What is an advance agreement when purchasing an apartment? During negotiations between the parties involved in a purchase and sale transaction, a situation may arise when the buyer wants to secure the selected premises. To confirm the seriousness of intentions to further complete the transaction, he can transfer an advance payment to the seller. It is in such situations that an advance payment agreement when purchasing an apartment comes in handy.

Buying an apartment is a very responsible process, often involving large sums of money.

Registration of a purchase and sale transaction has a large number of nuances that can lead to dire consequences if you do not know them.

Concluding an advance payment agreement is only the beginning of the journey in completing a purchase and sale transaction, however, it is one of its important parts that requires a lot of attention. It sets the tone for the entire process.

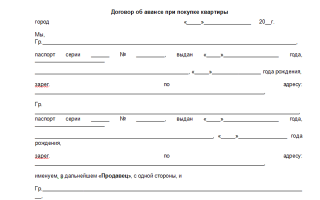

Download the advance payment agreement form for purchasing an apartment in 2023

When selling a secondary home, the advance agreement (agreement) is written in free form, with the participation of all interested parties. There are options when, on behalf of the Seller or Buyer, the advance payment is made or accepted by an authorized person (real estate agency).

An agreement on an advance payment for an apartment can be concluded and completed in a notary’s office. This measure is not mandatory, however, the presence of a notary in the transaction will guarantee the correctness of the procedure for transferring the advance payment. In this case, he is a witness to the fact of the transfer of money from hand to hand. This significantly reduces the likelihood of a deal falling through.

An equivalent document to an advance agreement is a preliminary agreement for the purchase and sale of an apartment with a deposit when making a transaction for the transfer of an apartment between individuals. They are similar in structure, but the main emphasis in the PDCP is on listing the points of a future transaction, to secure which funds will be contributed by the Buyer.

What is the difference between an advance payment agreement and a deposit agreement?

The legislation does not explain the concept of an advance; it is only mentioned when considering the concept of a deposit in matters of purchase and sale of real estate.

Advance and deposit are forms of preliminary payment, however, there are certain differences between them:

- when concluding an agreement on a deposit, the buyer cannot return his money; with an agreement on an advance payment, on the contrary, it is possible to return the money;

- When concluding an agreement on a deposit, the seller, breaking the deal, is obliged to return the funds in double amount; with an advance agreement, such a need disappears.

In real life, Sellers often avoid receiving an advance payment in the form of a deposit, preferring an advance payment with various additions.

Thus, the advance agreement may include clauses regarding penalties on the part of the Buyer. If he evades the deal, the advance is withheld as compensation.

If the seller changes his mind, he simply returns the money taken without penalties (Clause 8 in the contract form).

Of course, this infringes on the rights of the Buyer, but these are the rules by which the real estate market in Russia operates today (Article 381.1 of the Civil Code of the Russian Federation).

Therefore, for both one party to the transaction and the other, an advance agreement is the most preferable option.

How to draw up an advance payment agreement in 2023?

There are requirements in accordance with which the advance agreement is filled out. In the legal field, regulation is carried out using Art. 429 of the Civil Code of the Russian Federation. Completing the contract begins with filling out the header of the document.

First you need to indicate the place and date of the agreement. As a place, just write the name of the locality. The date is indicated in the format DD.MM.YYYY. Next, we fill out personal data about the parties to the transaction. For both sides it is indicated:

- FULL NAME;

- Date of Birth;

- registration address;

- passport data (series, number, date and place of issue).

After filling out the header, you can proceed to filling out the main part.

Point 1. It is necessary to indicate:

- name of the object of the transaction, for example, “apartment”, “share in an apartment”, etc. The title can be found in the Certificate of Title;

- Address of the object;

- The equivalent cost of the object is also indicated.

Clause 2. The person or group of persons who will act as future owners is indicated.

Point 3. Designed to fill in the characteristics of the object. The first part of the paragraph indicates data on the area of the object. The area of the apartment is indicated separately: common, living, kitchen.

This paragraph also indicates information about the phone, its availability, number, whether it is paired or individual.

Clause 4. It is necessary to indicate the amount of the advance payment that was handed over to the seller.

Clause 5. Intended for entering data about the owner of the apartment. It indicates the name and details of the title documents.

Clause 6. Necessary to confirm important information on the part of the seller to complete the transaction. In particular, it is confirmed:

- that the object is not encumbered and that the right to use it is not limited;

- list of persons registered in the apartment;

- that no illegal redevelopment was carried out in the apartment;

- whether or not it is included in the list of residential areas for demolition, reconstruction or major repairs;

- no ban on registering third parties in the apartment;

- the reliability of the title documents used to complete the transaction.

Clause 7. The seller’s obligations are prescribed to provide all necessary documents to the buyer to complete the purchase and sale transaction within the established time frame.

Clause 8. Stipulates the amount of the penalty that the Seller will be obliged to return if the deal fails due to his fault.

