The acquisition of housing in a new building has many benefits, and a person gets an apartment that has never been sold, where no one has lived before, you can say, a clean page.

The new apartment has no owner history, and thus no documentary history, which precludes litigation with previous owners.

In addition, such housing may cost less than a second-market dwelling if it is purchased during the construction process.

But this applies only to part of the country ' s multi-storey buildings, and there are many small and large firms on the Russian market that build houses with irregularities and do not think about the surrounding territory, even if this is provided for by law.

For example, a person buys a dwelling and then learns that there are communication problems at home, or that the house has so thin partitions between apartments that even the slightest noise is heard from the neighbors.

Of course, all of this can be envisaged and found precisely the kind of housing that the owners will settle for 100%, and then we'll give you a step-by-step instruction to buy an apartment in a new building, which will allow you to avoid a lot of unnecessary errors in the process.

Step instruction

In most cases, the purchase of housing in the new structure takes place before the house is put into operation, at the construction stage, and the person must realize that the real duration of a possible settlement is very vague; first, the developer may not be able to rent the house by the specified date; secondly, the time needed to repair the house will have to be spent, since most apartments are sold without interior trim.

In order not to make the wrong choice and avoid possible problems with the developer,The best thing to do is to act like this.:

- A thorough examination of the object;

- Formalize the contract with the developer;

- To obtain keys and an apartment on receipt/transfer certificate;

- I'm gonna book the apartment and sign off on it.

However, no one can guarantee that the house will be rented: the development firm may simply not have the funds, or it may not be able to obtain a building permit (this may also happen after the construction of one, the second, the other floors), which will freeze the process, perhaps for a while, or perhaps for a permanent period.

Housework, which is in the process of being completed, can in principle also be frozen for a variety of reasons, so the first thing a person has to do is get to know the project, check the name of the developer, but this does not rule out any problems.

We're checking the Internet first.We're looking for information, articles that mention the developer, there may be some information in social media, forums, groups of people who have been affected by the actions of untruthful or dishonest builders.

There's another interesting way to test it is to apply to the bank for a loan to buy an apartment in a building house. Credit organizations always carefully examine the situation of the developer and agree to grant the loan only if the house is registered and the documents for it are in order.

You can also ask a lawyer to check all the documents of the developer: information about the site, the project statement, financial and other documents, the building permit, the ownership of the site, all of which are difficult to verify without legal education.

Forming a contract

If the documents are in order and the reputation of the developer is clean and the person is comfortable with the location of the house, the price, the layout, the contract can be processed; however, it is desirable to enter into an agreement with an independent lawyer.

There are three options for acquiring an apartment in a new building:

- Under the contract of assignment of law, such a contract is concluded if an apartment is purchased from a co-investor or previous owner who resells a dwelling; this procedure is regulated by several legal acts and therefore may give rise to disputes, in which case the parties may enter into a transaction that provides for the possibility of buying a finished dwelling in the future or of participating in the construction process; the latter option is subject to compulsory State registration; the buyer must retain the contract of transfer, confirmation of payment, consent of the developer, and the act of transfer of documents.

- Under the equity contract, which is directly with the developer, it is not possible to agree to conclude the so-called prior equity contract, which is contrary to federal law; the offer itself must be questionable to the buyer, since this is likely to indicate that the firm is not in a position to enter into a contract under the law, has problems with the authorization documents, is not ready to assume obligations; while the developers also promise substantial discounts, this cannot be accepted: the only acceptable option remains a full-fledged contract for participation in the equity construction.

- Under a contract with the Housing and Construction Cooperative (HKC), such a cooperative is established by agreement of the future owners of the dwelling; the purchase of the dwelling is effected by the payment of tea, the procedure is not subject to registration and is therefore considered to be sufficiently risky, although legal.

Payment is made only after the conclusion of the contract and its State registration (in the first two cases), and it is again desirable that the transaction be accompanied by a professional lawyer; initially only a portion of the sum may be issued and the rest paid gradually.

The following package of documents will be required for the processing of the contract:

- :: Agreement for participation in the construction of shares;

- Project declaration;

- A certificate of ownership of a built-in piece of land;

- Civil passports of the parties to the agreement;

- Statements by the parties to the agreement;

- Original cadastral plan;

- A plan of the object, indicating the address, the deck, the number of rooms;

- A building permit issued by the public authorities;

To download a sample of the equity contract.

Other documents may be required in some cases.

In any event, the signing of the contract will have to focus on the time limits prescribed for the completion of the construction and the transfer of the dwelling and the documentation for registration, the terms of termination of the contract and the obligations of the parties (which are likely to result in breach of the contract).

We get the keys and the apartment.

After the signature of the certificate of receipt and receipt of the keys, the owner will begin to charge the utility charges. According to the law, the public utilities must be paid only after the establishment of the CRT or the signing of the contract with the operating company, but this usually does not occur immediately after the settlement, but after a period of time, before the costs are borne by the developer, so the tenants are usually required to pay for the LKH for several, not more than four months in advance.

