According to the legislation of our country, heirs have the right to challenge a will after the death of the testator. Relatives and heirs of seven orders can lay claim to part of the inherited property.

How to challenge a will for a grandson?

According to the Civil Code of the Russian Federation, a will is a unilateral transaction that comes into force after the death of the testator. Therefore, the appeal process is not possible during the life of the testator.

According to a testamentary document, the property or property part of the deceased is left to his successors - children, grandchildren, wives, husbands and other generations.

In the absence of a document, the property is distributed among the first priority heirs.

The described will of the deceased is subject to execution. However, there are often relatives who do not agree with the contents of the document and want to challenge it. You can challenge the entire inheritance or share. The challenge procedure must be carried out in court.

To challenge a will for a grandson, the procedure is as follows:

- Stage 1 - collecting a package of documents;

- Stage 2 - collection of testimony, in case of possible assistance to the case;

- Stage 3 - conducting a forensic examination, if there is a need for it;

- Stage 4 - drawing up a lawsuit;

- Stage 5 - filing a statement of claim in court;

- Stage 6 is the final stage, the court makes a decision on inheritance of property - houses, apartments.

Additional information: Testamentary refusal and testamentary assignment.

Reasons

To challenge a will for a grandchild, two grounds can be taken into account:

To prove that the will is void:

- There are no signs of notarization - notary signature, seal;

- A document was written with no legislative norms;

- The personal details of the testator or heir are not indicated;

- The document was compiled by other persons. According to the law, a will is drawn up personally by the testator;

- The last will of the deceased was drawn up on behalf of several people. By law, a will is drawn up by one citizen;

- Complete or partial incapacity of the testator.

A document drawn up by the testator with the above criteria is considered invalid by law.

The will is voidable:

- they wrote the document under threats, under deception, under delusion, under violence;

- exclusion from the will of the heirs of the obligatory share;

- there is a dubious signature on the paper by the testator;

- the paper describes property that does not belong to the property of the deceased;

- the document was drawn up in an unconscious state, the testator could not be responsible for his actions.

Who can argue?

According to the law of the Russian Federation, all applicants for the inheritance have the right to challenge the last will, except for unworthy heirs. Unworthy heirs are:

- Criminals who committed atrocities against the testator, close relatives claiming to receive the inheritance;

- Parents who have been deprived of custody rights over their children (child);

- Heirs who, according to a previously concluded agreement, were supposed to look after the testator, but in fact did nothing.

In most cases, people want to challenge the last will drawn up for a grandson:

- son of the deceased;

- daughter of the deceased;

- brother of a grandson, or brother of the deceased;

- sister of a grandson or sister of the deceased;

- other grandchildren.

To appeal the testamentary document, close relatives who are directly related to the deceased citizen go to court.

Son

According to the Civil Code, the son of the testator has the right to challenge the will drawn up for his grandson, but if there are compelling reasons. The main thing is to prove the incapacity of the grandmother (grandfather), who wrote the last will for their grandson. That is, an incapacitated person is not able to make adequate decisions on his own.

Incapacity must be proven only in court. Reasons for testator's incapacity:

- mental disorder;

- frequent drinking of alcohol;

- private drug use.

The son, in order to prove the incapacity of the testator, must go to court by providing testimony. Witnesses can prove the use of drugs and alcohol. But to transfer inheritance rights from a grandson to a son, the testimony of witnesses is not enough. A forensic medical examination should be carried out by exhuming the body.

If medical experts confirm the incompetence of the testator, his property will be distributed in equal parts among the first-priority heirs.

Daughter

A daughter has a chance to challenge a will executed in favor of a grandson if there is evidence of the incapacity of the person who drew it up.

According to the legislative norms of the Civil Code, the daughter has the right to challenge the share of the will, provided that she herself is:

- an incapacitated person;

- a minor citizen.

According to the Civil Code, incapacitated and minor citizens have the right to receive an obligatory share in the inheritance. But provided that they are heirs of the first stage, since heirs of the first stage:

In other cases, it is impossible to challenge a will drawn up for a grandson, son or daughter.

Required documents

It is possible to challenge the last will document in court. To begin the trial, the son (daughter) needs to collect a package of documents:

- statement of claim;

- a copy of the plaintiff's passport;

- a copy of the will;

- a copy of the forensic report;

- witness statements;

- a copy of the testator's death certificate;

- receipt of paid state duty;

- other documents at the request of the judge.

A statement of claim to challenge a will for a grandson must contain:

- name of the institution to which it is submitted;

- defendant's details;

- plaintiff's details;

- table of contents;

- complete information about the testator;

- information about the notary who certified the document;

- reasons for challenging, indicating references to legislative acts;

- demands for division of heritage;

- list of documents attached to the claim;

- date, painting.

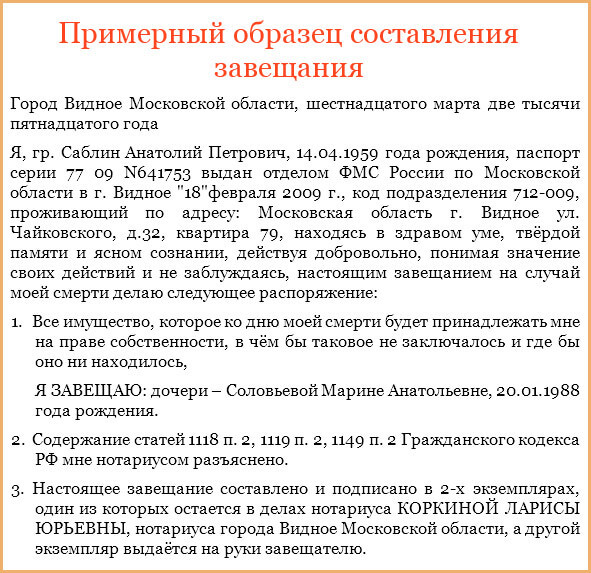

Download sample

Before filing a claim, you need to consult a specialist, because... The court may not accept the incorrectly stated circumstances in the application.

