An installment plan deal can be beneficial to both parties. The seller solves the problem with the sale of real estate, and the buyer receives an apartment and does not overpay the bank for interest on the loan. The seller is more interested in the correct drafting of the contract, since it is he who provides the buyer with a loan and bears the risks if the receipt of cash payments ceases.

When drawing up a contract, civil law rules are applied . According to Article 489 of the Civil Code, it is possible to sell goods by installments. Installment payment is a payment method in which goods are paid for in installments over a certain period of time. In this case, the contract must indicate the cost, payment procedure, terms and amounts of payments.

If the buyer does not make timely payments or stops paying, then the amount of the penalty (fines, penalties) is specified in the contract. This is the amount of money that the debtor must pay in the event of improper (as provided for in the contract) fulfillment of his obligations (Article 330 of the Civil Code of the Russian Federation).

Under certain circumstances, one of the parties may terminate the contract and file a claim in court.

Peculiarities

- Property price and repayment terms.

- Interest (if applicable). It is regulated by the Civil Code of the Russian Federation (Article 395) and depends on the key rate of the Central Bank.

- Down payment (10-50%).

- Payment schedule indicating the date and amount paid.

- Responsibility of the parties.

- Amount of penalties (fines, penalties). Regulated by the Civil Code of the Russian Federation (Article 330-333).

The last point is very important, since on the basis of it the seller can collect a penalty from the buyer (in case of violation of agreements). also important to stipulate that the apartment will be held as collateral by the seller until the entire debt is fully repaid .

How to formalize an agreement between individuals?

In its content, a mortgage agreement with installment payment is similar to a mortgage agreement, but in a more specific form. If necessary, the payment schedule can be drawn up as a separate agreement to the main agreement.

At the initial stage, it is necessary to prepare a package of documents:

- passports of the parties to the transaction;

- certificate of state registration of rights;

- a fresh extract from the unified state real estate register;

- a document on the basis of which the ownership right is registered (privatization agreement, purchase and sale, donation, certificate of inheritance, by court decision, etc.);

- a recent certificate from the house register about registered persons (housing office);

- receipt of payment of state duty (2000 rubles).

If the apartment is owned or jointly owned, these documents are quite sufficient to draw up a purchase and sale agreement and register the transaction. If necessary, a notarized consent of one of the spouses is issued.

Terms and procedure of repayment

It is negotiated individually and specified in the contract or a separate agreement. In this case, you need to pay attention to:

- An initial fee . It is issued in advance (prepayment) or as a deposit. Can range from 10 to 50% of the cost of the apartment.

- Procedure and payment schedule . It is written down in the contract in separate paragraphs (in numbers and in words) indicating the specific date and amount to be paid.

- Repayment terms . If the remaining payment amount is small, then the contract can indicate a specific date when the buyer undertakes to repay the entire debt. In this case, the payment schedule does not need to be specified.

- Possibility of early repayment . If the installments are paid with interest, then this point is important for the buyer.

- Responsibility of the parties . When signing a contract, each party assumes certain obligations and must comply with them. The seller undertakes to provide the apartment and remove the encumbrance after repayment of the debt. The buyer assumes the obligation to make timely payments.

- Amount of penalty . This clause in the contract disciplines the buyer, as it provides for fines and penalties for late payments. An important point for the apartment seller.

Pitfalls for the parties to the transaction

- The seller risks being left without money and will be forced to prove his rights in court.

- The buyer may be left without an apartment and lose a certain amount of money.

Main points

Before registering property rights, check the terms of the contract, namely:

- passport details of the parties to the transaction;

- data about the property (address, floor, area, number of rooms, etc.);

- price of the object and payment procedure;

- repayment terms (date of last installment);

- the amount of the down payment and the payment procedure;

- clause on the mortgage of the apartment (important for the seller);

- liability of the parties;

- procedure for vacating the apartment and deregistration (deadlines);

- amount of the penalty (in case of non-compliance with the payment schedule).

Is it necessary to draw up a transfer and acceptance certificate?

The act of acceptance and transfer of residential premises can be prescribed in a separate clause in the contract and in many regions a separate agreement is not required (Article 556, paragraph 1 of the Civil Code of the Russian Federation).

If the keys are transferred when signing the purchase and sale agreement, then there is no need to draw up a separate document. It is enough to state that the apartment is considered transferred and the agreement is at the same time a deed of transfer.

The transfer deed is drawn up as a separate document, which is mandatory when the customer is a municipal or state institution. Signed only after acceptance of the premises and receipt of the keys.

After signing the CP agreement, each party assumes certain obligations. The seller undertakes to hand over the apartment in the condition in which the inspection was carried out. The buyer undertakes to make timely payments within the terms established by the contract.

All obligations of the seller and buyer are regulated by the civil code, and all controversial issues are resolved independently or in court. In this case, the party that violated the terms of the contract pays legal costs.

Cost and terms

The price of an apartment is discussed in advance between the seller and the buyer and only then fixed on paper . As for the terms, they are set from 3 to 12 months. It is extremely rare for a seller to go for a longer period, since the money may simply depreciate and the property may rise in price. In this case, the contract must indicate the specific payment amount and date, as well as the form of payment (cash, current account, card, etc.).

Important points

Please pay attention to the important points in the contract, namely:

- Object price. Written in numbers and words. Once signed it cannot be changed.

- Payment period. The contract specifies the date of the last payment as a separate clause.

