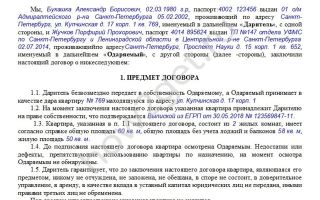

The gift contract is a fairly common transaction in use; the transfer of ownership is the main idea of the agreement; a certain percentage of real estate may also be the subject of the agreement.

It takes many nuances and conditions to be taken into account, otherwise the invalidity is "not beyond the mountain".

How can a document be drawn up, and how much does a contract cost a notary's share of the apartment? This and many questions of interest will be discussed in more detail.

What is the deal of giving a share of an apartment?

Owing to the frequent need to dispose of property by citizens, the issuance of a gift contract is particularly popular among the population.

The agreement provides for the transfer of items from the previous owner to the new owner; the procedure is free of charge; the procedure is subject to compulsory State registration in Rosreestre; the unilateral dissolution of the gift is not permitted; the recipients of the gift may be relatives or outsiders.

Russian civil law refers to three main conditions:

- The gift is not subject to arrest, is not laid down or sold to third parties.

- At the time of the conclusion of the contract, each individual party has the capacity to act, without guardianship, and there is no medical evidence to prevent the conscious signing of a power of attorney.

- Part of the dwelling is handed over to the new owner after the documentation has been completed.

There is a list of individuals, more specifically those not eligible to be gifted (for the purpose of curbing corruption):

- Civil servants;

- Staff of treatment and education institutions;

- Employees of social protection agencies.

Talking about gifters who are visitors.

If the property is handed over to a minor (under 14 years of age), the right of personal signature is given to the parent (guardian, guardian) and the young person, up to the age of majority, places a mark on the individual next to the parent.

The husband and wife often use a contract to give property rather than money so that the dwelling will remain in the possession of the child and not be the property of the child's family.

When the giving party is a person in a registered marriage and the gift is a jointly acquired item, the required list of documents shall be accompanied by the spouse ' s written consent to the disposition.

The basis for the popularity of this contract is the value of giving to close relatives; there is no compulsory tax equivalent to 13 per cent of the value of the property in this situation.

The transaction is conducted in accordance with Russian law and the violation of the rules is the basis for the challenge in the court proceedings.

Tariffs for the provision of standard notary services

The gift contract for the next of kin has the value defined by the Russian Tax Code.

Close relatives are:

- spouse (-ha)

- children (blood, adopted)

- Mom and Dad are giving,

- Sister, brother (bloody, half-brothers).

The cost of the notary ' s gift will be as follows:

- In accordance with the tariff plan, 0.3 per cent of the asset peer review;

- Additional services — at least 4,500 rubles grew.

The award of a contract in favour of an outsider is characterized by an increase in the cost of the notary ' s services:

- No more than 1,000 thousand were grown. - 1% of the value of the property.

- Between 1000 000 and 10,000 thousand rubles grew from 10,000 rupees. + 0.75% of the estimated value over 1 million rupees.

- Over 10,000 000 rubles grew - 77, 5,000 rubles + 0.5 percent of the sum of more than 10 million rubles.

The cost of a notary ' s paperwork for the benefit of relatives would be approximately Rupees 4,000, and it should be borne in mind that additional waste, including the provision of gift-making services and registration services, would be incurred in accordance with the established procedure.

Payment of a notary ' s work in the form of a gift

The property owner ' s expense is divided into three types:

- Notary's job.

- State duty.

- Property tax.

The price policy of a notary ' s services is shaped by two factors:

- The standard list provided by the NKK of the Russian Federation.

- Support services.

The scope of the notary ' s activity is set by the Tax Code and is carried out in the same way within the territory of the State and is paid according to individual prices, which are not regulated by the law; therefore, the same process of obtaining an apartment is assessed differently in different regions.

The notary shall issue, on the application of citizens, a paper indicating the services provided by law and defined as additional services.

The latter include:

- The drafting and printing of the contract;

- To receive and provide information advice to the client;

- Using the assistance of other experts;

- Print out the required number of copies of the contract.

The law enforcement authorities do not control the price position of notaries, and the decision to determine the value is made alone.

The amount paid for the services of a notary may vary from 2,000 to 10,000 roubles.

No more than Rs 2,000 will be required to be processed with the participation of persons with family ties.

How much is the extra services?

A notary can be contacted with a written document, which will be required to verify the data and conduct State registration of the gift.

