- The agreement to give children a share of the purchase of housing on the basis of maternal capital, a sample of which can be found on the Internet, is linked to the State ' s support for families.

- Parents are legally entitled to receive maternal capital, which amounts to almost half a million roubles as soon as they have a second child.

- However, it can only be spent on certain needs.

Children ' s accommodation

Many people think that if the capital is "mother's," it means that his money belongs to the mother, that is, the part of the property that was bought from them, is also hers.

It is important to know that the father can also receive maternal capital if he is the adopter of two babies.

If the family has decided to spend a certificate to improve living conditions, it must be kept in mind that it is necessary to allocate a part of the dwelling to the heirs; this must be done, since every minor is required by law to have his or her propiska and right to a dwelling; this has given rise to the notion of allocating a share of the estate to a minor.

The procedure may occur in three ways:

- If the parents choose to change the apartment or buy a new one, they simply prescribe their heirs as owners;

- If the family already owns the property and pays the mortgage, it can use the money to repay the debt to the bank, in which case the parents must make a notarized commitment to provide the children with a share in the estate.

- As soon as the mortgage is fully paid, it is possible to formalize a gift, whereby the descendants will be allocated specific parts of the property owned by the parents; until the mortgage is paid, the dwelling is considered to be the property of the bank and cannot be transferred.

How the procedure is going

- First, parents have to invest in a mortgage, and to do so, they write an application to the Pension Fund asking them to pay the mortgage, which indicates that the children are bound to receive their share.

Note that the certificate cannot be the first contribution; it is accepted only as a further payment.

- After that, a standard gift contract is drawn up, one side of which is the parents, the other side is their descendants. He is assured by the notary. The document must be written, signed by the adults, and must be in good mind and a solid memory.

- The gift contract is registered in Rosreestre and a new property right of the children is issued.

It's worth remembering that under the age of 18, their parents are responsible for their children as legal guardians, and they sign documents, which means that the parents are officially handing over the share, and they're signing up for what they got.

How a treaty of giving is drawn up

The following data should be provided in the document:

- FIO and passport data from both sides are signed downstairs.

- What kind of real estate is given: its address and characteristics (number of rooms, area, floor), cadastral number.

- On what basis they own the dwelling: they bought it, they got it free, they traded it, and there's a document number that confirms it.

- What part passes on to the children: it can be both the entire dwelling area and the share.

- Except for the parents, who's written in the apartment.

Please bear in mind that before signing the documents, the notary should check whether the contract has been properly completed.

It should also be pointed out that:

- The document is signed voluntarily by the parties, and it is in their right mind and deep memory.

- The premises handed over have not been arrested, donated to other people or laid down.

- The parties to the transaction are familiar with the articles of the Civil Code, which are responsible for the transfer of gifts.

- How many copies are made: one party (e.g. mother, father and two children) and one copy to the Federal Service Office.

Documents for registration

- Parental passports and birth certificates, as well as SNIL and marriage certificates, if the parents are married;

- Documents confirming owner ' s rights to an apartment: e.g. a contract of sale;

- Expensions from the EGRP and the home book;

- Cadastral passport, technical documentation;

- A certificate of maternal capital;

- A certificate from the LAC stating that there are no outstanding payments on the part of the family;

- Bank statement that the apartment was mortgaged;

- The consent of the second spouse or the guardianship department for the gift.

You can't give an apartment that's in the mortgage right now – it's a notarized promise to give the kids a portion after they've paid off.

A gift from a part of the apartment to the children

The main feature of this option is that property is acquired by more than one owner (child) (parents and children).

That is, when the children reach the age of majority, they will not be able to expel their parents from their homes, nor will they be able to sell property without the consent of all the owners.

It's good to know that one parent or both can give a share.

However, the agreement of all owners is not required when giving because the giver controls only his property.

Formulating a treaty to give children a share of the child ' s

An example: The father wants to give half of his share of the apartment to two children, and the mother doesn't give anything; in this case, the gift must indicate what everyone gets for 1/8 apartments: the father is entitled to half of the dwelling (1/2), half of it is 1/4.

Note that without specifying the proportion of paper, it will be considered invalid.

Therefore, each child is required half of the 1/4: the mother ' s consent is not required, since only part of the spouse is transferred.

How shares in maternal capital are allocated

But you don't think you can leave an unloved son 1/1000 shares of the dwelling and the rest, and that's not gonna be approved by the guardianship department, which will result in their rejection and inability to give.

According to the Housing Code, the minimum standard is 12 square metres, and by sanitary standards the figure is reduced to 6 square metres.

This is important: the norm may vary from region to region.

It happens that the mother ' s capital was used after the birth of the second child for a portion of the mortgage; the mortgage itself was fully paid only a few years after the third child was born in the family; in this case, each of the three children is entitled to a portion of the share, regardless of whether or not it was in the use of the certificate.

