Registration of an inheritance often requires time, effort and money. The heir has to visit the notary several times and, in certain cases, visit various authorities. Thus, visits add up to wasted time, which sometimes simply does not exist.

It’s a completely stalemate situation when an inheritance awaits in another city; it’s practically impossible to constantly travel between cities if a person is tied to certain matters.

Part 1 of Article 1153 of the Civil Code of the Russian Federation allows you to make a power of attorney for registration of inheritance - a notarized document of transfer of inheritance, which will allow a third party to manage procedural issues on behalf of the heir.

Appointment of a power of attorney

This power of attorney to receive an inheritance is a document that allows you to transfer a certain number of powers, including opening, registration processes, and other matters, to a third party to whom the heir fully trusts his rights.

The grantor must reflect in the document certain powers to receive an inheritance, including direct acceptance of the inheritance, otherwise this will lead to additional problems and unnecessary signatures on the part of the heir.

The validity period of the power of attorney extends to the entire period of receipt of the inheritance. If the deadline for receipt is delayed, the power of attorney is extended accordingly. The authorized representative is fully authorized to act; he can sign, visit courts, and communicate with a notary.

Is it possible to enter into an inheritance by proxy?

The obvious answer is yes.

- Some people, for their own reasons, do not want to deal with the inheritance process themselves. Although papers go through notaries and other legal entities, there are people who are completely far from such matters. In addition, it should be understood that inheritance occurs due to loss, and the processing time is six months, so a person may not be mentally prepared to go through the authorities or win back his own.

- The modern rhythm of life forces almost everyone to work hard, so there is very little time left for third-party tasks, in addition, many employers refuse to put themselves in the position of a person who is given a certain period of time to complete all the documents. Government agencies have clearly fixed working hours, so it is physically impossible to get there outside of working hours.

- The inheritance opens where the testator lived; more often, a certain district of the city is even taken into account; it is the district notary who draws up all the documents. However, a person may be a resident of another city or region. It will be too difficult to visit authorities in another city just to put one of your signatures. Authorities do not send documents by postal order, so distances also play a big role.

- Many people know the joke about an uncle or aunt from America who leaves millions, but this situation sometimes really happens. If other countries have their own legislative framework for registration of inheritance law, then citizens from other countries, using a power of attorney, can draw up the necessary documentation in Russia.

Therefore, the answer to the question of whether it is possible to enter into an inheritance by proxy is an unequivocal answer - it is possible. By completing the paperwork once, you can subsequently save yourself a lot of effort, time and nerves.

Procedure for issuing a power of attorney

After deciding that the procedures will take place through inheritance by proxy, you need to pay a visit to the notary. You can discuss all the necessary points with a notary, he will tell you how to start the entry process, and also provide a power of attorney form with a serial identification number.

The introduction of third parties must be carried out competently, taking into account the main nuances of the inheritance system. Therefore, a general power of attorney for registration of inheritance is drawn up only by a legally savvy person authorized to draw up these documents by a person.

In most cases, a power of attorney is issued simply, quickly, requiring minimal financial and time costs. The notary carries out the registration, tells you how to draw up a power of attorney, and notarizes the validity of the transaction. After certain actions, the power of attorney receives legal force, after which the heir is freed from subsequent paperwork.

- Only after receiving a notarized copy of the power of attorney can a third party begin the process of writing and filing an application for inheritance. Until the document is issued, all rights belong exclusively to the heir.

- The notary must check the attorney's documents so that this person can act as the main person in the transaction. After checking the documents, the notary may require additional certificates, which must be provided.

- Any legal case is built on materials. The nature of the materials is determined by the necessary requirements of the law, but if any papers are missing, you will have to start collecting them. If the heir has limited time resources, the attorney independently handles the collection.

- After checking all the documents provided, the notary makes a decision on the entry into force of the power of attorney. In most cases, a power of attorney is issued fairly quickly, but if a legal entity has a number of questions, or the documents are drawn up incorrectly or are brought in incompletely, the process may be delayed.

Registration of inheritance by power of attorney is a simple legal process, a formality that sometimes, given our laws, seems almost impossible. However, the final decision whether it is possible to formalize an inheritance by power of attorney rests, of course, with a specialized legal entity, which assesses the situation from the perspective of the available documents, which play a decisive role in the entry.

There is a certain layer of people who most often become attorneys

- Close relatives are the most popular option. If relatives have the same surnames, it’s doubly better, the proof of relationship is unambiguous, so these persons are most suitable for the role of verified persons. Relatives are the most preferable option.