A qualified lawyer can be contacted for help in the correct form of the document.

| Action | Price (R.R.R.) |

| Procedure for the compilation of documents for registration actions | To 10,000 from 1,000 to 5,000. |

We must not forget the State Ministry, which must be paid for the provision of public registration services, the amount of which is 1,000 roubles; the execution of this process by a notary will require additional payment.

On average, it takes more than one week (in practice - 2). Most depend on the speed at which documents are processed in the registration department.

It must be understood that part of the amount provided to the notary for work depends on the expert assessment of the transferred property.

Formation for close relatives and third parties

The option of giving a share is quite common within the family – the advantage of changing ownership of a blood relative without paying an income tax of 13% of the gift estimate – is the real value of the dwelling. This is a characteristic feature that differs from other types of agreement.

In this case, the relatives of the giver are:

- The husband or wife;

- Brothers, sisters;

- Grandkids;

- Grandparents;

- Kids.

If the person who receives the gift free of charge is not close to the donor, payment of 13% of the cadastral value of the immovable property is compulsory.

Secretary of State

The State is one of the legally binding payments.

This year's government tax is equivalent to 2,000 rubles for natural persons and 22 for legal entities.

The issuance and re-submission to legitimate owners of a document showing property rights amounts to 3.5 hundred roubles for citizens and 1,000 for enterprises, institutions and organizations.

For the adjustments provided for in the agreement, the person is required to pay two hundred rubles and the enterprise is required to pay six rubles.

The value of the gift may vary considerably depending on the circumstances.

How can you save on the cost of writing a gift contract? How can you avoid a notary?

The simplest way to suffer the least monetary loss in the process of contract formation is through self-writing.

The existing provisions of the Civil Code of the Russian Federation establish the obligation to write and carry out registration actions, with information on the right of ownership of individual real property in Rosreestre.

It's not necessary for a notary to write and certify this type of transaction, which is done at its own discretion to confirm the correct order of writing.

The following action algorithm is required for the self-determination of the agreement:

- The proper drafting of the treaty;

- Registration.

It should be borne in mind that the slightest error could lead to the invalidation of the document.

The legislator shall establish a list of property classified as real property connected to the land area. This type of property cannot be moved without causing damage to the property.

- A plot on the ground;

- Apartment;

- Housing area;

- :: Delivery;

- Private construction;

- The garage;

- Business facilities;

- A vessel.

The contents of the gift must be in accordance with the information provided by the Divisions: the Technical Inventory Office, the House Book, the Register; the existence of the heirs and their share of the inheritance should be taken into account.

The agreement should specify:

- Personal information on the passport;

- Contact information;

- A detailed description of the object of the gift;

- Legally establishing documents for the purpose of the treaty;

- Personal signatures of the parties to the transaction.

- It's a calendar date.

The registration of the contract shall be accompanied by the payment of the public service and the submission of such a list of documents:

- Passports;

- A gift;

- The number of copies of the treaty corresponds to the number of parties to the agreement;

- Expensions from the home book;

- :: Written approval of the spouse in the award of the joint property;

- Trust (in the case of representation of interests);

- The decision of the guardianship authorities (when the interests of the minor child are affected).

The list shall be adjusted to the requirements of a particular registry office.

Conclusion

The cost of giving a share depends on such factors:

- A bond between the giver and the giver,

- The way in which a contractual relationship is established (with the assistance of a notary or on its own).

Documentation, text and registration in Rosreister should be properly prepared and, at the end of all actions, a certificate of ownership should be issued.

What and who have to pay to sign the gift contract

If you want to give away your real estate, you need to know that you're handing over your property "free, that is, free," and you're gonna have to pay a blood money and not a small one.

How much does a gift contract cost, and where do you start it? What kind of taxes do you pay?

In order to obtain a gift contract, you need to contact a notary office where you will be told how much the apartment is worth.

This is more expensive, but if the gift contract is ever challenged in court by your next of kin or other interested persons (the practice shows that whatever excellent relationship you have with your sister Masha or brother Tolay when it comes to the division of property, related feelings go missing), the notary who certified the transaction may appear before the court as a witness that the giver and the giftee have entered into the contract voluntarily and in "sweet mind and sober memory." To challenge such a treaty is a long procedure that requires material expense, but there are certain cases where the gift can be challenged in court.

How to draft a gift contract on your own

How much is gift money?

- If the property is donated to family members (spouses, parents, children) or close relatives (under art.