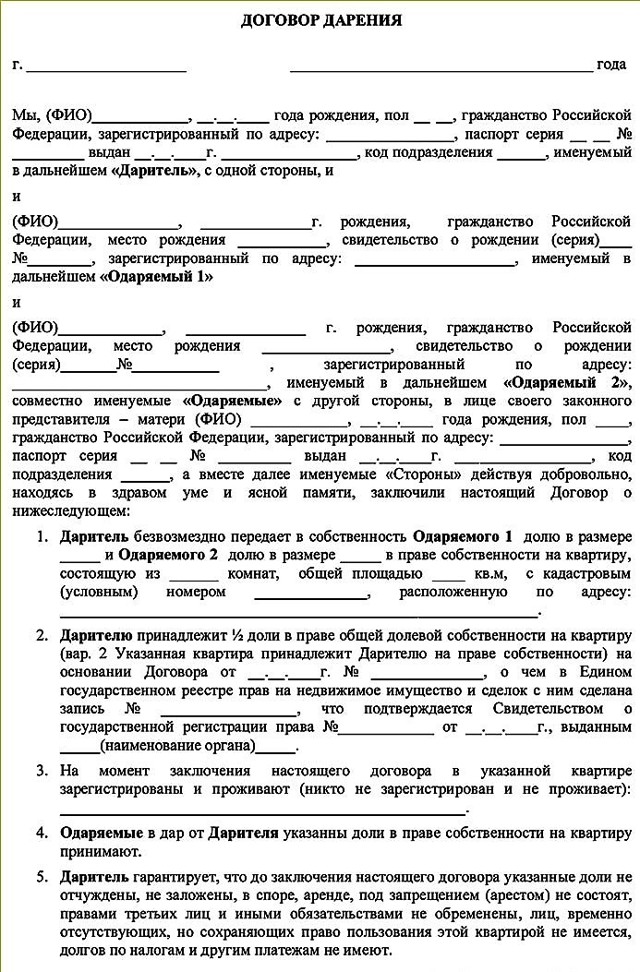

A model of a gift contract for maternal capital

Model contract (press for extension)

Seeing how a gift can be filled in at any notary office, it's also easy to find on the Internet. It's a regular real estate gift contract: maternal capital is just part of a financial investment in housing, and therefore not even mentioned further.

The following are examples of an apartment gift and an obligation to allocate shares after the mortgage has been paid:

- The Gift Treaty — A Model

- Obligation to allocate shares — a sample

A gift may be refused if:

- The document is not correct or the necessary documents are not available.

- There is no precise indication of the dwelling to be given, or any inaccuracy in the description.

Legal advice: "I'm giving up my apartment" cannot be written because it can be about any apartment, but it needs to be specific.

- Some paragraphs run counter to the law: for example, the conditions that suppress the freedom of the gifted are specified; the most common conditions are that of marrying a certain person, choosing a profession, giving birth to a child, or refusing to do so; instead, there may be a time limit: completion of studies, marriage.

- The apartment is not owned by a citizen, for example, is municipal, arrested or laid down.

Consequences for non-performance of treaty obligations

This results in unpleasant consequences: the person concerned may apply to the court and demand that the interests of the child be legally satisfied.

Comment by a specialist: In some regions of Russia, the public authorities themselves are responsible for observing the obligation: the Public Prosecutor ' s Office, the Department of Care or the Pension Fund.

If the apartment has been sold, you can challenge it in court, in which case there is a reverse exchange: the seller returns the money and the buyer the real estate, and the plaintiff may be the adult children themselves, their relative or the public authority.

Can you sell an apartment where a child has a share?

- Despite the fact that their parents are the legal representatives of the babies, they are not in a position to make decisions for minors, because of the desire to prevent adult fraud.

- Young heirs cannot decide for themselves because they are legally incapable.

- Unlike adults, it is not possible to get babies out of the apartment for a few months, a maximum of 1 to 2 weeks, and although it may be extended if moved to another city, it is still too short.

However, it is possible to sell the apartment, which requires that you go to the guardianship department and convince them that the sale of real estate will not affect the children ' s well-being: parents will not take all the money and leave it.

In order to do so, parents must write a statement and attach a certified commitment to provide the children with a part of the new home, in which case the office will give consent and the family will be able to file the documents.

Important advice: If the sale is necessary for the purchase of a new apartment, it will be necessary to write a statement that sons and daughters will receive the same or most of the new property.

Maternal capital for many families helps buy a new apartment, but the availability of underage family members can significantly increase the processing time, and it is important to keep in mind that all the authorities to which they have to turn must first be sure that children ' s rights are respected.

How to enter into a contract for the sale of an apartment using maternal capital, see the advice in the following video:

Maternal Capital and Mortgage: How to treat children correctly

An agreement to give an underage child a share of the dwelling according to the mother's capital — a model

The mother's capital is a great help in getting a small citizen on his feet, and the State's money can go to his education, treatment, or the purchase of a dwelling.

