Last update: 08/19/2022

When it comes to the costs of purchasing an apartment , the Buyer usually only thinks about the cost of the apartment itself, without taking into account the additional costs associated with such a transaction. And these costs can be quite significant... and unexpected.

In comparison with the price of real estate and interest on the mortgage, the costs of legal support of the transaction, organizing mutual settlements, paying state duties, etc. – seem small. However, such “little things” add up to a considerable amount. These are the additional (sometimes unforeseen) expenses of the Buyer when purchasing an apartment.

Moreover, it must be borne in mind that part of these expenses may be lost to the Buyer if the transaction with the apartment ultimately falls through and/or is not registered. Therefore, it is better to take care of thoroughly preparing the transaction in advance (see INSTRUCTIONS for how to do this).

How to properly fill out a deposit when buying or selling an apartment - conditions, term and amount. See the note at the link.

Additional costs when purchasing an apartment

If we divide all possible expenses of the Buyer (except for the cost of the apartment and interest on the loan) into separate categories of costs, we will get something like this:

- Realtor services (you can do without them, but some prefer to work through intermediaries);

- Legal services (it is advisable for each Buyer to have legal control of the transaction for security purposes and protection from challenging the rights to the apartment);

- Notary services (required for some types of transactions, in other cases - optional);

- Collection of information about the apartment, its owners and persons who may have any rights to it (including rights of use);

- State duty for registering a transaction in Rosreestr;

- Costs for secure transfer of money (renting a safe deposit box in a bank or commission for non-cash payments);

- Title insurance (if you need additional security against loss of title);

- Payment of debt on utility bills (if the previous owner still has a debt);

- Services for accepting an apartment in a new building (if we are talking about the primary market);

- Additional payments to the Developer (after transfer of the apartment to the Buyer).

A separate list can be made of additional costs when purchasing an apartment with a mortgage :

- Commission of the bank;

- Insurance (property, life and disability);

- Estimation of the value of the collateral property (apartment);

- Mortgage broker services.

Now let's look at these Buyer costs in more detail.

How to buy a mortgaged apartment that is pledged to the bank? 3 ways - see the link.

Realtor commission costs

The cost of real estate agency services is on average 3 - 4% of the price of the apartment (in Moscow these amounts reach several hundred thousand rubles). This amount also includes part of the additional costs listed above for the purchase and sale transaction: realtors will prepare the necessary documents, organize the transfer of money, and register the transfer of rights. But the size of the agent's commission is several times higher than the real costs of buying an apartment.

A buyer who considers his main wealth to be time, and not money, can safely contact a real estate agency for a full package of services, not forgetting, however, that realtors do not bear real responsibility for the consequences of the transaction (more about this in the link).

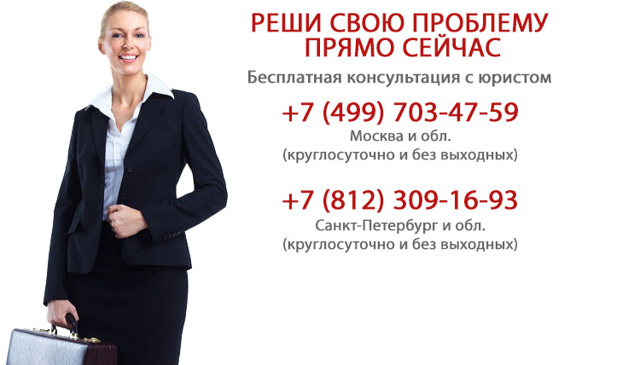

Payment for lawyers' services

At some stages of preparing a transaction, it is useful to seek the help of specialized lawyers . The Buyer should always keep these costs in mind, since the very essence of the apartment purchase transaction is exclusively a legal issue.

In the secondary market , lawyers specializing in real estate transactions provide certain services (checking the legal cleanliness of the apartment, checking the identity of the Seller, preparing an agreement, etc.

), and also offer a full package of services, which may include registering a transaction and organizing the transfer of money.

The cost ranges from several thousand rubles for a separate service (for example, preparation of an agreement) to several tens of thousands of rubles for full legal support of the transaction.

In the primary market, the preparation of an agreement for the purchase of an apartment in a new building is undertaken by the Developer’s lawyers. But it makes sense for a reasonable Buyer to check all the terms of the transaction with the help of his (hired) specialized lawyer , especially if the new building is not sold under an Equity Participation Agreement.

Even in the Equity Participation Agreement (EPA), designed to maximally protect the rights of the shareholder, the Developer can add clauses that will entail additional costs (not included in our list).