- Often, close friends and good acquaintances turn out to be closer than real relatives. Some people trust their affairs more to them than to blood relatives. The main requirement is a good reputation. If a friend had, or has difficulties with the law, any other dark spots in his biography, it will be almost impossible to notarize a power of attorney for such a person; the representative must be one hundred percent clear before the law.

- People who do not want to owe anything to third parties hire notary offices. Of course, this option will be the most unprofitable, but the most correct. By paying for certain services, you can be sure that all work will be carried out on time, documents will be filled out, signatures will be provided. For a notary, this process is standard work.

You can entrust your inheritance to different people, the main thing is to make a reliable choice, because if a person gives the right to dispose of his inheritance to a third party, there will be no turning back.

Required documents

It was stated above that the notary will request certain documents in order to verify the attorney. In addition to the trust of the heir, additional verification is an important point in order to exclude all points that simply may not be known. Thus, you need to provide the following documents:

- Two passports, directly of the heir and of the confidant. Originals are provided along with copies.

- Death certificate of the testator.

- Any documents that confirm the relationship with the testator, possibly a will (acceptance of inheritance by law), or house books, a lease agreement, confirming joint registration, joint ownership of a car.

- Documents confirming the existence, ownership of property, ownership: documents for the house, vehicle title, checks, if the property is small.

The necessary certificates and documents are provided at a time to obtain notarization for each, then draw up a power of attorney.

A power of attorney gives the right to manage the details of a transaction either permanently or for a certain period: one year, three years, five years. The deadlines must be specified, otherwise the power of attorney will be declared invalid.

In addition to the deadlines, additional details are prescribed, for example, the possibility of revoking the power of attorney - an important point if something suddenly goes against the plan, the possibility of refusal by the attorney, and the possibility of incapacity of both parties.

After drawing up this paper, you can begin to work through the processes, write an application for acceptance of the inheritance, and work out the moments of transfer of property.

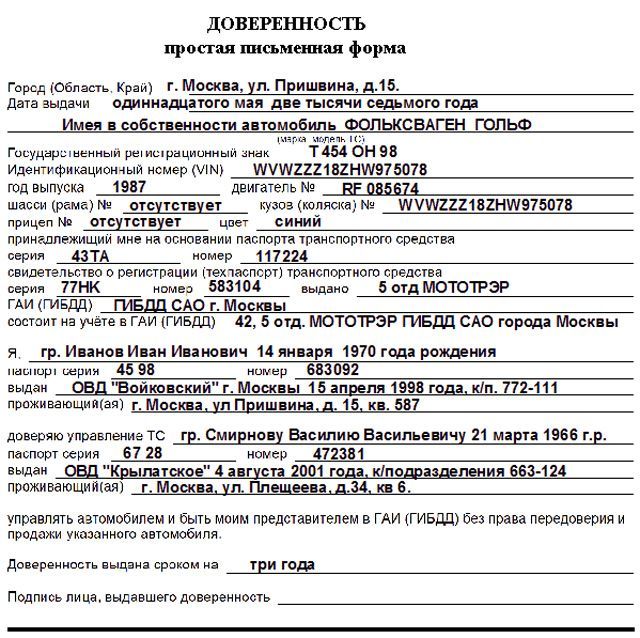

Sample power of attorney

Power of attorney for inheritance is widely used on the Internet. This is due, firstly, to the widespread use of self-drafting of this document.

However, if any controversial issues arise, it will become much more difficult to resolve them if the paper is simply written by the participant in the process without additional notarizations.

That is why a power of attorney to accept an inheritance, a sample of which is widespread everywhere, is best drawn up at a notary’s office. There are several types of power of attorney.

- One-time is designed to perform a specific action. For example, if the testator can independently control the process, travel, but there is some obstacle, for example, you need to attend a court hearing, but there is no opportunity.

- A special one allows you to perform several identical actions, for example, signing documents or attending court.

- General offers the widest range of possibilities. During the entire specified period, you can perform any actions in place of the heir.

Samples of filling out the power of attorney, an example of writing is available from the notary, or to familiarize yourself with the rules for filling out, you can first look on the Internet. Certain information must be provided.

- Date of compilation, place of compilation. If there is a notary office, the name of the office.

- Principal's passport details.

- Passport details of the person being trusted.

- The powers vested in the guarantor are indicated.

- List of property that is being transferred.

- Signatures of the principal, notary, official seal.

In this way, one document regulates the list of all assigned powers, is certified, and therefore acts as a full-fledged supporting document.

Duration of power of attorney

There are several options for writing an official paper. The main criterion is the extent to which the testator himself cannot participate in the inheritance process. Thus, given the six-month duration of the entry process, the most common power of attorney is valid for one year with the right to sign, as well as participate in all meetings that may arise.

