In the acquisition of real estate, as usual, there is a deposit for an apartment, the amount of which is indicated by a receipt for receipt of money. This document confirms the seriousness of the buyer's aspirations regarding the chosen home.

But you need to correctly fill out the receipt so as not to lose the funds specified in it in the event of force majeure situations.

Deposit or advance?

The meanings of these concepts by the parties to the agreement are often interpreted as interchangeable. However, there is a difference between the terms.

The person selling the apartment takes the deposit from the buyer in the form of an advance payment. The financial amount indicated in the receipt for purchase and sale is included in the final payment.

The transmitted receipt for receiving a deposit when purchasing an apartment has the following features:

- it is concluded only in written form and becomes valid upon registration of the purchase and sale agreement;

- the document clearly states that the contribution is recognized as a deposit;

- the parameters of the real estate, the details of the parties, and the amount of financial resources in the transaction are indicated in the contractual document.

The deposit has the following functions:

- security – it is responsible for the fulfillment by both parties of the terms of the transaction;

- payment, guaranteeing inclusion of the contribution amount in the full cost;

- evidentiary – it indicates the conclusion of an agreement.

If you correctly fill out a deposit when purchasing a home, you will be able to insure yourself against unforeseen circumstances.

What is an advance? The term is explained as partial payment for real estate before the transaction is completed. Its purpose is payment and does not guarantee the completion of the transaction. And if it fails, the owner of the property is obliged to return the money indicated in the receipt to the purchaser.

When the seller receives an advance, the document indicates the actual price, information about housing and details of the parties.

Conditions and guarantees for both parties

The receipt for the transfer of the deposit informs about the guarantees and requirements for the seller and the buyer. For the buyer, it is a guarantee that the owner of the property being sold will sell the apartment to him, and for the seller of residential property, that the buyer will not reject the deal.

When writing a contract, a deposit when purchasing an apartment is taken by those participating in the trading transaction.

What do you need to know before transferring an advance payment?

- The amount is determined within reasonable limits. A 100% contribution does not ensure the seller's performance to the buyer. And, if the first one refuses the deal, the last one loses both money and apartment.

- To secure the purchase and sale of an apartment, the receipt is drawn up in writing and notarized. If one of the participants fails to fulfill the transaction, it is easier for the second to return the double payment through the judicial authorities.

- A special approach to drawing up a receipt for the deposit is required if there are several owners of the property being sold. It is necessary to thoroughly check the certificates of registration of shares provided to the buyer, and familiarize yourself with the registration of each owner of his part in the apartment being sold.

According to the rules, a contribution when buying and selling an apartment turns into a guarantee of a transaction without problems.

How is the amount of the deposit determined?

In the absence of a legislative framework on the amount of the advance payment, the amount of the deposit is agreed upon by both parties. They are guided by 2 methods for determining the amount of the contribution:

- 5% of the cost of the apartment, accepted on the real estate market, but sometimes increased to 12%;

- a fixed amount of 50 thousand - 100 thousand rubles.

The inflated advance payment is advantageous for the seller, and he will receive the full amount if the buyer renounces his obligations under the contract.

The seller also risks money in receiving a deposit for the apartment by receipt if he refuses to fulfill the concluded agreement. And the return of the money deposited by the counterpart for him is equal to the double tariff. An increased prepayment will result in a proportionate amount of financial loss.

Rules for issuing a receipt for a deposit

The main thing is to correctly draw up a deposit when purchasing an apartment, taking into account the following conditions:

- at the time of drawing up, there must be a purchase and sale agreement indicating the type of payment, first as an advance and security deposit and in the final part - as the remaining amount of money;

- with several owners, they write a receipt for receipt of money indicating their share of the deposit;

- 2 dates are required in the form - both the signing of the contract and the delivery of cash, but amendments, additions, and crossing out are unacceptable;

- For a minor owner, his parents are required to write a receipt confirming receipt of the deposit, and it is better for the offspring;

- the deposit document for a real estate transaction is drawn up in the presence of all interested persons, including the wife/husband of the owner of the property being sold;

- the text of the receipt for receiving a deposit for an apartment is written by hand or printed on a printer, but in the hard copy the full name, address, information from the passport, financial value (in words) is entered in one’s own hand with a ballpoint pen;

- It is preferable to transfer money for sold residential property when invited (preferably not relatives).