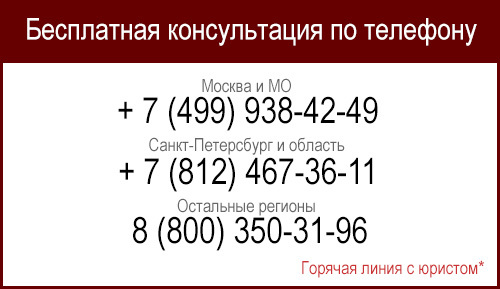

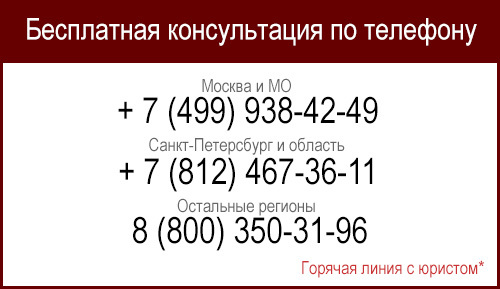

Tell our lawyer about your problem, describe your individual situation, ask a question and receive a detailed answer. Consulting a lawyer will help you correctly draw up a claim and challenge the inheritance.

Can a grandchild challenge his grandparents' will?

If grandchildren are indicated in the will as heirs, the share of the property is guaranteed. In other cases, they have the right to challenge the heritage by right of representation.

The grandchildren of the deceased can present their rights to the inheritance and challenge it. But this is provided that the children (son, daughter) of the testator died before the death of the testator. In a different situation, the property will be distributed among the priority recipients of the inheritance - between sons and daughters.

Right to present an illustrative example:

The grandmother had a son and daughter. The son and daughter each have two children of their own. The son died before the grandmother died. The inheritance, according to the law, is divided in equal shares (50/50) between the daughter (first priority) and the children of the deceased son (right of representation). If there were more than two grandchildren, then they are still entitled to 50% of the property, the remaining 50% belongs to the daughter.

If he is underage

Can a minor grandson challenge a will?

If a minor citizen and the deceased are registered in the same apartment, then he automatically has a share in the inheritance. But this is provided that his mother (father), who is the deceased person’s daughter (son), are dead.

In this situation, the remaining heirs claiming the property do not have the right to leave the minor without an obligatory share. To challenge a share of the inheritance for a minor grandchild, legal guardians must submit documents to the court.

If you have questions, consult a lawyer. You can ask your question in the form below, in the online consultant window at the bottom right of the screen, or call the numbers (24 hours a day, 7 days a week): ( 6 ratings, average: 4.33 out of 5) Loading…

How to make a will for a minor grandchild

The law does not limit the circle of children to whom property can be bequeathed. It is allowed to inherit separate property or parts of property. The testator has the right to indicate special conditions - refusal and testamentary assignment. For a grandson If desired, the testator can draw up a will for a grandson who has not reached the age of majority. In such a situation, it must be indicated in the document as one of the heirs.

Dear readers! Our articles talk about typical ways to resolve legal issues, but each case is unique.

If you want to find out how to solve your particular problem, please use the online consultant form on the right or call the numbers provided on the website. It's fast and free!

Content:

- How is it guaranteed to bequeath housing to children and protect them from other heirs?

- Is it possible to write a will for a minor child?

- Will for a minor child: features and procedure for execution

- Will for a minor son or grandson

- Is it possible to write a will for a minor child?

- Is it possible to make a will in favor of a minor grandson?

- Will for a minor child

- How to make a will for a minor?

- Pros and cons of making a will for a minor child

WATCH THE VIDEO ON THE TOPIC: 28052019 Tax news about personal income tax when donating real estate / gift of real estate

How is it guaranteed to bequeath housing to children and protect them from other heirs?

Free from mobile and landline Free multi-channel phone 8 If you find it difficult to formulate a question, call the free multi-channel phone 8, a lawyer will help you 1.

If I draw up a will for my minor child, and after registration I get married, will my husband have any rights to the apartment if something happens to me?

Hello, dear Natalia! All issues related to inheritance, both under the Law and under the Will, are regulated in detail by the Civil Code of the Russian Federation, part 3 briefly - the Civil Code of the Russian Federation, which you can carefully read for yourself right now.

If this apartment is owned only by you alone, then in this case you have the right to bequeath it to your child from a notary. And if something happens to you, God grant you to live to at least 99 years, then this apartment will belong only to your child.

And in this case, your future husband will not have any rights to this apartment. In addition, you can change such a will at any time or cancel it in the future.

Good luck to you. If there is such a will, the husband will be able to claim only the obligatory share if at the time of opening the inheritance he is disabled (Art. The apartment was sold with an encumbrance, the seller died.

There was a will for the apartment in favor of a minor. How to remove the encumbrance? Dear Natalya Georgievna! Who imposed the encumbrance and what? Who is the seller and when did you buy? Social payments are transferred to the minor’s account, and this is where the bank transferred the money according to the will. How can a mother withdraw money? Is it clear where the social payments are and where the inheritance is?

Take a bank statement for your personal account. Based on the statement, you will be able to determine how much money went to the minor’s account as an inheritance. The apartment was purchased during marriage.

In addition to the apartment, he left huge debts as an inheritance. I was offered to renounce my inheritance in favor of my son, but I refused. They didn’t explain whether I could change my decision after the notary opened the inheritance case.

And exactly what inheritance I had to give up by law, by will, or all at once. Thank you in advance. The heirs are liable for the debts of the testator to the extent of the value of the inheritance. You have the right to refuse the inheritance in favor of your son before the expiration of 6 months from the death of your husband.

