We all know how important it is to prepare documentation correctly and how this can later affect the validity of the document. This issue does not bypass the payment of alimony. Very often, a negligent attitude to the execution of a money transfer or simply ignorance of how to correctly fill out a payment order for alimony can result in a lot of problems for us. Therefore, if you want payments to be made legally, then you must correctly indicate the purpose of the payment when transferring alimony.

Payment in cash directly to the recipient

This type of money transfer is called “hand to hand”. As practice shows, this is one of the most common methods, as it is quite convenient.

However, when we choose this option, we do not always think about the consequences.

After all, if at one certain moment the transfer of money does not occur, then it will be almost impossible to prove this fact in court, since you will not have the relevant evidence.

Therefore, if you nevertheless choose this method of transferring funds for yourself, then at least give it legal force, namely, draw up a receipt each time. This will help avoid common mistakes and will serve as confirmation of receipt of alimony.

In order not to write a receipt every time, you can prepare a ready-made template in advance or ask a lawyer about it, where the details of the recipient, the payer and the grounds for payment of funds will already be written down. You will only need to enter the date, the amount of alimony (in numbers and in words) and the purpose of payment - child support, full name and for what period.

After this, the document is endorsed with the signatures of both parties. It does not need to be certified by a notary.

Lawyers have a negative attitude towards this type of transfers, since cash payments are associated with the largest number of disputes, which are quite difficult to resolve. Especially in the absence of evidence.

Transfer through an electronic system - mail, bank cash desk, client-bank, self-service terminals

If the alimony payer himself is engaged in transferring funds, then a reliable method is a bank transfer or transfer through a post office. Transfer of alimony in non-cash form can be carried out without even leaving home, for example, using the “Client-Bank” banking service.

However, regardless of the chosen method of transferring money - through a cash register, terminal, banking or mail, it is very important to correctly indicate its purpose in the payment document. Otherwise, this payment may be classified as other expenses, but not as alimony.

Therefore, in the “Purpose of payment” field, write down “Payment of child support, full name, for a certain month, on the basis of writ of execution No...”

Make the transfer 2-3 days before the specified date in the writ of execution, since according to banking regulations, they can credit funds up to 3 days, thereby unintentionally triggering the formation of debt and the accrual of penalties.

Thanks to the convenience and reliability of a bank payment order, you can check the status of your transfer, make statements for a certain period, and receive a certificate from the bank about the crediting of funds.

All this helps to prove the fact of payment of alimony in the event of a controversial situation.

Transfer of alimony from wages at the place of work

When the alimony payer has an official place of work, alimony is usually collected automatically by the accounting department or the employer in accordance with the alimony agreement or writ of execution.

From this moment, the parent’s responsibility for the timely payment of funds is removed and falls on the shoulders of the accountant.

He also fills out a document where you need to correctly indicate the purpose of payment when transferring alimony.

The basis for regular payments can also be a personal statement written by the employee, if the parents did not go to court to collect alimony. This method is no less reliable, since the correctness and regularity of payments is controlled by a bailiff, and if necessary, an accountant can issue an appropriate certificate of the transferred amounts.