Clause 9. Contains information that the money remains with the seller in the event of a deal failure due to the Buyer’s fault.

Clause 10. The conditions under which the Seller returns the entire advance amount to the Buyer are agreed upon.

Clause 11. The place of the transaction is indicated.

Clause 12. The procedure for completing the transaction is stipulated:

- calculation procedure;

- type of alienation agreement (notarial/simple);

- registration period in Rosreestr.

Clause 13. Indicate who will pay the costs associated with the transaction.

Clause 14. It is necessary to indicate the date of entry into force of the agreement.

Clause 15. Contains information about the fact of transfer of the advance and the number of copies of the completed application.

The contract ends with the full names of the parties involved, as well as their signatures.

Features of concluding an advance agreement when purchasing an apartment

Filling out an advance payment agreement has its own characteristics, which are very important when drawing up and can affect the legality of the document and the completion of the entire apartment purchase and sale transaction:

- Advance amount . Typically, when making a purchase and sale transaction, the amount of advance payment is 5-10% of the total cost of the apartment.

- Display the amount . In addition to the digital expression, all amounts in the contract are indicated in words.

- Authenticity of documents . Before drawing up an agreement, you must ensure the authenticity of the documents provided by the opposing party.

- Corrections . It is prohibited to correct the content; the document loses its legal force. Marks are also not allowed. In any doubtful situation, it is better to rewrite the contract again.

- Number of copies . When concluding, it is necessary to draw up such a number of contracts that each person appearing in the document has one copy.

Refund of advance payment for apartment

- If the deal falls through, the advance must be returned to the Buyer. The procedure and terms for its return must be specified in the advance payment agreement, otherwise this procedure may take a long time.

- You can also stipulate in the agreement penalties for non-compliance with the procedure for returning the advance payment.

- To return the advance payment, it is necessary to draw up a written document - Agreement on Termination of the Contract. If there are no claims from both sides, you can destroy all documents drawn up earlier.

How to return the advance payment for an apartment from the seller if he is hiding?

In this situation, to begin with, the Seller is sent a pre-trial claim in writing with a requirement to fulfill the obligations to return the advance payment specified in the relevant agreement. If there is no response, we go to court with a statement of failure to fulfill our obligations, or you can also contact the prosecutor’s office on the fact of fraud.

Nuances and risks when buying an apartment in case of an advance payment and a deposit

How to properly draw up an advance payment agreement when buying an apartment?

The advance agreement is a mandatory document when buying/selling an apartment.

Agreements on the transfer of rights to residential real estate are usually concluded on a daily basis. Not only the buyer and seller participate in such transactions, but also possibly realtors or various real estate agencies. In the case of the participation of specialists, the parties feel more comfortable and confident, since a person with special knowledge controls the progress of the process.

However, the parties do not always resort to the help of professionals. In this regard, they need to have some knowledge that will help them draw up the agreement correctly and protect themselves from possible risks.

Since the buyer does not always have the full amount to pay for the apartment, many sellers are ready to take an advance and then the rest of the cost. In this case, each of the parties to the agreement should be aware of the procedure for concluding an agreement on an advance payment when purchasing an apartment.

Sample of a standard advance payment agreement for the purchase of an apartment

The agreement to make an advance payment must be in writing. Before signing it, the parties must agree on the following provisions:

- Advance payment amount. Due to the fact that the advance represents a part of the total amount that must be paid, it must be calculated based on the total cost of the apartment. In practice, the parties initially agree on the total cost of the property. Only after this provision has been agreed upon can the parties agree on the amount of the advance. It can be set either as a percentage of the total amount or as a fixed amount;

- Procedure for making advance payments. The parties must determine how the funds will be deposited (cash, non-cash), the period of time in which the funds must be deposited; about the procedure for writing a receipt by the seller after receiving funds. All of these provisions must be specified in as much detail as possible in the text of the agreement. This need is caused by the possible subsequent protection of one’s interests in court by this document;

- Object of the purchase and sale agreement. The residential real estate property in the agreement should be described in as much detail as possible. The parties must indicate its location; if it is an apartment, then its number must be indicated. It is necessary to indicate its technical characteristics and area. If the seller is in an officially registered marriage, they must provide the consent of the spouse to complete the transaction. The text must indicate all the features of the transferred residential property (presence of registered persons or any encumbrances);

- Responsibility of the parties in case of violation of the provisions of the agreement. The parties must agree on measures of liability in the event that one of them violates the provisions of the current agreement, as well as indicate methods of judicial protection of violated rights.

If a realtor takes part in the transaction, then he offers to draw up a plan for depositing funds, which will be an annex to the contract for the purchase and sale of a real estate property.

The text of the agreement must indicate the date of drawing up and signing the agreement on the purchase and sale of the apartment. It is mandatory to reflect the personal and passport data of the parties to the transaction. At the end of the document, the parties put their signatures. From this moment the form receives its legal force.

- Download a sample advance payment agreement for the purchase of an apartment.