Moving to a new dwelling, and even more so, it is desirable to carry out repairs only after obtaining a certificate of ownership, prior to which BTI specialists may inspect the premises if they find any inconsistencies with the condition of the premises after entry into service, they may request that the rooms be returned to their former view.

We'll take possession, we'll sign it.

You can own the apartment yourself at the Registration Chamber, so much cheaper, but it takes a lot of time and effort, or through a lawyer, and you're gonna need a reception act and a decision to put into service.

After obtaining a certificate, you can apply for a residence permit by applying to the OFMS, and you must carry a passport, a certificate of ownership of the dwelling, a model application for a residence permit and an discharge from your previous place of residence.

Underwater stones

When you buy an apartment in a new building, you can face certain problems, many of them due to negligence or legal illiteracy, but there are other problems that even a professional lawyer can't predict.

Main risks:

- Formation of a contract that does not specify the obligations of the developer;

- A contract for an apartment that has already been sold to other people;

- Freezing the building of the house;

- The long, long-term construction of the house;

- Poor quality of housing;

- Incompatibility of the layout and range of the dwelling;

- Absence of well-established territory.

Legal advice

In order to eliminate such phenomena, lawyers advise that all deals should be concluded only by a notary, which, yes, is a certain waste, but it avoids more serious problems.

General advice:

- Now, the real estate market is not stable, but it's not chaotic. People are often afraid that prices will rise much soon, but usually the growth process rarely goes up, and the recovery often comes at periods of price decline. The best way to measure their strength and ability, to choose the area, to decide with the developer, to test it carefully for reliability.

- It's not a matter of days before a developer is tested. The absence of negative information on the Internet does not mean that the reputation of the developer should be credible. It's probably a young or fake firm that's not going to comply with all the legal requirements. Even if the company's documents are in order, there's indirect proof of its reliability.A firm should be refused if it proposes to enter into a pre-contract of equity participationI mean, it's against federal law.

- If you don't remodel the premises until you get the property rights certificate, so you don't have to correct the BTI requirements. By the way, the checks on the premises by BTI specialists can lead to conflicts with the developer. Let's say the man paid for an apartment with an area of 70 square metres. And the experts will count another five metres. In that case, the developer will have to pay more. It's possible that people won't be able to pay the rent at once because they didn't count on these costs, and some people may even be able to point to the fact that they didn't agree on "over" metres. Of course, all this will lead to litigation with the developer.

A mortgage can be used to purchase an apartment in a new building. You can apply to a bank where you can find a convenient option for a customer. This purchase also requires caution and follows a special pattern.

Buying an apartment from a developer: order of business in 2023

Ask a lawyer.It's free!

The purchase of an apartment in a new building is always cheaper than in a secondary market.

And the sooner a contract is concluded, the cheaper the real estate will be – but on the other hand, we will have to wait longer to finish construction.

What it looked like to buy an apartment from a developer and what the procedure was for 2023 required clarification, as many changes had been made to the law.

How to buy an apartment in a new building

General algorithm

The actions taken to purchase housing from the developer are generally the same regardless of the manner in which the contract was concluded.

- Searching for a developer and a suitable purchase facility;

- Determination of the price and mode of payment;

- The conclusion of a contract;

- Payment - cash, transfer, bank, etc.;

- If there is a breakdown, payment of minimum contributions over a specified period;

- Pending completion of construction;

- Checking and acceptance of the dwelling;

- The registration of property rights.

The new owner can then sign in the apartment and move..

If mortgage taken

A significant difference is made if it is decided to purchase an apartment in a mortgage, in which case the order of discharge will be as follows:

- A suitable developer and an apartment are being searched;

- The future buyer needs to check with the developer the list of banks from which he has been accredited;

- The bank is then submitted with documents confirming the borrower ' s ability to pay;

- If the bank approves the loan, a tripartite equity agreement shall be drawn up;

- The contract is signed first with the developer and then the applicant goes to the bank;

- The representative of the bank accepts the contract and transfers the money to the developer;

- The DDU is normally recorded through the IFC.

If the mortgage is not paid at that time, a new mortgage will be issued.

How to Check the Developer

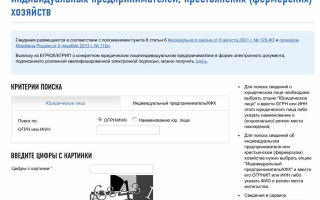

The first and basic stage is to select a suitable developer. It is important to check the legal clean-up deal. If a mistake is made here, you can face a situation in which the construction organization fails to fulfil its obligations and the construction is frozen. You can also check the EGRUL release on the official tax website egrul.nalog.ru:

- The company has all the necessary documents, including permission to build on leased land or ownership of land;

- Feedback from clients who have already acquired an apartment from the developer (can be found on the Internet or communicated on their own);

- Quality and number of completed facilities;

- Photos and video materials on construction;

- Who is the founder and manager of the company, how authoritative these people are;

- The size of the capital stock – if it is only 10,000 rubles, it is likely to be a front firm or another one day;

- Whether there are lawsuits or performance sheets addressed to the developer (can be viewed in the case files on the local court and bailiff sites).