- Payment schedule. It is paid by agreement between the parties to the transaction, indicating specific dates and amounts.

- Possibility of early repayment.

- Transfer of ownership. After signing the contract, the rights to the apartment are transferred to the buyer. From this moment on, he bears all the risks of maintaining and paying for utilities.

- The act of acceptance and transfer of the apartment. It is prescribed as a separate clause in the contract or an additional document is drawn up (Article 556 of the Civil Code of the Russian Federation).

- Apartment deposit. The residential premises will be pledged to the seller until full repayment. An important point for the seller. Regulated by the Civil Code of the Russian Federation (Article 488, paragraph 5).

- The procedure for vacating an apartment and deregistration. It is discussed in advance and written down in the contract. An important point for the buyer.

- Amount of penalty. The payment schedule, interest (if any) and penalties (in case of late payment) are drawn up in a separate agreement. As a rule, the contract only includes a payment schedule.

There are situations when the buyer does not have the amount of money to buy an apartment and he does not officially work (he cannot provide a salary certificate). In this case, the credit institution can provide the missing amount, but on the security of their own apartment.

When selling a house, pay attention to the clauses in the contract as when selling an apartment. Check the details of the parties to the transaction and the details of the object of sale. The difference can only be in the price and conditions, which are discussed in advance between the seller and the buyer.

Drawing up an agreement without real estate collateral

If you have not encountered this type of transaction in your practice, then contact an experienced lawyer . He will help you draw up an agreement taking into account your wishes. And only after consultations, make a decision on the transaction.

Useful video

We invite you to watch a video in which a lawyer talks about the nuances of drawing up a real estate contract with installment payments:

If you find an error, please select a piece of text and press Ctrl+Enter.

Apartment purchase and sale agreement with installment payment (sample) between individuals

Home » Purchase and sale of an apartment » Agreement for the purchase and sale of an apartment with installment payment

1,757 views

Buying an apartment in installments is a real opportunity to acquire your own home if you don’t have the required amount. However, it is difficult to find a seller willing to wait for payment.

This is due to distrust in the integrity and solvency of the buyer, and instability of exchange rates.

If, nevertheless, the buyer has found a seller who is willing to wait for the money to arrive in the account, it is necessary to conclude an agreement for the purchase and sale of an apartment with an installment plan.

The feasibility of concluding a contract with deferred payment

There is no benefit to the seller from executing an agreement for the sale of an apartment that involves installments.

It is easier to receive the amount in full or at intervals of a maximum of 1-3 months than to wait several years for cash receipts. Realtors note: for every 1,000 transactions for the purchase and sale of an apartment, there are 1-2 with an installment plan.

It is decided to draw up an agreement for the purchase of real estate with the condition of extending the payment period for the following reasons:

- the buyer’s request to wait until the Pension Fund transfers the amount of capital towards the purchase of real estate;

- the need to attract borrowed funds from the buyer, and therefore the purchase is postponed until the mortgage agreement is approved;

- the presence of a close trusting relationship between the seller and the buyer and the latter’s request to provide the opportunity to buy an apartment in installments.

The need to conclude an agreement is determined by the requirements of banks or government agencies issuing funds for the purchase of real estate. They need to provide evidence of the subsequent direction of finance in order to avoid fraud on the part of the recipient of the mortgage loan.

If the installment plan involves a delay in full payment for several months, the seller loses nothing. It’s another matter if payments are extended over a longer period. For the property owner, the risks of non-repayment of funds and a significant decrease in the purchasing power of the monetary unit of account increase.

Underwater rocks

The main threat to the seller of an apartment in installments is the buyer’s failure to fulfill obligations. There could be many reasons for this:

- bank refusal to issue a mortgage;

- refusal of the Pension Fund to issue an MK for the purchase of an existing facility;

- difficult life situation and other circumstances that prevent you from collecting the required amount on time.

To avoid problems, you should include a penalty clause in the contract. According to Art. 330 of the Civil Code of the Russian Federation, the agreement may indicate a specific amount paid by the buyer if the established payment deadlines are not met. To claim a penalty, you must enter into an agreement in writing.

An alternative to drawing up an agreement for the purchase and sale of an apartment in installments is the conclusion of a preliminary DCT and an agreement on a deposit. The deposited amount will be a guarantee of fulfillment of obligations.

If the buyer refuses to pay the cost of the apartment, the deposit amount remains with the seller.

The latter will suffer losses in the amount of double the amount of the deposit if he violates the terms of the concluded agreement and becomes the culprit for the failure of the transaction.

The Civil Code establishes rules that must be followed when drawing up an agreement for the sale of real estate. The form must be written (Article 550 of the Civil Code of the Russian Federation).

Failure to comply with the rules regarding the form of the contract is the reason for its invalidity.

The difference between this agreement and the others is the presence of a clause specifying the procedure for payment in installments.

Sample agreement for the purchase and sale of an apartment in installments with an encumbrance between individuals

Download a sample contract for the purchase and sale of an apartment in installments with an encumbrance between individuals

The agreement is standard, but must be adjusted taking into account the accompanying conditions of the transaction.

Read more about the mandatory clauses of the agreement. It must indicate:

- Details of the parties to the transaction. If a third party acts on behalf of the buyer (seller), you must enter his details, the number of the notarized power of attorney and the date of its issue.

- Subject of the agreement. It is the property being sold - a house, a dacha, an apartment, a plot of land. In relation to the apartment, its address, number of floors, size are indicated, specifying the residential and non-residential area.