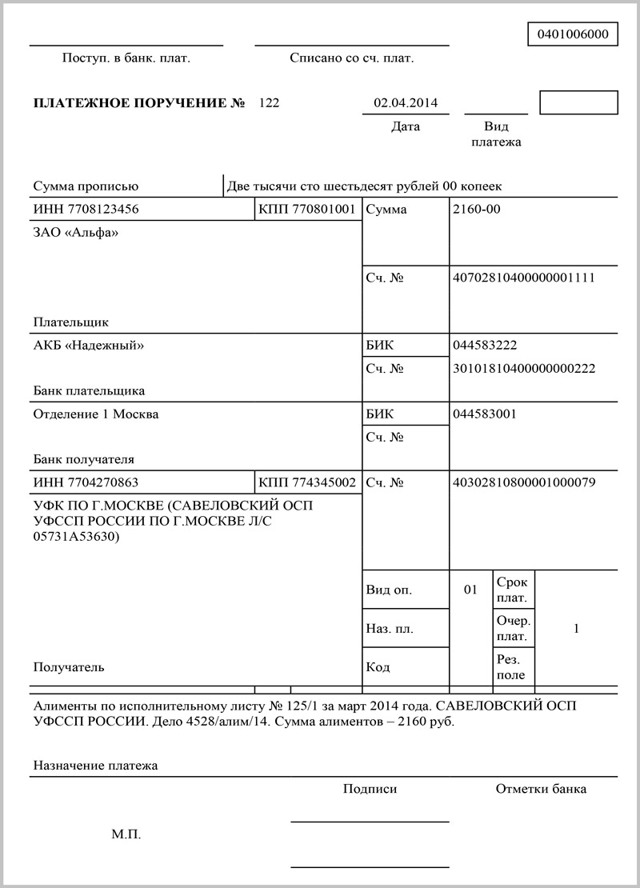

How to transfer alimony by payment order

A payment order is a document on the basis of which funds are transferred from one current account to another. When transferring alimony funds, you must follow certain rules.

Required documents

As for the documents, you will only need those papers that contain the necessary information to fill out the payment order. It can be:

- Passport;

- TIN;

- A document serving as the basis for the legal collection of alimony;

- Recipient details.

How to fill out a payment order

How should a document about the transfer of alimony funds be filled out, and what information must be contained in it:

- The payment order is assigned a number. It is indicated at the top and is created automatically after saving the typed payment;

- Date of the document;

- Document type: electronic;

- Information about the payer – full name, INN, account details, bank name, OKPO;

- Information about the recipient - full name, INN, account details, bank name, OKPO;

- The amount must be entered in numbers and words;

- Payment type. For alimony, select 01;

- The order of deduction (that is, in what sequence this document must be paid) – 1. Alimony payments are made first, in accordance with Article 855 of the Civil Code of the Russian Federation;

- Purpose of payment – child support, full name, date, month, grounds for collection;

- Payer's signature.

Remember that any bank document filled out incorrectly will not be processed, resulting in the money not being credited to the recipient's account. You will be notified of this, and you will have to correct errors in the order or refuse and create a new one.

Each of the listed items in the payment order has its own field, so it’s easy to figure out where and what information to enter. If you are worried that you will fill out the document incorrectly, you can ask an accountant at work or a bank employee for a sample.

How to correctly indicate the purpose of payment in a payment order for alimony?

For any payment order, it is very important to enter the “Purpose of payment” field, especially if the transfer has a specific purpose. This field must contain the following information:

- The purpose of transferring money is alimony;

- To whom – Ivanov D.S.;

- For what period – month, year;

- If alimony is paid officially, then you need to indicate the grounds - the number of the writ of execution, court order or alimony agreement;

- VAT/excl. VAT. When alimony is always written without VAT, since this type of collection is not taxed.

For example, the assignment is as follows: “Child support for D.S. Ivanov, for January 2018, according to writ of execution No. 135-67, excluding VAT.” If you have indicated everything correctly, then the transfer of funds usually occurs on the same day, and the saved receipt, if necessary, will serve as proof of regular alimony payments.

That is, you understand how important it is to correctly indicate all the information in the order, and especially in the “Purpose of payment” field. With an irresponsible attitude, an incorrectly drawn up payment order may become a reason for the accrual of penalties, even though the funds will be transferred to the recipient’s account, they will not apply to the intended purpose, that is, alimony.

How to correctly fill out a payment order for the transfer of alimony

According to the legislation of the Russian Federation, each parent is obliged to allocate funds for the maintenance of their minor children. One of the legal options for transferring alimony in favor of children is a payment order. In this case, the parent who is obligated to pay child support will only need a valid bank account.

The payer can transfer money independently through a financial institution. However, in some cases, accounting employees from the place of work of the alimony payer are authorized to perform this function for the worker. Let’s look at how the process occurs, as well as how the payment order is filled out, in more detail.

How to transfer alimony by payment order for an employee?

The Civil Code of the Russian Federation regulates that a payment order is an obligation of a banking institution to transfer funds on behalf of a client. Money can be transferred from one current account to another, as well as to an account opened in another bank.

Money according to the document arrives within the time limits established by the banking organization. The bank is usually given three working days to carry out such operations. In practice, this period is one day. For example, if a client pays on November 5th, the money will be credited to the account on the morning of November 6th.

When the payer does not want to use banking services, he has the right not to open a bank account. An individual has the right to transfer money from a deposit account without opening additional accounts. To transfer alimony by payment order, you should learn how to fill out the document. The form of the order is approved by Appendix No. 2 to Rules No. 383-P.