- Download the advance payment agreement form for purchasing an apartment.

- Download a sample agreement for the purchase and sale of an apartment under a Sberbank mortgage.

- Download the form of an apartment purchase and sale agreement with a Sberbank mortgage.

- Download a sample contract for the purchase and sale of an apartment by proxy from the seller.

- Download the form of the agreement for the purchase and sale of an apartment by proxy from the seller.

As previously mentioned, the document must be in writing. Oral agreements will not have legal force.

Before signing it, it is necessary to agree or reach mutual agreements on the following conditions:

- The amount of the transferred advance;

- The procedure for transferring funds, as well as their form;

- Liability measures applied to a party in case of violation of accepted provisions.

When deciding on the amount of the advance, the parties calculate it based on the cost of the apartment.

When determining the procedure for depositing funds, the parties must determine:

- Form of depositing funds (bank account, card or cash);

- The period of time during which funds must be deposited;

- The procedure for drawing up a receipt after receiving funds.

About the apartment, as previously mentioned, the following information must be indicated:

- Location, its condition, area, technical characteristics;

- Information about the presence of persons registered in the apartment;

- About the presence of encumbrances imposed on the apartment.

- We recommend indicating the circumstances under which the parties have the right to refuse to fulfill the agreement or apply to the court to protect their violated rights.

- In order for the agreement to be correct and not be a reason for the transaction to be subsequently declared invalid, we recommend entrusting its drafting to a specialist with sufficient knowledge in this area.

- If this is not possible, then before signing it you need to go to the Internet to familiarize yourself with standard samples of such documents.

The law does not determine the maximum or minimum amount of the advance payment charged from the buyer of the property. The amount of the advance payment is set by the seller independently.

As a rule, the advance amount should be commensurate with the cost of the entire apartment. It can be set either as a fixed sum of money or as a percentage of the total cost of the apartment.

The seller must understand that the amount must be such that the buyer can part with it, since in the case of purchasing housing in installments, it is obvious that the buyer does not have large sums of money. On the other hand, the seller must protect himself from an unscrupulous buyer, since various types of scams can currently be found in the real estate market.

Of course, when the seller expects to purchase a new residential property with the proceeds from the sale of an apartment, he is interested in quickly receiving the entire amount. In this regard, the main task, if the condition for making advance payments is permissible, is to agree on all conditions with the buyer.

Experts recommend not setting a large down payment amount, since the seller will already receive the entire amount of funds established for the sale of the apartment, just not immediately.

Such recommendations are justified by the fact that by asking for a large advance amount, the seller may frighten the potential buyer, as a result of which the latter will refuse to participate in the transaction.

Advance and deposit agreements when purchasing an apartment

When selling or buying an apartment, the parties to the transaction secure all decisions and actions in contracts. The agreement should be drawn up competently and professionally, so that there are no future problems due to an incorrectly drawn up document. First of all, you should draw up an advance or deposit agreement. It would seem that nothing is simpler, but there are differences in their functions that are important for both the seller and the buyer to understand. Therefore, let's learn to distinguish between these concepts in order to be protected.

An advance is a cash advance payment, which often does not exceed 10% of the cost of the apartment.

Let us note that there is no clearly formulated concept of “advance” in the Code of the Russian Federation or in other documents. In order to understand it, it is necessary to study the functions and mechanisms of the advance from a legal point of view. In turn, the concept of “deposit” has a clear definition, which is spelled out in the Civil Code of the Russian Federation (Chapter 23, Article 380).

A deposit is a sum of money that is proof of the concluded contract and the fulfillment of its terms.

According to the above article in the Civil Code of the Russian Federation, if there are doubts regarding the deposit agreement, then the funds transferred to the seller will be considered an advance.

What is the difference between a deposit and an advance

In order to avoid problems in the future, you should learn to distinguish between an advance and a deposit. Let's take a closer look at their main differences.

As we have already said, there is no exact definition of what an advance is. However, there is a regulated system of relations that requires partial and full prepayment. In turn, the advance payment does not oblige the parties to fulfill the requirements of the contract. Each party can terminate the agreement without consequences, and the buyer receives his advance back.

In the case of a deposit agreement, things are different. Here the conditions are more controllable and the parties undertake to compensate for losses if the contract is violated. So, for example, if the transaction is broken due to the fault of the buyer (there can be many reasons), then the deposit is not returned. In this case, additional compensation is provided.

Another scenario is that the contract is terminated due to the fault of the seller. Then the latter undertakes to return the funds previously transferred to him. In case of refusal to return, the buyer may demand compensation in court, with the imposition of penalties.

It should be noted that in practice, an advance agreement with additional conditions is more often used, which will stipulate possible fines in case of violation of the agreement. In this case, the parties to the transaction have the right to indicate the amount of compensation at their discretion.

How to draw up a deposit agreement when buying an apartment

The deposit registration scheme includes:

- advance payment amount;

- responsibilities of buyer and seller.