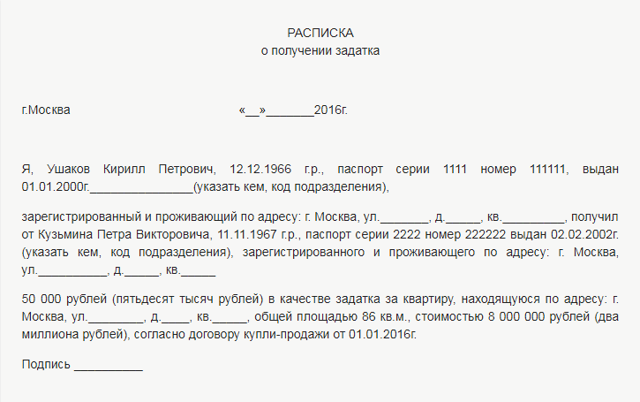

Sample receipt for a deposit for an apartment

The receipt contains both the deposit in total terms and the necessary:

- passport details of the parties to the agreement, taking into account registration, also if it differs from the address of actual residence;

- primary parameters and real price of residential real estate;

- signatures of those participating in the purchase and sale.

In the completed receipt, it is permissible to indicate (optional) the payment of a 1% penalty of the contract price if the buyer subsequently does not pay the initial part of the money on the appointed day.

Basic rules for transferring money

Today in the real estate purchase and sale market, sellers prefer to receive part of the money before registration. And those who buy housing do not refuse to make a partial payment for the purchased apartment. The rules that provide for payment for the deposit only according to the receipt will help to secure the transfer of finances.

It includes: information from the passports of the parties involved, the amount of money handed over, the expected date of signing the purchase and sale agreement, the date of acceptance of the receipt, the signature of the person who received part of the money. As a precaution, if the signatures of 2 witnesses are added to the receipt, they will certify the transfer of finances.

Payment of the agreed deposit is also possible through a safe deposit box. The buyer of residential real estate will invest an advance payment amount into it, which will be verified by both the seller of the apartment and the bank employee. The final transfer of money for the apartment will occur after the transaction documentation has been received by the banking structure. If the conclusion of the contract fails, all money will be returned to the buyer.

Under what circumstances can a deal be cancelled?

Cases of refusal by the seller to transfer the apartment to the buyer for payment:

- the former owner did not leave the apartment within the specified time and did not give the keys to the new owner;

- Unforeseen circumstances emerged in the form of an unexpectedly appearing heir to an apartment that had already been sold. After the successor applies to the judicial authority and if the latter makes a positive decision, the contract of purchase and sale of housing is canceled.

Due to the fault of the future owner, the transaction is canceled if he does not agree to pay for the acquisition of residential real estate.

There is also the possibility of the transaction being declared invalid. This happens due to :

- violations of laws by the transaction;

- incapacity or mental impairment of one of the parties involved;

- drawing up a contractual agreement with the threat of violence, deception, collusion, etc.;

- the sham nature of the transaction, which indicates its creation without legal influence.

Early contact with residential real estate specialists will help you avoid negative consequences.

Fraud protection rules

Tips on how to complete transactions with the purchase and sale of apartments will help you with ways to deceive home buyers.

- Documentation must be drawn up only with the participation of those buying and selling housing.

- Indicate in the documents the actual cost of purchasing the apartment.

- Carefully check the discharge records of previously registered residents.

- Ignore negotiations regarding the speed of concluding a deal.

Transfer money to the seller when completing documentation for the purchase and sale of residential real estate in front of witnesses (friends, relatives, acquaintances).

Today, title insurance is considered an effective protection against fraud when making a transaction. And you need to insure your apartment at the time of purchasing a home.

Video on the topic:

How is a receipt for a deposit for an apartment prepared? Link to main publication

Sample receipt for a deposit when purchasing an apartment

March 15, 2018 | AJAX-Realt

If you have already bought or sold a home, you are well aware that even after making the final choice, sometimes people still need time to think or search for the full amount. In such cases, a deposit becomes a mutually beneficial option: this way the owner receives a certain guarantee that the purchase of the apartment will take place, and the client does not have to worry that the dream home will remain “on display.”

But, of course, simply transferring part of the funds from hand to hand is not enough. It is also important to fully protect both parties; it is especially important to take into account the interests of the buyer.

AJAKS-Realt specialists decided to help figure out what a sample receipt for a deposit should be when buying an apartment and what steps should be taken to ensure that the process is as transparent as possible.

Understanding the concepts

First, let's figure out what kind of schemes are used when buying a home, when the buyer does not immediately have the full amount on hand (and we are not talking about a mortgage). There are two mechanisms: deposit and advance. Some believe that these are essentially the same thing, but in reality there are significant differences.

Earnest money is understood as securing a transaction when the parties actually agree. Let's say, if an apartment costs 2 million rubles, then the buyer gives about five percent of the amount in advance, sometimes a little more. This money then goes towards the full payment.