A shorter period (up to a year) is chosen if a person can independently regulate the process of receiving an inheritance.

However, there are completely different cases of inheritance. So, sometimes there are too many applicants for one property. Such issues are resolved in court, so the inheritance process is often drawn out, lasting for years.

If it is not possible to attend all meetings, there is a need to hire an attorney who will close all open issues with his signature.

There are people who simply do not like various types of authorities; for such, the right of transfer will also be a real salvation.

Procedure for registering a power of attorney to receive an inheritance

If the direct heir cannot independently formalize his right to inheritance, he can transfer his powers to a trustee. The list of transferred obligations is recorded in a power of attorney issued by a notary.

Kinds

To issue a power of attorney to receive an inheritance, you need to know about their types and the functions of each of them. Types of Trust Deeds:

- one-time - issued for single transactions of the person issuing the power of attorney;

- special - necessary for the participation of a trusted person in legal transactions over a long period;

- general power of attorney for registration of inheritance - gives the right to the authorized person to make transactions on behalf of the principal, regardless of their legal status and affiliation.

How to apply?

Any citizen of the Russian Federation who has received an inheritance but does not have the ability to register it independently can issue a power of attorney to accept inherited property.

A trust deed can be drawn up:

- heir in his own right;

- using notary services.

A sample of trust deeds is available in every notary office and its preparation will not be difficult for the heir.

The heir has the right to contact a notary, having previously chosen him depending on his legal status and in the presence of a trustee.

Important! A power of attorney is issued only on behalf of a legally capable citizen. If it is discovered that the document was signed by a person who does not understand the consequences, it will be declared invalid.

A power of attorney for registration of inheritance can be issued:

- relative of the heir;

- to a friend;

- to an acquaintance;

- a citizen who does not have a family relationship with the principal.

The legislation of the Russian Federation specifies a number of requirements for a trustee:

- It must be capable.

- Reach adulthood.

- An authorized citizen must be aware of the significance of his signature and understand the legal force of the transactions being made.

When executing a power of attorney to receive an inheritance, the trustee is vested with the following powers:

- submit an application on behalf of the heir to accept the inheritance due to him and to obtain a certificate of inheritance rights;

- demonstrate the will of the principal in government organizations;

- collect the documentation necessary to accept the inheritance;

- submit an application to the Rosreestr office to obtain ownership rights to the inheritance required by law;

- sign documents on behalf of the heir;

- pay the state fee for the procedure for registering an inheritance case.

A trust document on the acceptance of inherited property is drawn up for a period of no more than three years. To recognize it as valid, the date of preparation and the expiration date must be indicated.

The cost of issuing a power of attorney to receive an inheritance depends on the prices for services established at the notary's office. The fixed cost that applicants will have to pay is the price of the state duty, the amount of which is 200 rubles.

Package of documents

Before drawing up a power of attorney to formalize an inheritance, the heir must collect a package of documents. It includes:

- identity card of the heir and trustee;

- papers for inheritance;

- death certificate of the testator;

- original and copy of the will;

- documents confirming the relationship of the heir with the deceased.

The notary may request citizens to provide additional papers. For example: if the heir is incapacitated or a minor, then permission from the guardianship and trusteeship authorities will be required.

Executing a power of attorney to receive an inheritance requires compliance with legal requirements:

- The document is drawn up on official letterhead, which must be certified by the signatures of the parties to the transaction.

- The paper must be notarized.

- The text of the document is written correctly and without ambiguous interpretations.

- The lawyer must indicate the registration number of the power of attorney and put his stamp and signature on it.

The choice of a notary office does not depend on the location of the inherited property and the heir.

The document form must contain the following information:

- Full name of the parties to the transaction;

- place of residence and information from the identity card of the trustee and heir;

- list of inherited property;

- list of powers transferred to a trusted citizen;

- the amount of state duty;

- validity period of the power of attorney;

- lawyer's signature;

- signatures of the parties to the transaction.

The power of attorney can be drawn up in any form, but the paper must be certified by a notary. The form of the trust document in notary offices may differ.

How to correctly draw up a power of attorney for inheritance registration

A power of attorney is a document according to which a citizen authorizes an attorney to perform any actions on behalf of the principal in front of third parties.

The power of attorney specifies the duties or tasks of the attorney, as well as his responsibility to the principal.

Let's look at how to issue a power of attorney to register an inheritance and what nuances should be remembered when filling out the document.