It is clear that the fulfilment of such an obligation involvesA lot of paperwork and a lot of business.And it seems like it's hard at first sight...

Dear readers, our articles talk about model ways of dealing with legal issues, but each case is unique.

If you want to know,How do you solve your problem -- go online in the right or call at +7 (499) 938-44-61. It's quick and free!

Show Content

Find out on our website the benefits and disadvantages of giving up real estate and what's best: giving, willing, or buying and selling.

The possibility of being processed

- Mother ' s capital, according to the law, is nothing butcommon property of parents and children.

- The square metres acquired by it are treated as equity property (Federal Act No. 256-FZ of 29 December 2006).

- At the same time, the law adopted a term such as the obligation of parents to allocate a share in the child ' s real estate.

- This can be done.in two different ways:

- a notary obligation is drawn up and then an agreement is made for the allocation of shares in the purchased property owned by the father or mother or for the giving of part of the property by the father or mother;

- A new dwelling shall be acquired, one of whose owners shall be the son or daughter.

The obligation is fulfilled for all registered family members, i.e. relatives or adopted offspring.

Strictly speaking,Purchase of equity property- It's also a gift, but it's not the traditional gift.

They won't give you the mortgage, it can only be used as a means of repayment later!

An agreement to give a share of the dwelling to the parent capital is a model.

Agreement on the allocation of the proportion of children in an apartment acquired from the mother ' s capital.

How will this happen?

- Before you do anything, you have to get it first.

- Therefore, a citizen who has received money from the State for having a second child needs to contact the territorial division of the Russian Pension Fund.

- And there's a statement that says where the money is going to be used -- that's,to improve housing conditions.

After that, there's a deal, and it's better to use a lawyer, but you can download a sample on the Internet and then print it out.

The only way to give, to allocate shares and, indeed, to do anything is with real estate, which is legally private property.

The proponent of the transaction must remain in a clear mind and be completeAcquired by a person who is capable of performing his or her functionsThe contract is concluded on paper, in hard copy.

You can download here a sample of the application form for the donation of parts of the apartment.

Form and content

An agreement to give a share of real estate to a child is written by the first person. In multiple or single numbers, it depends on one owner or two. For example, there is a dwelling where two partners are husband and wife and two recipients.

Then, first, we write down the details of each of the partners that will be named in the paper."Grantors"and then each of the children who are called, respectively,"flammable".

The content of the agreementmust be specified:

- City of discharge and year;

- The passport details of the donors, where they are prescribed, the series, the number and date of issuance of the identity card;

- The phrase that parents, in their right mind and firm memory, freely give part of their property;

- On what right do parents own these square metres, what document confirms this when a certificate of ownership has been obtained?

- Which part passes over to the recipients;

- The characteristics of the dwelling — at which address, on which floor it is located, how many rooms it contains;

- The cadastral number of the dwelling;

- Information on the absence of encumbrances: A place part of which is donated shall not be arrested, served or secured, nor shall there be any claim by others at all;

- Who in this territory is prescribed?

- References to legislation — namely, that the providers are familiar with articles of the Civil Code of the Russian Federation (131, 209, 223, 572-580, 162);

- Data on the transfer of these pieces of land to property after the registration of the Treaty in Rosreestre;

- How many copies of the document have been drawn up (five are required in this situation: one for each partner and one will have to be transferred to the territorial unit of the Federal Public Registry Office, where the contract is to be registered);

- Participants ' signatures are signed by their representatives on behalf of minors.

The transaction should then be registered with the Register Office or the Register Office at the place of residence, and the Multifunctional Centre (My Documents) can also be used.

See our article about the design and registration of a gift transaction in Rosreister.

The following documents will be required:

- General civil identity cards for all persons involved in the procedure, their SNILS;

- Directly gifted;

- Documents confirming property rights to housing;

- An extract from the EGRP;

- An extract from the home book;

- Monetary documents from the State;

- The cadastral passport;

- Technical documentation on housing;

- Authorization from the guardianship authorities;

- Certificate from the management company on the absence of debts and fines;

- A mortgage from a bank (if the apartment was mortgaged).

If you have a mortgage, it is only after payment of the debt; and if you have a mortgage, then it is only after payment of the debt; and if you have a mortgage, then it is possible for you to make a transaction.

If you need the consent of a second spouse or partner for a gift, you can find out on our website. Please also read about how to make sure that you have the power of attorney for the donation of an apartment.

The representative of the registration authority checks the completeness and takes the package together with the contract.receiptThe date for the end of the procedure is also indicated.

Traditionally, it's taken up.weekSometimes more if, for example, there are some difficult nuances.

Can they say no?

