;

– “Tax period” – the period for which the tax is paid – KV.02.2022.

Payment order sample filling 2023 download

What order of alimony payments should be indicated in the payment order in 2023?

As you know, in 2016 new requirements began to apply relating to the preparation of certain accounting documents and regulating the procedure for making various types of payments. Among other things, something has changed in such an issue as the procedure for withholding alimony.

Alimony - what is the order of payment according to the law?

The responsibilities of the accounting department include creating a sufficiently large number of payment orders. They are listed:

- taxes;

- salaries;

- mandatory contributions to various state funds;

- payment for services received, etc.

Among other things, the accountant compiling this document also has to fill out column number 21. It is here that they indicate in what order the money must be transferred.

Thus, this parameter is, in fact, an order to the bank, on the basis of which it makes calculations according to their priority. That is, if the organization has enough funds in its account, the order does not play any role other than a formal one. But if there is a financial deficit, this parameter is very important.

Should child support be paid to full-time students over 18 years of age?

There are a total of five queues provided for by the Civil Code. Strictly following this rule when transferring money is the responsibility of every accountant.

The first is payments based on court decisions based on executive documents:

- compensation for damage resulting in harm to health or life;

- alimony.

The second stage is the transfer of funds for payment:

- severance benefits and salaries (both former and current employees);

- royalties;

- funds due to owners of intellectual property rights.

Third:

- calculation of current wages;

- debts on taxes and contributions to state funds.

The fourth is servicing other writs of execution and accounts.

Fifth – the remaining payments transferred in accordance with the calendar queue.

Payment order - important points

It should be noted that in the corresponding order the column “Payment order” is conditionally mandatory. At the same time, practice shows that it is absolutely necessary to fill it out.

This is due to the fact that there is always a danger of a lack of funds in the company’s account, and this circumstance, in turn, calls into question the fulfillment of obligations under various types of debts.

In such a situation, you should be guided by the procedure given in the Civil Code of Russia, in Article 855. If there is a financial deficit, non-cash payments are carried out in accordance with the order specified in the payment order.

Meanwhile, back in 1912, the Central Bank of the Russian Federation issued a special resolution, according to which incorrect indication of such a parameter should not be considered as a sufficient basis for refusing to transfer certain payments. Based on this norm, many accountants believe that the need to indicate the order is a completely optional condition.

Amount of child support for 4 children

It should, in turn, be recognized that incorrectly filling out this column does not mean that the document contains incorrect details or is missing altogether. Thus, from a formal point of view, the bank cannot refuse to accept such an order.

After all, if the priority was determined incorrectly, it will not be difficult for the bank, subject to the law, to process the payment as it should. The problem, as a rule, arises if this column, which sets priorities, remains completely blank.

Experienced accountants note that most often banks simply do not accept a payment order form with an empty priority column. At the same time, recently, more and more often, financial institutions are also wrapping up payments with an incorrect indication of this parameter, which in general can be attempted to be challenged.

Be that as it may, it is much easier to prepare the document correctly from the beginning and thus save yourself time and nerves.

Withholding of alimony from salary

In the event that the alimony payer works on the basis of a concluded contract, that is, completely officially, the accounting department, after receiving a writ of execution or an application from the employee (if he draws up a voluntary agreement), deducts part of his earnings in favor of the recipient.

The amount of such withholdings is usually specified in the documents mentioned earlier. This may be a certain amount or a share of total income.

According to the law, alimony must be transferred to the recipient’s account no later than three days after the salary is issued in person.

Calculating the amount due for alimony is the responsibility of an accountant. Having determined this value, he generates a payment order, on the basis of which the bank transfers funds to the recipient’s account.

What is paid first: loan or alimony?

Thus, alimony is given first priority. When creating a payment order for their payment, the accountant must enter a unit (1) in the appropriate column. This means that even in cases where the organization’s financial resources are significantly limited, these funds will still be transferred without fail.

Order of payment for alimony

Let's look at how the order of payment is filled out in a payment order in 2023. See further in the article for what order to indicate for wages and taxes. One of the main details of a payment document is the order of payment.

The sequence of debiting funds from the organization’s current account depends on the value of the indicator. Let’s figure out the order in which the order of payment in the payment order is filled out in 2023 - the table of current indicators is given below.