For example, the Developer sometimes obliges the shareholder to pay for his own services for registering property rights.

While the shareholder is not legally obligated to do this, and can independently register the DDU by paying only the state fee.

Also, the contract “from the Developer” may stipulate an additional payment for “extra” square meters if they appear as a result of a mistake by the builders. Such a clause in some cases violates the Buyer’s rights. An experienced lawyer will tell you when an additional payment can be excluded or reduced, and will help you challenge the contract on the basis of the law.

In general, legal expenses for an apartment purchase and sale transaction are usually borne by the Buyer, because It is in his interests to ensure a reduction in risk and a guarantee of the “legal purity” of the acquired right to real estate.

The risk of purchasing an apartment previously purchased with maternity capital. Trap for the Buyer.

Notary fees when purchasing an apartment

The law obliges you to draw up a contract for the sale and purchase of an apartment with a notary in cases where:

Who must pay for the purchase and sale agreement: the buyer or the seller?

When thinking about purchasing living space, the buyer should take into account that in addition to the cost of the apartment itself, he will be required to ensure payment of expenses associated with organizing this transaction, as well as making monetary payments between him and the seller, and, in addition, registering the purchase and sale agreement.

For a potential seller, it would not be amiss to mention the preparation of documents for the apartment, all the papers that will be necessary for state registration of the agreement with the justice authorities.

Preparation and collection of documents are traditionally paid by the seller. This amount includes payment for BTI certificates, absence of debts on utility bills, as well as payment of the necessary property taxes.

As for certificates from the technical inventory bureau, their cost will be from 1000 to 1500 rubles - it will depend on the size of the property. In some cases, additional certificates from the BTI are paid for, for example, compliance with the area and address. The cost of issuing a power of attorney for a representative will cost from 400 to 600 rubles.

The execution of the purchase and sale transaction itself is the responsibility of the buyer - this point must be agreed upon in advance when making an advance payment.

As for renting a bank safe (safe deposit box), you will have to pay from 1,500 to 3,000 rubles - everything will depend on the prices of a particular banking institution, as well as the size of the safe deposit box (they also come in different sizes).

Provided that the agreement is concluded in a simple written form, its preparation within the registration centers will cost approximately 3-5 thousand rubles. If this agreement was drawn up by a notary, then you will have to pay neither more nor less, but 0.8-1.5% of the value of the property specified in this agreement. In addition, you will need to pay a fee for state registration of the contract.

Provided that a person does not want to waste time and personally submit documents for registration, and also taking into account the traditionally long queues at state registration institutions, you can issue a power of attorney in the name of the registrar or an employee of a real estate agency, and pay him approximately 3-3 for these services. 4 thousand rubles.

The amount of the amount will directly depend on factors such as the reputation of the specialist, experience, location of the office space, and also do not forget about trivial human self-interest.

When preparing a package of documentation for each party to the transaction, it is necessary to fill out various applications - this costs another 400 to 1000 rubles. The number of these statements will directly depend on the transaction, the number of participants, as well as the presence of any family relationships between the participants in the transaction, the presence of official marital status and similar circumstances.

As a result, the buyer will spend approximately 10 to 15 thousand rubles on completing a purchase and sale transaction, and the seller will spend approximately 2-3 thousand rubles.

The above amounts are indicated without taking into account the costs of so-called acceleration. For example, documents from the BTI that will be required to complete a transaction involving a specialist technician are prepared for issuance within 1.5 months, which, it should be noted, is a fairly long period of time for such an urgent event as the sale of an apartment.

In addition, in order to then pick up the specified documents from the BTI, you again need to stand in a long line, receive a payment receipt, pay for it at the savings bank, and then return to the BTI to confirm the fact of payment, and only after all these “circles of hell” receive the documents .

Enterprising specialists from specialized companies came to the rescue in this situation, helping citizens with the preparation of all documents in an accelerated, accelerated manner. The cost of this service ranges from 9,000 to 30,000 rubles - it all depends on the desired timing and a number of other aspects.

Basic provisions for a correct real estate purchase and sale transaction

To recognize a real estate purchase and sale transaction as valid, the transaction must meet the following conditions:

- The transaction must be carried out in accordance with the current legislation of the Russian Federation. For example, it is not allowed to enter into an agreement aimed at the sale of objects that are common areas in a “high-rise building”;

- Mandatory compliance of transaction participants with the statuses “legal capacity” and “capacity”;

- A person who sells real estate must naturally have title to the property;

- The voluntary nature of the transaction - none of the parties to the purchase and sale should be forced to complete this transaction;

- The act of consent of the buyer and seller to the purchase and, accordingly, the sale must be confirmed by notarization of the purchase and sale agreement;

- A prerequisite is that the purchase and sale transaction must go through registration with government agencies.