- Information about the existence of legal grounds for selling the apartment. The owner must indicate the document through which the right to dispose of the property arose. This may be a purchase and sale agreement, a certificate of inheritance, a deed of gift or another document submitted to Rosreestr to formalize the transfer of ownership. The number and date of the state registration certificate are also indicated (and since 2016 - the registration number and date indicated in the USRN extract).

- Price. According to Art. 555 of the Civil Code of the Russian Federation, the contract must necessarily include the price of the property, otherwise it is considered not concluded. You can indicate the price for the entire apartment, or for 1 m2. If the apartment belongs to several persons, it is allowed to indicate both the full cost and the price of each share separately.

- Conditions for transferring money. The payment procedure, the deadline for making payments, and their frequency must be indicated. You can designate one date by which the buyer undertakes to transfer money for the apartment, or you can create a payment schedule, for example, once a month or quarter.

- Data on the condition of the apartment, on the preparation of the transfer deed. To ensure that the buyer does not make claims regarding the condition of the property, a transfer deed is drawn up. It describes in detail: when the repairs were made, whether there are any complaints from the buyer regarding the object. What is it for? The fact is that, according to Art. 475 of the Civil Code of the Russian Federation, a buyer who discovers defects not specified in the agreement may demand a price reduction, elimination of defects within a limited time frame, or reimbursement of expenses for eliminating breakdowns and defects. According to paragraph 2 of the article, if the shortcomings are significant, you can even refuse to fulfill the contract and demand a refund of previously paid money.

- Information about the need for state registration and a deposit for an apartment. When signing an agreement, you should familiarize yourself with the provisions of Article 488 of the Civil Code of the Russian Federation. According to the law, if the contract states that the buyer must make payment within a certain time or period, but violates these obligations, the seller has the right to demand payment or return of the property. The presence of property as collateral means the presence of an encumbrance that will not allow the buyer to dispose of the property. This is a kind of “safety net” for the seller, thanks to which he can be sure that during the installment period there will be no change of ownership, and the buyer will not be able to evade fulfilling his obligations.

- List of persons entitled to use the apartment. It is of interest to the seller to enter into an agreement with installments if the citizens living in the apartment remain in it for some period (for example, relatives, tenants). The buyer must agree on the deadline for deregistration of all residents.

- The information that the apartment is the property of the seller and was not sold or donated is not the subject of dispute.

- Information about the legal capacity of the parties.

- Data on the need for state registration of the contract.

- Number of copies , place of registration of the agreement and signatures of the parties.

In paragraph 2 of Art. 489 of the Civil Code of the Russian Federation states that the seller may refuse to fulfill the contract and demand the transfer of the apartment back if the buyer does not pay the amount towards the cost of the property within the prescribed period. But if half the price of the apartment has been paid, the seller will not be able to return the property unless the contract provides otherwise.

For example, if the buyer regularly makes payments according to schedule for six months and paid half or more of the amount specified in the contract, and then disappeared from view, the seller will not be able to return the status of owner of the apartment.

However, if we write into the agreement that “...if the payment schedule is violated, the buyer undertakes to return the apartment to the seller, even if we have been paid more than half the cost of the apartment at the time of violation of the terms of the contract,” the seller will be able to demand the apartment back.

So, when concluding an agreement for the purchase and sale of an apartment in installments, the parties must stipulate the price, specify the terms of payment, and approve the conditions for returning to the original state (the seller gets the apartment, the buyer gets money in case of failure to fulfill obligations).

Transfer deed

Any transaction for the alienation of property requires the preparation of a transfer deed.

When drawing up an agreement with installments, it is of particular importance, because it is unknown whether the owners will decide to leave the furniture, plumbing, or, contrary to the agreements, the buyer will find an empty apartment.

The document is a guarantee that all the property specified in it will be transferred to the buyer intact and safe.

Without execution of the transfer deed, the contract is considered unfulfilled.

Other documents for execution of the contract

- To formalize the agreement, the buyer will need a passport, as well as, at the seller’s request, documents on the solvency of the counterparty.

- When making payments using a safe deposit box, the buyer must enter into a safe deposit box rental agreement with the bank to deposit the amount.

- The owner will have to collect a package of documentation:

- passport;

- state registration certificate or USRN extract;

- apartment purchase and sale agreement with installments;

- cadastral passport;

- act of acceptance and transfer;

- personal account statement;

- a certificate about the number of persons registered in the apartment;

- consent of the spouse to complete the transaction;

- consent of the guardianship authorities, if the apartment belongs to a minor or incompetent citizen (in this case, the agreement will have to be certified by a notary);

- power of attorney (if necessary).

The full package of documents can be checked with a lawyer.

About state registration

According to Art. 551 of the Civil Code of the Russian Federation, when concluding an agreement, the transfer of ownership must be registered. If one of the parties is against it, the counterparty has the right to go to court to force the violator to re-register, as well as to compensate for losses associated with the delay. But when is it better to contact Rosreestr if the amount under the apartment purchase and sale agreement has not been paid in full?

The parties must agree in person on the possibility of registering ownership rights. Experienced lawyers advise the seller not to rush into re-registration and wait until all payments under the contract are received. Otherwise, the buyer becomes the owner and the “seller’s power” is to release the deposit once funds are paid.

The situation is different when concluding a PDCP. It is not registered, which means there is no transfer of ownership.