Funds for the benefit of children can be transferred either personally or through an employer. If the organization receives a writ of execution from the Bailiff Service (Bailiff Service) or the alimony collector, then the company’s responsibilities will include the monthly deduction of contributions in favor of children from the employee’s wages.

When rendering a verdict, judges stipulate a percentage of withholding or a fixed payment amount. Taking this information into account, accounting specialists calculate the employee’s former spouse’s share of the employee’s salary.

After the employer receives a writ of execution from the claimant or a copy from the SSP, which states that the employee is a debtor for alimony obligations, authorized persons are obliged to withhold funds regardless of the desire of the worker.

The amounts specified in the writ of execution are withheld from all income that the debtor receives from the company. This point is clarified by Federal Law No. 229 (Article 98 Part 3). Execution documents can be received by the company both from employees of the SSP and from the plaintiff (the claimant himself). As a rule, in most cases the claimants are former wives of workers.

After the document has arrived at the organization, it is imperative to notify the employee about this, and also ask him to put a personal signature confirming familiarization with the received document. This point is explained in the letter of Rostrud No. 52-6-0 dated December 19. 2007

How to correctly fill out a payment order for the transfer of alimony according to a writ of execution?

The document on the basis of which funds are transferred from one account to another current account is called a payment order. To transfer payments to minor children, certain rules must be taken into account.

Documentation that may be required to fill out a payment document must be prepared in advance; you may need:

- general passport;

- TIN;

- any documents on the basis of which alimony payments are assigned (court order, writ of execution, etc.);

- bank details of the recipient of the funds.

How to fill out a payment order?

The payment document is always filled out according to certain rules.

The order must include the following information:

- document name and number. The data is indicated at the top and is created automatically if the previous order was saved after creation;

- current date of order generation;

- type of payment – electronic;

- personal data of the payer, including full name, details and name of the bank, OKPO, as well as personal current account;

- personal data of the recipient, including full name, details and name of the banking institution, OKPO, as well as the recipient’s individual account;

- the amount that must be indicated in numbers and words;

- payment code (code 01 is used for alimony transfers);

- The order of deduction is the sequence of payment for the order (number one is selected). Alimony is always paid first. This point is clarified by Article 855 of the Civil Code of the Russian Federation;

- purpose of the transfer – payment of child support obligations (full name, children, date and grounds for collection);

- personal signature of the payer.

It should be noted that every incorrectly completed bank document will not be posted, therefore, the funds will not be credited to the recipient’s account in a timely manner. In such cases, employees of the financial organization inform the client about the presence of errors in the document. After this, you should contact the bank branch and draw up a new order.

All of the above data is recorded in the payment order in specially designated fields, so there should not be any difficulties when filling out the document. If the payer is worried that he has filled out the document incorrectly, he can consult the responsible bank employee or request the form at work from accounting specialists.

Purpose of payment when transferring to a Sberbank card/passbook

In any payment order for the transfer of alimony, it is very important to correctly indicate the purpose of the payment; this column must contain the following information:

- the purpose of the funds transfer is payment of alimony;

- information about the recipient of funds - full name of the second parent;

- payment period – month and year;

- basis for payment (court order number, writ of execution number or details of a voluntary agreement);

- the amount of VAT (in the case of transfer of alimony, it is always stated without VAT, because such a payment is not taxed).

Let's give an example of the wording of the purpose of payment: “Alimony for the children of Petrov I.A. and Petrov I.A., for October 2018, according to court decision No. 768-90 of May 12, 2016, excluding VAT.

If all information is recorded correctly, the money will be credited the next day. It is better to keep receipts so that there is documentary evidence of payment in the future. It is convenient and easy to make alimony payments through Sberbank of Russia.

There are many ways to deposit funds:

- transfers from account to account through a mobile application, Internet banking;

- online transfers from your personal account;

- payment through self-service terminals;

- payment through bank employees in the transaction window.

To make payments through the Savings Bank, it is important to know some of the nuances associated with the procedure, namely:

- if money is transferred to the account of the second parent, then you should ask him for a receipt of payments;

- payment can be made by the payer independently, as well as through the accounting department of the enterprise where he works.

When transferring alimony to a card account or savings book, the payer must indicate his full name in the purpose of payment and make a note that this is alimony for a minor for such and such a period.

purpose of payment when transferring alimony: for employees

Correct execution of the “purpose of payment” column when transferring alimony is very important. In this material we will talk about how to correctly draw up documents for transferring money, depending on who and on what basis they are transferred.