You have the right to refuse inheritance both by will and by law. Either from one thing or from all at once. You can refuse the inheritance without indicating in whose favor you are doing this.

You don't have to accept the inheritance at all. What is your goal? Get rid of your husband's debts? There is an option that they will be “pinned” on their son.

Write what your goal is and then we can advise you what to do. The will was written by my grandfather for my minor son, is it possible to find out whether it has been annulled or rewritten? You can find out this only from the testator himself, or after the opening of the inheritance.

If grandpa doesn’t want to tell you about it, then there’s no way you’ll find out. Is it possible to obtain a certificate of ownership by allocating it from a will to a minor, since there is no intestate?

Hello, Valentina! If you want to allocate a share and register it for a minor in the inheritance property, you can donate it when you register your ownership after receiving a certificate of inheritance. The transaction on behalf of the minor in his interests must be signed by one of the parents, but not by you.

Because you can’t make a deal with yourself. If I guessed the situation wrong, don’t blame me! I'm not an extrasensory. You have written very little about the situation. Write more details! I want to make a will for a minor child. I am officially married and have a daughter from my first marriage.

I want to bequeath everything to my child. The apartment is mine, bought by me before marriage. Do I need permission or something similar from my spouse who is not the father of my child?

Hello Maria! If you are an owner, you have the right to dispose of your property as you wish. The consent of the second husband is not needed.

The only caveat is that if at the time of your death your spouse is a pensioner, he will have the right to an obligatory share in the inheritance, regardless of the will. Maria, in order for your will to be certified by a notary, no consent is required, incl.

My grandmother made a will for me. But there is another minor granddaughter, her father, the grandmother’s son, died before the grandmother’s death. Is she entitled to the mandatory part? My grandmother's other son, my father, is alive. No, she does not have the right if she was not a dependent.

Grandchildren have no right to a compulsory share. Only for children - pensioners or disabled people. This year my mother died, leaving a will for the apartment of my minor daughter. They did not enter into inheritance due to living in another country and the inability to come within 6 months, because the child was attending school.

My father, the surviving husband, lived in this apartment all this time and paid utility bills, as he did before the death of my mother, with whom he ran a joint household.

He also did not enter into inheritance rights within the period established by law, due to his physical condition, he is a sedentary disabled person of group 2, believing that by still running a household, he thereby actually accepted the inheritance, and his granddaughter, having reached the age of 18, will be able to independently register an inheritance for the apartment .

After 3 years and 3 months, dad finds a savings book for the cash deposit of the deceased mother, which no one knew about and, accordingly, which was not included in the inheritance. How to proceed? The heirs are also my sister, who also did not declare her right to inheritance within the prescribed period.

Restore the term and enter into inheritance. Good afternoon Due to the missed deadline for filing an application for her inheritance rights, it is possible for the granddaughter to go through the courts and for the surviving spouse without a trial, which may serve as a basis for the granddaughter to enter into an inheritance without a trial.

I wish you not to get confused in inheritance rights. Natalia, believe me, your father accepted the inheritance on time. That's for sure. I have been involved in such cases for a long time, and I often see that the heirs accept the inheritance on time and, moreover, do not know about it themselves.

No trial needed. One most important thing needs to be done: when visiting the notary, your father should not tell him anything unnecessary, answer all the questions correctly.

It is impossible to explain how to do this in three or even twenty-three sentences. At least an hour, and most likely even more, to explain even briefly.

And still the nuances will remain undiscussed. And your daughter will be able to accept the inheritance with the written consent of your father. She has this right by law. And also, in any case, she has a second option to accept the inheritance, since she is a minor. I wanted to know that my grandfather made a will for my minor daughter and a will for his part of the apartment.

This is an apartment for two for grandparents, they wanted to make this apartment for their daughter. But my grandfather gave a gift to his great-granddaughter, that is, my daughter, she is 5 months old. Can his daughter challenge this will after his death? Challenging a will does not depend on the agreements of the testators and the age of the heirs.

It can be challenged on the grounds of violation of the form of the will, the will of the testator, and his being in a state unable to account for his actions, which must be confirmed by medical documents.

But keep in mind that the grandfather can also make another will for his share, and each subsequent will will cancel the previous one. The grandfather wrote a will for his cousin, a minor grandson, the will states that the disabled spouse has the right to half of the property that he would be entitled to.

Is it possible to challenge such a will in its entirety? Or can they split it in half? Yes, of course it is possible, due to violation of the requirements of the civil code. A will made for a minor grandson approximately 25 years ago will have legal force.

Is it possible to write a will for a minor child?

Disposal of inheritance received Is it possible to write a will for a minor child? When thinking about the well-being of their children, they often consider the possibility of registering property through inheritance.

The sequence of transfer of property by inheritance established by law presupposes the possibility of obtaining property from the mother or father of the parents only in the order of hereditary transmission. It is possible to transfer property by inheritance to grandchildren under a will. A bank deposit can be transferred to a grandson.

A will for a minor grandchild will have a number of features of the adoption procedure, which we will consider separately.

How to make a will for a minor? The testator can assign property to his grandson, ignoring the rights of other heirs.

Current legislation does not impose age restrictions. The number of years lived has no legal meaning. A will for a minor is drawn up at any age from the date of registration and registration with the registry office.

The only mandatory requirement for drawing up a will is the fact of being born alive. The heir will be able to become the full owner of the property after reaching the age of majority, when he turns 18 years old.

Writing wills for minors is a common practice, which is based on specific articles of the Civil Code.

The order of inheritance under the law The law determines the order of priority for making claims under a will to the property left behind by deceased family members. The orphan receives everything that the parents owned, regardless of whether they were legally married.

Will for a minor son or grandson

This must be remembered if you want to draw up a will document with a notary. The child will be able to assume the rights of a full-fledged heir, but he does not have the right to independently dispose of property until he reaches 18 years of age or becomes emancipated. It is possible by court decision if the minor is 16 years old, married or engaged in entrepreneurial activity. Is it possible?