- If one of the above points is violated by the parties, this may entail the recognition of the transaction as invalid, as a result of which civil legal relations of this kind between the buyer and seller will be severed.

- It is quite clear that all buyers are concerned about the issue of security during the acquisition of real estate, since unscrupulous persons and simply professional swindlers have not disappeared; rather, on the contrary, their number and adaptability to the realities of modern life have only improved.

- However, often problematic issues arise not because of scammers and swindlers, but because of poor legal knowledge in matters of real estate transactions, as well as a lack of experience in these matters.

If you want to buy a property, you should first check such an important point as title documents, because only they can confirm the seller’s right to this property, which, in turn, will prevent you from possible fraudulent actions in the initial stages of preparation for the transaction. transactions.

The following documents may serve as legal documents:

- Certificate of ownership of real estate;

- Contract of sale;

- A document confirming the acceptance of the inheritance in accordance with the law or the will of the testator;

- Deed of gift (or gift agreement).

Each of the above documents must be submitted in original form - no copies and no assurances from the other side about the presence of such originals in principle, however, being temporarily unavailable. In addition, the originals must contain seals and registration details of government bodies (BTI, etc.).

Also required is a certificate from the housing office, which will indicate the number of persons registered in the housing space being sold.

If the seller does not have such documents, you can, if desired, check independently at the Housing Office.

This point of clarification is mandatory because it is quite undesirable for citizens who have temporarily left, but retain their rights regarding the property, to be registered at this address.

In addition, it would be a good idea to pay attention to the seller’s passport and look at the notes in it regarding marriage registration and place of residence. This is important because real estate that was acquired during marriage will belong to both the husband and wife as joint property (with the exception of inherited property).

As for the transfer of funds, there are several. Examples of payment methods are: cash and non-cash payment, payment before or after the conclusion of a transaction, the presence or absence of an advance payment, etc. These points must be agreed upon in advance.

Documentation

All documents required to formalize a real estate purchase and sale transaction are conventionally divided into 2 types:

- Documentation, the presence or absence of which determines the possibility of notarizing the transaction, as well as certifying the transfer of ownership of real estate. These are: documents of legal significance, certificates assessing the value of real estate, technical documentation for the apartment, form No. 3, passports and TIN of the parties, a permit from the guardianship council (if necessary, when there are minor children).

- Reference documents on payment of utilities for the object being sold, and, in addition, other reference data on the absence of burdensome circumstances of a tax or credit nature.

- Let us proceed directly to the consideration of the algorithm for the purchase and sale of real estate.

- This transaction usually occurs in 5 stages.

- Stage No. 1 – searching for a property, selecting and viewing possible options.

- At the end of this stage, the potential buyer chooses one option that is most suitable for him in all key parameters.

- At this stage, the seller may receive part of the cost of the apartment as an advance payment, which will mark a preliminary agreement between the parties.

- At this stage, the buyer must initiate a legal check of the property for the so-called purity.

- Stage No. 2 – preparatory steps for drawing up an agreement

- Concluding a written purchase and sale agreement, which can subsequently be certified by a notary.

- Stage No. 3 – transfer of funds

One of the most exciting and sensitive moments in the entire transaction. It is recommended to use the least dangerous option - transferring funds through the use of a safe deposit box. Money from the box is issued in favor of the seller only upon presentation of a Certificate of Ownership, which is issued in his name.

- Stage No. 4 – the property undergoes state registration in a division of the Federal State Registration Service.

- The wait for the registration document usually occurs within approximately 14 days.

- Stage No. 5 – the stage during which the property (apartment) is vacated by the old owner.

- It is also better to stipulate the deadlines for release in advance in order to avoid embarrassing situations.

- When releasing and handing over the keys, an apartment acceptance certificate is drawn up and signed.

Share:

No comments yet

Who pays for the apartment purchase agreement and transaction: expenses 2023

In practice, the sale and purchase of real estate incur certain costs. Who pays for the apartment purchase and sale agreement is determined by the parties to the transaction themselves. They have the right to establish the distribution of expenses and the procedure for payment.