As a result, certain conditions are included in the receipt, for example:

- While the transaction is being prepared (documents, checks), it is no longer possible to refuse the purchase

- It is no longer possible to sell to a new buyer

- Even if something serious happens on the market and prices skyrocket, you cannot change the previously established value of the object

As a result, thanks to the deposit, the parties can be quite confident in each other. If the buyer violates his obligations, the seller does not have to return the deposit at all. And the buyer will get the money back in double amount if the seller fails. All agreed conditions are included in the prepared sample receipt for the deposit when purchasing an apartment.

And in fact, this serves as confirmation of the conclusion of the purchase and sale agreement. The rest is just details.

What is the difference between an advance payment and a deposit for an apartment?

Another thing is the advance payment. Here everything is not so strict, since Russian laws define an advance as “full or partial payment” of something. It could be a service or a product – it doesn’t matter. If the buyer is given an advance by the owners, he is not obliged to ultimately buy the property. And this amount will absolutely have to be returned if the sale does not take place, say AJAX-Realt lawyers.

By the way, while a document must be drawn up when paying a deposit, an advance payment does not require written certification, so there is not even a sample of such paper.

How much money is enough for a deposit? As we have already mentioned, usually five percent of the cost of the property is enough, but in special cases the amount is increased or decreased.

So, if a person is not yet completely sure of his choice, but still wants to reserve an apartment, he can ask for a minimum payment.

In fact, a person simply pays so that a potentially profitable option does not “float away” and, if something happens, he is ready to easily part with this money (if he finds a better house).

The seller still wins: he will either eventually sell the property, or simply receive money for a temporary break in showing the property.

Sometimes even the owner himself says: let’s have a smaller deposit. This is a sign that the person has most likely sold on the price and expects to find a buyer for a higher price.

On the contrary, if the owner is not satisfied with the standard five to seven percent, and he wants a more impressive deposit, most likely, the price of the apartment is already too high and you are probably on the hook.

Nuances in the receipt for the deposit

- To ensure that the transaction is secure, it is best to take a sample receipt for the deposit when purchasing an apartment from lawyers.

- But you yourself can also evaluate the quality of the document’s elaboration if you know the main points that should be contained there.

First of all, this is complete information about the participants in the process: names, passport details, the price you agreed on, the exact amount of the deposit (all numbers must also be duplicated in letters, for example: 2,000,000 rubles (Two million rubles). It is also important to describe the object of the transaction itself, including technical specifications and address.

Next: we prescribe the mandatory actions of the parties and sanctions for their failure to comply. If the subject of the transaction is something other than housing (an air conditioner or a kitchen unit, that’s not the point) - all this must also be recorded in the receipt.

Then the parties sign the documents and receive an identical copy in their hands. There is no need to take this paper to the notary. Please note: a deposit agreement in the form of a piece of paper on which something is written by hand does not guarantee you anything.

The deposit was transferred: how to confirm?

But after transferring or transferring funds, the owner must write in his own hand: you received such and such an amount within the framework of such and such agreements. All passport data, technical information about the house, date, signature.

Then, if a dispute arises and you have to go to court, the examination will show that it was this person who wrote. By the way: no pencils or gel pens; only ball-shaped, with regular paste. If the owner does not want to write by hand, then the paper must be printed and notarized.

We also recommend transferring money only in the presence of third parties: neighbors, acquaintances (but best of all, not acquaintances at all).

These and other measures listed in the article will allow you to calmly complete the transaction without worrying about the deposit. A balanced approach, attention to detail and the help of specialists will be the surest guarantee of a successful purchase!

Sample receipt for a deposit when purchasing an apartment

Photo from the site sudelko.ru

When, after a long search, you finally find the home you have been dreaming about for so long, the problem of paying for it arises. Often, if the buyer cannot pay the entire amount at once or asks to postpone this moment to “think it over,” the seller has no choice but to ask him for a deposit - a small amount that will help him gain confidence in the buyer’s actions.

Sometimes it happens that an advance is paid at the request of someone who wants to purchase an apartment. In this case, the amount is an indicator of serious intentions for the living space; receiving this money, the seller removes the apartment from sale and, as it were, assigns it to the potential future owner.

From the materials in this article, you can learn how to correctly fill out a deposit when buying an apartment, write a receipt for receiving an advance payment for living space, draw up an agreement on a deposit when renting, and familiarize yourself with samples of all forms.

Advance or deposit when buying an apartment: what is it?

In fact, these concepts are very different, and a person who does not understand the difference between them risks his money in case of impossibility or failure of a purchase or sale transaction.

A deposit is a certain amount that is divided between two parties under a special agreement. A kind of interim measure. These funds are given by the buyer to the seller as certain proof that the contract will be fulfilled.

In other words, if one person agrees to purchase an apartment, he gives the second a certain amount of money. This serves as some confirmation that his intentions are serious. If everything goes well and the sale is completed, these funds will be used to pay for living space.

