- The sellers and buyers of apartments are equally interested in a reliable way of calculating the result of a sales transaction.

- At the same time, the notion of "reliability" varies from party to party.

- Often, the parties to the transaction have a very vague idea of when money should be transferred for the apartment being sold.

A little bit about the cash settlement.

- The vast majority of transactions in the Russian real estate market are in cash.

- In such cases, the money is transferred to the seller at the time of signature of the contract of sale, after which the package is submitted for public registration.

- This approach to calculation takes full account of the seller ' s interests: it is also the owner of the apartment and has already been paid for it.

In such a situation, the buyer should not relax until he has obtained documents confirming his ownership of the apartment.

In cash, the buyer may face the following difficulties:

for various reasonsThe registration authority may refuse State registrationIn this case, the seller must return the money received, but it may already spend it in whole or in part;

for various reasonsThe registration authority may refuse State registrationIn this case, the seller must return the money received, but it may already spend it in whole or in part;- The seller may owe a sum to a natural or legal personwhich, after learning of the sale of the dwelling, has the right to take legal action until the moment of the transfer of ownership of the property, is carried out very quickly, making it impossible for the buyer to complete the transaction, and the buyer will be very lucky if the seller has not spent the money at that time;

- In case of damage to property (fire, flooding) before delivery of the dwelling to the buyerThe seller won't have much incentive to clean up the property sold because he's already got his money.

These are only the most serious underwater stones that can be encountered in cash calculations.

What is a depositary?

The alternative to the cash settlement for the purchase or sale of an apartment is to rent a bank deposit box.

This form of transfer of funds is equally responsive to the interests of both the seller and the buyer.

Calculations through the cell are not so common because most of our citizens do not know what a depositary is.

It is a secure bank repository, which is regulated by separate legislation.

- Banks are entitled to such services only with a special licence.

- The depositories themselves are space for a variety of cells, ranging from a few tens to one or two thousand.

- Depositary offices are usually located on minus 1 or minus 2 floors, i.e. underground.

- Entry to the depositary has several degrees of protection: several levels of security, video surveillance.

- Entry into the depositary is strictly limited to the list of persons listed in the documents granting access.

- Cells vary in size because they are designed to store different amounts, ranging from several hundred thousand rubles to many tens of millions.

- The cost of the bank cell depends on the size and duration of the stock.

The standard cell for one month in different banks will cost between 2.5 and 5,000 rubles.

It's usually paid by the real estate buyer.

Computation through a bank cell when buying an apartment

If you choose to use the cell, you can be fully confident of the security of your assets.

In order to obtain the box, the following must be done:

- Select a depositary with terms and conditions of access that will accommodate all parties to the transaction.

- On the day of the transaction, check the bank cell lease.

- Fill in additional agreement to the treatyIn most banks, specialists are responsible for filling out the lease and the supplementary agreement.

By filling out the contract, recalculating and checking the bills for authenticityThis service is usually provided by bank cashiers in front of the seller and buyer, and after checking and re-counting, the bills are packed and sealed by the banker, and a transparent package containing the sum and signature of the cashier is placed in the package, and the money is given to the seller, after which all the parties to the transaction, without losing sight of the person carrying the money, are deposited with the depositary.

By filling out the contract, recalculating and checking the bills for authenticityThis service is usually provided by bank cashiers in front of the seller and buyer, and after checking and re-counting, the bills are packed and sealed by the banker, and a transparent package containing the sum and signature of the cashier is placed in the package, and the money is given to the seller, after which all the parties to the transaction, without losing sight of the person carrying the money, are deposited with the depositary.- The inspection service is paid forOn average, this costs 0.1% of the amount tested. For example, one million rubles will have to be paid for for this service. Whoever needs to be checked, i.e. the buyer, pays for the service. The seller is generally confident that all of his money is real, but practice shows that counterfeit bills are found both in the rubles and in the currency. If such bills are identified, the cashier will return them to the buyer with a request for replacement. The cashiers are often picky and to a particularly dilapidated bill.

- If the buyer can check the money, he can cancel the cashier's service and count and check the money himself. Banks provide account machines with detectors for self-checking.

- Only the persons referred to in the supplementary agreement and the treaty will be admitted to the depositary.When entering the vault, the buyer, who is the tenant under the contract, receives the key from the bank cell. Each cell is locked into two separate locks. The key to the first lock is given to the lessee. The key to the second lock is stored in the bank.

- The only way to open a cell is by using both keys at the same time.The bank officer conducts the transaction to the cage and leaves the vault. The buyer must remove the cassette from the cassette, place a cash bag sealed by the cashier. All parties to the transaction must verify that the money is in the cassette and then enter it into the box and close the door by the buyer.