How to guarantee the fulfillment of will?

What kind of property can be bequeathed? A will is the surest way to dispose of property in the event of death, especially if the property is significant, such as real estate, and the number of potential heirs is not limited by law to a single relative.

Representatives of the Federal Notary Chamber told the RIA Real Estate website how to correctly draw up a will in order to express your will as accurately as possible and deprive careless claimants of the inheritance of the opportunity to challenge it.

In what case can the heir specified in the will be excluded from inheritance? By a court decision, an heir, including one specified in the will, may be excluded from inheritance if he is found unworthy.

Is it possible to make a will in favor of a minor grandson?

In many countries, the last will of the deceased is law. However, in our country any will can be challenged. It is not uncommon for cases when, after the death of a person, numerous distant and close relatives immediately appear, claiming inheritance, including real estate, especially in the capital.

How can you be sure to bequeath a home to your children so that no one can deprive them of even part of the inheritance that you would like to leave them? And is this possible within the framework of current legislation? Heirs of the first stage First of all, you need to understand that the children of the deceased are the heirs of the first stage.

But they are not alone.

How to be sure to bequeath housing to your children so that no one, including minor children, is protected, but you should remember that in many cases, therefore, drawing up a will is still necessary.

Moreover, this can be done as many times as the testator wants. As for the circle of people to whom he can assign his property, it is not limited. This can be an individual of any age and citizenship, a legal entity, a private or public enterprise, a charitable foundation and even the state.

How to make a will for a minor?

Free from mobile and landline Free multi-channel phone 8 If you find it difficult to formulate a question, call the free multi-channel phone 8, a lawyer will help you 1.

If I draw up a will for my minor child, and after registration I get married, will my husband have any rights to the apartment if something happens to me? Hello, dear Natalia! All issues related to inheritance, both under the Law and under the Will, are regulated in detail by the Civil Code of the Russian Federation, part 3 briefly - the Civil Code of the Russian Federation, which you can carefully read for yourself right now. If this apartment is owned only by you alone, then in this case you have the right to bequeath it to your child from a notary.

Often, after the death of a person, numerous relatives appear and claim their rights to the property.

But in our country, cases of challenging a will are not uncommon.

The testator is faced with the task of how to transfer property to the chosen person and protect him from illegal attacks by numerous close and distant relatives? Often such a chosen person becomes a minor child - a son or daughter, grandson or granddaughter.

In this article we will look at the features of drawing up a will for a minor child. Is it possible to draw up a will for a minor child? As you know, the law provides for two methods of inheritance - by law and by will.

.

VIDEO ON THE TOPIC: Inheritance for a minor

How is it guaranteed to bequeath housing to children and protect them from other heirs?

In many countries, the last will of the deceased is law. However, in our country any will can be challenged.

It is not uncommon for cases when, after the death of a person, numerous distant and close relatives immediately appear, claiming inheritance, including real estate, especially in the capital.

How can you be sure to bequeath housing to your children so that no one can deprive them of even part of the inheritance that you would like to leave them? And is this possible within the framework of current legislation?

In many countries, the last will of the deceased is law. However, in our country any will can be challenged.

It is not uncommon for cases when, after the death of a person, numerous distant and close relatives immediately appear, claiming inheritance, including real estate, especially in the capital.

How can you be sure to bequeath housing to your children so that no one can deprive them of even part of the inheritance that you would like to leave them? And is this possible within the framework of current legislation?

Heirs of the first stage

First of all, you need to understand that the children of the deceased are the heirs of the first priority. But they are not alone. The head of the consulting bureau WISECONSALT, lawyer Elena Somuseva told Realestate.ru that in accordance with Art.

1142 of the Civil Code of the Russian Federation, the heirs of the first priority according to the law are the children, spouse and parents of the testator. In accordance with Art.

1143 of the Civil Code of the Russian Federation, if there are no heirs of the first stage, the heirs of the second stage by law are the full (common parents) and half (common mother or father) brothers and sisters of the testator, his grandparents, both on the father’s and mother’s sides.

It would seem that everything is simple: make a will in favor of the child and live in peace. But there is one caveat.

“You can bequeath your property to any individual, including minor children, but you should remember that in Russia there is such a thing as a mandatory share in the inheritance,” explained Elena Somuseva.

“Minor or disabled children of the testator, his disabled spouse and parents, as well as disabled dependents of the testator are entitled to it.”

These persons inherit, regardless of the contents of the will, at least half of the share that would be due to each of them if inherited by law.

“In my practice, there was a case when a person purchased an apartment, which went to the seller by way of inheritance according to a will, and after some time the testator’s minor son appeared, who knew nothing about his father’s death and through the court received a share in the apartment,” said the lawyer . – The buyer had to buy out his share, in fact, again.

The real estate agency refused to be held responsible, although this child had previously been registered in this apartment, and the usual archival extract from the house register showed this if the agency had fulfilled its obligations to verify the purity of the transaction in good faith.”

However, not all lawyers consider a will to be such an unreliable means.

Chairman of the bar association “Your Legal Attorney” Konstantin Trapaidze noted that the chances of challenging a will drawn up in favor of a child are minimal, and challenging his right to property is much more difficult.

“The child is the same participant in civil legal relations as other persons,” the expert noted. Therefore, in many cases, making a will is still the best option for the development of events.

Deed of gift or will?

So, if there are many applicants for the inheritance and you still consider a will not a very reliable way to carry out your will, you can draw up a deed of gift. As explained by IntermarkSavills legal adviser Anton Ladygin , an alternative way to register housing for a child, in addition to a will, is a gift agreement or deed of gift.

“However, the difference between these methods is very significant, since a deed of gift for an apartment makes the heir the owner of the apartment from the moment new state registration documents are received for it. And, accordingly, the donor automatically loses all rights to the apartment by signing the deed of gift,” the expert explained.