In our country, this practice is typical specifically for the real estate market. Firstly, because its processes take a lot of time: preparation of documents, registration, registration of rights. Secondly, they always involve large sums of money. That is why both the seller and the buyer need some kind of guarantees.

And they can be as follows:

- The buyer will not be able to refuse to purchase the apartment while the documents are being drawn up.

- The seller will not be able to sell the property to someone else.

- The price of the product will not change. At the last moment, the owner will not be able to raise the price of housing.

- In addition, the deposit performs important functions:

- It is she who is responsible for ensuring that both parties fulfill all the terms of the deal.

- Ensures that the deposit amount is allocated to the total cost of housing.

- The payment of a deposit is considered proof that the contract has been concluded.

Photo from the site www.rosned.ru

What is an advance?

The legislative acts do not provide an accurate and comprehensive answer to this question. However, Article No. 487 of the Civil Code of the Russian Federation gives us the most transparent interpretation of this term. According to its text, an advance is a full or partial payment for a specific service or product.

Payment of this amount does not obligate the parties to fulfill the terms of the agreement and is returned in full. An agreement on an advance payment when purchasing an apartment does not even have to be drawn up in writing; there is no state standard for such an agreement. It's just a condition.

Attention

An important difference between a deposit and an advance is that if the transaction cannot take place for some reason, the buyer who has issued the first type of deposit will not have to guess whether the deposit for the apartment will be returned to him or not according to the law. If the seller is guilty of terminating the agreement, then he is obliged to return the entire amount paid in double amount. If the one who intended to purchase the property is guilty, then the owner is not obliged to give him the money.

What can be the amount of the deposit?

The text of the Civil Code of the Russian Federation does not say anything about what the specific amount of the deposit should be. Everything is decided by the parties independently and included in the relevant agreement.

Usually, when it comes to sales on the real estate market, it is customary to talk about an amount of 5-7% of the total cost of the apartment.

This is considered optimal. But there are a number of cases when this money can change significantly in different directions at the request of people; we will consider them in more detail.

Situation 1

The buyer asks the apartment owner to reduce the cost of the deposit.

This may happen if he has not yet made a final choice, wants to consider other options and then decide. It is beneficial for him to lose a minimum amount when he finds an apartment that suits him better.

Situation 2

The seller asks to significantly increase the value of the collateral.

Such a case suggests that the price of real estate is too high. This should alert you, perhaps they just want to take as much money from you as possible.

Situation 3

The homeowner insists on reducing the down payment.

Everything suggests that the seller is simply waiting for more favorable offers from other people wishing to purchase a home.

photo from juresovet.ru

How to correctly draw up a deposit agreement when buying an apartment: sample 2016

Let's start by advising you to seek help from lawyers. After all, they are the ones who can tell you the most advantageous positions that should be indicated in this document.

In the form of the deposit agreement when purchasing an apartment, which is regulated by Articles No. 380 and No. 381 of the Civil Code, it is worth noting the following important points:

- Full names of all owners of the property being sold and buyers.

- Passport details of representatives of both parties.

- The final final cost of the property.

- The amount of the deposit, which is written down several times: in words and in numbers.

- Apartment characteristics: area, address, etc.

- Responsibilities of both parties: in case of interruption of the transaction due to the fault of the seller, the buyer is returned the entire amount of the deposit in double amount. And provided that the buyer is at fault, the money remains with the owner of the apartment.

- Other conditions (optional). Here you can write about whether the owner leaves the furniture in the apartment, who will pay for housing and communal services, and whether the buyer needs an existing telephone line.

This agreement is drawn up in 2 copies. One for the seller, one for the buyer. It does not require notarization.

Important

Do not agree to draw up such an agreement in the form of a simple receipt. After all, the owner of the property may not sell it to you and may not return the money, and his relatives will provide a fake certificate stating that he was not himself when he took the deposit amount from you. Then you will have to go to court and spend a lot of time and effort on this. And no one will give you a guarantee that his decision will be in your favor.

To download a sample deposit agreement when purchasing an apartment, follow this link.

Deposit when purchasing an apartment: what is a sample receipt?

After the contract is concluded, the buyer must take a receipt from the seller, in which he confirms the fact of transfer of funds. The owner of the apartment must write it himself, by hand.

This will help you in case of litigation, since a person’s signature can be forged, but handwriting is very difficult.

The receipt is written only with a ballpoint pen, because the gel paste or pencil can be erased or smeared.

The document test must include the following:

- The correct name is: “Receipt for the transfer of the deposit under the agreement dated ... date.”

- The exact date of preparation of the paper.

- Full passport data of representatives of both parties with registration, series and number of the document, indicating the department that issued it.

- Confirm with text the fact of making a deposit (NOT ADVANCE OR DEPOSIT!).

- Investment amount: both in words and in numbers.