Below, download the table of the priority of payments in a payment order in 2023. According to the generally accepted order, the priority of payment is a value that indicates the priority of debiting funds. If there are not enough funds in the client’s account, the write-off is carried out according to the rules of stat.

The details are given in field “21” (Regulation of the Bank of the Russian Federation No. 383-P dated).

When an organization submits payment orders to the bank, the financial institution is obliged to execute payments within 1 day (operational) after the day the documents were received (p. The indicator is indicated in numbers and takes a value from 1 to 5. In this case, the most urgent payment has a priority of 1, the least - 5. An accountant must know how to fill out the details correctly.

If there are errors, the bank may refuse to execute the payment.

For example, when transferring wages to staff, you need to indicate code 3, and when paying taxes, including insurance contributions and personal income tax, code 5. The table will tell you more about the order of payment in the payment order in 2023.

It is necessary to determine the type of transfer in order to understand what the priority of payment should be in the payment order in 2023. The table below contains the classification of payments by queue: Payment to authors for the results of intellectual activity.

Executive documents that contain requirements for the payment of wages and severance pay to both workers and dismissed employees of the enterprise. How to correctly fill out the queue in field 21 of the payment slip? 855) if there are sufficient funds in the account, all claims are repaid in the order in which payment documents are received by the bank.

When entering details, you need to remember that values with numbers from 1 to 3 are reflected on closed grounds for debiting funds. If there is not enough money in the account, the debit is carried out taking into account the priority rules.

Is there a statute of limitations for alimony?

When filling out the tax payment order in the 2023 payment order, you must indicate the value 3 or 5.

If the institution pays its obligations to the state in good faith and on time, code 5 is given when paying taxes. When the organization has an arrears, and the control body (IFTS, Social Insurance Fund, Pension Fund, etc.)

) issues a request for payment, code 3 is used. A similar procedure applies when transferring insurance premiums and personal income tax by tax agents.

If funds are paid at the request of the tax authorities, code 3 is entered. When independently transferring current amounts or arrears - 5. As for the state duty, the order of payment in the payment order in 2023 for the state duty is 5.

This is due to the fact that the payment of the fee is almost always carried out before the government service is provided, that is, after confirmation of the voluntary transfer of funds. Queue value 5 is the most common for organizations.

This code is indicated when transferring funds to suppliers and contractors for goods, work or services. This indicator is also entered when current payment of tax obligations, including state duty, arrears, personal income tax, contributions, etc. When several documents with code 5 are received at the same time by the bank field “21”, write-off is carried out in calendar order.

The order of payment in the payment order in 2023 for wages is indicated with code 3.

Purpose of payment when transferring alimony - law

The same value is used to pay sickness and maternity benefits. Therefore, for any transfers to employees under employment contracts, the value 3 is assigned. When profits are distributed among the co-owners of the business, the last option of priority 5 (for dividends) is used.

If the organization has debts to staff regarding wages, severance pay, and the obligations are repaid in accordance with writs of execution, it is required to indicate code 2. And when transferring alimony in accordance with the writ of execution - 1.

Filling out payment orders for taxes and insurance premiums has a number of features. You cannot make mistakes, otherwise the payment will not reach the budget on time and the organization will have to pay penalties.

Use the cheat sheet for filling out a payment order in the State Finance System. At the regulatory level, the write-off queue is approved in the stat. If you carefully study this article, you will notice that taxes are mentioned there, but nothing is said about fines and penalties for them.

The Supreme Court indicated that when choosing a priority code, it is necessary to take into account whether funds are written off voluntarily or involuntarily.

For this reason, there was confusion about which attribute value to use. If the organization independently makes a payment to pay a penalty or fine, you need to enter the value 5. When the amount is paid at the request of the tax authorities, indicate 3.

Reason for payment 106 decoding, filling rules

The reason is that the Regulations on the procedure for non-cash transfers do not contain a regulatory ban on writing off funds if there are errors in the order (No. 383-P of the city). Banks do not have the right to return payment documents to customers with errors in field 21. Moreover, in such situation, financial institutions are not authorized to ask the payer to clarify the payment.

Bank employees independently decide on the transfer of funds according to the legally approved order. Therefore, the client can make corrections at his own discretion.

If an organization has disputes on this issue, officials recommend seeking clarification from the Bank of Russia.

But the financial institution must execute the payment document in any case, without any delay.