– When drawing up a will, the heir receives the apartment only after the death of the testator. A deed of gift can be legally formalized only once; a will can be rewritten. It is drawn up in simple written form and is subject to mandatory state registration.

If both parties to the gift agreement for objective reasons cannot be present at the execution of the agreement, then relatives or friends can do this, while the will must necessarily be drawn up personally.”

When drawing up a deed of gift, it is necessary to clearly weigh all the pros and cons, experts are sure.

Director of the Investment Department of Tekta Group Roman Semchishin believes that a deed of gift can only be drawn up if the parents are confident in their child and maintain a trusting relationship with him, there is a real possibility of control, and there is a high risk of challenging the will by third parties (after the opening of the inheritance).

Yes, in this case there is no need to fear that your child will not receive an inheritance. “But it’s not a fact that a parent will be able to raise a person who will not kick him out of this apartment later,” says Elena Somuseva. – The advantages of making a will are that there will be no abuse on the part of the child when the parent is old.

A common disadvantage for a situation where the heir is a minor is that transactions with inherited property can be carried out by a guardian or trustee, and there is no way to insure against the abuses of these persons. Of course, there is hope for the guardianship authorities, but judicial practice indicates the presence of a corruption component in these bodies, which leads to violation of the rights of minors.”

How to draw up a will?

“Currently, there are frequent cases of errors in documents drawn up in notary offices - full names, passport details, addresses of objects are incorrectly indicated,” says Elena Somuseva. – In my judicial practice, there was a case when a notary made a mistake in the will and indicated the wrong address of the object of inheritance. When the time came to formalize inheritance rights, the testator’s daughter was unable to enter into inheritance rights under the will. The situation was complicated by the fact that in addition to her there were other heirs who, during the life of the testator, received their shares in the testator’s property, but did not fail to exercise their right to inheritance and significantly reduce the share of the testator’s daughter.”

Hence the conclusion: carefully read what you sign, check all the dates, addresses and personal data of all participants in the process, check the correct spelling of real estate in the will in order to avoid consequences.

“You can bequeath the housing you own to whomever you want,” explained Anton Ladygin. – This could be a child, including a minor. You can even bequeath your home to a conceived but unborn child. Housing can be bequeathed to one heir or divided in shares among several heirs.”

In addition, according to the expert, a condition can be included in the will, according to which, at the expense of the inheritance, the heir or heirs are required to fulfill any obligation of a property nature in favor of one or more persons. This is called testamentary refusal.

It is possible to include in the will a condition of a different nature, requiring the heirs, at the expense of their share in the inheritance, to perform any action of a property or non-property nature aimed at achieving a generally beneficial purpose (testamentary assignment).

A will may contain conditions of a different nature at the same time: both a refusal and an assignment.

The only thing that cannot be done is to include in the will conditions that limit the rights and freedoms of citizens guaranteed by the Russian Constitution.

For example, it is impossible to require the heirs to fulfill the conditions of choosing a profession, living in a certain locality, converting to another faith or renouncing one, marrying or refusing to marry someone.

You cannot introduce a condition under which the heir will be obliged to support someone for life. It is also impossible to make it a condition of the will to restrict the heir’s right to dispose of inherited housing - an obligation not to sell, donate, or rent.

At the same time, it is possible to stipulate in the will that if the inherited home is sold, the heir is obliged to pay part of the cost to someone else.

In case of emergency

Typically, a notary can be called to your home or hospital to draw up a will. However, in very urgent cases, instead of a notary, the will can be certified by the head physician of the hospital - this is allowed by law, although it happens extremely rarely. According to Elena Somuseva, the head physician may refuse to certify a will if he doubts the patient’s adequate perception of reality.

To bequeath real estate to a child, you must provide the notary with the following documents:

• Your passport; • title documents for real estate; • if you bequeath a share in housing, you will need to add an agreement on determining the shares to the documents;

• if the housing is your personal property, you will need to present a notarized statement stating that at the time of acquiring ownership of the housing you were not married.

It is important to understand that a will can only be executed in person; this cannot be done through a representative.

According to our experts, the will is drawn up in 2 copies in writing - written by hand or printed, and then signed by the testator in the presence of a notary, who certifies the authenticity of the signature. One copy of the will remains with the notary, the second - with the testator. The notary is obliged to keep the will secret.

If you do not want the contents of the will to be known to the notary himself, you can draw up a closed will. It is handed over to the notary in a sealed envelope in the presence of two witnesses who sign the envelope. In this case, you must write the text of the will yourself and sign it.

A will can be drawn up in the presence of a witness if there is reason to suspect that after the will comes into force it will be challenged in court on the pretext that it is false. “The witness will help prove the legality of the will if the will is challenged on the pretext that the testator acted under duress, was incapacitated, etc.

The witness, like the notary, is obliged to keep the will secret,” emphasized Anton Ladygin.

Notification

According to Art. 61 of the Fundamentals of the legislation of the Russian Federation on notaries (approved by the Supreme Court of the Russian Federation on February 11, 1993 N 4462-1), the notary is obliged to notify about the opening of the inheritance those heirs whose place of residence or work is known to him.

“It is important to understand that the law does not oblige the notary to request a certificate from the place of residence of the testator or otherwise search for heirs,” explained Elena Somuseva. Thus, it is necessary for a parent who wants to provide his child with an inheritance to ensure that in the event of his death, the child does not experience difficulties in registering inheritance rights.

“To do this, I recommend distributing copies of the will to close relatives or friends, who, in the event of the death of a parent, will inform the child about the inheritance,” the expert recommends.

Konstantin Trapaidze added that registering a child at the place of residence does not matter, but if the child is registered at the place of residence, then from a legal point of view it will be easier to notify him.