- At the end of this procedure, the documents issued by the bank must remain in the hands of the seller and the buyer, indicating the timing and conditions of access to the cell; usually either the contracts or the contracts and the bank agreements – the documents vary slightly from bank to bank but contain the full amount of information required.

The key to the bank cell is usually retained by the buyer.– He is formally the owner of the money until the transfer of ownership, i.e. the registration of the sales contract with the registrar.

The key to the bank cell is usually retained by the buyer.– He is formally the owner of the money until the transfer of ownership, i.e. the registration of the sales contract with the registrar.- The seller shouldn't be afraid to keep the money safe.The right of access to the cell may be obtained by the buyer only if the transaction is not registered with the authorized authority.

- On the date of receipt of the documents, the buyer must hand over the key to the cell to the seller.If the key is lost, there is no need to panic – the party that lost the key will have to pay a fine, the average amount of which is between 5,000 and 10,000 rubles, and then access to the cell will be opened.

Requirements for the preparation of a contract for the rental of a bank cell and its pre-selection

The lease agreement shall normally state:

- The passport data of the person(s) who has the right of access to the depositary by the seller and by the buyer;

- The exact address of the dwelling to be purchased;

- Conditions and time limits for the seller ' s access to the depositary to recover money for the apartment sold;

- The conditions and time limits for the buyer ' s access to the depositary for the withdrawal of funds in the event of a refusal to register a transaction by the State.

- You'll probably be interested to see the mental map of "Home acquisition methods", which explains all the options in detail.

- Or TUT you'll learn about the consequences of invalidating a transaction.

- What's the tax on the sale of the apartment:

- https://legalmap.ru/articles/fp/fiz/nalog-s-prodazhi-kvartiry/

Underground stones when bank documents are filled in

There is only one case where it is difficult to use a cell-based calculation: if the contract is not properly completed.

There's no problem with that, and the mistakes are caused by a basic lack of attention.

To avoid this, follow the following recommendations.

- The preamble of the contract should indicate the persons who will deposit the money (buyer) and take it (seller).

- If a communal dwelling is sold, a separate cell is issued for each of the sellers.

- For each seller, the bank issues separate contracts, all include the buyer.

You need to fill out your passport data strictly on the document. Inaccuracy in one letter or number will make access to money more difficult.

By completing the passport data accurately according to the contract, after checking the certificate of ownership of the dwelling, indicate the full and precise address of the dwelling being purchased.

The next important step is the dates and conditions of access to the bank cell.

The seller is normally admitted to the depositary, holding a passport, the original of a registered contract for the sale of an apartment or a certificate of ownership, the key to the cell.

If the authorities refuse to register the transaction, the buyer will receive the money if there is a passport, key and bank agreement.

On the day of deposit, the seller and the buyer have the right of simultaneous access.

Starting the next day, the right of access is granted to the seller, and it's important to keep up with the dates.

To date, the State registration of a transaction takes 10 working days.

So the calculation will be done as follows, for example, the transaction took place on the 1st of the month, Monday.

We count down 10 working days -- the 12th, Friday.

It's the day the documents have to be registered, but I'm sure it won't be until Monday on the 15th.

So the minimum time for a seller is the 15th.

But it is necessary to take account of irregular situations: not to leave the bank, to break down the car, etc., so we should not limit our access to the cell to a minimum of 3 to 5 days.

- In terms of access, this would be as follows: "The seller shall have access from 2 to 20 inclusive".

- If the deal doesn't take place, the money must be taken by whoever put it in, that is, the buyer.

- His access to the cell will be from 21 to 30, respectively.

- Equally careful consideration should be given to the content of the contract of sale to which reference would be made under conditions of access.

- In order to avoid any trouble, be careful to fill in or verify the conditions for the list of persons listed as buyers in the contract.

- The wording would be along the following lines:

- "Petrov Petrović has access to a cell from 1 to 20 in the award of a contract for the sale of an apartment at Moscow, Street of Leninsky, house 1, square 1, registered with the Office of the Federal Public Registry, Inventory and Cartography in the name of the new owner Ivan Ivan Ivanovich."

- If the apartment is purchased by Ivanov, his wife and child, the contract must include their names, patronymics and surnames.

- One last thing.

- The name of the authority in which the sales contract submitted to the bank is registered should be specified.

- To date, this is the Office of the Federal Public Registry, Inventory and Cartography Service.

So using a bank cell is a reliable and civilized way of calculating a transaction.

It is particularly attractive in cases involving large sums or participants in a transaction that are not of particular trust to either party.