The content of the contract must contain certain data:

- about property owners;

- about the buyer and seller of the apartment;

- evaluating characteristics of the apartment;

- about the amount to be paid as a deposit;

- about the apartment (location, size, etc.);

- deadlines for transferring the deposit;

- additional conditions that are established by both parties to the transaction.

The deposit agreement obliges the two parties to fulfill the terms of the agreement. Otherwise, one of the parties may lose a large amount of money.

Don’t forget about the receipt, which will confirm the receipt of funds from the buyer to the seller. This document is always written manually with a ballpoint pen. This is explained by the fact that someone else's handwriting cannot be faked. Consequently, the buyer will protect himself from possible fraud.

Download a sample deposit agreement when purchasing an apartment

Advance agreement for purchasing an apartment

The advance agreement is drawn up in writing. In order to be confident in all the nuances and the correct drafting of the agreement, you need to seek help from realtors.

The latter, in turn, already have samples where the details of the agreement are spelled out. However, you should know what should be in the contract itself, as well as what should be included in it.

Thus, the agreement should contain the following points:

- information about the apartment;

- advance payment amount, terms and methods of prepayment;

- information about the parties to the agreement;

- date of the purchase and sale transaction;

- duration of the contract;

- date of signing the contract;

- possible penalties in case of violation or termination of the contract.

Just as in the case of a deposit, the seller should write a receipt at the time of receipt of funds. Its content should read:

- document title and date;

- information about the parties to the transaction;

- deposit amount (in capital letters and numbers);

- characteristic features of the apartment;

- seller's signature.

Remember, it’s better to check everything several times before signing anything!

Download a sample advance payment agreement for purchasing an apartment

Other Features

If you have already found an apartment that you like not only for its external parameters, but also for the price, you should pay attention to the history of the property. Having learned all the details and nuances, you will save yourself from problems.

First of all, pay attention to your passport and the apartment layout. Is everything true? All redevelopment and changes must be recorded. You can check the accuracy of the information by requesting a certificate from the BTI.

Registered minor children or other persons may become an obstacle to the purchase and sale of an object. To check this fact, you can ask for a house register. It is also important to know information about the owner, on what basis he is the owner and whether there are other owners without whom he will not be able to sell the apartment.

Do not forget that the deposit or advance payment is transferred to the presence of the owners. If there are several of them, then they must all be present when the deposit is transferred.

Therefore, you should be familiar with:

- 1 with documentation that confirms ownership of the apartment;

- 2 availability of a registration certificate. There should not be persons in it who are temporarily discharged from the apartment;

- 3 availability of a passport and information about redevelopment.

There are a number of other nuances that should be taken into account before signing agreements on the transfer of deposits or advances. In order to understand and remember them, considerable experience in the field of buying and selling is required. Therefore, you should not experiment, but contact the experts.

Related articles on the topic:

Comments on the article

Buying an apartment on a mortgage with a deposit agreement or an advance payment agreement: the pros and cons of such transactions

Quite often, sellers insist on an advance payment or transfer of a deposit before concluding a contract for the sale of real estate in order to have additional guarantees.

The process, as a rule, lasts for several months - negotiations, collection of documents to verify legal purity, organization of cashless transfer of money.

In such circumstances, the property owner wants to obtain proof of the seriousness of the buyer's intentions.

You will read about the features of an advance payment and a deposit, their differences and the correct execution of documentation for preliminary payments in our material.

To solve your problem RIGHT NOW get a free LEGAL consultation: +7 (812) 385-57-31 St. Petersburg

Types and differences of prepayments

Real estate transactions often include a small cash deposit to the seller as a sign that the buyer is serious about the deal.

- Between individuals, payments in the secondary housing market usually occur in cash; developers prefer non-cash payments or offer to deposit money into the organization’s cash desk.

- Purchasing an apartment with a mortgage may require an advance payment, which the buyer negotiates directly with the seller. The legislation offers two options for the form of payment :

- There are fundamental differences between them and the buyer must know what legal obligations the payment does or does not impose on him.

Deposit

A deposit is a form of prepayment for an apartment . This is insurance for the seller, because if the deal falls through in the future due to the fault of the buyer, the money transferred earlier will remain with the current owner of the property.

If the deal falls through due to the fault of the seller, the deposit will be returned to the buyer in double amount. It is a real guarantee of obligations and leverage for both parties.

The party responsible for the failure will bear financial responsibility and losses.

It is financial responsibility that stops many participants from choosing a deposit as an advance payment. This is a concept regulated by law, its essence is spelled out in the civil code, articles 380 and 381, and the deposit itself is formalized in a separate agreement.

Article 381 of the Civil Code of the Russian Federation. Consequences of termination and failure to fulfill an obligation secured by a deposit

- If the obligation is terminated before the start of its performance by agreement of the parties or due to the impossibility of performance, the deposit must be returned.