But the financial institution must execute the payment document in any case, without any delay. The order of payment in the payment order is determined in accordance with Art.

The order of payment in a payment order is just one number, due to which the bank may not accept your payment.

Let's consider what this indicator means, why it is needed and what value to choose in a given case.

The order of payment is indicated in all types of bank payment documents. So, let’s look in detail at what the order of payment in a payment order means.

As the name suggests, this is a sequence or queue of debiting funds from your current account at the bank when there are several payments and there is not enough money in the account to pay them in full. If there are sufficient funds in the current account, the bank processes payment orders as they are received from the client.

Card index on the current account, which means its presence and

The procedure for writing off money from a bank account is established so that if there is insufficient money in the bank account, the most important expenses are paid first - compensation for harm caused to a person’s health and/or life, as well as claims for alimony payments.

In this case, all payment documents of the client end up in the so-called bank file. If there are no funds in the account or are insufficient to satisfy all the requirements presented to the organization or individual entrepreneur, then payment will be made in the order of priority of payment in the payment order in 2018 (Art.

855 of the Civil Code of the Russian Federation): Writs of execution are writs of execution that are issued by court decision.

Also, executive documents include court orders, notarized agreements on the payment of alimony, as well as documents issued by labor dispute commissions, judicial acts, acts of other bodies and officials in cases of administrative offenses, and others in accordance with the legislation of the Russian Federation.

Settlement or payment documents are payment or collection orders, payment requests, payment or bank orders. Calendar sequencing is the debiting of funds from the current account of an individual or legal entity in the order of receipt of client orders and other payment documents for debiting.

If several payment documents are included in one priority group, then they will be paid within this group also in the calendar order of receipt of payment documents.

For example, the bank received several payment documents: a payment order for the transfer of wages on February 2, a request from the Federal Tax Service for payment of taxes on February 3, a payment order for the payment of financial assistance on February 5.

If there are insufficient funds in the client’s current account, the bank will first issue a payment for wages, then the tax claim, and finally transfer financial assistance. What order of payment to the budget should I indicate in the payment order when paying taxes? 855 of the Civil Code of the Russian Federation raised many questions about how to fill out the payment priority field in a payment order when paying taxes and fees to the budget. Payments and fees to regulatory authorities are of an indisputable nature, therefore, the 3rd priority is indicated in the “Priority” field. But in case of timely (independent and/or voluntary) payment of taxes and fees, the 5th priority of payment is indicated in the payment order.

Payment under a writ of execution to the FSSP sample advokat

So, in addition to ordinary business transactions to pay the supplier for purchased goods, works or services, the 5th stage also includes payments for the payment of any taxes, fees, penalties and fines to the budget of the Russian Federation, as well as payments for insurance contributions to the budgets of state extra-budgetary funds .Payments of the first, second, fourth and partially third stages are carried out by the bank without the client’s consent, since the basis for payment is an executive document. That is, an organization or individual entrepreneur can indicate only the 3rd or 5th stage in the payment order. Thus, the field “Payment order” has code 21 and is located in the lower right part of the payment order. Let’s consider in which field the order of payment is indicated: The form of the payment order and the values of all its details are approved by the Regulations on the rules for transferring funds of the Bank of Russia dated No. 383- P (ed. *** So, let’s summarize what the order of payment in a payment order means. The order is the legally established procedure for banks to pay payment and/or executive documents from clients’ current accounts when there is insufficient money in their accounts. If the payment order is incorrect If the payment priority code is indicated, the bank may refuse to make the payment. Therefore, it is important to fill out this detail correctly in order to avoid delays in paying taxes and under agreements with counterparties. Withholding of alimony is made from almost all income of an individual, a complete list of which is approved by Decree of the Government of the Russian Federation No. 841 from .Alimony can be paid voluntarily or compulsorily.

The order of payment in the payment order in 2023

Sometimes organizations face a lack of funds in their account. How credit institutions execute orders in this case and how in 2023 the order of payment must be indicated in the payment order can be found in this article.

Where is the order of payments indicated in the payment order in 2023?

Payment order is a type of payment document. The current form has 110 fields to fill out, incl. and a field with the order of payments (form 0401060, approved by Bank of Russia Regulation No. 383-P dated June 19, 2012). Organizations may not supplement or change it in any way. But soon two more new fields will be added, in which these details are dangerous for the chief accountant>>

The priority in 2023 must be indicated in the field with 21 digits - a value from 1 to 5 (See example below).