If, after studying all the documents and reviews, the developer seems reliable, then it is worth investing millions of rubles in the treaty.

Possible risks

Buying an apartment in a new building is very profitable (especially when it is still in the boiler stage or when building one or two floors) but there are certain risks that have to be taken over by:

- Bankruptcy of the developer (the Government is currently developing a mechanism to reduce this risk by investing investors in escrow accounts);

- The issuance of a contract for a twice or even three times a sold dwelling;

- Breaking the deadline for delivery of the house;

- "freezing" of the project by the supervisory authorities;

- Poor quality of housing;

- Suspicious "surprises" in the form of a reduction in the total area or poor planning;

- Lack of adequate infrastructure.

Most underwater stones avoid a well-established contract, for example, where money can be sought back in the event of a "freezing" of the building, as well as poor housing quality in other situations.

The dangers of a preliminary treaty

Often, bad-faith developers suggest that a so-called pre-contract be concluded in lieu of full-fledged participation; they say that these documents are equivalent, but because of incomplete construction or lack of any permit from the main DUD, they cannot conclude.

Let's introduce you to a contract that can't be signed..

Pick up a sample of the pre-contract in equity participation in the construction of the multi-quarror house.

In fact, such a contract does not contain an obligation to sell you an apartment – it only compels the parties to conclude a basic agreement, and it may contain moments that allow the developer to give up his obligations.

Thus, the existence of a preliminary contract does not in fact give you the right to demand housing after the completion of the construction, and if the developer refuses to enter into the main contract, he will have to go to court twice.

In addition, the risk of double sale of the dwelling is added.The developer may enter into a basic contract with some buyers and register it in the manner prescribed by law, and the rest will have to return their investment through the court.

Options for the formulation of a contract

There aren't many real options for a housing contract in a new building.And they are all subject to State registration, which further protects the rights of shareholders.

Share participation

The best option is to work under an equity agreement.It best protects the investor's interests and provides full responsibility to the developer for any irregularities during the construction process, and also fears the risk of double sales – a contract is registered in Rosreestre, so the developer will not be able to sell one apartment to different shareholders.

Pick up a sample of the contract for equity participation in construction

The treaty shall specify::

- The characteristics of the object, specifying the address, location, area;

- Planning of the apartment;

- The cost of housing (this value can only be changed if the real area and design are substantially separated);

- Time frame for the delivery of the house and apartment in particular;

- Quality of trim;

- Cash infrastructure (tubes, cranes, plumbers, etc.).

The contract also provides for the liability of the developer to the buyers, dispute resolution, financial mattersetc.

Sales

The contract of sale is also a good option; it, like the DDU, is officially registered, which provides additional protection; it is most often used in the sale of apartments in a rented house.

In fact, the developer or intermediary (real estater) makes arrangements for the apartment and then sells it to the private person.

The value of the dwelling under the contract of sale will be higher than that of the uncompleted, but in terms of reliability this option is better: the apartment is already available, it can be valued and viewed, and a cheaper loan can be taken from the bank, as it will technically be processed as a new building.

Transfer of rights

It's a more complicated option, most often when it comes to buying an apartment from someone else.The person who concluded the DDU has the right to transfer his share to another person.In fact, however, it transfers its right to claim housing from the developer upon completion of the construction, rather than the apartment.

In order not to get into an unpleasant situation, the buyer should examine the terms of the contract in advance and agree on all points of assignment with the developer.

The contract of assignment is subject to State registration, which protects against double sale of the apartment..

Other options

Sometimes, the purchase of new construction takes place in other, somewhat exotic ways:

- The conclusion of an investment contract – the investor actually co-finances the developer by acquiring the right to some of his property, i.e. an apartment;

- An investment in a trust fund – creates a special structure that distributes housing once the house has been put into service in line with what has been put into operation, plus this method is that the rations are tax-free, so that the developer can sell property less cheaply;

- The acquisition of a share in the co-operative – the actual owner of real estate will be a special co-operative (a separate jurist composed of future tenants of the home).

All of these options are more risky than the standard DDU because contracts are not formally registered; in case of difficulty, the problem will be resolved in court or by agreement on the basis of the existing contract.

Which will change from 1 July 2023

President Putin, in a direct line on 7 June, proposed a more "civilized" way of building housing without direct funds from individuals.This in fact means abandoning the usual equity scheme.