217 The Tax Code of the Russian Federation, which consists of brothers, sisters, grandchildren, grandparents, and notaries, will take a government service equal to 0.3% of the estimated value of the dwelling, but not less than 300 p. In calculating the government service, it is not the market value, but the estimated value, which is "two large differences".

For example, if the BTI estimates the cost of your apartment at 200,000 p.p., the notary will take 400 p.p. from you for a gift contract.

- If the rent is made available to a person who is not a relative of you, the rates are different.

If the price of the dwelling is up to 1 million rubles, it will cost you 1% of the estimated value, but not less than 300 p.p.; if the cost of the dwelling is between 1 million and 10 million, 0.75% for an amount that exceeds 1 million plus 10,000 p.p.; or more than 10 million - 0.5% for an amount that exceeds 10 million p., plus 75,000 p.

It is also necessary to pay for the registration of the property of the gifted person, an additional 500p.

On this basis, it will be easy for you to calculate the cost of such services.

What else should a gifted person pay under the law?

The man you gave your apartment to will also pay the tax to the State, as the apartment that was handed over under the gift contract passes through the tax money as an individual's income.

Such a tax shall not be imposed if the giver and giftee are close relatives (parents, siblings, children, adopted children, grandparents, etc.).

In all other cases, if an apartment is donated, the tax is charged at 13% of the estimated value of the BTI.

You can learn about the amount of the tax and the obligation to pay it from the notice sent by the FNS. If the gifted person has not received such notice (either by receipt or by registered letter), the FNS will not be able to prosecute you for the late payment of the tax.

The tax should be paid in equal shares: half within 30 days of the date on which the notification was received and the second half within 30 days of the payment of the first half.

If, for some reason, the gifted person is unable to pay the taxes in full, he has the right to apply to the tax and to file an application for the restructuring of the tax in accordance with the law.

Top

How much is it worth to make a gift?

A gift is a way to transfer property to a third party's property, in fact and in a documentary way. Anyone who plans to give a real estate is wondering how much it costs to do a gift to a home, land or apartment? Consider what money is expected of the giver, and also determine the key rules for the transfer, registration and taxation of the gifted object.

What's a gifted one?

Tendering is a special type of transaction in which one of the parties (the giver) transfers property, real estate or rights to the property of another person (the recipient), free of charge.

Note that most gifts are made between relatives; however, minors, as well as those who are incapable of being able to do so, may not serve as a giver.

However, the recipients of gifts, including real estate, may not be public servants, municipal employees, representatives of educational and health institutions, social protection workers, and such measures are envisaged to prevent corruption in the performance of their immediate duties.

That's what you're gonna do.

We're used to giving apartments, homes, and cars, but the subject of a contract can be any personal property.

It could be real estate:

- The apartment;

- A private house;

- A plot of land;

- The garage;

- Commercial premises;

- Seagoing vessels.

As well as items falling under the category of movable property:

- Clothes;

- Furniture;

- ornaments;

- Cars.

You can also receive money as a gift, for example from relatives for certain purposes (most often for the purchase of a new apartment), but as a rule, the gift is not prepared and the notary's assurance is not required.

There are some exceptions for the former owner, if he survives the gift, and if the gift comes into effect, the gift will be returned to him, and the gift will be returned to him.

What you have to pay for.

In response to a question about how much a gifted dwelling or other real estate is worth, it is worth noting that the law permits a gift in a simple writing and notary form. In concluding a contract on your own, you will avoid much of the cost.

Therefore, it is not necessary to contact a notary to process a gift transaction; it is only necessary to formalize the contract, to sign the grantor and the recipient (specify), and then to register the document in Rosreister. We have described the characteristics and value of this type of registration below. The current form of the contract can be downloaded at the end of the article.

The question to be singled out is: how much is a gift in an apartment? Such a contract must be certified by a notary (art. 24, para. 1, of Act No. 122-FZ of 21 July 1997, on State registration of real property rights and transactions).

The services of a notary are paid for, and it makes sense to contact him if a complex transaction is made, for example, property with an encumbrance or with the participation of a minor.

Or when a gift is made to the detriment of a relative and there is even the slightest possibility that in the future he may be challenged.

In such a situation, the notary would be able to testify in court and confirm that the agreement had been reached by mutual consent and on legal grounds.

To calculate the value of a notary ' s gift contract (2019), you need to know what the value of his services is.

Any notary act is subject to a public service, the amount of which is regulated by tax law (art. 333.24 of the Code of Criminal Procedure), and it is also necessary to pay for work of a technical nature.

This amount is not fixed and may differ from one notary office to another.

How much is a notary's gift in 2023?