When drawing up an agreement to sell an apartment in installments, the seller can only rely on the buyer’s good faith and his willingness to pay the agreed amount despite unfavorable circumstances.

If you are not sure that the buyer will still be able to meet the payment deadlines, it is better to ask a lawyer: is it worth concluding an installment purchase agreement? What items should be included to guarantee payment? What threatens the buyer if the terms of payment under the contract are not met? A free consultation will be provided by a lawyer from the site ros-nasledstvo.ru.

FREE CONSULTATIONS are available for you! If you want to solve exactly your problem, then :

- describe your situation to a lawyer in an online chat;

- write a question in the form below;

- call +7(499)369-98-20 - Moscow and Moscow region

- call +7(812)926-06-15 - St. Petersburg and region

Selling an apartment in installments between individuals: sample

A significant part of real estate purchase and sale transactions is secured through credit funds taken under a mortgage agreement from a bank.

However, a mortgage can arise without the participation of a credit institution - between citizens.

Selling an apartment in installments between individuals is a flexible and legal instrument that will allow the parties to transfer housing, taking into account the specific financial situation.

Is it worth getting involved with installment plans between individuals: pros and cons

Buying an apartment in installments is another method of payment within the framework of the DCT, along with prepayment, payment at the time of signing the contract or upon completion of registration of rights in Rosreestr. It also has its advantages and disadvantages.

Advantages of installments:

- you can think of fairly flexible installment terms and a payment repayment schedule, taking into account the situation and interests of the parties;

- Only individuals participate, which excludes claims from banking organizations;

- it is possible to agree on both a low interest rate under the contract (lower than in a bank) and generally interest-free payment;

- The interests of the seller are guaranteed by mortgaging the property until full payment is made.

Disadvantages of installments:

- a rather risky instrument - if the parties do not fulfill the agreement, then they will have to go to court for protection;

- there is a risk of not receiving the expected amount on time or not removing the encumbrance on time;

- All documents must be drawn up and controlled by the parties very carefully in order to protect themselves from conflict situations.

IMPORTANT ! The installment plan will automatically arise if the buyer pays with maternity capital funds without using additional money. The Pension Fund transfers money within 2-3 months from the date of registration of rights to the apartment.

What does the law say about this?

The law allows the conclusion of apartment purchase and sale agreements with installment payment between private individuals. As part of the agreement, they have the right to establish absolutely any conditions, in particular:

- full cost;

- the amount of the down payment;

- payment schedule and their amount;

- procedure for making payments (cash, bank transfer, etc.);

- sanctions for violation of requirements;

- procedure for repaying the pledge record.

In the case of selling an apartment in installments, in accordance with Art. 488 of the Civil Code of the Russian Federation, the seller’s right of pledge arises. In other words, until full payment is made, there will be an encumbrance on the property in favor of the former owner. This encumbrance will allow him, in the event of non-payment of the contract, to protect his rights and receive compensation through the sale of the apartment.

The condition of a pledge can be canceled by writing in the contract itself a clause stating that a pledge does not arise. However, in practice, sellers do not agree to such conditions, since this deprives them of a fairly reliable protection tool.

What is a pledge in its essence? It is precisely this that is considered a mortgage within the meaning of the law. It is precisely because of the presence of collateral that an apartment purchased from a private person is considered to be purchased with a mortgage.

The deferred payment also applies to the purchase of primary goods. Installment plans when purchasing an apartment in a new building, as a rule, are developed by the developer himself on favorable terms.

An installment plan should not be confused with an apartment rental agreement with purchase of housing. These are different legal instruments, for the implementation of which completely different procedures are provided.

Transaction procedure

The difference between the algorithm for concluding and executing a contract for the purchase and sale of an apartment with an installment payment plan from a regular DCT lies precisely in the nuances associated with paying for housing. It can be represented step by step like this:

- Search for a counterparty, verification of documents, preliminary agreement of conditions. Some at this stage prefer to conclude a preliminary agreement, but this is not necessary.

- Drawing up and signing a purchase and sale agreement for an apartment with installment payment. This point needs to be given special attention, since it is the DCP that will become the key payment document until full settlement.

- Transfer of housing under a transfer deed and payment of the first installment.

- Transfer of documents to Rosreestr for registration. Specialists will simultaneously record the pledge.

- Payment in accordance with the installment schedule.

- After full payment - removal of the lien in the Unified State Register of Real Estate.

Using this algorithm, you can buy an apartment in installments on the secondary market.

What documents will be needed

To complete the transaction you will need:

- Apartment purchase and sale agreement with installment payment and transfer deed.

- Document of ownership: certificate or extract from the Unified State Register of Real Estate.

- Document-basis of ownership: DCT, inheritance certificate, deed of gift, etc.

- Technical papers: technical passport, cadastral passport (if available), documents on redevelopment (if carried out).

- Confirmation of the absence of registration: a certificate from the passport office, house register, etc.

- Confirmation of absence of debt for utilities.

- Consent of the parties' spouses to the transaction (notarial).

- Receipt of state duty 2,000 rubles.

If there are minors in the transaction, permission from the guardianship authority will be additionally required. In case of sale of a share, evidence of compliance with the pre-emptive right of co-owners is required.

Agreement for the sale of an apartment in installments between individuals: sample 2023

An agreement with installment payment is always drawn up in writing, one document with signatures of both parties. To be recognized as concluded, the text of the agreement must contain:

- Full names of the parties, their passport details and places of registration (according to the passport).