The bill currently adopted on second reading is subject to significant changes:

- Companies will be required to obtain a separate licence to build each facility.

- The developer would have to have frozen capital equivalent to 10 per cent of its liabilities.

- There will be no equity contract per se.

- Investors will invest in special escro-accounts, where they will be kept until the construction is completed and then transferred to the developer.

- An escrow account will open a credit line to the developer through which he will build.

All of these measures are aimed at protecting the rights of contributors. If the construction organization fails or fails in principle to fulfil its obligations, the escrow accounts will be returned to all those involved in the construction, and the firm will be responsible to the bank for the property, both its own and its owners.

It is planned that the new law will come into effect on 1 July 2023, and those developers who cannot meet the requirements will be forced to leave the market.

Experts note that innovation undoubtedly protects the rights of shareholders, but is likely to have a negative impact on the price of a square metre, triggering an increase in the cost of participating in equity construction.

Conclusion and registration of a treaty

In order to buy an apartment in a new DUD building, the depreciator will need a minimum of documents:

- Passport;

- Application for the purchase of a share;

- Proof of the necessary amount in the account or approval from the bank for the mortgage;

- Notarized consent of the spouse for the purchase of real property.

The model form of the contract is defined by the developer; the debtor only needs to see it and propose its corrections, if any.

The equity contract is then registered in Rosreestre, with a copy of the buyer ' s passport and the documents for the apartment from the developer to the IFC, usually decided by the developer.

If a contract of assignment is concluded between individuals, they must be present at the time of registration in person.

Once a contract is registered, the parties shall proceed to the calculation.

- By transferring cash;

- Free transfer through the bank;

- with the use of a letter of credit or a bank cell;

- If the mortgage, the bank itself transfers the funds.

If the buyer has made an advance, it is taken into account in the contract; depending on the conditions, the calculation can be done in whole or in parts, in instalments.

How to accept an apartment

Once the dwelling has been put into service, the buyer must have seen the object within 3 months.to draw up a certificate of acceptance and take possession.

- According to the area and planning stated in the project;

- All engineering networks are available and operational;

- No visible defects.

If any deficiencies have been identified, the receipt and transfer certificate need not be signed until the developer has removed them by your instructions. The signature of the certificate means that the buyer has no claim to the quality of the dwelling.

If the defects occur later, during the guarantee period, the developer must repair them at his own expense..

Realization of housing

Once the act has been signed, it is necessary to invite specialists from the BTI to examine the apartment for compliance with the project declaration and to issue a technical plan.

Together with this plan, the act of reception and transfer and the documents confirming the right of ownership, it is necessary to contact the IFC for registration of ownership rights.

Previously, the certificate had been issued, and it was now necessary to request an extract from Rostreestra on its own, and it would be ready in three or four weeks.

With this discharge, you can go to the migration service and make a permanent registration card..

Practical advice on the purchase of new construction

What do you need to know before you buy a new building to avoid problems and not spend a lot of money?

- If you have the opportunity, make sure that you deal with the developer through a notary, which will immediately save you a lot of trouble.

- Don't rush into buying cheap housing from an unknown developer, better pick a proven and reliable option;

- If you are forced to make a deal, scaring the price increase, consider other objects better;

- Do not enter into preliminary contracts, but only full-fledged ones - the exception when an advance is made;

- Better to buy housing in summer and spring, as well as under New Year's Eve – the developer often makes a discount at that time to boost sales and execute the plan;

- The first and last floors of the apartment are cheaper;

- They also often make discounts on apartments outside an elevator or a garbage pipe, with an unattractive view from the window, etc.

Also, the developer often gives a discount if you buy a dwelling at once, for example, in a mortgage; you can arrange for a break-off without a bank's involvement with the developer directly, but in this case you have to be prepared for higher prices.

So the best way to buy a house in a new building is to make a equity contract and register it. This removes many risks and allows the developer to demand an apartment after the construction works have been completed. If the DDU wants to be resold, it can be resold.As of 2023, there's been a change in the rate of participation - all deals will pass through the bank..

QUESTIONS?

What do you need to know about the pre-sale contract?

I want to buy an apartment in a new building in the light of recent developments in the housing market, and I'm careful about buying an apartment in an unprepared apartment.

In such cases, the purchase of an apartment does not take place under an equity contract, but under a pre-sale contract.

And if the developer has already made the apartment his own, it's under a sales contract.

The equity contract provides certain guarantees on the timing, characteristics and quality of the dwelling, if any, but on the pre-sale contract, I found no guarantee, except for one, the period within which the contract itself will be concluded.

Please tell me what risks the buyer can take if it prepares an apartment in a rented housing complex under a pre-sale contract and a contract of sale?

In Moscow, for example, one of the complexes proposes to arrange for the assignment of rights from the developer. How legitimate is this, and is there a reasonable explanation for this?

Oleg P.