The price of a notary ' s apartment (2019) depends on the degree of relationship with the donor, and all the rates are strictly specified in the NK of the Russian Federation.

According to the Family Code, this circle includes spouses; parents and children; grandparents; brothers and sisters (art. 14, para.

The cost of processing will be 3,000 roubles + 0.2 per cent of the real estate valuation, but not more than 50,000 roubles, and technical services will be about 5,000 roubles.

When entering into a contract between outsiders, the gift rate is calculated on the basis of the cost of the dwelling:

- Up to 1,000,000 - 3,000 roubles + 0.4% of the value of the transaction;

- 1 000 001 to 10,000,000 - 7,000 roubles + 0.2% of the value of the transaction exceeding 1,000,000;

- More than 10,000,000 - 25,000 roubles + 0.1% of the value of the transaction exceeding 10,000,000;

- The technical works are about 5,000 rubles.

If you want to give a country-owned property, you can calculate how much it is worth to have a gifted property or land from a notary using the figures mentioned above, and the tariffs are common to all real estate assets.

Recording of the transaction

The change of ownership of real property is subject to compulsory registration in Rosreestre (art. 131, para. 1, of the Civil Code of the Russian Federation). Otherwise, a self-contained gift contract is considered null and void; in order to change the ownership of real property, the gift will have to be registered with the Register Office or the Cadastral Chamber.

It will be recalled that if a gift transaction is processed through a notary office, the notary is responsible for conducting the registration procedure in Rosreestre.

The registration of a transaction involving the transfer of an apartment, an interest in an apartment or a house is subject to a payment of 2,000 roubles from the Government, with the exception of the giving of land. How much is the land given to the land? If the subject of the contract is an agricultural land, the fee will be 350 roubles.

Giving Taxes

There is no tax on the income of natural persons (art. 217, para. 18.1). If the parties are not close relatives, the giftee must himself file a 3-NFFL declaration and pay a 13 per cent tax on the value of the gift.

Let us recall that it is necessary to file a tax return with the FNS no later than 30 April of the year following the year of the transaction, but that the NPFL can be listed before 15 July, when the 3-NFFL declaration was filed.

It's important!The way in which a gift transaction is processed does not play a role in taxation; the tax will have to be paid for both a self-written contract and a notarized one if the person is not a close relative.

What other costs are waiting for

Often, when approaching a notary, everyone tries to save on something, so they draw up contracts on their own, using the tips of acquaintances, comments in specialized forums or any information obtained from the Internet, and the lawyer only checks the transactions and helps with their registration.

But if you are not sure that the document is correct, or if you have any doubts, it is better to provide it to a notary. The services of a notary in the collection of documents, the drafting of a contract, the certification of documents, etc. are also subject to separate payment.

In order to focus on how much a notary's gift contract is worth in 2023, we will provide average prices:

- Treaty-making up to 10,000 roubles;

- Collection of a package of documents, from 1,000 roubles;

- Registration in the relevant division is from 5,000 roubles.

There is also a need to pay the government for registration, which is an average of 1,000 roubles (the cost of the service is very different if you provide it to a notary; the cost of the service is determined by the notary himself.

In order to clarify, for example, how much it costs to make a donation to a notary ' s apartment (2019), you need to contact the notary office you will be working with, each notary ' s office forms the cost of making a gift contract, depending on the complexity of the work and the number of projects.

Let's take stock.

We looked at the value of the gift on the house and on the ground.

If the agreement is processed independently, it will only be spent on the State Ministry for the registration of the transaction, which will amount to 2,000 roubles for the transfer of real estate, and 350 roubles for the allocation of land for agricultural purposes.

If the contract is certified by the notary, the additional cost would be 8,000 rubles.

The gifted person must pay the NPFL 13% of the value of the acquired property if he or she does not have a close relationship with the giver.

Model gift contract

Similar articles

comments powered by HyperComments

Donations — Prices and Taxes

"I want to give my house to my grandson, how to do it, what difficulties can arise, and what's important.— How much money will you pay for the paperwork? And the other question is, can you make a gift without the gifter's physical presence, by attorney?

Olga COSTENCO,

"Pgt. Kalanczak."

Diffusion of real estate—It's a serious and responsible move that's made you own the property you once owned, and it's completely free of charge.

Under Ukrainian law, an apartment, house, plot and any other property may be donated, using a gift contract or a gift contract.

In the article, we will try to provide you with all the important and up-to-date information about the treaty of giving and giving in Ukraine for 2018.