- Reference to the concluded agreement. For example, “... a deposit in the amount of 50,000 (fifty thousand) rubles was made towards payment under the purchase and sale agreement, which will be concluded on April 25, 2038...”

- Description of the apartment: area, address.

- Signature of the property owner (required as in the passport).

An example of a receipt form for receiving a deposit for an apartment or house can be seen below.

Photo from the site www.papajurist.ru

If the owner did not write the text by hand, but compiled it on a computer, then it is best to have such a document certified by a lawyer. Then you need to hand over the money to the property owner in front of witnesses, preferably two or three. Let it be just strangers, and not someone’s relatives or close friends. Wait until he recalculates the amount and declares that he has no claims against you.

To summarize all that has been said: registration of a pledge can save both parties involved in a real estate purchase and sale transaction from mistakes.

It is enough to know the provisions of the Civil Code of the Russian Federation, to be aware of your rights, and then you can easily register all the necessary documents for an agreement under which you can return your money and receive certain guarantees from the seller of the apartment.

data-block2= data-block3= data-block4=>

Deposit when purchasing an apartment (sample receipt)

Once, after a long search, you have finally found an apartment option that is called “to your liking,” it can be very disappointing to lose it.

In this case, the most popular way to secure obligations is a pledge.

Having come close to the issue of documenting this procedure, the question arises, how to draw up a deposit when buying an apartment (sample receipt)? And is it possible to combine it with the purchase and sale transaction of an apartment?

- Deposit when purchasing an apartment

- If you can’t get away from the deposit

Deposit when purchasing an apartment

Before talking about the possibility of using a deposit when buying an apartment, you need to find out what it is. The definition of a deposit is given by civil legislation (Article 380).

It represents a sum of money that is transferred by one party to the agreement to the other party and is security for the fulfillment of a financial obligation, the fulfillment of which is provided for by the agreement concluded between the parties.

In other words, it is a certain guarantee that the contract concluded between the parties will be fulfilled in the future.

Since the deposit is security for the fulfillment of the transaction for both parties involved in concluding the contract, if it is not fulfilled, the buyer will lose the amount of the deposit, and if the seller refuses to fulfill obligations under the contract, then he will need to return the deposit to the buyer in two times more. This, on the one hand, not a complicated procedure actually raises quite a lot of questions from a legal point of view.

Civil legislation (Article 558) provides that the validity of an apartment purchase and sale agreement begins from the moment of its state registration.

In accordance with this, obligations to transfer the apartment, on the one hand, and pay its cost, on the other, arise after state registration is completed.

It follows from this that the security of a transaction, which is a pledge, can only be applied after its parties have registered it with Rosreestr.

However, in practice, the deposit is most often transferred much earlier, at the time of concluding a preliminary agreement for the purchase of an apartment.

It should be noted that the initiators of such a security measure in our country were realtors, who often do not have a special legal education that would allow them to understand the legal intricacies that arise in the field of these legal relations.

In their actions, they are most often guided by the experience of their colleagues or their own intuition, rather than by the requirements of the law.

The conclusion of a preliminary pledge agreement cannot be called an absolutely useless measure, but this measure has nothing to do with the registration of the deposit.

Deposit when purchasing an apartment (sample receipt)

The legislation does not provide for any special sample of this document. Moreover, civil legislation does not contain such a concept at all.

In practice, a deposit when buying a house is an advance payment, which is made on the basis of a concluded contract before the deadline for fulfilling obligations under it has arrived.

That is, we can talk about an advance or prepayment when the contract has already been concluded, and the obligations will actually be fulfilled later, not at the moment when the transaction is concluded, but at another date that will occur in the future.

Judicial practice very often, when considering disputes that relate to the return of the deposit in the event of a failed agreement, treats it as an advance, regardless of whether it was transferred within the framework of a preliminary agreement or without it.

Most legal experts believe that the most accurate classification of this monetary payment is unjust enrichment.

What this means is that the party to the transaction in this case received income to which it was not entitled either by law or by contract.

The result of such disputes, as a rule, is a decision according to which the person who unjustifiably enriched himself is obliged to return the amount received as a deposit. In addition, the court can also collect interest from such a person for the use of other people's money.

The legislation provides that these interests are calculated in accordance with the refinancing rate of the Central Bank of the Russian Federation.

If the amount is not sufficient to cover all losses (if any), then an additional recovery may be made for the difference between the amount of interest calculated and the amount of losses incurred. What to do, not make any calculations at all before the contract is concluded?

If circumstances permit, then it is best to act according to this scheme:

- the seller checks out of the apartment;

- an apartment purchase agreement is concluded;

- registration is in progress;

- the buyer makes payment.

However, this scheme very rarely suits real estate sellers. They can be understood; after all, just like buyers, they need a guarantee that the obligations under the contract will be fulfilled.