- The subject of the agreement is “The seller sold and the buyer bought”, followed by a detailed description of the apartment indicating the address, area, number of rooms and other information necessary for its identification.

- Financial terms of sale: full price of the apartment, procedure, terms and amounts of payments. This is a very important section of the contract that must be written down in as much detail as possible.

- If third parties remain living in the apartment being sold, a list of them must be indicated.

Additionally, the parties indicate:

- links to the document providing the basis for the seller’s ownership of the apartment;

- the procedure for transferring real estate and drawing up a transfer deed;

- the fact of the creation of a pledge and the procedure for its removal;

- guarantees of absence of encumbrances and restrictions;

- sanctions for violating the terms of depositing money;

- other conditions that the parties deem necessary.

IMPORTANT ! Installment sales do not need to be certified by a notary. A simple written form is sufficient.

If you have difficulties filling out the document, you can seek advice from our on-duty lawyer, who will help resolve any issues that may arise.

You can download the form for the purchase and sale of an apartment in installments here.

Risks of the seller and buyer

Since installment plans involve making deferred payments, rather than the usual one-time payment, the parties to the contract face additional risks. Let's take a closer look at how to sell an apartment in installments without risk.

When selling an apartment in installments, the seller faces the risk of not receiving money within the period stipulated by the contract. An unscrupulous buyer may simply refuse to pay or constantly cite endless “good reasons”. To avoid this, the law provided for an instrument of collateral on real estate until full settlement - the main thing is not to cancel it by the terms of the contract.

In addition, late payment may result in:

- accrual of interest on the amount of debt;

- return of the apartment to the previous owner.

The risk for the buyer is that the seller will avoid removing the deposit after full payment. To force him to do this, you will need to save all payment documents indicating timely repayment of the debt, and then go to court.

Taxes

Upon the sale of the apartment and receipt of money, the seller is obliged to calculate and pay personal income tax (if he owned the apartment for less than the established period - 3 or 5 years). In the case of installment plans, the moments of receiving income are extended over time and often fall into different tax periods (different years).

In this case, income should be declared sequentially for the years in which it was received. Deductions are taken into account at the request of the taxpayer, in accordance with the explanation of the Federal Tax Service of Russia dated February 11, 2015 No. BS-4-11/2049.

For example, if the seller bought an apartment for 4 million rubles, and a year later sold it for 6 million, then he is obliged to pay 13% on 2 million rubles. However, if the installment plan provides for payments of 3 million rubles over 2 years, then in the first year the seller will declare income of 3 million plus an expense deduction of 3 million, and in the next year - again an income of 3 million plus the balance of the tax deduction of 1 million rubles.

So, selling an apartment with an installment plan can be useful if the buyer expects a large amount of money to arrive soon (for example, within six months).

On the other hand, if the buyer’s solvency is clearly suffering, then it is better for the seller to refuse such a transaction.

The decision to use installment plans in each situation is made by the parties to the transaction independently, after weighing all the pros and cons of a particular situation.

If you still have questions on this topic, you can clarify all the remaining nuances in a free consultation with a lawyer. Sign up through an online consultant.

- We also recommend that you find out what is more profitable: a mortgage or an installment plan; perhaps this way of solving the current housing issue will be more convenient.

- We will be grateful for rating the post, liking and reposting.

Agreement for the purchase and sale of an apartment with installment payment sample 2018

Buying a home in the current reality involves using different payment methods. Moreover, this applies not only to the acquisition of real estate in new buildings, but also on the secondary market.

One of the schemes is a transaction under an agreement for the purchase and sale of an apartment in installments (clause 1 of Article 489 of the Civil Code of the Russian Federation). As its name implies, such a transaction provides for payment of the acquired real estate in installments.

However, this option is fraught with risks for both parties. We will dwell on them in detail further in the text of the material.

How to draw up an agreement for the purchase and sale of an apartment in installments

Let's start with the fact that it can be written either in standard form or certified by a notary. In the latter case, the parties will bear additional costs for notarization of the transaction.

Now let’s look point by point at what should be spelled out in the contract itself. Of course, this is a preamble that contains information regarding the seller and buyer, indicating their passports and TIN.

Then follows the subject of the contract, which describes in detail the subject of sale (address, floor, number of rooms, size of living and total area). It is also necessary to indicate the details of those documents by virtue of which the housing is the property of the seller.

It should also reflect the procedure for transferring ownership of real estate, taking into account the fact that it will be provided with installment payment. In particular, the agreement may stipulate that the housing is transferred simultaneously with the conclusion of the contract.

It would be useful to stipulate that until full payment is made, the property is pledged to the seller by virtue of clause 5 of Art. 488 Civil Code of the Russian Federation. This rule of law disciplines the buyer, because the seller can initiate the procedure for selling the sold apartment through the court in order to ensure the buyer’s obligations for full payment.

Financial side of the agreement

One of the main conditions of the transaction is the price of the apartment being sold. It must be clearly stated in the contract. Since we are talking about installment payments, the seller and buyer are required to agree on a schedule for making payments for the purchased property. Otherwise, the deal can be considered unconcluded.

The law does not provide or indicate that payments must be made monthly. Therefore, an agreement for the purchase and sale of an apartment in installments between individuals may provide for a different frequency of payments (once a quarter, every six months, etc.).

It should also be noted that payment for the purchased apartment does not have to be made in equal installments. For example, large amounts of payments can be provided at the beginning and at the end.