Why is it important to indicate the purpose of payment in payment documents?

Due to the fact that funds for a child are paid, as a rule, by the ex-husband to his wife’s account, if the “purpose” of the payment is not filled out, the bank may consider the payment suspicious and block the account until all details of the payment are clarified.

What problems may arise

Problems may arise if the alimony payer has debt obligations and a case has been filed against him by the bailiffs. According to the law, alimony cannot be seized; however, it is necessary to prove that the money in the recipient’s account is alimony, the easiest way is an extract, or payment slips containing the correct indication of the purpose of the payment.

Well, of course, we cannot ignore the issue of dishonesty of the recipient of alimony. Sometimes, alimony payers have to prove in court that the funds sent to the ex-wife’s account were alimony and not other payments. And correctly filling out the “purpose of payment” column will not leave an unscrupulous spouse a chance to win in court.

What information should be included in the payment instructions?

In order to exclude any misinterpretation of the payment, the following information should be indicated in its purpose:

- An indication that the funds transferred are alimony;

- Link to the document by which alimony was assigned;

- Full name of the child for whom the funds are paid;

- The period for which funds are paid.

If payment for the month is made in parts, then the payment document must also contain information that this is a partial payment.

Payment of child support under a contract (agreement)

A contract (agreement) on alimony is a written document concluded between the parents of a child in order to agree on the amount of payments, as well as the timing, procedure and methods of their implementation. The agreement is certified by a notary.

If such a document is concluded, no additional application to the court is required to establish alimony.

As a rule, the payment of alimony under the agreement is carried out by the payer independently.

In the case of a transfer of money by the alimony payer, the column “purpose of payment” must indicate: “Alimony under the Agreement from (date) to (child’s full name) for (month, year).”

Payment of alimony under a court order

If alimony is assigned in court, then based on the results of the consideration of the case, the recipient of the alimony is issued a court order.

After the court issues an order, the payer can begin to independently pay funds for the child.

In this case, the “payment purpose” should be formatted as follows: “Alimony according to Court Order No. dated (date) to (child’s full name) for (month, year).”

Payment of money according to the writ of execution

A writ of execution is issued by the court in the case when the court hearing simultaneously considers the issues of assigning alimony and recognizing or challenging paternity, or when the decision to assign alimony affects the rights of other persons. Also, a writ of execution is issued when alimony is assigned to adult citizens.

When the payer pays alimony according to a writ of execution, the “purpose of payment” field should look like this: “Alimony according to the writ of execution No. from (date) to (full name of the child) for (month, year).”

Payment of alimony according to a decision made by a bailiff

If a citizen does not fulfill his obligations to voluntarily pay alimony under an agreement or a court decision, the recipient has the right to transfer the case to the bailiffs.

Based on the application received from the recipient of alimony (collector), the bailiff begins enforcement proceedings. A corresponding decision is made about this, a copy of which is sent to the payer.

The resolution contains a deadline for starting payments on a voluntary basis.

The alimony payer has the right, when making payments, to refer to this resolution, but it would be more correct to indicate the document on the basis of which alimony was assigned - an agreement, or a court document.

Payment of alimony by the organization's accounting department for an employee - alimony payer

Payment for an employee can be made not only by order from the bailiff. Funds for the child can be paid by the organization at the request of the employee.

What to indicate in a payment order

When preparing a payment document, the organization’s accountant must correctly fill in the “payment purpose” column. This column should contain the following information:

- For whom the translation is carried out;

- On what basis?

- For what period?

Example wording: “Alimony for (employee’s full name) by (name of document, No., date) for (month, year).”

Transfer of money by bailiffs

If the alimony payer does not have a permanent place of work and does not pay the money voluntarily, the transfer of money can be carried out by bailiffs.

The money can be transferred from the funds in the accounts of the alimony payer, or from the proceeds from the sale of his property.

Bailiffs also indicate in the purpose of payment, information about the document on the basis of which the money is transferred, as well as the period for which the debt is repaid.

Postal transfers

Sending money by mail is also accompanied by documentation. Alimony payments can be sent by mail not only by the payer himself, but also by the accountant of the organization in which he works.

In both cases, filling out the “purpose” field of the payment is similar to filling out the corresponding field in the payment documents accompanying the bank transfer - a receipt or payment order.

Cash payments

Alimony payments are not always made cashless. Often money is transferred “from hand to hand”, and in this case, the correct execution of documents is also important.