Transfer of money through a bank cell at the time of sale of the dwelling

The cost of a modern apartment or house is substantial, which is why financial security is a major concern in transactions involving the purchase or sale of housing. We suggest that we understand how the bank cell is used in the settlement of real estate.

Buying real estate is a big deal.

Buying an apartment or a house from a developer isn't a big deal. With no cash, the money is transferred to the organization's account through the bank and the risks are minimal. But the process of acquiring a dwelling on the secondary market is a little different.

The question is, "How is it safe to hand over a large amount of money to the seller?"

In the secondary real estate market, there are three ways of mutual accounting:

- Using a rental cell in the bank;

- Transfer of money through a notary deposit;

- A non-revocable letter of credit (applicable only for non-cash transfers).

We suggest that we consider the most convenient and needed calculation option - the transfer of money through a box in a bank vault.

Such a method would cost less than a notary deposit and would be more appropriate to pay for the purchase of cash.

The conditions of the procedure are adapted for the purchase of physical property and multi-stage transactions are also envisaged.

Banking Cell — Basic Concepts

In fact, the deposit box is a simple safe, only small in size; it can serve as a repository not only for money, but also for jewelry, art, shares or bonds.

The financial organization secures the property of the client; the storage facility where the cells are located is equipped with special equipment: fire alarms, surveillance cameras; once the contract has been drawn up, the value is placed in the custodians for the necessary period of time.

In order to get them back, the owner will have to present his passport.

There are two ways of operating a mini-seife: a lease and a storage contract.In the first case, third parties ' access to the cell is restricted.

Only tenants and employees of a bank with a special permit may enter the depositary; once the contract has been signed, the bank is responsible for the preservation of the property.

Property deposited is accepted on the basis of a list.

How the Cell is used in financial calculations

The transfer of money through a bank cell at the time of sale of the dwelling takes place as follows: the parties to the transaction read out the bills together and deposit them; the money is blocked for a specified period; the seller obtains access to them once the terms of the contract have been fulfilled by submitting the necessary documents to the bank ' s employees.

The service is used at the inter-accounting stage, when the agreements are reached, the necessary papers are in place and the conditions are met by both parties. This procedure is not mandatory, but the real estate agencies use the bank cell as a guarantee of the security of the financial side of the transaction. Next, let's consider the benefits and disadvantages of this method.

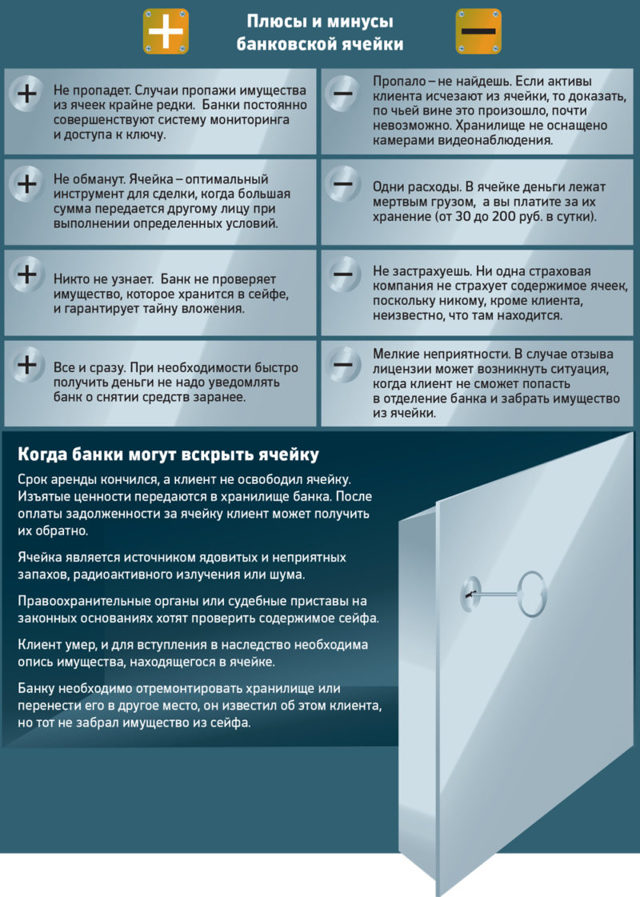

Adds and minuses

So what's a bank cell when you buy an apartment and what's the advantage of it:

- The storage of money in a rented cell makes it impossible to cancel the transaction unilaterally when the seller or buyer changed its mind at the last moment.

- A man who breaks the law wouldn't risk showing up in front of surveillance cameras.

- Guarantees the seller ' s receipt of the money after the new owner becomes the full owner of the real estate, i.e. a certificate of registration of the property.