Yeah, they can.And that's when:

- The contract is based on errors;

- The document contains paragraphs that are contrary to the law;

- The object has not been identified or incorrect characteristics have been reported;

- There is no one or more documents that are binding on the annex;

- This area is not legally the property of the initiators of the transaction.

Read about fraud and other private cases when giving an apartment on our website, and see if you can challenge or cancel part of the property.

Now you can talk about kids like that.to the owners of the dwelling.

Their shares cannot be sold or donated on their behalf, even to their legal representatives (article 575 of the Criminal Code of the Russian Federation).

It is clear that the procedure for giving your Chad shares in housing is not difficult, despite the seemingly large amount of paperwork.

Anyway,A specialist may also be hired to facilitate workor go to one of many law firms, they'll take over the entire paper side of the procedure.

If you have found a mistake, please select a piece of the text and click Ctrl+Enter.

You didn't find the answer to your question?How to solve your problem, call me right now:

+7 (499) 938-44-61 (Moscow)

It's quick and free!

A model contract to give a child ' s share of the mother ' s capital

The principal heir is Darius.

Dear readers, our articles talk about model ways of dealing with legal issues, but each case is unique.

If you want to know,How to solve your problem is to use the form of an online consultant on the right or call on the phone at +7 (499) 455-03-75. It's quick and free!

With two or more children in the family, the mother of the State allocates a sum of 450,000 roubles, which she has the right to spend on children ' s education or to purchase real estate.

When buying housing within six months, she is obliged to divide into equal shares an apartment for her children, which is a compulsory procedure that is monitored by law.

An agreement to give children a share of their mother's capital — a model

Parents who have acquired a living space using a uterus are given six months to become full owners of the house and then are obliged to share it equally among all members of the family.

It is generally believed that there are two dominant owners in the real estate:

Let's celebrate!They are obliged to divide their half into all children who are in the family, and the shares must be the same for all persons who live in the premises.

How to make a proper contract?

- It is necessary to enter into a gift contract in a notary office, thus creating a 100% guarantee that the document is fully correct.

- The treaty of giving itself must be written and confirmed by all signatures and seals.

- It should specify and complete the following data:

- F.i. on all sides;

- A search of all persons involved in the process;

- Address of real estate;

- The whole area;

- Number of premises;

- Floor (if it is an apartment);

- No. No.

- Children have the right to manage their shares as soon as they reach the age of 14, but only with the permission of guardianship, which will actively monitor the proportion of children up to the age of majority.

- It is only when the child is 18 years of age that he or she has the right to decide on the fate of the gifted part of the estate independently.

- Once a contract has been concluded, it is possible to transfer the share in two ways:

- Through a notary office where the last point of transmission will need to be concluded and approved, a certificate of the amount of the dwelling should be prepared in advance.

- It's self-contained to make a contract, to divide all property in equal parts between all the children, to transfer the document to the Rostrestor.

Each point is carefully checked.

Form and content of the document

The writing of the document is done directly by the mother of the children; she is the legal owner of the mother ' s capital, since the children are minors.

The document should contain:

- All the details of the owners of the apartment are usually the mother and father of the children.

- In the future, they are identified as givers.

- Birth certificate for all children, indicating their gifted faces.

- The city where the act of giving takes place.

- Number, month, year.

- Full passport records.

- It must be written that the act of giving takes place on its own and in its own health.

- Indicate how and to what extent real estate was purchased.

- Document the data.

- A complete description of the state of the property.

- It's an apartment or house number.

- To confirm that real estate has not been arrested or previously donated by previous owners.

- Promise of all persons participating in the process

- Data showing all shares registered by Rostreestro.

- Specify the number of copies of the treaty

- Signature of all participants.

Let's celebrate!A given gift contract is registered with the cadastre authority of the place of residence, since the children are persons who have not reached the age of majority and must be signed by their legal representatives instead.

Necessary documents for registration

Background notes and documents should be prepared in advance:

- SNIL of both parents;

- Passports;

- A gift document;

- The right to real property;

- Full copies of the home book;

- A full report on the waste of maternal capital;

- Passport from the cadastre;

- No arrest certificate.

The authorities that are beginning to familiarize themselves with all the documents have the full right to take them away while they are under consideration, to provide a written list of all the documents and to return them to the full.

Note!No matter what the originals are, there's nothing to worry about here; since the receipt is a complete guarantee that no document will be lost; it must be kept until the documents are returned, the receipt must be given in return.

When can a child ' s mother ' s share of the dwelling be refused?

It is legitimate to deny people a share of their children's organs.

In order not to encounter this problem in the future, it is necessary to:

- Completely, without any mistakes or omissions, fill in the act of giving.

- Specify the object of the gift correctly and all its data.

- Collect a full package of documents.

- It is documented that parents are the owners of real estate.

- Provide data on maternal capital.