The most common option is that the assignment of the right of claim in the language of lawyers is called the contract of an assignment, under which one party to an existing contract transfers to the other its right to claim performance of the obligations under the contract; whoever assigns rights is referred to as the assignor and whoever accepts it as the assignee.

Let's say at some point the landlord decides to sell the real estate, for example, the developer at the construction stage paid for working with the contractor's apartment, and now the contractor wants to sell it and get the money.

However, since the contractor has not yet acquired ownership, it can only transfer its right to an apartment, resulting in a contract of assignment of claim rights, and the contractor in the contract "gives its place" to the new debtor.

The Civil Code calls this "change of persons in obligation".

When they make a deal with a mess.The right to claim DUD may be waived at any time prior to the signing of the certificate of admission and transfer of the dwelling, and the act of acceptance and transfer of the dwelling is signed only after the house has been put into service, i.e. when the developer has completed the construction, the State Commission has accepted the house and now the tenants can reside there.

It happens that the donor does not immediately sign the receiving act, so it is possible to give up the right to share in the contract after the house has been put into service, but within a limited period of time, and there are nuances.

The contract should read as follows: "Because the assignor's rights have not been paid in full (paid in part), the parties have agreed to transfer the debt to the assignee in the amount of 2 million roubles.

The person who gives up the right to demand the developer must hand over the originals of all the documents confirming his right to enter into such a contract.

- Original registered in Rostreestra, DDU, or a certified copy of it.

- Original documents supporting payment under this contract or a certificate from the developer that payment has been made.

A contract of assignment of a claim may also be concluded after the house has been put into operation.

This is usually the period between obtaining permission to put the multi-family house into operation and placing it on cadastral records.

When a home is placed on cadastre, Rosreestre tends to refuse to register contracts of assignment of claims, but in practice this may vary from region to region.

In addition, the developer himself is often not interested in such concessions once the house has been put into service because it is too expensive for him; until he has handed over all the apartments to the landlords, he has to keep them at his own expense; the procedure for registering the contract of assignment usually takes up to 10 days.

In all other respects, in the assignment of the right, there is no difference between the direct contract of equity participation and the actual new payer takes the place of the original payer and receives all his rights and obligations, both before and after the entry into service of the house.

There are several options for pre-contracts related to the purchase of housing, some of which are normal, some of which should alert and some of which are illegal, and I will explain in more detail.

The history of pre-contracts is very complex, and the design of the pre-contract itself is based on the fact that the seller has nothing to sell at the time of the conclusion of the contract.

So the item is not at all, it will appear to the seller in the future under certain conditions and deadlines, or the subject matter of the contract is, but the seller is not yet entitled to dispose of it; for example, it has a mortgage in favour of the bank.

Until the bank gives its consent or the seller turns off the mortgage, he can't sell the apartment.

What we now call equity participation in construction is, in fact, a contract for the sale of future real estate, that is, the seller, the developer, sells an apartment that he undertakes to build, to register for it, and to hand it over to you within a certain period of time.

But there are, for example, preliminary contracts for the sale of real property, which are concluded when the developer has put the house into operation, i.e. the apartment is physically built, but its ownership has not yet been registered.

There are also preliminary contracts for the sale of future real estate.

This legal design is covered up by bad-faith developers in order to avoid State registration of transactions, the requirement of the law on equity participation, etc.

You can't make a contract like this: it's a huge risk, the developer may then refuse to sell the apartment, and you'll have to prove your right to it in court if it's built at all.

There's a chance that the developer will sell the apartment to several buyers at the same time, so only the first person to sign the contracts is entitled to it through the court.

Therefore, if the developer proposes to enter into a preliminary contract for the sale of an apartment in a house that has not yet been put into operation, it is better to be wary.

I would also suggest that such a developer has problems with compliance with the law on equity participation in construction, so it's not worth the risk.

For example, a story from St. Petersburg, a woman bought a pre-sale apartment in a building house in 2010, and the house was only built in 2017.

The buyer settled in the apartment, but could not obtain title to it because the developer avoided the conclusion of the main contract of sale; she was lucky to have the house completed and then moved there.

This is why she was able to prove in court that she had actually acquired ownership of the apartment. If the apartment had not been given to her by act, the problems would have been even greater. The court recognized her ownership of the apartment.

If the house is put into operationThe developer is no longer able to sell unsold apartments under the DUD, and it is not yet possible to sell them under sales contracts because he has not yet acquired ownership.

Usually, a dead period does not last long — from two weeks to two months — and that is perfectly normal. Many banks, for example, issue mortgage loans under pre-sale contracts in a dead period and call it a "dead period mortgage".

A preliminary contract for the sale of an apartment itself is a contract that obliges the buyer and the seller to enter into a basic contract for the sale and to register the transfer of the right to the flat from the seller to the buyer for a certain period of time.