Transaction costs

The main list of transaction costs is as follows:

- government duties are mandatory costs that can only be reduced if certain benefits are available;

- legal services are used to eliminate errors and increase the overall level of reliability;

- an experienced realtor will help you quickly sell (buy) an apartment;

- A notary is needed to confirm the authenticity of documents.

In addition to the above actions, one should not forget about the value of convenience, psychological comfort, and other important factors. The following information will help you optimize the costs of the purchase and sale transaction, taking into account your personal requirements and preferences.

Registration of the contract

It is not necessary to pay for the preparation of the text of the agreement. Any user can download a standard sample of an apartment purchase and sale agreement from our website using the following links:

- preliminary agreement;

- main purchase and sale agreement;

- deed of transfer.

You need to contact a lawyer for help if you are talking about selling:

- real estate owned by a minor child;

- shared ownership;

- apartment received by inheritance (rental agreement).

The cost of legal services is determined:

- complexity of the transaction;

- the status and commercial policy of the performer;

- regional price level in the corresponding market segment.

An alternative solution is to study thematic information in the corresponding section of our website. These publications are updated promptly. Consultation with an experienced lawyer for the correct preparation of an apartment purchase and sale agreement can be obtained from us online.

You can pay for the production of the contract in half. If one of the parties insists on a specific lawyer, then it will bear the full costs.

Preparation of an extract from the Unified State Register of Real Estate

This document defines:

- basic parameters of the property;

- ownership;

- cadastral value;

- presence of encumbrances.

For your information! Only the seller (owner) has the right to receive the extended option. It indicates the former owners and other additional information.

You can receive an extract in person or through the official website of the relevant organization:

- "Rosreestr";

- MFC;

- Government services.

Order fulfillment time ranges from a few minutes to 5 working days. You can order delivery to the desired address (courier, postal). The cost depends on the composition of the selected services and the method of obtaining the document: 250 – 1,950 rubles.

Read a separate useful material about extracts from the Unified State Register of Real Estate for purchase and sale.

Preparation of additional documents

The list of accompanying documentation is determined by the specifics of the transaction. You can collect refusals from other residents when selling a share yourself. It is more convenient to entrust written notification to several third parties in different cities to a notary. If necessary, certificates and other confirmations will be prepared and collected by an authorized representative.

A separate expense item is technical documents. For an updated technical plan, you will have to pay from 1,000 rubles to the local BTI, but it is impossible to confirm the absence or legality of the redevelopment in any other way.

The seller usually pays for the preparation of additional documents.

Notarization

The biggest costs you will have to take into account when selling are:

- shared ownership;

- real estate owned by a minor child.

In these cases, the law establishes mandatory registration through a notary office. They pay 0.5% of the cost of the apartment under the purchase and sale agreement - at least 20, but up to 300 thousand rubles.

Attention! Who pays the notary is decided by the parties themselves by agreement. You can agree and split the costs in half, because both participants are interested in notarization.

When selling an apartment that is not complicated by the facts listed above, there is no need to notarize the contract - but it is permissible if desired. The party that expresses such a desire pays the notary in full.

Additionally, in certain situations it is necessary to certify:

- consent of the spouse to the sale of jointly acquired property;

- refusals of other owners;

- powers of attorney.

These costs are borne by the interested party.

Real estate services

The costs of the realtor are borne by the person who hired him. If a specialist prohibits the parties from interacting on sales issues, you need to be wary - he probably plans to receive a double commission from both of them at once.

The cost of the intermediary's services can be fixed (for example, 50,000 rubles) or as a percentage of the contract price (for example, 5% of the transaction amount). Read more about the services of a realtor when buying and selling here.

State registration fee

This procedure completes the transaction and is therefore mandatory. Only after state registration the buyer becomes the full owner of the property.

Standard rate – 2,000 rub. The buyer pays the state fee. If there are several buyers, each pays their share - for example, 2 buyers each pay 1,000 rubles.

Bank services

When selling an apartment, it is necessary to ensure the security of the transfer of funds. Cash transactions are organized through a safe deposit box (approximately 2,000 rubles). A wire transfer will require approximately 1% commission of the amount.

Payments through a letter of credit have recently become very popular - the seller receives access to funds after presenting an extract from Rosreestr to the checking employee at the bank confirming the transfer of ownership rights to the buyer. Cost – from 2 to 15 thousand rubles.

The bank may offer additional services. So, for checking the authenticity (counting) of banknotes they charge 0.15-0.5% of the amount. Some branches offer a separate room for calculations, equipped with specialized equipment.