If one of the paragraphs is violated and not complied with, the authorities shall notify in writing of the refusal, indicating the grounds on which the decision was taken.

If a document has not been produced, it can be made available within one week, and the errors that have been made can also be corrected by starting to produce a gifted first.

Note!It's a lot harder if you try to cheat your organs, then you start checking the real estate.

How are shares allocated to maternal capital?

To give a share to their children, parents can do two things:

- To draw up an agreement;

- To conclude a gift.

Both types of property are donated.

It's good to know!Parents have the right to share their share of each child independently; according to the law, every person, regardless of age, must have 12 metres of square space; depending on the size of the real estate, the minimum area is 6 metres of square space per person.

Consequences for non-performance of treaty obligations

If the obligations of the treaty are breached, there may be:

- Not a recognition of the validity of the transaction.

- Coercive enforcement.

- Fine.

- Administrative punishment.

- Returning the entire amount of maternal capital back to the State.

- It's a deadline.

- The seizure of property.

Note!The State was always following the matter closely because it was interested in the children ' s future; when their rights began to be violated by their parents, the procuratorial authorities began to conduct a detailed review of the case and then determined the extent to which the law had not been implemented.

Mother ' s capital helps children to improve their future, so it is not worth trying to circumvent the law; it is severely punished.

If real estate has been acquired with money provided by the State, the property shall not be sold further until the age of 18.It is mandatory to verify the authenticity of all documents before buying housing, as well as to verify arrests by the State or the bank.

You didn't find the answer to your question?How to solve your problem, call me right now:+7 (499) 455-03-75(Moscow)+7 (812) 407-26-30(St. Petersburg)

It's quick and free!

How can a contract be drawn up to give children a share of their mother's capital?

An agreement to give a share of the dwelling to children by mother capital (model)

480 views

One way of expropriating real estate is by way of gift, an agreement can be concluded not only between family members but also between third parties, the main requirement for the removal of a part of the apartment is a notarized transaction certificate, and it is necessary to take into account separately the FZ regulations of 29 December 2006 No. 256-FZ if public money has been used in the purchase of housing.

Family capital liabilities

Since the adoption of the above-mentioned law, citizens have made use of the ICN throughout the world. Public money can be used for the following purposes:

- Purchase, construction of housing: If necessary, citizens may participate in housing and construction cooperatives, and the mother ' s capital is transferred by means of a cash-free settlement of the relevant organization, including the bank; for example, if the housing has been acquired by borrowing funds.

- Construction, reconstruction of previously constructed housing, construction of the facility may take place under a contractual arrangement.

- Payment of advance mortgage payment.

- The repayment of the loan debt.

- Payment of interest on the loan.

A bought, built, reconstructed real property is registered as the common property of citizens (children and parents) and the amount of the share is determined by a separate contract.

The minimum housing standards need to be taken into account when concluding an agreement; they vary from region to region.

The timing of the transition to ownership depends on the following circumstances:

- What legal action has been taken – buying ready-made housing, building/renovating a house;

- How housing is purchased and on the basis of which the funds are transferred (contract of sale, mortgage, etc.);

- who will be the title holder at the time of the closing of the obligations.

Purchase of acquired/constructed property into common property takes place6 months ' timeFrom:.................................................................

- The basic requirement - housing is private property of the buyers (parents/children);

- Payment of the balance under the sales agreement, e.g. if the transaction involved the distribution of the payment;

- Rescission of the mortgage, usually after repayment of the loan;

- The establishment of an individual housing facility and the receipt of documents for it;

- The calculation with the JSC.

Possible ways of closing obligations are a joint-owner agreement or a court decision. If necessary, relatives may enter into a donation to a part of the apartment, but there are nuances.

Parents may not always decide on their own how to fulfil their obligations; sometimes they have to take into account Rostreestra's internal requirements.

Details as to which document is the basis for the issuance of the common equity property may be specified at the branch of the Cadastral Chamber.

Performance of treaty obligations

The gift is a form of closure of the child ' s obligation to provide a part of the dwelling, which is used when the property is in the joint property, the owner is one parent or there is a marriage contract providing for the possibility of transferring the property to one of the spouses.

Two separate agreements may be required for the issuance of a gift, for example, if the children are separated from the property of both parents.

A single agreement is sufficient for the father or mother to dispose of the dwelling; the number of children and the size of their parts are specified; however, there is a reservation; the parent is not entitled to be the provider and representative of the child at the same time; the persons concerned will have to engage the guardianship authorities.

The same rule applies when a marriage contract has been concluded, for example, if it provides for the transfer of property to the exclusive property of the spouse, the children and the husband are entitled to a portion of the property, and the provisions of Ordinance No. 862 must be taken into account in the writing of the papers.

If the property is jointly owned, notaries often require two separate agreements: one on the division of property, the other on the removal of parts of children; in such circumstances, the State is retained twice; and the share of the property purchased from public funds is divided exclusively between parents/children.