The need for a power of attorney arises in cases where a citizen is located outside the city in which the inheritance case was opened. Also, if legal proceedings arise regarding the acceptance and entry into force of an inheritance, the document stipulates the conditions for the conduct of legal proceedings by an attorney in the interests of the heir.

The Civil Code is the central legislative act regulating the rules for issuing a power of attorney.

Article 182 of the Civil Code of the Russian Federation contains information about representation by power of attorney, articles 185-187 disclose the terms of the power of attorney, and article 1153 describes methods of accepting an inheritance (more details here). Article 333.24 of the Tax Code of the Russian Federation determines the amount of the state fee for notarization of a document (two hundred rubles).

If there is a piece of real estate in the inheritance estate, then it will be necessary to register the rights to it. This can also be delegated to a representative. But such a right must be specifically stipulated in the power of attorney for registration of inheritance. It is better to immediately consult with a notary, who will tell you what powers should be included in the power of attorney and which ones should be specifically specified in it.

To accept an inheritance, an important step is to submit a corresponding application to the notary department. A power of attorney allows the attorney to perform all actions related to receiving an inheritance for the heir.

According to Article 1153 of the Civil Code of the Russian Federation, acceptance of an inheritance through an attorney is permitted if the power of attorney reflects such powers.

Persons who can act under a power of attorney on behalf of the heir:

- advocate;

- lawyer;

- another person.

You can learn more about inheritance under the Civil Code of the Russian Federation from the article https://nasledstvo.today/3605-normy-grazhdanskogo-kodeksa-v-nasledstvennom-prave-soderzhanie-statei-gk-rf.

The parties determine the payment for the procedure for registering an inheritance by proxy independently. The law does not reflect instructions on payment, so registration of inheritance is allowed absolutely free.

Most often, a relative, friend or stranger is chosen as a principal who agrees to act in the interests of the principal.

An important requirement for the attorney is legal capacity and age of majority, otherwise the transaction will be declared invalid.

Based on Article 185 of the Civil Code of the Russian Federation, in order to accept an inheritance through an attorney, it is necessary to draw up a power of attorney in the name of the citizen who is chosen as his representative.

Trustee's tasks

A person acting in the interests of an heir is authorized to perform the following actions within the framework of an inheritance case:

In legal practice, many cases with controversial issues arise. If the notary cannot independently resolve the dispute between the heirs, he sends them to court. Therefore, it is more expedient to include in the power of attorney the transfer of powers to conduct affairs in court.

- draw up an application and other documents necessary for registration of inheritance;

- collect a document package (find out what documents are needed to register an inheritance here);

- protect the interests of the principal in government agencies or court;

- ensure the safety of the heir's property;

- send requests, petitions and statements;

- sign documents instead of the principal;

- pay fees, state duties and bills;

- other rights and obligations provided for by law.

The authorized person has rights and obligations during the allotted period (up to three years). The term must be indicated in the document, otherwise the power of attorney will be invalid. According to Article 188 of the Civil Code of the Russian Federation, the principal has the right to indicate other grounds for termination of the document:

- Revocation of power of attorney;

- Refusal of the authorized person to fulfill the imposed duties;

- Recognition of the trustee as incompetent or death of one of the parties to the contract.

Types of powers of attorney

There are three types of powers of attorney:

- One-time power of attorney.

Grants the authorized person the authority to perform one action. Visit a notary's office and submit an application on behalf of the principal if he is unable to do this in person due to valid reasons. - Special power of attorney.

It is issued when the authorized person performs a number of monotonous actions during the allotted period of time (participation in court hearings, filing a complaint or petition). - General power of attorney.

The fiduciary has a wide range of powers to perform actions in the interests of the principal during the specified period of time.

Power of attorney for registration of inheritance, sample

The legislation does not provide for strict rules on the form and content of a power of attorney: citizens have the right to draw up a document in free form.

When drawing up a document, you must adhere to the rules of document flow. A power of attorney to conduct an inheritance case should be drawn up in writing on a special form.

The document is signed by the principal and certified by a notary.

The power of attorney contains the following information:

- details of the principal (full name, date of birth, address);

- details of the authorized representative (full name, date of birth, address);

- list of powers within the framework of conducting inheritance business on behalf of the heir;

- list of inherited property;

- signature of the principal;

- signature and seal of the notary.

When completing the document you will need the following documents:

- Death certificate of the testator;

- Passports of the principal and the authorized representative;

- Documents for inherited property;

- A will or documents proving kinship with the deceased.

If necessary, the notary has the right to request other documents.

Power of attorney to conduct inheritance business: sample design

Entering into inheritance rights is a procedure that requires a number of actions within a limited period of time.