- If the party who gave the deposit is responsible for the failure to fulfill the contract, it remains with the other party. If the party who received the deposit is responsible for non-fulfillment of the contract, he is obliged to pay the other party double the amount of the deposit.

In addition, the party responsible for failure to fulfill the contract is obliged to compensate the other party for losses, minus the amount of the deposit, unless otherwise provided in the contract.

Prepaid expense

An advance differs from a deposit in that it is only officially mentioned in the Civil Code of the Russian Federation . It is considered that an advance payment made in a form other than a deposit will be an advance payment.

Payment in the form of a deposit does not have a security function approved at the legislative level.

In practice, the advance payment is returned back to the buyer, regardless of the party responsible for breaking the agreement. If each participant is willing to provide guarantees but does not want to deal with the legal consequences, an advance would be a more desirable option.

The advance payment when purchasing an apartment with a mortgage is expressed in monetary units . Pledge is a way of encumbering the subject of a transaction. Thanks to the registration of this type of security for the fulfillment of obligations, the apartment is limited in turnover.

In practice, certain penalties can be specified in the advance agreement, bringing it closer to the deposit. For example, a buyer who unreasonably refused the purchase does not receive the advance payment back, and the seller who failed the deal returns the advance payment to the buyer with a certain penalty interest. There may be other options - by personal agreement.

Drawing up an agreement

The parties who have come to an agreement regarding the transfer of the deposit must draw it up correctly . This is a mandatory condition that ensures the order of the transaction and guarantees.

The earnest money agreement is a guarantee that the parties will sign the main purchase and sale agreement on the terms specified in the preliminary one. Therefore, the seller and buyer must agree on two documents at once. The deposit agreement itself does not create legal obligations unless a preliminary agreement of intent is additionally signed.

Contents of the document

A deposit agreement in Russia is subject to classical requirements that make it possible to identify both the subject of the agreement and the parties entering into it.

The standard content of the document includes the following information points:

- Full name, registration address, passport information of the seller and buyer.

- A clear description of the property, including its address and cadastral number.

- The amount of the deposit (you can enter it as a percentage of the cost of the apartment, but you must specify the amount - indicate it in numerical and alphabetic form).

- The period within which the parties undertake to fulfill the contract.

- Date and place of signing.

The legislation does not regulate the amount of the deposit; it is determined by the parties independently. Often it is about 2% of the amount, but sometimes it can reach 10% of the cost of the apartment.

Not in every case, the seller and buyer agree on a deposit in the form of a percentage of the amount; it also exists in the form of a round sum. The direct dependence of the size of the prepayment and, as a consequence, the financial guarantee can be traced to the seriousness of the intentions of the two parties.

Implementation of the deal in stages

Signing the contract

One of the central documents when applying for a mortgage is the purchase and sale agreement concluded between the borrower-buyer and the seller-owner. The purchase and sale agreement may be preceded by a preliminary agreement .

When agreeing on a mortgage loan, the client must immediately protect himself financially and be one hundred percent sure that the chosen transaction will be completed in accordance with all the rules.

It is not necessary to notarize the preliminary agreement . After drawing up the document, the seller and the buyer sign with a transcript (the first and middle names are indicated in initials, the last name in full).

Receiving a receipt

The form of the receipt must be in writing; otherwise, the law does not regulate its preparation. However, this is a legally competent document - in the interests of both parties.

The receipt must include the following mandatory items::

- Passport details of both parties.

- Date of receipt.

- Amount received from the buyer.

- Date of conclusion of the main contract.

- Signature of the person who received the money.

Transfer of money

The deposit is transferred through the channels used to transfer money under the purchase and sale agreement. You can use the cash method and give the funds to the seller from hand to hand.

For those who want to play it safe, renting a safe deposit box is suitable.

In the case of a deposit, it is possible to transfer money both upon the fact and after registration of the transaction using banking services.

However, you should not refuse to draw up a receipt - an additional document confirming that the money was transferred - in any case, it increases the security of the transaction.

Consequences of termination and non-fulfillment of obligations

If, before fulfilling the obligations, the parties terminated them, for example, signed an agreement on the liquidation of the approved preliminary contract, then the deposit is returned in full to the buyer - neither party bears losses.

The Civil Code of the Russian Federation provides for sanctions:

- The buyer who refuses the transaction loses the opportunity to return the deposit.

- The seller who refuses the transaction pays the buyer double the amount of the deposit.

In some cases, the amount of compensation can be reduced in court if it turns out to be incommensurate with the losses received by the injured party.

Differences between contracts

The advance agreement includes a standard list of provisions that makes it possible to understand and, if necessary, identify who signed the document and for what reason.

It is not necessary to indicate that we are talking about an advance; we can limit ourselves to the wording “advance payment.” Since in the Civil Code of the Russian Federation any prepayment that is not called a deposit will be considered an advance.

Another difference between an advance agreement and a deposit agreement is that the document does not necessarily indicate the methods and conditions for returning or not returning the money.

Payment methods are specified in the preliminary contract with the wording about prepayment.