Moreover, the pre-contract is an obligation to conclude a basic contract in the future, and the seller may begin to evade it by simply ignoring the buyer and the promised time limits, and the buyer is likely to have already paid the money — at least the advance.

If the buyer buys apartments under a pre-sale contract in a building that has not yet been built, he risks it; if something goes wrong, such as building a house, or if the developer refuses to enter into a basic contract, it is only in court that his rights can be protected, and the buyer is likely to claim the money in advance.

There are lots of schemes here that can form the rights to future apartments, so I can't give you universal advice, you have to study every particular treaty.

When it comes to buying apartments and you don't understand the scheme the developer offers you, go to the legal clinic. You'd better choose the one that specializes in real estate.

If you have a question about personal finances, rights, or laws, write.We'll answer the most interesting questions in the magazine.

Documents on the purchase of an apartment in a building house

Xenia Evgenyevna, Lawyer, Legal Consulting, Experience in Tax Inspection, date: 6 December 2017, reading time 8 minutes.

The purchase of an apartment in a new building takes place after checking the developer, analysing his documents and partners, the construction progress and other parameters, and before entering into a contract, it is recommended that the buyer obtain information on the manner in which the transaction is processed and assess its reliability, settle the matter with the bank, and borrow funds.

Buying an apartment, including in a new building, is a risk. A developer can go bankrupt, trickle down a few deals on a single site, delay construction. In other words, it's no less dangerous than choosing a dwelling on a secondary market.

Therefore, the main thing to know when buying an apartment at the developer's house is the list of documents that must be available, the optimal form of the contract, the best way to protect the buyer's interests, the likely risks, and the ways to reduce them.

Buying an apartment in a new building: what to know and where to start

- So the first thing to pay attention to when buying a new building is the readiness of the house. If the building is active, there are builders and workers on the site, most of it's already built, and there's a possibility that the developer will finish his business. This is quite contingent, because the building can be shut down at any time.

It is also recommended to assess the investment attractiveness of the apartment. It is expressed in a combination of parameters: distance from transport, infrastructure, parking, green areas, land improvement plan. If an object is literally in the field, it will not buy apartments because of numerous restrictions.

Which means the house can turn into a long-term home.

- Good feedback on the developers hired by the contracting companies, usually the same developers in the big cities that everyone knows about, they're stable, they always finish construction, they don't cheat, you can ask questions about the company's activities in person with sales managers.

- The choice of contract: This criterion may be used to assess the reliability of a potential counterparty. The various schemes used by developers to avoid taxes and other frauds do not add weight to the buyer ' s eyes.

- Study of the developer, his documents and other parameters.

Pay attention!The number of cheated shareholders in Russia has been halved in five years (as of 2016).

Normative framework

The basic document that regulates the relationship between the developer and the buyer – FL No. 214 of 30 December 2004 – sets out the rules governing the activities of the developer, the procedure for the conclusion of the contract of equity participation in the construction, and the requirements for its content.

The following information may also be useful:

- For a sales contract, chapter 30 of the Russian Civil Code regulates this area of activity;

- Preliminary treaty - Chapter 27 of the Russian Civil Code (art. 429);

Buy an apartment in a new building: expert advice at all stages

Buying an apartment is an important and difficult task, and a potential buyer is faced with a huge, fantastic world with new constructions for all tastes and wallets.

And buying an apartment on the primary market in a house that's just starting to build is also very risky. In this article Novostroy-M.

Ru will tell us how to proceed well at all stages of the acquisition of housing in the new structure of Moscow or Podmoskovya.

- Pick a new structure.

- It's all personal, but, as Maria Litynetska notes, the CEO of Metroum Group, in order to make the right choice, needs to determine the purchase budget, based on which options are sought in a particular area.

- "It is worth examining average real estate market prices within the range and class of housing in question: today there are many articles on the Internet that include an analyst of large companies. If the price of the project is very low, it should alert."

- Natalia Nemchaninova, Adviser to the Director General for the Sales of the OAO "OPIN"

The key is whether you invest or want to buy an apartment to live in yourself.

If it's a quick earner, and you plan to sell an apartment on a trade-off when it grows at a price, or on a secondary market when the house is put into service, that's one thing.

If you choose a new structure for life, it's a very different matter, and it's important to analyse both the level of infrastructure, the transport development of the area, and much more that fits you specifically.

Assess your capacity to buy a dwelling — can you pay the full amount or plan to buy an apartment in instalments or mortgages? Find out whether the housing complex at the bank on which you are on the map is accredited; whether the military mortgage in the project works, whether the developer accepts the capital of the mother, or whether, because of the lack of accreditation of a certain bank, a person can choose another new development.

Developer vs real estate developer

By the way, weighing the pros and cons can help an experienced real estate agent. How do you know who's better off buying an apartment? If you're sure about the new structure, go to the developer, if you have an estimated amount of money that you just want to invest properly without being tied to a particular project, go to the realtor.