The form of the gift contract must be written with a mandatory notary certificate and must be signed by a notary, and the legislation requires the landlord to confirm to the notary a number of essential circumstances on which the registration of the contract depends.

According to statistics from the Ministry of Justice, in 2017, 110,235 housing and housing contracts were issued in Ukraine, 50,132 land plots were donated, and both private notaries and State-owned notaries were in the process of being processed.

- Features of the Gift Contract

- Article 203 of the Civil Code states that any contract of exclusion shall be valid in such cases:

- - its conditions are not contrary to the provisions of the GCC, other laws and the moral principles of society;

- - The giver has full civil capacity;

- – The desire to give is freely exercised without pressure and is in keeping with the will of the giver;

- – The conclusion of a contract of gift under the influence of delusion, deception, harsh circumstances is illegal, the court does not recognize such agreements;

- - The contract must be in accordance with the rules of the law;

- - The terms of the treaty will ensure that the legal consequences provided for in the agreement are real;

- - If the object of the gift contract is the property owned by the children and the contract is performed by their parents, adoptive parents or guardians, the agreement may not violate the property rights of the child owners.

- What notaries check

Act No. 1952-15 of 4 June 2017, on State registration of real property rights and their encumbrances, describes the general principles of State registration of property rights and their encumbrances.

In detail, the actions of notaries are regulated by Cabinet of Ministers Decision No. 1127-2015 on State registration of real property rights and their encumbrances, as amended on 1 March 2018.

This document approved an instruction, "Rules for State registration of real property rights and their encumbrances".

Article 8 of the Order states that the notary shall register the application of the giver of the property at the State Secretary ' s property rights database; the grantor shall certify the statement formulated by its signature.

- According to the rules of paragraph 9, the notary shall establish the applicant ' s identity on such documents:

- - The passport of a Ukrainian citizen or other legally approved documents;

- - The passport of a citizen of another country or a document approved by law for stateless persons;

- - When submitting an application for registration through an authorized person, the notary checks the extent of his or her power of attorney in writing.

- In order to confirm the validity of the gift contract, the notary checks the certificate of ownership of the facility and its record with the State Secretary of Property Rights.

Article 369, paragraph 2, of the CCS specifies the rules for the performance of the gift contract if the property to be disposed of is the joint property of the spouses and was acquired by them during the marriage, in which case the giver shall present to the notary the notarized written consent of the spouse of the co-owner for the transaction.

- Documents for processing:

- - a certificate of ownership;

- - Valuation of real property (if tax is provided);

- - a certificate (form 1) of the persons registered in the dwelling;

- - the consent of the spouse to the transaction (if the property was acquired during the marriage);

- the permission of the guardianship and guardianship authority if the gifted person is under 18 years of age or the children are registered in the apartment.

- Features of the Gift Contract

- The giver may request the cancellation of the gift contract if the gifted person has committed, threatened or blackmailed him or her with a crime against him or his family, forcing him or her to sign a contract of a known disadvantage, and on the grounds that he or she has been deceived or misled about the legal consequences of the transaction, as well as for other reasons.

- The period of limitation during which it is possible to apply to the court for termination of the gift contract is one year.

If the property has been given to one of the spouses in the marriage, the other spouse may not claim it; but if the property has been purchased by one of the spouses in the marriage, it shall be considered as joint property and, in the event of divorce, shall be divided.

The giver has the right to give his share of the property ownership without the knowledge of the other owners.

Additional conditions

The gift treaty is free of charge, so that no reward is given from the gifted one to the giver, but it may include in the gift a condition of duty to perform certain acts against a third person.

For example, in an apartment donation contract, you state that your relative will live in it and that you cannot evict him, or by entering into a land donation agreement for the construction of a dwelling, you provide that your neighbor may use some part of it to park his car.

Sometimes there is a gift contract with an obligation to transfer property in the future.

So, for example, you say in the contract that you have an obligation to give your apartment at some time or to have a gift in time for a particular event.

In this case, it is necessary to specify the exact period of time or the circumstances in which the gift will be given; it may be a wedding, a certificate or a diploma, or the attainment of the age of majority.

However, in the event of a specified event, the giver has the right to refuse to fulfil the terms of the contract; this can only be done if his property and material situation deteriorates significantly by the time specified in the contract.

If the date or condition of the contract of gift comes, with the obligation to deliver the gift in the future, the gifted person shall have the right to demand from the giver a gift or a refund of its value; and if the giver disagrees with the gifter, the gifted person shall have the right to bring it before a court.