When transferring cash, it is important to require from the recipient a receipt containing information that allows you to reliably establish who transferred the money, who received it, in what amount, for what purpose. The document must contain the date and signature of the recipient.

If such documents are not drawn up, then an unscrupulous recipient of alimony will be able to demand their re-payment, and the payer will not be able to confirm the payments, since he will not have any supporting documents on hand.

Transfer of alimony assignment in the payment order

For any payment order, it is very important to enter the “Purpose of payment” field, especially if the transfer has a specific purpose. This field must contain the following information:

- The purpose of transferring money is alimony;

- To whom – Ivanov D.S.;

- For what period – month, year;

- If alimony is paid officially, then you need to indicate the grounds - the number of the writ of execution, court order or alimony agreement;

- VAT/excl. VAT. When alimony is always written without VAT, since this type of collection is not taxed.

For example, the assignment is as follows: “Child support for D.S. Ivanov, for January 2018, according to writ of execution No. 135-67, excluding VAT.” If you have indicated everything correctly, then the transfer of funds usually occurs on the same day, and the saved receipt, if necessary, will serve as proof of regular alimony payments.

That is, you understand how important it is to correctly indicate all the information in the order, and especially in the “Purpose of payment” field. With an irresponsible attitude, an incorrectly drawn up payment order may become a reason for the accrual of penalties, even though the funds will be transferred to the recipient’s account, they will not apply to the intended purpose, that is, alimony.

Purpose of payment is information containing information about why the money is transferred. In this case, it is alimony. In addition, various documents require information about the number of enforcement proceedings (IP), the period and date of initiation of the IP.

If the person obligated for alimony transfers money by non-cash payment from a bank card for a long time after the initiation of an individual entrepreneur, without indicating the purpose, the recipient has the opportunity to collect a penalty, despite the actual receipt of money. The reason is the lack of evidence of payment. If the receipt contains the phrase “for alimony,” it is impossible to claim the debt.

There should be no errors or inaccuracies in “money” matters. Especially when material relationships are built on difficult human relationships.

Often the relationship between the payer and recipient of alimony is complex.

Therefore, in order to avoid disputes and conflicts, it is necessary to be extremely careful about the procedure for money transfers and the preparation of supporting documents. This article explains how alimony can be transferred and what should be indicated in documents confirming payment.

- If you are worried that you will fill out the document incorrectly, you can ask an accountant at work or a bank employee for a sample.

- That is, you understand how important it is to correctly indicate all the information in the order, and especially in the “Purpose of payment” field.

- The employer must fulfill it unconditionally.

According to the writ of execution, in addition to current alimony, the resulting debt is collected. The total percentage of such deduction can reach 70% of the employee’s earnings.

Example

If they are voluntarily transferred by the payer himself, then the assignment indicates the date and number of the agreement between the payer and the person to whom the funds are intended, or his legal representative (mother, father, orphanage, etc.).

The column “Purpose of payment” when transferring alimony should in 2017 give unambiguous answers to the following questions:

- what is the purpose of the payments, what prompted you to issue the payment;

- what document allowed the recipient to submit a demand for payment (the full details of the writ of execution can be provided by the bailiff);

- for what period the payment is made (for example, for January 2017);

- is there VAT?

It is clear that the goal is alimony. This word must appear in the text of the order.

Funds can be transferred based on:

- a voluntary agreement concluded, for example, between an employee and an employer;

- executive document issued by a judicial authority.

VAT is not charged when transferring alimony.

- travel expenses and other accountable amounts;

- compensation payments in connection with the use of the employee’s personal property in the interests of the organization;

- compulsory social insurance benefits, with the exception of sick leave payments;

- financial assistance in connection with an emergency or the death of a family member.

- There should be no errors or inaccuracies in “money” matters. Especially when material relationships are built on difficult human relationships. Often the relationship between the payer and recipient of alimony is complex. Therefore, in order to avoid disputes and conflicts, it is necessary to be extremely careful about the procedure for money transfers and the preparation of supporting documents.

Dear readers! Our articles talk about typical ways to resolve legal issues, but each case is unique.

If you want to find out how to solve your particular problem, please use the online consultant form on the right or call:

Perhaps this is the simplest and most accessible way. However, it has a significant drawback - the parties often ignore the strong recommendation to draw up a receipt, so it is subsequently difficult to prove the fact of transfer and receipt of money.