It is also important to provide for liability for violation of the schedule. In addition to the penalty, you can also indicate the seller’s right to terminate the contract and take the apartment back.

This possibility exists only if the condition for terminating the transaction is specified in the contract, otherwise the law states that if half of the payments have already been made, the seller can no longer demand the return of the apartment (Part 3, Article 489 of the Civil Code of the Russian Federation ).

This provision does not apply to real estate in the case of mortgage lending.

The payment schedule can be made as an integral annex to the agreement. Moreover, the parties can adjust it at any time by changing both the timing of payments and their amount. At the same time, changes to the agreement for the purchase and sale of an apartment in installments by agreement of the parties are subject to state registration.

Risks for the parties

The main one for the seller is the buyer’s violation of payment terms. After all, if an apartment is sold in installments, then it is possible that you will have to wait years for money from unscrupulous buyers.

The buyer also has his own risks. The main one is that if the payment schedule fails, the seller has the right to take back the sold apartment. In addition, it must be taken into account that there are some categories of persons who retain the right to use the apartment after the sale.

This is especially true in cases of housing privatization. Therefore, if such a fact occurs, then it is important to immediately list such citizens in the contract so that there are no unpleasant surprises for the buyer later.

The seller may deny that another payment for the apartment was made. Therefore, the buyer should keep all bank receipts for payments made (if the money was received into the seller’s account). When the buyer paid for housing in cash, each payment should be confirmed with a receipt from the seller.

The contract may provide that the buyer does not have the right to alienate (resell, exchange, donate) until the full amount for the apartment has been paid. This aspect should also be taken into account.

Finally, if the order of payments is not followed, the buyer risks paying large financial penalties. This point should also not be overlooked when concluding an agreement for the purchase and sale of an apartment with an installment plan.

Installment sales and taxes

If the seller alienates an apartment, he will have a personal income tax liability. In particular, the transaction must be declared in the annual tax return and a certain amount of tax must be paid on it, provided that the apartment has been owned for less than 5 years. This rule applies to real estate acquired after January 1, 2016.

In turn, the buyer will receive the right to apply a tax deduction. It involves the return of part of the personal income tax withheld by the employer from his salary. If, after the transfer of ownership, the installment plan lasts for several years, then the deduction can be used in appropriate parts.

However, you must remember that the right to deduction is limited to the amount for the purchase of real estate. Its size is 2 million rubles.

To apply for a deduction, you must bring to the Federal Tax Service an application and an agreement, confirmation of the transfer of ownership of the home, as well as copies of receipts or bank receipts.

Sample agreement for the purchase and sale of an apartment in installments

To simplify the task of the seller or buyer, you can take as a basis the form of an agreement for the purchase and sale of an apartment in installments, a sample of which any of the participants in the upcoming transaction can download using our resource.

Subsequently, the proposed form can be modified in relation to the content of a specific transaction.

It is always necessary to remember that purchasing housing in installments involves some nuances, which we described above. Therefore, all the terms of the contract should be carefully worked out before signing it. You should also objectively assess your own financial capabilities.

Agreement for the sale and purchase of an apartment with installment payment

Transfer deed to the agreement for the sale and purchase of an apartment with installment payment

Share:

Agreement for the purchase and sale of an apartment with installment payment between individuals

On our website you can download the Agreement for the purchase and sale of an apartment with installment payment sample 2023 for free using the link below.

Typical example of an apartment purchase and sale agreement with installment payment

Download Agreement for the sale and purchase of an apartment with installment payment

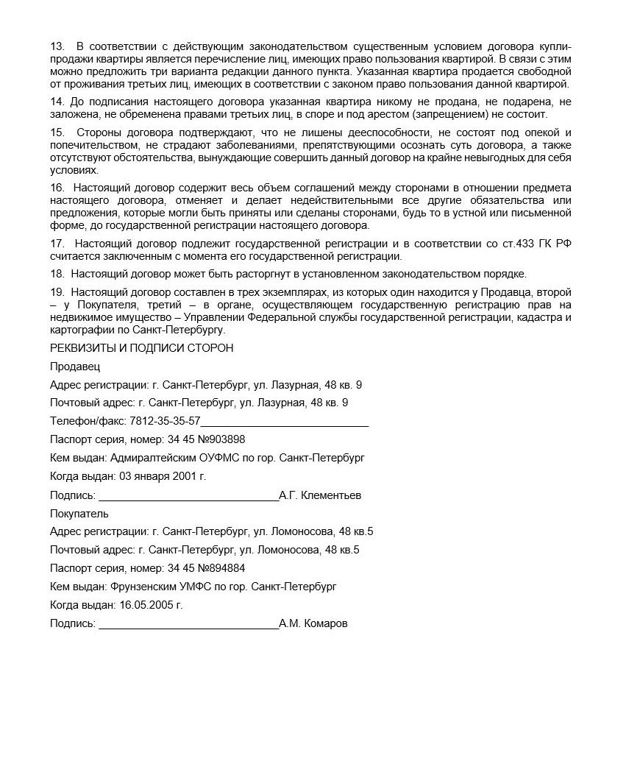

Agreement

purchase and sale of an apartment with installment payment

_______________ "_____" _______________ 20

Citizen ______________________________, passport: series __________, No. __________, issued by ____________________, residing at the address: ______________________________, hereinafter referred to as the “ Seller ”, on the one hand, and Citizen ______________________________, passport: series __________, No. __________, issued by ____________________, residing at the address: ______________________________, hereinafter referred to as the “ Buyer ”, on the other hand, hereinafter referred to as the “Parties”, have entered into this agreement, hereinafter referred to as the “Agreement”, as follows:

- I, Citizen ____________________, undertake to transfer ownership, and I, Citizen ____________________, undertake to accept and pay in accordance with the terms of this agreement the following real estate: an apartment with cadastral number __________, located on the __________ floor ____________________ of the building, located at the address: ______________________________, consisting of __________ room(s) with a total area of __________ sq. m., including living area __________ sq. m.