It is necessary to collect certificates, extracts and other papers required by the notary, stand in queues at many different authorities, and the heir does not always have the opportunity to do this.

Most often, the discovery of an inheritance happens unexpectedly for the heirs. The law allows only six months for entering into an inheritance, and this period can only be extended for valid reasons.

And if you consider that not all people are able to deal with these issues due to their business, family circumstances, health status, or geographic location of the inherited property, it is not surprising that there is a demand for the execution of such a notarial document as a power of attorney to conduct inheritance business.

The period for entering into inheritance rights is limited by law, which puts the heirs in front of the need to resolve the issue of accepting inherited property not when it is convenient for them, but when it is provided for by law.

In addition, sometimes the testator leaves behind property, rights and obligations, decisions regarding which require an understanding of legal subtleties, which not everyone has.

We may be talking about the right to inherit a house, apartment, money or other property, as well as rights and obligations to third parties.

Therefore, the law allows for the execution of a notarized power of attorney to enter into an inheritance, on the basis of which the heir’s authorized representative makes decisions and acts on behalf of the principal.

Important! The Law on Notaries also regulates the issue of drawing up a power of attorney to conduct inheritance business (every notary has a sample, since the requirements for drawing up are quite clearly stated in the law).

Legislation on the execution of a power of attorney

The laws of the Russian Federation provide fairly precise explanations regarding the execution of powers of attorney.

Failure to comply with the requirements of the law when drafting leads to its loss of legal force and, accordingly, the impossibility of the authorized person to perform prescribed actions on behalf of the principal.

For this reason, it is better to prepare documents of this kind in notarial form according to the established template for each case.

The drawing up of powers of attorney is regulated by the Civil Code of the Russian Federation. Article No. 182 describes the issue of representation. Articles No. 185-187 clarify issues of prescribed conditions. Article No. 1153 refers to the part of the Civil Code of the Russian Federation, which regulates issues of inheritance legislation and describes the methods for accepting inherited property personally by the heir and on the basis of a document issued by a notary.

The Tax Code of the Russian Federation also makes its contribution to clarifying such an issue as entering into an inheritance by proxy, giving instructions on the amount of state duty for notarization. This issue is regulated by Article No. 333.24.

Registration of a power of attorney to receive an inheritance

A power of attorney is a formal power of attorney that has legal force and gives the trustee the authority to act on behalf of the principal. This means that the specified person has the right, on behalf of the heir, to participate in all necessary procedures provided for by law when conducting an inheritance case and entering into inheritance rights.

Who can be the trustee?

Any person, when opening an inheritance to which he legally claims, has the right to draw up a power of attorney to register an inheritance in the name of another person, if for some reason he cannot or does not want to deal with visiting a notary, opening an inheritance case and other issues of entering into inheritance rights.

If the heir is legally incapacitated or has not reached the age of majority, his legal representative - a parent or adoptive parent, guardian, trustee - has the right to draw up a power of attorney on his behalf to formalize inheritance rights, with the consent of the guardianship and trusteeship authorities.

Who can become a trustee?

With regard to the identity of the authorized person, the decision is made by the principal himself, with the consent of this person. This could be a mother, son, another relative or friend, as well as a person with the necessary professional qualities and knowledge (for example, a lawyer).

Important! The law imposes two requirements on the person of the trustee: age that allows him to perform independent actions without restrictions (the age of majority is over 18 years old) and legal capacity. If these requirements are not met, the actions performed by such a proxy are not considered legal.

What type of power of attorney is suitable for registration of inheritance?

When figuring out whether it is possible to enter into an inheritance by proxy, it is important to note that there are three types of this document:

- one-time - gives the person in whose name it is issued the legal right to perform one action on behalf of the principal; such an action may be, for example, visiting a notary and submitting a package of documents to open an inheritance case, or the right to receive any official papers if the heir cannot do this himself;

- special - gives the right to perform a number of actions specified in it and participate in certain procedures within a specified period; in particular, this may include representing the legal interests of the principal in government bodies, in court, filing applications, complaints and petitions, obtaining certificates and extracts, as well as other specified actions;

- general - gives the trustee many powers in the interests of the principal during the entire period of validity.

Most often, when entering into inheritance rights, a general power of attorney is drawn up, because it is this that gives the trustee the opportunity to most effectively resolve all issues of entering into inheritance rights in the interests of the heir.

What rights and responsibilities does a trustee have?