Who pays for secure payments is decided by the parties themselves - but, as a rule, the buyer pays. Read more about payment options for purchases and sales.

Who pays for what?

The parties themselves determine who pays for the apartment purchase and sale agreement. However, some actions imply financial participation only by the current owner or future owner. The following information will help you find out what is done in typical situations.

Buyer's expenses

The buyer performs with the help of appropriate services:

- searching for a suitable property;

- choice of financing scheme;

- clarification of technical and sanitary parameters of the property;

- checking the legal purity of the transaction.

Additional funds will be needed when applying for a mortgage. Some banks require an expert assessment of the cost. Individual preparatory actions can be paid under a preliminary agreement for the purchase and sale of an apartment using an advance payment:

- eviction and relocation of tenants;

- cleaning and repair of premises;

- repayment of debts (utilities, loans and others).

Seller expenses

The seller can perform the above preparatory operations at his own expense to increase the attractiveness (the stated price) of the property.

Like the buyer, he uses the services of qualified specialists to speed up individual processes and ensure a high level of security.

Who pays for the registration and other mandatory actions are determined during the preparation of the preliminary or main agreement for the sale and purchase of the apartment.

Taxes after the transaction

The seller pays tax on the value of the apartment purchase and sale agreement at a rate of 13%. The buyer does not receive income, so does not pay personal income tax. He can exercise the right to return part of the funds spent. Compensation is calculated as 13% of the following expenses (maximum value in rubles):

- cost of the apartment;

- mortgage interest.

The following articles on taxes have been published on our portal: for the seller and for the buyer.

To eliminate mistakes, it is recommended to draw up a payment plan for the apartment purchase and sale agreement in advance and indicate who pays for what. Going through the steps step by step will help clarify individual costs. The parties indicate the approved terms and conditions in the text of the agreement.

In difficult situations, the help of a professional will come in handy. Use remote consultations to accurately prepare an apartment purchase and sale agreement.

- We will be grateful for your like and repost!

- Read more in this additional article about the costs of a purchase and sale transaction.

Buyer's expenses when completing a transaction for the purchase and sale of an apartment

When drawing up a purchase and sale agreement, the buyer of an apartment must be prepared for the fact that, in addition to the basic amount, he will be subject to a number of additional expenses.

Drawing up a transaction involves paying state fees, issuing certificates and documents, renting a safe deposit box, and the services of a notary and realtor.

The parties independently agree on the procedure for payment, but the buyer is traditionally responsible for everything related to his documents and taking possession. He also pays all costs associated with obtaining a mortgage himself.

https://www.youtube.com/watch?v=NC7OIL_VAzM

Purchasing an apartment or other real estate property involves significant expenses on the part of the buyer. Many people choose an apartment at a close price that matches the buyer’s available funds. However, in addition to the cost of the object, both parties to the transaction are subject to additional costs associated with its execution.

The legislation does not establish the party that must pay for them, so the seller and buyer independently agree on who makes the payment and for what. But in the real estate purchase and sale market, certain traditions have developed regarding this issue.

Who bears the cost of paying state fees?

Payment of the state duty is a mandatory condition for carrying out a transaction related to the sale of real estate. Registration of the right to real estate is traditionally assigned to the buyer - the person acquiring it. However, the parties may agree on a different settlement procedure.

Since for individuals the amount of this type of state duty is small (only 2 thousand rubles), usually there are no problems with its payment. And for legal entities concluding a real estate transaction, its size is more impressive - 22 thousand rubles.

The buyer is also required to register changes in ownership of the property in the cadastral register. Application for it is carried out without charging a fee to the applicant.

Who pays for the registration of an apartment purchase and sale agreement?

Today, a purchase and sale agreement does not require mandatory notarization, as it was previously. The refusal of this person to participate significantly reduces the cost of registration, since his services cost the parties from 1% to 1.5% of the total transaction price.

The parties can either draw up the agreement themselves or seek the help of a lawyer or real estate agency. The cost of services for drawing up such documents varies from company to company, but generally ranges from 3 to 5 thousand rubles. Based on the complexity of the transaction, the price may rise to 15 thousand rubles.

Traditionally, the costs of drawing up a purchase and sale agreement are borne by the buyer of the real estate property. This is due to the fact that it is he, as a party to the transaction, who is most interested in the proper execution of this document. You can avoid this expense item by drawing up a contract yourself. However, in this case, having saved funds now, you can lose them in the future.