- The specified apartment belongs to the Seller by right of ownership on the basis of: ______________________________, which is confirmed by the Certificate of State Registration of Rights dated “_____” _______________20, series __________ No.__________, issued by ____________________, registration number __________ dated “_____” _______________20.

- The inventory assessment of the specified apartment is __________ rubles, which is confirmed by certificate No. __________, issued by “_____” _______________20 by the technical inventory bureau of the city ____________________.

- The indicated apartment is sold for __________ rubles. Agreement on price is an essential term of this contract.

- The Buyer undertakes to pay the price of the apartment specified in clause 4 of the agreement by transferring money to the Seller within the following terms: ______________________________. The buyer has the right to early fulfillment of payment obligations.

- The Buyer is satisfied with the quality condition of the apartment, established through an internal inspection of the apartment before concluding this agreement, and did not discover during the inspection any defects or shortcomings that the Seller did not inform him about.

- The risk of accidental death or damage to the apartment passes to the Buyer from the moment of state registration of the transaction in the justice institution ____________________.

- In accordance with Article 556 of the Civil Code of the Russian Federation, when transferring an apartment, the parties draw up a transfer act.

- The buyer acquires ownership of the specified apartment after state registration of the transfer of ownership.

- When selling an apartment on credit, including on credit with payment in installments, in accordance with clause 5 of Article 488 of the Civil Code of the Russian Federation, the apartment is recognized as being pledged to the Seller to ensure that the Buyer fulfills his obligation to pay for the apartment, unless otherwise established by the agreement. From the moment of state registration of the transfer of ownership rights to the Buyer and until the Buyer pays in full the cost of the apartment, the specified apartment is pledged to the Seller. The Buyer does not have the right to alienate the apartment without the written consent of the Seller. After the Buyer makes full payment for the purchased apartment, the Seller undertakes to submit to the body that carries out state registration of rights to real estate an application for termination of the pledge.

- The buyer carries out, at his own expense, the repair and operation of the specified apartment in accordance with the rules and regulations in force in the Russian Federation for the state and municipal housing stock.

- With the content of Art. 167, 209, 223, 288, 292, 549, and 556 of the Civil Code of the Russian Federation are familiarized with the parties.

- In accordance with current legislation, an essential condition of the apartment purchase and sale agreement is the listing of persons who have the right to use the apartment. In this regard, three options for wording this paragraph can be proposed. The specified apartment is sold free of residence by third parties who, in accordance with the law, have the right to use this apartment.

- Before the signing of this agreement, the specified apartment has not been sold to anyone, not given as a gift, not mortgaged, not encumbered with the rights of third parties, and is not in dispute or under arrest (ban).

- The parties to the agreement confirm that they are not deprived of legal capacity, are not under guardianship or guardianship, do not suffer from diseases that prevent them from understanding the essence of the agreement, and there are no circumstances forcing them to enter into this agreement on extremely unfavorable terms for themselves.

- This agreement contains the entire scope of agreements between the parties regarding the subject matter of this agreement, cancels and invalidates all other obligations or proposals that may have been accepted or made by the parties, whether oral or written, prior to the state registration of this agreement.

- This agreement is subject to state registration and, in accordance with Article 433 of the Civil Code of the Russian Federation, is considered concluded from the moment of its state registration.

- This agreement may be terminated in accordance with the procedure established by law.

- This agreement has been drawn up in three copies, one of which is kept by the Seller, the second by the Buyer, and the third by the body carrying out state registration of rights to real estate ____________________.

LEGAL ADDRESSES AND BANK DETAILS OF THE PARTIES

Salesman________________________________________________

|

Buyer ________________________________________________

|

SIGNATURES OF THE PARTIES

Features of a real estate purchase and sale transaction with installment payment. How is the contract drawn up?

To solve your problem RIGHT NOW get

free consultation:

Show content

What it is?

Installment plans involve paying for an apartment in equal installments over a certain period of time. The frequency of depositing funds, the amount of payment and the duration of the installment period are stipulated in the contract. This can be monthly, quarterly or even annual payment. Usually, installment plans do not imply the accrual of interest for the use of money, but there are exceptions.

The necessary conditions

To sell a home in installments, the following conditions must be met::

- The seller, an individual, has the right of ownership to the proposed object.

- The seller, a legal entity, enters into a share participation agreement or sells apartments in a finished building after registration in the cadastral register.

- The buyer has a stable income and is confident in the ability to fulfill the terms of the contract.

Possible methods

- With or without a down payment . The amount and procedure for making the down payment are specified in the preliminary purchase and sale agreement. If the buyer refuses the transaction, these funds are often not returned (if issued as a deposit).

- With and without interest . The interest rate can be either purely symbolic or quite tangible. In this case, the buyer should think about the feasibility of such a transaction.