As mentioned above, in Russia the conditions for providing an advance are left to the parties to the agreement; they, if they wish, can prescribe a financial liability similar to the deposit for the advance or completely rid themselves of it.

Is it worth using an advance?

The bank requires documents for housing to verify the legal purity of the property . And the seller decides to make sure of the seriousness of his intentions with the help of an advance payment - what if he spends a week collecting information, and the buyer simply refuses?

In this case, the buyer must insist on an advance payment that does not carry legal consequences.

After all, even after the loan is approved by the bank, there remains a possibility that the transaction will be prohibited due to oddities found in the documents, the lack of permission from the seller’s spouse, the lack of a certificate from the guardianship and trusteeship authority (needed for transactions with owners who are minor children), and so on. .

An advance payment when purchasing an apartment is a special form of guarantee that determines the seriousness of the buyer’s intentions.

Now you know what a deposit is, what features an advance payment has and in what situations they are used.

It is important to remember that only a deposit by default imposes obligations on the parties to fulfill the contract; the advance, in turn, acts as an advance payment, which is most often returned to the buyer if the deal is terminated.

The seller and buyer, having decided to use one of the above instruments, must sign a special agreement and, upon transfer of money, a receipt for receipt of funds. The buyer has the right to reduce the amount of the non-refundable deposit in court .

Useful video

We invite you to watch a video about how a deposit and an advance payment when buying an apartment with a mortgage differ from each other:

If you find an error, please select a piece of text and press Ctrl+Enter.

To solve your problem RIGHT NOW get a free LEGAL consultation: +7 (812) 385-57-31 St. Petersburg

Realtor tips: how to arrange an advance payment when buying and selling an apartment? Sample contract for download

Civil disputes when the seller receives an advance and the transaction is disrupted after receiving it are very relevant.

They are often caused by a lack of basic legal competencies among counterparties, who do not take into account the difference in the laws applicable to advance payments and deposits.

From this article you will learn about what an advance payment is and how to arrange it correctly. And also what risks exist when making an advance.

Dear readers! Our articles talk about typical ways to resolve legal issues, but each case is unique.

If you want to find out how to solve your particular problem, please use the online consultant form on the right or call +7 (499) 938-46-18. It's fast and free!

Show content

What it is?

Advance is a form of prepayment for a transaction . It is provided by the buyer to the seller as a guarantee of the seriousness of intentions to conclude a transaction.

Reference! The advance payment is transferred in the form of a commensurate amount of money specified in the preliminary purchase and sale agreement (PPSA) and the additional advance agreement, which is subsequently counted towards the full price of the apartment.

An advance payment is necessary to confirm the seller’s obligation to conclude a transaction when buying and selling an apartment in the near future, in return for the property being reserved for the person who provided the advance payment. From this moment on, the parties are exclusively preparing for the transaction:

- the buyer resolves the issue of money for payment;

- the seller prepares the documentation.

What laws govern it?

The advance is regulated by the provisions of Articles 421, 422 of the Civil Code of the Russian Federation . Significantly different from the norms of Articles 380 and 381 of the Civil Code of the Russian Federation on the deposit, which can be retained by the seller or returned in double amount to the buyer. Such rules do not apply to advance payments, as stated in the provisions of Part 3 of Article 487 and Article 1102 of the Civil Code of the Russian Federation.

Article 422 of the Civil Code of the Russian Federation. Treaty and law

- The agreement must comply with the rules obligatory for the parties, established by law and other legal acts (imperative norms) in force at the time of its conclusion.

- If, after the conclusion of an agreement, a law is adopted that establishes rules binding on the parties other than those that were in force at the conclusion of the agreement, the terms of the concluded agreement remain in force, except in cases where the law establishes that its effect extends to relations arising from previously concluded agreements.

How to apply correctly?

Mostly, such an advance payment is formalized by an additional agreement, which is attached to the PDCP, obliging the parties to conclude a transaction. Or - an independent advance purchase and sale agreement or an agreement having autonomous legal force. It can be concluded only after a thorough inspection of the premises has been carried out and its compliance with the buyer’s requests has been noted.

Required documents

When drawing up a document on prepayment, the seller must have the following documents::

- Civil passport with registration.

- Document of title: a privatization agreement, a certificate of inheritance or a property transaction agreement, as a result of which he acquired ownership of the apartment.

- Certificate of ownership, if such a right arose before July 2016, or an extract from the Unified State Register of Real Estate.

- Cadastral certificate confirming the absence of arrest and encumbrances.

Attention! The buyer must be presented with the originals of these documents.

The rest of the documentation can be collected before the start of the transaction. The buyer must present only a civil passport with registration. If representatives act in the interests of the parties, they are required to have a notarized power of attorney.

Advance contract (agreement) for purchase and sale

A document is drawn up in free form, intended for drawing up contracts . At the beginning it states:

- Title of the document;

- place and date of compilation.