Don't repeat this common mistake! Prepare a receipt form that you just need to fill out with basic information - full name.

payer and recipient, passport details and identification code, date, amount of money.

It is necessary to indicate the purpose of the payment - alimony (for a minor child, spouse, mother or father) and the grounds (agreement, executive document).

The recipient must personally sign for receipt of the money.

When transferring alimony using one of the above methods, you must indicate the required details, including the purpose of payment. It should be as accurate and detailed as possible.

- For example, alimony for a minor child for XX month of XX year according to writ of execution No. XXX.

- Receipt, check, payment order, statement - documents containing the purpose, date, amount of payment - will help track and confirm payment and receipt of funds.

- Transfer in non-cash form is a paid service, but the purpose of the payment is reflected in the payment order, you can track the fate of the money, and it is easy to prove the fact of payment.

The vast majority of alimony payments are made by the accounting department of the organization, enterprise, or institution where the alimony payer works. The basis for this is the employee’s application and/or a writ of execution (alimony agreement, writ of execution, court order).

The accountant making the transfers himself enters the necessary information into the payment order and is responsible for the accuracy and timeliness of payments. The document confirming payment can be a certificate from the accounting department - it is recommended to order such a certificate at least once a year or upon dismissal.

A payment order for alimony payments is filled out according to the same rules as for any other money transfers. If the document is filled out incorrectly, the bank will not accept it.

The document must contain the following information:

- Payment order number;

- Date (indicate the date of creation of the payment order, the date of transfer to the bank and the date of debiting funds from the account);

- Payer details (full name, identification code) and bank details;

- Recipient details and bank details;

- Suma in cuirsive);

- Purpose of payment;

- Other mandatory details of the payment order: type of payment (electronic), priority (alimony is a priority payment, so it is carried out first - even in relation to taxes, salaries, payment for goods or services, and other money transfers).

The purpose of payment in the “payment order” is one of the most important details of the document, on which the timely receipt of funds and documentary confirmation of payment depend.

So, the purpose of payment consists of the following information:

- The purpose for which the funds are allocated is alimony;

- Grounds – a document (application of the payer, alimony agreement, writ of execution, court order) indicating the number and date of the document;

- Period – year and month;

- VAT – excluding VAT (of course, tax is not charged on alimony payments, but this needs to be clarified).

Alimony based on court order No. XXXX for February 2023. Without VAT.

Compliance with the above recommendations will allow you to provide evidence of compliance with the law, court decision and voluntary agreement at any time in the event of a child support dispute.

- Due to frequent changes in legislation, information sometimes becomes outdated faster than we can update it on the website.

- All cases are very individual and depend on many factors. Basic information does not guarantee a solution to your specific problems.

When spouses who have common minor children divorce, the parent who leaves the family retains the obligation to support their child. As a rule, funds in a certain amount are transferred for maintenance.

The methods of transferring money to the recipient can be very diverse, but it is important, in order to avoid possible problems for the payer and the formation of debt for him, to correctly indicate the purpose of the payment when transferring alimony.

Payment order for alimony: sample filling, how to fill out a payment order for transfer, order of payment

After a divorce, the Family Code of the Russian Federation obliges one of the parents who does not live with the minor to withhold funds to support the child.

There are several ways to transfer them: a personal meeting of the former spouses (it is recommended to draw up a receipt as proof of the transfer of money); Postal transfer; electronic payment service; payment order through the accounting department of the alimony provider’s employer.

The executive documents do not indicate the method of transferring money. The parties use a more convenient option for each of them, which can be changed at any time.

The main condition is the timely transfer of funds in the amount established by law.

How to transfer alimony amounts?

- Alimony payments are withheld from the parent and transferred by the accounting department only upon presentation of a writ of execution or alimony agreement indicating monthly amounts for child support.

- In addition to the document, a statement from the defendant is attached indicating the bank details for the transfer.

- The writ of execution can be submitted by the payer, the claimant and the bailiff.

- As a rule, alimony is transferred in the required amount from the employee’s income in favor of the claimant - the former spouse, parents.

The alimony payer also has the right to pay money directly to his child’s account, and not to his ex-spouse.

After all, the funds allocated must be used for the needs of the child: food, treatment, clothing. The employer's accountant issues a payment order for the transfer of funds.

How to fill out a payment form when making a transfer?