How to make an agreement to give a share of the dwelling to children on the basis of their mother ' s capital

The basic requirement for a gift form is that of a letter: the key condition is that the agreement is free of charge; it is necessary to take into account the general provisions of the law and individual regulations on the use of maternal capital.

Form

A model of the agreement can be downloaded from the website. The necessary fields will remain to be filled. The basic sections of the agreement are as follows:

- Name of document.

- City, country, date of writing.

- Data of the parties to the transaction (FIO, date of birth, passport data, address of the propiska).

- Subject matter: The transfer of the object (size, area, location) to the gifted entity is described.

- Reference to a document confirming the grantor ' s rights (contract of sale, certificate).

- Confirmation of acceptance of the gift by the beneficiary.

- The guarantor's assurance that there are no charges.

- Moment of the origin of the property right.

- Procedure for the payment of the costs of the current transaction.

- Reference to the number of copies of the agreement.

- Signature of the parties to the transaction.

Contents

The draft agreement should be prepared on the basis of life ' s circumstances; normally, citizens use a ready-made template in which to complete the relevant sections.

The introductory part refers to the parties to the transaction (FIO, address of registration, when and by whom the passport is issued). The text of the agreement should indicate the specific will of the grantor with respect to the property to be disposed of.

Provides free ownership to the gifted person of a 16.4 square metres room, which is located in a two-room apartment, with an additional indication of the general and useful area of the dwelling, as well as its location and cadastral number.

Next, there's a reference to the law-making papers, for example, the room belongs to me on the basis of a sales contract dated 10 December 2015, and it is necessary to specify by whom and when the contract, the number and date of the State registration certificate were registered.

- The next paragraph of the contract is a reference to confirmation of the acceptance of the property by the gifted entity.

- In drafting the agreement, the donor must provide guarantees that housing is not under arrest and is not subject to judicial proceedings.

- In addition, the parties must record the time when ownership of the property arose.

Another important point was the provision on the payment of expenses, which included notarization of gifts and public registration of property rights; usually, the burden was on the beneficiary; however, the parties to the transaction could change the procedure.

Further, the parties refer to the number of copies of the document and sign.

Model contract to give children a share of the mother ' s capital 2023

The model agreement is as follows:

Procedures for the processing of a child ' s share of the dwelling

If a part of the apartment is taken away, a notarized transaction is required. Otherwise, the contract will be null and void. A draft agreement can be ordered from a professional lawyer. If necessary, a model form can be supplemented by new sections. The only condition is compliance with the law. The contract is verified by the notary for legality.

The parties to the agreement are required to prepare a package of documents, pay the Minister ' s Office, and upon certification of the transaction, the right holder will be visited by Rosreest. The registration of the right takes place on the application of the gifted entity.

Procedure

The gifter and the gifted person need to agree on the main points of the transaction. For example, whether a relative is willing to accept the gift, the amount of the share that will be paid. You can order a draft contract from a professional lawyer. The specialist will listen to the wishes and move them to paper.

Further, documents should be prepared for the notary; the transaction will not take place without them; if the necessary documents are available, you can go to the notary; he will identify the citizens; he will check the papers for completeness and conformity with the law; then the notary will explain to the citizens their rights and obligations; and he will issue requisitions for payment of the fee.

Later, the representative of the notary will ask the citizens to sign the agreement, then certify the gift contract and enter the data into the notary register, after which the notary will remind the citizens of the need to register property rights.

Documents

The transaction requires:

- Certification of the identity of citizens (gift, gifted).

- Expropriated property papers (extract from EGRP, sales agreement).

- Family profile.

- Confirmation of affinity.

The last document exempts citizens from paying income tax (art.

Expenditure

The notary certificate of the gift agreement shall retain a fee of 0.5 per cent of the value of the property to be disposed of; however, the amount may not be less than 300 rubles; the border rate shall be 20,000 rubles; the fee shall be calculated on the basis of two documents, the property value report or the cadastral certificate.

The payer of the government may be the giver or the beneficiary.

In addition, a notary is to be paid for a side of the agreement; the average rate for the country is 5,000 roubles. Tariffs may vary from region to region.

The registration of property rights is paid separately; if the room is in a multi-family house, the amount of the fee will be 200 roubles; 2,000 roubles will be retained when the entire apartment is re-formed.

Time frame

When the gift parties decide on their own, however, some provisions of the law need to be taken into account.6 months.

Registration of ownership

Real estate transactions (homes, apartments, land) are subject to public registration; property rights are registered in Rosreestre; additional papers can be submitted through the IFC; changes to the EGP are made on the basis of the beneficiary ' s statement; the document ' s form is available on the Rosreestre website; and the application is accompanied by the following documents:

- It's a gift.