The developer has only his own housing pool, he can't offer new buildings to a rival, and the realtor has a base of new structures from a few developers, and therefore he has more choice.

"Vartan Pogosyan, Director of Marketing, TEKTA GROUP, often helps clients to sell their old homes to buy new ones, which most developers cannot boast of," notes Wartan Pogosyan.

Contact large agencies that have long worked in the real estate market, "most often as a single window, solving much faster design issues," says Maria Litenetsky.

Minus working with the realtor only one is a commission, often hidden.

Internet exploration

We live with the age of computer technology. Today, almost every "serious" development has its own website. Sometimes it is supplemented by a promo page on the website of a developer or a salesman (real estate agencies). It also usually includes a forum. It is also a product of a developer, and sometimes it is created by buyers, both potential and present.

And, of course, social media -- these days, there's nowhere to go without them. To complete the map, you have to look at everything. Start with the site of the new building, look at the sections of the documents, the builder.

If there's a project declaration, a construction permit, a communication document, it means the developer has nothing to hide, and you have nothing to worry about, which is the "transparency" of the project when all the documentation is publicly available.

The developer or the developer?

Read the history of the developer or developer. How are they different? It's simple. The developer is a company that develops the project from "A" to "I", because to develop from English is to develop, develop, and therefore the developer is involved in the whole building complex, from the choice of land to the commissioning of the dwelling.

The developer works exclusively on construction, he does not develop anything, the documents are not approved by the officials, he either builds the house himself or supervises its construction if the developer decides to hire a general contractor (relevant to large residential projects).

Note that if a housing complex is built by a poorly known U.S. under the brand of a large company, it is likely that the development company was created specifically under the new structure, in which case there is no need to worry about the unknown nature of the developer, because he is building the complex under the wing of a large developer.

In any case, in order to assess the reliability of a developer or developer, Vartan Pogosyan recommends checking the existence of a good business reputation, substantial market experience and portfolio of projects implemented.

But let's get back to the site.

Note the content of the portal, is it "living"? How often is the "news" section updated? Is there a webcam working? Is the online consultant function fulfilled? All this important, because the site of the renovation is its "portret." As Natalia Nemchanininov points out: "It all demonstrates the responsible approach and attitude of the developer towards his clients, both the buyers and the potential.

Visit to the construction site

So you've decided on a new structure, and you've looked at its website, as well as forums to determine the reliability of a developer or a developer, and it's time to call the sales office, to specify the time of the construction visit, because it's better to see, as they say, once than a hundred pages of forums to read.

However, if you do not have time to visit the site or the developer's policy does not require visits due to Novostroy-M safety.

ru can help you: look for your housing complex among the Video New Structures from the Air; maybe you can find your object in the Aerophoto-Simulation section; and our video-installors have already made a lot of videos about Moscow and Pomoskovya's new structures, and the main thing is to check the housing complex for you may be our Privy Buyer, just leave the application.

If you are able to get to the site, note the pace of the construction. It is important to assess the state of the site, whether the building materials are chaotic or normal. Do you have a job or perhaps a lunch break? Please note that the monolithic houses are built slower than the panels.

Sales office

Usually there are sales offices at the facilities where you'll be advised about everything. If you're lucky to have a sales manager, he'll tell you not only about all the nuances of buying an apartment in a new building, but also about the company and the neighborhood.

The manager should show you the documentation you saw on the site: the project declaration, the building permit (which will specify the status of the land) and the communication paper. As Novostroy-M.ru told the city 21st century developer's lawyer Vasily Sharapov, he would ask you to show:

- - The founding documents of the developer;

- - State registration of the developer;

- - a certificate of registration with the tax authority;

- – Accounting balance and income statement;

- - Audit report for the last year of business development by the developer.

However, all of these documents may not end up in the sales office at the construction site, so we recommend that you do not neglect your trip to the central office of the developer or the developer, where you are required to present the full documentation.

"If the seller does not provide any of the above documents, he probably has something to hide.

Natalia Kozlova, Commercial Director of Sampo

According to Sophia Lebedeva, the basic information about the developer and the building house can be obtained from two documents: the EGRUL statement on the lawn and the project declaration. "You will learn from the release the necessary information about the lawn, from the project declaration – what documents the developer has and what his plans for the construction of the project are", the expert clarified.

Let's make a deal.

You've chosen an apartment, you've made sure that the developer is reliable, you've got to keep an eye on the Web camera on the building site, and it's showing a good rate of construction -- it's about time you entered into a contract to buy an apartment.

Most of the new structures are now being implemented in the Moscow region for 214-FZs through the conclusion of a equity contract, but some developers prefer to sell housing through joining the JSC, and you may also encounter a contract of assignment of claim rights (if an attractive apartment has already bought a physical person before you but wants to sell) and a pre-contract.