The most correct way out of this situation would be to resort to the services of a safe deposit box.

This solution to the issue will suit both the buyer and the seller, since the seller will be confident that the buyer has deposited the agreed amount and will not be able to withdraw it until the end of the transaction.

He will be able to access the cell only if the conditions under which access to it is possible are met (such conditions, as a rule, are a passport and a purchase and sale agreement registered in Rosreestr).

On the other hand, the buyer will be confident that if the apartment purchase agreement remains unregistered for any reason, then his money will remain in place.

In the event that the seller still insists on formalizing a deposit, and it is not possible to make payments after the transaction is completed, then the best option is to issue a receipt for receipt of money.

It must be drawn up in writing. It indicates the passport details of the buyer and seller, the date when the money is transferred, and the amount that is transferred. In these circumstances, it is advisable to also indicate the purpose of the transfer of money - prepayment for the apartment (list the individual characteristics of the apartment: address, area, etc.).

The receipt indicates the date when the contract is planned to be concluded and the conditions under which the money will be returned if the conclusion of the contract does not take place due to the fault of one of the parties.

The receipt is certified by the person who compiled it and received money from it.

The best option is if there are witnesses present during its preparation, who, if necessary, will be able to confirm the fact of the transfer of money, which they will sign on the completed receipt.

It is necessary to understand that if the transaction does not go through, you will only be able to return the amount that was paid as a deposit. In addition, the deposit does not oblige the seller to enter into an agreement. As a result, an unscrupulous seller may continue to look for a buyer for the apartment, wanting to find more suitable conditions for himself, without fear of any adverse consequences.

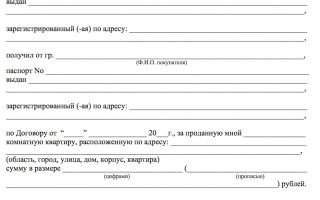

Sample receipt for receiving a deposit when renting an apartment

Receipts for receipt of a deposit and advance payment (prepayment) are the most common methods of advance payment when concluding an apartment rental agreement .

The purpose of transferring funds in the form of a deposit or advance payment is to confirm the parties’ intentions to enter into a lease agreement for an apartment .

A deposit and an advance payment (prepayment) have common features - funds are paid towards future payments, before the actual execution of the apartment lease agreement . The difference between an advance and a deposit is manifested in the consequences of failure to fulfill the obligation to conclude a rental agreement for an apartment.

If the party who gave the deposit is responsible for the failure to fulfill the contract, it remains with the other party. If the party who received the deposit is responsible for non-fulfillment of the contract, he is obliged to pay the other party double the amount of the deposit. This rule does not apply to advance payments. The advance is returned, and the party guilty of disrupting the transaction does not bear any sanctions.

“...” …………………. 20… g.……………………

I, ………………………………………….……, passport ………. No………………… issued

…………………………………………… "……" ……………….. 20…. city, department code (name of the authority that issued the passport)

registered at:

city …………………… street …..……………………..… house …… building ……… apt …..

received from .…………………………………………, passport ………. No………………… issued

…………………………………………… "……" ……………….. 20…. city, department code (name of the authority that issued the passport)

registered at:

city …………………… street …..……………………..… house …… building ……… apt …..

- as a deposit a sum of money in the amount of

- ……………………………………………………………………………………………. rubles (in words)

- towards future payment for the rental of property owned by me

……-room apartment located at the address: ……………….………………………

st. ……………………………………. house……………….. bldg. ……………… sq. …………..

The fact that I receive money means that I undertake to rent out this apartment

gr …………………………………………………………………………………………………………….

The conclusion of the lease agreement will take place no later than “……………………………. 20….. g.

Lessor ……………………………………/…………………….

“……………………. 20….. g.

Employer ……………………………………/…………………….

“……………………. 20….. g.

Note: Civil Code of the Russian Federation Chapter 23

Article 380. Concept of deposit. Deposit agreement form

- A deposit is recognized as a sum of money given by one of the contracting parties in payment of payments due from it under the contract to the other party, as proof of the conclusion of the contract and to ensure its execution.

- The agreement on the deposit, regardless of the amount of the deposit, must be made in writing.

- In case of doubt as to whether the amount paid towards payments due from the party under the contract is a deposit, in particular due to non-compliance with the rule established by paragraph 2 of this article, this amount is considered to be paid as an advance unless proven otherwise.

Article 381. Consequences of termination and failure to fulfill an obligation secured by a deposit

- If the obligation is terminated before the start of its performance by agreement of the parties or due to the impossibility of performance (Article 416), the deposit must be returned.

- If the party who gave the deposit is responsible for the failure to fulfill the contract, it remains with the other party. If the party who received the deposit is responsible for non-fulfillment of the contract, he is obliged to pay the other party double the amount of the deposit.