- Protects against unfair buyers. Transfers are checked by a bank employee for authenticity.

- Ensures the confidentiality of the real estate transaction; the amount deposited is not specified anywhere.

It is clear that renting a cell will protect the buyer and seller from unnecessary risks. In addition to the safe itself, the bank can rent a negotiating room between the parties to the transaction. Some organizations provide this service free of charge, otherwise the cost is between 1,000 and 1,500 rubles per hour of use.

Weaknesses also exist in this way, especially in terms of time spent on finding a bank with suitable conditions and signing a contract; renting a bank cell must be paid a certain amount; some organizations request bail in case of loss of keys and charge an additional insurance contribution.

I guess so.The most significant negative is the need to pay for the authentication of bills.In order to save money on a service, you have to change the money into a big one, and you have to take into account that the standard bank agreement doesn't take into account force majeure. You have to make nuances with a supplementary agreement that is paid separately.

What's a bank cell gonna cost?

The rent is determined daily or monthly, the price depends on the size of the cell. Since the mini-seifes are of different sizes, it is better to specify immediately whether the entire amount will be used. Each bank sets its own price for the service.

- At the Russian branch of the Rifeisenbank, you can book a small cell for 2,000 400 rubles for 30 days.

- The BWV 24 has a regional calibration. The highest prices in the capital are 135 roubles per day. The client is given two sets of keys.

- The potential customers of Rosbank will be able to book the safe in advance via the Internet, as well as send the employee documents for the contract. A small cell will cost 4,250 rubles per month. A key deposit will cost 3,500 rubles.

- ==Career==Sberbank has an attractive service cost. Cell subscriptions will cost approximately 65 rubles. Once the contract is concluded, if the transaction fails, the money can be kept free of charge for another week.

- Alpha Bank offers a similar service for 35 roubles/day, provided that the cell is used for at least three weeks.

The cost of services varies from region to region, and even in one bank it may vary significantly.

Rental of a bank cell for a real estate deal, how's the procedure going?

After notarization of the contract between the seller and the buyer, it is necessary to select the agency that provides mini-seife rental services in the depositary. By visiting the financial institution with the passport, the prospective client prepares a model contract with the bank.

The cash is counted, checked and stored in the deposit box and the key set is then handed over by the bank employee to the buyer; the seller does not have access to the safe at this stage.

He will be able to obtain the money due only after the purchase of the property by the new owner, which takes seven calendar days to register in Rosreister.

This is the time limit established by the legislation of the Russian Federation.

Main items of the lease agreement

The mini-seaf lease is usually initiated by the real estate buyer, but there are also situations where both parties order a service at the same time.

The document and the principles of access to the safe remain unchanged.

A model for the lease of a real estate bank cell can be downloaded on the Internet and completed in advance or obtained from employees of a financial organization.

The document contains the client ' s passport data and the licence number of the service provider, followed by the parameters of the bank cell:

- Number;

- The duration of the lease;

- Amount of payment;

- Key number;

- Timetable for access to the vault;

- Restrictions on use.

The following section defines the rules for the operation of the leased cell, describes the obligations and rights of the parties and the liability to be incurred in case of breach of the terms of the contract; the document specifies the nuances involved in the conduct of the transaction, in particular those relating to its avoidance; and the last page lists the details of the parties, the date and the signatures.

Additional conditions

The cell lease agreement contains a minimum set of terms and conditions, but the parties to the transaction have the possibility of drawing up a supplementary agreement that will determine the possibilities of access to the safe. A time limit is set for the seller to collect the money and the documents deposited.

The keys remain at the buyer ' s disposal until the seller gives him a receipt to receive the money, but the parties have the opportunity to resolve the matter immediately so that they do not waste time.

The seller will still not be able to access the money without confirming that the transaction has been registered by the State.

A written agreement may provide for additional documents that will confirm the withdrawal from registration of previously registered tenants in this area.

A supplementary agreement could provide for the possibility of joint access to funds transferred to the bank for preservation.

Thanks to this paragraph, in force majeure circumstances, when the transaction becomes impossible, the buyer receives the money back without delay.

But it will only be possible to do so in the presence of another party, i.e. the seller, which will cost between 2,000 and 5,000 rubles.

Calculation through a bank cell when buying an apartment. Underwater stones.

It's no longer necessary to arrange a meeting, and you can get the money at a convenient time, but it's where the seller risks selling the apartment through a bank cell.To open the safe if you lose the key, you have to go to another bidder.

Bank employees perform this operation only in the presence of both parties.That is, for the duration of the contract, the possibility that the buyer will simply take its money is excluded, but once the specified time limit is reached, the buyer and seller will have unimpeded access to the safe.