“According to the law, from the date of death of the testator and within 6 months, it is impossible to receive the inherited property, since six months are given to those potential heirs (except for the main ones) who wish to show up and claim the remaining property,” explained Anton Ladygin.

– Only after 6 months has passed, the notary has the right to deal with the inheritance. The heir must contact the notary at the place of last registration of the testator. If it turns out that the inherited property has already been accepted by one of the heirs by law, then it will be necessary to file a claim against these persons.

If the child himself cannot perform the specified actions, this must be done by his parents or other legal representatives.”

If the child is underage

According to Elena Somuseva, your heir will become the full owner only upon reaching 18 years of age. Until his 14th birthday, in the absence of legal representatives, transactions with the alienation of residential premises are carried out by a guardian*, and from 14-18 years old - by a trustee**, but always with the consent of the guardianship and trusteeship authorities.

Anton Ladygin added that parents or persons replacing them are the legal representatives of children and can alienate housing owned by their wards.

“When selling residential real estate owned by a minor, he must be provided with another living space, and no worse than the previous one,” the expert noted. – Compliance with this condition is monitored by the guardianship and trusteeship authorities.

They are obliged to intervene if the child’s property is alienated without providing him with similar conditions, that is, a share in an apartment (or an entire apartment if he owned the entire living space) that is no worse than the one in which the minor lived before.

Moreover, the footage, area, general condition of the premises, proximity to children's educational and health institutions and much more will be taken into account. If this condition is not met, the child may be refused to be deregistered from the apartment that belongs to him. Also, in the future, this may lead to the recognition of the transaction as invalid.”

If the state guardianship authorities do not inspire confidence in you, and there is a possibility that the heir will assume his rights as a minor, the only parent of such a child has the right to independently determine a guardian or trustee in the event of his death. He can make the corresponding order in an application submitted to the guardianship and trusteeship authority at the child’s place of residence.

Maria Lukina

*A guardian is a person who, as a parent, is entrusted with the guardianship of a child. Guardianship is valid until the child reaches 14 years of age. From 14 to 18 years of age, trustees assume their rights.

**Guardian is a person who cares about the interests, needs or requirements of the child, protects his rights and interests within the framework of guardianship. Grandparents and adult brothers and sisters of a minor ward have a priority right to be his guardians or trustees over all other persons.

Will for a minor child - what to consider for the testator

More often, such needs arise when it is necessary to draw up a will for a minor grandchild. You need to understand that the rights of a minor child differ from the rights of an adult.

Because of this, inheritance of property, and therefore the execution of a will, has its own nuances.

When drawing up the last statement of will, it is necessary to indicate the executors and take care of guarantees for the implementation of the will.

The basic rules for the transfer of inheritance are specified in Chapter 62 of the Civil Code of the Russian Federation. Pay special attention to Article 1125, which outlines the minimum requirements for a will.

Is it possible to make a will for a child before he or she reaches adulthood?

There is no need to worry about whether it is possible to write a will for a minor child, since there are no legal problems on this side. There is a ban for minors themselves; they cannot draw up a will. But it must be taken into account that some groups of relatives have the right to an obligatory share in the inheritance.

This means that direct disabled heirs (disabled spouses, children, etc.) have the right to a share of the property, regardless of the contents of the will. This share is half of the portion of the inheritance that would have belonged to them if the will had not existed.

More information about the obligatory share in the inheritance can be found in Art. 1149 of the Civil Code of the Russian Federation.

How to write a will for a minor

A person cannot dispose of an inheritance until he reaches 18 years of age. Until this moment, the guardianship authorities or the trustee monitor the safety of the bequeathed property. Also, until the age of 14, he does not have the right to enter into transactions. After receiving a passport, a teenager can enter into transactions with the consent of his parents, guardian or trustee.

For all these reasons, a minor cannot fully manage property until he is 18 years old. The exception is emancipation - a court decision that equates a 16-year-old person to an adult. This happens in the case of marriage or opening a private enterprise.

Despite all the peculiarities, a will is drawn up for children according to standard rules:

- information about the object of inheritance (apartments, cars, etc.) is indicated;

- the heir's details are indicated - full name, date of birth, other passport details (if any) or information on the birth certificate;

- the maker of the will signs himself and must put the date;

- The will must also be signed and stamped by a notary.

Attention! It is not necessary to notify the heir's parents about the preparation of a will in favor of the child.

A will for an apartment that has entered into force, drawn up for a minor child, gives him the right to live in it until he turns 18, but he will be able to fully use it (sell, exchange, pay for) only upon reaching adulthood. In this case, the executor or executor must be indicated. This person can pay utility bills and taxes in exchange for the right to live in the living space until the heir reaches 18 years of age.

Advantages and disadvantages

A will in favor of a minor has a number of advantages and disadvantages related to the age of the heir.

Advantages:

- the child is unlikely to try to kill the owner of the property in order to quickly become an heir;

- children, due to psychology, are less interested in material goods, therefore they are sincere with the testator;

- minors are not interested in receiving an inheritance quickly, since they still will not be able to use it until they turn 18.

Flaws:

- in case of legal disputes or fraud, the child is highly dependent on the will of the guardian or trustee;

- children are easier to manipulate due to little life experience;

- during inheritance, much will depend on the executor and guardianship authorities.

Consider the pros and cons when choosing whether to create a will or a gift deed.

Advantages:

- with a will, the heir receives property only after the death of the testator; with a gift, the child receives the rights of the owner immediately;

- a will can be rewritten, a decision can be changed, a deed of gift does not provide such an opportunity;

- the will must be drawn up personally; the deed of gift can be drawn up by relatives.

Flaws:

- it is difficult to challenge a deed of gift, while wills are constantly contested;

- a minor heir cannot use the received property; the rights of the child are protected by the executor of the will and the guardianship authorities.

Contents of the will

It is better if the will is drawn up on a computer and printed out, since a handwritten will is not always clear from handwriting.