If the priority is indicated incorrectly, the bank may not allow the payment to pass through. Therefore, we will tell you what types of payment priority exist and how to apply them.

Use the links below to download ready-made payment order samples for free:

See payer status in payment order in 2023

Types of priority of payment in a payment order in 2023

The order of payments in 2023 is regulated by Article 855 of the Civil Code of the Russian Federation.

There are five queues for debiting funds from the account:

- “5” - when paying taxes and contributions, transfers to suppliers, etc.;

- “1”, “2” and “4” - for payments under executive documents;

- “3” - for voluntary transfer of wages, forced write-off of debt on collection orders, which the tax authorities themselves send to the bank.

Legislation may establish cases when the queue should not be indicated. Typically this field does not work. It is provided for periods of cash gaps in the activities of the enterprise, as well as during liquidation or bankruptcy procedures.

In order to determine how to fill out field 21 of the payment order in 2023, the accountant starts from the type of the basis document being paid. Examples are shown in the table below. Here are some documents for direct debit, which have their own characteristics.

For example, a court order from a magistrate - in accordance with Article 121 of the Code of Civil Procedure of the Russian Federation dated November 14, 2002 No. 138-FZ - can be issued for claims in an amount of no more than 500 thousand rubles; tax collection order - can be issued no later than two months after the expiration of the period specified in the Requirements for payment of taxes, fees, penalties, fines (clause 3 of Article 46 of the Tax Code of the Russian Federation).

Therefore, if money has been debited from an organization’s current account without your consent, we recommend checking the correctness of the debits and, if possible, challenging them.

The order of payment in the payment order in 2023

Sequence of payment Type of payment and documents - basis for payment Examples of documents to be paid (lists are not exhaustive)| First (“1”) | — enforcement documents for compensation for harm caused to life and health; | The writ of execution received by the organization from the bailiffs, the order of payment for the writ of execution 2017 - «1» |

| — writs of execution on the collection of alimony | — a notarized agreement on the payment of alimony (has the force of a writ of execution in accordance with clause 2 of Article 100 of the RF IC); - a writ of execution received by the organization from the bailiffs. Payment orders are drawn up in order of priority «1» | |

| Second (“2”) | — executive documents for the payment of severance pay and wages to employees under an employment agreement or contract; — executive documents on payment to authors of the results of intellectual activity | - a court order from a magistrate received by the bank - paid in order of priority “2” ; - writ of execution received by the organization from the bailiffs - the organization itself draws up a payment order with payment order “2” |

| Third (“3”) | — payment documents for the transfer or payment of salaries to employees under an employment agreement (contract); | Payroll payroll. The order of salary payment 2017 is “3” |

| — instructions from tax authorities regarding the payment of taxes and fees to the budgets of the Russian Federation; | A collection order from the tax authorities received by the bank is paid in order of priority “3”. The organization does not issue payment orders | |

| — instructions from bodies monitoring the payment of insurance contributions to the budgets of state extra-budgetary funds | ||

| Fourth (“4”) | writs of execution on grounds not listed in the first and second stages | A court order from a magistrate to collect arrears of payment for utilities and telephone services - funds are written off in order of priority “4”. Payment order is not prepared |

| Fifth ("5") | all other payments |

Payment orders are drawn up with payment order “5” |

The order of payment in the payment order for alimony

The order of alimony payments is important in the interaction between accounting and a financial institution. If payments for a child are deducted from the salary of the alimony obligee, the accountant fills out a payment order and sends it to the bank. To do this correctly, you need to know the legal norms and rules for drawing up the document.

What is the order of payment?

The order of payment is a kind of algorithm that indicates the degree of importance of deductions from a legislative point of view. All payments are divided into 5 stages; first of all, money is transferred to recipients whose interests, according to the law, are most important.

To understand the order in which funds are deducted from your salary, just look at the table:

Sequence of paymentsWhat does this include?

| Priority | Payments deducted under writs of execution (IL): alimony, compensation for damage to life or health |

| Minor | Deductions under executive documents (ID), involving calculations for severance pay, salaries, and remunerations for intellectual work |

| Tertiaries | Salary according to employment contracts; insurance, medical and tax contributions; payment of late fees for government fees |

| Fourth stage | Payments under individual entrepreneurs initiated in connection with causing property or financial damage |

| Fifth stage | Other payments made according to payment documents |

How to fill out a payment order correctly?