When deciding whether it is possible to formalize an inheritance using a general or special power of attorney, it is important to understand the powers that the person in whose name it is written out receives. The person to whom the document is issued receives legal rights and obligations to do the following:

- submitting a package of documentation for inheritance;

- representation of the interests of the heir in the notary’s office, judicial and other government authorities;

- submission of applications and requests;

- obtaining extracts, certificates, originals and duplicates of documents, including certificates of inheritance;

- the right to sign on behalf of the principal;

- payment of government duties and bills;

- other rights and obligations that are specified in the powers of the trustee and provided for by law.

Document validity period

When a document is drawn up giving the trustee permission to take a number of actions on behalf of the heir, it is important to consider that these rights come into force immediately upon receipt, but are not given forever, but for the period specified in the power of attorney. The heir decides how long it will last. This can be one year, 3 or 5 years, at the request of the principal, but indicating the limitation period in the document is mandatory, since this is one of the conditions for its validity.

Any notary, when writing out a power of attorney to enter into an inheritance, has a sample established in his office, however, even if the accepted form may vary slightly in different notary offices, a clause on the validity period is mandatory.

In addition to the deadline, you can specify other conditions under which the document will cease to be valid on the basis of Article 188 of the Civil Code of the Russian Federation. Such conditions include:

- cancellation by the principal;

- refusal of the authorized person from the powers transferred to him;

- limitation or loss of legal capacity, as well as death of the trustee or principal;

Retrust

Article 187 of the Civil Code of the Russian Federation stipulates the right of a trustee to delegate the powers given to him to a third party. This is possible by drawing up a power of attorney.

The trustee has the right to make such decisions independently; however, in order to exercise his right of sub-trust, it is necessary to provide the notary with documentary evidence of valid reasons why it is impossible to fulfill the rights and obligations assigned by the original document. In addition, the power of attorney issued by the heir must indicate the right of subrogation. When registering a transfer of power to a third party, the principal must be notified. Responsibility for actions under the power of attorney remains with the original power of attorney.

Procedure for issuing a power of attorney

Despite the fact that the notary has a sample for a power of attorney to formalize an inheritance, the law does not impose requirements regarding the content and form of this paper. Moreover, you can even write this document in free form. However, it is still necessary to adhere to the rules of document flow:

- the power of attorney is executed in writing and on a special form;

- certification by a notary is required;

- the text should not contain corrections or abbreviations that allow for different interpretations;

- It is obligatory to indicate the date of compilation and place, information about the principal and authorized person (full name, passport details), transferred powers;

- the property to be inherited must be listed;

- signature of the principal and certification by a notary.

Attention! Registration of the transfer of powers to an authorized person is possible from any notary, regardless of the address of opening the inheritance case and the places of residence of the authorized person and the principal. Thus, it is not necessary to draw up this document with the same notary who is handling the inheritance case.

Required documents

If you are going to inherit property through a trustee, for registration you need to provide the notary with:

- passports (of the heir himself and his authorized representative);

- death certificate of the testator;

- documents confirming the principal's right to inheritance (will or other documents confirming relationship - birth or marriage certificate);

- documents of title for inherited property (purchase and sale agreements, donations, exchanges, rents, transfers of ownership to citizens, etc.).

In addition to these documents, the notary has the right to require others, depending on the situation.

How much does it cost to issue a power of attorney?

As a rule, when preparing this document, cost is not one of the particularly pressing issues, since the state duty for such notarial actions is always low. For 2018, the cost of this service is set by the Tax Code at 200 rubles. The state fee is collected directly by the notary upon registration.

Power of attorney for registration of inheritance - sample, is it possible to enter into, to receive, register, with subsequent sale, to refuse

A notarized power of attorney for entering into an inheritance gives the right to a third party to carry out a list of those actions for which the heir has authorized, as well as to act on his behalf.

What it is?

A power of attorney to receive an inheritance is a notarized document that gives the attorney the right to carry out specific actions to formalize and receive an inheritance, which the principal has authorized, in his interests.

In accordance with Article 1153 of the Civil Code of the Russian Federation, the law does not prohibit the acceptance of inheritance by proxy by third parties in the event that:

- such powers are actually indicated in the power of attorney;

- certified by a notary.

If the power of attorney does not indicate the authority to accept the inheritance, but only to formalize it, and the attorney needs to submit to the notary a notarized application for entry into the right of inheritance, in this case it is necessary to indicate in the power of attorney the right to submit such an application.

The notarized application must bear the signature of the heir.

As a rule, to perform a full range of actions in inheritance matters, it is best to issue a so-called “general power of attorney”, which gives the attorney a full list of powers.

If the principal does not know how best to write down the necessary powers in the power of attorney for inheritance, it is better to tell the notary for what specific actions the power of attorney will be needed.

Who can do it?