The lease period must therefore be monitored with particular care.

The buyer may knowingly delay the process of processing the property and simply take the cash or paper supporting its entitlement from the cell, in which case the seller will be left with nothing.

Sometimes for the transaction, both participants rent separate safes, one holds cash, the other puts the seller ' s receipt confirming receipt of money and documents.

This allows the seller to obtain additional guarantees from the buyer against deception.

Buyer ' s advice

Cash settlements carry risks not only for the seller but also for the buyer, especially when the seller acts through a real estate agent or other trusted persons.

It is best if the exchange takes place in the presence of witnesses to whom the financial institution providing the service is invited.

The power of attorney also needs to be clarified, as the seller may well have withdrawn it.

As you can see, the transfer of funds through a bank cell is a reliable guarantee that the terms of the contract will be fulfilled when large sums are transferred for the purchase of real property, but there are some nuances here as well. To avoid risk, you need to document the transfer and receipt of money.

Bank cell in real estate payments in 2023: order, sales pattern

The sale of an apartment is a responsible, serious transaction involving the transfer of a large amount of money.Regardless of how difficult it was for the family to raise funds, buyers try to take certain steps to ensure the safety of the procedure.

And in that case, when real estate is to be bought and sold, banks offer to use a bank cell.

And in that case, when real estate is to be bought and sold, banks offer to use a bank cell.

It's gonna make sales safer and quieter.A scheme has already been drawn up for buyers, sellers and bank employees, and a model contract for the lease of bank property has been drawn up.

Is a bank cell really a convenient and safe way to use it when calculating real estate? You can also get information on this from any bank, its specialists.Many banking institutions provide this service.

As a rule, bank cells for the sale of apartments are contracted by buyers, they leave money there, and access to the seller is transferred after the sale and registration of real property has been completed.

Benefits

When selling an apartment from the buyer, the seller is given a substantial amount of money, and it can be charged by more than one million dollars.

Both sides of the deal are always worried that the operation will go smoothly, safely, that they will not run into fraudsters, that they will not fall victim to fraud, and that the buyer and seller will engage lawyers and realtors to secure the transaction.

But sometimes these measures also seem to be insufficient.Therefore, the purchase and sale of real estate is increasingly using a bank cell in which money is kept for an apartment intended for the seller.

It's important!The rental of the cell takes place when the transaction is in the process of signing the contract and transferring the money.

In order to use the bank cell properly, it is also necessary to know the correct manner in which the sale is to be processed.The sale of an apartment through or without an agency is carried out according to a general scheme (there may be only some additions and nuances).General sales scheme:

- First, the seller prepares the dwelling for the buyer ' s examination and puts it on the market; real estate is advertised; ads can be posted on special websites, accompanied by photographs.

- After the examinations, the buyer is identified and the nuances of the sale, the timing, the exact amount are negotiated with him; a preliminary contract is concluded first, and a pledge is granted.

- If the transaction is done with a real estate agent, it helps the seller and buyer prepare the documents, checks them, but the parties can act on their own without paying for the real estate company.

- The Parties shall sign a contract whereby the dwelling shall be transferred from one owner to another.

- And now comes the settlement stage, the registration of real estate by the new owner, and the registration needs to be submitted to the Single Real Estate Register.

What is it?

It's a small safe where money, jewelry, securities, and even works of art can be stored.The safe itself provides reliable protection, but the bank's security system increases this protection even more.

A security system, a video surveillance system, is used to keep users calm about the valuables stored in the cells.

Access to bank cells is closed, so only bank employees and persons who have entered into a lease may enter the premises where they are located.Bank employees are also not all – only those with the right authority.

What makes use of the cell

The sale of an apartment through a bank cell reduces the seller ' s risk effectively.It keeps the amount of funds earmarked for the payment of real estate.

And the seller can only get it once the new owner has been registered in Rostreister and checked out all the documents on the apartment.

And the seller can only get it once the new owner has been registered in Rostreister and checked out all the documents on the apartment.

Real estate scams are pretty common right now, and both the buyer and the real estate dealer can get hurt.And Rosreister collects all the data on citizens ' real estate, conducts a thorough check, and after registration, the transaction will be checked for legality:

- The use of a bank in the purchase of a cell would guarantee that the registration of real estate by the new owner would be subject to all the rules.

- Swindlers won't contact banks where there's a security system, and a lease on a bank cell deal can keep away those who want to sell or buy housing.

- If both parties know how a transaction takes place when using a bank cell, they'll only go to it if they're sure they want to. You can't cancel a deal halfway through a bank.

If the registration at Rostreestra takes place without problem, the seller receives a guarantee of its value.If there are obstacles to the registration process, the buyer will not lose its funds.