A payment order (PP) is drawn up in form 0401060, approved by Bank of Russia Regulation No. 383-P dated June 19, 2012, but it is not mandatory for use. To fill out the order correctly, it is recommended that you familiarize yourself with the rules and information about what information is indicated in a specific field:

- Field 21: order of payment. The number “1” is put here, because alimony is considered a priority. First, write-offs are made for them, then for other obligations.

- Field 17: Recipient's current account. The account details of the ex-wife are indicated where the money should be transferred.

- Field 19: payment term. Remains empty.

- Field 24: purpose of payment – “alimony”.

- Field 60: Payer's TIN. For individuals – 12 digits, for legal entities – 10.

This is also important to know: How to send alimony by mail?

In total, there are about 110 fields in the order, but the above ones are the most important when paying alimony.

Important! Payments for the maintenance of a minor must be transferred monthly no later than 3 days from the date of payment of wages. For failure to meet deadlines, you will have to pay a penalty - 0.1% of the debt for each day of delay.

Sample payment order

Free legal consultation We will answer your question in 5 minutes!

As mentioned earlier, the payment order form is approved by law, but you can deviate from it and use your own samples. The document must contain the following information:

- number and date of registration of the PP;

- amount to be received by the bank and written off;

- payment type;

- information about the payer. Individuals indicate their full name and registration address, legal entities - name and address;

- recipient's name;

- recipient's account number;

- name of the payer's bank;

- name and address of the recipient's bank, BIC, subaccount number;

- payment queue – 1;

- code, signature and seal of the payer;

- bank marks - stamp and signature of employees. If the form is electronic – the date of execution of the order;

- date of receipt and debit from the bank. To be completed by authorized employees of the financial institution;

- checkpoint between payer and recipient;

- KBK, code OKTMO.

Sample payment order for alimony - download

It is important to note that the order is drawn up in 4 copies:

- the first one remains in the bank after debiting,

- the second is kept in the documentation for the recipient bank,

- the third is attached to confirm the bank transaction to the recipient’s account statement,

- the fourth is returned to the payer to confirm the transaction.

Latest changes in the law

The main changes in legislation regarding payment orders affect their content. Thus, in 2014, the Bank of Russia made it mandatory to indicate the UIN code. If it is not there, “0” is placed opposite the corresponding field. Individuals indicate 25 numbers, legal entities – 20.

This is also important to know: What documents are needed to apply for alimony?

In 2016, the “KBK” field appeared in the payment invoice, reflecting the type of income of the Russian Federation budget: insurance premiums, taxes, etc. Two years earlier, instead of OKATO, the Bank of Russia obliged to indicate the OKTMO code - numbers assigned to the constituent entity of the Russian Federation.

Conclusion

Didn't find the answer to your question? Our lawyer will answer your question for free in 5 minutes!

Correctly filling out the “payment priority” field allows the bank to determine the degree of its importance and transfer money first. Alimony is of paramount importance, and if the payer does not have enough funds in the account, payments for it must be made without fail, and other payments are made later.

It is important to know!

- Each case is individual and requires special attention. The information presented on the site is general and does not guarantee a solution to your specific problem.

- We carefully monitor changes in legislation and try to make changes in a timely manner, but this does not always happen quickly.

Therefore, 24-hour legal assistance on any issues is available to you FREE OF CHARGE! Ask your question right now!

Lawyer. 2 years of experience. I specialize in civil disputes in the field of family law.

Still have questions? Ask them to the duty lawyer!

The order of payment in the payment order from 2023 alimony

- The State Duma of the Russian Federation adopted in the third and final reading amendments to the Family Code, establishing the right of citizens of pre-retirement age to demand alimony from their former spouses due to incapacity for work.

- The document introducing an additional, eighth paragraph to Article 169 was adopted on March 12.

- According to the amendments, the age at which Russians acquire the right to alimony for disability has been kept at 55 years for women and 60 years for men.

- Accordingly, the right to alimony will now apply not only to pensioners, but also to citizens of pre-retirement age.

- Chairman of the Committee on State Building and Legislation Pavel Krasheninnikov noted that parents are obliged to support their disabled adult children if they need help, just as, accordingly, able-bodied adult children “are obliged to support their parents who need help and take care of them.”