To obtain a notarized power of attorney, you must contact a notary.

Notaries, as a rule, have sample forms with the necessary powers.

If the heir has a prepared version of the power of attorney, it must be submitted to the notary for approval, because sometimes the person:

- cannot fully take into account all the nuances of inheritance legislation when drawing up a notarial document;

- use legal vocabulary correctly.

Power of attorney for registration of inheritance

Registration of an inheritance will require a lot of effort, documents and time.

That is why heirs are increasingly resorting to the help of representatives, for whom they issue a notarized power of attorney, indicating in it the necessary powers to carry out actions.

The text of the power of attorney must include:

- the powers under which the attorney is authorized to act;

- rights that are directly related to his powers.

So, in order to formalize the right of inheritance, an attorney needs to find out:

- whether a will was left;

- if it exists, then find out its location.

If there is no will, then register the right of inheritance in accordance with the law with a notary at the last place of residence of the testator.

Thus, the list of powers must be exactly interrelated with the rights that are transferred by the heir by proxy, and also correspond to the actions that need to be carried out.

Content

A power of attorney for registration of inheritance must include the following information:

- information about the heir (principal) and attorney (passport details, date of issue of passport, registration address, as well as identification code);

- information about the testator (full name, date of death, death certificate number, address of last place of residence);

- date and place of registration of the inheritance.

Thus, when registering the right of inheritance, the attorney can perform the following actions:

- submit a notarized application for acceptance of inheritance;

- receive a certificate of inheritance;

- represent the interests of the principal in notaries, local authorities, Rosreestr, ZhEK;

- sign and act on behalf and in the interests of the principal;

- register ownership of the principal;

- pay state duty and other payments.

Conditions

- According to Article 1153 of the Civil Code of the Russian Federation, the heir has the right to instruct a third party, by issuing a notarized power of attorney, to formalize the right of inheritance.

- An attorney can be an adult capable individual, either a relative or a lawyer.

- A representative has the right to act only within the framework of the powers granted to him.

Notarization

A power of attorney to carry out actions in the field of inheritance must have a notarized form, which:

- certified by a notary;

- is registered in the register.

A notarized power of attorney must have the notary's seal, his signature, and also be signed by the heir himself.

The power of attorney must include:

- the city where the power of attorney is executed;

- date of registration;

- on whose behalf the attorney will act (full details of the heir);

- complete information about the attorney;

- list of powers;

- a list of property in relation to which the attorney can perform certain actions;

- validity period of the power of attorney;

- signature of the principal;

- date of certification of the power of attorney;

- FULL NAME. the notary who certified the power of attorney;

- name of the notarial district;

- registration number of the power of attorney.

With subsequent sale

The apartment can be sold only after it has been registered as the property of the heir.

This means that the power of attorney must include an expanded range of powers, which will include:

- entry into ownership;

- registration and registration;

- sale.

But having skipped one of the stages of entering into the right of inheritance in the power of attorney, the attorney will not be able to sell the property without registering it in the name of the successor.

It is necessary to announce the necessary actions in advance so that you do not have to later issue a separate power of attorney to complete the sale, because this, as we know, entails additional costs.

To refuse

As was noted in relation to actions for the sale of property, and in relation to refusal, it is necessary to indicate the authority to write a refusal of inheritance in a notarized power of attorney as one of the powers.

You should not issue a power of attorney to an attorney if the heir’s legal representative (mother, father, guardian) wants to write a refusal.

Entry procedure

To enter into the right of inheritance, the successor must contact a notary at the place of last residence of the testator within six months from the date of his death in accordance with Article 1154 of the Civil Code of the Russian Federation.

For this you will need:

- death certificates;

- a document confirming relationship with the testator.

After the successor writes a statement to the notary, an inheritance case will be opened.

Here is a sample application for acceptance of inheritance.

After six months, you must return to the notary to obtain a certificate of inheritance.

This document serves as the basis for further registration of the received property as the property of the heir.

Required documents

To enter into an inheritance, you must prepare the following documents:

- successor's passport;

- death certificate of the testator;

- title documents for property (if available);

- a document from the housing office about the last place of residence of the testator.

A power of attorney provides an opportunity for a third party to perform the necessary list of actions if the principal himself does not have the opportunity to carry them out independently.

With this document, the heir expresses confidence in the attorney, thereby authorizing him to act in his interests and on his behalf.

Sample text of a power of attorney for the conduct of inheritance matters and registration of inheritance

1 500 rubles – power of attorney to conduct inheritance business.