Further, in the introductory part, the parties who compiled it are indicated. They may be:

- buyer and seller;

- one of the parties and a representative of the counterparty;

- representatives of the parties.

The following clauses are included in the agreement::

- Subject of the agreement. Here they indicate the address and main characteristics of the apartment for the purchase of which an advance payment is made.

- Price. The price of the object established for the transaction is entered in numbers and in words. Should not change during the transaction.

- Advance term. The exact or approximate date is indicated when the transaction must take place for which full settlement will be made.

- Conditions for transfer of prepayment.

Reference! The advance amount is paid in figures and words. The method of transferring money is also indicated here.

- Rights and obligations of the parties. The buyer's right is a requirement of the transaction, the obligation is to pay an advance. The seller has the right to receive an advance payment, the obligation is to reserve the property before the transaction.

- The responsibility of the parties provides for the terms of return (withholding), the accrual of penalties (fine) for delay and other sanctions at the discretion of the parties.

- Conditions for termination of the contract.

- Details and signatures.

Features of compilation for legal entities and individuals

If one or both parties are legal entities, then the agreement may be concluded:

- general director;

- representative by proxy.

The next feature of such a transaction is the method of transferring the advance, which can only be withdrawn from the personal account of a legal entity and sent to the personal account of a legal entity, with a mandatory report in the accounting documentation.

There is another significant difference in the execution of contracts between individuals and legal entities.:

- When determining the parties physical. persons, their last name, first name, patronymic and passport details are indicated. From the legal side person is operated by an organization whose name is indicated in the document, along with information about the head and his passport data.

- In conclusion, the personal data of the individual is given and his signature or legal details are affixed. person, the signature of the manager (representative) is affixed.

Attention! The transaction is additionally accompanied by a package of constituent documentation and the founder’s permission for the transaction.

Download the advance agreement form for the purchase and sale of an apartment between legal entities and individuals

How to issue a receipt? If the seller is an individual. the person to whom cash was sent to a bank card or handed over in person - you need to get a receipt from him; in other cases, bank documents will be valid.

The receipt is drawn up in free form on behalf of the seller, necessarily by him personally, indicating his passport details. In the text of the receipt, the seller must indicate the following :

- from whom did they receive the money?

- in what amount – amount in numbers and words;

- that the money was received as an advance.

Next, a date and a handwritten signature with an explanation of the surname must be put.

Transfer rules

The advance payment can be transferred at the time of signing the contract . This is possible if money is transferred from one bank card to another.

At the time of payment confirmation via SMS from the bank, you can exchange signed copies and hand over a receipt.

If there is a cash transfer, the algorithm may be as follows:

- the parties sign the agreement;

- the seller writes a receipt, receives and counts the money;

- keeps the money for himself and gives the receipt.

In other cases, the parties can sign an agreement, then go to a bank branch, from where the money will be transferred to the current account. Legal entities can track the receipt of money to the personal account specified in the agreement , which can be verified.

Important! In the case of drawing up a document and simultaneously transferring money, it is advisable to seek legal support.

Responsibility for choosing the amount and option for transferring the advance lies with both parties and is decided by agreement.

A difference of opinion may arise already at the stage of determining the amount of the advance. It is generally accepted that it should be within 5% of the total cost of housing; for luxury apartments it is allowed to set 5-10%.

Sometimes it is set to a fixed size, convenient for subsequent calculations. You can assign 30 thousand rubles for shares and rooms.

For individual apartments, depending on their cost - 50 or 100 thousand.

To avoid risk, the buyer should not pay an inflated advance amount . Especially if, at the same time, the price of the object itself is illegally reduced - such schemes are used by scammers who disappear after the advance agreement is signed, and subsequently there will be no one to recover the transferred funds from. In such a situation, it is best to seek assistance.

Common scammers include:

- double preliminary contracts with advance payment from several people;

- counterfeit money transferred in cash;

- receiving an advance using forged documents.

Unscrupulous citizens can receive an advance, subsequently breaking the deal and not returning it . Of course, if the offender is known, it will be possible to recover the transferred money from him through the court.

Can I get my money back if I change my mind about buying?

The advance period is valid from the date of its official transfer until the conclusion of the transaction.

Attention! If the transaction is cancelled, the parties must return the legal relationship to its original state - the buyer receives the money transferred as an advance payment, and the seller receives the right to search for a new buyer.

The advance payment is fully returned to the buyer if he cancels the transaction for reasons stipulated in the contract as objective . For example, the bank did not approve the transaction and did not issue a loan. In this and similar cases, the seller not only has the right, but also the obligation to return the advance to the buyer.

Since the advance is always paid only for receiving the goods. If the product in the form of an apartment was not purchased, the advance payment is returned.

But here a condition is required: the prepayment must be officially designated as an advance, and not a deposit (read about what is better to choose - an advance or a deposit when buying an apartment).

Other situations depend on the terms of the contract, since they have legal priority.