- In September 2018, the State Duma finally adopted a bill on criminal liability for dismissal or refusal to hire people of pre-retirement age.

- A new article 144 will appear in the Criminal Code, for violation of which the employer faces a fine of up to 200 thousand rubles or in the amount of the employee’s salary for 18 months or compulsory work for up to 360 hours.

- In 2023, Russia launched a reform to increase the retirement age.

The State Duma has secured the right of former spouses to apply for alimony for disability five years before retirement - Takie Dela

- Women will retire at 60 (previously from 55), men - at 65 (previously from 60).

- In March 2018, several Russian journalists reported harassment by the chairman of the State Duma Committee on International Affairs, Leonid Slutsky.

- On March 21, the State Duma Ethics Commission found no violations in the deputy’s behavior.

- From the list above it follows that before paying wages for the past month, the employer is obliged to pay off arrears of wages and severance pay.

Sequence of payment: what is it? | Contour.VAT+

- However, it means debt for which there are enforcement documents.

- In fact, the mentioned payments do not have priority over each other.

- The fact that they are in the same queue implies the following: the payment will be made in advance, the order for the transfer of which was received by the bank earlier.

- If the order to pay wages was made earlier than a collection order was received from the tax authority to write off the debt, then the wages will be paid first, and then the tax debts.

- If an order from the tax office was received earlier, then this payment will go forward.

- Current tax payments will go to the last, fifth place.

- This same level of priority includes, for example, payment for goods and services, payment of state duties, and so on.

- There is a chronological order inside the queue, that is, the payment that arrived earlier will go first.

- , the sequence of payments is also determined in accordance with the provisions of paragraph 2 of Article 855 of the Civil Code of the Russian Federation.

Payment order | Download the form and sample | How to fill

The procedure for filling out payment orders is established by the Ministry of Finance, since the documents are processed automatically. You can fill out a payment order online in My Warehouse - it's fast, free and guaranteed to be error-free.

To avoid mistakes, download a sample payment order form and simply fill in your details.

The document refers to strict reporting forms, form according to OKUD 0401060. Filling out the document is not difficult, the main thing is to prevent corrections.

- The most convenient and reliable way to fill out a payment order is online.

- You do not have to fill in all the fields manually: you just need to indicate the company, counterparty, amount and expense item.

- My Warehouse will do the rest: you will receive a finished document and can immediately print it.

- Filling out a payment order online through My Warehouse is easier than entering the data into the form yourself - you will save time and do everything without corrections or blots.

- You receive a finished document in convenient Excel and PDF formats.

- Below we have answered frequently asked questions about the procedure for filling out a payment order.

- Filling out the payment order form at the request of the Federal Tax Service has its own peculiarities.

For convenience, we have collected them in a table: Field 22 (unique accrual identifier) must be filled in when paying fines, penalties and arrears.

But the tax office explained that this is not necessary - you can simply enter 0 (letter from the Federal Tax Service of the Russian Federation dated No. ZN-4-1/4434@).

When transferring money to legal entities, it is not necessary to indicate the checkpoint (regulations of the Central Bank of the Russian Federation dated June 19. But to determine the recipient and payer, it is better to enter it.

The main difference is that a payment request is an application to the bank to withdraw money from the client’s current account.

Thus, with an order you ask the bank to transfer money from your account to the counterparty, and with a demand - from the payer’s account to yours. See our example of a payment order and instructions for filling it out here. This is field 110.

It only needs to be filled out when transferring money from the budget to individuals, for example, salaries to public sector employees.

If you don’t know how to fill out the remaining fields in the payment order, read our instructions. This is field 110, which is filled out only when transferring funds from the budget to individuals.

If the payment is made to the budget, enter a two-digit numeric code; in other cases, leave it blank.

For the remaining details of the payment order in 2023, see here Your own form will not work.

The payment order form has been approved by the Central Bank, and only it can be used.

- If there is enough money in the account, the order of payments does not matter.

- If there are not enough funds to fulfill all orders, the bank will write off the amounts in the manner prescribed by law: the first payment in line is alimony and health payments, and tax debt is number 3.

- Budget income classification codes are divided not only by type of payment, but also by purpose.

- The payment of funds ordered by a court verdict is called payment under a writ of execution.