POWER OF ATTORNEY

Locality ______ Seventh June two thousand and seventeen I, citizen Vera Ilyinichna Ivanov, born July 22, 1970, born in ________, passport UU UUUUUUU, Ministry of Internal Affairs of the city ______________ April 12, 2000, code XXX-XXX, registration of place residence: _______, st. Malinovskaya, 14, apt. 27 I hereby instruct and trust gr. ___1 full name, identification information, gr. ___2 full name, identification information, powers that allow the persons indicated by me to act on my behalf and, in order to carry out my instructions: to accept inherited property; open and ensure the legal passage of the relevant inheritance case until its complete completion; obtain a certificate establishing the right to the property that was left as an inheritance by the mother of Yulia Gennadievna Usatova, who died in “_”________ 2017, regardless of its composition and location.

To carry out the assignment, I grant the persons I have indicated permission to: submit to the official bodies and authorities the statements required by the procedure, informing about the intention to accept the inheritance; obtain a certificate of title, why put your signatures in concluded agreements with co-heirs on determining the size of property shares and allocating them in jointly accepted, common property, which are associated with a decrease in the number of co-heirs.

I authorize you to request the necessary copies of title and other documentation in the form of duplicates and copies to carry out the assignment, by submitting applications and acting in other permitted ways that are necessary to ensure the ability to: manage inherited property; ensure its safety and maintain proper content and condition, with the possibility of requesting reference information from the BTI on identifying the address, correcting data and correcting inaccuracies in the technical description of the premises.

In order for the persons authorized by me to freely carry out the above instructions, I authorize them to officially declare their requirements in writing, take extracts and all kinds of documented materials from the technical inventory bureau, the Federal Tax Service, specialized notarial structures, various kinds of archival storage facilities, municipal and administrative bodies , structural divisions of Rosreestr, as well as in authorized representative offices of the cadastral chamber, passport offices and other official bodies, to register the right issued in my name, including in state registration services, including cadastre and cartography, to suspend state registration, receive notifications attached to this action informing about the suspension of state registration, receive an official message in case of refusal in the registration procedure, make amendments and additions: to the USRN records with receipt of the corresponding extracts from the register, pay fees and state duties at the necessary established rates, demand and receive documented extracts on the state registration of the acquired property rights and all related documents, as well as sign them and perform legal acts related to the conscientious execution of orders, as if I were performing them personally, except for the receipt of funds or property .

I have set the maximum validity period of the power of attorney at 3 calendar months; the entrusted powers and duties that are intended for proxies can be entrusted to other executors. The meaning and legal consequences of my decision to trust the indicated persons and the essence of Articles 185-189 of the Civil Code of the Russian Federation, before signing this document, the notary clearly, intelligibly and understandably explained to me, my actions are conscious in their legal consequences and correspond to the essence of my intentions. The meaning of the content as a whole and the legal significance of this document are absolutely clear to me, I am familiar with the text personally, I have read it carefully, and also read it loudly and clearly to me. ________________________________ Locality____________. The seventh of June two thousand seventeen.

The signature is certified by _______________________, by a notary n/a ______.

For persons interested in a convenient and inexpensive opportunity to enter into an inheritance by proxy, our company offers the most profitable and productive conditions for legal services. We professionally provide clients with successful passage of succession stages, which include:

- opening of inheritance and notarial inheritance business;

- assessing the value of property and determining the shares of participants;

- competent participation in litigation with co-heirs;

- entry into inheritance by proxy with the possibility of obtaining certificates either by the customers of the service personally or by their proxies;

- other necessary actions.

General power of attorney for inheritance

Our company provides successful results of the succession procedure, confirmed by real guarantees, to customers in all cases without exception, when:

- the legal prospects for fulfilling your order have been preliminarily assessed by our experts with positive conclusions about the possibility of achieving them using a power of attorney for registration of inheritance;

- The terms and conditions agreed with you are formalized by relevant contractual obligations.

The powers to receive an inheritance, which customers of services grant to our company’s employees, do not include the functions of receiving money and completely exclude the possibility of unauthorized management and disposal of property registered in your name by trusted persons.

Additional actions that can be competently carried out by our employees in relation to your property after completing the main order and providing you with a fully executed certificate of inheritance:

- are subject to separate agreements;

- may include issues of management, alienation, etc.

Is it possible to cancel (revoke) a power of attorney for the right of inheritance?

When deciding to transfer powers to our employees, you can, in full and in accordance with the civil legislation of Russia, exercise the right that allows you to:

- change the quantitative and qualitative composition of the actions entrusted to the authorized persons by certifying a new document with a notary;

- completely cancel the validity of the issued document before the expiration of the period of authority specified in it.