Post-Death Donation Contract

If the giver or gifted person dies before the arrival of the date or delay specified by the gift contract with the obligation to deliver in the future, the gift contract will be null and void.

For example, Grandpa gives his apartment to his grandson, but as an additional condition indicates that the gift will pass to him on the day of the wedding or the marriage registration, and the grandchild will not marry, and the grandfather will suddenly die, in which case the gift contract will be null and void, and the grandfather's apartment will be delivered to his heirs in six months' time.

The price of a gift

The cost will depend on who gives the property to whom. You can give it to a relative, a friend or a foreigner. In each case there are different taxes and charges. Consider each case.

When a relative is given a first degree of kinship, the tax is not paid; the first degree of kinship is children, parents, spouses; and in this case, there is no need to evaluate real estate before the transaction takes place.

The value of the gift contract in this case is minimal.

The only item of expenditure is the payment of a notary ' s services (State duty of 1% of the contract amount, administrative fee/notary ' s services of 0.1% of the subsistence minimum established on 1 January of this year).

If the gifted person is not a relative of the first degree of kinship, he must pay a tax of 5 per cent and a military fee of 1.5 per cent, in which case the real estate must be evaluated before the transaction takes place, as well as the notary ' s services; the real estate valuation is worth up to 1,000 hryvnias.

If a non-resident gives real estate to a Ukrainian citizen or vice versa, the gifted person must pay a tax of 18 per cent and a military fee of 1.5 per cent.

How to Accept a Gift

Once a contract is made, the gift becomes the right of ownership of the gift from the moment it is given, i.e. if you have given an apartment or a house of gift, then the gift becomes the property of the recipient; once you have given the property, it is no longer yours, but the new owner.

If you give a house, you take possession of the new owner and the piece of land where he is, which is prescribed in article 120 of the Ukrainian Land Code.

- "Minuses" of the gift treaty

- Once a gift contract had been made, the gifter could sue at its dissolution on the grounds that: he had been threatened and had signed the contract under duress; he or his family members had been subjected to an offence by the giftee; the contract was not a free transaction but was a transfer of money; the giver had been deceived or misled about the legal consequences of signing the contract.

- And another downside is if the gift contract is between outsiders, not relatives of the first degree of kinship, the gifted must pay a tax of 5% and a military fee of 1.5%.

- How to Dissolve a Contract

The grounds for the cancellation of the gift contract are provided for in art.

727. The giver has the right to demand the termination of the contract for the giving of real property if the gifted person intentionally committed a crime against his life, health, property or his parents, spouse or children; if the gifted person committed the intentional murder of the giver, the heirs of the giver have the right to demand the termination of the contract for the giving.

It is not lawful for a giver to take action on other grounds, for him to be deceived or coerced, to be unaware of his actions by the giver at the time of the signing of the contract, or to be unable to direct them; and if the giver is mistaken about circumstances that are essential, then the transaction may be declared null and void through the court.

A contract of giving is usually more difficult to break than, for example, invalidating a will; one reason may be the mental illness of the giver, which may have caused him to be unaware of his actions and actions at the time of the conclusion of the contract.

But this may involve the opening of criminal proceedings against a notary; this is an important factor for the court, because the notary is at risk, and it is incumbent upon him to ascertain the sincerity and adequacy of the giver at the time of the transaction; he must explain to the parties the consequences and the main points of the contract.

It is only by mutual agreement between the giver and the gifted that a contract of gift can be broken without trial.

Any sale of real estate may be challenged in court, but there are a number of circumstances in which it is easier and easier to do so, especially if there is a material interest.

- The most common reason for litigation is the old age or poor health of the giver.

- And if, in the event of these circumstances, the giver dies shortly after the conclusion of the transaction, there are dissenting applicants for inheritance who try to declare the gift transaction null and void through a court of law.

- Trust of the United Nations, United Nations, United Nations, United Nations, United Nations, United Nations, Organization for Security and Cooperation in Europe, United Nations, United Nations, United Nations, United Nations, United Nations, United Nations, United Nations, United Nations, United Nations, United Nations, United Nations, United Nations, United Nations, United Nations, United Nations, United Nations, United Nations, United Nations, United Nations, United Nations, United Nations, United Nations, United Nations, United Nations, United Nations, United Nations, United Nations, United Nations, United Nations, United Nations, United Nations, United Nations, Office at Geneva, United Nations, Office at Geneva, United Nations.

According to article 720 of the Civil Code of Ukraine, a gift contract on behalf of a giver may be concluded by his representative on the basis of a power of attorney.