- Extract from EGRP, sales contract, technical documentation for housing.

- Grantor's passport, beneficiary's passport.

- Child birth certificate (if necessary).

- Marriage registration certificate.

- The extract from the home book.

- Evidence of payment of the duty.

Parents act on behalf of small children. Children over the age of 14 go to Rostreister on their own. The only condition is parental consent.

Average registration procedureIt takes 7 days.The time limit is 12 days, and consideration must be given to the manner in which the application is made and the type of action to be recorded.

At the same time, the parties to the agreement must take into account the requirements of the FL of 29 December 2006 No. 256-FZ. In order to avoid errors and waste of time, it is desirable to consult a lawyer. Several professionals work on our website. An application for a return call is submitted via an online form.

- Due to the constant changes in legislation, regulations and judicial practice, we sometimes fail to update information on the website.

- Your legal problem is 90 per cent individual, so self-protection and basic solutions are often not appropriate and will only complicate the process!

So contact our lawyer for a free consultation right now and get rid of the problems in the future!

Save the link or share it with your friends.

Assess the article.

(1:: Average:..................................................................................................................................5,00(5) Loading..........................................

Agreement to provide a percentage of children with housing when buying from their mother ' s capital

In Russia, there is support for families where second and subsequent children were born, which is expressed in the provision of maternal capital.full or partialRepayment of mortgage loanas at AcquisitionFamily housing.

This requires an obligation to allocate shares in real estate in a notary office; the allocation of shares is possible by drawing up an agreement or a gift contract that is subject to State registration.The legal consequences of these documents differ.

Notary commitment to share in the purchase of housing on the basis of mother ' s capital

Once a person receives a certificate of maternal capital, he or she will have to apply to the territorial division of the Russian Pension Fund (hereinafter the Russian Federation ' s PF) at his or her place of residence, where he or she will have to write a statement indicating that the citizen wishes to send funds on the certificate for payment of the housing loan.

Documents should be provided together with the application.obligationIt will be required under the following circumstances:

- A second and subsequent child was born in the complainant ' s family.

- A certificate was obtained.

- There is an outstanding mortgage for the purchase of housing.

- The funds or a portion of the maternal capital will be used for the full or partial repayment of the mortgage.

If the obligation has not been settled, the FRF of the Russian Federation will not grant permission to repay the loan.Such a document must be issued by the owner of the dwellingThis person will guarantee that the children and the other spouse will have a share in the property.

If the dwelling has been acquired during the marriage, it is either in the share or in the joint property of the spouses, in which case the owners of the property shall be both spouses.

An obligation must be entered into in a notary office where it is certified.

Otherwise, such a document will not have any legal effect; it will require the presence of both parents, who are borrowers on loan; and if the owner is a single spouse, only one must be present.

The document will indicate that the owner(s) is committed to regularizing the housing for which the maternal capital has been used into their own property and that of the children who were in possession at the date of the performance of the obligation.

At the end of the document, the date of its compilation and the signature of the parents with the decryption should be indicated.

Implementation of the obligation to provide children with shared property on housing

The process of allocating children ' s share of ownership of a dwelling on the basis of a mother ' s certificate may take placein two ways:

- By establishing an agreement on the allocation of children ' s share of housing in connection with the use of maternal capital;

- By signing a gift contract between parents and their minor children.

Under civil law, these methods are free of charge, and the first option may be said to be a gift, but not a gift in its classical form.

On the practical side of the choice of how to dispose of real estate shares, the registration authority of a particular region should be consulted.

Under an agreement on the determination of shares

There is no single model for an agreement on the determination of shares, all of which are illustrative.

The requirements for its presentation may vary slightly.by regionthe location of real estate.

Therefore, prior to drafting the agreement, a specialist will need to be consulted, if such a document is prepared on its own, and a notary office can be contacted to draft it.

Warning

The law does not establish a mandatory procedure for notarizing the agreement.

The services of a lawyer were also available, and it was possible to be sure that the document was legally sound and would be adopted by the registration authority.

Under an agreement to give children a share of the child ' s mother ' s capital

It is possible to draw up a gift contract on its own or to avail itself of the services of a specialist, notary or lawyer.

A model contract can be found on the Internet; it is easy to compile; the registrars are quite willing to record such transactions.

But there are many nuances that an untrained person does not know, so it would be useful to seek qualified help from a specialist.

Procedure for the allocation of children ' s shares under the gift agreement

In the preparation of a gift contract, controversial issues may arise when it comes to the type of ownership of real property; housing may be in common ownership or equity.

In the first case, the shares are not determined between the spouses, and in the second, they are determined by 1/2 of the assets of each spouse.

In the case of common joint property, it is assumed that each spouse ownshalfReal estate.

And it seems that there should be no problem in giving a share to their children.

But, in some cases, registrars may require parents to first determine the proportions of their share of the housing between them and then assign them to their children in this way, by means of a gift contract.