Sales Scheme

When the sale of an apartment comes to the stage of the transfer of ownership and the transfer of funds, it is possible to sign a contract for the rental of a cell in a bank for the storage of money:

- The rent service is provided by various banks, and the terms and cost will not differ greatly in these banks. It is possible to know in advance what the Bank of Sberbank has set the price of the bank cell, comparing it with the prices of other banking institutions.

- The cost of most institutions is set per day, and the tenant must choose the duration of the use of bank assets; Realtors and other real estate professionals advise that a lease be entered into for a period of one month or more.

- You may need a deposit for the cell, depending on the bank's terms, and if everything goes well, the property is handed over on time and without problem, the mortgage will be returned to the tenant.

- Cells in banks are provided for the storage of various items authorized by law and banking regulations, and the list of authorized items includes securities, precious commodities and money.

- For a certain period, one of the parties to a sale of real estate leases a special box in a bank, a box in which the money will be secured and protected.

Who pays, buyer or seller, rent a cell?This does not matter in principle to the bank, but it is often required that the contract be drawn up by the seller.The contract specifies under what conditions it will be able to access the safe and the funds for its former immovable property.

ATTENTION!The most practical option is to provide a bank employee with a sales contract that already contains a reference to transfer of rights.

In such a case, the seller itself, without the buyer, may, after the transaction and the registration of the apartment, apply to the bank to obtain the money it is expected to pay for the housing sold.

Bank participation

The bank is not a party to the transaction, which means that its employees will not check the documents of the parties to the transaction, will not check the money (but it is possible to order a separate service) and will not count them.

A banking institution simply provides for a month or more of its property (cell) for the safe transfer of money from the buyer to the seller.

A banking institution simply provides for a month or more of its property (cell) for the safe transfer of money from the buyer to the seller.

On the day of the signing of the contract, the buyer and seller arrive at a bank where the buyer (in the presence of the other party to the transaction) transfers its funds into a box, which must be counted and checked for the absence of counterfeit bills.

If a mortgage was granted for real property, the amount in the cell would be reduced by the amount of the deposit.

ATTENTION!The key to the cell is kept by the seller.

But he'll only be able to open the box to them when he shows the contract with the registration mark.

The registration of the transfer of property rights to another person takes place in the Rostreister of Real Estate.The duty of the new owner of the dwelling to carry it out as soon as possible after the contract of sale has been signed.

How money is transferred through a bank cell when the apartment is sold

The transfer of money through a bank cell is the most common option for selling an apartment and other real estate. The Algorithm is simple enough. The seller must find the buyer, enter into a sales contract with him.

The safe is then jointly rented and deposited.When the accompanying documentation is completed, the seller shall recover the funds previously deposited.

During the course of the transaction procedure, the bank shall keep the money and ensure the safe settlement of the transaction upon its termination.

Transfer of money when selling an apartment: risks and how to avoid them

It's dangerous to hand over cash for real estate.

to meet many nuances in order to reduce risks, and banking

The cell, letter of credit or deposit reduces them to a minimum.

Most Inquired

The calculation option is a box in a bank vault.

of this type is the complete adaptation of operations to natural persons and simplicity.

Action.

Consider the main factors that influence risk.

Enterprises:

- Lack of knowledge of the law.

- Fraud schemes.

- In an effort to save lives, people refuse

The participation of the notary and the legal profession in the conclusion of the transaction. - There's a risk of losing cash transfers.

Not only theirs, but also the future of the dwelling. - The bank cell excludes the fact that the bills have been tampered with.

(in the case of the use of a money-checking service). - The main risk arises when a transaction is concluded and

The transfer of money. - Transfer of the apartment to ownership after

Payment (registration procedure takes about a month).

Pick an experienced lawyer and notary. The existence of a diploma does not yet indicate a person ' s legal literacy; judge by the reputation of a specialist; it is difficult for a simple user to understand that a transaction is a fake transaction, and the transfer of money without bank insurance is an additional risk; the participation of third parties must always alert buyers and sellers.

Basic concepts

A bank cell is a safe that is secure

Protection of money and other valuables of citizens in the premises of a financial institution

The bank shall guarantee the preservation of the contents.

The safes are securely protected by special instruments and additional security.

In order to gain access to the cell, a person must conclude

An agreement with a bank or a safe is sufficient for the participants ' passports

The process.

After the signature of the contract, the items or funds on the list shall be accepted

by the bank ' s employees, who are further fully responsible for the

Someone's property.

In the future, a man can gain access to the safe,

The contract holder, the persons he listed in the paper, and the bank ' s employees

Special passes.