The payment order must be filled out in the form established by the Central Bank of the Russian Federation. The payment document must contain the following information:

- about the payer and recipient of funds (name, full name);

- about the sender's and recipient's banks;

- on the date of preparation of the payment order and the actual transfer;

- about the permitted transfer amount;

- purpose of payment and other mandatory details for payment orders.

To carry out the transfer, the official indicates in the payment document the details of the enterprise paying alimony for the employee: INN, KPP, OGRN, as well as data on the credit institutions of the recipient and the sender (BIC, bank name, current and correspondent account).

Information about the recipient's bank must be provided by the account owner himself.

In the payment purpose field, it is indicated what kind of payment is being made (alimony), the full details of the writ of execution or voluntary agreement, for what period the transfer is made, the presence of VAT (without VAT).

Payment order

In the “Type of payment” field in the payment order, the number 01 is entered. This means that bank employees execute this payment order first. The first group of payments (alimony, funds intended for health compensation).

For example, a company needs to pay taxes and also child support, but there are not enough funds in the account.

In this case, alimony is paid, but tax obligations remain outstanding. Thus, the state has designated the priority of the most important tasks.

Important points

- Particular attention should be paid to filling out all the necessary details, otherwise the transfer of funds will not take place.

- Payments for the maintenance of minor children must be made in strict accordance with the law.

Delays lead to the accumulation of debts, and the company may be subject to a fine and a penalty.

The Family Code (Article 109) indicates the period for transferring alimony is at least 3 days from the date of calculation of wages (scholarships, pensions).

At the enterprise, alimony is withheld from the employee once a month, and then transferred to the alimony recipient.

But if there is another agreement between the former spouses, for example, a weekly payment of alimony, there are no restrictions on such matters from the state.

If the worker’s earnings are paid twice a month, deduction is made from the amount that closes the month.

Sometimes funds for child support must be sent to the account of the Bailiff Service. The reasons for these actions may be:

- lack of information about the bank accounts of the claimant or the child;

- evasion of the alimony from his obligations;

- closing alimony debt upon sale of the debtor's property.

This type of scheme is extremely rare for employers in practice.

Compliance with deadlines for paying alimony will avoid conflicts and litigation in court.

Payment for alimony sample 2023-2020 payment order

Today we offer an article on the topic: “alimony payment sample 2023-2020 payment order”, written in simple and accessible language. Please ask all questions in the section after the article or to our duty lawyer.

Withholding of alimony from an employee is possible either by writ of execution or by personal application of the employee.

If the organization receives a writ of execution, then child support is withheld regardless of the employee’s wishes. It specifies the amounts and procedure for withholding, and the details of the recipient.

If the transfer to the recipient is made by bank transfer, then it is necessary to fill out a payment order. Alimony ceases to be withheld according to a writ of execution only when the child reaches the age of majority or when an employee is dismissed.

Maintenance for minors is paid from all employee income during work, as well as during absence from work:

- wages;

- bonuses, allowances, and other remuneration for performing job duties;

- vacation pay;

- temporary disability benefits.

The full list is given in Government Decree No. 841 dated July 18, 1996.

Deductions should be made from wages after personal income tax has been deducted.

The types of payments from which child support is not withheld include (Article 101 229-FZ):

- travel expenses and other accountable amounts;

- compensation payments in connection with the use of the employee’s personal property in the interests of the organization;

- compulsory social insurance benefits, with the exception of sick leave payments;

- financial assistance in connection with an emergency or the death of a family member.

If the parents have not agreed on the amount of child support, then it is collected in court in the amount of:

- quarters of income - per child;

- thirds of income - for two children;

- half of earnings - on three or more.

If a citizen does not comply with the court’s demand voluntarily, then the writ of execution is sent to his place of work. The employer must fulfill it unconditionally.

According to the writ of execution, in addition to current alimony, the resulting debt is collected. The total percentage of such deduction can reach 70% of the employee’s earnings.

Semenov Andrey Petrovich pays, according to the writ of execution for his son, to his ex-wife, Semenova Inna Leonidovna, a payment in the amount of 25% of the income. In May 2023, he received a salary of 30,000 rubles. He did not submit an application for personal income tax deductions. Let's calculate the amount of deduction:

The employer is obliged to transfer the amounts withheld from the employee's wages to the recipient of support for a minor within three days from the date of payment of wages to the employee (Part 3 of Article 98 229-FZ).