- In order to pay a particular debt according to a court decision, you need to indicate in the payment order the details of the KBK according to the writ of execution of the bailiffs of 2023.

- In 2018, the ciphers of the corresponding year were used.

- This article presents codes and a sample for filling out a payment order to bailiffs, since the preparation of this documentation has nuances.

- Individuals and legal entities that owe money to organizations or third parties are more likely to pay their debts after a court decision.

What is the order of payment? Circuit. VAT+

Such debts include: alimony, unpaid loans, loans from friends, relatives, banking organizations or damage. The article states that in such a situation, the citizen is obliged to pay the enforcement fee of the bailiffs in 2018, the BCC of which is entered in field 104 of the payment order.

But some citizens sometimes do not pay fines assessed by the court. The budget classification code for paying fees assigned by bailiffs is in this article.

After the court renders a verdict on the guilt of a citizen or company and imposes a fine, the bailiff service begins to work.

The latter generate payment orders and send them by mail of the Russian Federation: The receipt form, encrypted under the number 0401060, is regulated by Appendix No. 2 of Bank of Russia Regulation No. 383-P dated (ed. The payment is needed by FSSS employees to confirm the payment of debt money according to the writ of execution.

- The contents of the receipt have two types: for withholding tax and non-tax arrears.

- The latter include alimony, credit loans, etc.

- The budget classification code in the Purpose of payment field of the receipt is indicated only when paying tax debts.

- Extra-budgetary arrears are characterized by the corresponding word or code, which is provided by clause.

The State Duma has secured the right of former spouses to file for alimony

- 7 Appendix No. 2 according to Order of the Ministry of Finance of Russia No. 107n dated (ed.

- Having received a payment slip, a citizen does not need to pay the debt on his own, since FSSS employees often write off money from the debtor’s salary or from the company’s current account.

- If an individual does not work anywhere, then the citizen’s property is confiscated for the amount owed.

In such a situation, no payment orders will be received.

If you do not take the payment of the debt under the writ of execution seriously and do not pay the money, then a fine is imposed - an enforcement fee, which is 7% of the accrued amount calculated for payment.

The BCC of the enforcement fee differs from the codes for other payments to the federal budget.

Since the receipt form is regulated at the legislative level, the rules for filling it out are also regulated by law.

Memo to an accountant - Federal Bailiff Service of Russia for the Tambov region

- Thus, before transferring the employee’s debt money to the budget, the accountant of the company in which the debtor citizen works will draw up a payment order as follows: After this procedure, the funds calculated for payment are debited from the employee’s salary and transferred to the budget.

- Another example of calculations based on a writ of execution is offered by Letter of the Ministry of Taxation of the Russian Federation No. BG-6-10/253 dated No. 10.

- The letter contains examples of filling out payment forms for different situations.

- Number 10 shows an example of a receipt filled out by an organization that reimburses a tax debt.

- Bailiffs order various types of payments: alimony, arrears on loans or taxes.

- But there are fixed types of payments to the federal budget, which correspond to a code that classifies payments.

- At the legislative level, budget classification codes are established for payment: State duty for entering information about a legal entity into the state register of legal entities engaged in the collection of overdue debts as the main activity. Citizens often receive payment orders in which the details are indicated by bailiffs.

- KBK 3220000000000000180, the decoding of which is incomprehensible to most citizens, means that the citizen missed a payment under the writ of execution.

- Missing payments ordered by a court hearing will result in a fine, which is coded by this number.

- A receipt with this code must be paid within five working days, otherwise a further fine will be assessed.

Priority of alimony payments in 2023: in the payment order

The order of child support payments is a sequence of deductions that confirms the importance of financial support for children for legislation.

There are 5 priority groups, alimony payments are in the 1st group.

This means that if there are several obligations and a lack of funds to cover them, alimony arrears are paid first. All other payments are secondary.

Filling out a payment form

The basis for withholding alimony is a writ of execution or an agreement to pay alimony, certified by a notary. The amount indicated in the document is subject to withholding. To transfer money in favor of the payee, a payment order is issued in the accounting department. It is transferred to the bank, which must comply with the order indicated in the payment order.

The payment order contains the following information:

- block 17 must contain the current account of the alimony payment collector, to which the withheld money will be received;

- no information is entered in block 19 (payment term);

- Block 21 indicates the order of payment, you must enter the number “1”;

- block 24 indicates the purpose of the payment – “alimony”;

- block 60 indicates the debtor’s tax identification number (12-digit number for individuals and 10-digit number for legal entities).