Procedure for the calculation of the sale of real property

Consider the step-by-step calculation algorithm for a transaction.

Sales:

- A contract for the sale of real property is being negotiated.

- A bank cell with a contract of sale is leased.

- The money and the deposit are checked in the presence of all parties to the proceedings. The safe is locked into two locks. One key remains in the bank and the other is handed over to the seller. He will only be able to collect the money in the presence of the bank's employee, after the presentation of the document confirming that the transaction has been completed.

- Participants in the process are given a document setting out the terms of access and duration of the lease.

- The withdrawal of money from the safe takes place with two keys.

You don't have to worry if the key is lost, and in this situation, the salesman can get the money, but you're gonna have to pay the commission to lose the key to the cell.

Model contract with bank

Reference is made to a model contract with a bank (Sberbank example), but specific conditions depend on the financial institution. Consider the basic requirements for a bank cell lease:

- The passport data of the participants in the process.

- The address of the real estate that's bought.

- Conditions and duration of the safe lease.

- The FIO of those who have access to the cell.

- The terms and conditions of access if the deal fails.

Bank staff are involved in the drafting of this document and will be able to point to certain nuances that are worth noting.

The main conditions for the use of a bank cell are time.

The minimum time interval is 24 hours, the maximum time limit is no limit.

The end of a contract with a bank is the day on which the money

In the event of delays, the initial period may be extended.

Infinitely.

Remember, the longer it takes, the lower the daily rate.

The size of the safe also affects the price: the larger it is, the higher it is.

Cost.

Some banks require a deposit in the event that the key to the safe is not returned for some reason or another; the deposit will be returned after withdrawal of the funds from the safe.

It's worth renting a box from a reliable bank.

Consider the vendor ' s action algorithm and the Sberbank ' s

buyer and tariff rates:

- We need to visit a branch where it's convenient to come after the money and conclude a contract involving three parties: a bank, a buyer, and a real estate seller.

- The bank offers standard safes for the transfer of funds, with a width of up to 35 cm and a depth of up to 100 cm. Cell heights may vary from 6 cm, to 9 cm, to 14 cm, to 35 cm and others. You can specify the availability of free safes in your region on the official website of Sberbank.

- The average lease is 30 days, the maximum is 36 months.

- The money is checked for authenticity and placed in a box that is locked on two locks. The bank's employee gives two keys after signing the contract. One key gets the money owner and the other one stays in the bank.

- Once the buyer has obtained a certificate of ownership of the new home, he gives the key to the bank. If the deal fails, he can come and collect his money at any time.

- The seller visits the bank and, in the presence of an employee of the financial company, opens the safe and extracts the money; the basis for access to the cell is an additional document that is prescribed in the contract for the lease of the safe, such as an extract from the Single State Secretary.

- It's possible to transfer the right of seizure from a power of attorney, which must be certified by a notary office.

- There is no deposit for the keys to the cell.

- The rental of a small safe up to 10 centimetres will be 75 rubles, up to 20 centimetres, 94 rubles, up to 50 centimetres and above, 151 rubles per day. If paid for more than a year, the cost will start at 34 rubles per day.

- We need to determine at least the approximate length of the lease, because the money for using the safe is paid in one-time terms.

It is desirable not to waste money and order a check and a recalculation of the bills, most often on the seller, and on the buyer ' s rent of the cell; the cost of checking the banknotes is 0.1 per cent of the amount audited.

Benefits and disadvantages

The performance of a transaction under a contract of sale through a bank safe has many advantages when compared to other means:

- Excludes the possibility of unilateral cancellation of a transaction.

- There's no possibility of fraud.

- If the money is checked and recosted, this precludes the transfer of counterfeit currency.

- The bank gives a guarantee to the seller that after processing all the documentation, he will receive the money for the real estate.

- The bank guarantees the buyer that he will be the owner of real estate and, in the event of registration problems, will return his money.

- The bank ensures the confidentiality of the transaction.

The cost of checking the authenticity of the bills is also a cost, but it guarantees that the money isn't forged. The bank cell only makes it safe to make a cash settlement.

Read also

A scheme for selling an apartment through a bank cell

When selling real estate, it's important to do the right thing to avoid trouble. Bank cells are actually used to reduce the risks in this matter. The lease of the safe is contracted by the buyer, he pays the money, and the seller gets access to the box if the apartment is re-registered successfully.

The sale of an apartment is often a deal of more than a million rubles, and it's important to do the right thing from a legal point of view, so as not to get caught by fraudsters with money.

There are two parties to the contract, the buyer and the seller, and there may be intermediaries: banks, realtors, lawyers. Natural persons usually use a bank cell to settle real estate. It is rented in any bank at the stage when all the agreements between the buyer and the seller are reached and the contract is signed.