The will must be drawn up in as much detail as possible, with a detailed description of the object of the inheritance and its recipient.

The will states:

- date of its preparation;

- the place where the document is signed (locality);

- information about the testator: full name, passport information, place of residence must be indicated;

- information about the heir is indicated in the same way;

- the property transferred by inheritance is described;

- it is indicated that the will was drawn up by the testator of his own free will, in a sober and sound mind.

A will can be drawn up in free form, but all of the above points must be disclosed in it.

Further actions

When a will is drawn up for a minor, it is advisable for the testator to pay the state fee (200 rubles) in case the heir is unable to do so. Then you need to go to the notary, taking the following documents:

- passport;

- documents confirming ownership of property;

- the will itself (not a copy);

- certificate of payment of state duty.

The will must be certified by a notary in person, and the presence of two persons not interested in the will will be required. The will is placed in an envelope on which witnesses sign. The testator himself must also leave his signature in the presence of a notary.

It is better to determine the executor (executor) immediately, when drawing up the will. His duty under the law is to monitor the execution of the will, eliminate delays while respecting the will of the deceased. Since the interpretation of the will may reveal ambiguities, the executor is a kind of guarantor of the execution of the will.

It is better to determine the executor immediately when drawing up the will.

It is important for heirs to know when the will comes into force and to comply with the deadlines provided by law. Find out when the notary should open the envelope with a closed will here. The announcement of a closed will has a number of features.

How to guarantee the fulfillment of will?

There is a proven method of executing a will - appointing an executor. He must be appointed by the testator when making a will. The responsibilities of the performer include:

- control the process of transfer of ownership;

- provide all conditions so that the heirs avoid delays;

- control over the execution of the will of the deceased in strict accordance with the will.

It is advisable to choose an executor in whom the testator can completely trust, while the executor is not interested in dividing the property.

Conclusion: you can draw up a will for a minor child, similar to writing a regular will. But there are several nuances. A minor cannot fully use the property. Therefore, to guarantee compliance with the will, it is necessary to appoint an executor of the will, who will ensure that the child receives his inheritance upon reaching 18 years of age.

For additional information on this issue, please see the “Wills and Donations” section here.

Will for a young grandson - Lawyers Ivanov and Co.

If you need assistance of a legal nature (you have a complex case and you don’t know how to fill out documents, the MFC unreasonably requires additional papers and certificates or refuses them altogether), then we offer free legal advice:

- For residents of Moscow and Moscow Region - +7 (499) 653-60-72 Ext. 448

- St. Petersburg and Len. region - +7 (812) 426-14-07 Ext. 773

Ask a question to an expert A citizen can assign an apartment to his minor child or grandchild. He can also divide the property between 2 heirs in equal shares or assign a large part of the property to one person.

Is it possible to make a will for minor grandchildren, bypassing the children? Moreover, the will may provide for the receipt of an apartment by an unborn grandchild. If on the day of the testator’s death the child has not yet been born, then the notary shall suspend the issuance of the certificate Art.

The notarial act continues immediately after the birth of the baby.

Our mother died, we were left with a three-room apartment, we have a share by inheritance, this is mine, and a share by will, this is my minor niece. A loan was also issued to my mother, my husband helped pay the loan, payment slips are available, after my mother’s death they paid off the loan for six months, then there were money problems and the loan was not paid.

Current legislation does not impose age restrictions. The number of years lived has no legal meaning. A will for a minor is drawn up at any age from the date of registration and registration with the registry office. The only mandatory requirement for drawing up a will is the fact of being born alive.

Will for a minor child: features and procedure for execution

This must be remembered if you want to draw up a will document with a notary. The child will be able to assume the rights of a full-fledged heir, but he does not have the right to independently dispose of property until he reaches 18 years of age or becomes emancipated.

It is possible by court decision if the minor is 16 years old, married or engaged in entrepreneurial activity. Is it possible? The law allows inheritance to be issued to any heir.

There are no age restrictions for performing such a legal act. It is prohibited for minors to make a will themselves. In other cases, an adult heir has the right to draw up a will for a child of any age. A will for a minor child It is drawn up in the usual manner.

The testator should indicate information about the heir, including the data indicated in the passport and birth certificate of the minor. It is not necessary to notify the child's parents or guardians about the preparation of a will. The will must be signed and stamped by a notary.

In exceptional cases, a document may be drawn up under emergency circumstances or signed by another official, a list of which is indicated in an article of the Civil Code of the Russian Federation. For an apartment A will for a minor child is possible if you wish to transfer an apartment or other living space to such an heir.

The expression of will specifies information about housing and its parameters. A possible testamentary refusal in favor of a third party - to transfer certain property, leave the right of residence in the living space - then the executor will be obliged to execute it.

The testator can assign property to his grandson, ignoring the rights of other heirs under the law. Grandchildren also have the right to inherit by right of representation if the main testator dies before the opening of the inheritance or during the period of registration of documents in the notary's office.

An example of a will with a condition can be used as a guide when drawing up an order. How to find a will from a notary? Read here. Pros and cons To find out whether it is possible to write a will for a minor child, you should find out the advantages of such a will document.

The child, due to his age, is not interested in significant property benefits. He will not pretend, wait for the speedy execution of the will and the possible death of the testator. It is unlikely that the child will try to commit crimes against the testator in order to quickly receive the property.

The disadvantages of such a document may lie in possible obstacles from other interested parties - legal disputes, fraud under the trust agreement for the most valuable property of the young heir.

Each case of registration of inheritance is individual and contains different formalities - in terms of the composition of the inheritance mass, the age and character of the heir, and relationships in the family. How to compose? A will can be drawn up by hand, but more often notaries require that it be typewritten.

The document can be written in advance, defining the circle of heirs. The shares of each heir should be identified, preferably with a detailed description of each valuable movable or immovable object.