When submitting a payment order, you must indicate your full name. recipient, as well as his bank details. They are either indicated in the writ of execution, or the employee must indicate them in the application (when paying maintenance for minors by agreement).

Payment of maintenance for children is debited from the account first (Article 855 of the Civil Code of the Russian Federation), therefore, in field 21 of the payment order you must indicate “1”.

When transferring by agreement between the child’s parents, the details of this document should be indicated in the purpose of payment.

Transfer of alimony: sample payment order for payment at the request of an employee

If maintenance is paid for a minor by court decision, then the purpose of payment must indicate the number and date of the writ of execution.

Sample payment order: alimony under a writ of execution

Sometimes the decree on the execution of a court decision does not indicate the second parent as the recipient, but the Office of the Federal Bailiff Service.

This situation may arise, for example, when debt is collected, the applicant or child is unable to receive funds either in cash or in non-cash form (no bank card or account), and also if the children are supported by the state.

In this case, the recipient of the payment will be the Federal Bailiff Service. But despite the fact that the funds are transferred to a government agency, the payment order when transferring alimony should not be filled in the fields intended for payments to the budget.

This is explained by the fact that, in essence, such a payment is not a transfer to the budget (tax, fee), but is simply accumulated by the bailiff service in a special account for further payment to the recipient.

The employer is obliged to transfer alimony if he has received a writ of execution, where an employee of the organization or individual entrepreneur is indicated as the debtor. Legislators determine the procedure for withholding payments under a writ of execution, as well as the deadlines for transferring the withheld amount to the recipient. The article provides a sample payment order for the payment of alimony.

The basis for the payment of alimony by the employer is a writ of execution sent by the bailiff or the claimant himself to the organization or individual entrepreneur where the alimony payer is employed.

The obligation to withhold alimony and transfer it to the claimant arises immediately after receiving the writ of execution. At the same time, even if the writ of execution is received in the middle of the month, the amount for the full month is withheld, since the law does not provide for a reduction in alimony in this case.

The payment order for alimony is sent to the bank within three days from the date of payment of wages. If the salary was deposited for some reason, the transfer of alimony is delayed until the actual payment of earnings to the employee himself.

The Simplified 24/7 program fills out payments taking into account the latest changes in the KBK. Uploading payments for online banking takes place in one click. The program allows you to maintain tax and accounting records and prepares primary documents and reporting. Take a trial access to the program for 365 days. Consultation on all accounting issues is available to users 24 hours a day, 7 days a week.

How to fill out a payment order for alimony: required details

Like any payment order, the document for payment of alimony must contain:

- document number and date;

- amount to be paid in figures and words;

- details of the organization sending the payment;

- details of the payment recipient;

- purpose of payment, which must indicate the details of the writ of execution;

- priority and type of payment.

According to paragraph 2 of Art. 855 of the Civil Code of the Russian Federation, alimony is included in the group of first-priority payments. This means that the number 1 should be entered in the corresponding column of the payment order.

In some cases, the recipient of alimony is a bailiff. Then the payment goes to the budget, after which it is transferred to the creditor.

The writ of execution specifies the monthly amount of alimony. Usually it is tied to the minimum wage, so the amount must be indexed if the minimum wage changes.

Please note that alimony can be withheld in an amount not exceeding 70% of wages. This norm is specified in paragraph. 3 tbsp. 138 Labor Code of the Russian Federation.

The purpose of payment must include a reference to the writ of execution, as well as an indication of the period for which alimony is transferred. If the transfer is made to bailiffs, then the purpose of payment also indicates the personal account of the district service unit.

Usually, completing a payment to an individual does not raise any questions, and the sample below for filling out a payment order for alimony will help you transfer the collection to bailiffs.

If the payment is transferred to a bank card or savings book of an individual, then the recipient must clarify the bank details and the personal account linked to the card or savings book for crediting the money. How a document for payment is drawn up in this case can be seen in the example of a payment order for alimony from Sberbank.

How to correctly indicate the purpose of payment in a payment order for alimony?

How to correctly indicate the purpose of payment in a payment order for alimony? Documentation that may be required to fill out a payment document must be prepared in advance; you may need:

Documentation that may be required to fill out a payment document must be prepared in advance; you may need:

After a divorce, the Family Code of the Russian Federation obliges one of the parents who does not live with the minor to withhold funds to support the child.

After a divorce, the Family Code of the Russian Federation obliges one of the parents who does not live with the minor to withhold funds to support the child.