- "It is not necessary to buy an apartment from a developer who proposes to enter into a pre-contract or purchase a promissory note; in both cases, the money is handed over at the time the documents are signed, but the buyer does not receive any guarantee in return."

- Sophia Lebedeva, Director-General of MIEL Novostrostria

- A pre-sale contract is safe to conclude if the house is built but has not been given up, in which case there is no fear of failure, but if you are asked to sign before the DDU, it makes sense to think about it.

"To date, the surest way to protect their rights as a future co-investor is through the DDU's conclusion. It is subject to public registration, thus eliminating the risk of double sales, as well as requiring the developer to respect the deadline for delivery of the house. Any delays will be subject to fines," says Maria Litinetska.

If the developer asks you to pay the rent before registration of the DDU, it's a violation of the law.

According to Dmitry Pantelmonov, Director of Marketing and Sales, Team Leader, the following parameters must be specified in the DDS: the design number of the apartment, the layout of the apartment with the metres of all the premises, the total (taking into account the summer space calculated by the downward factor) the size of the apartment and the number of rooms, its location on the floor and the floor number; the time frame for the completion of the construction and transfer of the dwelling to the buyer, the time frame for the issuance of the title (if you have signed a contract with the developer for the provision of the services); the cost of the apartment (full or one square metre); it is also worth paying close attention to the grounds for its dissolution specified in the contract.

Irina Goodhotova recommends careful consideration of the signing of the treaty: "After the conclusion of the DDU, it will not be possible to change the apartment: either it will be necessary to break the DDU (usually at the initiative of the debtor, punishable by non-consensual penalties) or to sell the apartment on a trade-off and buy another one."

The JSC is the most controversial form of buying an apartment: the contract is not registered in Regpalat, so your pi can buy a second, the JSC can't protect itself from long-term growth, much less disgruntling. Novostroy-M.ru met with the cheated Su-155s, all of whom were victims of the SSC contract.

The contract of assignment (in simple terms) also has its nuances, the main one of which is that the developer may simply not allow you to purchase a share from the previous buyer if the buyer is dumping in price.

Mortgage: Features of purchase

"A potential mortgage borrowers today should not only carefully choose a bank, but also properly assess their own financial capacities, taking into account all possible risks, including personal, that is, domestic, " considers Dmitry Pantelmons. " It is obvious that it is impossible to take a mortgage on those who lack confidence in the current job: if they are dismissed, the unemployment rate is rising. "

So you figured you could get a mortgage, apply to the bank, and get a loan approval.

Yuri Commissionerenko, Director of the Sales Department of ICE, describes the way forward: the developer's representative negotiates a mortgage with the representative of the bank, and the date of the transaction is set.

In the bank, the donor signs the loan contract, then the developer ' s office signs the DDU. Once the DDU is registered, the buyer pays the initial contribution, and the bank transfers the remainder of the money to the developer.

Maria Litinetska emphasizes that if the bank allocates funds for the construction of a particular housing complex and is itself a financial partner of the project, the likelihood of a successful completion of the project is close to 100 per cent, in agreement with the colleague Irina Goodhotov, who believes that if the new building is accredited to a large bank with State participation, this minimizes the risk of the debtor.

"The same is true of mortgage lending: In a situation where banks have little or no mortgage in the early stages of construction, the ability to obtain credit even at the boiler stage is proof that the bank has complete and complete confidence in the developer and "believes" in the project," the Lithuanian emphasizes.

We're taking the apartment.

You've bought an apartment, you've got a contract, you've got a house built, you've got to take a place, and this is a very important point, because if you find a fault after you sign up for the reception-transfer certificate, the developer may refuse to redo anything, and we advise you to read our article carefully about what needs to be looked at when you take up the apartment in the new house.

Developer or Bank — Bankruptcy

Despite the fact that the authorities are keeping the real estate market under close review today and making sure that there are no cheated shareholders or mercenaries, they still exist.

"Today, the risks to shareholders are lower than, for example, during the 2008-2009 crisis, as there was no compulsory development insurance law (in force since 2015) or amendments defining the bankruptcy of construction companies (adopted in 2011)," notes Irina Goodhotov.

In the expert's view, as a sign of reliability, the start of sales is not at the boilers, but at the construction stage, which means that the developer has already invested his own money in the project, and he needs less money from the shareholders.

And what to do to a buyer if a bank in which he took a mortgage failed or his license was revoked? The Altukhov Grigory, the commercial director of the Leder FSC, suggests that even if the bank is closed for any reason, he must have a successor, with whom he will continue to make further calculations.

This view is shared by Yuri Commissionerenko: "When you go to a small bank, the client risks nothing; in the event that the bank fails or remains without a licence, the loan will be granted to another organization, the loan terms for the borrower will remain the same".

Date of publication 15 July 2015