If the parties have resorted to the services of a real estate agency, then the execution of a purchase and sale agreement may be included in the cost of their services. This is possible if the company has a lawyer on staff, but the cost of services will be higher.

Who pays for paperwork when concluding a transaction?

Registration of documents when concluding a purchase and sale agreement is another expense item. Among them there are both mandatory ones, without which the transaction is impossible, and optional ones. The presence of the latter, although not necessary, often allows you to avoid many problems after signing the contract.

Table 1 Documents when concluding a transaction

| Document | Where to apply | Price | Mandatory or not | |

| Salesman | Cadastral passport, explication | BTI | Not fixed, depends on the area of the object. On average it ranges from 2 to 3 thousand rubles. | Required |

| Extract from the Unified State Register of Real Estate about the property | MFC or Cadastral Chamber | 750 rubles | Required | |

| Certificate of registered persons in the apartment being sold | Housing office or management company | For free | Required | |

| Certificate of absence of debts for utility services | Housing Office or Criminal Code | For free | Optional | |

| Certificate of absence of tax debts | MFC or Local tax office | For free | Optional | |

| Buyer | Certificates stating that the seller is not registered with the PND and ND | District or regional office of PND and ND | From 1 to 4 thousand rubles. Required to verify the legal purity of the transaction and the absence of the possibility of challenging it | Optional |

| Archival extract from the house register | Housing office or management company servicing this property | From 1 to 6 thousand rubles. Required to check the presence of other tenants who may have the right to challenge the transaction | Optional |

When preparing documents, one rule applies: the one who needs them pays for them. The seller receives the required documents for the apartment, since he is the owner of the property. If the seller or buyer wants to speed up the procedure for processing documents and transactions, then he pays for it.

When registering the consent of the spouse for the purchase or sale of real estate and other co-owners, notarization of the document is required. Its price ranges from 500 to 1.5 thousand rubles. The consent is also paid for by the person whose spouse gives it.

Certificates of no debt are optional, although their presence makes the transaction more transparent, and therefore more attractive. But if these documents are not available, and the buyer wants to clarify the information, then he can get the certificates himself.

There is an opinion that the costs of obtaining certificates are borne by the realtor if he is involved in concluding a transaction. This is only partially justified and only when the parties order the service of completing a turnkey transaction from an agent. Its cost starts from 15 thousand rubles and varies depending on the specifics of the situation and the necessary documents.

In all other cases, the parties pay for documents and commissions separately.

Paying for a safe deposit box

To carry out transactions involving large amounts of cash, the parties often rent a safe deposit box and enter into a three-party transaction. The document sets out the conditions under which each party is allowed access to the money in storage.

At the moment, the cost of renting a safe deposit box ranges from 2-4 thousand rubles, depending on the credit institution and its prices. Also, to the possible expenses you should add a deposit, which is taken “for the key” and amounts to about 3-4 thousand rubles. Subsequently, this amount is returned to the payer after completion of the transaction.

The costs of renting a safe deposit box are borne by the buyer of the apartment, but the parties can agree to pay the required amount in half.

If, due to the specifics of the transaction, the parties require several safe deposit boxes, then the costs of their use are paid by the interested parties.

For example, if a property has several owners, each of them will pay for their own cell.

The standard rental period for a safe deposit box is one month. During this time, the parties must draw up the necessary documents, as well as register the transfer of rights to the real estate property in Rosreestr.

The seller's access to funds becomes possible from the 13th day after the start of the lease. This clause is separately stated in the cell rental agreement. The access period ends on the 20th of the month. After this, this right is transferred back to the buyer.

If the transaction is delayed, the parties need to contact the bank to extend the lease of the locker. To do this, you will need to submit documents confirming the fact of the delay in the transaction. The lease agreement will need to be amended accordingly.

Who pays for the realtor's services?

From a legal point of view, the second party in these legal relations is the seller, since it is he who enters into the agreement, but in practice different situations occur.

The broker's commission may be added to the seller's principal price for the property. In this case, the buyer actually pays the realtor, transferring to the seller the entire declared amount, taking into account the commission declared by the real estate agency.

In other cases, the realtor may take a percentage of the transaction amount. In this situation, the seller essentially pays for his services, since he will receive a smaller amount from the desired price for the apartment.

For his assistance, a real estate agent can ask for either a fixed amount or a percentage of the total transaction value. In the first case, this amount fluctuates around 30-50 thousand rubles, in the second - from 2% to 5% of the total amount of the contract.