In accordance with the instruction "On the procedure for notarial action by notaries of Ukraine", the text of the power of attorney must indicate the place and date of its preparation (signature), name, name, patronymic, domicile of the representative and the person to whom it is submitted.

The term of the power of attorney shall be fixed in the document itself; if the term of the power of attorney is not fixed, it shall remain valid until its expiry; and a power of attorney which does not specify the date of its commission shall be null and void.

Prepared by Anatoly JICKY.

New Year's Eve at Telegram. t.me/newsnewday

The value of the gift from the notary

A contract for the giving of property (salary) may be concluded in a notary form, which has a number of its characteristics and is not mandatory under Russian law; the exception is the exclusion of a share or part of it in the statutory capital of a limited liability society.

The cost of the notary ' s services consists of two tariffs: standard and technical and legal work, and the payment of the notary ' s services will depend on the object of the gift and the relationship of the parties to the transaction.

A gift notary will require a package of documents that will vary depending on the gift.

Whether the notarized form of the gift contract is mandatory

Notary uniformThe conclusion of a gift contract is the most difficult, in which case it is prepared not only in the form of a written document, but it must be certified by a notary, who, when issued, shall be satisfied of the legality of its terms and of the genuine will of the parties.

The characteristics of this form of gift contract are as follows:

- is made exclusively by a notary in a notary ' s office;

- is drawn up only at the place where the property is located;

- Sign the gift only in the presence of a notary;

- To be written on a special notary form of the model;

- The signature of a treaty requires the mandatory presence of all participants with passports;

- Original documents are mandatory;

- A statement of the value of the property is required.

Example

A notary from the city of Tomsk cannot prepare and assure the gift of property located in the Tomsk region.

It should be noted that the legislation of the Russian Federation does not provide for mandatory notarization of a gift, except for the exclusion of a share or part of it in a limited liability society (hereinafter referred to as the CBO).

It is better for a notary to draw up a contract if a party fears that after a period of time the contract may be challenged by a court, in which case the notary bears witness that the signature of the gift was agreed upon by all parties to the transaction, without coercion and with all due respect.

It is difficult to challenge her in court because a notary's assurance adds to her reliability and credibility; therefore, when giving expensive things, it is worth using to warn herself of possible problems in the future.

A contract for the giving of a share or part of it in the statutory capital of the GLD shall be in writing.Certification by notaryAn exception to this rule may be made in the following cases:

- If exclusion occurs directly to society itself;

- If the transaction is made between the participants in the GLD.

In order to perform the transaction, the notary must first verify the grantor's authority to dispose of the share or part thereof (article 21.13 of the FL "On limited liability societies").

- It is confirmed by a certified notarized contract by which such a share or part of it was acquired, as well as by a discharge from the single State register of legal persons (hereinafter EGRUL), which contains this information as well as information on its size.

- If the giver provides a duplicate of the contract for this purpose, the statement must be preparednot earlier than 10 daysuntil the day of the address to the notary.

- If a share or part of it was obtained during the succession process (transfer of rights from one person to another with original rights and obligations from the first owner) or in other cases where no notary certificate was required, the power is confirmed by one of the following means:

- By the instrument on the transition of a share in the succession process.

- By the decision of the founder (participant) to create a society if it was founded by one person.

In addition, there will be a need to provide an extract from the EGRUL, formed not earlier than 30 days prior to the day of appeal to the notary.

In the event that the share of the statutory capital is given by the founder of a society which has been created by several persons, his authority must be confirmed by a notarized copy of the treaty establishing him, as well as by a discharge prepared by him or her.not earlier than 30 daysuntil the day of the address to the notary.

After the certificate of the gift contract has been issued, the notary shall, not later than three days from that date, transmit the application, together with the necessary documents, to the authority conducting the State registration of legal persons, in order to make the necessary changes to the EGRUL; such declaration shall be signed by the member of the society who has excluded a share or part of the share.

In all other cases, if the notary form has not been complied with, the transaction shall be declared null and void (FL art. 21, para. 11, "On limited liability societies").

If the gift is subject to such an assurance, the share (or part) of the statutory capital of the GTO passes to the gifted transaction from the time of certification by the notary.

In cases where this is not required, the rights shall be transferred as soon as the required changes are made to the single State register of legal entities on the basis of the legal setting documents.

GiftCan be challengedIn order to do so, interested persons must file an application with the arbitral tribunal.

How much is a notary's service when making a gift?