Summary of the procedure for the sale of an apartment

Regardless of whether the real estate services are used or not, the sale of the dwelling consists of the following steps:

- Preparation for sale (preparation of the dwelling, assignment of value);

- The placing of real estate for sale;

- Purchasing the buyer, conducting inspections, reaching agreements (total tender price, timing of transaction, transfer of ownership, etc.);

- Preparation of the contract and other documents, verification by the buyer of the cleanness of the dwelling on his own or with the assistance of other specialists (lawyer, realtor, etc.);

- Signature of the treaty;

- The calculation and registration of real estate in Rosreestre (the steps are combined using the safe).

The bank cell is used in the settlement phase between buyer and seller; it is not a mandatory condition for a transaction; you can sell an apartment without it.

Most often, payments through a bank cell are made between individuals if the buyer wishes to pay in cash.

Why do you need a bank cell?

- It's a security guarantee, and when you sell an apartment through a bank cell, the seller's risks are reduced.

- This is an exercise of due diligence in the conduct of the transaction.

- It's a risk insurance, including risks from the buyer's bad faith.

- This is a guarantee against a transaction being declared invalid after settlement.

- This guarantee of registration of property in Rosreister is appropriate and the property will be entirely transferred to the new owner.

- It's a reduction in the risk of getting caught by fraudsters, they're trying to bypass the calculations through the banks.

- It's a protection against a half-way deal.

For a seller, a bank cell is a guarantee that he will be paid in any case if the real estate registration has been successful, and if not, the buyer will return the entire amount in peace.

Find out all about the safe sale of the apartment in six important steps.

Rent arrangements and a scheme for the sale of the dwelling through the bank ' s cell

It's important to choose a bank. Credit institutions have different prices. There may be minimum and maximum lease terms. There are also restrictions on the list of items that can be placed in the safe. Money is included in the authorized list.

The actions to be undertaken are described below.

Step 1: Bank selection, contract formation

It is necessary to come to the seller ' s office, enter into a contract and place the seller on the list of trusted persons for access to the cell. The rent depends on the duration. Banks usually set a fee for one calendar day.

The contract should be concluded by at least one month, with an average rent price of 30 roubles/day, and a deposit would also be required, in case the key is lost or the lease period has to be increased.

At the end of the contract, the bail is returned.

But the conditions are different everywhere, so the price of renting a bank cell in Sberbank when buying an apartment in the Kurgan branch is 24 roubles/day (up to 30 days), no mortgage, and in Yekaterinburg, 50 roubles/day will be worth a safe with similar parameters.

Whoever pays rent doesn't matter, the amount of the bank cell rent is insignificant compared to the amount of the transaction, but the contract is with the seller, and he has to specify in this contract the terms of access to the safe.

The buyer has the right to specify any documents, but it is important that this does not delay the process and make it possible for the seller to obtain the money; the best solution is to produce a sales contract with a mark on the transfer of ownership of the real estate, in which case the seller and buyer act independently of each other and everyone is protected.

It is important to understand here that the bank is not part of the buying/selling process. It only provides rental services. It does not have to check the cleanness of the transaction, count the money, check the authenticity of the bills, etc. But you can ask the bank's employees to help you count it. This is done in the cash register and under the cameras.

Step 2: Money deposit

When entering into a contract for a bank cell, the key is given to the buyer; on the same day, both parties follow to the warehouse, and the buyer, under the seller ' s control, puts the money in the safe of the Coupura, needs to be recalculated and make sure that the amount is correct.

100 per cent of the value of the dwelling, minus the advance, is placed in the cell, if any. A deposit can also be made. After leaving the vault, the key (is issued in a single copy) is handed over to the seller. He will be required to come with him after the transaction has been registered.

Step 3: Registration of real estate transactions

At this stage, the seller must register the sale transaction; this is its duty as owner of the premises; real estate will not be considered sold and without the relevant document, which confirms this, it will not have access to the cell (document specified by the seller).

Step 4: Final calculation

There are two options:

- The seller registers the transaction and accesss the cell from which the money is taken;

- The transaction is not registered and the buyer returns to the bank for his money.

At this stage, the deal is either made or cancelled.

The rental service of a bank cell for real estate transactions is popular and many banks set their terms for such customers; for example, the Bank of Sberbank does not charge rent to the buyer within 7 days of the end of the contract if the transaction does not take place.

This is how you calculate when you sell an apartment through a bank cell, and this is a mechanism that is well organized and used by many realtors. It protects both the seller and the buyer from both fraud and from what one of the parties changes its mind after signing the contract.