Who pays the notary: buyer or seller

The participation of a notary in concluding a transaction for the sale and purchase of real estate is generally not mandatory. They resort to his help if it is necessary to prepare additional documents required for drawing up an agreement. These include:

- power of attorney if one of the parties cannot be present at the conclusion of the transaction;

- the consent of the spouse to sell the apartment, if he is its co-owner or this object belongs to jointly acquired property;

- consent of the buyer’s spouse if jointly acquired funds are used to purchase real estate;

- other documents.

The cost of processing such documents consists of two parts - the mandatory state fee for certification and the notary's markup. In this regard, prices can range from 4-5 hundred to 1-2 thousand rubles. The costs of document preparation are borne by the party that needs them.

Notarization of the purchase and sale transaction of an apartment will be required if the purchase is carried out using mortgage funds. This is a mandatory condition for the execution of such contracts in accordance with current legislation.

This expense item must be paid by the buyer, since the mortgage is issued in his interests. In this case, you will have to add about 1.5% of the value of the real estate to the costs.

Additional costs when applying for a mortgage

A mortgage, in addition to the costs of notarizing the purchase and sale transaction, involves a number of additional expenses. All of them are assigned to the buyer, since the involvement of a credit institution is carried out in his interests. Moreover, without these documents, the bank may not give him the necessary funds to pay the cost of the apartment.

Due to current legislation, when applying for a mortgage, the buyer will be required to provide an assessment of the value of the property being purchased. The document can be issued at any company that provides such services and has a license to carry out this type of activity.

To obtain an assessment of the market value of an apartment, the buyer must prepare a sum of money within 3 thousand rubles. In different companies, the price for this type of service may vary and mainly depends on the area of the facility.

To complete the assessment, you will need to prepare a package of documents. It includes:

- documents confirming ownership of this real estate object;

- cadastral passport for the apartment;

- explication and plan of the object;

- identification document of the owner.

After providing the necessary documents and concluding a contract for the provision of services, the appraiser goes to the site and inspects it. Based on the results of the assessment, the specialist draws up a report within 5 days, in which he indicates the market and liquid value of the apartment.

The assessment report, along with photographs of the property and copies of the documents provided, is sent to the bank. Along with it, the buyer may be required to submit a notarized statement from a spouse or other adults who are not borrowers.

This document must indicate that they have been notified that the property being purchased will be pledged under a mortgage agreement. They are also aware of the fact that if the loan obligations are not fulfilled, this property will be subject to foreclosure, up to and including the eviction of the residents.

Concluding a loan agreement in most cases involves insuring the life and health of the recipient of the funds, as well as the property itself. On average, this expense item will require from the buyer an amount in the range of 0.5% -1.5% of the total price of the apartment. More detailed information about insurance when applying for a mortgage in the following video:

In general, the buyer’s additional expenses when applying for a mortgage will require him to pay several tens, in some cases even hundreds of thousands of rubles. These expenses are not mandatory, since the law does not require them to conclude a transaction. But to obtain borrowed funds, the buyer of the apartment will have to spend money.

If the buyer refuses to provide them, they may reject the request for the issuance of funds or offer other conditions for obtaining a mortgage. In the second case, credit conditions deteriorate significantly: the rate increases, as does the entry fee, the loan term changes, etc.

When calculating costs after a change in conditions, buyers prefer to complete the necessary documents and obtain a mortgage on more favorable terms. Another option would be to look for a banking organization that does not require insurance, but in this case the lending conditions will be less attractive.

Buying a home: what expenses does the buyer bear when buying an apartment?

To solve your problem RIGHT NOW get

free consultation:

Show content

Basic costs, total amount

- A real estate company or a free real estate agent will find an apartment among the options offered on the market, help prepare documents for the transaction, and provide support services in departments; or, on the contrary, they will show the object to the buyer.

On average in Russia the cost will be 50 thousand rubles. (or 5% is added to the original price of the apartment).

- Drawing up a purchase and sale agreement from a lawyer, on average - 1,500 rubles. on the territory of the Russian Federation.

- The state duty for the assignment of property rights in Rosreestr is 2000 rubles. These costs are most often borne by the acquirer of property rights - the buyer of the apartment.

- To certify ownership and the absence of encumbrances on the apartment, an extract from the Unified State Register of Real Estate in Rosreestr or the MFC is taken; on a regular paper form the amount will be 300 rubles, and on an electronic medium 750 rubles, respectively.

- It is necessary to obtain a notarized consent of the spouse to sell the property from a notary, for which you need to pay 500 rubles.