The cost of a notary ' s gift is as follows:

- Standard tariffs for work done.

- Tariffs for technical and legal work.

Technical work included the preparation and printing of documents and, in some cases, home visits were required, and since notary always operated strictly within the framework of the law, he had to address legal issues from time to time.

The cost of its work depends on what is the subject of the transaction: real estate (home, land, apartment, etc.) or movable property (vehicles, appliances, etc.).

It's also important.a close relationshipbetween the parties to the gift treaty.

The value of the notary ' s work is as follows, depending on the subject matter of the transaction:

- In the case of real estate: 0.2 per cent of the contract sum plus 3,000 roubles.

- Driving equipment: 0.3 per cent of the contract value (but not less than 200 roubles).

In case of exclusionto othersReal property with a value of:

- Up to 1 million roubles, the value of the transaction will be 4% of the value of the contract plus 3,000 roubles;

- Between 1 million and 10 million roubles - 0.2 per cent plus 7,000 roubles;

- More than 10 million roubles - 0.1 per cent of the contract sum plus 25,000 roubles.

If the gift of movable property is processed, the price of the work will be 1 per cent of the value of the contract (but not less than 300 roubles).

The contract should indicate the real price of the gift rather than the understatement, particularly in the case of real estate, as this may cause suspension or denial of registration of the transfer of rights to it.

In addition to the standard tariffs considered, a notary may take up to 7,000 roubles for technical and legal activities, depending on the complexity and volume of work.

Cost of notary ' s services under the certificate of gift

To assure the notary of this transaction, as for his direct activities, you will pay one sum because he works at standard rates.

Since he would not produce documents, print a gift contract or anything like that, the tariff would not be collected for technical and legal work.

But exceptions are possible, and this needs to be specified directly by the notary himself on a case-by-case basis.

Documents required for notarization of gifts

If a notary has chosen to draw up and process a gift contract, it will be necessary to provide him with a package of documents depending on the subject matter of the transaction.

In any case, the personal presence of all the persons participating in the contract would be required, and they would be required to carry the identity documents; if the representative was on the side of the transaction, his passport and his duly certified credentials would be required.

It is also necessary to submit a document confirming the right of ownership of the gift, and a notarized certificate must be prepared in the event of the disposition of the immovable property by the married persons.Consent of the spouse.

The following documents will be further required:

- If the object of the gift island:

- The grantor ' s right-setting documents;

- An extract from the Single State Register of Rights (EGRP) with all the necessary information on the land to be disposed of;

- A certificate confirming that there is no debt to the tax authorities.

- Forhomeand the land on which it is situated:

- The documents necessary for the giving of land;

- Right-making documents for the home;

- A technical passport and a plan for it;

- a certificate of registered or resident persons in this house.

- In the case of dischargeapartments:

- An extract from the EGRP with all the necessary information;

- A cadastral passport and a technical plan for an apartment;

- Copies of the face account in two copies;

- Tax certificate on the absence of tax arrears.

- When givinggarage:

- Law-making documents for the ownership of the garage by the giver;

- An extract from the EGRP;

- Technical passport;

- Certificate of non-debt in the tax administration.

Formation of the transaction with theWorld Forum for Harmonization of Vehicle RegulationsorDomestic appliancesIn the event of a vehicle being donated, a certificate of non-debt to HIDDD would still have to be provided.

Conclusion

The notary form of the contract is the most complex and has a number of characteristics: when documents are issued, the notary ascertains the legality of the contract, in the true will of the parties to it.

It is mandatory to engage a notary in a transaction if a share in the statutory capital of the CBO is given, except for the exclusion of the company itself or members of the community; in other cases, the law does not provide for the issuance of a gift from the notary.

The cost of its work consists of a sum of standard operating rates and tariffs for legal and technical work involving the preparation of documents, the preparation of a contract and, in some cases, a home visit to a client; it will require certain documents, a list of which will depend on the subject matter of the transaction.

Question — Answer

I own an apartment, I want to give it to my granddaughter.

Under article 14 of the Russian Federation (the Family Code), grandchildren belong to close relatives.

My brother and I want to make a contract for a car, and I want to sign it with a notary, but my brother says no, can he be forced to sign it at a notary office?

The legislation of the Russian Federation does not require mandatory notarization of a gift treaty; no one may be compelled to certify a gift from a notary or to draw it up; this requires the wish of all parties to the treaty.

Do you have any more questions?

Acquisitions:

- Total anonymity

- Free of charge

- An opportunity to discuss any topics related to giving