- Short term or long term . The shorter the period for full repayment of the cost of housing, the more profitable it is for the seller and more difficult for the buyer, and vice versa.

Each method has its own nuances and is agreed upon by the seller and the buyer before signing the contract. If it is possible to come to an option that suits both parties, all the details of the agreement are spelled out in detail in the purchase and sale agreement.

Drawing up a contract for the sale and purchase of an apartment in a new building and on the secondary market has its own characteristics.

In the secondary

Drawing up a contract for the purchase and sale of real estate in installments between individuals consists of the following stages:

- Collection of documents:

- For the seller - a passport, certified consent of the spouse, documents for housing, an extract from the house register, a certificate of absence of debts for housing and communal services.

- For the buyer - passport and power of attorney (if necessary).

- Preliminary agreement on the terms of the contract (down payment amount, payment schedule, total repayment period).

- Signing of the contract by both parties.

- Registration of a transaction with an encumbrance in Rosreestr.

You should pay particular attention to those clauses of the contract that reflect the terms of staged payment:

- Availability and amount of deposit . Usually it does not exceed 30% of the total cost of housing.

- Payment schedule, total repayment period . Here it is necessary to note the exact amount and frequency of payment. It would also be a good idea to include the possibility of early repayment if interest is charged.

- Procedure for calculating interest . Rate, frequency, maximum amount and payment procedure - sometimes interest is paid separately from the main payment.

- Details for depositing funds . When concluding a transaction between individuals, this can be a bank card, current account or cash.

- Responsibility of the parties in case of failure to fulfill the terms of the contract . This point mainly concerns buyers, because... your financial situation may change and payments will become burdensome. The seller has the right to provide for the accrual of late fees and the obligation to keep the property in pre-sale condition until its cost is fully repaid.

At the developer's in a new building

When applying for an installment plan for an apartment in a new building, in addition to everything listed above, you must check the following documents from the seller:

- Charter

- Registration certificate.

- TIN.

- Construction permit.

- Accounting statements.

- Extract from the Unified State Register of Legal Entities.

If the house is unfinished, not an installment plan agreement is drawn up, but a DDU - an equity participation agreement.

Is notarization necessary?

Notarization is desirable, it will protect both the seller and the buyer. For 3-5 thousand rubles. you will receive a document drawn up in accordance with all the rules.

The agreement is registered with Rosreestr indicating the encumbrance, which is removed after full repayment of the cost of housing.

The buyer's ownership of the home arises immediately after registering the contract with Rosreestr, but transactions with it can be carried out only after making the last payment and removing the encumbrance. Until the property is purchased in full, it cannot be sold, donated or inherited without the consent of the former owner.

Features and calculation procedure

It is important to specify in the contract the frequency and amount of payments, as well as the procedure for the seller to confirm the receipt of funds. This could be a receipt, a card statement or a copy of a check.

In case of delays in payments, the seller has the right to demand a refund through the court with payment of a penalty. According to the Civil Code of the Russian Federation, in the event of malicious failure to fulfill obligations by the buyer, the contract is terminated and the housing must be returned to the seller.

Advantages and disadvantages

Given the unstable state of the economy, fewer and fewer real estate buyers are able to fully pay for its cost. Installment is a much more profitable option than a loan or mortgage.

Phased payment over a long period of time is suitable for any buyer who does not want to overpay interest to the bank for a loan. This method is especially relevant for young families, as well as those who are expecting a large influx of funds soon in order to close the payment schedule.

Possible risks and pitfalls

Paying the cost of housing over time, in addition to positive aspects, carries certain risks.

The buyer risks, first of all, that his income may decrease and payments will become unaffordable, which in the worst case will lead to the loss of both money and apartment. Therefore, it is advisable to draw up an installment agreement only if you are absolutely sure of the stability of your income , and not to stretch it out for a long time.

In addition, you should keep all payment receipts to avoid disputes with the seller about the amount already paid.

To avoid problems with removing the encumbrance after fulfilling the terms of the contract, you need to agree in advance with the seller about the timing and responsibility.

When implementing

The longer the period for which the seller provides installment plans when purchasing real estate, the more risks he bears - these include fluctuations in the ruble exchange rate, the financial situation of the buyer, and changes in housing prices.

How to sell an apartment or other housing without risk? To protect yourself as much as possible, you should stipulate in the contract the need to maintain the premises in proper condition (in case the contract is terminated and the apartment is returned to the seller), and also try not to spend all the money received from the buyer at once (for the same reason, because if the contract is terminated, the money will have to be returned ).

What are the differences between such a transaction and a mortgage?

Phased payments for the buyer are always much more profitable than a mortgage . The savings are obtained primarily through interest, which when applying for an installment plan is always much lower than that of banks, or is completely absent. In addition, it is possible to save money on insurance and bank commissions, and time on checking the reliability of the buyer.

The option of making payments when purchasing real estate in equal amounts over a long period of time is beneficial, first of all, for the buyer. Sellers are willing to make such a deal in the event of an urgent departure (for individuals) or at the very beginning of housing construction (in the case of a sale under the DDU).

The successful fulfillment of their obligations by the parties depends on how detailed all the nuances of the transaction are spelled out in the contract.

We already understand that you have a SPECIAL problem.

Call us and we will decide:

Download a sample contract for the purchase and sale of an apartment in installments with an encumbrance between individuals

Download a sample contract for the purchase and sale of an apartment in installments with an encumbrance between individuals