These are the most important blocks for filling out the payment form. There are a total of 110 blocks in the document.

The law requires that alimony be transferred to the recipient’s account within 3 days from the date of payment of wages. If the requirements are not met, you will have to pay a penalty of 0.1% for each day overdue.

Example of filling out a payment form

The Bank of Russia has approved the payment order form numbered 0401060. But the form is not mandatory for use. Legal entities can develop their own form, but it must contain the following data:

- number and date of creation of the payment order;

- the amount transferred to the bank for further debiting;

- type of payment;

- information about the debtor (for individuals - full name and registration address, for legal entities - name, address information);

- Full name and bank account of the claimant;

- name of the banking organization of the claimant;

- information about the bank (address information, BIC, subaccount number);

- payment order - 1;

- code, signature and stamp of the payer;

- marks of the banking organization (sign and stamp), if electronic banking services are used, then the date of execution of the order must be indicated;

- bank employees must indicate the date of receipt and debit of money at the financial institution;

- checkpoint for participants in alimony relations;

- OKTMO, KBK.

The payment order must be executed in 4 copies:

- The banking organization stores the document after the required amount is written off.

- The following copy is located in the records for the payee's financial institution.

- The payment is attached to the claimant's account statement to record the bank transaction.

- The last copy is kept by the payer to certify the transfer.

Let's sum it up

If there are several writs of execution for one employee, then alimony payments and compensation for damage caused to human health are of paramount importance. The remaining obligations are paid off after the alimony obligations are fulfilled.

Thus, obligations for alimony payments must be repaid first; for this, the corresponding code is entered in the payment slip. On its basis, the banking organization carries out the necessary operations in accordance with the priority specified by the accountant.

If you want to find out how to solve your particular problem, please use the online consultant form below or call :

Alimony and order of payment in the payment order

Last year there were some changes that affected the procedure for preparing accounting documentation and the actual process of making payments. Similar amendments are noted in relation to the procedure for calculating and withholding alimony payments.

What is the procedure for deducting alimony from wages received?

To deduct alimony payments from wages, there must be a legal basis. This can be either a voluntary agreement concluded between the parties, or a writ of execution issued on the basis of an existing court decision.

Collection methods may also vary - a share of wages, a lump sum or property.

Within the framework of this article, we will dwell in some detail on the question of what is the relationship between withheld alimony payments and the order of their transfer.

A few words about the payment order

If the alimony worker is officially employed in accordance with the norms of current legislation, then payment will be made from his salary every month in a specific fixed amount based on the results of the court or alimony agreement.

The accountant of the company where the payer works makes all the necessary calculations and generates a payment order, according to which the payment will subsequently be made to the account of the alimony recipient.

What is the order of payment?

The company's accountant has to generate a lot of payment orders every day: for the tax authorities, payment of wages to employees, for making appropriate contributions to all government funds. When creating a payment order, the accountant needs to fill out line No. 21, which reflects the order of payment.

This is a specific instruction to the bank regarding the order in which certain payments should be made. If there are sufficient funds in the company's bank account, filling out this column does not play a special role, since all payments will be made simultaneously. However, in the absence of finances, priority is extremely important.

Accordingly, the bank will focus directly on the information specified in column 21.

At the same time, a question may arise as to how all of the above relates to the withholding of accrued alimony payments. And as it turned out, the most direct.

The relationship between alimony payments and their order in the payment order

In accordance with the changes introduced at the legislative level, the procedure for preparing accounting documentation was also coordinated.

Now alimony is transferred first, like other deductions under writs of execution. Thus, it turns out that the accountant must enter the number 1 in the corresponding column.

It is also important to note that in the absence of sufficient funds in the company’s account, alimony will be paid first.

Please note that information in legislation changes quite often. Accordingly, the page of this portal may contain information that is not entirely up-to-date, despite the fact that we strive to publish publications regularly and promptly.

In addition, each case should be considered individually, taking into account certain factors and prevailing circumstances. By contacting our specialists, you can receive up-to-date information and professional assistance in resolving your issue.

Consulting is carried out in any way convenient for you, almost around the clock and completely free, so you can contact us exactly at the moment when help is needed.