Contents The date and place of drawing up the document (city, other locality) is noted. The will contains information about the testator, including his place of permanent residence and passport details. It is noted that the testator is of sound mind and understands the meaning of his expression of will and its possible consequences.

The following is information about: The document can be drawn up in any form, but in such a way that its contents are understandable to the heirs and other persons. Minor typos and clerical errors are not taken into account when interpreting the contents of the document.

Procedure for registration The testator contacts a notary office, draws up a document with the help of an official, personally signs it, preferably in the presence of at least two witnesses who are not interested in the transaction. You can draw up a closed will, the contents of which will not be known even to a notary in accordance with the article of the Civil Code of the Russian Federation: An envelope with a document, in the presence of two witnesses, is placed in another.

Witnesses sign it, indicating their personal data. If the testator cannot personally sign the document, then a hand-applier has the right to sign for him.

The will must indicate the reason why the author of the document was unable to sign in person. There are two such reasons - illiteracy of the testator and severe physical illness.

Do you need a notary? Even in exceptional cases, when a will is drawn up under conditions equivalent to those of a notary, the officials who signed the document must send it to the notary’s office at the place of residence of the testator.

List of documents To register an inheritance for a minor, you must provide the following documents: The will must be drawn up in person.

Execution of a document through a representative is not permitted. But consultation with a lawyer is possible at the preliminary stage of document preparation. How to write a will? What documents are needed to register a will with a notary?

A complete list is in this article. Sample A sample document will help you draw up a will more competently, taking into account the possible interests of other persons.

A sample will for property is here. Disposal of received inheritance A minor has the right to dispose of the most valuable property only when he turns 18 years old. Before this, the notary or executor must take care of the safety of the inheritance by transferring it to trust management.

It is prohibited to sell such property without the consent of the guardianship and trusteeship authorities, or to perform other actions that will entail a reduction in the size of the inheritance.

A will for a minor must be drawn up taking into account the consequences of such a transaction. Disputes are possible regarding the authenticity of the will of the testator.

Such conflicts are resolved in court with the support of experienced lawyers. In the video about inheritance by will Attention! Due to frequent changes in legislation, information sometimes becomes outdated faster than we can update it on the website. All cases are very individual and depend on many factors.

Basic information does not guarantee a solution to your specific problems. Ask a question using the form below, or via online chat Call the hotline:

Pros and cons of making a will for a minor child

How to guarantee the fulfillment of will? Is it possible to make a will for a child before he or she reaches adulthood? There is no need to worry about whether it is possible to write a will for a minor child, since there are no legal problems on this side. There is a ban for minors themselves; they cannot draw up a will.

Will for an apartment for a grandson

Moreover, this can be done as many times as the testator wants. As for the circle of people to whom he can assign his property, it is not limited.

This can be an individual of any age and citizenship, a legal entity, a private or public enterprise, a charitable foundation and even the state.

The main condition is that the rights of relatives who have the right to an obligatory part and execution of a will cannot be violated in accordance with the requirements of the law. Is it possible to make a will for a minor?

Is it possible to write a will for a minor child?

The former mother-in-law died, a daughter remained and a grandson remained from the deceased son. The grandson of the deceased son is registered in the apartment belonging to the former mother-in-law. There is no will. Who has the right to file for inheritance and how? The daughter and grandson inherit by right of representation in equal shares.

My grandmother died, she had an apartment, I am the granddaughter, there is also a father who is the heir, he drinks a fair amount, we learned about the death of my grandmother from other people, is it possible to claim an inheritance? I heard that grandchildren can also inherit, but there was no will.

Unfortunately, not if there is no will and there are first-degree heirs.

Will for a minor

Disposal of inheritance received Is it possible to write a will for a minor child? When thinking about the well-being of their children, they often consider the possibility of registering property through inheritance.

The sequence of transfer of property by inheritance established by law presupposes the possibility of obtaining property from the mother or father of the parents only in the order of hereditary transmission.

It is possible to transfer property by inheritance to grandchildren under a will.

To challenge a will for a grandson, two grounds can be taken into account: To prove that the will is void:

This must be remembered if you want to draw up a will document with a notary. The child will be able to assume the rights of a full-fledged heir, but he does not have the right to independently dispose of property until he reaches 18 years of age or becomes emancipated. It is possible by court decision if the minor is 16 years old, married or engaged in entrepreneurial activity. Is it possible?

How do minor heirs inherit?

Paustovskaya In practice, it is not always clear how to act correctly when minor heirs accept an inheritance, how are the rights of a minor to property left by relatives exercised? Young family members often do not realize the significance of the events happening around them - the death of relatives, the acquisition of an inheritance. Due to their young age, they can neither enter into their inheritance rights nor fulfill the obligations arising from inheritance. The law does not establish restrictions on the age at which one can receive an inheritance. Thus, inherited property may be due to minors, minors and even the conceived children of the testator if they are born alive. A teenager can become a full owner of inherited rights and have the opportunity to dispose of property only upon reaching the age of majority. Entry into inheritance by will by a minor Minor children may enter into inheritance on the basis of a will. We all know how grandparents cherish their grandchildren and want to take care of them. In this case, the testator writes a will for the minor grandson.

Will for a minor son or grandson

But in our country, cases of challenging a will are not uncommon. The testator is faced with the task of how to transfer property to the chosen person and protect him from illegal attacks by numerous close and distant relatives? Often such a chosen person becomes a minor child - a son or daughter, grandson or granddaughter.

Will for a minor child

Often, after the death of a person, numerous relatives appear and claim their rights to the property. How to bequeath housing to your minor children so that no one can deprive them of it? And will it be possible to do this within the framework of this legislation? Inheritance Is it possible to write a will for a minor child? Yes, the inheritance can be transferred to him.

Who can challenge a will for a grandson?

.

.