In addition, the party responsible for failure to fulfill the contract is obliged to compensate the other party for losses, minus the amount of the deposit, unless otherwise provided in the contract.

__________________

- Download a sample receipt for receiving a deposit when renting an apartment

__________________

See also:

- Apartment rental agreement

- Apartment acceptance and transfer certificate

Sample receipt for receiving a deposit for an apartment, registration rules, options

Paying a deposit for the apartment guarantees the completion of the transaction. Thus, the buyer confirms his intentions to buy a home and reserves the first right of purchase.

The functions of the deposit and other civil legal relations upon its receipt are regulated by Articles 380 and 381 of the Civil Code of the Russian Federation:

- Confirms the buyer's serious intentions.

- Guarantees the seller a quick sale of the property, since under the terms of receiving a deposit, the buyer undertakes to pay the remaining amount within a certain period of time.

- The transaction involves paying 10% of the cost of the apartment, which significantly eases the burden on the buyer (this amount is deducted from the total cost) and helps the seller resolve current financial issues (if there are property debts or similar obligations).

Dear readers! Our articles talk about typical ways to resolve legal issues, but each case is unique.

If you want to find out how to solve your particular problem, please use the online consultant form on the right or call +7 (499) 653-60-72 (extension 784). It's fast and free!

Rules for issuing a receipt

Upon receipt of a deposit, uniform rules and regulations apply for the transfer of funds, execution of a purchase and sale agreement, and so on.

The sequence of actions, upon agreement between the seller and the buyer, is as follows:

- Drawing up a purchase and sale agreement, on the basis of which the buyer, within a specified period (subject to payment of the missing amount of money) becomes the full owner of the property.

- Transfer of the entire deposit amount. It is carried out exclusively in front of witnesses. The recalculation of funds can also be entrusted to an uninterested person.

- Drawing up a receipt indicating the amount and other data.

- The document is signed by the seller, the buyer and all owners of the apartment or third parties who have a share of the living space or are registered on it.

Read more about registering the purchase and sale of a car: read a sample contract here.

Subtleties and nuances of the procedure

When drawing up a receipt, you should take into account the following subtleties and nuances:

- Before drawing up a contract, the buyer must verify ownership of the apartment. View documents, collect additional information.

- Agree with the seller to obtain a certificate from the house management about the composition of the family. It displays the total number of citizens registered in this apartment.

- View the technical plan of the premises. Check with existing layout. This will help protect the buyer from additional fees for illegal redevelopment.

- Read the certificate from the Unified State Register of Real Estate about the number of applicants for the apartment.

How to register ownership of an apartment with a mortgage?

[box type=”download”] Once all the necessary certificates and documents have been studied, and the buyer is convinced of the transparency of the situation, a purchase and sale agreement can be drawn up with a notary.[/box]

At the time of receiving the deposit, based on the practical side of the issue, it would be useful to take into account the following:

- The receipt is drawn up in the presence of the buyer.

- Money must be transferred in front of witnesses.

- After writing the text (by hand or on a computer), you need to double-check all the data.

- Not only the seller and the buyer sign the document. But also all persons, one way or another, related to this apartment. They are also required to be present when the receipt is drawn up and the deposit is transferred.

These simple rules will help reliably protect both the seller and the buyer from scammers or any other problems related to the purchase of a home.

Receipt text

The fact of transfer of funds must be documented. The seller, in accordance with the established procedure, draws up a receipt for receipt of the deposit. Thus, entering into civil legal relations with the buyer.

The text of the receipt must contain:

- Name

- Date of compilation

- Full name of the seller and buyer, with all passport data.

- Indicate what exactly is transferred as a deposit (it is worth noting that the deposit is not always transferred in cash equivalent).

- If the deposit is transferred in foreign currency, you must accurately indicate the amount and its affiliation (euros, dollars, rubles).

- Description of the property: total footage, number of rooms, address.

- Seller's signature.

Receipt options for receiving a deposit

There are several options for drawing up a receipt: with or without the involvement of third parties.

The first one is drawn up if the owners of the apartment are several people. Before receiving the deposit and executing the purchase and sale agreement, they must notarize their consent to the transaction. Thus, the receipt additionally includes information about the consent of third parties, their personal signature and passport data.

The receipt option if there is one owner is issued according to the standard procedure.

[box type=”download”] A number of additional items are included in both types of receipts if the deposit is not a sum of money, but securities, personal property of the buyer or any other type of property.[/box]

What documents are drawn up before drawing up a receipt?

Receiving a deposit is not an end in itself for preparing primary documentation. The seller needs to exclude a number of those persons who can claim their rights to the apartment. Indeed, in the event of termination of the contract with the buyer, after receiving the deposit, the seller is obliged to return the amount in double amount.