- If a representative of one of the parties will participate in the execution of the purchase and sale transaction, a notarized power of attorney is required - 100 rubles for close relatives and 500 rubles for all individuals.

The total cost will average 55 thousand rubles.

Costs that the buyer may face:

| Name of expense item | Amount of expenses in rubles |

| Finding an apartment realtor | 50 000 |

| Preparation of contract | 1500 |

| State duty | 2000 |

| Spouse's consent | 500 |

| Notarised power of attorney | 100 |

| total: | 54 100 |

Costs that the seller may face:

| Name of expense item | Amount of expenses in rubles |

| Preparation of contract | 1500 |

| Spouse's consent | 500 |

| Extract from the Unified State Register of Real Estate | 525 |

| Notarised power of attorney | 100 |

| total: | 2625 |

Who pays state fees?

The state duty is traditionally paid by the acquirer of ownership of the object under a sales contract , that is, a receipt is issued to the buyer, which must also indicate his passport details. If spouses purchase an apartment for joint use, one of them can then indicate his name and make the payment himself.

The amount of state duty for standard real estate in Rosreestr is stable and amounts to 2,000 rubles. The state exempted from payment only individuals who are legally recognized as low-income citizens (they must be registered and have the appropriate certificate with them).

Important! This amount of state duty when completing a purchase and sale transaction is established for an individual, both for a citizen of Russia and for a national of another country.

Minor citizens are not exempt from paying the fee , and their receipt must be paid to their parents or guardians. Thus, if you represent the interests of a child under 14 years of age in a purchase and sale transaction, put your name on the receipt, but only the legal representative has the right to do so.

An older child has the right to put his name on the receipt and even pay for it himself using his passport (you can learn about the specifics of registering the purchase of an apartment for a minor in our article).

If the transaction is made to take ownership of common property in an apartment building, and this fact is stated in the purchase and sale agreement, the state duty will be only 200 rubles.

If a transaction involves several participants at the same time, and three or more shareholders enter into rights, the state duty is divided equally among everyone.

For example, three buyers, then each contributes 667 rubles (666, 67 must be rounded). In this case, a receipt is issued to each acquirer of rights and is paid by him.

We talked in more detail about registering the purchase of an apartment in joint ownership in this material.

Who pays the agency?

Most often, the buyer himself turns to the agent to find a suitable apartment, in which case he is told about the range of services; a receipt or agency agreement is drawn up indicating the price. But it happens that a company adds up the cost of its services and the cost of the property.

It may happen that the client does not even know that he is paying for the work of a realtor. Many agencies do not charge a fee at all from the seller , even if they advertise his apartment in their sources, especially if the apartment is regarded as a profitable property. The reason again is that the entire cost of the cost will be covered by the buyer.

But in the case when clients order transaction support, assistance with drawing up an agreement, or specify additional services, the seller can also be provided with an invoice.

Quite affordable prices are maintained on the market for services among Moscow lawyers for drawing up sales and purchase agreements. This is largely due to the prevailing competition of the metropolis, as well as the right approach to work and labor organization (consultations on the Internet, a significant staff of young specialists). The price for a standard purchase and sale agreement is on average 1,850 thousand rubles.

The services of legal firms in St. Petersburg are a little more expensive - drawing up an agreement costs an average of 2,800 rubles. But it should be noted that the approach to the matter is truly thorough. Almost all agencies and consulting companies offer a personal meeting, notarization, and support.

The services of law firms in Novosibirsk and Nizhny Novgorod will cost much less , although market offers are noticeably limited and the choice is relatively small compared to Moscow and the northern capital. Ekaterinburg does not differ in prices, and they can be said to be average for Russia. The average price for drawing up a standard contract is 1,500 rubles.

Chelyabinsk lawyers also maintain average prices. A regular sales contract, which will be drawn up within three days, will cost the customer 2,000 rubles. Prices in Kazan are not much different. But you can often find a ready-made package of services. So for 5000 rubles. lawyers in this city will check the encumbrances on the property, prepare the necessary documents and accompany you during the transaction at the department.

On a note. In Samara they promise to prepare a purchase and sale agreement in 1-2 days. The cost is one of the lowest in the country - only 1,300 rubles.

And there really are a lot of such proposals. Changes to the clauses of the standard document are paid additionally, but if the transaction does not cause any concern to the parties, a standard agreement may be quite sufficient.

The most unusual conditions for drawing up an agreement are found in Omsk - companies are ready to offer their clients installments and split payments, while the prices are both very low and high - if we are talking about a package of services.