If it defines the conditions for collecting a certain amount as compensation for the seller’s lost profits, they must be observed, and if there are references to Article 380 of the Civil Code of the Russian Federation and it is stated that a deposit has been paid, then a transaction that was disrupted due to the fault of the buyer deprives him of the money paid. The seller who fails the deal will be required to return the deposit in double amount.

Preliminary agreements on the purchase and sale of an apartment may result in the receipt of an advance payment, after which the seller is obliged to prepare the property for a transaction with the person who made the advance payment. The procedure is formalized by an agreement in which the payment is indicated as an advance and not a deposit. If the transaction fails, the amount is returned, unless otherwise provided by the contract.

If you find an error, please select a piece of text and press Ctrl+Enter.

Didn't find the answer to your question? Find out how to solve exactly your problem - call right now:

+7 (499) 938-46-18 (Moscow)

It's fast and free!

How to draw up an advance agreement when buying a home

In the case of alienation of residential real estate, the parties very often resort to a certain form of making an advance payment - concluding an advance payment agreement. The execution of such a document makes it possible to consolidate the agreement reached and confirms the readiness of the parties to conduct the final transaction.

We will tell you how to correctly draw up an advance payment agreement when purchasing an apartment using the 2023 sample. In addition, we will tell you which points must be present in the document, as well as who and how determines the amount transferred to the seller through the conclusion of an advance agreement.

What is an advance agreement and why is it needed?

There are a number of reasons why participants in a real estate purchase and sale transaction draw up an agreement.

Most often, an advance is issued when the buyer has found suitable housing, and the seller wants to receive some guarantees that the property will be purchased in the future.

Both parties are ready to stop searching and begin preparing documents for the transaction. An advance under such circumstances confirms the seriousness of the intentions of both the seller and the buyer.

The transfer of funds in the form of an advance is made in the case when the transaction is planned to be carried out within a few days from the date of conclusion of the agreement. In addition to confirming the intentions of the parties, this procedure can be carried out by citizens if, for example, not all documents for the sale of an apartment have been prepared or not all the required amount has been collected.

Sometimes the reasons are completely banal - a reliable notary went on vacation or the transaction needs additional verification. After drawing up a special agreement, the seller stops showing the apartment to potential buyers, and the buyer does not look for another living space.

Features of drawing up an advance agreement

There is no clear concept of “advance” in the Civil Code of the Russian Federation. This procedure is regulated using materials from judicial practice. The basis is the economic definition of the term, which can be found in any textbook.

So, an advance is an advance payment for a transaction, forming part of the final amount (about 10%), which is transferred to the owner of the apartment before the purchase and sale transaction is concluded.

The remaining amount is paid immediately after signing the main agreement. The only mention of an advance is in Art.

380 of the Civil Code of the Russian Federation, which states that if there is any doubt as to whether the amount paid is a deposit, it is recommended to consider the prepayment as an advance payment.

A few words should be said about the fact that an advance and a deposit are two completely different concepts. Both are a form of prepayment, but the conditions of application and the procedure for registration have significant differences. In addition, each option has its own functions, as well as different legal consequences.

How to draw up an advance payment agreement?

The agreement to make an advance payment is drawn up in writing. To do this, the parties must discuss in advance the terms of the transaction and the transfer of the advance. You should also decide on the amount of the advance.

In short, the participants in the procedure must agree on the following points:

- Advance payment amount. It is calculated based on the cost of the apartment specified in the purchase and sale agreement. Therefore, the parties must first discuss the starting price for the apartment, and then decide what percentage the advance will be.

- Procedure for depositing the amount. The important thing here is to decide how the money will be transferred to the seller. The law does not establish any specific requirements, so money can be transferred to the seller’s bank account or transferred to the citizen in cash.

- The document must indicate the object of the transaction and specify the responsibility of the parties for non-compliance with the terms of the agreement.

Another significant aspect of the agreement is its duration. The advance agreement specifies the date on which the transaction is to be completed. In addition, the agreement specifies the personal data of the parties and their passport information. In conclusion, each participant puts his signature, thereby confirming his consent.

What else should you consider when preparing a document?

When concluding a purchase and sale agreement, significant attention should be paid to the “purity” of the procedure. In order to have time to additionally check the documentation, as well as to find out the identity of the seller and obtain a statement of the absence of encumbrance, an advance agreement is drawn up by the parties.

Despite the transfer of funds, the apartment remains the property of the seller until the registration of ownership rights to the housing as a result of the final transaction for the transfer of residential premises from one citizen to another.

Conclusion

If the participants in a transaction for the purchase and sale of real estate require additional time to prepare mandatory documentation or need to additionally check the “purity” of the transaction, the parties enter into an advance agreement.

Making an advance, on the one hand, acts as a guarantor of the participants’ interest in concluding the final agreement, and on the other, makes it possible to prepare all the required papers.

For the document to be valid, the advance agreement should be drawn up taking into account existing advice, recommendations and on the basis of a modern model that is taken into account in judicial practice.