Minutes of the general meeting of apartment building residents: sample

To prevent this from happening, you must:

- Issue a certificate of ownership of the apartment . In the event that the property is shared, it is necessary to resolve the issue of sale with the other owner of the property.

- Title document nt. That is, a certificate on what basis the seller received this property (as a result of purchase, exchange, donation, inheritance).

- Owner's passport.

- Conclusion from the technical expertise bureau (it reflects the floor plan according to the developer’s project, information about redevelopment, major repairs, etc.)

- Certificate from the house management. This will help to certify the buyer that there are no registered relatives, acquaintances or any third parties in this living space who will then be unable to be evicted.

- Extract from the Unified State Register (stating that the owner has no debts for the apartment).

- Consent of third parties to sell an apartment.

- In the case of older people , a certificate of mental health may be required. This applies to owners who have suffered a serious traumatic brain injury or complex illness that indirectly or directly affects the brain and affects capacity.

Read more about the correct execution of a receipt for the return of funds here.

Under what circumstances can a deal be cancelled?

Based on the text of Article 450 of the Civil Code of the Russian Federation, a transaction to receive a deposit can be canceled on a general basis. That is, by agreement of the two parties, at the request of the seller or buyer, in case of gross violation of the rules of the agreement.

Judicial practice identifies only a few really compelling reasons for terminating a contract in favor of a real estate buyer:

- An agreement is considered invalid if the procedure for its preparation has been violated. Proving this fact is extremely difficult, but possible. To do this, the buyer only needs to refuse to double-check the data at least once. If at least one number or letter in the receipt is written incorrectly, it is considered invalid, and the amount of money in the form of a deposit is considered an advance payment.

- If the purchase and sale agreement is canceled by the court due to force majeure circumstances. That is, those that do not depend in any way on the seller. For example: distant relatives suddenly showed up and have the right to claim an apartment.

- Situations in which property was damaged in whole or in part - fire, flood, etc. - the deal is completely cancelled.

Until what year can an apartment be privatized?

[box type=”download”] In addition to the above reasons, the buyer himself can refuse to purchase a home. There is also a limitation period for the contract; after this period, the transaction is considered invalid and the deposit is not returned.[/box]

Read about the sale of an apartment purchased with maternity capital here.

Sample receipt for receipt of deposit

[box] RECEIPT for receipt of deposit

____________ “___”__________ ____

I, gr. _____________________________________________________,

citizen's passport (full full name)

- Russian Federation: series ______ N ________,

- issued by ______________________ _______________

- from “___”__________ ____,

- department code _____-_____),

- registered at: ________________________________________

- (option if the registration address differs from the actual residence address:

- residing at the address: ___________________________________)

- (hereinafter referred to as Party 1), received from gr. ___________________________________,

(full full name)

- passport of a citizen of the Russian Federation:

- series _______ N ___________,

- issued by _______________________________________________

- from “___”__________ ____, department code _____-_____),

- registered at the address: ________ __________________________________________

- (option if the registration address differs from the actual residence address: resident(s) at the address: _____________________________________________)

(hereinafter referred to as Party 2), a deposit to secure the fulfillment of obligations under Agreement No. _____ dated “__”__________ ____ on _______________________________ in the amount of _____ (__________) rubles (specify the subject of the agreement) in accordance with clause ___________ of the specified Agreement (option: Agreement about (indicate the clause of the Agreement containing the agreement on the deposit) deposit dated “___”__________ ____, N _____) .

SIGNATURES OF THE PARTIES

Side 1_________________/_____________ (full name) (signature)

Side 2 __________________/___________ (full name) (signature)

——————————–

Information for your information:

In accordance with paragraph 2 of Art. 380 of the Civil Code of the Russian Federation, an agreement on a deposit, regardless of the amount of the deposit, must be made in writing.[/box]

YOU CAN DOWNLOAD THE SAMPLE HERE

[box type=”download”] When carrying out a transaction for the purchase and sale of property, the buyer is the most unprotected. Fraudulent actions on the part of sellers are sometimes well veiled and even an experienced lawyer will not immediately be able to understand what is going on.[/box]

In order not to be deceived by the buyer, it is better to complete all transactions through reputable real estate agencies. Since it is the brokers who will bear financial losses in the event of the seller’s unreliability and resolve current issues on their own. The buyer will be guaranteed to receive his down payment.

Didn't find the answer to your question? Find out how to solve exactly your problem - call right now:

+7 (499) 653-60-72 (ext. 784) (Moscow)

+7 (812) 426-14-07 (ext. 943) (St. Petersburg)

+8 (800) 500-27-29 (ext. 391) (All Russia)

It's fast and free!

Inconvenient to call? Ask a question online →