Therefore, if it is decided that the document should be prepared on its own, it is also advisable to begin with a priorconsult with specialistsThe registration authority is specific to your region, and then the treaty is drawn up.

The Russian Federation ' s legislation does not refer to certainChild ' s sharewhich must be reflected in the commitment and then highlighted, but the Russian Housing Code also refers to:standard of total living area per personThis rule may vary from region to region of the Russian Federation.

Example

The housing area in Voronezh is counted at 11 square metres per person.

- Therefore, the size of the rule should be taken into account when allocating a share to their children.

- It's important.

- The text of the obligation does not need to indicate the exact size of the proportion to be allocated to children.

- But the issue should be taken seriously at the time of the registration and registration of real estate.

Legal implications of allocating a percentage of children under a gift agreement

Since mother ' s capital is to be divided into the whole family, it is to be divided into real estate.by Agreementif there are further children who claim a share in the property, there will be a need to redistribute the share of the right to housing among all members of the family.

Donation agreementIn other words, it will not be possible to redistribute the shares among all the parties to the contract; parents will only be able to do so with respect to their part of the estate.

In the end, all members of the family will be owners of the dwelling, but in this case there will be someLimitations in transactionsThus, under article 575 (1) of the Civil Code of the Russian Federation, gifts on behalf of minors are not permitted.

If they wish to sell the dwelling, they shall seek permission from the guardianship authorities to deal with the parts of the property belonging to their minor children, provided that they have obtained a replacement, where the share of the property of the minor members of the family is equal to or greater than that of those who have been sold.

Registration of children ' s ownership with shares

Regardless of the manner in which the spouses chose to give their children share of the right to own housing, this procedure is subject to:RegistrationFederal State Registration, Inventory and Cartography Service (Rosreestrom).

This will require a package of documents to be made available to the territorial office of Rosreestra or through the Multifunctional Centre, which includes:

- Applications for registration of ownership of part of the property on behalf of each party to the transaction (to be completed by the public registrar).

- Agreement on the allocation of shares or agreement on the provision of the required number of copies.

- Identification documents.

- Marriage certificate.

- Birth certificates.

- Certificate of registration of ownership of housing.

- Documents on the basis of the transfer of ownership (contract of sale).

- Acquits confirming payment of State duty.

- Other documents that may be required by the registration authority (individually on a case-by-case basis).

The parties to the transaction will be issued a receipt indicating the date of receipt by each owner.Certificates of ownership.

Once the children ' s share is recorded, the obligation will be met.

It does not need to be notified to the Fed of the Russian Federation, nor does it need to be withdrawn from the pension fund itself.

In order to use all or part of the mortgage, it is necessary to apply to the Russian FP, which needs to be provided.obligation to allocate shares, certified and certified by a notary.

It is possible to single out parts of real property ownership by means of either an agreement or a gift contract, which will have different legal effects.

These documents are subject to State registration by the Federal State Registration, Inventory and Cartography Service (Rosreestrom).

Upon receipt of the certificates of registration of ownership of the shares of the dwelling,the obligation will be deemed to have been fulfilled.

Legal advice

Question

My wife has a daughter from a previous marriage. After the birth of a joint child, we were given a certificate of maternal capital.

- Response

- In this situation, it will be necessary to allocate a share of the property ownership of your wife ' s daughter ' s daughter, since both children have been taken into account when there is a reason to provide maternal capital.

- Question

We have the right to receive maternal capital after the birth of a third child, and the eldest son is already 19 years old. Should I allocate a share of the right to an apartment to all three children or only those who are minors?

Response

You are obliged to allocate shares in the right to real property to all your children, including your older adult son, in the Federal Act of 29 July 2003 on additional measures of State support for families with children.

12.2006 No. 256-FZ does not specify age limits, i.e. all children have equal rights in the allocation of shares, but the adult has the right to give up his or her share if he or she has a different home.

Question

When buying an apartment, the mother ' s capital was paid an initial mortgage contribution. Is it possible to allocate a percentage of the children until the loan is fully repaid?

Response

Yes, it is possible to do so before the mortgage is repaid, but it requires the consent of the bank in which the loan was issued.

Do you have any more questions?

Three important reasons to use the legal aid right now.

Quick.

Quick answer to all your questions!

Qualitative

Your problem will not go unheeded!

Precisely.

You're spoken to by practicing lawyers!

Structure of our work

Question

You're asking the lawyer on duty.

Lawyer

The lawyer is analysing your question.

Communications

The lawyer is contacting you.

Question

You're asking the lawyer on duty.

Lawyer

The lawyer is analysing your question.

Communications

The lawyer is contacting you.

Our Benefits

You'll soon get an answer to your question.

Average speed of response

Number of consultations today

Total number of consultations

Ask your lawyer your question!